|

|

市場調査レポート

商品コード

1083118

土壌改良資材の世界市場:タイプ(有機、無機)、土壌タイプ(砂、ローム、粘土、シルト)、作物タイプ(穀類・穀物、油糧種子・豆類、果物・野菜)、形状(乾燥、液体)、地域別 - 2027年までの予測Soil Amendments Market by Type (Organic, Inorganic), Soil Type (Sand, Loam, Clay, Slit), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), Form (Dry and Liquid) and Region (North America, Europe, APAC, Row) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 土壌改良資材の世界市場:タイプ(有機、無機)、土壌タイプ(砂、ローム、粘土、シルト)、作物タイプ(穀類・穀物、油糧種子・豆類、果物・野菜)、形状(乾燥、液体)、地域別 - 2027年までの予測 |

|

出版日: 2022年06月01日

発行: MarketsandMarkets

ページ情報: 英文 225 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の土壌改良資材の市場規模は、予測期間中に11.0%のCAGRで推移し、2022年の36億米ドルから、2027年までに60億米ドルに達すると予測されています。

タイプ別市場では、有機土壌改良資材が全体の89.7%のシェア(金額)を占めています。持続可能な農業へのシフトや、有機食品の消費増加が、需要拡大の要因となっています。

当レポートでは、世界の土壌改良資材市場について調査し、市場力学、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

- 特許分析

第6章 タイプ別:土壌改良資材市場

- 有機

- バイオ肥料

- 海藻エキス

- フミン酸

- 多糖類誘導体

- 無機

- 石膏

- 石灰

第7章 作物タイプ別:土壌改良資材市場

- 果物・野菜

- 穀類・穀物

- 油糧種子・豆類

- その他

第8章 土壌タイプ別:土壌改良資材市場

- 砂

- 粘土

- シルト

- ローム

第9章 形状別:土壌改良資材市場

- 液体

- 乾燥

第10章 地域別:土壌改良資材市場

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- フランス

- ドイツ

- ロシア

- スペイン

- 英国

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- 南アフリカ

- トルコ

- その他

第11章 競合情勢

- 概要

- 主要企業の収益分析

- 企業評価クアドラント(主要企業)

- その他の企業の評価クアドラント(2021)

- 競合シナリオ

第12章 企業プロファイル

- BASF SE

- UPL

- FMC CORPORATION

- NUFARM

- ADAMA

- EVONIK INDUSTRIES AG

- BAYER

- NOVOZYMES A/S

- AGRINOS

- T.STANES & COMPANY

- LALLEMAND INC

- SA LIME & GYPSUM

- TIMAC AGRO

- BIOSOIL FARMS

- PROFILE PRODUCTS LLC

- THE FERTRELL COMPANY

- HAIFA GROUP

- SYMBORG

- SOIL TECHNOLOGIES CORPORATION

- DELBON

第13章 隣接および関連市場

- 制限

- バイオ肥料市場

- バイオスティミュラント市場

- ソイルコンディショナー市場

第14章 付録

The global soil amendments market is estimated at USD 3.6 Billion in 2022. It is projected to reach USD 6.0 Billion by 2027, recording a CAGR of 11.0 % during the forecast period. Soil amendments are ingredients that are added to the soil to enhance its physical properties. This include permeability, water retention, water infiltration, aeration, drainage, and soil structure. To improve soil health, soil amendments are mixed properly into the soil. The types of soil amendments available in the industry can be classified as organic and inorganic, serving different soils such as sand, loam, clay, and slit.

"North America is projected to witness the growth of 9.8% during the forecast period."

Rise in industrial events is a one of the important factors that has caused soil degradation in the North America. Additionally, North America is a home of several mine which is also responsible for barren soil land and causes erosion by wind and rain. In 2017, soil disappears ten times faster in the US than it is naturally replenished at an estimated rate of nearly 1.7 billion tons of farmland per year, as per the Cornell Study. Plus, it affects the economy leads to loss around USD 37 billion annually in the agricultural production because of soil loss.

The report by Soil Science Society of America suggest, organizations such as the Land Institute and American Farmland Trust are supporting farmers to seek economical soil conservation substitutes and encouraging them to use natural soil amendments to revive the soil.

"The organic soil amendments dominate the market with 89.7% of total market share in value."

The shift toward sustainable agriculture and the rise in consumption of organic foods are factors that have led to a rise in demand for organic soil amendments, which include polysaccharides, humic acid, seaweed extracts, and biofertilizers. Key players, such as BASF SE (Germany), Syngenta (Switzerland), and Bayer (Germany), are majorly involved in producing new biofertilizer products, which are bio-based and do not cause any harm to the environment, unlike their chemical counterparts.

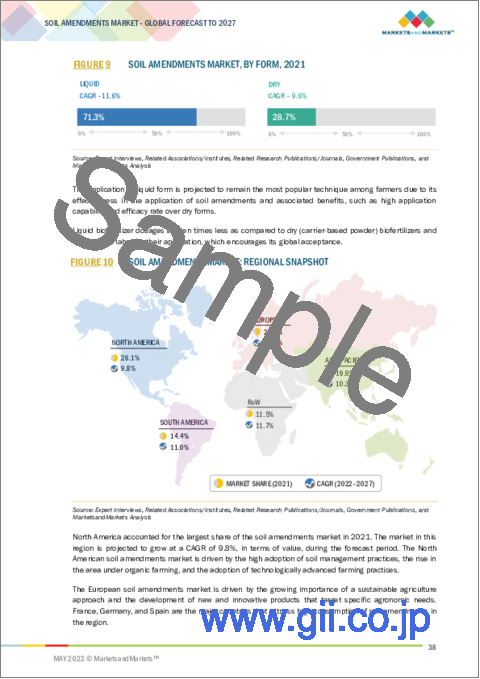

"High efficacy rate to drive the demand for liquid soil amendments."

Liquid formulations of soil amendments include suspensions or solutions that contain microorganisms to make the aerobic fermentation process promote the growth of microbes. The liquid form provides various options for crop growers to mix soil amendments with insecticides, fungicides, or adjuvants. However, liquid formulations differ significantly in the nature of their characteristics that influence the selection, application rate, method of application, and environmental impact. The liquid form is convenient to use and is effective for the application of soil amendments. Therefore, the demand for liquid soil amendments is expected to upsurge in the coming years.

Break-up of Primaries:

- By Company Type: Tier 1 - 45.0%, Tier 2- 30.0%, Tier 3 - 25.0%

- By Designation: Managers - 50.0%, CXOs - 20.0%, and Executives- 30.0%

- By Region: US - 15%, India - 50%, Italy - 15%, South America - 20%

Leading players profiled in this report:

- BASF SE (Germany)

- UPL Limited (India)

- FMC Corporation (US)

- Adma (Israel)

- Nufarm (Australia)

- Evonik Industries (Germany)

- Novozymes A/S (Denmark)

- Bayer (Germany)

- T Stanes & Company (India)

- Lallemand Inc (Canada)

Research Coverage:

The report segments the coconut oil market on the basis of product type, source, nature, application and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global coconut oil, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the coconut oil market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the coconut oil market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 SOIL AMENDMENTS MARKET SEGMENTATION

- FIGURE 2 REGIONS COVERED

- 1.4 PERIODIZATION CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2021

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 RESEARCH DESIGN: SOIL AMENDMENTS MARKET

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

- 2.4.1 ASSUMPTIONS

- 2.4.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

- FIGURE 7 SOIL AMENDMENTS MARKET, BY CROP TYPE, 2022 VS. 2027

- FIGURE 8 SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2022 VS. 2027

- FIGURE 9 SOIL AMENDMENTS MARKET, BY FORM, 2021

- FIGURE 10 SOIL AMENDMENTS MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF THE SOIL AMENDMENTS MARKET

- FIGURE 11 GROWING RISK OF SOIL DEGRADATION AND DESERTIFICATION OF LAND TO DRIVE THE GROWTH OF THE SOIL AMENDMENTS MARKET

- 4.2 SOIL AMENDMENTS MARKET, BY TYPE

- FIGURE 12 ORGANIC SEGMENT OCCUPIED THE LARGEST SHARE IN THE SOIL AMENDMENT MARKET IN 2021

- 4.3 NORTH AMERICA: SOIL AMENDMENTS MARKET, BY CROP TYPE AND KEY COUNTRIES

- FIGURE 13 UNITED STATES WAS THE MAJOR CONSUMER OF SOIL AMENDMENTS IN THE NORTH AMERICAN REGION, 2021

- 4.4 SOIL AMENDMENTS MARKET, BY SOIL TYPE AND REGION

- FIGURE 14 NORTH AMERICA HELD THE LARGEST MARKET SHARE FOR SILT IN 2021

- 4.5 SOIL AMENDMENTS MARKET, BY KEY COUNTRY

- FIGURE 15 GERMANY TO GROW AT THE HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISE IN ORGANIC FARM AREA

- FIGURE 16 ORGANIC FARM AREA GROWTH TREND, BY KEY COUNTRY, 2017-2019 (THOUSAND HA)

- 5.2.2 DECLINE IN ARABLE LAND

- FIGURE 17 ARABLE LAND AREA PER CAPITA, 1960-2050 (HA)

- 5.3 MARKET DYNAMICS

- FIGURE 18 SOIL AMENDMENTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.3.1 DRIVERS

- 5.3.1.1 Easier availability of humic substances as raw materials

- 5.3.1.2 Strong market demand for organic food products and high-value crops

- FIGURE 19 AREA HARVESTED UNDER FRUITS & VEGETABLES, 2013-2017 (MILLION HA)

- 5.3.1.3 Initiatives by government agencies to promote the use of organic amendments

- 5.3.1.4 Growing awareness about soil health management

- 5.3.2 RESTRAINTS

- 5.3.2.1 Supply of adulterated and low-quality products

- 5.3.2.2 Short shelf life of soil amendments

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Incorporation of soil amendments into fertilizer formulations

- 5.3.3.2 Strong growth in developing countries

- 5.3.4 CHALLENGES

- 5.3.4.1 Lack of awareness among farmers

- 5.4 PATENT ANALYSIS

- FIGURE 20 NUMBER OF PATENTS APPROVED FOR HUMIC SUBSTANCES IN THE GLOBAL MARKET, 2017-2022

- FIGURE 21 NUMBER OF PATENTS APPROVED FOR BIOFERTILIZER STRAINS IN THE GLOBAL MARKET, 2017-2022

- FIGURE 22 NUMBER OF PATENTS APPROVED FOR SEAWEED IN THE GLOBAL MARKET, 2017-2022

- FIGURE 23 NUMBER OF PATENTS APPROVED FOR POLYSACCHARIDE DERIVATIVES IN THE GLOBAL MARKET, 2017-2022

- FIGURE 24 NUMBER OF PATENTS APPROVED FOR GYPSUM IN THE GLOBAL MARKET, 2017-2022

- FIGURE 25 NUMBER OF PATENTS APPROVED FOR LIME IN THE GLOBAL MARKET, 2017-2022

- TABLE 2 LIST OF IMPORTANT PATENTS FOR SOIL AMENDMENTS, 2017-2022

6 SOIL AMENDMENTS MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 26 ORGANIC SEGMENT IS PROJECTED TO DOMINATE THE SOIL AMENDMENTS MARKET DURING THE FORECAST PERIOD

- TABLE 3 SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 4 SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- 6.2 ORGANIC

- TABLE 5 ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 6 ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 7 ORGANIC SOIL AMENDMENTS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 8 ORGANIC SOIL AMENDMENTS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- 6.2.1 BIOFERTILIZERS

- 6.2.1.1 Rise in soil pollution and soil degradation drives the soil amendments market

- TABLE 9 BIOFERTILIZERS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 10 BIOFERTILIZERS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- 6.2.2 SEAWEED EXTRACTS

- 6.2.2.1 Increase in global seaweed production to drive the seaweed extract market for soil amendments

- TABLE 11 SEAWEED EXTRACTS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 12 SEAWEED EXTRACTS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- 6.2.3 HUMIC ACID

- 6.2.3.1 Cheaper source of humic acid reduces the cost of soil amendments

- TABLE 13 HUMIC ACID MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 14 HUMIC ACID MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- 6.2.4 POLYSACCHARIDE DERIVATIVES

- 6.2.4.1 Europe dominated the polysaccharide derivatives segment

- TABLE 15 POLYSACCHARIDE DERIVATIVES MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 16 POLYSACCHARIDE DERIVATIVES MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- 6.3 INORGANIC SOIL AMENDMENTS

- TABLE 17 INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 18 INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 19 INORGANIC SOIL AMENDMENTS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 20 INORGANIC SOIL AMENDMENTS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- 6.3.1 GYPSUM

- 6.3.1.1 Ability to improve water infiltration and enhance acidic soils to drive the demand for gypsum as soil amendments

- TABLE 21 GYPSUM MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 22 GYPSUM MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- 6.3.2 LIME

- 6.3.2.1 Lime helps to raise the pH of the soil

- TABLE 23 LIME MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 24 LIME MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

7 SOIL AMENDMENTS MARKET, BY CROP TYPE

- 7.1 INTRODUCTION

- FIGURE 27 SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 25 SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 26 SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 7.2 FRUITS & VEGETABLES

- 7.2.1 ORGANIC SOIL AMENDMENTS ARE HIGHLY PREFERRED FOR THE CULTIVATION OF FRUITS & VEGETABLES

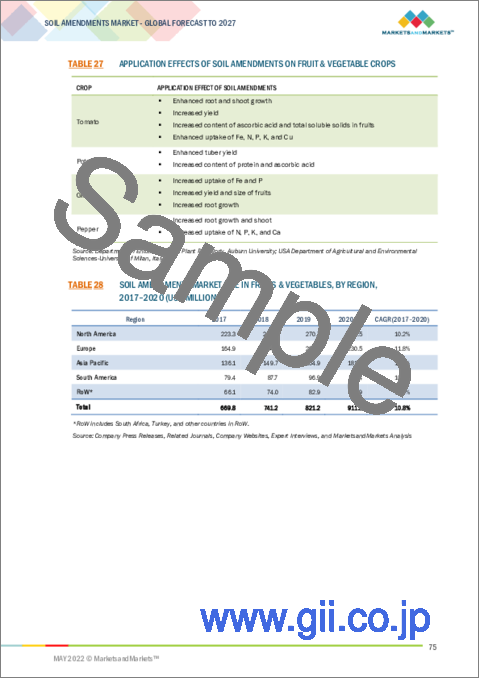

- TABLE 27 APPLICATION EFFECTS OF SOIL AMENDMENTS ON FRUIT & VEGETABLE CROPS

- TABLE 28 SOIL AMENDMENTS MARKET SIZE IN FRUITS & VEGETABLES, BY REGION, 2017-2020 (USD MILLION)

- TABLE 29 SOIL AMENDMENTS MARKET SIZE IN FRUITS & VEGETABLES, BY REGION, 2021-2027 (USD MILLION)

- 7.3 CEREALS & GRAINS

- 7.3.1 APPLICATION OF SOIL AMENDMENTS ON CEREAL CROPS TO IMPROVE THEIR PRODUCTIVITY BY ENHANCING SOIL PROPERTIES

- TABLE 30 SOIL AMENDMENTS MARKET SIZE IN CEREALS & GRAINS, BY REGION, 2017-2020 (USD MILLION)

- TABLE 31 SOIL AMENDMENTS MARKET SIZE IN CEREALS & GRAINS, BY REGION, 2021-2027 (USD MILLION)

- 7.4 OILSEEDS & PULSES

- 7.4.1 HIGH DEMAND FOR BIOFERTILIZERS TO DRIVE THE GROWTH OF THE OILSEEDS & PULSES SEGMENT

- TABLE 32 SOIL AMENDMENTS MARKET SIZE IN OILSEEDS & PULSES, BY REGION, 2017-2020 (USD MILLION)

- TABLE 33 SOIL AMENDMENTS MARKET SIZE IN OILSEEDS & PULSES, BY REGION, 2021-2027 (USD MILLION)

- 7.5 OTHER CROP TYPES

- TABLE 34 SOIL AMENDMENTS MARKET SIZE IN OTHER CROP TYPES, BY REGION, 2017-2020 (USD MILLION)

- TABLE 35 SOIL AMENDMENTS MARKET SIZE IN OTHER CROP TYPES, BY REGION, 2021-2027 (USD MILLION)

8 SOIL AMENDMENTS MARKET, BY SOIL TYPE

- 8.1 INTRODUCTION

- FIGURE 28 SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 36 SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2017-2020 (USD MILLION)

- TABLE 37 SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2021-2027 (USD MILLION)

- 8.2 SAND

- 8.2.1 COMPOST ARE HIGHLY PREFERRED FOR APPLICATION IN SANDY SOILS

- TABLE 38 SOIL AMENDMENTS MARKET SIZE FOR SAND, BY REGION, 2017-2020 (USD MILLION)

- TABLE 39 SOIL AMENDMENTS MARKET SIZE FOR SAND, BY REGION, 2021-2027 (USD MILLION)

- 8.3 CLAY

- 8.3.1 ORGANIC SOIL AMENDMENTS ARE USED ON CLAY SOILS TO LOOSEN THE SOIL TEXTURE AND IMPROVE DRAINAGE

- TABLE 40 SOIL AMENDMENTS MARKET SIZE FOR CLAY, BY REGION, 2017-2020 (USD MILLION)

- TABLE 41 SOIL AMENDMENTS MARKET SIZE FOR CLAY, BY REGION, 2021-2027 (USD MILLION)

- 8.4 SILT

- 8.4.1 APPLICATION OF LIMESTONE BALANCES THE PH OF SILT SOIL

- TABLE 42 SOIL AMENDMENTS MARKET SIZE FOR SILT, BY REGION, 2017-2020 (USD MILLION)

- TABLE 43 SOIL AMENDMENTS MARKET SIZE FOR SILT, BY REGION, 2021-2027 (USD MILLION)

- 8.5 LOAM

- 8.5.1 HIGH FERTILITY OF LOAMY SOIL TO INCREASE THE CULTIVATION OF HIGH-VALUE CROPS

- TABLE 44 SOIL AMENDMENTS MARKET SIZE FOR LOAM, BY REGION, 2017-2020 (USD MILLION)

- TABLE 45 SOIL AMENDMENTS MARKET SIZE FOR LOAM, BY REGION, 2021-2027 (USD MILLION)

9 SOIL AMENDMENTS MARKET, BY FORM

- 9.1 INTRODUCTION

- FIGURE 29 SOIL AMENDMENTS MARKET SIZE, BY FORM, 2022 VS. 2027 (USD BILLION)

- TABLE 46 SOIL AMENDMENTS MARKET SIZE, BY FORM, 2017-2020 (USD MILLION)

- TABLE 47 SOIL AMENDMENTS MARKET SIZE, BY FORM, 2021-2027 (USD MILLION)

- 9.2 LIQUID

- 9.2.1 HIGH EFFICACY RATE TO DRIVE THE DEMAND FOR LIQUID SOIL AMENDMENTS

- TABLE 48 LIQUID SOIL AMENDMENTS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 49 LIQUID SOIL AMENDMENTS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- 9.3 DRY

- 9.3.1 IMPROVED SHELF LIFE TO PROVIDE BETTER OPPORTUNITIES FOR DRY SOIL AMENDMENTS

- TABLE 50 DRY SOIL AMENDMENTS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 51 DRY SOIL AMENDMENTS MARKET, BY REGION, 2021-2027 (USD MILLION)

10 SOIL AMENDMENTS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 30 US: MAJOR SOIL AMENDMENTS MARKET IN 2021

- TABLE 52 SOIL AMENDMENTS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 53 SOIL AMENDMENTS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 31 NORTH AMERICA: SOIL AMENDMENTS MARKET SNAPSHOT, 2021

- TABLE 54 NORTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 55 NORTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 57 NORTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 58 NORTH AMERICA: ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 59 NORTH AMERICA: ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 61 NORTH AMERICA: INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 62 NORTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 63 NORTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- TABLE 64 NORTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2017-2020 (USD MILLION)

- TABLE 65 NORTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2021-2027 (USD MILLION)

- TABLE 66 NORTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY FORM, 2017-2020 (USD MILLION)

- TABLE 67 NORTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY FORM, 2021-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Reclamation of abandoned mines land to drive the market for soil amendments in the US

- TABLE 68 US: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 69 US: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 70 US: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 71 US: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Degrading soil quality of prairies in Canada to increase the demand for organic soil amendments

- TABLE 72 CANADA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 73 CANADA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 74 CANADA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 75 CANADA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.2.3 MEXICO

- 10.2.3.1 Soil degradation due to metal contamination drives the soil amendments market in Mexico

- TABLE 76 MEXICO: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 77 MEXICO: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021- 2027 (USD MILLION)

- TABLE 78 MEXICO: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 79 MEXICO: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.3 EUROPE

- FIGURE 32 EUROPE: SOIL AMENDMENTS MARKET SNAPSHOT, 2021

- TABLE 80 EUROPE: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 81 EUROPE: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 82 EUROPE: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 83 EUROPE: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 84 EUROPE: ORGANIC SOIL AMENDMENTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 85 EUROPE: ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 86 EUROPE: INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 87 EUROPE: INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 88 EUROPE: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2017-2020 (USD MILLION)

- TABLE 89 EUROPE: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2021-2027 (USD MILLION)

- TABLE 90 EUROPE: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 91 EUROPE: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- TABLE 92 EUROPE: SOIL AMENDMENTS MARKET SIZE, BY FORM, 2017-2020 (USD MILLION)

- TABLE 93 EUROPE: SOIL AMENDMENTS MARKET SIZE, BY FORM, 2021-2027 (USD MILLION)

- 10.3.1 FRANCE

- 10.3.1.1 Adoption of organic farming practices to drive the market growth for soil amendments

- TABLE 94 FRANCE: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 95 FRANCE: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 96 FRANCE: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 97 FRANCE: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Increase in awareness about soil health management to drive the growth of the soil amendments market

- TABLE 98 GERMANY: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 99 GERMANY: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 100 GERMANY: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 101 GERMANY: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.3.3 RUSSIA

- 10.3.3.1 Increase in the degradation of soil quality to drive the growth of the soil amendments market

- TABLE 102 RUSSIA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 103 RUSSIA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 104 RUSSIA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 105 RUSSIA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.3.4 SPAIN

- 10.3.4.1 Poor structural conditions of soils encourage the demand for soil amendments

- TABLE 106 SPAIN: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 107 SPAIN: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 108 SPAIN: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 109 SPAIN: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.3.5 UK

- 10.3.5.1 Adoption of intensive farming has led to higher usage of soil amendments

- TABLE 110 UK: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 111 UK: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 112 UK: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 113 UK: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 114 REST OF EUROPE: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 115 REST OF EUROPE: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 116 REST OF EUROPE: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 117 REST OF EUROPE: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- TABLE 118 ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 119 ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 120 ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 121 ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 122 ASIA PACIFIC: ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 123 ASIA PACIFIC: ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 124 ASIA PACIFIC: INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 125 ASIA PACIFIC: INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 126 ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2017-2020 (USD MILLION)

- TABLE 127 ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2021-2027 (USD MILLION)

- TABLE 128 ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 129 ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- TABLE 130 ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY FORM, 2017-2020 (USD MILLION)

- TABLE 131 ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY FORM, 2021-2027 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Growing need to reduce soil erosion drives the demand for organic soil amendments in the Chinese market

- TABLE 132 CHINA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 133 CHINA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 134 CHINA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 135 CHINA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.4.2 INDIA

- 10.4.2.1 Rise in demand for high-value crops to encourage the utilization of soil amendments

- TABLE 136 INDIA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 137 INDIA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 138 INDIA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 139 INDIA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Adoption of sustainable agricultural practices to drive the growth of the Japanese soil amendments market

- TABLE 140 JAPAN: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 141 JAPAN: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 142 JAPAN: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 143 JAPAN: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.4.4 AUSTRALIA

- 10.4.4.1 Increase in preference for organic food has encouraged the adoption of organic soil amendments

- TABLE 144 AUSTRALIA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 145 AUSTRALIA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 146 AUSTRALIA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 147 AUSTRALIA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.4.5 REST OF ASIA PACIFIC

- TABLE 148 REST OF ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- 10.5 SOUTH AMERICA

- TABLE 152 SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 153 SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 154 SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 155 SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 156 SOUTH AMERICA: ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 157 SOUTH AMERICA: ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 158 SOUTH AMERICA: INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 159 SOUTH AMERICA: INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 160 SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2017-2020 (USD MILLION)

- TABLE 161 NORTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2021-2027 (USD MILLION)

- TABLE 162 SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 163 SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- TABLE 164 SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY FORM, 2017-2020 (USD MILLION)

- TABLE 165 SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY FORM, 2021-2027 (USD MILLION)

- 10.5.1 BRAZIL

- 10.5.1.1 Reduction in organic matter in soils to increase the demand for organic soil amendment products in Brazil

- TABLE 166 BRAZIL: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 167 BRAZIL: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 168 BRAZIL: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 169 BRAZIL: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.5.2 ARGENTINA

- 10.5.2.1 Organic amendments dominated the soil amendments market in Argentina

- TABLE 170 ARGENTINA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 171 ARGENTINA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 172 ARGENTINA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 173 ARGENTINA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.5.3 REST OF SOUTH AMERICA

- TABLE 174 REST OF SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 175 REST OF SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 176 REST OF SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 177 REST OF SOUTH AMERICA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.6 REST OF THE WORLD (ROW)

- TABLE 178 ROW: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 179 ROW: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 180 ROW: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 181 ROW: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 182 ROW: ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 183 ROW: ORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 184 ROW: INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 185 ROW: INORGANIC SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 186 ROW: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 187 ROW: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- TABLE 188 ROW: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2017-2020 (USD MILLION)

- TABLE 189 ROW: SOIL AMENDMENTS MARKET SIZE, BY SOIL TYPE, 2021-2027 (USD MILLION)

- TABLE 190 ROW: SOIL AMENDMENTS MARKET SIZE, BY FORM, 2017-2020 (USD MILLION)

- TABLE 191 ROW: SOIL AMENDMENTS MARKET SIZE, BY FORM, 2021-2027 (USD MILLION)

- 10.6.1 SOUTH AFRICA

- 10.6.1.1 Increasing risk of soil erosion and a decrease in agricultural land to drive the market growth

- TABLE 192 SOUTH AFRICA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 193 SOUTH AFRICA: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 194 SOUTH AFRICA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 195 SOUTH AFRICA: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.6.2 TURKEY

- 10.6.2.1 Overgrazing and soil erosion drive the soil amendments market in Turkey

- TABLE 196 TURKEY: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 197 TURKEY: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 198 TURKEY: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 199 TURKEY: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2021-2027 (USD MILLION)

- 10.6.3 OTHERS IN ROW

- TABLE 200 OTHERS IN ROW: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 201 OTHERS IN ROW: SOIL AMENDMENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 202 OTHERS IN ROW: SOIL AMENDMENTS MARKET SIZE, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 203 OTHERS IN ROW: SOIL AMENDMENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 33 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018-2020 (USD BILLION)

- 11.3 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 11.3.1 STARS

- 11.3.2 PERVASIVE PLAYERS

- 11.3.3 EMERGING LEADERS

- 11.3.4 PARTICIPANTS

- FIGURE 34 SOIL AMENDMENTS MARKET, COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 11.3.5 PRODUCT FOOTPRINT

- TABLE 204 COMPANY FOOTPRINT, BY FORM

- TABLE 205 COMPANY FOOTPRINT, BY CROP TYPE

- TABLE 206 COMPANY FOOTPRINT, BY REGION

- 11.4 SOIL AMENDMENTS MARKET, OTHER PLAYERS EVALUATION QUADRANT, 2021

- 11.4.1 PROGRESSIVE COMPANIES

- 11.4.2 STARTING BLOCKS

- 11.4.3 RESPONSIVE COMPANIES

- 11.4.4 DYNAMIC COMPANIES

- FIGURE 35 SOIL AMENDMENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- TABLE 207 SOIL AMENDMENTS MARKET: DETAILED LIST OF KEY STARTUP/SMES

- 11.5 COMPETITIVE SCENARIO

- 11.5.1 NEW PRODUCT LAUNCHES

- TABLE 208 NEW PRODUCT LAUNCHES, 2018-2022

- 11.5.2 EXPANSIONS

- TABLE 209 EXPANSIONS, 2018-2022

- 11.5.3 MERGERS & ACQUISITIONS

- TABLE 210 MERGERS & ACQUISITIONS, 2018-2022

- 11.5.4 PARTNERSHIPS & AGREEMENTS

- TABLE 211 PARTNERSHIPS & AGREEMENTS, 2018-2022

12 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 12.1 BASF SE

- TABLE 212 BASF SE: BUSINESS OVERVIEW

- FIGURE 36 BASF SE: COMPANY SNAPSHOT

- 12.2 UPL

- TABLE 213 UPL: BUSINESS OVERVIEW

- FIGURE 37 UPL: COMPANY SNAPSHOT

- 12.3 FMC CORPORATION

- TABLE 214 FMC CORPORATION: BUSINESS OVERVIEW

- FIGURE 38 FMC CORPORATION: COMPANY SNAPSHOT

- 12.4 NUFARM

- TABLE 215 NUFARM: BUSINESS OVERVIEW

- FIGURE 39 NUFARM: COMPANY SNAPSHOT

- 12.5 ADAMA

- TABLE 216 ADAMA: BUSINESS OVERVIEW

- FIGURE 40 ADAMA: COMPANY SNAPSHOT

- 12.6 EVONIK INDUSTRIES AG

- TABLE 217 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

- FIGURE 41 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- 12.7 BAYER

- TABLE 218 BAYER: BUSINESS OVERVIEW

- FIGURE 42 BAYER: COMPANY SNAPSHOT

- 12.8 NOVOZYMES A/S

- TABLE 219 NOVOZYMES: BUSINESS OVERVIEW

- FIGURE 43 NOVOZYMES: COMPANY SNAPSHOT

- 12.9 AGRINOS

- TABLE 220 AGRINOS: BUSINESS OVERVIEW

- 12.10 T.STANES & COMPANY

- TABLE 221 T.STANES & COMPANY: BUSINESS OVERVIEW

- 12.11 LALLEMAND INC

- TABLE 222 LALLEMAND INC.: BUSINESS OVERVIEW

- 12.12 SA LIME & GYPSUM

- TABLE 223 SA LIME & GYPSUM: BUSINESS OVERVIEW

- 12.13 TIMAC AGRO

- TABLE 224 TIMAC AGRO: BUSINESS OVERVIEW

- 12.14 BIOSOIL FARMS

- TABLE 225 BIOSOIL FARMS: BUSINESS OVERVIEW

- 12.15 PROFILE PRODUCTS LLC

- 12.16 THE FERTRELL COMPANY

- TABLE 226 THE FERTRELL COMPANY: BUSINESS OVERVIEW

- 12.17 HAIFA GROUP

- TABLE 227 HAIFA GROUP: BUSINESS OVERVIEW

- 12.18 SYMBORG

- TABLE 228 SYMBORG: BUSINESS OVERVIEW

- 12.19 SOIL TECHNOLOGIES CORPORATION

- 12.20 DELBON

- TABLE 229 DELBON: BUSINESS OVERVIEW

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 230 ADJACENT MARKETS TO SOIL AMENDMENTS

- 13.2 LIMITATIONS

- 13.3 BIOFERTILIZERS MARKET

- 13.3.1 LIMITATIONS

- 13.3.2 MARKET DEFINITION

- 13.3.3 MARKET OVERVIEW

- 13.3.4 BIOFERTILIZERS MARKET, BY TYPE

- FIGURE 44 NITROGEN-FIXING BIOFERTILIZERS SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- TABLE 231 BIOFERTILIZERS MARKET SIZE, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 232 BIOFERTILIZERS MARKET SIZE, BY TYPE, 2021-2026 (USD MILLION)

- 13.3.5 BIOFERTILIZERS MARKET, BY REGION

- TABLE 233 BIOFERTILIZERS MARKET SIZE, BY REGION, 2021-2026 (USD MILLION)

- 13.4 BIOSTIMULANTS MARKET

- 13.4.1 LIMITATIONS

- 13.4.2 MARKET DEFINITION

- 13.4.3 MARKET OVERVIEW

- 13.4.4 BIOSTIMULANTS MARKET, BY CROP TYPE

- FIGURE 45 FRUITS & VEGETABLES SEGMENT TO DOMINATE THE BIOSTIMULANTS MARKET BY 2026

- TABLE 234 BIOSTIMULANTS MARKET SIZE, BY CROP TYPE, 2016-2020 (USD MILLION)

- TABLE 235 BIOSTIMULANTS MARKET SIZE, BY CROP TYPE, 2021-2026 (USD MILLION)

- 13.4.5 BIOSTIMULANTS MARKET, BY REGION

- TABLE 236 BIOSTIMULANTS MARKET SIZE, BY REGION, 2016-2020 (USD MILLION)

- TABLE 237 BIOSTIMULANTS MARKET SIZE, BY REGION, 2021-2026 (USD MILLION)

- 13.5 SOIL CONDITIONERS MARKET

- 13.5.1 LIMITATIONS

- 13.5.2 MARKET DEFINITION

- 13.5.3 MARKET OVERVIEW

- 13.5.4 SOIL CONDITIONERS MARKET, BY TYPE

- FIGURE 46 SURFACTANTS SEGMENT TO DOMINATE THE SOIL CONDITIONERS MARKET DURING THE FORECAST PERIOD

- TABLE 238 SOIL CONDITIONERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

- 13.5.5 SOIL CONDITIONERS MARKET, BY REGION

- TABLE 239 SOIL CONDITIONERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS