|

|

市場調査レポート

商品コード

1126038

MSポリマー接着剤の世界市場:種類別 (接着剤、シーラント)・最終用途産業別 (建築・建設、自動車・輸送、工業組立)・地域別 (アジア太平洋、欧州、北米/南米、中東・アフリカ) の将来予測 (2027年まで)MS Polymer Adhesives Market by Type (Adhesives, Sealants), End Use Industry (Building & Construction, Automotive & Transportation, Industrial Assembly) and Region (APAC, Europe, N/S America, Middle East & Africa) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| MSポリマー接着剤の世界市場:種類別 (接着剤、シーラント)・最終用途産業別 (建築・建設、自動車・輸送、工業組立)・地域別 (アジア太平洋、欧州、北米/南米、中東・アフリカ) の将来予測 (2027年まで) |

|

出版日: 2022年09月07日

発行: MarketsandMarkets

ページ情報: 英文 244 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の接着剤市場では、従来の樹脂接着剤からMSポリマー接着剤への消費シフトが進んでいます。

ハイブリッド接着剤・シーラントは、主にシリル化ウレタンとシリル化ポリエーテル (MSポリマー) をベースとした製品で、従来のポリウレタン系接着剤・シーラントの特性範囲を拡大するために開発されました。シリル化ポリエーテル系ハイブリッドは、低粘度、低ガラス転移温度、広い温度範囲で柔軟性があり、臭気が少ないという特徴があります。

"自動車や航空宇宙分野での使用が市場を牽引"

航空宇宙産業向けのMSポリマー接着剤市場は、新型機の開発や保守・修理・運用 (MRO) に全面的に依存しています。航空輸送量の増加、燃費の良い航空機の需要、老朽化した航空機の代替、新興市場の経済成長などが、航空宇宙産業の分野におけるMSポリマー接着剤の需要を予測期間中に押し上げると思われます。

"予測期間中、欧州が最も成長率の高い市場になる"

欧州におけるMSポリマー接着剤の需要は、主にドイツ、英国、フランスなどの西欧諸国が牽引しています。欧州では自動車産業が最も盛んであり、多くの世界的な自動車メーカーがこの地域に設立されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- バリューチェーンの概要

- 市場力学

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- マクロ経済の概要と主な動向

- イントロダクション

- GDPの動向と予測

- 技術概要

- ケーススタディ

- 平均価格の分析

- 主要な輸出国と輸入国

- エコシステムマップ

- トレンドと技術革新が接着剤・シーラントメーカーに与える影響:YC・YCCのシフト

- 世界の規制の枠組みとMSポリマー接着剤市場への影響

- 特許分析

- 主な会議とイベント (2022年~2023年)

第6章 MSポリマー接着剤市場:種類別

- イントロダクション

- 接着剤

- シーラント

第7章 MSポリマー接着剤市場:最終用途産業別

- イントロダクション

- 建築・建設

- 自動車・輸送

- 工業

- その他

第8章 MSポリマー接着剤、地域別

- イントロダクション

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- インドネシア

- マレーシア

- タイ

- ベトナム

- 他のアジア太平洋諸国

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- トルコ

- スペイン

- 他の欧州諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 中東・アフリカ

- アラブ首長国連邦

- アフリカ

- 他の中東・アフリカ諸国

第9章 競合情勢

- 概要

- 市場シェア分析

- 市場ランキング分析

- 主要企業の戦略/有力企業

- 企業の収益分析

- 競合リーダーシップマッピング (2021年)

- 中小企業マトリックス (2021年)

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合ベンチマーキング

- 競合シナリオ

- 戦略的展開

- 新製品開発

- 資本取引

- その他の動向

第10章 企業プロファイル

- 主要企業

- HENKEL AG

- SIKA AG

- ARKEMA (BOSTIK)

- THE 3M COMPANY

- WACKER CHEMIE AG

- H.B. FULLER

- TREMCO ILLBRUCK GMBH & CO. KG.

- HERMANN OTTO GMBH

- SOUDAL GROUP

- MAPEI S.P.A.

- その他の企業

- NOVACHEM CORPORATION LTD

- PERMABOND LLC.

- KISLING AG

- WEICON GMBH & CO.KG

- MERZ+BENTELI AG

- AMERICAN SEALANTS, INC

- WEISS CHEMIE+TECHNIK GMBH & CO. KG

- DL CHEMICALS

- FORGEWAY LIMITED

- TECH-MASTERS

第11章 隣接・関連市場

- イントロダクション

- 制限事項

- MSポリマー市場

第12章 付録

The adhesives market is witnessing a shift from the consumption of conventional resin adhesives to that of MS polymer adhesives. Hybrid adhesives and sealants are mainly silylated urethane and silylated polyether (MS polymer)-based products. They have been developed to extend the property range of conventional polyurethane adhesives & sealants. Silylated polyether-based hybrids provide low viscosity, low glass transition temperature, flexibility over a wide temperature range, and low odor.

Use in automobiles and aerospace applications to drive market

The MS polymer adhesives market for the aerospace end-use industry is entirely dependent on developing new aircraft and maintenance, repair, and operations (MRO). The commercial aerospace market has witnessed high demand in the past few years owing to the rise in demand for advanced aircraft, which is largely influenced by the entry of new airlines and the expansion of existing airlines. An increase in air traffic, demand for fuel-efficient aircraft, replacement of obsolete aircraft, and economic growth in the emerging markets are likely to drive the demand for MS polymer adhesives in this end-use industry segment during the forecast period. The growing middle-class population and their rising income in emerging countries are contributing to the demand for air travel, thereby driving the demand for new commercial aircraft. Such developments will play an important role in fueling the growth of the MS polymer adhesives market.

Europe projected to be the fastest-growing market during the forecast period

The demand for MS polymer adhesives in Europe is mainly driven by Western European countries, such as Germany, UK, and France. The automotive industry is one of the biggest in Europe, and many global automotive manufacturing leaders are established in the region. According to ACEA (Association des Constructeurs Europeens d'Automobiles), vehicle manufacturing is a strategic industry in Europe, where 19.2 million cars, vans, trucks, and buses are manufactured annually. Automobile manufacturers operate 309 vehicle assembly and production plants in 27 countries across Europe.

Information was gathered from secondary research, and in-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the food packaging films market to verify the market size of several segments and subsegments.

- By Company Type: Tier 1 - 36%, Tier 2 - 18%, and Tier 3 - 46%

- By Designation: C Level - 15%, D Level - 34%, and Others - 51%

- By Region: North America - 18%, Asia Pacific- 55%, Europe - 9%, Middle East & Africa - 9%, and South America - 9%

The key companies profiled in this report are Henkel AG (Germany), Sika AG (Switzerland), Arkema (Bostik) (France), 3M Company (US), H.B. Fuller (US), Wacker Chemie AG (Germany), Tremco Illbruck GmbH & Co. KG (Germany), Hermann Otto GmbH (Germany), Mapei S.p.A (Italy), and Soudal Group (Belgium).

Research coverage:

This report provides detailed segmentation of the MS polymer adhesives market based on type, end-use industry, and region. The market type is divided into adhesives and sealants. Based on end use industry, the market has been segmented into automotive & transportation, building & construction, industrial assembly, and others. Based on the region, the market has been segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Key benefits of buying report

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market ranking of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the market; high growth regions; and market drivers, restraints, opportunities, and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MS POLYMER ADHESIVES: MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- FIGURE 2 REGIONAL SCOPE

- 1.3.3 MARKET INCLUSIONS AND EXCLUSIONS

- 1.3.3.1 Market inclusions

- 1.3.3.2 Market exclusions

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 MS POLYMER ADHESIVES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Critical secondary inputs

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary data sources

- 2.1.2.2 Critical primary inputs

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.2.5 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 MS POLYMER ADHESIVES MARKET SIZE ESTIMATION, BY END-USE INDUSTRY

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 MS POLYMER ADHESIVES MARKET SIZE ESTIMATION, BY VALUE

- FIGURE 8 MS POLYMER ADHESIVES MARKET SIZE ESTIMATION, BY REGION

- 2.3 MARKET FORECAST APPROACH

- 2.3.1 SUPPLY SIDE FORECAST

- FIGURE 9 MS POLYMER ADHESIVES MARKET: SUPPLY SIDE FORECAST

- FIGURE 10 METHODOLOGY FOR SUPPLY SIDE SIZING OF MS POLYMER ADHESIVES MARKET

- 2.3.2 DEMAND SIDE FORECAST

- FIGURE 11 MS POLYMER ADHESIVES MARKET: DEMAND SIDE FORECAST

- 2.4 FACTOR ANALYSIS

- FIGURE 12 FACTOR ANALYSIS OF MS POLYMER ADHESIVES MARKET

- 2.5 DATA TRIANGULATION

- FIGURE 13 MS POLYMER ADHESIVES MARKET: DATA TRIANGULATION

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY

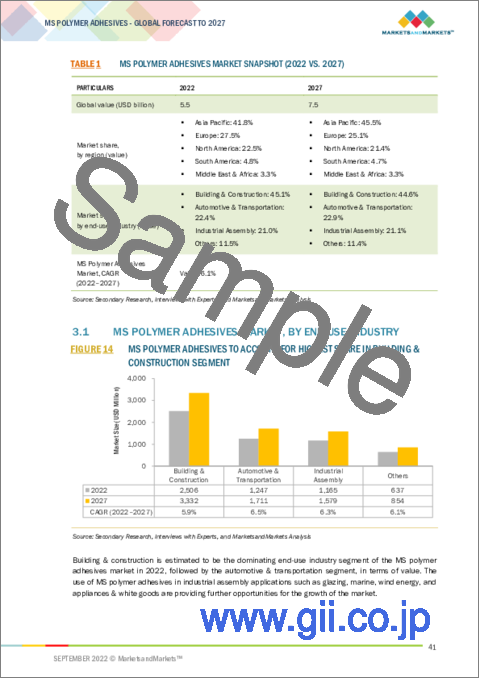

- TABLE 1 MS POLYMER ADHESIVES MARKET SNAPSHOT (2022 VS. 2027)

- 3.1 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY

- FIGURE 14 MS POLYMER ADHESIVES TO ACCOUNT FOR HIGHEST SHARE IN BUILDING & CONSTRUCTION SEGMENT

- 3.2 MS POLYMER ADHESIVES MARKET, BY REGION

- FIGURE 15 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN MS POLYMER ADHESIVES MARKET

- FIGURE 16 MARKET TO WITNESS MODERATE GROWTH BETWEEN 2022 AND 2027

- 4.2 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY

- FIGURE 17 BUILDING & CONSTRUCTION TO BE LARGEST END-USE INDUSTRY

- 4.3 MS POLYMER ADHESIVES MARKET: DEVELOPED VS. EMERGING COUNTRIES

- FIGURE 18 EMERGING COUNTRIES TO WITNESS HIGHER GROWTH

- 4.4 ASIA PACIFIC MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY AND COUNTRY, 2021

- FIGURE 19 BUILDING & CONSTRUCTION AND CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- 4.5 MS POLYMER ADHESIVES MARKET, BY MAJOR COUNTRIES

- FIGURE 20 INDIA TO BE LUCRATIVE MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 VALUE CHAIN OVERVIEW

- 5.2.1 VALUE CHAIN ANALYSIS

- FIGURE 21 MS POLYMER ADHESIVES: VALUE CHAIN ANALYSIS

- TABLE 2 MS POLYMER ADHESIVES MARKET: SUPPLY CHAIN ECOSYSTEM

- 5.3 MARKET DYNAMICS

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MS POLYMER ADHESIVES MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Demand for hybrid resins in adhesives & sealants

- 5.3.1.2 Nonavailability of new polymeric materials

- 5.3.1.3 Environmental regulations in North America and Europe

- 5.3.2 RESTRAINTS

- 5.3.2.1 Low acceptance by end users

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Non-hazardous, green, and sustainable adhesives & sealants

- 5.3.4 CHALLENGES

- 5.3.4.1 Limited opportunities in developed countries

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS: MS POLYMER ADHESIVES MARKET

- TABLE 3 MS POLYMER ADHESIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.4.2 BARGAINING POWER OF BUYERS

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 THREAT OF SUBSTITUTES

- 5.4.5 THREAT OF NEW ENTRANTS

- 5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

- TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP INDUSTRIES (%)

- 5.5.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR MS POLYMER ADHESIVES

- TABLE 5 KEY BUYING CRITERIA FOR MS POLYMER ADHESIVES

- 5.6 MACROECONOMIC OVERVIEW AND KEY TRENDS

- 5.6.1 INTRODUCTION

- 5.6.2 GDP TRENDS AND FORECAST

- TABLE 6 GDP TRENDS AND FORECAST: PERCENTAGE CHANGE

- 5.7 TECHNOLOGY OVERVIEW

- FIGURE 26 HISTORY OF DEVELOPMENT

- 5.8 CASE STUDY

- 5.9 AVERAGE PRICING ANALYSIS

- FIGURE 27 AVERAGE PRICE COMPETITIVENESS IN MS POLYMER ADHESIVES MARKET, BY REGION

- FIGURE 28 AVERAGE PRICE COMPETITIVENESS IN MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY

- 5.10 KEY EXPORTING AND IMPORTING COUNTRIES

- TABLE 7 INTENSITY OF TRADE, BY KEY COUNTRIES

- 5.10.1 EXPORT-IMPORT TRADE STATISTICS

- 5.10.1.1 Trade Scenario 2019-2021

- TABLE 8 EXPORT DATA FOR PAINTS AND VARNISHES, INCLUDING ENAMELS AND LACQUERS, BASED ON SYNTHETIC POLYMERS OR CHEMICALLY MODIFIED NATURAL POLYMERS, DISPERSED OR DISSOLVED IN AN AQUEOUS MEDIUM (USD THOUSAND)

- TABLE 9 IMPORT DATA OF PREPARED GLUES AND OTHER PREPARED ADHESIVES, N.E.S.; PRODUCTS SUITABLE FOR USE AS GLUES OR ADHESIVES, FOR RETAIL SALE (USD THOUSAND)

- 5.11 ECOSYSTEM MAP

- FIGURE 29 ADHESIVES & SEALANTS ECOSYSTEM

- 5.12 IMPACT OF TRENDS AND TECHNOLOGY DISRUPTIONS ON MANUFACTURERS OF ADHESIVES & SEALANTS: YC AND YCC SHIFT

- FIGURE 30 ADHESIVE INDUSTRY: YC AND YCC SHIFT

- 5.12.1 AUTOMOTIVE & TRANSPORTATION

- 5.12.1.1 Electric vehicles

- 5.12.1.2 Shared mobility

- 5.12.1.3 Battery types for electric vehicles

- 5.12.2 AEROSPACE

- 5.12.2.1 Ultralight and light aircraft

- 5.12.2.2 Unmanned aircraft systems (UAS) or drones

- 5.12.3 HEALTHCARE

- 5.12.3.1 Wearable medical devices

- 5.12.3.2 Microfluidics-based POC and LOC diagnostic devices for laboratory testing

- 5.12.4 ELECTRONICS

- 5.12.4.1 Digitalization

- 5.12.4.2 Artificial intelligence

- 5.12.4.3 Augmented reality

- 5.13 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON MS POLYMER ADHESIVES MARKET

- 5.13.1 LEED STANDARDS

- TABLE 10 BY ARCHITECTURAL APPLICATIONS

- TABLE 11 BY SPECIALTY APPLICATIONS

- TABLE 12 BY SUBSTRATE-SPECIFIC APPLICATIONS

- TABLE 13 BY SECTOR

- TABLE 14 BY SEALANT PRIMERS

- 5.14 PATENT ANALYSIS

- 5.14.1 METHODOLOGY

- 5.14.2 PUBLICATION TRENDS

- FIGURE 31 PUBLICATION TRENDS, 2018-2022

- 5.14.3 JURISDICTION

- FIGURE 32 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2018-2022

- 5.14.4 TOP APPLICANTS

- FIGURE 33 TOP APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- TABLE 15 MAJOR PATENTS PUBLISHED BY COMPANIES

- 5.15 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 16 MS POLYMER ADHESIVES MARKET: LIST OF CONFERENCES AND EVENTS

6 MS POLYMER ADHESIVES MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 ADHESIVES

- 6.3 SEALANTS

7 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY

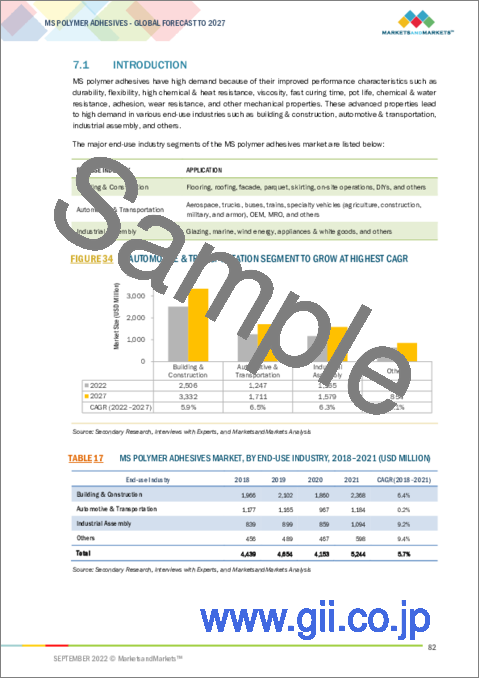

- 7.1 INTRODUCTION

- FIGURE 34 AUTOMOTIVE & TRANSPORTATION SEGMENT TO GROW AT HIGHEST CAGR

- TABLE 17 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 18 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 19 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 20 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 7.2 BUILDING & CONSTRUCTION

- 7.2.1 BONDING, RENOVATION, AND MAINTENANCE & REPAIR OF BUILDINGS

- TABLE 21 BUILDING & CONSTRUCTION: MS POLYMER ADHESIVES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 22 BUILDING & CONSTRUCTION: MS POLYMER ADHESIVES MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 23 BUILDING & CONSTRUCTION: MS POLYMER ADHESIVES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 24 BUILDING & CONSTRUCTION: MS POLYMER ADHESIVES MARKET, BY REGION, 2022-2027 (KILOTON)

- 7.3 AUTOMOTIVE & TRANSPORTATION

- 7.3.1 AUTOMOBILES AND AEROSPACE APPLICATIONS TO DRIVE MARKET

- TABLE 25 AUTOMOTIVE & TRANSPORTATION: MS POLYMER ADHESIVES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 26 AUTOMOTIVE & TRANSPORTATION: MS POLYMER ADHESIVES MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 27 AUTOMOTIVE & TRANSPORTATION: MS POLYMER ADHESIVES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 28 AUTOMOTIVE & TRANSPORTATION: MS POLYMER ADHESIVES MARKET, BY REGION, 2022-2027 (KILOTON)

- 7.4 INDUSTRIAL ASSEMBLY

- 7.4.1 MARINE AND WIND ENERGY APPLICATIONS TO DRIVE MARKET

- TABLE 29 INDUSTRIAL ASSEMBLY: MS POLYMER ADHESIVES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 INDUSTRIAL ASSEMBLY: MS POLYMER ADHESIVES MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 31 INDUSTRIAL ASSEMBLY: MS POLYMER ADHESIVES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 32 INDUSTRIAL ASSEMBLY: MS POLYMER ADHESIVES MARKET, BY REGION, 2022-2027 (KILOTON)

- 7.5 OTHERS

- TABLE 33 OTHERS: MS POLYMER ADHESIVES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 34 OTHERS: MS POLYMER ADHESIVES MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 35 OTHERS: MS POLYMER ADHESIVES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 36 OTHERS: MS POLYMER ADHESIVES MARKET, BY REGION, 2022-2027 (KILOTON)

8 MS POLYMER ADHESIVES, BY REGION

- 8.1 INTRODUCTION

- FIGURE 35 ASIA PACIFIC EMERGING STRATEGIC MARKET

- TABLE 37 MS POLYMER ADHESIVES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 MS POLYMER ADHESIVES MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 39 MS POLYMER ADHESIVES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 40 MS POLYMER ADHESIVES MARKET, BY REGION, 2022-2027 (KILOTON)

- 8.2 ASIA PACIFIC

- FIGURE 36 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET SNAPSHOT

- TABLE 41 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 42 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 43 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 44 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 45 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 46 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 47 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 48 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.2.1 CHINA

- 8.2.1.1 Cheap labor and raw materials

- TABLE 49 CHINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 50 CHINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 51 CHINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 52 CHINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.2.2 JAPAN

- 8.2.2.1 Environmental regulations to drive demand

- TABLE 53 JAPAN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 54 JAPAN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 55 JAPAN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 56 JAPAN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.2.3 INDIA

- 8.2.3.1 Government initiatives to lead to market growth

- TABLE 57 INDIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 58 INDIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 59 INDIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 60 INDIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.2.4 SOUTH KOREA

- 8.2.4.1 Automotive industry to lead market growth

- TABLE 61 SOUTH KOREA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 62 SOUTH KOREA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 63 SOUTH KOREA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 64 SOUTH KOREA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.2.5 INDONESIA

- 8.2.5.1 Cheap labor and raw materials to propel market

- TABLE 65 INDONESIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 66 INDONESIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 67 INDONESIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 68 INDONESIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.2.6 MALAYSIA

- 8.2.6.1 Auto manufacturing hub to boost demand

- TABLE 69 MALAYSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 70 MALAYSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 71 MALAYSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 72 MALAYSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.2.7 THAILAND

- 8.2.7.1 Growing aviation industry to boost demand

- TABLE 73 THAILAND: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 74 THAILAND: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 75 THAILAND: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 76 THAILAND: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.2.8 VIETNAM

- 8.2.8.1 Increased investments in automotive industry

- TABLE 77 VIETNAM: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 78 VIETNAM: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 79 VIETNAM: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 80 VIETNAM: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.2.9 REST OF ASIA PACIFIC

- TABLE 81 REST OF ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 82 REST OF ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 83 REST OF ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 84 REST OF ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.3 NORTH AMERICA

- FIGURE 37 NORTH AMERICA: MS POLYMER ADHESIVES MARKET SNAPSHOT

- TABLE 85 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 86 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 87 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 89 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 90 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 91 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 92 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.3.1 US

- 8.3.1.1 Largest share of regional market

- TABLE 93 US: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 94 US: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 95 US: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 96 US: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.3.2 CANADA

- 8.3.2.1 Growing end-use industries to lead demand

- TABLE 97 CANADA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 98 CANADA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 99 CANADA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 100 CANADA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.3.3 MEXICO

- 8.3.3.1 Low-cost manufacturing to drive market

- TABLE 101 MEXICO: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 102 MEXICO: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 103 MEXICO: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 104 MEXICO: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.4 EUROPE

- FIGURE 38 EUROPE: MS POLYMER ADHESIVES MARKET SNAPSHOT

- TABLE 105 EUROPE: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 106 EUROPE MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 107 EUROPE: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 108 EUROPE MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 109 EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 110 EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 111 EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 112 EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.4.1 GERMANY

- 8.4.1.1 Largest producer in Europe

- TABLE 113 GERMANY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 114 GERMANY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 115 GERMANY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 116 GERMANY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.4.2 FRANCE

- 8.4.2.1 Growth in end-use industries to boost market

- TABLE 117 FRANCE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 118 FRANCE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 119 FRANCE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 120 FRANCE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.4.3 ITALY

- 8.4.3.1 Automobile production and exports to drive market

- TABLE 121 ITALY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 122 ITALY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 123 ITALY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 124 ITALY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.4.4 UK

- 8.4.4.1 Advancements in manufacturing technology

- TABLE 125 UK: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 126 UK: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 127 UK: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 128 UK: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.4.5 RUSSIA

- 8.4.5.1 Currency devaluation to hamper market growth

- TABLE 129 RUSSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 130 RUSSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 131 RUSSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 132 RUSSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.4.6 TURKEY

- 8.4.6.1 Government infrastructure investments to boost demand

- TABLE 133 TURKEY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 134 TURKEY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 135 TURKEY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 136 TURKEY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.4.7 SPAIN

- 8.4.7.1 Large automotive sector to lead market growth

- TABLE 137 SPAIN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 138 SPAIN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 139 SPAIN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 140 SPAIN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.4.8 REST OF EUROPE

- TABLE 141 REST OF EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 142 REST OF EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 143 REST OF EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 144 REST OF EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.5 SOUTH AMERICA

- FIGURE 39 BRAZIL TO BE FASTER-GROWING MARKET

- TABLE 145 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 146 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 147 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 148 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 149 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 150 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 151 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 152 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.5.1 BRAZIL

- 8.5.1.1 Automotive industry to fuel market

- TABLE 153 BRAZIL: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 154 BRAZIL: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 155 BRAZIL: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 156 BRAZIL: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.5.2 ARGENTINA

- 8.5.2.1 Increasing population and improved economic conditions

- TABLE 157 ARGENTINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 158 ARGENTINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 159 ARGENTINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 160 ARGENTINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.5.3 REST OF SOUTH AMERICA

- TABLE 161 REST OF SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 162 REST OF SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 163 REST OF SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 164 REST OF SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.6 MIDDLE EAST & AFRICA

- FIGURE 40 AFRICA TO BE LARGEST MARKET

- TABLE 165 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 167 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 169 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 171 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.6.1 UAE

- 8.6.1.1 Growing aircraft manufacturing activities

- TABLE 173 UAE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 174 UAE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 175 UAE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 176 UAE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.6.2 AFRICA

- 8.6.2.1 Automotive industry to boost demand

- TABLE 177 AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 178 AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 179 AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 180 AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- 8.6.3 REST OF MIDDLE EAST & AFRICA

- TABLE 181 REST OF MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- TABLE 185 STRATEGIES ADOPTED BY KEY MANUFACTURERS OF MS POLYMER ADHESIVES

- 9.2 MARKET SHARE ANALYSIS

- FIGURE 41 GLOBAL MS POLYMER ADHESIVES MARKET SHARE, BY KEY PLAYERS (2021)

- TABLE 186 MS POLYMER ADHESIVES MARKET: DEGREE OF COMPETITION

- 9.3 MARKET RANKING ANALYSIS

- FIGURE 42 RANKING OF KEY PLAYERS

- 9.4 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 187 STRATEGIC POSITIONING OF KEY PLAYERS

- 9.5 COMPANY REVENUE ANALYSIS

- FIGURE 43 REVENUE ANALYSIS FOR KEY COMPANIES DURING PAST FIVE YEARS

- 9.6 COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.6.1 STAR PLAYERS

- 9.6.2 EMERGING LEADERS

- 9.6.3 PERVASIVE PLAYERS

- 9.6.4 EMERGING COMPANIES

- FIGURE 44 MS POLYMER ADHESIVES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.7 SME MATRIX, 2021

- 9.7.1 PROGRESSIVE COMPANIES

- 9.7.2 DYNAMIC COMPANIES

- 9.7.3 STARTING BLOCKS

- 9.7.4 RESPONSIVE COMPANIES

- FIGURE 45 MS POLYMER ADHESIVES MARKET: EMERGING COMPANIES' COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.8 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 46 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MS POLYMER ADHESIVES MARKET

- 9.9 BUSINESS STRATEGY EXCELLENCE

- FIGURE 47 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MS POLYMER ADHESIVES MARKET

- 9.10 COMPETITIVE BENCHMARKING

- TABLE 188 MS POLYMER ADHESIVES MARKET: DETAILED LIST OF KEY PLAYERS

- 9.11 COMPETITIVE SCENARIO

- 9.11.1 MARKET EVALUATION FRAMEWORK

- TABLE 189 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 190 HIGHEST ADOPTED STRATEGIES

- TABLE 191 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- 9.11.2 MARKET EVALUATION MATRIX

- TABLE 192 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 193 COMPANY REGION FOOTPRINT

- TABLE 194 COMPANY FOOTPRINT

- 9.12 STRATEGIC DEVELOPMENTS

- 9.12.1 NEW PRODUCT DEVELOPMENTS

- TABLE 195 NEW PRODUCT LAUNCHES, 2017-2022

- 9.12.2 DEALS

- TABLE 196 DEALS, 2018-2022

- 9.12.3 OTHER DEVELOPMENTS

- TABLE 197 OTHERS, 2018-2022

10 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 10.1 KEY PLAYERS

- 10.1.1 HENKEL AG

- TABLE 198 HENKEL AG: COMPANY OVERVIEW

- FIGURE 48 HENKEL AG: COMPANY SNAPSHOT

- TABLE 199 HENKEL AG: OTHERS

- 10.1.2 SIKA AG

- TABLE 200 SIKA AG: COMPANY OVERVIEW

- FIGURE 49 SIKA AG: COMPANY SNAPSHOT

- TABLE 201 SIKA AG: NEW PRODUCT LAUNCHES

- TABLE 202 SIKA AG: DEALS

- TABLE 203 SIKA AG: OTHERS

- 10.1.3 ARKEMA (BOSTIK)

- TABLE 204 ARKEMA (BOSTIK): COMPANY OVERVIEW

- FIGURE 50 ARKEMA (BOSTIK): COMPANY SNAPSHOT

- TABLE 205 ARKEMA (BOSTIK): NEW PRODUCT LAUNCHES

- TABLE 206 ARKEMA (BOSTIK): DEALS

- TABLE 207 ARKEMA (BOSTIK): OTHERS

- 10.1.4 THE 3M COMPANY

- TABLE 208 THE 3M COMPANY: COMPANY OVERVIEW

- FIGURE 51 THE 3M COMPANY: COMPANY SNAPSHOT

- 10.1.5 WACKER CHEMIE AG

- TABLE 209 WACKER CHEMIE AG: COMPANY OVERVIEW

- FIGURE 52 WACKER CHEMIE AG: COMPANY SNAPSHOT

- TABLE 210 WACKER CHEMIE AG: NEW PRODUCT LAUNCHES

- TABLE 211 WACKER CHEMIE AG: DEALS

- TABLE 212 WACKER CHEMIE AG: OTHERS

- 10.1.6 H.B. FULLER

- TABLE 213 H.B. FULLER: COMPANY OVERVIEW

- FIGURE 53 H.B. FULLER: COMPANY SNAPSHOT

- TABLE 214 H.B. FULLER: DEALS

- TABLE 215 H.B. FULLER: OTHERS

- 10.1.7 TREMCO ILLBRUCK GMBH & CO. KG.

- TABLE 216 TREMCO ILLBRUCK GMBH & CO. KG.: COMPANY OVERVIEW

- TABLE 217 TREMCO ILLBRUCK GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 218 TREMCO ILLBRUCK GMBH & CO. KG: DEALS

- 10.1.8 HERMANN OTTO GMBH

- TABLE 219 HERMANN OTTO GMBH: COMPANY OVERVIEW

- 10.1.9 SOUDAL GROUP

- TABLE 220 SOUDAL GROUP: BUSINESS OVERVIEW

- FIGURE 54 SOUDAL GROUP: COMPANY SNAPSHOT

- TABLE 221 SOUDAL GROUP: DEALS

- TABLE 222 SOUDAL GROUP: OTHERS

- 10.1.10 MAPEI S.P.A.

- TABLE 223 MAPEI S.P.A.: COMPANY OVERVIEW

- FIGURE 55 MAPEI S.P.A.: COMPANY SNAPSHOT

- 10.2 OTHER KEY PLAYERS

- 10.2.1 NOVACHEM CORPORATION LTD

- TABLE 224 NOVACHEM CORPORATION LTD: COMPANY OVERVIEW

- 10.2.2 PERMABOND LLC.

- TABLE 225 PERMABOND LLC.: COMPANY OVERVIEW

- 10.2.3 KISLING AG

- TABLE 226 KISLING AG: COMPANY OVERVIEW

- 10.2.4 WEICON GMBH & CO.KG

- TABLE 227 WEICON GMBH & CO.KG: COMPANY OVERVIEW

- 10.2.5 MERZ+BENTELI AG

- TABLE 228 MERZ+BENTELI AG: COMPANY OVERVIEW

- 10.2.6 AMERICAN SEALANTS, INC

- 10.2.7 WEISS CHEMIE + TECHNIK GMBH & CO. KG

- TABLE 230 WEISS CHEMIE + TECHNIK GMBH & CO. KG: COMPANY OVERVIEW

- 10.2.8 DL CHEMICALS

- TABLE 231 DL CHEMICALS: COMPANY OVERVIEW

- 10.2.9 FORGEWAY LIMITED

- TABLE 232 FORGEWAY LIMITED: COMPANY OVERVIEW

- 10.2.10 TECH-MASTERS

- TABLE 233 TECH-MASTERS: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

11 ADJACENT & RELATED MARKETS

- 11.1 INTRODUCTION

- 11.2 LIMITATIONS

- 11.3 MS POLYMERS MARKET

- 11.3.1 MARKET DEFINITION

- 11.3.2 MARKET OVERVIEW

- 11.3.3 MS POLYMERS MARKET, BY TYPE

- TABLE 234 MS POLYMERS MARKET SIZE, BY TYPE, 2019-2026 (USD MILLION)

- TABLE 235 MS POLYMERS MARKET SIZE, BY TYPE, 2019-2026 (KILOTON)

- 11.3.3.1 Silyl Modified Polyethers

- 11.3.3.2 Silyl Terminated Polyurethanes (Spur)

- 11.3.4 MS POLYMERS MARKET, BY APPLICATION

- TABLE 236 MS POLYMERS MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

- TABLE 237 MS POLYMERS MARKET SIZE, BY APPLICATION, 2019-2026 (KILOTON)

- 11.3.4.1 Adhesives & Sealants

- 11.3.4.2 Coatings

- 11.3.5 MS POLYMERS MARKET, BY END-USE INDUSTRY

- TABLE 238 MS POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2026 (USD MILLION)

- TABLE 239 MS POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2026 (KILOTON)

- 11.3.5.1 Building & Construction

- 11.3.5.2 Automotive & Transportation

- 11.3.5.3 Electronics

- 11.3.5.4 Industrial Assembly

- 11.3.5.5 Others

- 11.3.6 MS POLYMERS MARKET, BY REGION

- TABLE 240 MS POLYMERS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

- TABLE 241 MS POLYMERS MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

- 11.3.6.1 Asia Pacific

- 11.3.6.2 North America

- 11.3.6.3 Europe

- 11.3.6.4 South America

- 11.3.6.5 Middle East & Africa

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS