|

|

市場調査レポート

商品コード

1172590

不揮発性メモリの世界市場:種類別 (フラッシュ、EPROM、nvSRAM、EEPROM、3D NAND、MRAM、FRAM、NRAM、ReRAM、PMC)・ウエハーのサイズ別 (200mm、300mm)・エンドユーザー別 (民生用、企業用ストレージ、医療、自動車)・地域別の将来予測 (2027年まで)Non-Volatile Memory Market by Type (Flash, EPROM, nvSRAM, EEPROM, 3D NAND, MRAM, FRAM, NRAM, ReRAM, PMC), Wafer Size (200 mm, 300mm), End-user (Consumer Electronics, Enterprise Storage, Healthcare, Automotive) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 不揮発性メモリの世界市場:種類別 (フラッシュ、EPROM、nvSRAM、EEPROM、3D NAND、MRAM、FRAM、NRAM、ReRAM、PMC)・ウエハーのサイズ別 (200mm、300mm)・エンドユーザー別 (民生用、企業用ストレージ、医療、自動車)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年12月09日

発行: MarketsandMarkets

ページ情報: 英文 240 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の不揮発性メモリの市場規模は、2022年から2027年にかけて10.7%のCAGRで成長し、2027年には1,241億米ドルに達すると予測されています。

種類別では、3D NANDタイプが2021年に約27%のシェアを占めています。

地域別に見ると、予測期間中、欧州地域が健全な成長を遂げると予想されています。その主な要因として、エレクトロニクス産業の成長や、域内の大手メーカー・サプライヤーの存在などが挙げられます。特に、欧州の経済大国であるドイツは不揮発性メモリー市場においても重要な役割を担お、同市場の成長を牽引するものと期待されています。

当レポートでは、世界の不揮発性メモリの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・ウエハーのサイズ別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 顧客のビジネスに影響を与えるトレンド

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 価格分析

- ケーススタディ分析

- 技術分析

- 補完技術

- 隣接技術

- 特許分析

- 主な会議とイベント (2022年~2023年)

- 関税と規制の状況

- 貿易分析

第6章 不揮発性メモリ市場:種類別

- イントロダクション

- 従来型不揮発性メモリ

- フラッシュメモリー

- EEPROM

- nvSRAM

- EPROM

- 新規の不揮発性メモリ

- 3D NAND

- MRAM

- FRAM

- ReRAM

- PCM

- NRAM

- NVDIMM

- その他 (ナノブリッジ、量子ドット、ミリピード、分子、透明/柔軟)

第7章 不揮発性メモリ市場:ウエハーのサイズ別

- イントロダクション

- 200ミリ

- 300ミリ

第8章 不揮発性メモリ市場:エンドユーザー別

- イントロダクション

- 民生用

- 企業用ストレージ

- 自動車・輸送機械

- 軍事・航空宇宙

- 産業用

- 通信

- エネルギー・電力

- 医療

- 農業

- 小売業

第9章 不揮発性メモリ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- 他のアジア太平洋諸国

- 他の国々 (RoW)

第10章 競合情勢

- 主要企業が採用した戦略

- 不揮発性メモリ市場:収益分析

- 市場シェア分析 (2021年)

- 企業評価クアドラント (2021年)

- 中小企業 (SME) の評価クアドラント (2021年)

- 競合シナリオと動向

- 製品の発売

- 資本取引

- その他

第11章 企業プロファイル

- 主要企業

- SAMSUNG

- WESTERN DIGITAL TECHNOLOGIES, INC.

- KIOXIA HOLDINGS CORPORATION

- MICRON TECHNOLOGY, INC.

- SK HYNIX INC.

- MICROCHIP TECHNOLOGY INC.

- ROHM CO., LTD.

- RENESAS ELECTRONICS CORPORATION

- STMICROELECTRONICS

- INFINEON TECHNOLOGIES AG

- NANTERO, INC.

- CROSSBAR, INC.

- EVERSPIN TECHNOLOGIES INC.

- WINBOND

- PURE STORAGE, INC.

- その他の企業

- FUJITSU

- VIKING TECHNOLOGY

- NVMDURANCE

- AVALANCHE TECHNOLOGY

- SMART MODULAR TECHNOLOGIES

- FLEXXON PTE LTD

- YMTC

- ATP ELECTRONICS, INC.

- HT MICRON

- SKYHIGH MEMORY LIMITED

第12章 付録

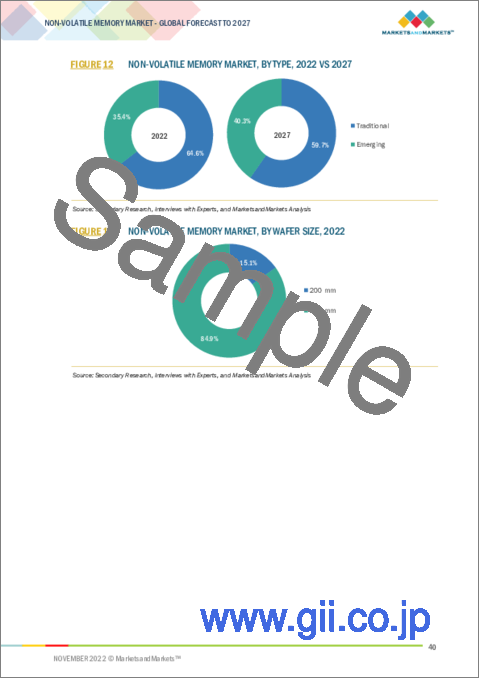

The non-volatile memory market is projected to reach USD 124.1 billion by 2027, growing at a CAGR of 10.7% from 2022 to 2027. This report covers key end users, namely, consumer electronics, enterprise storage, automotive & transportation, military & aerospace, industrial, telecommunication, energy & power, healthcare, agriculture, and retail. The 3D NAND type in non-volatile memory accounted for a market share of about 27% of the global market in 2021.

"Europe region is expected to grow at a healthy rate in the Non-volatile memory market during the forecast period."

The non-volatile memory market in Europe is driven by the growth of the electronics industry and the presence of top manufacturers and suppliers in the region. Companies such as Infineon Technologies AG (Germany) and STMicroelectronics NV (Switzerland) offer a wide range of non-volatile memory solutions, including EEPROM, flash, EPROM, and nvSRAM non-volatile memories. Mass storage and mobile phones are the major applications of non-volatile memory in Europe. Germany, the economic powerhouse of Europe, plays a crucial role in the non-volatile memory market in Europe and is expected to drive the growth of this market.

The key players operating in the non-volatile memory market include SAMSUNG (South Korea), Western Digital Technologies, Inc. (US), KIOXIA Holdings Corporation (Japan), Micron Technology, Inc. (US), and SK HYNIX INC. (South Korea) among others. The other companies profiled in the report are Microchip Technology Inc. (US), ROHM CO., LTD. (Japan), Renesas Electronics Corporation (Japan), STMicroelectronics (US), Infineon Technologies AG (Germany), Nantero, Inc. (US), Crossbar Inc. (US), Everspin Technologies Inc. (US), Winbond (Taiwan), Pure Storage, Inc. (US), Fujitsu (Japan), Viking Technology (US), NVMdurance (Ireland), Avalanche Technology (US), SMART Modular Technologies (US), Flexxon Pte Ltd (Singapore), YMTC (China), ATP Electronics, Inc. (Taiwan), HT Micron (Brazil), and SkyHigh Memory Limited (China). The non-volatile memory market has been segmented into type, wafer size, , end user, and region.

Based on type the non-volatile memory market has been segmented as traditional memory (Flash Memory, EEPROM, nvSRAM, EPRoM) and emerging memories (3D NAND, MRAM / STT-MRAM, FRAM, ReRAM/CBRAM, NVDIMM, PCM, NRAM, and Others). Based on end use the non-volatile memory market has been segmented by consumer electronics, enterprise storage, automotive & transportation, military & aerospace, industrial, telecommunication, energy & power, healthcare, agriculture, and retail. Based on region the Non-volatile memory market has been segmented by North America, Europe, Asia Pacific, and Rest of the World.

- Illustrative segmentation, analysis, and forecast of the market based on type, wafer size, end user, and region have been conducted to give an overall view of the non-volatile memory market.

- A value chain analysis has been performed to provide in-depth insights into the non-volatile memory market.

- The key drivers, restraints, opportunities, and challenges pertaining to the non-volatile memory market have been detailed in this report.

- The report includes a detailed competitive landscape of the market, along with key players, as well as an in-depth analysis of their revenues

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 NON-VOLATILE MEMORY MARKET

- FIGURE 2 NON-VOLATILE MEMORY MARKET, BY GEOGRAPHY

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 NON-VOLATILE MEMORY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 4 RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Key data from secondary sources

- 2.1.3.3 Primary interviews

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 5 BOTTOM-UP APPROACH: MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 6 MARKET SIZE ESTIMATION RESEARCH METHODOLOGY

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 8 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

- FIGURE 9 NON-VOLATILE MEMORY MARKET, 2018-2027

- FIGURE 10 NON-VOLATILE MEMORY MARKET (THOUSAND PETABYTES), 2018-2027

- FIGURE 11 CONSUMER ELECTRONICS SEGMENT HELD LARGEST SHARE OF NON-VOLATILE MEMORY MARKET, BY END USER, IN 2021

- FIGURE 12 NON-VOLATILE MEMORY MARKET, BY TYPE, 2022 VS 2027

- FIGURE 13 NON-VOLATILE MEMORY MARKET, BY WAFER SIZE, 2022

- FIGURE 14 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF NON-VOLATILE MEMORY MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR NON-VOLATILE MEMORY MARKET PLAYERS

- FIGURE 15 HIGH ADOPTION OF MEMORY STORAGE DEVICES IN CONSUMER ELECTRONICS TO PROPEL MARKET GROWTH

- 4.2 NON-VOLATILE MEMORY MARKET, BY TYPE

- FIGURE 16 TRADITIONAL SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2021

- 4.3 NON-VOLATILE MEMORY MARKET, BY END USER

- FIGURE 17 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 NON-VOLATILE MEMORY MARKET, BY REGION

- FIGURE 18 MARKET IN ASIA PACIFIC TO GROW SIGNIFICANTLY DURING FORECAST PERIOD

- 4.5 ASIA PACIFIC: NON-VOLATILE MEMORY MARKET, BY END USER AND COUNTRY

- FIGURE 19 CONSUMER ELECTRONICS AND CHINA LARGEST SHAREHOLDERS OF NON-VOLATILE MEMORY MARKET IN ASIA PACIFIC IN 2021

- 4.6 NON-VOLATILE MEMORY MARKET, BY GEOGRAPHY

- FIGURE 20 SOUTH KOREA TO REGISTER HIGHEST CAGR IN NON-VOLATILE MEMORY MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 NON-VOLATILE MEMORY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 22 IMPACT OF DRIVERS ON NON-VOLATILE MEMORY MARKET

- 5.2.1.1 Surging demand for smartphones and smart wearables

- 5.2.1.2 Shift from hard disk drives (HDDs) toward solid-state drives (SSDs) in enterprise storage

- TABLE 1 DIFFERENCE BETWEEN SSD AND HDD

- 5.2.1.3 Increasing demand for fast access and low power-consuming memory devices

- TABLE 2 ATTRIBUTES OF DIFFERENT TYPES OF NON-VOLATILE MEMORIES

- 5.2.1.4 Integration of emerging technologies to support digitalization in automotive sector

- FIGURE 23 GLOBAL VEHICLE PRODUCTION, 2017-2021 (MILLION UNITS)

- 5.2.2 RESTRAINTS

- FIGURE 24 IMPACT OF RESTRAINTS ON NON-VOLATILE MEMORY MARKET

- 5.2.2.1 Low write endurance rate

- TABLE 3 WRITE ENDURANCE OF DIFFERENT MEMORY TECHNOLOGIES

- 5.2.2.2 Decline in growth of semiconductor industry

- 5.2.3 OPPORTUNITIES

- FIGURE 25 IMPACT OF OPPORTUNITIES ON NON-VOLATILE MEMORY MARKET

- 5.2.3.1 Advent of innovative technologies for IoT applications

- 5.2.3.2 Increasing traction of industrial-grade flash memories

- 5.2.4 CHALLENGES

- FIGURE 26 IMPACT OF CHALLENGES ON NON-VOLATILE MEMORY MARKET

- 5.2.4.1 Optimization of storage densities and capacities

- 5.2.4.2 High design costs and complexities

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 27 NON-VOLATILE MEMORY MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 28 NON-VOLATILE MEMORY MARKET: ECOSYSTEM ANALYSIS

- TABLE 4 NON-VOLATILE MEMORY MARKET: ROLE IN ECOSYSTEM

- 5.5 TRENDS IMPACTING CUSTOMERS' BUSINESSES

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 NON-VOLATILE MEMORY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- 5.7.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA, BY END USER

- TABLE 7 KEY BUYING CRITERIA, BY END USER

- 5.8 PRICING ANALYSIS

- FIGURE 31 AVERAGE SELLING PRICE OF NON-VOLATILE MEMORY MODULES, BY TECHNOLOGY TYPE

- TABLE 8 AVERAGE SELLING PRICE OF NON-VOLATILE MEMORY MODULES, BY COMPANY

- TABLE 9 PRICE OF NON-VOLATILE MEMORY, BY COMPANY

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 EVERSPIN SIGNED CONTRACT WITH QUICK LOGIC CORPORATION TO PROVIDE MRAM

- 5.9.2 NVMDURANCE EXTENDED NAND FLASH LIFETIME OF ALTERA'S NVME DATA STORAGE SOLUTION

- 5.9.3 EVERSPIN TECHNOLOGIES HELPS BMW OPTIMIZE MOTORSPORT SUPERBIKE WITH MRAM MEMORY

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 COMPLEMENTARY TECHNOLOGY

- 5.10.2 ADJACENT TECHNOLOGY

- 5.11 PATENT ANALYSIS

- FIGURE 32 PATENT ANALYSIS

- TABLE 10 PATENTS RELATED TO NON-VOLATILE MEMORY MARKET

- 5.12 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 11 NON-VOLATILE MEMORY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATORY LANDSCAPE

- 5.13.2.1 US regulations

- 5.13.2.1.1 California Consumer Privacy Act

- 5.13.2.1.2 Anticybersquatting Consumer Protection Act

- 5.13.2.2 EU regulations

- 5.13.2.2.1 General Data Protection Regulation

- 5.13.2.1 US regulations

- 5.13.3 STANDARDS

- 5.13.3.1 CEN/ISO

- 5.13.3.2 ISO/IEC JTC 1

- 5.13.3.2.1 ISO/IEC JTC 1/SC 3 1

- 5.13.3.2.2 ISO/IEC JTC 1/SC 27

- 5.13.3.3 European Technical Standards Institute (ETSI)

- 5.13.3.4 Institute of Electrical and Electronics Engineers Standards Association (IEEE)

- 5.13.4 TARIFF ANALYSIS

- TABLE 16 TARIFF FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY US, 2020

- TABLE 17 TARIFF FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY CHINA, 2020

- TABLE 18 TARIFF FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY GERMANY, 2020

- 5.14 TRADE ANALYSIS

- TABLE 19 EXPORT DATA FOR HS CODE 854232, BY COUNTRY, 2017-2021 (USD MILLION)

- FIGURE 33 EXPORT DATA FOR HS CODE 854232, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 20 IMPORT DATA FOR HS CODE 854232, BY COUNTRY, 2017-2021 (USD MILLION)

- FIGURE 34 IMPORT DATA FOR HS CODE 854232, BY COUNTRY, 2017-2021 (USD MILLION)

6 NON-VOLATILE MEMORY MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 35 NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027

- TABLE 21 NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 22 NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD BILLION)

- 6.2 TRADITIONAL NON-VOLATILE MEMORY

- TABLE 23 TRADITIONAL: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 24 TRADITIONAL: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 6.2.1 FLASH MEMORY

- 6.2.1.1 Most prominently used non-volatile memory type

- 6.2.1.2 NAND flash

- 6.2.1.3 NOR flash

- TABLE 25 FLASH MEMORY: NOR AND NAND

- TABLE 26 FLASH MEMORY: NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD MILLION)

- FIGURE 36 NON-VOLATILE FLASH MEMORY MARKET, BY END USER (USD BILLION), 2022-2027

- TABLE 27 FLASH MEMORY: NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD MILLION)

- 6.2.2 ELECTRICALLY ERASABLE PROGRAMMABLE READ-ONLY MEMORY (EEPROM)

- 6.2.2.1 Offers non-volatility, byte-level control, simplicity of usage, and low power consumption

- TABLE 28 EEPROM: NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 29 EEPROM: NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD MILLION)

- 6.2.3 NON-VOLATILE SRAM (NVSRAM)

- 6.2.3.1 Provides unlimited read and write cycles

- TABLE 30 NVSRAM: NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD THOUSAND)

- TABLE 31 NVSRAM: NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD THOUSAND)

- 6.2.4 ERASABLE PROGRAMMABLE READ-ONLY MEMORY (EPROM)

- 6.2.4.1 Addresses limitations of ROM and PROM

- TABLE 32 EPROM: NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 33 EPROM: NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD MILLION)

- 6.3 EMERGING NON-VOLATILE MEMORY

- FIGURE 37 EMERGING NON-VOLATILE MEMORY MARKET, BY END USER (USD BILLION), 2022-2027

- TABLE 34 EMERGING: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 35 EMERGING: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 6.3.1 3D NAND

- 6.3.1.1 Market for 3D NAND reaching maturity stage

- TABLE 36 3D NAND: NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 37 3D NAND: NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD MILLION)

- 6.3.2 MAGNETO-RESISTIVE RANDOM ACCESS MEMORY (MRAM)

- 6.3.2.1 Offers improved data fidelity and system form factor

- TABLE 38 MRAM: NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD MILLION)

- FIGURE 38 MRAM: NON-VOLATILE MEMORY MARKET, BY END USER (USD MILLION), 2022-2027

- TABLE 39 MRAM: NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD MILLION)

- 6.3.3 FERROELECTRIC RANDOM ACCESS MEMORY (FRAM)

- 6.3.3.1 Apt for mission-critical applications

- TABLE 40 FRAM: NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD THOUSAND)

- TABLE 41 FRAM: NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD THOUSAND)

- 6.3.4 RESISTIVE RANDOM ACCESS MEMORY (RERAM)

- 6.3.4.1 Deployed in low-power applications

- TABLE 42 RERAM: NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD MILLION)

- FIGURE 39 RERAM NON-VOLATILE MEMORY MARKET, BY END USER (USD MILLION), 2022-2027

- TABLE 43 RERAM: NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD MILLION)

- 6.3.5 PHASE CHANGE MEMORY (PCM)

- 6.3.5.1 Most developed emerging NVM technology

- TABLE 44 PCM: NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD THOUSAND)

- TABLE 45 PCM: NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD THOUSAND)

- 6.3.6 NANOTUBE-BASED NON-VOLATILE RANDOM-ACCESS MEMORY (NRAM)

- 6.3.6.1 Provides very-high-density memory solutions

- TABLE 46 NRAM: NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD THOUSAND)

- FIGURE 40 NRAM: NON-VOLATILE MEMORY MARKET, BY END USER (MILLION), 2022-2027

- TABLE 47 NRAM: NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD THOUSAND)

- 6.3.7 NON-VOLATILE DUAL IN-LINE MEMORY MODULE (NVDIMM)

- 6.3.7.1 Hybrid memory that retains data during service outage

- TABLE 48 NVDIMM: NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD THOUSAND)

- TABLE 49 NVDIMM: NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD THOUSAND)

- 6.3.8 OTHERS (NANOBRIDGE, QUANTUM-DOT, MILLIPEDE, MOLECULAR, TRANSPARENT/FLEXIBLE)

- TABLE 50 OTHERS: NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD THOUSAND)

- TABLE 51 OTHERS: NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD THOUSAND)

7 NON-VOLATILE MEMORY MARKET, BY WAFER SIZE

- 7.1 INTRODUCTION

- FIGURE 41 NON-VOLATILE MEMORY MARKET, BY WAFER SIZE

- TABLE 52 NON-VOLATILE MEMORY MARKET, BY WAFER SIZE, 2018-2021 (USD BILLION)

- TABLE 53 NON-VOLATILE MEMORY MARKET, BY WAFER SIZE, 2022-2027 (USD BILLION)

- 7.2 200 MM

- 7.2.1 USED IN ELECTRONIC PRODUCTS

- 7.3 300 MM

- 7.3.1 MOST NVM CHIPS MANUFACTURED FROM 300 MM WAFERS

- TABLE 54 WAFER FABRICATION FACILITIES IN US, 2021

8 NON-VOLATILE MEMORY MARKET, BY END USER

- 8.1 INTRODUCTION

- FIGURE 42 NON-VOLATILE MEMORY MARKET, BY END USER, 2022 & 2027

- TABLE 55 NON-VOLATILE MEMORY MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 56 NON-VOLATILE MEMORY MARKET, BY END USER, 2022-2027 (USD MILLION)

- 8.2 CONSUMER ELECTRONICS

- 8.2.1 CONSUMER ELECTRONICS EQUIPPED WITH NON-VOLATILE MEMORY DELIVER HIGH PERFORMANCE WHILE CONSUMING LOW POWER

- 8.2.1.1 Use case: Mobile phones, tablets, and laptops

- 8.2.1.2 Use case: Wearable electronic devices

- 8.2.1.3 Use case: Smart home (lighting control, security & access control, smart kitchen, and others)

- 8.2.1.4 Use case: Others (washing machines, dishwashers, and more)

- FIGURE 43 CONSUMER ELECTRONICS: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027

- TABLE 57 CONSUMER ELECTRONICS: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 58 CONSUMER ELECTRONICS: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 59 CONSUMER ELECTRONICS: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 60 CONSUMER ELECTRONICS: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2022-2027 (USD MILLION)

- TABLE 61 CONSUMER ELECTRONICS: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 62 CONSUMER ELECTRONICS: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2022-2027 (USD MILLION)

- 8.2.1 CONSUMER ELECTRONICS EQUIPPED WITH NON-VOLATILE MEMORY DELIVER HIGH PERFORMANCE WHILE CONSUMING LOW POWER

- 8.3 ENTERPRISE STORAGE

- 8.3.1 HYBRID MEMORY CUBE AND HIGH-BANDWIDTH MEMORY SUITABLE FOR ENTERPRISE STORAGE APPLICATIONS

- FIGURE 44 ENTERPRISE STORAGE: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027

- TABLE 63 ENTERPRISE STORAGE: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 64 ENTERPRISE STORAGE: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 65 ENTERPRISE STORAGE: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 66 ENTERPRISE STORAGE: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2022-2027 (USD MILLION)

- TABLE 67 ENTERPRISE STORAGE: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 68 ENTERPRISE STORAGE: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2022-2027 (USD MILLION)

- 8.4 AUTOMOTIVE & TRANSPORTATION

- 8.4.1 EMERGENCE OF INFOTAINMENT AND TELEMATICS TO FUEL DEMAND FOR NVM

- 8.4.1.1 Use case: Smart airbags

- 8.4.1.2 Use case: Navigation

- 8.4.1.3 Use case: Black box

- TABLE 69 AUTOMOTIVE & TRANSPORTATION: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 70 AUTOMOTIVE & TRANSPORTATION: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 71 AUTOMOTIVE & TRANSPORTATION: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 72 AUTOMOTIVE & TRANSPORTATION: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2022-2027 (USD MILLION)

- TABLE 73 AUTOMOTIVE & TRANSPORTATION: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 74 AUTOMOTIVE & TRANSPORTATION: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2022-2027 (USD THOUSAND)

- 8.4.1 EMERGENCE OF INFOTAINMENT AND TELEMATICS TO FUEL DEMAND FOR NVM

- 8.5 MILITARY & AEROSPACE

- 8.5.1 HIGH STORAGE DENSITY AND LOW COST MAKE FLASH MEMORY IDEAL FOR MILITARY & AEROSPACE APPLICATIONS

- TABLE 75 MILITARY & AEROSPACE: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 76 MILITARY & AEROSPACE: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 77 MILITARY & AEROSPACE: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 78 MILITARY & AEROSPACE: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2022-2027 (USD MILLION)

- TABLE 79 MILITARY & AEROSPACE: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 80 MILITARY & AEROSPACE: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2022-2027 (USD THOUSAND)

- 8.6 INDUSTRIAL

- 8.6.1 NON-VOLATILE MEMORY USED FOR DATA BACKUP AND FASTER READ/WRITE OPERATIONS

- 8.6.1.1 Use case: Industrial automation

- 8.6.1.2 Use case: HMI

- 8.6.1.3 Use case: PLC

- TABLE 81 INDUSTRIAL: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 82 INDUSTRIAL: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 83 INDUSTRIAL: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 84 INDUSTRIAL: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2022-2027 (USD MILLION)

- TABLE 85 INDUSTRIAL: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 86 INDUSTRIAL: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2022-2027 (USD THOUSAND)

- 8.6.1 NON-VOLATILE MEMORY USED FOR DATA BACKUP AND FASTER READ/WRITE OPERATIONS

- 8.7 TELECOMMUNICATION

- 8.7.1 ADVENT OF 5G TO GENERATE DEMAND FOR EMERGING NVM

- 8.7.1.1 Use case: Cybersecurity & networking

- TABLE 87 TELECOMMUNICATION: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 88 TELECOMMUNICATION: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 89 TELECOMMUNICATION: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 90 TELECOMMUNICATION: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2022-2027 (USD MILLION)

- TABLE 91 TELECOMMUNICATION: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 92 TELECOMMUNICATION: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2022-2027 (USD MILLION)

- 8.7.1 ADVENT OF 5G TO GENERATE DEMAND FOR EMERGING NVM

- 8.8 ENERGY & POWER

- 8.8.1 FLASH MEMORY USED WIDELY IN ENERGY AND POWER APPLICATIONS

- 8.8.1.1 Use case: Smart grid

- 8.8.1.2 Use case: Smart metering

- 8.8.1.3 Use case: Solar and wind applications

- TABLE 93 ENERGY & POWER: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 94 ENERGY & POWER: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 95 ENERGY & POWER: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 96 ENERGY & POWER: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2022-2027 (USD MILLION)

- TABLE 97 ENERGY & POWER: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 98 ENERGY & POWER: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2022-2027 (USD THOUSAND)

- 8.8.1 FLASH MEMORY USED WIDELY IN ENERGY AND POWER APPLICATIONS

- 8.9 HEALTHCARE

- 8.9.1 EMERGENCE OF DATA-DRIVEN DIAGNOSIS TO CREATE DEMAND FOR NVM

- 8.9.1.1 Use case: Pacemakers

- 8.9.1.2 Use case: Heart rate monitors and health monitoring devices

- TABLE 99 HEALTHCARE: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 100 HEALTHCARE: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 101 HEALTHCARE: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 102 HEALTHCARE: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2022-2027 (USD MILLION)

- TABLE 103 HEALTHCARE: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 104 HEALTHCARE: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2022-2027 (USD MILLION)

- 8.9.1 EMERGENCE OF DATA-DRIVEN DIAGNOSIS TO CREATE DEMAND FOR NVM

- 8.10 AGRICULTURE

- 8.10.1 HEIGHTENED FOCUS ON MONITORING AND ANALYSIS IN AGRICULTURE TO GENERATE DEMAND FOR NVM

- 8.10.1.1 Use case: Field/crop management

- 8.10.1.2 Use case: Soil analysis/monitoring

- TABLE 105 AGRICULTURE: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 106 AGRICULTURE: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 107 AGRICULTURE: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2018-2021 (USD MILLION)

- TABLE 108 AGRICULTURE: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2022-2027 (USD MILLION)

- TABLE 109 AGRICULTURE: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 110 AGRICULTURE: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2022-2027 (USD THOUSAND)

- 8.10.1 HEIGHTENED FOCUS ON MONITORING AND ANALYSIS IN AGRICULTURE TO GENERATE DEMAND FOR NVM

- 8.11 RETAIL

- 8.11.1 RETAIL SEGMENT TO BE DRIVEN BY DIGITAL TRANSFORMATION

- 8.11.1.1 Use case: Inventory management

- TABLE 111 RETAIL: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 112 RETAIL: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 113 RETAIL: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 114 RETAIL: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2022-2027 (USD THOUSAND)

- TABLE 115 RETAIL: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 116 RETAIL: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2022-2027 (USD THOUSAND)

- 8.11.1 RETAIL SEGMENT TO BE DRIVEN BY DIGITAL TRANSFORMATION

9 NON-VOLATILE MEMORY MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 45 NON-VOLATILE MEMORY MARKET IN ASIA PACIFIC TO GROW AT SIGNIFICANT PACE FROM 2022 TO 2027

- TABLE 117 NON-VOLATILE MEMORY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 118 NON-VOLATILE MEMORY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 46 NORTH AMERICA: NON-VOLATILE MEMORY MARKET SNAPSHOT

- 9.2.1 US

- 9.2.1.1 Surge in enterprise storage applications to support market

- 9.2.2 CANADA

- 9.2.2.1 Close ties with US to pivot NVM market growth in Canada

- 9.2.3 MEXICO

- 9.2.3.1 Focus on improving semiconductor production capability to boost market

- TABLE 119 NORTH AMERICA: NON-VOLATILE MEMORY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 120 NORTH AMERICA: NON-VOLATILE MEMORY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.3 EUROPE

- FIGURE 47 EUROPE: NON-VOLATILE MEMORY MARKET SNAPSHOT

- 9.3.1 GERMANY

- 9.3.1.1 Growth of end user industries to accelerate market growth

- 9.3.2 UK

- 9.3.2.1 High consumption of non-volatile memory to drive market

- 9.3.3 FRANCE

- 9.3.3.1 High demand from enterprise storage segment to foster market growth

- 9.3.4 REST OF EUROPE

- TABLE 121 EUROPE: NON-VOLATILE MEMORY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 122 EUROPE: NON-VOLATILE MEMORY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: NON-VOLATILE MEMORY MARKET SNAPSHOT

- 9.4.1 CHINA

- 9.4.1.1 Government support for R&D of non-volatile memory technologies to back market growth

- 9.4.2 JAPAN

- 9.4.2.1 Presence of memory and digital device manufacturers to favor market

- 9.4.3 INDIA

- 9.4.3.1 Focus on domestic production of semiconductors to augment market growth

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Presence of established consumer electronics industry to support market expansion

- 9.4.5 REST OF ASIA PACIFIC

- TABLE 123 ASIA PACIFIC: NON-VOLATILE MEMORY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 124 ASIA PACIFIC: NON-VOLATILE MEMORY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.5 REST OF THE WORLD

- TABLE 125 REST OF THE WORLD: NON-VOLATILE MEMORY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 126 REST OF THE WORLD: NON-VOLATILE MEMORY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.1.1 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

- TABLE 127 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

- 10.2 NON-VOLATILE MEMORY MARKET: REVENUE ANALYSIS

- FIGURE 49 THREE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN NON-VOLATILE MEMORY MARKET

- 10.3 MARKET SHARE ANALYSIS (2021)

- TABLE 128 NON-VOLATILE MEMORY MARKET: MARKET SHARE ANALYSIS

- 10.4 COMPANY EVALUATION QUADRANT, 2021

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE PLAYERS

- 10.4.4 PARTICIPANTS

- FIGURE 50 NON-VOLATILE MEMORY MARKET (GLOBAL): KEY COMPANY EVALUATION QUADRANT, 2021

- 10.4.5 COMPETITIVE BENCHMARKING

- TABLE 129 NON-VOLATILE MEMORY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 130 NON-VOLATILE MEMORY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- FIGURE 51 NON-VOLATILE MEMORY MARKET (GLOBAL), SME EVALUATION QUADRANT, 2021

- TABLE 131 NON-VOLATILE MEMORY MARKET: COMPANY FOOTPRINT

- TABLE 132 NON-VOLATILE MEMORY MARKET: TYPE FOOTPRINT

- TABLE 133 NON-VOLATILE MEMORY MARKET: END USER FOOTPRINT

- TABLE 134 NON-VOLATILE MEMORY MARKET: REGION FOOTPRINT

- 10.6 COMPETITIVE SCENARIOS AND TRENDS

- 10.6.1 PRODUCT LAUNCHES

- TABLE 135 NON-VOLATILE MEMORY MARKET: PRODUCT LAUNCHES, JUNE 2018-SEPTEMBER 2022

- 10.6.2 DEALS

- TABLE 136 NON-VOLATILE MEMORY MARKET: DEALS, MAY 2018-SEPTEMBER 2022

- 10.6.3 OTHERS

- TABLE 137 NON-VOLATILE MEMORY MARKET: OTHERS, DECEMBER 2020-OCTOBER 2022

11 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 11.1 KEY PLAYERS

- 11.1.1 SAMSUNG

- TABLE 138 SAMSUNG: COMPANY OVERVIEW

- FIGURE 52 SAMSUNG: COMPANY SNAPSHOT

- TABLE 139 SAMSUNG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 140 SAMSUNG: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 141 SAMSUNG: DEALS

- TABLE 142 SAMSUNG: OTHERS

- 11.1.2 WESTERN DIGITAL TECHNOLOGIES, INC.

- TABLE 143 WESTERN DIGITAL TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 53 WESTERN DIGITAL TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 144 WESTERN DIGITAL TECHNOLOGIES, INC.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 145 WESTERN DIGITAL TECHNOLOGIES, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 146 WESTERN DIGITAL TECHNOLOGIES, INC.: DEALS

- TABLE 147 WESTERN DIGITAL TECHNOLOGIES, INC.: OTHERS

- 11.1.3 KIOXIA HOLDINGS CORPORATION

- TABLE 148 KIOXIA HOLDINGS CORPORATION: COMPANY OVERVIEW

- FIGURE 54 KIOXIA HOLDINGS CORPORATION: COMPANY SNAPSHOT

- TABLE 149 KIOXIA HOLDINGS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 150 KIOXIA HOLDINGS CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 151 KIOXIA HOLDINGS CORPORATION: DEALS

- TABLE 152 KIOXIA HOLDINGS CORPORATION: OTHERS

- 11.1.4 MICRON TECHNOLOGY, INC.

- TABLE 153 MICRON TECHNOLOGY, INC.: COMPANY OVERVIEW

- FIGURE 55 MICRON TECHNOLOGY, INC.: COMPANY SNAPSHOT

- TABLE 154 MICRON TECHNOLOGY, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 155 MICRON TECHNOLOGY, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 156 MICRON TECHNOLOGY, INC.: OTHERS

- 11.1.5 SK HYNIX INC.

- TABLE 157 SK HYNIX INC.: COMPANY OVERVIEW

- FIGURE 56 SK HYNIX INC.: COMPANY SNAPSHOT

- TABLE 158 SK HYNIX INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 159 SK HYNIX INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 160 SK HYNIX INC.: DEALS

- 11.1.6 MICROCHIP TECHNOLOGY INC.

- TABLE 161 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- FIGURE 57 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- TABLE 162 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 163 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- 11.1.7 ROHM CO., LTD.

- TABLE 164 ROHM CO., LTD.: COMPANY OVERVIEW

- FIGURE 58 ROHM CO., LTD.: COMPANY SNAPSHOT

- TABLE 165 ROHM CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.8 RENESAS ELECTRONICS CORPORATION

- TABLE 166 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- FIGURE 59 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- TABLE 167 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.9 STMICROELECTRONICS

- TABLE 168 STMICROELECTRONICS: COMPANY OVERVIEW

- FIGURE 60 STMICROELECTRONICS: COMPANY SNAPSHOT

- TABLE 169 STMICROELECTRONICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 170 STMICROELECTRONICS: PRODUCT LAUNCHES

- 11.1.10 INFINEON TECHNOLOGIES AG

- TABLE 171 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- FIGURE 61 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- TABLE 172 INFINEON TECHNOLOGIES AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 173 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES AND DEVELOPMENTS

- 11.1.11 NANTERO, INC.

- TABLE 174 NANTERO, INC.: COMPANY OVERVIEW

- TABLE 175 NANTERO, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 176 NANTERO, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- 11.1.12 CROSSBAR, INC.

- TABLE 177 CROSSBAR, INC.: COMPANY OVERVIEW

- TABLE 178 CROSSBAR, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 179 CROSSBAR, INC.: DEALS

- 11.1.13 EVERSPIN TECHNOLOGIES INC.

- TABLE 180 EVERSPIN TECHNOLOGIES INC.: COMPANY OVERVIEW

- FIGURE 62 EVERSPIN TECHNOLOGIES INC.: COMPANY SNAPSHOT

- TABLE 181 EVERSPIN TECHNOLOGIES INC.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 182 EVERSPIN TECHNOLOGIES INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 183 EVERSPIN TECHNOLOGIES INC.: DEALS

- TABLE 184 EVERSPIN TECHNOLOGIES INC.: OTHERS

- 11.1.14 WINBOND

- TABLE 185 WINBOND: COMPANY OVERVIEW

- FIGURE 63 WINBOND: COMPANY SNAPSHOT

- TABLE 186 WINBOND: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 187 WINBOND: PRODUCT LAUNCHES AND DEVELOPMENTS

- 11.1.15 PURE STORAGE, INC.

- TABLE 188 PURE STORAGE, INC.: COMPANY OVERVIEW

- FIGURE 64 PURE STORAGE, INC.: COMPANY SNAPSHOT

- TABLE 189 PURE STORAGE, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 FUJITSU

- 11.2.2 VIKING TECHNOLOGY

- 11.2.3 NVMDURANCE

- 11.2.4 AVALANCHE TECHNOLOGY

- 11.2.5 SMART MODULAR TECHNOLOGIES

- 11.2.6 FLEXXON PTE LTD

- 11.2.7 YMTC

- 11.2.8 ATP ELECTRONICS, INC.

- 11.2.9 HT MICRON

- 11.2.10 SKYHIGH MEMORY LIMITED

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS