|

|

市場調査レポート

商品コード

1078879

ホームセキュリティシステムの世界市場:住宅タイプ別(戸建て、アパート)、セキュリティ別(業者による設置・監視、DIY)、システム別(アクセス制御システム)、サービス別(セキュリティシステム統合サービス)、地域別(2022年~2027年)Home Security Systems Market by Home Type (Independent Homes, Apartments), Security (Professionally Installed & Monitored, Do-It-Yourself), Systems (Access Control Systems), Services (Security System Integration Services), Region (2022-2027) |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ホームセキュリティシステムの世界市場:住宅タイプ別(戸建て、アパート)、セキュリティ別(業者による設置・監視、DIY)、システム別(アクセス制御システム)、サービス別(セキュリティシステム統合サービス)、地域別(2022年~2027年) |

|

出版日: 2022年05月20日

発行: MarketsandMarkets

ページ情報: 英文 165 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のホームセキュリティシステムの市場規模は、2022年の569億米ドルから、2027年までに844億米ドルに達し、予測期間中のCAGRで8.2%の成長が予測されています。

市場の成長は、ホームセキュリティシステムに対する意識の高まり、IoTやワイヤレス技術の出現などの要因によって促進されています。

当レポートでは、世界のホームセキュリティシステム市場について調査分析し、市場概要、業界動向、セグメント別の市場分析、競合情勢、主要企業などについて、最新の情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 新興動向

第6章 ホームセキュリティシステム市場:システム別

- 防火システム

- ビデオ監視システム

- アクセス制御システム

- 入口制御システム

- 侵入者警報システム

第7章 ホームセキュリティシステム市場:サービス別

- セキュリティシステム統合サービス

- リモート監視サービス

- 火災セキュリティサービス

- ビデオ監視サービス

- アクセス制御サービス

第8章 ホームセキュリティシステム市場:セキュリティ別

- 業者による設置・監視システム

- 自己設置・業者による監視システム

- DIY

第9章 ホームセキュリティシステム市場:住宅タイプ別

- 戸建て

- コンドミニアム/アパート

第10章 地域分析

- 北米

- 欧州

- アジア太平洋地域

- その他の地域

第11章 競合情勢

- 概要

- 上位企業5社の収益分析

- 市場シェア分析

- 企業の評価象限

- 競合状況・動向

第12章 企業プロファイル

- 主要企業

- ADT

- RESIDEO TECHNOLOGIES INC

- JOHNSON CONTROLS

- HANGZHOU HIKVISION DIGITAL TECHNOLOGY

- ASSA ABLOY

- SECOM

- ROBERT BOSCH

- ALLEGION

- SNAP ONE, LLC

- ABB

- その他の企業

- COMCAST

- ALARM.COM

- NORTEK SECURITY & CONTROL

- VIVINT

- SIMPLISAFE

- ARMORAX

- CANARY

- SCOUT

- LEGRAND

- SCHNEIDER ELECTRIC

第13章 隣接・関連市場

第14章 付録

The global home security systems market size is expected to grow from USD 56.9 Billion in 2022 to USD 84.4 Billion by 2027, at a CAGR of 8.2% during the forecast period.The growth of the home security systems market is driven by factors such as growing awareness regarding home security systems andthe emergence of the Internet of Things (IoT) and wireless technologies.

"Home security system market for independent homes to account for largest market share in 2027"

Security is one of the major concerns among independent homeowners. Independent dwellings are high in economically developed countries, such as the US, Canada, and Germany. People who own an induvial home usually have a high household income. The independent homes are more frequently built-in isolated locations. Thus, in case of medical emergencies or criminal activities, such as burglary or theft, the necessary help may not be available nearby. Considering these factors, the adoption of home security systems among independent homeowners is growing at a significant rate.

"Professionally installed and monitored security systems to account for the largest share of the market by2027."

The large market for professionally installed and monitored security systems is mainly attributed to the growing concern among consumers about consistent security and real-time monitoring, and rising disposable income. The professionally installed and monitored systems are installed and monitored by professionals without any intervention from owners. One of the key benefits of this type of security system is that the user gets a set of dedicated consulting and engineering services. The systems are set up appropriately by professional installers. The third-party professionals managing this category of security systems ensure security and hassle-free operations of the systems without the intervention of the customers.

"Home security system market inAPAC to grow at higher CAGR during the forecast period."

Asia Pacific is a developing region in terms of technology and economy. China, Japan, and South Korea, with a higher urbanization rate and growing construction sector, are driving the overall growth of the home security systems market in this region. The technological advancements and economic growth in the region are factors expected to increase the demand for security systems. The rapid growth of the construction industry and real estate sector is expected to boost the growth of the residential fire protection system market in the coming years.

- By Company Type: Tier 1 =55%, Tier 2 =25%, and Tier 3 =20%

- By Designation: C-Level Executives =35%, Directors =40%, and Others =25%

- By Region: Americas= 30%, Europe = 20%, APAC =40%, and RoW=10%

The home security systems market comprises major players such as ADT (US), Resideo Technologies, Inc. (US), Johnson Controls (Ireland), Hangzhau Hikvision Digital Technology (China), ASSA ABLOY (Sweden), SECOM (Japan), Robert Bosch (Germany), Allegion (Ireland), Snap One, LLC (US), ABB (Switzerland) are the key players in the home security systems market. These top players have strong portfolios of products and services and presence in both mature and emerging markets.

The study includes an in-depth competitive analysis of these key players in the home security systems market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The report defines, describes, and forecasts the home security systems marketbased on systems, services, security, home type, and geography. It provides detailed information regarding factors such as drivers, restraints, opportunities, and challenges influencing the growth of the home security systems market. It also analyzes competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and developments carried out by the key players to grow in the market.

Key Benefits of Buying the Report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall home security systems market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 HOME SECURITY SYSTEMS MARKET: SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH FLOW

- FIGURE 3 HOME SECURITY SYSTEMS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Key data from primary sources

- 2.1.3.2 Key industry insights

- 2.1.3.3 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market size through bottom-up analysis (demand side)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for capturing the market size by top-down analysis (supply side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 HOME SECURITY SYSTEMS MARKET: SUPPLY-SIDE APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 HOME SECURITY SYSTEMS MARKET, 2018-2027 (USD BILLION)

- FIGURE 9 MARKET FOR CONDOMINIUMS/APARTMENTS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 HOME SECURITY SYSTEMS MARKET FOR DIY SYSTEMS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 HOME SECURITY SYSTEMS MARKET SHARE (%), BY OFFERING, 2022 & 2027

- FIGURE 12 NORTH AMERICA TO DOMINATE HOME SECURITY SYSTEMS MARKET BETWEEN 2022-2027, BY REGION

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN HOME SECURITY SYSTEMS MARKET

- FIGURE 13 INTEGRATION OF AI AND DEEP LEARNING IN HOME SECURITY SYSTEMS TO OFFER ATTRACTIVE GROWTH OPPORTUNITIES DURING FORECAST PERIOD

- 4.2 HOME SECURITY SYSTEMS MARKET, BY SYSTEM

- FIGURE 14 VIDEO SURVEILLANCE SYSTEM SEGMENT TO HVE HIGHEST GROWTH FROM 2022 TO 2027

- 4.3 HOME SECURITY SYSTEMS MARKET, BY SYSTEMS AND COUNTRY

- FIGURE 15 VIDEO SURVEILLANCE SYSTEM SEGMENT AND US HELD LARGEST SHARES OF MARKET IN 2021

- 4.4 US ACQUIRED LARGEST SHARE OF HOME SECURITY SYSTEMS MARKET IN 2021

- FIGURE 16 HOME SECURITY SYSTEMS MARKET IN CHINA TO INFLUENCE HIGHEST GROWTH FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 HOME SECURITY SYSTEMS MARKET: DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Emergence of Internet of Things (IoT) and wireless technologies

- 5.2.1.2 Growing awareness regarding home security systems

- FIGURE 18 HOME SECURITY SYSTEMS MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation, maintenance, and operational costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Implementation of artificial intelligence (AI) and deep learning in home security systems

- 5.2.3.2 Worldwide proliferation of smart cities initiative

- FIGURE 19 HOME SECURITY SYSTEMS MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 System complexity

- 5.2.4.2 Privacy of highly confidential information

- FIGURE 20 HOME SECURITY SYSTEMS MARKET: IMPACT ANALYSIS OF RESTRAINTS AND CHALLENGES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 21 ORIGINAL EQUIPMENT MANUFACTURERS ADD MAXIMUM VALUE TO VALUE CHAIN OF HOME SECURITY SYSTEMS MARKET

- 5.4 EMERGING TRENDS

- 5.4.1 INCREASING ADOPTION OF CLOUD TECHNOLOGIES FOR SMART SURVEILLANCE

6 HOME SECURITY SYSTEMS MARKET, BY SYSTEMS

- 6.1 INTRODUCTION

- TABLE 1 HOME SECURITY SYSTEMS MARKET, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 2 HOME SECURITY SYSTEMS MARKET, BY TYPE, 2022-2027 (USD BILLION)

- 6.2 SYSTEMS

- FIGURE 22 VIDEO SURVEILLANCE SYSTEM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 3 HOME SECURITY SYSTEMS MARKET, BY SYSTEMS, 2018-2021 (USD BILLION)

- TABLE 4 HOME SECURITY SYSTEMS MARKET, BY SYSTEMS, 2022-2027 (USD BILLION)

- 6.3 FIRE PROTECTION SYSTEM MARKET

- 6.3.1 DEVELOPMENT OF INNOVATIVE AND EFFICIENT SYSTEMS TO BOOST GROWTH OF FIRE PROTECTION SYSTEMS MARKET

- TABLE 5 HOME SECURITY SYSTEMS MARKET FOR FIRE PROTECTION SYSTEM, BY REGION, 2018-2021 (USD MILLION)

- TABLE 6 HOME SECURITY SYSTEMS MARKET FOR FIRE PROTECTION SYSTEM, BY REGION, 2022-2027 (USD MILLION)

- TABLE 7 HOME SECURITY SYSTEMS MARKET FOR FIRE PROTECTION SYSTEM, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 8 HOME SECURITY SYSTEMS MARKET FOR FIRE PROTECTION SYSTEM, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.3.1.1 Hardware

- 6.3.1.1.1 Market for fire alarm devices to register highest CAGR

- 6.3.1.1 Hardware

- TABLE 9 HOME SECURITY SYSTEMS MARKET FOR FIRE PROTECTION SYSTEM, BY DEVICE, 2018-2021 (USD MILLION)

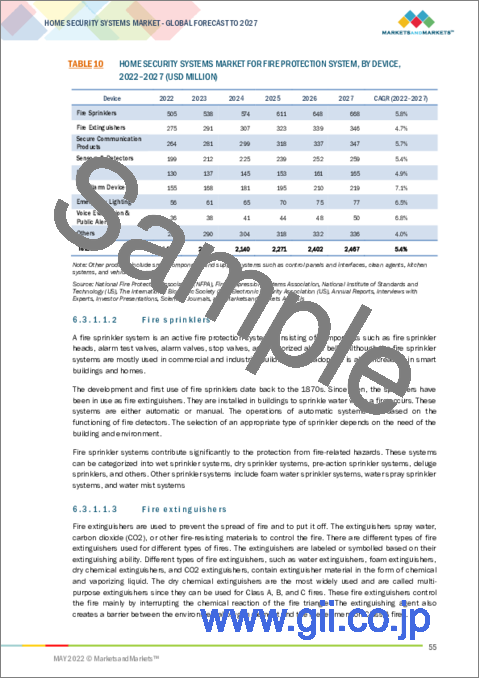

- TABLE 10 HOME SECURITY SYSTEMS MARKET FOR FIRE PROTECTION SYSTEM, BY DEVICE, 2022-2027 (USD MILLION)

- 6.3.1.1.2 Fire sprinklers

- 6.3.1.1.3 Fire extinguishers

- 6.3.1.1.4 Secure communication products

- 6.3.1.1.5 Sensors and detectors

- 6.3.1.1.6 Radiofrequency identification (RFID)

- 6.3.1.1.7 Fire alarm devices

- 6.3.1.1.8 Emergency lighting

- 6.3.1.1.9 Voice evacuation and public products

- 6.3.1.1.10 Others

- 6.3.1.2 Software

- 6.3.1.2.1 Increasing adoption of fire modeling and simulation software to fuel market growth

- TABLE 11 HOME SECURITY SYSTEMS MARKET FOR FIRE PROTECTION SYSTEM, BY SOFTWARE, 2018-2021 (USD MILLION)

- TABLE 12 HOME SECURITY SYSTEMS MARKET FOR FIRE PROTECTION SYSTEM, BY SOFTWARE, 2022-2027 (USD MILLION)

- 6.3.1.2.2 Fire mapping & analysis software

- 6.3.1.2.3 Fire modeling & simulation software

- 6.4 VIDEO SURVEILLANCE SYSTEMS

- 6.4.1 INCREASING DEMAND FOR REAL-TIME MONITORING AND PERIMETER SURVEILLANCE

- TABLE 13 HOME SECURITY SYSTEMS MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY REGION, 2018-2021 (USD MILLION)

- TABLE 14 HOME SECURITY SYSTEMS MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY REGION, 2022-2027 (USD MILLION)

- TABLE 15 HOME SECURITY SYSTEMS MARKET, FOR VIDEO SURVEILLANCE SYSTEM, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 16 HOME SECURITY SYSTEMS MARKET, FOR VIDEO SURVEILLANCE SYSTEM, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.4.1.1 Hardware

- 6.4.1.1.1 Growing demand for IP cameras to push market demand for video surveillance systems

- 6.4.1.1 Hardware

- TABLE 17 HOME SECURITY SYSTEMS MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY HARDWARE TYPE, 2018-2021 (USD MILLION)

- TABLE 18 HOME SECURITY SYSTEMS MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY HARDWARE TYPE, 2022-2027 (USD MILLION)

- 6.4.1.1.2 Camera

- TABLE 19 HOME SECURITY SYSTEMS MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY CAMERA TYPE, 2018-2027 (USD MILLION)

- TABLE 20 HOME SECURITY SYSTEMS MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY CAMERA TYPE, 2022-2027 (USD MILLION)

- 6.4.1.1.2.1 IP cameras

- 6.4.1.1.2.2 Analog cameras

- 6.4.1.1.3 Monitors

- 6.4.1.1.4 Server

- 6.4.1.1.5 Storage

- 6.4.1.1.6 Others

- 6.4.1.2 Software

- 6.4.1.2.1 Market for video management software to exhibit highest CAGR

- TABLE 21 HOME SECURITY SYSTEMS MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY SOFTWARE, 2018-2021 (USD MILLION)

- TABLE 22 HOME SECURITY SYSTEMS MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY SOFTWARE, 2022-2027 (USD MILLION)

- 6.4.1.2.2 Video analytics software

- 6.4.1.2.3 Video management software (VMS)

- 6.4.1.2.4 Neural networks and algorithms

- 6.5 ACCESS CONTROL SYSTEMS

- 6.5.1 INCREASING DEPLOYMENT OF CONTROLLERS AND SERVERS TO AMPLIFY MARKET FOR ACCESS CONTROL SYSTEMS

- TABLE 23 HOME SECURITY SYSTEMS MARKET FOR ACCESS CONTROL SYSTEM, BY REGION, 2018-2021 (USD MILLION)

- TABLE 24 HOME SECURITY SYSTEMS MARKET FOR ACCESS CONTROL SYSTEM, BY REGION, 2022-2027 (USD MILLION)

- TABLE 25 HOME SECURITY SYSTEMS MARKET FOR ACCESS CONTROL SYSTEM, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 26 HOME SECURITY SYSTEMS MARKET FOR ACCESS CONTROL SYSTEM, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.5.1.1 Hardware

- 6.5.1.1.1 Rising demand for access control hardware in residential projects

- 6.5.1.1 Hardware

- TABLE 27 HOME SECURITY SYSTEMS MARKET FOR ACCESS CONTROL SYSTEM, BY DEVICE, 2018-2021 (USD MILLION)

- TABLE 28 HOME SECURITY SYSTEMS MARKET FOR ACCESS CONTROL SYSTEM, BY DEVICE, 2022-2027 (USD MILLION)

- 6.5.1.1.2 Controller/server

- 6.5.1.1.3 Card readers

- TABLE 29 HOME SECURITY SYSTEMS MARKET FOR ACCESS CONTROL CARDS AND READERS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 30 HOME SECURITY SYSTEMS MARKET FOR ACCESS CONTROL CARDS AND READERS, BY TYPE, 2022-2027 (USD MILLION)

- 6.5.1.1.3.1 Magnetic strip readers

- 6.5.1.1.3.2 Proximity card & readers

- 6.5.1.1.3.3 Smart cards & readers

- 6.5.1.1.4 Biometrics

- 6.5.1.1.5 Electronic locks

- TABLE 31 HOME SECURITY SYSTEMS MARKET FOR ACCESS CONTROL ELECTRONIC LOCKS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 32 HOME SECURITY SYSTEMS MARKET FOR ACCESS CONTROL ELECTRONIC LOCKS, BY TYPE, 2022-2027 (USD MILLION)

- 6.5.1.1.5.1 Electromagnetic locks

- 6.5.1.1.5.2 Electric strike locks

- 6.5.1.1.5.3 Wireless locks

- 6.5.1.1.6 Multi-technology readers

- 6.5.1.2 Software

- 6.5.1.2.1 Rising deployment of access control software in new building projects to propel market during forecast period

- 6.6 ENTRANCE CONTROL SYSTEMS

- 6.6.1 INCREASING ADOPTION OF INTEGRATED ENTRANCE CONTROL SYSTEMS IN APARTMENTS AND CONDOMINIUMS

- TABLE 33 HOME SECURITY SYSTEMS MARKET FOR ENTRANCE CONTROL SYSTEM, BY REGION, 2018-2021 (USD MILLION)

- TABLE 34 HOME SECURITY SYSTEMS MARKET FOR ENTRANCE CONTROL SYSTEM, BY REGION, 2022-2027 (USD MILLION)

- 6.7 INTRUDER ALARM

- 6.7.1 INCREASING CRIME RATE AND THEFTS TO POSITIVELY INFLUENCE DEMAND FOR INTRUDER ALARMS

- TABLE 35 HOME SECURITY SYSTEMS MARKET FOR INTRUDER ALARM, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 HOME SECURITY SYSTEMS MARKET FOR INTRUDER ALARM, BY REGION, 2022-2027 (USD MILLION)

7 HOME SECURITY SYSTEMS MARKET, BY SERVICES

- 7.1 INTRODUCTION

- FIGURE 23 VIDEO SURVEILLANCE SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 37 HOME SECURITY SYSTEMS MARKET, BY SERVICES, 2018-2021 (USD MILLION)

- TABLE 38 HOME SECURITY SYSTEMS MARKET, BY SERVICES, 2022-2027 (USD MILLION)

- TABLE 39 HOME SECURITY SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 40 HOME SECURITY SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2 SECURITY SYSTEM INTEGRATION SERVICES

- 7.2.1 INCREASING ADOPTION OF SECURITY SYSTEM INTEGRATION BY ACCESS CONTROL SERVICE PROVIDERS

- TABLE 41 SECURITY SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 SECURITY SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 REMOTE MONITORING SERVICES

- 7.3.1 COST-EFFECTIVE USER INTERFACES PROVIDED BY REMOTE MONITORING SERVICES

- TABLE 43 REMOTE MONITORING SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 REMOTE MONITORING SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 FIRE SECURITY SERVICES

- 7.4.1 GROWING NEED TO MAINTAIN FIRE SECURITY SYSTEMS TO DRIVE MARKET GROWTH

- TABLE 45 FIRE SECURITY SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 46 FIRE SECURITY SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 47 FIRE SECURITY SERVICES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 48 FIRE SECURITY SERVICES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.4.2 ENGINEERING SERVICES

- 7.4.2.1 Rise in demand for fire risk management services

- 7.4.3 INSTALLATION AND DESIGN

- 7.4.3.1 Growing demand for installation and design services in independent homes

- 7.4.4 MAINTENANCE SERVICES

- 7.4.4.1 Growing demand for testing and inspection of fire protection systems

- 7.4.5 MANAGED SERVICES

- 7.4.5.1 Implementation of tested solutions in residential buildings

- 7.4.6 OTHERS

- 7.5 VIDEO SURVEILLANCE SERVICES

- 7.5.1 MARKET FOR VIDEO SURVEILLANCE SERVICES TO EXHIBIT HIGHEST CAGR

- TABLE 49 VIDEO SURVEILLANCE SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 50 VIDEO SURVEILLANCE SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 51 VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 52 VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.5.2 INSTALLATION AND MAINTENANCE

- 7.5.2.1 High cost of repair commands more demand for installation and maintenance services

- 7.5.3 VIDEO SURVEILLANCE AS SERVICES (VSAAS)

- 7.5.3.1 Surging demand in security companies

- TABLE 53 VIDEO SURVEILLANCE-AS-A-SERVICE MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 54 VIDEO SURVEILLANCE-AS-A-SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.6 ACCESS CONTROL SERVICES

- 7.6.1 ADVANCEMENTS IN CLOUD TECHNOLOGY TO PUSH DEMAND FOR ACCESS CONTROL SERVICES

- TABLE 55 ACCESS CONTROL SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 56 ACCESS CONTROL SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 57 ACCESS CONTROL SERVICES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 58 ACCESS CONTROL SERVICES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.6.2 INSTALLATION & INTEGRATION

- 7.6.2.1 Integration enables devices to connect and provide communication access

- 7.6.3 MAINTENANCE SERVICE

- 7.6.3.1 Increasing adoption of real-time monitoring of access control systems to raise demand for maintenance services

- 7.6.4 ACCESS CONTROL-AS-A-SERVICE

- 7.6.4.1 Cost-effective operations provided by access control-as-a-services

8 HOME SECURITY SYSTEMS MARKET, BY SECURITY

- 8.1 INTRODUCTION

- FIGURE 24 PROFESSIONALLY INSTALLED AND MONITORED SYSTEMS TO HOLD LARGEST SHARE OF MARKET

- TABLE 59 HOME SECURITY SYSTEMS MARKET, BY SECURITY, 2018-2021 (USD BILLION)

- TABLE 60 HOME SECURITY SYSTEMS MARKET, BY SECURITY, 2022-2027 (USD BILLION)

- 8.2 PROFESSIONALLY INSTALLED AND MONITORED SYSTEMS

- 8.2.1 PROFESSIONALLY INSTALLED AND MONITORED SECURITY SYSTEMS PROVIDE USERS WITH SET OF DEDICATED CONSULTING AND ENGINEERING SERVICES

- 8.3 SELF-INSTALLED AND PROFESSIONALLY MONITORED SYSTEMS

- 8.3.1 INCREASING CONSUMER PREFERENCE FOR SELF-INSTALLED HOME SECURITY SYSTEMS TO DRIVE MARKET GROWTH

- 8.4 DO-IT-YOURSELF (DIY)

- 8.4.1 GROWING DEMAND FOR DIY SECURITY SYSTEMS TO FUEL MARKET GROWTH DURING FORECAST PERIOD

9 HOME SECURITY SYSTEMS MARKET, BY HOME TYPE

- 9.1 INTRODUCTION

- FIGURE 25 MARKET FOR CONDOMINIUM/APARTMENTS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 61 HOME SECURITY SYSTEMS MARKET, BY HOME TYPE, 2018-2021 (USD BILLION)

- TABLE 62 HOME SECURITY SYSTEMS MARKET, BY HOME TYPE, 2022-2027 (USD BILLION)

- 9.2 INDEPENDENT HOUSES

- 9.2.1 INDEPENDENT HOMEOWNERS LEVERAGE COST EFFECTIVENESS OF ADVANCED AND CONNECTED HOME SECURITY SYSTEMS

- 9.3 CONDOMINIUMS/APARTMENTS

- 9.3.1 GROWING DEMAND FOR INTEGRATED SECURITY SOLUTIONS IN CONDOMINIUMS/APARTMENTS

10 GEOGRAPHIC ANALYSIS

- 10.1 INTRODUCTION

- FIGURE 26 GEOGRAPHIC ANALYSIS: HOME SECURITY SYSTEMS MARKET (2022-2027)

- TABLE 63 HOME SECURITY SYSTEMS MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 64 HOME SECURITY SYSTEMS MARKET, BY REGION, 2022-2027 (USD BILLION)

- 10.2 NORTH AMERICA

- 10.2.1 PRESENCE OF STRINGENT REGULATION AND ADOPTION OF INNOVATIVE TECHNOLOGIES TO BOOST MARKET GROWTH

- FIGURE 27 NORTH AMERICA: SNAPSHOT OF HOME SECURITY SYSTEMS MARKET

- TABLE 65 HOME SECURITY SYSTEMS MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 66 HOME SECURITY SYSTEMS MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 67 HOME SECURITY SYSTEMS MARKET IN NORTH AMERICA, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 68 HOME SECURITY SYSTEMS MARKET IN NORTH AMERICA, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 69 HOME SECURITY SYSTEMS MARKET IN NORTH AMERICA, BY SYSTEMS, 2018-2021 (USD MILLION)

- TABLE 70 HOME SECURITY SYSTEMS MARKET IN NORTH AMERICA, BY SYSTEMS, 2022-2027 (USD MILLION)

- TABLE 71 HOME SECURITY SYSTEMS MARKET IN NORTH AMERICA, BY SERVICES, 2018-2021 (USD MILLION)

- TABLE 72 HOME SECURITY SYSTEMS MARKET IN NORTH AMERICA, BY SERVICES, 2022-2027 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Increasing demand for intelligent video surveillance systems in US

- 10.2.3 CANADA

- 10.2.3.1 Low mortgage and interest rates for construction activities to drive demand for home security systems in Canada

- 10.2.4 MEXICO

- 10.2.4.1 High crime rate to increase adoption of video surveillance security solutions in Mexico

- 10.3 EUROPE

- 10.3.1 GROWING ADOPTION OF FIRE PROTECTION SYSTEMS DURING RENOVATION OF CONVENTIONAL BUILDINGS TO FUEL EUROPEAN HOME SECURITY SYSTEMS MARKET

- FIGURE 28 EUROPE: SNAPSHOT OF HOME SECURITY SYSTEMS MARKET

- TABLE 73 HOME SECURITY SYSTEMS MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 74 HOME SECURITY SYSTEMS MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 75 HOME SECURITY SYSTEMS MARKET IN EUROPE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 76 HOME SECURITY SYSTEMS MARKET IN EUROPE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 77 HOME SECURITY SYSTEMS MARKET IN EUROPE, BY SYSTEMS, 2018-2021 (USD MILLION)

- TABLE 78 HOME SECURITY SYSTEMS MARKET IN THE EUROPE, BY SYSTEMS, 2022-2027 (USD MILLION)

- TABLE 79 HOME SECURITY SYSTEMS MARKET IN EUROPE, BY SERVICES, 2018-2021 (USD MILLION)

- TABLE 80 HOME SECURITY SYSTEMS MARKET IN EUROPE, BY SERVICES, 2022-2027 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Stringent regulations and privacy laws to increase demand for home security systems in Germany

- 10.3.3 UK

- 10.3.3.1 Stringent regulations for fire safety to propel market growth in UK

- 10.3.4 FRANCE

- 10.3.4.1 Increasing adoption of home security systems in conventional buildings to push market in France

- 10.3.5 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 GROWING DEMAND FOR INTELLIGENT CAMERAS IN HOUSING PROJECTS TO RAISE MARKET DEMAND IN ASIA PACIFIC

- FIGURE 29 ASIA PACIFIC: SNAPSHOT OF HOME SECURITY SYSTEMS MARKET

- TABLE 81 HOME SECURITY SYSTEMS MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 82 HOME SECURITY SYSTEMS MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 83 HOME SECURITY SYSTEMS MARKET IN ASIA PACIFIC, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 84 HOME SECURITY SYSTEMS MARKET IN ASIA PACIFIC, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 85 HOME SECURITY SYSTEMS MARKET IN ASIA PACIFIC, BY SYSTEMS, 2018-2021 (USD MILLION)

- TABLE 86 HOME SECURITY SYSTEMS MARKET IN ASIA PACIFIC, BY SYSTEMS, 2022-2027 (USD MILLION)

- TABLE 87 HOME SECURITY SYSTEMS MARKET IN ASIA PACIFIC, BY SERVICES, 2018-2021 (USD MILLION)

- TABLE 88 HOME SECURITY SYSTEMS MARKET IN ASIA PACIFIC, BY SERVICES, 2022-2027 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Rapid urbanization to generate demand for home security systems in China

- 10.4.3 JAPAN

- 10.4.3.1 Growing emphasis by government on fire safety measures to grow market for home security systems in Japan

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Increasing R&D for innovative security products to drive market in South Korea

- 10.4.5 INDIA

- 10.4.5.1 Increasing demand for wireless technologies and advanced cameras to raise market growth in India

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD

- 10.5.1 GROWING DEMAND FOR VIDEO SURVEILLANCE AND ACCESS CONTROL SYSTEMS TO BOOST MARKET IN REST OF THE WORLD

- TABLE 89 HOME SECURITY SYSTEMS MARKET IN REST OF THE WORLD, BY REGION, 2018-2021 (USD MILLION)

- TABLE 90 HOME SECURITY SYSTEMS MARKET IN REST OF THE WORLD, BY REGI0N, 2022-2027 (USD MILLION)

- TABLE 91 HOME SECURITY SYSTEMS MARKET IN REST OF THE WORLD, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 92 HOME SECURITY SYSTEMS MARKET IN REST OF THE WORLD, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 93 HOME SECURITY SYSTEMS MARKET IN REST OF THE WORLD, BY SYSTEMS, 2018-2021 (USD MILLION)

- TABLE 94 HOME SECURITY SYSTEMS MARKET IN REST OF THE WORLD, BY SYSTEMS, 2022-2027 (USD MILLION)

- TABLE 95 HOME SECURITY SYSTEMS MARKET IN REST OF THE WORLD, BY SERVICES, 2018-2021 (USD MILLION)

- TABLE 96 HOME SECURITY SYSTEMS MARKET IN REST OF THE WORLD, BY SERVICES, 2022-2027 (USD MILLION)

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Increasing adoption of security solutions by independent homeowners to influence positive demand in South America

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Increasing urbanization and government spending on infrastructure development in the Middle East

- 10.5.4 AFRICA

- 10.5.4.1 Growing demand for security systems from residential homeowners to help grow African market

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS OF TOP FIVE COMPANIES

- FIGURE 30 HOME SECURITY SERVICES MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017-2021

- 11.3 MARKET SHARE ANALYSIS, 2021

- TABLE 97 HOME SECURITY SYSTEMS MARKET: MARKET SHARE ANALYSIS (2021)

- 11.4 COMPANY EVALUATION QUADRANT

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE COMPANIES

- 11.4.4 PARTICIPANTS

- FIGURE 31 HOME SECURITY SYSTEMS MARKET: COMPANY EVALUATION QUADRANT, 2021

- 11.5 COMPETITIVE SITUATIONS AND TRENDS

- TABLE 98 HOME SECURITY SYSTEMS MARKET: PRODUCT LAUNCHES, DECEMBER 2019-MARCH 2021

- TABLE 99 HOME SECURITY SYSTEMS MARKET: DEALS, FEBRUARY 2019-APRIL 2022

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business overview, Products offered, Recent developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)**

- 12.1.1 ADT

- TABLE 100 ADT: BUSINESS OVERVIEW

- FIGURE 32 ADT: COMPANY SNAPSHOT

- TABLE 101 ADT: PRODUCTS OFFERED

- 12.1.2 RESIDEO TECHNOLOGIES INC

- TABLE 102 RESIDEO TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 33 RESIDEO TECHNOLOGIES INC.: COMPANY SNAPSHOT

- TABLE 103 RESIDEO TECHNOLOGIES, INC.: PRODUCTS OFFERED

- 12.1.3 JOHNSON CONTROLS

- TABLE 104 JOHNSON CONTROLS: BUSINESS OVERVIEW

- FIGURE 34 JOHNSON CONTROLS: COMPANY SNAPSHOT

- TABLE 105 JOHNSON CONTROLS: PRODUCTS OFFERED

- 12.1.4 HANGZHOU HIKVISION DIGITAL TECHNOLOGY

- TABLE 106 HANGZHOU HIGVISION DIGITAL TECHNOLOGY: BUSINESS OVERVIEW

- FIGURE 35 HANGZHOU HIGVISION DIGITAL TECHNOLOGY: COMPANY SNAPSHOT

- TABLE 107 HANGZHAU HIGVISION DIGITAL TECHNOLOGY: PRODUCTS OFFERED

- 12.1.5 ASSA ABLOY

- TABLE 108 ASSA ABLOY: BUSINESS OVERVIEW

- FIGURE 36 ASSA ABLOY: COMPANY SNAPSHOT

- TABLE 109 ASSA ABLOY: PRODUCTS OFFERED

- 12.1.6 SECOM

- TABLE 110 SECOM: BUSINESS OVERVIEW

- FIGURE 37 SECOM: COMPANY SNAPSHOT

- TABLE 111 SECOM: PRODUCTS OFFERED

- 12.1.7 ROBERT BOSCH

- TABLE 112 ROBERT BOSCH: BUSINESS OVERVIEW

- FIGURE 38 ROBERT BOSCH: COMPANY SNAPSHOT

- TABLE 113 ROBERT BOSCH: PRODUCTS OFFERED

- 12.1.8 ALLEGION

- ABLE 114 ALLEGION: BUSINESS OVERVIEW

- FIGURE 39 ALLEGION: COMPANY SNAPSHOT

- TABLE 115 ALLEGION: PRODUCTS OFFERED

- 12.1.9 SNAP ONE, LLC

- TABLE 116 SNAP ONE, LLC: BUSINESS OVERVIEW

- FIGURE 40 SNAP ONE, LLC: COMPANY SNAPSHOT

- TABLE 117 SNAP ONE, LLC: PRODUCT OFFERINGS

- 12.1.10 ABB

- TABLE 118 ABB: BUSINESS OVERVIEW

- FIGURE 41 ABB: COMPANY SNAPSHOT

- TABLE 119 ABB: PRODUCT OFFERINGS

- 12.2 OTHER PLAYERS

- 12.2.1 COMCAST

- TABLE 120 COMCAST: BUSINESS OVERVIEW

- 12.2.2 ALARM.COM

- TABLE 121 ALARM.COM: BUSINESS OVERVIEW

- 12.2.3 NORTEK SECURITY & CONTROL

- TABLE 122 NORTEK SECURITY & CONTROL: BUSINESS OVERVIEW

- 12.2.4 VIVINT

- TABLE 123 VIVINT: BUSINESS OVERVIEW

- 12.2.5 SIMPLISAFE

- TABLE 124 SIMPLISAFE: BUSINESS OVERVIEW

- 12.2.6 ARMORAX

- TABLE 125 ARMORAX: BUSINESS OVERVIEW

- 12.2.7 CANARY

- TABLE 126 CANARY: BUSINESS OVERVIEW

- 12.2.8 SCOUT

- TABLE 127 SCOUT: BUSINESS OVERVIEW

- 12.2.9 LEGRAND

- TABLE 128 LEGRAND: BUSINESS OVERVIEW

- 12.2.10 SCHNEIDER ELECTRIC

- TABLE 129 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- *Details on Business overview, Products offered, Recent developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 VIDEO SURVEILLANCE MARKET, BY SYSTEM

- TABLE 130 VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2017-2020 (USD MILLION)

- TABLE 131 VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2021-2026 (USD MILLION)

- 13.3.1 ANALOG VIDEO SURVEILLANCE SYSTEM

- 13.3.1.1 Analog surveillance systems mainly consist of analog cameras and DVRs

- 13.3.2 IP VIDEO SURVEILLANCE SYSTEM

- 13.3.2.1 IP video surveillance systems offer enhanced security and better resolution

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS