|

|

市場調査レポート

商品コード

1087898

PET樹脂発泡体の世界市場:原材料(バージンPET、リサイクルPET)、グレード(低密度、高密度)、用途(風力エネルギー、輸送、船舶、建築・建設、包装)、地域別 - 2027年までの予測PET Foam Market by Raw Material (Virgin PET and Recycled PET), Grade (Low-density and High-density), Application (Wind Energy, Transportation, Marine, Building & Construction, Packaging) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| PET樹脂発泡体の世界市場:原材料(バージンPET、リサイクルPET)、グレード(低密度、高密度)、用途(風力エネルギー、輸送、船舶、建築・建設、包装)、地域別 - 2027年までの予測 |

|

出版日: 2022年06月01日

発行: MarketsandMarkets

ページ情報: 英文 168 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のPET樹脂発泡体の市場規模は、2022年から2027年にかけて6.9%のCAGRで成長する見通しで、2022年の3億6,100万米ドルから、2027年までに5億300万米ドルに達すると予測されています。

同市場の成長は、主にアジア太平洋の経済成長によって牽引されています。

当レポートでは、世界のPET樹脂発泡体市場について調査し、市場力学、価格や特許、ケーススタディ、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

第6章 動向

- ポーターのファイブフォース分析

第7章 マクロ経済の概要と主な動向

- 風力エネルギー産業の成長

- 自動車業界の動向

- 建設業界の動向

- 価格分析

- バリューチェーン分析

- 特許分析

- 関税と規制状況

- ケーススタディ

- 貿易の流れ

- 市場におけるYCCシフト

第8章 原料別:PET樹脂発泡体市場

- リサイクルペット

- ヴァージンペット

第9章 グレード別:PET樹脂発泡体市場

- 低密度

- 高密度

第10章 用途別:PET樹脂発泡体市場

- 風力エネルギー

- 輸送機関

- 船舶

- 包装

- 建物・建設

- その他

第11章 地域別:PET樹脂発泡体市場

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- 中東・アフリカ

- 中東

- アフリカ

- 南米

- ブラジル

- その他

第12章 競合情勢

- 概要

- 市場シェア分析

- 企業評価クアドラントマトリックスの定義と手法(2019年)

- 競合ベンチマーキング

- 主な市場開発

第13章 企業プロファイル

- 3A COMPOSITES

- DIAB GROUP

- GURIT HOLDING AG

- ARMACELL INTERNATIONAL S.A.

- SEKISUI CHEMICAL CO LTD

- CHANGZHOU TIANSHENG NEW MATERIALS CO. LTD

- PETRO POLYMER SHARGH (PPS)

- CARBON-CORE CORP.

- COMPOSITE ESSENTIAL MATERIALS LLC

- VISIGHT COMPOSITE MATERIAL CO., LTD

- CORELITE

- HUNAN RIFENG COMPOSITE CO., LTD

- XTX COMPOSITES

第14章 隣接・関連市場

- 制限

- ポリマー改質セメントコーティング市場

- 構造コア材料市場

- バルサ

第15章 付録

The PET foam market is projected to grow from USD 361 million in 2022 to USD 503 million by 2027, at a CAGR of 6.9% from 2022 to 2027. The PET foam market growth is estimated to be majorly driven by growing economies of Asia Pacific region.

"Recycled PET foam dominated the PET foam market, by raw material in terms of value and volume, in 2021"

Recycled PET foams offer several benefits such as cost-effectiveness and reduced carbon footprint. They are used as core materials in automotive applications, and as structural foams in construction applications. Moreover, few companies such as Armacell International S.A. (Luxembourg), Petro Polymer Shargh (Iran), recycle PET found in food and beverage bottles into the foam.

"Low-density PET foam dominated the PET foam market, by grade in terms of value and volume, in 2021"

The low-density PET foam dominated the PET foam market, in terms of volume and value, in 2021. Low-density foam is widely used as a thermal insulator due to the low thermal conductivity of the gas phase and as a structural material for construction and furniture. Thus, the wide application of low-density PET foam and its superior qualities compared to the other core materials is driving the segment.

"Wind energy application dominated the PET foam market, in terms of value and volume, in 2021"

The wind energy application segment dominated the PET foam market, in terms of volume and value, in 2021. PET foam can be an ideal replacement for other core materials such as PVC, SAN, PU foams, and balsa. Core materials are used in wind turbine blades as sandwich panels in composite forms. The blades are made by combining core materials and glass-reinforced polyester/epoxy.

"Asia Pacific region dominated the PET foam market, in terms of value and volume, in 2021"

The increasing demand for PET foam in transportation, wind energy, and building & construction applications is driving the market in this region. The growth of the wind energy industry in this region has increased the demand for producing lightweight composite structures.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 37%, Tier 2 - 42%, and Tier 3 - 21%

- By Designation: C-level Executives - 30%, Directors - 25%, and Managers - 45%

- By Region: North America - 20%, Europe - 27%, Asia Pacific - 40%, South America - 7%, Middle East & Africa - 6%

Armacell International SA (Luxembourg), 3A Composites (Switzerland), Gurit Holding (Switzerland), DIAB Group (Sweden), Changzhou Tiansheng New Materials Co. Ltd (China), Sekisui Plastics (Japan), Petro Polymer Shargh (Iran), and Carbon-Core Corp. (US) are some of the key players operating in the PET foam market. These players have adopted strategies such as agreements, partnerships & joint ventures, new product & technology launches, and expansions to enhance their business revenue and market share.

Research Coverage:

The report defines, segments, and projects the PET foam market based on raw material, grade, application, and region. It provides detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges. It strategically profiles, PET foam manufacturers and comprehensively analyzes their market shares and core competencies as well as tracks and analyzes competitive developments, such as expansions, acquisitions, and product launches, undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them the closest approximations of revenue numbers of the PET foam market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 COMPETITIVE INTELLIGENCE

- 1.3 MARKET DEFINITION

- 1.4 INCLUSIONS & EXCLUSIONS

- TABLE 1 PET FOAM MARKET: INCLUSIONS & EXCLUSIONS

- 1.5 MARKET SCOPE

- FIGURE 1 PET FOAM MARKET: MARKET SEGMENTATION

- 1.5.1 REGIONAL SCOPE

- 1.6 YEARS CONSIDERED FOR THE STUDY

- 1.7 CURRENCY

- 1.8 PACKAGE SIZE

- 1.9 STAKEHOLDERS

- 1.10 RESEARCH LIMITATIONS

- 1.11 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PET FOAM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 Breakdown of primary interviews

- 2.1.1.3 Key primary insights

- 2.2 MATRIX CONSIDERED FOR DEMAND SIDE

- FIGURE 3 MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR PET FOAM

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY FOR SUPPLY SIDE SIZING OF PET FOAM MARKET (1/2)

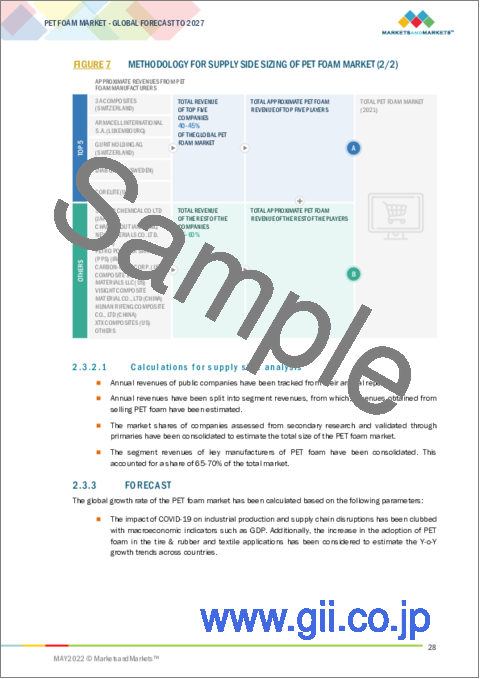

- FIGURE 7 METHODOLOGY FOR SUPPLY SIDE SIZING OF PET FOAM MARKET (2/2)

- 2.3.2.1 Calculations for supply side analysis

- 2.3.3 FORECAST

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- FIGURE 8 PET FOAM MARKET: DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.6.1 ASSUMPTIONS

- 2.6.2 LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 9 SCENARIO ANALYSIS: PET FOAM MARKET

- 3.1 PRE-COVID-19 SCENARIO

- TABLE 2 PRE-COVID-19 SCENARIO: PET FOAM MARKET, 2018-2027 (USD MILLION)

- 3.2 OPTIMISTIC

- TABLE 3 OPTIMISTIC SCENARIO: PET FOAM MARKET, 2018-2027 (USD MILLION)

- 3.3 PESSIMISTIC SCENARIO

- TABLE 4 PESSIMISTIC SCENARIO: PET FOAM MARKET, 2018-2027 (USD MILLION)

- 3.4 REALISTIC SCENARIO

- TABLE 5 REALISTIC SCENARIO: PET FOAM MARKET, 2018-2027 (USD MILLION)

- TABLE 6 PET FOAM MARKET SNAPSHOT (2022 VS. 2027)

- FIGURE 10 WIND ENERGY SEGMENT PROJECTED TO DOMINATE PET FOAM MARKET FROM 2022 TO 2027, IN TERMS OF VALUE

- FIGURE 11 HIGH-DENSITY PET FOAM SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD, IN TERMS OF VALUE

- FIGURE 12 MIDDLE EAST & AFRICA PROJECTED TO BE FASTEST-GROWING MARKET FOR PET FOAM DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN PET FOAM MARKET

- FIGURE 13 INCREASING USE OF PET FOAM IN WIND ENERGY AND PACKAGING APPLICATIONS EXPECTED TO DRIVE MARKET

- 4.2 PET FOAM MARKET, BY REGION

- FIGURE 14 ASIA PACIFIC PROJECTED TO LEAD PET FOAM MARKET FROM 2022 TO 2027, IN TERMS OF VOLUME

- 4.3 ASIA PACIFIC PET FOAM MARKET, BY COUNTRY

- FIGURE 15 CHINA ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC PET FOAM MARKET IN 2022, IN TERMS OF VOLUME

- 4.4 PET FOAM MARKET, BY RAW MATERIAL

- FIGURE 16 RECYCLED PET MATERIAL SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD, IN TERMS OF VOLUME

- 4.5 PET FOAM MARKET, BY APPLICATION

- FIGURE 17 WIND ENERGY SEGMENT PROJECTED TO DOMINATE PET FOAM MARKET FROM 2022 TO 2027, IN TERMS OF VOLUME

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growth of the wind energy sector

- 5.2.1.2 Growing demand for lightweight vehicles worldwide

- TABLE 7 AUTOMOTIVE APPLICATIONS OF PET FOAM

- TABLE 8 PROPERTIES OF PET FOAM

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing competition from substitutes

- TABLE 9 COMMON SUBSTITUTES TO PET FOAM AND THEIR APPLICATIONS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising trend of using recycled materials

- 5.2.4 CHALLENGES

- 5.2.4.1 Impact of COVID-19 on various end-use industries

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS

- 6.2.1 DEGREE OF COMPETITION

- 6.2.2 THREAT OF SUBSTITUTES

- 6.2.3 BARGAINING POWER OF BUYERS

- 6.2.4 BARGAINING POWER OF SUPPLIERS

- 6.2.5 THREAT 0F NEW ENTRANTS

7 MACROECONOMIC OVERVIEW AND KEY TRENDS

- 7.1 INTRODUCTION

- 7.1.1 ECONOMIC OUTLOOK

- TABLE 10 TABLE BELOW PRESENTS ECONOMIC OUTLOOK FOR 2020, 2021, AND 2022

- 7.2 GROWTH IN WIND ENERGY INDUSTRY

- TABLE 11 WIND ENERGY INSTALLATION, BY COUNTRY, 2019-2020 (MW)

- FIGURE 20 NEW WIND POWER CAPACITY BY REGION, 2020

- 7.3 TRENDS IN THE AUTOMOTIVE INDUSTRY

- TABLE 12 AUTOMOTIVE PRODUCTION, BY COUNTRY, 2020-2021 (UNIT)

- 7.4 TRENDS IN THE CONSTRUCTION INDUSTRY

- TABLE 13 NORTH AMERICA: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2017-2024 (USD BILLION)

- TABLE 14 EUROPE: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2017-2024 (USD BILLION)

- TABLE 15 ASIA PACIFIC: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2017-2024 (USD BILLION)

- TABLE 16 MIDDLE EAST & AFRICA: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2017-2024 (USD BILLION)

- TABLE 17 SOUTH AMERICA: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2017-2024 (USD BILLION)

- 7.5 PRICE ANALYSIS

- 7.6 VALUE CHAIN ANALYSIS

- FIGURE 21 PET FOAM VALUE CHAIN ANALYSIS

- 7.7 PATENT ANALYSIS

- 7.8 TARIFF AND REGULATORY LANDSCAPE

- 7.9 CASE STUDY

- 7.9.1 USE CASES

- TABLE 18 CASE STUDY 1: IMPROVED MECHANICAL PROPERTIES AND COST-EFFECTIVE PRODUCT

- 7.10 TRADE FLOW

- 7.11 YCC SHIFT IN PET FOAM MARKET

- FIGURE 22 PET FOAM MARKET: YCC SHIFT

8 PET FOAM MARKET, BY RAW MATERIAL

- 8.1 INTRODUCTION

- FIGURE 23 RECYCLED PET SEGMENT PROJECTED TO DOMINATE PET FOAM MARKET DURING FORECAST PERIOD, IN TERMS OF VALUE

- TABLE 19 PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- TABLE 20 PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018-2027 (TONS)

- 8.2 RECYCLED PET

- 8.2.1 SHIFT TOWARDS SUSTAINABLE USE OF PET BOTTLES IS EXPECTED TO DRIVE THIS SEGMENT

- 8.3 VIRGIN PET

- 8.3.1 VIRGIN PET FOAM MATERIALS HAVE HIGH APPLICABILITY IN VARIED APPLICATIONS

9 PET FOAM MARKET, BY GRADE

- 9.1 INTRODUCTION

- FIGURE 24 LOW-DENSITY SEGMENT PROJECTED TO LEAD PET FOAM MARKET FROM 2022 TO 2027, IN TERMS OF VALUE

- TABLE 21 PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 22 PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- 9.2 LOW-DENSITY

- 9.2.1 WIDE RANGING APPLICATIONS AND PROPERTIES OF LOW-DENSITY PET FOAM ARE DRIVING THIS SEGMENT

- TABLE 23 PET FOAM MARKET SIZE, BY LOW-DENSITY, 2018-2027 (USD MILLION)

- TABLE 24 PET FOAM MARKET SIZE, BY LOW-DENSITY, 2018-2027 (TONS)

- 9.3 HIGH-DENSITY

- 9.3.1 HIGH DEMAND IN PACKAGING APPLICATION DRIVING HIGH-DENSITY PET FOAM SEGMENT

- TABLE 25 PET FOAM MARKET SIZE, BY HIGH-DENSITY, 2018-2027 (USD MILLION)

- TABLE 26 PET FOAM MARKET SIZE, BY HIGH-DENSITY, 2018-2027 (TONS)

10 PET FOAM MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 25 WIND ENERGY SEGMENT EXPECTED TO LEAD PET FOAM MARKET DURING FORECAST PERIOD

- TABLE 27 PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 28 PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 10.2 WIND ENERGY

- 10.2.1 PET FOAM EXPECTED LEAD IN WIND ENERGY SEGMENT AS IT ENABLES LIGHTWIEGHT WIND BLADES

- TABLE 29 PET FOAM MARKET IN WIND ENERGY, BY REGION, 2018-2027 (USD MILLION)

- TABLE 30 PET FOAM MARKET IN WIND ENERGY, BY REGION, 2018-2027 (TONS)

- 10.3 TRANSPORTATION

- 10.3.1 UTILIZATION OF PET FOAM IN TRANSPORTATION LEADING TO DECREASING FUEL CONSUMPTION

- TABLE 31 PET FOAM MARKET IN TRANSPORTATION, BY REGION, 2018-2027 (USD MILLION)

- TABLE 32 PET FOAM MARKET IN TRANSPORTATION, BY REGION, 2018-2027 (TONS)

- 10.4 MARINE

- 10.4.1 CORROSION-RESISTANCE PROPERTY EXPECTED TO INCREASE USE OF PET FOAM IN MARINE SEGMENT

- TABLE 33 PET FOAM MARKET IN MARINE, BY REGION, 2018-2027 (USD MILLION)

- TABLE 34 PET FOAM MARKET IN MARINE, BY REGION, 2018-2027 (TONS)

- 10.5 PACKAGING

- 10.5.1 FACTORS SUCH AS RECYCLABILITY AND LOW WEIGHT EXPECTED TO INCREASE USE OF PET FOAM IN PACKAGING INDUSTRY

- TABLE 35 PET FOAM MARKET IN PACKAGING, BY REGION,2018-2027 (USD MILLION)

- TABLE 36 PET FOAM MARKET IN PACKAGING, BY REGION, 2018-2027 (TONS)

- 10.6 BUILDING & CONSTRUCTION

- 10.6.1 ENERGY EFFICIENT PROPERTY OF PET FOAM EXPECTED TO PROPEL DEMAND IN BUILDING & CONSTRUCTION INDUSTRY

- TABLE 37 PET FOAM MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2018-2027 (USD MILLION)

- TABLE 38 PET FOAM MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2018-2027 (TONS)

- 10.7 OTHERS

- TABLE 39 PET FOAM MARKET IN OTHER APPLICATIONS, BY REGION, 2018-2027 (USD MILLION)

- TABLE 40 PET FOAM MARKET IN OTHER APPLICATIONS, BY REGION, 2018-2027 (TONS)

11 PET FOAM MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 26 MARKET IN MIDDLE EAST & AFRICA EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 41 GLOBAL: PET FOAM MARKET SIZE, BY REGION, 2018-2027 (USD MILLION)

- TABLE 42 GLOBAL: PET FOAM MARKET SIZE, BY REGION, 2018-2027 (TONS)

- 11.2 ASIA PACIFIC

- FIGURE 27 ASIA PACIFIC PET FOAM MARKET SNAPSHOT

- TABLE 43 ASIA PACIFIC: PET FOAM MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

- TABLE 44 ASIA PACIFIC: PET FOAM MARKET, BY COUNTRY, 2018-2027 (TONS)

- TABLE 45 ASIA PACIFIC: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- TABLE 46 ASIA PACIFIC: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018-2027 (TONS)

- TABLE 47 ASIA PACIFIC: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 48 ASIA PACIFIC: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 49 ASIA PACIFIC: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 50 ASIA PACIFIC: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.2.1 CHINA

- 11.2.1.1 Growth of the wind energy sector and the presence of leading PET foam manufacturers drive the market in China

- TABLE 51 CHINA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 52 CHINA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 53 CHINA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 54 CHINA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.2.2 INDIA

- 11.2.2.1 High demand for PET foam in wind energy application is driving the market growth in India

- TABLE 55 INDIA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 56 INDIA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 57 INDIA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 58 INDIA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.2.3 JAPAN

- 11.2.3.1 Growth of automotive & transportation industries is expected to boost the demand for PET foam

- TABLE 59 JAPAN: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 60 JAPAN: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 61 JAPAN: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 62 JAPAN: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Rising demand for renewable energy is driving the PET foam market

- TABLE 63 SOUTH KOREA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 64 SOUTH KOREA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 65 SOUTH KOREA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 66 SOUTH KOREA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.2.5 REST OF ASIA PACIFIC

- TABLE 67 REST OF ASIA PACIFIC: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 68 REST OF ASIA PACIFIC: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 69 REST OF ASIA PACIFIC: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 70 REST OF ASIA PACIFIC: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.3 NORTH AMERICA

- FIGURE 28 NORTH AMERICA PET FOAM MARKET SNAPSHOT

- TABLE 71 NORTH AMERICA: PET FOAM MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

- TABLE 72 NORTH AMERICA: PET FOAM MARKET, BY COUNTRY, 2018-2027 (TONS)

- TABLE 73 NORTH AMERICA: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- TABLE 74 NORTH AMERICA: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018-2027 (TONS)

- TABLE 75 NORTH AMERICA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 76 NORTH AMERICA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 77 NORTH AMERICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.3.1 US

- 11.3.1.1 High demand for marine applications expected to drive market

- TABLE 79 US: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 80 US: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 81 US: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 82 US: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.3.2 CANADA

- 11.3.2.1 Increased demand for PET foam in wind energy applications is expected to boost the market

- TABLE 83 CANADA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 84 CANADA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 85 CANADA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 86 CANADA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.3.3 MEXICO

- 11.3.3.1 Growing investment in renewable power generation is expected to drive the market

- TABLE 87 MEXICO: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 88 MEXICO: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 89 MEXICO: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 90 MEXICO: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.4 EUROPE

- FIGURE 29 EUROPE PET FOAM MARKET SNAPSHOT

- TABLE 91 EUROPE: PET FOAM MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

- TABLE 92 EUROPE: PET FOAM MARKET, BY COUNTRY, 2018-2027 (TONS)

- TABLE 93 EUROPE: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- TABLE 94 EUROPE: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018-2027 (TONS)

- TABLE 95 EUROPE: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 96 EUROPE: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 97 EUROPE: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 98 EUROPE: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.4.1 GERMANY

- 11.4.1.1 Wind energy largest consumer of PET foam

- TABLE 99 GERMANY: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 100 GERMANY: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 101 GERMANY: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 102 GERMANY: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.4.2 FRANCE

- 11.4.2.1 Growing investments in wind energy will propel the demand in the country

- TABLE 103 FRANCE: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 104 FRANCE: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 105 FRANCE: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 106 FRANCE: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.4.3 UK

- 11.4.3.1 Growing initiatives in reduction of greenhouse gases expected to drive the market

- TABLE 107 UK: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 108 UK: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 109 UK: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 110 UK: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.4.4 ITALY

- 11.4.4.1 Growth of the marine industry will fuel the market for PET foam

- TABLE 111 ITALY: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 112 ITALY: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 113 ITALY: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 114 ITALY: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.4.5 SPAIN

- 11.4.5.1 Government initiatives towards the growth of wind energy will propel the demand for PET foams

- TABLE 115 SPAIN: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 116 SPAIN: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 117 SPAIN: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 118 SPAIN: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.4.6 REST OF EUROPE

- TABLE 119 REST OF EUROPE: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 120 REST OF EUROPE: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 121 REST OF EUROPE: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 122 REST OF EUROPE: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.5 MIDDLE EAST & AFRICA

- TABLE 123 MIDDLE EAST & AFRICA: PET FOAM MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: PET FOAM MARKET, BY COUNTRY, 2018-2027 (TONS)

- TABLE 125 MIDDLE EAST & AFRICA: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018-2027 (TONS)

- TABLE 127 MIDDLE EAST & AFRICA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 129 MIDDLE EAST & AFRICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.5.1 MIDDLE EAST

- 11.5.1.1 Growth of the wind energy sector is expected to propel the demand for PET foams

- TABLE 131 MIDDLE EAST: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 132 MIDDLE EAST: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 133 MIDDLE EAST: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 134 MIDDLE EAST: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.5.2 AFRICA

- 11.5.2.1 Growth of the wind energy and construction sectors in Africa is expected to drive the demand for PET foams

- TABLE 135 AFRICA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 136 AFRICA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 137 AFRICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 138 AFRICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.6 SOUTH AMERICA

- TABLE 139 SOUTH AMERICA: PET FOAM MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

- TABLE 140 SOUTH AMERICA: PET FOAM MARKET, BY COUNTRY, 2018-2027 (TONS)

- TABLE 141 SOUTH AMERICA: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- TABLE 142 SOUTH AMERICA: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018-2027 (TONS)

- TABLE 143 SOUTH AMERICA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 144 SOUTH AMERICA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 145 SOUTH AMERICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 146 SOUTH AMERICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.6.1 BRAZIL

- 11.6.1.1 Growth of wind energy sector propel the demand for PET foams

- TABLE 147 BRAZIL: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 148 BRAZIL: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 149 BRAZIL: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 150 BRAZIL: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

- 11.6.2 REST OF SOUTH AMERICA

- TABLE 151 REST OF SOUTH AMERICA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (USD MILLION)

- TABLE 152 REST OF SOUTH AMERICA: PET FOAM MARKET SIZE, BY GRADE, 2018-2027 (TONS)

- TABLE 153 REST OF SOUTH AMERICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 154 REST OF SOUTH AMERICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018-2027 (TONS)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- TABLE 155 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS

- 12.2 MARKET SHARE ANALYSIS

- 12.2.1 MARKET SHARE ANALYSIS OF TOP PLAYERS IN THE PET FOAM MARKET

- FIGURE 30 REVENUE ANALYSIS OF LEADING COMPANIES IN PET FOAM MARKET, 2017-2020

- 12.3 COMPANY EVALUATION QUADRANT MATRIX DEFINITIONS AND METHODOLOGY, 2019

- 12.3.1 STAR

- 12.3.2 EMERGING LEADERS

- 12.3.3 PERVASIVE

- 12.3.4 PARTICIPANTS

- FIGURE 31 PET FOAM MARKET: COMPETITIVE LANDSCAPE MAPPING, 2019

- 12.4 COMPETITIVE BENCHMARKING

- 12.4.1 STRENGTH OF PRODUCT PORTFOLIOS

- 12.4.2 BUSINESS STRATEGY EXCELLENCE

- 12.5 KEY MARKET DEVELOPMENTS

- TABLE 156 DEALS, 2017-2021

- TABLE 157 OTHERS, 2017-2021

- TABLE 158 PRODUCT LAUNCHES, 2017-2021

13 COMPANY PROFILE

- (Business Overview, Products Offered, Recent Developments, MNM VIEW, Key strengths/right to win, Strategic choices made Weaknesses and competitive threats)**

- 13.1 3A COMPOSITES

- TABLE 159 3A COMPOSITES: COMPANY OVERVIEW

- FIGURE 32 3A COMPOSITES: COMPANY SNAPSHOT

- 13.2 DIAB GROUP

- TABLE 160 DIAB GROUP: COMPANY OVERVIEW

- FIGURE 33 DIAB GROUP: COMPANY SNAPSHOT

- 13.3 GURIT HOLDING AG

- TABLE 161 GURIT HOLDING AG: COMPANY OVERVIEW

- FIGURE 34 GURIT HOLDING AG: COMPANY SNAPSHOT

- 13.4 ARMACELL INTERNATIONAL S.A.

- TABLE 162 ARMACELL INTERNATIONAL S.A.: COMPANY OVERVIEW

- FIGURE 35 ARMACELL INTERNATIONAL S.A.: COMPANY SNAPSHOT

- 13.5 SEKISUI CHEMICAL CO LTD

- TABLE 163 SEKISUI CHEMICAL CO LTD: COMPANY OVERVIEW

- FIGURE 36 SEKISUI CHEMICAL CO LTD: COMPANY SNAPSHOT

- 13.6 CHANGZHOU TIANSHENG NEW MATERIALS CO. LTD

- TABLE 164 CHANGZHOU TIANSHENG NEW MATERIALS CO. LTD.: COMPANY OVERVIEW

- FIGURE 37 CHANGZHOU TIANSHENG NEW MATERIALS CO. LTD.: COMPANY SNAPSHOT

- 13.7 PETRO POLYMER SHARGH (PPS)

- TABLE 165 PETRO POLYMER SHARGH (PPS): COMPANY OVERVIEW

- 13.8 CARBON-CORE CORP.

- TABLE 166 CARBON-CORE CORP.: COMPANY OVERVIEW

- 13.9 COMPOSITE ESSENTIAL MATERIALS LLC

- TABLE 167 COMPOSITE ESSENTIAL MATERIALS LLC: COMPANY OVERVIEW

- 13.10 VISIGHT COMPOSITE MATERIAL CO., LTD

- TABLE 168 VISIGHT COMPOSITE MATERIAL CO., LTD: COMPANY OVERVIEW

- 13.11 CORELITE

- TABLE 169 CORELITE: COMPANY OVERVIEW

- 13.12 HUNAN RIFENG COMPOSITE CO., LTD

- TABLE 170 HUNAN RIFENG COMPOSITE CO., LTD: COMPANY OVERVIEW

- 13.13 XTX COMPOSITES

- TABLE 171 XTX COMPOSITES: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MNM VIEW, Key strengths/right to win, Strategic choices made Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.2.1 PET FOAM INTERCONNECTED MARKETS

- 14.3 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.4 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE

- 14.4.1 ACRYLIC POLYMERS

- 14.4.2 SBR LATEX

- TABLE 172 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY POLYMER TYPE, 2018-2025 (USD MILLION)

- TABLE 173 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY POLYMER TYPE, 2018-2025 (KILOTONS)

- 14.5 STRUCTURAL CORE MATERIALS MARKET

- 14.5.1 MARKET DEFINITION

- 14.5.2 MARKET OVERVIEW

- 14.6 STRUCTURAL CORE MATERIALS MARKET, BY TYPE

- 14.6.1 FOAM

- 14.6.2 HONEYCOMB

- 14.7 BALSA

- TABLE 174 STRUCTURAL CORE MATERIALS MARKET SIZE, BY TYPE, 2015-2022 (USD MILLION)

- TABLE 175 STRUCTURAL CORE MATERIALS MARKET SIZE, BY TYPE, 2015-2022 (KILOTON)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS