|

|

市場調査レポート

商品コード

1170841

医薬品用ゼラチンの世界市場:原料別 (豚、牛皮、牛骨、マリン、家禽)・用途別 (ハードカプセル、ソフトカプセル、錠剤、吸収性止血剤)・機能別 (安定化、増粘、ゲル化)・地域別の将来予測 (2027年まで)Pharmaceutical Gelatin Market by Source (Porcine, Bovine Skin, Bovine Bone, Fish, Poultry), Application (Hard Capsule, Soft Capsule, Tablet, Absorbable Hemostat), Function (Stabilizing, Thickening, Gelling), Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 医薬品用ゼラチンの世界市場:原料別 (豚、牛皮、牛骨、マリン、家禽)・用途別 (ハードカプセル、ソフトカプセル、錠剤、吸収性止血剤)・機能別 (安定化、増粘、ゲル化)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年12月06日

発行: MarketsandMarkets

ページ情報: 英文 190 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の医薬品用ゼラチンの市場規模は、2022年の11億米ドルから2027年には15億米ドルに達し、予測期間中 (2022年~2027年) に5.5%のCAGRで成長すると予測されています。

市場成長の要因は、経済的・環境的なメリットを持つゼラチンの機能的能力にあると考えられます。しかし、菜食主義者の増加などの要因がベジタリアンカプセルの需要を押し上げ、予測期間中の同市場の成長を抑制すると予測されています。

"ハードカプセルが圧倒的なシェアを占め、予測期間中もその優位性を保つ"

用途別では、ソフトジェルカプセルのセグメントが予測期間中に最も速く成長すると予想されます。この成長は、主に患者に優しい投与形態に起因しています。

"マリンゼラチンがエンドユーザーから大きな注目を集め、市場成長に高い影響を与える可能性"

原料別では、2021年には豚セグメントが支配的なシェアを占めています。その要因として、短い製造サイクルや最小限の生産コストなどが挙げられます。一方、マリン (魚由来) セグメントは、主要企業による新規の魚ベースゼラチンの市場への投入などの様々な要因により、今後数年間で大きなシェアを獲得すると予想されます。

"安定化剤機能セグメントが2021年に市場を独占"

機能別では、増粘剤のセグメントが、シロップ・エリキシル剤・その他の液体投与での使用増加により、より速いペースで成長すると予想されます。

"2021年には、B型セグメントが圧倒的なシェアを占める"

種類別では、B型のセグメントが2021年に最大のシェアを占めました。ほとんどの地域でウシ原料を容易に入手でき、製造工程が安価なことが、このセグメントの主な成長促進要因となっています。

"2021年に北米が支配的なシェアを占めた"

地域別に見ると、2021年には北米が大きなシェアを占めています。その要因として、製薬業界におけるゼラチンの需要増加や、同地域に多数の企業が存在することなどが挙げられます。

当レポートでは、世界の医薬品用ゼラチンの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、用途別・原料別・機能別・種類別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- 原材料の調達

- 原材料の収集・輸送

- 原材料の処理・加工

- ゼラチン製造

- エコシステム分析

- 技術分析

- 特許分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 規制状況

- 貿易分析

- 主な会議とイベント (2022年~2023年)

第6章 医薬品用ゼラチン市場:用途別

- イントロダクション

- ハードカプセル

- ソフトジェルカプセル

- 錠剤

- 吸収性止血剤

- その他の用途

第7章 医薬品用ゼラチン市場:原料別

- イントロダクション

- 豚

- 牛皮

- 牛骨

- マリン (魚由来)

- 家禽

第8章 医薬品用ゼラチン市場:機能別

- イントロダクション

- 安定剤

- 増粘剤

- ゲル化剤・その他の機能

第9章 医薬品用ゼラチン市場:種類別

- イントロダクション

- B型ゼラチン

- A型ゼラチン

第10章 医薬品用ゼラチン市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 日本

- 中国

- インド

- 他のアジア太平洋諸国

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要企業が採用している権利獲得アプローチ

- 収益分析

- 市場シェア分析

- 企業評価クアドラント

- 企業評価クアドラント:中小企業/スタートアップ向け (2021年)

- 競合ベンチマーキング

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- DARLING INGREDIENTS

- NITTA GELATIN

- TESSENDERLO GROUP

- GELITA AG

- WEISHARDT

- TROBAS GELATINE

- LAPI GELATINE

- INDIA GELATINE & CHEMICALS

- GELNEX

- JUNCA GELATINES

- HEBEI CHENGDA MINGJIAO

- ITALGEL

- XIAMEN GELKEN GELATIN

- GELCO INTERNATIONAL

- HENAN BOOM GELATIN

- NORLAND PRODUCTS

- GELIKO

- KENNEY & ROSS LIMITED

- BAOTOU DONGBAO BIO-TECH

- GELTEC

- NARMADA GELATINES.

- REINERT GRUPPE INGREDIENTS GMBH

- JELLICE GELATIN & COLLAGEN

- STERLING GELATIN

- ATHOS COLLAGEN

第13章 付録

The global pharmaceutical gelatin market is projected to reach USD 1.5 Billion by 2027 from USD 1.1 Billion in 2022, at a CAGR of 5.5% during the forecast period of 2022-2027. Market growth can be attributed to the functional abilities of gelatin which has economic and environmental benefits. However, factors such as increased veganism have driven the demand for vegetarian capsules and are anticipated to restrain the growth of this market during the forecast period.

"Hard capsules segment held dominant share and anticipated to retain its dominance during the forecast period."

Based on application, the pharmaceutical gelatin market is segmented into hard capsules, softgel capsules, tablets, absorbable hemostats & other applications. The softgel capsules segment is anticipated to grow faster in the pharmaceutical gelatin market during the forecast period. The growth is majorly attributable to the patient-friendly dosage form.

"Fish gelatin is gaining major attention from end users, and this is likely to have a higher impact on the market growth."

Based on source, the pharmaceutical gelatin market is further segmented into porcine, bovine skin, bovine bone, marine & poultry. The porcine segment held dominant share in pharmaceutical gelatin market in 2021. The dominance of the segment is due to various factors such as short manufacturing cycle and minimal production cost of gelatin from source . The marine segment is also expected to gain a significant share in coming years, owing to various factors such as the launch of novel fish-based gelatin in the market by key market players.

"Stabilizing agent function segment dominated the market in 2021."

Based on function, the pharmaceutical gelatin market is further segmented into stabilizing agent, thickening agent, gelling agent & other functions. The thickening agent segment is anticipated to grow at a faster pace owing to its increased use in syrups, elixirs, and other liquid dosages.

"Type B segment held a dominant share in 2021"

Based on type, the pharmaceutical gelatin market is further segmented into type A and type B. The type B segment held the largest share of the pharmaceutical gelatin market in 2021. The easier availability of bovine raw material in most regions and less expensive manufacturing processes are some of the factors likely to project the segment growth during the forecast period.

"North America held a dominant share in 2021."

Geographically, the pharmaceutical gelatin market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2021, North America accounted for the major share in the pharmaceutical gelatin market. The large share of the North American region is due to increased demand for gelatin in the pharmaceutical industry and the presence of a large number of market players in the region. These factors can be attributed to the market growth of the North American region during the forecast period.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type - Supply Side: 70.0%, Demand Side: 30.0%

- By Designation - Managers: 45.0%, CXOs & Directors:30.0%, Excecutives:25.0%

- By Region - North America: 20%, Europe: 10%, Asia Pacific: 55%, Latin America: 10%, Middle East & Africa: 5%

- List of Companies Profiled in the Report

- Darling Ingredients Inc. (US)

- Gelita AG (Germany)

- Tessenderlo Group (Belgium)

- Nitta Gelatin (Japan)

- Weishardt (France)

- Italgel S.p.A (Italy)

- Lapi Gelatine S.p.A (Italy)

- India Gelatine & Chemicals Ltd. (India)

- Gelnex (Brazil)

- Baotou Dongbao Bio-Tech (China)

- Henan Boom Gelatin (China)

- Heibei Chengda Mingjiao (China)

- Kenney & Ross Limited (Canada)

- Narmada Gelatin Limited (India)

- Junca Gelatines (Spain)

- Trobas Gelatine B.V. (Netherlands)

- Jellice Gelatin (Japan)

- Norland Products Inc. (US)

- Xiamen Gelken Gelatin Co. Ltd. (China)

- Athos Collagen (India)

- Geliko LLC (US)

- Reinert Gruppe Ingredients (Germany)

- Gelco International (Brazil)

- Sterling Gelatin (India)

- Geltec (South Korea)

Research Coverage:

This report provides a detailed picture of the global pharmaceutical gelatin market. It aims at estimating the size and future growth potential of the market across different segments, such as application, source, function, type, and region. The report also analyzes factors (such as drivers, restraints, and opportunities) affecting the market growth. It evaluates the opportunities in the market for stakeholders and provides details of the competitive landscape for market leaders. The report also studies micromarkets with respect to their growth trends, prospects, and contributions to the total pharmaceutical gelatin market. The report forecasts the revenue of the market segments with respect to five major regions.

Reasons to Buy the Report:

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on pharmaceutical gelatin offered by the top 25 players in the pharmaceutical gelatin market. The report analyses the pharmaceutical gelatin market by application, source, function, type and region.

- Market Development: Comprehensive information about beneficial emerging markets. The report analyzes the markets for various pharmaceutical gelatin products across key geographic regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the pharmaceutical gelatin market.

- Competitive Assessment: In-depth assessment of market ranking and strategies of the leading players in the pharmaceutical gelatin market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.3.2 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- FIGURE 2 PHARMACEUTICAL GELATIN MARKET: BREAKDOWN OF PRIMARIES

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2021)

- FIGURE 4 AVERAGE MARKET SIZE ESTIMATION (2021)

- 2.3 DATA TRIANGULATION APPROACH

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

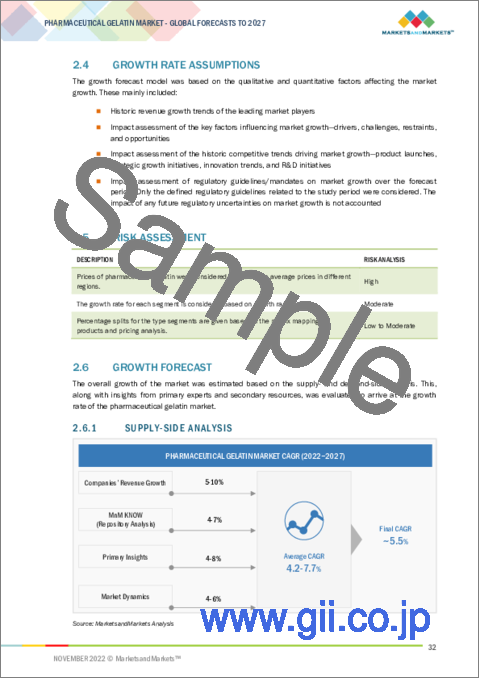

- 2.4 GROWTH RATE ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 GROWTH FORECAST

- 2.6.1 SUPPLY-SIDE ANALYSIS

- 2.6.1.1 Insights from primary experts

- 2.6.1 SUPPLY-SIDE ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 6 PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 7 PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 PHARMACEUTICAL GELATIN MARKET SHARE, BY FUNCTION, 2021

- FIGURE 9 PHARMACEUTICAL GELATIN MARKET SHARE, BY TYPE, 2021

- FIGURE 10 GEOGRAPHICAL SNAPSHOT OF PHARMACEUTICAL GELATIN MARKET

4 PREMIUM INSIGHTS

- 4.1 PHARMACEUTICAL GELATIN MARKET OVERVIEW

- FIGURE 11 VERSATILITY OF GELATIN IN PHARMACEUTICAL AND BIOMEDICAL APPLICATIONS TO DRIVE MARKET GROWTH

- 4.2 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET SHARE, BY APPLICATION (2021)

- FIGURE 12 HARD CAPSULES ACCOUNTED FOR LARGEST SHARE IN 2021

- 4.3 PHARMACEUTICAL GELATIN MARKET SHARE, BY SOURCE, 2022 VS. 2027

- FIGURE 13 PORCINE GELATIN TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 PHARMACEUTICAL GELATIN MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 14 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 PHARMACEUTICAL GELATIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Advantages and properties of gelatin

- 5.2.1.2 Launch of advanced pharma gelatins

- 5.2.1.3 Increasing biomedical applications of gelatin

- 5.2.2 RESTRAINTS

- 5.2.2.1 Cultural restrictions in certain regions

- 5.2.2.2 Shift toward non-gelatin capsules

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Demand for pharma gelatin in developing countries

- 5.2.3.2 Adoption of gelatin in vaccines and biomedical applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Insufficient raw materials

- 5.2.4.2 Increasing incidence of animal-borne diseases

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 16 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PHARMACEUTICAL GELATIN

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND

- TABLE 1 AVERAGE SELLING PRICE OF PHARMACEUTICAL GELATIN, BY REGION

- 5.4.2 INDICATIVE PRICING ANALYSIS, BY MARKET PLAYER

- TABLE 2 XIAMEN GELKEN GELATIN: AVERAGE SELLING PRICE OF PHARMACEUTICAL GELATIN

- TABLE 3 HENAN BOOM GELATIN: AVERAGE SELLING PRICE OF PHARMACEUTICAL GELATIN

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 17 PHARMACEUTICAL GELATIN MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 SOURCING OF RAW MATERIAL

- 5.5.2 COLLECTION AND TRANSPORT OF RAW MATERIAL

- 5.5.3 RAW MATERIAL PREPARATION AND PROCESSING

- 5.5.4 GELATIN PRODUCTION

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 FARMING INPUT

- 5.6.2 FARMING

- 5.6.3 SLAUGHTERING

- 5.6.4 MANUFACTURING

- 5.6.5 SUPPLIERS/DISTRIBUTORS

- 5.6.6 END-PRODUCT MANUFACTURERS

- FIGURE 18 PHARMACEUTICAL GELATIN MARKET: ECOSYSTEM ANALYSIS

- 5.6.7 ROLE IN ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- TABLE 4 PHARMACEUTICAL GELATIN MARKET: TECHNOLOGICAL ADVANCEMENTS, 2019-2022

- 5.8 PATENT ANALYSIS

- 5.8.1 LIST OF MAJOR PATENTS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 PHARMACEUTICAL GELATIN MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 COMPETITIVE RIVALRY AMONG EXISTING PLAYERS

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT FROM SUBSTITUTES

- 5.9.5 THREAT FROM NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PHARMACEUTICAL GELATIN

- FIGURE 20 KEY BUYING CRITERIA FOR PHARMACEUTICAL GELATIN AMONG END USERS

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 NORTH AMERICA

- 5.11.2 EUROPE

- 5.11.3 ASIA PACIFIC

- 5.11.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 TRADE ANALYSIS

- 5.12.1 US

- 5.12.2 INDIA

- TABLE 7 TOP IMPORTERS OF GELATIN FROM INDIA, BY VALUE, 2020-2021 (APR-NOV)

- 5.12.3 BRAZIL

- 5.12.4 OVERVIEW OF GELATIN TRADE/IMPEX, BY COUNTRY

- 5.13 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 8 PHARMACEUTICAL GELATIN MARKET: DETAILED LIST OF EVENTS AND CONFERENCES

6 PHARMACEUTICAL GELATIN MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- TABLE 9 PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.2 HARD CAPSULES

- 6.2.1 ADVANTAGES OF GELATIN-BASED HARD CAPSULES TO PROPEL MARKET

- TABLE 10 TYPICAL HARD GELATIN CAPSULE COMPOSITION

- TABLE 11 DIMENSIONS (IN MILLIMETERS) AND VOLUME (IN MILLIMETERS) OF TWO-PIECE HARD CAPSULES

- TABLE 12 PHARMACEUTICAL GELATIN MARKET FOR HARD CAPSULES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 13 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR HARD CAPSULES, BY COUNTRY, 2020-2027 (USD MILLION)

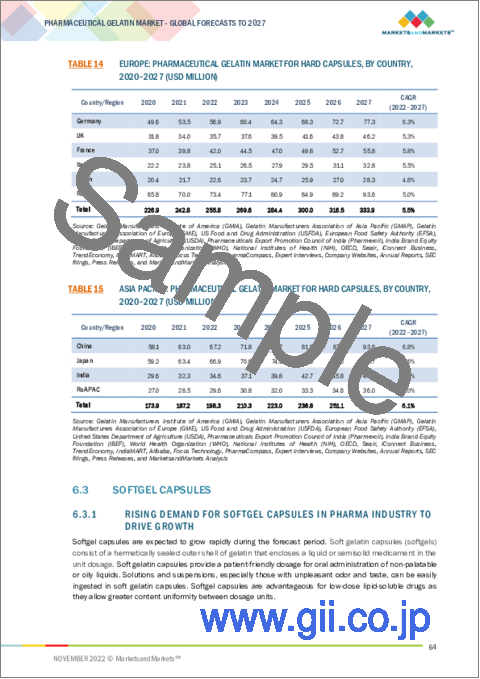

- TABLE 14 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR HARD CAPSULES, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 15 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR HARD CAPSULES, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3 SOFTGEL CAPSULES

- 6.3.1 RISING DEMAND FOR SOFTGEL CAPSULES IN PHARMA INDUSTRY TO DRIVE GROWTH

- TABLE 16 DIFFERENCES BETWEEN HARD CAPSULES AND SOFTGEL CAPSULES

- TABLE 17 PHARMACEUTICAL GELATIN MARKET FOR SOFTGEL CAPSULES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 18 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR SOFTGEL CAPSULES, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 19 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR SOFTGEL CAPSULES, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 20 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR SOFTGEL CAPSULES, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.4 TABLETS

- 6.4.1 USE OF GELATIN AS BINDERS IN TABLETS TO CONTRIBUTE TO SEGMENTAL GROWTH

- TABLE 21 IN VITRO PROPERTIES OF TABLETS WITH GELATIN AS BINDER (CONCENTRATIONS 2.0-8.0%)

- TABLE 22 PHARMACEUTICAL GELATIN MARKET FOR TABLETS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 23 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR TABLETS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 24 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR TABLETS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 25 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR TABLETS, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.5 ABSORBABLE HEMOSTATS

- 6.5.1 INCREASED ADOPTION OF ABSORBABLE HEMOSTATS TO DRIVE MARKET

- TABLE 26 PHARMACEUTICAL GELATIN MARKET FOR ABSORBABLE HEMOSTATS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 27 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR ABSORBABLE HEMOSTATS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 28 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR ABSORBABLE HEMOSTATS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 29 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR ABSORBABLE HEMOSTATS, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.6 OTHER APPLICATIONS

- TABLE 30 PHARMACEUTICAL GELATIN MARKET FOR OTHER APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 31 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 32 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 33 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

7 PHARMACEUTICAL GELATIN MARKET, BY SOURCE

- 7.1 INTRODUCTION

- TABLE 34 AMINO ACID COMPOSITION OF GELATINS, BY SOURCE

- TABLE 35 PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 36 PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (KT)

- 7.2 PORCINE

- 7.2.1 LOWER MANUFACTURING COSTS OF PORCINE RAW MATERIALS TO PROPEL MARKET GROWTH

- TABLE 37 US: PORK EXPORTS IN USD MILLION (2017-2021)

- TABLE 38 PORCINE PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: PORCINE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 40 EUROPE: PORCINE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 41 ASIA PACIFIC: PORCINE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 BOVINE SKIN

- 7.3.1 INCREASING AVAILABILITY OF BOVINE SKIN TO BOOST GROWTH

- TABLE 42 BOVINE SKIN PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: BOVINE SKIN PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 44 EUROPE: BOVINE SKIN PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 45 ASIA PACIFIC: BOVINE SKIN PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.4 BOVINE BONE

- 7.4.1 ADVANTAGES OF BOVINE BONE LIKELY TO SUPPORT DEMAND GROWTH

- TABLE 46 BOVINE BONE PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 47 NORTH AMERICA: BOVINE BONE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 48 EUROPE: BOVINE BONE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 49 ASIA PACIFIC: BOVINE BONE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.5 MARINE

- 7.5.1 INCIDENCE OF ZOONOTIC DISEASES IN CATTLE AND PIGS TO DRIVE DEMAND FOR MARINE GELATIN

- TABLE 50 MARINE PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: MARINE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 52 EUROPE: MARINE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 53 ASIA PACIFIC: MARINE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.6 POULTRY

- 7.6.1 AVAILABILITY OF POULTRY AS A RAW MATERIAL TO BOOST UTILITY

- TABLE 54 POULTRY PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: POULTRY PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 56 EUROPE: POULTRY PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 57 ASIA PACIFIC: POULTRY PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

8 PHARMACEUTICAL GELATIN MARKET, BY FUNCTION

- 8.1 INTRODUCTION

- TABLE 58 PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- 8.2 STABILIZING AGENTS

- 8.2.1 RISING VACCINE AND CAPSULE PRODUCTION TO DRIVE DEMAND FOR STABILIZING AGENTS

- TABLE 59 PHARMACEUTICAL GELATIN MARKET FOR STABILIZING AGENTS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR STABILIZING AGENTS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 61 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR STABILIZING AGENTS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 62 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR STABILIZING AGENTS, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.3 THICKENING AGENTS

- 8.3.1 GROWING USE OF GELATIN IN SYRUPS AND LIQUID DOSAGE FORMS TO DRIVE MARKET

- TABLE 63 PHARMACEUTICAL GELATIN MARKET FOR THICKENING AGENTS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 64 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR THICKENING AGENTS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 65 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR THICKENING AGENTS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 66 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR THICKENING AGENTS, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.4 GELLING AGENTS & OTHER FUNCTIONS

- 8.4.1 WIDE APPLICATIONS IN SOFTGEL CAPSULES AND HEMOSTATS TO BOOST DEMAND FOR GELLING AGENTS

- TABLE 67 PHARMACEUTICAL GELATIN MARKET FOR GELLING AGENTS & OTHER FUNCTIONS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 68 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR GELLING AGENTS & OTHER FUNCTIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 69 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR GELLING AGENTS & OTHER FUNCTIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 70 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR GELLING AGENTS & OTHER FUNCTIONS, BY COUNTRY, 2020-2027 (USD MILLION)

9 PHARMACEUTICAL GELATIN MARKET, BY TYPE

- 9.1 INTRODUCTION

- TABLE 71 PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.2 TYPE B GELATIN

- 9.2.1 INCREASED DEMAND FOR BOVINE-BASED GELATIN TO PROPEL MARKET GROWTH

- TABLE 72 NUTRITIONAL COMPOSITION OF TYPE B GELATIN

- TABLE 73 TYPE B PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 74 NORTH AMERICA: TYPE B PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 75 EUROPE: TYPE B PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 76 ASIA PACIFIC: TYPE B PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.3 TYPE A GELATIN

- 9.3.1 COST-EFFECTIVENESS OF PROCESSING TYPE A GELATIN TO DRIVE GROWTH

- TABLE 77 NUTRITIONAL COMPOSITION OF TYPE A GELATIN

- TABLE 78 TYPE A PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: TYPE A PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 80 EUROPE: TYPE A PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 81 ASIA PACIFIC: TYPE A PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

10 PHARMACEUTICAL GELATIN MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 82 PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 21 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET SNAPSHOT

- TABLE 83 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 84 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 87 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Increased prevalence of chronic diseases to drive market

- TABLE 88 US: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 89 US: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 90 US: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 91 US: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Increasing demand for biopharmaceuticals to support growth

- TABLE 92 CANADA: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 93 CANADA: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 94 CANADA: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 95 CANADA: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.3 EUROPE

- TABLE 96 EUROPE: PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 97 EUROPE: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 98 EUROPE: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 99 EUROPE: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 100 EUROPE: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Rising focus and investment in pharmaceutical R&D to promote market growth

- TABLE 101 GERMANY: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 102 GERMANY: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 103 GERMANY: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 104 GERMANY: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Investments in novel drug development to propel demand for pharmaceutical gelatin

- TABLE 105 UK: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 106 UK: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 107 UK: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 108 UK: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Increased investment in pharmaceutical R&D to drive demand for pharmaceutical gelatin

- TABLE 109 FRANCE: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 110 FRANCE: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 111 FRANCE: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 112 FRANCE: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 Pharma R&D and innovation efforts to boost gelatin usage

- TABLE 113 ITALY: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 114 ITALY: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 115 ITALY: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 116 ITALY: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.3.5 SPAIN

- 10.3.5.1 Growing pharma manufacturing to fuel demand for gelatin

- TABLE 117 SPAIN: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 118 SPAIN: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 119 SPAIN: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 120 SPAIN: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 121 ROE: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 122 ROE: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 123 ROE: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 124 ROE: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 22 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET SNAPSHOT

- TABLE 125 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 127 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 128 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 129 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.4.1 JAPAN

- 10.4.1.1 Increasing aging population to create growth opportunities

- TABLE 130 JAPAN: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 131 JAPAN: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 132 JAPAN: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 133 JAPAN: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Large population and availability of raw materials to contribute to market growth in China

- TABLE 134 CHINA: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 135 CHINA: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 136 CHINA: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 137 CHINA: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Booming pharmaceutical industry to drive market

- TABLE 138 INDIA: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 139 INDIA: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 140 INDIA: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 141 INDIA: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.4.4 REST OF ASIA PACIFIC

- TABLE 142 ROAPAC: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 143 ROAPAC: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 144 ROAPAC: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 145 ROAPAC: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 RISING DEMAND FOR PHARMA GELATIN IN LATIN AMERICA TO DRIVE MARKET GROWTH

- TABLE 146 LATAM: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 147 LATAM: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 148 LATAM: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 149 LATAM: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RISING ADOPTION OF GELATIN-BASED PHARMA PRODUCTS TO PROPEL GROWTH

- TABLE 150 MEA: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 151 MEA: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020-2027 (USD MILLION)

- TABLE 152 MEA: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020-2027 (USD MILLION)

- TABLE 153 MEA: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

- FIGURE 23 PHARMACEUTICAL GELATIN MARKET: STRATEGIES ADOPTED

- 11.3 REVENUE ANALYSIS

- FIGURE 24 REVENUE ANALYSIS FOR KEY COMPANIES (2019-2021)

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 25 PHARMACEUTICAL GELATIN MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

- TABLE 154 PHARMACEUTICAL GELATIN MARKET: DEGREE OF COMPETITION

- 11.5 COMPANY EVALUATION QUADRANT

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 26 PHARMACEUTICAL GELATIN MARKET: COMPANY EVALUATION QUADRANT, 2021

- 11.6 COMPANY EVALUATION QUADRANT FOR SMES/START-UPS (2021)

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 STARTING BLOCKS

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 27 PHARMACEUTICAL GELATIN MARKET: COMPANY EVALUATION QUADRANT FOR SMES/START-UPS, 2021

- 11.7 COMPETITIVE BENCHMARKING

- TABLE 155 OVERALL COMPANY FOOTPRINT

- TABLE 156 COMPANY PRODUCT FOOTPRINT

- TABLE 157 COMPANY REGIONAL FOOTPRINT

- 11.8 COMPETITIVE SCENARIO AND TRENDS

- TABLE 158 PHARMACEUTICAL GELATIN MARKET: PRODUCT LAUNCHES, JANUARY 2019-OCTOBER 2022

- TABLE 159 PHARMACEUTICAL GELATIN MARKET: DEALS, JANUARY 2019-OCTOBER 2022

- TABLE 160 PHARMACEUTICAL GELATIN MARKET: OTHER DEVELOPMENTS, JANUARY 2019-OCTOBER 2022

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1.1 DARLING INGREDIENTS

- TABLE 161 DARLING INGREDIENTS: BUSINESS OVERVIEW

- FIGURE 28 DARLING INGREDIENTS: COMPANY SNAPSHOT (2022)

- 12.1.2 NITTA GELATIN

- TABLE 162 NITTA GELATIN: BUSINESS OVERVIEW

- FIGURE 29 NITTA GELATIN: COMPANY SNAPSHOT (2022)

- 12.1.3 TESSENDERLO GROUP

- TABLE 163 TESSENDERLO GROUP: BUSINESS OVERVIEW

- FIGURE 30 TESSENDERLO GROUP: COMPANY SNAPSHOT (2022)

- 12.1.4 GELITA AG

- TABLE 164 GELITA AG: BUSINESS OVERVIEW

- 12.1.5 WEISHARDT

- TABLE 165 WEISHARDT: BUSINESS OVERVIEW

- 12.1.6 TROBAS GELATINE

- TABLE 166 TROBAS GELATINE: BUSINESS OVERVIEW

- 12.1.7 LAPI GELATINE

- TABLE 167 LAPI GELATINE S.P.A: BUSINESS OVERVIEW

- 12.1.8 INDIA GELATINE & CHEMICALS

- TABLE 168 INDIA GELATINE & CHEMICALS: BUSINESS OVERVIEW

- FIGURE 31 INDIA GELATINE & CHEMICALS: COMPANY SNAPSHOT (2022)

- 12.1.9 GELNEX

- TABLE 169 GELNEX: BUSINESS OVERVIEW

- 12.1.10 JUNCA GELATINES

- TABLE 170 JUNCA GELATINES: BUSINESS OVERVIEW

- 12.1.11 HEBEI CHENGDA MINGJIAO

- TABLE 171 HEBEI CHENGDA MINGJIAO: BUSINESS OVERVIEW

- 12.1.12 ITALGEL

- TABLE 172 ITALGEL: BUSINESS OVERVIEW

- 12.1.13 XIAMEN GELKEN GELATIN

- TABLE 173 XIAMEN GELKEN GELATIN BUSINESS OVERVIEW

- 12.1.14 GELCO INTERNATIONAL

- TABLE 174 GELCO INTERNATIONAL: BUSINESS OVERVIEW

- 12.1.15 HENAN BOOM GELATIN

- TABLE 175 HENAN BOOM GELATIN: BUSINESS OVERVIEW

- 12.1.16 NORLAND PRODUCTS

- TABLE 176 NORLAND PRODUCTS: BUSINESS OVERVIEW

- 12.1.17 GELIKO

- TABLE 177 GELIKO: BUSINESS OVERVIEW

- 12.1.18 KENNEY & ROSS LIMITED

- TABLE 178 KENNEY & ROSS LIMITED: BUSINESS OVERVIEW

- 12.1.19 BAOTOU DONGBAO BIO-TECH

- TABLE 179 BAOTOU DONGBAO BIO-TECH: BUSINESS OVERVIEW

- 12.1.20 GELTEC

- TABLE 180 GELTEC: BUSINESS OVERVIEW

- 12.1.21 NARMADA GELATINES.

- TABLE 181 NARMADA GELATINES: BUSINESS OVERVIEW

- FIGURE 32 NARMADA GELATINES: COMPANY SNAPSHOT (2022)

- 12.1.22 REINERT GRUPPE INGREDIENTS GMBH

- TABLE 182 REINERT GRUPPE INGREDIENTS GMBH: BUSINESS OVERVIEW

- 12.1.23 JELLICE GELATIN & COLLAGEN

- TABLE 183 JELLICE GELATIN AND COLLAGEN: BUSINESS OVERVIEW

- 12.1.24 STERLING GELATIN

- TABLE 184 STERLING GELATIN: BUSINESS OVERVIEW

- 12.1.25 ATHOS COLLAGEN

- TABLE 185 ATHOS COLLAGEN: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS