|

|

市場調査レポート

商品コード

1241253

ハイドロコロイドの世界市場:種類別 (ゼラチン、ペクチン、カラギーナン、キサンタンガム、寒天、アラビアゴム、アルギン酸塩、グアーガム、MCC)・原料別 (植物、微生物、動物、海藻、合成)・機能別・用途別・地域別の将来予測 (2028年まで)Hydrocolloids Market by Type (Gelatin, Pectin, Carrageenan, Xanthan gum, Agar, Gum Arabic, Alginates, Guar gum, MCC), Source (Botanical, Microbial, Animal, Seaweed, Synthetic), Function, Application and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ハイドロコロイドの世界市場:種類別 (ゼラチン、ペクチン、カラギーナン、キサンタンガム、寒天、アラビアゴム、アルギン酸塩、グアーガム、MCC)・原料別 (植物、微生物、動物、海藻、合成)・機能別・用途別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月14日

発行: MarketsandMarkets

ページ情報: 英文 259 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のハイドロコロイドの市場規模は、2023年に112億米ドル、2028年には145億米ドルに達すると予測され、予測期間中のCAGRは5.4%です。

ハイドロコロイドは、品質属性と保存性を向上させるために、多くの食品配合物に広く使用されています。食品に発現するハイドロコロイドは、配向と分子結合、水結合と膨潤、濃度、粒子径、分散度、他のガムとの相互作用など、いくつかの要因によって影響を受け、充填物の特性向上に役立ちます。ハイドロコロイドの主な用途は、増粘剤とゲル化剤としての2つです。また、ケーキ、パイ、ドーナツ、冷凍食品などの保湿にも使用されています。

"種類別では、ゼラチン分野が2022年に市場を独占する"

ゼラチンは食品業界で広く使用されていますが、食品への添加は特定の人々にとって問題を引き起こします。ゼラチンが特定の動物の組織から作られるため、宗教的・倫理的な理由でゼラチンの使用に反対する人がいます。植物素材の中には、水の中でゲルを形成し、ゼラチンの代用となるものもありますが、動物性とは若干異なる性質を持っています。しかし、動物から得られる物質を使いたくない人にとっては、良い選択肢となります。このようなゼラチンの代用品として、寒天 とカラギーナンがあります。ゼラチンは製薬業界でも使用されており、ハードカプセルやソフトジェルの製造に賦形剤として使用されています。

"原料別では、動物分野が2022年に最大のシェアを占める"

動物由来のハイドロコロイドは、牛、豚、魚などの皮や骨を使って製造されます。ゼラチンは、菓子類に応用される動物由来の主要なハイドロコロイドの一つです。動物由来のハイドロコロイドは、一般に油中水型エマルションを形成します。動物由来のハイドロコロイドは、アレルギーを引き起こす可能性が高く、微生物の繁殖や腐敗の影響を受け易くなっています。ゼラチンは通常、牛や豚などの動物の結合組織、骨、皮などを煮て作られます。ゼラチンは、消化がよく、お湯に溶け、積極的な結合作用を形成することができ、強力で透明なゲルや柔軟なフィルムを形成することができるため、食品加工、医薬品、写真、製紙などの分野で重宝されています。

"機能別では、増粘剤のセグメントが2022年に最大のシェアを占めた"

ハイドロコロイドは、スープ、サラダドレッシング、グレービー、ソース、トッピングなど、様々な食品に増粘剤として広く使用されています。増粘剤としてハイドロコロイドを使用する主な理由は、水と接触すると容易に分散し、エマルジョンに増粘効果を与えるからです。増粘剤として使用される主なハイドロコロイドには、キサンタンガム、グアーガム、LBG、アラビアガム、CMCなどがあります。これらのハイドロコロイドがもたらす増粘効果は、使用するハイドロコロイドの種類、濃度、および使用する食品系に依存します。また、食品系のpHや温度にも左右されます。ケチャップは、ハイドロコロイドが使用される最も一般的な食品の1つです。

"用途別では、食品・飲料分野が2022年に最大のシェアを占めた"

ハイドロコロイドは、保存性と品質を高めるために、多くの種類の食品に使用される機能性炭水化物です。アイスクリーム、サラダドレッシング、グレービー、加工肉、飲食品など、食品の粘度や食感を調整するために使用されます。これらは主に食品系のレオロジー、具体的には粘度やテクスチャーを調整するために使用されます。単独で使用されるものもあれば、相乗的な組み合わせで使用されるものもあります。これらは増粘剤として使用されます。しかし、これらの添加物の中には、ゲルを形成するために使用できるものもあります。これは、各成分が水に対してどのように反応するか、つまり溶解度や、さまざまな温度にさらされたときにどのように機能するかに大きく関係しています。水が固定化されることで、ゲルは使用するハイドロコロイドの種類によってユニークな特性を持つようになります。

"地域別では、北米市場が予測期間中に最も高いCAGRで成長する"

北米市場の消費者は、食感が良く、保存期間が長い、加工度の低いインスタント食品を求めています。そのため、適切な食品安全対策へのニーズが高まっています。また、品質や食感の向上、保存期間の延長のために食品添加物を活用しており、その重要性はますます高まっています。このようなインスタント食品に対する需要の急増が、北米のハイドロコロイド市場に高い影響を与えると予想されます。食品の品質と保存性を高めるための化学的手法や添加物に対する消費者の関心の高まりがもたらす課題として、メーカーは合成製品の効率的な代替品となる新しい技術やハイドロコロイドを模索しています。天然添加物はより健康的な選択肢であるという一般的な認識が、北米のハイドロコロイド市場の動向を牽引しています。

当レポートでは、世界のハイドロコロイドの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・原料別・機能別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- 技術分析

- バリューチェーン分析

- サプライチェーン

- エコシステム

- 顧客のビジネスに影響を与える動向/混乱

- ポーターのファイブフォース分析

- 価格動向分析

- 特許分析

- 主な会議とイベント

- ケーススタディ

- 関税・規制状況

- 貿易分析

第7章 ハイドロコロイド市場:規制

第8章 ハイドロコロイド市場:種類別

- イントロダクション

- ゼラチン

- キサンタンガム

- カラギーナン

- アルギン酸塩

- 寒天

- ペクチン

- グアーガム

- ローカストビーンガム

- アラビアゴム

- カルボキシメチルセルロース (CMC)

- 微結晶セルロース (MCC)

第9章 ハイドロコロイド市場:原料別

- イントロダクション

- 植物

- 微生物

- 動物

- 海藻

- 合成

第10章 ハイドロコロイド市場:機能別

- イントロダクション

- 増粘剤

- 安定剤

- ゲル化剤

- 脂肪代替品

- コーティング材

- その他の機能

第11章 ハイドロコロイド市場:用途別

- イントロダクション

- 食品・飲料

- ベーカリー製品・菓子類

- 食肉・鶏肉製品

- ソース・ドレッシング

- 乳製品

- その他

- 化粧品・パーソナルケア用品

- 医薬品

第12章 ハイドロコロイド市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- オーストラリア・ニュージーランド

- インド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東・アフリカ

- 南米

第13章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場シェア分析

- 主要企業の収益シェア分析

- 企業評価クアドラント (主要企業)

- 製品フットプリント

- スタートアップ/中小企業の評価クアドラント (その他の企業)

- 競合シナリオ

- 製品の発売

- 資本取引

- その他

第14章 企業プロファイル

- 主要企業

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- INGREDION

- CARGILL, INCORPORATED

- KERRY GROUP PLC

- ARCHER DANIELS MIDLAND COMPANY (ADM)

- DARLING INGREDIENTS INC.

- DSM

- ASHLAND

- TATE & LYLE

- FUFENG GROUP

- PALSGAARD A/S

- CP KELCO U.S., INC.

- NEXIRA

- DEOSEN BIOCHEMICAL (ORDOS) LTD.

- BASF SE

- その他の企業

- EST-AGAR AS

- EXANDAL USA CORP.

- INDIAN HYDROCOLLOIDS

- LUCID COLLOIDS LTD

- SUNITA HYDROCOLLOIDS PVT LTD

- BHANSALI INTERNATIONAL

- B & V SRL

- ALTRAFINE GUMS

- AGARMEX

- AGAR DEL PACIFICO S.A.

第15章 隣接・関連市場

- イントロダクション

- 分析の制約要因

- 食品乳化剤市場

- ペクチン市場

第16章 付録

The global hydrocolloids market is estimated to be valued at USD 11.2 Billion in 2023 and is projected to reach USD 14.5 billion by 2028, at a CAGR of 5.4% during the forecast period. Hydrocolloids are widely used in many food formulations to improve quality attributes and shelf-life. Hydrocolloids expressed in food are affected by several factors, such as orientation and molecular association, water-binding and swelling, concentration, particle size, degree of dispersion, interaction with other gums, and help in improving the properties of the filling. The two main uses of hydrocolloids are as a thickening and gelling agents. They are also used for moisture retention in cakes, pies, donuts, and frozen food. Companies such as International Flavors & Fragrances Inc. (US), Ingredion (US), Cargill, Incorporated (US), Associated Archer Daniels Midland Company (US), Darling Ingredients Inc. (US), Ashland (US), and CP Kelco U.S., Inc. (US) produce and supply different types of hydrocolloids for the food and beverage industry.

"The gelatin segment amongst the various types of hydrocolloids dominated the market in the year 2022."

Although gelatin is widely used in the food industry, its addition to food creates problems for certain people. Some people object to the use of gelatin for religious or ethical reasons because it is produced from animal tissues or because it is made from the tissues of specific animals. Some plant materials form gels in water and can be substituted for gelatin, but they have slightly different properties from animal products. Nevertheless, they are a good option for people who do not want to use a substance obtained from animals. Two of these gelatin substitutes are agar (also called agar-agar) and carrageenan. Gelatin is also used in the pharmaceutical industry; it is used as an excipient in the production of hard capsules and soft gels.

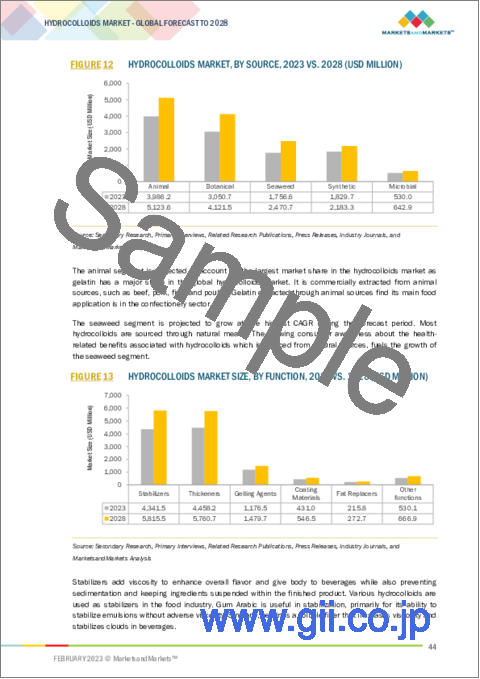

"The animal segment of hydrocolloids market accounted for the largest share in the year 2022"

Hydrocolloids of animal origin are produced using skins and bones of different sources, such as beef, pork, and fish. Gelatin is one of the major hydrocolloids derived from animal sources having applications in the confectionery industry. The animal-derived hydrocolloids generally form water in oil emulsions. They are quite likely to cause allergies and are susceptible to microbial growth and rancidity. Gelatin is a protein substance derived from collagen, a natural protein present in the tendons, ligaments, and tissues of mammals. It is produced by boiling the connective tissues, bones, and skins of animals, usually cows and pigs. Gelatin's ability to form strong, transparent gels and flexible films that are easily digested, soluble in hot water, and capable of forming a positive binding action, have made it a valuable commodity in food processing, pharmaceuticals, photography, and paper production.

"The thickener segment by function of hydrocolloids market accounted for the largest share in the year 2022."

Hydrocolloids are widely used as thickeners in various food products, such as soups, salad dressings, gravies, sauces, and toppings. The main reason for using hydrocolloids as thickeners is that they easily disperse when in contact with water to provide a thickening effect to the emulsion. Major hydrocolloids used as thickeners include xanthan gum, guar gum, LBG, gum Arabic, and CMC. The thickening effect produced by these hydrocolloids depends on the type of hydrocolloid used, its concentration, as well as the food system in which it is used. It also depends on the pH of the food system and temperature. Ketchup is one of the most common food items where hydrocolloids find their application.

"The food & beverage segment by application of hydrocolloids market accounted for the largest share in the year 2022."

Hydrocolloids are functional carbohydrates used in many types of food to enhance their shelf life and quality. They are used to modify the viscosity and texture of food products, such as ice cream, salad dressings, gravies, processed meats, and beverages. They are chiefly used to modify the rheology of the food system, specifically viscosity and texture. Some are used alone, while others are used in synergistic combinations. They are used as thickening agents. However, some of these additives can be used in forming gels. Much of this is related to the way each ingredient reacts to water, including its solubility and how it performs when exposed to varying temperatures. As water is immobilized, the gel can take on unique characteristics depending on the types of hydrocolloids used.

"North American market for hydrocolloids is projected to grow at the highest CAGR during the forecast period. "

Consumers in the North American market are on the lookout for minimally processed convenience foods with good texture and long storage lives. This has heightened the need for appropriate food safety measures. It has also leveraged food additives to improve quality, texture, and extend shelf life, which are becoming increasingly important and critical. The burgeoning demand for such convenience food products is expected to have a high impact on the hydrocolloid market in North America. With the challenge posed by the growing concern among consumers with respect to chemical methods and additives to enhance food quality and shelf life, manufacturers are exploring newer technologies and hydrocolloids, which would be efficient alternates to synthetic products. The popular perception that natural additives are a healthier option is driving the trend in the hydrocolloids market in North America.

In the process of determining and verifying the market size for several segments and sub-segments gathered through secondary research, extensive primary interviews have been conducted with the key experts.

Break-up of Primaries:

- By Company type: Tier 1 - 23%, Tier 2 - 30%, and Tier 3 - 47%

- By Designation: C level - 24%, director level - 36%, Executives - 40%

- By Geography: North America- 20%, Europe - 30%, Asia Pacific - 45%, and RoW - 5%

Leading players profiled in this report:

- Flavors & Fragrances Inc. (US), Ingredion (US)

- Cargill, Incorporated (US)

- Associated Archer Daniels Midland Company (US)

- Darling Ingredients Inc. (US), Ashland (US)

- CP Kelco U.S., Inc. (US)

- Kerry Group plc (Ireland)

- Palsgaard A/S (Denmark)

- DSM (Netherlands)

- Tate & Lyle (UK), Nexira (France)

- Deosen Biochemical (Ordos) Ltd. (China)

- Fufeng Group (China)

- BASF SE (Germany).

Research Coverage:

The report segments the hydrocolloids market on the basis of type, source, application, function, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges of the global hydrocolloids market.

Reasons to buy this report:

- To get a comprehensive overview of the hydrocolloids market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the hydrocolloids market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.6.1 CURRENCY (VALUE UNIT)

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2021

- 1.6.2 VOLUME UNIT

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 HYDROCOLLOIDS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 HYDROCOLLOIDS MARKET SIZE ESTIMATION: SUPPLY SIDE (1/2)

- FIGURE 5 HYDROCOLLOIDS MARKET SIZE ESTIMATION: SUPPLY SIDE (2/2)

- FIGURE 6 HYDROCOLLOIDS MARKET SIZE ESTIMATION: DEMAND SIDE

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 7 HYDROCOLLOIDS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 HYDROCOLLOIDS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.4 RECESSION IMPACT ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 2 HYDROCOLLOIDS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 10 HYDROCOLLOIDS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 HYDROCOLLOIDS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 HYDROCOLLOIDS MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 HYDROCOLLOIDS MARKET SIZE, BY FUNCTION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 HYDROCOLLOIDS MARKET SHARE (VALUE), BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR HYDROCOLLOIDS MARKET PLAYERS

- FIGURE 15 NORTH AMERICA TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.2 EUROPE: HYDROCOLLOIDS MARKET, BY KEY FUNCTION AND COUNTRY

- FIGURE 16 FRANCE AND THICKENERS SEGMENTS ACCOUNTED FOR LARGEST RESPECTIVE SHARES IN 2022

- 4.3 HYDROCOLLOIDS MARKET, BY TYPE, 2023 VS. 2028

- FIGURE 17 GELATIN TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 HYDROCOLLOIDS MARKET, BY SOURCE, 2023 VS. 2028

- FIGURE 18 ANIMAL SOURCE TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 HYDROCOLLOIDS MARKET, BY FUNCTION, 2023 VS. 2028

- FIGURE 19 STABILIZERS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.6 HYDROCOLLOIDS MARKET, BY APPLICATION, 2023 VS. 2028

- FIGURE 20 FOOD & BEVERAGES TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.7 HYDROCOLLOIDS MARKET, BY APPLICATION AND REGION, 2023 VS. 2028

- FIGURE 21 NORTH AMERICA AND FOOD & BEVERAGES TO DOMINATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 MARKET DYNAMICS: HYDROCOLLOIDS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Multifunctionality of hydrocolloids to lead to wide range of applications

- TABLE 3 APPLICATIONS AND FUNCTIONALITIES OF VARIOUS HYDROCOLLOIDS

- 5.2.1.2 Rise in demand for clean-label products due to rise in health and wellness trend

- 5.2.1.3 Expansion of ready meal and convenience food industry to catalyze demand

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations and international quality standards

- 5.2.2.2 Inadequate supply of raw materials and price fluctuation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging markets in Asia pacific and Africa

- 5.2.3.2 Hydrocolloids to replace and reduce other ingredients in food products

- 5.2.3.3 Increase in investments in R&D

- 5.2.4 CHALLENGES

- 5.2.4.1 Intense competition and product rivalry due to similar products

- 5.2.4.2 Unclear labeling to lead to ambiguity and uncertainty

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY ANALYSIS

- 6.2.1 PROTEIN HYDROLYSIS

- 6.2.2 ALCOHOL PRECIPITATION

- 6.2.3 CROSSLINKING OF POLYSACCHARIDES

- 6.2.4 CO-GELATION

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 23 HYDROCOLLOIDS MARKET: VALUE CHAIN

- 6.4 SUPPLY CHAIN

- FIGURE 24 PRODUCT DEVELOPMENT AND DISTRIBUTION TO ADD VALUE TO SUPPLY CHAIN FOR HYDROCOLLOIDS

- 6.5 ECOSYSTEM

- 6.5.1 UPSTREAM

- 6.5.2 DOWNSTREAM

- FIGURE 25 HYDROCOLLOIDS MARKET: ECOSYSTEM MAP

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 6.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 HYDROCOLLOIDS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.7.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.7.2 BARGAINING POWER OF SUPPLIERS

- 6.7.3 BARGAINING POWER OF BUYERS

- 6.7.4 THREAT OF SUBSTITUTES

- 6.7.5 THREAT OF NEW ENTRANTS

- 6.8 PRICE TREND ANALYSIS

- 6.8.1 AVERAGE SELLING PRICES, BY KEY TYPE

- FIGURE 27 GLOBAL AVERAGE SELLING PRICES, BY KEY TYPE

- TABLE 5 GELATIN: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TON)

- TABLE 6 PECTIN: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TON)

- TABLE 7 CMC: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TON)

- 6.9 PATENT ANALYSIS

- FIGURE 28 PATENTS GRANTED FOR HYDROCOLLOIDS MARKET, 2013-2022

- FIGURE 29 REGIONAL ANALYSIS OF PATENTS GRANTED FOR HYDROCOLLOIDS MARKET, 2013-2022

- TABLE 8 KEY PATENTS PERTAINING TO HYDROCOLLOIDS, 2013-2022

- 6.10 KEY CONFERENCES AND EVENTS

- TABLE 9 KEY CONFERENCES AND EVENTS IN HYDROCOLLOIDS MARKET, 2023

- 6.11 CASE STUDIES

- 6.11.1 CASE STUDY 1

- TABLE 10 FOOD HYDROCOLLOID BATCH-TO-BATCH VARIATION (USA)

- 6.11.2 CASE STUDY 2

- TABLE 11 ASSESSMENT OF NOVEL FAT REPLACER

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.13 TRADE ANALYSIS

- TABLE 16 TOP 10 IMPORTERS AND EXPORTERS, 2021

- TABLE 17 TOP 10 IMPORTERS AND EXPORTERS, 2020

- TABLE 18 TOP 10 IMPORTERS AND EXPORTERS, 2019

- TABLE 19 TOP 10 IMPORTERS AND EXPORTERS, 2018

7 HYDROCOLLOIDS MARKET: REGULATIONS

- 7.1 INTRODUCTION

- 7.2 CODEX ALIMENTARIUS

- 7.3 EUROPEAN COMMISSION

- TABLE 20 LIST OF HYDROCOLLOIDS USED IN FOOD INDUSTRY

8 HYDROCOLLOIDS MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 30 GELATIN TO LEAD HYDROCOLLOIDS MARKET DURING FORECAST PERIOD (USD MILLION)

- TABLE 21 HYDROCOLLOIDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 22 HYDROCOLLOIDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 23 HYDROCOLLOIDS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 24 HYDROCOLLOIDS MARKET, BY TYPE, 2023-2028 (KT)

- 8.2 GELATIN

- 8.2.1 WIDE USE OF GELATIN IN FOOD APPLICATION

- TABLE 25 GELATIN: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 GELATIN: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 27 GELATIN: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 28 GELATIN: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (KT)

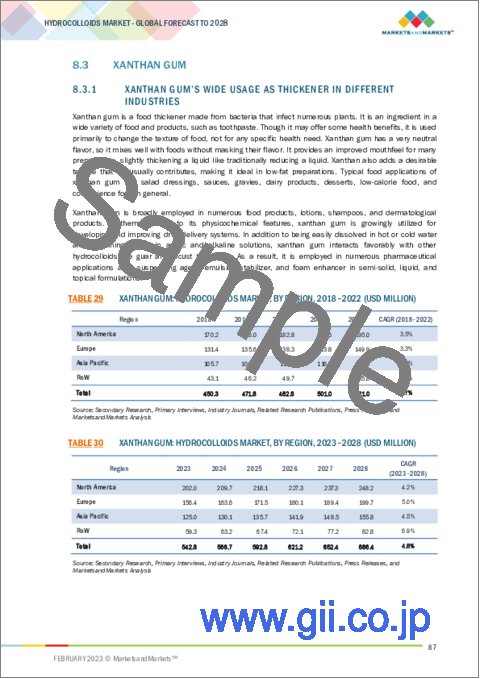

- 8.3 XANTHAN GUM

- 8.3.1 XANTHAN GUM'S WIDE USAGE AS THICKENER IN DIFFERENT INDUSTRIES

- TABLE 29 XANTHAN GUM: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 XANTHAN GUM: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 31 XANTHAN GUM: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 32 XANTHAN GUM: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (KT)

- 8.4 CARRAGEENAN

- 8.4.1 USAGE OF CARRAGEENAN AS GELATIN ALTERNATIVE IN JELLY-BASED PRODUCTS

- TABLE 33 CARRAGEENAN: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 CARRAGEENAN: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 35 CARRAGEENAN: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 36 CARRAGEENAN: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (KT)

- 8.5 ALGINATES

- 8.5.1 APPLICATION OF ALGINATE TO COAT FRUITS AND VEGETABLES AS MICROBIAL AND VIRAL PROTECTION PRODUCTS

- TABLE 37 ALGINATES: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 ALGINATES: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 39 ALGINATES: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 40 ALGINATES: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (KT)

- 8.6 AGAR

- 8.6.1 PREFERENCE OF AGAR OVER SYNTHETIC MATERIALS AS ALTERNATIVE SOURCE OF RAW MATERIALS FOR PHARMACEUTICAL APPLICATIONS

- TABLE 41 AGAR: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 AGAR: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 43 AGAR: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 44 AGAR: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (KT)

- 8.7 PECTIN

- 8.7.1 USAGE OF PECTIN AS VISCOSITY ENHANCER DUE TO GELLING ABILITY

- TABLE 45 PECTIN: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 PECTIN: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 47 PECTIN: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 48 PECTIN: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (KT)

- 8.8 GUAR GUM

- 8.8.1 USE OF GUAR GUM IN DIFFERENT INDUSTRIES AS STABILIZER

- TABLE 49 GUAR GUM: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 GUAR GUM: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 51 GUAR GUM: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 52 GUAR GUM: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (KT)

- 8.9 LOCUST BEAN GUM

- 8.9.1 LOCUST BEAN GUM TO DECREASE BLOOD SUGAR AND BLOOD FAT LEVELS

- TABLE 53 LBG: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 LBG: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 55 LBG: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 56 LBG: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (KT)

- 8.10 GUM ARABIC

- 8.10.1 GUM ARABIC ACTS AS STABILIZER TO EXTEND PRODUCT'S SHELF LIFE

- TABLE 57 GUM ARABIC: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 GUM ARABIC: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 59 GUM ARABIC: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 60 GUM ARABIC: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (KT)

- 8.11 CARBOXYMETHYL CELLULOSE (CMC)

- 8.11.1 USAGE OF CMC AS THICKENER AND STABILIZER IN FOOD PRODUCTS

- TABLE 61 CMC: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 62 CMC: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 63 CMC: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 64 CMC: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (KT)

- 8.12 MICROCRYSTALLINE CELLULOSE (MCC)

- 8.12.1 APPLICATION OF MCC AS CELLULOSE DERIVATIVE IN FOOD INDUSTRY

- TABLE 65 MCC: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 MCC: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 67 MCC: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 68 MCC: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (KT)

9 HYDROCOLLOIDS MARKET, BY SOURCE

- 9.1 INTRODUCTION

- FIGURE 31 ANIMAL HYDROCOLLOIDS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

- TABLE 69 HYDROCOLLOIDS MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 70 HYDROCOLLOIDS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 9.2 BOTANICAL

- 9.2.1 BOTANICAL HYDROCOLLOIDS CONSIDERED AS 'CLEAN LABEL' AND SAFE OPTION AGAINST SYNTHETIC ADDITIVES

- TABLE 71 BOTANICAL: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 72 BOTANICAL: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 MICROBIAL

- 9.3.1 WIDE USAGE OF MICROBIAL-SOURCED HYDROCOLLOIDS SUCH AS XANTHAN GUM

- TABLE 73 MICROBIAL: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 MICROBIAL: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 ANIMAL

- 9.4.1 ANIMAL-DERIVED GELATIN TO OCCUPY MAJOR MARKET SHARE

- TABLE 75 ANIMAL: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 76 ANIMAL: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 SEAWEED

- 9.5.1 APPLICATION OF HIGH-VALUE SEAWEED HYDROCOLLOIDS AS THICKENING AGENTS IN PHARMACEUTICALS AND BIOTECHNOLOGICAL APPLICATIONS

- TABLE 77 SEAWEED: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 78 SEAWEED: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 SYNTHETIC

- 9.6.1 RESISTANCE TO MICROBIAL DEGRADATION TO BE MAJOR ADVANTAGE OF SYNTHETIC HYDROCOLLOIDS OVER NATURAL HYDROCOLLOIDS

- TABLE 79 SYNTHETIC: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 80 SYNTHETIC: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 HYDROCOLLOIDS MARKET, BY FUNCTION

- 10.1 INTRODUCTION

- FIGURE 32 STABILIZERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

- TABLE 81 HYDROCOLLOIDS MARKET, BY FUNCTION, 2018-2022 (USD MILLION)

- TABLE 82 HYDROCOLLOIDS MARKET, BY FUNCTION, 2023-2028 (USD MILLION)

- 10.2 THICKENERS

- 10.2.1 APPLICATION OF THICKENING AGENTS IN SOUPS, SALAD DRESSINGS, GRAVIES, SAUCES, AND TOPPINGS

- TABLE 83 HYDROCOLLOIDS USED AS THICKENING AGENTS

- TABLE 84 THICKENERS: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 85 THICKENERS: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 STABILIZERS

- 10.3.1 HYDROCOLLOIDS ACT AS STABILIZERS IN DAIRY PRODUCTS, BEVERAGES, AND DESSERTS

- TABLE 86 STABILIZERS: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 87 STABILIZERS: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 GELLING AGENTS

- 10.4.1 USAGE OF HYDROCOLLOID GELATION IN VARIOUS FOOD APPLICATIONS

- TABLE 88 HYDROCOLLOIDS USED AS GELLING AGENTS

- TABLE 89 GELLING AGENTS: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 90 GELLING AGENTS: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 FAT REPLACERS

- 10.5.1 PREFERENCE OF CONSUMERS OF REDUCED-FAT PRODUCTS IN THEIR ROUTINE DIET

- TABLE 91 FAT REPLACERS: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 92 FAT REPLACERS: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6 COATING MATERIALS

- 10.6.1 USAGE OF HYDROCOLLOIDS IN EDIBLE FILM-FORMING FUNCTIONS

- TABLE 93 COATING MATERIALS: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 94 COATING MATERIALS: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7 OTHER FUNCTIONS

- 10.7.1 HYDROCOLLOIDS TO GAIN POPULARITY AS EMULSIFIERS AND MOISTURE-BINDING AGENTS

- TABLE 95 OTHER FUNCTIONS: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 96 OTHER FUNCTIONS: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

11 HYDROCOLLOIDS MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 33 FOOD & BEVERAGES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 97 HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 98 HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2 FOOD & BEVERAGES

- 11.2.1 HYDROCOLLOIDS TO REPLACE FAT BY USING STARCHES SOLUBLE IN WATER

- TABLE 99 FOOD & BEVERAGES: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 100 FOOD & BEVERAGES: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2.2 BAKERY & CONFECTIONERY

- 11.2.2.1 Hydrocolloids to improve quality of bakery products by providing texture, stability, and extended shelf-life

- 11.2.3 MEAT & POULTRY PRODUCTS

- 11.2.3.1 Hydrocolloids to improve cooking yield, texture, and slice characteristics

- 11.2.4 SAUCES & DRESSINGS

- 11.2.4.1 Hydrocolloids to be used in sauces and dressing applications

- 11.2.5 DAIRY PRODUCTS

- 11.2.5.1 Food hydrocolloids used as stabilizers, thickeners, and gelling agents

- 11.2.6 OTHERS

- 11.3 COSMETICS & PERSONAL CARE PRODUCTS

- 11.3.1 USE OF HYDROCOLLOIDS AS VISCOSITY CONTROL AGENTS DUE TO THEIR THICKENING AND GELLING PROPERTIES

- TABLE 101 COSMETICS & PERSONAL CARE PRODUCTS: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 102 COSMETICS & PERSONAL CARE PRODUCTS: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 PHARMACEUTICALS

- 11.4.1 POTENTIAL OF NATURALLY OCCURRING HYDROCOLLOIDS IN DRUG FORMULATION DUE TO EXTENSIVE APPLICATION AS FOOD ADDITIVES

- TABLE 103 PHARMACEUTICALS: HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 104 PHARMACEUTICALS: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

12 HYDROCOLLOIDS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 34 HYDROCOLLOIDS MARKET GROWTH RATE, BY KEY COUNTRY, 2023-2028

- TABLE 105 HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 106 HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 107 HYDROCOLLOIDS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 108 HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (KT)

- 12.2 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: HYDROCOLLOIDS MARKET SNAPSHOT

- 12.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 36 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 109 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 114 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 115 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 116 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY FUNCTION, 2018-2022 (USD MILLION)

- TABLE 120 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY FUNCTION, 2023-2028 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Higher demand for low-fat food products to drive market growth

- TABLE 121 US: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 122 US: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Substantial growth of functional food segment to trigger demand for different hydrocolloids

- TABLE 123 CANADA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 124 CANADA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.2.4 MEXICO

- 12.2.4.1 Rise in consumption of dairy products to drive market growth

- TABLE 125 MEXICO: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 126 MEXICO: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 37 EUROPE: HYDROCOLLOIDS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 127 EUROPE: HYDROCOLLOIDS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 128 EUROPE: HYDROCOLLOIDS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 129 EUROPE: HYDROCOLLOIDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 130 EUROPE: HYDROCOLLOIDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 131 EUROPE: HYDROCOLLOIDS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 132 EUROPE: HYDROCOLLOIDS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 133 EUROPE: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 134 EUROPE: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 135 EUROPE: HYDROCOLLOIDS MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 136 EUROPE: HYDROCOLLOIDS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 137 EUROPE: HYDROCOLLOIDS MARKET, BY FUNCTION, 2018-2022 (USD MILLION)

- TABLE 138 EUROPE: HYDROCOLLOIDS MARKET, BY FUNCTION, 2023-2028 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Increase in consumption of different baked goods to drive market

- TABLE 139 GERMANY: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 140 GERMANY: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Presence of large food sector as well as cosmetic industry to propel market growth

- TABLE 141 UK: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 142 UK: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.4 FRANCE

- 12.3.4.1 High consumption of confectionery products to drive market

- TABLE 143 FRANCE: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 144 FRANCE: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.5 ITALY

- 12.3.5.1 Wide presence of dairy sector and increased production of ice cream to increase use of hydrocolloids

- TABLE 145 ITALY: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 146 ITALY: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.6 SPAIN

- 12.3.6.1 Demand for healthier processed food to increase demand for natural hydrocolloids

- TABLE 147 SPAIN: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 148 SPAIN: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.7 REST OF EUROPE

- TABLE 149 REST OF EUROPE: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 150 REST OF EUROPE: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4 ASIA PACIFIC

- 12.4.1 RECESSION IMPACT ANALYSIS

- FIGURE 38 ASIA PACIFIC HYDROCOLLOIDS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 151 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 154 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 155 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 156 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 157 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 158 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 159 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 160 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 161 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY FUNCTION, 2018-2022 (USD MILLION)

- TABLE 162 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY FUNCTION, 2023-2028 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Rise in demand for healthy beverages and dairy products to drive market growth

- TABLE 163 CHINA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 164 CHINA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.3 JAPAN

- 12.4.3.1 Demand for variety of Japanese beverages to drive market

- TABLE 165 JAPAN: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 166 JAPAN: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.4 AUSTRALIA & NEW ZEALAND

- 12.4.4.1 Consumption of beverages to increase demand for different preservative manufacturers

- TABLE 167 AUSTRALIA & NEW ZEALAND: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 168 AUSTRALIA & NEW ZEALAND: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.5 INDIA

- 12.4.5.1 Increase in demand for healthy processed food products to increase demand for hydrocolloids

- TABLE 169 INDIA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 170 INDIA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.6 REST OF ASIA PACIFIC

- TABLE 171 REST OF ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.5 REST OF THE WORLD (ROW)

- FIGURE 39 ROW: HYDROCOLLOIDS MARKET SNAPSHOT

- 12.5.1 RECESSION IMPACT ANALYSIS

- FIGURE 40 ROW HYDROCOLLOIDS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 173 ROW: HYDROCOLLOIDS MARKET, BY SUB-REGION, 2018-2022 (USD MILLION)

- TABLE 174 ROW: HYDROCOLLOIDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 175 ROW: HYDROCOLLOIDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 176 ROW HYDROCOLLOIDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 177 ROW: HYDROCOLLOIDS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 178 ROW: HYDROCOLLOIDS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 179 ROW: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 180 ROW: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 181 ROW: HYDROCOLLOIDS MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 182 ROW: HYDROCOLLOIDS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 183 ROW: HYDROCOLLOIDS MARKET, BY FUNCTION, 2018-2022 (USD MILLION)

- TABLE 184 ROW: HYDROCOLLOIDS MARKET, BY FUNCTION, 2023-2028 (USD MILLION)

- 12.5.2 MIDDLE EAST & AFRICA

- 12.5.2.1 Rising demand for nutritional labeling to increase demand for natural hydrocolloids

- TABLE 185 MIDDLE EAST & AFRICA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.5.3 SOUTH AMERICA

- 12.5.3.1 Gradual increase in purchasing power of Argentinians and Brazilians to increase consumption of convenience food

- TABLE 187 SOUTH AMERICA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 188 SOUTH AMERICA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 189 STRATEGIES ADOPTED BY KEY PLAYERS IN HYDROCOLLOIDS MARKET

- 13.3 MARKET SHARE ANALYSIS

- TABLE 190 GLOBAL HYDROCOLLOIDS MARKET: DEGREE OF COMPETITION

- 13.4 REVENUE SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS, 2019-2021 (USD BILLION)

- 13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 42 HYDROCOLLOIDS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 13.6 PRODUCT FOOTPRINT

- TABLE 191 COMPANY PRODUCT FOOTPRINT, BY APPLICATION

- TABLE 192 COMPANY PRODUCT FOOTPRINT, BY REGION

- TABLE 193 OVERALL COMPANY PRODUCT FOOTPRINT

- 13.7 STARTUP/SME EVALUATION QUADRANT (OTHER PLAYERS)

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 STARTING BLOCKS

- 13.7.3 RESPONSIVE COMPANIES

- 13.7.4 DYNAMIC COMPANIES

- FIGURE 43 HYDROCOLLOIDS MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- 13.7.5 COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- TABLE 194 DETAILED LIST OF OTHER PLAYERS

- TABLE 195 COMPETITIVE BENCHMARKING (OTHER PLAYERS), 2021

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 PRODUCT LAUNCHES

- TABLE 196 HYDROCOLLOIDS MARKET: NEW PRODUCT LAUNCHES, 2018-2022

- 13.8.2 DEALS

- TABLE 197 HYDROCOLLOIDS MARKET: DEALS, 2018-2022

- 13.8.3 OTHERS

- TABLE 198 HYDROCOLLOIDS MARKET: OTHERS, 2018-2022

14 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

- 14.1 KEY PLAYERS

- 14.1.1 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- TABLE 199 INTERNATIONAL FLAVORS & FRAGRANCES INC.- BUSINESS OVERVIEW

- FIGURE 44 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- TABLE 200 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCT LAUNCHES

- TABLE 201 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- TABLE 202 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHERS

- 14.1.2 INGREDION

- TABLE 203 INGREDION: BUSINESS OVERVIEW

- FIGURE 45 INGREDION: COMPANY SNAPSHOT

- TABLE 204 INGREDION: PRODUCT LAUNCHES

- 14.1.3 CARGILL, INCORPORATED

- TABLE 205 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- FIGURE 46 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 206 CARGILL, INCORPORATED: OTHERS

- 14.1.4 KERRY GROUP PLC

- TABLE 207 KERRY GROUP PLC: BUSINESS OVERVIEW

- FIGURE 47 KERRY GROUP PLC: COMPANY SNAPSHOT

- TABLE 208 KERRY GROUP PLC: OTHERS

- 14.1.5 ARCHER DANIELS MIDLAND COMPANY (ADM)

- TABLE 209 ARCHER DANIELS MIDLAND COMPANY - BUSINESS OVERVIEW

- FIGURE 48 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

- TABLE 210 ARCHER DANIELS MIDLAND COMPANY: DEALS

- TABLE 211 ARCHER DANIELS MIDLAND COMPANY: OTHERS

- 14.1.6 DARLING INGREDIENTS INC.

- TABLE 212 DARLING INGREDIENTS INC.: BUSINESS OVERVIEW

- FIGURE 49 DARLING INGREDIENTS INC.: COMPANY SNAPSHOT

- TABLE 213 DARLING INGREDIENTS INC.: NEW PRODUCT LAUNCHES

- 14.1.7 DSM

- TABLE 214 DSM: BUSINESS OVERVIEW

- FIGURE 50 DSM: COMPANY SNAPSHOT

- TABLE 215 DSM: PRODUCT LAUNCHES

- TABLE 216 DSM: OTHERS

- 14.1.8 ASHLAND

- TABLE 217 ASHLAND - BUSINESS OVERVIEW

- FIGURE 51 ASHLAND: COMPANY SNAPSHOT

- 14.1.9 TATE & LYLE

- TABLE 218 TATE & LYLE: BUSINESS OVERVIEW

- FIGURE 52 TATE & LYLE: COMPANY SNAPSHOT

- TABLE 219 TATE & LYLE: OTHERS

- 14.1.10 FUFENG GROUP

- TABLE 220 FUFENG GROUP - BUSINESS OVERVIEW

- FIGURE 53 FUFENG GROUP: COMPANY SNAPSHOT

- 14.1.11 PALSGAARD A/S

- TABLE 221 PALSGAARD A/S: BUSINESS OVERVIEW

- TABLE 222 PALSGAARD A/S: DEALS

- TABLE 223 PALSGAARD: OTHERS

- 14.1.12 CP KELCO U.S., INC.

- TABLE 224 CP KELCO U.S., INC. - BUSINESS OVERVIEW

- TABLE 225 CP KELCO U.S., INC.: PRODUCT LAUNCHES

- TABLE 226 CP KELCO U.S., INC.: DEALS

- TABLE 227 CP KELCO U.S., INC.: OTHERS

- 14.1.13 NEXIRA

- TABLE 228 NEXIRA - BUSINESS OVERVIEW

- TABLE 229 NEXIRA: PRODUCT LAUNCHES

- TABLE 230 NEXIRA: DEALS

- 14.1.14 DEOSEN BIOCHEMICAL (ORDOS) LTD.

- TABLE 231 DEOSEN BIOCHEMICAL (ORDOS) LTD. - BUSINESS OVERVIEW

- 14.1.15 BASF SE

- TABLE 232 BASF SE: BUSINESS OVERVIEW

- FIGURE 54 BASF SE: COMPANY SNAPSHOT

- 14.2 OTHER PLAYERS

- 14.2.1 EST-AGAR AS

- TABLE 233 EST-AGAR AS - BUSINESS OVERVIEW

- 14.2.2 EXANDAL USA CORP.

- TABLE 234 EXANDAL USA CORP.- BUSINESS OVERVIEW

- 14.2.3 INDIAN HYDROCOLLOIDS

- TABLE 235 INDIAN HYDROCOLLOIDS - BUSINESS OVERVIEW

- 14.2.4 LUCID COLLOIDS LTD

- TABLE 236 LUCID COLLOIDS LTD - BUSINESS OVERVIEW

- 14.2.5 SUNITA HYDROCOLLOIDS PVT LTD

- TABLE 237 SUNITA HYDROCOLLOIDS PVT LTD - BUSINESS OVERVIEW

- 14.2.6 BHANSALI INTERNATIONAL

- 14.2.7 B & V SRL

- 14.2.8 ALTRAFINE GUMS

- 14.2.9 AGARMEX

- 14.2.10 AGAR DEL PACIFICO S.A.

Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 238 ADJACENT MARKETS TO HYDROCOLLOIDS MARKET

- 15.2 STUDY LIMITATIONS

- 15.3 FOOD EMULSIFIERS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- TABLE 239 FOOD EMULSIFIERS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

- 15.4 PECTIN MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- TABLE 240 PECTIN MARKET SIZE, BY TYPE, 2017-2025 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.4 AUTHOR DETAILS