|

|

市場調査レポート

商品コード

1184190

無人潜水艇の世界市場:種類別 (自律型潜水艇 (AUV)、遠隔操作型潜水艇 (ROV))・用途別・推進方式別 (電動、非電動)・システム別・速度別・形状別・深度別・製品種類別・地域別の将来予測 (2027年まで)Unmanned Underwater Vehicles Market by type (Autonomous Underwater Vehicles (AUVs), Remotely Operated Vehicles (ROVs), Application, Propulsion (Electric, Non-Electric), System, Speed, Shape, Depth, Product Type, and Region - Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 無人潜水艇の世界市場:種類別 (自律型潜水艇 (AUV)、遠隔操作型潜水艇 (ROV))・用途別・推進方式別 (電動、非電動)・システム別・速度別・形状別・深度別・製品種類別・地域別の将来予測 (2027年まで) |

|

出版日: 2023年01月09日

発行: MarketsandMarkets

ページ情報: 英文 387 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の無人潜水艇の市場規模は、2022年に35億米ドル、2027年に74億米ドルに達すると予測されています。

また、2022年から2027年まで16.0%のCAGRで成長する見通しです。この市場の成長は、戦闘支援、ISR、地雷除去などの軍事用途と、海洋掘削や水路測量などの商業用途の増加に起因していると考えられます。

遠隔操作型潜水艇 (ROV) 市場を推進方式別に見ると、バッテリー技術の進歩により、完全電動システムが市場をリードし、高いCAGRで成長すると予想されます。

地域別では、北米市場がUUVの最大の市場となっています。域内各国は戦闘能力を備えたUUVの提供に向けて大手企業と複数の契約を交わしており、それが市場成長の促進材料となっています。

当レポートでは、世界の無人潜水艇の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別 (ROV・AUV) およびシステム別・推進方式別・形状別・深度別・速度別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 市場分析に対する景気後退の影響

- 主な動向 (2022年1月~12月)

- 顧客のビジネスに影響を与える動向/混乱

- 市場のエコシステム

- 価格分析

- 関税・規制状況

- 貿易データ

- 特許分析

- バリューチェーン分析

- 技術分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ユースケース

- 主な会議とイベント (2022年~2023年)

第6章 産業動向

- イントロダクション

- サプライチェーン分析

- 主要企業

- 中小企業

- エンドユーザー/顧客

- 業界の新たな動向

- 遠隔操作型潜水艇 (ROV)

- 自律型潜水艇 (AUV)

- デジタル船舶自動化システム

- 制御アルゴリズム

- コネクティビティソリューション

- 電子海図情報表示装置 (ECDIS)

- 通信システム

- メガトレンドの影響

- 人工知能

- ビッグデータ分析

- モノのインターネット (IoT)

- 宇宙技術を利用した衛星測位への関心増大

- 無人潜水艇での3Dプリント

- イノベーションと特許登録

第7章 無人潜水艇市場:航続距離別

第8章 無人潜水艇市場:種類別

- イントロダクション

- 遠隔操作型潜水艇 (ROV)

- 自立型潜水艇 (AUV)

第9章 遠隔操作型潜水艇 (ROV) 市場:システム別

- イントロダクション

- 推進装置

- ディーゼル/ガソリンエンジン

- ハイブリッド

- 電動

- 太陽電池

- 衝突回避システム

- ナビゲーションシステム

- 通信システム

- センサー

- ペイロード

- カメラ

- ソナー

- 照明システム

- ビデオスクリーン

- その他

- シャーシ

第10章 遠隔操作型潜水艇 (ROV) 市場:製品種類別

- イントロダクション

- 小型艇

- 大型艇

- 軽作業艇

- 重作業艇

第11章 遠隔操作型潜水艇 (ROV) 市場:推進方式別

- イントロダクション

- 電動システム

- 先進バッテリー技術

- 完全電動式

- ハイブリッド式

- 非電動システム

第12章 遠隔操作型潜水艇 (ROV) 市場:用途別

- イントロダクション

- 商業

- 海洋掘削

- 海底測量・製図

- パイプライン/ケーブル配線/検査

- 通信

- 科学調査

- 海底製図・撮影

- 海洋学研究

- 環境モニタリング

- 医薬品研究

- 防衛

- 機雷対策・対潜戦向け用途

- 諜報・監視・偵察 (ISR)

- 地雷対策

- 対潜戦

- 警備・検出・検査

- ナビゲーション・事故調査

- その他

- 捜索・救助

- 海難救助・破片除去

- 海洋考古学

第13章 自律型潜水艇 (AUV)市場:形状別

- イントロダクション

- 魚雷型

- 層流型

- 流線型・長方形

- 多胴型

第14章 自律型潜水艇 (AUV) 市場:深度別

- イントロダクション

- 浅水域 (100m以下)

- 中水域 (1,000m以下)

- 深水域 (1,000m以上)

第15章 自律型潜水艇 (AUV) 市場:速度別

- イントロダクション

- 5ノット未満

- 5ノット以上

第16章 自律型潜水艇 (AUV) 市場:推進方式別

- イントロダクション

- 電動システム

- 非電動システム

第17章 自律型潜水艇 (AUV) 市場:システム別

- イントロダクション

- 推進システム

- 電動式

- ハイブリッド

- 太陽電池式

- 衝突回避システム

- ナビゲーションシステム

- コンパスベースのナビゲーションシステム

- 慣性航法システム (INS)

- 通信システム

- リアルタイムデータ転送

- 音響通信

- 衛星通信

- センサー

- ペイロード

- カメラ

- ソナー

- エコーサウンダ

- 音響ドップラー電流プロファイラー

- その他

- シャーシ

第18章 自律型潜水艇 (AUV) 市場:用途別

- イントロダクション

- 商業

- 科学調査

- 防衛

- その他

第19章 無人潜水艇市場:地域別の分析

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- ロシア

- ノルウェー

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- 他のアジア太平洋諸国

- 中東・アフリカ

- イスラエル

- トルコ

- サウジアラビア

- 他の中東・アフリカ諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第20章 競合情勢

- イントロダクション

- 主要企業の市場シェア分析 (2021年)

- ランク分析 (2021年)

- 競争評価クアドラント

- 競合ベンチマーキング

- 主要な新興企業/中小企業の一覧と競合ベンチマーキング

- 競合シナリオ

- 新製品の発売

- 資本取引

第21章 企業プロファイル

- イントロダクション

- 主要企業

- KONGSBERG MARITIME

- SAAB AB

- OCEANEERING INTERNATIONAL INC.

- GENERAL DYNAMICS CORP.

- THE BOEING COMPANY

- FUGRO

- L3HARRIS TECHNOLOGIES

- BAE SYSTEMS

- LEONARDO SPA

- LOCKHEED MARTIN CORP.

- NORTHROP GRUMMAN CORPORATION

- MITSUI E&S HOLDINGS CO., LTD.

- MITSUBISHI HEAVY INDUSTRIES

- TELEDYNE TECHNOLOGIES

- SUBSEA 7

- THYSSENKRUPP

- ECA GROUP

- ST ENGINEERING

- HUNTINGTON INGALLS INDUSTRIES

- LARSEN & TOUBRO (L&T)

- LIG NEX 1

- HANWHA SYSTEMS

- その他の企業

- ARGEO

- ANDURIL

- OCEANSCAN MST

- INTERNATIONAL SUBMARINE ENGINEERING LTD.

- MSUBS

- RTSYS

第22章 付録

The unmanned underwater vehicles market is estimated to be USD 3.5 billion in 2022 and is projected to reach USD 7.4 billion by 2027, at a CAGR of 16.0% from 2022 to 2027. Growth of this market can be attributed to the rise in military applications like combat support, ISR, mine clearance, etc., and commercial applications like offshore drilling & hydrographic surveying.

unmanned marine surveying

In May 2020, Deep BV, a survey company specializing in hydrography, marine geophysics, and oceanography, upgraded its underwater survey vessel with a Sea Machines SM300 autonomous command and remote-helm control system. The Sea Machines system enables remote command of the vessel, including navigation and positioning, the control of onboard auxiliaries and sensors, and ship-to-shore data flow. Deep operators can command and control the unmanned vessel and all onboard payloads (including survey sonars, hydrophones, winches, cranes, and davits) from its shore-side Survey Control Room, which has been equipped to manage several surveys simultaneously. Deep is transferring all collected data from the vessel to the control room via 4G and satellite connection. The combination of Sea Machines' technology and the Survey Control Room has enabled Deep to shift from minimally manned missions to unmanned missions.

SwarmDiver by Aquabotix (Australia)

Launched in April 2019 by Aquabotix (Australia), SwarmDiver is the first commercial hybrid vehicle that can be used as both an unmanned ground vehicle (UGV) and an unmanned underwater vehicle (UUV) in a swarm. Its swarm can be controlled on the surface by a human operator as a single coordinated entity, which dives on command. Since it is able to function like a UGV, SwarmDiver solves the problem of slow underwater communication caused by the use of acoustic waves; it can transmit data through electromagnetic waves once on the surface in the UGV mode. Application areas of SwarmDiver include defense and security, environmental monitoring, harbor management, and plume tracking and research. A bio-inspired mini robot weighing 3.7 pounds, SwarmDiver is 29.5 inches long, and has an endurance of 2.5 hours with a diving reach of 150-feet. It measures the temperature and pressure of the water and can be tracked through GPS at a maximum depth of 3.3 feet from the surface of the water. In January 2019, Aquabotix (Australia) received a contract worth USD 70,000 from the US Navy for the further development of SwarmDiver.

.

"Electric Systems: The fastest-growing segment of the remotely operated vehicles market, by propulsion "

Based on electric systems, propulsion systems of remotely operated vehicles are further divided into fully electric systems and hybrid systems. Fully electric systems are expected to lead the segment as well as record the higher CAGR across the forecast period due to increasing advancements in battery technology.

"North America: The largest contributing region in the unmanned underwater vehicles market."

North America includes the US and Canada. The US is one of the largest global developers, operators, and exporters of unmanned military systems. Thus, it accounts for a large share of the North American region in the global unmanned underwater vehicles market. The main functions of UUVs include ensuring marine border security, Intelligence, Surveillance & Reconnaissance (ISR), and anti-submarine warfare. North American countries are awarding several contracts to major players in the unmanned underwater vehicles market to deliver UUVs with combat capabilities, thus driving the growth of the unmanned underwater vehicles market in the region.

Oceaneering International Inc. (US), Kongsberg Maritime (Norway), The Boeing Company (US), General Dynamics Corp. (US), Saan AB (Sweden), and Fugro (Netherlands) are the key players in the unmanned underwater vehicles market.

Research Coverage

The study covers the unmanned underwater vehicles market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on Application, Mobility, Size, Mode of Operation, System, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall unmanned underwater vehicles market and its segments. This study is also expected to provide region wise information about the end use, and wherein unmanned underwater vehicles are used. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKETS SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 UNMANNED UNDERWATER VEHICLES MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 USD EXCHANGE RATES

- 1.6 LIMITATIONS

- 1.7 MARKET STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.2 FACTOR ANALYSIS

- 2.2.1 SECONDARY DATA

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Key primary sources

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 RECESSION IMPACT ANALYSIS

- 2.3.1 DEMAND-SIDE INDICATORS

- FIGURE 5 NUMBER OF UUV CONTRACTS SECURED PER REGION, 2020-2022

- 2.3.2 SUPPLY-SIDE ANALYSIS

- FIGURE 6 EUROPE: REVENUE TREND FOR MARKET PLAYERS IN MARITIME INDUSTRY

- FIGURE 7 ASIA PACIFIC: REVENUE TREND FOR MARKET PLAYERS IN MARITIME INDUSTRY

- FIGURE 8 NORTH AMERICA: REVENUE TREND FOR MARKET PLAYERS IN MARITIME INDUSTRY

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 SEGMENTS AND SUBSEGMENTS

- 2.5 RESEARCH APPROACH AND METHODOLOGY

- 2.5.1 BOTTOM-UP APPROACH

- TABLE 1 UNMANNED UNDERWATER VEHICLES MARKET ESTIMATION PROCEDURE

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.5.2 TOP-DOWN APPROACH

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.6 DATA TRIANGULATION

- FIGURE 11 DATA TRIANGULATION

- 2.6.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.7 GROWTH RATE ASSUMPTIONS

- 2.8 ASSUMPTIONS FOR RESEARCH STUDY

- 2.9 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 12 AUV SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 COMMERCIAL SEGMENT TO LEAD MARKET FOR REMOTELY OPERATED VEHICLES DURING FORECAST PERIOD

- FIGURE 14 PROPULSION SYSTEMS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 LIGHT WORK CLASS VEHICLES TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 ELECTRIC SYSTEMS SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 DEFENSE SEGMENT TO ACCOUNT FOR LARGER SHARE OF AUV MARKET DURING FORECAST PERIOD

- FIGURE 18 DEEP WATER AUTONOMOUS UNDERWATER VEHICLES WITH OPERATING DEPTH OF MORE THAN 1,000 M TO ACCOUNT FOR LARGER MARKET SHARE

- FIGURE 19 AUVS WITH MORE THAN 5 KNOTS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 20 ELECTRIC SEGMENT TO REGISTER HIGHEST CAGR IN AUV MARKET DURING FORECAST PERIOD

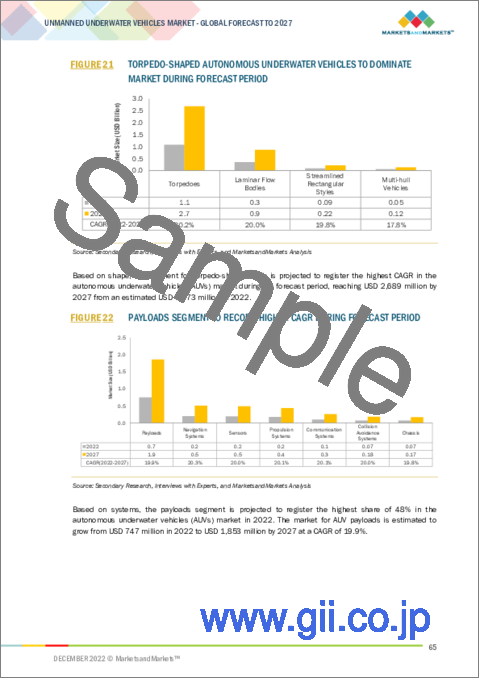

- FIGURE 21 TORPEDO-SHAPED AUTONOMOUS UNDERWATER VEHICLES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 22 PAYLOADS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 23 UNMANNED UNDERWATER VEHICLES MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN UNMANNED UNDERWATER VEHICLES MARKET

- FIGURE 24 INCREASING INVESTMENTS IN UNMANNED UNDERWATER VEHICLES TECHNOLOGY TO DRIVE MARKET

- 4.2 UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE

- FIGURE 25 AUV SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.3 REMOTELY OPERATED VEHICLES (ROVS) MARKET, BY APPLICATION

- FIGURE 26 COMMERCIAL SEGMENT ESTIMATED TO LEAD MARKET FROM 2022 TO 2027

- 4.4 AUTONOMOUS UNDERWATER VEHICLES (AUVS) MARKET, BY APPLICATION

- FIGURE 27 DEFENSE SEGMENT ESTIMATED TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 REMOTELY OPERATED VEHICLES (ROVS) MARKET, BY PROPULSION

- FIGURE 28 ELECTRIC SYSTEMS SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- 4.6 AUTONOMOUS UNDERWATER VEHICLES (AUVS) MARKET, BY PROPULSION

- FIGURE 29 ELECTRIC SYSTEMS SEGMENT ESTIMATED TO HAVE HIGHER MARKET SHARE DURING FORECAST PERIOD

- 4.7 REMOTELY OPERATED VEHICLES (ROVS) MARKET, BY SYSTEM

- FIGURE 30 PROPULSION SYSTEMS SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

- 4.8 AUTONOMOUS UNDERWATER VEHICLES (AUVS) MARKET, BY SYSTEM

- FIGURE 31 PAYLOADS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.9 UNMANNED UNDERWATER VEHICLES MARKET, BY COUNTRY

- FIGURE 32 UNMANNED UNDERWATER VEHICLES MARKET IN CHINA TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 33 UNMANNED UNDERWATER VEHICLES MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing capital expenditure of offshore oil & gas companies

- 5.2.1.2 Need for ocean data and mapping

- 5.2.1.3 Rising defense spending worldwide

- 5.2.2 RESTRAINTS

- 5.2.2.1 Failures in UUVs

- 5.2.2.2 High operational cost of UUVs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development and incorporation of advanced technologies in UUVs

- 5.2.3.2 Use of UUVs for mine disposal and anti-submarine warfare

- FIGURE 34 NUMBER OF UUVS PROCURED FOR DEFENSE APPLICATIONS, 2018 VS. 2021

- 5.2.4 CHALLENGES

- 5.2.4.1 Slow underwater survey speed

- 5.3 RECESSION IMPACT ON MARKET ANALYSIS

- FIGURE 35 RECESSION IMPACT ANALYSIS ON UNMANNED UNDERWATER VEHICLES MARKET

- 5.4 KEY DEVELOPMENTS FROM JANUARY 2019 TO DECEMBER 2022

- TABLE 2 KEY DEVELOPMENTS IN UNMANNED UNDERWATER VEHICLES MARKET IN 2022

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 36 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- 5.6 MARKET ECOSYSTEM

- FIGURE 37 UNMANNED UNDERWATER VEHICLES MARKET ECOSYSTEM

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 PRIVATE AND SMALL ENTERPRISES

- 5.6.3 END USERS

- TABLE 3 UNMANNED UNDERWATER VEHICLES MARKET ECOSYSTEM

- 5.7 PRICING ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE ANALYSIS OF UNMANNED SYSTEMS, 2021

- FIGURE 38 AVERAGE SELLING PRICE OF UNMANNED UNDERWATER VEHICLES FOR DIFFERENT APPLICATIONS

- 5.8 TARIFF REGULATORY LANDSCAPE

- 5.8.1 NORTH AMERICA

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- 5.8.2 EUROPE

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- 5.8.3 ASIA PACIFIC

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- 5.8.4 MIDDLE EAST & AFRICA

- TABLE 8 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- 5.8.5 LATIN AMERICA

- TABLE 9 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- 5.9 TRADE DATA

- TABLE 10 COUNTRY-WISE IMPORTS, 2019-2021 (USD THOUSAND)

- 5.10 PATENT ANALYSIS

- FIGURE 39 LIST OF MAJOR PATENTS FOR UNMANNED UNDERWATER VEHICLES

- TABLE 11 LIST OF MAJOR PATENTS FOR UNMANNED UNDERWATER VEHICLES

- 5.11 VALUE CHAIN ANALYSIS

- FIGURE 40 VALUE CHAIN ANALYSIS

- 5.11.1 RESEARCH & DEVELOPMENT

- 5.11.2 RAW MATERIALS

- 5.11.3 COMPONENT/PRODUCT MANUFACTURERS (OEMS)

- 5.11.4 ASSEMBLERS AND INTEGRATORS

- 5.11.5 END USERS

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGY

- 5.12.1.1 CROSS-PLATFORM OPERATIONS

- FIGURE 41 CROSS-PLATFORM OPERATIONS

- 5.12.1.2 Marine AI software for UUVs

- 5.12.1.3 Hybrid ROVs

- 5.12.2 SUPPORTING TECHNOLOGY

- 5.12.2.1 HD camera and video

- 5.12.2.2 Multibeam echo sounder

- 5.12.1 KEY TECHNOLOGY

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 42 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 43 INFLUENCE OF STAKEHOLDERS IN BUYING UNMANNED UNDERWATER VEHICLES, BY APPLICATION

- TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING UNMANNED UNDERWATER VEHICLES, BY APPLICATION

- 5.14.2 BUYING CRITERIA

- FIGURE 44 KEY BUYING CRITERIA FOR UNMANNED UNDERWATER VEHICLES, BY TYPE

- TABLE 14 KEY BUYING CRITERIA FOR UNMANNED UNDERWATER VEHICLES, BY TYPE

- 5.15 USE CASES

- 5.15.1 UNMANNED MARINE SURVEYING

- 5.15.2 SWARMDIVER BY AQUABOTIX (AUSTRALIA)

- 5.16 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 15 UNMANNED UNDERWATER VEHICLES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 45 SUPPLY CHAIN ANALYSIS

- 6.2.1 MAJOR COMPANIES

- 6.2.2 SMALL AND MEDIUM ENTERPRISES

- 6.2.3 END USERS/CUSTOMERS

- 6.3 EMERGING INDUSTRY TRENDS

- 6.3.1 REMOTELY OPERATED VEHICLES (ROVS)

- 6.3.1.1 Rescue vehicles

- 6.3.1.2 Reduced vehicle size

- 6.3.2 AUTONOMOUS UNDERWATER VEHICLES (AUVS)

- 6.3.2.1 Rapid technological advancement

- 6.3.2.2 Pipeline inspection trend in AUV

- 6.3.2.3 Longer mission life

- 6.3.2.4 Increased functionality

- 6.3.2.5 Miniaturization

- 6.3.3 DIGITAL MARINE AUTOMATION SYSTEMS

- 6.3.4 CONTROL ALGORITHMS

- 6.3.5 CONNECTIVITY SOLUTIONS

- 6.3.6 ELECTRONIC CHART DISPLAY AND INFORMATION SYSTEMS

- 6.3.7 COMMUNICATION SYSTEMS

- 6.3.1 REMOTELY OPERATED VEHICLES (ROVS)

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 ARTIFICIAL INTELLIGENCE

- 6.4.2 BIG DATA ANALYTICS

- 6.4.3 INTERNET OF THINGS (IOT)

- 6.4.4 INCREASING FOCUS ON SATELLITE-BASED POSITIONING USING SPACE TECHNOLOGIES

- 6.4.5 3D PRINTING IN UNMANNED UNDERWATER VEHICLE

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 16 INNOVATIONS AND PATENT REGISTRATIONS, 2014-2022

7 UNMANNED UNDERWATER VEHICLES MARKET, BY RANGE

- TABLE 17 RANGE OF UNMANNED UNDERWATER VEHICLES, BY COMMERCIAL APPLICATION

- TABLE 18 RANGE OF UNMANNED UNDERWATER VEHICLES, BY SCIENTIFIC RESEARCH APPLICATION

- TABLE 19 RANGE OF UNMANNED UNDERWATER VEHICLES, BY DEFENSE APPLICATION

- TABLE 20 RANGE OF UNMANNED UNDERWATER VEHICLES, BY MISCELLANEOUS APPLICATION

8 UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 46 AUTONOMOUS UNDERWATER VEHICLES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 21 UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 22 UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.2 REMOTELY OPERATED VEHICLES (ROVS)

- 8.2.1 MORE MATURED AND TECHNOLOGICALLY ADVANCED MARKET

- 8.3 AUTONOMOUS UNDERWATER VEHICLES (AUVS)

- 8.3.1 BETTER PAYLOAD CAPACITY TO PROVIDE MORE ACCURATE DATA

9 REMOTELY OPERATED VEHICLES MARKET, BY SYSTEM

- 9.1 INTRODUCTION

- FIGURE 47 PROPULSION SYSTEMS SEGMENT PROJECTED TO LEAD REMOTELY OPERATED VEHICLES MARKET DURING FORECAST PERIOD

- TABLE 23 REMOTELY OPERATED VEHICLES MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 24 REMOTELY OPERATED VEHICLES MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- 9.2 PROPULSION SYSTEMS

- 9.2.1 PROVIDE COMPACT, LIGHTWEIGHT, AND RELIABLE POWER

- FIGURE 48 HYBRID PROPULSION SYSTEMS TO LEAD ROV MARKET DURING FORECAST PERIOD

- TABLE 25 REMOTELY OPERATED VEHICLES MARKET, BY PROPULSION SYSTEM, 2018-2021 (USD MILLION)

- TABLE 26 REMOTELY OPERATED VEHICLES MARKET, BY PROPULSION SYSTEM, 2022-2027 (USD MILLION)

- 9.2.2 DIESEL/GASOLINE ENGINES

- 9.2.3 HYBRID

- 9.2.4 ELECTRIC

- 9.2.5 SOLAR

- 9.3 COLLISION AVOIDANCE SYSTEMS

- 9.3.1 ABILITY TO CONSULT STORED ENVIRONMENT MODELS AND DETECT PREVIOUSLY KNOWN OBSTACLES

- 9.4 NAVIGATION SYSTEMS

- 9.4.1 EQUIPPED WITH INERTIAL NAVIGATION SYSTEMS

- 9.5 COMMUNICATION SYSTEMS

- 9.5.1 ENSURE CONTINUOUS LINK BETWEEN ROVS AND GROUND CONTROL STATIONS

- 9.6 SENSORS

- 9.6.1 DETECT SUBSEA OBJECTS

- 9.7 PAYLOADS

- 9.7.1 INCREASING EFFORTS TO EXTEND ROV APPLICATION AREAS TO BOOST DEMAND FOR PAYLOADS

- FIGURE 49 CAMERAS SEGMENT PROJECTED TO GROW AT HIGHEST CAGR, BY ROV-PAYLOAD

- TABLE 27 REMOTELY OPERATED VEHICLES MARKET, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 28 REMOTELY OPERATED VEHICLES MARKET, BY PAYLOAD, 2022-2027 (USD MILLION)

- 9.7.2 CAMERAS

- 9.7.3 SONARS

- 9.7.4 LIGHTING SYSTEMS

- 9.7.5 VIDEO SCREENS

- 9.7.6 OTHERS

- 9.8 CHASSIS

- 9.8.1 GROWING USE OF LIGHTWEIGHT MATERIALS FOR CHASSIS

10 REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE

- 10.1 INTRODUCTION

- FIGURE 50 LIGHT WORK CLASS VEHICLES SEGMENT TO LEAD REMOTELY OPERATED VEHICLES MARKET

- TABLE 29 REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 30 REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- 10.2 SMALL VEHICLES

- 10.2.1 COST-EFFECTIVE FOR UNDERWATER SCRUTINY AND SEARCH & RECOVERY OPERATIONS

- 10.3 HIGH-CAPACITY VEHICLES

- 10.3.1 INCREASING APPLICABILITY ACROSS VARIED INDUSTRY VERTICALS

- 10.4 LIGHT WORK CLASS VEHICLES

- 10.4.1 GROWING DEMAND FOR ENGINEERING AND SCIENTIFIC RESEARCH IN OCEAN

- 10.5 HEAVY WORK CLASS VEHICLES

- 10.5.1 USED FOR MINE COUNTERMEASURE AND THREAT IDENTIFICATION

11 REMOTELY OPERATED VEHICLES MARKET, BY PROPULSION

- 11.1 INTRODUCTION

- FIGURE 51 ELECTRIC SYSTEMS TO ACQUIRE HIGHEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 31 REMOTELY OPERATED VEHICLES MARKET, BY PROPULSION SYSTEM, 2018-2021 (USD MILLION)

- TABLE 32 REMOTELY OPERATED VEHICLES MARKET, BY PROPULSION SYSTEM, 2022-2027 (USD MILLION)

- 11.2 ELECTRIC SYSTEMS

- 11.2.1 ADVANCED BATTERY TECHNOLOGY

- FIGURE 52 FULLY ELECTRIC SYSTEMS TO HAVE HIGHER CAGR DURING FORECAST PERIOD

- TABLE 33 REMOTELY OPERATED VEHICLES MARKET, BY ELECTRIC PROPULSION SYSTEM, 2018-2021 (USD MILLION)

- TABLE 34 REMOTELY OPERATED VEHICLES MARKET, BY ELECTRIC PROPULSION SYSTEM, 2022-2027 (USD MILLION)

- 11.2.2 FULLY ELECTRIC

- 11.2.3 HYBRID

- 11.3 NON-ELECTRIC SYSTEMS

- 11.3.1 USE FUEL CELLS

12 REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- FIGURE 53 COMMERCIAL SEGMENT PROJECTED TO LEAD REMOTELY OPERATED VEHICLES MARKET

- TABLE 35 REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 36 REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.2 COMMERCIAL

- 12.2.1 GROWING NEED FOR OIL & GAS EXPLORATION TO DRIVE GLOBAL DEMAND FOR ROV

- FIGURE 54 OFFSHORE DRILLING TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 37 REMOTELY OPERATED VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2018-2021 (USD MILLION)

- TABLE 38 REMOTELY OPERATED VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2022-2027 (USD MILLION)

- 12.2.2 OFFSHORE DRILLING

- 12.2.3 SURVEY AND SEABED MAPPING

- 12.2.4 PIPELINE/CABLING/INSPECTION

- 12.2.5 COMMUNICATION

- 12.3 SCIENTIFIC RESEARCH

- 12.3.1 HIGHER DEMAND FOR ENVIRONMENTAL MONITORING TO DRIVE SEGMENT

- FIGURE 55 ENVIRONMENTAL MONITORING PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 39 REMOTELY OPERATED VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2018-2021 (USD MILLION)

- TABLE 40 REMOTELY OPERATED VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2022-2027 (USD MILLION)

- 12.3.2 SEABED MAPPING AND IMAGING

- 12.3.3 OCEANOGRAPHIC STUDIES

- 12.3.4 ENVIRONMENTAL MONITORING

- 12.3.5 PHARMACEUTICAL RESEARCH

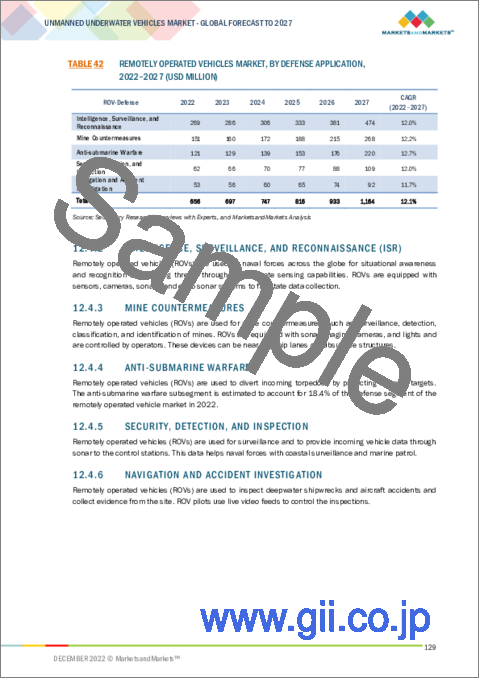

- 12.4 DEFENSE

- 12.4.1 MINE COUNTERMEASURES AND ANTI-SUBMARINE WARFARE APPLICATIONS

- FIGURE 56 ISR SEGMENT PROJECTED TO LEAD REMOTELY OPERATED VEHICLES MARKET

- TABLE 41 REMOTELY OPERATED VEHICLES MARKET, BY DEFENSE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 42 REMOTELY OPERATED VEHICLES MARKET, BY DEFENSE APPLICATION, 2022-2027 (USD MILLION)

- 12.4.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

- 12.4.3 MINE COUNTERMEASURES

- 12.4.4 ANTI-SUBMARINE WARFARE

- 12.4.5 SECURITY, DETECTION, AND INSPECTION

- 12.4.6 NAVIGATION AND ACCIDENT INVESTIGATION

- 12.5 MISCELLANEOUS

- 12.5.1 INCREASING USE OF ROVS SEARCH & RESCUE OPERATIONS TO DRIVE SEGMENT

- FIGURE 57 SEARCH & RESCUE TO BE DOMINANT SUBSEGMENT FROM 2022 TO 2027

- TABLE 43 REMOTELY OPERATED VEHICLES MARKET, BY MISCELLANEOUS APPLICATION, 2018-2021 (USD MILLION)

- TABLE 44 REMOTELY OPERATED VEHICLES MARKET, BY MISCELLANEOUS APPLICATION, 2022-2027 (USD MILLION)

- 12.5.2 SEARCH & RESCUE

- 12.5.3 MARINE SALVAGE AND DEBRIS REMOVAL

- 12.5.4 MARINE ARCHAEOLOGY

13 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SHAPE

- 13.1 INTRODUCTION

- FIGURE 58 TORPEDOES SEGMENT TO RECORD HIGHEST CAGR FROM 2022 TO 2027

- TABLE 45 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SHAPE, 2018-2021 (USD MILLION)

- TABLE 46 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SHAPE, 2022-2027 (USD MILLION)

- 13.2 TORPEDOES

- 13.2.1 EXPERIENCE MORE DRAG IN SHALLOW WATERS

- FIGURE 59 EXHIBIT OF TORPEDO AUVS

- 13.3 LAMINAR FLOW BODIES

- 13.3.1 INCREASED USE IN MILITARY APPLICATIONS

- FIGURE 60 EXHIBIT OF LAMINAR FLOW BODY AUVS

- 13.4 STREAMLINED RECTANGULAR STYLES

- 13.4.1 STABILITY AND HIGH ACCURACY FOR UNDERWATER INFORMATION COLLECTION

- 13.5 MULTI-HULL VEHICLES

- 13.5.1 COVER MORE SURFACE AREA AND EXPERIENCE GREATER DRAG

- FIGURE 61 EXHIBIT OF MULTI-HULL VEHICLES

14 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH

- 14.1 INTRODUCTION

- TABLE 47 FEATURES OF DIFFERENT TYPES OF AUVS

- FIGURE 62 DEEP AUV MARKET TO RECORD HIGHEST CAGR FROM 2022 TO 2027

- TABLE 48 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 49 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- 14.2 SHALLOW (UP TO 100 M)

- 14.2.1 GROWING ADOPTION FOR MAPPING, ROUTE SURVEYS, AND FISHERY

- TABLE 50 VARIOUS APPLICATIONS AND OEMS OF SHALLOW AUVS

- 14.3 MEDIUM (UP TO 1,000 M)

- 14.3.1 INCREASED ADOPTION DUE TO HIGH-SPECIFICATION POSITIONING, NAVIGATION, AND TRACKING CAPABILITIES

- TABLE 51 VARIOUS APPLICATIONS AND OEMS OF MEDIUM AUVS

- 14.4 DEEP (MORE THAN 1,000 M)

- 14.4.1 INCREASED USE FOR DEEPWATER MAPPING AND SURVEYING APPLICATIONS

- TABLE 52 VARIOUS APPLICATIONS AND OEMS OF DEEP AUVS

15 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SPEED

- 15.1 INTRODUCTION

- FIGURE 63 MORE THAN 5 KNOTS SEGMENT TO RECORD HIGHER CAGR FROM 2022 TO 2027

- TABLE 53 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SPEED, 2018-2021

- TABLE 54 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SPEED, 2022-2027

- 15.2 LESS THAN 5 KNOTS

- 15.2.1 LONGER THAN 24 HOURS OF ENDURANCE

- 15.3 MORE THAN 5 KNOTS

- 15.3.1 DEFENSE AND SURVEILLANCE APPLICATIONS

16 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY PROPULSION

- 16.1 INTRODUCTION

- FIGURE 64 ELECTRIC SYSTEMS ESTIMATED TO LEAD MARKET IN 2022

- TABLE 55 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY PROPULSION, 2018-2021 (USD MILLION)

- TABLE 56 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY PROPULSION, 2022-2027 (USD MILLION)

- 16.2 ELECTRIC SYSTEMS

- 16.2.1 ADVANCEMENTS IN BATTERY TECHNOLOGY

- FIGURE 65 FULLY ELECTRIC SYSTEMS SEGMENT ESTIMATED TO LEAD AUV MARKET DURING FORECAST PERIOD

- TABLE 57 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY ELECTRIC PROPULSION, 2018-2021 (USD MILLION)

- TABLE 58 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY ELECTRIC PROPULSION, 2022-2027 (USD MILLION)

- 16.2.2 FULLY ELECTRIC SYSTEMS

- 16.2.3 HYBRID SYSTEMS

- 16.3 NON-ELECTRIC SYSTEMS

- 16.3.1 HIGHER ENDURANCE AND ENERGY

- TABLE 59 MAPPING: DEVELOPMENT OF FUEL CELLS

17 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SYSTEM

- 17.1 INTRODUCTION

- FIGURE 66 NAVIGATION SYSTEMS TO WITNESS HIGHEST CAGR FROM 2022 TO 2027

- TABLE 60 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 61 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- 17.2 PROPULSION SYSTEMS

- 17.2.1 GROWING EFFORTS TO DECREASE WEIGHT AND ENHANCE THRUST GENERATION

- FIGURE 67 ELECTRIC PROPULSION SYSTEMS OF AUV MARKET TO WITNESS HIGHEST CAGR FROM 2022 TO 2027

- TABLE 62 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY PROPULSION SYSTEMS, 2018-2021 (USD MILLION)

- TABLE 63 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY PROPULSION SYSTEMS, 2022-2027 (USD MILLION)

- 17.2.2 ELECTRIC

- TABLE 64 TYPES OF BATTERIES

- TABLE 65 AUVS AND THEIR BATTERIES

- 17.2.3 HYBRID

- 17.2.4 SOLAR

- 17.3 COLLISION AVOIDANCE SYSTEMS

- 17.3.1 DETECT AND AVOID OBSTACLES

- 17.4 NAVIGATION SYSTEMS

- 17.4.1 GROWING USE FOR DEEPWATER APPLICATIONS

- FIGURE 68 INERTIAL NAVIGATION SYSTEMS TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 66 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY NAVIGATION SYSTEMS, 2018-2021 (USD MILLION)

- TABLE 67 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY NAVIGATION SYSTEMS, 2022-2027 (USD MILLION)

- 17.4.2 COMPASS-BASED NAVIGATION SYSTEMS

- 17.4.3 INERTIAL NAVIGATION SYSTEMS (INS)

- 17.5 COMMUNICATION SYSTEMS

- 17.5.1 REAL-TIME DATA TRANSFER

- TABLE 68 COMMUNICATION FOR SEARAPTOR AUVS MANUFACTURED BY TELEDYNE MARINE (US)

- FIGURE 69 SATELLITE COMMUNICATION SYSTEMS TO GROW WITH HIGHER CAGR FROM 2022 TO 2027

- TABLE 69 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY COMMUNICATION SYSTEMS, 2018-2021 (USD MILLION)

- TABLE 70 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY COMMUNICATION SYSTEMS, 2022-2027 (USD MILLION)

- 17.5.2 ACOUSTIC COMMUNICATION

- 17.5.3 SATELLITE COMMUNICATION

- 17.6 SENSORS

- 17.6.1 USED TO SCAN, DETECT, AND MAP

- 17.7 PAYLOADS

- 17.7.1 INCREASED PROCUREMENT OF UUVS TO DRIVE SEGMENT

- FIGURE 70 ECHO SOUNDERS TO LEAD WITH HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 71 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 72 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY PAYLOAD, 2022-2027 (USD MILLION)

- 17.7.2 CAMERAS

- 17.7.3 SONARS

- 17.7.4 ECHO SOUNDERS

- 17.7.5 ACOUSTIC DOPPLER CURRENT PROFILERS

- 17.7.6 OTHERS

- 17.8 CHASSIS

- 17.8.1 LESSER WEIGHT, FLEXIBILITY, AND INEXPENSIVE

18 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION

- 18.1 INTRODUCTION

- FIGURE 71 DEFENSE SEGMENT PROJECTED TO LEAD AUTONOMOUS UNDERWATER VEHICLES MARKET IN 2022

- TABLE 73 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 74 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 18.2 COMMERCIAL

- 18.2.1 BETTER FOR UNDERWATER OPERATIONS

- FIGURE 72 SURVEY AND SEABED MAPPING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 75 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2018-2021 (USD MILLION)

- TABLE 76 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2022-2027 (USD MILLION)

- 18.2.2 OFFSHORE DRILLING

- 18.2.3 SURVEY AND SEABED MAPPING

- 18.2.4 PIPELINE/CABLING/INSPECTION

- 18.2.5 COMMUNICATION

- 18.3 SCIENTIFIC RESEARCH

- 18.3.1 GROWING INTEREST IN DEEPWATER SCIENTIFIC RESEARCH TO DRIVE DEMAND

- FIGURE 73 OCEANOGRAPHIC STUDIES PROJECTED TO LEAD AUTONOMOUS UNDERWATER VEHICLE MARKET IN 2022

- TABLE 77 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2018-2021 (USD MILLION)

- TABLE 78 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2022-2027 (USD MILLION)

- 18.3.2 SEABED MAPPING AND IMAGING

- 18.3.3 OCEANOGRAPHIC STUDIES

- 18.3.4 ENVIRONMENTAL MONITORING

- 18.3.5 PHARMACEUTICAL RESEARCH

- 18.4 DEFENSE

- 18.4.1 IMPROVED PROCESSING CAPABILITIES TO DRIVE DEMAND FOR AUVS

- FIGURE 74 ANTI-SUBMARINE WARFARE TO HAVE HIGHEST GROWTH FROM 2022 TO 2027

- TABLE 79 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEFENSE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 80 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEFENSE APPLICATION, 2022-2027 (USD MILLION)

- 18.4.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

- 18.4.3 MINE COUNTERMEASURES

- 18.4.4 ANTI-SUBMARINE WARFARE

- 18.4.5 SECURITY, DETECTION, AND INSPECTION

- 18.4.6 NAVIGATION AND ACCIDENT INVESTIGATION

- 18.5 MISCELLANEOUS

- 18.5.1 GROWING UNDERWATER SCRUTINY TO DRIVE DEMAND FOR AUVS

- FIGURE 75 SEARCH & RESCUE SEGMENT PROJECTED TO GROW AT HIGHEST CAGR

- TABLE 81 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY MISCELLANEOUS APPLICATION, 2018-2021 (USD MILLION)

- TABLE 82 AUTONOMOUS UNDERWATER VEHICLES MARKET, BY MISCELLANEOUS APPLICATION, 2022-2027 (USD MILLION)

- 18.5.2 SEARCH & RESCUE

- 18.5.3 MARINE SALVAGE AND DEBRIS REMOVAL

- 18.5.4 MARINE ARCHAEOLOGY

19 UNMANNED UNDERWATER VEHICLES MARKET, REGIONAL ANALYSIS

- 19.1 INTRODUCTION

- FIGURE 76 UUV MARKET IN ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 83 UNMANNED UNDERWATER VEHICLES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 84 UNMANNED UNDERWATER VEHICLES MARKET, BY REGION, 2022-2027 (USD MILLION)

- FIGURE 77 UUV VOLUME BY REGION, 2021

- 19.2 NORTH AMERICA

- 19.2.1 NORTH AMERICA: PESTLE ANALYSIS

- FIGURE 78 SNAPSHOT OF UUV MARKET IN NORTH AMERICA

- 19.2.2 RECESSION IMPACT ON NORTH AMERICA

- FIGURE 79 NAVAL BUDGET TREND, BY COUNTRY, 2019-2022

- TABLE 85 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 86 NORTH AMERICA: UNMANNED UNDERWATER VEHICLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 87 NORTH AMERICA: UNMANNED UNDERWATER VEHICLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 89 NORTH AMERICA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 90 NORTH AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 91 NORTH AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 92 NORTH AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2018-2021 (USD MILLION)

- TABLE 93 NORTH AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2022-2027 (USD MILLION)

- TABLE 94 NORTH AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2018-2021 (USD MILLION)

- TABLE 95 NORTH AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2022-2027 (USD MILLION)

- TABLE 96 NORTH AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 97 NORTH AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 98 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 99 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 100 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2018-2021 (USD MILLION)

- TABLE 101 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2022-2027 (USD MILLION)

- TABLE 102 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEFENSE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 103 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEFENSE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 104 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 105 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- FIGURE 80 NORTH AMERICA: UUV VOLUME, BY COUNTRY, 2021

- 19.2.3 US

- 19.2.3.1 Growing use of UUVs for collecting ocean data and mapping

- TABLE 106 US: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION

- TABLE 107 US: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 108 US: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 109 US: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 110 US: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 111 US: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 112 US: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 113 US: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 114 US: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 115 US: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- 19.2.4 CANADA

- 19.2.4.1 Increasing demand from oil & gas industry for video or sonar surveys of pipelines

- TABLE 116 CANADA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 117 CANADA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 118 CANADA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 119 CANADA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 120 CANADA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 121 CANADA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 122 CANADA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 123 CANADA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 124 CANADA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 125 CANADA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- 19.3 EUROPE

- 19.3.1 EUROPE: PESTLE ANALYSIS

- FIGURE 81 SNAPSHOT OF UUV MARKET IN EUROPE

- 19.3.2 RECESSION IMPACT ON EUROPE

- FIGURE 82 NAVAL BUDGET TREND, BY COUNTRY, 2019-2022

- TABLE 126 EUROPE: RECESSION IMPACT ANALYSIS

- TABLE 127 EUROPE: UNMANNED UNDERWATER VEHICLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 128 EUROPE: UNMANNED UNDERWATER VEHICLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 129 EUROPE: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 130 EUROPE: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 131 EUROPE: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 132 EUROPE: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 133 EUROPE: REMOTELY OPERATED VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2018-2021 (USD MILLION)

- TABLE 134 EUROPE: REMOTELY OPERATED VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2022-2027 (USD MILLION)

- TABLE 135 EUROPE: REMOTELY OPERATED VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2018-2021 (USD MILLION)

- TABLE 136 EUROPE: REMOTELY OPERATED VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2022-2027 (USD MILLION)

- TABLE 137 EUROPE: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 138 EUROPE: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 139 EUROPE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 140 EUROPE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 141 EUROPE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2018-2021 (USD MILLION)

- TABLE 142 EUROPE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2022-2027 (USD MILLION)

- TABLE 143 EUROPE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEFENSE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 144 EUROPE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEFENSE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 145 EUROPE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 146 EUROPE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- FIGURE 83 EUROPE: UUV VOLUME BY COUNTRY, 2021

- 19.3.3 UK

- 19.3.3.1 Growing applicability of UUVs in defense sector

- TABLE 147 UK: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 148 UK: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 149 UK: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 150 UK: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 151 UK: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 152 UK: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 153 UK: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 154 UK: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 155 UK: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 156 UK: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- 19.3.4 GERMANY

- 19.3.4.1 Increasing use of UUVs in offshore drilling

- TABLE 157 GERMANY: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 158 GERMANY: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 159 GERMANY: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 160 GERMANY: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 161 GERMANY: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 162 GERMANY: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 163 GERMANY: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 164 GERMANY: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 165 GERMANY: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 166 GERMANY: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- 19.3.5 FRANCE

- 19.3.5.1 Growing investment by navy in UUVs

- TABLE 167 FRANCE: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 168 FRANCE: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 169 FRANCE: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 170 FRANCE: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 171 FRANCE: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 172 FRANCE: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 173 FRANCE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 174 FRANCE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 175 FRANCE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 176 FRANCE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- 19.3.6 RUSSIA

- 19.3.6.1 Increasing applicability of UUVs for ocean exploration and surveillance

- TABLE 177 RUSSIA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 178 RUSSIA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 179 RUSSIA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 180 RUSSIA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 181 RUSSIA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 182 RUSSIA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 183 RUSSIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 184 RUSSIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 185 RUSSIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 186 RUSSIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- 19.3.7 NORWAY

- 19.3.7.1 Increased focus on UUV production

- TABLE 187 NORWAY: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 188 NORWAY: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 189 NORWAY: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 190 NORWAY: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 191 NORWAY: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 192 NORWAY: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 193 NORWAY: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 194 NORWAY: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 195 NORWAY: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 196 NORWAY: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- 19.3.8 REST OF EUROPE

- TABLE 197 REST OF EUROPE: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 198 REST OF EUROPE: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 199 REST OF EUROPE: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 200 REST OF EUROPE: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 201 REST OF EUROPE: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 202 REST OF EUROPE: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 203 REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 204 REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 205 REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 206 REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- 19.4 ASIA PACIFIC

- 19.4.1 ASIA PACIFIC: PESTLE ANALYSIS

- FIGURE 84 SNAPSHOT OF UUV MARKET IN ASIA PACIFIC

- 19.4.2 RECESSION IMPACT ON ASIA PACIFIC

- FIGURE 85 NAVAL BUDGET TREND, BY COUNTRY, 2019-2022

- TABLE 207 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- TABLE 208 ASIA PACIFIC: UNMANNED UNDERWATER VEHICLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 209 ASIA PACIFIC: UNMANNED UNDERWATER VEHICLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 210 ASIA PACIFIC: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 211 ASIA PACIFIC: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 212 ASIA PACIFIC: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 213 ASIA PACIFIC: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 214 ASIA PACIFIC: REMOTELY OPERATED VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2018-2021 (USD MILLION)

- TABLE 215 ASIA PACIFIC: REMOTELY OPERATED VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2022-2027 (USD MILLION)

- TABLE 216 ASIA PACIFIC: REMOTELY OPERATED VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2018-2021 (USD MILLION)

- TABLE 217 ASIA PACIFIC: REMOTELY OPERATED VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2022-2027 (USD MILLION)

- TABLE 218 ASIA PACIFIC: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 219 ASIA PACIFIC: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 220 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 221 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 222 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2018-2021 (USD MILLION)

- TABLE 223 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2022-2027 (USD MILLION)

- TABLE 224 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEFENSE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 225 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEFENSE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 226 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 227 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- FIGURE 86 ASIA PACIFIC: UUV VOLUME, BY COUNTRY, 2021

- 19.4.3 CHINA

- 19.4.3.1 Increasing military expenditure to drive UUV procurement

- TABLE 228 CHINA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 229 CHINA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 230 CHINA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 231 CHINA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 232 CHINA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 233 CHINA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 234 CHINA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 235 CHINA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 236 CHINA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 237 CHINA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- 19.4.4 INDIA

- 19.4.4.1 Increasing use of UUVs for subsea inspection and maintenance surveys

- TABLE 238 INDIA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 239 INDIA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 240 INDIA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 241 INDIA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 242 INDIA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 243 INDIA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 244 INDIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 245 INDIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 246 INDIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 247 INDIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- 19.4.5 JAPAN

- 19.4.5.1 Adoption of UUVs for sea exploration

- TABLE 248 JAPAN: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 249 JAPAN: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 250 JAPAN: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 251 JAPAN: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 252 JAPAN: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 253 JAPAN: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 254 JAPAN: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 255 JAPAN: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 256 JAPAN: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 257 JAPAN: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- 19.4.6 AUSTRALIA

- 19.4.6.1 Technological developments in UUVs

- TABLE 258 AUSTRALIA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 259 AUSTRALIA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 260 AUSTRALIA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 261 AUSTRALIA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 262 AUSTRALIA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 263 AUSTRALIA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 264 AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 265 AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 266 AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 267 AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- 19.4.7 SOUTH KOREA

- 19.4.7.1 Growing number of UUV manufacturers

- TABLE 268 SOUTH KOREA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 269 SOUTH KOREA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 270 SOUTH KOREA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 271 SOUTH KOREA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 272 SOUTH KOREA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 273 SOUTH KOREA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 274 SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 275 SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 276 SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 277 SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- 19.4.8 REST OF ASIA PACIFIC

- TABLE 278 REST OF ASIA PACIFIC: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 279 REST OF ASIA PACIFIC: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 280 REST OF ASIA PACIFIC: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 281 REST OF ASIA PACIFIC: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 282 REST OF ASIA PACIFIC: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 283 REST OF ASIA PACIFIC: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 284 REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 285 REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 286 REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 287 REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- 19.5 MIDDLE EAST & AFRICA

- 19.5.1 MIDDLE EAST & ARICA: PESTLE ANALYSIS

- FIGURE 87 SNAPSHOT OF UUV MARKET IN MIDDLE EAST & AFRICA

- 19.5.2 RECESSION IMPACT ON MIDDLE EAST & AFRICA

- FIGURE 88 NAVAL BUDGET TREND, BY COUNTRY, 2019-2022

- TABLE 288 MIDDLE EAST & AFRICA: RECESSION IMPACT ANALYSIS

- TABLE 289 MIDDLE EAST & AFRICA: UNMANNED UNDERWATER VEHICLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 290 MIDDLE EAST & AFRICA: UNMANNED UNDERWATER VEHICLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 291 MIDDLE EAST & AFRICA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 292 MIDDLE EAST & AFRICA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 293 MIDDLE EAST & AFRICA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 294 MIDDLE EAST & AFRICA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 295 MIDDLE EAST & AFRICA: REMOTELY OPERATED VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2018-2021 (USD MILLION)

- TABLE 296 MIDDLE EAST & AFRICA: REMOTELY OPERATED VEHICLE MARKET, BY COMMERCIAL APPLICATION, 2022-2027 (USD MILLION)

- TABLE 297 MIDDLE EAST & AFRICA: REMOTELY OPERATED VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2018-2021 (USD MILLION)

- TABLE 298 MIDDLE EAST & AFRICA: REMOTELY OPERATED VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2022-2027 (USD MILLION)

- TABLE 299 MIDDLE EAST & AFRICA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 300 MIDDLE EAST & AFRICA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 301 MIDDLE EAST & AFRICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 302 MIDDLE EAST & AFRICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 303 MIDDLE EAST & AFRICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2018-2021 (USD MILLION)

- TABLE 304 MIDDLE EAST & AFRICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2022-2027 (USD MILLION)

- TABLE 305 MIDDLE EAST & AFRICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEFENSE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 306 MIDDLE EAST & AFRICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEFENSE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 307 MIDDLE EAST & AFRICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 308 MIDDLE EAST & AFRICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

- FIGURE 89 MIDDLE EAST & AFRICA: UUV VOLUME, BY COUNTRY, 2021

- 19.5.3 ISRAEL

- 19.5.3.1 State-of-the-art equipment to drive market

- TABLE 309 ISRAEL: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 310 ISRAEL: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 311 ISRAEL: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 312 ISRAEL: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 313 ISRAEL: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 314 ISRAEL: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 315 ISRAEL: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 316 ISRAEL: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 317 ISRAEL: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 318 ISRAEL: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- 19.5.4 TURKEY

- 19.5.4.1 Presence of UUV manufacturers

- TABLE 319 TURKEY: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 320 TURKEY: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 321 TURKEY: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 322 TURKEY: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 323 TURKEY: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 324 TURKEY: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 325 TURKEY: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 326 TURKEY: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 327 TURKEY: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 328 TURKEY: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- 19.5.5 SAUDI ARABIA

- 19.5.5.1 Increasing oil & gas exploration

- TABLE 329 SAUDI ARABIA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 330 SAUDI ARABIA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 331 SAUDI ARABIA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 332 SAUDI ARABIA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 333 SAUDI ARABIA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 334 SAUDI ARABIA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 335 SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 336 SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 337 SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 338 SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- 19.5.6 REST OF MIDDLE EAST & AFRICA

- 19.5.6.1 Largest share of oil & gas sector

- TABLE 339 REST OF MIDDLE EAST & AFRICA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 340 REST OF MIDDLE EAST & AFRICA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 341 REST OF MIDDLE EAST & AFRICA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 342 REST OF MIDDLE EAST & AFRICA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 343 REST OF MIDDLE EAST & AFRICA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 344 REST OF MIDDLE EAST & AFRICA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 345 REST OF MIDDLE EAST & AFRICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 346 REST OF MIDDLE EAST & AFRICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 347 REST OF MIDDLE EAST & AFRICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 348 REST OF MIDDLE EAST & AFRICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- 19.6 LATIN AMERICA

- 19.6.1 PESTLE ANALYSIS: LATIN AMERICA

- FIGURE 90 SNAPSHOT OF UUV MARKET IN LATIN AMERICA

- 19.6.2 RECESSION IMPACT ON LATIN AMERICA

- FIGURE 91 NAVAL BUDGET TREND, BY COUNTRY, 2019-2022

- TABLE 349 LATIN AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 350 LATIN AMERICA: UNMANNED UNDERWATER VEHICLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 351 LATIN AMERICA: UNMANNED UNDERWATER VEHICLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 352 LATIN AMERICA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 353 LATIN AMERICA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 354 LATIN AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 355 LATIN AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 356 LATIN AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2018-2021 (USD MILLION)

- TABLE 357 LATIN AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY COMMERCIAL APPLICATION, 2022-2027 (USD MILLION)

- TABLE 358 LATIN AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2018-2021 (USD MILLION)

- TABLE 359 LATIN AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2022-2027 (USD MILLION)

- TABLE 360 LATIN AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 361 LATIN AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 362 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 363 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 364 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2018-2021 (USD MILLION)

- TABLE 365 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY SCIENTIFIC RESEARCH APPLICATION, 2022-2027 (USD MILLION)

- TABLE 366 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEFENSE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 367 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEFENSE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 368 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 369 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- FIGURE 92 LATIN AMERICA: UUV VOLUME, BY COUNTRY, 2021

- 19.6.3 BRAZIL

- 19.6.3.1 Increased investments in offshore drilling

- TABLE 370 BRAZIL: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 371 BRAZIL: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 372 BRAZIL: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 373 BRAZIL: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 374 BRAZIL: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 375 BRAZIL: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 376 BRAZIL: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 377 BRAZIL: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 378 BRAZIL: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 379 BRAZIL: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- 19.6.4 MEXICO

- 19.6.4.1 Suitable geography for market growth

- TABLE 380 MEXICO: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 381 MEXICO: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 382 MEXICO: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 383 MEXICO: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 384 MEXICO: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 385 MEXICO: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 386 MEXICO: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 387 MEXICO: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 388 MEXICO: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 389 MEXICO: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2022-2027 (USD MILLION)

- 19.6.5 REST OF LATIN AMERICA

- TABLE 390 REST OF LATIN AMERICA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 391 REST OF LATIN AMERICA: UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 392 REST OF LATIN AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 393 REST OF LATIN AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 394 REST OF LATIN AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 395 REST OF LATIN AMERICA: REMOTELY OPERATED VEHICLES MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 396 REST OF LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 397 REST OF LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 398 REST OF LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH, 2018-2021 (USD MILLION)

- TABLE 399 REST OF LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLES MARKET, BY DEPTH 2022-2027 (USD MILLION)

20 COMPETITIVE LANDSCAPE

- 20.1 INTRODUCTION

- TABLE 400 KEY DEVELOPMENTS IN UNMANNED UNDERWATER VEHICLES MARKET BETWEEN JANUARY 2022 AND DECEMBER 2022

- 20.2 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2021

- TABLE 401 DEGREE OF COMPETITION

- FIGURE 93 REVENUE GENERATED BY MAJOR PLAYERS IN UNMANNED UNDERWATER VEHICLES MARKET, 2021

- FIGURE 94 COLLECTIVE REVENUE SHARE OF TOP 5 PLAYERS, 2019-2021

- 20.3 RANK ANALYSIS, 2021

- FIGURE 95 REVENUE SHARE OF TOP 5 PLAYERS IN UNMANNED UNDERWATER VEHICLES MARKET IN 2021

- TABLE 402 COMPANY REGION FOOTPRINT

- TABLE 403 COMPANY APPLICATION FOOTPRINT

- TABLE 404 COMPANY UUV TYPE FOOTPRINT

- 20.4 COMPETITIVE EVALUATION QUADRANT

- 20.4.1 STARS

- 20.4.2 PERVASIVE COMPANIES

- 20.4.3 EMERGING LEADERS

- 20.4.4 PARTICIPANTS

- FIGURE 96 UNMANNED UNDERWATER VEHICLES MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- 20.5 COMPETITIVE BENCHMARKING

- FIGURE 97 UNMANNED UNDERWATER VEHICLES MARKET COMPETITIVE LEADERSHIP MAPPING (SME)

- 20.5.1 PROGRESSIVE COMPANIES

- 20.5.2 RESPONSIVE COMPANIES

- 20.5.3 STARTING BLOCKS

- 20.5.4 DYNAMIC COMPANIES

- 20.6 DETAILED LIST AND COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 405 UNMANNED UNDERWATER VEHICLES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 406 UNMANNED UNDERWATER VEHICLES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 20.7 COMPETITIVE SCENARIO

- 20.7.1 NEW PRODUCT LAUNCHES

- TABLE 407 NEW PRODUCT LAUNCHES, JANUARY 2019-DECEMBER 2022

- 20.7.2 DEALS

- TABLE 408 DEALS, JANUARY 2019-DECEMBER 2022

21 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 21.1 INTRODUCTION

- 21.2 KEY PLAYERS

- 21.2.1 KONGSBERG MARITIME

- TABLE 409 KONGSBERG MARITIME: BUSINESS OVERVIEW

- FIGURE 98 KONGSBERG MARITIME: COMPANY SNAPSHOT

- 21.2.2 SAAB AB

- TABLE 410 SAAB AB: BUSINESS OVERVIEW

- FIGURE 99 SAAB AB: COMPANY SNAPSHOT

- 21.2.3 OCEANEERING INTERNATIONAL INC.

- TABLE 411 OCEANEERING INTERNATIONAL INC.: BUSINESS OVERVIEW

- FIGURE 100 OCEANEERING INTERNATIONAL INC.: COMPANY SNAPSHOT

- 21.2.4 GENERAL DYNAMICS CORP.

- TABLE 412 GENERAL DYNAMICS CORP.: BUSINESS OVERVIEW

- FIGURE 101 GENERAL DYNAMICS CORP.: COMPANY SNAPSHOT

- 21.2.5 THE BOEING COMPANY

- TABLE 413 THE BOEING COMPANY: BUSINESS OVERVIEW

- FIGURE 102 THE BOEING COMPANY: COMPANY SNAPSHOT

- 21.2.6 FUGRO

- TABLE 414 FUGRO: BUSINESS OVERVIEW

- FIGURE 103 FUGRO: COMPANY SNAPSHOT

- 21.2.7 L3HARRIS TECHNOLOGIES

- TABLE 415 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 104 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

- 21.2.8 BAE SYSTEMS

- TABLE 416 BAE SYSTEMS: BUSINESS OVERVIEW

- FIGURE 105 BAE SYSTEMS: COMPANY SNAPSHOT

- 21.2.9 LEONARDO SPA

- TABLE 417 LEONARDO SPA: BUSINESS OVERVIEW

- FIGURE 106 LEONARDO SPA: COMPANY SNAPSHOT

- 21.2.10 LOCKHEED MARTIN CORP.

- TABLE 418 LOCKHEED MARTIN CORP.: BUSINESS OVERVIEW

- FIGURE 107 LOCKHEED MARTIN CORP.: COMPANY SNAPSHOT

- 21.2.11 NORTHROP GRUMMAN CORPORATION

- TABLE 419 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- FIGURE 108 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- 21.2.12 MITSUI E&S HOLDINGS CO., LTD.

- TABLE 420 MITSUI E&S HOLDINGS CO., LTD.: BUSINESS OVERVIEW

- FIGURE 109 MITSUI E&S HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- 21.2.13 MITSUBISHI HEAVY INDUSTRIES

- TABLE 421 MITSUBISHI HEAVY INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 110 MITSUBISHI HEAVY INDUSTRIES: COMPANY SNAPSHOT

- 21.2.14 TELEDYNE TECHNOLOGIES

- TABLE 422 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 111 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

- 21.2.15 SUBSEA 7

- TABLE 423 SUBSEA 7: BUSINESS OVERVIEW

- FIGURE 112 SUBSEA 7: COMPANY SNAPSHOT

- 21.2.16 THYSSENKRUPP

- TABLE 424 THYSSENKRUPP: BUSINESS OVERVIEW

- FIGURE 113 THYSSENKRUPP: COMPANY SNAPSHOT

- 21.2.17 ECA GROUP

- TABLE 425 ECA GROUP: BUSINESS OVERVIEW

- FIGURE 114 ECA GROUP: COMPANY SNAPSHOT

- 21.2.18 ST ENGINEERING

- TABLE 426 ST ENGINEERING: BUSINESS OVERVIEW

- FIGURE 115 ST ENGINEERING: COMPANY SNAPSHOT

- 21.2.19 HUNTINGTON INGALLS INDUSTRIES

- TABLE 427 HUNTINGTON INGALLS INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 116 HUNTINGTON INGALLS INDUSTRIES: COMPANY SNAPSHOT

- 21.2.20 LARSEN & TOUBRO (L&T)

- TABLE 428 LARSEN & TOUBRO (L&T): BUSINESS OVERVIEW

- FIGURE 117 LARSEN & TOUBRO (L&T): COMPANY SNAPSHOT

- 21.2.21 LIG NEX 1

- TABLE 429 LIG NEX 1: BUSINESS OVERVIEW

- FIGURE 118 LIG NEX 1: COMPANY SNAPSHOT

- 21.2.22 HANWHA SYSTEMS

- TABLE 430 HANWHA SYSTEMS: BUSINESS OVERVIEW

- FIGURE 119 HANWHA SYSTEMS: COMPANY SNAPSHOT

- 21.3 OTHER PLAYERS

- 21.3.1 ARGEO

- TABLE 431 ARGEO: BUSINESS OVERVIEW

- 21.3.2 ANDURIL

- TABLE 432 ANDURIL: BUSINESS OVERVIEW

- 21.3.3 OCEANSCAN MST

- TABLE 433 OCEANSCAN MST: BUSINESS OVERVIEW

- 21.3.4 INTERNATIONAL SUBMARINE ENGINEERING LTD.

- TABLE 434 INTERNATIONAL SUBMARINE ENGINEERING LTD.: BUSINESS OVERVIEW

- 21.3.5 MSUBS

- TABLE 435 MSUBS: BUSINESS OVERVIEW

- 21.3.6 RTSYS

- TABLE 436 RTSYS: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

22 APPENDIX

- 22.1 DISCUSSION GUIDE

- 22.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 22.3 CUSTOMIZATION OPTIONS

- 22.4 RELATED REPORTS

- 22.5 AUTHOR DETAILS