|

|

市場調査レポート

商品コード

1342068

セルロース発泡性耐火塗料の世界市場:タイプ別(水性、溶剤性)、最終用途別、材料タイプ別(アクリル、エポキシ、アルキド、VAE)、基材タイプ別(構造用鋼、鋳鉄、木材)、地域別-2028年までの予測Cellulosic Fire Protection Intumescent Coatings Market by Type (Water-borne, Solvent-borne), End-use, Material Type (Acrylic, Epoxy, Alkyd, VAE), Substrate Type (Structural Steel & Cast Iron, Wood), and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| セルロース発泡性耐火塗料の世界市場:タイプ別(水性、溶剤性)、最終用途別、材料タイプ別(アクリル、エポキシ、アルキド、VAE)、基材タイプ別(構造用鋼、鋳鉄、木材)、地域別-2028年までの予測 |

|

出版日: 2023年08月25日

発行: MarketsandMarkets

ページ情報: 英文 289 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のセルロース発泡性耐火塗料の市場規模は、2023年の6億100万米ドルから3.8%のCAGRで拡大し、7億2,500万米ドルに成長すると予測されています。

セルロース発泡性耐火塗料は防火安全技術の最前線に位置し、さまざまな産業の安全対策に革命をもたらす態勢を整えています。これらの塗料は、熱にさらされると断熱炭化層を形成して下地の基材を火災による損傷から守る、高度な防御メカニズムを提供します。主な特性や利点としては、鉄鋼、木材、コンクリートなどの材料の耐火性を向上させ、火災事故時の構造的完全性を長持ちさせる能力が挙げられます。さらに、これらのコーティングは断熱性に優れ、熱伝導を抑え、安定性を維持します。建築デザインに目立たないように組み込むことで美観を保ち、環境に優しい成分を配合することで持続可能性の目標に合致します。

水性セルロース発泡性耐火塗料は、セルロースを燃料とする炎に対して極めて効果的です。溶剤系塗料よりも環境に優しいため、噴気性塗料はますます人気が高まっています。水性発煙性塗料は有害な粒子が少ないため、環境規制の厳しい国や地域に適しています。これらの塗料は、住宅や商業施設の屋内や乾燥地帯で広く使用されています。近い将来、都市化の進展が水性セルロース発泡性耐火塗料市場の成長を支える重要な役割を果たすと思われます。

構造用鋼と鋳鉄の基材は、建築・建設業界の広範な領域で極めて重要な建築材料としての地位を確立しています。これらの基材の影響力は国境を越えており、米国鉄骨建設協会(American Society of Steel Construction)は、特に米国における建設資材の展望における優位性を報告しています。実際、その重要性は、世界鉄鋼協会が強調しているように、世界の鉄鋼生産量の50%以上を占める住宅・建設セクターの驚異的な鉄鋼消費量に反映されています。鉄鋼の多面的な有用性は、エネルギー、自動車、輸送、インフラ、包装、機械など、重要なセクターの広範囲に及んでいます。世界人口の急増に伴い、鉄鋼の役割はさらに重要なものとなり、急増する需要に対応するため、2050年までに鉄鋼の使用量が20%急増するという予測もあります。

北米は、セルロース発泡性耐火塗料の最大市場です。北米のセルロース発泡性耐火塗料市場の成長は、主に米国防火協会(NFPA)の厳しい規制や基準・規範に起因しており、その結果、難燃性塗料は建築・建設業界で大きな注目を集めています。その背景には、住宅・商業分野や大型プロジェクト建設への投資の増加があります。さらに、新しい空港、地下鉄、トンネルの建設がこの地域の経済を活性化しています。北米の建築・建設部門は、その運命を左右する様々な力の合流に支えられながら、発展の可能性を秘めた有望なパノラマを提供しています。この地域の建設セクターは経済成長の重要なエンジンであり、起こりうるハードルを乗り越えながら、さまざまな可能性を活用する立場にあります。

当レポートでは、世界のセルロース発泡性耐火塗料市場について調査し、タイプ別、最終用途別、材料タイプ別、基材タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標分析

- 市場の成長に影響を与える世界経済シナリオ

- バリューチェーン分析

- 価格分析

- 塗料およびコーティングのエコシステムと相互接続された市場

- セルロース発泡性耐火塗料のメーカーに対する動向と技術の混乱の影響

- 貿易分析

- 特許分析

- ケーススタディ分析

- 技術分析

- 2023年の主な会議とイベント

- 関税と規制状況

第6章 セルロース発泡性耐火塗料市場、タイプ別

- イントロダクション

- 溶剤性

- 水性

第7章 セルロース発泡性耐火塗料市場、基材タイプ別

- イントロダクション

- 形鋼・鋳鉄

- 木材

- その他

第8章 セルロース発泡性耐火塗料市場、材料タイプ別

- イントロダクション

- アクリル

- エポキシ

- アルキド

- VAE

- その他

第9章 セルロース発泡性耐火塗料市場、最終用途別

- イントロダクション

- 住宅

- 商業

第10章 セルロース発泡性耐火塗料市場、地域別

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 製品ポートフォリオの強み

- 競合ベンチマーキング

- 市場シェア分析

- 市場ランキング分析

- 収益分析

- 競合シナリオ

- 戦略的開発

第12章 企業プロファイル

- 主要参入企業

- AKZONOBEL N.V.

- THE SHERWIN-WILLIAMS COMPANY

- PPG INDUSTRIES, INC.

- JOTUN

- HEMPEL A/S

- RPM INTERNATIONAL INC.

- SIKA AG

- ETEX GROUP

- KANSAI PAINT CO., LTD.

- TEKNOS GROUP

- その他の企業

- GCP APPLIED TECHNOLOGIES

- RUDOLF HENSEL GMBH

- CONTEGO INTERNATIONAL INC.

- ARABIAN VERMICULITE INDUSTRIES

- ISOLATEK INTERNATIONAL

- ALBI PROTECTIVE COATINGS

- JF AMONN SRL

- BOLLOM

- DEKOTERM

- INTUMESCENT SYSTEMS LTD.

- COATINGS & SPECIALTIES SOLUTIONS

- STANCOLAC S.A.

- UNITED SUPREME GROUP

第13章 隣接市場および関連市場

第14章 付録

The global cellulosic fire protection intumescent coatings market size is projected to grow from USD 601 million in 2023 to USD 725 million, at a CAGR of 3.8%. Cellulosic fire protection intumescent coatings stand at the forefront of fire safety technology, poised to revolutionize safety measures across various industries. These coatings offer a sophisticated defense mechanism, reacting to heat exposure by forming an insulating char layer that shields underlying substrates from fire damage. Key attributes and benefits include their ability to enhance fire resistance in materials like steel, wood, and concrete, thereby prolonging structural integrity during fire incidents. Additionally, these coatings excel in thermal insulation, reducing heat transfer and maintaining stability. Their discreet integration into architectural designs preserves aesthetic appeal, while their formulation with environmentally-friendly components aligns with sustainability goals.

The water-borne segment is expected to register one of the highest market share during the forecast period

Water-borne cellulosic fire prevention intumescent coatings are extremely effective against cellulose-fueled flames. Because they are more ecologically benign than solvent-borne coatings, intumescent coatings are becoming increasingly popular. Water-borne intumescent coatings contain less hazardous particles, making them more suited for nations or regions with stringent environmental restrictions. These coatings are widely used in the indoor and dry regions of residential and commercial constructions. In the near future, the growing trajectory of urbanization is likely to play a critical role in supporting the growth of the water-based cellulosic fire prevention intumescent coatings market.

The structural steel & cast iron segment in substrate type is expected to register one of the highest market share during the forecast period

Structural steel and cast iron substrates have established themselves as pivotal building materials within the expansive domain of the building and construction industry. The influence of these substrates transcends borders, with the American Society of Steel Construction reporting their dominance in the construction materials landscape, particularly in the United States. In fact, their significance is mirrored by the housing and construction sector's staggering consumption of steel, accounting for over 50% of the global steel production, as highlighted by the World Steel Association. Steel's multifaceted utility extends its grasp across a spectrum of critical sectors, spanning energy, automotive, transportation, infrastructure, packaging, and machinery. As the world's population burgeons, steel's role becomes even more pivotal, with projections indicating a 20% surge in steel use by 2050 to cater to burgeoning demands.

North America cellulosic fire protection intumescent coatings market is estimated to capture one of the highest share in terms of volume during the forecast period

North America has the greatest market for cellulosic fire prevention intumescent coatings. The growth of the North American cellulosic fire protection intumescent coatings market is primarily attributed to the National Fire Protection Association's (NFPA) stringent regulations and standards & norms in the US, as a result of which intumescent coatings have gained significant attention in the building & construction industry. It is attributable to increasing investment in the residential and commercial sectors, as well as megaproject building. In addition, the building of new airports, metros, and tunnels is increasing the region's economy. The North American building and construction sector offers a promising panorama of development potential, supported by a confluence of forces that influence its destiny collectively. The region's construction sector is a critical engine of economic growth, positioned to capitalize on different possibilities while navigating possible hurdles.

The break-up of the profile of primary participants in the cellulosic fire prevention intumescent coatings market:

- By Company Type: Tier 1 - 46%, Tier 2 - 43%, and Tier 3 - 27%

- By Designation: D Level - 23%, C Level - 21%, and Others - 56%

- By Region: North America - 37%, Asia Pacific- 26%, Europe - 23%, Middle East & Africa - 10%, and South America - 4%

The key companies profiled in this report are Kansai Paints Co. Ltd (Japan), ETEX Group (Belgium), Sika AG (Switzerland), RPM International Inc (US), Jotun (Norway), PPG Industries, Inc (US), The Sherwin-Williams Company (US), AkzoNobel N.V. (Netherlands), and others.

Research Coverage:

The cellulosic fire protection intumescent coatings market is segmented by Type (Water-borne, Solvent-borne), Material Type (Epoxy, Alkyd, Acrylic, VAE, and Others), End Use (Residential and Commercial), Substrate (Structural Steel & Cast Iron, Wood, and Others), and Region (North America, Europe, Asia Pacific, the Middle East & Africa, and South America). The study's coverage covers detailed information on the key factors influencing the growth of the cellulosic fire protection intumescent coatings market, such as drivers, constraints, challenges, and opportunities. A thorough examination of the top industry players was carried out in order to provide insights into their company overview, solutions, and services; essential strategies; contracts, partnerships, and agreements. There includes coverage of new product and service launches, mergers and acquisitions, and ongoing developments in the cellulosic fire prevention intumescent coatings market. A competitive analysis of emerging companies in the cellulosic fire prevention intumescent coatings business ecosystem is included in this study. Reasons to buy this report: The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall cellulosic fire protection intumescent coatings market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand for fire protection coatings in the commercial sector), restraints (volatility in raw material prices), opportunities (collaboration of distributors in untapped markets), and challenges (stringent regulatory policies).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the cellulosic fire protection intumescent coatings market

- Market Development: Comprehensive information about lucrative markets - the report analyses the cellulosic fire protection intumescent coatings market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the cellulosic fire protection intumescent coatings market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Kansai Paints Co. Ltd (Japan), ETEX Group (Belgium), Sika AG (Switzerland), RPM International Inc (US), Jotun (Norway), PPG Industries, Inc (US), The Sherwin-Williams Company (US), and AkzoNobel N.V. (Netherlands). The report also helps stakeholders understand the pulse of the cellulosic fire protection intumescent coatings market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 MARKET INCLUSIONS

- 1.2.2 MARKET EXCLUSIONS

- 1.3 STUDY SCOPE

- FIGURE 1 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.3 Primary data sources

- 2.1.2.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE ESTIMATION, BY REGION

- FIGURE 7 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TECHNOLOGY

- 2.2.3 SUPPLY-SIDE FORECAST

- FIGURE 8 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- 2.2.4 RECESSION IMPACT

- FIGURE 10 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION AND THEIR IMPACT ON CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- 2.3 DATA TRIANGULATION

- FIGURE 11 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 STUDY LIMITATIONS

- 2.6 GROWTH FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SNAPSHOT

- FIGURE 12 ACRYLIC CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 WATER-BORNE TYPE TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 14 STRUCTURAL STEEL & CAST IRON TO BE FASTEST-GROWING APPLICATION OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS

- FIGURE 15 COMMERCIAL TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 NORTH AMERICA DOMINATED MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- FIGURE 17 HIGH DEMAND FROM COMMERCIAL SECTOR IN DEVELOPED ECONOMIES TO DRIVE MARKET

- 4.2 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET GROWTH, BY MATERIAL TYPE

- FIGURE 18 ACRYLIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET IN ASIA PACIFIC, BY TYPE AND COUNTRY

- FIGURE 19 SOLVENT-BORNE TYPE SEGMENT AND CHINA ACCOUNTED FOR FASTEST GROWTH IN 2022

- 4.4 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: DEVELOPED VS. EMERGING COUNTRIES

- FIGURE 20 MARKET IN DEVELOPED COUNTRIES TO GROW FASTER THAN EMERGING COUNTRIES

- 4.5 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY KEY COUNTRY

- FIGURE 21 INDIA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent safety regulations

- 5.2.1.2 Increased preference for lightweight materials in building & construction sector

- 5.2.1.3 Regulations for green and smart buildings and focus on obtaining green certification

- 5.2.2 RESTRAINTS

- 5.2.2.1 Issues pertaining to material compatibility and cost

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in demand for fire-resistant coatings in renovation projects

- 5.2.3.2 Increased demand for water-borne intumescent coatings

- 5.2.4 CHALLENGES

- 5.2.4.1 Navigating regulatory complexity

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- 5.4.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS

- TABLE 4 KEY BUYING CRITERIA FOR CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS

- 5.5 MACROECONOMIC INDICATOR ANALYSIS

- 5.5.1 INTRODUCTION

- 5.5.2 TRENDS AND FORECAST OF GDP

- TABLE 5 TRENDS AND FORECAST OF GDP, 2020-2027 (% CHANGE)

- 5.5.3 TRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

- FIGURE 26 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014-2035

- 5.6 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTH

- 5.6.1 RUSSIA-UKRAINE WAR

- 5.6.2 CHINA

- 5.6.2.1 Debt issues

- 5.6.2.2 Trade war with Australia

- 5.6.2.3 Environmental commitments

- 5.6.3 EUROPE

- 5.6.3.1 Energy crisis

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 27 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: VALUE CHAIN ANALYSIS

- 5.8 PRICING ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICES OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS, BY REGION, 2022

- FIGURE 29 AVERAGE SELLING PRICES OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS, BY TYPE, 2022

- FIGURE 30 AVERAGE SELLING PRICES OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS, BY MATERIAL TYPE, 2022

- FIGURE 31 AVERAGE SELLING PRICES OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS, BY END USE, 2022

- FIGURE 32 AVERAGE SELLING PRICES OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS, BY COMPANY, 2023

- 5.9 PAINTS & COATINGS ECOSYSTEM AND INTERCONNECTED MARKETS

- TABLE 6 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 33 PAINTS & COATINGS ECOSYSTEM

- FIGURE 34 ECOSYSTEM EXTENSION TO INTUMESCENT COATINGS MARKET

- 5.10 IMPACT OF TRENDS AND TECHNOLOGY DISRUPTION ON MANUFACTURERS OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS

- 5.11 TRADE ANALYSIS

- TABLE 7 COUNTRY-WISE EXPORT DATA, 2019-2021 (USD THOUSAND)

- TABLE 8 COUNTRY-WISE IMPORT DATA, 2019-2021 (USD THOUSAND)

- 5.12 PATENT ANALYSIS

- 5.12.1 METHODOLOGY

- 5.12.2 PUBLICATION TRENDS

- FIGURE 35 NUMBER OF PATENTS PUBLISHED, 2018-2023

- 5.12.3 TOP JURISDICTION

- FIGURE 36 PATENTS PUBLISHED BY JURISDICTION, 2018-2023

- 5.12.4 TOP APPLICANTS

- FIGURE 37 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2018-2023

- TABLE 9 TOP PATENT OWNERS

- 5.13 CASE STUDY ANALYSIS

- 5.14 TECHNOLOGY ANALYSIS

- TABLE 10 C1-C5 CLASSIFICATION SCHEME

- TABLE 11 INTUMESCENT COATINGS FOR FIRE PROTECTION-BS EN 16623:2015 CLASSIFICATION

- 5.15 KEY CONFERENCES AND EVENTS IN 2023

- TABLE 12 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: KEY CONFERENCES AND EVENTS

- 5.16 TARIFF AND REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 38 WATER-BORNE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 17 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 18 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 19 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 20 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 6.2 SOLVENT-BORNE

- 6.2.1 INCREASED DEMAND FROM EMERGING COUNTRIES TO DRIVE SEGMENT

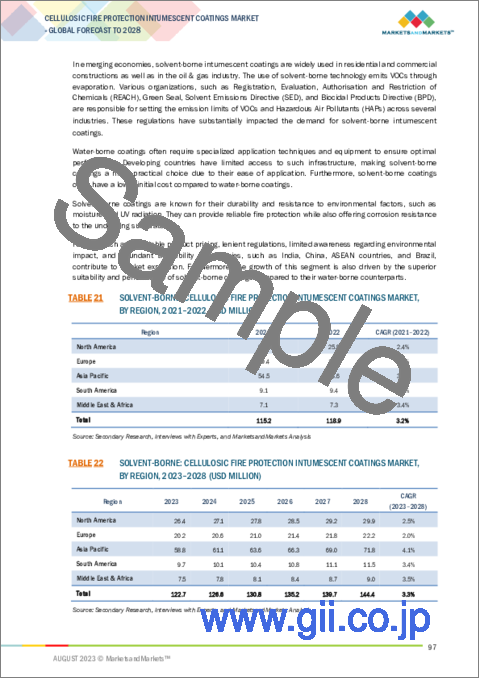

- TABLE 21 SOLVENT-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 22 SOLVENT-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 23 SOLVENT-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 24 SOLVENT-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

- 6.3 WATER-BORNE

- 6.3.1 STRINGENT REGULATIONS AND INCREASED DEMAND FOR ECO-FRIENDLY COATINGS TO SPUR SEGMENT

- TABLE 25 WATER-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 26 WATER-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 27 WATER-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 28 WATER-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

7 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE

- 7.1 INTRODUCTION

- FIGURE 39 STRUCTURAL STEEL & CAST IRON SUBSTRATE TO DOMINATE MARKET

- TABLE 29 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021-2022 (USD MILLION)

- TABLE 30 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023-2028 (USD MILLION)

- TABLE 31 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021-2022 (THOUSAND LITER)

- TABLE 32 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023-2028 (THOUSAND LITER)

- 7.2 STRUCTURAL STEEL & CAST IRON

- 7.2.1 INCREASED USE OF STEEL IN CONSTRUCTION ACTIVITIES TO DRIVE SEGMENT

- TABLE 33 STRUCTURAL STEEL & CAST IRON: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 34 STRUCTURAL STEEL & CAST IRON: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 35 STRUCTURAL STEEL & CAST IRON: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 36 STRUCTURAL STEEL & CAST IRON: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

- 7.3 WOOD

- 7.3.1 GROWING PENETRATION OF WOOD AS BUILDING MATERIAL IN DEVELOPED COUNTRIES TO DRIVE SEGMENT

- TABLE 37 WOOD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 38 WOOD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 39 WOOD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 40 WOOD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

- 7.4 OTHERS

- TABLE 41 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 42 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 43 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 44 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

8 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE

- 8.1 INTRODUCTION

- FIGURE 40 ACRYLIC TO BE LARGEST MATERIAL TYPE FOR CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS DURING FORECAST PERIOD

- TABLE 45 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021-2022 (USD MILLION)

- TABLE 46 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 47 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 48 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023-2028 (THOUSAND LITER)

- 8.2 ACRYLIC

- 8.2.1 INCREASED DEMAND FROM CONSTRUCTION SECTOR TO DRIVE SEGMENT

- TABLE 49 ACRYLIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 50 ACRYLIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 51 ACRYLIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 52 ACRYLIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

- 8.3 EPOXY

- 8.3.1 EXTENSIVE USE IN VARIOUS INDUSTRIAL APPLICATIONS TO PROPEL SEGMENT

- TABLE 53 EPOXY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 54 EPOXY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 55 EPOXY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 56 EPOXY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

- 8.4 ALKYD

- 8.4.1 HIGH-PERFORMANCE CHARACTERISTICS TO DRIVE DEMAND ACROSS INDUSTRIES

- TABLE 57 ALKYD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 58 ALKYD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 59 ALKYD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 60 ALKYD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

- 8.5 VAE

- 8.5.1 ENHANCED FIRE SAFETY AND DURABILITY PROPERTIES TO PROPEL SEGMENT

- TABLE 61 VAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 62 VAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 63 VAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 64 VAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

- 8.6 OTHERS

- TABLE 65 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 66 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 67 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 68 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

9 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE

- 9.1 INTRODUCTION

- FIGURE 41 COMMERCIAL SEGMENT TO LEAD OVERALL CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET DURING FORECAST PERIOD

- TABLE 69 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021-2022 (USD MILLION)

- TABLE 70 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 71 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021-2022 (THOUSAND LITER)

- TABLE 72 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023-2028 (THOUSAND LITER)

- 9.2 RESIDENTIAL

- 9.2.1 GROWING CONSTRUCTION SPENDING IN RESIDENTIAL SEGMENT TO BOOST MARKET

- TABLE 73 RESIDENTIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 74 RESIDENTIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 75 RESIDENTIAL CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 76 RESIDENTIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

- 9.3 COMMERCIAL

- 9.3.1 INCREASED INVESTMENTS IN DEVELOPMENT OF COMMERCIAL OFFICE SPACES TO DRIVE DEMAND

- TABLE 77 COMMERCIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 78 COMMERCIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 79 COMMERCIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 80 COMMERCIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

10 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 42 ASIA PACIFIC TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- TABLE 81 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 82 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 83 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021-2022 (THOUSAND LITER)

- TABLE 84 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023-2028 (THOUSAND LITER)

- 10.2 ASIA PACIFIC

- 10.2.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 43 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SNAPSHOT

- TABLE 85 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021-2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021-2022 (THOUSAND LITER)

- TABLE 88 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023-2028 (THOUSAND LITER)

- TABLE 89 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021-2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 92 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023-2028 (THOUSAND LITER)

- TABLE 93 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 96 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- TABLE 97 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021-2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023-2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021-2022 (THOUSAND LITER)

- TABLE 100 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023-2028 (THOUSAND LITER)

- TABLE 101 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021-2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021-2022 (THOUSAND LITER)

- TABLE 104 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023-2028 (THOUSAND LITER)

- 10.2.2 CHINA

- 10.2.2.1 Foreign investments to drive market

- TABLE 105 CHINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 106 CHINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 107 CHINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 108 CHINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.2.3 INDIA

- 10.2.3.1 Boom in real estate industry to drive market

- TABLE 109 INDIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 110 INDIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 111 INDIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 112 INDIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.2.4 JAPAN

- 10.2.4.1 Investments by government in commercial construction to boost demand

- TABLE 113 JAPAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 114 JAPAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 115 JAPAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 116 JAPAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.2.5 SOUTH KOREA

- 10.2.5.1 Support from government as well as private sector to drive market

- TABLE 117 SOUTH KOREA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 118 SOUTH KOREA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 119 SOUTH KOREA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 120 SOUTH KOREA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.2.6 TAIWAN

- 10.2.6.1 Growth in semiconductor industry to spur market

- TABLE 121 TAIWAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 122 TAIWAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 123 TAIWAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 124 TAIWAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.2.7 OCEANIA

- 10.2.7.1 Regulations related to safety and sustainability to drive market

- TABLE 125 OCEANIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 126 OCEANIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 127 OCEANIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 128 OCEANIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.2.8 REST OF ASIA PACIFIC

- TABLE 129 REST OF ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 132 REST OF ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.3 NORTH AMERICA

- 10.3.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 44 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SNAPSHOT

- TABLE 133 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021-2022 (USD MILLION)

- TABLE 134 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021-2022 (THOUSAND LITER)

- TABLE 136 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023-2028 (THOUSAND LITER)

- TABLE 137 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021-2022 (USD MILLION)

- TABLE 138 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 139 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 140 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023-2028 (THOUSAND LITER)

- TABLE 141 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 142 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 143 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 144 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- TABLE 145 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021-2022 (USD MILLION)

- TABLE 146 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023-2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021-2022 (THOUSAND LITER)

- TABLE 148 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023-2028 (THOUSAND LITER)

- TABLE 149 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021-2022 (USD MILLION)

- TABLE 150 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021-2022 (THOUSAND LITER)

- TABLE 152 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023-2028 (THOUSAND LITER)

- 10.3.2 US

- 10.3.2.1 Increased private residential and non-residential construction spending to boost market

- TABLE 153 US: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 154 US: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 155 US: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 156 US: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.3.3 CANADA

- 10.3.3.1 Significant rise in residential constructions to propel market

- TABLE 157 CANADA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 158 CANADA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 159 CANADA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 160 CANADA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.3.4 MEXICO

- 10.3.4.1 Increased investments in energy and commercial construction projects to drive market

- TABLE 161 MEXICO: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 162 MEXICO: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 163 MEXICO: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 164 MEXICO: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.4 EUROPE

- 10.4.1 EUROPE: RECESSION IMPACT

- FIGURE 45 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SNAPSHOT

- TABLE 165 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021-2022 (USD MILLION)

- TABLE 166 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 167 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021-2022 (THOUSAND LITER)

- TABLE 168 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023-2028 (THOUSAND LITER)

- TABLE 169 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021-2022 (USD MILLION)

- TABLE 170 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 171 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 172 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023-2028 (THOUSAND LITER)

- TABLE 173 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 174 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 175 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 176 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- TABLE 177 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021-2022 (USD MILLION)

- TABLE 178 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023-2028 (USD MILLION)

- TABLE 179 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021-2022 (THOUSAND LITER)

- TABLE 180 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023-2028 (THOUSAND LITER)

- TABLE 181 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021-2022 (USD MILLION)

- TABLE 182 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 183 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021-2022 (THOUSAND LITER)

- TABLE 184 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023-2028 (THOUSAND LITER)

- 10.4.2 GERMANY

- 10.4.2.1 Technological advancements and rise in demand from residential sector to boost demand

- TABLE 185 GERMANY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 186 GERMANY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 187 GERMANY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 188 GERMANY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.4.3 RUSSIA

- 10.4.3.1 Growing population to fuel demand in residential constructions

- TABLE 189 RUSSIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 190 RUSSIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 191 RUSSIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 192 RUSSIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.4.4 UK

- 10.4.4.1 Growing construction sector to boost demand

- TABLE 193 UK: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 194 UK: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 195 UK: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 196 UK: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.4.5 FRANCE

- 10.4.5.1 Improved housing affordability and developed renewable energy infrastructure to drive demand

- TABLE 197 FRANCE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 198 FRANCE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 199 FRANCE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 200 FRANCE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.4.6 ITALY

- 10.4.6.1 New project finance rules and investment policies in construction sector to support market growth

- TABLE 201 ITALY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 202 ITALY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 203 ITALY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 204 ITALY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.4.7 SPAIN

- 10.4.7.1 Government investments in infrastructure and housing development to boost market

- TABLE 205 SPAIN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 206 SPAIN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 207 SPAIN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 208 SPAIN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.4.8 TURKEY

- 10.4.8.1 Rapid urbanization to drive demand

- TABLE 209 TURKEY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 210 TURKEY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 211 TURKEY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 212 TURKEY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.4.9 REST OF EUROPE

- TABLE 213 REST OF EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 214 REST OF EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 215 REST OF EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 216 REST OF EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- FIGURE 46 SAUDI ARABIA TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- TABLE 217 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021-2022 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021-2022 (THOUSAND LITER)

- TABLE 220 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023-2028 (THOUSAND LITER)

- TABLE 221 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021-2022 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 224 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023-2028 (THOUSAND LITER)

- TABLE 225 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 228 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- TABLE 229 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021-2022 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023-2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021-2022 (THOUSAND LITER)

- TABLE 232 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023-2028 (THOUSAND LITER)

- TABLE 233 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021-2022 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021-2022 (THOUSAND LITER)

- TABLE 236 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023-2028 (THOUSAND LITER)

- 10.5.2 SAUDI ARABIA

- 10.5.2.1 Increased government investment in housing sector to propel demand

- TABLE 237 SAUDI ARABIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 238 SAUDI ARABIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 239 SAUDI ARABIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 240 SAUDI ARABIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Rapid urbanization and opportunities in building & construction sector to drive demand

- TABLE 241 SOUTH AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 242 SOUTH AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 243 SOUTH AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 244 SOUTH AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.5.4 UAE

- 10.5.4.1 Growing industrial activities to drive market

- TABLE 245 UAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 246 UAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 247 UAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 248 UAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 249 REST OF MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 250 REST OF MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 251 REST OF MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 252 REST OF MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.6 SOUTH AMERICA

- 10.6.1 SOUTH AMERICA: RECESSION IMPACT

- FIGURE 47 BRAZIL TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- TABLE 253 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021-2022 (USD MILLION)

- TABLE 254 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 255 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021-2022 (THOUSAND LITER)

- TABLE 256 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023-2028 (THOUSAND LITER)

- TABLE 257 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021-2022 (USD MILLION)

- TABLE 258 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 259 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 260 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023-2028 (THOUSAND LITER)

- TABLE 261 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 262 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 263 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 264 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- TABLE 265 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021-2022 (USD MILLION)

- TABLE 266 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023-2028 (USD MILLION)

- TABLE 267 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021-2022 (THOUSAND LITER)

- TABLE 268 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023-2028 (THOUSAND LITER)

- TABLE 269 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021-2022 (USD MILLION)

- TABLE 270 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 271 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021-2022 (THOUSAND LITER)

- TABLE 272 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023-2028 (THOUSAND LITER)

- 10.6.2 BRAZIL

- 10.6.2.1 Rise in investment from government to drive market

- TABLE 273 BRAZIL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 274 BRAZIL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 275 BRAZIL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 276 BRAZIL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.6.3 ARGENTINA

- 10.6.3.1 Increased population and improved economic conditions to drive demand

- TABLE 277 ARGENTINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 278 ARGENTINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 279 ARGENTINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 280 ARGENTINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

- 10.6.4 REST OF SOUTH AMERICA

- TABLE 281 REST OF SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 282 REST OF SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 283 REST OF SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021-2022 (THOUSAND LITER)

- TABLE 284 REST OF SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023-2028 (THOUSAND LITER)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- TABLE 285 OVERVIEW OF STRATEGIES ADOPTED BY KEY CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS PLAYERS (2018-2023)

- 11.2 COMPANY EVALUATION MATRIX

- 11.2.1 STARS

- 11.2.2 EMERGING LEADERS

- 11.2.3 PARTICIPANTS

- 11.2.4 PERVASIVE PLAYERS

- FIGURE 48 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- 11.3 START-UPS/SMES EVALUATION MATRIX

- 11.3.1 RESPONSIVE COMPANIES

- 11.3.2 PROGRESSIVE COMPANIES

- 11.3.3 STARTING BLOCKS

- 11.3.4 DYNAMIC COMPANIES

- FIGURE 49 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: SME MATRIX, 2022

- 11.4 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 50 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- 11.5 COMPETITIVE BENCHMARKING

- TABLE 286 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: KEY START-UPS/SMES

- TABLE 287 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 288 COMPANY EVALUATION MATRIX: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- 11.6 MARKET SHARE ANALYSIS

- FIGURE 51 MARKET SHARE, BY KEY PLAYER, 2022

- TABLE 289 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: INTENSITY OF COMPETITIVE RIVALRY, 2022

- 11.7 MARKET RANKING ANALYSIS

- FIGURE 52 MARKET RANKING ANALYSIS, 2022

- 11.8 REVENUE ANALYSIS

- FIGURE 53 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2022

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 MARKET EVALUATION FRAMEWORK

- TABLE 290 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 291 HIGHEST ADOPTED GROWTH STRATEGIES

- TABLE 292 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- 11.9.2 MARKET EVALUATION MATRIX

- TABLE 293 COMPANY FOOTPRINT: BY END USE

- TABLE 294 COMPANY FOOTPRINT: BY REGION

- TABLE 295 COMPANY FOOTPRINT

- 11.10 STRATEGIC DEVELOPMENTS

- TABLE 296 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: PRODUCT LAUNCHES, 2018-2023

- TABLE 297 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: DEALS, 2018-2023

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 12.1.1 AKZONOBEL N.V.

- TABLE 298 AKZONOBEL N.V.: COMPANY OVERVIEW

- FIGURE 54 AKZONOBEL N.V.: COMPANY SNAPSHOT

- TABLE 299 AKZONOBEL N.V.: DEALS

- TABLE 300 AKZONOBEL N.V.: PRODUCT LAUNCHES

- 12.1.2 THE SHERWIN-WILLIAMS COMPANY

- TABLE 301 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- FIGURE 55 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- TABLE 302 THE SHERWIN-WILLIAMS COMPANY: DEALS

- TABLE 303 THE SHERWIN-WILLIAMS COMPANY: EXPANSIONS

- TABLE 304 THE SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES

- 12.1.3 PPG INDUSTRIES, INC.

- TABLE 305 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 56 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 306 PPG INDUSTRIES, INC.: DEALS

- TABLE 307 PPG INDUSTRIES, INC: PRODUCT LAUNCHES

- 12.1.4 JOTUN

- TABLE 308 JOTUN: COMPANY OVERVIEW

- FIGURE 57 JOTUN: COMPANY SNAPSHOT

- TABLE 309 JOTUN: EXPANSION

- 12.1.5 HEMPEL A/S

- TABLE 310 HEMPEL A/S: COMPANY OVERVIEW

- FIGURE 58 HEMPEL A/S: COMPANY SNAPSHOT

- TABLE 311 HEMPEL A/S: PRODUCT LAUNCHES

- TABLE 312 HEMPEL A/S: EXPANSION

- TABLE 313 HEMPEL A/S: DEALS

- 12.1.6 RPM INTERNATIONAL INC.

- TABLE 314 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 59 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 315 RPM INTERNATIONAL INC.: EXPANSION

- 12.1.7 SIKA AG

- TABLE 316 SIKA AG: COMPANY OVERVIEW

- FIGURE 60 SIKA AG: COMPANY SNAPSHOT

- TABLE 317 SIKA AG: DEALS

- TABLE 318 SIKA AG: PRODUCT LAUNCHES

- 12.1.8 ETEX GROUP

- TABLE 319 ETEX GROUP: COMPANY OVERVIEW

- FIGURE 61 ETEX GROUP: COMPANY SNAPSHOT

- TABLE 320 ETEX GROUP: DEALS

- 12.1.9 KANSAI PAINT CO., LTD.

- TABLE 321 KANSAI PAINT CO., LTD.: COMPANY OVERVIEW

- FIGURE 62 KANSAI PAINT CO., LTD.: COMPANY SNAPSHOT

- 12.1.10 TEKNOS GROUP

- TABLE 322 TEKNOS GROUP: COMPANY OVERVIEW

- FIGURE 63 TEKNOS GROUP: COMPANY SNAPSHOT

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 GCP APPLIED TECHNOLOGIES

- TABLE 323 GCP APPLIED TECHNOLOGIES: COMPANY OVERVIEW

- 12.2.2 RUDOLF HENSEL GMBH

- TABLE 324 RUDOLF HENSEL GMBH: COMPANY OVERVIEW

- 12.2.3 CONTEGO INTERNATIONAL INC.

- TABLE 325 CONTEGO INTERNATIONAL INC.: COMPANY OVERVIEW

- 12.2.4 ARABIAN VERMICULITE INDUSTRIES

- TABLE 326 ARABIAN VERMICULITE INDUSTRIES: COMPANY OVERVIEW

- 12.2.5 ISOLATEK INTERNATIONAL

- TABLE 327 ISOLATEK INTERNATIONAL: COMPANY OVERVIEW

- 12.2.6 ALBI PROTECTIVE COATINGS

- TABLE 328 ALBI PROTECTIVE COATINGS: COMPANY OVERVIEW

- 12.2.7 JF AMONN SRL

- TABLE 329 JF AMONN SRL: COMPANY OVERVIEW

- 12.2.8 BOLLOM

- TABLE 330 BOLLOM: COMPANY OVERVIEW

- 12.2.9 DEKOTERM

- TABLE 331 DEKOTERM: COMPANY OVERVIEW

- 12.2.10 INTUMESCENT SYSTEMS LTD.

- TABLE 332 INTUMESCENT SYSTEMS LTD: COMPANY OVERVIEW

- 12.2.11 COATINGS & SPECIALTIES SOLUTIONS

- TABLE 333 COATINGS & SPECIALTIES SOLUTIONS: COMPANY OVERVIEW

- 12.2.12 STANCOLAC S.A.

- TABLE 334 STANCOLAC S.A.: COMPANY OVERVIEW

- 12.2.13 UNITED SUPREME GROUP

- TABLE 335 UNITED SUPREME GROUP: COMPANY OVERVIEW

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 336 FIRE-RESISTANT COATINGS MARKET DEFINITION

- 13.2 FIRE-RESISTANT COATINGS MARKET LIMITATIONS

- 13.3 FIRE-RESISTANT COATINGS MARKET OVERVIEW

- 13.4 FIRE-RESISTANT COATINGS MARKET, BY TYPE

- TABLE 337 FIRE-RESISTANT COATINGS MARKET, BY TYPE, 2016-2018 (TON)

- TABLE 338 FIRE-RESISTANT COATINGS MARKET, BY TYPE, 2019-2026 (TON)

- TABLE 339 FIRE-RESISTANT COATINGS MARKET, BY TYPE, 2016-2018 (USD MILLION)

- TABLE 340 FIRE-RESISTANT COATINGS MARKET, BY TYPE, 2019-2026 (USD MILLION)

- 13.5 FIRE-RESISTANT COATINGS MARKET, BY TECHNOLOGY

- TABLE 341 FIRE-RESISTANT COATINGS MARKET, BY TECHNOLOGY, 2016-2018 (TON)

- TABLE 342 FIRE-RESISTANT COATINGS MARKET, BY TECHNOLOGY, 2019-2026 (TON)

- TABLE 343 FIRE-RESISTANT COATINGS MARKET, BY TECHNOLOGY, 2016-2018 (USD MILLION)

- TABLE 344 FIRE-RESISTANT COATINGS MARKET, BY TECHNOLOGY, 2019-2026 (USD MILLION)

- 13.6 FIRE-RESISTANT COATINGS MARKET, BY APPLICATION TECHNIQUE

- TABLE 345 FIRE-RESISTANT COATINGS MARKET, BY APPLICATION TECHNIQUE, 2016-2018 (TON)

- TABLE 346 FIRE-RESISTANT COATINGS MARKET, BY APPLICATION TECHNIQUE, 2019-2026 (TON)

- TABLE 347 FIRE-RESISTANT COATINGS MARKET, BY APPLICATION TECHNIQUE, 2016-2018 (USD MILLION)

- TABLE 348 FIRE-RESISTANT COATINGS MARKET, BY APPLICATION TECHNIQUE, 2019-2026 (USD MILLION)

- 13.7 FIRE-RESISTANT COATINGS MARKET, BY SUBSTRATE

- TABLE 349 FIRE-RESISTANT COATINGS MARKET, BY SUBSTRATE, 2016-2018 (TON)

- TABLE 350 FIRE-RESISTANT COATINGS MARKET, BY SUBSTRATE, 2019-2026 (TON)

- TABLE 351 FIRE-RESISTANT COATINGS MARKET, BY SUBSTRATE, 2016-2018 (USD MILLION)

- TABLE 352 FIRE-RESISTANT COATINGS MARKET, BY SUBSTRATE, 2019-2026 (USD MILLION)

- 13.8 FIRE-RESISTANT COATINGS MARKET, BY REGION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS