|

|

市場調査レポート

商品コード

1103431

UV殺菌装置の世界市場:コンポーネント別(UVランプ、リアクターチャンバー、石英スリーブ、コントローラーユニット)、出力定格別(高、中、低)、用途別、エンドユーザー別、地域別 - 2027年までの予測UV Disinfection Equipment Market by Component (UV Lamps, Reactor Chambers, Quartz Sleeves, Controller Units), Power Rating (High, Medium, Low), Application, End-user (Municipal, Residential, Industrial, Commercial) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| UV殺菌装置の世界市場:コンポーネント別(UVランプ、リアクターチャンバー、石英スリーブ、コントローラーユニット)、出力定格別(高、中、低)、用途別、エンドユーザー別、地域別 - 2027年までの予測 |

|

出版日: 2022年07月14日

発行: MarketsandMarkets

ページ情報: 英文 228 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のUV殺菌装置の市場規模は、2022年の50億米ドルから2027年までに91億米ドルに達し、2022年から2027年までのCAGRで12.5%の成長が予測されています。

"病院環境の殺菌を目的とした医療施設でのUV殺菌装置の広範な使用"

UV殺菌装置は、水中、空気中、表面上の微生物汚染に対抗するために紫外線を搭載しています。紫外線は、細菌、ウイルス、原生動物などの微生物を不活性化することができるため、これらの機器に適しています。細菌、ウイルス、原生動物に殺菌波長の紫外線を照射すると、光が微生物を透過してそのDNAを破壊します。DNAが破壊されると、微生物は機能しなくなり、繁殖しなくなるため、汚染された場所を殺菌することができるのです。このエコシステムで事業を展開する企業は、さまざまな用途やエンドユーザー向けに設計された幅広いUV殺菌装置を提供しています。

病院環境は、疾病の主要な感染源です。病院内の多数の患者、スタッフ、訪問者は、病院内に存在する様々な細菌やウイルスによって感染し、院内感染(HAI)を発症する可能性があります。

"世界の水・廃水処理におけるUV殺菌装置の採用拡大"

水・廃水処理用のUV殺菌装置の採用が拡大していることは、UV殺菌装置のメーカーに有利な機会を生み出しています。自治体組織は、水・廃水処理用途のためのUV殺菌装置の主要なユーザーです。水処理が自治体によって行われる用途はいくつかあります。その中には、飲料水処理、金属除去、廃水処理などがあります。

水の殺菌方法の中で、UV殺菌はオゾンや塩素ベースの殺菌に比べていくつかの利点があります。UV殺菌は、オゾン殺菌よりも安価です。また、塩素系殺菌と異なり、水を殺菌するための薬剤を必要としないため、環境にも優しいです。こうした利点から、世界の自治体でUV殺菌装置に対する需要が高まっています。世界の人口増加に伴い、自治体の多くは飲料水や廃水を処理するための第一選択肢としてUV殺菌装置を選んでおり、人々に安全な飲料水を供給するためにUV殺菌装置の設置にますます力を入れるようになっています。この機会の影響は現在中程度であり、今後数年間は高くなると予想されます。

"アジア太平洋地域は予測期間中に最も速い速度で成長する"

アジア太平洋地域におけるUV殺菌装置市場の成長は、人口の増加と、水を媒介とする病気の蔓延を避けるために清潔で安全な水に対する要求が高まっていることに起因しています。アジア太平洋地域のUV殺菌装置は、主に自治体による上下水道の殺菌用途に使用されています。COVID-19の発生と拡散に伴い、表面や空気を浄化するためのUV殺菌装置の需要が一夜にして高まり、これらの装置の不足を招いています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- UV殺菌装置エコシステム

- ポーターのファイブフォース分析

- ケーススタディ

- テクノロジー分析

- 貿易分析

- 特許分析

- UVランプに関連する関税と規制

- UV殺菌装置に使用されるさまざまな展開モード

- 平均販売価格分析

第6章 UV殺菌装置市場:コンポーネント別

- イントロダクション

- UVランプ

- マーキュリーUVランプ

- UV LED

- 石英スリーブ

- リアクターチャンバー

- コントローラーユニット

- その他

第7章 UV殺菌装置市場:出力定格別

- イントロダクション

- 低

- 中

- 高

第8章 UV殺菌装置市場:用途別

- イントロダクション

- 水・廃水殺菌

- プロセス水殺菌

- 空気殺菌

- 表面殺菌

第9章 UV殺菌装置市場:エンドユーザー別

- イントロダクション

- 住宅

- 商業

- 工業

- 地方自治体

第10章 UV殺菌装置市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- オランダ

- フランス

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- その他の地域

- 南米

- 中東

- アフリカ

第11章 競合情勢

- イントロダクション

- 主要企業戦略/有力企業

- 5年間の企業収益分析

- 市場シェア分析:UV殺菌装置市場

- 市場評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合状況・動向

第12章 企業プロファイル

- 主要企業

- XYLEM INC.

- TROJAN TECHNOLOGIES

- HALMA GROUP

- KURARAY CO., LTD

- ATLANTIC ULTRAVIOLET CORPORATION

- EVOQUA WATER TECHNOLOGIES LLC

- ATLANTIUM TECHNOLOGIES LTD.

- AMERICAN ULTRAVIOLET

- HONLE AG

- ADVANCED UV, INC.

- LUMALIER CORPORATION

- その他の主要企業

- SEOUL VIOSYS CO., LTD.

- HITECH ULTRAVIOLET PVT. LTD.

- UVO3 LTD.

- SUEZ WATER TECHNOLOGIES & SOLUTIONS

- UV PURE TECHNOLOGIES

- LIT COMPANY

- ALFAA UV

- ULTRAAQUA

- AUSTRALIAN ULTRA VIOLET SERVICES PTY. LTD. (AUVS)

- S.I.T.A. SRL

- TYPHON TREATMENT SYSTEMS LTD.

- AQUATIC SOLUTIONS

- INTEGRATED AQUA SYSTEMS, INC.

- AQUANETTO GROUP GMBH

- NECTAR SOLUTIONS

第13章 付録

The UV disinfection equipmentmarket is projected to grow from USD 5.0 billion in 2022 to USD 9.1 billion by 2027; it is expected to grow at a CAGR of 12.5% from 2022 to 2027.

"Extensive use of UV disinfection equipment in healthcare facilities for disinfecting hospital environment"

Ultraviolet (UV) disinfection equipment are equipped with UV light to combat microbial contamination in water, air, and on surfaces. UV light is suitable for these equipment, as it is capable of inactivating microorganisms such as bacteria, viruses, and protozoa. When bacteria, viruses, and protozoa are exposed to germicidal wavelengths of UV light, the light penetrates the microorganisms and destroys their DNA. When the DNA of the microorganism is damaged, it stops functioning and reproducing; this helps to disinfect the area of contamination. Companies operating in this ecosystem offer a wide range of UV disinfection equipment designed for different applications and end users.

The hospital environment is a major source of disease transmission. Numerous patients, staff, and visitors in the hospitals can get infected due to various bacteria and viruses present in the hospitals and develop hospital-acquired infection (HAI).

"Growing adoption of UV disinfection equipment for water and wastewater treatment worldwide"

The growing adoption of UV disinfection equipment for water and wastewater treatment is creating lucrative opportunities for the manufacturers of UV disinfection equipment. Municipal organizations are the major users of UV disinfection equipment for water and wastewater treatment applications. There are several applications for which water treatment is carried out by municipal organizations. Some of them are drinking water treatment, metal removal, and wastewater treatment.

Among the methods of water disinfection, UV disinfection offers several advantages over ozone-based and chlorine-based disinfection. UV disinfection method is cheaper than ozone-based disinfection, and unlike chlorine-based disinfection, it does not require a chemical to disinfect water. It is more environmentally friendly and requires lesser contact time with water during the disinfection process. Owing to these benefits, the demand for UV disinfection equipment is increasing among municipal corporations worldwide. With the increasing population across the world, most of the municipal corporations are choosing UV disinfection equipment as their first choice to treat drinking water and wastewater and are increasingly focusing on the installation of UV disinfection equipment for the distribution of safe drinking water to people. The impact of this opportunity is currently moderate and is expected to be high in the coming years.

"Asia Pacificto grow at a fastest rate in the forecast period"

The growth of the UV disinfection equipment market in Asia Pacific can be attributed to the increasing population and the growing requirement for clean and safe water to avoid the spread of water-borne diseases. Kuraray Co., Ltd., Alfaa UV, Australian Ultra Violet Services Pty. Ltd. (AUVS), Hitech Ultraviolet Pvt. Ltd., Nectar Solutions, and Aquatic Solutions are some leading providers of UV disinfection equipment in Asia Pacific. The UV disinfection equipment in this region are mainly used for water and wastewater disinfection applications by municipal corporations. With the outbreak and the spread of the COVID-19, the demand for UV disinfection equipment for cleansing surfaces and air has increased overnight, leading to a shortage of these equipment.

Breakdown ofprofiles of primary participants:

- By Company: Tier 1 =15%, Tier 2 =50%, and Tier 3 =35%

- By Designation: C-level Executives = 45%, Directors= 35%, and Others (sales, marketing, and product managers, as well as members of various organizations) =20%

- By Region: North America = 45%, Asia Pacific=12%, Europe=35%, and South America=3% and Middle East and Africe = 5%.

Major players profiled in this report:

TheUV disinfection equipmentmarket is dominated by a few established players such as Xylem Inc. (US), Trojan Technologies (UK), Halma Group (UK), Kuraray Co., Ltd. (Japan), Atlantic Ultraviolet Corporation (US), Evoqua Water Technologies LLC (US), Advanced UV, Inc. (US), American Ultraviolet (US), Atlantium Technologies Ltd. (Israel), Hoenle AG (Germany), and Lumalier Corporation (US).

Research coverage

This report offers detailed insights into theUV disinfection equipmentmarket based on component,application, end user, power rating, and region.

The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the UV disinfection equipmentmarket. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Key Benefits of Buying the Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the UV disinfection equipmentmarket and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 STUDY SCOPE

- FIGURE 1 UV DISINFECTANT EQUIPMENT MARKET SEGMENTATION

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY

- 1.4 MARKET STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 UV DISINFECTION EQUIPMENT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.2 FACTOR ANALYSIS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1-TOP-DOWN (SUPPLY SIDE)-REVENUE GENERATED BY COMPANIES FROM SALES OF UV DISINFECTION EQUIPMENT

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1-TOP-DOWN (SUPPLY SIDE)-ILLUSTRATION OF REVENUE ESTIMATIONS FOR ONE COMPANY IN UV DISINFECTION EQUIPMENT MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2-BOTTOM-UP (DEMAND SIDE)-DEMAND FOR UV DISINFECTION EQUIPMENT COMPONENTS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach for capturing market share using bottom-up analysis (demand side)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach for capturing market share using top-down analysis (supply side)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.5.1 ASSUMPTIONS

- TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5.2 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 UV DISINFECTION EQUIPMENT MARKET, 2018-2027 (USD BILLION)

- FIGURE 10 UV LAMPS SEGMENT PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 11 MUNICIPAL SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 12 WATER & WASTEWATER DISINFECTION SEGMENT ACCOUNTED FOR LARGEST MARKET SIZE IN 2021

- FIGURE 13 UV DISINFECTION EQUIPMENT MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

4 PREMIUM INSIGHTS

- 4.1 UV DISINFECTION EQUIPMENT MARKET OVERVIEW

- FIGURE 14 INCREASING DEMAND FOR UV DISINFECTION EQUIPMENT DUE TO THREATS OF INFECTIOUS DISEASES IS EXPECTED TO FUEL MARKET GROWTH

- 4.2 UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT AND POWER RATING

- FIGURE 15 UV LAMPS AND HIGH-POWER UV DISINFECTION EQUIPMENT SEGMENTS PROJECTED TO ACCOUNT FOR LARGEST SHARE OF UV DISINFECTION EQUIPMENT MARKET IN 2027

- 4.3 UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION

- FIGURE 16 WATER & WASTEWATER DISINFECTION APPLICATION PROJECTED TO ACCOUNT FOR LARGEST SHARE OF UV DISINFECTION EQUIPMENT MARKET IN 2027

- 4.4 UV DISINFECTION EQUIPMENT MARKET, BY END USER

- FIGURE 17 MUNICIPAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF UV DISINFECTION EQUIPMENT MARKET IN 2027

- 4.5 UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY

- FIGURE 18 UV DISINFECTION EQUIPMENT MARKET IN INDIA IS PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 UV DISINFECTION EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Extensive use of UV disinfection equipment in healthcare facilities for disinfecting hospital environment

- FIGURE 20 PERCENTAGE OF HAI PATIENTS IN EUROPE

- 5.2.1.2 Increasing demand for UV disinfection equipment to combat COVID-19 pandemic

- 5.2.1.3 Intensifying concerns regarding safe drinking water in emerging countries

- 5.2.1.4 Long life and low power consumption of UVC LED-based UV disinfection equipment

- FIGURE 21 ANALYSIS OF IMPACT OF DRIVERS ON UV DISINFECTION EQUIPMENT MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lower cost of conventional disinfectants compared to UV lights

- 5.2.2.2 Lack of residual ability of UV disinfection equipment

- FIGURE 22 ANALYSIS OF IMPACT OF RESTRAINTS ON UV DISINFECTION EQUIPMENT MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for ultrapure water

- 5.2.3.2 Growing adoption of UV disinfection equipment for water and wastewater treatment worldwide

- FIGURE 23 ANALYSIS OF IMPACT OF OPPORTUNITIES ON UV DISINFECTION EQUIPMENT MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Misconceptions regarding UV disinfection systems

- 5.2.4.2 Expansion of UV disinfection equipment manufacturing facilities in short period of time

- FIGURE 24 ANALYSIS OF IMPACT OF CHALLENGES ON UV DISINFECTION EQUIPMENT MARKET

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 25 UV DISINFECTION EQUIPMENT VALUE CHAIN

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR UV DISINFECTION EQUIPMENT MARKET

- FIGURE 26 REVENUE SHIFT IN UV DISINFECTION EQUIPMENT MARKET

- 5.5 UV DISINFECTION EQUIPMENT ECOSYSTEM

- FIGURE 27 UV DISINFECTION EQUIPMENT ECOSYSTEM

- TABLE 2 LIST OF OEMS, SUPPLIERS, AND DISTRIBUTORS OF UV DISINFECTION EQUIPMENT

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 UV DISINFECTION EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7 CASE STUDY

- 5.7.1 ST. FRANCIS WAS ABLE TO ACHIEVE ITS GOAL OF MEETING NEW REGULATORY LIMITS BY USING XYLEM'S UV DISINFECTION SYSTEM

- 5.7.2 WEDECO UV SYSTEMS HELPED FRENCH CREEK WASTEWATER TREATMENT PLANT (WWTP) TO SAVE ENERGY AND REDUCE MAINTENANCE

- 5.7.3 WHITE TANKS REGIONAL WATER TREATMENT FACILITY MET LT2 RULE USING UV DISINFECTION SOLUTION FROM TROJAN TECHNOLOGIES

- 5.7.4 METHODIST HEALTHCARE SYSTEMS CHOSE UVC GERMICIDAL FIXTURES FROM AMERICAN ULTRAVIOLET

- 5.7.5 MONITORING EFFECTIVENESS OF UV LAMPS TO DISINFECT MEDICAL-GRADE FACEPIECE RESPIRATORS FOR SAFE REUSE

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Ultraviolet (UV) light technology

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 UVA technology

- 5.8.1 KEY TECHNOLOGIES

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO

- TABLE 4 IMPORT DATA, BY COUNTRY, 2017-2021 (USD THOUSAND)

- 5.9.2 EXPORT SCENARIO

- TABLE 5 EXPORT DATA, BY COUNTRY, 2017-2021 (USD THOUSAND)

- 5.10 PATENT ANALYSIS

- TABLE 6 NUMBER OF PATENTS REGISTERED RELATED TO UV DISINFECTION MARKET IN LAST 10 YEARS

- FIGURE 28 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENTS IN LAST 10 YEARS

- FIGURE 29 NO. OF PATENTS GRANTED PER YEAR, 2012-2021

- 5.11 TARIFFS AND REGULATIONS RELATED TO UV LAMPS

- 5.11.1 TARIFFS

- 5.11.2 REGULATORY COMPLIANCE

- 5.11.3 STANDARDS

- 5.12 DIFFERENT DEPLOYMENT MODES USED FOR UV DISINFECTION EQUIPMENT

- FIGURE 30 DIFFERENT DEPLOYMENT MODES USED FOR UV DISINFECTION EQUIPMENT

- 5.12.1 MOBILE

- 5.12.2 WALL MOUNTED

- 5.12.3 OTHERS

- 5.13 AVERAGE SELLING PRICE ANALYSIS

- TABLE 7 AVERAGE SELLING PRICE OF UV DISINFECTION EQUIPMENT COMPONENTS

- TABLE 8 AVERAGE SELLING PRICE OF COMPONENTS IN NORTH AMERICA

6 UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 31 UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT

- FIGURE 32 UV LAMPS PROJECTED TO REGISTER HIGHEST CAGR IN UV DISINFECTION EQUIPMENT MARKET FROM 2022 TO 2027

- TABLE 9 UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 10 UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

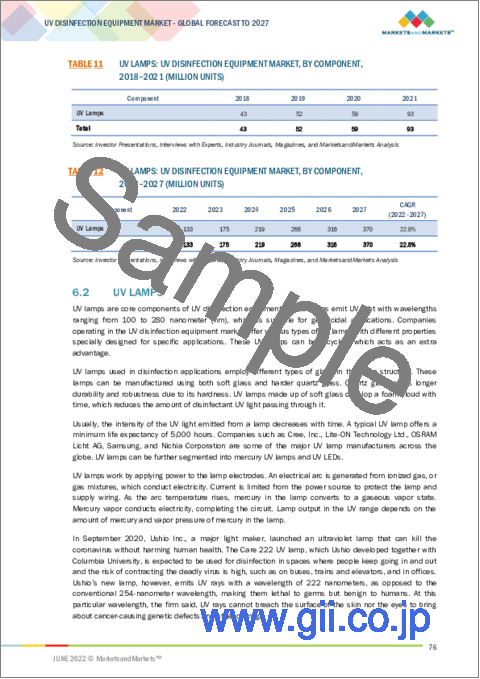

- TABLE 11 UV LAMPS: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2018-2021 (MILLION UNITS)

- TABLE 12 UV LAMPS: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2022-2027 (MILLION UNITS)

- 6.2 UV LAMPS

- TABLE 13 COMPARISON OF MERCURY UV LAMPS AND UV LEDS

- TABLE 14 UV LAMPS: UV DISINFECTION EQUIPMENT MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 15 UV LAMPS: UV DISINFECTION EQUIPMENT MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 16 UV LAMPS: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 17 UV LAMPS: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1 MERCURY UV LAMPS

- 6.2.1.1 Mercury UV lamps emit varied wavelengths

- TABLE 18 MERCURY UV LAMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 19 MERCURY UV LAMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 6.2.1.2 Low-pressure mercury UV lamps

- 6.2.1.2.1 Low-pressure mercury UV lamps offer 12,000 hours of life and convert up to 40% of electricity into UV

- 6.2.1.3 Medium-pressure mercury UV lamps

- 6.2.1.3.1 Medium-pressure mercury UV lamps are extensively used in food & beverages and pharmaceuticals industries

- 6.2.1.4 Amalgam mercury UV lamps

- 6.2.1.4.1 Amalgam mercury UV lamps produce more UV output than standard low-pressure lamps of same wavelength

- 6.2.1.2 Low-pressure mercury UV lamps

- 6.2.2 UV LEDS

- 6.2.2.1 Shift towards mercury-free UV lamps will accelerate demand for UV LEDs

- 6.3 QUARTZ SLEEVES

- 6.3.1 QUARTZ SLEEVES PROTECT UV LAMPS FROM EXTERNAL ENVIRONMENTAL HAZARDS

- TABLE 20 QUARTZ SLEEVES: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 21 QUARTZ SLEEVES: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 REACTOR CHAMBERS

- 6.4.1 REACTOR CHAMBERS HOUSE UV LAMPS AND SLEEVES IN UV DISINFECTION EQUIPMENT

- TABLE 22 REACTOR CHAMBERS: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 23 REACTOR CHAMBERS: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 CONTROLLER UNITS

- 6.5.1 CONTROLLER UNITS CONTROL ELECTRICAL OUTPUT IN UV DISINFECTION EQUIPMENT

- TABLE 24 CONTROLLER UNITS: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 25 CONTROLLER UNITS: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.6 OTHERS

- TABLE 26 OTHERS: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 27 OTHERS: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

7 UV DISINFECTION EQUIPMENT MARKET, BY POWER RATING

- 7.1 INTRODUCTION

- FIGURE 33 UV DISINFECTION EQUIPMENT MARKET, BY POWER RATING

- FIGURE 34 MEDIUM-POWER UV DISINFECTION EQUIPMENT MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 28 UV DISINFECTION EQUIPMENT MARKET, BY POWER RATING, 2018-2021 (USD MILLION)

- TABLE 29 UV DISINFECTION EQUIPMENT MARKET, BY POWER RATING, 2022-2027 (USD MILLION)

- 7.2 LOW

- 7.2.1 LOW-POWER UV DISINFECTION EQUIPMENT SUITABLE FOR RESIDENTIAL AND COMMERCIAL APPLICATIONS

- 7.3 MEDIUM

- 7.3.1 MEDIUM-POWER UV DISINFECTION EQUIPMENT DEPLOYED FOR INDUSTRIAL AND COMMERCIAL APPLICATIONS

- 7.4 HIGH

- 7.4.1 HIGH-POWER UV DISINFECTION EQUIPMENT ARE MAINLY USED FOR LARGE-SCALE APPLICATIONS

8 UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 35 UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION

- FIGURE 36 SURFACE DISINFECTION APPLICATION SEGMENT TO RECORD HIGHEST CAGR FROM 2022 TO 2027

- TABLE 30 UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 31 UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.2 WATER AND WASTEWATER DISINFECTION

- 8.2.1 WATER AND WASTEWATER DISINFECTION SEGMENT TO LEAD UV DISINFECTION EQUIPMENT MARKET DURING FORECAST PERIOD

- TABLE 32 WATER & WASTEWATER DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 33 WATER & WASTEWATER DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 PROCESS WATER DISINFECTION

- 8.3.1 HIGH DEMAND FOR PURE WATER IN PHARMACEUTICALS, COSMETICS, AND FOOD & BEVERAGES INDUSTRIES TO DRIVE MARKET

- TABLE 34 PROCESS WATER DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 PROCESS WATER DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 AIR DISINFECTION

- 8.4.1 COMMERCIAL SPACES AND HEALTHCARE ORGANIZATIONS USE UV DISINFECTION EQUIPMENT FOR AIR DISINFECTION

- TABLE 36 AIR DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 37 AIR DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.5 SURFACE DISINFECTION

- 8.5.1 UV DISINFECTION EQUIPMENT FIND APPLICATIONS IN PACKAGING AND FOOD PROCESSING INDUSTRIES FOR SURFACE DISINFECTION

- TABLE 38 SURFACE DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 SURFACE DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

9 UV DISINFECTION EQUIPMENT MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 37 UV DISINFECTION EQUIPMENT MARKET, BY END USER

- FIGURE 38 MUNICIPAL SEGMENT TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

- TABLE 40 UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 41 UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 9.2 RESIDENTIAL

- 9.2.1 GROWING CONCERNS REGARDING SAFETY AND HYGIENE TO DRIVE RESIDENTIAL SEGMENT

- TABLE 42 RESIDENTIAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 RESIDENTIAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 COMMERCIAL

- 9.3.1 COMMERCIAL END USERS USE UV DISINFECTION SYSTEMS TO TREAT POTABLE WATER AND WASTEWATER

- TABLE 44 COMMERCIAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 45 COMMERCIAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 INDUSTRIAL

- 9.4.1 DEMAND FROM PHARMACEUTICALS AND FOOD & BEVERAGES INDUSTRIES TO BOOST MARKET

- TABLE 46 INDUSTRIAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 INDUSTRIAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 MUNICIPAL

- 9.5.1 GOVERNMENT FOCUS ON PROVIDING SAFE WATER TO INCREASE ADOPTION OF UV DISINFECTION EQUIPMENT

- TABLE 48 MUNICIPAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 49 MUNICIPAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

10 UV DISINFECTION EQUIPMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 39 UV DISINFECTION EQUIPMENT MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 50 UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 40 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET SNAPSHOT

- TABLE 52 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 53 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 55 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY UV LAMPS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 57 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY UV LAMPS, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 58 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 59 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 61 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 62 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 63 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 US to lead UV disinfection equipment market in North America from 2022 to 2027

- TABLE 64 US: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 65 US: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 66 US: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 67 US: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Presence of leading UV disinfection equipment manufacturers favors market growth in Canada

- TABLE 68 CANADA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 69 CANADA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 70 CANADA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 71 CANADA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.2.3 MEXICO

- 10.2.3.1 Increased adoption of UV disinfection equipment by municipal corporations to contribute to market growth

- TABLE 72 MEXICO: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 73 MEXICO: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 74 MEXICO: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 75 MEXICO: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3 EUROPE

- FIGURE 41 EUROPE: UV DISINFECTION EQUIPMENT MARKET SNAPSHOT

- TABLE 76 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 77 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 78 EUROPE: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 79 EUROPE: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 80 EUROPE: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY UV LAMPS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 81 EUROPE: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY UV LAMPS, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 82 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 83 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 84 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 85 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 86 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 87 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.3.1 UK

- 10.3.1.1 Demand from commercial applications to contribute to market growth

- TABLE 88 UK: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 89 UK: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 90 UK: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 91 UK: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Requirement of reliable and sustainable solutions for water treatment to fuel demand for UV disinfection equipment

- TABLE 92 GERMANY: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 93 GERMANY: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 94 GERMANY: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 95 GERMANY: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3.3 NETHERLANDS

- 10.3.3.1 Government initiatives to reduce use of chlorine to generate demand for UV disinfection equipment

- TABLE 96 NETHERLANDS: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 97 NETHERLANDS: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 98 NETHERLANDS: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 99 NETHERLANDS: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Presence of multiple water and wastewater treatment plants spurs UV disinfection equipment demand in France

- TABLE 100 FRANCE: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 101 FRANCE: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 102 FRANCE: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 103 FRANCE: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Heightened adoption of UV disinfection equipment in healthcare facilities to contribute to market growth

- TABLE 104 ITALY: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 105 ITALY: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 106 ITALY: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 107 ITALY: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 108 REST OF EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 109 REST OF EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 110 REST OF EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 111 REST OF EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET SNAPSHOT

- TABLE 112 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 113 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 114 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 115 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 116 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY UV LAMPS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 117 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY UV LAMPS, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 118 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 119 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 120 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 121 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 122 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 123 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Favorable regulations and government support drive UV disinfection equipment market in China

- TABLE 124 CHINA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 125 CHINA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 126 CHINA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 127 CHINA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Presence of key UV disinfection equipment manufacturers in Japan to augment market growth

- TABLE 128 JAPAN: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 129 JAPAN: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 130 JAPAN: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 131 JAPAN: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Clean Ganga project to drive demand for UV disinfection equipment in India

- TABLE 132 INDIA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 133 INDIA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 134 INDIA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 135 INDIA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4.4 AUSTRALIA

- 10.4.4.1 Rise in number of projects using UV technology in Australia to underpin market growth

- TABLE 136 AUSTRALIA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 137 AUSTRALIA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 138 AUSTRALIA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 139 AUSTRALIA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4.5 SOUTH KOREA

- 10.4.5.1 River-cleaning initiatives undertaken in South Korea to promote use of UV disinfection equipment

- TABLE 140 SOUTH KOREA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 141 SOUTH KOREA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 142 SOUTH KOREA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 143 SOUTH KOREA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 144 REST OF ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.5 REST OF THE WORLD (ROW)

- TABLE 148 ROW: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 149 ROW: UV DISINFECTION EQUIPMENT MARKET IN ROW, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 150 ROW: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 151 ROW: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 152 ROW: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY UV LAMPS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 153 ROW: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY UV LAMPS, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 154 ROW: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 155 ROW: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 156 ROW: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 157 ROW: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 158 ROW: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 159 ROW: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Significant investments in UV disinfection equipment by public authorities to drive market in South America

- TABLE 160 SOUTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 161 SOUTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 162 SOUTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 163 SOUTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Heightened need for reusing wastewater to spur demand for UV disinfection equipment in Middle East

- TABLE 164 MIDDLE EAST: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 165 MIDDLE EAST: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 166 MIDDLE EAST: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 167 MIDDLE EAST: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.5.3 AFRICA

- 10.5.3.1 Scarcity of clean water in Africa to accelerate adoption of UV disinfection equipment

- TABLE 168 AFRICA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 169 AFRICA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 170 AFRICA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 171 AFRICA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 172 OVERVIEW OF STRATEGIES DEPLOYED BY KEY UV DISINFECTION EQUIPMENT OEMS

- 11.2.1 PRODUCT PORTFOLIO

- 11.2.2 REGIONAL FOCUS

- 11.2.3 MANUFACTURING FOOTPRINT

- 11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

- FIGURE 43 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN UV DISINFECTION EQUIPMENT MARKET

- 11.4 MARKET SHARE ANALYSIS: UV DISINFECTION EQUIPMENT MARKET, 2021

- TABLE 173 UV DISINFECTION EQUIPMENT MARKET: DEGREE OF COMPETITION, 2021

- 11.5 MARKET EVALUATION MATRIX

- 11.5.1 STAR

- 11.5.2 PERVASIVE

- 11.5.3 EMERGING LEADER

- 11.5.4 PARTICIPANT

- FIGURE 44 UV DISINFECTION EQUIPMENT MARKET COMPANY EVALUATION QUADRANT, 2021

- 11.5.5 COMPANY FOOTPRINT

- TABLE 174 COMPANY INDUSTRY FOOTPRINT

- TABLE 175 COMPANY APPLICATION FOOTPRINT

- TABLE 176 COMPANY REGION FOOTPRINT

- 11.6 START-UP/ SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

- TABLE 177 LIST OF START-UP COMPANIES IN UV DISINFECTION EQUIPMENT MARKET

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 45 UV DISINFECTION EQUIPMENT MARKET, START-UP/SME EVALUATION MATRIX, 2021

- 11.7 COMPETITIVE SITUATIONS AND TRENDS

- 11.7.1 PRODUCT LAUNCHES

- TABLE 178 PRODUCT LAUNCHES (JANUARY 2018 TO APRIL 2022)

- 11.7.2 DEALS

- TABLE 179 DEALS (JANUARY 2018 TO APRIL 2022)

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)**

- 12.2.1 XYLEM INC.

- TABLE 180 XYLEM INC: COMPANY SNAPSHOT

- FIGURE 46 XYLEM INC.: COMPANY SNAPSHOT

- 12.2.2 TROJAN TECHNOLOGIES

- TABLE 181 TROJAN TECHNOLOGIES: COMPANY SNAPSHOT

- 12.2.3 HALMA GROUP

- TABLE 182 HALMA GROUP: COMPANY SNAPSHOT

- FIGURE 47 HALMA GROUP: COMPANY SNAPSHOT

- 12.2.4 KURARAY CO., LTD

- TABLE 183 KURARAY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 48 KURARAY CO., LTD.: COMPANY SNAPSHOT

- 12.2.5 ATLANTIC ULTRAVIOLET CORPORATION

- TABLE 184 ATLANTIC ULTRAVIOLET CORPORATION: COMPANY SNAPSHOT

- 12.2.6 EVOQUA WATER TECHNOLOGIES LLC

- TABLE 185 EVOQUA WATER TECHNOLOGIES LLC: COMPANY SNAPSHOT

- FIGURE 49 EVOQUA WATER TECHNOLOGIES LLC: COMPANY SNAPSHOT

- 12.2.7 ATLANTIUM TECHNOLOGIES LTD.

- TABLE 186 ATLANTIUM TECHNOLOGIES LTD.: COMPANY SNAPSHOT

- 12.2.8 AMERICAN ULTRAVIOLET

- TABLE 187 AMERICAN ULTRAVIOLET: COMPANY SNAPSHOT

- 12.2.9 HONLE AG

- TABLE 188 HONLE AG: COMPANY SNAPSHOT

- FIGURE 50 HONLE AG: COMPANY SNAPSHOT

- 12.2.10 ADVANCED UV, INC.

- TABLE 189 ADVANCED UV, INC.: COMPANY SNAPSHOT

- 12.2.11 LUMALIER CORPORATION

- TABLE 190 LUMALIER CORPORATION: COMPANY SNAPSHOT

- * Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

- 12.3 OTHER KEY PLAYERS

- 12.3.1 SEOUL VIOSYS CO., LTD.

- 12.3.2 HITECH ULTRAVIOLET PVT. LTD.

- 12.3.3 UVO3 LTD.

- 12.3.4 SUEZ WATER TECHNOLOGIES & SOLUTIONS

- 12.3.5 UV PURE TECHNOLOGIES

- 12.3.6 LIT COMPANY

- 12.3.7 ALFAA UV

- 12.3.8 ULTRAAQUA

- 12.3.9 AUSTRALIAN ULTRA VIOLET SERVICES PTY. LTD. (AUVS)

- 12.3.10 S.I.T.A. SRL

- 12.3.11 TYPHON TREATMENT SYSTEMS LTD.

- 12.3.12 AQUATIC SOLUTIONS

- 12.3.13 INTEGRATED AQUA SYSTEMS, INC.

- 12.3.14 AQUANETTO GROUP GMBH

- 12.3.15 NECTAR SOLUTIONS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS