|

|

市場調査レポート

商品コード

1111253

デジタル造船所の世界市場:造船所の種類別 (民間、軍用)・造船能力別 (大規模・中規模・小規模)・プロセス別・技術別・エンドユーザー別 (実装、更新・修理)・デジタル化のレベル別・地域別の将来予測 (2030年まで)Digital Shipyard Market by Shipyard Type (Commercial, Military), Capacity (Large, Medium, Small), Process, Technology, End Use (Implementation, Upgrades & Services), Digitalization Level and Region - Global Forecast to 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| デジタル造船所の世界市場:造船所の種類別 (民間、軍用)・造船能力別 (大規模・中規模・小規模)・プロセス別・技術別・エンドユーザー別 (実装、更新・修理)・デジタル化のレベル別・地域別の将来予測 (2030年まで) |

|

出版日: 2022年08月03日

発行: MarketsandMarkets

ページ情報: 英文 316 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

デジタル造船所市場は、2022年の13億米ドルから2030年には55億米ドルへと、予測期間中に19.1%のCAGRで成長すると予測されています。

デジタル造船所のビジョンには、スマート製品の創出のために設計されたスマートなインフラや、顧客に継続的な運用サポートとサポートサービスを提供するデリバリーモデルを確立することなどが含まれています。造船における製品ライフサイクル管理 (PLM) やデジタルツイン、3Dモデリング機能は、製品 (生産・設計プロセス) の完全統合を可能にし、設計段階から製品廃棄時まで、製品と部品の完全かつ連続的な検査を可能にします。

現在、多くの企業が高品質なシステムの需要に対応するため、製造プロセスの高度化に投資しています。また、軽量コンポーネントを開発するための研究開発への投資が増加していることも、技術的な進歩につながっています。効率性の向上と復元力の改善に対する需要の高まりは、デジタル造船所市場を活性化させ、市場参入企業に新たな収益機会をもたらすと予想されます。

"民間造船所分野が予測期間中に最も高い成長を遂げる"

造船所の種類別では、民間造船所セグメントが予測期間中に最も高い成長を遂げると予想されます。民間造船所は垂直統合を開始し、新素材から船舶を建造するのに必要な作業を請け負っています。これらの造船所では、大型旅客船、大型貨物船、クルーズ、フェリー、作業船などを建造しています。民間造船所の需要は、単純な成形・溶接工程に依存する事業量の多さ、比較的少ないエンジニアリングサポート、買収プロセスの簡素化などの促進要因によって、世界市場で増加しています。

"2022年には大型造船所が大きな市場シェアを占める"

2022年の市場規模は、造船能力ベースで大型造船所が最も大きなシェアを占めています。大規模造船所は、高付加価値のニッチ市場とそれに対応する生産工程に比較的特化しています。これらの造船所は、様々なソリューションの助けを借りて、特定のタスクやビジネスプロセス全体を外注化・共有することによって、自分たちのビジネスモデルを最適化しており、それが様々な中小造船所やソフトウェア/ソリューションプロバイダ、システムインテグレーターなどにとっての市場の実現性を高めています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 運用データ

- 価格分析

- バリューチェーン

- デジタル造船所市場のエコシステム

- 大手企業

- 非上場・小規模企業

- エンドユーザー

- 貿易統計データ

- デジタル造船所市場における技術動向

- デジタルツイン

- モノのインターネット (IoT)

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向/混乱

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 主な会議とイベント (2022年~2023年)

- 関税・規制状況

第6章 産業動向

- イントロダクション

- 造船所における技術進歩

- 拡張現実

- ブロックチェーン

- ロボティクス

- 造船業の新たな傾向

- 3Dプリント

- ビッグデータ

- 予知保全

- サプライチェーン分析

- ユースケース

- イノベーションと特許分析

第7章 デジタル造船所市場:造船所の種類別

- イントロダクション

- 民間造船所

- 軍用造船所

第8章 デジタル造船所市場:技術別

- イントロダクション

- 拡張・仮想現実 (AR・VR)

- デジタルツイン・シミュレーション

- 積層造形 (AM)

- 人工知能 (AI)・ビッグデータ分析

- ロボティックプロセスオートメーション

- IIoT (産業用モノのインターネット)

- サイバーセキュリティ

- ブロックチェーン

- クラウドコンピューティング・マスターデータ管理

第9章 デジタル造船所市場:造船能力別

- イントロダクション

- 小規模造船所

- 中型造船所

- 大型造船所

第10章 デジタル造船所市場:プロセス別

- イントロダクション

- 研究・開発

- 設計・エンジニアリング

- 製造・企画

- 整備・サポート

- 訓練・シミュレーション

第11章 デジタル造船所市場:デジタル化のレベル別

- イントロダクション

- 完全デジタル化造船所

- 半デジタル化造船所

- 部分的にデジタル化された造船所

第12章 デジタル造船所市場:最終用途別

- イントロダクション

- 実装

- 更新・修理

第13章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- オランダ

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 韓国

- 日本

- ロシア

- インド

- オーストラリア

- 他のアジア太平洋諸国

- 中東

- アラブ首長国連邦

- トルコ

- 他の中東諸国

- 他の国々 (RoW)

- ラテンアメリカ

- アフリカ

第14章 競合情勢

- イントロダクション

- 市場シェア分析 (2021年)

- 上位5社の収益分析 (2021年)

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合ベンチマーキング

- 競合シナリオ

- 資本取引

- 製品の発売

- その他

第15章 企業プロファイル

- 主要企業

- SIEMENS

- DASSAULT SYSTEMES

- ACCENTURE

- SAP

- BAE SYSTEMS

- AVEVA GROUP PLC

- HEXAGON

- ALTAIR ENGINEERING, INC.

- WARTSILA

- INMARSAT

- KUKA AG

- IFS AB

- PEMAMEK LTD.

- ARAS

- KREYON SYSTEMS

- SSI

- IBASET

- PROSTEP AG

- KRANENDONK SMART ROBOTICS

- DAMEN SHIPYARDS GROUP

- THYSSENKRUPP MARINE SYSTEMS

- NAVANTIA

- BUREAU VERITAS

- CADMATIC

- INROTECH

第16章 付録

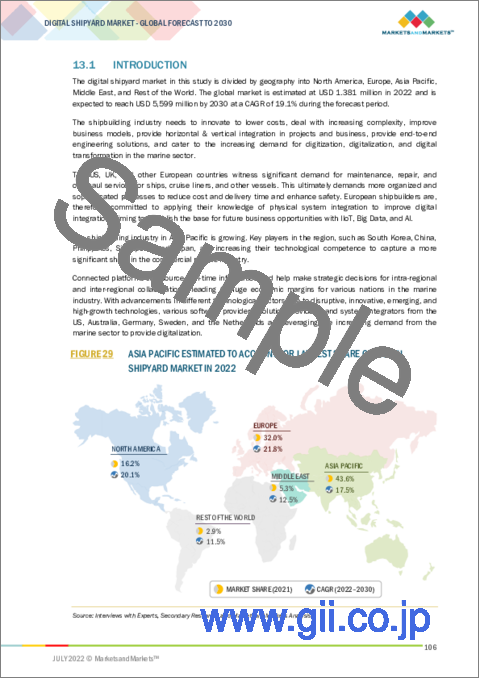

The Digital Shipyard Market is projected to grow from USD 1.3 billion in 2022 to USD 5.5 billion by 2030, at a CAGR of 19.1% during the forecast period.

The digital shipyard vision involves the establishment of smart infrastructure designed to create a smart product and a delivery model that provides ongoing operational support and support services to customers. Product lifecycle management (PLM), digital twins, and 3D modeling functionalities in shipbuilding enable 360 degrees of integration of the product (production and design processes), enabling the complete and continuous inspection of the product and parts from the design phase through to when the product is decommissioned

Many players are currently investing in advancements in manufacturing processes to cater to the demand for high-quality systems. Increasing investments in R&D to develop lightweight components are also leading to technological advancements. A rise in demand for increased efficiency and improved resiliency are expected to fuel the market for Digital Shipyard, leading to new revenue opportunities for players in the market.

Commercial Shipyard segment to witness highest growth in the forecast period

By Shipyard Type, the commercial shipyard segment is expected to growth the highest in the forecast period. Commercial shipyards have started to vertically integrate, undertaking tasks needed to build ships from new materials. These shipyards accommodate large passenger ships, large cargo ships, cruises, ferries, workboats, etc. The demand for commercial shipyards has increased in the global marketplace due to its driving factors such as the high volume of business that depends on simple forming & welding processes, comparatively lesser engineering support, and simpler acquisition process.

Large shipyards to witness large market share in 2022.

Based on Capacity, the Large shipyard are witnessing largest market share in 2022. Large shipyards are comparatively specialized in high-value-added niche markets and corresponding production processes. With the help of various solutions, these shipyards optimize their business model by outsourcing or sharing certain tasks or complete business processes, which increases the market availability for various small and medium-sized shipyards, software & solution providers, and system integrators, etc.

Break-up of profile of primary participants in the digital shipyard market:

- By Company Type: Tier 1 - 20%, Tier 2 - 55%, and Tier 3 - 25%

- By Designation: C Level - 50%, Director Level - 25%, and Others - 25%

- By Region: North America -60%, Europe - 20%, AsiaPacific - 10%,South America- 5%, and RoW - 5%

Major players operating in the digital shipyard market include Siemens (Germany), Dassault Systemes (France), Accenture (Ireland), SAP (Germany), BAE Systems (UK)among others. These key players offer digital shipyard solutions and services to different key stakeholders.

Research Coverage:

This research report categorizes the digital shipyard market on the basis of Shipyard Type (Commercial, Military), by Capacity (Large, Medium, Small), by Process, by Technology, By End Use (Implementation, Upgrades & Services), by Digitalization Level. These segments have been mapped across major regions, namely, North America, Europe, Asia Pacific, Middle East,Rest of the World. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the digital shipyard market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; new product launches; mergers; and partnerships, agreements, and collaborations; and recent developments associated with the digital shipyard market. In addition, the startups in digital shipyard market ecosystem are covered in this report to provide usable insights and developments happening in the emerging market of digital shipyard.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall digital shipyard market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on digital shipyard market offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches, contracts, agreements, and expansion plans in the digital shipyard market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the digital shipyard market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the digital shipyard market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the digital shipyard market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN DIGITAL SHIPYARD MARKET

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD YEARLY AVERAGE EXCHANGE RATES

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- FIGURE 1 DIGITAL SHIPYARD MARKET TO GROW AT HIGHER RATE THAN PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.2 DEMAND- AND SUPPLY-SIDE ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 Procurement of advanced vessels by navies worldwide

- 2.2.2.2 Rise in global seaborne trade

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.3.1 High regulations and need for reduced overheads

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 SEGMENTS AND SUBSEGMENTS

- 2.4 RESEARCH APPROACH AND METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Digital shipyard market: Bottom-up approach

- 2.4.1.2 Digital shipyard market, by shipyard type

- 2.4.1.3 Digital shipyard market, by capacity

- 2.4.1.4 Digital shipyard market, by end use

- 2.4.1.5 Digital shipyard market, by process

- 2.4.1.6 Digital shipyard market, by country

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.3 TRIANGULATION THROUGH SECONDARY RESEARCH

- FIGURE 6 DATA TRIANGULATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 GROWTH RATE ASSUMPTIONS

- 2.5.2 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5.3 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 7 COMMERCIAL SHIPYARD SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 MANUFACTURING & PLANNING SEGMENT HAD LARGEST MARKET IN 2021

- FIGURE 9 ASIA PACIFIC DOMINATED DIGITAL SHIPYARD MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN DIGITAL SHIPYARD MARKET

- FIGURE 10 INCREASING NEED FOR ADVANCED MANUFACTURING SOLUTIONS IN SHIPBUILDING EXPECTED TO DRIVE MARKET FROM 2022 TO 2030

- 4.2 DIGITAL SHIPYARD MARKET, END USE

- FIGURE 11 IMPLEMENTATION SEGMENT TO LEAD MARKET FROM 2022 TO 2030

- 4.3 DIGITAL SHIPYARD MARKET, BY CAPACITY

- FIGURE 12 LARGE SHIPYARD SEGMENT PROJECTED TO HAVE HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 DIGITAL SHIPYARD MARKET, BY COUNTRY

- FIGURE 13 DIGITAL SHIPYARD MARKET IN UK PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2030

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DIGITAL SHIPYARD: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Product lifecycle management (PLM) solutions

- 5.2.1.2 Cloud-based maintenance systems

- 5.2.1.3 New manufacturing technologies in shipbuilding

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increased vulnerability to cyber threats

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Digital twin in shipbuilding industry

- 5.2.3.2 Augmented reality in shipbuilding

- 5.2.4 CHALLENGES

- 5.2.4.1 High acquisition costs of digital shipyard software solutions

- 5.3 OPERATIONAL DATA

- TABLE 3 TOTAL SHIPYARD TYPES ACROSS REGIONS, 2021

- 5.4 PRICING ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE RANGE: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY (USD)

- FIGURE 15 PRICING ANALYSIS FOR DIGITAL SHIPYARD SOLUTIONS, BY TECHNOLOGY (USD)

- 5.5 VALUE CHAIN

- FIGURE 16 VALUE CHAIN ANALYSIS

- 5.6 DIGITAL SHIPYARD MARKET ECOSYSTEM

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 PRIVATE AND SMALL ENTERPRISES

- 5.6.3 END USERS

- FIGURE 17 DIGITAL SHIPYARD MARKET ECOSYSTEM MAP

- TABLE 5 DIGITAL SHIPYARD MARKET ECOSYSTEM

- 5.7 TRADE DATA STATISTICS

- TABLE 6 TRADE DATA TABLE FOR SHIPYARD

- 5.8 TECHNOLOGY TRENDS IN DIGITAL SHIPYARD MARKET

- 5.8.1 DIGITAL TWIN

- 5.8.2 INTERNET OF THINGS (IOT)

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 KD MARINE DESIGN IMPLEMENTS AR AND VR INNOVATIONS TO STREAMLINE SHIP DESIGN

- 5.9.2 3D DESIGN IN JAPANESE SHIPBUILDING

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DIGITAL SHIPYARD PRODUCT AND SOLUTION MANUFACTURERS

- FIGURE 18 REVENUE SHIFT IN DIGITAL SHIPYARD MARKET

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 DIGITAL SHIPYARD MARKET: PORTER'S FIVE FORCE ANALYSIS

- FIGURE 19 DIGITAL SHIPYARD MARKET: PORTER'S FIVE FORCE ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF DIGITAL SHIPYARD PRODUCTS AND SOLUTIONS

- TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF DIGITAL SHIPYARD PRODUCTS AND SOLUTIONS (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 21 KEY BUYING CRITERIA FOR DIGITAL SHIPYARD PRODUCTS AND SOLUTIONS

- TABLE 9 KEY BUYING CRITERIA FOR DIGITAL SHIPYARD PRODUCTS AND SOLUTIONS

- 5.13 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 10 DIGITAL SHIPYARD MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGICAL ADVANCEMENTS IN SHIPYARDS

- 6.2.1 AUGMENTED REALITY

- 6.2.2 BLOCKCHAIN

- 6.2.3 ROBOTICS

- 6.3 EMERGING TRENDS IN SHIPBUILDING

- 6.3.1 3D PRINTING

- 6.3.2 BIG DATA

- 6.3.3 PREDICTIVE MAINTENANCE

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 22 DIGITAL SHIPYARD MARKET: SUPPLY CHAIN ANALYSIS

- 6.5 USE CASES

- 6.5.1 DAMEN SHIPYARD IN COLLABORATION WITH RAMLAB TO MANUFACTURE FIRST 3D-PRINTED PROPELLER

- 6.5.2 DEMATEC TO DEVELOP DIGITAL PLATFORM CAPABILITY FOR BAE SYSTEMS SHIPYARD IN AUSTRALIA

- 6.5.3 PEMAMEK DESIGNED MODULAR PLATFORM SOLUTION TO FACILITATE PROCESSES WITH PROSTEP AG

- 6.6 INNOVATION AND PATENT ANALYSIS

- TABLE 15 INNOVATIONS AND PATENT REGISTRATIONS

7 DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE

- 7.1 INTRODUCTION

- FIGURE 23 DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030

- TABLE 16 DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 17 DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- 7.2 COMMERCIAL SHIPYARDS

- 7.2.1 INCREASING MARITIME TRADE BOOSTS DEMAND FOR COMMERCIAL SHIPYARDS

- 7.3 MILITARY SHIPYARDS

- 7.3.1 PROCUREMENT OF ADVANCED VESSELS BY NAVIES WORLDWIDE DRIVES SEGMENT

8 DIGITAL SHIPYARD MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- FIGURE 24 DIGITAL SHIPYARD MARKET SHARE, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 18 DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 19 DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- 8.2 AUGMENTED & VIRTUAL REALITY (AR & VR)

- 8.2.1 AR & VR DEVICES FOR SHIPBUILDING TO AID MARKET GROWTH

- 8.3 DIGITAL TWIN & SIMULATION

- 8.3.1 DIGITAL TWIN & SIMULATION TO BE EMERGING TECHNOLOGIES

- 8.4 ADDITIVE MANUFACTURING

- 8.4.1 ADDITIVE MANUFACTURING ASSISTS NAVIES IN DESIGNING AND ENGINEERING SOLUTIONS

- 8.5 ARTIFICIAL INTELLIGENCE & BIG DATA ANALYTICS

- 8.5.1 INCREASING GLOBAL MARITIME TRADE FUELS DEMAND FOR AI-POWERED ANALYTICS

- 8.6 ROBOTIC PROCESS AUTOMATION

- 8.6.1 SOPHISTICATED AND TIME-SAVING SOLUTIONS TO DRIVE DEMAND

- 8.7 INDUSTRIAL INTERNET OF THINGS (IIOT)

- 8.7.1 DEMAND FOR TECHNOLOGICAL ADVANCEMENTS TO BOOST SEGMENT

- 8.8 CYBERSECURITY

- 8.8.1 NEED TO COMBAT INCREASING CYBERTHREATS TO FUEL SEGMENT

- 8.9 BLOCKCHAIN

- 8.9.1 RISING DEMAND FOR BLOCKCHAIN TECHNOLOGY IN MEDIUM AND LARGE SHIPYARDS

- 8.10 CLOUD COMPUTING & MASTER DATA MANAGEMENT

- 8.10.1 INCREASED ADOPTION OF PLM AND CLOUD-BASED MAINTENANCE SYSTEMS ACROSS SHIPBUILDING

9 DIGITAL SHIPYARD MARKET, BY CAPACITY

- 9.1 INTRODUCTION

- FIGURE 25 DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030

- TABLE 20 DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 21 DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- 9.2 SMALL SHIPYARD

- 9.2.1 INCREASE IN MODERNIZATION PLANS OF SMALL SHIPYARDS DRIVES MARKET

- 9.3 MEDIUM SHIPYARD

- 9.3.1 SMART SOLUTIONS TO INCREASE MARKET SHARE FOR MEDIUM SHIPYARDS

- 9.4 LARGE SHIPYARD

- 9.4.1 UPGRADING AND PROCUREMENT PLANS BY NAVIES GLOBALLY DRIVE SEGMENT

10 DIGITAL SHIPYARD MARKET, BY PROCESS

- 10.1 INTRODUCTION

- FIGURE 26 DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030

- TABLE 22 DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 23 DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 10.2 RESEARCH & DEVELOPMENT

- 10.2.1 DEMAND FOR MODERNIZATION DRIVES R&D ACTIVITIES IN DIGITAL SHIPYARDS

- 10.3 DESIGN & ENGINEERING

- 10.3.1 DEMAND FOR SOPHISTICATED DESIGN & ENGINEERING SOLUTIONS TO INCREASE

- 10.4 MANUFACTURING & PLANNING

- 10.4.1 USE OF ADVANCED MANUFACTURING TECHNOLOGIES AND PLM SOLUTIONS ON RISE

- 10.5 MAINTENANCE & SUPPORT

- 10.5.1 HIGH-END TECHNOLOGIES FOR MAINTENANCE & SUPPORT OF PRODUCTS & SERVICES DRIVE SEGMENT

- 10.6 TRAINING & SIMULATION

- 10.6.1 TRAINING & SIMULATION PROGRAMS FOR SKILLED WORKFORCE EXPECTED TO BE HIGH

11 DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL

- 11.1 INTRODUCTION

- FIGURE 27 DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2022-2030

- TABLE 24 DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2018-2021 (USD MILLION)

- TABLE 25 DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2022-2030 (USD MILLION)

- 11.2 FULLY DIGITAL SHIPYARD

- 11.2.1 PROCUREMENT PLANS FOR ADVANCED VESSELS BY NAVIES GLOBALLY TO DRIVE SEGMENT

- 11.3 SEMI DIGITAL SHIPYARD

- 11.3.1 MODERNIZATION PLANS TO LEAD GROWTH IN SMALL AND MEDIUM-SIZED SEMI DIGITAL SHIPYARDS

- 11.4 PARTIALLY DIGITAL SHIPYARD

- 11.4.1 INCREASE IN ADOPTION OF PLM SOLUTIONS DRIVES MARKET

12 DIGITAL SHIPYARD MARKET, BY END USE

- 12.1 INTRODUCTION

- FIGURE 28 DIGITAL SHIPYARD MARKET, BY END USE, 2022-2030 (USD MILLION)

- TABLE 26 DIGITAL SHIPYARD MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 27 DIGITAL SHIPYARD MARKET, BY END USE, 2022-2030 (USD MILLION)

- 12.2 IMPLEMENTATION

- 12.2.1 PROCUREMENT PLANS BY NAVIES DRIVE IMPLEMENTATION OF DISRUPTIVE TECHNOLOGIES IN SHIPYARDS

- 12.3 UPGRADES & SERVICES

- 12.3.1 NEED TO UPGRADE EXISTING TECHNOLOGIES DRIVES SEGMENT GROWTH

13 REGIONAL ANALYSIS

- 13.1 INTRODUCTION

- FIGURE 29 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF DIGITAL SHIPYARD MARKET IN 2022

- TABLE 28 DIGITAL SHIPYARD MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 29 DIGITAL SHIPYARD MARKET, BY REGION, 2022-2030 (USD MILLION)

- 13.2 NORTH AMERICA

- FIGURE 30 NORTH AMERICA: DIGITAL SHIPYARD MARKET SNAPSHOT

- 13.2.1 PESTLE ANALYSIS: NORTH AMERICA

- TABLE 30 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 31 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 32 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 33 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 34 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 35 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 36 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 37 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- TABLE 38 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2018-2021 (USD MILLION)

- TABLE 39 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2022-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 41 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY END USE, 2022-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 43 NORTH AMERICA: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 13.2.2 US

- 13.2.2.1 Modern technologies led to digitalization of shipyards in US

- TABLE 44 US: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 45 US: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 46 US: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 47 US: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 48 US: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 49 US: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.2.3 CANADA

- 13.2.3.1 Shipyards in Canada to move toward Industry 4.0

- TABLE 50 CANADA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 51 CANADA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 52 CANADA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 53 CANADA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 54 CANADA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 55 CANADA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.3 EUROPE

- FIGURE 31 EUROPE: DIGITAL SHIPYARD MARKET SNAPSHOT

- 13.3.1 PESTLE ANALYSIS: EUROPE

- TABLE 56 EUROPE: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 57 EUROPE: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 58 EUROPE: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 59 EUROPE: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 60 EUROPE: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 61 EUROPE: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 62 EUROPE: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 63 EUROPE: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- TABLE 64 EUROPE: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2018-2021 (USD MILLION)

- TABLE 65 EUROPE: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2022-2030 (USD MILLION)

- TABLE 66 EUROPE: DIGITAL SHIPYARD MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 67 EUROPE: DIGITAL SHIPYARD MARKET, BY END USE, 2022-2030 (USD MILLION)

- TABLE 68 EUROPE: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 69 EUROPE: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 13.3.2 UK

- 13.3.2.1 Strong currency value of UK over US drives growth in maritime sector

- TABLE 70 UK: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 71 UK: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 72 UK: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 73 UK: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 74 UK: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 75 UK: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.3.3 GERMANY

- 13.3.3.1 Expansion of shipyards to lead to digitalization

- TABLE 76 GERMANY: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 77 GERMANY: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 78 GERMANY: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 79 GERMANY: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 80 GERMANY: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 81 GERMANY: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.3.4 FRANCE

- 13.3.4.1 Acquisitions and collaborations to drive market

- TABLE 82 FRANCE: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 83 FRANCE: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 84 FRANCE: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 85 FRANCE: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 86 FRANCE: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 87 FRANCE: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.3.5 ITALY

- 13.3.5.1 Modernization and procurement plans in navy to result in digitalization of shipyards

- TABLE 88 ITALY: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 89 ITALY: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 90 ITALY: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 91 ITALY: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 92 ITALY: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 93 ITALY: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.3.6 NETHERLANDS

- 13.3.6.1 Highly successful network of shipyards, suppliers, and service providers to aid market growth

- TABLE 94 NETHERLANDS: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 95 NETHERLANDS: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 96 NETHERLANDS: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 97 NETHERLANDS: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 98 NETHERLANDS: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 99 NETHERLANDS: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.3.7 SPAIN

- 13.3.7.1 Complex construction projects in shipyards to attract investments in modernization programs

- TABLE 100 SPAIN: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 101 SPAIN: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 102 SPAIN: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 103 SPAIN: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 104 SPAIN: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 105 SPAIN: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.3.8 REST OF EUROPE

- 13.3.8.1 Collaborations, contracts, and aftermarket services to enhance maritime presence

- TABLE 106 REST OF EUROPE: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 107 REST OF EUROPE: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 108 REST OF EUROPE: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 109 REST OF EUROPE: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 110 REST OF EUROPE: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 111 REST OF EUROPE: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.4 ASIA PACIFIC

- FIGURE 32 ASIA PACIFIC: DIGITAL SHIPYARD MARKET SNAPSHOT

- 13.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- TABLE 112 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 113 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 115 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 117 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 119 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2018-2021 (USD MILLION)

- TABLE 121 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2022-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 123 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY END USE, 2022-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 13.4.2 CHINA

- 13.4.2.1 Advancements in marine industry fuel demand for digitalization in China

- TABLE 126 CHINA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 127 CHINA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 128 CHINA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 129 CHINA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 130 CHINA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 131 CHINA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.4.3 SOUTH KOREA

- 13.4.3.1 Major shipyard mergers to give stiff competition to rival yards

- TABLE 132 SOUTH KOREA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 133 SOUTH KOREA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 134 SOUTH KOREA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 135 SOUTH KOREA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 136 SOUTH KOREA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 137 SOUTH KOREA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.4.4 JAPAN

- 13.4.4.1 Shipbuilders to leverage technical capability and R&D resources

- TABLE 138 JAPAN: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 139 JAPAN: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 140 JAPAN: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 141 JAPAN: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 142 JAPAN: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 143 JAPAN: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.4.5 RUSSIA

- 13.4.5.1 Geographic location allows leveraging high-end technologies

- TABLE 144 RUSSIA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 145 RUSSIA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 146 RUSSIA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 147 RUSSIA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 148 RUSSIA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 149 RUSSIA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.4.6 INDIA

- 13.4.6.1 Shows remarkable progress in use of new technologies and initiatives

- TABLE 150 INDIA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 151 INDIA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 152 INDIA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 153 INDIA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 154 INDIA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 155 INDIA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.4.7 AUSTRALIA

- 13.4.7.1 Transformation of shipbuilding industry to develop market

- TABLE 156 AUSTRALIA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 157 AUSTRALIA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 158 AUSTRALIA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 159 AUSTRALIA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 160 AUSTRALIA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 161 AUSTRALIA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.4.8 REST OF ASIA PACIFIC

- 13.4.8.1 New technologies and sophisticated processes drive digitalization opportunities

- TABLE 162 REST OF ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.5 MIDDLE EAST

- 13.5.1 PESTLE ANALYSIS: MIDDLE EAST

- TABLE 168 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 169 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 171 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 173 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 174 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 175 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- TABLE 176 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2018-2021 (USD MILLION)

- TABLE 177 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2022-2030 (USD MILLION)

- TABLE 178 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 179 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY END USE, 2022-2030 (USD MILLION)

- TABLE 180 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 181 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 13.5.2 UAE

- 13.5.2.1 Adopting cutting-edge technologies to bring higher operational efficiency

- TABLE 182 UAE: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 183 UAE: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 184 UAE: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 185 UAE: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 186 UAE: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 187 UAE: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.5.3 TURKEY

- 13.5.3.1 Construction of modern and large ships to increase

- TABLE 188 TURKEY: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 189 TURKEY: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 190 TURKEY: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 191 TURKEY: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 192 TURKEY: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 193 TURKEY: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.5.4 REST OF MIDDLE EAST

- 13.5.4.1 Development of new shipyards to provide scope for digitalization

- TABLE 194 REST OF MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 195 REST OF MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 196 REST OF MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 197 REST OF MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 198 REST OF MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 199 REST OF MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.6 REST OF THE WORLD

- 13.6.1 PESTLE ANALYSIS: REST OF THE WORLD

- TABLE 200 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 201 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 202 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 203 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 204 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 205 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 206 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 207 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- TABLE 208 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2018-2021 (USD MILLION)

- TABLE 209 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2022-2030 (USD MILLION)

- TABLE 210 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 211 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY END USE, 2022-2030 (USD MILLION)

- TABLE 212 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 213 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 13.6.2 LATIN AMERICA

- 13.6.2.1 Shipping sector to witness growth by overseas investments

- TABLE 214 LATIN AMERICA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 215 LATIN AMERICA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 216 LATIN AMERICA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 217 LATIN AMERICA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 218 LATIN AMERICA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 219 LATIN AMERICA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

- 13.6.3 AFRICA

- 13.6.3.1 Presence of aftermarket service companies to drive market growth

- TABLE 220 AFRICA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018-2021 (USD MILLION)

- TABLE 221 AFRICA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022-2030 (USD MILLION)

- TABLE 222 AFRICA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 223 AFRICA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022-2030 (USD MILLION)

- TABLE 224 AFRICA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 225 AFRICA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022-2030 (USD MILLION)

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 MARKET SHARE ANALYSIS, 2021

- TABLE 226 DEGREE OF COMPETITION

- FIGURE 33 MARKET SHARE OF TOP PLAYERS IN DIGITAL SHIPYARD MARKET, 2021 (%)

- 14.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2021

- FIGURE 34 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS IN DIGITAL SHIPYARD MARKET

- 14.4 COMPANY EVALUATION QUADRANT

- 14.4.1 STARS

- 14.4.2 EMERGING LEADERS

- 14.4.3 PERVASIVE PLAYERS

- 14.4.4 PARTICIPANTS

- FIGURE 35 DIGITAL SHIPYARD MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- TABLE 227 COMPANY PRODUCT FOOTPRINT

- TABLE 228 COMPANY FOOTPRINT BY TYPE

- TABLE 229 COMPANY FOOTPRINT BY END USE

- TABLE 230 COMPANY REGION FOOTPRINT

- 14.5 STARTUPS/SME EVALUATION QUADRANT

- 14.5.1 PROGRESSIVE COMPANIES

- 14.5.2 RESPONSIVE COMPANIES

- 14.5.3 DYNAMIC COMPANIES

- 14.5.4 STARTING BLOCKS

- FIGURE 36 DIGITAL SHIPYARD MARKET STARTUPS/SME COMPETITIVE LEADERSHIP MAPPING, 2021

- 14.6 COMPETITIVE BENCHMARKING

- TABLE 231 DIGITAL SHIPYARD MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 232 DIGITAL SHIPYARD MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- 14.7 COMPETITIVE SCENARIO

- 14.7.1 DEALS

- TABLE 233 DEALS, 2018-2022

- 14.7.2 PRODUCT LAUNCHES

- TABLE 234 PRODUCT LAUNCHES, 2018-2022

- 14.7.3 OTHERS

- TABLE 235 OTHERS: 2018-2022

15 COMPANY PROFILES

- 15.1 KEY COMPANIES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)**

- 15.1.1 SIEMENS

- TABLE 236 SIEMENS: BUSINESS OVERVIEW

- FIGURE 37 SIEMENS: COMPANY SNAPSHOT

- TABLE 237 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 SIEMENS: DEALS

- TABLE 239 SIEMENS: PRODUCT LAUNCHES

- TABLE 240 SIEMENS: OTHERS

- 15.1.2 DASSAULT SYSTEMES

- TABLE 241 DASSAULT SYSTEMES: BUSINESS OVERVIEW

- FIGURE 38 DASSAULT SYSTEMES: COMPANY SNAPSHOT

- TABLE 242 DASSAULT SYSTEMES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 DASSAULT SYSTEMES: DEALS

- 15.1.3 ACCENTURE

- TABLE 244 ACCENTURE: BUSINESS OVERVIEW

- FIGURE 39 ACCENTURE: COMPANY SNAPSHOT

- TABLE 245 ACCENTURE: DEALS

- 15.1.4 SAP

- TABLE 246 SAP: BUSINESS OVERVIEW

- FIGURE 40 SAP: COMPANY SNAPSHOT

- TABLE 247 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 SAP: DEALS

- 15.1.5 BAE SYSTEMS

- TABLE 249 BAE SYSTEMS: BUSINESS OVERVIEW

- FIGURE 41 BAE SYSTEMS: COMPANY SNAPSHOT

- TABLE 250 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 BAE SYSTEMS: DEALS

- 15.1.6 AVEVA GROUP PLC

- TABLE 252 AVEVA GROUP PLC: BUSINESS OVERVIEW

- FIGURE 42 AVEVA GROUP PLC: COMPANY SNAPSHOT

- TABLE 253 AVEVA GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 AVEVA GROUP PLC: DEALS

- TABLE 255 AVEVA GROUP PLC: PRODUCT LAUNCHES

- 15.1.7 HEXAGON

- TABLE 256 HEXAGON: BUSINESS OVERVIEW

- FIGURE 43 HEXAGON: COMPANY SNAPSHOT

- TABLE 257 HEXAGON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 HEXAGON: DEALS

- TABLE 259 HEXAGON: PRODUCT LAUNCHES

- 15.1.8 ALTAIR ENGINEERING, INC.

- TABLE 260 ALTAIR ENGINEERING, INC.: BUSINESS OVERVIEW

- FIGURE 44 ALTAIR ENGINEERING, INC.: COMPANY SNAPSHOT

- TABLE 261 ALTAIR ENGINEERING, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 ALTAIR ENGINEERING, INC.: DEALS

- TABLE 263 ALTAIR ENGINEERING, INC.: PRODUCT LAUNCHES

- 15.1.9 WARTSILA

- TABLE 264 WARTSILA: BUSINESS OVERVIEW

- FIGURE 45 WARTSILA: COMPANY SNAPSHOT

- TABLE 265 WARTSILA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 WARTSILA: DEALS

- TABLE 267 WARTSILA: PRODUCT LAUNCHES

- 15.1.10 INMARSAT

- TABLE 268 INMARSAT: BUSINESS OVERVIEW

- FIGURE 46 INMARSAT: COMPANY SNAPSHOT

- TABLE 269 INMARSAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 INMARSAT: DEALS

- TABLE 271 INMARSAT: PRODUCT LAUNCHES

- 15.1.11 KUKA AG

- TABLE 272 KUKA AG: BUSINESS OVERVIEW

- FIGURE 47 KUKA AG: COMPANY SNAPSHOT

- TABLE 273 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 KUKA AG: DEALS

- 15.1.12 IFS AB

- TABLE 275 IFS AB: BUSINESS OVERVIEW

- TABLE 276 IFS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 IFS AB: DEALS

- 15.1.13 PEMAMEK LTD.

- TABLE 278 PEMAMEK LTD.: BUSINESS OVERVIEW

- TABLE 279 PEMAMEK LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 PEMAMEK LTD.: DEALS

- TABLE 281 PEMAMEK LTD.: PRODUCT LAUNCHES

- TABLE 282 PEMAMEK LTD.: OTHERS

- 15.1.14 ARAS

- TABLE 283 ARAS: BUSINESS OVERVIEW

- TABLE 284 ARAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 ARAS: DEALS

- TABLE 286 ARAS: PRODUCT LAUNCHES

- 15.1.15 KREYON SYSTEMS

- TABLE 287 KREYON SYSTEMS: BUSINESS OVERVIEW

- TABLE 288 KREYON SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.1.16 SSI

- TABLE 289 SSI: BUSINESS OVERVIEW

- TABLE 290 SSI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.1.17 IBASET

- TABLE 291 IBASET: BUSINESS OVERVIEW

- TABLE 292 IBASET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 IBASET: DEALS

- TABLE 294 IBASET: PRODUCT LAUNCHES

- 15.1.18 PROSTEP AG

- TABLE 295 PROSTEP AG: BUSINESS OVERVIEW

- TABLE 296 PROSTEP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 PROSTEP AG: DEALS

- TABLE 298 PROSTEP AG: PRODUCT LAUNCHES

- 15.1.19 KRANENDONK SMART ROBOTICS

- TABLE 299 KRANENDONK SMART ROBOTICS: BUSINESS OVERVIEW

- TABLE 300 KRANENDONK SMART ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 KRANENDONK SMART ROBOTICS: DEALS

- TABLE 302 KRANENDONK SMART ROBOTICS: PRODUCT LAUNCHES

- 15.1.20 DAMEN SHIPYARDS GROUP

- TABLE 303 DAMEN SHIPYARDS GROUP: BUSINESS OVERVIEW

- TABLE 304 DAMEN SHIPYARDS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 DAMEN SHIPYARDS GROUP: DEALS

- TABLE 306 DAMEN SHIPYARDS GROUP: PRODUCT LAUNCHES

- 15.1.21 THYSSENKRUPP MARINE SYSTEMS

- TABLE 307 THYSSENKRUPP MARINE SYSTEMS: BUSINESS OVERVIEW

- TABLE 308 THYSSENKRUPP MARINE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 THYSSENKRUPP MARINE SYSTEMS: DEALS

- 15.1.22 NAVANTIA

- TABLE 310 NAVANTIA: BUSINESS OVERVIEW

- TABLE 311 NAVANTIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 NAVANTIA: DEALS

- TABLE 313 NAVANTIA: PRODUCT LAUNCHES

- 15.1.23 BUREAU VERITAS

- TABLE 314 BUREAU VERITAS: BUSINESS OVERVIEW

- TABLE 315 BUREAU VERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 BUREAU VERITAS: DEALS

- TABLE 317 BUREAU VERITAS: PRODUCT LAUNCHES

- 15.1.24 CADMATIC

- TABLE 318 CADMATIC: BUSINESS OVERVIEW

- TABLE 319 CADMATIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 CADMATIC: DEALS

- 15.1.25 INROTECH

- TABLE 321 INROTECH: BUSINESS OVERVIEW

- TABLE 322 INROTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 INROTECH: DEALS

- * Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS