|

|

市場調査レポート

商品コード

1275436

航空機用透明材料の世界市場:用途別、航空機タイプ別(軍用航空、民間航空、ビジネス)、最終用途別(OEM、アフターマーケット)、材料別(ガラス、アクリル、ポリカーボネート)、地域別 - 2028年までの予測Aircraft Transparencies Market Application, by Aircraft Type (Military Aviation, Commercial Aviation, Business), End-Use (Oem, and Aftermarket), Material (Glass, Acrylic, and Polycarbonate), and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 航空機用透明材料の世界市場:用途別、航空機タイプ別(軍用航空、民間航空、ビジネス)、最終用途別(OEM、アフターマーケット)、材料別(ガラス、アクリル、ポリカーボネート)、地域別 - 2028年までの予測 |

|

出版日: 2023年05月15日

発行: MarketsandMarkets

ページ情報: 英文 216 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の航空機用透明材料の市場規模は、2023年に16億米ドルと推定され、2028年までに23億米ドルに達し、2023年から2028年までのCAGRで7.3%の成長が予測されています。

この市場の成長は、航空会社が燃料効率の向上、メンテナンスコストの削減、乗客の快適性の向上のために航空機の近代化に努めていることに起因していると考えられます。この動向には、古い航空機を退役させ、より新しい、より技術的に進んだモデルに置き換えることが含まれています。新しい航空機が導入されるにつれて、航空機用透明材料の需要は増加します。

予測期間中、アフターマーケットセグメントが最も高いCAGRを記録すると予測される

最終用途別では、航空機用透明材料市場のアフターマーケットセグメントが予測期間中に最も高い成長率を保持すると予測されます。航空機用透明材料市場のアフターマーケットセグメントは、航空機の老朽化、改修活動、規制対応、費用対効果、技術進歩、競合状況などにより、大きな成長が見込まれています。

航空機タイプ別では、民間航空セグメントが航空機用透明材料市場で優位に立つと予測される

航空機タイプ別では、予測期間中、民間航空セグメントが市場シェアを独占すると予測されます。これは主に、航空旅客数の増加、航空会社による機体の近代化および拡張の取り組み、旅客体験の向上に対する需要に起因します。民間航空セグメントには、国内線と国際線の両方を運航する大手航空会社が含まれており、新しい航空機や透明材料の交換ニーズが市場を牽引しています。さらに、民間航空部門は、燃料効率、規制遵守、技術的進歩に重点を置いており、航空機用透明材料市場における大きな市場シェアにさらに貢献しています。

2023年、北米が最大の市場シェアを占める見込み

航空機用透明材料市場業界は、北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカで調査されています。2023年に最大の市場シェアを占めたのは北米です。北米における航空機用透明材料の最大市場は、一般的に米国です。米国は航空産業において大きな存在感を示しており、多数の大手航空機メーカー、サプライヤー、オペレーターが同国を拠点としています。この強力な航空部門が、北米市場における航空機用透明材料の需要を牽引しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 貿易分析

- ケーススタディ分析

- 価格分析

- エコシステムマッピング

- バリューチェーン分析

- 技術分析

- 航空機用透明材料市場:ポーターのファイブフォース分析

- 景気後退の影響分析

- 主要な利害関係者と購入基準

- 数量データ

- 主な会議とイベント(2023年)

- 規制状況

第6章 業界動向

- イントロダクション

- サプライチェーン分析

- 技術分析

- メガトレンドの影響

- 特許分析

第7章 航空機用透明材料市場:材料別

- イントロダクション

- ガラス

- アクリル

- ポリカーボネート

第8章 航空機用透明材料市場:航空機タイプ別

- イントロダクション

- 民間航空

- ナローボディ航空機(NBA)

- ワイドボディ航空機(WBA)

- リージョナル輸送機(RTA)

- 商用ヘリコプター

- 軍用航空

- 戦闘機

- 輸送機

- 軍用ヘリコプター

- 特殊任務航空機

- ビジネス・ジェネラルアビエーション

- ビジネスジェット

- ジェネラルアビエーション

- 次世代エアモビリティ

- エアタクシー

- エアシャトル・エアメトロ

- パーソナルエアビークル

- 航空救急車・医療緊急車両

第9章 航空機用透明材料市場:用途別

- イントロダクション

- 窓

- フロントガラス

- キャノピー

- 着陸灯・翼端レンズ

- チンバブル

- キャビンインテリア(セパレーター)

- 天窓

第10章 航空機用透明材料市場:最終用途別

- イントロダクション

- OEM

- アフターマーケット

第11章 航空機用透明材料市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- インドネシア

- シンガポール

- 韓国

- その他のアジア太平洋地域

- 欧州

- フランス

- ドイツ

- 英国

- イタリア

- スペイン

- ロシア

- その他の欧州

- 中東・アフリカ

- イスラエル

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

第12章 競合情勢

- イントロダクション

- 主要企業の市場シェア分析(2022年)

- 上位企業5社の市場ランキング分析(2022年)

- 競合ベンチマーキング

- 企業の評価象限

- スタートアップ/中小企業の評価象限

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- PPG INDUSTRIES, INC.

- GKN AEROSPACE

- SAINT-GOBAIN

- GENERAL ELECTRIC COMPANY

- GENTEX CORPORATION

- BELL TEXTRON INC.

- LEE AEROSPACE

- ABLE 175 LEE AEROSPACE

- THE NORDAM GROUP LLC

- LLAMAS PLASTICS INC.

- SPARTECH

- MECAPLEX LTD.

- CONTROL LOGISTICS INC.

- PLEXIWEISS GMBH

- AEROPAIR LTD.

- TECH-TOOL PLASTICS, INC.

- CEE BAILEY'S AIRCRAFT PLASTICS

- THE WAG AERO GROUP

- LP AERO PLASTICS INC.

- AVIATIONGLASS & TECHNOLOGY B.V.

- その他の企業

- MICRO-SURFACE FINISHING PRODUCTS, INC.

- PACIFIC AERO TECH, LLC

- SOUNDAIR AVIATION

- MAGNETIC MRO AS

- DESSER AEROSPACE

- DART AEROSPACE

第14章 付録

The global market for aircraft transparencies market is estimated to be USD 1.6 billion in 2023 and expected to reach USD 2.3 billion by 2028 at a CAGR of 7.3% from 2023 to 2028. The growth of this market can be attributed to the airlines striving to modernize their fleets to improve fuel efficiency, reduce maintenance costs, and enhance passenger comfort. This trend involves retiring older aircraft and replacing them with newer, more technologically advanced models. As new aircraft are introduced, the demand for aircraft transparencies increases.

The aftermarket segment is projected to witness the highest CAGR during the forecast period.

Based on end-use, the aftermarket segment of the aircraft transparencies market is projected to hold the highest growth rate during the forecast period. Aftermarket segment in the aircraft transparencies market is expected to experience significant growth due to the aging aircraft fleet, retrofitting activities, regulatory compliance, cost-effectiveness, technological advancements, and the competitive market landscape.

The commercial aviation segment is projected to dominate the aircraft transparencies market by frequency

Based on aircraft type, the commercial aviation segment is projected to dominate the market share during the forecast period. This is primarily due to the increasing air passenger traffic, fleet modernization and expansion efforts by airlines, and the demand for enhanced passenger experience. The commercial aviation segment includes major airlines operating both domestic and international flights, and their need for new aircraft and transparency replacements drives the market. Additionally, the commercial aviation segment's focus on fuel efficiency, regulatory compliance, and technological advancements further contributes to its significant market share in the aircraft transparencies market.

North America is expected to account for the largest market share in 2023

The aircraft transparencies market industry has been studied in North America, Europe, Asia Pacific, Middle East and Africa and Latin America. North America accounted for the largest market share in 2023. The largest market for aircraft transparencies in North America is typically the United States. The United States has a significant presence in the aviation industry, with numerous major aircraft manufacturers, suppliers, and operators based in the country. This robust aviation sector drives the demand for aircraft transparencies in the North American market. The United States has a strong aerospace industry, with leading companies like Boeing and Lockheed Martin based in the country. These companies manufacture a large number of commercial and military aircraft, which require aircraft transparencies for windshields, windows, and canopies. The demand from these manufacturers drives the market for aircraft transparencies in the United States

The break-up of the profile of primary participants in the AIRCRAFT TRANSPARENCIES market:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level - 30%, Director Level - 20%, Others-50%

- By Region: North America -35%, Europe - 20%, Asia Pacific - 30%, Middle East & Africa - 10%, and Latin America - 5%

Prominent companies include PPG Industries, Inc. (US), GKN Aerospace (UK), Saint-Gobain (France), General Electric Company (US), and Gentex Corporation (US) among others.

Research Coverage:

This research report categorizes the aircraft transparencies market by application (windows, windshields, canopies, landing lights & wingtip lenses, chin bubbles, cabin interiors, and skylights), by aircraft type, (military aviation, commercial aviation, business & general aviation, and advanced air mobility), by end-use(oem, and aftermarket), by material (glass , acrylic, and polycarbonate), and region (North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the aircraft transparencies market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the aircraft transparencies market. Competitive analysis of upcoming startups in the aircraft transparencies market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aircraft transparencies market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on aircraft transparencies offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the aircraft transparencies market

- Market Development: Comprehensive information about lucrative markets - the report analyses the aircraft transparencies market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aircraft transparencies market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players in the aircraft transparencies market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES

- 1.5 INCLUSIONS AND EXCLUSIONS

- TABLE 2 AIRCRAFT TRANSPARENCIES MARKET: INCLUSIONS AND EXCLUSIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 AIRCRAFT TRANSPARENCIES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 High demand for aftermarket services

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.3.1 Need for minimizing operational limitations

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 SEGMENTS AND SUB-SEGMENTS

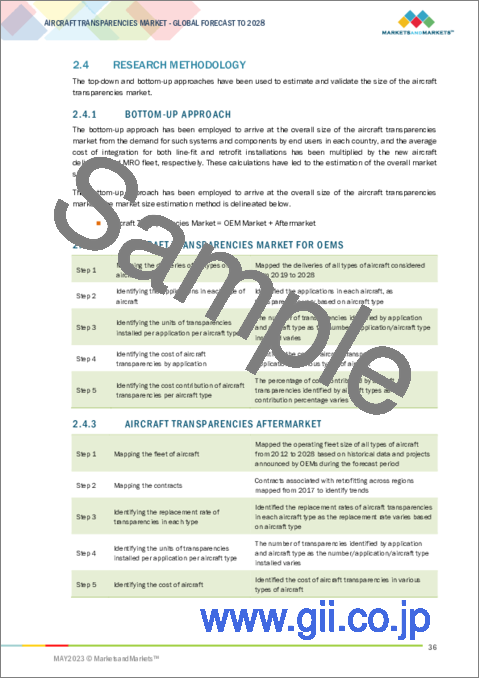

- 2.4 RESEARCH METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 AIRCRAFT TRANSPARENCIES MARKET FOR OEMS

- 2.4.3 AIRCRAFT TRANSPARENCIES AFTERMARKET

- FIGURE 3 BOTTOM-UP APPROACH

- 2.4.4 TOP-DOWN APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.5.1 DATA TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.6 GROWTH RATE ASSUMPTIONS

- 2.7 RECESSION IMPACT ANALYSIS

- FIGURE 6 MAJOR AIRCRAFT MANUFACTURERS' QUARTERLY REVENUE, 2022-2023

- 2.8 RESEARCH ASSUMPTIONS

- FIGURE 7 PARAMETRIC ASSUMPTIONS FOR MARKET FORECAST

- 2.9 RESEARCH LIMITATIONS

- 2.10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 POLYCARBONATE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 9 WINDOWS SEGMENT TO BE LARGEST APPLICATION OF AIRCRAFT TRANSPARENCIES IN 2023

- FIGURE 10 AFTERMARKET END-USE SEGMENT TO ACCOUNT FOR LARGER SHARE OF AIRCRAFT TRANSPARENCIES MARKET IN 2023

- FIGURE 11 AIRCRAFT TRANSPARENCIES MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN AIRCRAFT TRANSPARENCIES MARKET

- FIGURE 12 TECHNOLOGICAL ADVANCEMENTS IN AEROSPACE INDUSTRY TO DRIVE MARKET

- 4.2 AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE

- FIGURE 13 MILITARY AVIATION SEGMENT TO LEAD MARKET

- 4.3 AIRCRAFT TRANSPARENCIES MARKET, BY END-USE

- FIGURE 14 OEM SEGMENT TO LEAD MARKET

- 4.4 AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY

- FIGURE 15 AIRCRAFT TRANSPARENCIES MARKET IN FRANCE TO REGISTER HIGHEST CAGR

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 AIRCRAFT TRANSPARENCIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Modernization and technological advancements in aerospace industry

- 5.2.1.2 Adoption of aircraft transparencies to increase aircraft performance, efficiency, and safety

- 5.2.1.3 Rise in aircraft renewals and deliveries

- 5.2.1.4 Large fleets of commercial and military aircraft

- TABLE 3 REGIONAL OUTLOOK ON GROWTH OF AIR TRAFFIC, FLEET, AND AIRCRAFT DELIVERIES

- 5.2.1.5 Increasing use of UAVs and hybrid VTOLs

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of MRO services

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of advanced air mobility

- 5.2.3.2 Reduction in material costs

- 5.2.4 CHALLENGES

- 5.2.4.1 Legal and regulatory barriers

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR AIRCRAFT TRANSPARENCIES MANUFACTURERS

- FIGURE 17 REVENUE SHIFTS IN AIRCRAFT TRANSPARENCIES MARKET

- 5.4 TRADE ANALYSIS

- TABLE 4 IMPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, USD MILLION (2017-2021)

- TABLE 5 EXPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, USD MILLION (2017-2021)

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 WINDSHIELDS

- 5.5.2 CANOPIES

- 5.5.3 WINDOWS

- 5.6 PRICING ANALYSIS

- TABLE 6 AVERAGE SELLING PRICE RANGE: OEM AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION (2022)

- TABLE 7 AVERAGE SELLING PRICE RANGE: AFTERMARKET AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION (2022)

- 5.7 ECOSYSTEM MAPPING

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 PRIVATE AND SMALL ENTERPRISES

- 5.7.3 END USERS

- FIGURE 18 AIRCRAFT TRANSPARENCIES MARKET: ECOSYSTEM MAPPING

- TABLE 8 AIRCRAFT TRANSPARENCIES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 19 AIRCRAFT TRANSPARENCIES MARKET: VALUE CHAIN ANALYSIS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 COATINGS FOR AIRCRAFT TRANSPARENCIES

- 5.9.1.1 Indium Tin Oxide (ITO)

- 5.9.1.2 Polyurethane

- 5.9.1.3 Gold

- 5.9.1.4 Bismuth Oxide

- 5.9.1 COATINGS FOR AIRCRAFT TRANSPARENCIES

- 5.10 AIRCRAFT TRANSPARENCIES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 AIRCRAFT TRANSPARENCIES MARKET: IMPACT OF PORTER'S FIVE FORCES

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 RECESSION IMPACT ANALYSIS

- FIGURE 21 AIRCRAFT TRANSPARENCIES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 22 FACTORS IMPACTING AIRCRAFT TRANSPARENCIES MARKET IN 2022-2023

- FIGURE 23 PROBABLE SCENARIO OF IMPACT ON AIRCRAFT TRANSPARENCIES MARKET

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT TRANSPARENCIES

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AIRCRAFT TRANSPARENCIES (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR AIRCRAFT TRANSPARENCIES

- TABLE 11 KEY BUYING CRITERIA FOR AIRCRAFT TRANSPARENCIES

- 5.13 VOLUME DATA

- TABLE 12 AIRCRAFT TRANSPARENCIES OEM MARKET, BY AIRCRAFT TYPE (UNITS)

- TABLE 13 AIRCRAFT TRANSPARENCIES AFTERMARKET, BY AIRCRAFT TYPE (UNITS)

- 5.14 KEY CONFERENCES AND EVENTS IN 2023

- TABLE 14 AIRCRAFT TRANSPARENCIES MARKET: KEY CONFERENCES AND EVENTS

- 5.15 REGULATORY LANDSCAPE

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

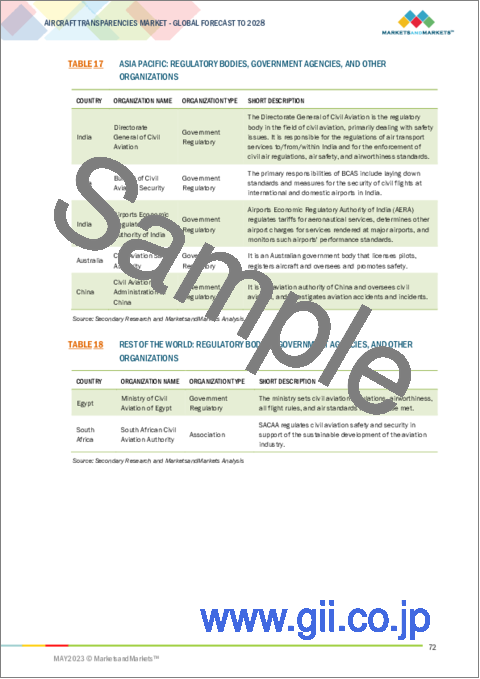

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 26 AIRCRAFT TRANSPARENCIES MARKET: SUPPLY CHAIN ANALYSIS

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 ELECTRONICALLY DIMMABLE AIRCRAFT WINDOWS

- 6.3.2 WINDOWLESS AIRCRAFT

- 6.3.3 AIRCRAFT GLAZING

- 6.3.4 PANORAMIC WINDOWS

- 6.3.5 TRANSPARENCY COATING

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 IMPLEMENTATION OF INDUSTRY 4.0

- 6.4.2 GLOBALIZATION OF SUPPLY CHAIN FOR AIRCRAFT TRANSPARENCIES MANUFACTURING

- 6.5 PATENT ANALYSIS

7 AIRCRAFT TRANSPARENCIES MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- FIGURE 27 POLYCARBONATE TO BE LARGEST MATERIAL SEGMENT DURING FORECAST PERIOD

- TABLE 19 AIRCRAFT TRANSPARENCIES MARKET, BY MATERIAL, 2019-2022 (USD MILLION)

- TABLE 20 AIRCRAFT TRANSPARENCIES MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- 7.2 GLASS

- 7.2.1 DEMAND FOR SMART GLASS IN AIRCRAFT WINDOWS AND WINDSHIELDS

- 7.3 ACRYLIC

- 7.3.1 AMONG PUREST PLASTICS USED IN AIRCRAFT PARTS

- 7.4 POLYCARBONATE

- 7.4.1 LIGHTWEIGHT AND HIGH-PERFORMANCE PLASTIC

8 AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE

- 8.1 INTRODUCTION

- FIGURE 28 COMMERCIAL AVIATION SEGMENT TO LEAD DURING FORECAST PERIOD

- TABLE 21 AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 22 AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- 8.2 COMMERCIAL AVIATION

- 8.2.1 NARROW BODY AIRCRAFT (NBA)

- 8.2.1.1 Airbus ramping up production of NBA

- 8.2.2 WIDE BODY AIRCRAFT (WBA)

- 8.2.2.1 To be fastest-growing segment of commercial aviation

- 8.2.3 REGIONAL TRANSPORT AIRCRAFT (RTA)

- 8.2.3.1 US and India to drive demand

- 8.2.4 COMMERCIAL HELICOPTERS

- 8.2.4.1 Used to conduct missions, including emergency medical service missions

- 8.2.1 NARROW BODY AIRCRAFT (NBA)

- 8.3 MILITARY AVIATION

- 8.3.1 FIGHTER AIRCRAFT

- 8.3.1.1 Growing concerns over border tensions to boost fighter aircraft procurement

- 8.3.2 TRANSPORT AIRCRAFT

- 8.3.2.1 To grow at slower rate than military aviation aircraft

- 8.3.3 MILITARY HELICOPTERS

- 8.3.3.1 Increasing use in medical evacuation, parachute drop, and search and rescue

- 8.3.4 SPECIAL MISSION AIRCRAFT

- 8.3.4.1 Growing defense spending and territorial disputes

- 8.3.1 FIGHTER AIRCRAFT

- 8.4 BUSINESS & GENERAL AVIATION

- 8.4.1 BUSINESS JETS

- 8.4.1.1 Rise in demand for private/corporate jets

- 8.4.2 GENERAL AVIATION

- 8.4.2.1 Increasing use of lightweight materials

- 8.4.1 BUSINESS JETS

- 8.5 ADVANCED AIR MOBILITY

- 8.5.1 AIR TAXIS

- 8.5.1.1 Need for on-demand urban transportation

- 8.5.2 AIR SHUTTLES AND AIR METROS

- 8.5.2.1 Require electric motors for take-off and propulsion

- 8.5.3 PERSONAL AERIAL VEHICLES

- 8.5.3.1 Used for point-to-point pick-up and drop services

- 8.5.4 AIR AMBULANCES AND MEDICAL EMERGENCY VEHICLES

- 8.5.4.1 Serve medical emergency services

- 8.5.1 AIR TAXIS

9 AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 29 WINDOWS SEGMENT TO LEAD AIRCRAFT TRANSPARENCIES MARKET DURING FORECAST PERIOD

- TABLE 23 AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 24 AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 WINDOWS

- 9.2.1 ASIA PACIFIC, NORTH AMERICA, AND EUROPE TO LEAD MARKET

- 9.3 WINDSHIELDS

- 9.3.1 LIGHTWEIGHT ACRYLIC MATERIALS WIDELY USED IN AIRCRAFT WINDSHIELDS

- 9.4 CANOPIES

- 9.4.1 ADVANCEMENTS IN MATERIALS SUCH AS MONOLITHIC POLYCARBONATE

- 9.5 LANDING LIGHTS & WINGTIP LENSES

- 9.5.1 GROWING CONCERNS OVER PILOT & PASSENGER SAFETY

- 9.6 CHIN BUBBLES

- 9.6.1 PRIMARILY USED FOR HELICOPTER DOORS

- 9.7 CABIN INTERIORS (SEPARATORS)

- 9.7.1 INVOLVE USE OF COMPOSITES AND REAL THIN GLASS

- 9.8 SKYLIGHTS

- 9.8.1 COMPOSITE & LIGHTWEIGHT MATERIALS IN SKYLIGHTS PROVIDE DURABILITY

10 AIRCRAFT TRANSPARENCIES MARKET, BY END-USE

- 10.1 INTRODUCTION

- FIGURE 30 AFTERMARKET SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 25 AIRCRAFT TRANSPARENCIES MARKET, BY END-USE, 2019-2022 (USD MILLION)

- TABLE 26 AIRCRAFT TRANSPARENCIES MARKET, BY END-USE, 2023-2028 (USD MILLION)

- 10.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

- 10.2.1 LINE-FIT OPTIONS TO REDUCE TIME CONSUMED IN INSTALLING AIRCRAFT TRANSPARENCIES

- 10.3 AFTERMARKET

- 10.3.1 INCREASING AIRCRAFT FLEET SIZE WITH MORE PASSENGER-FRIENDLY FEATURES

11 AIRCRAFT TRANSPARENCIES MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 31 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN AIRCRAFT TRANSPARENCIES MARKET IN 2023

- 11.1.1 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 27 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 28 AIRCRAFT TRANSPARENCIES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 AIRCRAFT TRANSPARENCIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 32 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET SNAPSHOT

- 11.2.1 PESTLE ANALYSIS: NORTH AMERICA

- TABLE 30 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Presence of leading OEMs and MRO providers

- TABLE 36 US: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 37 US: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 38 US: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 39 US: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Aircraft modernization programs

- TABLE 40 CANADA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 41 CANADA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 42 CANADA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 43 CANADA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3 ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET SNAPSHOT

- 11.3.1 PESTLE ANALYSIS: ASIA PACIFIC

- TABLE 44 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 45 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 47 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 49 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.2 CHINA

- 11.3.2.1 Growing number of aging fleets

- TABLE 50 CHINA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 51 CHINA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 52 CHINA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 53 CHINA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.3 INDIA

- 11.3.3.1 Improving capabilities of domestic aerospace industry

- TABLE 54 INDIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 55 INDIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 56 INDIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 57 INDIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.4 JAPAN

- 11.3.4.1 Increasing in-house development of aircraft

- TABLE 58 JAPAN: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 59 JAPAN: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 60 JAPAN: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 61 JAPAN: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.5 AUSTRALIA

- 11.3.5.1 Growth in air traffic and new aircraft deliveries

- TABLE 62 AUSTRALIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 63 AUSTRALIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 64 AUSTRALIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 65 AUSTRALIA AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.6 INDONESIA

- 11.3.6.1 Burgeoning middle-class population with high demand for travel

- TABLE 66 INDONESIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 67 INDONESIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 68 INDONESIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 69 INDONESIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.7 SINGAPORE

- 11.3.7.1 Thriving UAM ecosystem

- TABLE 70 SINGAPORE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 71 SINGAPORE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 72 SINGAPORE: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 73 SINGAPORE: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.8 SOUTH KOREA

- 11.3.8.1 Launch of UAM services by 2025

- TABLE 74 SOUTH KOREA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 75 SOUTH KOREA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 76 SOUTH KOREA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 77 SOUTH KOREA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.9 REST OF ASIA PACIFIC

- TABLE 78 REST OF ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 79 REST OF ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 80 REST OF ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 81 REST OF ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4 EUROPE

- FIGURE 34 EUROPE: AIRCRAFT TRANSPARENCIES MARKET SNAPSHOT

- 11.4.1 PESTLE ANALYSIS

- TABLE 82 EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 83 EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 84 EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 85 EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 86 EUROPE: AIRCRAFT TRANSPARENCIES MARKET BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 87 EUROPE: AIRCRAFT TRANSPARENCIES MARKET BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.2 FRANCE

- 11.4.2.1 Heavy investments in aerospace industry

- TABLE 88 FRANCE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 89 FRANCE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 90 FRANCE: AIRCRAFT TRANSPARENCIES MARKET BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 91 FRANCE: AIRCRAFT TRANSPARENCIES MARKET BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.3 GERMANY

- 11.4.3.1 Growing investments in air travel and connectivity

- TABLE 92 GERMANY: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 93 GERMANY: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 94 GERMANY: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 95 GERMANY: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.4 UK

- 11.4.4.1 Consistent increase in number of passengers arriving and departing at airport terminals

- TABLE 96 UK: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 97 UK: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 98 UK: AIRCRAFT TRANSPARENCIES MARKET BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 99 UK: AIRCRAFT TRANSPARENCIES MARKET BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.5 ITALY

- 11.4.5.1 High demand for civil and corporate helicopters

- TABLE 100 ITALY: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 101 ITALY: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 102 ITALY: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 103 ITALY: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.6 SPAIN

- 11.4.6.1 Strategic investment plans with EU and Airbus

- TABLE 104 SPAIN: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 105 SPAIN: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 106 SPAIN: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 107 SPAIN: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.7 RUSSIA

- 11.4.7.1 Increase in defense spending

- TABLE 108 RUSSIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 109 RUSSIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 110 RUSSIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 111 RUSSIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.8 REST OF EUROPE

- TABLE 112 REST OF EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 113 REST OF EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 115 REST OF EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 PESTLE ANALYSIS

- TABLE 116 MIDDLE EAST & AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.2 ISRAEL

- 11.5.2.1 Increased expenditure on R&D of UAVs for military and commercial applications

- TABLE 122 ISRAEL: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 123 ISRAEL: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 124 ISRAEL: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 125 ISRAEL: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.3 UAE

- 11.5.3.1 Widescale adoption of advanced air mobility platform for commercial applications

- TABLE 126 UAE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 127 UAE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 128 UAE: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 129 UAE: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.4 SAUDI ARABIA

- 11.5.4.1 Aviation sector modernization programs

- TABLE 130 SAUDI ARABIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 131 SAUDI ARABIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 132 SAUDI ARABIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 133 SAUDI ARABIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Development of airport infrastructure

- TABLE 134 SOUTH AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 135 SOUTH AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 136 SOUTH AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 137 SOUTH AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6 LATIN AMERICA

- 11.6.1 PESTLE ANALYSIS

- TABLE 138 LATIN AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 139 LATIN AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 140 LATIN AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 141 LATIN AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 142 LATIN AMERICA: AIRCRAFT TRANSPARENCIES SIZE, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 143 LATIN AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.2 BRAZIL

- 11.6.2.1 Presence of OEMs and growth opportunities for airlines

- TABLE 144 BRAZIL: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 145 BRAZIL: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 146 BRAZIL: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 147 BRAZIL: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.3 MEXICO

- 11.6.3.1 Manufacturing hub for aerospace industry

- TABLE 148 MEXICO: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 149 MEXICO: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 150 MEXICO: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 151 MEXICO: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- TABLE 152 AIRCRAFT TRANSPARENCIES MARKET: DEGREE OF COMPETITION

- FIGURE 35 SHARE OF TOP PLAYERS IN AIRCRAFT TRANSPARENCIES MARKET, 2022

- 12.2.1 COMPANIES ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGY FROM 2019 TO 2022

- 12.3 MARKET RANKING ANALYSIS FOR TOP 5 PLAYERS, 2022

- FIGURE 36 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2022

- 12.4 COMPETITIVE BENCHMARKING

- TABLE 153 COMPANY PRODUCT FOOTPRINT

- TABLE 154 COMPANY APPLICATION FOOTPRINT

- TABLE 155 COMPANY AIRCRAFT TYPE FOOTPRINT

- TABLE 156 COMPANY REGION FOOTPRINT

- 12.5 COMPANY EVALUATION QUADRANT

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 37 MARKET COMPETITIVE LEADERSHIP MAPPING, 2022

- 12.6 START-UP/SME EVALUATION QUADRANT

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 STARTING BLOCKS

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 38 AIRCRAFT TRANSPARENCIES MARKET: COMPETITIVE LEADERSHIP MAPPING OF START-UPS/SMES, 2022

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 MARKET EVALUATION FRAMEWORK

- 12.7.2 RECENT DEVELOPMENTS

- TABLE 157 DEALS, 2019-2023

13 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 PPG INDUSTRIES, INC.

- TABLE 158 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 39 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 159 PPG INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 PPG INDUSTRIES, INC.: DEALS

- 13.2.2 GKN AEROSPACE

- TABLE 161 GKN AEROSPACE: COMPANY OVERVIEW

- TABLE 162 GKN AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 GKN AEROSPACE: OTHERS

- TABLE 164 GKN AEROSPACE: DEALS

- 13.2.3 SAINT-GOBAIN

- TABLE 165 SAINT-GOBAIN: COMPANY OVERVIEW

- FIGURE 40 SAINT-GOBAIN: COMPANY SNAPSHOT

- TABLE 166 SAINT-GOBAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.4 GENERAL ELECTRIC COMPANY

- TABLE 167 GENERAL ELECTRIC COMPANY: COMPANY OVERVIEW

- FIGURE 41 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

- TABLE 168 GENERAL ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.5 GENTEX CORPORATION

- TABLE 169 GENTEX CORPORATION: COMPANY OVERVIEW

- FIGURE 42 GENTEX CORPORATION: COMPANY SNAPSHOT

- TABLE 170 GENTEX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 GENTEX CORPORATION: DEALS

- 13.2.6 BELL TEXTRON INC.

- TABLE 172 BELL TEXTRON INC.: COMPANY OVERVIEW

- TABLE 173 BELL TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 BELL TEXTRON INC.: DEALS

- 13.2.7 LEE AEROSPACE

- ABLE 175 LEE AEROSPACE: COMPANY OVERVIEW

- TABLE 176 LEE AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 LEE AEROSPACE: DEALS

- 13.2.8 THE NORDAM GROUP LLC

- TABLE 178 THE NORDAM GROUP LLC: COMPANY OVERVIEW

- TABLE 179 THE NORDAM GROUP LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.9 LLAMAS PLASTICS INC.

- TABLE 180 LLAMAS PLASTICS INC.: COMPANY OVERVIEW

- TABLE 181 LLAMAS PLASTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.10 SPARTECH

- TABLE 182 SPARTECH: COMPANY OVERVIEW

- TABLE 183 SPARTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.11 MECAPLEX LTD.

- TABLE 184 MECAPLEX LTD.: COMPANY OVERVIEW

- TABLE 185 MECAPLEX LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.12 CONTROL LOGISTICS INC.

- TABLE 186 CONTROL LOGISTICS INC.: COMPANY OVERVIEW

- TABLE 187 CONTROL LOGISTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.13 PLEXIWEISS GMBH

- TABLE 188 PLEXIWEISS GMBH: COMPANY OVERVIEW

- TABLE 189 PLEXIWEISS GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.14 AEROPAIR LTD.

- TABLE 190 AEROPAIR LTD.: COMPANY OVERVIEW

- TABLE 191 AEROPAIR LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.15 TECH-TOOL PLASTICS, INC.

- TABLE 192 TECH-TOOL PLASTICS, INC.: COMPANY OVERVIEW

- TABLE 193 TECH-TOOL PLASTICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.16 CEE BAILEY'S AIRCRAFT PLASTICS

- TABLE 194 CEE BAILEY'S AIRCRAFT PLASTICS: COMPANY OVERVIEW

- TABLE 195 CEE BAILEY'S AIRCRAFT PLASTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.17 THE WAG AERO GROUP

- TABLE 196 THE WAG AERO GROUP: COMPANY OVERVIEW

- TABLE 197 THE WAG AERO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.18 LP AERO PLASTICS INC.

- TABLE 198 LP AERO PLASTICS INC.: COMPANY OVERVIEW

- TABLE 199 LP AERO PLASTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.19 AVIATIONGLASS & TECHNOLOGY B.V.

- TABLE 200 AVIATIONGLASS & TECHNOLOGY B.V.: COMPANY OVERVIEW

- TABLE 201 AVIATIONGLASS & TECHNOLOGY B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 13.3 OTHER PLAYERS

- 13.3.1 MICRO-SURFACE FINISHING PRODUCTS, INC.

- TABLE 202 MICRO-SURFACE FINISHING PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 203 MICRO-SURFACE FINISHING PRODUCTS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.3.2 PACIFIC AERO TECH, LLC

- TABLE 204 PACIFIC AERO TECH, LLC: COMPANY OVERVIEW

- TABLE 205 PACIFIC AERO TECH, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.3.3 SOUNDAIR AVIATION

- TABLE 206 SOUNDAIR AVIATION: COMPANY OVERVIEW

- TABLE 207 SOUNDAIR AVIATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.3.4 MAGNETIC MRO AS

- TABLE 208 MAGNETIC MRO AS: COMPANY OVERVIEW

- TABLE 209 MAGNETIC MRO AS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.3.5 DESSER AEROSPACE

- TABLE 210 DESSER AEROSPACE: COMPANY OVERVIEW

- TABLE 211 DESSER AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.3.6 DART AEROSPACE

- TABLE 212 DART AEROSPACE: COMPANY OVERVIEW

- TABLE 213 DART AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS