|

|

市場調査レポート

商品コード

1153486

ソフトウェア無線の世界市場:プラットフォーム別 (航空、海上、陸上、宇宙)・用途別 (政府・防衛、商業)・コンポーネント別 (ハードウェア、ソフトウェア)・種類別・周波数帯域別 (シングルバンド、マルチバンド)・地域別の将来予測 (2027年まで)Software Defined Radio Market by Platform (Airborne, Maritime, Land, Space), Application (Government & Defense, Commercial), Component (Hardware, Software), Type, Frequency (Single Band, Multi-Band) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ソフトウェア無線の世界市場:プラットフォーム別 (航空、海上、陸上、宇宙)・用途別 (政府・防衛、商業)・コンポーネント別 (ハードウェア、ソフトウェア)・種類別・周波数帯域別 (シングルバンド、マルチバンド)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月10日

発行: MarketsandMarkets

ページ情報: 英文 280 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のソフトウェア無線市場は、2022年の100億米ドルから2027年には125億米ドルに成長し、2022年から2027年までのCAGRは4.6%と予測されています。

最新の軍事戦術通信システムの調達が増加していることが、予測期間中のソフトウェア無線市場の成長を促進すると考えられています。

プラットフォーム別では、陸上セグメントが2022年に最大の市場シェアで市場をリードする見通しです。

用途別では、政府・防衛分野が基準年に最大のシェアを記録しています。現在のシナリオでは、防衛通信システムは大きな変革期を迎えており、防衛用のダイナミックなニーズに対応するために、各企業によって多くの技術進歩が行われています。

北米は2022年に最大の市場シェア (37.3%) で市場を独占すると推定されます。特に、米国が主要なシェアを占めています。米国企業は、自社のポートフォリオを強化し、競合他社に対する競争力を獲得するために、新製品や新技術の投入や開発に取り組んでいます。

当レポートでは、世界のソフトウェア無線の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、プラットフォーム別・用途別・コンポーネント別・種類別・周波数帯域別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 範囲とシナリオ

- 顧客のビジネスに影響を与える動向/混乱

- ソフトウェア無線市場のエコシステム

- バリューチェーン分析

- 貿易分析

- ポーターのファイブフォース分析

- 関税と規制の状況

- 平均販売価格分析

- 主な利害関係者と購入基準

- 主な会議とイベント (2022年~2023年)

第6章 産業動向

- イントロダクション

- ソフトウェア無線番組のビジネスモデル

- 技術動向

- SDRAN (ソフトウェア無線アクセスネットワーク)

- RF-ID

- ソフトウェア定義のドップラーレーダー

- 近距離通信

- マルチバンド戦術通信アンプ

- 次世代IP

- WEB SDR

- HDSDR (高性能ソフトウェア無線)

- GNU Radio

- 使用事例分析:ソフトウェア無線市場

- 技術分析

- コグニティブ無線:人工知能とソフトウェア無線の融合

- 5G技術におけるソフトウェア無線とコグニティブ無線 (CR) の使用

- MUOS (MOBILE USER OBJECTIVE SYSTEM):ソフトウェア無線における携帯電話のような機能

- メガトレンドの影響

- サプライチェーン管理における破壊的技術

- 世界経済力のシフト

- 新規技術の採用によるSDRの進歩

- イノベーションと特許登録

第7章 ソフトウェア無線市場:プラットフォーム別

- イントロダクション

- 航空

- 民間航空機

- 軍用機

- 無人航空機

- 海上

- 商船

- 軍艦

- 潜水艦

- 無人海上車両

- 陸上

- 移動式

- 固定式

- 宇宙

- LEO (低軌道)

- GEO (静止軌道)

- MEO (中軌道)

第8章 ソフトウェア無線市場:用途別

- イントロダクション

- 政府・防衛

- 軍事通信

- 国土安全保障・緊急対応

- 商業

- 航空通信

- 海上通信

- 電気通信

- 交通機関

- 宇宙通信

第9章 ソフトウェア無線市場:コンポーネント別

- イントロダクション

- ハードウェア

- 汎用プロセッサー

- DSP (デジタル信号処理装置)

- 統合回路

- アンプ

- アンテナ

- コンバーター

- その他

- ソフトウェア

第10章 ソフトウェア無線市場:種類別

- イントロダクション

- 汎用無線

- JTRS (共同戦術無線システム)

- コグニティブ/インテリジェント無線

- TETRA (地上基盤無線)

第11章 ソフトウェア無線市場:周波数帯域別

- イントロダクション

- シングルバンド

- LF

- MF

- HF

- VHF

- UHF

- SHF

- EHF

- マルチバンド

第12章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ロシア

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- 他のアジア太平洋諸国

- 中東

- イスラエル

- トルコ

- サウジアラビア

- アラブ首長国連邦

- ラテンアメリカ

- ブラジル

- アルゼンチン

- メキシコ

- アフリカ

- 南アフリカ

- エジプト

第13章 競合情勢

- イントロダクション

- 企業概要

- 主要企業のランキング分析 (2021年)

- 収益分析 (2021年)

- 市場シェア分析 (2021年)

- 製品フットプリント分析

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合ベンチマーキング

- 競合シナリオ

第14章 企業プロファイル

- イントロダクション

- 主要企業

- L3HARRIS TECHNOLOGIES, INC.

- RAYTHEON TECHNOLOGIES CORPORATION

- NORTHROP GRUMMAN CORPORATION

- GENERAL DYNAMICS CORPORATION

- THALES GROUP

- BAE SYSTEMS

- ROHDE & SCHWARZ

- ELBIT SYSTEMS LTD.

- LEONARDO S.P.A.

- VIASAT, INC.

- ASELSAN A.S.

- NATIONAL INSTRUMENTS CORPORATION

- ZTE CORPORATION

- HUAWEI TECHNOLOGIES CO., LTD.

- ANALOG DEVICES, INC.

- DATASOFT CORPORATION

- STMICROELECTRONICS N.V.

- TEXAS INSTRUMENTS INCORPORATED

- FLEXRADIO

- ULTRA

- その他の企業

- BARRETT COMMUNICATIONS PTY LTD.

- NXP SEMICONDUCTORS N.V.

- PENTEK INC.

- BITTIUM CORPORATION

- RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

- ASTRA RAFAEL COMSYS PVT. LTD.

- BHARAT ELECTRONICS LIMITED

- ROLTA INDIA LIMITED

- SAANKHYA LABS PVT. LTD.

- INNTOT TECHNOLOGIES PVT. LTD.

第15章 付録

The software defined radio market is projected to grow from USD 10.0 Billion in 2022 to USD 12.5 Billion by 2027, at a CAGR of 4.6% from 2022 to 2027. Rising procurement of modern military tactical communication systems is expected to drive the software defined radio market growth during the forecast period.

Continuously evolving dynamics of the software defined radio (SDR) market are attributed to the changing intergovernmental situations in countries such as North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa.

Growing demand of SDR from telecommunication industry and increasing procurement of next generation military communication system are some factors that are expected to boost the growth of SDR market during the projection period.

Government authorities in multiple developed and developing countries across the globe are continuously focusing on their military spending, including the procurement of technologically advanced products. Countries like the US, France, Russia, and Israel have majorly focused on gaining an edge in the military and defense manufacturing sectors. However, there could be a shift in global economic power towards Asia, wherein countries like China, India, and South Korea have enhanced their military spending in recent years. China is one of the major defense spenders in the world. With the emergence of China as a strong player in the military & defense sector, neighboring countries, including India, Vietnam, and Japan, are also focusing on increasing their military spending. These countries, along with the US, have high defense budgets to enhance their border and national security. For instance, in November 2019, L3Harris Technologies, Inc. was awarded a contract worth over USD 86 million by the US Special Operations Command (USSOCOM) to supply tactical radios. Elbit Systems was awarded a contract worth over USD 200 million in October 2019 by the Swiss army for the supply of radio communication systems. Such contracts will, in turn, drive the software defined radio market during the forecast period.

Based on platform, the land segment is expected to lead market with largest share in 2022

Based on platform, the software-defined radio market has been segmented into airborne, maritime, land, and space. The increasing requirement for secure and jam-free communication in the defense sector has led to the growth of the software-defined radio (SDR) market. SDR finds a number of distinct applications in multiple sectors, such as military, public safety, and telecommunications. SDR is an advanced technology that helps accelerate the expansion of multi-service, multi-featured, and multi-band radio equipment.

SDR allows single wireless equipment to support a broad range of capabilities that were previously available by integrating several radio components. The initial focus of industry players during the manufacturing of SDRs is on developing a multi-purpose device. A single software-defined radio device could provide cellular connectivity, offer GPS position location service, act as an AM/FM receiver, connect with wireless data networks, and function as an HDTV receiver. It offers the upgradeability and flexibility required to satisfy the users' needs by enabling the instantaneous operation of numerous standards on a single hardware device. This technology also supports software RAN solutions, which allow cellular operators to support several standards simultaneously on a single hardware platform that includes shared RF equipment along with backhaul transport. The SDR market is growing at a significant rate in North America and Asia Pacific, owing to the increased manufacturing facilities of communication systems and electronic platforms in these regions. The US, China, Japan, South Korea, and India are some of the major hubs of communication systems and electronic platforms manufacturing.

Based on Application, government & Defense segment registered largest share in base year

Based on application, the software-defined radio market has been segmented into government & defense and commercial. The government & defense segment accounted for a larger share of the software-defined radio market owing to the modernization of military communications and the implementation of tactical communication systems. In the current scenario, defense communication systems are going through a major transformation, with numerous technological advancements being made by market players to cater to the dynamic needs of defense forces.

Software-defined radio relies on typical hardware components that are implemented in software and networked communications technology to provide a shared awareness of the battlespace to defense forces. Defense experts say that a shared awareness increases synergy for command and control, resulting in superior decision-making and the ability to coordinate complex defense operations over long distances for an overwhelming war-fighting advantage. Software-defined radio is highly dependent on the interoperability of communications equipment, data, and software to enable the networking of people, sensors, and manned and unmanned platforms.

The North America region dominated the market with largest share in 2022

North America is estimated to account for the major share (37.3%) of the software-defined radio market. The presence of leading SDR manufacturers in the US such as Northrop Grumman Corporation (US), L3Harris Technologies, Inc. (US), Raytheon Technologies Corporation (US), General Dynamics Corporation (US), National Instruments (US), and FlexRadio (US) are supporting the SDR market growth in the North America. The US holds major share in North America in 2021. The increasing need to minimize the complexity of mobile communication systems and improve security in networking, along with the requirement for jam-free and error free communications, will help to expand the SDR market size in the US. For instance, in November 2020, the Intelligence Advanced Research Projects Agency (IARPA) made an announcement (IARPA-BAA-20-03) for securing information through the smart radio systems (SCISRS) program. Industry players in the US are engaged in launching and developing new products and technologies to boost their portfolio and gain a competitive edge over their competitors. For instance, in April 2019, BAE Systems showcased a software-defined radio assembly allowing customers to engage their spacecraft for various space missions.

The break-up of the profiles of primary participants in the Software Defined Radio Market is as follows:

- By Company Type: Tier 1-32%; Tier 2-40%; and Tier 3-28%

- By Designation: C Level Executives-35%; Directors-25%; and Others-40%

- By Region: North America-37.32%; Europe-21.58%; Asia Pacific-29.26%; Middle East-5.60%; Latin America-4.20%; and Africa-2.05%

Major players in the software defined radio market are L3Harris Technologies, Inc. (US), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), General Dynamics Corporation (US), and Thales Group (France). These companies adopted strategies including product development and service launches, contracts, partnerships, agreements, and expansions to sustain their position in the market. Also focusing on expanding distribution networks in the defense and commercial business across North America, Europe, Asia Pacific and other regions in turn driving the demand for SDR.

Research Coverage

This research report categorizes the software defined radio market into platfrom, application, cmponent, type, frequency and region. Based on platform the market is divided into airborne, maritime, land, and space. On the basis of application, the market is fragmented into government & defense and commercial. By component, the market is classified into hardware and software. Based on type, the market is divided into general purpose radio, joint tactical radio system (JTRS), cognitive/intelligent radio, and terrestrial trunked radio (TETRA). By frequency, the software defined radio market is segmented into single band frequency and multi band frequency. The software defined radio market has been studied for North America, Europe, Asia Pacific, Middle East, Latin America, and Africa.

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the software defined radio market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches associated with the software defined radio market. Competitive analysis of upcoming startups in the software defined radio market ecosystem is covered in this report.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall Software Defined Radio Market and its segments. This study is also expected to provide region wise information about the end-use industrial sectors, wherein Software Defined Radio is used. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on software defined radio offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the software defined radio market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the software defined radio market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the software defined radio market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the software defined radio market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- TABLE 1 SOFTWARE-DEFINED RADIO MARKET: INCLUSIONS & EXCLUSIONS

- 1.4 CURRENCY

- 1.5 USD EXCHANGE RATE

- 1.6 MARKET SCOPE

- 1.6.1 MARKETS COVERED

- FIGURE 1 SOFTWARE-DEFINED RADIO MARKET SEGMENTATION

- 1.6.2 YEARS CONSIDERED

- 1.6.3 REGIONAL SCOPE

- 1.7 MARKET STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- FIGURE 2 SOFTWARE-DEFINED RADIO MARKET TO GROW AT LOWER RATE COMPARED TO PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 RESEARCH PROCESS FLOW

- FIGURE 4 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.4 RESEARCH APPROACH & METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Software-defined radio market for airborne

- 2.4.1.2 Software-defined radio market for maritime

- 2.4.1.3 Software-defined radio market for land

- 2.4.1.4 Software-defined radio market for space

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.6 GROWTH RATE ASSUMPTIONS

- 2.7 RESEARCH ASSUMPTIONS

- FIGURE 9 ASSUMPTIONS FOR RESEARCH STUDY

- 2.8 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 10 LAND PLATFORM SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 11 GOVERNMENT & DEFENSE APPLICATIONS TO HOLD LARGER MARKET SHARE IN 2022

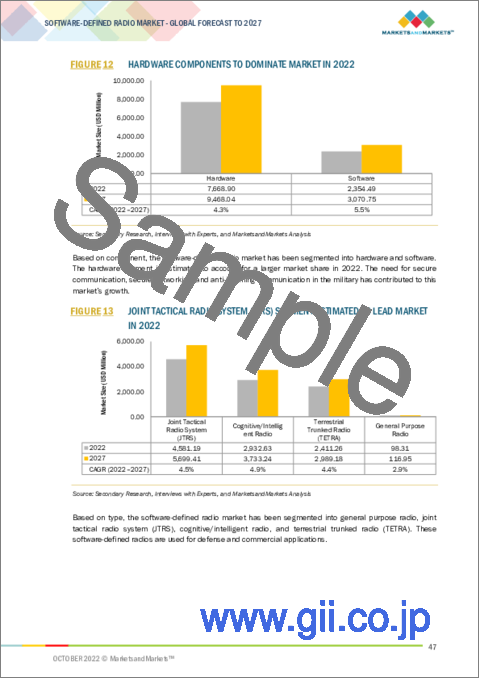

- FIGURE 12 HARDWARE COMPONENTS TO DOMINATE MARKET IN 2022

- FIGURE 13 JOINT TACTICAL RADIO SYSTEM (JTRS) SEGMENT ESTIMATED TO LEAD MARKET IN 2022

- FIGURE 14 MULTIBAND FREQUENCY SEGMENT PROJECTED TO REGISTER HIGHER CAGR FROM 2022 TO 2027

- FIGURE 15 NORTH AMERICA PROJECTED TO COMMAND MAJOR SHARE FROM 2022 TO 2027

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN SOFTWARE-DEFINED RADIO MARKET

- FIGURE 16 INCREASING ADOPTION OF SOFTWARE-DEFINED RADIO IN DEFENSE SECTOR TO BOOST MARKET DURING FORECAST PERIOD

- 4.2 SOFTWARE-DEFINED RADIO MARKET, BY AIRBORNE PLATFORM

- FIGURE 17 COMMERCIAL AIRCRAFT SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 SOFTWARE-DEFINED RADIO MARKET, BY COMMERCIAL AIRCRAFT

- FIGURE 18 NBA SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 SOFTWARE-DEFINED RADIO MARKET, BY MARITIME PLATFORM

- FIGURE 19 UNMANNED MARITIME VEHICLES TO GROW FASTEST DURING FORECAST PERIOD

- 4.5 SOFTWARE-DEFINED RADIO MARKET, BY LAND PLATFORM

- FIGURE 20 MOBILE SEGMENT PROJECTED TO HAVE HIGHER CAGR DURING FORECAST PERIOD

- 4.6 SOFTWARE-DEFINED RADIO MARKET, BY MOBILE PLATFORM

- FIGURE 21 HANDHELD SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- 4.7 SOFTWARE-DEFINED RADIO MARKET, BY FIXED PLATFORM

- FIGURE 22 OTHERS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- 4.8 SOFTWARE-DEFINED RADIO MARKET, BY SPACE PLATFORM

- FIGURE 23 LEO SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- 4.9 SOFTWARE-DEFINED RADIO MARKET, BY GOVERNMENT & DEFENSE APPLICATION

- FIGURE 24 MILITARY COMMUNICATIONS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- 4.10 SOFTWARE-DEFINED RADIO MARKET, BY COMMERCIAL APPLICATION

- FIGURE 25 TELECOMMUNICATION SEGMENT PROJECTED TO COMMAND MARKET DURING FORECAST PERIOD

- 4.11 SOFTWARE-DEFINED RADIO MARKET, BY HARDWARE TYPE

- FIGURE 26 CONVERTERS SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- 4.12 SOFTWARE-DEFINED RADIO MARKET, BY SINGLE BAND FREQUENCY

- FIGURE 27 VHF SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 28 SOFTWARE-DEFINED RADIO MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Constant development of next-generation software-defined radios

- 5.2.1.2 Increasing demand from telecommunications industry

- 5.2.1.3 Rising procurement of modern military tactical communication systems

- FIGURE 29 MILITARY EXPENDITURE OF MAJOR COUNTRIES, 2019-2021 (USD MILLION)

- 5.2.1.4 Growing demand for mission-critical communications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Security concerns associated with new SDR installations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased focus on development of next-generation IP radio systems

- 5.2.3.2 Rising usage of SDR in commercial, industrial, and homeland security applications

- 5.2.3.3 Innovations in new cognitive radio technology

- 5.2.3.4 Implementation of TETRA Enhanced Data Service (TEDS)

- 5.2.4 CHALLENGES

- 5.2.4.1 Interoperability between disparate communication technologies

- 5.2.4.2 Development of SDR with low power consumption

- 5.2.4.3 Maintaining partnerships between vendors and operators

- 5.2.4.4 Upgrading communication standards

- 5.3 RANGES AND SCENARIOS

- FIGURE 30 IMPACT OF COVID-19 ON SOFTWARE-DEFINED RADIO MARKET: THREE GLOBAL SCENARIOS

- 5.4 TRENDS/BUSINESS IMPACTING CUSTOMER BUSINESS

- 5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SOFTWARE-DEFINED RADIO MANUFACTURERS

- FIGURE 31 REVENUE SHIFT IN SOFTWARE-DEFINED RADIO MARKET

- 5.5 SOFTWARE-DEFINED RADIO MARKET ECOSYSTEM

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- FIGURE 32 MARKET ECOSYSTEM MAP: SOFTWARE-DEFINED RADIO

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 33 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING OEM AND SYSTEM INTEGRATION PHASES

- 5.7 TRADE ANALYSIS

- TABLE 2 COUNTRY-WISE EXPORTS, 2020 & 2021 (USD THOUSAND)

- TABLE 3 COUNTRY-WISE IMPORTS, 2020 & 2021 (USD THOUSAND)

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 SOFTWARE-DEFINED RADIO MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 SOFTWARE-DEFINED RADIO MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.10 AVERAGE SELLING PRICE ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE: SOFTWARE-DEFINED RADIOS

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP TWO APPLICATIONS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP TWO APPLICATIONS (%)

- 5.11.2 BUYING CRITERIA

- FIGURE 36 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- TABLE 7 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- 5.12 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 8 SOFTWARE-DEFINED RADIO MARKET: CONFERENCES & EVENTS (2022-2023)

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.1.1 EVOLUTION: SOFTWARE-DEFINED RADIO

- 6.2 BUSINESS MODELS FOR SOFTWARE-DEFINED RADIO PROGRAMS

- 6.2.1 INVESTMENT MODELS

- 6.2.1.1 Government funding

- 6.2.1.2 Military off-the-shelf (MOTS) solutions

- 6.2.1.3 Government-industry convergence: Government off-the-shelf (GOTS) solutions

- 6.2.1 INVESTMENT MODELS

- 6.3 TECHNOLOGY TRENDS

- FIGURE 37 TECHNOLOGICAL ADVANCEMENT - A GROWING TREND IN SOFTWARE-DEFINED RADIO MARKET

- 6.3.1 SOFTWARE-DEFINED RADIO ACCESS NETWORK (SDRAN)

- 6.3.2 NEAR-FIELD RADIO FREQUENCY IDENTIFICATION (RFID)

- 6.3.3 SOFTWARE-DEFINED DOPPLER RADAR

- 6.3.4 NEAR FIELD COMMUNICATION

- 6.3.5 MULTIBAND TACTICAL COMMUNICATION AMPLIFIERS

- 6.3.6 NEXT-GENERATION IP

- 6.3.7 WEBSDR

- 6.3.8 HIGH-PERFORMANCE SOFTWARE-DEFINED RADIO (HPSDR)

- 6.3.9 GNU RADIO

- 6.4 USE CASE ANALYSIS: SOFTWARE-DEFINED RADIO MARKET

- 6.4.1 RF AND MICROWAVE COMPONENTS TO ENABLE SDR TO OPERATE IN CONTESTED ENVIRONMENTS

- 6.4.2 DARPA BLACKJACK EXPERIMENTS WITH SDR TO LINK LEO AND TACTICAL RADIOS

- 6.4.3 SCISRS PROGRAM SEEKS TO DEVELOP SMART RADIO TECHNIQUES TO DETECT SUSPICIOUS SIGNALS AND OTHER RF ANOMALIES

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 COGNITIVE RADIO: A MERGER OF ARTIFICIAL INTELLIGENCE AND SOFTWARE-DEFINED RADIO

- 6.5.1.1 Cognitive radio

- 6.5.1.2 Adaptive radio

- 6.5.1.3 Intelligent radio

- 6.5.2 USE OF SOFTWARE-DEFINED RADIO AND COGNITIVE RADIO (CR) IN 5G TECHNOLOGY

- 6.5.3 MOBILE USER OBJECTIVE SYSTEM (MUOS): CELLPHONE-LIKE CAPABILITY IN SOFTWARE-DEFINED RADIO

- 6.5.1 COGNITIVE RADIO: A MERGER OF ARTIFICIAL INTELLIGENCE AND SOFTWARE-DEFINED RADIO

- 6.6 IMPACT OF MEGATRENDS

- 6.6.1 DISRUPTIVE TECHNOLOGIES IN SUPPLY CHAIN MANAGEMENT

- 6.6.2 SHIFTING GLOBAL ECONOMIC POWERS

- 6.6.3 SDR ADVANCEMENTS THROUGH NEW TECHNOLOGY ADOPTION

- 6.7 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 9 SOFTWARE-DEFINED RADIO MARKET: KEY PATENTS (2019-2022)

7 SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- FIGURE 38 LAND SEGMENT TO LEAD SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

- TABLE 10 SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 11 SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 7.2 AIRBORNE

- FIGURE 39 COMMERCIAL AIRCRAFT SEGMENT TO DOMINATE SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

- TABLE 12 SOFTWARE-DEFINED RADIO MARKET, BY AIRBORNE PLATFORM, 2018-2021 (USD MILLION)

- TABLE 13 SOFTWARE-DEFINED RADIO MARKET, BY AIRBORNE PLATFORM, 2022-2027 (USD MILLION)

- 7.2.1 COMMERCIAL AIRCRAFT

- 7.2.1.1 Increase in air passenger traffic to boost demand for commercial aircraft

- FIGURE 40 COMMERCIAL NBA AIRCRAFT TO BE LARGEST SEGMENT IN SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

- TABLE 14 SOFTWARE-DEFINED RADIO MARKET, BY COMMERCIAL AIRCRAFT, 2018-2021 (USD MILLION)

- TABLE 15 SOFTWARE-DEFINED RADIO MARKET, BY COMMERCIAL AIRCRAFT, 2022-2027 (USD MILLION)

- 7.2.1.2 Wide-body aircraft

- 7.2.1.3 Narrow-body aircraft

- 7.2.1.4 Regional transport aircraft

- 7.2.2 MILITARY AIRCRAFT

- 7.2.2.1 Long-term procurement and maintenance contracts for fixed-wing military aircraft to fuel market growth

- 7.2.3 UNMANNED AERIAL VEHICLES

- 7.2.3.1 Increasing demand for UAVs by defense forces and advancements in communication technologies to assist market growth

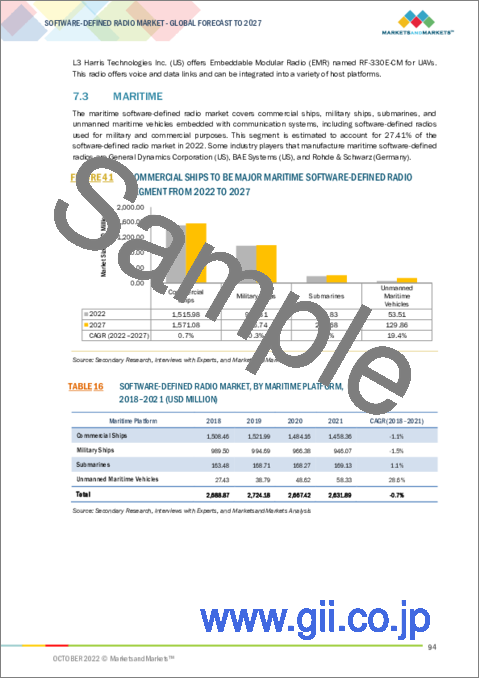

- 7.3 MARITIME

- FIGURE 41 COMMERCIAL SHIPS TO BE MAJOR MARITIME SOFTWARE-DEFINED RADIO SEGMENT FROM 2022 TO 2027

- TABLE 16 SOFTWARE-DEFINED RADIO MARKET, BY MARITIME PLATFORM, 2018-2021 (USD MILLION)

- TABLE 17 SOFTWARE-DEFINED RADIO MARKET, BY MARITIME PLATFORM, 2022-2027 (USD MILLION)

- 7.3.1 COMMERCIAL SHIPS

- 7.3.1.1 Increase in number of cargo ships to accommodate rise in marine trade to drive market

- 7.3.2 MILITARY SHIPS

- 7.3.2.1 Improved communication and navigation capacity of navy ships with new SDR technology to boost market

- 7.3.3 SUBMARINES

- 7.3.3.1 Market driven by increased procurement of submarines by defense forces in North America and Asia Pacific

- 7.3.4 UNMANNED MARITIME VEHICLES

- 7.3.4.1 Growing demand for maritime autonomous search missions and border security to aid market growth

- 7.4 LAND

- FIGURE 42 MOBILE LAND PLATFORMS TO BE DOMINANT IN SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

- TABLE 18 SOFTWARE-DEFINED RADIO MARKET, BY LAND PLATFORM, 2018-2021 (USD MILLION)

- TABLE 19 SOFTWARE-DEFINED RADIO MARKET, BY LAND PLATFORM, 2022-2027 (USD MILLION)

- 7.4.1 MOBILE

- 7.4.1.1 Increased procurement of modern handheld radios for armed forces in North America and Asia Pacific to drive market

- FIGURE 43 HANDHELD SEGMENT TO LEAD LAND-BASED SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

- TABLE 20 LAND: SOFTWARE-DEFINED RADIO MARKET, BY MOBILE PLATFORM, 2018-2021 (USD MILLION)

- TABLE 21 LAND: SOFTWARE-DEFINED RADIO MARKET, BY MOBILE PLATFORM, 2022-2027 (USD MILLION)

- 7.4.1.2 Handheld

- 7.4.1.3 Manpack

- 7.4.1.4 Vehicle-mounted

- 7.4.2 FIXED

- 7.4.2.1 Rising demand in traffic control stations to boost market growth

- FIGURE 44 FIXED AIR TRAFFIC CONTROL STATIONS TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 22 LAND: SOFTWARE-DEFINED RADIO MARKET, BY FIXED PLATFORM, 2018-2021 (USD MILLION)

- TABLE 23 LAND: SOFTWARE-DEFINED RADIO MARKET, BY FIXED PLATFORM, 2022-2027 (USD MILLION)

- 7.4.2.2 Command stations

- 7.4.2.3 Air traffic control stations

- 7.4.2.4 Maritime traffic control stations

- 7.4.2.5 Others

- 7.5 SPACE

- FIGURE 45 LEO SEGMENT TO LEAD SPACE SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

- TABLE 24 SOFTWARE-DEFINED RADIO MARKET, BY SPACE PLATFORM, 2018-2021 (USD MILLION)

- TABLE 25 SOFTWARE-DEFINED RADIO MARKET, BY SPACE PLATFORM, 2022-2027 (USD MILLION)

- 7.5.1 LEO

- 7.5.2 GEO

- 7.5.3 MEO

8 SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 46 GOVERNMENT & DEFENSE APPLICATIONS TO LEAD SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

- TABLE 26 SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 27 SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.2 GOVERNMENT & DEFENSE

- FIGURE 47 MILITARY COMMUNICATIONS SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

- TABLE 28 GOVERNMENT & DEFENSE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 29 GOVERNMENT & DEFENSE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.2.1 MILITARY COMMUNICATION

- 8.2.1.1 Increased demand for secure communications for military ISR operations

- 8.2.2 HOMELAND SECURITY & EMERGENCY RESPONSE

- 8.2.2.1 Rising demand for software-defined radio by law enforcement agencies

- 8.3 COMMERCIAL

- FIGURE 48 TELECOMMUNICATION SEGMENT TO WITNESS FASTEST GROWTH DURING 2022- 2027

- TABLE 30 COMMERCIAL: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 31 COMMERCIAL: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.3.1 AVIATION COMMUNICATION

- 8.3.1.1 Increased use of advanced communication systems for improved air traffic flow management

- 8.3.2 MARINE COMMUNICATION

- 8.3.2.1 Use of SDR for commercial vessel traffic monitoring and communications

- 8.3.3 TELECOMMUNICATION

- 8.3.3.1 Increasing adoption of SDR at cellular base stations

- 8.3.4 TRANSPORTATION

- 8.3.4.1 Use of software-defined radio in intelligent transportation systems for improved safety

- 8.3.5 SPACE COMMUNICATION

- 8.3.5.1 Increasing use of space communications for military operations

9 SOFTWARE-DEFINED RADIO MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- FIGURE 49 HARDWARE SEGMENT TO LEAD SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

- TABLE 32 SOFTWARE-DEFINED RADIO MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 33 SOFTWARE-DEFINED RADIO MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 9.2 HARDWARE

- FIGURE 50 INTEGRATED CIRCUITS TO LEAD AMONG HARDWARE COMPONENTS FROM 2022 TO 2027

- TABLE 34 SOFTWARE-DEFINED RADIO MARKET, BY HARDWARE COMPONENT, 2018-2021 (USD MILLION)

- TABLE 35 SOFTWARE-DEFINED RADIO MARKET, BY HARDWARE COMPONENT, 2022-2027 (USD MILLION)

- 9.2.1 GENERAL PURPOSE PROCESSORS

- 9.2.2 DIGITAL SIGNAL PROCESSORS

- 9.2.3 INTEGRATED CIRCUITS

- 9.2.4 AMPLIFIERS

- 9.2.5 ANTENNAS

- 9.2.6 CONVERTORS

- 9.2.7 OTHERS

- 9.3 SOFTWARE

10 SOFTWARE-DEFINED RADIO MARKET, BY TYPE

- 10.1 INTRODUCTION

- FIGURE 51 COGNITIVE/INTELLIGENT RADIO SEGMENT ANTICIPATED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 36 SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 37 SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.2 GENERAL PURPOSE RADIO

- 10.2.1 TYPICALLY USED FOR SHORT-DISTANCE, TWO-WAY VOICE COMMUNICATION USING HANDHELD RADIOS

- 10.3 JOINT TACTICAL RADIO SYSTEM (JTRS)

- 10.3.1 ONGOING PROGRAMS FOR DEVELOPMENT OF ADVANCED SDR FOR DEFENSE FORCES

- 10.4 COGNITIVE/INTELLIGENT RADIO

- 10.4.1 TECHNOLOGICAL ADVANCEMENTS & INCREASING ADOPTION OF 5G

- 10.5 TERRESTRIAL TRUNKED RADIO (TETRA)

- 10.5.1 INCREASED USAGE IN EMERGENCY & TRANSPORT SERVICES, AND MILITARY SECTOR

11 SOFTWARE-DEFINED RADIO MARKET, BY FREQUENCY BAND

- 11.1 INTRODUCTION

- TABLE 38 DIFFERENT TYPES OF FREQUENCY BANDS

- FIGURE 52 MULTIBAND SEGMENT LIKELY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 39 SOFTWARE-DEFINED RADIO MARKET, BY FREQUENCY BAND, 2018-2021 (USD MILLION)

- TABLE 40 SOFTWARE-DEFINED RADIO MARKET, BY FREQUENCY BAND, 2022-2027 (USD MILLION)

- 11.2 SINGLE BAND

- 11.2.1 SINGLE BAND FREQUENCY WIDELY USED IN SECURE MILITARY COMMUNICATIONS

- FIGURE 53 VERY HIGH FREQUENCY SEGMENT TO LEAD SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

- TABLE 41 SINGLE BAND: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 42 SINGLE BAND: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.2 LF

- 11.2.3 MF

- 11.2.4 HF

- 11.2.5 VHF

- 11.2.6 UHF

- 11.2.7 SHF

- 11.2.8 EHF

- 11.3 MULTIBAND

- 11.3.1 USED FOR COHERENT DETECTION AND TRACKING OF MOVING TARGET OBJECTS

12 REGIONAL ANALYSIS

- 12.1 INTRODUCTION

- FIGURE 54 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF SOFTWARE-DEFINED RADIO MARKET IN 2022

- TABLE 43 SOFTWARE-DEFINED RADIO MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 SOFTWARE-DEFINED RADIO MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 INTRODUCTION

- 12.2.2 PESTLE ANALYSIS

- FIGURE 55 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET SNAPSHOT

- TABLE 45 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 46 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 47 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 48 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 50 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 52 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.2.3 US

- 12.2.3.1 Increasing focus on development of advanced SDR for government and commercial use

- TABLE 53 US: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 54 US: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 55 US: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 56 US: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.2.4 CANADA

- 12.2.4.1 Promotion of various defense development programs by government

- TABLE 57 CANADA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 58 CANADA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 59 CANADA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 60 CANADA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 INTRODUCTION

- 12.3.2 PESTLE ANALYSIS: EUROPE

- FIGURE 56 EUROPE: SOFTWARE-DEFINED RADIO MARKET SNAPSHOT

- TABLE 61 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 62 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 63 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 64 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 65 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 66 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 67 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 68 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Supportive government initiatives for development of communication systems to increase SDR demand

- TABLE 69 UK: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 70 UK: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 71 UK: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 72 UK: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.4 GERMANY

- 12.3.4.1 Continuous focus on upgrading battle management and communication systems

- TABLE 73 GERMANY: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 74 GERMANY: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 75 GERMANY: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 76 GERMANY: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.5 FRANCE

- 12.3.5.1 Manufacturers focused on business expansion owing to rising demand

- TABLE 77 FRANCE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 78 FRANCE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 79 FRANCE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 80 FRANCE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.6 ITALY

- 12.3.6.1 Increasing requirement for SDRs from Italian armed forces and law enforcement agencies

- TABLE 81 ITALY: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 82 ITALY: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 83 ITALY: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 84 ITALY: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.7 SPAIN

- 12.3.7.1 Rising focus of Government of Spain on strengthening defense force capabilities

- TABLE 85 SPAIN: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 86 SPAIN: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 87 SPAIN: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 88 SPAIN: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.8 RUSSIA

- 12.3.8.1 Rising frequency of cyber threats in Russia

- TABLE 89 RUSSIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 90 RUSSIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 91 RUSSIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 92 RUSSIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.9 REST OF EUROPE

- TABLE 93 REST OF EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 94 REST OF EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 95 REST OF EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 96 REST OF EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- 12.4.1 INTRODUCTION

- 12.4.2 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 57 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET SNAPSHOT

- TABLE 97 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 98 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 99 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 100 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 101 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 102 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 103 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.4.3 CHINA

- 12.4.3.1 High investment in development and procurement of emerging defense technologies

- TABLE 105 CHINA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 106 CHINA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 107 CHINA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 108 CHINA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.4 INDIA

- 12.4.4.1 Rising focus on procurement of government and defense equipment

- TABLE 109 INDIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 110 INDIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 111 INDIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 112 INDIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.5 JAPAN

- 12.4.5.1 Increasing requirement from government and defense sectors

- TABLE 113 JAPAN: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 114 JAPAN: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 115 JAPAN: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 116 JAPAN: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Rising security concerns from neighboring countries

- TABLE 117 SOUTH KOREA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 118 SOUTH KOREA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 119 SOUTH KOREA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 120 SOUTH KOREA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.7 AUSTRALIA

- 12.4.7.1 Rising incidences of violence resulting in upgrade of communication equipment

- TABLE 121 AUSTRALIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 122 AUSTRALIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 123 AUSTRALIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 124 AUSTRALIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.8 REST OF ASIA PACIFIC

- TABLE 125 REST OF ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.5 MIDDLE EAST

- 12.5.1 INTRODUCTION

- 12.5.2 PESTLE ANALYSIS

- FIGURE 58 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET SNAPSHOT

- TABLE 129 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 130 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 131 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 132 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 133 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 134 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 135 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 136 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.5.3 ISRAEL

- 12.5.3.1 Advanced technologies in communication systems and presence of major players

- TABLE 137 ISRAEL: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 138 ISRAEL: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 139 ISRAEL: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 140 ISRAEL: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.5.4 TURKEY

- 12.5.4.1 High focus on indigenous equipment manufacturing

- TABLE 141 TURKEY: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 142 TURKEY: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 143 TURKEY: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 144 TURKEY: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.5.5 SAUDI ARABIA

- 12.5.5.1 Increased focus on military equipment procurement, including communication systems

- TABLE 145 SAUDI ARABIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 146 SAUDI ARABIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 147 SAUDI ARABIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 148 SAUDI ARABIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.5.6 UAE

- 12.5.6.1 Increasing involvement in border safety and security to propel demand for SDR

- TABLE 149 UAE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 150 UAE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 151 UAE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 152 UAE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.6 LATIN AMERICA

- 12.6.1 INTRODUCTION

- 12.6.2 PESTLE ANALYSIS

- FIGURE 59 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET SNAPSHOT

- TABLE 153 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 154 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 155 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 156 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 157 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 158 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 159 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 160 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.6.3 BRAZIL

- 12.6.3.1 High focus on increasing military and defense strength

- TABLE 161 BRAZIL: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 162 BRAZIL: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 163 BRAZIL: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 164 BRAZIL: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.6.4 ARGENTINA

- 12.6.4.1 Rising SDR requirement for law enforcement personnel

- TABLE 165 ARGENTINA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 166 ARGENTINA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 167 ARGENTINA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 168 ARGENTINA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.6.5 MEXICO

- 12.6.5.1 Increasing illegal activities result in SDR demand for use in critical communication

- TABLE 169 MEXICO: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 170 MEXICO: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 171 MEXICO: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 172 MEXICO: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.7 AFRICA

- 12.7.1 INTRODUCTION

- 12.7.2 PESTLE ANALYSIS

- FIGURE 60 AFRICA: SOFTWARE-DEFINED RADIO MARKET SNAPSHOT

- TABLE 173 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 174 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 175 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 176 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 177 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 178 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 179 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 180 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.7.3 SOUTH AFRICA

- 12.7.3.1 Increased government focus on defense sector

- TABLE 181 SOUTH AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 182 SOUTH AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 183 SOUTH AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 184 SOUTH AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.7.4 EGYPT

- 12.7.4.1 Contracts by defense forces for military aids to support SDR market growth

- TABLE 185 EGYPT: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 186 EGYPT: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 187 EGYPT: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 188 EGYPT: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 COMPANY OVERVIEW

- TABLE 189 KEY DEVELOPMENTS OF LEADING PLAYERS IN SOFTWARE-DEFINED RADIO MARKET

- 13.3 RANKING ANALYSIS OF KEY PLAYERS, 2021

- FIGURE 61 RANKING OF KEY PLAYERS IN SOFTWARE-DEFINED RADIO MARKET, 2021

- 13.4 REVENUE ANALYSIS, 2021

- FIGURE 62 REVENUE ANALYSIS FOR KEY COMPANIES IN SOFTWARE-DEFINED RADIO MARKET, 2021

- 13.5 MARKET SHARE ANALYSIS, 2021

- FIGURE 63 MARKET SHARE ANALYSIS: KEY SOFTWARE-DEFINED RADIO PLAYERS, 2021

- TABLE 190 SOFTWARE-DEFINED RADIO MARKET: DEGREE OF COMPETITION

- 13.6 PRODUCT FOOTPRINT ANALYSIS

- FIGURE 64 PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS IN SOFTWARE-DEFINED RADIO MARKET, 2021

- 13.7 COMPANY EVALUATION QUADRANT

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- FIGURE 65 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- 13.8 START-UP/SME EVALUATION QUADRANT

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 STARTING BLOCKS

- 13.8.4 DYNAMIC COMPANIES

- FIGURE 66 SOFTWARE-DEFINED RADIO MARKET (START-UP/SME) COMPETITIVE LEADERSHIP MAPPING, 2021

- 13.9 COMPETITIVE BENCHMARKING

- TABLE 191 SOFTWARE-DEFINED RADIO MARKET: KEY START-UPS/SMES

- TABLE 192 SOFTWARE-DEFINED RADIO MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 13.10 COMPETITIVE SCENARIO

- TABLE 193 NEW PRODUCT LAUNCHES, 2018-AUGUST 2022

- TABLE 194 DEALS, 2018-AUGUST 2022

- TABLE 195 OTHERS, 2018-AUGUST 2022

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- (Business overview, Products/Services/Solutions offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats)**

- 14.2.1 L3HARRIS TECHNOLOGIES, INC.

- TABLE 196 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 67 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 197 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 199 L3HARRIS TECHNOLOGIES, INC.: DEALS

- 14.2.2 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 200 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- FIGURE 68 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 201 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 203 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- 14.2.3 NORTHROP GRUMMAN CORPORATION

- TABLE 204 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- FIGURE 69 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 205 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 206 NORTHROP GRUMMAN CORPORATION: DEALS

- 14.2.4 GENERAL DYNAMICS CORPORATION

- TABLE 207 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- FIGURE 70 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- TABLE 208 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES

- TABLE 210 GENERAL DYNAMICS CORPORATION: DEALS

- 14.2.5 THALES GROUP

- TABLE 211 THALES GROUP: BUSINESS OVERVIEW

- FIGURE 71 THALES GROUP: COMPANY SNAPSHOT

- TABLE 212 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 THALES GROUP: PRODUCT LAUNCHES

- TABLE 214 THALES GROUP: DEALS

- 14.2.6 BAE SYSTEMS

- TABLE 215 BAE SYSTEMS: BUSINESS OVERVIEW

- FIGURE 72 BAE SYSTEMS: COMPANY SNAPSHOT

- TABLE 216 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 BAE SYSTEMS: PRODUCT LAUNCHES

- TABLE 218 BAE SYSTEMS: DEALS

- 14.2.7 ROHDE & SCHWARZ

- TABLE 219 ROHDE & SCHWARZ: BUSINESS OVERVIEW

- TABLE 220 ROHDE & SCHWARZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 ROHDE & SCHWARZ: PRODUCT LAUNCHES

- TABLE 222 ROHDE & SCHWARZ: DEALS

- TABLE 223 ROHDE & SCHWARZ: OTHERS

- 14.2.8 ELBIT SYSTEMS LTD.

- TABLE 224 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

- FIGURE 73 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 225 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 ELBIT SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 227 ELBIT SYSTEMS LTD.: DEALS

- 14.2.9 LEONARDO S.P.A.

- TABLE 228 LEONARDO S.P.A.: BUSINESS OVERVIEW

- FIGURE 74 LEONARDO S.P.A.: COMPANY SNAPSHOT

- TABLE 229 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 LEONARDO S.P.A.: DEAL

- 14.2.10 VIASAT, INC.

- TABLE 231 VIASAT, INC.: BUSINESS OVERVIEW

- FIGURE 75 VIASAT, INC.: COMPANY SNAPSHOT

- TABLE 232 VIASAT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 VIASAT, INC.: DEALS

- 14.2.11 ASELSAN A.S.

- TABLE 234 ASELSAN A.S.: BUSINESS OVERVIEW

- FIGURE 76 ASELSAN A.S.: COMPANY SNAPSHOT

- TABLE 235 ASELSAN A.S.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 ASELSAN A.S.: DEALS

- 14.2.12 NATIONAL INSTRUMENTS CORPORATION

- TABLE 237 NATIONAL INSTRUMENTS CORPORATION: BUSINESS OVERVIEW

- FIGURE 77 NATIONAL INSTRUMENTS CORPORATION: COMPANY SNAPSHOT

- TABLE 238 NATIONAL INSTRUMENTS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 NATIONAL INSTRUMENTS CORPORATION: PRODUCT LAUNCHES

- 14.2.13 ZTE CORPORATION

- TABLE 240 ZTE CORPORATION: BUSINESS OVERVIEW

- FIGURE 78 ZTE CORPORATION: COMPANY SNAPSHOT

- TABLE 241 ZTE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.14 HUAWEI TECHNOLOGIES CO., LTD.

- TABLE 242 HUAWEI TECHNOLOGIES CO., LTD.: BUSINESS OVERVIEW

- FIGURE 79 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- 14.2.15 ANALOG DEVICES, INC.

- TABLE 243 ANALOG DEVICES, INC.: BUSINESS OVERVIEW

- FIGURE 80 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- TABLE 244 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 ANALOG DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 246 ANALOG DEVICES, INC.: DEALS

- 14.2.16 DATASOFT CORPORATION

- TABLE 247 DATASOFT CORPORATION: BUSINESS OVERVIEW

- TABLE 248 DATASOFT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.17 STMICROELECTRONICS N.V.

- TABLE 249 STMICROELECTRONICS N.V.: BUSINESS OVERVIEW

- FIGURE 81 STMICROELECTRONICS N.V.: COMPANY SNAPSHOT

- TABLE 250 STMICROELECTRONICS N.V.: DEALS

- 14.2.18 TEXAS INSTRUMENTS INCORPORATED

- TABLE 251 TEXAS INSTRUMENTS INCORPORATED: BUSINESS OVERVIEW

- FIGURE 82 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- TABLE 252 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- 14.2.19 FLEXRADIO

- TABLE 254 FLEXRADIO: BUSINESS OVERVIEW

- TABLE 255 FLEXRADIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 FLEXRADIO: PRODUCT LAUNCHES

- TABLE 257 FLEXRADIO: DEALS

- 14.2.20 ULTRA

- TABLE 258 ULTRA: BUSINESS OVERVIEW

- FIGURE 83 ULTRA: COMPANY SNAPSHOT

- TABLE 259 ULTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.3 OTHER PLAYERS

- 14.3.1 BARRETT COMMUNICATIONS PTY LTD.

- TABLE 260 BARRETT COMMUNICATION PTY LTD.: COMPANY OVERVIEW

- 14.3.2 NXP SEMICONDUCTORS N.V.

- TABLE 261 NXP SEMICONDUCTORS N.V.: COMPANY OVERVIEW

- 14.3.3 PENTEK INC.

- TABLE 262 PENTEK INC.: COMPANY OVERVIEW

- 14.3.4 BITTIUM CORPORATION

- TABLE 263 BITTIUM CORPORATION: COMPANY OVERVIEW

- 14.3.5 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

- TABLE 264 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY OVERVIEW

- 14.3.6 ASTRA RAFAEL COMSYS PVT. LTD.

- TABLE 265 ASTRA RAFAEL COMSYS PVT. LTD.: COMPANY OVERVIEW

- 14.3.7 BHARAT ELECTRONICS LIMITED

- TABLE 266 BHARAT ELECTRONICS LIMITED: COMPANY OVERVIEW

- 14.3.8 ROLTA INDIA LIMITED

- TABLE 267 ROLTA INDIA LIMITED: COMPANY OVERVIEW

- 14.3.9 SAANKHYA LABS PVT. LTD.

- TABLE 268 SAANKYA LABS PVT. LTD.: COMPANY OVERVIEW

- 14.3.10 INNTOT TECHNOLOGIES PVT. LTD.

- TABLE 269 INNTOT TECHNOLOGIES PVT. LTD: COMPANY OVERVIEW

- *Details on Business overview, Products/Services/Solutions offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS