|

|

市場調査レポート

商品コード

1121217

ワイヤレス接続の世界市場:接続(Wi-Fi、Bluetooth Classic、Bluetooth 4X、Bluetooth 5X、ZigBee、Z-Wave、UWB、NFC、Thread、GNSS、セルラー、EnOcean、Sigfox、LoRa、LTE Cat-M1、NB-IoT)、最終用途、地域別 - 2027年までの予測Wireless Connectivity Market by Connectivity (Wi-Fi, Bluetooth Classic, Bluetooth 4X, Bluetooth 5X, ZigBee, Z-Wave, UWB, NFC, Thread, GNSS, Cellular, EnOcean, Sigfox, LoRa, LTE Cat-M1, NB-IoT), End-use and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ワイヤレス接続の世界市場:接続(Wi-Fi、Bluetooth Classic、Bluetooth 4X、Bluetooth 5X、ZigBee、Z-Wave、UWB、NFC、Thread、GNSS、セルラー、EnOcean、Sigfox、LoRa、LTE Cat-M1、NB-IoT)、最終用途、地域別 - 2027年までの予測 |

|

出版日: 2022年08月23日

発行: MarketsandMarkets

ページ情報: 英文 285 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のワイヤレス接続の市場規模は、2022年から2027年にかけてCAGR12.8%で成長し、2027年には1,993億米ドルに達すると予測されます。

本レポートでは、ワイヤレス接続市場における主要アプリケーションであるウェアラブルデバイス、ヘルスケア、家電、ビルディングオートメーション、自動車・輸送、その他を対象としています。ワイヤレス接続の導入におけるWi-Fi接続タイプは、2021年の市場で約21.3%という圧倒的なシェアを占めています。

"エンドユース別では、ヘルスケア分野の市場が予測期間中に最も高いペースで成長すると予想される"

日常生活の計測やバイタルデータの収集が可能な医療機器、救急病院でのセンサー、これらを統合したデータ分析ツールは、ヘルスケアシステムの進化に伴い重要性を増すと予想されます。糖尿病、高血圧、不整脈、心不全などの慢性疾患の増加により、特にコンシューマーヘルスや予防医療が注目される中、ワイヤレス技術を機器に組み込むことで成長機会が期待されます。商業的に広く利用されている製品は少ないもの、多くのデバイスが発売の初期段階にあり、将来の医療アプリケーションについて何らかの示唆を与えてくれる可能性があります。

"北米地域は、予測期間中、ワイヤレス接続市場で健全な成長を遂げると予想される"

この地域は技術革新の拠点であり、新技術をいち早く採用する地域です。この地域には大手企業が多く存在し、コネクテッドテクノロジーに対する高い需要があり、革新的なデバイスの利用が増加していることから、検討期間中に北米市場の成長を促進すると予想されます。この地域には、ワイヤレス接続市場においてIntel(米国)、Qualcomm(米国)、Texas Instruments(米国)などの大企業が進出しており、重要な市場となっています。IoTおよび関連技術の分野における研究開発への支出が増加していることが、北米におけるより優れたワイヤレス接続技術へのニーズを後押ししています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- ワイヤレス接続ASP分析

- 技術分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- 貿易分析

- 特許分析

- 規制状況と規制の状況

第6章 ワイヤレス接続市場:接続技術別

- イントロダクション

- WI-FI

- Bluetooth Classic

- Bluetooth 4X

- Bluetooth 5X

- ZigBee

- Z-WAVE

- Thread

- NFC

- GNSS

- ENOCEAN

- セルラー

- 2G

- 3G

- 4G+

- 5G

- UWB

- LORA

- Sigfox

- NB-IOT

- LTE CAT M1

- その他

第7章 ワイヤレス接続市場:タイプ別

- イントロダクション

- ワイヤレスローカルエリアネットワーク

- ワイヤレスパーソナルエリアネットワーク

- 衛星

- 低電力広域ネットワーク

- セルラー

第8章 ワイヤレス接続市場:最終用途別

- イントロダクション

- ウェアラブルデバイス

- ヘルスケア

- 家電

- ビルの自動化

- 自動車と輸送

- その他

第9章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- フランス

- ドイツ

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- 韓国

- その他

- その他の地域

- 中東・アフリカ

- 南米

第10章 競合情勢

- 概要

- 収益分析

- 市場シェア分析(2021)

- 企業評価クアドラント(2021)

- 中小企業評価クアドラント2021)

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- INTEL CORPORATION

- TEXAS INSTRUMENTS

- QUALCOMM TECHNOLOGIES, INC.

- BROADCOM

- STMICROELECTRONICS

- その他の企業

- NXP SEMICONDUCTORS

- MICROCHIP TECHNOLOGY INC.

- MEDIATEK INC.

- INFINEON TECHNOLOGIES AG

- RENESAS ELECTRONICS CORPORATION

- NEXCOM INTERNATIONAL CO., LTD.

- SKYWORKS SOLUTIONS INC.

- MURATA MANUFACTURING CO., LTD.

- NORDIC SEMICONDUCTOR

- SEMTECH

- イノベーター

- ENOCEAN GMBH

- ESPRESSIF SYSTEMS(SHANGHAI)CO., LTD.

- CEVA, INC.

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- PERASO TECHNOLOGIES INC.

- PANASONIC HOLDINGS CORPORATION

- BEHR TECHNOLOGIES INC.

- MEIG SMART TECHNOLOGY

- NEOWAY TECHNOLOGY

- XIAMEN CHEERZING IOT TECHNOLOGY CO., LTD

第12章 付録

The wireless connectivity market is projected to reach USD 199.3 billion by 2027, growing at a CAGR of 12.8% from 2022 to 2027. This report covers key applications, namely, wearable devices, healthcare, consumer electronics, building automation, automotive & transportation, and others in wireless connectivity market. The Wi-Fi connectivity type in deploying wireless connectivity accounted for a whopping share of about 21.3% of the market in 2021.

"By end use, the market for healthcare segment is expected to grow at highest pace during the forecast period"

Medical devices that can measure daily routines and collect vital data, sensors in emergency rooms, and data analytics tools that integrate all these are expected to gain importance with the evolution of healthcare systems. The increasing prevalence of chronic diseases such as diabetes, hypertension, cardiac arrhythmias, and heart failure is expected to offer growth opportunities for wireless technologies to be integrated into devices, particularly as consumer health and preventive medicine are gaining greater prominence. While a few products have wide commercial use, a number of devices are in the early stages of launch and may offer some insights into future medical applications.

"North America region is expected to grow at healthy rate in the Wireless Connectivity market during the forecast period."

The region is a hub for technological innovations and an early adopter of new technologies. The large presence of major companies in the region, high demand for connected technologies, and increased use of innovative devices are expected to drive the growth of the North American market during the review period. This region is a key market as it is home to some of the largest companies such as Intel (US), Qualcomm (US), and Texas Instruments (US) in the wireless connectivity market. The increased spending on research and development in the field of IoT and related technologies is driving the need for better wireless connectivity technologies in North America.

Break-up of the profiles of primary participants:

- By Company Type -Tier 1 - 27%, Tier 2 - 41%, and Tier 3 - 32%

- By Designation - C-level - 26%, Director-level - 40%, and, Other - 34%

- By Region- North America - 47%, Europe - 28%, APAC - 19%, and RoW - 8%

The key players operating in the Wireless Connectivity market include are Intel Corporation (US), Texas Instruments Incorporated (US), Qualcomm Incorporated (US), Broadcom (US), STMicroelectronics N.V. (Switzerland), NXP Semiconductors N.V. (Netherlands), Microchip Technology Inc. (US), MediaTek Inc. (Taiwan), and Renesas Electronics Corporation (Japan). Infineon Technologies AG (Germany), EnOcean (Germany), Nexcom International Co., Ltd. (Taiwan), Skyworks Solutions, Inc. (US), Murata Manufacturing Co., Ltd. (Japan), Nordic Semiconductor (Norway), Expressif Systems (China), CEVA, Inc. (US), Peraso Technologies, Inc. (Canada), Panasonic Corporation (Japan), BehrTech (Canada), Skyworks Solutions, Inc. (US), Semtech (US), MeiG Smart Technology Co., Ltd. (China), Neoway Technology (China), and XIAMEN CHEERZING IoT Technology Co., Ltd. (China).The wireless connectivity market has been segmented into connectivity technology, type, end-use, and region.

Based on connectivity type the Wireless Connectivity market has been segmented by WI-Fi, Bluetooth Classic, Bluetooth 4X, Bluetooth 5X, ZigBee, Z-Wave, UWB, NFC, Thread, GNSS, Cellular, EnOcean, Sigfox, LoRa, LTE Cat-M1, NB-IoT, and Others. Based on end use the Wireless Connectivity market has been segmented by Wearable Devices, Healthcare, Consumer Electronics, Building Automation, Automotive & Transportation, and Others. Based on region the Wireless Connectivity market has been segmented by North America, Europe, Asia Pacific, and Rest of the World.

- Illustrative segmentation, analysis, and forecast of the market based on connectivity technology, type, end use, and region have been conducted to give an overall view of the Wireless Connectivity market.

- A value chain analysis has been performed to provide in-depth insight into the Wireless Connectivity market.

- The key drivers, restraints, opportunities, and challenges pertaining to the Wireless Connectivity market have been detailed in this report.

- The report includes a detailed competitive landscape of the market, along with key players, as well as in-depth analysis of their revenues

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- FIGURE 1 MARKETS COVERED

- 1.3.1 GEOGRAPHIC SCOPE

- FIGURE 2 WIRELESS CONNECTIVITY MARKET: REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- FIGURE 3 WIRELESS CONNECTIVITY MARKET: FORECAST YEARS

- 1.4 CURRENCY CONSIDERED

- 1.5 PACKAGE SIZE

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 4 WIRELESS CONNECTIVITY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 PROCESS FLOW OF MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- 3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

- FIGURE 9 LPWAN-ENABLED CONNECTIVITY TYPE SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

- FIGURE 10 CELLULAR SEGMENT TO GENERATE HIGHEST MARKET OPPORTUNITY FROM 2022 TO 2027

- FIGURE 11 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC TO EXHIBIT HIGHEST CAGR BETWEEN 2022 AND 2027

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WIRELESS CONNECTIVITY MARKET, 2022-2027 (USD BILLION)

- FIGURE 12 INCREASING DEMAND FOR WIRELESS SENSOR NETWORKS FOR DEVELOPING SMART INFRASTRUCTURE IS DRIVING GROWTH OF WIRELESS CONNECTIVITY MARKET

- 4.2 WIRELESS CONNECTIVITY MARKET, BY END-USE

- FIGURE 13 CONSUMER ELECTRONICS SEGMENT HELD LARGEST SHARE OF WIRELESS CONNECTIVITY MARKET IN 2022

- 4.3 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY CONNECTIVITY TECHNOLOGY AND COUNTRY

- FIGURE 14 CELLULAR TECHNOLOGY AND CHINA ARE LARGEST SHAREHOLDERS OF WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC IN 2022

- 4.4 WIRELESS CONNECTIVITY MARKET, BY REGION

- FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 MARKET DYNAMICS: WIRELESS CONNECTIVITY MARKET

- 5.2.1 DRIVERS

- FIGURE 17 WIRELESS CONNECTIVITY MARKET DRIVERS AND THEIR IMPACT

- 5.2.1.1 Increasing demand for wireless sensors to develop smart infrastructure

- 5.2.1.2 Growing internet penetration rate

- FIGURE 18 GLOBAL MACHINE-TO-MACHINE CONNECTIONS FROM 2018 TO 2025 (BILLION UNITS)

- FIGURE 19 GLOBAL IOT CONNECTIONS, 2020 & 2026 (BILLION UNITS)

- 5.2.1.3 Surging adoption of Internet of Things

- FIGURE 20 GLOBAL IOT-CONNECTED DEVICES, 2015-2025

- 5.2.1.4 Rising demand for low-power wide-area networks in IoT applications

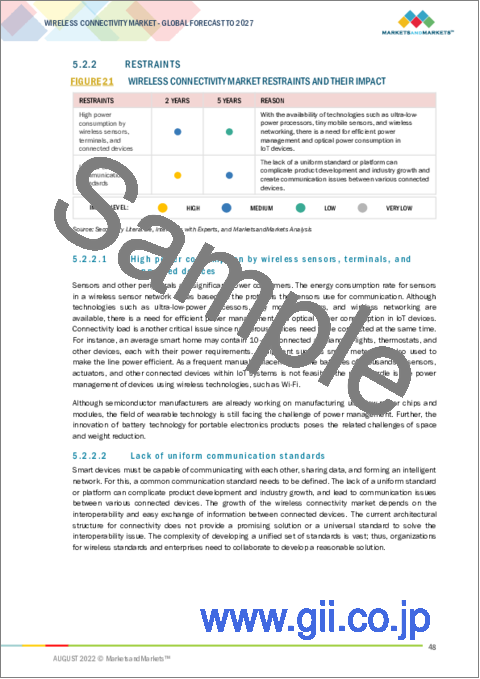

- 5.2.2 RESTRAINTS

- FIGURE 21 WIRELESS CONNECTIVITY MARKET RESTRAINTS AND THEIR IMPACT

- 5.2.2.1 High power consumption by wireless sensors, terminals, and connected devices

- 5.2.2.2 Lack of uniform communication standards

- 5.2.3 OPPORTUNITIES

- FIGURE 22 WIRELESS CONNECTIVITY MARKET OPPORTUNITIES AND THEIR IMPACT

- 5.2.3.1 Development of 5G network, particularly in automotive sector

- FIGURE 23 GLOBAL VEHICLE PRODUCTION, 2017-2021 (MILLION UNITS)

- 5.2.3.2 Significant financial support from governments worldwide for R&D in Internet of Things

- TABLE 1 GOVERNMENT FUNDING PLANS FOR INTERNET OF THINGS

- 5.2.3.3 Growing need for cross-domain applications

- 5.2.4 CHALLENGES

- FIGURE 24 WIRELESS CONNECTIVITY MARKET CHALLENGES AND THEIR IMPACT

- 5.2.4.1 Increasing privacy and security concerns in the age of IoT

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS OF WIRELESS CONNECTIVITY ECOSYSTEM: SOLUTION & PLATFORM PROVIDERS ADD MAXIMUM VALUE

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 26 WIRELESS CONNECTIVITY MARKET: ECOSYSTEM

- TABLE 2 WIRELESS CONNECTIVITY ECOSYSTEM

- 5.5 WIRELESS CONNECTIVITY ASP ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 COMPLEMENTARY TECHNOLOGY

- 5.6.1.1 Message queuing telemetry transport

- 5.6.2 ADJACENT TECHNOLOGY

- 5.6.2.1 5G

- 5.6.1 COMPLEMENTARY TECHNOLOGY

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 WIRELESS CONNECTIVITY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 HEALTHCARE

- 5.8.2 BUILDING AUTOMATION

- 5.8.3 RETAIL

- 5.9 TRADE ANALYSIS

- TABLE 4 EXPORT DATA FOR HS CODE 851769 FOR TOP COUNTRIES, 2017-2021 (THOUSAND USD)

- FIGURE 27 EXPORT DATA FOR HS CODE 851769 FOR TOP COUNTRIES, 2017-2021 (THOUSAND UNITS)

- TABLE 5 IMPORT DATA FOR HS CODE 851769 FOR TOP COUNTRIES, 2017-2021 (THOUSAND USD)

- FIGURE 28 IMPORT DATA FOR HS CODE 851769 FOR TOP COUNTRIES, 2017-2021 (THOUSAND UNITS)

- 5.10 PATENT ANALYSIS

- FIGURE 29 WIRELESS CONNECTIVITY: PATENT ANALYSIS

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 REGULATORY LANDSCAPE

- 5.11.2 TARIFF

- TABLE 6 TARIFF FOR ELECTRONIC-INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY US, 2020

- TABLE 7 TARIFF FOR ELECTRONIC-INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY CHINA, 2020

- TABLE 8 TARIFF FOR ELECTRONIC-INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY GERMANY, 2020

6 WIRELESS CONNECTIVITY MARKET, BY CONNECTIVITY TECHNOLOGY

- 6.1 INTRODUCTION

- FIGURE 30 NB-IOT TECHNOLOGY SEGMENT TO EXHIBIT HIGHEST CAGR IN WIRELESS CONNECTIVITY MARKET, IN TERMS OF VOLUME, FROM 2022 TO 2027

- TABLE 9 WIRELESS CONNECTIVITY MARKET, BY CONNECTIVITY TECHNOLOGY, 2018-2021 (MILLION UNITS)

- TABLE 10 WIRELESS CONNECTIVITY MARKET, BY CONNECTIVITY TECHNOLOGY, 2022-2027 (MILLION UNITS)

- 6.2 WI-FI

- TABLE 11 WIRELESS CONNECTIVITY MARKET FOR WI-FI TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 12 WIRELESS CONNECTIVITY MARKET FOR WI-FI TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 13 WIRELESS CONNECTIVITY MARKET FOR WI-FI TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 14 WIRELESS CONNECTIVITY MARKET FOR WI-FI TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1 WI-FI, BY BAND

- 6.2.1.1 Single band

- 6.2.1.1.1 Overlapping channels with limited capacity

- 6.2.1.2 Dual band

- 6.2.1.2.1 High data rate applications such as video streaming and gaming

- 6.2.1.3 Tri band

- 6.2.1.3.1 High data transfer rate with negligible congestion

- 6.2.1.1 Single band

- TABLE 15 WIRELESS CONNECTIVITY MARKET FOR WI-FI TECHNOLOGY, BY BAND, 2018-2021 (MILLION UNITS)

- TABLE 16 WIRELESS CONNECTIVITY MARKET FOR WI-FI TECHNOLOGY, BY BAND, 2022-2027 (MILLION UNITS)

- 6.3 BLUETOOTH CLASSIC

- 6.3.1 USED TO TRANSFER DATA OVER SHORT DISTANCES

- TABLE 17 WIRELESS CONNECTIVITY MARKET FOR BLUETOOTH CLASSIC TECHNOLOGY, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 18 WIRELESS CONNECTIVITY MARKET FOR BLUETOOTH CLASSIC TECHNOLOGY, BY REGION, 2018-2022 (USD MILLION)

- 6.4 BLUETOOTH 4X

- 6.4.1 OPTIMIZED VERSION OF PROPRIETARY WIRELESS BLUETOOTH TECHNOLOGY

- TABLE 19 WIRELESS CONNECTIVITY MARKET FOR BLUETOOTH 4X TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 20 WIRELESS CONNECTIVITY MARKET FOR BLUETOOTH 4X TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 21 WIRELESS CONNECTIVITY MARKET FOR BLUETOOTH 4X TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 22 WIRELESS CONNECTIVITY MARKET FOR BLUETOOTH 4X TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.5 BLUETOOTH 5X

- 6.5.1 USED IN WIRELESS HEADPHONES AND OTHER AUDIO HARDWARE

- TABLE 23 WIRELESS CONNECTIVITY MARKET FOR BLUETOOTH 5X TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 24 WIRELESS CONNECTIVITY MARKET FOR BLUETOOTH 5X TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 25 WIRELESS CONNECTIVITY MARKET FOR BLUETOOTH 5X TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 26 WIRELESS CONNECTIVITY MARKET FOR BLUETOOTH 5X TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.6 ZIGBEE

- 6.6.1 PERSONAL AREA NETWORKS WITH SMALL AND LOW-POWER DIGITAL RADIOS

- TABLE 27 WIRELESS CONNECTIVITY MARKET FOR ZIGBEE TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 28 WIRELESS CONNECTIVITY MARKET FOR ZIGBEE TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 29 WIRELESS CONNECTIVITY MARKET FOR ZIGBEE TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 WIRELESS CONNECTIVITY MARKET FOR ZIGBEE TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.7 Z-WAVE

- 6.7.1 USED TO CREATE WIRELESS MESH NETWORK

- TABLE 31 WIRELESS CONNECTIVITY MARKET FOR Z-WAVE TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 32 WIRELESS CONNECTIVITY MARKET FOR Z-WAVE TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 33 WIRELESS CONNECTIVITY MARKET FOR Z-WAVE TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 34 WIRELESS CONNECTIVITY MARKET FOR Z-WAVE TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.8 THREAD

- 6.8.1 IPV6-BASED MESH NETWORKING PROTOCOL

- TABLE 35 WIRELESS CONNECTIVITY MARKET FOR THREAD TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 36 WIRELESS CONNECTIVITY MARKET FOR THREAD TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 37 WIRELESS CONNECTIVITY MARKET FOR THREAD TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 WIRELESS CONNECTIVITY MARKET FOR THREAD TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.9 NEAR-FIELD COMMUNICATIONS

- 6.9.1 ENABLES COMMUNICATION BETWEEN DEVICES WHEN PLACED IN PROXIMITY

- TABLE 39 WIRELESS CONNECTIVITY MARKET FOR NFC TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 40 WIRELESS CONNECTIVITY MARKET FOR NFC TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 41 WIRELESS CONNECTIVITY MARKET FOR NFC TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 WIRELESS CONNECTIVITY MARKET FOR NFC TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.10 GLOBAL NAVIGATION SATELLITE SYSTEMS

- 6.10.1 POPULAR TECHNOLOGY FOR MOBILITY

- TABLE 43 WIRELESS CONNECTIVITY MARKET FOR GNSS TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 44 WIRELESS CONNECTIVITY MARKET FOR GNSS TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 45 WIRELESS CONNECTIVITY MARKET FOR GNSS TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 46 WIRELESS CONNECTIVITY MARKET FOR GNSS TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

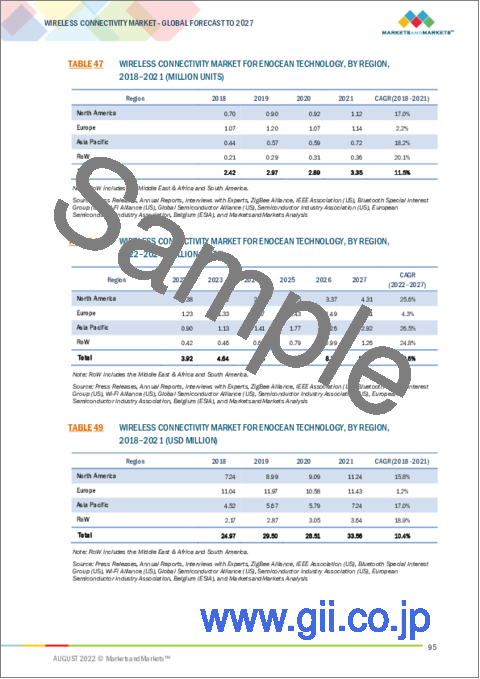

- 6.11 ENOCEAN

- 6.11.1 USED FOR WIRELESS SENSORS, CONTROLLERS, AND GATEWAYS

- TABLE 47 WIRELESS CONNECTIVITY MARKET FOR ENOCEAN TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 48 WIRELESS CONNECTIVITY MARKET FOR ENOCEAN TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 49 WIRELESS CONNECTIVITY MARKET FOR ENOCEAN TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 50 WIRELESS CONNECTIVITY MARKET FOR ENOCEAN TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.12 CELLULAR

- 6.12.1 WIRELESS NETWORKS DISTRIBUTED OVER LAND AREAS CALLED CELLS

- 6.12.2 2G

- 6.12.3 3G

- 6.12.4 4G+

- 6.12.5 5G

- TABLE 51 WIRELESS CONNECTIVITY MARKET FOR CELLULAR TECHNOLOGY, BY TECHNOLOGY, 2018-2021 (MILLION UNITS)

- TABLE 52 WIRELESS CONNECTIVITY MARKET FOR CELLULAR TECHNOLOGY, BY TECHNOLOGY, 2022-2027 (MILLION UNITS)

- TABLE 53 WIRELESS CONNECTIVITY MARKET FOR CELLULAR TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 54 WIRELESS CONNECTIVITY MARKET FOR CELLULAR TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 55 WIRELESS CONNECTIVITY MARKET FOR CELLULAR TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 56 WIRELESS CONNECTIVITY MARKET FOR CELLULAR TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.13 UWB

- 6.13.1 IDEAL FOR SHORT-RANGE DATA TRANSMISSION

- TABLE 57 WIRELESS COMMUNICATION MARKET FOR UWB TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 58 WIRELESS COMMUNICATION MARKET FOR UWB TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 59 WIRELESS CONNECTIVITY MARKET FOR UWB TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 60 WIRELESS CONNECTIVITY MARKET FOR UWB TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.14 LORA

- 6.14.1 LONG-RANGE, LOW-POWER WIRELESS PLATFORM

- TABLE 61 WIRELESS CONNECTIVITY MARKET FOR LORA TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 62 WIRELESS CONNECTIVITY MARKET FOR LORA TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 63 WIRELESS CONNECTIVITY MARKET FOR LORA TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 64 WIRELESS CONNECTIVITY MARKET FOR LORA TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.15 SIGFOX

- 6.15.1 LOW-POWER WIDE-AREA NETWORK COVERAGE

- TABLE 65 WIRELESS CONNECTIVITY MARKET FOR SIGFOX TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 66 WIRELESS CONNECTIVITY MARKET FOR SIGFOX TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 67 WIRELESS CONNECTIVITY MARKET FOR SIGFOX TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 68 WIRELESS CONNECTIVITY MARKET FOR SIGFOX TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.16 NB-IOT

- 6.16.1 LOW COST, WIDE COVERAGE, AND LONG BATTERY LIFE

- TABLE 69 WIRELESS CONNECTIVITY MARKET FOR NB- IOT TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 70 WIRELESS CONNECTIVITY MARKET FOR NB-IOT TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 71 WIRELESS CONNECTIVITY MARKET FOR NB-IOT TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 72 WIRELESS CONNECTIVITY MARKET FOR NB-IOT TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.17 LTE CAT M1

- 6.17.1 LONGER BATTERY LIFE, EXTENDED RANGE, AND DEEP PENETRATION IN BUILDINGS AND BASEMENTS

- TABLE 73 WIRELESS CONNECTIVITY MARKET FOR LTE-CAT M1 TECHNOLOGY, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 74 WIRELESS CONNECTIVITY MARKET FOR LTE-CAT M1 TECHNOLOGY, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 75 WIRELESS CONNECTIVITY MARKET FOR LTE-CAT M1 TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 76 WIRELESS CONNECTIVITY MARKET FOR LTE-CAT M1 TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 6.18 OTHERS

- TABLE 77 WIRELESS CONNECTIVITY MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 78 WIRELESS CONNECTIVITY MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 79 WIRELESS CONNECTIVITY MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2018-2021 (USD MILLION)

- TABLE 80 WIRELESS CONNECTIVITY MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2022-2027 (USD MILLION)

7 WIRELESS CONNECTIVITY MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 31 WPAN-ENABLED CHIPSETS SEGMENT TO HOLD LARGEST SHARE OF WIRELESS CONNECTIVITY MARKET FROM 2022 TO 2027

- TABLE 81 WIRELESS CONNECTIVITY MARKET, BY TYPE, 2018-2021 (MILLION UNITS)

- TABLE 82 WIRELESS CONNECTIVITY MARKET, BY TYPE, 2022-2027 (MILLION UNITS)

- TABLE 83 WIRELESS CONNECTIVITY MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 84 WIRELESS CONNECTIVITY MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.2 WIRELESS LOCAL AREA NETWORK

- 7.2.1 EXPONENTIAL GROWTH IN BANDWIDTH AND HIGHER THROUGHPUT

- TABLE 85 WIRELESS CONNECTIVITY MARKET FOR WLAN, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 86 WIRELESS CONNECTIVITY MARKET FOR WLAN, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 87 WIRELESS CONNECTIVITY MARKET FOR WLAN, BY REGION, 2018-2021 (USD MILLION)

- TABLE 88 WIRELESS CONNECTIVITY MARKET FOR WLAN, BY REGION, 2022-2027 (USD MILLION)

- 7.3 WIRELESS PERSONAL AREA NETWORK

- 7.3.1 HIGH ADOPTION OF WPAN TECHNOLOGY ATTRIBUTED TO ITS LOW COST, FLEXIBILITY, SECURITY, AND EASE OF USE

- TABLE 89 WIRELESS CONNECTIVITY MARKET FOR WPAN, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 90 WIRELESS CONNECTIVITY MARKET FOR WPAN, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 91 WIRELESS CONNECTIVITY MARKET FOR WPAN, BY REGION, 2018-2021 (USD MILLION)

- TABLE 92 WIRELESS CONNECTIVITY MARKET FOR WPAN, BY REGION, 2022-2027 (USD MILLION)

- 7.4 SATELLITE

- 7.4.1 GNSS TECHNOLOGY WIDELY USED FOR NAVIGATION SOLUTIONS

- TABLE 93 WIRELESS CONNECTIVITY MARKET FOR GNSS, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 94 WIRELESS CONNECTIVITY MARKET FOR GNSS, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 95 WIRELESS CONNECTIVITY MARKET FOR GNSS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 96 WIRELESS CONNECTIVITY MARKET FOR GNSS, BY REGION, 2022-2027 (USD MILLION)

- 7.5 LOW-POWER WIDE-AREA NETWORK

- 7.5.1 LOW POWER CONSUMPTION OF LPWAN TECHNOLOGY IDEAL FOR SEVERAL APPLICATIONS

- TABLE 97 WIRELESS CONNECTIVITY MARKET FOR LPWAN, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 98 WIRELESS CONNECTIVITY MARKET FOR LPWAN, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 99 WIRELESS CONNECTIVITY MARKET FOR LPWAN, BY REGION, 2018-2021 (USD MILLION)

- TABLE 100 WIRELESS CONNECTIVITY MARKET FOR LPWAN, BY REGION, 2022-2027 (USD MILLION)

- 7.6 CELLULAR

- 7.6.1 INCREASING ADOPTION OF 5G TO PROPEL GROWTH OF CELLULAR TECHNOLOGY

- TABLE 101 WIRELESS CONNECTIVITY MARKET FOR CELLULAR, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 102 WIRELESS CONNECTIVITY MARKET FOR CELLULAR, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 103 WIRELESS CONNECTIVITY MARKET FOR CELLULAR, BY REGION, 2018-2021 (USD MILLION)

- TABLE 104 WIRELESS CONNECTIVITY MARKET FOR CELLULAR, BY REGION, 2022-2027 (USD MILLION)

8 WIRELESS CONNECTIVITY MARKET, BY END-USE

- 8.1 INTRODUCTION

- FIGURE 32 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SIZE OF WIRELESS CONNECTIVITY MARKET BETWEEN 2022 AND 2027

- TABLE 105 WIRELESS CONNECTIVITY MARKET, BY END-USE, 2018-2021 (MILLION USD)

- TABLE 106 WIRELESS CONNECTIVITY MARKET, BY END-USE, 2022-2027 (MILLION USD)

- 8.2 WEARABLE DEVICES

- 8.2.1 SURGING DEMAND FOR SMARTWATCHES, HEARABLES, AND HEAD-MOUNTED DISPLAYS TO DRIVE MARKET

- 8.3 HEALTHCARE

- 8.3.1 INCREASING TREND OF REMOTE HEALTH MONITORING TO SUPPORT MARKET GROWTH

- 8.4 CONSUMER ELECTRONICS

- 8.4.1 GROWING ADOPTION OF SMART APPLIANCES, SMARTPHONES, AND LAPTOPS TO DRIVE MARKET

- 8.5 BUILDING AUTOMATION

- 8.5.1 RISING SMART CITY PROJECTS WORLDWIDE TO BOOST MARKET GROWTH

- 8.6 AUTOMOTIVE & TRANSPORTATION

- 8.6.1 EXPANDING CONNECTED CARS MARKET

- 8.6.2 INCREASING VEHICLE FLEET TO PROLIFERATE DEMAND FOR IOT-BASED ASSET TRACKERS

- 8.7 OTHERS

9 REGIONAL ANALYSIS

- 9.1 INTRODUCTION

- FIGURE 33 WIRELESS CONNECTIVITY MARKET, BY GEOGRAPHY

- FIGURE 34 ASIA PACIFIC TO DOMINATE WIRELESS CONNECTIVITY MARKET DURING FORECAST PERIOD

- TABLE 107 WIRELESS CONNECTIVITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 108 WIRELESS CONNECTIVITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 109 WIRELESS CONNECTIVITY MARKET, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 110 WIRELESS CONNECTIVITY MARKET, BY REGION, 2022-2027 (MILLION UNITS)

- 9.2 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: WIRELESS CONNECTIVITY MARKET SNAPSHOT

- TABLE 111 WIRELESS CONNECTIVITY MARKET IN NORTH AMERICA, BY CONNECTIVITY TECHNOLOGY, 2018-2021 (MILLION UNITS)

- TABLE 112 WIRELESS CONNECTIVITY MARKET IN NORTH AMERICA, BY CONNECTIVITY TECHNOLOGY, 2022-2027 (MILLION UNITS)

- TABLE 113 NORTH AMERICAN WIRELESS CONNECTIVITY MARKET FOR WI-FI TECHNOLOGY, BY BAND, 2018-2021 (MILLION UNITS)

- TABLE 114 NORTH AMERICAN WIRELESS CONNECTIVITY MARKET FOR WI-FI TECHNOLOGY, BY BAND, 2022-2027 (MILLION UNITS)

- TABLE 115 WIRELESS CONNECTIVITY MARKET IN NORTH AMERICA, BY TYPE, 2018-2021 (MILLION UNITS)

- TABLE 116 WIRELESS CONNECTIVITY MARKET IN NORTH AMERICA, BY TYPE, 2022-2027 (MILLION UNITS)

- TABLE 117 WIRELESS CONNECTIVITY MARKET IN NORTH AMERICA, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 118 WIRELESS CONNECTIVITY MARKET IN NORTH AMERICA, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 119 WIRELESS CONNECTIVITY MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (MILLION UNITS)

- TABLE 120 WIRELESS CONNECTIVITY MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (MILLION UNITS)

- TABLE 121 WIRELESS CONNECTIVITY MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 122 WIRELESS CONNECTIVITY MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Increasing adoption of smart homes, smart medical equipment, and connected cars

- 9.2.2 CANADA

- 9.2.2.1 Growing adoption of advanced technologies by small and medium enterprises

- 9.2.3 MEXICO

- 9.2.3.1 Rising use of advanced technologies by traditional companies

- 9.3 EUROPE

- FIGURE 36 EUROPE: WIRELESS CONNECTIVITY MARKET SNAPSHOT

- TABLE 123 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY CONNECTIVITY TECHNOLOGY, 2018-2021 (MILLION UNITS)

- TABLE 124 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY CONNECTIVITY TECHNOLOGY, 2022-2027 (MILLION UNITS)

- TABLE 125 WIRELESS CONNECTIVITY MARKET IN EUROPE FOR WI-FI TECHNOLOGY, BY BAND, 2018-2021 (MILLION UNITS)

- TABLE 126 WIRELESS CONNECTIVITY MARKET IN EUROPE FOR WI-FI TECHNOLOGY, BY BAND, 2022-2027 (MILLION UNITS)

- TABLE 127 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY TYPE, 2018-2021 (MILLION UNITS)

- TABLE 128 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY TYPE, 2022-2027 (MILLION UNITS)

- TABLE 129 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 130 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 131 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY COUNTRY, 2018-2021 (MILLION UNITS)

- TABLE 132 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY COUNTRY, 2022-2027 (MILLION UNITS)

- TABLE 133 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 134 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.3.1 UK

- 9.3.1.1 Growing adoption of wireless technologies in consumer applications

- 9.3.2 FRANCE

- 9.3.2.1 Increasing investments in R&D to modernize industrial sector

- 9.3.3 GERMANY

- 9.3.3.1 Rising deployment of smart factory solutions due to adoption of Industry 4.0

- 9.3.4 ITALY

- 9.3.4.1 High focus on digital development

- 9.3.5 REST OF EUROPE

- 9.4 ASIA PACIFIC

- FIGURE 37 ASIA PACIFIC: WIRELESS CONNECTIVITY MARKET SNAPSHOT

- TABLE 135 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY CONNECTIVITY TECHNOLOGY, 2018-2021 (MILLION UNITS)

- TABLE 136 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY CONNECTIVITY TECHNOLOGY, 2022-2027 (MILLION UNITS)

- TABLE 137 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC FOR WI-FI TECHNOLOGY, BY BAND, 2018-2021 (MILLION UNITS)

- TABLE 138 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC FOR WI-FI TECHNOLOGY, BY BAND, 2022-2027 (MILLION UNITS)

- TABLE 139 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY TYPE, 2018-2021 (MILLION UNITS)

- TABLE 140 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY TYPE, 2022-2027 (MILLION UNITS)

- TABLE 141 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 142 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 143 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (MILLION UNITS)

- TABLE 144 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (MILLION UNITS)

- TABLE 145 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 146 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Growing adoption of IoT technology

- 9.4.2 JAPAN

- 9.4.2.1 Increasing use of wireless connectivity solutions in IoT applications

- 9.4.3 SOUTH KOREA

- 9.4.3.1 Surging advancements in cellular technologies

- 9.4.4 REST OF APAC

- 9.5 ROW

- TABLE 147 WIRELESS CONNECTIVITY MARKET IN ROW, BY CONNECTIVITY TECHNOLOGY, 2018-2021 (MILLION UNITS)

- TABLE 148 WIRELESS CONNECTIVITY MARKET IN ROW, BY CONNECTIVITY TECHNOLOGY, 2022-2027 (MILLION UNITS)

- TABLE 149 WIRELESS CONNECTIVITY MARKET IN ROW FOR WI-FI TECHNOLOGY, BY BAND, 2018-2021 (MILLION UNITS)

- TABLE 150 WIRELESS CONNECTIVITY MARKET IN ROW FOR WI-FI TECHNOLOGY, BY BAND, 2022-2027 (MILLION UNITS)

- TABLE 151 WIRELESS CONNECTIVITY MARKET IN ROW, BY TYPE, 2018-2021 (MILLION UNITS)

- TABLE 152 WIRELESS CONNECTIVITY MARKET IN ROW, BY TYPE, 2022-2027 (MILLION UNITS)

- TABLE 153 WIRELESS CONNECTIVITY MARKET IN ROW, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 154 WIRELESS CONNECTIVITY MARKET IN ROW, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 155 WIRELESS CONNECTIVITY MARKET IN ROW, BY COUNTRY, 2018-2021 (MILLION UNITS)

- TABLE 156 WIRELESS CONNECTIVITY MARKET IN ROW, BY COUNTRY, 2022-2027 (MILLION UNITS)

- TABLE 157 WIRELESS CONNECTIVITY MARKET IN ROW, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 158 WIRELESS CONNECTIVITY MARKET IN ROW, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.5.1 MIDDLE EAST & AFRICA

- 9.5.2 SOUTH AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 REVENUE ANALYSIS

- FIGURE 38 THREE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN WIRELESS CONNECTIVITY MARKET

- 10.3 MARKET SHARE ANALYSIS (2021)

- TABLE 159 WIRELESS CONNECTIVITY MARKET: MARKET SHARE ANALYSIS

- 10.4 COMPANY EVALUATION QUADRANT, 2021

- 10.4.1 STARS

- 10.4.2 PERVASIVE PLAYERS

- 10.4.3 EMERGING LEADERS

- 10.4.4 PARTICIPANTS

- FIGURE 39 WIRELESS CONNECTIVITY MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

- 10.5 SMALL AND MEDIUM ENTERPRISES EVALUATION QUADRANT, 2021

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- FIGURE 40 WIRELESS CONNECTIVITY MARKET (GLOBAL), SME EVALUATION QUADRANT, 2021

- TABLE 160 WIRELESS CONNECTIVITY MARKET: COMPANY FOOTPRINT

- TABLE 161 WIRELESS CONNECTIVITY MARKET: CONNECTIVITY TYPE FOOTPRINT

- TABLE 162 WIRELESS CONNECTIVITY MARKET: END-USE FOOTPRINT

- TABLE 163 WIRELESS CONNECTIVITY MARKET: REGIONAL FOOTPRINT

- 10.6 COMPETITIVE SCENARIO AND TRENDS

- 10.6.1 PRODUCT LAUNCHES

- TABLE 164 WIRELESS CONNECTIVITY MARKET: PRODUCT LAUNCHES, JANUARY 2018-JUNE 2022

- 10.6.2 DEALS

- TABLE 165 WIRELESS CONNECTIVITY MARKET: DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)**

- 11.1.1 INTEL CORPORATION

- TABLE 166 INTEL CORPORATION: BUSINESS OVERVIEW

- FIGURE 41 INTEL CORPORATION: COMPANY SNAPSHOT

- TABLE 167 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 INTEL CORPORATION: PRODUCT LAUNCHES

- TABLE 169 INTEL CORPORATION: DEALS

- 11.1.2 TEXAS INSTRUMENTS

- TABLE 170 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

- FIGURE 42 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

- TABLE 171 TEXAS INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 TEXAS INSTRUMENTS: PRODUCT LAUNCHES

- TABLE 173 TEXAS INSTRUMENTS: DEALS

- 11.1.3 QUALCOMM TECHNOLOGIES, INC.

- TABLE 174 QUALCOMM TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 43 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 175 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 QUALCOMM TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 177 QUALCOMM TECHNOLOGIES, INC.: DEALS

- 11.1.4 BROADCOM

- TABLE 178 BROADCOM: BUSINESS OVERVIEW

- FIGURE 44 BROADCOM: COMPANY SNAPSHOT

- TABLE 179 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 BROADCOM: PRODUCT LAUNCHES

- TABLE 181 BROADCOM: DEALS

- 11.1.5 STMICROELECTRONICS

- TABLE 182 STMICROELECTRONICS: BUSINESS OVERVIEW

- FIGURE 45 STMICROELECTRONICS: COMPANY SNAPSHOT

- TABLE 183 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 185 STMICROELECTRONICS: DEALS

- 11.2 OTHER KEY PLAYERS

- 11.2.1 NXP SEMICONDUCTORS

- TABLE 186 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

- FIGURE 46 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- TABLE 187 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

- TABLE 189 NXP SEMICONDUCTORS: DEALS

- 11.2.2 MICROCHIP TECHNOLOGY INC.

- TABLE 190 MICROCHIP TECHNOLOGY INC.: BUSINESS OVERVIEW

- FIGURE 47 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- TABLE 191 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES

- 11.2.3 MEDIATEK INC.

- TABLE 193 MEDIATEK INC.: BUSINESS OVERVIEW

- FIGURE 48 MEDIATEK INC.: COMPANY SNAPSHOT

- TABLE 194 MEDIATEK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 MEDIATEK INC.: PRODUCT LAUNCHES

- TABLE 196 MEDIATEK INC.: DEALS

- 11.2.4 INFINEON TECHNOLOGIES AG

- TABLE 197 INFINEON TECHNOLOGIES AG: BUSINESS OVERVIEW

- FIGURE 49 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- TABLE 198 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 200 INFINEON TECHNOLOGIES AG: DEALS

- 11.2.5 RENESAS ELECTRONICS CORPORATION

- TABLE 201 RENESAS ELECTRONICS CORPORATION: BUSINESS OVERVIEW

- FIGURE 50 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- TABLE 202 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES

- TABLE 204 RENESAS ELECTRONICS CORPORATION: DEALS

- 11.2.6 NEXCOM INTERNATIONAL CO., LTD.

- TABLE 205 NEXCOM INTERNATIONAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 206 NEXCOM INTERNATIONAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 NEXCOM INTERNATIONAL CO., LTD.: PRODUCT LAUNCHES

- 11.2.7 SKYWORKS SOLUTIONS INC.

- TABLE 208 SKYWORKS SOLUTIONS INC.: BUSINESS OVERVIEW

- FIGURE 51 SKYWORKS SOLUTIONS INC.: COMPANY SNAPSHOT

- TABLE 209 SKYWORKS SOLUTIONS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 SKYWORKS SOLUTIONS INC.: PRODUCT LAUNCHES

- TABLE 211 SKYWORKS SOLUTIONS INC.: DEALS

- 11.2.8 MURATA MANUFACTURING CO., LTD.

- TABLE 212 MURATA MANUFACTURING CO., LTD.: BUSINESS OVERVIEW

- FIGURE 52 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

- TABLE 213 MURATA MANUFACTURING CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 MURATA MANUFACTURING CO., LTD.: PRODUCT LAUNCHES

- TABLE 215 MURATA MANUFACTURING CO., LTD.: DEALS

- 11.2.9 NORDIC SEMICONDUCTOR

- TABLE 216 NORDIC SEMICONDUCTOR: BUSINESS OVERVIEW

- FIGURE 53 NORDIC SEMICONDUCTOR: COMPANY SNAPSHOT

- TABLE 217 NORDIC SEMICONDUCTOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 NORDIC SEMICONDUCTOR: PRODUCT LAUNCHES

- TABLE 219 NORDIC SEMICONDUCTOR: DEALS

- 11.2.10 SEMTECH

- TABLE 220 SEMTECH: BUSINESS OVERVIEW

- FIGURE 54 SEMTECH: COMPANY SNAPSHOT

- TABLE 221 SEMTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 SEMTECH: PRODUCT LAUNCHES

- TABLE 223 SEMTECH: DEALS

- *Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

- 11.3 INNOVATORS

- 11.3.1 ENOCEAN GMBH

- 11.3.2 ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD.

- 11.3.3 CEVA, INC.

- 11.3.4 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 11.3.5 PERASO TECHNOLOGIES INC.

- 11.3.6 PANASONIC HOLDINGS CORPORATION

- 11.3.7 BEHR TECHNOLOGIES INC.

- 11.3.8 MEIG SMART TECHNOLOGY

- 11.3.9 NEOWAY TECHNOLOGY

- 11.3.10 XIAMEN CHEERZING IOT TECHNOLOGY CO., LTD

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS