|

|

市場調査レポート

商品コード

1088370

バイオ分析試験サービスの世界市場:種類別・用途別 (腫瘍、神経症、感染症、消化器疾患、循環器疾患)・エンドユーザー別・地域別 (北米、欧州、アジア太平洋、中南米、中東・アフリカ) の将来予測 (2027年まで)Bioanalytical Testing Services Market by Type, Application (Oncology, Neurology, Infectious Diseases, Gastroenterology, Cardiology), End User and Region (North America, Europe, APAC, Latin America, MEA) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| バイオ分析試験サービスの世界市場:種類別・用途別 (腫瘍、神経症、感染症、消化器疾患、循環器疾患)・エンドユーザー別・地域別 (北米、欧州、アジア太平洋、中南米、中東・アフリカ) の将来予測 (2027年まで) |

|

出版日: 2022年06月06日

発行: MarketsandMarkets

ページ情報: 英文 203 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のバイオ分析試験サービスの市場規模は、2022年には29億米ドル、2027年までに60億米ドルに達すると予測されています。

また、予測期間中のCAGRは15.6%となる見込みです。

種類別では細胞ベースアッセイ部門が、用途別では腫瘍のセグメントが、エンドユーザー別では製薬・バイオ医薬品企業が、最大のシェアを占める見通しです。地域別に見ると、アジア太平洋が最も高いCAGRで成長すると見込まれています。

当レポートでは、世界のバイオ分析試験サービスの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、市場動向の見通し、種類別・用途別・エンドユーザー別・地域別の詳細動向、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 分析方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- 課題

- 新型コロナウイルス感染症 (COVID-19):バイオ分析試験サービス市場の経済シナリオへの影響評価

第6章 バイオ分析試験サービス市場:種類別

- イントロダクション

- 細胞ベースアッセイ

- 細菌性細胞ベースアッセイ

- ウイルス細胞ベースアッセイ

- ウイルス試験

- in vitro (体外) ウイルス試験

- in vivo (体内) ウイルス試験

- 種特異性ウイルスPCRアッセイ

- メソッド開発の最適化・検証

- 血清・免疫原性・中和抗体

- バイオマーカー試験

- 薬物動態試験

- 他のサービス

第7章 バイオ分析試験サービス市場:用途別

- イントロダクション

- 腫瘍

- 神経症

- 感染症

- 消化器疾患

- 心臓疾患

- その他の用途

第8章 バイオ分析試験サービス市場:エンドユーザー別

- イントロダクション

- 製薬・バイオ医薬品企業

- CDMO (医薬品製造開発業務受託機関)

- CRO (医薬品開発業務受託機関)

第9章 バイオ分析試験サービス市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 他のアジア太平洋諸国

- ラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 競合リーダーシップマッピング

- バイオ分析試験サービスの市場シェア分析

- バイオ分析試験サービス市場:地域別分析

- 競争の状況と動向

- 製品発売 (2020年~2022年)

- 拡張 (2020年~2022年)

- 取引 (2020年~2022年)

第11章 企業プロファイル

- CHARLES RIVER

- MEDPACE HOLDINGS

- WUXI APPTEC

- EUROFINS SCIENTIFIC

- IQVIA INC.

- SGS SA

- LABORATORY CORPORATION OF AMERICA HOLDINGS

- INTERTEK GROUP PLC

- SYNEOS HEALTH

- ICON PLC

- FRONTAGE LABS

- PPD, INC.

- PAREXEL INTERNATIONAL CORPORATION

- ALMAC GROUP

- CELERION

- ALTASCIENCES

- BIOAGILYTIX LABS

- LOTUS LABS PVT. LTD.

- LGC LIMITED

- SARTORIUS AG

- CD BIOSCIENCES INC

- ABSORPTION SYSTEMS LLC

- PACE ANALYTICAL

- BIONEEDS INDIA PRIVATE LIMITED

- VIPRAGEN BIOSCIENCES

第12章 付録

Bioanalytical testing involves analytical methods used for the detailed examination of biological and biotechnology products. Bioanalysis enables the quantitative measurement of drugs and their metabolites, biological molecules in unnatural locations or concentrations, DNA, and large molecules. The global bioanalytical testing services market is projected to reach USD 6.0 billion by 2027 from an estimated USD 2.9 billion in 2022, at a CAGR of 15.6% during the forecast period.

"The Cell-based assays segment is expected to account for the largest share of the bioanalytical testing services market"

The increasing prevalence of chronic diseases and the rising number of clinical trials are expected to support the growth of the cell-based assays market. Cell-based assays are in vitro assays used for the quantitative and qualitative assessment of cellular mechanisms and functions using a wide range of reagents and cells. These assays are used to study the characteristics of a cell in natural conditions.

"The the oncology segment is expected to account for the largest share of the bioanalytical testing services market"

The oncology segment accounted for the largest share of the global bioanalytical testing services market in 2021. With the increasing burden of cancer on healthcare systems worldwide, both government and private organizations are increasingly focusing on developing novel cancer therapies. This is expected to drive the demand for bioanalytical testing services in the clinical trials of cancer drugs. ICON (Ireland), Syneos Health (US), and PAREXEL International (US) are the leading players offering services for the clinical trials of oncology drugs.

"The pharmaceutical and biopharmaceutical companies segment is expected to account for the largest share of the bioanalytical testing services market"

The pharmaceutical and biopharmaceutical companies segment accounted for the largest share of the global bioanalytical testing services market in 2021. Pharmaceutical and biopharmaceutical companies mainly focus on developing new drugs for the treatment of various diseases. These companies need to submit specific data related to drug development during the drug development process and subsequent filing of applications to regulatory bodies. This necessitates a wide spectrum of services in the early development phases and clinical phases to comply with regulatory requirements.

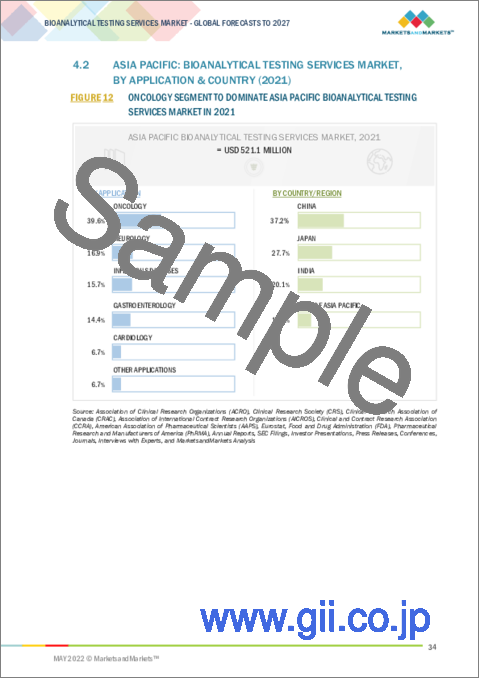

"Asia Pacific market to witness the highest growth during the forecast period"

The APAC market is estimated to grow at the highest CAGR during the forecast period. This is majorly attributed to the rapid growth in the pharmaceutical and biopharmaceutical industries, low cost of clinical trials, and favorable government policies in several countries in this region.

A breakdown of the primary participants for the bioanalytical testing services market referred to for this report is provided below:

- By Company Type: Tier 1-35%, Tier 2-45%, and Tier 3-20%

- By Designation: C-level-30%, Director Level-55%, and Others-15%

- By Region: North America-40%, Europe-25%, Asia Pacific-20%, Latin America- 10%, Middle East & Africa-5%

The prominent players in the bioanalytical testing services market include Charles River (US), Medpace (US), WuXi AppTec (China), Eurofins Scientific (Luxembourg), IQVIA (US), SGS SA (Switzerland), Laboratory Corporation of America Holdings (US), Intertek Group (UK), Syneos Health (US), ICON (Ireland), Frontage Labs (US), PPD (US), PAREXEL International Corporation (US), Almac Group (UK), Celerion (US), Altasciences (US), BioAgilytix Labs (US), Lotus Labs (India), LGS Limited (UK), Sartorius AG (Germany), CD BioSciences (US), Absorption Systems LLC (US), Pace Analytical Services (US), Bioneeds India Private Limited (India) and Vipragen Biosciences (India).

Research Coverage:

The report analyzes the market for various bioanalytical testing services and their adoption pattern. It aims at estimating the market size and future growth potential of the global bioanalytical testing services market and different segments such as type, application, end user, and region. The report also includes an in-depth competitive analysis of the key players in this market along with their company profiles, product & service offerings, and recent developments.

Reasons to Buy the Report

The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one or any combination of the below-mentioned five strategies for strengthening their market presence.

This report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the global bioanalytical testing services market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product or service launches in the global bioanalytical testing services market

- Market Development: Comprehensive information on the lucrative emerging regions by type, application, end user, and region

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the global bioanalytical testing services market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, revenue analysis, and products & services of leading players in the global bioanalytical testing services market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION & SCOPE

- 1.2.1 MARKETS COVERED

- FIGURE 1 BIOANALYTICAL TESTING SERVICES MARKET SEGMENTATION

- 1.2.2 YEARS CONSIDERED FOR THE STUDY

- 1.3 CURRENCY

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET RANKING ANALYSIS

- 2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY

- FIGURE 7 BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 BIOANALYTICAL TESTING SERVICES MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 BIOANALYTICAL TESTING SERVICES MARKET OVERVIEW

- FIGURE 11 RISING FOCUS ON ANALYTICAL TESTING OF BIOLOGICS AND BIOSIMILARS TO DRIVE MARKET GROWTH

- 4.2 ASIA PACIFIC: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION & COUNTRY (2021)

- FIGURE 12 ONCOLOGY SEGMENT TO DOMINATE ASIA PACIFIC BIOANALYTICAL TESTING SERVICES MARKET IN 2021

- 4.3 BIOANALYTICAL TESTING SERVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 13 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.4 REGIONAL MIX: BIOANALYTICAL TESTING SERVICES MARKET

- FIGURE 14 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 BIOANALYTICAL TESTING SERVICES MARKET: DEVELOPING VS. DEVELOPED COUNTRIES

- FIGURE 15 DEVELOPING COUNTRIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 BIOANALYTICAL TESTING SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising focus on the analytical testing of biologics and biosimilars

- TABLE 2 PATENT EXPIRY OF BEST-SELLING BIOLOGICS

- 5.2.1.2 Increasing preference for outsourcing analytical testing

- 5.2.1.3 Growing R&D expenditure in the pharmaceutical and biopharmaceutical industry

- FIGURE 17 PHARMACEUTICAL & BIOPHARMACEUTICAL R&D EXPENDITURE, 2017-2024

- 5.2.1.4 Rising adoption of the Quality by Design approach

- 5.2.2 RESTRAINTS

- 5.2.2.1 Dearth of skilled professionals

- 5.2.2.2 Pricing pressure faced by major players

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging countries in the Asia Pacific region

- 5.2.3.2 Rising demand for specialized bioanalytical testing services

- 5.2.4 CHALLENGES

- 5.2.4.1 Innovative formulations demanding a unique bioanalytical testing approach

- 5.2.4.2 Growing need to improve the sensitivity of bioanalytical methods

- 5.3 ASSESSMENT OF COVID-19 IMPACT ON THE ECONOMIC SCENARIO IN THE BIOANALYTICAL TESTING SERVICES MARKET

6 BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 3 BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 6.2 CELL-BASED ASSAYS

- TABLE 4 BIOANALYTICAL TESTING SERVICES MARKET FOR CELL-BASED ASSAYS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 5 BIOANALYTICAL TESTING SERVICES MARKET FOR CELL-BASED ASSAYS, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.2.1 BACTERIAL CELL-BASED ASSAYS

- 6.2.1.1 Bacterial cell-based assays dominate the bioanalytical testing services market for cell-based assays

- TABLE 6 BIOANALYTICAL TESTING SERVICES MARKET FOR BACTERIAL CELL-BASED ASSAYS, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.2.2 VIRAL CELL-BASED ASSAYS

- 6.2.2.1 Increasing outbreaks of viral diseases to support the growth of this market segment

- TABLE 7 BIOANALYTICAL TESTING SERVICES MARKET FOR VIRAL CELL-BASED ASSAYS, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3 VIROLOGY TESTING

- TABLE 8 BIOANALYTICAL TESTING SERVICES MARKET FOR VIROLOGY TESTING, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 9 BIOANALYTICAL TESTING SERVICES MARKET FOR VIROLOGY TESTING, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3.1 IN VITRO VIROLOGY TESTING

- 6.3.1.1 Higher uptake of in vitro virology assays in the development of anti-viral pharmaceuticals to drive the growth of this market segment

- TABLE 10 BIOANALYTICAL TESTING SERVICES MARKET FOR IN VITRO VIROLOGY TESTING, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3.2 IN VIVO VIROLOGY TESTING

- 6.3.2.1 High utilization of in vivo assays during important production phases to drive their demand

- TABLE 11 BIOANALYTICAL TESTING SERVICES MARKET FOR IN VIVO VIROLOGY TESTING, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3.3 SPECIES-SPECIFIC VIRAL PCR ASSAYS

- 6.3.3.1 Wide application of species-specific viral PCR assays in the detection of viral risks to support the growth of this market segment

- TABLE 12 BIOANALYTICAL TESTING SERVICES MARKET FOR SPECIES-SPECIFIC VIRAL PCR ASSAYS, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.4 METHOD DEVELOPMENT OPTIMIZATION AND VALIDATION

- 6.4.1 MANDATORY REQUIREMENT BY REGULATORY AUTHORITIES TO DRIVE THE GROWTH OF THIS MARKET SEGMENT

- TABLE 13 BIOANALYTICAL TESTING SERVICES MARKET FOR METHOD DEVELOPMENT OPTIMIZATION AND VALIDATION, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.5 SEROLOGY, IMMUNOGENICITY, AND NEUTRALIZING ANTIBODIES

- 6.5.1 INCREASING APPLICATIONS OF SEROLOGY, IMMUNOGENICITY, AND NEUTRALIZING ANTIBODIES TO DRIVE THE GROWTH OF THIS MARKET SEGMENT

- TABLE 14 BIOANALYTICAL TESTING SERVICES MARKET FOR SEROLOGY, IMMUNOGENICITY, AND NEUTRALIZING ANTIBODIES, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.6 BIOMARKER TESTING

- 6.6.1 GROWING EMPHASIS ON THE DEVELOPMENT OF PERSONALIZED MEDICINES TO DRIVE THE DEMAND FOR BIOMARKER TESTING SERVICES

- TABLE 15 BIOANALYTICAL TESTING SERVICES MARKET FOR BIOMARKER TESTING, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.7 PHARMACOKINETIC TESTING

- 6.7.1 INCREASING INCIDENCE OF INFECTIOUS DISEASES TO DRIVE THE DEMAND FOR PHARMACOKINETIC TESTING SERVICES

- TABLE 16 BIOANALYTICAL TESTING SERVICES MARKET FOR PHARMACOKINETIC TESTING, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.8 OTHER SERVICES

- TABLE 17 BIOANALYTICAL TESTING SERVICES MARKET FOR OTHER SERVICES, BY COUNTRY, 2020-2027 (USD MILLION)

7 BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 18 BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 7.2 ONCOLOGY

- 7.2.1 ONCOLOGY IS THE LARGEST APPLICATION SEGMENT IN THE BIOANALYTICAL TESTING SERVICES MARKET

- FIGURE 18 WORLDWIDE CANCER INCIDENCE AND MORTALITY (2018-2040)

- TABLE 19 BIOANALYTICAL TESTING SERVICES MARKET FOR ONCOLOGY APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 NEUROLOGY

- 7.3.1 ROBUST PIPELINE OF DRUGS FOR CNS DISEASES TO DRIVE THE GROWTH OF THIS MARKET SEGMENT

- TABLE 20 LIST OF PIPELINE DRUGS FOR NEUROLOGICAL DISORDERS (2020)

- TABLE 21 BIOANALYTICAL TESTING SERVICES MARKET FOR NEUROLOGY APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.4 INFECTIOUS DISEASES

- 7.4.1 OUTBREAK OF COVID-19 TO BOOST THE GROWTH OF THIS MARKET SEGMENT

- TABLE 22 BIOANALYTICAL TESTING SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.5 GASTROENTEROLOGY

- 7.5.1 RISING PREVALENCE OF CHRONIC DIGESTIVE DISORDERS TO SUPPORT THE GROWTH OF THIS MARKET SEGMENT

- TABLE 23 BIOANALYTICAL TESTING SERVICES MARKET FOR GASTROENTEROLOGY APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

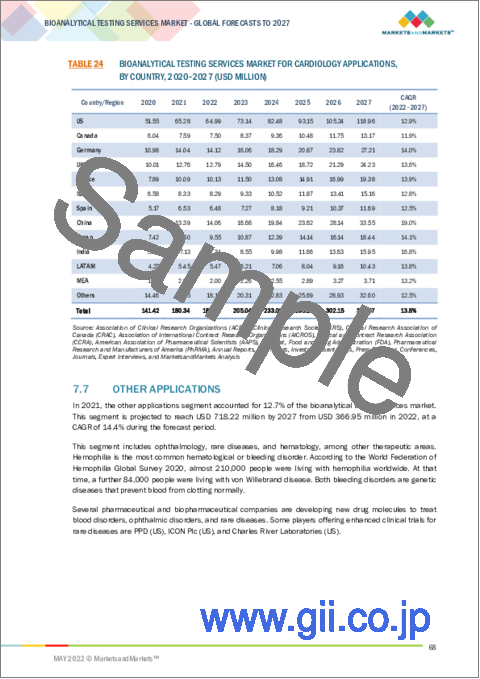

- 7.6 CARDIOLOGY

- 7.6.1 INCREASING PREVALENCE OF CARDIOVASCULAR DISEASES TO SUPPORT THE GROWTH OF THIS MARKET SEGMENT

- TABLE 24 BIOANALYTICAL TESTING SERVICES MARKET FOR CARDIOLOGY APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.7 OTHER APPLICATIONS

- TABLE 25 BIOANALYTICAL TESTING SERVICES MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

8 BIOANALYTICAL TESTING SERVICES MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 26 BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

- 8.2.1 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES ARE THE LARGEST END USERS OF BIOANALYTICAL TESTING SERVICES

- FIGURE 19 PHARMACEUTICAL R&D SPENDING, 2010-2024

- TABLE 27 BIOANALYTICAL TESTING SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.3 CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATIONS

- 8.3.1 CDMOS PROVIDE SERVICES SUCH AS ANALYTICAL DEVELOPMENT, FORMULATION SCREENING AND DEVELOPMENT, STABILITY STUDIES, AND PRE-CLINICAL SAFETY ASSESSMENT STUDIES

- TABLE 28 BIOANALYTICAL TESTING SERVICES MARKET FOR CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.4 CONTRACT RESEARCH ORGANIZATIONS

- 8.4.1 CONTRACT RESEARCH ORGANIZATIONS ARE INCREASINGLY SUBCONTRACTING THEIR ACTIVITIES TO NICHE LABORATORIES SPECIALIZED IN PROVIDING BIOANALYTICAL TESTING SERVICES

- TABLE 29 BIOANALYTICAL TESTING SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

9 BIOANALYTICAL TESTING SERVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 20 CHINA TO WITNESS HIGHEST GROWTH DURING THE FORECAST PERIOD

- TABLE 30 BIOANALYTICAL TESTING SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 21 NORTH AMERICA: BIOANALYTICAL TESTING SERVICES MARKET SNAPSHOT

- TABLE 31 NORTH AMERICA: BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 32 NORTH AMERICA: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 33 NORTH AMERICA: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 34 NORTH AMERICA: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 35 NORTH AMERICA: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 36 NORTH AMERICA: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 US is largest market for bioanalytical testing services in North America

- TABLE 37 US: KEY INDICATORS

- TABLE 38 US: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 39 US: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 40 US: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 41 US: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 42 US: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Increasing number of clinical trials in Canada to support market growth

- TABLE 43 CANADA: KEY INDICATORS:

- TABLE 44 CANADA: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 45 CANADA: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 46 CANADA: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 47 CANADA: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 48 CANADA: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3 EUROPE

- TABLE 49 EUROPE: BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 50 EUROPE: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 51 EUROPE: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 52 EUROPE: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 53 EUROPE: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 54 EUROPE: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Government support and flexible labor laws have made Germany a favorable location for clinical trials

- TABLE 55 GERMANY: KEY INDICATORS

- TABLE 56 GERMANY: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 57 GERMANY: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 58 GERMANY: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 59 GERMANY: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 60 GERMANY: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.2 FRANCE

- 9.3.2.1 High number of oncology clinical trials in France to drive market growth

- TABLE 61 FRANCE: KEY INDICATORS

- TABLE 62 FRANCE: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 63 FRANCE: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 64 FRANCE: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 65 FRANCE: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 66 FRANCE: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Investment by pharmaceutical sponsors for drug discovery services to support market growth

- TABLE 67 UK: KEY INDICATORS

- TABLE 68 UK: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 69 UK: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 70 UK: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 71 UK: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 72 UK: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Low drug approval time in Italy, along with the growing number of clinical trials, to drive market growth

- TABLE 73 ITALY: KEY INDICATORS

- TABLE 74 ITALY: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 75 ITALY: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 76 ITALY: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 77 ITALY: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 78 ITALY: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Rising R&D expenditure to boost market growth

- TABLE 79 SPAIN: KEY INDICATORS

- TABLE 80 SPAIN: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 81 SPAIN: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 82 SPAIN: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 83 SPAIN: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 84 SPAIN: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 85 ROE: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 86 ROE: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 87 ROE: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 88 ROE: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 89 ROE: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 22 ASIA PACIFIC: BIOANALYTICAL TESTING SERVICES MARKET SNAPSHOT

- TABLE 90 ASIA PACIFIC: BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 91 ASIA PACIFIC: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 92 ASIA PACIFIC: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 93 ASIA PACIFIC: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 94 ASIA PACIFIC: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 95 ASIA PACIFIC: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 China is largest market for bioanalytical testing services in Asia Pacific

- TABLE 96 CHINA: KEY INDICATORS

- TABLE 97 CHINA: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 98 CHINA: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 99 CHINA: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 100 CHINA: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 101 CHINA: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Rising geriatric population to drive market growth in Japan

- TABLE 102 JAPAN: KEY INDICATORS

- TABLE 103 JAPAN: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 104 JAPAN: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 105 JAPAN: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 106 JAPAN: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 107 JAPAN: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Growing pharmaceutical industry in India to drive market growth

- TABLE 108 INDIA: KEY INDICATORS

- TABLE 109 INDIA: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 110 INDIA: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 111 INDIA: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 112 INDIA: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 113 INDIA: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.4 REST OF ASIA PACIFIC

- TABLE 114 ROAPAC: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 115 ROAPAC: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 116 ROAPAC: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 117 ROAPAC: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 118 ROAPAC: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.5 LATIN AMERICA

- 9.5.1 GROWING R&D EXPENDITURE IN PHARMACEUTICAL & BIOPHARMACEUTICAL SECTOR TO DRIVE MARKET GROWTH

- TABLE 119 LATIN AMERICA: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 120 LATIN AMERICA: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 121 LATIN AMERICA: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 122 LATIN AMERICA: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 123 LATIN AMERICA: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWING PHARMACEUTICAL INDUSTRY TO DRIVE MARKET GROWTH

- TABLE 124 MIDDLE EAST & AFRICA: BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: CELL-BASED ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: VIROLOGY TESTING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: BIOANALYTICAL TESTING SERVICES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- FIGURE 23 KEY DEVELOPMENTS IN BIOANALYTICAL TESTING SERVICES MARKET

- 10.2 COMPETITIVE LEADERSHIP MAPPING

- 10.2.1 STARS

- 10.2.2 EMERGING LEADERS

- 10.2.3 PERVASIVE PLAYERS

- 10.2.4 PARTICIPANTS

- FIGURE 24 BIOANALYTICAL TESTING SERVICES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.3 BIOANALYTICAL TESTING SERVICES MARKET SHARE ANALYSIS

- FIGURE 25 MARKET SHARE ANALYSIS: BIOANALYTICAL TESTING SERVICES MARKET (2021)

- 10.4 BIOANALYTICAL TESTING SERVICES MARKET: GEOGRAPHICAL ASSESSMENT

- FIGURE 26 GEOGRAPHIC ASSESSMENT OF KEY PLAYERS IN BIOANALYTICAL TESTING SERVICES MARKET (2021)

- 10.5 COMPETITIVE SITUATIONS & TRENDS

- 10.5.1 PRODUCT LAUNCHES (2020-2022)

- 10.5.2 EXPANSIONS (2020-2022)

- 10.5.3 DEALS (2020-2022)

11 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1 CHARLES RIVER

- TABLE 129 CHARLES RIVER: BUSINESS OVERVIEW

- FIGURE 27 CHARLES RIVER: COMPANY SNAPSHOT (2021)

- 11.2 MEDPACE HOLDINGS

- TABLE 130 MEDPACE HOLDINGS: BUSINESS OVERVIEW

- FIGURE 28 MEDPACE HOLDINGS: COMPANY SNAPSHOT (2021)

- 11.3 WUXI APPTEC

- TABLE 131 WUXI APPTEC: BUSINESS OVERVIEW

- FIGURE 29 WUXI APPTEC: COMPANY SNAPSHOT (2021)

- 11.4 EUROFINS SCIENTIFIC

- TABLE 132 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

- FIGURE 30 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2021)

- 11.5 IQVIA INC.

- TABLE 133 IQVIA: BUSINESS OVERVIEW

- FIGURE 31 IQVIA: COMPANY SNAPSHOT (2021)

- 11.6 SGS SA

- TABLE 134 SGS SA: BUSINESS OVERVIEW

- FIGURE 32 SGS SA: COMPANY SNAPSHOT (2021)

- 11.7 LABORATORY CORPORATION OF AMERICA HOLDINGS

- TABLE 135 LABCORP: BUSINESS OVERVIEW

- FIGURE 33 LABCORP: COMPANY SNAPSHOT (2021)

- 11.8 INTERTEK GROUP PLC

- TABLE 136 INTERTEK GROUP PLC: BUSINESS OVERVIEW

- FIGURE 34 INTERTEK GROUP PLC: COMPANY SNAPSHOT (2021)

- 11.9 SYNEOS HEALTH

- TABLE 137 SYNEOS HEALTH: BUSINESS OVERVIEW

- FIGURE 35 SYNEOS HEALTH: COMPANY SNAPSHOT (2021)

- 11.10 ICON PLC

- TABLE 138 ICON: BUSINESS OVERVIEW

- FIGURE 36 ICON: COMPANY SNAPSHOT (2021)

- 11.11 FRONTAGE LABS

- TABLE 139 FRONTAGE LABS: BUSINESS OVERVIEW

- FIGURE 37 FRONTAGE LABS: COMPANY SNAPSHOT (2021)

- 11.12 PPD, INC.

- TABLE 140 PPD, INC: BUSINESS OVERVIEW

- 11.13 PAREXEL INTERNATIONAL CORPORATION

- TABLE 141 PARAXEL INTERNATIONAL: BUSINESS OVERVIEW

- 11.14 ALMAC GROUP

- TABLE 142 ALMAC GROUP: BUSINESS OVERVIEW

- 11.15 CELERION

- TABLE 143 CELERION: BUSINESS OVERVIEW

- 11.16 ALTASCIENCES

- TABLE 144 ALTASCIENCES: BUSINESS OVERVIEW

- 11.17 BIOAGILYTIX LABS

- TABLE 145 BIOAGILYTIX: BUSINESS OVERVIEW

- 11.18 LOTUS LABS PVT. LTD.

- TABLE 146 LOTUS LABS: BUSINESS OVERVIEW

- 11.19 LGC LIMITED

- TABLE 147 LGC LIMITED: BUSINESS OVERVIEW

- 11.20 SARTORIUS AG

- TABLE 148 SARTORIUS AG: BUSINESS OVERVIEW

- 11.21 CD BIOSCIENCES INC

- TABLE 149 CD BIOSCIENCES INC: BUSINESS OVERVIEW

- 11.22 ABSORPTION SYSTEMS LLC

- TABLE 150 ABSORPTION SYSTEMS LLC: BUSINESS OVERVIEW

- 11.23 PACE ANALYTICAL

- TABLE 151 PACE ANALYTICAL: BUSINESS OVERVIEW

- 11.24 BIONEEDS INDIA PRIVATE LIMITED

- TABLE 152 BIONEEDS INDIA PRIVATE LIMITED: BUSINESS OVERVIEW

- 11.25 VIPRAGEN BIOSCIENCES

- TABLE 153 VIPRAGEN BIOSCIENCES: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 AVAILABLE CUSTOMIZATIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS