|

|

市場調査レポート

商品コード

1102613

動物用腸内健康の世界市場:添加剤別 (プロバイオティクス、プレバイオティクス、植物性、免疫賦活剤)・家畜別 (家禽、豚、反芻動物、養殖魚)・形状別 (乾燥、液体)・原料別・地域別の将来予測 (2027年まで)Animal Intestinal Health Market by Additive (Probiotics, Prebiotics, Phytogenics, Immunostimulants), Livestock (Poultry, Swine, Ruminant, Aquaculture), Form (Dry, Liquid), Source, Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 動物用腸内健康の世界市場:添加剤別 (プロバイオティクス、プレバイオティクス、植物性、免疫賦活剤)・家畜別 (家禽、豚、反芻動物、養殖魚)・形状別 (乾燥、液体)・原料別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年07月12日

発行: MarketsandMarkets

ページ情報: 英文 223 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の動物用腸内健康市場は、2022年に37億米ドルに達した後、2022年から2027年にかけてCAGR8.2%で成長し、2027年までに54億米ドルに成長すると予測されています。

飼料添加物は、動物が摂取する通常の食事に栄養価を与えるものです。人口の増加に伴い、動物腸内健康製品も需要の急増を目の当たりにしています。飼料製品の需要増に対応するため、メーカーはプロバイオティクス、プレバイオティクス、植物性飼料添加物、その他の飼料添加物を活用して、家畜の腸内環境と生産性を高めることに注力しています。肉や乳製品に対する意識の高まり、家畜に関連する健康への懸念、動物加工製品の工業化の進展などが、動物腸管健康市場の世界の成長を促す主な要因となっています。政府機関による抗生物質の使用に関する規制の実施に伴い、腸内健康を改善するための天然飼料添加物の需要は今後も高く維持されると予想されます。

"予測期間中、微生物セグメントがより大きな市場シェアを占めた"

微生物を利用して製造された飼料添加物の増加により、予測期間中、微生物セグメントがより大きな市場シェアを占めました。プロバイオティクスは、豚、反芻動物、家禽などの家畜種において、体重増加、飼料製品の消化率向上、腸内細菌叢全体の強化に役立つとされています。しかし、微生物由来の代替品に関するさまざまな認識が広まるにつれ、フィトジェニックや特定のプレバイオティクスなど、植物由来の腸内健康素材が人気を博しています。

"乾燥セグメントが2022年の金額ベースで市場全体の73.64%のシェアを占め、市場を支配している"

乾燥状の動物用腸内健康製品は、液体よりも比較的安価であるため、飼料メーカーに好まれています。また、異なる添加物を粉末状にすることで混合が容易になります。乾燥形態は保存期間が長く、輸送も簡単です。これらのことから、飼料メーカーや給餌業者の間で好まれています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

第6章 産業動向

- イントロダクション

- 顧客のビジネスに影響を与える傾向/混乱

- バリューチェーン

- 貿易分析

- テクノロジー分析

- 特許分析

- エコシステムマップ

- ポーターのファイブフォース分析

- ケーススタディ

- 価格分析

- 規制の枠組み

- 主要な利害関係者と購入基準

- 主要な会議とイベント (2022年~2023年)

第7章 動物用腸内健康市場:添加剤の種類別

- イントロダクション

- プロバイオティクス

- プレバイオティクス

- 植物性

- 免疫賦活剤

第8章 動物用腸内健康市場:家畜別

- イントロダクション

- 家禽

- 豚

- 反芻動物

- 養殖魚

- その他の家畜

第9章 動物用腸内健康市場:形状別

- イントロダクション

- 乾燥

- 液体

第10章 動物用腸内健康市場:機能別

- 代謝

- 体重の増加

- 栄養素の消化

- 病気の予防

- 骨・関節の健康

第11章 動物用腸内健康市場:原料別

- イントロダクション

- 微生物

- 植物ベース

第12章 動物用腸内健康市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- スペイン

- ドイツ

- フランス

- イタリア

- 英国

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア・ニュージーランド

- 他のアジア太平洋諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- その他の地域

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 市場評価フレームワーク

- 市場シェア分析

- 主要企業の収益分析 (単位:10億米ドル、2019年~2021年)

- 企業評価クアドラント

- スタートアップの評価クアドラント

- 製品のフットプリント (主要企業)

- 主要企業の競合ベンチマーキング

- 中小企業/他の企業の競争ベンチマーク

- 製品発売、取引、その他の動向

第14章 企業プロファイル

- 主要企業

- ADM

- KONINKLIJKE DSM N.V.

- DUPONT NUTRITION & BIOSCIENCES (DANISCO ANIMAL NUTRITION)

- CARGILL INCORPORATED

- NOVOZYMES

- KEMIN INDUSTRIES INC.

- NUTRECO

- CHR. HANSEN HOLDING A/S

- BLUESTAR ADISSEO CO. LTD.

- ALLTECH

- EVONIK INDUSTRIES

- LALLEMAND INC.

- BIORIGIN

- LAND O'LAKES

- LESAFFRE

- CALPIS CO LTD

- AB VISTA

- PURE CULTURES

- DR. ECKEL ANIMAL NUTRITION GMBH & CO. KG

- UNIQUE BIOTECH

第15章 隣接・関連市場

- イントロダクション

- 制限

- 植物性飼料添加物市場

- 動物用飼料向けプロバイオティクス市場

第16章 付録

The animal intestinal health market, estimated at USD 3.7 billion in 2022 and is projected to grow to USD 5.4 billion in 2027, at a CAGR of 8.2% from 2022 to 2027. Feed additives provide nutritional value to the regular meal consumed by animals. With the increase in population, animal intestinal feed products have also witnessed a surge in demand. To cater to the growing demand for feed products, manufacturers are focusing on utilizing probiotics, prebiotics, phytogenic feed additives, and other feed additives to enhance the gut health and productivity of livestock. The rise in awareness about meat and dairy products, health concerns related to livestock, and the increase in the industrialization of animal-processed products are the major factors driving the growth of the animal intestinal health market globally. With the imposition of regulations by government agencies on the use of antibiotics, the demand for natural feed additives to improve the quality of intestinal health products is expected to remain high.

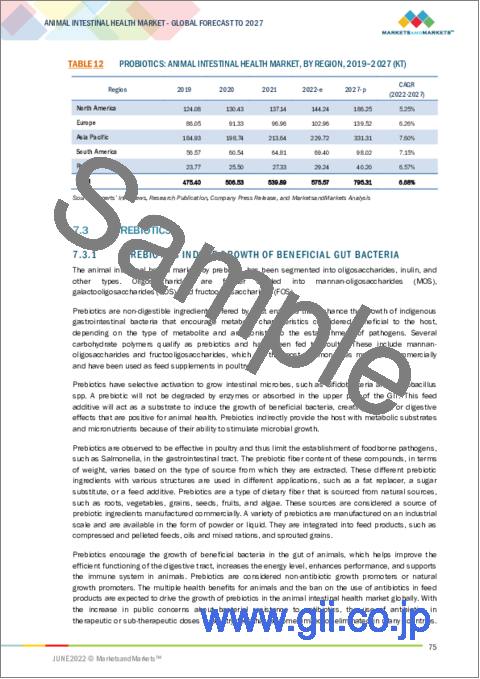

"Europe is the second fastest growing region, projected to witness the growth of 7.62% during the forecast period in terms of volume."

The European feed industry is one of the largest markets for feed production at a global level. European feed producers are using various feed additives based on probiotics, prebiotics, phytogenics, and immunostimulants to cater to the increase in demand for high-quality feed products for enhanced performance of livestock. Various feed producers in the region are witnessing a shift in their focus on the inclusion of prebiotics, such as mannan oligosaccharides and fructooligosaccharides, which improves performance in livestock. The European feed producers prefer using phytogenics, such as essential oils, as an alternative to feed-grade antibiotics used in pork feed production. These phytogenics act as a key feed additive, help increase feed intake and improve gut functions in the livestock.

"The microbial segment accounted for a larger market share during the forecast period"

The microbial segment accounted for a larger market share during the forecast period due to the increase in the availability of feed additives manufactured by using microorganisms. Probiotics help in weight gain, improve the digestibility of feed products, and enhance the overall gut microflora in livestock species, such as swine, ruminants, and poultry. However, with the increase in awareness about the various alternatives to microbial sources, plant-based sources of intestinal health, such as phytogenics and certain prebiotics have become popular.

"The dry form segment dominates the market with 73.64% of total market share in terms of value in 2022."

Dry animal intestinal health products are preferred by feed manufacturers as they are relatively cheaper than their liquid counterparts. Also, it is easier to mix the powder form of different additives. The dry form has a higher shelf life and is easier to transport. All this makes it a preferred alternative among feed manufacturers and feeders.

Break-up of Primaries:

- By Company Type: Tier 1 - 60.0%, Tier 2- 25.0%, Tier 3 - 15.0%

- By Designation: Managers - 45.0%, CXOs - 35.0%, and Executives- 20.0%

- By Region: Europe - 45%, North America - 10%, Asia Pacific - 25%, South America-5%, RoW - 15%

Leading players profiled in this report:

1. Cargill, Incorporated (US)

2. Koninklijke DSM N.V. (Netherlands)

3. Archer Daniels Midland Company (US)

4. DuPont de Nemours, Inc. (US)

5. Evonik Industries (Germany)

6. Novozymes (Denmark)

7. Nutreco (Netherlands)

8. Chr. Hansen Holdings (Denmark)

9. Bluestar Adisseo Pvt Ltd. (China).

10. Alltech (US)

11. Evonik Industries (Germany)

12. Lallemand, Inc. (Canada)

13. Biorigin (Brazil)

14. Land and O'Lakes, Inc. (US)

15. Lesaffre (France)

16. Calpis Co., Ltd. (Japan)

17. AB Vista (England)

18. Pure Cultures (US)

19. Dr. Eckel Animal Nutrition GmbH & Co. KG (Germany)

20. Unique Biotech (India)

Research Coverage:

The report segments the Animal intestinal health market on the basis of Additive, Function, Source, Livestock, Form, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the Animal intestinal health market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the Animal Intestinal Health market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the Animal Intestinal Health market market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2021

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 ANIMAL INTESTINAL HEALTH MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 ANIMAL INTESTINAL HEALTH MARKET SIZE ESTIMATION: SUPPLY SIDE (1/2)

- FIGURE 5 ANIMAL INTESTINAL HEALTH MARKET SIZE ESTIMATION: SUPPLY SIDE (2/2)

- FIGURE 6 ANIMAL INTESTINAL HEALTH MARKET SIZE ESTIMATION: DEMAND SIDE

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.4.1 ASSUMPTIONS

- 2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 PROBIOTICS SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

- FIGURE 11 POULTRY SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

- FIGURE 12 DRY FORM SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE BY 2022

- FIGURE 13 MICROBIAL SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE BY 2027

- FIGURE 14 ASIA PACIFIC EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES IN ANIMAL INTESTINAL HEALTH MARKET

- FIGURE 15 INCREASE IN DEMAND FOR FEED AND FEED ADDITIVES DRIVING GROWTH OF ANIMAL INTESTINAL HEALTH MARKET

- 4.2 ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE

- FIGURE 16 PROBIOTICS SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- 4.3 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK AND KEY COUNTRIES

- FIGURE 17 CHINA AND POULTRY SEGMENT EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN ASIA PACIFIC MARKET IN 2022

- 4.4 ANIMAL INTESTINAL HEALTH MARKET, BY FORM AND REGION

- FIGURE 18 DRY SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

- 4.5 ANIMAL INTESTINAL HEALTH MARKET, BY MAJOR REGIONAL SUBMARKETS

- FIGURE 19 CHINA EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 ANIMAL INTESTINAL HEALTH MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increased production of compound feed

- FIGURE 21 GLOBAL COMPOUND FEED PRODUCTION, 2012-2021 (MILLION METRIC TONS)

- FIGURE 22 COMPOUND FEED PRODUCTION, BY TOP 7 COUNTRIES, 2016-2020 (MILLION METRIC TONS)

- 5.2.1.2 Rising demand for animal protein

- TABLE 2 PER CAPITA CONSUMPTION OF LIVESTOCK PRODUCTS, BY REGION

- 5.2.1.3 Intestinal disorders among livestock

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations for use of feed additives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Innovations and technological advancements in feed industry

- 5.2.3.2 Increased awareness about feed and food safety

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of feed additives

- 5.2.4.1.1 R&D costs associated with development of probiotics

- 5.2.4.1.2 High cost of active ingredients used in development of phytogenic feed additives

- 5.2.4.1 High cost of feed additives

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS IMPACTING CUSTOMERS' BUSINESS

- FIGURE 23 TRENDS IMPACTING ANIMAL INTESTINAL HEALTH MARKET

- 6.3 VALUE CHAIN

- FIGURE 24 VALUE CHAIN ANALYSIS

- 6.4 TRADE ANALYSIS

- FIGURE 25 EXPORT OF LIVESTOCK SPECIES, 2016-2021 (USD MILLION)

- 6.5 TECHNOLOGY ANALYSIS

- 6.6 PATENT ANALYSIS

- TABLE 3 KEY PATENTS PERTAINING TO ANIMAL INTESTINAL HEALTH, 2019-2022

- 6.7 ECOSYSTEM MAP

- 6.7.1 ANIMAL INTESTINAL HEALTH MARKET: ECOSYSTEM MAP

- FIGURE 26 FEED AND ANIMAL NUTRITION: ECOSYSTEM MAP

- 6.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 PORTER'S FIVE FORCES ANALYSIS

- 6.8.1 THREAT OF NEW ENTRANTS

- 6.8.2 THREAT OF SUBSTITUTES

- 6.8.3 BARGAINING POWER OF SUPPLIERS

- 6.8.4 BARGAINING POWER OF BUYERS

- 6.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.9 CASE STUDIES

- 6.9.1 REGULATIONS ON ANTIBIOTICS LEADING TO A SHIFT TOWARD PROBIOTICS

- 6.10 PRICING ANALYSIS

- 6.10.1 ANIMAL INTESTINAL HEALTH MARKET: AVERAGE SELLING PRICE TREND ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE, BY ADDITIVE, 2019-2027 (USD/KG)

- 6.11 REGULATORY FRAMEWORK

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 CODEX ALIMENTARIUS COMMISSION (CAC)

- 6.11.2.1 North America

- 6.11.2.2 Europe

- 6.11.2.3 Asia Pacific

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING ANIMAL INTESTINAL HEALTH PRODUCTS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON TOP THREE PRODUCT TYPES

- 6.12.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR ADDITIVES

- TABLE 7 KEY BUYING CRITERIA FOR ADDITIVES

- 6.13 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 8 ANIMAL INTESTINAL HEALTH MARKET: DETAILED LIST OF CONFERENCES & EVENTS, BY REGION, 2022-2023

7 ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE

- 7.1 INTRODUCTION

- FIGURE 29 PROBIOTICS SEGMENT EXPECTED TO DOMINATE ANIMAL INTESTINAL HEALTH MARKET BY 2027

- TABLE 9 ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019-2027 (USD MILLION)

- TABLE 10 ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019-2027 (KT)

- 7.2 PROBIOTICS

- 7.2.1 PROBIOTIC MICROORGANISMS OFFER HEALTH BENEFITS

- TABLE 11 PROBIOTICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 12 PROBIOTICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

- 7.3 PREBIOTICS

- 7.3.1 PREBIOTICS INDUCE GROWTH OF BENEFICIAL GUT BACTERIA

- 7.3.1.1 Oligosaccharides

- 7.3.1.2 Inulin

- 7.3.1.3 Other additives

- TABLE 13 PREBIOTICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 14 PREBIOTICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

- 7.3.1 PREBIOTICS INDUCE GROWTH OF BENEFICIAL GUT BACTERIA

- 7.4 PHYTOGENICS

- 7.4.1 PHYTOGENIC FEED ADDITIVES OFFER MORE THAN FLAVORING PROPERTIES

- 7.4.1.1 Essential oils

- 7.4.1.2 Flavonoids

- 7.4.1.3 Saponins

- 7.4.1.4 Oleoresins

- 7.4.1.5 Other additives

- TABLE 15 PHYTOGENICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 16 PHYTOGENICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

- 7.4.1 PHYTOGENIC FEED ADDITIVES OFFER MORE THAN FLAVORING PROPERTIES

- 7.5 IMMUNOSTIMULANTS

- 7.5.1 IMMUNOSTIMULANTS IMPROVE IMMUNITY AND REDUCE STRESS AND DISEASES IN AQUACULTURE

- TABLE 17 IMMUNOSTIMULANTS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 18 IMMUNOSTIMULANTS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

8 ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK

- 8.1 INTRODUCTION

- FIGURE 30 POULTRY SEGMENT EXPECTED TO DOMINATE ANIMAL INTESTINAL HEALTH MARKET DURING FORECAST PERIOD

- TABLE 19 ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- TABLE 20 ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (KT)

- 8.2 POULTRY

- 8.2.1 FEED ADDITIVES ENHANCE POULTRY PERFORMANCE

- TABLE 21 POULTRY: ANIMAL INTESTINAL HEALTH MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 22 POULTRY: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 23 POULTRY: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

- 8.2.1.1 Broilers

- 8.2.1.2 Layers

- 8.2.1.3 Turkey

- 8.2.1.4 Other poultry species

- 8.3 SWINE

- 8.3.1 RISE IN PORK TRADE AND CONCERNS OVER MEAT SAFETY

- TABLE 24 PROBIOTIC MICROORGANISMS USED IN SWINE FEED

- TABLE 25 SWINE: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 26 SWINE: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

- 8.4 RUMINANTS

- 8.4.1 FEED ADDITIVES BOOST PRODUCTION EFFICIENCY IN RUMINANTS

- TABLE 27 RUMINANTS: ANIMAL INTESTINAL HEALTH MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 28 RUMINANTS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 29 RUMINANTS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

- 8.4.1.1 Dairy cattle

- 8.4.1.2 Beef cattle

- 8.4.1.3 Calves

- 8.4.1.4 Other ruminant species

- 8.5 AQUACULTURE

- 8.5.1 FEED ADDITIVES IMPROVE FEED QUALITY AND ENHANCE AQUACULTURE PERFORMANCE

- TABLE 30 AQUACULTURE: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 31 AQUACULTURE: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

- 8.6 OTHER LIVESTOCK

- 8.6.1 PHYTOGENIC-BASED ANIMAL INTESTINAL PRODUCTS IMPROVE DIGESTIBILITY IN PETS

- TABLE 32 OTHER LIVESTOCK: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 33 OTHER LIVESTOCK: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

9 ANIMAL INTESTINAL HEALTH MARKET, BY FORM

- 9.1 INTRODUCTION

- FIGURE 31 DRY SEGMENT EXPECTED TO DOMINATE ANIMAL INTESTINAL HEALTH MARKET DURING FORECAST PERIOD

- TABLE 34 ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019-2027 (USD MILLION)

- TABLE 35 ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019-2027 (KT)

- 9.2 DRY

- 9.2.1 EASE OF STORAGE AND TRANSPORTATION

- TABLE 36 DRY FORM: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 37 DRY FORM: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

- 9.3 LIQUID

- 9.3.1 LIQUID SUPPLEMENTS PROVIDE UNIFORM TEXTURE TO FINAL PRODUCTS

- TABLE 38 LIQUID FORM: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 39 LIQUID FORM: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

10 ANIMAL INTESTINAL HEALTH MARKET, BY FUNCTION

- 10.1 METABOLISM

- 10.1.1 ADDITIVES IMPROVE SURVIVAL AND IMPLANTATION OF LIVE MICROBIAL DIETARY SUPPLEMENTS IN GI TRACT

- 10.2 WEIGHT GAIN

- 10.2.1 FEED ADDITIVES IMPROVE PRODUCTION AND PERFORMANCE OF RUMINANTS

- 10.3 NUTRIENT DIGESTION

- 10.3.1 FEED ADDITIVES IMPROVE DIGESTIBILITY OF NUTRIENTS

- 10.4 DISEASE PREVENTION

- 10.4.1 USE OF FEED ADDITIVES PREVENTS DISEASES IN ANIMALS AND IMPROVES HEALTH

- 10.5 BONE AND JOINT HEALTH

- 10.5.1 PREBIOTICS BETTER CALCIUM METABOLISM AND BONE HEALTH

11 ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE

- 11.1 INTRODUCTION

- FIGURE 32 MICROBIAL SEGMENT EXPECTED TO DOMINATE ANIMAL INTESTINAL HEALTH MARKET DURING FORECAST PERIOD

- TABLE 40 ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019-2027 (USD MILLION)

- TABLE 41 ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019-2027 (KT)

- 11.2 MICROBIAL

- 11.2.1 PROBIOTICS PREPARED USING BACILLUS SUBTILIS AND STREPTOCOCCI IMPROVE EFFICIENCY IN POULTRY AND SWINE

- TABLE 42 MICROBIAL: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 43 MICROBIAL: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

- 11.3 PLANT-BASED

- 11.3.1 PLANT-BASED SUBSTANCES IMPROVE NUTRIENT DIGESTIBILITY IN ANIMALS

- TABLE 44 PLANT-BASED: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 45 PLANT-BASED: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (KT)

12 ANIMAL INTESTINAL HEALTH MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 33 INDIA EXPECTED TO WITNESS HIGH GROWTH IN ANIMAL INTESTINAL HEALTH MARKET BETWEEN 2022 AND 2027

- TABLE 46 ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 47 ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019-2027(KT)

- 12.2 NORTH AMERICA

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 48 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019-2027 (USD MILLION)

- TABLE 50 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019-2027 (KT)

- TABLE 51 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (KT)

- TABLE 53 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019-2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019-2027 (KT)

- TABLE 55 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019-2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019-2027 (KT)

- 12.2.1 US

- 12.2.1.1 Rise in consumption of poultry products

- TABLE 57 US: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.2.2 CANADA

- 12.2.2.1 Food safety concerns and government regulations

- TABLE 58 CANADA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.2.3 MEXICO

- 12.2.3.1 Rise in import of high-quality meat products

- TABLE 59 MEXICO: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.3 EUROPE

- TABLE 60 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 61 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019-2027 (USD MILLION)

- TABLE 62 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019-2027 (KT)

- TABLE 63 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- TABLE 64 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (KT)

- TABLE 65 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019-2027 (USD MILLION)

- TABLE 66 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019-2027 (KT)

- TABLE 67 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019-2027 (USD MILLION)

- TABLE 68 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019-2027 (KT)

- 12.3.1 SPAIN

- 12.3.1.1 Increased demand for meat and dairy products

- TABLE 69 SPAIN: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Focus on offering high-quality meat products

- TABLE 70 GERMANY: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Rising instances of disease outbreaks

- TABLE 71 FRANCE: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.3.4 ITALY

- 12.3.4.1 Need for alternative growth promoters encourage use of probiotics

- TABLE 72 ITALY: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.3.5 UK

- 12.3.5.1 Intensive farming results in high use of premium quality nutrients in animal intestinal health products

- TABLE 73 UK: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.3.6 REST OF EUROPE

- 12.3.6.1 Need for alternatives to antibiotic growth promoters encourage demand for phytogenics

- TABLE 74 REST OF EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 35 ASIA PACIFIC: REGIONAL SNAPSHOT

- TABLE 75 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 76 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019-2027 (USD MILLION)

- TABLE 77 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019-2027 (KT)

- TABLE 78 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- TABLE 79 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (KT)

- TABLE 80 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019-2027 (USD MILLION)

- TABLE 81 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019-2027 (KT)

- TABLE 82 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019-2027 (USD MILLION)

- TABLE 83 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019-2027 (KT)

- 12.4.1 CHINA

- 12.4.1.1 High consumption of meat

- TABLE 84 CHINA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.4.2 JAPAN

- 12.4.2.1 Preference for high-quality feed products

- TABLE 85 JAPAN: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.4.3 INDIA

- 12.4.3.1 Growing demand for high-quality poultry products

- TABLE 86 INDIA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Increase in consumption of meat products

- TABLE 87 SOUTH KOREA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 High consumption of meat products

- TABLE 88 AUSTRALIA & NEW ZEALAND: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.4.6 REST OF ASIA PACIFIC

- 12.4.6.1 Commercialization of livestock products

- TABLE 89 REST OF ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.5 SOUTH AMERICA

- TABLE 90 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 91 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019-2027 (USD MILLION)

- TABLE 92 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019-2027 (KT)

- TABLE 93 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- TABLE 94 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (KT)

- TABLE 95 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019-2027 (USD MILLION)

- TABLE 96 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019-2027 (KT)

- TABLE 97 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019-2027 (USD MILLION)

- TABLE 98 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019-2027 (KT)

- 12.5.1 BRAZIL

- 12.5.1.1 High demand for meat products due to high purchasing power of people

- TABLE 99 BRAZIL: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.5.2 ARGENTINA

- 12.5.2.1 Growth in animal husbandry sector

- TABLE 100 ARGENTINA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.3.1 Increased awareness among farmers about importance of feed supplements

- TABLE 101 REST OF SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.6 REST OF THE WORLD

- TABLE 102 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 103 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019-2027 (USD MILLION)

- TABLE 104 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019-2027 (KT)

- TABLE 105 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- TABLE 106 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (KT)

- TABLE 107 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019-2027 (USD MILLION)

- TABLE 108 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019-2027 (KT)

- TABLE 109 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019-2027 (USD MILLION)

- TABLE 110 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019-2027 (KT)

- 12.6.1 MIDDLE EAST

- 12.6.1.1 High demand for animal-based protein products

- TABLE 111 MIDDLE EAST: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

- 12.6.2 AFRICA

- 12.6.2.1 Improvement in livestock health

- TABLE 112 AFRICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 MARKET EVALUATION FRAMEWORK

- FIGURE 36 MARKET EVALUATION FRAMEWORK, 2019-2022

- 13.3 MARKET SHARE ANALYSIS

- TABLE 113 ANIMAL INTESTINAL HEALTH MARKET SHARE ANALYSIS, 2021

- 13.4 REVENUE ANALYSIS FOR KEY COMPANIES, 2019-2021 (USD BILLION)

- FIGURE 37 REVENUE ANALYSIS OF KEY COMPANIES, 2019-2021 (USD BILLION)

- 13.5 COMPANY EVALUATION QUADRANT

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 38 ANIMAL INTESTINAL HEALTH MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2021

- 13.6 STARTUP EVALUATION QUADRANT

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 STARTING BLOCKS

- 13.6.3 RESPONSIVE COMPANIES

- 13.6.4 DYNAMIC COMPANIES

- FIGURE 39 ANIMAL INTESTINAL HEALTH MARKET: COMPANY EVALUATION QUADRANT FOR SMES/STARTUPS, 2021

- 13.7 PRODUCT FOOTPRINT (KEY PLAYERS)

- TABLE 114 COMPANY FOOTPRINT, BY LIVESTOCK

- TABLE 115 COMPANY FOOTPRINT, BY ADDITIVE

- TABLE 116 COMPANY FOOTPRINT, BY REGION

- TABLE 117 OVERALL COMPANY FOOTPRINT

- 13.7.1 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 118 ANIMAL INTESTINAL HEALTH MARKET: DETAILED LIST OF KEY PLAYERS

- 13.7.2 COMPETITIVE BENCHMARKING OF SMES/OTHER PLAYERS

- TABLE 119 ANIMAL INTESTINAL HEALTH MARKET: DETAILED LIST OF SMES/OTHER PLAYERS

- 13.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

- 13.8.1 NEW PRODUCT LAUNCHES

- TABLE 120 ANIMAL INTESTINAL HEALTH MARKET: NEW PRODUCT LAUNCHES, 2019-2021

- 13.8.2 OTHER DEVELOPMENTS

- TABLE 121 ANIMAL INTESTINAL HEALTH MARKET: OTHER DEVELOPMENTS, 2019-2020

- 13.8.3 DEALS

- TABLE 122 ANIMAL INTESTINAL HEALTH MARKET: DEALS, 2020-2021

14 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 14.1 KEY PLAYERS

- 14.1.1 ADM

- TABLE 123 ADM: BUSINESS OVERVIEW

- FIGURE 40 ADM: COMPANY SNAPSHOT

- TABLE 124 ADM: PRODUCTS OFFERED

- TABLE 125 ADM: OTHERS, 2021

- TABLE 126 ADM: PRODUCT LAUNCHES, 2020

- 14.1.2 KONINKLIJKE DSM N.V.

- TABLE 127 KONINKLIJKE DSM N.V.: BUSINESS OVERVIEW

- FIGURE 41 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

- TABLE 128 KONINKLIJKE DSM N.V.: PRODUCTS OFFERED

- TABLE 129 KONINKLIJKE DSM N.V.: DEALS, 2020

- 14.1.3 DUPONT NUTRITION & BIOSCIENCES (DANISCO ANIMAL NUTRITION)

- TABLE 130 DUPONT NUTRITION & BIOSCIENCES: BUSINESS OVERVIEW

- FIGURE 42 DUPONT NUTRITION & BIOSCIENCES: COMPANY SNAPSHOT

- TABLE 131 DUPONT NUTRITION & BIOSCIENCES: PRODUCTS OFFERED

- TABLE 132 DUPONT NUTRITION & BIOSCIENCES: DEALS, 2019-2021

- TABLE 133 DUPONT NUTRITION & BIOSCIENCES: PRODUCT LAUNCHES, 2019

- TABLE 134 DUPONT NUTRITION & BIOSCIENCES: OTHERS, 2020

- 14.1.4 CARGILL INCORPORATED

- TABLE 135 CARGILL INCORPORATED: BUSINESS OVERVIEW

- FIGURE 43 CARGILL INC.: COMPANY SNAPSHOT

- TABLE 136 CARGILL INCORPORATED: PRODUCTS OFFERED

- TABLE 137 CARGILL INCORPORATED: DEALS, 2020

- TABLE 138 CARGILL INCORPORATED: OTHERS, 2022

- 14.1.5 NOVOZYMES

- TABLE 139 NOVOZYMES: BUSINESS OVERVIEW

- FIGURE 44 NOVOZYMES: COMPANY SNAPSHOT

- TABLE 140 NOVOZYMES: PRODUCTS OFFERED

- TABLE 141 NOVOZYMES: DEALS, 2020

- 14.1.6 KEMIN INDUSTRIES INC.

- TABLE 142 KEMIN INDUSTRIES INC.: BUSINESS OVERVIEW

- TABLE 143 KEMIN INDUSTRIES INC.: PRODUCTS OFFERED

- TABLE 144 KEMIN INDUSTRIES: PRODUCT LAUNCHES, 2020

- 14.1.7 NUTRECO

- TABLE 145 NUTRECO: BUSINESS OVERVIEW

- FIGURE 45 NUTRECO: COMPANY SNAPSHOT

- TABLE 146 NUTRECO: PRODUCTS OFFERED

- TABLE 147 NUTRECO: DEALS 2019-2020

- 14.1.8 CHR. HANSEN HOLDING A/S

- TABLE 148 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

- FIGURE 46 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

- TABLE 149 CHR. HANSEN HOLDING A/S: PRODUCTS OFFERED

- TABLE 150 CHR. HANSEN HOLDING A/S: PRODUCT LAUNCHES, 2019-2021

- TABLE 151 CHR. HANSEN HOLDING A/S: DEALS, 2020

- 14.1.9 BLUESTAR ADISSEO CO. LTD.

- TABLE 152 BLUESTAR ADISSEO: BUSINESS OVERVIEW

- FIGURE 47 BLUESTAR ADISSEO CO. LTD.: COMPANY SNAPSHOT

- TABLE 153 BLUESTAR ADISSEO CO. LTD.: PRODUCTS OFFERED

- TABLE 154 BLUESTAR ADISSEO CO. LTD.: DEALS, 2020

- 14.1.10 ALLTECH

- TABLE 155 ALLTECH: BUSINESS OVERVIEW

- TABLE 156 ALLTECH: PRODUCTS OFFERED

- 14.1.11 EVONIK INDUSTRIES

- TABLE 157 EVONIK INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 48 EVONIK INDUSTRIES: COMPANY SNAPSHOT

- TABLE 158 EVONIK INDUSTRIES: PRODUCTS OFFERED

- TABLE 159 EVONIK INDUSTRIES: PRODUCT LAUNCHES, 2020

- 14.1.12 LALLEMAND INC.

- TABLE 160 LALLEMAND INC.: BUSINESS OVERVIEW

- TABLE 161 LALLEMAND INC.: PRODUCTS OFFERED

- TABLE 162 LALLEMAND INC.: OTHER DEVELOPMENTS, 2019-2020

- 14.1.13 BIORIGIN

- TABLE 163 BIORIGIN: BUSINESS OVERVIEW

- TABLE 164 BIORIGIN: PRODUCTS OFFERED

- TABLE 165 BIORIGIN: DEALS, 2019

- 14.1.14 LAND O'LAKES

- TABLE 166 LAND O'LAKES: BUSINESS OVERVIEW

- FIGURE 49 LAND O'LAKES: COMPANY SNAPSHOT

- TABLE 167 LAND O'LAKES: PRODUCTS OFFERED

- TABLE 168 LAND O'LAKES: OTHERS, 2019

- TABLE 169 LAND O'LAKES: DEALS, 2019

- 14.1.15 LESAFFRE

- TABLE 170 LESAFFRE: BUSINESS OVERVIEW

- TABLE 171 LESAFFRE: PRODUCTS OFFERED

- TABLE 172 LESAFFRE: OTHER DEVELOPMENTS, 2019-2020

- TABLE 173 LESAFFRE: PRODUCT LAUNCHES, 2019

- 14.1.16 CALPIS CO LTD

- TABLE 174 CALPIS CO LTD.: BUSINESS OVERVIEW

- 14.1.17 AB VISTA

- 14.1.18 PURE CULTURES

- 14.1.19 DR. ECKEL ANIMAL NUTRITION GMBH & CO. KG

- 14.1.20 UNIQUE BIOTECH

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 175 ADJACENT MARKETS TO ANIMAL INTESTINAL HEALTH

- 15.2 LIMITATIONS

- 15.3 PHYTOGENIC FEED ADDITIVES MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- TABLE 176 PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2016-2019 (USD MILLION)

- TABLE 177 PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2020-2025 (USD MILLION)

- 15.4 PROBIOTICS IN ANIMAL FEED MARKET

- 15.4.1 MARKET DEFINITION

- TABLE 178 PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2017-2020 (USD MILLION)

- TABLE 179 PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2021-2026 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 AVAILABLE CUSTOMIZATION

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS