|

|

市場調査レポート

商品コード

1213712

3Dスキャナーの世界市場:提供製品/サービス別・種類別・技術別・距離別・産業別・地域別の将来予測 (2028年まで)3D Scanners Market by Offering (Hardware, Software, Services), Type (3D Laser Scanners, Structured Light Scanners), Technology (Laser Triangulation, Pattern Fringe, Laser Pulse, Laser Phase-shift), Range, Industry and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 3Dスキャナーの世界市場:提供製品/サービス別・種類別・技術別・距離別・産業別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年02月06日

発行: MarketsandMarkets

ページ情報: 英文 244 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の3Dスキャナーの市場規模は、2023年の11億米ドルから2028年には15億米ドルへと、予測期間中に6.9%のCAGRで成長すると予測されています。

スマートファクトリーの進化が、3D計測システムおよび3Dスキャナーの需要を促進しています。

種類別では、構造化光スキャナーが予測期間中に最も高いCAGRで成長すると考えられています。特に航空宇宙・防衛産業では、複数の生産・組立工程にわたる3D検査のニーズが高まっていることが、構造化光スキャナーの需要を後押ししています。

地域別に見ると、アジア太平洋市場が予測期間中に最も高いCAGRで成長すると予想されています。中国・日本などの急速な経済成長やインフラ開発、自動化の進展などが、3Dスキャナーの需要を促進しています。また、同地域では防衛航空機の製造部門が拡大しており、検査に使用される3Dスキャナーの需要も大きく伸びています。さらに、製造施設における労働者や機械の安全性を確保するための政府の厳しい規制が、3Dスキャナーの大きな需要につながっています。

当レポートでは、世界の3Dスキャナーの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、提供製品/サービス別・種類別・距離別・技術別・製品種類別・用途別・産業別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主な会議とイベント (2022年~2023年)

- 規制機関、政府機関、その他の組織

第6章 3Dスキャナー市場:提供製品/サービス別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

- アフターサービス

- STaaS (サービスとしてのストレージ)

- 測定サービス

第7章 3Dスキャナー市場:種類別

- イントロダクション

- 3Dレーザースキャナー

- 構造化光スキャナー

第8章 3Dスキャナー市場:距離別

- イントロダクション

- 短距離

- 中距離

- 長距離

第9章 3Dスキャナー市場:技術別

- イントロダクション

- レーザー三角測量

- パターンフリンジ三角測量

- レーザーパルスベース

- レーザー位相シフトベース

第10章 3Dスキャナー市場:製品種類別

- イントロダクション

- 据置型

- 三脚搭載型

- 卓上型

第11章 3Dスキャナー市場:用途別

- イントロダクション

- 品質管理・検査

- リバースエンジニアリング

- 仮想シミュレーション

- その他の用途

第12章 3Dスキャナー市場:産業別

- イントロダクション

- 航空宇宙・防衛

- 民間航空機

- 防衛

- 宇宙

- 自動車

- 自動車設計・スタイリング

- パイロットプラント計測

- 自動車部品検査

- 建築・建設

- プラントスキャン

- 屋外・屋内スキャン

- 医学

- 歯科

- 整形外科

- 神経外科

- エレクトロニクス

- エネルギー・電力

- 水力発電

- 風力

- 石油化学

- 埋蔵物・遺跡保存

- 鉱業

- その他の産業

第13章 3Dスキャナー市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東

- アフリカ

- 南米

第14章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 上位5社の収益分析

- 市場シェア分析 (2022年)

- 企業評価クアドラント (2022年)

- 中小企業向け企業評価クアドラント (2022年)

- 3Dスキャナー市場:企業のフットプリント

- 競合ベンチマーキング

- 競合状況・動向

- 3Dスキャナー市場:製品の発売

- 3Dスキャナー市場:資本取引

第15章 企業プロファイル

- 主要企業

- HEXAGON AB

- TRIMBLE INC.

- FARO TECHNOLOGIES, INC.

- CARL ZEISS AG

- NIKON CORPORATION

- ARTEC EUROPE, S.A.R.L.

- CREAFORM

- CYBEROPTICS CORPORATION

- JENOPTIK AG

- MAPTEK PTY LTD.

- TOPCON CORPORATION

- その他の企業

- AUTOMATED PRECISION, INC.

- EVATRONIX SA

- KREON TECHNOLOGIES

- POLYGA INC.

- RANGEVISION LLC

- REVOPOINT 3D TECHNOLOGIES INC.

- RIEGL LASER MEASUREMENT SYSTEMS GMBH

- SCANTECH (HANGZHOU) CO., LTD.

- SHINING 3D TECH CO., LTD.

- SURPHASER

- SMARTTECH

- STONEX SRL

- THUNK3D

- ZOLLER & FROHLICH GMBH

- ZG TECHNOLOGY CO., LTD.

第16章 隣接・関連市場

- イントロダクション

- ロボットビジョン市場:地域別

第17章 付録

The global 3D scanners market size is projected to grow from USD 1.1 Billion in 2023 to USD 1.5 Billion by 2028, at a CAGR of 6.9% during the forecast period. Industry 4.0, referring to smart factories, is a new phase of the industrial revolution, linking the manufacturing industry, IT, and all associated activities. It is being adopted in manufacturing facilities to improve productivity by maximizing asset utilization, minimizing downtime, and improving labor efficiency. This is expected to enhance operations at all levels of the value chain, starting from the R&D stage to the end-user stage. The evolution of smart factories has driven demand for 3D metrology systems and 3D scanners.

" Structured light scanners segment is projected to grow at significant CAGR during the forecast period"

Structured light scanners use a series of light patterns projected on objects to be scanned, and cameras or sensors detect the distortions in the reflected patterns. One of the key advantages of structured light scanners is their speed. Instead of scanning one point at a time, structured light scanners scan multiple points or the entire field simultaneously. This minimizes or eliminates the issue of distortion caused by the motion. Aerospace & defense companies use 3D optical scanners for aircraft maintenance, repair, and overhaul (MRO), which is an indispensable requirement to guarantee that aircraft is maintained in pre-determined conditions of airworthiness for safe transportation. During the flight, aircraft experience bird and lightning strikes, resulting in deformation or damage. Therefore, airline companies are under increased pressure to conduct a thorough 3D inspection of their aircraft promptly to avoid accidents. This increasing requirement for 3D inspection across several production assemblies drives the demand for structured light scanners in the aerospace and defense industry.

"The market in Asia Pacific is expected to grow at the highest CAGR during the forecast period"

The 3D scanners market in Asia Pacific continues to flourish at a high rate owing to the increased economic growth witnessed by key countries such as China and Japan. The key countries contributing to the growth of the 3D scanners market in the Asia Pacific are Japan, China, India, and South Korea. The Asia Pacific market is growing due to rapid infrastructural developments taking place in the region. Several infrastructural development projects in the Asia Pacific are underway or scheduled to occur during the forecast period. The high growth of the 3D scanners market in the Asia Pacific can also be attributed to the ongoing infrastructural advancements and automation in the manufacturing industry of countries such as India and China. The region also has a growing defense aircraft manufacturing sector, showcasing significant demand for 3D scanners used in inspection. Furthermore, stringent government regulations for ensuring the safety of the workforce and machines in manufacturing facilities have resulted in a significant demand for 3D scanners.

Major players profiled in this report are as follows: Hexagon AB (Sweden), FARO Technologies, Inc. (US), Trimble Inc. (US), Nikon Corporation (Japan), Carl Zeiss AG (Germany) and others.

Research Coverage

In this report, the 3D scanners market has been segmented based on offering, type, technology, range, product type, application, industry, and region. The 3D scanners market based on offering has been segmented into hardware, software and services. Based on type, the market has been segmented into 3D laser scanners and structured light scanners. Based on range, the market has been segmented into short range, medium range, and long range. Based on technology, the market has been segmented into laser triangulation, pattern fringe triangulation, laser pulse based, and laser phase-shift based. Based on product type, the market has been segmented into tripod mounted, fixed, portable, and desktop. Based on application, the market has been segmented into reverse engineering, quality control & inspection, virtual simulation and other applications. Based on industry, the market has been segmented into automotive, medical, aerospace & defense, electronics, architecture & construction, energy & power, mining, artifact & heritage preservation and other industries. The study also forecasts the size of the market in four main regions-North America, Europe, Asia Pacific, and RoW.

Key Benefits of Buying the Report:

The report would help market leaders/new entrants in this market in the following ways:

This report segments of the 3D scanners market comprehensively and provides the closest approximation of the overall market size and subsegments that include offering, type, technology, range, product type, application, industry, and region.

The report would help stakeholders understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities pertaining to the 3D scanners market.

This report would help stakeholders understand their competitors better and gain more insights to enhance their position in the business.

The competitive landscape section includes the competitor ecosystem, as well as growth strategies such as product launches and acquisitions carried out by major market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 3D SCANNERS MARKET: SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 3D SCANNERS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 3 3D SCANNERS MARKET: RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for deriving market size by bottom-up analysis

- FIGURE 4 3D SCANNERS MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for deriving market size by top-down analysis

- FIGURE 5 3D SCANNERS MARKET: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR 3D SCANNERS MARKET: SUPPLY-SIDE ANALYSIS

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 8 ASSUMPTIONS

- 2.5 APPROACHES TO UNDERSTAND RECESSION IMPACT ON 3D SCANNERS MARKET

- 2.6 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 HARDWARE TO DOMINATE 3D SCANNERS MARKET FROM 2023 TO 2028

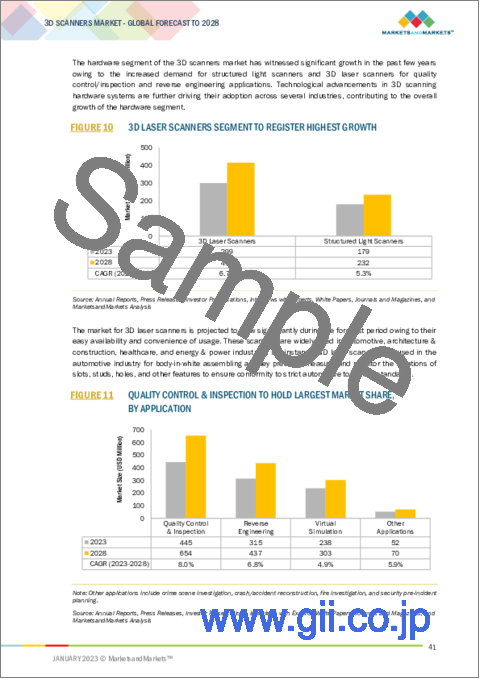

- FIGURE 10 3D LASER SCANNERS SEGMENT TO REGISTER HIGHEST GROWTH

- FIGURE 11 QUALITY CONTROL & INSPECTION TO HOLD LARGEST MARKET SHARE, BY APPLICATION

- FIGURE 12 AUTOMOTIVE SEGMENT TO DOMINATE 3D SCANNERS MARKET, BY INDUSTRY

- FIGURE 13 NORTH AMERICA TO HOLD LARGEST MARKET SHARE, BY REGION

- 3.1 3D SCANNERS MARKET: RECESSION IMPACT

- FIGURE 14 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 15 IMPACT OF RECESSION ON 3D SCANNERS MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN 3D SCANNERS MARKET

- FIGURE 16 GROWING MEDICAL INDUSTRY AND TECHNOLOGICAL ADVANCEMENT IN 3D SCANNERS TO DRIVE MARKET GROWTH

- 4.2 3D SCANNERS MARKET, BY RANGE

- FIGURE 17 SHORT-RANGE SCANNERS TO ACCOUNT FOR LARGEST SHARE

- 4.3 3D SCANNERS MARKET, BY TECHNOLOGY

- FIGURE 18 LASER TRIANGULATION TECHNOLOGY TO REGISTER HIGHEST CAGR

- 4.4 3D SCANNERS MARKET, BY APPLICATION

- FIGURE 19 QUALITY CONTROL & INSPECTION TO ACCOUNT FOR LARGEST SHARE IN 2028

- 4.5 NORTH AMERICA: 3D SCANNERS MARKET, BY INDUSTRY AND COUNTRY

- FIGURE 20 AUTOMOTIVE SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT SHARE

- 4.6 3D SCANNERS MARKET, BY COUNTRY

- FIGURE 21 CHINA TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 3D SCANNERS MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for 3D scanning in manufacturing

- 5.2.1.2 Growing importance of 3D data in product modeling and visualization

- 5.2.1.3 Increasing preference for 3D scanning over traditional inspection methods for quality control

- 5.2.1.4 Growing implementation of 3D scanning in medical industry

- 5.2.1.5 Rapid technological advancements in 3D scanning

- FIGURE 23 IMPACT OF DRIVERS ON 3D SCANNERS MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of substitutes

- FIGURE 24 IMPACT OF RESTRAINTS ON 3D SCANNERS MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing investments in Industry 4.0 adoption

- 5.2.3.2 Increasing adoption of 3D scanners in public safety

- FIGURE 25 IMPACT OF OPPORTUNITIES ON 3D SCANNERS MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexity of 3D scanning software solutions

- 5.2.4.2 High costs of using 3D scanners

- FIGURE 26 IMPACT OF CHALLENGES ON 3D SCANNERS MARKET

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 27 3D SCANNERS MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 28 3D SCANNERS MARKET: ECOSYSTEM ANALYSIS

- TABLE 2 3D SCANNERS MARKET ECOSYSTEM

- 5.5 PRICING ANALYSIS

- FIGURE 29 AVERAGE SELLING PRICES OF 3D SCANNERS, BY COMPANY (USD)

- TABLE 3 AVERAGE SELLING PRICES OF 3D SCANNERS, BY COMPANY (USD)

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- FIGURE 30 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 CLOUD-BASED SOLUTIONS

- 5.7.2 ARTIFICIAL INTELLIGENCE

- 5.7.3 5G

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 3D SCANNERS MARKET: PORTER'S FIVE FORCES ANALYSIS, 2022

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES, 2022

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES, 2022

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- 5.10 CASE STUDY ANALYSIS

- TABLE 7 CASE STUDY: ARTEC LEO HELPED VORTEQ CREATE FASTEST CYCLING SKINSUITS

- TABLE 8 CASE STUDY: 3D SCANNERS HELP DRIVE INNOVATION IN INSPECTION

- TABLE 9 CASE STUDY: USE OF POINT CLOUD DATA FOR AUTOMATIC INSPECTION MEASUREMENT

- TABLE 10 CASE STUDY: 3D SCANNER HELPED TO ACHIEVE ACCURATE AND FASTER MEASUREMENTS

- TABLE 11 CASE STUDY: 3D SCANNING FOR DESIGNING REPLACEMENT PIPING IN POWER PLANT

- 5.11 TRADE ANALYSIS

- FIGURE 33 IMPORT VALUE OF LASERS, BY COUNTRY, 2017-2021 (USD MILLION)

- FIGURE 34 EXPORT VALUE OF LASERS, BY COUNTRY, 2017-2021 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 12 US: TOP 20 PATENT OWNERS IN LAST 10 YEARS

- FIGURE 36 NUMBER OF PATENTS GRANTED PER YEAR, 2013-2022

- TABLE 13 3D SCANNERS MARKET: LIST OF PATENTS, 2020-2022

- 5.13 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 14 3D SCANNERS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1 STANDARDS

- TABLE 19 STANDARDS FOR 3D SCANNERS MARKET

6 3D SCANNERS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 37 3D SCANNERS MARKET: BY OFFERING

- FIGURE 38 3D SCANNERS MARKET, BY OFFERING, 2023 VS. 2028

- TABLE 20 3D SCANNERS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 21 3D SCANNERS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 HARDWARE

- 6.2.1 CONTINUOUS ADVANCEMENTS IN 3D SCANNING HARDWARE TO BOOST MARKET

- TABLE 22 3D SCANNING HARDWARE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 23 3D SCANNING HARDWARE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 24 3D SCANNING HARDWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 25 3D SCANNING HARDWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SOFTWARE

- 6.3.1 RISING ADOPTION OF AI TO FAVOR GROWTH

- TABLE 26 3D SCANNING SOFTWARE MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 27 3D SCANNING SOFTWARE MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 28 3D SCANNING SOFTWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 3D SCANNING SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 SERVICES

- 6.4.1 NEED FOR REGULAR HARDWARE AND SOFTWARE MAINTENANCE DRIVING SERVICES MARKET

- FIGURE 39 3D SCANNING SERVICES MARKET, BY TYPE, 2022

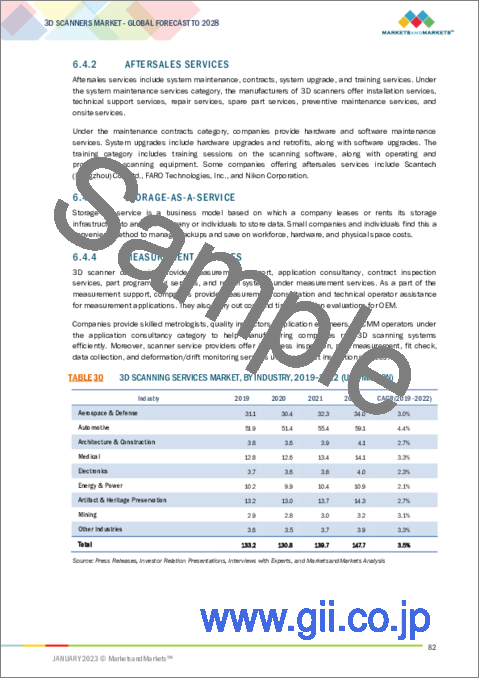

- 6.4.2 AFTERSALES SERVICES

- 6.4.3 STORAGE-AS-A-SERVICE

- 6.4.4 MEASUREMENT SERVICES

- TABLE 30 3D SCANNING SERVICES MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 31 3D SCANNING SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 32 3D SCANNING SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 33 3D SCANNING SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

7 3D SCANNERS MARKET, BY TYPE

- 7.1 INTRODUCTION

- TABLE 34 ADVANTAGES OF 3D LASER SCANNERS AND STRUCTURED LIGHT SCANNERS

- TABLE 35 DISADVANTAGES OF 3D LASER SCANNERS AND STRUCTURED LIGHT SCANNERS

- FIGURE 40 3D SCANNERS MARKET: BY TYPE

- FIGURE 41 3D LASER SCANNERS TO HOLD LARGEST MARKET SHARE

- TABLE 36 3D SCANNERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 37 3D SCANNERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2 3D LASER SCANNERS

- 7.2.1 RISING DEMAND FOR RAPID, NON-CONTACT MEASUREMENT TO DRIVE ADOPTION

- TABLE 38 3D LASER SCANNERS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 39 3D LASER SCANNERS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 40 3D LASER SCANNERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 41 3D LASER SCANNERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 STRUCTURED LIGHT SCANNERS

- 7.3.1 GROWING NEED FOR COST-EFFECTIVE SCANNING SOLUTIONS TO BOOST MARKET

- TABLE 42 STRUCTURED LIGHT SCANNERS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 43 STRUCTURED LIGHT SCANNERS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 44 STRUCTURED LIGHT SCANNERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 STRUCTURED LIGHT SCANNERS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 3D SCANNERS MARKET, BY RANGE

- 8.1 INTRODUCTION

- FIGURE 42 3D SCANNERS MARKET: BY RANGE

- TABLE 46 3D SCANNERS MARKET: RANGE COMPARISON

- FIGURE 43 SHORT-RANGE SCANNERS TO DOMINATE MARKET, BY RANGE

- TABLE 47 3D SCANNERS MARKET, BY RANGE, 2019-2022 (USD MILLION)

- TABLE 48 3D SCANNERS MARKET, BY RANGE, 2023-2028 (USD MILLION)

- 8.2 SHORT RANGE

- 8.2.1 HIGH DEMAND IN INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 8.3 MEDIUM RANGE

- 8.3.1 RISING USAGE IN ARCHITECTURE AND CONSTRUCTION TO SUPPORT GROWTH

- 8.4 LONG RANGE

- 8.4.1 GROWING DEMAND FOR HIGH ACCURACY IN LARGE-AREA SCANNING TO BOOST ADOPTION

9 3D SCANNERS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- FIGURE 44 3D SCANNERS MARKET: BY TECHNOLOGY

- FIGURE 45 LASER TRIANGULATION TO DOMINATE MARKET

- TABLE 49 3D SCANNERS MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 50 3D SCANNERS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 9.2 LASER TRIANGULATION

- 9.2.1 HIGH RESOLUTION AND ACCURACY TO BOOST GROWTH

- 9.3 PATTERN FRINGE TRIANGULATION

- 9.3.1 TECHNOLOGY ADOPTION TO RELY ON DEMAND FOR STRUCTURED LIGHT SCANNERS

- 9.4 LASER PULSE BASED

- 9.4.1 PRECISION IN MEASURING LARGE OBJECTS TO SUPPORT DEMAND

- 9.5 LASER PHASE-SHIFT BASED

- 9.5.1 GROWING DEMAND FOR AS-BUILT PLANS IN INDUSTRIES TO ENSURE GROWTH

10 3D SCANNERS MARKET, BY PRODUCT TYPE

- 10.1 INTRODUCTION

- FIGURE 46 3D SCANNERS MARKET: BY PRODUCT TYPE

- FIGURE 47 PORTABLE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 51 3D SCANNERS MARKET, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 52 3D SCANNERS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- 10.2 FIXED

- 10.2.1 HIGH DEMAND TO INSPECT CRITICAL COMPONENTS ACROSS INDUSTRIES TO DRIVE MARKET

- 10.2.1.1 Bridge CMM

- 10.2.1.2 Gantry CMM

- 10.2.1.3 Horizontal arm CMM

- 10.2.1 HIGH DEMAND TO INSPECT CRITICAL COMPONENTS ACROSS INDUSTRIES TO DRIVE MARKET

- 10.3 TRIPOD-MOUNTED

- 10.3.1 GROWING DEMAND FOR 3D SCANNING IN ARCHITECTURE AND CONSTRUCTION TO BOOST MARKET

- 10.4 PORTABLE 111 10.4.1 HIGH PORTABILITY AND CAPABILITY TO SCAN SMALL SPACES TO DRIVE ADOPTION

- 10.5 DESKTOP

- 10.5.1 GROWING NEED FOR 3D SCANNING OF COMPLEX OBJECTS TO SUPPORT GROWTH

11 3D SCANNERS MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 48 3D SCANNERS MARKET: BY APPLICATION

- FIGURE 49 QUALITY CONTROL & INSPECTION TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 53 3D SCANNERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 54 3D SCANNERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2 QUALITY CONTROL & INSPECTION

- 11.2.1 STRINGENT QUALITY STANDARDS IN CRITICAL INDUSTRIES TO DRIVE MARKET

- 11.3 REVERSE ENGINEERING

- 11.3.1 GROWING DEMAND FOR 3D MODELING AND PART RECONSTRUCTION TO PUSH ADOPTION

- 11.4 VIRTUAL SIMULATION

- 11.4.1 INCREASING USAGE OF REAL-TIME SIMULATION AND ANALYSIS PUSHING DEMAND SURGE

- 11.5 OTHER APPLICATIONS

12 3D SCANNERS MARKET, BY INDUSTRY

- 12.1 INTRODUCTION

- FIGURE 50 3D SCANNERS MARKET: BY INDUSTRY

- FIGURE 51 AUTOMOTIVE TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 55 3D SCANNERS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 56 3D SCANNERS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 12.2 AEROSPACE & DEFENSE

- 12.2.1 REQUIREMENT TO MAINTAIN HIGH QUALITY AND SAFETY STANDARDS TO DRIVE ADOPTION OF 3D SCANNERS

- 12.2.2 COMMERCIAL AIRCRAFT

- 12.2.3 DEFENSE

- 12.2.4 SPACE

- TABLE 57 3D SCANNERS MARKET FOR AEROSPACE & DEFENSE, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 58 3D SCANNERS MARKET FOR AEROSPACE & DEFENSE, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 59 3D SCANNERS MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 60 3D SCANNERS MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2023-2028 (USD MILLION)

- 12.3 AUTOMOTIVE

- 12.3.1 NEED FOR QUALITY INSPECTION AND REVERSE ENGINEERING TO DRIVE DEMAND FOR 3D SCANNERS

- 12.3.2 AUTOMOTIVE DESIGNING AND STYLING

- 12.3.3 PILOT PLANT METROLOGY

- 12.3.4 AUTOMOTIVE COMPONENT INSPECTION

- TABLE 61 3D SCANNERS MARKET FOR AUTOMOTIVE INDUSTRY, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 62 3D SCANNERS MARKET FOR AUTOMOTIVE INDUSTRY, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 63 3D SCANNERS MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 3D SCANNERS MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- 12.4 ARCHITECTURE & CONSTRUCTION

- 12.4.1 RISING DEMAND IN BUILDING MODELING AND SURVEYING TO AUGMENT MARKET

- 12.4.2 PLANT SCANNING

- 12.4.3 OUTDOOR AND INDOOR SCANNING

- TABLE 65 3D SCANNERS MARKET FOR ARCHITECTURE & CONSTRUCTION, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 66 3D SCANNERS MARKET FOR ARCHITECTURE & CONSTRUCTION, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 67 3D SCANNERS MARKET FOR ARCHITECTURE & CONSTRUCTION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 68 3D SCANNERS MARKET FOR ARCHITECTURE & CONSTRUCTION, BY REGION, 2023-2028 (USD MILLION)

- 12.5 MEDICAL

- 12.5.1 GROWING DEMAND IN DENTAL AND ORTHOPEDICS APPLICATIONS TO BOOST SCANNER USAGE

- 12.5.2 DENTAL

- 12.5.3 ORTHOPEDICS

- 12.5.4 NEUROSURGERY

- TABLE 69 3D SCANNERS MARKET FOR MEDICAL INDUSTRY, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 70 3D SCANNERS MARKET FOR MEDICAL INDUSTRY, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 71 3D SCANNERS MARKET FOR MEDICAL INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 3D SCANNERS MARKET FOR MEDICAL INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- 12.6 ELECTRONICS

- 12.6.1 GROWING INVESTMENTS IN SEMICONDUCTOR INDUSTRY TO SUPPORT GROWTH

- TABLE 73 3D SCANNERS MARKET FOR ELECTRONICS, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 74 3D SCANNERS MARKET FOR ELECTRONICS, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 75 3D SCANNERS MARKET FOR ELECTRONICS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 3D SCANNERS MARKET FOR ELECTRONICS, BY REGION, 2023-2028 (USD MILLION)

- 12.7 ENERGY & POWER

- 12.7.1 NEED FOR REGULAR INSPECTIONS TO DRIVE ADOPTION

- 12.7.2 HYDROPOWER

- 12.7.3 WIND POWER

- 12.7.4 PETROCHEMICALS

- TABLE 77 3D SCANNERS MARKET FOR ENERGY & POWER, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 78 3D SCANNERS MARKET FOR ENERGY & POWER, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 79 3D SCANNERS MARKET FOR ENERGY & POWER, BY REGION, 2019-2022 (USD MILLION)

- TABLE 80 3D SCANNERS MARKET FOR ENERGY & POWER, BY REGION, 2023-2028 (USD MILLION)

- 12.8 ARTIFACT & HERITAGE PRESERVATION

- 12.8.1 GROWING DEMAND FOR ACCURATE AND DETAILED SCANS FOR RENOVATION TO BOOST MARKET

- TABLE 81 3D SCANNING MARKET FOR ARTIFACT & HERITAGE PRESERVATION, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 82 3D SCANNING MARKET FOR ARTIFACT & HERITAGE PRESERVATION, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 83 3D SCANNING MARKET FOR ARTIFACT & HERITAGE PRESERVATION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 84 3D SCANNING MARKET FOR ARTIFACT & HERITAGE PRESERVATION, BY REGION, 2023-2028 (USD MILLION)

- 12.9 MINING

- 12.9.1 RAPID DETECTION CAPABILITIES TO ATTRACT END-USER INTEREST IN 3D SCANNING

- TABLE 85 3D SCANNERS MARKET FOR MINING, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 86 3D SCANNERS MARKET FOR MINING, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 87 3D SCANNERS MARKET FOR MINING, BY REGION, 2019-2022 (USD MILLION)

- TABLE 88 3D SCANNERS MARKET FOR MINING, BY REGION, 2023-2028 (USD MILLION)

- 12.10 OTHER INDUSTRIES

- TABLE 89 3D SCANNERS MARKET FOR OTHER INDUSTRIES, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 90 3D SCANNERS MARKET FOR OTHER INDUSTRIES, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 91 3D SCANNERS MARKET FOR OTHER INDUSTRIES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 92 3D SCANNERS MARKET FOR OTHER INDUSTRIES, BY REGION, 2023-2028 (USD MILLION)

13 3D SCANNERS MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 52 3D SCANNERS MARKET, BY REGION

- FIGURE 53 CHINA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 93 3D SCANNERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 94 3D SCANNERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.2 NORTH AMERICA

- FIGURE 54 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN 3D SCANNERS MARKET DURING FORECAST PERIOD

- FIGURE 55 NORTH AMERICA: 3D SCANNERS MARKET SNAPSHOT

- TABLE 95 NORTH AMERICA: 3D SCANNERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: 3D SCANNERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: 3D SCANNERS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: 3D SCANNERS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: 3D SCANNERS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: 3D SCANNERS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 13.2.1 US

- 13.2.1.1 US to hold largest share of North American market

- 13.2.2 CANADA

- 13.2.2.1 High demand in several industries to favor 3D scanners market

- 13.2.3 MEXICO

- 13.2.3.1 Growing automotive industry to boost market growth

- 13.3 EUROPE

- FIGURE 56 GERMANY TO REGISTER HIGHEST CAGR IN EUROPEAN 3D SCANNERS MARKET DURING FORECAST PERIOD

- FIGURE 57 EUROPE: 3D SCANNERS MARKET SNAPSHOT

- TABLE 101 EUROPE: 3D SCANNERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 102 EUROPE: 3D SCANNERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 103 EUROPE: 3D SCANNERS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 104 EUROPE: 3D SCANNERS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 105 EUROPE: 3D SCANNERS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 106 EUROPE: 3D SCANNERS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 13.3.1 GERMANY

- 13.3.1.1 Germany to dominate European market

- 13.3.2 UK

- 13.3.2.1 Huge aerospace and automotive manufacturing sectors to ensure strong demand

- 13.3.3 FRANCE

- 13.3.3.1 Growing investment in medical industry to augment growth

- 13.3.4 ITALY

- 13.3.4.1 Strong focus on strengthening manufacturing to drive market

- 13.3.5 SPAIN

- 13.3.5.1 High investments in automotive manufacturing to support growth

- 13.3.6 REST OF EUROPE

- 13.4 ASIA PACIFIC

- FIGURE 58 CHINA TO DOMINATE ASIA PACIFIC 3D SCANNERS MARKET

- FIGURE 59 ASIA PACIFIC: 3D SCANNERS MARKET SNAPSHOT

- TABLE 107 ASIA PACIFIC: 3D SCANNERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: 3D SCANNERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: 3D SCANNERS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: 3D SCANNERS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: 3D SCANNERS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: 3D SCANNERS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 13.4.1 CHINA

- 13.4.1.1 China held the largest share of Asia Pacific market in 2022

- 13.4.2 JAPAN

- 13.4.2.1 Rising aerospace and semiconductor industry to boost demand

- 13.4.3 SOUTH KOREA

- 13.4.3.1 Growing expansion by automotive manufacturers to augment growth

- 13.4.4 INDIA

- 13.4.4.1 Huge investments in developing manufacturing industry to favor market

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 ROW

- FIGURE 60 SOUTH AMERICA TO HOLD LARGEST SHARE OF ROW 3D SCANNERS MARKET DURING FORECAST PERIOD

- TABLE 113 ROW: 3D SCANNERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 114 ROW: 3D SCANNERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 115 ROW: 3D SCANNERS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 116 ROW: 3D SCANNERS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 117 ROW: 3D SCANNERS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 118 ROW: 3D SCANNERS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 13.5.1 MIDDLE EAST

- 13.5.1.1 Favorable government initiatives to drive market

- 13.5.2 AFRICA

- 13.5.2.1 Rising focus on infrastructure development to drive market

- 13.5.3 SOUTH AMERICA

- 13.5.3.1 High growth in automotive industry to boost demand

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 119 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 14.3 REVENUE ANALYSIS OF TOP FIVE COMPANIES

- FIGURE 61 3D SCANNERS MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2017-2021

- 14.4 MARKET SHARE ANALYSIS, 2022

- TABLE 120 3D SCANNERS MARKET SHARE ANALYSIS (2022)

- 14.5 COMPANY EVALUATION QUADRANT, 2022

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- FIGURE 62 3D SCANNERS MARKET: COMPANY EVALUATION QUADRANT, 2022

- 14.6 COMPANY EVALUATION QUADRANT FOR SMES, 2022

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- FIGURE 63 3D SCANNERS MARKET: COMPANY EVALUATION QUADRANT FOR SMES, 2022

- 14.7 3D SCANNERS MARKET: COMPANY FOOTPRINT

- TABLE 121 COMPANY FOOTPRINT

- TABLE 122 INDUSTRY: COMPANY FOOTPRINT

- TABLE 123 REGIONAL: COMPANY FOOTPRINT

- 14.8 COMPETITIVE BENCHMARKING

- TABLE 124 3D SCANNERS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 125 3D SCANNERS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 14.9 COMPETITIVE SITUATIONS AND TRENDS

- 14.9.1 3D SCANNERS MARKET: PRODUCT LAUNCHES

- 14.9.2 3D SCANNERS MARKET: DEALS

15 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 15.1 KEY PLAYERS

- 15.1.1 HEXAGON AB

- TABLE 126 HEXAGON AB: BUSINESS OVERVIEW

- FIGURE 64 HEXAGON AB: COMPANY SNAPSHOT

- TABLE 127 HEXAGON AB: PRODUCT OFFERINGS

- TABLE 128 HEXAGON AB: PRODUCT LAUNCHES

- TABLE 129 HEXAGON AB: DEALS

- 15.1.2 TRIMBLE INC.

- TABLE 130 TRIMBLE INC.: BUSINESS OVERVIEW

- FIGURE 65 TRIMBLE INC.: COMPANY SNAPSHOT

- TABLE 131 TRIMBLE INC.: PRODUCT OFFERINGS

- TABLE 132 TRIMBLE INC.: PRODUCT LAUNCHES

- 15.1.3 FARO TECHNOLOGIES, INC.

- TABLE 133 FARO TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 66 FARO TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 134 FARO TECHNOLOGIES, INC.: PRODUCT OFFERINGS

- TABLE 135 FARO TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 136 FARO TECHNOLOGIES, INC.: DEALS

- 15.1.4 CARL ZEISS AG

- TABLE 137 CARL ZEISS AG: BUSINESS OVERVIEW

- FIGURE 67 CARL ZEISS AG: COMPANY SNAPSHOT

- TABLE 138 CARL ZEISS AG: PRODUCT OFFERINGS

- TABLE 139 CARL ZEISS AG: PRODUCT LAUNCHES

- TABLE 140 CARL ZEISS AG: DEALS

- 15.1.5 NIKON CORPORATION

- TABLE 141 NIKON CORPORATION: BUSINESS OVERVIEW

- FIGURE 68 NIKON CORPORATION: COMPANY SNAPSHOT

- TABLE 142 NIKON CORPORATION: PRODUCT OFFERINGS

- TABLE 143 NIKON CORPORATION: PRODUCT LAUNCHES

- TABLE 144 NIKON CORPORATION: DEALS

- 15.1.6 ARTEC EUROPE, S.A.R.L.

- TABLE 145 ARTEC EUROPE, S.A.R.L.: BUSINESS OVERVIEW

- TABLE 146 ARTEC EUROPE, S.A.R.L.: PRODUCT OFFERINGS

- TABLE 147 ARTEC EUROPE, S.A.R.L.: PRODUCT LAUNCHES

- 15.1.7 CREAFORM

- TABLE 148 CREAFORM: BUSINESS OVERVIEW

- TABLE 149 CREAFORM: PRODUCT OFFERINGS

- TABLE 150 CREAFORM: PRODUCT LAUNCHES

- 15.1.8 CYBEROPTICS CORPORATION

- TABLE 151 CYBEROPTICS CORPORATION: BUSINESS OVERVIEW

- FIGURE 69 CYBEROPTICS CORPORATION: COMPANY SNAPSHOT

- TABLE 152 CYBEROPTICS CORPORATION: PRODUCT OFFERINGS

- 15.1.9 JENOPTIK AG

- TABLE 153 JENOPTIK AG: BUSINESS OVERVIEW

- FIGURE 70 JENOPTIK AG: COMPANY SNAPSHOT

- TABLE 154 JENOPTIK AG: PRODUCT OFFERINGS

- TABLE 155 JENOPTIK AG: DEALS

- 15.1.10 MAPTEK PTY LTD.

- TABLE 156 MAPTEK PTY LTD.: BUSINESS OVERVIEW

- TABLE 157 MAPTEK PTY LTD.: PRODUCT OFFERINGS

- 15.1.11 TOPCON CORPORATION

- TABLE 158 TOPCON CORPORATION: BUSINESS OVERVIEW

- FIGURE 71 TOPCON CORPORATION: COMPANY SNAPSHOT

- TABLE 159 TOPCON CORPORATION: PRODUCT OFFERINGS

- TABLE 160 TOPCON CORPORATION: PRODUCT LAUNCHES

- 15.2 OTHER PLAYERS

- 15.2.1 AUTOMATED PRECISION, INC.

- 15.2.2 EVATRONIX SA

- 15.2.3 KREON TECHNOLOGIES

- 15.2.4 POLYGA INC.

- 15.2.5 RANGEVISION LLC

- 15.2.6 REVOPOINT 3D TECHNOLOGIES INC.

- 15.2.7 RIEGL LASER MEASUREMENT SYSTEMS GMBH

- 15.2.8 SCANTECH (HANGZHOU) CO., LTD.

- 15.2.9 SHINING 3D TECH CO., LTD.

- 15.2.10 SURPHASER

- 15.2.11 SMARTTECH

- 15.2.12 STONEX SRL

- 15.2.13 THUNK3D

- 15.2.14 ZOLLER & FROHLICH GMBH

- 15.2.15 ZG TECHNOLOGY CO., LTD.

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- 16.2 ROBOTIC VISION MARKET, BY REGION

- TABLE 161 ROBOTIC VISION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 162 ROBOTIC VISION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 16.3 NORTH AMERICA

- TABLE 163 NORTH AMERICA: ROBOTIC VISION MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 164 NORTH AMERICA: ROBOTIC VISION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 165 NORTH AMERICA: ROBOTIC VISION MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 166 NORTH AMERICA: ROBOTIC VISION MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 16.3.1 US

- 16.3.1.1 US to hold largest share of robotic vision market in North America in 2021

- 16.3.2 CANADA

- 16.3.2.1 Rising government funding to drive growth of robotic vision market

- 16.3.3 MEXICO

- 16.3.3.1 Mexico to emerge as major manufacturing hub in North America

17 APPENDIX

- 17.1 INSIGHTS OF INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS