|

|

市場調査レポート

商品コード

1125039

画像センサーの世界市場:技術別 (CMOS画像センサー)・処理技術別 (2D画像センサー、3D画像センサー)・スペクトル別・アレイの種類別・解像度別・エンドユーザー別 (家電、自動車)・地域別の将来予測 (2027年まで)Image Sensor Market by Technology (CMOS Image Sensors), Processing Technique (2D Image Sensors, 3D Image Sensors), Spectrum, Array Type, Resolution, End-User (Consumer Electronics, Automotive) and Geography - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 画像センサーの世界市場:技術別 (CMOS画像センサー)・処理技術別 (2D画像センサー、3D画像センサー)・スペクトル別・アレイの種類別・解像度別・エンドユーザー別 (家電、自動車)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年08月30日

発行: MarketsandMarkets

ページ情報: 英文 289 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

画像センサーの世界市場規模は、2022年に261億米ドルと推定され、2027年には386億米ドルに達すると予測され、予測期間中のCAGRは8.1%となります。

この市場は、先進的な医療用画像ソリューションにおける画像センサーの利用増加や、自動車におけるADASの採用拡大など、いくつかの要因から有望な成長可能性を秘めています。

"3D画像センサー:処理技術別で最も急成長しているセグメント"

3D画像センサーのセグメントは、予測期間中に高いCAGRで成長すると予測されています。この成長は、3D画像センサーの奥行き感知能力により、AR/VR・自動車・3Dセンシング・SLAM用途での採用が増加していることに起因している可能性があります。また、3D画像センサーは、2Dセンサの欠点を補うために、正しい奥行き情報を記録することができ、その結果、点群として、精度の面でかなり優れたオブジェクトになるため、2Dセンサよりも優れた選択肢です。

"解像度5~10MP:画像センサー市場の中で2番目に大きなセグメント"

2021年、5~10MPのセグメントが解像度別で2番目に大きな規模を占めています。このセグメントの成長は、消費電力の低さやフットプリントの小ささなどの利点に起因しています。また、顔認証システム、先進運転支援システム (ADAS)、車載ADAS、タブレットなどのローエンド機器に画像センサーが広く採用されているため、自動車向けADASの成長がこのセグメントの成長を牽引しています。

"エリア画像センサー:アレイの種類別では最も成長率の高いセグメント"

エリア画像センサーのセグメントは、ディスクリートコンポーネント上で見事に動作し、それらは不釣り合いに多くの単純なマシンビジョンアプリケーションで使用されているため、予測期間中に画像センサー市場をリードすると予測されます。さらに、ライン画像センサーよりも使いやすく、設置も簡単で、コスト効率も高く、応用範囲も広くなっています。

"可視スペクトル:スペクトル別で最大セグメント"

2021年の画像センサー市場において、可視スペクトルセグメントは最も大きなシェアを占めています。このセグメントの成長は、消費電力の削減、統合の簡素化、スピード、コスト要因などの利点により、民生用電子機器での画像センサーの使用が増加したことに起因すると考えられます。また、スマートフォン撮影、ウェアラブル、商用ドローン、サービスロボットなどで使用される様々な解像度のカメラに対する需要の増加が、市場の成長を後押ししています。

"自動車分野:エンドユーザーで最も成長率の高いセグメント"

自動車分野は2022年から2027年にかけて最も高いCAGRで成長すると予測されています。このセグメントの成長の主な要因は、自動車メーカーにおける安全性への懸念の高まりです。ADASに画像センサーが採用され、自律走行車の動向が市場成長の機会を提供しています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- サプライチェーン分析

- 画像センサー市場のエコシステム

- 平均販売価格の分析

- 技術動向

- 主要な技術

- 補完的な技術

- 隣接技術

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 特許分析 (2012年~2022年)

- 主な会議とイベント (2022年~2023年)

- 関税分析

- 規格・規制状況

第6章 画像センサー市場:技術別

- イントロダクション

- CMOS画像センサー

- CCD画像センサー

- その他

第7章 画像センサー市場:処理技術別

- イントロダクション

- 2D画像センサー

- 3D画像センサー

第8章 画像センサー市場:スペクトル別

- イントロダクション

- 可視スペクトル

- 非可視スペクトル

- 赤外線

- X線

第9章 画像センサー市場:アレイの種類別

- イントロダクション

- リニア画像センサー

- エリア画像センサー

第10章 画像センサー市場:解像度別

- イントロダクション

- VGA

- 1.3~3MP

- 5~10MP

- 12MP~16MP

- 16MP以上

第11章 画像センサー市場:エンドユーザー別

- イントロダクション

- 航空宇宙・防衛、国土安全保障

- 自動車

- リアビュー/サイドビューカメラ

- 前方用ADAS

- 車内用ADAS

- カメラミラーシステム

- 家電

- スマートフォン・タブレット

- デスクトップ・ラップトップ

- 業務用コピー機・スキャナー

- 写真・動画撮影ソリューション

- 住宅用監視システム

- ウェアラブル

- 商用ドローン

- サービスロボット

- 医療・ライフサイエンス

- X線

- 内視鏡検査

- 工業用

- マシンビジョン

- ロボットビジョン

- 業務用監視・モニタリング

- 商業

- バーコードスキャナー

- 監視システム

第12章 画像センサー市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 他のアジア太平洋諸国

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- 他の欧州諸国

- 他の国々 (RoW)

- 中東・アフリカ

- 南米

第13章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 製品ポートフォリオ

- 注力地域

- 製造フットプリント

- 有機・無機戦略

- 市場シェア分析 (2021年)

- 企業収益分析 (5年間分)

- 企業評価クアドラント

- スタートアップ/中小企業 (SME) の評価クアドラント

- 企業のフットプリント

- 競合シナリオと動向

- 製品の発売

- 資本取引

第14章 企業プロファイル

- 主要企業

- SONY GROUP

- SAMSUNG ELECTRONICS CO., LTD.

- OMNIVISION

- STMICROELECTRONICS N.V.

- GALAXYCORE SHANGHAI LIMITED CORPORATION

- ON SEMICONDUCTOR CORPORATION

- PANASONIC HOLDINGS CORPORATION

- CANON INC.

- SK HYNIX INC.

- PIXART IMAGING INC.

- その他の企業

- HAMAMATSU PHOTONICS K.K.

- PIXELPLUS CO., LTD

- AMS AG

- HIMAX TECHNOLOGIES, INC

- TELEDYNE TECHNOLOGIES INCORPORATED

- SHARP CORPORATION

- GPIXEL INC.

- NUVOTON TECHNOLOGY CORPORATION

- DIODES INCORPORATED

- GIGAJOT TECHNOLOGY INC.

- ISDI

- ANDANTA GMBH

- PHOTONFOCUS AG

- NEW IMAGING TECHNOLOGIES

- RUIXIN MICROELECTRONICS CO., LTD.

第15章 付録

The global image sensor market size is estimated to be USD 26.1 billion in 2022 and is projected to reach 38.6 billion by 2027, at a CAGR of 8.1% during the forecast period. The market has a promising growth potential due to several factors, increasing use of image sensors in advanced medical imaging solutions and growing adoption of ADAS in automobiles.

An image sensor is a semiconductor device that can convert optical images into digital signals. They are widely used in digital cameras and other electronic optical devices. An image sensor uses the photoelectric conversion function of the photoelectric device to convert the light image on the photosensitive surface into an electrical signal in a proportional relationship with the light image.

"3D image sensors: The fastest-growing segment of the image sensor market, by processing technique"

The 3D image sensors segment of the market is projected to grow at a higher CAGR during the forecast period. This growth can be attributed to the rising adoption of 3D image sensors in AR/VR, automotive, 3D sensing, and simultaneous localization and mapping (SLAM) applications owing to their depth-sensing ability. Further, 3D image sensors are a superior choice than 2D sensors as they can compensate for the shortcomings of 2D by recording correct depth information, resulting in a point cloud, which is a considerably superior object in terms of precision.

"5 MP to 10 MP resolution: The second largest resolution segment of the image sensor market."

In 2021, the 5 MP to 10 MP resolution segment accounted for the second largest size of the image sensor market. The growth of this segment can be attributed to its benefits such as have low power consumption and a small footprint.They are widely used in low-end devices such as facial authentication systems, advanced driver assistance systems (ADAS), in-cabin ADAS, tablets, etc The growth of ADAS in automobiles drives the growth of this segment. Further, companies have also been actively launching new products within this range. For instance, in 2021, Sony Group, launched a 2/3-type CMOS image sensor for industrial equipment that is ultraviolet light (UV)-compliant and has the industry's highest effective pixel count of roughly 8.13 megapixels, and OMNIVISION launched OH08A and OH08B CMOS image sensors-the first 8-megapixel resolution sensors for single-use and reusable endoscopes

"Area Image Sensors: The fastest-growing segment of the image sensor market, by array type"

The area image sensors segment is projected to lead the image sensor market during the forecast period as they perform admirably on discrete components, they are used in a disproportionately high number of simple machine vision applications. Further, they are simpler to use and easier to install than their line image sensors counterparts, more cost-efficient and have a broader range of applications than line image sensors. Thus, the segment is expected to grow at a higher CAGR during the forecast period.

"Visible spectrum: The largest segment of the image sensor market, by spectrum"

In 2021, the visible spectrum segment held a larger share of the image sensor market than the non-visible spectrum segment. The growth of this segment can be attributed to the increased use of image sensors in consumer electronics due to the advantages of reduced power consumption, simplicity of integration, speed, and cost factor. The increased demand for cameras with varied resolutions for use in smartphone photography, wearables, commercial drone, and service robots has bolstered the market growth.

"Automotive: The fastest-growing segment in the image sensor market, end-user."

The automotive segment of the market is projected to grow at the highest CAGR from 2022 to 2027. The key factor contributing to the growth of this segment is the increasing safety concerns among automobile manufacturers. The adoption of image sensors in advanced driver assistance systems (ADAS) and the trend of autonomous vehicles provide opportunities for market growth.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type- Tier 1- 45%, Tier 2- 35% Tier 3 - 20%

- By Designation- C level - 32%, Managers - 40%, Other Level - 28%

- By Region- North America - 30%, Europe - 24%, Asia Pacific - 33%, Rest of the World- 13%,

The image sensor market is dominated by a few globally established players such as Sony Group (Japan), Samsung Electronics Co., Ltd. (Japan), OMNIVISION (US), STMicroelectronics N.V. (Switzerland), and GalaxyCore Shanghai Limited Corporation (China).

The study includes an in-depth competitive analysis of these key players in the image sensor market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the image sensor market and forecasts its size, by volume and value, based on region (Asia Pacific, Europe, North America, and Rest of the World), technology(CMOS image sensors, CCD image sensors, and others), processing technique (2D image sensors, and 3D image sensors), spectrum (visible spectrum, and non-visible spectrum), array type (area image sensors, and linear image sensors) resolution (VGA, 1.3 MP to 3 MP, 5 MP to 10 MP, 12 MP to 16 MP, and More than 16 MP) and end-users (aerospace, defense, and homeland security, automotive, consumer electronics, medical and life sciences, industrial, and commercial)

The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the image sensor market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Key Benefits of Buying the Report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the image sensor market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 IMAGE SENSOR MARKET SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 IMAGE SENSOR MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of key primary interview participants

- 2.1.3.2 Breakdown of primaries

- FIGURE 3 BREAKDOWN OF PRIMARIES

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 FACTOR ANALYSIS

- 2.2.1 SUPPLY-SIDE ANALYSIS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE ANALYSIS) - REVENUES GENERATED BY COMPANIES FROM SALES OF PRODUCTS OFFERED IN IMAGE SENSOR MARKET

- 2.2.2 DEMAND-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE ANALYSIS)

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to obtain market share using bottom-up analysis (demand side)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to obtain market share using top-down analysis (supply side)

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.3 GROWTH PROJECTIONS AND FORECASTING ASSUMPTIONS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 IMAGE SENSOR MARKET: DATA TRIANGULATION

- 2.5 ASSUMPTIONS

- TABLE 2 KEY ASSUMPTIONS: MACRO AND MICRO-ECONOMIC ENVIRONMENT

- 2.6 LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 3 RISK ASSESSMENT: IMAGE SENSOR MARKET

3 EXECUTIVE SUMMARY

- 3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- FIGURE 10 CMOS IMAGE SENSORS TO HOLD LARGEST SHARE OF IMAGE SENSOR MARKET IN 2022

- FIGURE 11 3D IMAGE SENSORS SEGMENT PROJECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

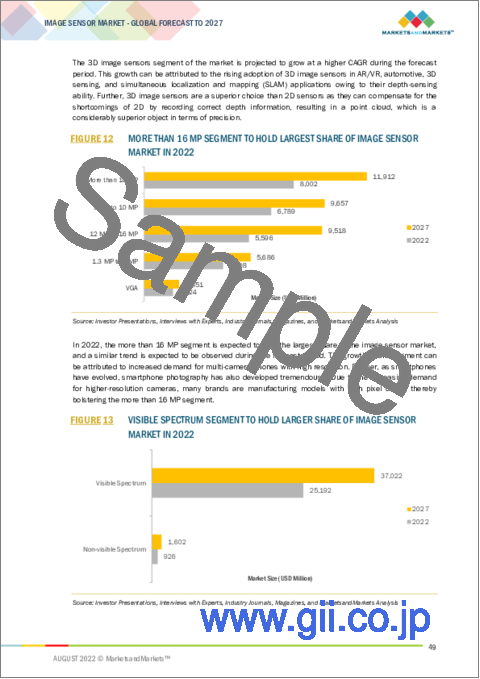

- FIGURE 12 MORE THAN 16 MP SEGMENT TO HOLD LARGEST SHARE OF IMAGE SENSOR MARKET IN 2022

- FIGURE 13 VISIBLE SPECTRUM SEGMENT TO HOLD LARGER SHARE OF IMAGE SENSOR MARKET IN 2022

- FIGURE 14 AREA IMAGE SENSORS TO HOLD LARGER SHARE OF IMAGE SENSOR MARKET IN 2022

- FIGURE 15 AUTOMOTIVE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IMAGE SENSOR MARKET

- FIGURE 17 GROWING ADOPTION OF IMAGE SENSORS IN SMARTPHONES, MEDICAL DEVICES, AND AUTONOMOUS VEHICLES TO DRIVE MARKET GROWTH

- 4.2 IMAGE SENSOR MARKET, BY TECHNOLOGY

- FIGURE 18 CMOS IMAGE SENSOR TO HOLD LARGEST SHARE OF IMAGE SENSOR MARKET IN 2027

- 4.3 IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE

- FIGURE 19 2D IMAGE SENSOR TO HOLD LARGER SHARE OF IMAGE SENSOR MARKET IN 2027

- 4.4 IMAGE SENSOR MARKET, BY RESOLUTION

- FIGURE 20 MORE THAN 16 MP TO HOLD LARGEST SHARE OF IMAGE SENSOR MARKET IN 2027

- 4.5 IMAGE SENSOR MARKET, BY SPECTRUM

- FIGURE 21 VISIBLE SPECTRUM TO HOLD LARGER SHARE OF IMAGE SENSOR MARKET IN 2027

- 4.6 IMAGE SENSOR MARKET, BY ARRAY TYPE

- FIGURE 22 AREA IMAGE SENSOR TO HOLD LARGER SHARE OF IMAGE SENSOR MARKET IN 2027

- 4.7 IMAGE SENSOR MARKET, BY END-USER

- FIGURE 23 CONSUMER ELECTRONICS TO HOLD LARGEST SHARE OF IMAGE SENSOR MARKET IN 2022

- 4.8 IMAGE SENSOR MARKET, BY REGION

- FIGURE 24 ASIA PACIFIC TO HOLD LARGEST SHARE OF IMAGE SENSOR MARKET IN 2027

- 4.9 IMAGE SENSOR MARKET, BY COUNTRY

- FIGURE 25 GERMANY TO RECORD HIGHEST CAGR IN OVERALL IMAGE SENSOR MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 26 IMAGE SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for multiple cameras in mobile devices

- 5.2.1.2 Growing adoption of ADAS in automobiles

- 5.2.1.3 Increasing use of image sensors in advanced medical imaging solutions

- FIGURE 27 DRIVERS AND THEIR IMPACT ON IMAGE SENSOR MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Growing preference for LiDAR solutions by automobile manufacturers

- 5.2.2.2 Declining demand for digital still cameras

- FIGURE 28 TOTAL SHIPMENT OF DIGITAL STILL CAMERAS, 2011-2021

- FIGURE 29 RESTRAINTS AND THEIR IMPACT ON IMAGE SENSOR MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising innovation and advancements in image sensors

- FIGURE 30 OPPORTUNITIES AND THEIR IMPACT ON IMAGE SENSOR MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Reduced time-to-market of smartphones

- 5.2.4.2 Issues associated with reducing pixel pitch

- FIGURE 31 CHALLENGES AND THEIR IMPACT ON IMAGE SENSOR MARKET

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 32 IMAGE SENSOR MARKET: SUPPLY CHAIN

- TABLE 4 IMAGE SENSOR MARKET: ECOSYSTEM

- 5.4 IMAGE SENSOR MARKET ECOSYSTEM

- FIGURE 33 ECOSYSTEM OF IMAGE SENSORS

- 5.5 AVERAGE SELLING PRICE ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF CMOS IMAGE SENSORS, BY KEY PLAYER

- FIGURE 34 AVERAGE SELLING PRICE OF CMOS IMAGE SENSORS, BY KEY PLAYER

- TABLE 5 AVERAGE SELLING PRICE OF CMOS IMAGE SENSORS, BY KEY PLAYER (USD)

- 5.5.2 AVERAGE SELLING PRICE TREND

- TABLE 6 AVERAGE SELLING PRICE OF IMAGE SENSOR PRODUCTS, BY END-USER (USD)

- FIGURE 35 AVERAGE PRICE: IMAGE SENSOR MARKET, BY END-USER

- 5.5.3 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR MARKET PLAYERS

- FIGURE 36 REVENUE SHIFT IN IMAGE SENSOR MARKET

- 5.6 TECHNOLOGY TRENDS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 sCMOS technology

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Quantum dot CMOS technology

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 LiDAR technology

- 5.6.3.2 Thermal imaging technology

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 IMAGE SENSOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USERS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USERS (%)

- 5.8.2 BUYING CRITERIA

- FIGURE 39 KEY BUYING CRITERIA FOR TOP THREE END-USERS

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE END-USERS

- 5.9 CASE STUDIES

- 5.9.1 MARS 2020 MISSION USED ON SEMICONDUCTOR CORPORATION'S PYTHON SERIES OF CMOS IMAGE SENSORS

- 5.9.2 LABSPHERE, INC. DEPLOYED HIGH-END IMAGE SENSORS IN ITS SPHERE UNIFORM LIGHT SOURCE SYSTEMS

- 5.9.3 IMAGE SENSOR-ENABLED VISION SYSTEMS UTILIZED TO INSPECT HUDS USED IN JET PLANES

- 5.9.4 IMAGE SENSOR-EQUIPPED CAMERA SYSTEMS BY PANASONIC CORPORATION ENSURE SECURITY OF INHABITANTS AND VISITORS IN SLOVAKIA

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- TABLE 10 IMPORT DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- 5.10.2 EXPORT SCENARIO

- TABLE 11 EXPORT DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- 5.11 PATENT ANALYSIS, 2012-2022

- FIGURE 40 NUMBER OF PATENTS GRANTED FOR IMAGE SENSOR PRODUCTS, 2012-2022

- FIGURE 41 REGIONAL ANALYSIS OF PATENTS GRANTED FOR IMAGE SENSOR PRODUCTS, 2021

- TABLE 12 LIST OF PATENTS PERTAINING TO IMAGE SENSORS, 2020-2021

- 5.12 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 13 IMAGE SENSOR MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.13 TARIFF ANALYSIS

- TABLE 14 MFN TARIFFS FOR HS CODE 854239-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 15 MFN TARIFFS FOR HS CODE 854239-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 16 MFN TARIFFS FOR HS CODE 854239-COMPLIANT PRODUCTS EXPORTED BY JAPAN

- 5.14 STANDARDS AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 REGULATORY STANDARDS

- 5.14.3 GOVERNMENT REGULATIONS

- 5.14.3.1 Canada

- 5.14.3.2 US

- 5.14.3.3 Europe

- 5.14.3.4 India

6 IMAGE SENSORS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- FIGURE 42 IMAGE SENSORS MARKET, BY TECHNOLOGY

- FIGURE 43 CMOS IMAGE SENSORS SEGMENT TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 21 IMAGE SENSOR MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 22 IMAGE SENSOR MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 23 IMAGE SENSOR MARKET, BY TECHNOLOGY, 2018-2021 (MILLION UNITS)

- TABLE 24 IMAGE SENSOR MARKET, BY TECHNOLOGY, 2022-2027 (MILLION UNITS)

- 6.2 CMOS IMAGE SENSORS

- 6.2.1 OFFER EASE OF INTEGRATION, PROVIDE FAST FRAME RATE, AND HAVE LOW MANUFACTURING COSTS

- 6.3 CCD IMAGE SENSORS

- 6.3.1 PREFERRED IN APPLICATIONS WHERE IMAGE QUALITY IS IMPORTANT

- 6.4 OTHERS

7 IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE

- 7.1 INTRODUCTION

- FIGURE 44 IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE

- FIGURE 45 3D IMAGE SENSORS SEGMENT OF IMAGE SENSOR MARKET PROJECTED TO GROW AT HIGH CAGR FROM 2022 TO 2027

- TABLE 25 IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 26 IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2022-2027 (USD MILLION)

- 7.2 2D IMAGE SENSORS

- 7.2.1 USE RESTRICTED TO FEW APPLICATIONS DUE TO DIFFICULT FABRICATION AND HIGH MANUFACTURING COSTS

- TABLE 27 2D IMAGE SENSORS: IMAGE SENSOR MARKET, BY END-USER, 2018-2021 (USD MILLION)

- TABLE 28 2D IMAGE SENSORS: IMAGE SENSOR MARKET, BY END-USER, 2022-2027 (USD MILLION)

- 7.3 3D IMAGE SENSORS

- 7.3.1 USE TIME OF MEASUREMENT METHOD FOR DEPTH-SENSING APPLICATIONS

- FIGURE 46 AUTOMOTIVE SEGMENT OF 3D IMAGE SENSOR MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

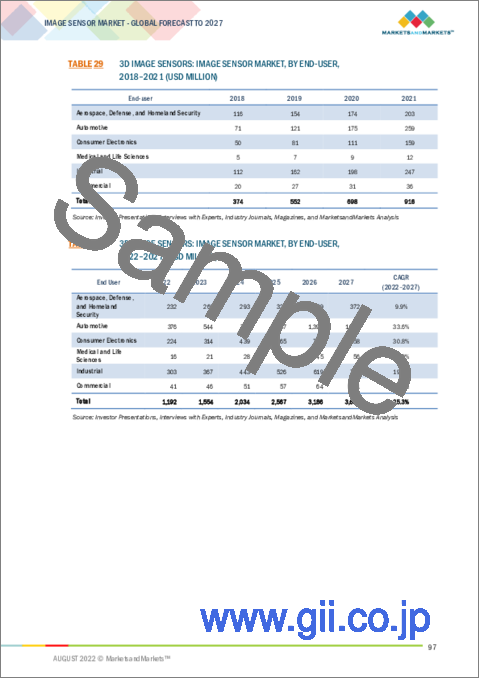

- TABLE 29 3D IMAGE SENSORS: IMAGE SENSOR MARKET, BY END-USER, 2018-2021 (USD MILLION)

- TABLE 30 3D IMAGE SENSORS: IMAGE SENSOR MARKET, BY END-USER, 2022-2027 (USD MILLION)

8 IMAGE SENSOR MARKET, BY SPECTRUM

- 8.1 INTRODUCTION

- FIGURE 47 IMAGE SENSOR MARKET, BY SPECTRUM

- FIGURE 48 NON-VISIBLE SPECTRUM SEGMENT OF IMAGE SENSOR MARKET TO GROW AT HIGHER CAGR FROM 2022 TO 2027

- TABLE 31 IMAGE SENSOR MARKET, BY SPECTRUM, 2018-2021 (USD MILLION)

- TABLE 32 IMAGE SENSOR MARKET, BY SPECTRUM, 2022-2027 (USD MILLION)

- 8.2 VISIBLE SPECTRUM

- 8.2.1 VISIBLE SPECTRUM-SENSITIVE IMAGE SENSORS USED IN CONSUMER ELECTRONICS

- TABLE 33 VISIBLE SPECTRUM: IMAGE SENSOR MARKET, BY END-USER, 2018-2021 (USD MILLION)

- TABLE 34 VISIBLE SPECTRUM: IMAGE SENSOR MARKET, BY END-USER, 2022-2027 (USD MILLION)

- 8.3 NON-VISIBLE SPECTRUM

- TABLE 35 NON-VISIBLE SPECTRUM: IMAGE SENSOR MARKET, BY END-USER, 2018-2021 (USD MILLION)

- TABLE 36 NON-VISIBLE SPECTRUM: IMAGE SENSOR MARKET, BY END-USER, 2022-2027 (USD MILLION)

- 8.3.1 INFRARED RAYS

- 8.3.1.1 IR image sensors used in surveillance, automotive, and machine vision applications

- 8.3.2 X-RAYS

- 8.3.2.1 X-ray image sensors used in dental and surgical radiography applications

9 IMAGE SENSOR MARKET, BY ARRAY TYPE

- 9.1 INTRODUCTION

- FIGURE 49 IMAGE SENSOR MARKET, BY ARRAY TYPE

- FIGURE 50 AREA IMAGE SENSORS SEGMENT TO GROW AT HIGHER CAGR FROM 2022 TO 2027

- TABLE 37 IMAGE SENSOR MARKET, BY ARRAY TYPE, 2018-2021 (USD MILLION)

- TABLE 38 IMAGE SENSOR MARKET, BY ARRAY TYPE, 2022-2027 (USD MILLION)

- 9.2 LINEAR IMAGE SENSORS

- 9.2.1 OFFER FAST SCANNING

- 9.3 AREA IMAGE SENSORS

- 9.3.1 IDEAL FOR MACHINE VISION APPLICATIONS

10 IMAGE SENSOR MARKET, BY RESOLUTION

- 10.1 INTRODUCTION

- FIGURE 51 IMAGE SENSOR MARKET, BY RESOLUTION

- FIGURE 52 12 MP TO 16 MP SEGMENT OF IMAGE SENSOR MARKET TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 39 IMAGE SENSOR MARKET, BY RESOLUTION, 2018-2021 (USD MILLION)

- TABLE 40 IMAGE SENSOR MARKET, BY RESOLUTION, 2022-2027 (USD MILLION)

- 10.2 VGA

- 10.2.1 USED IN AUTOMOTIVE, SURVEILLANCE, STEREO VISION, SMART VISION, AUTOMATION, AND MACHINE VISION APPLICATIONS

- 10.3 1.3 MP TO 3 MP

- 10.3.1 LARGER ADOPTION IN VIDEO SURVEILLANCE AND AUTOMOTIVE APPLICATIONS

- 10.4 5 MP TO 10 MP

- 10.4.1 FIND APPLICATIONS IN LOW-END DEVICES

- 10.5 12 MP TO 16 MP

- 10.5.1 USED FOR HIGH-QUALITY IMAGE CAPTURE

- 10.6 MORE THAN 16 MP

- 10.6.1 INCREASINGLY USED IN MULTI-CAMERA PHONES

11 IMAGE SENSORS MARKET, BY END-USER

- 11.1 INTRODUCTION

- FIGURE 53 IMAGE SENSOR MARKET, BY END-USER

- FIGURE 54 AUTOMOTIVE SEGMENT OF IMAGE SENSOR MARKET TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 41 IMAGE SENSOR MARKET, BY END-USER, 2018-2021 (USD MILLION)

- TABLE 42 IMAGE SENSOR MARKET BY END-USER, 2022-2027 (USD MILLION)

- 11.2 AEROSPACE, DEFENSE, AND HOMELAND SECURITY

- 11.2.1 VARIOUS PRODUCT LAUNCHES BY MARKET PLAYERS TO BOOST SEGMENT GROWTH

- TABLE 43 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 44 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 45 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET, BY SPECTRUM, 2018-2021 (USD MILLION)

- TABLE 46 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET, BY SPECTRUM, 2022-2027 (USD MILLION)

- TABLE 47 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 48 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 49 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 50 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 51 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 52 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 53 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 54 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 55 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET IN REST OF THE WORLD, BY REGION, 2018-2021 (USD MILLION)

- TABLE 56 AEROSPACE, DEFENSE, AND HOMELAND SECURITY: IMAGE SENSOR MARKET IN REST OF THE WORLD, BY REGION, 2022-2027 (USD MILLION)

- 11.3 AUTOMOTIVE

- TABLE 57 AUTOMOTIVE: IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 58 AUTOMOTIVE: IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 59 AUTOMOTIVE: IMAGE SENSOR MARKET, BY SPECTRUM, 2018-2021 (USD MILLION)

- TABLE 60 AUTOMOTIVE: IMAGE SENSOR MARKET, BY SPECTRUM, 2022-2027 (USD MILLION)

- TABLE 61 AUTOMOTIVE: IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 62 AUTOMOTIVE: IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 63 AUTOMOTIVE: IMAGE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 64 AUTOMOTIVE: IMAGE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 65 AUTOMOTIVE: IMAGE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 66 AUTOMOTIVE: IMAGE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 67 AUTOMOTIVE: IMAGE SENSOR MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 68 AUTOMOTIVE: IMAGE SENSOR MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 69 AUTOMOTIVE: IMAGE SENSOR MARKET IN REST OF THE WORLD, BY REGION, 2018-2021 (USD MILLION)

- TABLE 70 AUTOMOTIVE: IMAGE SENSOR MARKET IN REST OF THE WORLD, BY REGION, 2022-2027 (USD MILLION)

- FIGURE 55 IN-CABIN ADAS SEGMENT OF IMAGE SENSOR MARKET FOR AUTOMOTIVE TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 71 AUTOMOTIVE: IMAGE SENSOR MARKET, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 72 AUTOMOTIVE: IMAGE SENSOR MARKET, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- 11.3.1 REAR- AND SIDE-VIEW CAMERAS

- 11.3.1.1 Government mandates for vehicle and passenger safety to fuel demand for rear- and side-view cameras

- TABLE 73 REAR- AND SIDE-VIEW CAMERAS: AUTOMOTIVE IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 74 REAR- AND SIDE-VIEW CAMERAS: AUTOMOTIVE IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3.2 FORWARD-LOOKING ADAS

- 11.3.2.1 Forward-looking ADAS to capture largest share of automotive image sensor market during 2022-2027

- TABLE 75 FORWARD-LOOKING ADAS: AUTOMOTIVE IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 76 FORWARD-LOOKING ADAS: AUTOMOTIVE IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3.3 IN-CABIN ADAS

- 11.3.3.1 In-cabin ADAS segment to grow at highest rate during 2022-2027

- TABLE 77 IN-CABIN ADAS: AUTOMOTIVE IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 78 IN-CABIN ADAS: AUTOMOTIVE IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3.4 CAMERA MIRROR SYSTEMS

- 11.3.4.1 Recently commercialized camera mirror systems offer multiple benefits

- TABLE 79 CAMERA MIRROR SYSTEMS: AUTOMOTIVE IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 80 CAMERA MIRROR SYSTEMS: AUTOMOTIVE IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4 CONSUMER ELECTRONICS

- TABLE 81 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 82 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 83 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET, BY SPECTRUM, 2018-2021 (USD MILLION)

- TABLE 84 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET, BY SPECTRUM, 2022-2027 (USD MILLION)

- TABLE 85 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 86 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 87 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 88 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 89 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 90 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 91 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 92 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 93 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET IN REST OF THE WORLD, BY REGION, 2018-2021 (USD MILLION)

- TABLE 94 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET IN REST OF THE WORLD, BY REGION, 2022-2027 (USD MILLION)

- FIGURE 56 WEARABLE SEGMENT OF IMAGE SENSOR MARKET FOR CONSUMER ELECTRONICS TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 95 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 96 CONSUMER ELECTRONICS: IMAGE SENSOR MARKET, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- 11.4.1 SMARTPHONES AND TABLETS

- 11.4.1.1 Smartphones and tablets segment accounted for largest market share in 2021

- TABLE 97 SMARTPHONES AND TABLETS: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 98 SMARTPHONES AND TABLETS: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4.2 DESKTOPS AND LAPTOPS

- 11.4.2.1 Remote working trend augmented use of desktops and laptops

- TABLE 99 DESKTOPS AND LAPTOPS: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 100 DESKTOPS AND LAPTOPS: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4.3 COMMERCIAL COPIERS AND SCANNERS

- 11.4.3.1 Increased demand for commercial copiers and scanners to bolster growth of contact image sensors

- TABLE 101 COMMERCIAL COPIERS AND SCANNERS: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 102 COMMERCIAL COPIERS AND SCANNERS: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4.4 PHOTOGRAPHY AND VIDEOGRAPHY SOLUTIONS

- 11.4.4.1 Steady demand for photography and videography to fuel demand for image sensors

- TABLE 103 PHOTOGRAPHY AND VIDEOGRAPHY SOLUTIONS: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 104 PHOTOGRAPHY AND VIDEOGRAPHY SOLUTIONS: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4.5 RESIDENTIAL SURVEILLANCE SYSTEMS

- 11.4.5.1 Image sensor-equipped cameras commonly utilized to increase safety in residential areas

- TABLE 105 RESIDENTIAL SURVEILLANCE SYSTEMS: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 106 RESIDENTIAL SURVEILLANCE SYSTEMS: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4.6 WEARABLES

- 11.4.6.1 Wearables segment to grow at highest CAGR during 2022-2027

- TABLE 107 WEARABLES: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 108 WEARABLES: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4.7 COMMERCIAL DRONES

- 11.4.7.1 Growing utilization of drones in difficult operations to boost adoption of image sensors

- TABLE 109 COMMERCIAL DRONES: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 110 COMMERCIAL DRONES: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4.8 SERVICE ROBOTS

- 11.4.8.1 Image sensor-equipped service robots to become ubiquitous in future

- TABLE 111 SERVICE ROBOTS: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 112 SERVICE ROBOTS: CONSUMER ELECTRONICS IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.5 MEDICAL AND LIFE SCIENCES

- TABLE 113 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 114 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 115 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET, BY SPECTRUM, 2018-2021 (USD MILLION)

- TABLE 116 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET, BY SPECTRUM, 2022-2027 (USD MILLION)

- TABLE 117 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 118 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 119 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 120 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 121 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 122 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 123 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 124 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 125 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET IN REST OF THE WORLD, BY REGION, 2018-2021 (USD MILLION)

- TABLE 126 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET IN REST OF THE WORLD, BY REGION, 2022-2027 (USD MILLION)

- FIGURE 57 X-RAY IMAGING SEGMENT OF IMAGE SENSOR MARKET FOR MEDICAL AND LIFE SCIENCES TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 127 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 128 MEDICAL AND LIFE SCIENCES: IMAGE SENSOR MARKET, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- 11.5.1 X-RAY

- 11.5.1.1 X-ray image sensors to grow at higher CAGR in medical image sensor market

- TABLE 129 X-RAY: MEDICAL AND LIFE SCIENCES IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 130 X-RAY: MEDICAL AND LIFE SCIENCES IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.5.2 ENDOSCOPY

- 11.5.2.1 Advancements in medical industry propel use of image sensors in endoscopy

- TABLE 131 ENDOSCOPY: MEDICAL AND LIFE SCIENCES IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 132 ENDOSCOPY: MEDICAL AND LIFE SCIENCES IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.6 INDUSTRIAL

- TABLE 133 INDUSTRIAL: IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 134 INDUSTRIAL: IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 135 INDUSTRIAL: IMAGE SENSOR MARKET, BY SPECTRUM, 2018-2021 (USD MILLION)

- TABLE 136 INDUSTRIAL: IMAGE SENSOR MARKET, BY SPECTRUM, 2022-2027 (USD MILLION)

- TABLE 137 INDUSTRIAL: IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 138 INDUSTRIAL: IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 139 INDUSTRIAL: IMAGE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 140 INDUSTRIAL: IMAGE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 141 INDUSTRIAL: IMAGE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 142 INDUSTRIAL: IMAGE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 143 INDUSTRIAL: IMAGE SENSOR MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 144 INDUSTRIAL: IMAGE SENSOR MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 145 INDUSTRIAL: IMAGE SENSOR MARKET IN REST OF THE WORLD, BY REGION, 2018-2021 (USD MILLION)

- TABLE 146 INDUSTRIAL: IMAGE SENSOR MARKET IN REST OF THE WORLD, BY REGION, 2022-2027 (USD MILLION)

- FIGURE 58 ROBOTIC VISION SEGMENT OF IMAGE SENSOR MARKET FOR INDUSTRIAL TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 147 INDUSTRIAL: IMAGE SENSOR MARKET, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 148 INDUSTRIAL: IMAGE SENSOR MARKET, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- 11.6.1 MACHINE VISION

- 11.6.1.1 Product launches to fuel growth of machine vision segment

- TABLE 149 MACHINE VISION: INDUSTRIAL IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 150 MACHINE VISION: INDUSTRIAL IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.6.2 ROBOTIC VISION

- 11.6.2.1 Robotic vision segment to record highest CAGR during forecast period

- TABLE 151 ROBOTIC VISION: INDUSTRIAL IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 152 ROBOTIC VISION: INDUSTRIAL IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.6.3 INDUSTRIAL SURVEILLANCE AND MONITORING

- 11.6.3.1 Increasing terror threats and rising incidence of raw material thefts to fuel growth of segment

- TABLE 153 INDUSTRIAL SURVEILLANCE AND MONITORING: INDUSTRIAL IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 154 INDUSTRIAL SURVEILLANCE AND MONITORING: INDUSTRIAL IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.7 COMMERCIAL

- TABLE 155 COMMERCIAL: IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 156 COMMERCIAL: IMAGE SENSOR MARKET, BY PROCESSING TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 157 COMMERCIAL: IMAGE SENSOR MARKET, BY SPECTRUM, 2018-2021 (USD MILLION)

- TABLE 158 COMMERCIAL: IMAGE SENSOR MARKET, BY SPECTRUM, 2022-2027 (USD MILLION)

- TABLE 159 COMMERCIAL: IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 160 COMMERCIAL: IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 161 COMMERCIAL: IMAGE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 162 COMMERCIAL: IMAGE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 163 COMMERCIAL: IMAGE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 164 COMMERCIAL: IMAGE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 165 COMMERCIAL: IMAGE SENSOR MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 166 COMMERCIAL: IMAGE SENSOR MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 167 COMMERCIAL: IMAGE SENSOR MARKET IN REST OF THE WORLD, BY REGION, 2018-2021 (USD MILLION)

- TABLE 168 COMMERCIAL: IMAGE SENSOR MARKET IN REST OF THE WORLD, BY REGION, 2022-2027 (USD MILLION)

- FIGURE 59 SURVEILLANCE SEGMENT OF IMAGE SENSOR MARKET FOR COMMERCIAL TO GROW AT HIGHER CAGR FROM 2022 TO 2027

- TABLE 169 COMMERCIAL: IMAGE SENSOR MARKET, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 170 COMMERCIAL: IMAGE SENSOR MARKET, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- 11.7.1 BARCODE SCANNERS

- 11.7.1.1 Use image sensors to scan special codes printed on different products and components

- TABLE 171 BARCODE SCANNER: COMMERCIAL IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 172 BARCODE SCANNER: COMMERCIAL IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.7.2 SURVEILLANCE SYSTEMS

- 11.7.2.1 Rising demand for video surveillance systems from retail and banking sectors driving growth of segment

- TABLE 173 SURVEILLANCE SYSTEMS: COMMERCIAL IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 174 SURVEILLANCE SYSTEMS: COMMERCIAL IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

12 IMAGE SENSOR MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 60 IMAGE SENSOR MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 175 IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 176 IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 ASIA PACIFIC

- FIGURE 61 ASIA PACIFIC: IMAGE SENSOR MARKET SNAPSHOT

- TABLE 177 ASIA PACIFIC: IMAGE SENSOR MARKET, BY END-USER, 2018-2021 (USD MILLION)

- TABLE 178 ASIA PACIFIC: IMAGE SENSOR MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 179 ASIA PACIFIC: IMAGE SENSOR MARKET FOR AUTOMOTIVE, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 180 ASIA PACIFIC: IMAGE SENSOR MARKET FOR AUTOMOTIVE, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 181 ASIA PACIFIC: IMAGE SENSOR MARKET FOR CONSUMER ELECTRONICS, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 182 ASIA PACIFIC: IMAGE SENSOR MARKET FOR CONSUMER ELECTRONICS, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 183 ASIA PACIFIC: IMAGE SENSOR MARKET FOR MEDICAL AND LIFE SCIENCES, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 184 ASIA PACIFIC: IMAGE SENSOR MARKET FOR MEDICAL AND LIFE SCIENCES, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 185 ASIA PACIFIC: IMAGE SENSOR MARKET FOR INDUSTRIAL, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 186 ASIA PACIFIC: IMAGE SENSOR MARKET FOR INDUSTRIAL, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 187 ASIA PACIFIC: IMAGE SENSOR MARKET FOR COMMERCIAL, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 188 ASIA PACIFIC: IMAGE SENSOR MARKET FOR COMMERCIAL, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- FIGURE 62 CHINA TO ACCOUNT FOR LARGEST SIZE OF IMAGE SENSOR MARKET IN ASIA PACIFIC FROM 2022 TO 2027

- TABLE 189 ASIA PACIFIC: IMAGE SENSOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 190 ASIA PACIFIC: IMAGE SENSOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.2.1 CHINA

- 12.2.1.1 China to dominate image sensor market in Asia Pacific during forecast period

- 12.2.2 INDIA

- 12.2.2.1 Rise of autonomous vehicles in India to bolster market

- 12.2.3 JAPAN

- 12.2.3.1 Presence of car manufacturers to support market growth

- 12.2.4 REST OF ASIA PACIFIC

- 12.3 NORTH AMERICA

- FIGURE 63 NORTH AMERICA: IMAGE SENSOR MARKET SNAPSHOT

- TABLE 191 NORTH AMERICA: IMAGE SENSOR MARKET, BY END-USER, 2018-2021 (USD MILLION)

- TABLE 192 NORTH AMERICA: IMAGE SENSOR MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 193 NORTH AMERICA: IMAGE SENSOR MARKET FOR AUTOMOTIVE, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 194 NORTH AMERICA: IMAGE SENSOR MARKET FOR AUTOMOTIVE, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 195 NORTH AMERICA: IMAGE SENSOR MARKET FOR CONSUMER ELECTRONICS, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 196 NORTH AMERICA: IMAGE SENSOR MARKET FOR CONSUMER ELECTRONICS, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 197 NORTH AMERICA: IMAGE SENSOR MARKET FOR MEDICAL AND LIFE SCIENCES, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 198 NORTH AMERICA: IMAGE SENSOR MARKET FOR MEDICAL AND LIFE SCIENCES, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 199 NORTH AMERICA: IMAGE SENSOR MARKET FOR INDUSTRIAL, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 200 NORTH AMERICA: IMAGE SENSOR MARKET FOR INDUSTRIAL, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 201 NORTH AMERICA: IMAGE SENSOR MARKET FOR COMMERCIAL, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 202 NORTH AMERICA: IMAGE SENSOR MARKET FOR COMMERCIAL, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- FIGURE 64 US TO REGISTER HIGHEST CAGR IN IMAGE SENSOR MARKET IN NORTH AMERICA FROM 2022 TO 2027

- TABLE 203 NORTH AMERICA: IMAGE SENSOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 204 NORTH AMERICA: IMAGE SENSOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.3.1 US

- 12.3.1.1 US led global image sensor market in 2021

- 12.3.2 CANADA

- 12.3.2.1 Increased adoption of wearable technology to drive market

- 12.3.3 MEXICO

- 12.3.3.1 Increasing foreign direct investments from US to provide opportunities

- 12.4 EUROPE

- FIGURE 65 EUROPE: IMAGE SENSOR MARKET SNAPSHOT

- TABLE 205 EUROPE: IMAGE SENSOR MARKET, BY END-USER, 2018-2021 (USD MILLION)

- TABLE 206 EUROPE: IMAGE SENSOR MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 207 EUROPE: IMAGE SENSOR MARKET FOR AUTOMOTIVE, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 208 EUROPE: IMAGE SENSOR MARKET FOR AUTOMOTIVE, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 209 EUROPE: IMAGE SENSOR MARKET FOR CONSUMER ELECTRONICS, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 210 EUROPE: IMAGE SENSOR MARKET FOR CONSUMER ELECTRONICS, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 211 EUROPE: IMAGE SENSOR MARKET FOR MEDICAL AND LIFE SCIENCES, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 212 EUROPE: IMAGE SENSOR MARKET FOR MEDICAL AND LIFE SCIENCES, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 213 EUROPE: IMAGE SENSOR MARKET FOR INDUSTRIAL, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 214 EUROPE: IMAGE SENSOR MARKET FOR INDUSTRIAL, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 215 EUROPE: IMAGE SENSOR MARKET FOR COMMERCIAL, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 216 EUROPE: IMAGE SENSOR MARKET FOR COMMERCIAL, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- FIGURE 66 GERMANY TO REGISTER HIGHEST CAGR IN IMAGE SENSOR MARKET IN EUROPE FROM 2022 TO 2027

- TABLE 217 EUROPE: IMAGE SENSOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 218 EUROPE: IMAGE SENSOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.4.1 UK

- 12.4.1.1 Presence of premium vehicle companies to fuel market growth

- 12.4.2 GERMANY

- 12.4.2.1 Germany to be fastest-growing image sensor market in Europe during forecast period

- 12.4.3 FRANCE

- 12.4.3.1 Increased popularity of autonomous vehicles to foster market growth

- 12.4.4 REST OF EUROPE

- 12.5 REST OF THE WORLD

- TABLE 219 REST OF THE WORLD: IMAGE SENSOR MARKET, BY END-USER, 2018-2021 (USD MILLION)

- TABLE 220 REST OF THE WORLD: IMAGE SENSOR MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 221 REST OF THE WORLD: IMAGE SENSOR MARKET FOR AUTOMOTIVE, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 222 REST OF THE WORLD: IMAGE SENSOR MARKET FOR AUTOMOTIVE, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 223 REST OF THE WORLD: IMAGE SENSOR MARKET FOR CONSUMER ELECTRONICS, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 224 REST OF THE WORLD: IMAGE SENSOR MARKET FOR CONSUMER ELECTRONICS, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 225 REST OF THE WORLD: IMAGE SENSOR MARKET FOR MEDICAL AND LIFE SCIENCES, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 226 REST OF THE WORLD: IMAGE SENSOR MARKET FOR MEDICAL AND LIFE SCIENCES, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 227 REST OF THE WORLD: IMAGE SENSOR MARKET FOR INDUSTRIAL, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 228 REST OF THE WORLD: IMAGE SENSOR MARKET FOR INDUSTRIAL, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 229 REST OF THE WORLD: IMAGE SENSOR MARKET FOR COMMERCIAL, BY END-USE APPLICATION, 2018-2021 (USD MILLION)

- TABLE 230 REST OF THE WORLD: IMAGE SENSOR MARKET FOR COMMERCIAL, BY END-USE APPLICATION, 2022-2027 (USD MILLION)

- FIGURE 67 MIDDLE EAST AND AFRICA TO REGISTER HIGHER CAGR IN IMAGE SENSOR MARKET IN REST OF THE WORLD FROM 2022 TO 2027

- TABLE 231 REST OF THE WORLD: IMAGE SENSOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 232 REST OF THE WORLD: IMAGE SENSOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.5.1 MIDDLE EAST AND AFRICA

- 12.5.1.1 Increasing concerns regarding security to drive image sensor market

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Demand from consumer electronics and automotive end-users to create opportunities for image sensor manufacturers

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 233 OVERVIEW OF STRATEGIES DEPLOYED BY KEY IMAGE SENSOR COMPANIES

- 13.2.1 PRODUCT PORTFOLIO

- 13.2.2 REGIONAL FOCUS

- 13.2.3 MANUFACTURING FOOTPRINT

- 13.2.4 ORGANIC/INORGANIC STRATEGIES

- 13.3 MARKET SHARE ANALYSIS, 2021

- TABLE 234 IMAGE SENSOR MARKET: MARKET SHARE ANALYSIS (2021)

- 13.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

- FIGURE 68 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN CMOS IMAGE SENSOR MARKET, 2017-2021

- 13.5 COMPANY EVALUATION QUADRANT

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 69 IMAGE SENSOR MARKET: COMPANY EVALUATION QUADRANT, 2021

- 13.6 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT

- TABLE 235 IMAGE SENSOR MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 236 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) IN IMAGE SENSOR MARKET

- TABLE 237 IMAGE SENSOR MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (TECHNOLOGY FOOTPRINT)

- TABLE 238 IMAGE SENSOR MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (END-USER FOOTPRINT)

- TABLE 239 IMAGE SENSOR MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (REGION FOOTPRINT)

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 70 START-UP/SME EVALUATION QUADRANT

- 13.7 COMPANY FOOTPRINT

- TABLE 240 COMPANY FOOTPRINT

- TABLE 241 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 242 COMPANY END-USER FOOTPRINT

- TABLE 243 COMPANY REGION FOOTPRINT

- 13.8 COMPETITIVE SCENARIOS AND TRENDS

- 13.8.1 PRODUCT LAUNCHES

- TABLE 244 PRODUCT LAUNCHES, MARCH 2019-MAY 2022

- 13.8.2 DEALS

- TABLE 245 DEALS, MARCH 2019-MAY 2022

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- (Business overview, Products offered, Recent developments, Product launches, Deals, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)**

- 14.1.1 SONY GROUP

- TABLE 246 SONY GROUP: BUSINESS OVERVIEW

- FIGURE 71 SONY GROUP: COMPANY SNAPSHOT

- TABLE 247 SONY GROUP: PRODUCTS OFFERED

- TABLE 248 SONY GROUP: PRODUCT LAUNCHES

- TABLE 249 SONY GROUP: DEALS

- 14.1.2 SAMSUNG ELECTRONICS CO., LTD.

- TABLE 250 SAMSUNG ELECTRONICS CO., LTD.: BUSINESS OVERVIEW

- FIGURE 72 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

- TABLE 251 SAMSUNG ELECTRONICS CO., LTD.: PRODUCTS OFFERED

- TABLE 252 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES

- 14.1.3 OMNIVISION

- TABLE 253 OMNIVISION: BUSINESS OVERVIEW

- TABLE 254 OMNIVISION: PRODUCTS OFFERED

- TABLE 255 OMNIVISION: PRODUCT LAUNCHES

- TABLE 256 OMNIVISION: DEALS

- 14.1.4 STMICROELECTRONICS N.V.

- TABLE 257 STMICROELECTRONICS N.V.: BUSINESS OVERVIEW

- FIGURE 73 STMICROELECTRONICS N.V.: COMPANY SNAPSHOT

- TABLE 258 STMICROELECTRONICS N.V.: PRODUCTS OFFERED

- TABLE 259 STMICROELECTRONICS N.V.: PRODUCT LAUNCHES

- 14.1.5 GALAXYCORE SHANGHAI LIMITED CORPORATION

- TABLE 260 GALAXYCORE SHANGHAI LIMITED CORPORATION: BUSINESS OVERVIEW

- TABLE 261 GALAXYCORE SHANGHAI LIMITED CORPORATION: PRODUCTS OFFERED

- TABLE 262 GALAXYCORE SHANGHAI LIMITED CORPORATION: DEALS

- 14.1.6 ON SEMICONDUCTOR CORPORATION

- TABLE 263 ON SEMICONDUCTOR CORPORATION: BUSINESS OVERVIEW

- FIGURE 74 ON SEMICONDUCTOR CORPORATION: COMPANY SNAPSHOT

- TABLE 264 ON SEMICONDUCTOR CORPORATION: PRODUCTS OFFERED

- TABLE 265 ON SEMICONDUCTOR CORPORATION: PRODUCT LAUNCHES

- TABLE 266 ON SEMICONDUCTOR CORPORATION: DEALS

- 14.1.7 PANASONIC HOLDINGS CORPORATION

- TABLE 267 PANASONIC HOLDINGS CORPORATION: BUSINESS OVERVIEW

- FIGURE 75 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- TABLE 268 PANASONIC HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 269 PANASONIC HOLDINGS CORPORATION: PRODUCT LAUNCHES

- 14.1.8 CANON INC.

- TABLE 270 CANON INC.: BUSINESS OVERVIEW

- FIGURE 76 CANON INC.: COMPANY SNAPSHOT

- TABLE 271 CANON INC.: PRODUCTS OFFERED

- TABLE 272 CANON INC.: PRODUCT LAUNCHES

- 14.1.9 SK HYNIX INC.

- TABLE 273 SK HYNIX INC: BUSINESS OVERVIEW

- FIGURE 77 SK HYNIX INC: COMPANY SNAPSHOT

- TABLE 274 SK HYNIX INC: PRODUCTS OFFERED

- TABLE 275 SK HYNIX INC: PRODUCT LAUNCHES

- 14.1.10 PIXART IMAGING INC.

- TABLE 276 PIXART IMAGING INC.: BUSINESS OVERVIEW

- FIGURE 78 PIXART IMAGING INC.: COMPANY SNAPSHOT

- TABLE 277 PIXART IMAGING INC.: PRODUCTS OFFERED

- TABLE 278 PIXART IMAGING INC.: DEALS

- 14.2 OTHER PLAYERS

- 14.2.1 HAMAMATSU PHOTONICS K.K.

- TABLE 279 HAMAMATSU PHOTONICS K.K.: COMPANY OVERVIEW

- 14.2.2 PIXELPLUS CO., LTD

- TABLE 280 PIXELPLUS CO., LTD: COMPANY OVERVIEW

- 14.2.3 AMS AG

- TABLE 281 AMS AG: COMPANY OVERVIEW

- 14.2.4 HIMAX TECHNOLOGIES, INC

- TABLE 282 HIMAX TECHNOLOGIES, INC: COMPANY OVERVIEW

- 14.2.5 TELEDYNE TECHNOLOGIES INCORPORATED

- TABLE 283 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- 14.2.6 SHARP CORPORATION

- TABLE 284 SHARP CORPORATION: COMPANY OVERVIEW

- 14.2.7 GPIXEL INC.

- TABLE 285 GPIXEL INC.: COMPANY OVERVIEW

- 14.2.8 NUVOTON TECHNOLOGY CORPORATION

- TABLE 286 NUVOTON TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- 14.2.9 DIODES INCORPORATED

- TABLE 287 DIODES INCORPORATED: COMPANY OVERVIEW

- 14.2.10 GIGAJOT TECHNOLOGY INC.

- TABLE 288 GIGAJOT TECHNOLOGY INC.: COMPANY OVERVIEW

- 14.2.11 ISDI

- TABLE 289 ISDI: COMPANY OVERVIEW

- 14.2.12 ANDANTA GMBH

- TABLE 290 ANDANTA GMBH: COMPANY OVERVIEW

- 14.2.13 PHOTONFOCUS AG

- TABLE 291 PHOTONFOCUS AG: COMPANY OVERVIEW

- 14.2.14 NEW IMAGING TECHNOLOGIES

- TABLE 292 NEW IMAGING TECHNOLOGIES: COMPANY OVERVIEW

- 14.2.15 RUIXIN MICROELECTRONICS CO., LTD.

- TABLE 293 RUIXIN MICROELECTRONICS CO., LTD.: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent developments, Product launches, Deals, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS