|

|

市場調査レポート

商品コード

1297939

ダークファイバーの世界市場:シングルモードファイバー別、マルチモードファイバー別、ネットワークの種類別 (メトロ、長距離)、材料別 (ガラス、プラスチック)、エンドユーザー別 (通信、BFSI、航空宇宙、石油・ガス、医療)・地域別の将来予測 (2028年まで)Dark Fiber Market by Single-mode Fiber, Multimode Fiber (Step-index, Graded-Index), Network Type (Metro, Long Haul), Material (Glass, Plastic), End User (Telecommunication, BFSI, Aerospace, Oil & Gas, Healthcare) & Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ダークファイバーの世界市場:シングルモードファイバー別、マルチモードファイバー別、ネットワークの種類別 (メトロ、長距離)、材料別 (ガラス、プラスチック)、エンドユーザー別 (通信、BFSI、航空宇宙、石油・ガス、医療)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月22日

発行: MarketsandMarkets

ページ情報: 英文 237 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のダークファイバーの市場規模は、2023年の66億米ドルから、2028年には119億米ドルに達し、2023年から2028年の間に12.5%のCAGRで成長すると予測されています。

5Gネットワークに対する需要の高まり、インターネット帯域幅に対する需要の増加、信頼性が高く安全なネットワークに対する需要の高まりが、ダークファイバー市場の成長を促進すると予想されます。しかし、高い初期投資と定期的なメンテナンスがダークファイバー市場の成長を制限しています。

"エンドユーザー別では、銀行・金融サービス・保険 (BFSI) セグメントが予測期間中に第2位の市場シェアを占める"

プライベートダークファイバーネットワークは、金融機関のデータセンター接続に必要な制御とセキュリティを提供します。ダークファイバーは、事業継続性 (BC) と災害復旧 (DR) の信頼性を向上させ、痛みを伴わないようにするために使用されます。ダークファイバーは、BFSI機関の帯域幅需要の増大に対応する拡張性を提供します。データ要件の増加に伴い、ダークファイバーはインフラを大幅にアップグレードすることなく、より高いデータレートをサポートすることができます。このスケーラビリティにより、BFSI機関は、新たなネットワークインフラへの中断や大規模な投資をすることなく、進化する技術動向、データ量の増加、新たな用途に適応することができます。ダークファイバーは、BFSI組織の災害復旧および事業継続戦略において重要な役割を果たすことができます。ダークファイバーを通じて冗長接続を確立することで、金融機関は地理的に多様で独立したネットワーク経路を構築できます。ある場所でネットワーク障害や災害が発生した場合、トラフィックを代替経路にシームレスに迂回させることができるため、サービスの中断がなく、ダウンタイムを最小限に抑えることができます。銀行や金融サービス企業では、ファイル共有、大容量ファイル転送、ビジネスインテリジェンス (BI) 用途、データ分析など、帯域幅を必要とするコアトランスポートにダークファイバーを利用するケースが増えています。

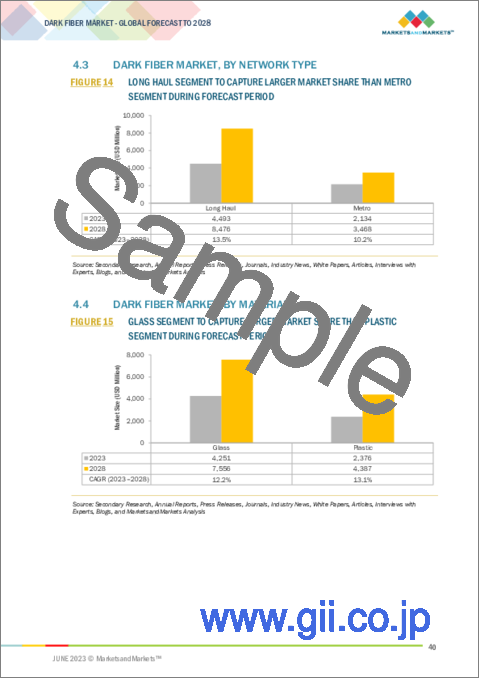

"長距離ネットワークのセグメントが予測期間中に高い成長を遂げる"

長距離ネットワークの導入は、さまざまな地域にまたがる高速で信頼性の高い接続に対する需要の高まりに対応するために増加しています。デジタルサービス、クラウドコンピューティング、ストリーミングメディア、モノのインターネット (IoT) デバイスの普及により、データトラフィックが急激に増加しています。長距離ネットワークは、この大量のデータを効率的に長距離輸送するために不可欠です。IXPの増加により、長距離ネットワークの需要が高まっています。IXPは、複数のネットワークがトラフィックを交換する主要な相互接続ハブとして機能します。異なる地域にあるネットワーク間のデータ交換を効率的に行うには、堅牢な長距離ネットワークが必要です。5Gネットワークの展開には、データレートの向上と低遅延をサポートする堅牢なバックホール・インフラが必要です。長距離ネットワーク、特に光ファイバーネットワークは、5G基地局に大容量のバックホール接続を提供する上で重要な役割を果たします。需要の増加に対応するため、通信会社、インフラプロバイダー、政府は、長距離ネットワークの拡張とアップグレード、新しい海底ケーブルの配備、光ファイバーネットワークの拡大、長距離接続を強化するための革新的技術の探求に投資を続けています。

"材料別では、プラスチックのセグメントが予測期間中に高成長が見込まれる"

プラスチックのセグメントは予測期間中、高成長が見込まれます。プラスチックファイバーは超短距離通信や民生用途に使用されるのに対し、グラスファイバーは短・中距離通信や長距離通信に使用されます。プラスチックファイバーは、電磁干渉 (EMI) や無線周波数干渉 (RFI) の影響を受けにくいです。またグラスファイバーと違って電気を通さないため、外部干渉源に対する耐性が高くなります。この特性により、プラスチックファイバーは、高レベルの電磁ノイズが存在する環境や、接地やシールドの要件が難しい環境に適しています。グラスファイバーに対するプラスチックファイバーの主な利点は、曲げや伸ばしに強いことです。

"欧州が予測期間中に地域別で大きなシェアを占める"

予測期間中、欧州がダークファイバー市場で大きなシェアを占めると予想されています。2022年の世界のダークファイバー市場において、欧州は第2位のシェアを占めています。ISPと通信産業の急成長は、この地域の市場を牽引する大きな要因の一つです。テレワーク、遠隔医療相談、ビデオオンデマンドなどの新しいデジタル用途がダークファイバーの需要を加速しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- エコシステム分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- 技術分析

- ダークファイバーの平均レンタルサービス価格

- 貿易分析

- 特許分析 (2019年~2022年)

- 関税

- 規制基準

第6章 ダークファイバー市場:種類別

- イントロダクション

- シングルモードファイバー

- マルチモードファイバー

- ステップインデックス (SI) マルチモードファイバー

- グレーデッドインデック (GI) スマルチモードファイバー

第7章 ダークファイバー市場:ネットワークの種類別

- イントロダクション

- メトロ

- 長距離

第8章 ダークファイバー市場:材料別

- イントロダクション

- ガラス

- プラスチック

第9章 ダークファイバー市場:エンドユーザー別

- イントロダクション

- インターネットサービスプロバイダー (ISP)・通信業界

- 銀行・金融サービス・保険 (BFSI) 産業

- IT対応サービス (ITeS)

- 軍事・航空宇宙産業

- 石油・ガス産業

- 医療産業

- 鉄道産業

- その他

第10章 ダークファイバー市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- その他の地域 (ROW)

- 中東・アフリカ

- 南米

第11章 競合情勢

- イントロダクション

- 上位5社の収益分析

- 市場シェア分析 (2022年)

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競争シナリオと動向

第12章 企業プロファイル

- 主要企業

- AT&T

- VERIZON COMMUNICATIONS, INC.

- CENTURYLINK, INC. (LUMEN TECHNOLOGIES)

- CONSOLIDATED COMMUNICATIONS

- EXA INFRASTRUCTURE (GTT COMMUNICATIONS)

- COMCAST CORPORATION

- COLT TECHNOLOGY SERVICES GROUP LIMITED

- NTT COMMUNICATIONS CORPORATION

- WINDSTREAM COMMUNICATIONS

- ZAYO GROUP, LLC

- その他の企業

- GLOBALCONNECT GROUP

- DARK FIBRE AFRICA (PTY) LTD.

- FRONTIER COMMUNICATIONS CORPORATION

- COLOGIX

- CROWN CASTLE

- DEPL

- FIRSTLIGHT

- UFINET

- DOBSON TECHNOLOGIES

- STERLITE POWER

- SORRENTO NETWORKS

- MICROSCAN

第13章 付録

The dark fiber market is projected to grow from USD 6.6 billion in 2023 and is projected to reach USD 11.9 billion by 2028; it is expected to grow at a CAGR of 12.5% from 2023 to 2028. Rising demand for 5G network, increasing demand for internet bandwidth, growing demand for reliable and secure network is expected to fuel the growth of the dark fiber market. However, High initial investment and regular maintenance is limiting the growth of the dark fiber market.

"BFSI end user segment of the dark fiber market to hold second largest market share during the forecast period."

The private dark fiber network provides the control and security required for data center connectivity by financial institutions. Dark fibers are used to improve and make business continuity (BC) and disaster recovery (DR) reliable and painless. Dark fiber offers scalability to meet the growing bandwidth demands of BFSI institutions. As data requirements increase, dark fiber can support higher data rates without the need for significant infrastructure upgrades. This scalability allows BFSI organizations to adapt to evolving technology trends, increasing data volumes, and emerging applications without disruption or major investments in new network infrastructure. Dark fiber can play a crucial role in a BFSI organization's disaster recovery and business continuity strategy. By establishing redundant connections through dark fiber, institutions can create geographically diverse and independent network paths. In the event of a network failure or a disaster in one location, traffic can be seamlessly rerouted to alternative paths, ensuring uninterrupted services and minimizing downtime. Banks and financial services companies are increasingly turning to dark fiber for their bandwidth-intensive core transport, including file sharing, large file transfers, business intelligence applications and data analysis.

"Long haul network segment to witness higher growth for dark fiber market during the forecast period." The deployment of long-haul networks has been increasing to meet the growing demand for high-speed and reliable connectivity across different regions. The proliferation of digital services, cloud computing, streaming media, and Internet of Things (IoT) devices has led to an exponential increase in data traffic. Long-haul networks are essential for transporting this massive volume of data over long distances efficiently. The growth of IXPs has led to increased demand for long-haul networks. IXPs serve as major interconnection hubs, where multiple networks exchange traffic. To facilitate efficient exchange of data between networks located in different regions, robust long-haul networks are required. The deployment of 5G networks requires a robust backhaul infrastructure to support the increased data rates and low latency. Long-haul networks, especially fiber-optic networks, play a crucial role in providing high-capacity backhaul connections for 5G base stations. To keep up with the increasing demand, telecommunication companies, infrastructure providers, and governments are continuing to invest in expanding and upgrading long-haul networks, deploying new submarine cables, expanding fiber-optic networks, and exploring innovative technologies to enhance long-distance connectivity.

"Market for plastic material is expected to exhibit higher growth during the forecast period " The plastic material segment is expected to exhibit a higher growth during the forecast period. Plastic fibers are used for very short-range and consumer applications, whereas glass fibers are used for short/medium-range and long-range telecommunications. Plastic fibers are immune to electromagnetic interference (EMI) and radio frequency interference (RFI). Unlike glass fibers, they do not conduct electricity, making them more resistant to external interference sources. This characteristic makes plastic fibers suitable for environments with high levels of electromagnetic noise or where grounding and shielding requirements are challenging. The primary advantage of plastic fiber over glass fiber is its robustness under bending and stretching.

"Europe to hold a significant share of the dark fiber market during the forecast period" Europe is expected to hold a significantly large share for dark fiber market during the forecast period. Europe held the second-largest share of the global dark fiber market in 2022. The rapid growth of the ISPs and Telecommunications Industry is one of the major factors driving the market in this region. The new digital applications such as teleworking, remote medical consultation, and video on demand has accelerated the demand for dark fibers.

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the dark fiber market space. The break-up of primary participants for the report has been shown below: By Company Type: Tier 1 - 40%, Tier 2 - 40%, and Tier 3 - 20% By Designation: C-level Executives - 40%, Directors -40%, and Others - 20% By Region: North America -30%, Asia Pacific- 40%, Europe - 20%, and RoW - 10%

The report profiles key players in dark fiber market with their respective market ranking analysis. Prominent players profiled in this report include AT&T (US), Verizon Communications, Inc. (US), CenturyLink (Lumen Technologies) (US) Colt Technology Services Group Limited (UK), Comcast Corporation (US), Consolidated Communications (US), Exa Infrastructure (GTT Communications, Inc.) (US), CenturyLink, Inc. (US), NTT Communications Corporation (Japan), Verizon Communications, Inc. (US), Windstream Communications (US), and Zayo Group, LLC (US). GlobalConnect Group (Denmark), Dark Fibre Africa (Pty) Ltd (South Africa), Frontier Communications Corporation (US), Cologix (US), Crown Castle (US), Dinesh Engineers Limited (India), FirstLight (US), UFINET (Spain), Dobson Technologies (US), Sterlite Power (India), Sorrento Networks (US), Microscan (India) are among a few emerging companies in the dark fiber market.

Research Coverage: This research report categorizes the dark fiber market on the basis of type, network type, material, end user, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the dark fiber market and forecasts the same till 2028. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the dark fiber market ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall dark fiber market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand for 5G network, Increasing government regulatory Increasing demand for internet bandwidth, Growing demand for reliable and secure network ), restraints (Risky installation, High initial investment and regular maintenance), opportunities (Telecommunication industry to create lucrative opportunities, Need for heavy data handling in manufacturing and logistics sectors, Augmented global demand for data centers) and challenges (Lack of proper monitoring systems) influencing the growth of the dark fiber market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the dark fiber market .

- Market Development: Comprehensive information about lucrative markets - the report analyses the dark fiber market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the dark fiber market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like AT&T (US), Verizon Communications, Inc. (US), CenturyLink (Lumen Technologies) (US), Consolidated Communications (US), EXA Infrastructure (GTT Communications, Inc.) (US), among others in the dark fiber market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 DARK FIBER MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 REGIONAL SCOPE

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT ANALYSIS

- FIGURE 2 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 DARK FIBER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Interviews with experts

- 2.1.2.2 Breakdown of primary interviews

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for capturing market size by bottom-up analysis (demand side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for capturing market share using top-down analysis (supply side)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DARK FIBER MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.5.1 RECESSION IMPACT ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- FIGURE 8 SINGLE-MODE FIBER SEGMENT TO HOLD LARGER MARKET SHARE THAN MULTIMODE FIBER SEGMENT DURING FORECAST PERIOD

- FIGURE 9 LONG HAUL SEGMENT TO WITNESS HIGHER GROWTH RATE THAN METRO SEGMENT FROM 2023 TO 2028

- FIGURE 10 INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY TO EXHIBIT HIGHEST CAGR IN DARK FIBER MARKET FROM 2023 TO 2028

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF DARK FIBER MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN DARK FIBER MARKET

- FIGURE 12 RISING DEMAND FOR 5G NETWORK TO FUEL DARK FIBER MARKET

- 4.2 DARK FIBER MARKET, BY TYPE

- FIGURE 13 SINGLE-MODE FIBER SEGMENT TO REGISTER HIGHER CAGR THAN MULTIMODE FIBER SEGMENT DURING FORECAST PERIOD

- 4.3 DARK FIBER MARKET, BY NETWORK TYPE

- FIGURE 14 LONG HAUL SEGMENT TO CAPTURE LARGER MARKET SHARE THAN METRO SEGMENT DURING FORECAST PERIOD

- 4.4 DARK FIBER MARKET, BY MATERIAL

- FIGURE 15 GLASS SEGMENT TO CAPTURE LARGER MARKET SHARE THAN PLASTIC SEGMENT DURING FORECAST PERIOD

- 4.5 DARK FIBER MARKET, BY REGION

- FIGURE 16 NORTH AMERICA TO CAPTURE LARGEST MARKET SHARE BY 2028

- 4.6 DARK FIBER MARKET, BY END USER AND REGION, 2022

- FIGURE 17 INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS AND CHINA SEGMENTS ACCOUNTED FOR LARGEST SHARES

- 4.7 DARK FIBER MARKET, BY COUNTRY

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DARK FIBER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for 5G network

- 5.2.1.2 Increasing demand for internet bandwidth

- 5.2.1.3 Growing demand for reliable and secure network

- FIGURE 20 DARK FIBER MARKET: DRIVERS AND THEIR IMPACT

- 5.2.2 RESTRAINTS

- 5.2.2.1 Risky installation

- 5.2.2.2 High initial investment and regular maintenance

- FIGURE 21 DARK FIBER MARKET: RESTRAINTS AND THEIR IMPACT

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Telecommunications industry to create lucrative opportunities

- 5.2.3.2 Need for heavy data handling in manufacturing and logistics

- 5.2.3.3 Increasing demand for data centers

- FIGURE 22 GLOBAL CLOUD DATA CENTER IP TRAFFIC FROM 2015 TO 2021

- FIGURE 23 DARK FIBER MARKET: OPPORTUNITIES AND THEIR IMPACT

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of proper monitoring systems

- FIGURE 24 DARK FIBER MARKET: CHALLENGES AND THEIR IMPACT

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 25 DARK FIBER MARKET: SUPPLY CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DARK FIBER MARKET

- FIGURE 26 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DARK FIBER SERVICE PROVIDERS

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 27 DARK FIBER MARKET: ECOSYSTEM ANALYSIS

- TABLE 1 DARK FIBER MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 DARK FIBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 DARK FIBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 BANDWIDTH IG AND FLEXENTIAL BROUGHT ADDITIONAL DARK FIBER CAPACITY TO OREGON DATA CENTER

- 5.7.2 PAC-12 NETWORKS TEAMED UP WITH ZAYO TO BOOST ITS PRODUCTION CAPABILITY

- 5.7.3 FIRSTLIGHT PROVIDED DARK FIBER SOLUTIONS TO MEET SOPHISTICATED CONNECTIVITY REQUIREMENTS

- 5.7.4 TELLUS VENTURE ASSOCIATES HELPED CITY OF SAN LEANDRO DEVELOP 11-MILE FIBER LOOP

- 5.7.5 FIBERLIGHT EXPANDED DARK FIBER NETWORK CAPABILITIES FOR ROSWELL

- 5.7.6 FIBERLIGHT EXPANDED FIBER NETWORKING AND DEDICATED INTERNET ACCESS (DIA) IN BASTROP

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Internet of Things

- 5.8.1.2 Edge computing

- 5.8.1.3 Artificial intelligence and machine learning

- 5.8.2 RELATED TECHNOLOGIES

- 5.8.2.1 Wavelength division multiplexing

- 5.8.2.2 Microwave data transmission

- 5.8.1 KEY TECHNOLOGIES

- 5.9 AVERAGE RENTAL SERVICE PRICE FOR DARK FIBER

- TABLE 3 AVERAGE RENTAL SERVICE PRICE FOR DARK FIBER

- TABLE 4 AVERAGE RENTAL SERVICE PRICE FOR DARK FIBER, BY END USER

- 5.10 TRADE ANALYSIS

- TABLE 5 IMPORT DATA, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 6 EXPORT DATA, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.11 PATENT ANALYSIS, 2019-2022

- TABLE 7 NUMBER OF PATENTS REGISTERED IN DARK FIBER MARKET FROM 2013 TO 2022

- FIGURE 29 DARK FIBER PATENTS PUBLISHED BETWEEN 2013 AND 2022

- FIGURE 30 DARK FIBER PATENTS PUBLISHED BETWEEN 2013 AND 2022

- TABLE 8 LIST OF MAJOR PATENT REGISTRATIONS RELATED TO DARK FIBER MARKET

- 5.12 TARIFFS

- 5.13 REGULATORY STANDARDS

- 5.13.1 REGULATORY COMPLIANCE

- 5.13.2 STANDARDS

6 DARK FIBER MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 31 DARK FIBER MARKET, BY TYPE

- FIGURE 32 SINGLE-MODE FIBER TO HOLD LARGER MARKET SHARE THAN MULTI-MODE FIBER DURING FORECAST PERIOD

- TABLE 9 DARK FIBER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 10 DARK FIBER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.2 SINGLE-MODE FIBER

- 6.2.1 WIDE USE IN LONG-DISTANCE DATA TRANSMISSIONS TO DRIVE MARKET

- TABLE 11 SINGLE-MODE DARK FIBER MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 12 SINGLE-MODE DARK FIBER MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 13 SINGLE-MODE DARK FIBER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 14 SINGLE-MODE DARK FIBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 15 SINGLE-MODE DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 16 SINGLE-MODE DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 17 SINGLE-MODE DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 18 SINGLE-MODE DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 19 SINGLE-MODE DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 20 SINGLE-MODE DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY REGION, 2023-2028 (USD MILLION)

- TABLE 21 SINGLE-MODE DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 22 SINGLE-MODE DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 23 SINGLE-MODE DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 24 SINGLE-MODE DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 25 SINGLE-MODE DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

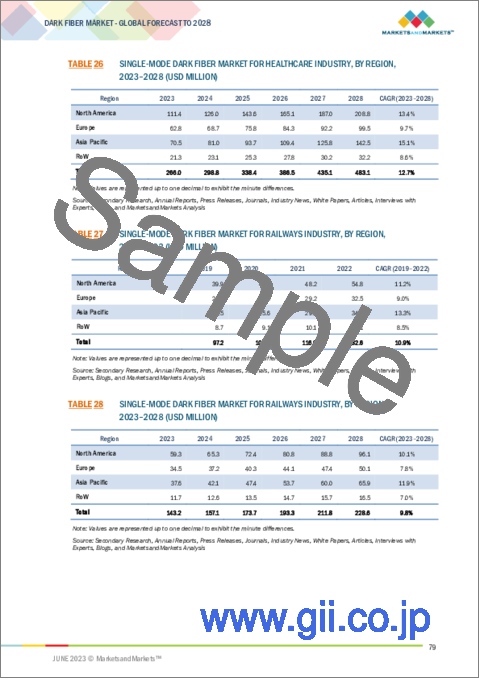

- TABLE 26 SINGLE-MODE DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 27 SINGLE-MODE DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 28 SINGLE-MODE DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 29 SINGLE-MODE DARK FIBER MARKET FOR OTHERS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 SINGLE-MODE DARK FIBER MARKET FOR OTHERS, BY REGION, 2023-2028 (USD MILLION)

- 6.3 MULTIMODE FIBER

- 6.3.1 ABILITY TO PROVIDE HIGH BANDWIDTH WITH HIGH SPEED TO BOOST DEMAND

- TABLE 31 MULTIMODE DARK FIBER MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 32 MULTIMODE DARK FIBER MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 33 MULTIMODE DARK FIBER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 MULTIMODE DARK FIBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 35 MULTIMODE DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 MULTIMODE DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 37 MULTIMODE DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 MULTIMODE DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 39 MULTIMODE DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 MULTIMODE DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY REGION, 2023-2028 (USD MILLION)

- TABLE 41 MULTIMODE DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 42 MULTIMODE DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 43 MULTIMODE DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 MULTIMODE DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 45 MULTIMODE DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 46 MULTIMODE DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 47 MULTIMODE DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 MULTIMODE DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 49 MULTIMODE DARK FIBER MARKET FOR OTHERS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 50 MULTIMODE DARK FIBER MARKET FOR OTHERS, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 STEP-INDEX MULTIMODE FIBER

- 6.3.3 GRADED-INDEX MULTIMODE FIBER

7 DARK FIBER MARKET, BY NETWORK TYPE

- 7.1 INTRODUCTION

- FIGURE 33 DARK FIBER MARKET, BY NETWORK TYPE

- FIGURE 34 LONG HAUL SEGMENT TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

- TABLE 51 DARK FIBER MARKET, BY NETWORK TYPE, 2019-2022 (USD MILLION)

- TABLE 52 DARK FIBER MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- 7.2 METRO

- 7.2.1 COST-EFFECTIVE CONTROL AND PHYSICAL ROUTING TO DRIVE DEMAND

- 7.3 LONG HAUL

- 7.3.1 DEMAND FOR HIGH-SPEED AND RELIABLE CONNECTIVITY TO SUPPORT MARKET

8 DARK FIBER MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- FIGURE 35 DARK FIBER MARKET, BY MATERIAL

- FIGURE 36 GLASS SEGMENT TO CAPTURE LARGER MARKET SHARE THAN PLASTIC SEGMENT DURING FORECAST PERIOD

- TABLE 53 DARK FIBER MARKET, BY MATERIAL, 2019-2022 (USD MILLION)

- TABLE 54 DARK FIBER MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- 8.2 GLASS

- 8.2.1 GROWING DEMAND FOR RUGGED FIBER TO PROPEL MARKET

- 8.3 PLASTIC

- 8.3.1 LOWER SIGNAL ATTENUATION THAN GLASS FIBER TO AUGMENT DEMAND

9 DARK FIBER MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 37 DARK FIBER MARKET, BY END USER

- FIGURE 38 INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 55 DARK FIBER MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 56 DARK FIBER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 9.2 INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY

- 9.2.1 USE OF DARK FIBER TO REDUCE CAPITAL EXPENDITURE IN TELECOMMUNICATIONS INDUSTRY

- TABLE 57 DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 58 DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 59 DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 60 DARK FIBER MARKET FOR INTERNET SERVICE PROVIDERS & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- 9.3 BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY

- 9.3.1 NEED FOR SCALABILITY TO MEET GROWING BANDWIDTH DEMAND IN FINANCIAL INSTITUTIONS TO DRIVE MARKET

- TABLE 61 DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 62 DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 63 DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 DARK FIBER MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- 9.4 IT-ENABLED SERVICES

- 9.4.1 ABILITY TO MINIMIZE DOWNTIME OF NETWORK TO INCREASE DEMAND FOR DARK FIBER

- TABLE 65 DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 66 DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 67 DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 68 DARK FIBER MARKET FOR IT-ENABLED SERVICES, BY REGION, 2023-2028 (USD MILLION)

- 9.5 MILITARY & AEROSPACE INDUSTRY

- 9.5.1 DEMAND FOR DARK FIBER TO INCREASE DUE TO ITS UNLIMITED BANDWIDTH AND HIGH-SECURITY FEATURES

- TABLE 69 DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 70 DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 71 DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 DARK FIBER MARKET FOR MILITARY & AEROSPACE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- 9.6 OIL & GAS INDUSTRY

- 9.6.1 ULTRA-LOW OPTICAL LOSS AND HIGH OPTICAL RETURN LOSS OF DARK FIBER TO DRIVE MARKET

- TABLE 73 DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 74 DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 75 DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 DARK FIBER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- 9.7 HEALTHCARE INDUSTRY

- 9.7.1 DARK FIBER AS OPTIMAL CONNECTIVITY SOLUTION TO DRIVE MARKET

- TABLE 77 DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 78 DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 79 DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 80 DARK FIBER MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- 9.8 RAILWAYS INDUSTRY

- 9.8.1 USE OF DARK FIBER TO MAKE OPERATIONS FUTURE-PROOF

- TABLE 81 DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 82 DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 83 DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 84 DARK FIBER MARKET FOR RAILWAYS INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- 9.9 OTHERS

- TABLE 85 DARK FIBER MARKET FOR OTHERS, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 86 DARK FIBER MARKET FOR OTHERS, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 87 DARK FIBER MARKET FOR OTHERS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 88 DARK FIBER MARKET FOR OTHERS, BY REGION, 2023-2028 (USD MILLION)

10 DARK FIBER MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 39 DARK FIBER MARKET, BY REGION

- FIGURE 40 DARK FIBER MARKET IN ASIA PACIFIC TO REGISTER HIGH GROWTH FROM 2023 TO 2028

- TABLE 89 DARK FIBER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 90 DARK FIBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 RECESSION IMPACT ANALYSIS

- 10.2.2 US

- 10.2.2.1 To dominate regional market during forecast period

- 10.2.3 CANADA

- 10.2.3.1 To hold significant share of regional market during forecast period

- 10.2.4 MEXICO

- 10.2.4.1 Expanding telecommunications industry to drive market

- FIGURE 41 NORTH AMERICA: DARK FIBER MARKET SNAPSHOT

- TABLE 91 DARK FIBER MARKET IN NORTH AMERICA, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 92 DARK FIBER MARKET IN NORTH AMERICA, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 93 DARK FIBER MARKET IN NORTH AMERICA, BY END USER, 2019-2022 (USD MILLION)

- TABLE 94 DARK FIBER MARKET IN NORTH AMERICA, BY END USER, 2023-2028 (USD MILLION)

- TABLE 95 DARK FIBER MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 96 DARK FIBER MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 RECESSION IMPACT ANALYSIS

- 10.3.2 UK

- 10.3.2.1 Focus on accelerating cloud adoption across public organizations to drive market

- 10.3.3 GERMANY

- 10.3.3.1 Investments in network upgrades to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Increasing focus on 5G to contribute to market growth

- 10.3.5 REST OF EUROPE

- FIGURE 42 EUROPE: DARK FIBER MARKET SNAPSHOT

- TABLE 97 DARK FIBER MARKET IN EUROPE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 98 DARK FIBER MARKET IN EUROPE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 99 DARK FIBER MARKET IN EUROPE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 100 DARK FIBER MARKET IN EUROPE, BY END USER, 2023-2028 (USD MILLION)

- TABLE 101 DARK FIBER MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 102 DARK FIBER MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 RECESSION IMPACT ANALYSIS

- 10.4.2 CHINA

- 10.4.2.1 Boom in internet and telecommunications users to boost market

- 10.4.3 JAPAN

- 10.4.3.1 Investments in telecom industry to propel market

- 10.4.4 INDIA

- 10.4.4.1 Unprecedented increase in data consumption to fuel demand

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Increasing focus on rolling out 5G network to drive market

- 10.4.6 REST OF ASIA PACIFIC

- FIGURE 43 ASIA PACIFIC: DARK FIBER MARKET SNAPSHOT

- TABLE 103 DARK FIBER MARKET IN ASIA PACIFIC, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 104 DARK FIBER MARKET IN ASIA PACIFIC, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 105 DARK FIBER MARKET IN ASIA PACIFIC, BY END USER, 2019-2022 (USD MILLION)

- TABLE 106 DARK FIBER MARKET IN ASIA PACIFIC, BY END USER, 2023-2028 (USD MILLION)

- TABLE 107 DARK FIBER MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 108 DARK FIBER MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5 REST OF THE WORLD (ROW)

- 10.5.1 RECESSION IMPACT ANALYSIS

- FIGURE 44 REST OF THE WORLD: DARK FIBER MARKET SNAPSHOT

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 Increasing data center establishments to fuel demand

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 To hold larger share of RoW dark fiber market than Middle East & Africa

- TABLE 109 DARK FIBER MARKET IN REST OF THE WORLD, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 110 DARK FIBER MARKET IN REST OF THE WORLD, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 111 DARK FIBER MARKET IN REST OF THE WORLD, BY END USER, 2019-2022 (USD MILLION)

- TABLE 112 DARK FIBER MARKET IN REST OF THE WORLD, BY END USER, 2023-2028 (USD MILLION)

- TABLE 113 DARK FIBER MARKET IN REST OF THE WORLD, BY REGION, 2019-2022 (USD MILLION)

- TABLE 114 DARK FIBER MARKET IN REST OF THE WORLD, BY REGION, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- TABLE 115 DARK FIBER MARKET: KEY GROWTH STRATEGIES ADOPTED BY COMPANIES FROM 2019 TO 2022

- 11.2 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- FIGURE 45 DARK FIBER MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2022

- 11.3 MARKET SHARE ANALYSIS (2022)

- TABLE 116 DARK FIBER MARKET: DEGREE OF COMPETITION

- FIGURE 46 DARK FIBER MARKET SHARE ANALYSIS, 2022

- 11.4 COMPANY EVALUATION QUADRANT

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 47 DARK FIBER MARKET: KEY COMPANY EVALUATION QUADRANT, 2022

- 11.5 START-UP/SME EVALUATION QUADRANT

- TABLE 117 LIST OF START-UPS/SMES IN DARK FIBER MARKET

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- FIGURE 48 DARK FIBER MARKET: START-UP/SME EVALUATION QUADRANT, 2022

- 11.5.5 DARK FIBER MARKET: COMPANY FOOTPRINT

- TABLE 118 COMPANY FOOTPRINT

- TABLE 119 COMPANY END USER FOOTPRINT

- TABLE 120 COMPANY REGION FOOTPRINT

- 11.6 COMPETITIVE SCENARIOS AND TRENDS

- 11.6.1 PRODUCT LAUNCHES

- TABLE 121 PRODUCT LAUNCHES, 2019-2023

- 11.6.2 DEALS

- TABLE 122 DEALS, 2019-2023

- 11.6.3 OTHERS

- TABLE 123 OTHERS, 2019-2023

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1 KEY COMPANIES

- 12.1.1 AT&T

- TABLE 124 AT&T: COMPANY OVERVIEW

- FIGURE 49 AT&T: COMPANY SNAPSHOT

- TABLE 125 AT&T: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 126 AT&T: DEALS

- TABLE 127 AT&T: OTHERS

- 12.1.2 VERIZON COMMUNICATIONS, INC.

- TABLE 128 VERIZON COMMUNICATIONS, INC.: COMPANY OVERVIEW

- FIGURE 50 VERIZON COMMUNICATIONS, INC.: COMPANY SNAPSHOT

- TABLE 129 VERIZON COMMUNICATIONS, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 130 VERIZON: DEALS

- 12.1.3 CENTURYLINK, INC. (LUMEN TECHNOLOGIES)

- TABLE 131 CENTURYLINK, INC. (LUMEN TECHNOLOGIES): COMPANY OVERVIEW

- FIGURE 51 CENTURYLINK, INC (LUMEN TECHNOLOGIES): COMPANY SNAPSHOT

- TABLE 132 CENTURYLINK, INC. (LUMEN TECHNOLOGIES): PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 133 CENTURYLINK, INC. (LUMEN TECHNOLOGIES): DEALS

- TABLE 134 CENTURYLINK, INC. (LUMEN TECHNOLOGIES): OTHERS

- 12.1.4 CONSOLIDATED COMMUNICATIONS

- TABLE 135 CONSOLIDATED COMMUNICATIONS: COMPANY OVERVIEW

- FIGURE 52 CONSOLIDATED COMMUNICATIONS: COMPANY SNAPSHOT

- TABLE 136 CONSOLIDATED COMMUNICATIONS: DEALS

- TABLE 137 CONSOLIDATED COMMUNICATIONS: OTHERS

- 12.1.5 EXA INFRASTRUCTURE (GTT COMMUNICATIONS)

- TABLE 138 EXA INFRASTRUCTURE (GTT COMMUNICATIONS): COMPANY OVERVIEW

- TABLE 139 EXA INFRASTRUCTURE (GTT COMMUNICATIONS): DEALS

- TABLE 140 EXA INFRASTRUCTURE (GTT COMMUNICATIONS): OTHERS

- 12.1.6 COMCAST CORPORATION

- TABLE 141 COMCAST CORPORATION: COMPANY OVERVIEW

- FIGURE 53 COMCAST CORPORATION: COMPANY SNAPSHOT

- TABLE 142 COMCAST CORPORATION: DEALS

- TABLE 143 COMCAST CORPORATION: OTHERS

- 12.1.7 COLT TECHNOLOGY SERVICES GROUP LIMITED

- TABLE 144 COLT TECHNOLOGY SERVICES GROUP LIMITED: COMPANY OVERVIEW

- TABLE 145 COLT TECHNOLOGY SERVICES GROUP LIMITED: DEALS

- TABLE 146 COLT TECHNOLOGY SERVICES GROUP LIMITED: OTHERS

- 12.1.8 NTT COMMUNICATIONS CORPORATION

- TABLE 147 NTT COMMUNICATIONS CORPORATION: COMPANY OVERVIEW

- FIGURE 54 NTT COMMUNICATIONS CORPORATION: COMPANY SNAPSHOT

- TABLE 148 NTT COMMUNICATIONS CORPORATION: DEALS

- TABLE 149 NTT COMMUNICATIONS CORPORATION: OTHERS

- 12.1.9 WINDSTREAM COMMUNICATIONS

- TABLE 150 WINDSTREAM COMMUNICATIONS: COMPANY OVERVIEW

- TABLE 151 WINDSTREAM COMMUNICATIONS: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 152 WINDSTREAM COMMUNICATIONS CORPORATION: DEALS

- TABLE 153 WINDSTREAM COMMUNICATIONS: OTHERS

- 12.1.10 ZAYO GROUP, LLC

- TABLE 154 ZAYO GROUP, LLC: COMPANY OVERVIEW

- TABLE 155 ZAYO GROUP, LLC: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 156 ZAYO GROUP, LLC: DEALS

- TABLE 157 ZAYO GROUP, LLC: OTHERS

- 12.2 OTHER PLAYERS

- 12.2.1 GLOBALCONNECT GROUP

- 12.2.2 DARK FIBRE AFRICA (PTY) LTD.

- 12.2.3 FRONTIER COMMUNICATIONS CORPORATION

- 12.2.4 COLOGIX

- 12.2.5 CROWN CASTLE

- 12.2.6 DEPL

- 12.2.7 FIRSTLIGHT

- 12.2.8 UFINET

- 12.2.9 DOBSON TECHNOLOGIES

- 12.2.10 STERLITE POWER

- 12.2.11 SORRENTO NETWORKS

- 12.2.12 MICROSCAN

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS