|

|

市場調査レポート

商品コード

1125034

デジタル印刷壁紙の世界市場:印刷技術別 (インクジェット、電子写真)・基材別 (不織布、ビニール、紙)・最終用途部門別 (非住宅、住宅、自動車・輸送機械)・地域別の将来予測 (2027年まで)Digitally Printed Wallpaper Market by Printing Technology (Inkjet, Electrophotography), Substrate (Nonwoven, Vinyl, Paper), End-Use Sector (Non-Residential, Residential, Automotive & Transportation) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| デジタル印刷壁紙の世界市場:印刷技術別 (インクジェット、電子写真)・基材別 (不織布、ビニール、紙)・最終用途部門別 (非住宅、住宅、自動車・輸送機械)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年08月31日

発行: MarketsandMarkets

ページ情報: 英文 146 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

デジタル印刷壁紙の世界市場は、47億米ドルから、2022年から2027年にかけて22.4%のCAGRで成長し、2027年には131億米ドルに達すると予測されます。

市場の成長は主に、壁紙におけるデジタル技術の需要の増加と、住宅・非住宅分野での室内装飾の拡大動向が引き金となっています。

"基材別では、ビニールのセグメントが2番目に大きなものになる"

ビニールのセグメントは、予測期間中に21.3%のCAGRで成長すると予測されています。耐久性が高く、メンテナンスが容易であること、コストが低いことなどが、主に新興国でのビニール壁紙の需要を高めています。

"予測期間中、住宅は2番目に大きなセグメントとなる"

急速な都市化による住宅建設需要の増加、住宅のリノベーション・リモデリング活動の増加、可処分所得水準の上昇が、住宅分野におけるデジタル印刷壁紙市場の成長を促進しています。

"デジタル印刷壁紙は欧州が第2位の市場へ"

欧州は2021年、デジタルプリント壁紙の金額ベースで2番目に大きな市場です。欧州の市場は、イノベーションが牽引しています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- バリューチェーン分析

- 平均販売価格の分析

- 特許分析

第6章 デジタル印刷壁紙市場:印刷技術別

- イントロダクション

- インクジェット

- 電子写真

第7章 デジタル印刷壁紙市場:基材別

- イントロダクション

- 不織布

- ビニール

- 紙

- その他

第8章 デジタル印刷壁紙市場:最終用途部門別

- イントロダクション

- 住宅

- 非住宅

- 自動車・輸送機械

第9章 デジタル印刷壁紙市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- イタリア

- 他の欧州諸国

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 他の中東・アフリカ諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

第10章 競合情勢

- 概要

- 市場ランキング

- 製品フットプリント

- 企業評価マトリックス

- 中小企業の評価マトリックス (2021年)

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- A.S. CREATION TAPETEN AG

- MURASPEC GROUP

- TAPETENFABRIK GEBR. RASCH GMBH & CO. KG

- MX DISPLAY

- 4WALLS

- GRAHAM & BROWN

- FLAVOR PAPER

- MCROBB DISPLAY LTD.

- ASTEK WALLPAPERS

- EFFECTIVE VISUAL MARKETING LIMITED

- その他の企業

- PEGGY-BETTY DESIGNS

- THE PRINTED WALLPAPER COMPANY

- HOLLYWOOD MONSTER

- GREAT WALL CUSTOM COVERINGS

- MOONAVOOR SISUSTUS

- OCTINK

- CASPAR GMBH

- JOHN MARK LTD.

- COLOR X

- MARSHALLS

- ECOSSE SIGNS

- VISION SIGN AND DIGITAL

- SURFACE PRINT

- MEGAPRINT INC.

- SENTEC INTERNATIONAL BV

第12章 付録

The global digitally printed wallpaper market is projected to grow from USD 4.7 billion and is projected to reach USD 13.1 billion by 2027, at a CAGR of 22.4% from 2022 to 2027. Growth of the market is primarily triggered by the increase in demand for digital technology in wallpapers and the growing trends in interior decoration in the residential and non-residential sectors.

"Vinyl segment to be the second largest substrate of digitally printed wallpaper "

The market for digitally printed wallpaper is projected to witness strong growth in the vinyl segment due to the vast applications. This segment is projected to grow at a CAGR of 21.3% during the forecast period. Factors such as high durability and easy maintenance coupled with lower cost boost the demand for vinyl wallpaper, mainly in emerging economies.

"Residential to be the second-largest segment during the forecast period."

The growing demand for residential construction due to rapid urbanization and rise in the number of housing renovation & remodeling activities, along with the increase in disposable income levels are propelling the growth of the digitally printed wallpaper market in the residential sector.

"Europe to be the second-largest market for digitally printed wallpaper "

Europe is the second-largest market for digitally printed wallpaper, in terms of value, in 2021. The market in Europe is driven by innovation. It has a significant number of existing manufacturers who are actively participating in development activities, especially in expansions and acquisitions. The region is home to major technical foam manufacturers, such as A.S. Creation Tapeten AG (Germany), Muraspec Group (UK), Tapetenfabrik Gebr. Rasch GmbH & Co. KG (Germany), MX Display (UK), Graham & Brown (UK), and McRobb Display Ltd. (UK).

This study has been validated through primaries conducted with various industry experts worldwide. These primary sources have been divided into 3 categories, namely by company, by designation, and by region.

- By Company- Tier 1 - 40%, Tier 2- 30%, Tier 3 - 40%

- By Designation- Directors - 30%, CXOs - 30%, Others- 40%

- By Region- North America- 20%, Europe- 20%, Asia Pacific- 40%, and Rest of World - 20%

The digitally printed wallpaper market comprises major manufacturers, The key players in the digitally printed wallpaper market are A.S. Creation Tapeten AG (Germany), Muraspec Group (UK), Tapetenfabrik Gebr. Rasch GmbH & Co. KG (Germany), MX Display (UK), 4Walls (US) Flavor Paper (US), The Printed Wallpaper Company (UK), Hollywood Monster (UK), and Great Wall Custom Coverings (US) and among others. The study includes an in-depth competitive analysis of these key players in the digitally printed wallpaper market, with their company profiles, and key market strategies.

Research Coverage:

The report covers the digitally printed wallpaper market based on by printing technology (inkjet, electrophotography), by substrate (nonwoven, vinyl, paper), by end-use sector (non-residential, residential, automotive & transportation) and by region. The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the digitally printed wallpaper market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Key Benefits of Buying the Report:

The report will help the leaders/new entrants in this market with information on the closest

approximations of the revenue numbers for the overall market and the sub-segments. This report will

help stakeholders understand the competitive landscape and gain more insights to better position

their businesses and plan suitable go-to-market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- TABLE 1 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 LIMITATIONS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 MARKET DEFINITION AND SCOPE

- 2.2 RESEARCH DATA

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primary interviews

- 2.2.2.3 Key industry insights

- 2.2.1 SECONDARY DATA

- 2.3 BASE NUMBER CALCULATION

- FIGURE 2 BASE NUMBER CALCULATION

- 2.4 FORECAST NUMBER CALCULATION

- 2.5 MARKET ENGINEERING PROCESS

- 2.5.1 TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.5.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 5 ASIA PACIFIC TO DOMINATE MARKET

- FIGURE 6 VINYL SUBSTRATE TO LEAD MARKET

- FIGURE 7 NON-RESIDENTIAL END-USE SECTOR TO LEAD MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN DIGITALLY PRINTED WALLPAPER MARKET

- FIGURE 8 VINYL SEGMENT OFFERS LUCRATIVE GROWTH OPPORTUNITIES

- 4.2 DIGITALLY PRINTED WALLPAPER MARKET, BY SUBSTRATE

- FIGURE 9 NONWOVEN TO BE FASTEST-GROWING SEGMENT

- 4.3 DIGITALLY PRINTED WALLPAPER MARKET, BY END-USE SECTOR

- FIGURE 10 NON-RESIDENTIAL SEGMENT TO LEAD MARKET

- 4.4 DIGITALLY PRINTED WALLPAPER MARKET, BY END-USE SECTOR AND REGION

- FIGURE 11 NON-RESIDENTIAL AND ASIA PACIFIC ACCOUNTED FOR LARGEST SHARES IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DIGITALLY PRINTED WALLPAPER MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of digital technology

- 5.2.1.2 Wallpapers with higher durability and esthetics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Competition from paint & coating manufacturers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Demand in commercial and marketing sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulations on chemicals in wallpapers

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 13 DIGITALLY PRINTED WALLPAPER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 AVERAGE SELLING PRICE ANALYSIS

- TABLE 2 AVERAGE PRICES OF SUBSTRATE, BY REGION (USD/SQUARE METER)

- 5.6 PATENT ANALYSIS

- 5.6.1 INTRODUCTION

- 5.6.2 METHODOLOGY

- 5.6.3 DOCUMENT TYPE

- TABLE 3 GRANTED PATENTS 57% OF TOTAL COUNT IN LAST 10 YEARS

- FIGURE 14 NUMBER OF PATENTS PUBLISHED FROM 2011 TO 2021

- FIGURE 15 NUMBER OF PATENTS PUBLISHED YEAR-WISE (2011-2021)

- 5.6.4 INSIGHTS

- 5.6.5 JURISDICTION ANALYSIS

- FIGURE 16 PATENT ANALYSIS, BY TOP JURISDICTION

- 5.6.6 TOP APPLICANTS

- FIGURE 17 TOP 10 PATENT APPLICANTS

6 DIGITALLY PRINTED WALLPAPER MARKET, BY PRINTING TECHNOLOGY

- 6.1 INTRODUCTION

- FIGURE 18 INKJET PRINTING TECHNOLOGY TO GROW AT HIGHER RATE

- TABLE 4 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY PRINTING TECHNOLOGY, 2021-2027 (USD MILLION)

- TABLE 5 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY PRINTING TECHNOLOGY, 2021-2027 (THOUSAND SQUARE METER)

- 6.2 INKJET

- 6.2.1 DEMAND FOR BETTER QUALITY AND LOW COST FOR SHORT RUN

- 6.3 ELECTROPHOTOGRAPHY

- 6.3.1 HIGH-QUALITY PRINT AT A HIGH-SPEED

7 DIGITALLY PRINTED WALLPAPER MARKET, BY SUBSTRATE

- 7.1 INTRODUCTION

- FIGURE 19 NONWOVEN SEGMENT TO GROW AT HIGHEST CAGR

- TABLE 6 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 7 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

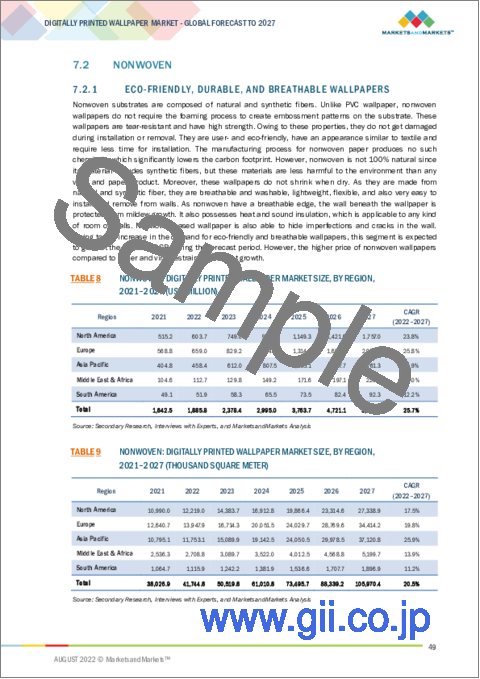

- 7.2 NONWOVEN

- 7.2.1 ECO-FRIENDLY, DURABLE, AND BREATHABLE WALLPAPERS

- TABLE 8 NONWOVEN: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 9 NONWOVEN: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (THOUSAND SQUARE METER)

- 7.3 VINYL

- 7.3.1 EASY MAINTENANCE AND LOWER COST

- TABLE 10 VINYL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 11 VINYL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (THOUSAND SQUARE METER)

- 7.4 PAPER

- 7.4.1 LOW COST OF PAPER-BASED DIGITALLY PRINTED WALLPAPER

- TABLE 12 PAPER: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 13 PAPER: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (THOUSAND SQUARE METER)

- 7.5 OTHERS

- TABLE 14 OTHER SUBSTRATES: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 15 OTHER SUBSTRATES: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (THOUSAND SQUARE METER)

8 DIGITALLY PRINTED WALLPAPER MARKET, BY END-USE SECTOR

- 8.1 INTRODUCTION

- FIGURE 20 NON-RESIDENTIAL SEGMENT TO LEAD DIGITALLY PRINTED WALLPAPER MARKET

- TABLE 16 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 17 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 8.2 RESIDENTIAL

- 8.2.1 IMPROVING ESTHETIC APPEAL OF INTERIOR WALLS

- TABLE 18 RESIDENTIAL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 19 RESIDENTIAL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (THOUSAND SQUARE METER)

- 8.3 NON-RESIDENTIAL

- 8.3.1 NON-RESIDENTIAL SECTOR PROJECTED TO FUEL MARKET

- TABLE 20 NON-RESIDENTIAL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 21 NON-RESIDENTIAL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (THOUSAND SQUARE METER)

- 8.4 AUTOMOTIVE & TRANSPORTATION

- 8.4.1 DEMAND FOR COMMERCIAL PURPOSES

- TABLE 22 AUTOMOTIVE & TRANSPORTATION: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 23 AUTOMOTIVE & TRANSPORTATION: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (THOUSAND SQUARE METER)

9 DIGITALLY PRINTED WALLPAPER MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 21 ASIA PACIFIC TO LEAD DIGITALLY PRINTED WALLPAPER MARKET

- TABLE 24 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 25 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021-2027 (THOUSAND SQUARE METER)

- 9.2 ASIA PACIFIC

- FIGURE 22 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SNAPSHOT

- TABLE 26 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 27 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 28 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 29 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 30 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 31 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.2.1 CHINA

- 9.2.1.1 Projected to lead market

- TABLE 32 CHINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 33 CHINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 34 CHINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 35 CHINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.2.2 JAPAN

- 9.2.2.1 Increasing residential and non-residential constructions

- TABLE 36 JAPAN: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 37 JAPAN: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 38 JAPAN: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 39 JAPAN: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.2.3 INDIA

- 9.2.3.1 Availability of labor and growing disposable income

- TABLE 40 INDIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 41 INDIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 42 INDIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 43 INDIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Rapid industrialization and urbanization

- TABLE 44 SOUTH KOREA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 45 SOUTH KOREA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 46 SOUTH KOREA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 47 SOUTH KOREA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.2.5 REST OF ASIA PACIFIC

- 9.2.5.1 Infrastructural developments in non-residential sector

- TABLE 48 REST OF ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 49 REST OF ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 50 REST OF ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 51 REST OF ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.3 EUROPE

- FIGURE 23 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SNAPSHOT

- TABLE 52 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 53 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 54 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 55 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 56 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 57 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.3.1 GERMANY

- 9.3.1.1 Growth of end-use sectors

- TABLE 58 GERMANY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 59 GERMANY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 60 GERMANY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 61 GERMANY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.3.2 UK

- 9.3.2.1 Government investments in construction and infrastructure

- TABLE 62 UK: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 63 UK: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 64 UK: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 65 UK: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.3.3 FRANCE

- 9.3.3.1 Increase in new construction projects

- TABLE 66 FRANCE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 67 FRANCE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 68 FRANCE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 69 FRANCE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.3.4 RUSSIA

- 9.3.4.1 Growth of construction sector

- TABLE 70 RUSSIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 71 RUSSIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 72 RUSSIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 73 RUSSIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.3.5 ITALY

- 9.3.5.1 Increasing industrial construction

- TABLE 74 ITALY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 75 ITALY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 76 ITALY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 77 ITALY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.3.6 REST OF EUROPE

- TABLE 78 REST OF EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 79 REST OF EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 80 REST OF EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 81 REST OF EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.4 NORTH AMERICA

- TABLE 82 NORTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 83 NORTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 84 NORTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 86 NORTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 87 NORTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.4.1 US

- 9.4.1.1 Leading market in North America

- TABLE 88 US: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 89 US: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 90 US: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 91 US: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.4.2 CANADA

- 9.4.2.1 Increasing construction activities

- TABLE 92 CANADA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 93 CANADA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 94 CANADA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 95 CANADA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.4.3 MEXICO

- 9.4.3.1 Increasing investments in construction

- TABLE 96 MEXICO: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 97 MEXICO: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 98 MEXICO: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 99 MEXICO: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.5 MIDDLE EAST & AFRICA

- TABLE 100 MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 102 MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 104 MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.5.1 SAUDI ARABIA

- 9.5.1.1 Increased car sales locally

- TABLE 106 SAUDI ARABIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 107 SAUDI ARABIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 108 SAUDI ARABIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 109 SAUDI ARABIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.5.2 UAE

- 9.5.2.1 Significant growth of construction industry

- TABLE 110 UAE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 111 UAE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 112 UAE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 113 UAE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- TABLE 114 REST OF MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 115 REST OF MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 116 REST OF MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 117 REST OF MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.6 SOUTH AMERICA

- TABLE 118 SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 119 SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 120 SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 121 SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 122 SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 123 SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.6.1 BRAZIL

- 9.6.1.1 Growing demand from residential sector fueling market

- TABLE 124 BRAZIL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 125 BRAZIL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 126 BRAZIL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 127 BRAZIL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.6.2 ARGENTINA

- 9.6.2.1 Growing commercial infrastructure

- TABLE 128 ARGENTINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 129 ARGENTINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 130 ARGENTINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 131 ARGENTINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.3.1 Economic growth of countries

- TABLE 132 REST OF SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (USD MILLION)

- TABLE 133 REST OF SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021-2027 (THOUSAND SQUARE METER)

- TABLE 134 REST OF SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (USD MILLION)

- TABLE 135 REST OF SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021-2027 (THOUSAND SQUARE METER)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 MARKET RANKING

- FIGURE 24 MARKET RANK ANALYSIS OF TOP PLAYERS

- 10.3 PRODUCT FOOTPRINT

- FIGURE 25 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

- 10.4 COMPANY EVALUATION MATRIX

- 10.4.1 STARS

- 10.4.2 PARTICIPANTS

- 10.4.3 PERVASIVE PLAYERS

- FIGURE 26 DIGITALLY PRINTED WALLPAPER MARKET: COMPANY EVALUATION MATRIX, 2021

- 10.5 SME EVALUATION MATRIX, 2021

- FIGURE 27 DIGITALLY PRINTED WALLPAPER MARKET: SME COMPANY EVALUATION MATRIX, 2019

- 10.6 COMPETITIVE SCENARIOS AND TRENDS

- 10.6.1 NEW PRODUCT LAUNCHES

- 10.6.2 PRODUCT LAUNCHES

- TABLE 136 PRODUCT LAUNCHES, 2019

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weakness/competitive threats) **

- 11.1 MAJOR PLAYERS

- 11.1.1 A.S. CREATION TAPETEN AG

- TABLE 137 A.S. CREATION TAPETEN AG: COMPANY OVERVIEW

- FIGURE 28 A.S. CREATION TAPETEN AG: COMPANY SNAPSHOT

- 11.1.2 MURASPEC GROUP

- TABLE 138 MURASPEC GROUP: COMPANY OVERVIEW

- TABLE 139 MURASPEC GROUP: PRODUCT LAUNCHES

- 11.1.3 TAPETENFABRIK GEBR. RASCH GMBH & CO. KG

- TABLE 140 TAPETENFABRIK GEBR. RASCH GMBH & CO. KG: COMPANY OVERVIEW

- 11.1.4 MX DISPLAY

- TABLE 141 MX DISPLAY: COMPANY OVERVIEW

- 11.1.5 4WALLS

- TABLE 142 4WALLS: COMPANY OVERVIEW

- 11.1.6 GRAHAM & BROWN

- TABLE 143 GRAHAM & BROWN: COMPANY OVERVIEW

- 11.1.7 FLAVOR PAPER

- TABLE 144 FLAVOR PAPER: COMPANY OVERVIEW

- 11.1.8 MCROBB DISPLAY LTD.

- TABLE 145 MCROBB DISPLAY LTD.: COMPANY OVERVIEW

- 11.1.9 ASTEK WALLPAPERS

- TABLE 146 ASTEK WALLPAPERS: COMPANY OVERVIEW

- 11.1.10 EFFECTIVE VISUAL MARKETING LIMITED

- TABLE 147 EFFECTIVE VISUAL MARKETING LIMITED: COMPANY OVERVIEW

- 11.2 ADDITIONAL PLAYERS

- 11.2.1 PEGGY-BETTY DESIGNS

- TABLE 148 PEGGY-BETTY DESIGNS: COMPANY OVERVIEW

- 11.2.2 THE PRINTED WALLPAPER COMPANY

- TABLE 149 THE PRINTED WALLPAPER COMPANY: COMPANY OVERVIEW

- 11.2.3 HOLLYWOOD MONSTER

- TABLE 150 HOLLYWOOD MONSTER: COMPANY OVERVIEW

- 11.2.4 GREAT WALL CUSTOM COVERINGS

- TABLE 151 GREAT WALL CUSTOM COVERINGS: COMPANY OVERVIEW

- 11.2.5 MOONAVOOR SISUSTUS

- TABLE 152 MOONAVOOR SISUSTUS: COMPANY OVERVIEW

- 11.2.6 OCTINK

- TABLE 153 OCTINK: COMPANY OVERVIEW

- 11.2.7 CASPAR GMBH

- TABLE 154 CASPAR GMBH: COMPANY OVERVIEW

- 11.2.8 JOHN MARK LTD.

- TABLE 155 JOHN MARK LTD: COMPANY OVERVIEW

- 11.2.9 COLOR X

- TABLE 156 COLOR X: COMPANY OVERVIEW

- 11.2.10 MARSHALLS

- TABLE 157 MARSHALLS: COMPANY OVERVIEW

- 11.2.11 ECOSSE SIGNS

- TABLE 158 ECOSSE SIGNS: COMPANY OVERVIEW

- 11.2.12 VISION SIGN AND DIGITAL

- TABLE 159 VISION SIGN AND DIGITAL: COMPANY OVERVIEW

- 11.2.13 SURFACE PRINT

- TABLE 160 SURFACE PRINT: COMPANY OVERVIEW

- 11.2.14 MEGAPRINT INC.

- TABLE 161 MEGAPRINT INC.: COMPANY OVERVIEW

- 11.2.15 SENTEC INTERNATIONAL BV

- TABLE 162 SENTEC INTERNATIONAL BV: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weakness/competitive threats might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS