|

|

市場調査レポート

商品コード

1105262

有効性試験の世界市場:サービスタイプ別(抗菌性・防腐効果試験、殺菌効果試験)、用途別(医薬品製造、化粧品・パーソナルケア製品、医療機器、消費者製品)、地域別 - 2027年までの予測Efficacy Testing Market by Service Type (Antimicrobial/Preservative Efficacy Testing, Disinfectant Efficacy Testing), Application (Pharma, Cosmetics & Personal Care, Medical Devices, Consumer Products) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 有効性試験の世界市場:サービスタイプ別(抗菌性・防腐効果試験、殺菌効果試験)、用途別(医薬品製造、化粧品・パーソナルケア製品、医療機器、消費者製品)、地域別 - 2027年までの予測 |

|

出版日: 2022年07月19日

発行: MarketsandMarkets

ページ情報: 英文 176 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の有効性試験の市場規模は、2022年の3億1,500万米ドルから2027年までに4億2,300万米ドルに達し、予測期間中のCAGRで6.1%の成長が予測されています。

この市場の成長は、主に医薬品製造、バイオ医薬品、化粧品業界において、汚染防止と製品安定性のために表面殺菌剤と防腐剤の使用が増加していること、有効性試験のアウトソーシングを好む傾向が高まっていること、QbDアプローチの採用が増加していることに起因しています。新興市場の高い成長性は、有効性試験市場で活動する企業に成長機会をもたらすと予想されます。

"サービスタイプ別では、従来型の試験が抗菌性・防腐効果試験市場で最大のシェアを占めている"

従来型の試験は、一般的に、長期間にわたる複数の試験ポイントでの微生物アッセイを必要とします。試験期間は、通常、最低28日間から12週間以上に及びます。より長期の一般的な課題プロトコルで採用されているのと同様の標準的な微生物学的技術が関与しているため、アッセイを実施するために特別な設備やトレーニングは必要ありません。実際、この加速二重課題(ADC)アッセイは、現在、多くの研究所で様々な用途に基本形またはバリエーションで使用されています。

"用途別では、予測期間中、医薬品製造セグメントが最も高い成長率を示す"

用途別では、有効性試験市場は、医薬品製造用途、化粧品・パーソナルケア製品用途、消費者製品用途、医療機器用途に区分されます。2021年、医薬品製造用途は、市場で最大の製品セグメントでした。この市場の成長は、大手製薬会社による研究開発製造の増加、政府の支援、製薬業界の成長、患者の安全性への注目の高まりに起因すると考えられます。

"アジア太平洋地域の市場は、予測期間(2020年~2027年)において最も高い成長率を示すと予測される"

アジア太平洋市場は、予測期間中に最も高いCAGRで成長すると予測されています。これは主に、ヘルスケアに対する政府支出の増加、老人人口の増加、消費者の健康意識の高まり、慢性疾患の発生率の増加によりこの地域の医薬品の成長の原因となっていること、APAC諸国で製造施設を設立する製薬会社の数が増加していることに起因しています。

"北米:有効性試験市場の最大シェア"

北米は有効性試験市場の最大シェアを占めています。同地域には確立された製薬業界が存在し、高い研究開発費、大手サービスプロバイダーの存在感、同地域の製薬会社や化粧品会社による分析試験(有効性試験を含む)のアウトソーシングの増加などの要因が、市場成長の主要因です。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 規制分析

- 有効性試験サービスに対するCOVID-19の影響

- 価格分析

- 特許分析

- 貿易分析

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 技術分析

第6章 有効性試験市場:サービスタイプ別

- イントロダクション

- 殺菌効果試験

- 表面試験

- 懸濁試験

- 抗菌性・防腐効果試験

- 従来型

- 迅速型

第7章 有効性試験市場:用途別

- イントロダクション

- 医薬品製造

- 化粧品・パーソナルケア製品

- 消費者製品

- 医療機器

第8章 有効性試験市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- アジア太平洋

- 中国

- 日本

- インド

- その他

- その他の地域

- ラテンアメリカ

- 中東・アフリカ

第9章 競合情勢

- 概要

- 主要企業戦略/有力企業

- 市場シェア分析

- 主要な市場企業の収益シェア分析

- 企業評価象限

- 企業評価象限:新興企業/中小企業

- 企業のフットプリント分析

- 競合シナリオ

第10章 企業プロファイル

- 有効性試験サービスプロバイダー

- EUROFINS SCIENTIFIC

- CHARLES RIVER LABORATORIES INTERNATIONAL, INC.

- WUXI APPTEC

- SGS SA

- INTERTEK GROUP PLC

- MICROCHEM LABORATORY

- ACCUGEN LABORATORIES, INC.

- PACIFIC BIOLABS

- NORTH AMERICAN SCIENCE ASSOCIATES

- TOXIKON

- BIOSCIENCE LABORATORIES, INC.

- CONSUMER PRODUCT TESTING COMPANY (CPTC)

- ALMAC GROUP

- MSL SOLUTION PROVIDERS

- NELSON LABORATORIES, LLC (A SOTERA HEALTH COMPANY)

- ALS LIMITED

- ABBOTT ANALYTICAL

- BLUTEST LABORATORIES LIMITED

- LUCIDEON

- HELVIC LABORATORIES (A TENTAMUS COMPANY)

- 殺菌剤メーカー

- PROCTER & GAMBLE

- THE CLOROX COMPANY

- 3M

- RECKITT BENCKISER GROUP PLC

- ECOLAB

- STERIS

- CANTEL MEDICAL

- DIVERSEY HOLDINGS LTD.

- CARROLLCLEAN

- PAUL HARTMANN AG

第11章 付録

The global efficacy testing market is projected to reach USD 423 million by 2027 from USD 315 million in 2022, at a CAGR of 6.1% during the forecast period. The growth of this market is mainly driven by the increasing use of surface disinfectants and preservatives in pharma, biopharma, and cosmetics industries for contamination control and product stability; growing preference for outsourcing efficacy testing; and the rising adoption of the QbD approach. The high growth potential in emerging markets will provide growth opportunities for players operating in the efficacy testing market.

"By method type, the traditional test method accounted for the largest share of the antimicrobial/preservative testing market"

Traditional testing methods generally require microbial assays at multiple test points over extended periods of time. Test durations typically range from a minimum of 28 days to 12 or more weeks. Because standard microbiological techniques similar to those employed in longer-term generic challenge protocols are involved, no special equipment or training is necessary to perform the assay. In fact, this accelerated double challenge (ADC) assay is currently being used in its basic form or in variations at numerous laboratories for a variety of applications.

"The pharmaceutical manufacturing application segment will grow at the highest rate during the forecast period."

On the basis of application, the efficacy testing market is segmented into pharmaceutical manufacturing applications, cosmetics and personal care product applications, consumer product applications, and medical device applications. In 2021, pharmaceutical manufacturing applications were the largest product segment in the market. Growth in this market can be attributed to the increasing R&D manufactures by leading pharmaceutical companies, government support, growth of the pharmaceutical industry, and a growing focus on patient safety.

"The market in the Asia Pacific is projected to witness the highest growth rate during the forecast period (2020-2027)."

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period, mainly due to the increasing government expenditure on healthcare, rising geriatric population, growing consumer health awareness, increasing incidence of chronic diseases thereby being responsible for the growth of pharmaceutical products in this region, and the increasing number of pharmaceutical companies that are establishing manufacturing facilities in APAC countries.

"North America: the largest share of the efficacy testing market"

North America accounted for the largest share of the efficacy testing market. Factors such as the presence of a well established pharmaceutical industry in the region, the high R&D expenditure, a strong presence of major service providers, and rising outsourcing of analytical testing (including efficacy testing) by pharmaceutical and cosmetic companies in the region are the major factors driving the market growth.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Respondent- Supply Side- 80%, Demand Side-20%

- By Designation- Executives- 25%, CXOs- 20%, Managers - 55%

- By Region- North America - 50%, Europe - 20%, APAC - 20%, RoW- 10%

The key players operating in the efficacy testing market are Charles River Laboratories (US), WuXi AppTec (China), Eurofins Scientific (Luxembourg), SGS (Switzerland), Intertek Group (UK), Nelson Laboratories, LLC (a Sotera Health company, US), Microbac Laboratories, Inc. (US), Almac Group (UK), North American Science Associates, Inc. (US), Toxikon (US), Pacific Biolabs (US), MSL Solution Providers (UK), Intertek Group PLC (UK), Accugen Laboratories, Inc. (US), Consumer Product Testing Company (US), Lucideon (UK), BioScience Laboratories, Inc. (US), ALS Limited (Australia), Microchem Laboratory (US), Oxford Biosciences Ltd. (UK), Abbott Analytical (Australia), Helvic Laboratories (a Tentamus Company, UK), Honeyman Group Limited (UK), Danish Technological Institute (DTI, Denmark), and BluTest Laboratories Limited (UK).

Research Coverage:

The report segments the efficacy testing market based on region (Asia Pacific, Europe, North America, and RoW), service type (disinfectant efficacy testing and antimicrobial/preservative efficacy testing), application (pharmaceutical manufacturing applications, cosmetics and personal care product applications, consumer product applications, and medical device applications).

The report also provides a comprehensive review of market drivers, challenges, and opportunities in the efficacy testing market

Key Benefits of Buying the Report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the efficacy testing market and provides them information on key market drivers, challenges, and opportunities.

This report provides insights into the following pointers:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the efficacy testing market. The report analyzes the market based on the service type, application, and region.

- Service Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service/product launches in the efficacy testing market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of efficacy testing solutions across regions.

- Market Diversification: Exhaustive information about products/ services, untapped regions, recent developments, and investments in the efficacy testing market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the efficacy testing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary sources

- FIGURE 1 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 3 EFFICACY TESTING MARKET: FINAL CAGR PROJECTIONS

- FIGURE 4 EFFICACY TESTING MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DEMAND-SIDE DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 5 EFFICACY TESTING MARKET: SEGMENTAL ASSESSMENT

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET RANKING ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 EFFICACY TESTING MARKET, BY SERVICE TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 EFFICACY TESTING MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 REGIONAL SNAPSHOT OF EFFICACY TESTING MARKET

4 PREMIUM INSIGHTS

- 4.1 EFFICACY TESTING MARKET OVERVIEW

- FIGURE 10 GROWING PREFERENCE FOR OUTSOURCING EFFICACY TESTING TO DRIVE MARKET GROWTH

- 4.2 ASIA PACIFIC: EFFICACY TESTING MARKET, BY APPLICATION AND COUNTRY (2021)

- FIGURE 11 PHARMACEUTICAL MANUFACTURING APPLICATIONS SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2021

- 4.3 GEOGRAPHICAL SNAPSHOT OF EFFICACY TESTING MARKET

- FIGURE 12 CHINA TO WITNESS HIGHEST GROWTH RATE FROM 2022 TO 2027

- 4.4 EFFICACY TESTING MARKET, BY REGION

- FIGURE 13 NORTH AMERICA TO DOMINATE MARKET IN 2027

- 4.5 EFFICACY TESTING MARKET: DEVELOPED VS. DEVELOPING MARKETS

- FIGURE 14 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 EFFICACY TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of surface disinfectants and preservatives in pharma, biopharma, and cosmetics industries for contamination control and product stability

- 5.2.1.1.1 Growing focus on contamination control

- 5.2.1.1.2 Increasing concerns over product stability

- 5.2.1.2 Growing preference for outsourcing efficacy testing

- 5.2.1.3 Rising adoption of quality by design approach

- 5.2.1.4 Stringent regulations for use of surface disinfectants

- 5.2.1.5 Growing awareness of sanitization and hygiene due to spread of COVID-19

- 5.2.1.1 Increasing use of surface disinfectants and preservatives in pharma, biopharma, and cosmetics industries for contamination control and product stability

- 5.2.2 RESTRAINTS

- 5.2.2.1 Adverse effects of chemical disinfectants

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging countries in Asia Pacific

- 5.2.4 CHALLENGES

- 5.2.4.1 Time-consuming process

- 5.3 REGULATORY ANALYSIS

- 5.3.1 DISINFECTANT EFFICACY TESTING

- 5.3.2 ANTIMICROBIAL EFFICACY TESTING

- 5.4 IMPACT OF COVID-19 ON EFFICACY TESTING SERVICES

- 5.5 PRICING ANALYSIS

- TABLE 1 PRICE OF SURFACE DISINFECTANT PRODUCTS (2022)

- 5.6 PATENT ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 TRADE ANALYSIS FOR DISINFECTANTS

- TABLE 2 IMPORT DATA FOR DISINFECTANTS, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 3 EXPORT DATA FOR DISINFECTANTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 16 VALUE CHAIN ANALYSIS: EFFICACY TESTING MARKET

- 5.9 ECOSYSTEM ANALYSIS

- FIGURE 17 SURFACE DISINFECTANTS MARKET: ECOSYSTEM ANALYSIS

- TABLE 4 ROLE IN ECOSYSTEM

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 EFFICACY TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 DEGREE OF COMPETITION

- 5.11 TECHNOLOGY ANALYSIS

6 EFFICACY TESTING MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- TABLE 6 EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- 6.2 DISINFECTANT EFFICACY TESTING

- TABLE 7 DISINFECTANT EFFICACY TESTING MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 8 NORTH AMERICA: DISINFECTANT EFFICACY TESTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 9 EUROPE: DISINFECTANT EFFICACY TESTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 10 APAC: DISINFECTANT EFFICACY TESTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 11 ROW: DISINFECTANT EFFICACY TESTING MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 12 DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- 6.2.1 SURFACE TEST METHOD

- 6.2.1.1 Surface test method segment to account for larger share of disinfectant efficacy testing market

- TABLE 13 SURFACE TEST METHOD MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 14 NORTH AMERICA: SURFACE TEST METHOD MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 15 EUROPE: SURFACE TEST METHOD MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 16 APAC: SURFACE TEST METHOD MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.2.2 SUSPENSION TEST METHOD

- 6.2.2.1 Suspension test method is typically performed by researchers during development stage of disinfectants

- TABLE 17 SUSPENSION TEST METHOD MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 18 NORTH AMERICA: SUSPENSION TEST METHOD MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 19 EUROPE: SUSPENSION TEST METHOD MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 20 APAC: SUSPENSION TEST METHOD MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3 ANTIMICROBIAL/PRESERVATIVE EFFICACY TESTING

- TABLE 21 EUROFINS SCIENTIFIC AET TEST PROTOCOL

- TABLE 22 ANTIMICROBIAL/PRESERVATIVE EFFICACY TESTING MARKET, BY REGION, 2020-2027 (USD MILLION)

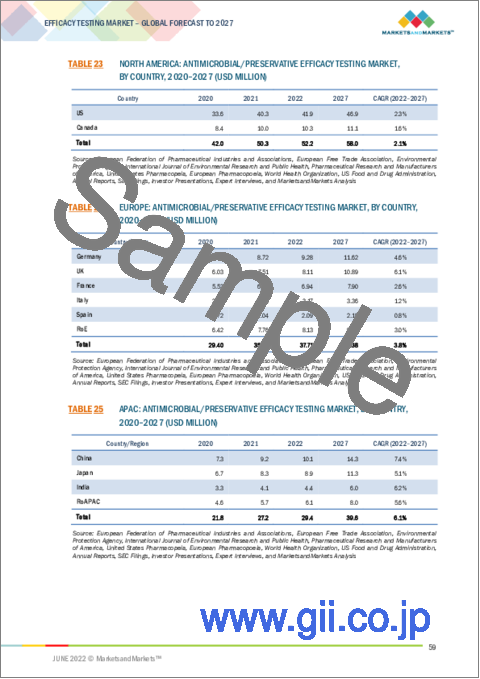

- TABLE 23 NORTH AMERICA: ANTIMICROBIAL/PRESERVATIVE EFFICACY TESTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 24 EUROPE: ANTIMICROBIAL/PRESERVATIVE EFFICACY TESTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 25 APAC: ANTIMICROBIAL/PRESERVATIVE EFFICACY TESTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 26 ROW: ANTIMICROBIAL/PRESERVATIVE EFFICACY TESTING MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 27 ANTIMICROBIAL/PRESERVATIVE EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- 6.3.1 TRADITIONAL TEST METHOD

- 6.3.1.1 Traditional test method segment to dominate AET/PET market

- TABLE 28 TRADITIONAL TEST METHOD MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.2 RAPID TEST METHOD

- 6.3.2.1 Regulatory uncertainties restraining adoption of rapid microbial methods

- TABLE 29 RAPID TEST METHOD MARKET, BY REGION, 2020-2027 (USD MILLION)

7 EFFICACY TESTING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 30 EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 7.2 PHARMACEUTICAL MANUFACTURING APPLICATIONS

- 7.2.1 INCREASING FOCUS ON ENSURING QUALITY OF DRUGS TO DRIVE SEGMENT GROWTH

- TABLE 31 EFFICACY TESTING MARKET FOR PHARMACEUTICAL MANUFACTURING APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 32 NORTH AMERICA: EFFICACY TESTING MARKET FOR PHARMACEUTICAL MANUFACTURING APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 33 EUROPE: EFFICACY TESTING MARKET FOR PHARMACEUTICAL MANUFACTURING APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 34 APAC: EFFICACY TESTING MARKET FOR PHARMACEUTICAL MANUFACTURING APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 COSMETICS AND PERSONAL CARE PRODUCT APPLICATIONS

- 7.3.1 EFFICACY TESTING IS AN ESSENTIAL PART OF STABILITY TESTING REGIMEN OF COSMETICS

- TABLE 35 EFFICACY TESTING MARKET FOR COSMETICS AND PERSONAL CARE PRODUCT APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 36 NORTH AMERICA: EFFICACY TESTING MARKET FOR COSMETICS AND PERSONAL CARE PRODUCT APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 37 EUROPE: EFFICACY TESTING MARKET FOR COSMETICS AND PERSONAL CARE PRODUCT APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 38 APAC: EFFICACY TESTING MARKET FOR COSMETICS AND PERSONAL CARE PRODUCT APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.4 CONSUMER PRODUCT APPLICATIONS

- 7.4.1 GROWING FOCUS ON HEALTHY ENVIRONMENT IN HOMES AND INDUSTRIAL FACILITIES TO DRIVE SEGMENT GROWTH

- TABLE 39 EFFICACY TESTING MARKET FOR CONSUMER PRODUCT APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 40 NORTH AMERICA: EFFICACY TESTING MARKET FOR CONSUMER PRODUCT APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 41 EUROPE: EFFICACY TESTING MARKET FOR CONSUMER PRODUCT APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 42 APAC: EFFICACY TESTING MARKET FOR CONSUMER PRODUCT APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.5 MEDICAL DEVICE APPLICATIONS

- 7.5.1 IMPOSITION OF STRINGENT GOVERNMENT REGULATIONS TO DRIVE SEGMENT GROWTH

- TABLE 43 EFFICACY TESTING MARKET FOR MEDICAL DEVICE APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 44 NORTH AMERICA: EFFICACY TESTING MARKET FOR MEDICAL DEVICE APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 45 EUROPE: EFFICACY TESTING MARKET FOR MEDICAL DEVICE APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 46 APAC: EFFICACY TESTING MARKET FOR MEDICAL DEVICE APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

8 EFFICACY TESTING MARKET, BY REGION

- 8.1 INTRODUCTION

- TABLE 47 EFFICACY TESTING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.2 NORTH AMERICA

- FIGURE 18 NORTH AMERICA: EFFICACY TESTING MARKET SNAPSHOT

- TABLE 48 NORTH AMERICA: EFFICACY TESTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 50 NORTH AMERICA: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: ANTIMICROBIAL/PRESERVATIVE EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2.1 US

- 8.2.1.1 US to dominate North American efficacy testing market during forecast period

- TABLE 53 US: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 54 US: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 55 US: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2.2 CANADA

- 8.2.2.1 Government initiatives to drive market growth in Canada

- TABLE 56 CANADA: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 57 CANADA: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 58 CANADA: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.3 EUROPE

- TABLE 59 EUROPE: EFFICACY TESTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 60 EUROPE: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 61 EUROPE: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 62 EUROPE: ANTIMICROBIAL/PRESERVATIVE EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 63 EUROPE: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.3.1 GERMANY

- 8.3.1.1 Germany to account for largest share in European market

- TABLE 64 GERMANY: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 65 GERMANY: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 66 GERMANY: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.3.2 FRANCE

- 8.3.2.1 High demand for cosmetics in France to drive market growth

- TABLE 67 FRANCE: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 68 FRANCE: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 69 FRANCE: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.3.3 UK

- 8.3.3.1 Efficacy testing market in UK is primarily driven by enforcement of regulatory and industry standards

- TABLE 70 UK: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 71 UK: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 72 UK: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.3.4 ITALY

- 8.3.4.1 Increasing pharmaceutical production in Italy to drive market growth

- TABLE 73 ITALY: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 74 ITALY: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 75 ITALY: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.3.5 SPAIN

- 8.3.5.1 Rising R&D expenditure to boost market growth in Spain

- TABLE 76 SPAIN: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 77 SPAIN: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 78 SPAIN: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.3.6 REST OF EUROPE

- TABLE 79 ROE: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 80 ROE: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 81 ROE: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4 ASIA PACIFIC

- FIGURE 19 ASIA PACIFIC: EFFICACY TESTING MARKET SNAPSHOT

- TABLE 82 APAC: EFFICACY TESTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 83 APAC: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 84 APAC: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 85 APAC: ANTIMICROBIAL/PRESERVATIVE EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 86 APAC: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4.1 CHINA

- 8.4.1.1 China to dominate Asia Pacific market

- TABLE 87 CHINA: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 88 CHINA: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 89 CHINA: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4.2 JAPAN

- 8.4.2.1 Rising R&D investments to drive market growth in Japan

- TABLE 90 JAPAN: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 91 JAPAN: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 92 JAPAN: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4.3 INDIA

- 8.4.3.1 Growing pharmaceutical industry in India to drive market growth

- TABLE 93 INDIA: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 94 INDIA: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 95 INDIA: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4.4 REST OF ASIA PACIFIC

- TABLE 96 ROAPAC: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 97 ROAPAC: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 98 ROAPAC: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.5 REST OF THE WORLD

- TABLE 99 ROW: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 100 ROW: DISINFECTANT EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 101 ROW: ANTIMICROBIAL/PRESERVATIVE EFFICACY TESTING MARKET, BY METHOD, 2020-2027 (USD MILLION)

- TABLE 102 ROW: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 103 ROW: EFFICACY TESTING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.5.1 LATIN AMERICA

- 8.5.1.1 Increasing pharmaceutical R&D expenditure to drive market growth in Latin America

- TABLE 104 LATAM: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 105 LATAM: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.5.2 MIDDLE EAST AND AFRICA

- 8.5.2.1 UAE has emerged as key market in MEA region

- TABLE 106 MEA: EFFICACY TESTING MARKET, BY SERVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 107 MEA: EFFICACY TESTING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- FIGURE 20 KEY DEVELOPMENTS IN EFFICACY TESTING MARKET, 2019-2022

- 9.3 MARKET SHARE ANALYSIS

- FIGURE 21 EFFICACY TESTING MARKET SHARE, BY KEY PLAYER, 2021

- TABLE 108 EFFICACY TESTING MARKET: DEGREE OF COMPETITION

- 9.4 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 9.5 COMPANY EVALUATION QUADRANT

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- 9.6 COMPANY EVALUATION QUADRANT: START-UPS/SMES

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 STARTING BLOCKS

- 9.6.3 RESPONSIVE COMPANIES

- 9.6.4 DYNAMIC COMPANIES

- 9.7 FOOTPRINT ANALYSIS OF COMPANIES

- 9.7.1 SERVICE FOOTPRINT OF COMPANIES

- TABLE 109 SERVICE FOOTPRINT OF COMPANIES: EFFICACY TESTING MARKET (2021)

- 9.7.2 REGIONAL FOOTPRINT OF COMPANIES

- TABLE 110 REGIONAL FOOTPRINT OF COMPANIES: EFFICACY TESTING MARKET (2021)

- 9.8 COMPETITIVE SCENARIO

- TABLE 111 PRODUCT LAUNCHES

- TABLE 112 DEALS

- TABLE 113 OTHER DEVELOPMENTS

10 COMPANY PROFILES

- 10.1 EFFICACY TESTING SERVICE PROVIDERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 10.1.1 EUROFINS SCIENTIFIC

- TABLE 114 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

- FIGURE 25 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2021)

- 10.1.2 CHARLES RIVER LABORATORIES INTERNATIONAL, INC.

- TABLE 115 CHARLES RIVER LABORATORIES INTERNATIONAL, INC.: BUSINESS OVERVIEW

- FIGURE 26 CHARLES RIVER LABORATORIES INTERNATIONAL, INC.: COMPANY SNAPSHOT (2021)

- 10.1.3 WUXI APPTEC

- TABLE 116 WUXI APPTEC: BUSINESS OVERVIEW

- FIGURE 27 WUXI APPTEC: COMPANY SNAPSHOT (2021)

- 10.1.4 SGS SA

- TABLE 117 SGS SA: BUSINESS OVERVIEW

- 10.1.5 INTERTEK GROUP PLC

- TABLE 118 INTERTEK GROUP PLC: BUSINESS OVERVIEW

- FIGURE 28 INTERTEK GROUP PLC: COMPANY SNAPSHOT (2021)

- 10.1.6 MICROCHEM LABORATORY

- TABLE 119 MICROCHEM LABORATORY: BUSINESS OVERVIEW

- 10.1.7 ACCUGEN LABORATORIES, INC.

- TABLE 120 ACCUGEN LABORATORIES, INC.: BUSINESS OVERVIEW

- 10.1.8 PACIFIC BIOLABS

- TABLE 121 PACIFIC BIOLABS: BUSINESS OVERVIEW

- 10.1.9 NORTH AMERICAN SCIENCE ASSOCIATES

- TABLE 122 NORTH AMERICAN SCIENCE ASSOCIATES: BUSINESS OVERVIEW

- 10.1.10 TOXIKON

- TABLE 123 TOXIKON: BUSINESS OVERVIEW

- 10.1.11 BIOSCIENCE LABORATORIES, INC.

- TABLE 124 BIOSCIENCE LABORATORIES, INC.: BUSINESS OVERVIEW

- 10.1.12 CONSUMER PRODUCT TESTING COMPANY (CPTC)

- TABLE 125 CONSUMER PRODUCT TESTING COMPANY (CPTC): BUSINESS OVERVIEW

- 10.1.13 ALMAC GROUP

- TABLE 126 ALMAC GROUP: BUSINESS OVERVIEW

- 10.1.14 MSL SOLUTION PROVIDERS

- TABLE 127 MSL SOLUTION PROVIDERS: BUSINESS OVERVIEW

- 10.1.15 NELSON LABORATORIES, LLC (A SOTERA HEALTH COMPANY)

- TABLE 128 NELSON LABORATORIES, LLC: BUSINESS OVERVIEW

- 10.1.16 ALS LIMITED

- TABLE 129 ALS LIMITED: BUSINESS OVERVIEW

- 10.1.17 ABBOTT ANALYTICAL

- TABLE 130 ABBOTT ANALYTICAL: BUSINESS OVERVIEW

- 10.1.18 BLUTEST LABORATORIES LIMITED

- TABLE 131 BLUTEST LABORATORIES LIMITED: BUSINESS OVERVIEW

- 10.1.19 LUCIDEON

- TABLE 132 LUCIDEON: BUSINESS OVERVIEW

- 10.1.20 HELVIC LABORATORIES (A TENTAMUS COMPANY)

- TABLE 133 HELVIC LABORATORIES: BUSINESS OVERVIEW

- 10.2 MANUFACTURERS OF DISINFECTANTS

- 10.2.1 PROCTER & GAMBLE

- TABLE 134 PROCTER & GAMBLE: BUSINESS OVERVIEW

- FIGURE 29 PROCTER & GAMBLE: COMPANY SNAPSHOT (2021)

- 10.2.2 THE CLOROX COMPANY

- TABLE 135 THE CLOROX COMPANY: BUSINESS OVERVIEW

- FIGURE 30 THE CLOROX COMPANY: COMPANY SNAPSHOT (2021)

- 10.2.3 3M

- TABLE 136 3M: BUSINESS OVERVIEW

- FIGURE 31 3M: COMPANY SNAPSHOT (2021)

- 10.2.4 RECKITT BENCKISER GROUP PLC

- TABLE 137 RECKITT BENCKISER GROUP PLC: BUSINESS OVERVIEW

- FIGURE 32 RECKITT BENCKISER GROUP PLC: COMPANY SNAPSHOT (2021)

- 10.2.5 ECOLAB

- TABLE 138 ECOLAB: BUSINESS OVERVIEW

- FIGURE 33 ECOLAB: COMPANY SNAPSHOT (2021)

- 10.2.6 STERIS

- TABLE 139 STERIS: BUSINESS OVERVIEW

- FIGURE 34 STERIS: COMPANY SNAPSHOT (2021)

- 10.2.7 CANTEL MEDICAL

- TABLE 140 CANTEL MEDICAL: BUSINESS OVERVIEW

- FIGURE 35 CANTEL MEDICAL: COMPANY SNAPSHOT (2021)

- 10.2.8 DIVERSEY HOLDINGS LTD.

- TABLE 141 DIVERSEY HOLDINGS LTD.: BUSINESS OVERVIEW

- FIGURE 36 DIVERSEY HOLDINGS LTD.: COMPANY SNAPSHOT (2021)

- 10.2.9 CARROLLCLEAN

- TABLE 142 CARROLLCLEAN: BUSINESS OVERVIEW

- 10.2.10 PAUL HARTMANN AG

- TABLE 143 PAUL HARTMANN AG: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 AVAILABLE CUSTOMIZATIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS