|

|

市場調査レポート

商品コード

1136310

抗菌コーティングの世界市場:タイプ(銀、銅、二酸化チタン)、エンドユーザー業界(医療・ヘルスケア、食品・飲料、建築・建設、HVACシステム、防護服、輸送)、地域別 - 2027年までの予測Antimicrobial Coatings Market by Type (Silver, Copper, Titanium dioxide), End-user Industry (Medical & Healthcare, Foods & Beverages, Building & Construction, HVAC system, Protective Clothing, Transportation), & Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 抗菌コーティングの世界市場:タイプ(銀、銅、二酸化チタン)、エンドユーザー業界(医療・ヘルスケア、食品・飲料、建築・建設、HVACシステム、防護服、輸送)、地域別 - 2027年までの予測 |

|

出版日: 2022年10月05日

発行: MarketsandMarkets

ページ情報: 英文 208 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の抗菌コーティングの市場規模は、2022年に42億米ドルと推定され、2027年までの間にCAGR10.8%で推移し、70億米ドルに達すると予測されています。

銀、銅、二酸化チタンの3種類のうち、銀が抗菌コーティングの主要な種類です。銀は、ウイルス、細菌、その他の真核微生物に対して高い効果を発揮するため、最大の市場シェアを誇っています。COVID-19は、ウイルスや細菌から身を守るために抗菌コーティングが重要であるという意識を消費者に植え付けました。これにより、輸送、建築・建設、防護服などの新しい最終用途産業での需要が増加しています。

タイプ別では、銀が予測期間中に最も高いCAGRを記録

銀系抗菌剤は、ウイルス、バクテリア、その他の真核微生物に対して高い効果を発揮するため、様々な用途で広く使用されています。銀系抗菌剤は、大腸菌、H1N1インフルエンザ、リステリアなどの細菌やウイルスに対して強い抑制効果があることが実証されています。銀系抗菌剤コーティングの効果は、コーティングの製造時に使用される銀イオンのサイズと形状に依存します。基材表面で放出されるイオンの速度に直接関係します。抗菌コーティングの製造には、均一な結晶構造を持つナノ粒子が主に使用されます。銀ベースの抗菌コーティングが基板に適用されると、銀コーティングは制御された方法で連続的に銀イオンを放出し、表面上の微生物や病原体の増殖を抑制します。

エンドユーザー業界別では、医療・ヘルスケア産業が予測期間中に最も高いCAGRを占めると予測

医療・ヘルスケア分野では、院内感染(HAI)とその健康への影響に対する懸念の高まりが、抗菌コーティングの採用を後押ししています。同様に、表面上のCOVID-19ウイルスやその他の細菌の拡散や増殖を避けるために、いくつかの仮設および既存のヘルスケア施設では、ドアハンドル、トレイル、ベッド、ヘルスケア器具など、人が触れるさまざまな表面に保護層として抗菌コーティングを使用しています。このように、抗菌コーティングは、医療・ヘルスケア分野において、COVID-19と戦うための効果的なソリューションとして浮上しています。

予測期間中、アジア太平洋が抗菌コーティング市場で最も高いCAGRを占めると予測

アジア太平洋は、予測期間中に抗菌コーティングの最も速い成長市場になると推定されます。抗菌コーティング市場は、豊富な原材料と低コストの労働力が利用できることから、中国、日本、インドで大きな成長を記録すると推定されます。COVID-19は、アジア太平洋において、ウイルスや細菌から身を守り健康を保つための抗菌コーティングの重要性に対する認識が高まっています。しかし、COVID-19により、医療・ヘルスケア、保護コーティング、HVACシステムアプリケーションにおける抗菌コーティングの需要が大幅に増加しています。

抗菌塗料市場は、AkzoNobel N.V.(オランダ)、Axalta Coating Systems Ltd.(米国)、The Sherwin-W.S.A.(米国)などの大手企業で構成されており、これらの企業は抗菌塗料を製造・販売しています。(米国)、The Sherwin-Williams Company(米国)、BASF(ドイツ)、PPG Industries Inc(米国)、日本ペイントホールディングス(日本)、RPM International Inc(米国)、Koninklijke DSM N.V(オランダ)、Sika AG(スイス)、Lanxess AG(ドイツ)などが含まれます。市場開拓、買収、合弁事業、新製品開発などは、抗菌コート剤市場における地位を高めるためにこれらの主要企業が採用した主な戦略の一部です。

調査対象

この市場調査は、様々なセグメントにわたる抗菌性コーティング剤市場を対象としています。この調査は、用途、タイプ、地域に基づく様々なセグメントにおける市場規模とその成長性の推定を目的としています。また、市場の主要企業の詳細な競合分析、企業プロファイル、製品や事業内容に関する主な見解、企業が取り組んでいる最近の発展、抗菌コーティング市場の地位を向上させるために企業が採用した主な成長戦略も含まれています。

レポート購入の主な利点

本レポートは、この市場のリーダー/新規参入者が抗菌コーティング市場全体とそのセグメントおよびサブセグメントの収益数の最も近い近似値を共有するのに役立つと期待されています。本レポートは、利害関係者が市場の競合情勢を理解し、自社のビジネスのポジションを向上させるための洞察を得て、適切な市場参入戦略を計画するのに役立つと予測されます。また、本レポートは、利害関係者が市場の鼓動を理解し、主要な市場促進要因・課題・機会に関する情報を提供することを目的としています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- YCとYCCシフト

- エコシステム分析

- ケーススタディ分析

- 技術分析

- 貿易分析

- 関税と規制分析

- 主な会議とイベント(2022年~2023年)

- 特許分析

第6章 抗菌コーティング市場:タイプ別

- イントロダクション

- 銀

- 銅

- 二酸化チタン

- その他

第7章 抗菌コーティング市場:用途別

- イントロダクション

- 医療・ヘルスケア

- 食品・飲料

- 建築・建設

- 防護服

- HVACシステム

- 輸送

- その他

第8章 抗菌コーティング市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州

- アジア太平洋

- 中国

- 韓国

- 日本

- インド

- オーストラリア・ニュージーランド

- その他アジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- イラン

- その他中東・アフリカ

第9章 競合情勢

- 概要

- 市場シェア分析

- 主要市場企業5社の収益分析

- 抗菌コーティング市場:企業評価クアドラント(2021年)

- 抗菌コーティング市場:中小企業(SME)マトリックス(2021年)

- 競合シナリオと動向

第10章 企業プロファイル

- 主要企業

- AKZONOBEL N.V.

- AXALTA COATING SYSTEMS LTD.

- THE SHERWIN-WILLIAMS COMPANY

- BASF

- PPG INDUSTRIES, INC.

- NIPPON PAINT HOLDINGS CO., LTD.

- RPM INTERNATIONAL INC.

- KONINKLIJKE DSM N.V.

- SIKA AG

- LANXESS AG.

- その他企業

- BURKE INDUSTRIAL COATINGS LLC

- LONZA GROUP AG

- CLEVELAND-CLIFFS INC.

- TROY CORPORATION

- SPECIALTY COATING SYSTEMS INC.

- ALLIED BIOSCIENCE INC.

- H.B. FULLER CONSTRUCTION PRODUCTS INC.

- FIBERLOCK TECHNOLOGIES, INC.

- FLORA COATINGS LLC

- HYDROMER INC.

- IFS COATINGS INC.

- NANO-CARE DEUTSCHLAND AG.

- PROTECH-OXYPLAST GROUP

- AEREUS TECHNOLOGIES INC

- MEDIVATORS INC.

第11章 付録

The Antimicrobial Coatings market size is estimated to be USD 4.2 Billion in 2022 and is projected to reach USD 7.0 Billion by 2027, at a CAGR of 10.8%. Out of three (Silver, Copper and Titanium dioxide) Silver is the major type of antimicrobial coatings. Silver has the largest market share due to its have high efficacy against viruses, bacteria, and other eukaryotic microorganisms. COVID-19 has created awareness among consumers about the importance of antimicrobial coatings in keeping themselves healthy and safe from virus and bacteria. This has increase demand in several new end-use industries like transportation, Building & Construction and Protective Clothing.

By Type, Silver accounted for the highest CAGR during the forecast period

Silver-based antimicrobial coatings are widely used in various applications because of there have high efficacy against viruses, bacteria, and other eukaryotic microorganisms. Silver-based antimicrobial coatings have proven strong inhibitory properties against bacteria and viruses, such as E.coli, H1N1 influenza, and Listeria. The efficacy of silver-based antimicrobial coatings depends on the size and shape of the silver ion used during manufacturing of coatings. It is directly related to the rate of ions released on the substrate surface. Nanoparticles with a uniform crystal structure are mostly used for manufacturing antimicrobial coatings. Once silver-based antimicrobial coatings are applied to the substrate, silver coatings release silver ions in a controlled manner continuously, which inhibits microbes or pathogens growth on the surface.

By End Use Industry, Medical & Healthcare industry accounted for the highest CAGR during the forecast period

In the medical & healthcare sector, the growing concern about hospital-acquired infections (HAIs) and their related impact on human health is driving the adoption of antimicrobial coatings. Similarly to avoid the spread and growth of the COVID-19 virus and other bacteria on the surfaces, several temporary built and existing healthcare facilities are using antimicrobial coatings as a protective layer on various human contact surfaces such as door handles, trails, beds and healthcare instruments. Antimicrobial coatings have thus emerged as an effective solution in the medical & healthcare sector to fight COVID-19.

APAC is projected to account for the highest CAGR in the antimicrobial coatings market during the forecast period

APAC is estimated to be the fastest growing market for antimicrobial coatings during the forecast period. Antimicrobial coatings market is estimated to register significant growth in China, Japan and India, due to availability of abundant raw materials and low-cost labor. COVID 19 has Increased awareness in APAC about the importance of antimicrobial coatings in keeping themselves healthy and safe from virus and bacteria. However, due to COVID-19, there has been a significant increase in the demand for antimicrobial coatings in medical & healthcare, protective coating, and HVAC system applications.

Antimicrobial Coatings Market comprises major players such as AkzoNobel N.V.(Netherlands), Axalta Coating Systems Ltd. (US), The Sherwin-Williams Company (US), BASF (Germany), PPG Industries Inc. (US), Nippon Paint Holdings Co. Ltd. (Japan), RPM International Inc. (US), Koninklijke DSM N.V.(Netherlands), Sika AG (Switzerland), Lanxess AG (Germany). Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the Antimicrobial Coatings Market.

By Company Type: Tier 1: 40%, Tier 2: 20%, and Tier 3: 40%

By Designation: C-level Executives: 20%, Directors: 20%, and Others: 60%

By Region: North America: 40%, Europe: 40%, Asia Pacific: 15%, Rest of the World: 5%

Research Coverage

The market study covers the Antimicrobial Coatings market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on application, type, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position Antimicrobial Coatings market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall Antimicrobial Coatings market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 ANTIMICROBIAL COATINGS MARKET: SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 ANTIMICROBIAL COATINGS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Critical inputs from secondary research

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Critical inputs from primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 APPROACH TO CALCULATE BASE NUMBER

- 2.2.1 ESTIMATION OF ANTIMICROBIAL COATINGS MARKET SIZE BASED ON MARKET SHARE ANALYSIS

- FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 3 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 6 ANTIMICROBIAL COATINGS MARKET: DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 FACTORS SUPPORTING GROWTH OF ANTIMICROBIAL COATINGS MARKET

- FIGURE 8 SILVER SEGMENT ACCOUNTED FOR LARGEST SHARE OF ANTIMICROBIAL COATINGS MARKET, BY TYPE, IN 2021

- FIGURE 9 MEDICAL & HEALTHCARE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE, BY APPLICATION, IN 2021

- FIGURE 10 NORTH AMERICA DOMINATED ANTIMICROBIAL COATINGS MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ANTIMICROBIAL COATINGS MARKET

- FIGURE 11 HIGH DEMAND FOR ANTIMICROBIAL COATINGS IN MEDICAL & HEALTHCARE SECTOR

- 4.2 ASIA PACIFIC ANTIMICROBIAL COATINGS MARKET, BY TYPE AND COUNTRY

- FIGURE 12 SILVER SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC ANTIMICROBIAL COATINGS MARKET IN 2021

- 4.3 ANTIMICROBIAL COATINGS MARKET, BY COUNTRY

- FIGURE 13 SAUDI ARABIA TO REGISTER HIGHEST CAGR IN ANTIMICROBIAL COATINGS MARKET DURING REVIEW PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 ANTIMICROBIAL COATINGS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increased demand for antimicrobial coatings in healthcare sector in post-COVID-19 period

- TABLE 1 NATIONAL ACUTE CARE HOSPITAL HOSPITAL-ACQUIRED INFECTION (HAI) METRICS, 2020

- 5.2.1.2 Rising installation of heating, ventilation, and air conditioning (HVAC) systems

- FIGURE 15 GLOBAL HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET SIZE IN VALUE (USD BILLION) AND Y-O-Y GROWTH (%), 2016-2021

- 5.2.1.3 Increasing demand for antimicrobial coatings in food & beverage industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs of antimicrobial coatings and requirement for skilled labor

- 5.2.2.2 Need to comply with stringent governmental regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing use of antimicrobial coatings in novel applications

- 5.2.3.2 Expanding smart antimicrobials market

- 5.2.4 CHALLENGES

- 5.2.4.1 Growing concern regarding toxicity of nanoparticles

- TABLE 2 TOXICITY OF METAL NANOPARTICLES

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 ANTIMICROBIAL COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 YC AND YCC SHIFT

- 5.5.1 YC SHIFT

- 5.5.2 YCC SHIFT

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 CASE STUDY ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.9 TRADE ANALYSIS

- TABLE 3 IMPORT TRADE DATA FOR SILVER NANOPARTICLES, 2021 (USD MILLION)

- TABLE 4 EXPORT TRADE DATA FOR SILVER NANOPARTICLES, 2021 (USD MILLION)

- 5.10 TARIFF AND REGULATORY ANALYSIS

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 6 ANTIMICROBIAL COATINGS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.11.1 PRODUCT SELECTION CRITERIA

- 5.12 PATENT ANALYSIS

- 5.12.1 METHODOLOGY

- 5.12.2 DOCUMENT TYPE

- FIGURE 17 DOCUMENT TYPE (2019)

- FIGURE 18 PUBLICATION TRENDS, 2015-2020

- 5.12.3 INSIGHTS

- FIGURE 19 JURISDICTION ANALYSIS (TILL 2019)

- 5.12.4 TOP APPLICANTS

- FIGURE 20 TOP APPLICANTS, BY NUMBER OF PATENTS (TILL 2019)

- TABLE 7 LIST OF PATENTS BY BECTON, DICKINSON AND COMPANY

- TABLE 8 LIST OF PATENTS BY ROHM AND HAAS COMPANY & DOW GLOBAL TECHNOLOGIES LLC.

- TABLE 9 LIST OF PATENTS BY ARGEN LAB GLOBAL LTD.

- TABLE 10 LIST OF PATENTS BY ETHICON INC.

6 ANTIMICROBIAL COATINGS MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 21 SILVER SEGMENT TO HOLD LARGEST SHARE OF ANTIMICROBIAL COATINGS MARKET DURING REVIEW PERIOD

- TABLE 11 ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 12 ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- 6.2 SILVER

- 6.2.1 RISING DEMAND FOR HIGH-EFFICACY PRODUCTS IN VARIOUS APPLICATIONS

- 6.3 COPPER

- 6.3.1 RISE IN DEMAND FOR COPPER-BASED ANTIMICROBIAL COATINGS IN MEDICAL & HEALTHCARE SECTOR

- 6.4 TITANIUM DIOXIDE

- 6.4.1 GROWING POPULARITY OF TITANIUM DIOXIDE-BASED COATINGS IN SEVERAL APPLICATIONS

- 6.5 OTHERS

7 ANTIMICROBIAL COATINGS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 22 MEDICAL & HEALTHCARE SEGMENT TO HOLD LARGEST SHARE OF ANTIMICROBIAL COATINGS MARKET DURING FORECAST PERIOD

- TABLE 13 ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 14 ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 7.2 MEDICAL & HEALTHCARE

- 7.2.1 GROWING DEMAND FOR ANTIMICROBIAL COATINGS TO PREVENT HOSPITAL-ACQUIRED INFECTIONS (HAIS)

- 7.3 FOOD & BEVERAGE

- 7.3.1 GROWING CONCERN REGARDING MAINTAINING QUALITY OF FOODS AND BEVERAGES

- 7.4 BUILDING & CONSTRUCTION

- 7.4.1 GROWING AWARENESS REGARDING BENEFITS OF ANTIMICROBIAL COATINGS AND INCREASING DEMAND IN DEVELOPING COUNTRIES

- 7.5 PROTECTIVE CLOTHING

- 7.5.1 GROWING DEMAND FOR PROTECTIVE CLOTHING IN MEDICAL & HEALTHCARE SECTOR

- 7.6 HVAC SYSTEM

- 7.6.1 PRESENCE OF REGULATORY POLICIES REGARDING INDOOR AIR QUALITY IN SEVERAL COUNTRIES

- 7.7 TRANSPORTATION

- 7.7.1 GROWING USE OF ANTIMICROBIAL COATINGS IN AEROSPACE INDUSTRY

- 7.8 OTHERS

8 ANTIMICROBIAL COATINGS MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 23 ASIA PACIFIC TO BE FASTEST-GROWING ANTIMICROBIAL COATINGS MARKET DURING FORECAST PERIOD

- TABLE 15 ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2027 (USD MILLION)

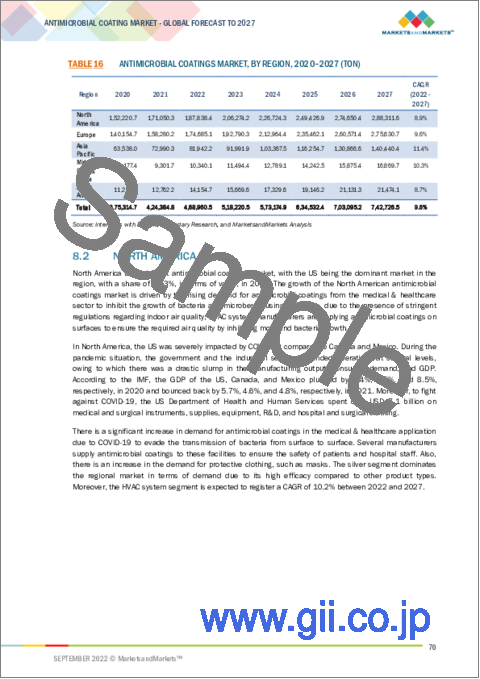

- TABLE 16 ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2027 (TON)

- 8.2 NORTH AMERICA

- FIGURE 24 NORTH AMERICA: SNAPSHOT OF ANTIMICROBIAL COATINGS MARKET

- TABLE 17 NORTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 18 NORTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2027 (TON)

- TABLE 19 NORTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 20 NORTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 21 NORTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 22 NORTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.2.1 US

- 8.2.1.1 Rising demand for antimicrobial coatings in medical & healthcare sector

- TABLE 23 US: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 24 US: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 25 US: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 26 US: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.2.2 CANADA

- 8.2.2.1 Booming medical & healthcare sector

- TABLE 27 CANADA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 28 CANADA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 29 CANADA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 30 CANADA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.2.3 MEXICO

- 8.2.3.1 Low purchasing power and limited awareness regarding antimicrobial coatings

- TABLE 31 MEXICO: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 32 MEXICO: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 33 MEXICO: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 34 MEXICO: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.3 EUROPE

- TABLE 35 EUROPE: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 36 EUROPE: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2027 (TON)

- TABLE 37 EUROPE: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 38 EUROPE: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 39 EUROPE: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 40 EUROPE: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.3.1 GERMANY

- 8.3.1.1 Rising emphasis on safety of patients and hospital staff

- TABLE 41 GERMANY: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 42 GERMANY: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 43 GERMANY: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 44 GERMANY: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.3.2 UK

- 8.3.2.1 Increasing healthcare spending

- TABLE 45 UK: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 46 UK: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 47 UK: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 48 UK: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.3.3 FRANCE

- 8.3.3.1 Expanding medical & healthcare sector

- TABLE 49 FRANCE: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 50 FRANCE: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 51 FRANCE: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 52 FRANCE: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.3.4 ITALY

- 8.3.4.1 Presence of stringent workplace safety norms

- TABLE 53 ITALY: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 54 ITALY: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 55 ITALY: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 56 ITALY: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.3.5 SPAIN

- 8.3.5.1 High focus on revival of economy after aftermath of COVID-19

- TABLE 57 SPAIN: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 58 SPAIN: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 59 SPAIN: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 60 SPAIN: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.3.6 RUSSIA

- 8.3.6.1 Growing concern about safety at workplaces

- TABLE 61 RUSSIA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 62 RUSSIA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 63 RUSSIA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 64 RUSSIA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.3.7 REST OF EUROPE

- TABLE 65 REST OF EUROPE: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 66 REST OF EUROPE: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 67 REST OF EUROPE: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 68 REST OF EUROPE: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.4 ASIA PACIFIC

- TABLE 69 ASIA PACIFIC: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 70 ASIA PACIFIC: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2027 (TON)

- TABLE 71 ASIA PACIFIC: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 72 ASIA PACIFIC: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 73 ASIA PACIFIC: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 74 ASIA PACIFIC: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.4.1 CHINA

- 8.4.1.1 Growing adoption of antimicrobial coatings in industrial sector to comply with international standards

- TABLE 75 CHINA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 76 CHINA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 77 CHINA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 78 CHINA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.4.2 SOUTH KOREA

- 8.4.2.1 Growing demand for protective clothing

- TABLE 79 SOUTH KOREA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 80 SOUTH KOREA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 81 SOUTH KOREA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 82 SOUTH KOREA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.4.3 JAPAN

- 8.4.3.1 Focus of paint and coating companies on strategizing growth plans by keeping antimicrobial coatings at epicenter

- TABLE 83 JAPAN: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 84 JAPAN: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 85 JAPAN: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 86 JAPAN: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.4.4 INDIA

- 8.4.4.1 Growing awareness regarding benefits of antimicrobial coatings

- TABLE 87 INDIA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 88 INDIA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 89 INDIA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 90 INDIA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.4.5 AUSTRALIA & NEW ZEALAND

- 8.4.5.1 Growing adoption of antimicrobial coatings in industrial sector

- TABLE 91 AUSTRALIA & NEW ZEALAND: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 92 AUSTRALIA & NEW ZEALAND: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 93 AUSTRALIA & NEW ZEALAND: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 94 AUSTRALIA & NEW ZEALAND: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.4.6 REST OF ASIA PACIFIC

- TABLE 95 REST OF ASIA PACIFIC: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 97 REST OF ASIA PACIFIC: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.5 SOUTH AMERICA

- TABLE 99 SOUTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 100 SOUTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2027 (TON)

- TABLE 101 SOUTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 102 SOUTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 103 SOUTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 104 SOUTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.5.1 BRAZIL

- 8.5.1.1 Rising demand for antimicrobial coatings in medical & healthcare sector

- TABLE 105 BRAZIL: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 106 BRAZIL: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 107 BRAZIL: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 108 BRAZIL: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.5.2 ARGENTINA

- 8.5.2.1 Rising healthcare spending

- TABLE 109 ARGENTINA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 110 ARGENTINA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 111 ARGENTINA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 112 ARGENTINA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.5.3 REST OF SOUTH AMERICA

- TABLE 113 REST OF SOUTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 114 REST OF SOUTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 115 REST OF SOUTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 116 REST OF SOUTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.6 MIDDLE EAST & AFRICA

- TABLE 117 MIDDLE EAST & AFRICA: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2027 (TON)

- TABLE 119 MIDDLE EAST & AFRICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 121 MIDDLE EAST & AFRICA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.6.1 SAUDI ARABIA

- 8.6.1.1 Government initiatives to develop healthcare sector

- TABLE 123 SAUDI ARABIA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 124 SAUDI ARABIA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 125 SAUDI ARABIA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 126 SAUDI ARABIA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.6.2 UAE

- 8.6.2.1 Rising healthcare spending

- TABLE 127 UAE: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 128 UAE: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 129 UAE: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 130 UAE: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.6.3 SOUTH AFRICA

- 8.6.3.1 Increasing penetration of antimicrobial coatings in medical & healthcare sector

- TABLE 131 SOUTH AFRICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 132 SOUTH AFRICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 133 SOUTH AFRICA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 134 SOUTH AFRICA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.6.4 IRAN

- 8.6.4.1 Rise in demand for protective clothing, healthcare instruments, and medical devices

- TABLE 135 IRAN: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 136 IRAN: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 137 IRAN: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 138 IRAN: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

- 8.6.5 REST OF MIDDLE EAST & AFRICA

- TABLE 139 REST OF MIDDLE EAST & AFRICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2027 (TON)

- TABLE 141 REST OF MIDDLE EAST & AFRICA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 142 REST OF MIDDLE EAST & AFRICA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2027 (TON)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- TABLE 143 COMPANIES ADOPTED PRODUCT LAUNCH AS KEY GROWTH STRATEGY BETWEEN 2019 AND 2022

- 9.2 MARKET SHARE ANALYSIS

- FIGURE 25 ANTIMICROBIAL COATINGS MARKET: MARKET SHARE ANALYSIS

- 9.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- FIGURE 26 REVENUE ANALYSIS FOR TOP FIVE COMPANIES IN ANTIMICROBIAL COATINGS MARKET

- 9.4 ANTIMICROBIAL COATINGS MARKET: COMPANY EVALUATION QUADRANT, 2021

- 9.4.1 STARS

- 9.4.2 EMERGING LEADERS

- 9.4.3 PERVASIVE PLAYERS

- 9.4.4 PARTICIPANTS

- FIGURE 27 COMPETITIVE LEADERSHIP MAPPING: ANTIMICROBIAL COATINGS MARKET, 2021

- 9.5 ANTIMICROBIAL COATINGS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISE (SME) MATRIX, 2021

- 9.5.1 PROGRESSIVE COMPANIES

- 9.5.2 RESPONSIVE COMPANIES

- 9.5.3 DYNAMIC COMPANIES

- 9.5.4 STARTING BLOCKS

- FIGURE 28 SME MATRIX: ANTIMICROBIAL COATING MARKET, 2021

- 9.6 COMPETITIVE SCENARIOS AND TRENDS

- 9.6.1 ANTIMICROBIAL COATINGS MARKET: DEALS

- TABLE 144 DEALS, 2018-2022

- 9.6.2 ANTIMICROBIAL COATING MARKET: PRODUCT LAUNCHES

- TABLE 145 PRODUCT LAUNCHES, 2017-2022

- 9.6.3 ANTIMICROBIAL COATING MARKET: OTHERS

- TABLE 146 OTHERS, 2017-2022

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 10.1.1 AKZONOBEL N.V.

- TABLE 147 AKZONOBEL N.V.: COMPANY OVERVIEW

- FIGURE 29 AKZONOBEL N.V.: COMPANY SNAPSHOT

- TABLE 148 AKZONOBEL N.V.: DEALS

- TABLE 149 AKZONOBEL N.V.: PRODUCT LAUNCHES

- TABLE 150 AKZONOBEL N.V.: OTHERS

- 10.1.2 AXALTA COATING SYSTEMS LTD.

- TABLE 151 AXALTA COATING SYSTEMS LTD.: COMPANY OVERVIEW

- FIGURE 30 AXALTA COATING SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 152 AXALTA COATING SYSTEMS LTD.: DEALS

- TABLE 153 AXALTA COATING SYSTEMS LTD.: OTHERS

- 10.1.3 THE SHERWIN-WILLIAMS COMPANY

- TABLE 154 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- FIGURE 31 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- TABLE 155 THE SHERWIN-WILLIAMS COMPANY: DEALS

- TABLE 156 THE SHERWIN-WILLIAMS COMPANY: OTHERS

- 10.1.4 BASF

- TABLE 157 BASF: COMPANY OVERVIEW

- FIGURE 32 BASF: COMPANY SNAPSHOT

- TABLE 158 BASF: DEALS

- TABLE 159 BASF: OTHERS

- 10.1.5 PPG INDUSTRIES, INC.

- TABLE 160 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 33 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 161 PPG INDUSTRIES, INC.: DEALS

- TABLE 162 PPG INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 163 PPG INDUSTRIES, INC.: OTHERS

- 10.1.6 NIPPON PAINT HOLDINGS CO., LTD.

- TABLE 164 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY OVERVIEW

- FIGURE 34 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- TABLE 165 NIPPON PAINT HOLDINGS CO., LTD.: DEALS

- TABLE 166 NIPPON PAINT HOLDINGS CO., LTD.: PRODUCT LAUNCHES

- TABLE 167 NIPPON PAINT HOLDINGS CO., LTD.: OTHERS

- 10.1.7 RPM INTERNATIONAL INC.

- TABLE 168 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 35 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 169 RPM INTERNATIONAL INC: DEALS

- TABLE 170 RPM INTERNATIONAL INC: OTHERS

- 10.1.8 KONINKLIJKE DSM N.V.

- TABLE 171 KONINKLIJKE DSM N.V.: COMPANY OVERVIEW

- FIGURE 36 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

- TABLE 172 KONINKLIJKE DSM N.V.: DEALS

- 10.1.9 SIKA AG

- TABLE 173 SIKA AG: COMPANY OVERVIEW

- FIGURE 37 SIKA AG.: COMPANY SNAPSHOT

- TABLE 174 SIKA AG.: DEALS

- TABLE 175 SIKA AG.: OTHERS

- 10.1.10 LANXESS AG.

- TABLE 176 LANXESS AG.: COMPANY OVERVIEW

- FIGURE 38 LANXESS AG.: COMPANY SNAPSHOT

- TABLE 177 LANXESS AG.: DEALS

- TABLE 178 LANXESS AG.: PRODUCT LAUNCHES

- TABLE 179 LANXESS AG: OTHERS

- 10.2 OTHER PLAYERS

- 10.2.1 BURKE INDUSTRIAL COATINGS LLC

- TABLE 180 BURKE INDUSTRIAL COATINGS LLC: COMPANY OVERVIEW

- 10.2.2 LONZA GROUP AG

- TABLE 181 LONZA GROUP AG: COMPANY OVERVIEW

- 10.2.3 CLEVELAND-CLIFFS INC.

- TABLE 182 CLEVELAND-CLIFFS INC.: COMPANY OVERVIEW

- 10.2.4 TROY CORPORATION

- TABLE 183 TROY CORPORATION: COMPANY OVERVIEW

- 10.2.5 SPECIALTY COATING SYSTEMS INC.

- TABLE 184 SPECIALTY COATING SYSTEMS INC.: COMPANY OVERVIEW

- 10.2.6 ALLIED BIOSCIENCE INC.

- TABLE 185 ALLIED BIOSCIENCE INC.: COMPANY OVERVIEW

- 10.2.7 H.B. FULLER CONSTRUCTION PRODUCTS INC.

- TABLE 186 H.B. FULLER CONSTRUCTION PRODUCTS INC.: COMPANY OVERVIEW

- 10.2.8 FIBERLOCK TECHNOLOGIES, INC.

- TABLE 187 FIBERLOCK TECHNOLOGIES, INC.: COMPANY OVERVIEW

- 10.2.9 FLORA COATINGS LLC

- TABLE 188 FLORA COATINGS LLC: COMPANY OVERVIEW

- 10.2.10 HYDROMER INC.

- TABLE 189 HYDROMER INC.: COMPANY OVERVIEW

- 10.2.11 IFS COATINGS INC.

- TABLE 190 IFS COATINGS INC.: COMPANY OVERVIEW

- 10.2.12 NANO-CARE DEUTSCHLAND AG.

- TABLE 191 NANO-CARE DEUTSCHLAND AG.: COMPANY OVERVIEW

- 10.2.13 PROTECH-OXYPLAST GROUP

- TABLE 192 PROTECH-OXYPLAST GROUP: COMPANY OVERVIEW

- 10.2.14 AEREUS TECHNOLOGIES INC

- TABLE 193 AEREUS TECHNOLOGIES INC: COMPANY OVERVIEW

- 10.2.15 MEDIVATORS INC.

- TABLE 194 MEDIVATORS INC.: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS