|

|

市場調査レポート

商品コード

1226514

IVD (体外診断) 品質管理の世界市場:供給源別 (血漿、全血、尿)・技術別 (免疫測定、血液検査、微生物検査、凝固検査)・メーカー別 (サードパーティ、OEM)・エンドユーザー別 (病院、検査室、研究) の将来予測 (2027年まで)In Vitro Diagnostics (IVD) Quality Control Market by Source (Plasma, Whole Blood, Urine), Technology (Immunoassay, Hematology, Microbiology, Coagulation), Manufacturer (Third party, OEM), End Users (Hospitals, Lab, Research) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| IVD (体外診断) 品質管理の世界市場:供給源別 (血漿、全血、尿)・技術別 (免疫測定、血液検査、微生物検査、凝固検査)・メーカー別 (サードパーティ、OEM)・エンドユーザー別 (病院、検査室、研究) の将来予測 (2027年まで) |

|

出版日: 2023年02月17日

発行: MarketsandMarkets

ページ情報: 英文 332 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のIVD (体外診断) 品質管理の市場規模は、2022年の13億米ドルから2027年には16億米ドルに達し、予測期間中に5.4%のCAGRで成長すると予測されています。

製品/サービス別では、品質管理製品の分野が2021年に最大のシェアを占めています。診断検査の結果の正確性を確保するための認定ラボの増加が、IVD品質管理製品市場の成長を牽引しています。品質管理製品の中でも、血清/血漿ベースのコントロール部門が最も高いシェアを占めています。

メーカー別では、サードパーティによる管理が市場の大半を占めています。特に、独立型管理の部門が最も高いCAGRで成長する見通しです。その要因として、規制機関が独立型管理を推奨していることが挙げられます。

エンドユーザー別では、病院が最も高いシェアを占めています。一方、臨床検査室が最も成長率が高くなる見通しです。世界中で感染症の負担が増加していることと、遺伝子検査の量が増加していることが、この分野の市場成長を促進する主な要因です。

地域別に見ると、北米が最も高いシェアを占め、欧州がそれに続く見通しです。一方、アジア太平洋が最も高いCAGRで成長すると見込まれています。

当レポートでは、世界のIVD品質管理の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、製品/サービス別・技術別・メーカーの種類別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場の課題

- 業界動向

- バリューチェーン分析

- サプライチェーン分析

- エコシステムマーケットマップ

- ポーターのファイブフォース分析

- 規制分析

- 特許分析

- 技術分析

第6章 IVD品質管理市場:製品/サービス別

- イントロダクション

- 品質管理製品

- 血清/血漿ベースのコントロール

- 全血ベースのコントロール

- 尿ベースのコントロール

- その他のコントロール

- データ管理ソリューション

- 品質保証サービス

第7章 IVD品質管理市場:技術別

- イントロダクション

- 免疫化学

- 臨床化学

- 分子診断

- 微生物検査

- 血液検査

- 凝固・止血検査

- その他の技術

第8章 IVD品質管理市場:メーカーの種類別

- イントロダクション

- サードパーティによる管理

- 独立型管理

- 装置独自の管理

- OEMによる管理

第9章 IVD品質管理市場:エンドユーザー別

- イントロダクション

- 病院

- 臨床検査室

- 教育・研究機関

- その他のエンドユーザー

第10章 IVD品質管理市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- 他の欧州諸国

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- 他のアジア太平洋諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要企業が採用した戦略

- 主要企業の収益シェア分析

- 市場シェア分析

- 競合ベンチマーキング

- 主要企業の地域フットプリント

- 主要企業向け企業評価クアドラント

- 研究開発費

- スタートアップ/中小企業向け企業評価クアドラント

- 競合状況・動向

- 資本取引

- 製品の発売

- その他の動向

第12章 企業プロファイル

- 主要企業

- BIO-RAD LABORATORIES, INC.

- THERMO FISHER SCIENTIFIC, INC.

- RANDOX LABORATORIES LTD.

- LGC LIMITED

- ROCHE DIAGNOSTICS

- ABBOTT LABORATORIES

- SIEMENS HEALTHINEERS

- QUIDEL CORPORATION

- DANAHER CORPORATION

- SYSMEX CORPORATION

- ORTHO-CLINICAL DIAGNOSTICS, INC.

- BIO-TECHNE CORPORATION

- SEEGENE INC.

- QNOSTICS

- MICROBIOLOGICS, INC.

- ZEPTOMETRIX CORPORATION

- FORTRESS DIAGNOSTICS

- MICROBIX BIOSYSTEMS INC.

- GRIFOLS, S.A.

- ALPHA-TEC SYSTEMS, INC.

- その他の企業

- HELENA LABORATORIES CORPORATION

- STRECK, INC.

- MAINE MOLECULAR QUALITY CONTROLS, INC.

- SUN DIAGNOSTICS, LLC

- SERO AS

第13章 付録

The global IVD quality control market is projected to reach USD 1.6 billion by 2027 from USD 1.3 billion in 2022, at a CAGR of 5.4% during the forecast period. The competitive landscape includes the analysis of the key growth strategies adopted by major players between January 2019 and January 2023. Players in the global IVD Quality Control market have employed various strategies to expand their global footprint and increase their market shares such as agreements, divestitures, expansions, and acquisitions.

The product & service segment holds the highest share of the total IVD quality control market during the forecast period.

The quality control products segment accounted for the largest share of the IVD quality control market in 2021. The increasing number of accredited laboratories to ensure the accuracy of diagnostic test results are driving the growth of the IVD quality control products market.

Serum/plasma-based controls segment accounted for the highest share for the Product and Services in total IVD quality control market during the forecast period.

Serum/plasma-based IVD quality controls are highly preferred by laboratories, as they are more stable after manipulation, such as freezing, storage, and lyophilization.; this segment accounted for the largest share of the quality control products market in 2021. The increasing number of IVD tests and the rising need for accuracy, reliability, and reproducibility of test results are the key factors driving the growth of the IVD quality control products market

Third-party controls dominated the Manufacturer segmented of IVD quality control market

Based on manufacturer, the IVD quality control market is segmented into OEM controls and third-party controls. The third-party controls segment accounted for the largest share of the manufacturer segment in the global IVD quality control market in 2021. The independent controls segment is expected to grow at the highest CAGR in the third-party controls market during the forecast period. The growth of this segment is attributed to the fact that regulatory bodies recommend independent controls.

During the forecast period, hospitals accounted for the highest share in the end users segment of the global IVD quality control market.

The end users of IVD quality controls included in this report are research & academic institutes, hospitals, clinical laboratories, and other end users (blood banks, local public health laboratories, home health agencies, and nursing homes). The hospitals segment accounted for the largest share of the IVD quality control market in 2021, and Clinical laboratories are estimated to be the fastest-growing end-user segment in this market. The increasing burden of infectious diseases across the globe and the growing volume of genetic testing are the key factors driving the growth of this end-user segment.

North America is will account for the highest share in the global IVD quality control market

By Region, the global IVD quality control market accounted in this report is divided into five major regions-North America, Europe, Latin America, the Asia Pacific, and the Middle East & Africa. In 2021, North America accounted for the largest share of the global IVD quality control market, followed by Europe. In North America, US accounted for the largest share folowed by Canada. The APAC region has the highest CAGR of the global IVD quality control market.

Key players in the IVD quality control Market

Some of the key players in the market include Bio-Rad Laboratories, Inc. (US), Randox Laboratories Ltd. (UK), Thermo Fisher Scientific, Inc. (US), LGC Limited (UK), and Abbott Laboratories (US). Other prominent payers in the market include Roche Diagnostics (Switzerland), Siemens Healthineers (Germany), Danaher Corporation (US), Fortress Diagnostics (UK), SERO AS (US), Sysmex Corporation (Japan), Ortho-Clinical Diagnostics (US), Helena Laboratories Corporation (US), Quidel Corporation (US), Sun Diagnostics, LLC (US), Seegene Inc. (South Korea), ZeptoMetrix Corporation (US), Qnostics (UK), Bio-Techne Corporation (US), Microbiologics (US), Microbix Biosystems (Canada), Streck, Inc. (US), Alpha-Tec Systems (US), Maine Molecular Quality Controls, Inc. (US), and Grifols, S.A. (Spain). These players aim to secure higher market shares through strategies such as product launches, expansions, agreements, and acquisitions.

Break of primary participants was as mentioned below:

- By Company Type - Tier 1-60%, Tier 2-30%, and Tier 3-10%

- By Designation - C-level-30%, Director-level-50%, Others-20%

- By Region - North America-45%, Europe-15%, Asia Pacific-25%, Latin America- 10%, Middle East and Africa-5%

Research Coverage:

The market study covers the endoscopy equipment market across various segments. It aims at estimating the market size and the growth potential of this market across different segments by product, by application, by end user, and by region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will help market leaders/new entrants in this market and provide information regarding the closest approximations of the IVD Quality Control market and its segments. This report will help stakeholders understand the competitive landscape, gain insights to position their businesses better, and plan suitable go-to-market strategies. The report will also help stakeholders in understanding the pulse of the market and gaining information on key market drivers, restraints, opportunities, and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKETS COVERED

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.5.1 REFINEMENTS IN SEGMENTS OF GLOBAL IVD QUALITY CONTROLS MARKET

- 1.5.2 UPDATED FINANCIAL INFORMATION/PRODUCT PORTFOLIOS OF PLAYERS

- 1.5.3 UPDATED MARKET DEVELOPMENTS OF PROFILED PLAYERS

- 1.5.4 ADDITION OF RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 5 REVENUE SHARE ANALYSIS ILLUSTRATION: BIO-RAD LABORATORIES, INC.

- FIGURE 6 REVENUE ANALYSIS OF TOP FIVE COMPANIES: IVD QUALITY CONTROLS MARKET (2021)

- FIGURE 7 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF IVD QUALITY CONTROLS MARKET (2022-2027)

- FIGURE 8 CAGR PROJECTIONS

- FIGURE 9 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 10 MARKET DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ESTIMATION

- 2.5 ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: IVD QUALITY CONTROLS MARKET

- 2.7 LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

- 2.8 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- FIGURE 11 IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 THIRD-PARTY CONTROLS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 IVD QUALITY CONTROLS MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 17 GEOGRAPHICAL SNAPSHOT OF IVD QUALITY CONTROLS MARKET

4 PREMIUM INSIGHTS

- 4.1 IVD QUALITY CONTROLS MARKET OVERVIEW

- FIGURE 18 GROWING ADOPTION OF THIRD-PARTY CONTROLS AND INCREASING DEMAND FOR EXTERNAL QUALITY ASSESSMENT TO DRIVE MARKET

- 4.2 ASIA PACIFIC: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY AND COUNTRY (2021)

- FIGURE 19 IMMUNOCHEMISTRY SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- 4.3 IVD QUALITY CONTROLS MARKET: REGIONAL MIX (2022-2027)

- FIGURE 20 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- 4.4 IVD QUALITY CONTROLS MARKET: DEVELOPED VS. DEVELOPING MARKETS

- FIGURE 21 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH FROM 2022 TO 2027

- 4.5 IVD QUALITY CONTROLS MARKET: GEOGRAPHIC MIX

- FIGURE 22 CHINA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 IVD QUALITY CONTROLS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 MARKET DRIVERS

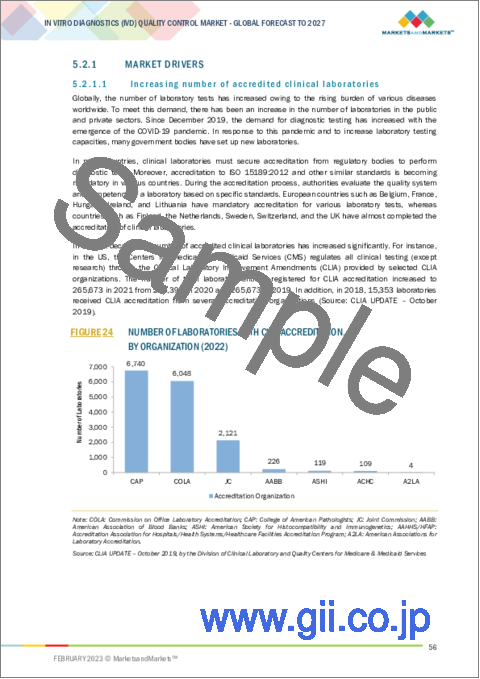

- 5.2.1.1 Increasing number of accredited clinical laboratories

- FIGURE 24 NUMBER OF LABORATORIES WITH CLIA ACCREDITATION, BY ORGANIZATION (2022)

- 5.2.1.2 Growing adoption of third-party quality controls

- 5.2.1.3 Rising demand for external quality assessment support

- 5.2.1.4 Rising geriatric population and subsequent growth in prevalence of chronic and infectious diseases

- TABLE 3 ESTIMATED INCREASE IN GERIATRIC POPULATION, BY REGION (2019-2050)

- FIGURE 25 ESTIMATED DIABETIC POPULATION, BY REGION, 2021 VS. 2030 VS. 2045 (MILLION)

- FIGURE 26 GLOBAL CANCER INCIDENCE, 2018-2040 (MILLION)

- 5.2.1.5 Increasing adoption of POC instruments in developed regions

- TABLE 4 MARKET DRIVERS: IMPACT ANALYSIS

- 5.2.2 MARKET RESTRAINTS

- 5.2.2.1 Additional costs and budget constraints in hospitals and laboratories

- 5.2.2.2 Unfavorable reimbursement scenario for IVD tests

- TABLE 5 MARKET RESTRAINTS: IMPACT ANALYSIS

- 5.2.3 MARKET OPPORTUNITIES

- 5.2.3.1 Rising demand for multianalyte controls

- TABLE 6 MARKET OPPORTUNITIES: IMPACT ANALYSIS

- 5.2.4 MARKET CHALLENGES

- 5.2.4.1 Stringent product approval process

- 5.2.4.2 Lack of regulations for clinical laboratory accreditation in several emerging countries

- TABLE 7 MARKET CHALLENGES: IMPACT ANALYSIS

- 5.3 INDUSTRY TRENDS

- 5.3.1 LYOPHILIZED/FREEZE-DRIED CONTROLS

- TABLE 8 LYOPHILIZED OR FREEZE-DRIED QUALITY CONTROLS OFFERED BY KEY MARKET PLAYERS

- 5.3.2 TRENDS ON ANALYTE SOURCE: HUMAN VS. ANIMAL ORIGIN

- 5.3.3 CONSOLIDATION OF LABORATORIES

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 27 IVD QUALITY CONTROLS MARKET: VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 28 IVD QUALITY CONTROLS MARKET: SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM MARKET MAP

- FIGURE 29 IVD QUALITY CONTROLS MARKET: ECOSYSTEM MARKET MAP

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.7.2 BARGAINING POWER OF SUPPLIERS

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 THREAT OF SUBSTITUTES

- 5.7.5 THREAT OF NEW ENTRANTS

- 5.8 REGULATORY ANALYSIS

- 5.8.1 NORTH AMERICA

- 5.8.1.1 US

- TABLE 10 US: CLASSIFICATION OF QUALITY CONTROL MATERIAL

- TABLE 11 US: TIME, COST, AND COMPLEXITY OF REGISTRATION

- 5.8.1.2 Canada

- TABLE 12 CANADA: CLASSIFICATION OF IVD PRODUCTS

- TABLE 13 CANADA: TIME, COST, AND COMPLEXITY OF REGISTRATION

- 5.8.2 EUROPE

- TABLE 14 EUROPE: ACCREDITATION BODIES FOR MEDICAL LABORATORIES

- TABLE 15 EUROPE: TIME, COST, AND COMPLEXITY OF REGISTRATION

- 5.8.3 ASIA PACIFIC

- 5.8.3.1 Japan

- TABLE 16 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION

- 5.8.3.2 China

- TABLE 17 CHINA: TIME, COST, AND COMPLEXITY OF REGISTRATION

- 5.8.3.3 India

- TABLE 18 INDIA: TIME, COST, AND COMPLEXITY OF REGISTRATION

- 5.8.1 NORTH AMERICA

- 5.9 PATENT ANALYSIS

- 5.9.1 PATENT PUBLICATION TRENDS FOR IVD QUALITY CONTROLS

- FIGURE 30 PATENT PUBLICATION TRENDS (2012-2022)

- 5.9.2 TOP APPLICANTS (COMPANIES) FOR PATENTS RELATED TO IVD QUALITY CONTROL

- FIGURE 31 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR IVD QUALITY CONTROL PATENTS (2012-2022)

- 5.9.3 JURISDICTION ANALYSIS: TOP APPLICANT (COUNTRIES/REGIONS) FOR PATENTS IN IVD QUALITY CONTROLS MARKET

- FIGURE 32 JURISDICTION ANALYSIS: TOP APPLICANT (COUNTRIES/REGIONS) FOR PATENTS IN IVD QUALITY CONTROL (2012-2022)

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Analyte extraction

- 5.10.1.1.1 Specimen pooling

- 5.10.1.1.2 Human monoclonals

- 5.10.1.2 Specimen processing

- 5.10.1.2.1 Inactivation

- 5.10.1.2.2 Dilution

- 5.10.1.3 Preservation

- 5.10.1.1 Analyte extraction

- 5.10.2 ADJACENT TECHNOLOGIES

- 5.10.2.1 Sensor-based quality control

- 5.10.3 COMPLEMENTARY TECHNOLOGIES

- 5.10.3.1 Storage

- 5.10.3.2 Transport

- 5.10.3.3 Temperature control

- 5.10.3.4 Temperature monitoring

- 5.10.1 KEY TECHNOLOGIES

6 IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE

- 6.1 INTRODUCTION

- TABLE 19 IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- 6.2 QUALITY CONTROL PRODUCTS

- TABLE 20 IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 21 IVD QUALITY CONTROL PRODUCTS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.2.1 SERUM/PLASMA-BASED CONTROLS

- 6.2.1.1 Greater stability and accuracy of diagnostic test results to increase demand for serum/plasma-based controls

- TABLE 22 SERUM/PLASMA-BASED QUALITY CONTROLS OFFERED BY KEY MARKET PLAYERS

- TABLE 23 SERUM/PLASMA-BASED QUALITY CONTROL PRODUCTS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.2.2 WHOLE BLOOD-BASED CONTROLS

- 6.2.2.1 Rising need to ensure high-quality clinical test results to drive market

- TABLE 24 WHOLE BLOOD-BASED QUALITY CONTROLS OFFERED BY KEY MARKET PLAYERS

- TABLE 25 WHOLE BLOOD-BASED QUALITY CONTROL PRODUCTS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.2.3 URINE-BASED CONTROLS

- 6.2.3.1 Growing incidence of kidney diseases to drive demand for urine-based controls

- TABLE 26 URINE-BASED IVD CONTROLS OFFERED BY KEY MARKET PLAYERS

- TABLE 27 URINE-BASED QUALITY CONTROL PRODUCTS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.2.4 OTHER CONTROLS

- TABLE 28 OTHER CONTROLS OFFERED BY KEY MARKET PLAYERS

- TABLE 29 OTHER QUALITY CONTROL PRODUCTS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3 DATA MANAGEMENT SOLUTIONS

- 6.3.1 RISING FOCUS ON IMPROVING ANALYTICAL PERFORMANCE OF CLINICAL LABORATORIES TO SUPPORT MARKET GROWTH

- TABLE 30 DATA MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 31 IVD DATA MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.4 QUALITY ASSURANCE SERVICES

- 6.4.1 GROWING NEED FOR PERFORMANCE ASSESSMENT OF CLINICAL LABORATORIES TO INCREASE DEMAND FOR QUALITY ASSURANCE SERVICES

- TABLE 32 QUALITY ASSURANCE SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 33 IVD QUALITY ASSURANCE SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

7 IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- TABLE 34 IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 7.2 IMMUNOCHEMISTRY

- 7.2.1 FOCUS ON MONITORING PRECISION OF IMMUNOASSAY TESTS TO DRIVE ADOPTION OF IMMUNOASSAY CONTROLS

- TABLE 35 QUALITY CONTROLS FOR IMMUNOCHEMISTRY OFFERED BY KEY MARKET PLAYERS

- TABLE 36 IVD QUALITY CONTROLS MARKET FOR IMMUNOCHEMISTRY, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 CLINICAL CHEMISTRY

- 7.3.1 RISING INCIDENCE OF LIFESTYLE DISEASES PROVIDES OPPORTUNITIES FOR MARKET GROWTH

- TABLE 37 QUALITY CONTROLS FOR CLINICAL CHEMISTRY OFFERED BY KEY MARKET PLAYERS

- TABLE 38 IVD QUALITY CONTROLS MARKET FOR CLINICAL CHEMISTRY, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.4 MOLECULAR DIAGNOSTICS

- 7.4.1 GROWING INCIDENCE OF INFECTIOUS DISEASES TO DRIVE DEMAND FOR MOLECULAR DIAGNOSTIC CONTROLS

- TABLE 39 QUALITY CONTROLS FOR MOLECULAR DIAGNOSTICS OFFERED BY KEY MARKET PLAYERS

- TABLE 40 IVD QUALITY CONTROLS MARKET FOR MOLECULAR DIAGNOSTICS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.5 MICROBIOLOGY

- 7.5.1 INCREASING ADOPTION OF AUTOMATED CLINICAL MICROBIOLOGY TESTING INSTRUMENTS TO SUPPORT MARKET GROWTH

- TABLE 41 QUALITY CONTROLS FOR MICROBIOLOGY OFFERED BY KEY MARKET PLAYERS

- TABLE 42 IVD QUALITY CONTROLS MARKET FOR MICROBIOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.6 HEMATOLOGY

- 7.6.1 NEED FOR ACCURACY IN HEMATOLOGICAL TEST RESULTS TO DRIVE RELIANCE ON HEMATOLOGY QUALITY CONTROLS

- TABLE 43 QUALITY CONTROLS FOR HEMATOLOGY OFFERED BY KEY MARKET PLAYERS

- TABLE 44 IVD QUALITY CONTROLS MARKET FOR HEMATOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.7 COAGULATION AND HEMOSTASIS

- 7.7.1 GROWING NUMBER OF CARDIOVASCULAR SURGERIES TO DRIVE DEMAND FOR COAGULATION AND HEMOSTASIS TESTING

- TABLE 45 QUALITY CONTROLS FOR COAGULATION AND HEMOSTASIS OFFERED BY KEY MARKET PLAYERS

- TABLE 46 IVD QUALITY CONTROLS MARKET FOR COAGULATION AND HEMOSTASIS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.8 OTHER TECHNOLOGIES

- TABLE 47 QUALITY CONTROLS FOR OTHER TECHNOLOGIES OFFERED BY KEY MARKET PLAYERS

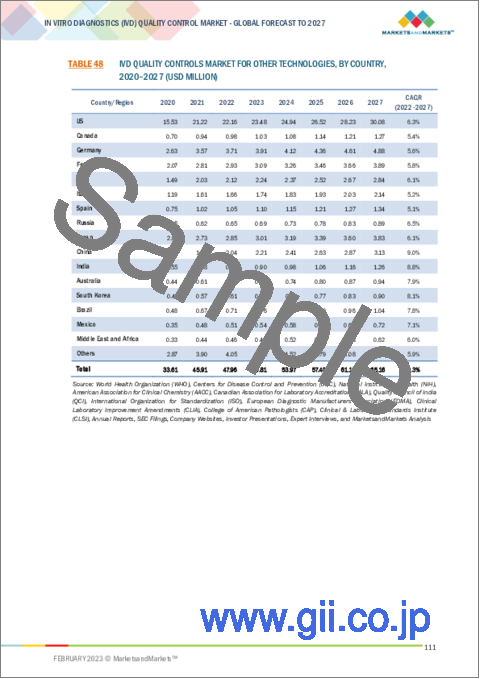

- TABLE 48 IVD QUALITY CONTROLS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2020-2027 (USD MILLION)

8 IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE

- 8.1 INTRODUCTION

- TABLE 49 IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- 8.2 THIRD-PARTY CONTROLS

- TABLE 50 IVD THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 51 IVD THIRD-PARTY CONTROLS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.2.1 INDEPENDENT CONTROLS

- 8.2.1.1 Provide unbiased and independent performance assessment for analytical processes

- TABLE 52 INDEPENDENT CONTROLS OFFERED BY KEY MARKET PLAYERS

- TABLE 53 INDEPENDENT THIRD-PARTY CONTROLS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.2.2 INSTRUMENT-SPECIFIC CONTROLS

- 8.2.2.1 Designed to evaluate and monitor performance of instruments

- TABLE 54 INSTRUMENT-SPECIFIC CONTROLS OFFERED BY KEY MARKET PLAYERS

- TABLE 55 INSTRUMENT-SPECIFIC THIRD-PARTY CONTROLS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.3 ORIGINAL EQUIPMENT MANUFACTURER CONTROLS

- 8.3.1 OEM CONTROLS TO WITNESS LOWER ADOPTION AS THEY ARE LESS SENSITIVE TO QC-RELATED ISSUES

- TABLE 56 OEM CONTROLS OFFERED BY KEY MARKET PLAYERS

- TABLE 57 IVD OEM CONTROLS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

9 IVD QUALITY CONTROLS MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 58 IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2 HOSPITALS

- 9.2.1 LARGE VOLUME OF IVD PROCEDURES PERFORMED TO DRIVE MARKET

- TABLE 59 IVD QUALITY CONTROLS MARKET FOR HOSPITALS, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.3 CLINICAL LABORATORIES

- 9.3.1 GROWING NUMBER OF ACCREDITED LABORATORIES TO DRIVE MARKET

- TABLE 60 IVD QUALITY CONTROLS MARKET FOR CLINICAL LABORATORIES, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.4 ACADEMIC AND RESEARCH INSTITUTES

- 9.4.1 RISING FOCUS ON ACCURATE RESEARCH RESULTS TO SUPPORT MARKET GROWTH

- TABLE 61 IVD QUALITY CONTROLS MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.5 OTHER END USERS

- TABLE 62 IVD QUALITY CONTROLS MARKET FOR OTHER END USERS, BY COUNTRY, 2020-2027 (USD MILLION)

10 IVD QUALITY CONTROLS MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 63 IVD QUALITY CONTROLS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 64 IVD QUALITY CONTROLS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 33 NORTH AMERICA: IVD QUALITY CONTROLS MARKET SNAPSHOT

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- TABLE 65 NORTH AMERICA: IVD QUALITY CONTROLS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 66 NORTH AMERICA: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 68 NORTH AMERICA: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 70 NORTH AMERICA: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 High healthcare expenditure to propel market growth

- TABLE 72 US: KEY MACROINDICATORS

- TABLE 73 US: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 74 US: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 75 US: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 76 US: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 77 US: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 78 US: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Government initiatives to support market growth

- TABLE 79 CANADA: KEY MACROINDICATORS

- TABLE 80 CANADA: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 81 CANADA: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 82 CANADA: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 83 CANADA: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 84 CANADA: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 85 CANADA: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- TABLE 86 EUROPE: IVD QUALITY CONTROLS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 87 EUROPE: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 88 EUROPE: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 89 EUROPE: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 90 EUROPE: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 91 EUROPE: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 92 EUROPE: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Rising volume of high-quality tests performed to support market growth

- TABLE 93 GERMANY: KEY MACROINDICATORS

- TABLE 94 GERMANY: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 95 GERMANY: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 96 GERMANY: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 97 GERMANY: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 98 GERMANY: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 99 GERMANY: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Increasing prevalence of infectious diseases and growing demand for early diagnosis to drive market

- TABLE 100 FRANCE: KEY MACROINDICATORS

- TABLE 101 FRANCE: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 102 FRANCE: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 103 FRANCE: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 104 FRANCE: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 105 FRANCE: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 106 FRANCE: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.4 UK

- 10.3.4.1 Growth in life sciences industry and increasing research to drive market

- TABLE 107 UK: KEY MACROINDICATORS

- TABLE 108 UK: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 109 UK: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 110 UK: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 111 UK: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 112 UK: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 113 UK: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Growing disease prevalence to drive demand for better and more accurate disease diagnosis

- TABLE 114 ITALY: KEY MACROINDICATORS

- TABLE 115 ITALY: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 116 ITALY: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 117 ITALY: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 118 ITALY: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 119 ITALY: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 120 ITALY: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.6 SPAIN

- 10.3.6.1 Increasing demand for prenatal and genetic testing and rising focus on laboratory consolidation to support market growth

- TABLE 121 SPAIN: KEY MACROINDICATORS

- TABLE 122 SPAIN: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 123 SPAIN: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 124 SPAIN: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 125 SPAIN: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 126 SPAIN: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 127 SPAIN: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.7 RUSSIA

- 10.3.7.1 Increasing access to quality healthcare and growing incidence of lifestyle and infectious diseases to drive market

- TABLE 128 RUSSIA: KEY MACROINDICATORS

- TABLE 129 RUSSIA: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 130 RUSSIA: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 131 RUSSIA: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 132 RUSSIA: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 133 RUSSIA: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 134 RUSSIA: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.8 REST OF EUROPE

- TABLE 135 REST OF EUROPE: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 136 REST OF EUROPE: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 137 REST OF EUROPE: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 138 REST OF EUROPE: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 139 REST OF EUROPE: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 140 REST OF EUROPE: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 34 ASIA PACIFIC: IVD QUALITY CONTROLS MARKET SNAPSHOT

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- TABLE 141 ASIA PACIFIC: IVD QUALITY CONTROLS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 142 ASIA PACIFIC: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 143 ASIA PACIFIC: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 144 ASIA PACIFIC: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 145 ASIA PACIFIC: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 146 ASIA PACIFIC: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 147 ASIA PACIFIC: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Well-developed healthcare system and demand for improvements in quality of IVD test results to drive market

- TABLE 148 JAPAN: KEY MACROINDICATORS

- TABLE 149 JAPAN: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 150 JAPAN: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 151 JAPAN: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 152 JAPAN: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 153 JAPAN: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 154 JAPAN: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Growing access to modern healthcare and government support to boost market growth

- TABLE 155 CHINA: KEY MACROINDICATORS

- TABLE 156 CHINA: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 157 CHINA: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 158 CHINA: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 159 CHINA: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 160 CHINA: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 161 CHINA: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Rising need to secure NABL accreditations to drive demand for quality controls

- FIGURE 35 INDIA: INCREASING NUMBER OF LABORATORIES WITH NABL ACCREDITATIONS, 2012-2022

- TABLE 162 INDIA: KEY MACROINDICATORS

- TABLE 163 INDIA: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 164 INDIA: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 165 INDIA: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 166 INDIA: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 167 INDIA: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 168 INDIA: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.5 AUSTRALIA

- 10.4.5.1 Initiatives to enhance access to healthcare and improve infrastructure to propel market growth

- TABLE 169 AUSTRALIA: KEY MACROINDICATORS

- TABLE 170 AUSTRALIA: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 171 AUSTRALIA: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 172 AUSTRALIA: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 173 AUSTRALIA: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 174 AUSTRALIA: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 175 AUSTRALIA: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Rising healthcare expenditure and growing number of hospitals to drive market

- TABLE 176 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 177 SOUTH KOREA: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 178 SOUTH KOREA: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 179 SOUTH KOREA: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 180 SOUTH KOREA: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 181 SOUTH KOREA: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 182 SOUTH KOREA: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 183 REST OF ASIA PACIFIC: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 186 REST OF ASIA PACIFIC: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 187 REST OF ASIA PACIFIC: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 188 REST OF ASIA PACIFIC: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 LATIN AMERICA: RECESSION IMPACT

- TABLE 189 LATIN AMERICA: IVD QUALITY CONTROLS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 190 LATIN AMERICA: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 191 LATIN AMERICA: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 192 LATIN AMERICA: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 193 LATIN AMERICA: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 194 LATIN AMERICA: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 195 LATIN AMERICA: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5.2 BRAZIL

- 10.5.2.1 Brazil dominates Latin American IVD quality controls market

- TABLE 196 BRAZIL: KEY MACROINDICATORS

- TABLE 197 BRAZIL: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 198 BRAZIL: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 199 BRAZIL: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 200 BRAZIL: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 201 BRAZIL: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 202 BRAZIL: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5.3 MEXICO

- 10.5.3.1 Increasing number of accredited clinical laboratories to support market growth

- TABLE 203 MEXICO: KEY MACROINDICATORS

- TABLE 204 MEXICO: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 205 MEXICO: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 206 MEXICO: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 207 MEXICO: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 208 MEXICO: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 209 MEXICO: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5.4 REST OF LATIN AMERICA

- TABLE 210 REST OF LATIN AMERICA: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 211 REST OF LATIN AMERICA: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 212 REST OF LATIN AMERICA: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 213 REST OF LATIN AMERICA: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 214 REST OF LATIN AMERICA: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 215 REST OF LATIN AMERICA: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.6 MIDDLE EAST AND AFRICA

- 10.6.1 MIDDLE EAST AND AFRICA: RECESSION IMPACT

- 10.6.2 RISING CANCER INCIDENCE TO DRIVE MARKET

- TABLE 216 MIDDLE EAST AND AFRICA: IVD QUALITY CONTROLS MARKET, BY PRODUCT AND SERVICE, 2020-2027 (USD MILLION)

- TABLE 217 MIDDLE EAST AND AFRICA: IVD QUALITY CONTROL PRODUCTS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 218 MIDDLE EAST AND AFRICA: IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 219 MIDDLE EAST AND AFRICA: IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2020-2027 (USD MILLION)

- TABLE 220 MIDDLE EAST AND AFRICA: THIRD-PARTY CONTROLS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 221 MIDDLE EAST AND AFRICA: IVD QUALITY CONTROLS MARKET, BY END USER, 2020-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS

- FIGURE 36 REVENUE ANALYSIS OF TOP PLAYERS IN IVD QUALITY CONTROLS MARKET

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 37 IVD QUALITY CONTROLS MARKET SHARE, BY KEY PLAYER, 2021

- 11.5 COMPETITIVE BENCHMARKING

- TABLE 222 PRODUCT PORTFOLIO ANALYSIS: IVD QUALITY CONTROLS MARKET

- TABLE 223 TECHNOLOGY PORTFOLIO ANALYSIS: IVD QUALITY CONTROLS MARKET

- TABLE 224 MANUFACTURER TYPE PORTFOLIO ANALYSIS: IVD QUALITY CONTROLS MARKET

- TABLE 225 END-USER PORTFOLIO ANALYSIS: IVD QUALITY CONTROLS MARKET

- 11.6 REGIONAL FOOTPRINT OF KEY PLAYERS

- TABLE 226 REGIONAL REVENUE MIX: IVD QUALITY CONTROLS MARKET

- 11.7 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- FIGURE 38 IVD QUALITY CONTROLS MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS (2021)

- 11.8 R&D EXPENDITURE

- FIGURE 39 IVD QUALITY CONTROLS MARKET: R&D EXPENDITURE (USD MILLION), 2021

- 11.9 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 DYNAMIC COMPANIES

- 11.9.3 STARTING BLOCKS

- 11.9.4 RESPONSIVE COMPANIES

- FIGURE 40 IVD QUALITY CONTROLS MARKET: COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES (2021)

- 11.10 COMPETITIVE SITUATIONS AND TRENDS

- 11.10.1 DEALS

- TABLE 227 DEALS, JANUARY 2019-JANUARY 2023

- 11.10.2 PRODUCT LAUNCHES

- TABLE 228 PRODUCT LAUNCHES, JANUARY 2019-JANUARY 2023

- 11.10.3 OTHER DEVELOPMENTS

- TABLE 229 OTHER DEVELOPMENTS, JANUARY 2019-JANUARY 2023

12 COMPANY PROFILES

(Business overview, Products and services offered, Recent developments & MnM View)**

- 12.1 KEY PLAYERS

- 12.1.1 BIO-RAD LABORATORIES, INC.

- TABLE 230 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- FIGURE 41 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2021)

- 12.1.2 THERMO FISHER SCIENTIFIC, INC.

- TABLE 231 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- FIGURE 42 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2021)

- 12.1.3 RANDOX LABORATORIES LTD.

- TABLE 232 RANDOX LABORATORIES LTD.: BUSINESS OVERVIEW

- 12.1.4 LGC LIMITED

- TABLE 233 LGC LIMITED: BUSINESS OVERVIEW

- FIGURE 43 LGC LIMITED: COMPANY SNAPSHOT (2021)

- 12.1.5 ROCHE DIAGNOSTICS

- TABLE 234 ROCHE DIAGNOSTICS: BUSINESS OVERVIEW

- FIGURE 44 ROCHE DIAGNOSTICS: COMPANY SNAPSHOT (2021)

- 12.1.6 ABBOTT LABORATORIES

- TABLE 235 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- FIGURE 45 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2021)

- 12.1.7 SIEMENS HEALTHINEERS

- TABLE 236 SIEMENS HEALTHINEERS: BUSINESS OVERVIEW

- FIGURE 46 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2021)

- 12.1.8 QUIDEL CORPORATION

- TABLE 237 QUIDEL CORPORATION: BUSINESS OVERVIEW

- FIGURE 47 QUIDEL CORPORATION: COMPANY SNAPSHOT (2021)

- 12.1.9 DANAHER CORPORATION

- TABLE 238 DANAHER CORPORATION: BUSINESS OVERVIEW

- FIGURE 48 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

- 12.1.10 SYSMEX CORPORATION

- TABLE 239 SYSMEX CORPORATION: BUSINESS OVERVIEW

- FIGURE 49 SYSMEX CORPORATION: COMPANY SNAPSHOT (2021)

- 12.1.11 ORTHO-CLINICAL DIAGNOSTICS, INC.

- TABLE 240 ORTHO-CLINICAL DIAGNOSTICS, INC.: BUSINESS OVERVIEW

- FIGURE 50 ORTHO-CLINICAL DIAGNOSTICS, INC.: COMPANY SNAPSHOT (2021)

- 12.1.12 BIO-TECHNE CORPORATION

- TABLE 241 BIO-TECHNE CORPORATION: BUSINESS OVERVIEW

- FIGURE 51 BIO-TECHNE CORPORATION: COMPANY SNAPSHOT (2021)

- 12.1.13 SEEGENE INC.

- TABLE 242 SEEGENE INC.: BUSINESS OVERVIEW

- FIGURE 52 SEEGENE INC.: COMPANY SNAPSHOT (2020)

- 12.1.14 QNOSTICS

- TABLE 243 QNOSTICS: BUSINESS OVERVIEW

- 12.1.15 MICROBIOLOGICS, INC.

- TABLE 244 MICROBIOLOGICS: BUSINESS OVERVIEW

- 12.1.16 ZEPTOMETRIX CORPORATION

- TABLE 245 ZEPTOMETRIX CORPORATION: BUSINESS OVERVIEW

- 12.1.17 FORTRESS DIAGNOSTICS

- TABLE 246 FORTRESS DIAGNOSTICS: BUSINESS OVERVIEW

- 12.1.18 MICROBIX BIOSYSTEMS INC.

- TABLE 247 MICROBIX BIOSYSTEMS INC.: BUSINESS OVERVIEW

- FIGURE 53 MICROBIX BIOSYSTEMS, INC.: COMPANY SNAPSHOT (2021)

- 12.1.19 GRIFOLS, S.A.

- TABLE 248 GRIFOLS, S.A.: BUSINESS OVERVIEW

- FIGURE 54 GRIFOLS, S.A.: COMPANY SNAPSHOT (2021)

- 12.1.20 ALPHA-TEC SYSTEMS, INC.

- TABLE 249 ALPHA-TEC SYSTEMS, INC.: BUSINESS OVERVIEW

- 12.2 OTHER PLAYERS

- 12.2.1 HELENA LABORATORIES CORPORATION

- TABLE 250 HELENA LABORATORIES CORPORATION: BUSINESS OVERVIEW

- 12.2.2 STRECK, INC.

- TABLE 251 STRECK, INC.: BUSINESS OVERVIEW

- 12.2.3 MAINE MOLECULAR QUALITY CONTROLS, INC.

- TABLE 252 MAINE MOLECULAR QUALITY CONTROLS, INC.: BUSINESS OVERVIEW

- 12.2.4 SUN DIAGNOSTICS, LLC

- TABLE 253 SUN DIAGNOSTICS, LLC: BUSINESS OVERVIEW

- 12.2.5 SERO AS

- TABLE 254 SERO AS: BUSINESS OVERVIEW

- *Details on Business overview, Products and services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS