|

|

市場調査レポート

商品コード

1421499

デジタル農業の世界市場、オファリング別、技術別(周辺、コア)、作業別(農作業・給餌、モニタリング・スカウティング、マーケティング・需要創出)、タイプ別(ハードウェア、ソフトウェア、サービス)、地域別-2028年までの予測Digital Agriculture Market Offering, Technology (Peripheral, Core), Operation (Farming & Feeding, Monitoring & Scouting, Marketing & Demand Generation) Type (Hardware, Software, Services), Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| デジタル農業の世界市場、オファリング別、技術別(周辺、コア)、作業別(農作業・給餌、モニタリング・スカウティング、マーケティング・需要創出)、タイプ別(ハードウェア、ソフトウェア、サービス)、地域別-2028年までの予測 |

|

出版日: 2024年01月29日

発行: MarketsandMarkets

ページ情報: 英文 490 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

デジタル農業の世界市場は、予測期間中に10.3%のCAGRで拡大し、2023年の220億米ドルから2028年には360億米ドルに成長すると予測されています。

デジタル農業は、人工知能(AI)、ビッグデータ、ブロックチェーン、クラウドコンピューティングなどの新興技術に後押しされ、大きな変革期を迎えています。これらの力は、透明性、効率性、持続可能性に大きな影響を及ぼしながら、食糧の栽培、管理、流通の方法に革命を起こすために協働しています。ブロックチェーンは、気象センサー、土壌分析、衛星画像など様々なソースからのデータを統合し、灌漑、施肥、害虫駆除に関するリアルタイムの洞察を農家に提供することができます。AIシステムは、ドローンや農業用ロボット、あるいは農家がスマートフォンのカメラで撮影したデジタル画像を調べて害虫を検出し、その蔓延を防いだり、被害を受けた植物を治療したり、被害を軽減したりする方法について、農業従事者に具体的なアドバイスを与えることができます。同時に、AIは家畜の行動データを分析して異常を検知し、病気の可能性のある家畜を特定することで、タイムリーな治療を可能にします。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(米ドル) |

| セグメント別 | オファリング別、タイプ別、作業別、技術別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

さらに、デジタル技術の普及性、使いやすさ、機動性により、農業と食品生産の状況は大きく変わりつつあります。特に農業と食糧の分野では、モバイルテクノロジー、リモートセンシングサービス、分散コンピューティングの普及により、小農民の重要な情報、投入資材、市場へのアクセスがすでに強化されています。この変革は、生産と生産性の向上、より効率的なサプライ・チェーン、運営コストの削減につながっています。このように、データ主導のアプローチは、資源配分を最適化し、無駄を省き、収穫量の増加につながります。

デジタル農業業界では、モニタリングとスカウティングは、作物の健康とパフォーマンスに関するリアルタイムの洞察を得るために技術を活用する2つの重要な慣行です。モニタリングとスカウティングはデジタル農業に不可欠なツールであり、農家は作物を積極的に管理し、資源を最適化し、収穫量を最大化することができます。センサー、ドローン、AIなど様々なテクノロジーを駆使したこれらの技術は、農家にリアルタイムのデータと洞察力を提供し、情報に基づいた意思決定を行う。継続的にデータを収集・分析することで、農家はより健康的で生産性が高く、持続可能な農場経営につながる情報に基づいた意思決定を行うことができます。

当レポートでは、世界のデジタル農業市場について調査し、オファリング別、タイプ別、作業別、技術別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

第6章 業界の動向

- イントロダクション

- 農業産業の情勢:

- バリューチェーン分析

- 技術分析

- 特許分析

- 生態系と市場マップ

- 貿易分析

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 主要な会議とイベント

- 関税と規制状況

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第7章 デジタル農業市場、オファリング別

- イントロダクション

- アドバイザリーサービス

- 精密な農業と農場管理

- 品質管理とトレーサビリティ

- デジタル調達

- Eコマース

- 金融業務

第8章 デジタル農業市場、技術別

- イントロダクション

- 周辺技術

- コア技術

第9章 デジタル農業市場、作業別

- イントロダクション

- 農作業・給餌

- モニタリング・スカウティング

- マーケティング・需要創出

第10章 デジタル農業市場、タイプ別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第11章 デジタル農業市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第12章 競合情勢

- 概要

- 主要参入企業の戦略/秘策

- 収益分析

- 市場シェア分析

- 主要企業の年間収益VS.成長

- 主要企業のEBITDA

- 主要な市場参入企業の世界スナップショット

- 企業評価クアドラント:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- CISCO SYSTEMS, INC.

- IBM CORPORATION

- ACCENTURE

- DEERE & COMPANY

- TRIMBLE INC.

- AKVA GROUP

- HEXAGON AB

- BAYER AG

- AGCO CORPORATION

- DELAVAL

- その他の企業

- DJI

- EPICOR SOFTWARE CORPORATION

- VODAFONE GROUP PLC

- RAVEN INDUSTRIES, INC.

- EUROFINS SCIENTIFIC

- TELUS

- SMALL ROBOT COMPANY

- GAMAYA

- PRECISIONHAWK

- AGRICULTURAL CONSULTING SERVICES

- AGREENA

- CERES IMAGING

- ZEMDIRBIU KONSULTACIJOS UAB

- EC2CE

- ARABLE

第14章 隣接市場および関連市場

第15章 付録

Report Description

The digital agriculture market is projected to grow from USD 22.0 Billion in 2023 to USD 36.0 Billion by 2028, at a CAGR of 10.3% during the forecast period. The digital agriculture industry is undergoing a major transformation, fueled by emerging technologies like artificial intelligence (AI), big data, blockchain, cloud computing, etc. These forces are working together to revolutionize the way we grow, manage, and distribute food, with significant impacts on transparency, efficiency, and sustainability. Blockchain can integrate data from various sources like weather sensors, soil analysis, and satellite imagery to provide farmers with real-time insights on irrigation, fertilization, and pest control. AI systems can examine digital images taken by drones, agricultural robots, or farmers using a simple smartphone camera to detect pests and give concrete advice to agricultural workers on how to prevent their spread, treat affected plants, or mitigate the damage caused. At the same time, AI can analyze data on the behavior of livestock to detect abnormalities and identify potentially sick animals, thus allowing timely treatment. (Source: FAO and International Telecommunication Union Report, 2021).

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) |

| Segments | By Offering, Type, Operation, Technology, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

Moreover, the pervasive nature, ease of use, and mobility of digital technologies are reshaping the landscape of agriculture and food production. Particularly in the agriculture and food sector, the proliferation of mobile technologies, remote-sensing services, and distributed computing is already enhancing smallholders' access to vital information, inputs, and markets. This transformation is leading to increased production and productivity, more efficient supply chains, and reduced operational costs. Thus, this data-driven approach optimizes resource allocation, reduces waste, and leads to increased yields.

During the projected period, the monitoring & scouting category within the spectrum of operation segment is anticipated to exhibit the most rapid growth, boasting the highest Compound Annual Growth Rate (CAGR).

In the digital agriculture industry, monitoring and scouting are two crucial practices that leverage technology to gain real-time insights into the health and performance of crops. Monitoring and scouting are essential tools in digital agriculture, allowing farmers to proactively manage their crops, optimize resources, and maximize yield. These techniques, powered by various technologies like sensors, drones, and AI, provide farmers with real-time data and insights to make informed decisions. By continuously collecting and analyzing data, farmers can make informed decisions that lead to a healthier, more productive, and sustainable farm operation.

Moreover, the integration with the SAS (Satellite Agriculture Solution) system enables precise resource allocation, optimizing the use of water, fertilizers, and pesticides based on the specific needs of different parts of the field. As stated in the Artificial Intelligence for Agriculture Report of the International Telecommunication Union (ITU), and FAO (2021), XAG has mobilized its partners and service providers to serve 40 million hectares of farmland with smart agtech, contributing to a total increase in crop yield of 3 490 000 tonnes. Farming labor costs have also been substantially reduced while removing occupational health risks for field workers. Thus, the integration of AI, as exemplified by XAG's initiative, showcases the transformative potential of digital agriculture. It not only addresses specific challenges in monitoring and scouting but also contributes to the overall efficiency, sustainability, and productivity of modern farming practices.

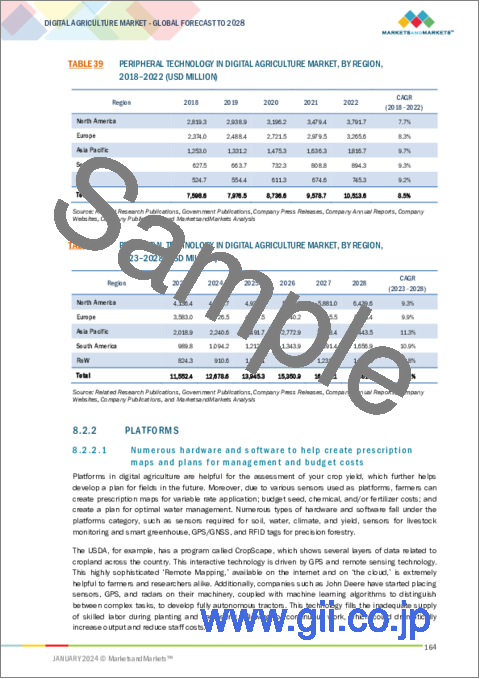

Peripheral technology is dominant within the technology segment of the market.

Peripheral technologies in digital agriculture are essentially the sensors, actuators, and other devices that collect and transmit data about the farm environment and the crops or livestock being raised. These devices can be mounted on drones, tractors, irrigation systems, or even directly on plants or animals. They can measure a wide range of factors, such as soil moisture, nutrient levels, temperature, humidity, pest and disease pressure, and plant growth. Platforms and apps that provide real-time data on soil health, crop conditions, and weather patterns are in high demand. This allows farmers to optimize irrigation, fertilizer application, and pest control, leading to increased yield and reduced costs.

The dominance of peripheral technology in the digital agriculture market is expected to continue in the coming years. As the cost of sensors and other peripheral technologies continues to decline, and as farmers become more comfortable with using data to make decisions, the adoption of these technologies is likely to accelerate.

The break-up of the profile of primary participants in the digital agriculture market:

- By Company Type: Tier 1 - 30%, Tier 2 - 45%, and Tier 3 - 25%

- By Designation: C Level - 25%, Director Level - 50%, Others-25%

- By Region: North America - 30%, Europe - 35%, Asia Pacific - 15%, South America - 10%, and Rest of the World -10%

Prominent companies are Cisco Systems, Inc. (US), IBM Corporation (US), Accenture (Ireland), Deere & Company (US), and Trimble Inc. (US) among others.

Research Coverage:

This research report categorizes the digital agriculture market by Offering (Advisory Services, Precision Agriculture & Farm Management, Quality Management & Traceability, Digital Procurement, Agri E-commerce, and Financial Services), Technology (Peripheral Technology, and Core Technology), Type (Hardware, Software, and Services), Operation (Farming & Feeding, Monitoring & Scouting, and Marketing & Demand Generation), and Region (North America, Europe, Asia Pacific, South America, and RoW). The report covers information about the key factors, such as drivers, restraints, opportunities, and challenges impacting the growth of the digital agriculture market. It also provides a detailed analysis of the major players in the market including their business overview, products offered; key strategies; partnerships, new product launches, and acquisitions. Competitive benchmarking of upcoming startups in the digital agriculture market is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall digital agriculture market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Demand for optimization of farm management using agricultural services and software integration, Increase in initiatives by the government and key players operating in the market, Growth in concerns regarding ecosystem change, Increasing adoption of IoT and AI by farmers and agriculturists), restraints (Lack of technical knowledge and training activities, and Large number of fragmented lands in developing countries), opportunity (Increase in the use of agricultural-based software via smartphones, and Early detection of crop diseases and ease of farm management), and challenges (High cost of devices and software to impact adoption among small-scale farmers, and Rise in concerns regarding data management and requirement for adequate training) influencing the growth of the digital agriculture market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital agriculture market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the digital agriculture market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the digital agriculture market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Cisco Systems, Inc. (US), IBM Corporation (US), Accenture (Ireland), Deere & Company (US), and Trimble Inc. (US) among others in the digital agriculture market strategies. The report also helps stakeholders understand the digital agriculture market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 DIGITAL AGRICULTURE MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.3.3 REGIONS COVERED

- FIGURE 2 DIGITAL AGRICULTURE MARKET SEGMENTATION, BY REGION

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES, 2018-2022

- 1.4.1 VOLUME UNIT CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 DIGITAL AGRICULTURE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 DIGITAL AGRICULTURE MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 DIGITAL AGRICULTURE MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (BASED ON GLOBAL MARKET)

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 8 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS & RISK ASSESSMENT

- 2.6 RECESSION IMPACT ANALYSIS

- 2.6.1 RECESSION MACROINDICATORS

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 GLOBAL INFLATION RATE, 2012-2022

- FIGURE 11 GLOBAL GROSS DOMESTIC PRODUCT, 2012-2022 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON DIGITAL AGRICULTURE MARKET

- FIGURE 13 GLOBAL DIGITAL AGRICULTURE MARKET: CURRENT FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 3 DIGITAL AGRICULTURE MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 14 DIGITAL AGRICULTURE MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 DIGITAL AGRICULTURE MARKET, BY OPERATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 DIGITAL AGRICULTURE MARKET, BY OFFERING, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 DIGITAL AGRICULTURE MARKET SHARE (VALUE), BY REGION, 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN DIGITAL AGRICULTURE MARKET

- FIGURE 19 HIGH ADOPTION OF DIGITAL AGRICULTURE IN DEVELOPING MARKETS TO FUEL MARKET GROWTH

- 4.2 DIGITAL AGRICULTURE MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS

- FIGURE 20 US TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY TYPE & COUNTRY

- FIGURE 21 HARDWARE AND CHINA TO ACCOUNT FOR LARGEST SEGMENTAL SHARES IN ASIA PACIFIC MARKET IN 2023

- 4.4 DIGITAL AGRICULTURE MARKET, BY TYPE

- FIGURE 22 DIGITAL AGRICULTURE HARDWARE TO LEAD MARKET ACROSS REGIONS DURING FORECAST PERIOD

- 4.5 DIGITAL AGRICULTURE MARKET, BY OPERATION

- FIGURE 23 FARMING & FEEDING OPERATIONS TO DOMINATE DURING FORECAST PERIOD

- 4.6 DIGITAL AGRICULTURE MARKET, BY OFFERING

- FIGURE 24 PRECISION AGRICULTURE & FARM MANAGEMENT OFFERING TO ACCOUNT FOR LION'S SHARE DURING FORECAST PERIOD

- 4.7 DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY

- FIGURE 25 PERIPHERAL TECHNOLOGIES TO DOMINATE DIGITAL AGRICULTURE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 DIGITALIZATION IN AGRICULTURAL SECTOR

- FIGURE 26 SMARTPHONE SUBSCRIBER PENETRATION, BY REGION, 2022 VS 2030

- FIGURE 27 GLOBAL GNSS DEMAND, 2021 VS 2031 (EUR BILLION)

- 5.3 MARKET DYNAMICS

- FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DIGITAL AGRICULTURE MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Demand for optimization of farm management using agricultural services and software integration.

- 5.3.1.2 Increase in initiatives by government and key players

- 5.3.1.3 Growth in need for optimization in light of ecological changes

- 5.3.1.4 Increase in adoption of IoT and AI by farmers and agriculturists

- 5.3.2 RESTRAINTS

- 5.3.2.1 Lack of technical knowledge and training activities

- 5.3.2.2 Large number of fragmented lands in emerging economies

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increase in use of agriculture-based software via smartphones

- 5.3.3.2 Early detection of crop diseases and ease of farm management

- 5.3.4 CHALLENGES

- 5.3.4.1 High cost of devices and software to impact adoption among small-scale farmers

- 5.3.4.2 Rise in concerns regarding data management and requirement for adequate training

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 CURRENT LANDSCAPE OF AGRICULTURAL INDUSTRY:

- FIGURE 29 SHARE OF GDP FROM AGRICULTURE IN KEY COUNTRIES, 2018-2021

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 30 VALUE CHAIN ANALYSIS: DIGITAL AGRICULTURE MARKET

- 6.3.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.3.2 DEVICE & COMPONENT MANUFACTURERS

- 6.3.3 SYSTEM INTEGRATORS

- 6.3.4 SERVICE PROVIDERS

- 6.3.5 END USERS

- 6.3.6 POST-SALES SERVICES

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 EXISTING TECHNOLOGIES IN DIGITAL AGRICULTURE

- 6.4.1.1 INTRODUCTION

- FIGURE 31 EXISTING TECHNOLOGIES IN DIGITAL AGRICULTURE

- 6.4.1.2 INTERACTIVE VOICE RESPONSE

- 6.4.1.3 WEB APPLICATIONS

- 6.4.1.4 INTERNET & BROADBAND

- 6.4.1.5 MOBILE

- 6.4.1.6 SATELLITE

- 6.4.1.6.1 Satellite Imagery for crop yield productions and price forecasts

- 6.4.1.6.2 GNSS devices shipment in digital agriculture

- FIGURE 32 GNSS DEVICES SHIPMENT, BY REGION, 2021-2031 (MILLION)

- 6.4.1.7 Broadcasting

- 6.4.2 EMERGING TECHNOLOGIES IN DIGITAL AGRICULTURE

- 6.4.2.1 INTRODUCTION

- FIGURE 33 EMERGING TECHNOLOGIES IN DIGITAL AGRICULTURE

- 6.4.2.2 ARTIFICIAL INTELLIGENCE

- 6.4.2.3 BLOCKCHAIN

- FIGURE 34 BLOCKCHAIN AND AI IN DIGITAL AGRICULTURE, LIVESTOCK MONITORING, AND FARM MANAGEMENT

- 6.4.2.4 BIG DATA

- 6.4.2.5 INTERNET OF THINGS (IoT)

- 6.4.2.6 Drones (unmanned aerial vehicles)

- 6.4.2.7 Cloud

- 6.4.2.8 Robotics (robotic cages and underwater drones in aquaculture farms)

- 6.4.2.9 Conclusion

- 6.4.1 EXISTING TECHNOLOGIES IN DIGITAL AGRICULTURE

- 6.5 PATENT ANALYSIS

- FIGURE 35 PATENTS GRANTED FOR DIGITAL AGRICULTURE MARKET, 2014-2023

- FIGURE 36 REGIONAL ANALYSIS OF PATENTS GRANTED FOR DIGITAL AGRICULTURE MARKET, 2014-2023

- TABLE 4 LIST OF MAJOR PATENTS PERTAINING TO DIGITAL AGRICULTURE MARKET, 2021-2023

- 6.6 ECOSYSTEM AND MARKET MAP

- 6.6.1 DEMAND SIDE

- 6.6.2 SUPPLY SIDE

- FIGURE 37 DIGITAL AGRICULTURE MARKET MAP

- TABLE 5 DIGITAL AGRICULTURE MARKET: SUPPLY CHAIN (ECOSYSTEM)

- 6.7 TRADE ANALYSIS

- TABLE 6 TOP 10 EXPORTERS AND IMPORTERS OF HS CODE 8432 PRODUCTS, 2022 (USD THOUSAND)

- TABLE 7 TOP 10 EXPORTERS AND IMPORTERS OF HS CODE 8432 PRODUCTS, 2022 (TON)

- 6.8 PRICING ANALYSIS

- 6.8.1 AVERAGE SELLING PRICE TREND, BY HARDWARE TYPE

- TABLE 8 DIGITAL AGRICULTURE MARKET: AVERAGE SELLING PRICE (ASP) OF AUTOMATION & CONTROL SYSTEMS, 2018-2022 (USD/PIECE)

- TABLE 9 DIGITAL AGRICULTURE MARKET: AVERAGE SELLING PRICE (ASP) OF SENSING & MONITORING DEVICES, 2018-2022 (USD/PIECE)

- 6.8.2 AVERAGE SELLING PRICE TREND OF DIGITAL AGRICULTURE SYSTEMS, BY KEY PLAYERS

- TABLE 10 DIGITAL AGRICULTURE MARKET: AVERAGE SELLING PRICE (ASP) OF IRRIGATION CONTROLLERS, BY KEY PLAYER, 2022 (USD/PIECE)

- TABLE 11 DIGITAL AGRICULTURE MARKET: AVERAGE SELLING PRICE (ASP) OF GPS/GNSS, BY KEY PLAYER, 2022 (USD/PIECE)

- TABLE 12 DIGITAL AGRICULTURE MARKET: AVERAGE SELLING PRICE (ASP) OF DISPLAYS, BY KEY PLAYER, 2022 (USD/PIECE)

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 38 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.10 KEY CONFERENCES & EVENTS

- TABLE 13 KEY CONFERENCES & EVENTS, 2023-2024

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.1.1 US

- 6.11.1.1.1 US: Agricultural Data Act 2018

- 6.11.1.1.2 National Mission For Sustainable Agriculture (NMSA)

- 6.11.1.1.3 Environmental Impact Assessment (EIA)

- 6.11.1.1.4 Nature Conservation - European Union (EU)

- 6.11.1.1.5 Tariff and regulations related to precision farming and smart greenhouses

- 6.11.1.1 US

- TABLE 14 TARIFF REGULATIONS: PRECISION FARMING AND SMART GREENHOUSES

- 6.11.1.1.6 Tariff and regulations related to precision aquaculture

- TABLE 15 TARIFF REGULATIONS: PRECISION AQUACULTURE

- 6.11.2 REGULATORY LANDSCAPE

- 6.11.2.1 Government Policies and Subsidies

- 6.11.2.1.1 Introduction

- 6.11.2.1.2 China

- 6.11.2.1.2.1 National plan for agricultural and rural informatization: China 14th five-year plan (2021-2026)

- 6.11.2.1.2.2 New guidelines for modernization of agriculture sector in China

- 6.11.2.1.2.3 Current state of development of smart agriculture machinery in China

- 6.11.2.1.2.4 Pollution and Climate Smart Agriculture in China (PACSAC)

- 6.11.2.1.2.5 World Bank initiatives toward promoting green agriculture and rural development in China

- 6.11.2.1.3 India

- 6.11.2.1.3.1 Greenhouse Farming Subsidy in India

- 6.11.2.1.3.2 Government initiatives for promoting organic farming in India

- 6.11.2.1.3.3 Government partnerships for smart agriculture

- 6.11.2.1.4 Netherlands

- 6.11.2.1.4.1 Climate-smart Agriculture Initiatives in Netherlands

- 6.11.2.1.4.2 Major government initiatives and subsidy programs in the Netherlands

- 6.11.2.1.4.3 Support for organic farmers

- 6.11.2.1.4.4 Greenhouses as source of energy

- 6.11.2.1.4.5 Subsidy scheme for agricultural innovation North Brabant, 2020-2023

- 6.11.2.1.5 Spain

- 6.11.2.1 Government Policies and Subsidies

- FIGURE 39 SPAIN: TOTAL AGRICULTURAL LAND UNDER CULTIVATION, 2013-2020 (MILLION HA)

- FIGURE 40 SPAIN: SHARE OF MAJOR AGRICULTURE PRODUCTS, 2021

- FIGURE 41 SPAIN: IMPORT AND EXPORT VALUE OF AGRICULTURE PRODUCTS, 2021 (USD MILLION)

- 6.11.2.1.5.1 Recent government policies in agriculture

- 6.11.2.1.5.2 Subsidy schemes for irrigation projects in Spain

- 6.11.2.1.6 Turkey

- 6.11.2.1.6.1 Current landscape of digital agriculture technology in Turkey

- FIGURE 42 TOTAL AGRICULTURE LAND UNDER CULTIVATION, 2013-2020 (MILLION HA)

- 6.11.2.1.6.2 Policies and implementation of smart agriculture technologies in Turkey

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12 CASE STUDY ANALYSIS

- 6.12.1 PVT AGRICULTURE USED HEXAGON'S DISPLAYS TO IMPROVE SALES OF SPRAYERS

- 6.12.2 ANNA BINNA FARMS USED AGWORLD SOFTWARE PLATFORMS FOR FARM RECORD-KEEPING

- 6.12.3 AGTECH-DRIVEN SOLUTIONS USED FOR BRIDGING GAPS IN ACCESS, ADVISORY, AND QUALITY INPUTS IN INDIAN FARMING

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 IMPACT OF PORTER'S FIVE FORCES ON DIGITAL AGRICULTURE MARKET

- FIGURE 43 DIGITAL AGRICULTURE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 THREAT OF NEW ENTRANTS

- 6.13.2 THREAT OF SUBSTITUTES

- 6.13.3 BARGAINING POWER OF SUPPLIERS

- 6.13.4 BARGAINING POWER OF BUYERS

- 6.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 44 INFLUENCE OF STAKEHOLDERS ON BUYING FOR KEY TYPES

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- 6.14.2 BUYING CRITERIA

- FIGURE 45 KEY BUYING CRITERIA FOR DIGITAL AGRICULTURE SYSTEM TYPES

- TABLE 18 KEY BUYING CRITERIA FOR DIGITAL AGRICULTURE SYSTEM TYPES

7 DIGITAL AGRICULTURE MARKET, BY OFFERING

- 7.1 INTRODUCTION

- FIGURE 46 PRECISION AGRICULTURE & FARM MANAGEMENT TO DOMINATE DURING FORECAST PERIOD

- TABLE 19 DIGITAL AGRICULTURE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 20 DIGITAL AGRICULTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 7.2 ADVISORY SERVICES

- 7.2.1 PROMOTING ADOPTION OF IMPROVED FARM TECHNOLOGIES TO INCREASE PRODUCTIVITY

- TABLE 21 DIGITAL AGRICULTURE ADVISORY SERVICES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 22 DIGITAL AGRICULTURE ADVISORY SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 PRECISION AGRICULTURE & FARM MANAGEMENT

- 7.3.1 INCREASE IN DATA MANAGEMENT SERVICES TO IMPROVE DECISION-MAKING FOR SMART FARMS

- TABLE 23 PRECISION AGRICULTURE & FARM MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 24 PRECISION AGRICULTURE & FARM MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 QUALITY MANAGEMENT & TRACEABILITY

- 7.4.1 INNOVATION OF DIGI-LED DATA TO ENHANCE QUALITY MANAGEMENT OF FARMS

- TABLE 25 AGRICULTURE QUALITY MANAGEMENT & TRACEABILITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 AGRICULTURE QUALITY MANAGEMENT & TRACEABILITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 DIGITAL PROCUREMENT

- 7.5.1 AGRIBUSINESSES GAINING INSIGHT INTO PRODUCTION TRENDS

- TABLE 27 DIGITAL PROCUREMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 28 DIGITAL PROCUREMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 AGRI ECOMMERCE

- 7.6.1 GROWTH IN AGRICULTURAL PRODUCE POPULARITY ON ECOMMERCE PLATFORMS

- TABLE 29 AGRI ECOMMERCE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 AGRI ECOMMERCE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.7 FINANCIAL SERVICES

- 7.7.1 INCREASE IN DEMAND FOR DIGITAL AGRICULTURE PAYMENT SERVICES

- TABLE 31 FINANCIAL SERVICES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 DIGITAL AGRICULTURE FINANCIAL SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

8 DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- FIGURE 47 PERIPHERAL TECHNOLOGY TO DOMINATE DIGITAL AGRICULTURE MARKET DURING FORECAST PERIOD

- TABLE 33 DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 34 DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 35 PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 36 PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 37 CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 38 CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.2 PERIPHERAL TECHNOLOGY

- 8.2.1 HIGH-VALUE INSIGHTS FOR PRECISION AGRICULTURE EQUIPMENT MANUFACTURERS TO MAKE REAL-TIME DECISIONS

- TABLE 39 PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.2 PLATFORMS

- 8.2.2.1 Numerous hardware and software to help create prescription maps and plans for management and budget costs

- TABLE 41 DIGITAL AGRICULTURE PLATFORMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 DIGITAL AGRICULTURE PLATFORMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.3 APPS

- 8.2.3.1 Greater penetration of mobile devices in emerging economies

- TABLE 43 DIGITAL AGRICULTURE APPS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 44 DIGITAL AGRICULTURE APPS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 CORE TECHNOLOGY

- 8.3.1 INCREASE IN APPLICATION OF CORE TECHNOLOGIES IN REDUCING ENVIRONMENTAL IMPACT

- TABLE 45 CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.2 AUTOMATION

- 8.3.2.1 Automation technology to increase yield and rate of farm production

- TABLE 47 AUTOMATION IN DIGITAL AGRICULTURE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 AUTOMATION IN DIGITAL AGRICULTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.3 DRONES

- 8.3.3.1 Offering ability to survey crops and herds over vast areas

- TABLE 49 DRONES IN DIGITAL AGRICULTURE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 DRONES IN DIGITAL AGRICULTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.4 ROBOTICS

- 8.3.4.1 Reduction in manual labor in farm activities

- TABLE 51 ROBOTICS IN DIGITAL AGRICULTURE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 52 ROBOTICS IN DIGITAL AGRICULTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.5 AI/ML

- 8.3.5.1 Real-time actionable insights to improve agriculture yield

- TABLE 53 AI & ML IN DIGITAL AGRICULTURE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 AI & ML IN AGRICULTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

9 DIGITAL AGRICULTURE MARKET, BY OPERATION

- 9.1 INTRODUCTION

- FIGURE 48 FARMING & FEEDING OPERATION OF DIGITAL AGRICULTURE TO DOMINATE DURING FORECAST PERIOD

- TABLE 55 DIGITAL AGRICULTURE MARKET, BY OPERATION, 2018-2022 (USD MILLION)

- TABLE 56 DIGITAL AGRICULTURE MARKET, BY OPERATION, 2023-2028 (USD MILLION)

- 9.2 FARMING & FEEDING

- 9.2.1 INCREASE IN DEMAND FOR MONITORING OF FARMING & FEEDING SYSTEMS TO DETERMINE CROP AND LIVESTOCK HEALTH

- TABLE 57 DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY REGION, 2023-2028 (USD MILLION)

- TABLE 59 DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 60 DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY TYPE, 2023-2028 (USD MILLION)

- 9.2.2 PRECISION AGRICULTURE

- 9.2.2.1 Trend of using technology to improve agricultural yield

- TABLE 61 DIGITAL AGRICULTURE MARKET FOR PRECISION AGRICULTURE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 62 DIGITAL AGRICULTURE MARKET FOR PRECISION AGRICULTURE, BY REGION, 2023-2028 (USD MILLION)

- 9.2.3 PRECISION ANIMAL REARING & FEEDING

- 9.2.3.1 Growth in importance of animal health and adoption of automation

- TABLE 63 DIGITAL AGRICULTURE MARKET FOR PRECISION ANIMAL REARING & FEEDING, BY REGION, 2018-2022 (USD MILLION)

- TABLE 64 DIGITAL AGRICULTURE MARKET FOR PRECISION ANIMAL REARING & FEEDING, BY REGION, 2023-2028 (USD MILLION)

- 9.2.4 PRECISION AQUACULTURE

- 9.2.4.1 Gradual adoption of integrated systems to enhance aquaculture operations

- TABLE 65 DIGITAL AGRICULTURE MARKET FOR PRECISION AQUACULTURE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 DIGITAL AGRICULTURE MARKET FOR PRECISION AQUACULTURE, BY REGION, 2023-2028 (USD MILLION)

- 9.2.5 PRECISION FORESTRY

- 9.2.5.1 Improved efficiency and ease of forestry operations

- TABLE 67 DIGITAL AGRICULTURE MARKET FOR PRECISION FORESTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 68 DIGITAL AGRICULTURE MARKET FOR PRECISION FORESTRY, BY REGION, 2023-2028 (USD MILLION)

- 9.2.6 SMART GREENHOUSES

- 9.2.6.1 Use of technology to control environment with sensors, data analytics, and automation to optimize growing conditions

- TABLE 69 DIGITAL AGRICULTURE MARKET FOR SMART GREENHOUSES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 DIGITAL AGRICULTURE MARKET FOR SMART GREENHOUSES, BY REGION, 2023-2028 (USD MILLION)

- 9.3 MONITORING & SCOUTING

- 9.3.1 GROWTH IN QUALITY CONCERNS TO IMPACT IMPORTANCE OF MONITORING & SCOUTING IN DIGITAL AGRICULTURE

- TABLE 71 DIGITAL AGRICULTURE MARKET FOR MONITORING & SCOUTING, BY REGION, 2018-2022 (USD MILLION)

- TABLE 72 DIGITAL AGRICULTURE MARKET FOR MONITORING & SCOUTING, BY REGION, 2023-2028 (USD MILLION)

- 9.4 MARKETING & DEMAND GENERATION

- 9.4.1 SURGE IN DEMAND FOR ONLINE SALES OF AGRICULTURAL OUTPUT

- TABLE 73 DIGITAL AGRICULTURE MARKET FOR MARKETING & DEMAND GENERATION, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 DIGITAL AGRICULTURE MARKET FOR MARKETING & DEMAND GENERATION, BY REGION, 2023-2028 (USD MILLION)

10 DIGITAL AGRICULTURE MARKET, BY TYPE

- 10.1 INTRODUCTION

- FIGURE 49 DIGITAL AGRICULTURE MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 75 DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 76 DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2 HARDWARE

- 10.2.1 VARIETY OF AUTOMATION AND MONITORING TOOLS IN DIFFERENT TYPES OF AGRICULTURE

- TABLE 77 DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 78 DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 79 DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 80 DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 81 DIGITAL AGRICULTURE HARDWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 82 DIGITAL AGRICULTURE HARDWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.2 AUTOMATION & CONTROL SYSTEMS

- 10.2.2.1 High demand for drones to monitor crop growth and pest control activity

- TABLE 83 AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 84 AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 85 AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 86 AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 87 AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 88 AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 89 AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 90 AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- 10.2.2.2 Drones/UAVs

- TABLE 91 AGRICULTURAL DRONES/UAVS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 92 AGRICULTURAL DRONES/UAVS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 93 AGRICULTURAL DRONES/UAVS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 94 AGRICULTURAL DRONES/UAVS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.3 Irrigation controllers

- TABLE 95 DIGITAL IRRIGATION CONTROLLERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 96 DIGITAL IRRIGATION CONTROLLERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 97 DIGITAL IRRIGATION CONTROLLERS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 98 DIGITAL IRRIGATION CONTROLLERS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.4 GPS/GNSS

- TABLE 99 AGRICULTURAL GPS/GNSS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 100 AGRICULTURAL GPS/GNSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 101 AGRICULTURAL GPS/GNSS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 102 AGRICULTURAL GPS/GNSS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.5 Flow & Application Control Devices

- TABLE 103 AGRICULTURAL FLOW & APPLICATION CONTROL DEVICES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 104 AGRICULTURAL FLOW & APPLICATION CONTROL DEVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 105 AGRICULTURAL FLOW & APPLICATION CONTROL DEVICES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 106 AGRICULTURAL FLOW & APPLICATION CONTROL DEVICES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.6 Guidance & steering

- TABLE 107 AGRICULTURAL GUIDANCE & STEERING SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 108 AGRICULTURAL GUIDANCE & STEERING SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 109 AGRICULTURAL GUIDANCE & STEERING SYSTEMS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 110 AGRICULTURAL GUIDANCE & STEERING SYSTEMS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.7 Handheld mobile devices/handheld computers

- TABLE 111 AGRICULTURAL HANDHELD MOBILE DEVICES/HANDHELD COMPUTERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 112 AGRICULTURAL HANDHELD MOBILE DEVICES/HANDHELD COMPUTERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 113 AGRICULTURAL HANDHELD MOBILE DEVICES/HANDHELD COMPUTERS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 114 AGRICULTURAL HANDHELD MOBILE DEVICES/HANDHELD COMPUTERS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.8 Displays

- TABLE 115 DIGITAL AGRICULTURAL DISPLAYS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 116 DIGITAL AGRICULTURAL DISPLAYS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 117 DIGITAL AGRICULTURAL DISPLAYS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 118 DIGITAL AGRICULTURAL DISPLAYS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.9 Harvesters & forwarders

- TABLE 119 DIGITAL HARVESTERS & FORWARDERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 120 DIGITAL HARVESTERS & FORWARDERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 121 DIGITAL HARVESTERS & FORWARDERS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 122 DIGITAL HARVESTERS & FORWARDERS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.10 Variable rate controllers

- TABLE 123 AGRICULTURAL VARIABLE RATE CONTROLLERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 124 AGRICULTURAL VARIABLE RATE CONTROLLERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 125 AGRICULTURAL VARIABLE RATE CONTROLLERS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 126 AGRICULTURAL VARIABLE RATE CONTROLLERS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.11 Control systems

- TABLE 127 DIGITAL AGRICULTURAL CONTROL SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 128 DIGITAL AGRICULTURAL CONTROL SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 129 DIGITAL AGRICULTURAL CONTROL SYSTEMS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 130 DIGITAL AGRICULTURAL CONTROL SYSTEMS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.12 Robotics hardware

- TABLE 131 AGRICULTURAL ROBOTICS HARDWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 132 AGRICULTURAL ROBOTICS HARDWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 133 AGRICULTURAL ROBOTICS HARDWARE MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 134 AGRICULTURAL ROBOTICS HARDWARE MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.13 HVAC systems

- TABLE 135 AGRICULTURAL HVAC SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 136 AGRICULTURAL HVAC SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 137 AGRICULTURAL HVAC SYSTEMS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 138 AGRICULTURAL HVAC SYSTEMS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.14 LED grow lights

- TABLE 139 LED GROW LIGHTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 140 LED GROW LIGHTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 141 LED GROW LIGHTS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 142 LED GROW LIGHTS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.2.15 Other automation & control systems

- TABLE 143 OTHER DIGITAL AGRICULTURE AUTOMATION & CONTROL SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 144 OTHER DIGITAL AGRICULTURE AUTOMATION & CONTROL SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 145 OTHER DIGITAL AGRICULTURE AUTOMATION & CONTROL SYSTEMS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 146 OTHER DIGITAL AGRICULTURE AUTOMATION & CONTROL SYSTEMS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3 SENSING & MONITORING DEVICES

- 10.2.3.1 High demand for sensors to make informed decisions

- TABLE 147 AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 148 AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 149 AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 150 AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 151 RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 152 RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 153 RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 154 RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 155 AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 156 AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 157 AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 158 AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.2 Yield monitors

- TABLE 159 YIELD MONITORS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 160 YIELD MONITORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 161 YIELD MONITORS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 162 YIELD MONITORS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.3 Soil sensors

- TABLE 163 SOIL SENSORS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 164 SOIL SENSORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 165 SOIL SENSORS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 166 SOIL SENSORS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.4 Water sensors

- TABLE 167 WATER SENSORS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 168 WATER SENSORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 169 WATER SENSORS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 170 WATER SENSORS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.5 Climate sensors

- TABLE 171 CLIMATE SENSORS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 172 CLIMATE SENSORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 173 CLIMATE SENSORS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 174 CLIMATE SENSORS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.6 Camera systems

- TABLE 175 CAMERA SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 176 CAMERA SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 177 CAMERA SYSTEMS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 178 CAMERA SYSTEMS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.7 RFID & sensors for precision forestry

- TABLE 179 RFID & SENSORS FOR PRECISION FORESTRY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 180 RFID & SENSORS FOR PRECISION FORESTRY MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 181 RFID & SENSORS FOR PRECISION FORESTRY MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 182 RFID & SENSORS FOR PRECISION FORESTRY MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.8 Temperature & environment monitoring sensors

- TABLE 183 TEMPERATURE & ENVIRONMENT MONITORING SENSORS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 184 TEMPERATURE & ENVIRONMENT MONITORING SENSORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 185 TEMPERATURE & ENVIRONMENT MONITORING SENSORS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 186 TEMPERATURE & ENVIRONMENT MONITORING SENSORS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.9 pH & dissolved oxygen sensors

- TABLE 187 PH & DISSOLVED OXYGEN SENSORS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 188 PH & DISSOLVED OXYGEN SENSORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 189 PH & DISSOLVED OXYGEN SENSORS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 190 PH & DISSOLVED OXYGEN SENSORS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.10 EC sensors

- TABLE 191 EC SENSORS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 192 EC SENSORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 193 EC SENSORS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 194 EC SENSORS MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.11 RFID Tags & readers for Livestock Monitoring

- TABLE 195 RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 196 RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 197 RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 198 RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.12 Sensors for livestock monitoring

- TABLE 199 SENSORS FOR LIVESTOCK MONITORING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 200 SENSORS FOR LIVESTOCK MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 201 SENSORS FOR LIVESTOCK MONITORING MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 202 SENSORS FOR LIVESTOCK MONITORING MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.13 Sensors for smart greenhouses

- TABLE 203 SENSORS FOR SMART GREENHOUSES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 204 SENSORS FOR SMART GREENHOUSES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 205 SENSORS FOR SMART GREENHOUSES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 206 SENSORS FOR SMART GREENHOUSES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.2.3.14 Other sensing & monitoring devices

- TABLE 207 OTHER SENSING & MONITORING DEVICES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 208 OTHER SENSING & MONITORING DEVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 209 OTHER SENSING & MONITORING DEVICES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 210 OTHER SENSING & MONITORING DEVICES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 10.3 SOFTWARE

- 10.3.1 AGRICULTURAL SOFTWARE DEVELOPMENTS BY KEY COMPANIES

- TABLE 211 DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 212 DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 213 DIGITAL AGRICULTURE SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 214 DIGITAL AGRICULTURE SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.2 ON-CLOUD

- 10.3.2.1 Easy data handling and storage of on-cloud software

- TABLE 215 ON-CLOUD DIGITAL AGRICULTURE SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 216 ON-CLOUD DIGITAL AGRICULTURE SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.3 ON-PREMISES

- 10.3.3.1 High data integrity and easy maintenance of on-premise software

- TABLE 217 ON-PREMISE DIGITAL AGRICULTURE SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 218 ON-PREMISE DIGITAL AGRICULTURE SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.4 AI & DATA ANALYTICS

- 10.3.4.1 Increase in trend of AI and data analytics to enhance farm operations

- TABLE 219 AGRICULTURAL AI & DATA ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 220 AGRICULTURAL AI & DATA ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 SERVICES

- 10.4.1 SERVICES TO BENEFIT FROM INCREASE IN IMPORTANCE OF PRECISION TECHNIQUES IN DIFFERENT SEGMENTS

- TABLE 221 DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 222 DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 223 DIGITAL AGRICULTURE SERVICES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 224 DIGITAL AGRICULTURE SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4.2 SYSTEM INTEGRATION & CONSULTING

- 10.4.2.1 Rise in importance of hardware and software integration for smooth farm functioning

- TABLE 225 DIGITAL AGRICULTURE SYSTEM INTEGRATION & CONSULTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 226 DIGITAL AGRICULTURE SYSTEM INTEGRATION & CONSULTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4.3 DATA COLLECTION & ANALYTICAL SERVICES

- 10.4.3.1 Need to integrate data in structured form

- TABLE 227 DATA COLLECTION & ANALYTICAL SERVICES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 228 DATA COLLECTION & ANALYTICAL SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4.4 CONNECTIVITY SERVICES

- 10.4.4.1 Opportunity for real-time data generation

- TABLE 229 DIGITAL AGRICULTURE CONNECTIVITY SERVICES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 230 DIGITAL AGRICULTURE CONNECTIVITY SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4.5 ASSISTANT PROFESSIONAL SERVICES

- 10.4.5.1 Need for improvements and professional services to manage entire value chain

- TABLE 231 DIGITAL AGRICULTURE ASSISTANT PROFESSIONAL SERVICES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 232 DIGITAL AGRICULTURE ASSISTANT PROFESSIONAL SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4.6 MAINTENANCE & SUPPORT SERVICES

- 10.4.6.1 Continuous need to maintain different digital agriculture systems

- TABLE 233 DIGITAL AGRICULTURE MAINTENANCE & SUPPORT SERVICES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 234 DIGITAL AGRICULTURE MAINTENANCE & SUPPORT SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

11 DIGITAL AGRICULTURE MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 50 INDIA TO BE FASTEST-GROWING COUNTRY IN DIGITAL AGRICULTURE MARKET, 2023-2028

- TABLE 235 DIGITAL AGRICULTURE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 236 DIGITAL AGRICULTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 51 NORTH AMERICA: DIGITAL AGRICULTURE MARKET SNAPSHOT

- TABLE 237 NORTH AMERICA: DIGITAL AGRICULTURE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 238 NORTH AMERICA: DIGITAL AGRICULTURE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 239 NORTH AMERICA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 240 NORTH AMERICA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 241 NORTH AMERICA: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 242 NORTH AMERICA: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 243 NORTH AMERICA: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 244 NORTH AMERICA: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 245 NORTH AMERICA: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 246 NORTH AMERICA: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 247 NORTH AMERICA: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 248 NORTH AMERICA: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 249 NORTH AMERICA: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 250 NORTH AMERICA: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 251 NORTH AMERICA: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 252 NORTH AMERICA: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 253 NORTH AMERICA: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 254 NORTH AMERICA: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 255 NORTH AMERICA: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 256 NORTH AMERICA: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 257 NORTH AMERICA: DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 258 NORTH AMERICA: DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 259 NORTH AMERICA: DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 260 NORTH AMERICA: DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 261 NORTH AMERICA: DIGITAL AGRICULTURE MARKET, BY OPERATION, 2018-2022 (USD MILLION)

- TABLE 262 NORTH AMERICA: DIGITAL AGRICULTURE MARKET, BY OPERATION, 2023-2028 (USD MILLION)

- TABLE 263 NORTH AMERICA: DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 264 NORTH AMERICA: DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 265 NORTH AMERICA: DIGITAL AGRICULTURE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 266 NORTH AMERICA: DIGITAL AGRICULTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 267 NORTH AMERICA: DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 268 NORTH AMERICA: DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 269 NORTH AMERICA: PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 270 NORTH AMERICA: PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 271 NORTH AMERICA: CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 272 NORTH AMERICA: CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 52 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- 11.2.2 US

- 11.2.2.1 Digital transformation of agricultural ecosystems, with focus on livestock health

- TABLE 273 US: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 274 US: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Federal investments, accessibility, and favorable regulatory environment framework

- TABLE 275 CANADA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 276 CANADA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.4 MEXICO

- 11.2.4.1 Financial government initiatives to tackle limited resources

- TABLE 277 MEXICO: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 278 MEXICO: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- TABLE 279 EUROPE: DIGITAL AGRICULTURE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 280 EUROPE: DIGITAL AGRICULTURE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 281 EUROPE: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 282 EUROPE: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 283 EUROPE: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 284 EUROPE: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 285 EUROPE: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 286 EUROPE: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 287 EUROPE: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 288 EUROPE: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 289 EUROPE: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 290 EUROPE: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 291 EUROPE: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 292 EUROPE: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 293 EUROPE: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 294 EUROPE: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 295 EUROPE: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 296 EUROPE: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 297 EUROPE: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 298 EUROPE: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 299 EUROPE: DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 300 EUROPE: DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 301 EUROPE: DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 302 EUROPE: DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 303 EUROPE: DIGITAL AGRICULTURE MARKET, BY OPERATION, 2018-2022 (USD MILLION)

- TABLE 304 EUROPE: DIGITAL AGRICULTURE MARKET, BY OPERATION, 2023-2028 (USD MILLION)

- TABLE 305 EUROPE: DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 306 EUROPE: DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 307 EUROPE: DIGITAL AGRICULTURE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 308 EUROPE: DIGITAL AGRICULTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 309 EUROPE: DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 310 EUROPE: DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 311 EUROPE: PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 312 EUROPE: PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 313 EUROPE: CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 314 EUROPE: CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 53 EUROPE: RECESSION IMPACT ANALYSIS

- 11.3.2 GERMANY

- 11.3.2.1 Increase in funding for research projects on farming technology

- TABLE 315 GERMANY: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 316 GERMANY: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.3 RUSSIA

- 11.3.3.1 Agriculture 4.0 to increase demand for modern technologies

- TABLE 317 RUSSIA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 318 RUSSIA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.4 FRANCE

- 11.3.4.1 Rise in awareness regarding technology and automation

- TABLE 319 FRANCE: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 320 FRANCE: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.5 ITALY

- 11.3.5.1 'Made in Italy' campaign to drive modernization

- TABLE 321 ITALY: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 322 ITALY: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.6 UK

- 11.3.6.1 Greater demand to meet growing automation needs

- TABLE 323 UK: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 324 UK: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.7 SWEDEN

- 11.3.7.1 Growth in utilization of agricultural technologies for soil monitoring

- TABLE 325 SWEDEN: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 326 SWEDEN: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.8 NETHERLANDS

- 11.3.8.1 Utilization of drones in greenhouses and leveraging 'virtual sensing' and satellite-based data

- TABLE 327 NETHERLANDS: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 328 NETHERLANDS: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.9 REST OF EUROPE

- TABLE 329 REST OF EUROPE: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 330 REST OF EUROPE: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 54 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET SNAPSHOT

- TABLE 331 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY COUNTRY/REGION, 2018-2022 (USD MILLION)

- TABLE 332 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- TABLE 333 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 334 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 335 ASIA PACIFIC: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 336 ASIA PACIFIC: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 337 ASIA PACIFIC: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 338 ASIA PACIFIC: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 339 ASIA PACIFIC: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 340 ASIA PACIFIC: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 341 ASIA PACIFIC: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 342 ASIA PACIFIC: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 343 ASIA PACIFIC: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 344 ASIA PACIFIC: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 345 ASIA PACIFIC: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 346 ASIA PACIFIC: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 347 ASIA PACIFIC: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 348 ASIA PACIFIC: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 349 ASIA PACIFIC: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 350 ASIA PACIFIC: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 351 ASIA PACIFIC: DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 352 ASIA PACIFIC: DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 353 ASIA PACIFIC: DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 354 ASIA PACIFIC: DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 355 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY OPERATION, 2018-2022 (USD MILLION)

- TABLE 356 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY OPERATION, 2023-2028 (USD MILLION)

- TABLE 357 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 358 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 359 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 360 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 361 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 362 ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 363 ASIA PACIFIC: PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 364 ASIA PACIFIC: PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 365 ASIA PACIFIC: CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 366 ASIA PACIFIC: CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 55 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- 11.4.2 CHINA

- 11.4.2.1 Large population and increase in food demand

- TABLE 367 CHINA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 368 CHINA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.3 JAPAN

- 11.4.3.1 Higher demand to make country's food industry self-sufficient

- TABLE 369 JAPAN: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 370 JAPAN: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Thriving poultry industry and increasing exports

- TABLE 371 AUSTRALIA & NEW ZEALAND: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 372 AUSTRALIA & NEW ZEALAND: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.5 INDIA

- 11.4.5.1 Government initiatives to provide great opportunities

- TABLE 373 INDIA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 374 INDIA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 375 REST OF ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 376 REST OF ASIA PACIFIC: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5 SOUTH AMERICA

- TABLE 377 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 378 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 379 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 380 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 381 SOUTH AMERICA: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 382 SOUTH AMERICA: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 383 SOUTH AMERICA: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 384 SOUTH AMERICA: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 385 SOUTH AMERICA: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 386 SOUTH AMERICA: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 387 SOUTH AMERICA: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 388 SOUTH AMERICA: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 389 SOUTH AMERICA: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 390 SOUTH AMERICA: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 391 SOUTH AMERICA: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 392 SOUTH AMERICA: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 393 SOUTH AMERICA: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 394 SOUTH AMERICA: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 395 SOUTH AMERICA: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 396 SOUTH AMERICA: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 397 SOUTH AMERICA: DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 398 SOUTH AMERICA: DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 399 SOUTH AMERICA: DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 400 SOUTH AMERICA: DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 401 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY OPERATION, 2018-2022 (USD MILLION)

- TABLE 402 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY OPERATION, 2023-2028 (USD MILLION)

- TABLE 403 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 404 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 405 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 406 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 407 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 408 SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 409 SOUTH AMERICA: PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 410 SOUTH AMERICA: PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 411 SOUTH AMERICA: CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 412 SOUTH AMERICA: CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 56 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- 11.5.2 BRAZIL

- 11.5.2.1 Growth in agricultural activities

- TABLE 413 BRAZIL: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 414 BRAZIL: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.3 ARGENTINA

- 11.5.3.1 Increase in public-private partnerships for agriculture innovations

- TABLE 415 ARGENTINA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 416 ARGENTINA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.4 REST OF SOUTH AMERICA

- TABLE 417 REST OF SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 418 REST OF SOUTH AMERICA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.6 REST OF THE WORLD (ROW)

- TABLE 419 ROW: DIGITAL AGRICULTURE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 420 ROW: DIGITAL AGRICULTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 421 ROW: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 422 ROW: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 423 ROW: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 424 ROW: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 425 ROW: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 426 ROW: DIGITAL AGRICULTURE HARDWARE MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 427 ROW: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 428 ROW: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 429 ROW: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 430 ROW: AGRICULTURAL AUTOMATION & CONTROL SYSTEMS MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 431 ROW: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 432 ROW: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 433 ROW: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 434 ROW: AGRICULTURAL SENSING & MONITORING DEVICES MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 435 ROW: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 436 ROW: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 437 ROW: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 438 ROW: RFID TAGS & READERS FOR LIVESTOCK MONITORING MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 439 ROW: DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 440 ROW: DIGITAL AGRICULTURE SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 441 ROW: DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 442 ROW: DIGITAL AGRICULTURE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 443 ROW: DIGITAL AGRICULTURE MARKET, BY OPERATION, 2018-2022 (USD MILLION)

- TABLE 444 ROW: DIGITAL AGRICULTURE MARKET, BY OPERATION, 2023-2028 (USD MILLION)

- TABLE 445 ROW: DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 446 ROW: DIGITAL AGRICULTURE MARKET FOR FARMING & FEEDING, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 447 ROW: DIGITAL AGRICULTURE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 448 ROW: DIGITAL AGRICULTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 449 ROW: DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 450 ROW: DIGITAL AGRICULTURE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 451 ROW: PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 452 ROW: PERIPHERAL TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 453 ROW: CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 454 ROW: CORE TECHNOLOGY IN DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.6.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 57 ROW: RECESSION IMPACT ANALYSIS

- 11.6.2 AFRICA

- 11.6.2.1 Increase in awareness and penetration of digitalization

- TABLE 455 AFRICA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 456 AFRICA: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.6.3 MIDDLE EAST

- 11.6.3.1 Rise in adoption of digital technologies for agriculture

- TABLE 457 MIDDLE EAST: DIGITAL AGRICULTURE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 458 MIDDLE EAST: DIGITAL AGRICULTURE MARKET, BY TYPE, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- TABLE 459 STRATEGIES ADOPTED BY KEY PLAYERS IN DIGITAL AGRICULTURE MARKET

- 12.3 REVENUE ANALYSIS

- FIGURE 58 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2018-2022 (USD BILLION)

- 12.4 MARKET SHARE ANALYSIS

- TABLE 460 DIGITAL AGRICULTURE MARKET: INTENSITY OF COMPETITIVE RIVALRY (COMPETITIVE)

- 12.5 KEY PLAYERS' ANNUAL REVENUE VS. GROWTH

- FIGURE 59 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020-2022

- 12.6 KEY PLAYERS' EBITDA

- FIGURE 60 EBITDA, 2022 (USD BILLION)

- 12.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 61 DIGITAL AGRICULTURE MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- 12.8 COMPANY EVALUATION QUADRANT: KEY PLAYERS

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- FIGURE 62 COMPANY EVALUATION MATRIX, 2022 (KEY PLAYERS)

- 12.8.5 COMPANY FOOTPRINT: KEY PLAYERS

- TABLE 461 OVERALL COMPANY FOOTPRINT: KEY PLATERS

- TABLE 462 COMPANY OFFERING FOOTPRINT

- TABLE 463 COMPANY TYPE FOOTPRINT

- TABLE 464 COMPANY OPERATION FOOTPRINT

- TABLE 465 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 466 COMPANY REGION FOOTPRINT

- 12.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- FIGURE 63 COMPANY EVALUATION MATRIX, 2022 (STARTUPS/SMES)

- 12.9.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 467 DIGITAL AGRICULTURE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES

- TABLE 468 DIGITAL AGRICULTURE MARKET: PRODUCT LAUNCHES, 2018-2023

- 12.10.2 DEALS

- TABLE 469 DIGITAL AGRICULTURE MARKET: DEALS, 2018-2023

- 12.10.3 OTHERS

- TABLE 470 DIGITAL AGRICULTURE MARKET: OTHERS, 2018-2023

13 COMPANY PROFILES

- 13.1 KEY PLAYERS