|

|

市場調査レポート

商品コード

1127462

集中型太陽光発電の世界市場:技術別(太陽光発電タワー、リニア集光システム、ディッシュスターリング)、運用タイプ別(スタンドアロン、ストレージ)、容量別、エンドユーザー別、地域別 - 2027年までの予測Concentrating Solar Power Market by Technology (Solar Power Tower, Linear Concentrating System, Dish Stirling), Operation Type(Stand-alone, Storage), Capacity (<50 MW, 50-99 MW, 100 MW & Above), End User(Utilities, EOR), Region - Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 集中型太陽光発電の世界市場:技術別(太陽光発電タワー、リニア集光システム、ディッシュスターリング)、運用タイプ別(スタンドアロン、ストレージ)、容量別、エンドユーザー別、地域別 - 2027年までの予測 |

|

出版日: 2022年09月12日

発行: MarketsandMarkets

ページ情報: 英文 226 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の集中型太陽光発電の市場規模は、2022年に60億米ドル、2027年には199億米ドルに達すると推定され、予測期間中に26.9%のCAGRで成長すると予測されています。

集中型太陽光発電市場の主な促進要因としては、集中型太陽光発電システムと蓄熱システムの効果的な統合、海水淡水化および石油増進回収プロセスにおける集中型太陽光発電の利用が挙げられます。

リニア集光システム集中型太陽光発電市場は、技術別に、ソーラーパワータワー、リニア集光システム、ディッシュスターリング技術に分類される

リニア集光システムは、2021年の集中型太陽光発電市場で2番目に大きなシェアを占めると推定されます。CAPEXの削減、パラボラトラフやリニアフレネル技術の普及が、リニア集光システムの導入の主な要因となっています。

100MW以上セグメントが容量ベースで最大セグメントになる見込み

集中型太陽光発電市場は、容量ベースで50MW未満、50MW~99MW、100MW以上にセグメント化されています。100MW以上が最大の市場シェアを占めると予想され、100MW以上セグメントは、アジア太平洋や中東・アフリカなどの地域で、公益発電用途に集中型太陽光発電システムを設置するニーズがあることが背景にあります。"中東・アフリカは、予測期間中に2番目に大きな市場になると予想されています。これは、水の脱塩のニーズがあることと、この地域の集中型太陽光発電の市場を促進しているUAE、サウジアラビア、南アフリカなどの国の再生可能セクターの開発によるものです。

集中型太陽光発電市場は、幅広い地域で存在感を示す少数の大手企業によって支配されています。集中型太陽光発電市場の主要プレイヤーは、Abengoa(スペイン)、BrightSource Energy(米国)、ACWA Power(サウジアラビア)、SolarReserve(米国)、Aalborg CSP(デンマーク)です。

このレポートは、世界の集中型太陽光発電市場を、技術、運転タイプ、容量、エンドユーザー、地域別に定義、記述、予測しています。また、市場の詳細な定性・定量分析も行っています。本レポートでは、主要な市場促進要因・抑制要因・機会・課題を包括的にレビューしています。また、市場の様々な重要な側面についても取り上げています。これらには、競合情勢、市場力学、市場推定値(金額ベース)、集中型太陽光発電市場の将来動向の分析が含まれます。

本レポートを購入する主なメリット

1.集中型太陽光発電の主要市場を特定し、対処しているため、CSP技術メーカーが需要の伸びを検討するのに役立つ

2.システムプロバイダーが市場の鼓動を理解するのに役立ち、促進要因・抑制要因・機会・課題に関する洞察を提供する

3.本レポートは、主要企業が競合他社の戦略をより良く理解し、より良い戦略的意思決定を行うのに役立つ

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 技術分析

- ケーススタディ分析

- 価格分析

第6章 集中型太陽光発電市場:技術別

- イントロダクション

- 太陽光発電タワー

- リニア集光システム

- ディッシュスターリング技術

第7章 集中型太陽光発電市場:運用タイプ別

- イントロダクション

- スタンドアロン

- ストレージ

第8章 集中型太陽光発電市場:容量別

- イントロダクション

- 50MW未満

- 50MW~99MW

- 100MW以上

第9章 集中型太陽光発電市場:エンドユーザー別

- イントロダクション

- ユーティリティ

- 原油増進回収法(EOR)

- その他

第10章 集中型太陽光発電市場:地域別

- イントロダクション

- 北米

- 技術別

- 運用タイプ別

- 容量別

- エンドユーザー別

- 国別

- アジア太平洋

- 技術別

- 運用タイプ別

- 容量別

- エンドユーザー別

- 国別

- 欧州

- 技術別

- 運用タイプ別

- 容量別

- エンドユーザー別

- 国別

- 中東およびアフリカ

- 技術別

- 運用タイプ別

- 容量別

- エンドユーザー別

- 国別

- 南米

- 技術別

- 運用タイプ別

- 容量別

- エンドユーザー別

- 国別

第11章 競合情勢

- 主要企業の戦略

- 主要企業5社の市場シェア分析

- 主要市場企業5社の収益分析

- 企業評価クアドラント

- 集中型太陽光発電市場:企業のフットプリント

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- GENERAL ELECTRIC

- ABENGOA

- BRIGHTSOURCE ENERGY

- ACWA POWER

- GLASSPOINT SOLAR

- ENEL GREEN POWER

- SOLARRESERVE

- AALBORG CSP

- TSK FLAGSOL ENGINEERING GMBH

- ALSOLEN

- ARCHIMEDE SOLAR ENERGY

- ACCIONA ENERGY

- COBRA ENERGIA

- FRENELL GMBH

- その他の企業

- SOLTIGUA

- ATLANTICA YIELD

- CHIYODA CORPORATION

- SOLASTOR

- TORRESOL ENERGY

- HELIOGEN

第13章 付録

The global concentrating solar power market size is estimated to be USD 6.0 Billion in 2022 and is projected to reach USD 19.9 Billion by 2027; it is projected to grow at a CAGR of 26.9% during the forecast period. The key drivers for the concentrating solar power market include effective integration of CSP systems with thermal storage systems, and Use of CSP in desalination and enhanced oil recovery processes.

"Linear concentrating systems: The second largest segment of the concentrating solar power market, by technology "

Based on technology, the concentrating solar power market has been split into solar power towers, linear concentrating systems, and dish stirling technology. Linear concentrating system were estimated to account for a second largest share of the concentrating solar power market in 2021. Reduced CAPEX and widespread implementation of parabolic troughs and linear Fresnel technologies are the key factors driving the implementation of linear concentrating systems.

"100 MW and Above segment is expected to emerge as the largest segment based on capacity"

The concentrating solar power market has been segmented into the less than 50 MW, 50 MW to 99 MW, and 100 MW and Above based on capacity. 100 MW and Above is expected to hold the largest market share. The 100 MW and above segment is driven by the need to install concentrating solar power systems for utility power generation applications in regions such as Asia Pacific and the Middle East & Africa

"Middle East & Africa is expected to be the second largest market during the forecast period."

Middle East & Africa is expected to be the second-fastest growing market due to need for water desalination, and development of renewable sectors in countries such as UAE, Saudi Arabia, and South Africa are driving the market for concentrating solar power in this region.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level Executives- 30%, Directors- 25%, and Others- 45%

By Region: North America- 27%, Europe- 20%, Asia Pacific- 33%, the Middle East & Africa- 8%, and South America- 12%

Note: Others includes product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The concentrating solar power market is dominated by a few major players that have a wide regional presence. The leading players in the concentrating solar power market are Abengoa (Spain), BrightSource Energy (US), ACWA Power (Saudi Arabia), SolarReserve (US), and Aalborg CSP (Denmark).

Research Coverage:

The report defines, describes, and forecasts the global concentrating solar power market, by technology, operation type, capacity, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the concentrating solar power market.

Key Benefits of Buying the Report

1. The report identifies and addresses the key markets for concentrating solar power, which would help CSP technology manufacturers review the growth in demand.

2. The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

3. The report will help key players understand the strategies of their competitors better and help them in making better strategic decisions.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY: INCLUSIONS AND EXCLUSIONS

- 1.3.2 CONCENTRATING SOLAR POWER MARKET, BY CAPACITY: INCLUSIONS AND EXCLUSIONS

- 1.3.3 CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE: INCLUSIONS AND EXCLUSIONS

- 1.3.4 CONCENTRATING SOLAR POWER MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKET SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 CONCENTRATING SOLAR POWER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.2 DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION: CONCENTRATING SOLAR POWER MARKET

- 2.3 STUDY SCOPE

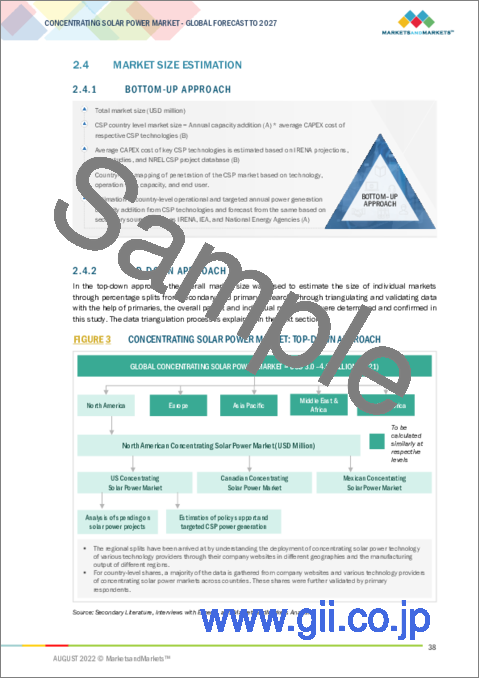

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 3 CONCENTRATING SOLAR POWER MARKET: TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- FIGURE 4 ESTIMATING MARKET SIZE THROUGH YEAR-ON-YEAR CAPACITY ADDITION OF CONCENTRATING SOLAR POWER TECHNOLOGY ACROSS COUNTRIES

- 2.4.3.1 Assumptions for demand-side analysis

- 2.4.3.2 Demand-side calculation

- 2.4.3.3 Capex cost projection

- FIGURE 5 GLOBAL AVERAGE CAPEX COST OF CSP TECHNOLOGIES INTEGRATED WITH STORAGE, 2020-2027 (USD/KW)

- FIGURE 6 GLOBAL AVERAGE CAPEX COST OF CSP TECHNOLOGY INTEGRATED WITH STAND-ALONE OPERATION TYPE, 2020-2027 (USD/KW)

- 2.4.4 SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Supply-side assumptions

- 2.4.4.2 Supply-side calculation

- 2.4.5 GROWTH FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 CONCENTRATING SOLAR POWER MARKET OVERVIEW

- FIGURE 7 MIDDLE EAST & AFRICA DOMINATED CONCENTRATING SOLAR POWER MARKET IN 2021

- FIGURE 8 SOLAR POWER TOWERS EXPECTED TO HOLD LARGEST MARKET SHARE, BY TECHNOLOGY, DURING FORECAST PERIOD

- FIGURE 9 UTILITIES EXPECTED TO LEAD MARKET, BY END USER, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR MARKET PLAYERS IN CONCENTRATING SOLAR POWER MARKET

- FIGURE 10 STAGNANT GROWTH OF RENEWABLE SECTOR EXPECTED TO DRIVE MARKET FROM 2022-2027

- 4.2 CONCENTRATING SOLAR POWER MARKET, BY REGION

- FIGURE 11 SOUTH AMERICA TO WITNESS HIGHEST CAGR IN CONCENTRATING SOLAR POWER MARKET DURING FORECAST PERIOD

- 4.3 CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY

- FIGURE 12 SOLAR POWER TOWERS DOMINATED CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, IN 2021

- 4.4 CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE

- FIGURE 13 CONCENTRATING SOLAR POWER STORAGE ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- 4.5 CONCENTRATING SOLAR POWER MARKET, BY CAPACITY

- FIGURE 14 100 MW AND ABOVE HELD LARGEST SHARE OF CONCENTRATING SOLAR POWER MARKET IN 2021

- 4.6 CONCENTRATING SOLAR POWER MARKET, BY END USER

- FIGURE 15 UTILITIES HELD LARGEST SHARE OF CONCENTRATING SOLAR POWER MARKET IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 CONCENTRATING SOLAR POWER MARKET: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing environmental concerns over carbon emissions and efforts to reduce air pollution

- FIGURE 17 SOURCES OF CARBON DIOXIDE EMISSION IN US, 2020

- 5.2.1.2 Support from governments to enable adoption of renewable technologies

- 5.2.1.3 Effective integration of CSP systems with thermal storage systems

- TABLE 2 CSP TOWER PROJECTS WITH STORAGE DURING FORECAST PERIOD

- 5.2.2 RESTRAINTS

- 5.2.2.1 Higher cost of generation compared with other renewable technologies

- TABLE 3 GLOBAL LCOE RANGE FOR RENEWABLE TECHNOLOGIES, 2021

- FIGURE 18 TOTAL GLOBAL LCOE RANGE FOR RENEWABLE TECHNOLOGIES, 2010 - 2021

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of CSP in hybrid power plants

- 5.2.3.2 Use of CSP in desalination and enhanced oil recovery processes

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical complexities of CSP plants

- 5.2.4.2 Solar PV is cheaper than CSP

- FIGURE 19 GLOBAL ANNUAL SOLAR PV CAPACITY, IN GW, 2021

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 20 CONCENTRATING SOLAR POWER: VALUE CHAIN

- 5.3.1 RESEARCH AND PROJECT DEVELOPMENT

- 5.3.2 RAW MATERIAL SOURCING

- 5.3.3 COMPONENTS SUPPLY

- 5.3.4 PLANT ENGINEERING

- 5.3.5 OPERATION

- 5.3.6 DISTRIBUTION

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 TEMPERATURE AND EFFICIENCY LIMITATIONS

- 5.4.2 NREL SUNSHOT INITIATIVE

- 5.4.3 MICRO-CSP

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 CRESCENT DUNES USES SOLAR POWER TOWER CSP FOR UTILITIES

- TABLE 4 CRESCENT DUNES PROJECT STATISTICS

- 5.5.2 SUPCON DELINGHA 50MW MOLTEN SALT TOWER CSP USES SOLAR POWER TOWER CSP FOR UTILITIES

- TABLE 5 SUPCON DELINGHA PROJECT STATISTICS

- 5.6 PRICING ANALYSIS

- 5.6.1 INDICATIVE PRICING ANALYSIS TREND

- 5.6.1.1 Break-up of installed cost of CSP

- FIGURE 21 TOTAL INSTALLED COST BREAKDOWN FOR PARABOLIC TROUGH, 2020

- FIGURE 22 TOTAL INSTALLED COST BREAKDOWN FOR POWER TOWER, 2020

- 5.6.1 INDICATIVE PRICING ANALYSIS TREND

6 CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- FIGURE 23 CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2021

- TABLE 6 CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 7 CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 6.2 SOLAR POWER TOWERS

- 6.2.1 POTENTIAL TO REACH HIGH TEMPERATURES THAN OTHER TECHNOLOGIES

- TABLE 8 SOLAR POWER TOWERS: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 9 SOLAR POWER TOWERS: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 LINEAR CONCENTRATING SYSTEMS

- 6.3.1 LESS CAPITAL EXPENDITURE THAN OTHER TECHNOLOGIES

- 6.3.2 PARABOLIC TROUGH

- 6.3.2.1 Ability to generate very high temperatures at low cost

- 6.3.3 LINEAR FRESNEL REFLECTORS

- 6.3.3.1 Greater surface area per receiver allows more mobility to track sun

- TABLE 10 LINEAR CONCENTRATING SYSTEMS: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 11 LINEAR CONCENTRATING SYSTEMS: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.4 DISH STIRLING TECHNOLOGY

- 6.4.1 REDUCED HEAT LOSS DURING POWER GENERATION

- TABLE 12 DISH STIRLING TECHNOLOGY: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 13 DISH STIRLING TECHNOLOGY: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (USD MILLION)

7 CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE

- 7.1 INTRODUCTION

- FIGURE 24 CONCENTRATING SOLAR POWER MARKET SHARE, BY OPERATION TYPE, 2021

- TABLE 14 CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 15 CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 7.2 STAND-ALONE

- 7.2.1 LOW CAPITAL EXPENDITURE TO DRIVE MARKET

- TABLE 16 STAND-ALONE: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 17 STAND-ALONE: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (USD MILLION)

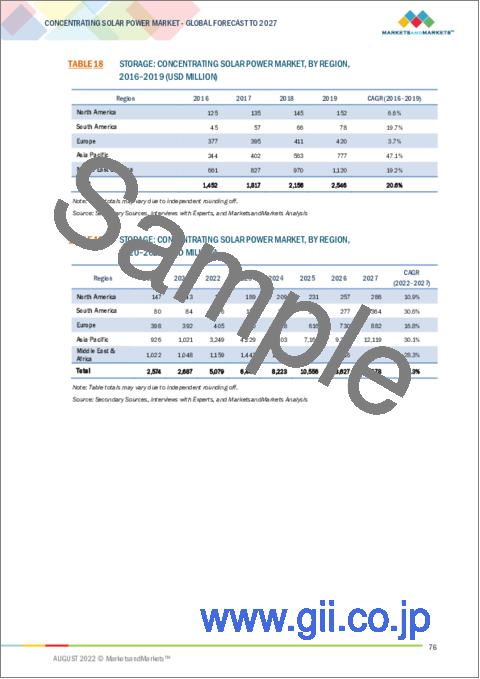

- 7.3 STORAGE

- 7.3.1 NEED FOR POWER GENERATION DURING NIGHTTIME IS DRIVING MARKET

- TABLE 18 STORAGE: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 19 STORAGE: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (USD MILLION)

8 CONCENTRATING SOLAR POWER MARKET, BY CAPACITY

- 8.1 INTRODUCTION

- FIGURE 25 CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2021

- TABLE 20 CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 21 CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 8.2 LESS THAN 50 MW

- 8.2.1 NEEDED FOR SMALL-SCALE RENEWABLE UTILITY POWER GENERATION

- TABLE 22 LESS THAN 50 MW: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 23 LESS THAN 50 MW: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.3 50 MW TO 99 MW

- 8.3.1 INCREASED UTILITY-SCALE POWER GENERATION WITH THERMAL STORAGE

- TABLE 24 50 MW TO 99 MW: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 25 50 MW TO 99 MW: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.4 100 MW AND ABOVE

- 8.4.1 NEED TO INSTALL CSP TECHNOLOGY TO MEET RENEWABLE ENERGY GENERATION DEMAND

- TABLE 26 100 MW AND ABOVE: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 27 100 MW AND ABOVE: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (USD MILLION)

9 CONCENTRATING SOLAR POWER MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 26 CONCENTRATING SOLAR POWER MARKET SHARE, BY END USER, 2021

- TABLE 28 CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 29 CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2 UTILITIES

- 9.2.1 INCREASING ENERGY DEMAND AND ABILITY TO STORE ENERGY FOR FUTURE USE

- TABLE 30 UTILITIES: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 31 UTILITIES: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.3 ENHANCED OIL RECOVERY (EOR)

- 9.3.1 NEED TO BOOST OIL PRODUCTION AND EXTEND LIFE OF OIL FIELDS

- TABLE 32 ENHANCED OIL RECOVERY (EOR): CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 33 ENHANCED OIL RECOVERY (EOR): CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.4 OTHERS

- 9.4.1 GROWING NEED FOR OFF-GRID POWER SUPPLY USING RENEWABLE POWER SOURCES

- TABLE 34 OTHERS: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 35 OTHERS: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (USD MILLION)

10 CONCENTRATING SOLAR POWER MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 27 MARKET IN SOUTH AMERICA EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 CONCENTRATING SOLAR POWER MARKET SHARE (VALUE), BY REGION, 2021

- TABLE 36 GLOBAL CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (IN MW)

- TABLE 37 GLOBAL CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (IN MW)

- TABLE 38 GLOBAL CONCENTRATING SOLAR POWER MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 39 GLOBAL CONCENTRATING SOLAR POWER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 BY TECHNOLOGY

- TABLE 40 NORTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 41 NORTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.2.2 BY OPERATION TYPE

- TABLE 42 NORTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 43 NORTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.2.3 BY CAPACITY

- TABLE 44 NORTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 45 NORTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.2.4 BY END USER

- TABLE 46 NORTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 47 NORTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.5 BY COUNTRY

- TABLE 48 NORTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 49 NORTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.2.5.1 US

- 10.2.5.1.1 Planned CSP power generation targets to drive market

- 10.2.5.1.2 By technology

- 10.2.5.1 US

- TABLE 50 US: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 51 US: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.2.5.1.3 By operation type

- TABLE 52 US: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 53 US: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.2.5.1.4 By capacity

- TABLE 54 US: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 55 US: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.2.5.1.5 By end user

- TABLE 56 US: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 57 US: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.5.2 Mexico

- 10.2.5.2.1 Potential of using CSP for numerous mini-grid applications

- 10.2.5.2.2 By technology

- 10.2.5.2 Mexico

- TABLE 58 MEXICO: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 59 MEXICO: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.2.5.2.3 By operation type

- TABLE 60 MEXICO: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 61 MEXICO: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.2.5.2.4 By capacity

- TABLE 62 MEXICO: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 63 MEXICO: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.2.5.2.5 By end user

- TABLE 64 MEXICO: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 65 MEXICO: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3 ASIA PACIFIC

- FIGURE 29 ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET SNAPSHOT, 2021

- 10.3.1 BY TECHNOLOGY

- TABLE 66 ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 67 ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.3.2 BY OPERATION TYPE

- TABLE 68 ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 69 ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.3.3 BY CAPACITY

- TABLE 70 ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 71 ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.3.4 BY END USER

- TABLE 72 ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 73 ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.5 BY COUNTRY

- TABLE 74 ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 75 ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.3.5.1 China

- 10.3.5.1.1 Increasing investments in CSP for power grid stabilization

- 10.3.5.1.2 By technology

- 10.3.5.1 China

- TABLE 76 CHINA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 77 CHINA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.3.5.1.3 By operation type

- TABLE 78 CHINA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 79 CHINA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.3.5.1.4 By capacity

- TABLE 80 CHINA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 81 CHINA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.3.5.1.5 By end user

- TABLE 82 CHINA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 83 CHINA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.5.2 India

- 10.3.5.2.1 Potential to integrate CSP with desalination plants

- 10.3.5.2.2 By technology

- 10.3.5.2 India

- TABLE 84 INDIA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 85 INDIA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.3.5.2.3 By operation type

- TABLE 86 INDIA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 87 INDIA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.3.5.2.4 By capacity

- TABLE 88 INDIA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 89 INDIA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.3.5.2.5 By end user

- TABLE 90 INDIA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 91 INDIA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.5.3 Australia

- 10.3.5.3.1 CSP to provide power grid balance and flexibility

- 10.3.5.3.2 By technology

- 10.3.5.3 Australia

- TABLE 92 AUSTRALIA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 93 AUSTRALIA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.3.5.3.3 By operation type

- TABLE 94 AUSTRALIA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 95 AUSTRALIA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.3.5.3.4 By capacity

- TABLE 96 AUSTRALIA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 97 AUSTRALIA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.3.5.3.5 By end user

- TABLE 98 AUSTRALIA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 99 AUSTRALIA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.5.4 Rest of Asia Pacific

- 10.3.5.4.1 By technology

- 10.3.5.4 Rest of Asia Pacific

- TABLE 100 REST OF ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 101 REST OF ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.3.5.4.2 By operation type

- TABLE 102 REST OF ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.3.5.4.3 By capacity

- TABLE 104 REST OF ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.3.5.4.4 By end user

- TABLE 106 REST OF ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4 EUROPE

- 10.4.1 BY TECHNOLOGY

- TABLE 108 EUROPE: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 109 EUROPE: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.4.2 BY OPERATION TYPE

- TABLE 110 EUROPE: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 111 EUROPE: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.4.3 BY CAPACITY

- TABLE 112 EUROPE: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 113 EUROPE: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.4.4 BY END USER

- TABLE 114 EUROPE: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 115 EUROPE: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.5 BY COUNTRY

- TABLE 116 EUROPE: CONCENTRATING SOLAR POWER MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 117 EUROPE: CONCENTRATING SOLAR POWER MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.4.5.1 Cyprus

- 10.4.5.1.1 CSP targets and suitable solar irradiation levels boosting market growth

- 10.4.5.1.2 By technology

- 10.4.5.1 Cyprus

- TABLE 118 CYPRUS: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 119 CYPRUS: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.4.5.1.3 By operation type

- TABLE 120 CYPRUS: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 121 CYPRUS: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.4.5.1.4 By capacity

- TABLE 122 CYPRUS: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 123 CYPRUS: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.4.5.1.5 By end user

- TABLE 124 CYPRUS: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 125 CYPRUS: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.5.2 Spain

- 10.4.5.2.1 Multitude of CSP deployments favoring market growth

- 10.4.5.2.2 By technology

- 10.4.5.2 Spain

- TABLE 126 SPAIN: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 127 SPAIN: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.4.5.2.3 By operation type

- TABLE 128 SPAIN: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 129 SPAIN: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.4.5.2.4 By capacity

- TABLE 130 SPAIN: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 131 SPAIN: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.4.5.2.5 By end user

- TABLE 132 SPAIN: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 133 SPAIN: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.5.3 Greece

- 10.4.5.3.1 Need to reduce energy imports and presence of favorable radiation levels

- 10.4.5.3.2 By technology

- 10.4.5.3 Greece

- TABLE 134 GREECE: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 135 GREECE: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.4.5.3.3 By operation type

- TABLE 136 GREECE: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 137 GREECE: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.4.5.3.4 By capacity

- TABLE 138 GREECE: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 139 GREECE: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.4.5.3.5 By end user

- TABLE 140 GREECE: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 141 GREECE: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.5.4 Rest of Europe

- 10.4.5.4.1 By technology

- 10.4.5.4 Rest of Europe

- TABLE 142 REST OF EUROPE: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 143 REST OF EUROPE: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.4.5.4.2 By operation type

- TABLE 144 REST OF EUROPE: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 145 REST OF EUROPE: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.4.5.4.3 By capacity

- TABLE 146 REST OF EUROPE: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 147 REST OF EUROPE: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.4.5.4.4 By end user

- TABLE 148 REST OF EUROPE: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 149 REST OF EUROPE: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- FIGURE 30 MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET SNAPSHOT, 2021

- 10.5.1 BY TECHNOLOGY

- TABLE 150 MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.5.2 BY OPERATION TYPE

- TABLE 152 MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.5.3 BY CAPACITY

- TABLE 154 MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.5.4 BY END USER

- TABLE 156 MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5.5 BY COUNTRY

- TABLE 158 MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.5.5.1 Saudi Arabia

- 10.5.5.1.1 Potential to transit from oil dependence and use CSP for renewable power generation

- 10.5.5.1.2 By technology

- 10.5.5.1 Saudi Arabia

- TABLE 160 SAUDI ARABIA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 161 SAUDI ARABIA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.5.5.1.3 By operation type

- TABLE 162 SAUDI ARABIA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 163 SAUDI ARABIA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.5.5.1.4 By capacity

- TABLE 164 SAUDI ARABIA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 165 SAUDI ARABIA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.5.5.1.5 By end user

- TABLE 166 SAUDI ARABIA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 167 SAUDI ARABIA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5.5.2 UAE

- 10.5.5.2.1 Potential for CSP to supply power for district cooling systems

- 10.5.5.2.2 By technology

- 10.5.5.2 UAE

- TABLE 168 UAE: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 169 UAE: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.5.5.2.3 By operation type

- TABLE 170 UAE: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 171 UAE: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.5.5.2.4 By capacity

- TABLE 172 UAE: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 173 UAE: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.5.5.2.5 By end user

- TABLE 174 UAE: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 175 UAE: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5.5.3 South Africa

- 10.5.5.3.1 Potential of CSP and mining hybridization

- 10.5.5.3.2 By technology

- 10.5.5.3 South Africa

- TABLE 176 SOUTH AFRICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 177 SOUTH AFRICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.5.5.3.3 By operation type

- TABLE 178 SOUTH AFRICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 179 SOUTH AFRICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.5.5.3.4 By capacity

- TABLE 180 SOUTH AFRICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 181 SOUTH AFRICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.5.5.3.5 By end user

- TABLE 182 SOUTH AFRICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 183 SOUTH AFRICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5.5.4 Morocco

- 10.5.5.4.1 Growing number of CSP projects and supportive legislation driving market

- 10.5.5.4.2 By technology

- 10.5.5.4 Morocco

- TABLE 184 MOROCCO: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 185 MOROCCO: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.5.5.4.3 By operation type

- TABLE 186 MOROCCO: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 187 MOROCCO: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.5.5.4.4 By capacity

- TABLE 188 MOROCCO: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 189 MOROCCO: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.5.5.4.5 By end user

- TABLE 190 MOROCCO: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 191 MOROCCO: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5.5.5 Rest of Middle East & Africa

- 10.5.5.5.1 By technology

- 10.5.5.5 Rest of Middle East & Africa

- TABLE 192 REST OF MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 193 REST OF MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.5.5.5.2 By operation type

- TABLE 194 REST OF MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 195 REST OF MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.5.5.5.3 By capacity

- TABLE 196 REST OF MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 197 REST OF MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.5.5.5.4 By end user

- TABLE 198 REST OF MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 199 REST OF MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.6 SOUTH AMERICA

- 10.6.1 BY TECHNOLOGY

- TABLE 200 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 201 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.6.2 BY OPERATION TYPE

- TABLE 202 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 203 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.6.3 BY CAPACITY

- TABLE 204 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 205 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.6.4 BY END USER

- TABLE 206 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 207 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.6.5 BY COUNTRY

- TABLE 208 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 209 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.6.5.1 Brazil

- 10.6.5.1.1 Availability of large suitable land area for CSP and supportive renewable energy policies

- 10.6.5.1.2 By technology

- 10.6.5.1 Brazil

- TABLE 210 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 211 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.6.5.1.3 By operation type

- TABLE 212 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 213 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.6.5.1.4 By capacity

- TABLE 214 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 215 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.6.5.1.5 By end user

- TABLE 216 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 217 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.6.5.2 Chile

- 10.6.5.2.1 Potential to supply components such as thermal energy storage molten salts

- 10.6.5.2.2 By technology

- 10.6.5.2 Chile

- TABLE 218 CHILE: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 219 CHILE: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.6.5.2.3 By operation type

- TABLE 220 CHILE: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 221 CHILE: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.6.5.2.4 By capacity

- TABLE 222 CHILE: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 223 CHILE: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.6.5.2.5 By end user

- TABLE 224 CHILE: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 225 CHILE: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.6.5.3 Rest of South America

- 10.6.5.3.1 By technology

- 10.6.5.3 Rest of South America

- TABLE 226 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2016-2019 (USD MILLION)

- TABLE 227 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 10.6.5.3.2 By operation type

- TABLE 228 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2016-2019 (USD MILLION)

- TABLE 229 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2020-2027 (USD MILLION)

- 10.6.5.3.3 By capacity

- TABLE 230 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 231 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2020-2027 (USD MILLION)

- 10.6.5.3.4 By end user

- TABLE 232 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 233 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 2020-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 KEY PLAYERS' STRATEGIES

- TABLE 234 OVERVIEW OF KEY STRATEGIES ADOPTED BY KEY PLAYERS, 2018-2022

- 11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- TABLE 235 CONCENTRATING SOLAR POWER MARKET: DEGREE OF COMPETITION

- FIGURE 31 CONCENTRATING SOLAR POWER MARKET SHARE ANALYSIS, 2021

- 11.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- FIGURE 32 TOP PLAYERS IN CONCENTRATING SOLAR POWER MARKET FROM 2017 TO 2021

- 11.4 COMPANY EVALUATION QUADRANT

- 11.4.1 STARS

- 11.4.2 PERVASIVE PLAYERS

- 11.4.3 EMERGING LEADERS

- 11.4.4 PARTICIPANTS

- FIGURE 33 CONCENTRATING SOLAR POWER MARKET (GLOBAL) KEY COMPANY EVALUATION MATRIX, 2021

- 11.5 CONCENTRATING SOLAR POWER MARKET: COMPANY FOOTPRINT

- TABLE 236 TECHNOLOGY: COMPANY FOOTPRINT

- TABLE 237 OPERATION TYPE: COMPANY FOOTPRINT

- TABLE 238 CAPACITY: COMPANY FOOTPRINT

- TABLE 239 REGION: COMPANY FOOTPRINT

- TABLE 240 COMPANY FOOTPRINT

- 11.6 COMPETITIVE SCENARIO

- TABLE 241 CONCENTRATING SOLAR POWER MARKET: DEALS, JANUARY 2018-MARCH 2022

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 KEY PLAYERS

- 12.1.1 GENERAL ELECTRIC

- TABLE 242 GENERAL ELECTRIC: BUSINESS OVERVIEW

- FIGURE 34 GENERAL ELECTRIC: COMPANY SNAPSHOT, 2021

- TABLE 243 GENERAL ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 244 GENERAL ELECTRIC: DEALS

- 12.1.2 ABENGOA

- TABLE 245 ABENGOA: BUSINESS OVERVIEW

- FIGURE 35 ABENGOA: COMPANY SNAPSHOT, 2021

- TABLE 246 ABENGOA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 247 ABENGOA: DEALS

- 12.1.3 BRIGHTSOURCE ENERGY

- TABLE 249 BRIGHTSOURCE ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 250 BRIGHTSOURCE ENERGY: DEALS

- 12.1.4 ACWA POWER

- TABLE 251 ACWA POWER: BUSINESS OVERVIEW

- TABLE 252 ACWA POWER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 253 ACWA POWER: DEALS

- 12.1.5 GLASSPOINT SOLAR

- TABLE 254 GLASSPOINT SOLAR: BUSINESS OVERVIEW

- TABLE 255 GLASSPOINT SOLAR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 256 GLASSPOINT SOLAR: DEALS

- 12.1.6 ENEL GREEN POWER

- TABLE 257 ENEL GREEN POWER: BUSINESS OVERVIEW

- TABLE 258 ENEL GREEN POWER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.7 SOLARRESERVE

- TABLE 259 SOLARRESERVE: BUSINESS OVERVIEW

- TABLE 260 SOLARRESERVE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 261 SOLARRESERVE: DEALS

- TABLE 262 SOLARRESERVE: OTHERS

- 12.1.8 AALBORG CSP

- TABLE 263 AALBORG CSP: BUSINESS OVERVIEW

- TABLE 264 AALBORG CSP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 265 AALBORG CSP: DEALS

- 12.1.9 TSK FLAGSOL ENGINEERING GMBH

- TABLE 266 TSK FLAGSOL ENGINEERING GMBH: BUSINESS OVERVIEW

- TABLE 267 TSK FLAGSOL ENGINEERING GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 268 TSK FLAGSOL ENGINEERING GMBH: DEALS

- 12.1.10 ALSOLEN

- TABLE 269 ALSOLEN: BUSINESS OVERVIEW

- TABLE 270 ALSOLEN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.11 ARCHIMEDE SOLAR ENERGY

- TABLE 271 ARCHIMEDE SOLAR ENERGY: BUSINESS OVERVIEW

- TABLE 272 ARCHIMEDE SOLAR ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.12 ACCIONA ENERGY

- TABLE 273 ACCIONA ENERGY: BUSINESS OVERVIEW

- TABLE 274 ACCIONA ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.13 COBRA ENERGIA

- TABLE 275 COBRA ENERGIA: BUSINESS OVERVIEW

- TABLE 276 COBRA ENERGIA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.14 FRENELL GMBH

- TABLE 277 FRENELL GMBH: BUSINESS OVERVIEW

- TABLE 278 FRENELL GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 279 FRENELL GMBH: OTHERS

- 12.2 OTHER PLAYERS

- 12.2.1 SOLTIGUA

- 12.2.2 ATLANTICA YIELD

- 12.2.3 CHIYODA CORPORATION

- 12.2.4 SOLASTOR

- 12.2.5 TORRESOL ENERGY

- 12.2.6 HELIOGEN

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS