|

|

市場調査レポート

商品コード

1111949

ビデオエンコーダーの世界市場:チャンネル数別(1チャンネル、2チャンネル、4チャンネル、8チャンネル、16チャンネル、16チャンネル以上)、タイプ別(スタンドアロン、ラックマウント)、用途別(放送、監視)、地域別 - 2027年までの予測Video Encoders Market by Number of Channel (1-Channel, 2-Channel, 4-Channel, 8-Channel, 16-Channel, more than 16-Channel), Type (Standalone, Rack-mounted), Application (Broadcasting, Surveillance) and Geography - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ビデオエンコーダーの世界市場:チャンネル数別(1チャンネル、2チャンネル、4チャンネル、8チャンネル、16チャンネル、16チャンネル以上)、タイプ別(スタンドアロン、ラックマウント)、用途別(放送、監視)、地域別 - 2027年までの予測 |

|

出版日: 2022年08月05日

発行: MarketsandMarkets

ページ情報: 英文 160 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のビデオエンコーダーの市場規模は、2022年から2027年までの間にCAGR7.6%で推移し、2022年の23億米ドルから、2027年には33億米ドルに達すると予測されています。

ビデオエンコーダー市場の成長を促す主な要因としては、ビデオエンコーディングにおける高効率ビデオコーディング(HEVC)規格の採用、ビデオエンコーダーを使用したアナログカメラのネットワークへの接続の容易さ、増加するデータ量の保存にクラウドサービスを使用することなどが挙げられます。市場の主要企業は、提供するビデオエンコーダーの機能を強化するために研究開発(R&D)に重点を置いています。さらに、モバイルストリーミングビデオの増加や新興国におけるOTTサービスの市場拡大も、ビデオエンコーダー市場に大きなチャンスをもたらしています。

"2022年から2027年にかけて、放送用途が最も高いCAGRで成長すると予測される"

放送アプリケーションの市場は、2022年から2027年にかけて最も高いCAGRで成長すると予想されています。ビデオエンコーダーは、放送、4K録画/オーバーIP、カメラのサポート(ライブイベントのモニタリングなど)において重要です。現在、ほとんどの放送局では、より低い帯域幅で高品質のビデオコンテンツを配信するためにビデオエンコーダーを使用しています。ビデオエンコーダーを導入することで、放送局は最小限のビットレートで高品質のビデオを配信することができます。したがって、サービスプロバイダーは高品質のコンテンツを伝送し、より良いストリーミングを確保する必要があるため、放送用エンコーダーの需要が増加しています。

"16チャンネルビデオエンコーダーは、予測期間中に高いCAGRで成長すると予測される"

16チャンネルエンコーダー市場は、予測期間中により高いCAGRで成長すると予測されています。16チャンネルビデオエンコーダーは、16チャンネルのビデオとオーディオの入力を備えています。16チャンネルビデオエンコーダーシステムの需要は、主に高価なIPベースのシステムに切り替えるよりも、16チャンネルビデオエンコーダーの導入が容易であることから、成長が見込まれています。また、商業施設や機関投資家向けに多数のカメラの設置が進んでいることも、この市場の成長を支える重要な要素になると考えられます。

"2021年のビデオエンコーダー市場は北米が最大のシェアを占めている"

2021年のビデオエンコーダー市場では、ノースメリカがより大きなシェアを占めました。北米では、政府とネットワーク分野の協力、ビデオエンコーダーメーカーと研究協力の制度的パートナーシップ、クラウドベースサービスへの大規模な投資が、ビデオエンコーダーの需要を促進しています。さらに、北米、特に米国では、政府が政府ビル、公共施設、教育機関などに監視システムを導入するためのイニシアチブをとっています。北米は、公共の安全のためにビデオ監視システムを採用したパイオニアと考えられています。ビデオエンコーダーは、既存のアナログシステムをIPベースのシステムに変換する際に大きな役割を果たします。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 関税と規制

- バリューチェーン分析

- ビデオエンコーダーエコシステム

- 平均販売価格

- 主なユースケース

- 特許分析

- 主な次世代ビデオエンコーダー技術

第6章 ビデオエンコーダー市場:コンポーネント別

- イントロダクション

- アナログビデオ入力

- 同軸ケーブル

- プロセッサ

- メモリー

- シリアルポート

- LANS

- ネットワークスイッチ

第7章 ビデオエンコーダー市場:チャンネル数別

- イントロダクション

- 1チャンネルビデオエンコーダー

- 2チャンネルビデオエンコーダー

- 4チャンネルビデオエンコーダー

- 8チャンネルビデオエンコーダー

- 16チャンネルビデオエンコーダー

- 16チャンネル超のビデオエンコーダー

第8章 ビデオエンコーダー市場:タイプ別

- イントロダクション

- スタンドアロン

- ラックマウント

第9章 ビデオエンコーダー市場:用途別

- イントロダクション

- 放送

- 監視

第10章 ビデオエンコーダー市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- その他の地域

- 南米

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 市場シェア分析(2021年)

- 企業評価クアドラント

- スタートアップ/中小企業評価クアドラント

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- HIKVISION

- VITEC

- HARMONIC

- MOTOROLA SOLUTIONS

- CISCO

- COMMSCOPE

- AXIS COMMUNICATIONS

- MATROX ELECTRONIC SYSTEMS

- DAHUA TECHNOLOGY

- HAIVISION

- BOSCH SECURITY SYSTEMS

- ATEME

- TELESTE

- その他の企業

- VIDICORE

- HAIWEITECH

- BEAMR

- ACTI

- ERICSSON

- HONEYWELL SECURITY GROUP

- LILIN

第13章 隣接および関連市場

- イントロダクション

- 制限事項

- ビデオ監視市場

第14章 付録

The video encoder market is estimated to reach USD 3.3 billion by 2027 from USD 2.3 billion in 2022 with a CAGR of 7.6% from 2022 to 2027. The major factors driving the growth of the video encoder market include adoption of high-efficiency video coding (HEVC) standards for video encoding, ease of connecting analog cameras using video encoder to a network, and use of cloud services to store increasing amount of data. Key players in the market focus on research and development (R&D) to enhance the functionalities of the video encoders offered. Morevoer, growth innumber of mobile-streaming videos and growing market for OTT services in developing countries are also creating immense opportunities for the video encoder market.

"BROADCASTING APPLICATION IS EXPECTED TO GROW AT THE HIGHEST CAGR FROM 2022 TO 2027"

The market for broadcasting application is expected to grow at the highest CAGR between 2022 and 2027. Video encoders are crucial in broadcasting, 4K recording/over IP, and supporting cameras (such as monitoring live events). Most broadcasters are now using video encoders to deliver high-quality video content using lower bandwidth. The installation of video encoders helps broadcasters deliver high-quality video at minimum bit rates. Hence, the need for service providers to transmit high-quality content and ensure better streaming has led to the increased demand for broadcast encoders.

"16-CHANNEL VIDEO ENCODERS IS PROJECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD"

The market for 16-channel encoders s projected to grow at a higher CAGR during forecast period. 16-channel video encoders have 16-channel video and audio inputs. The demand for 16-channel video encoder systems is expected to grow primarily due to the ease of 16-channel video encoder deployment rather than switching to expensive IP-based systems. The growing installation of a large number of cameras in commercial and institutional segments is expected to be another key factor supporting the growth of this market.

"NORTH AMERICA HELD THE LARGEST SHARE OF THE VIDEO ENCODERS MARKET IN 2021"

The North merica held a larger share of the video encoder market in 2021. Collaborations between the government and network arenas, institutional partnerships between video encoder manufacturers and research collaborations, and large-scale investments in cloud-based services in North America drive the demand for video encoders. Moreover,in North America, particularly in the US, the government has taken initiatives to implement surveillance systems at government buildings, public places, and educational institutes. North America is considered a pioneer in adopting video surveillance systems for public safety. Video encoders play a major role in converting the existing analog systems into IP-based systems.

The break-up of the profiles of primary participants for the report has been given below:

- By Company Type: Tier 1 = 25%, Tier 2 = 35%, and Tier 3 = 40%

- ByDesignation: C-Level Executives = 35%, Directors= 25%, and Others= 40%

- ByRegion: North America = 14%, Europe = 43%, Asia Pacific = 29%, and RoW = 14%

Major players operating in the video encoders market includeHikvision (China), VITEC (France), Harmonic (US), Motorola Solutions (US), and CISCO (US), among others.

Research Coverage:

The video encoder market has been segmented based on the number of channels, type, application, and region. Based on type, the market has been segmented into standalone and rack-mounted video encoders. Standalone video encoders are beneficial in situations where only a few cameras are to be connected, while rack-mounted video encoders are useful in instances where large installations with analog cameras are required. The video encoder market is segmented, by application, into broadcasting and surveillance. Cable operators and broadcasters use video encoders to improve the video quality delivered to their customers. Surveillance applications cover various verticals, such as institutional, commercial, residential, transportation, retail, and military and defense. The use of security cameras in these verticals has helped increase the demand for video encoders. The video encoder market has been segmented by the number of channels into 1-channel, 2-channel, 4-channel, 8-channel, 16-channel, and more than 16-channel video encoders. 1-channel or 2-channel video encoders are used for small-scale applications such as small shops or individual residents. 8-channel and 16-channel video encoders can be used for instances where many analog cameras are to be installed. The report covers four major regions, namely,North America, Europe, AsiaPacific (APAC), and Rest of the World (RoW).

Key Benefits of Buying the Report:

This report segments thevideo encoders market comprehensively and provides the closest approximations of the overall market size, as well as that of the subsegments across differentnumber of channels, type, application, and region.

The report helps stakeholders understand the pulse of the market, andexpected market scenario and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 VIDEO ENCODER MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 VIDEO ENCODER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 3 VIDEO ENCODER MARKET: RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF COMPANIES FROM VIDEO ENCODERS

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market size using bottom-up approach (demand side)

- FIGURE 5 VIDEO ENCODER MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for arriving at market size using top-down approach (supply side)

- FIGURE 6 VIDEO ENCODER MARKET: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 RACK-MOUNTED VIDEO ENCODERS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 9 1-CHANNEL VIDEO ENCODERS TO HOLD LARGEST MARKET SHARE FROM 2022-2027

- FIGURE 10 BROADCASTING TO REMAIN LARGEST APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 11 MIDDLE EAST & AFRICA EXPECTED TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN VIDEO ENCODER MARKET

- FIGURE 12 CONTINUOUS TECHNOLOGICAL ADVANCEMENTS TO BOOST MARKET GROWTH

- 4.2 VIDEO ENCODER MARKET, BY TYPE

- FIGURE 13 RACK-MOUNTED VIDEO ENCODERS TO HOLD MAJOR MARKET SHARE DURING FORECAST PERIOD

- 4.3 VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS

- FIGURE 14 1-CHANNEL VIDEO ENCODERS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

- 4.4 VIDEO ENCODER MARKET, BY APPLICATION

- FIGURE 15 BROADCASTING APPLICATIONS TO HOLD LARGEST MARKET SHARE IN 2027

- 4.5 VIDEO ENCODER MARKET, BY REGION

- FIGURE 16 NORTH AMERICA TO DOMINATE MARKET IN 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- FIGURE 17 VIDEO ENCODER MARKET DRIVERS AND THEIR IMPACT

- 5.2.1.1 Ease of connecting analog cameras using video encoders to a network

- 5.2.1.2 Use of cloud services to store increasing volumes of data

- 5.2.1.3 Adoption of HEVC standard for video encoding

- 5.2.2 RESTRAINTS

- FIGURE 18 VIDEO ENCODER MARKET RESTRAINTS AND THEIR IMPACT

- 5.2.2.1 Limited capability to deliver 4K streaming and broadcasting services

- 5.2.3 OPPORTUNITIES

- FIGURE 19 VIDEO ENCODER MARKET OPPORTUNITIES AND THEIR IMPACT

- 5.2.3.1 Increasing use of mobile devices to stream videos

- 5.2.3.2 Optimization of network bandwidth for cable operators

- 5.2.3.3 Developing countries witnessing increased OTT consumption

- 5.2.4 CHALLENGES

- FIGURE 20 VIDEO ENCODER MARKET CHALLENGES AND THEIR IMPACT

- 5.2.4.1 High cost associated with adoption of newer technologies

- 5.3 TARIFFS AND REGULATIONS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS: VIDEO ENCODER MARKET

- 5.5 VIDEO ENCODER ECOSYSTEM

- FIGURE 22 MARKET MAP OF VIDEO ENCODERS

- 5.6 AVERAGE SELLING PRICE

- TABLE 1 AVERAGE SELLING PRICE OF VIDEO ENCODERS FOR SURVEILLANCE APPLICATIONS, 2021

- 5.7 KEY USE CASES

- 5.7.1 GLOBO SETS NEW QUALITY STANDARDS IN 4K WITH BITMOVIN

- 5.7.2 NETFLIX UPDATES VIDEO CODECS FOR EFFICIENT ENCODING

- 5.7.3 TERRACE CITY COUNCIL TO BUY VIDEO ENCODERS

- 5.7.4 GOOGLE AND SAMSUNG OFFER SOLUTIONS TO SUPPORT AV1 CODEC

- 5.8 PATENT ANALYSIS

- 5.8.1 HEVC TECHNOLOGY PATENT

- FIGURE 23 TOP COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS RELATED TO HEVC TECHNOLOGY

- FIGURE 24 PATENT ANALYSIS RELATED TO HEVC TECHNOLOGY

- TABLE 2 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- 5.9 MAJOR NEXT-GENERATION VIDEO ENCODER TECHNOLOGIES

- 5.9.1 HEVC

- 5.9.2 VVC

- 5.9.3 AOMEDIA VIDEO 1 (AV1)

- 5.9.4 VP9

6 VIDEO ENCODER MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 ANALOG VIDEO INPUT

- 6.3 COAXIAL CABLES

- 6.4 PROCESSORS

- 6.5 MEMORY

- 6.6 SERIAL PORTS

- 6.7 LANS

- 6.8 NETWORK SWITCHES

7 VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS

- 7.1 INTRODUCTION

- FIGURE 25 VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS

- FIGURE 26 1-CHANNEL VIDEO ENCODER SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

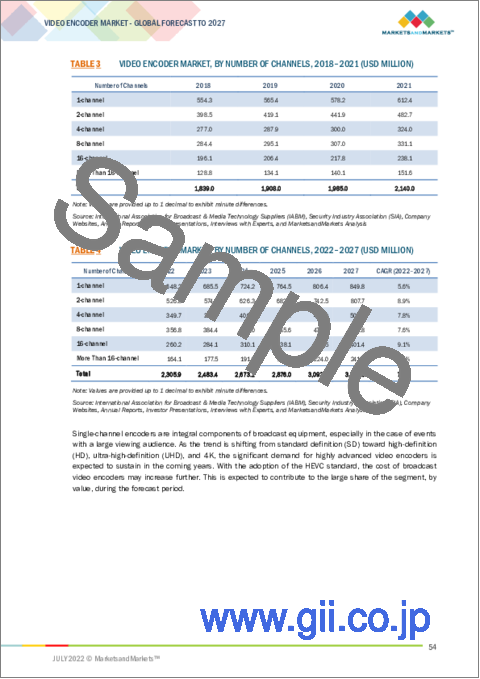

- TABLE 3 VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2018-2021 (USD MILLION)

- TABLE 4 VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2022-2027 (USD MILLION)

- 7.2 1-CHANNEL VIDEO ENCODERS

- 7.2.1 IN DEMAND FOR CONTRIBUTION APPLICATIONS

- TABLE 5 1-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 6 1-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 7 1-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 8 1-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.3 2-CHANNEL VIDEO ENCODERS

- 7.3.1 VIDEO SURVEILLANCE INDUSTRY SWITCHING TO IP-BASED SYSTEMS

- TABLE 9 2-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 10 2-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 11 2-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 12 2-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.4 4-CHANNEL VIDEO ENCODERS

- 7.4.1 USED IN IPTV, LIVE STREAMING, AND SURVEILLANCE/MONITORING APPLICATIONS

- TABLE 13 4-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 14 4-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 15 4-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 16 4-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.5 8-CHANNEL VIDEO ENCODERS

- 7.5.1 USED IN COMMERCIAL, INSTITUTIONAL, AND RETAIL APPLICATIONS

- TABLE 17 8-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 18 8-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 19 8-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 20 8-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.6 16-CHANNEL VIDEO ENCODERS

- 7.6.1 EASIER TO DEPLOY THAN EXPENSIVE IP-BASED SYSTEMS

- TABLE 21 16-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 22 16-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 23 16-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 24 16-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.7 MORE THAN 16-CHANNEL VIDEO ENCODERS

- 7.7.1 OFFERS ADVANCED NETWORK CAPABILITIES, BETTER AUDIO QUALITY, AND EFFECTIVE VIDEO PERFORMANCE

- TABLE 25 MORE THAN 16-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 26 MORE THAN 16-CHANNEL: VIDEO ENCODER MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 27 MORE THAN 16-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 28 MORE THAN 16-CHANNEL: VIDEO ENCODER MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

8 VIDEO ENCODER MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 27 VIDEO ENCODER MARKET, BY TYPE

- FIGURE 28 RACK-MOUNTED VIDEO ENCODERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 29 VIDEO ENCODER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 30 VIDEO ENCODER MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.2 STANDALONE

- 8.2.1 ELIMINATES NEED FOR ADDITIONAL CABLING

- TABLE 31 STANDALONE: VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2018-2021 (USD MILLION)

- TABLE 32 STANDALONE: VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2022-2027 (USD MILLION)

- 8.3 RACK-MOUNTED

- 8.3.1 RISING PRODUCT LAUNCHES PROVIDING TRACTION

- TABLE 33 RACK-MOUNTED: VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2018-2021 (USD MILLION)

- TABLE 34 RACK-MOUNTED: VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2022-2027 (USD MILLION)

9 VIDEO ENCODER MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 29 VIDEO ENCODER MARKET, BY APPLICATION

- FIGURE 30 BROADCASTING TO HOLD LARGEST MARKET SIZE IN 2027

- TABLE 35 VIDEO ENCODER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 36 VIDEO ENCODER MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2 BROADCASTING

- 9.2.1 ENCODERS CRUCIAL IN BROADCASTING, 4K RECORDING/OVER IP, AND SUPPORTING CAMERAS

- TABLE 37 BROADCASTING: VIDEO ENCODER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 38 BROADCASTING: VIDEO ENCODER MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 39 BROADCASTING: VIDEO ENCODER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 40 BROADCASTING: VIDEO ENCODER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 41 BROADCASTING: VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2018-2021 (USD MILLION)

- TABLE 42 BROADCASTING: VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2022-2027 (USD MILLION)

- 9.2.1.1 Pay TV

- TABLE 43 PAY TV: VIDEO ENCODER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 PAY TV: VIDEO ENCODER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2.1.2 Over-the-top (OTT) services

- TABLE 45 OTT: VIDEO ENCODER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 46 OTT: VIDEO ENCODER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 SURVEILLANCE

- 9.3.1 VIDEO SURVEILLANCE INDUSTRY SWITCHING TO IP-BASED SYSTEMS

- TABLE 47 SURVEILLANCE: VIDEO ENCODER MARKET, 2018-2021 (THOUSAND UNIT)

- TABLE 48 SURVEILLANCE: VIDEO ENCODER MARKET, 2022-2027 (THOUSAND UNIT)

- TABLE 49 SURVEILLANCE: VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2018-2021 (USD MILLION)

- TABLE 50 SURVEILLANCE: VIDEO ENCODER MARKET, BY NUMBER OF CHANNELS, 2022-2027 (USD MILLION)

- TABLE 51 SURVEILLANCE: VIDEO ENCODER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 52 SURVEILLANCE: VIDEO ENCODER MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 53 SURVEILLANCE: VIDEO ENCODER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 54 SURVEILLANCE: VIDEO ENCODER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.1.1 Retail

- TABLE 55 RETAIL: VIDEO ENCODER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 56 RETAIL: VIDEO ENCODER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.1.2 Transportation

- TABLE 57 TRANSPORTATION: VIDEO ENCODER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 58 TRANSPORTATION: VIDEO ENCODER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.1.3 Commercial

- TABLE 59 COMMERCIAL: VIDEO ENCODER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 60 COMMERCIAL: VIDEO ENCODER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.1.4 Residential

- TABLE 61 RESIDENTIAL: VIDEO ENCODER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 62 RESIDENTIAL: VIDEO ENCODER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.1.5 Institutional

- TABLE 63 INSTITUTIONAL: VIDEO ENCODER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 64 INSTITUTIONAL: VIDEO ENCODER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.1.6 Military and defense

- TABLE 65 MILITARY AND DEFENSE: VIDEO ENCODER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 66 MILITARY AND DEFENSE: VIDEO ENCODER MARKET, BY REGION, 2022-2027 (USD MILLION)

10 VIDEO ENCODER MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 31 MARKET IN INDIA EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 VIDEO ENCODER MARKET IN ROW TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 67 VIDEO ENCODER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 68 VIDEO ENCODER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 33 NORTH AMERICA: VIDEO ENCODER MARKET SNAPSHOT

- FIGURE 34 US TO CONTINUE TO LEAD VIDEO ENCODER MARKET IN NORTH AMERICA DURING FORECAST PERIOD

- TABLE 69 SURVEILLANCE: VIDEO ENCODER MARKET IN NORTH AMERICA, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 70 SURVEILLANCE: VIDEO ENCODER MARKET IN NORTH AMERICA, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 71 BROADCASTING: VIDEO ENCODER MARKET IN NORTH AMERICA, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 72 BROADCASTING: VIDEO ENCODER MARKET IN NORTH AMERICA, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 73 NORTH AMERICA: VIDEO ENCODER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 74 NORTH AMERICA: VIDEO ENCODER MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 US held largest share of video encoder market in North America in 2021

- 10.2.2 CANADA

- 10.2.2.1 Many cities installing CCTV street cameras

- 10.2.3 MEXICO

- 10.2.3.1 Upsurge in demand for personal safety from private sector

- 10.3 EUROPE

- FIGURE 35 EUROPE: VIDEO ENCODER MARKET SNAPSHOT

- FIGURE 36 GERMANY TO LEAD VIDEO ENCODER MARKET IN EUROPE IN 2022

- TABLE 75 SURVEILLANCE: VIDEO ENCODER MARKET IN EUROPE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 76 SURVEILLANCE: VIDEO ENCODER MARKET IN EUROPE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 77 BROADCASTING: VIDEO ENCODER MARKET IN EUROPE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 78 BROADCASTING: VIDEO ENCODER MARKET IN EUROPE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 79 EUROPE: VIDEO ENCODER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 80 EUROPE: VIDEO ENCODER MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.3.1 UK

- 10.3.1.1 Heightened city surveillance

- 10.3.2 GERMANY

- 10.3.2.1 Increased CCTV camera installations in public areas and transport networks

- 10.3.3 FRANCE

- 10.3.3.1 Dynamic broadcasting industry to boost market

- 10.3.4 SPAIN

- 10.3.4.1 Demand for video surveillance to boost market

- 10.3.5 ITALY

- 10.3.5.1 Broadcasters offering better video quality to subscribers

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- FIGURE 37 ASIA PACIFIC: VIDEO ENCODER MARKET SNAPSHOT

- FIGURE 38 JAPAN TO EXHIBIT HIGHEST CAGR IN ASIA PACIFIC DURING FORECAST PERIOD

- TABLE 81 SURVEILLANCE: VIDEO ENCODER MARKET IN ASIA PACIFIC, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 82 SURVEILLANCE: VIDEO ENCODER MARKET IN ASIA PACIFIC, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 83 BROADCASTING: VIDEO ENCODER MARKET IN ASIA PACIFIC, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 84 BROADCASTING: VIDEO ENCODER MARKET IN ASIA PACIFIC, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 85 ASIA PACIFIC: VIDEO ENCODER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 86 ASIA PACIFIC: VIDEO ENCODER MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Surveillance applications to drive demand

- 10.4.2 JAPAN

- 10.4.2.1 Active video surveillance systems to ensure safety of citizens

- 10.4.3 INDIA

- 10.4.3.1 Video encoder market to grow at highest pace

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Increasing security camera installations

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD

- FIGURE 39 MIDDLE EAST TO RECORD HIGHEST CAGR IN ROW DURING FORECAST PERIOD

- TABLE 87 SURVEILLANCE: VIDEO ENCODER MARKET IN ROW, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 88 SURVEILLANCE: VIDEO ENCODER MARKET IN ROW, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 89 BROADCASTING: VIDEO ENCODER MARKET IN ROW, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 90 BROADCASTING: VIDEO ENCODER MARKET IN ROW, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 91 ROW: VIDEO ENCODER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 92 ROW: VIDEO ENCODER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Growing demand for HD content

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Increasing use of security cameras

- 10.5.3 AFRICA

- 10.5.3.1 African viewers enjoy HD and SD video experience, IPTV, and pay TV at affordable price

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- FIGURE 40 KEY DEVELOPMENTS BY KEY PLAYERS IN VIDEO ENCODER MARKET (2020-2022)

- 11.2 MARKET SHARE ANALYSIS, 2021

- TABLE 93 VIDEO ENCODER MARKET: MARKET SHARE ANALYSIS

- 11.3 COMPANY EVALUATION QUADRANT

- 11.3.1 STARS

- 11.3.2 EMERGING LEADERS

- 11.3.3 PERVASIVE PLAYERS

- 11.3.4 PARTICIPANTS

- FIGURE 41 VIDEO ENCODER MARKET: (GLOBAL) COMPANY QUADRANT, 2021

- 11.4 START-UP/SME EVALUATION QUADRANT

- 11.4.1 PROGRESSIVE COMPANIES

- 11.4.2 RESPONSIVE COMPANIES

- 11.4.3 DYNAMIC COMPANIES

- 11.4.4 STARTING BLOCKS

- FIGURE 42 VIDEO ENCODER MARKET: START-UP/SME QUADRANT, 2021

- 11.5 COMPETITIVE SCENARIO

- 11.5.1 PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 94 PRODUCT LAUNCHES AND DEVELOPMENTS

- 11.5.2 DEALS

- TABLE 95 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions offered, Recent Developments, MnM view, Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1.1 HIKVISION

- TABLE 96 HIKVISION: BUSINESS OVERVIEW

- FIGURE 43 HIKVISION: COMPANY SNAPSHOT

- 12.1.2 VITEC

- TABLE 97 VITEC: BUSINESS OVERVIEW

- 12.1.3 HARMONIC

- TABLE 98 HARMONIC: BUSINESS OVERVIEW

- FIGURE 44 HARMONIC: COMPANY SNAPSHOT

- 12.1.4 MOTOROLA SOLUTIONS

- TABLE 99 MOTOROLA SOLUTIONS: BUSINESS OVERVIEW

- FIGURE 45 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

- 12.1.5 CISCO

- TABLE 100 CISCO: BUSINESS OVERVIEW

- FIGURE 46 CISCO: COMPANY SNAPSHOT

- 12.1.6 COMMSCOPE

- TABLE 101 COMMSCOPE: BUSINESS OVERVIEW

- FIGURE 47 COMMSCOPE: COMPANY SNAPSHOT

- 12.1.7 AXIS COMMUNICATIONS

- TABLE 102 AXIS COMMUNICATIONS: BUSINESS OVERVIEW

- 12.1.8 MATROX ELECTRONIC SYSTEMS

- TABLE 103 MATROX ELECTRONIC SYSTEMS: BUSINESS OVERVIEW

- 12.1.9 DAHUA TECHNOLOGY

- TABLE 104 DAHUA TECHNOLOGY.: BUSINESS OVERVIEW

- FIGURE 48 DAHUA TECHNOLOGY: COMPANY SNAPSHOT

- 12.1.10 HAIVISION

- TABLE 105 HAIVISION: BUSINESS OVERVIEW

- 12.1.11 BOSCH SECURITY SYSTEMS

- TABLE 106 BOSCH SECURITY SYSTEMS: BUSINESS OVERVIEW

- 12.1.12 ATEME

- TABLE 107 ATEME: BUSINESS OVERVIEW

- FIGURE 49 ATEME: COMPANY SNAPSHOT

- 12.1.13 TELESTE

- TABLE 108 TELESTE: BUSINESS OVERVIEW

- FIGURE 50 TELESTE: COMPANY SNAPSHOT

- *Details on Business Overview, Products/Services/Solutions offered, Recent Developments, MnM view, Key strengths/Right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 VIDICORE

- 12.2.2 HAIWEITECH

- 12.2.3 BEAMR

- 12.2.4 ACTI

- 12.2.5 ERICSSON

- 12.2.6 HONEYWELL SECURITY GROUP

- 12.2.7 LILIN

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 VIDEO SURVEILLANCE MARKET

- 13.3.1 VIDEO SURVEILLANCE MARKET, BY SYSTEM

- 13.3.1.1 Introduction

- TABLE 109 VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2017-2020 (USD MILLION)

- TABLE 110 VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2021-2026 (USD MILLION)

- 13.3.2 ANALOG VIDEO SURVEILLANCE SYSTEMS

- 13.3.2.1 Mainly consist of analog cameras and DVRs

- 13.3.3 IP VIDEO SURVEILLANCE SYSTEMS

- 13.3.3.1 Offer enhanced security and better resolution

- 13.3.1 VIDEO SURVEILLANCE MARKET, BY SYSTEM

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE - VIDEO ENCODER MARKET

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS