|

|

市場調査レポート

商品コード

1102609

航空機搭載用衛星通信 (SATCOM) の世界市場:設置の種類別 (新規設置、更新)・用途別 (政府・防衛、商用)・プラットフォーム別 (固定翼機、回転翼機、UAV)・周波数別・コンポーネント別・地域別の将来予測 (2027年まで)Airborne SATCOM Market by Installation Type ( New Installation, Upgrade), Application (Government & Defense, Commercial), Platform (Fixed Wing, Rotary Wing, UAVs), Frequency, Component and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 航空機搭載用衛星通信 (SATCOM) の世界市場:設置の種類別 (新規設置、更新)・用途別 (政府・防衛、商用)・プラットフォーム別 (固定翼機、回転翼機、UAV)・周波数別・コンポーネント別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年07月12日

発行: MarketsandMarkets

ページ情報: 英文 293 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

航空機搭載用衛星通信 (SATCOM) の市場は、2022年に54億米ドル、2027年には73億米ドルに達すると推定され、2022年から2027年までのCAGRは6.5%と予測されています。

この市場の成長は、衛星通信用トランシーバーの普及、航空機納入の増加、カスタム型SOTMソリューションの需要の増加によるものと思われます。

"衛星通信端末の普及拡大"

衛星通信用トランシーバーは、より大容量でスループット能力の高い次世代状況認識システムを提供するものです。航空会社では、乗客の利便性向上のために衛星通信用トランシーバーを導入しており、世界の航空機搭載用衛星通信市場には発展の余地があると言えます。

"設置の種類別では、新規設置セグメントが2022年に最大シェアを占めると予測"

新規設置セグメントは2022年に57.2%と予測されています。商業・軍用双方での高度システムの展開が、この市場セグメントを牽引しています。

"コンポーネント別では、衛星通信端末が2022年に最大の市場シェアを獲得すると予測される"

コンポーネント別では、トランシーバー分野が予測期間中に最も高いCAGRで成長すると予測されています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 範囲とシナリオ

- ケーススタディ分析

- 航空機搭載用衛星通信市場のエコシステム

- 顧客のビジネスに影響を与える混乱

- バリューチェーン分析

- 原材料

- 研究開発

- コンポーネント製造

- 組立・検査

- エンドユーザー

- 貿易データ分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 平均販売価格

- 価格分析

- 主要な会議とイベント (2022年から2023年)

- 関税・規制状況

第6章 産業動向

- イントロダクション

- 新たな動向

- 技術動向

- サプライチェーン分析

- 主要企業

- 中小企業

- MROサプライヤー

- SOTM (走行追尾型衛星通信) のエンドユーザー/顧客

- イノベーションと特許登録

- メガトレンドの影響

第7章 航空機搭載用衛星通信市場:設置の種類別

- イントロダクション

- 新規設置

- 更新

第8章 航空機搭載用衛星通信市場:コンポーネント別

- イントロダクション

- 衛星通信端末

- アンテナ

- 無線周波数 (RF) ユニット

- ネットワークデータユニット (NDU)

- アンテナサブシステム

- トランシーバー

- 受信機

- 送信機

- 機上無線機

- モデム・ルーター

- SATCOM用レドーム

- その他のコンポーネント

第9章 航空機搭載用衛星通信市場:用途別

- イントロダクション

- 政府・防衛

- ISR (諜報・監視・偵察) ミッション

- 緊急対応・公安

- 国境警備・監視

- 移動中のコマンド、制御、通信

- 商業

- 機内接続

- リアルタイムのデータ収集

- 遠隔医療

第10章 航空機搭載用衛星通信市場:周波数帯域別

- イントロダクション

- VHF/UHFバンド

- Lバンド

- Sバンド

- Cバンド

- Xバンド

- KUバンド

- KAバンド

- EHF/SHFバンド

- マルチバンド

- Qバンド

第11章 航空機搭載用衛星通信市場:プラットフォーム別

- イントロダクション

- 固定翼機

- 商用航空

- ビジネス機・ジェネラルアビエーション

- 軍用航空

- 回転翼機

- 商用ヘリコプター

- 軍用ヘリコプター

- 無人航空機 (UAV)

- 固定翼型UAV

- 固定翼型・ハイブリッドVTOL UAV

- 回転翼型UAV

第12章 航空機搭載用衛星通信市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- ロシア

- イタリア

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- ラテンアメリカ

- ブラジル

- メキシコ

- 中東・アフリカ

- トルコ

- サウジアラビア

- イスラエル

- 南アフリカ

第13章 競合情勢

- イントロダクション

- 市場シェア分析 (2021年)

- 上位5社の収益分析 (2021年)

- 企業評価クアドラント

- スタートアップの評価クアドラント

- 競合シナリオ

- 取引

- 新製品の開発

- その他

第14章 企業プロファイル

- イントロダクション

- 主要企業

- L3HARRIS TECHNOLOGIES

- THALES GROUP

- COLLINS AEROSPACE

- ISRAEL AEROSPACE INDUSTRIES

- HONEYWELL INTERNATIONAL INC.

- RAYTHEON INTELLIGENCE AND SPACE

- ASELSAN A.S.

- BAE SYSTEMS

- GENERAL DYNAMICS MISSION SYSTEMS, INC.

- GILAT SATELLITE NETWORKS

- HUGHES NETWORK SYSTEMS

- VIASAT, INC

- ORBIT COMMUNICATION SYSTEMS LTD

- SMITHS GROUP PLC

- ST ENGINEERING

- IRIDIUM COMMUNICATIONS INC.

- TELEDYNE DEFENSE ELECTRONICS

- その他の企業

- COBHAM AEROSPACE COMMUNICATIONS

- BALL CORPORATION

- ASTRONICS CORPORATION

- ECLIPSE GLOBAL CONNECTIVITY

- THINKOM SOLUTIONS

- GET SAT

- NORSAT INTERNATIONAL INC

- SATCOM DIRECT

- COMTECH TELECOMMUNICATIONS CORP.

第15章 付録

The airborne SATCOM market is estimated to be USD 5.4 billion in 2022 and is projected to reach USD 7.3 billion by 2027, at a CAGR of 6.5% from 2022 to 2027. Growth of this market can be attributed to increased adoption of SATCOM transceivers, Increasing aircraft deliveries and growing demand for customized SATCOM on the move solutions

"Increase in adoption of SATCOM transceivers"

SATCOM transceivers are two-way communication using a single device. The development of modern communication technologies such as two-way radios and the Internet began with the invention of transceivers. SATCOM transceivers also provide a next-generation situational awareness system with higher capacity and throughput capabilities. Various airlines are equipping their existing fleets with SATCOM transceivers to improve passenger travel experiences, indicating that the worldwide airborne SATCOM market has room to develop. According to a research paper published in ARTES 4.0 Programme, the demand for supporting UAV communications via satellite in the L-band has increased, offering new challenges such as ensuring satellite link availability and performance during all flight phases (including take-off, landing, and banking) and at low altitudes. Many UAVs can fly beyond-radio-line-of-sight (BRLOS) in unregulated remote air spaces where a terrestrial link may not be available, necessitating the use of satellite transceivers capable of maintaining satellite contact under the most extreme pitch and roll angles. In May 2022, Inmarsat launched the Elera L-band satellite network, and Honeywell supplied the SwiftJet SATCOM service-related airborne equipment.

Based on installation type: "The new installationsegmentis estimated to account for the largest share in 2022"

The new installation segment is projected to have 57.2% in 2022. The deployment of advanced airborne SATCOM systems across commercial and military applications is driving this market segment.

Based on Component: "The SATCOM terminalsegment is estimated to have the largest market sharein 2022."

Based on component, the transceivers segment of the market is projected to grow at the highest CAGR during the forecast period. SATCOM transceivers allow two-way communication using a single device. The invention of transceivers has led to the development of several modern communication technologies such as two-way radios and the Internet.

Based on Region: "Europeis estimated to account for the second largest marketshare in 2022"

Europe is projected to have second largest market share in 2022. The countries considered under this region are Uk, France, Russia, Italy and Germany. Growing advancements in unmanned technologies, increased demand for defense and commercial aircraft and increased spending on aviation to enhance aircraft capabilities are driving this market

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: CLevel Executives-35%; Directors-25%;and Others-40%

- By Region: North America-45%; Europe-18%; AsiaPacific-30%;and the Middle East & Africa-2%, and Latin America-5%

Major players operating in the airborne SATCOMmarketare Thales Group (France), Aselsan AS (Turkey), General Dynamics Corporation (US), Hughes Network Systems (US) and Raytheon Intelligence and Space (US).

Research Coverage

The study covers theairborne SATCOM marketacross various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based onapplication, platform, components, installation type, frequency, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall airborne SATCOM marketand its segments. This study is also expected to provide regionwise information aboutthe applications, wherein airborne SATCOM systemsare used. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, challenges, and opportunities influencing the growth of the market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 MARKETS COVERED

- 1.2.2 YEARS CONSIDERED

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 AIRBORNE SATCOM MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY AND PRICING

- TABLE 2 USD EXCHANGE RATES

- 1.5 LIMITATIONS

- 1.6 MARKET STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- FIGURE 1 AIRBORNE SATCOM MARKET TO GROW AT HIGHER RATE COMPARED TO PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 AIRBORNE SATCOM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SEGMENTS AND SUBSEGMENTS

- TABLE 3 SEGMENTS AND SUBSEGMENTS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- TABLE 4 AIRBORNE SATCOM MARKET FOR NEW INSTALLATION

- 2.3.2 AIRBORNE SATCOM MARKET FOR UPGRADE

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.3 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.5 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH ASSUMPTIONS

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY ON AIRBORNE SATCOM MARKET

- 2.6.1 MARKET SIZING AND MARKET FORECASTING

3 EXECUTIVE SUMMARY

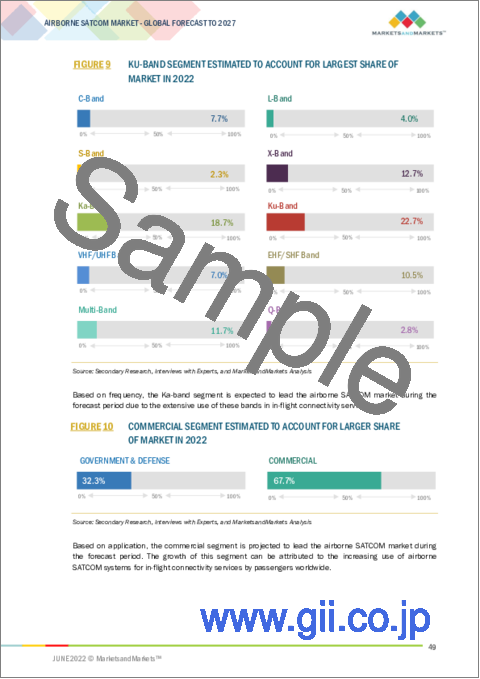

- FIGURE 9 KU-BAND SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

- FIGURE 10 COMMERCIAL SEGMENT ESTIMATED TO ACCOUNT FOR LARGER SHARE OF MARKET IN 2022

- FIGURE 11 NEW INSTALLATION SEGMENT ESTIMATED TO ACCOUNT FOR LARGER SHARE OF MARKET IN 2022

- FIGURE 12 AIRBORNE SATCOM MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN AIRBORNE SATCOM MARKET

- FIGURE 13 NEED FOR CUSTOMIZED SATCOM ON-THE-MOVE SOLUTIONS DRIVING AIRBORNE SATCOM MARKET

- 4.2 AIRBORNE SATCOM MARKET, BY COMPONENT

- FIGURE 14 TRANSCEIVERS SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

- 4.3 AIRBORNE SATCOM MARKET, BY FREQUENCY

- FIGURE 15 EHF/SHF BAND SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

- 4.4 AIRBORNE SATCOM MARKET, BY COUNTRY

- FIGURE 16 AIRBORNE SATCOM MARKET IN AUSTRALIA PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 AIRBORNE SATCOM MARKET DYNAMICS: DRIVERS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Need for customized SATCOM on-the-move solutions

- 5.2.1.2 Increasing number of aircraft fleet deliveries

- FIGURE 18 COMMERCIAL FLEET AND DELIVERIES (2019 TO 2040)

- 5.2.1.3 Increase in adoption of SATCOM transceivers

- 5.2.1.4 Growing demand for high-throughput satellites

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of development and maintenance of infrastructure to support SATCOM antennae

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased use of ultra-compact SATCOM terminals for UAVs

- 5.2.3.2 Increased need to enhance passenger experience

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity issues

- 5.3 RANGE AND SCENARIOS

- 5.4 CASE STUDY ANALYSIS

- 5.4.1 IN-FLIGHT CONNECTIVITY PROVIDED TO UNICOM AIR NET VIA SATELLITE

- 5.4.2 HIGH-SPEED INTERNET SYSTEMS OFFER IMPROVED BUSINESS EFFICIENCY

- 5.4.3 FLEXIBILITY OF ORBIT GX46 AIRBORNE SATCOM TERMINAL WIDENED ITS GOVERNMENT APPLICATIONS

- 5.5 AIRBORNE SATCOM MARKET ECOSYSTEM

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- FIGURE 19 AIRBORNE SATCOM MARKET ECOSYSTEM

- TABLE 5 AIRBORNE SATCOM MARKET ECOSYSTEM

- 5.6 DISRUPTION IMPACTING CUSTOMER'S BUSINESS

- FIGURE 20 REVENUE SHIFT IN AIRBORNE SATCOM MARKET

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS

- 5.7.1 RAW MATERIALS

- 5.7.2 R&D

- 5.7.3 COMPONENT MANUFACTURING

- 5.7.4 ASSEMBLY & TESTING

- 5.7.5 END USERS

- 5.8 TRADE DATA ANALYSIS

- TABLE 6 TRADE DATA ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 COMPONENTS

- TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 COMPONENTS (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR TOP 3 COMPONENTS

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 COMPONENTS

- 5.11 AVERAGE SELLING PRICE

- TABLE 9 AVERAGE SELLING PRICE: AIRBORNE SATCOM, BY COMPONENT (USD MILLION)

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICES OF AIRBORNE SATCOM, BY COMPONENT

- FIGURE 25 AVERAGE SELLING PRICES OF TACTICAL DATA LINK COMPONENTS

- 5.13 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 10 AIRBORNE SATCOM MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 NORTH AMERICA

- 5.14.3 EUROPE

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 EMERGING TRENDS

- FIGURE 26 EMERGING TRENDS

- 6.2.1 LASER COMMUNICATION TERMINALS

- 6.2.2 NEW SATCOM ANTENNA DESIGNS

- 6.2.3 DEVELOPMENT OF ACTIVE ELECTRONICALLY SCANNED ARRAY (AESA)

- 6.2.4 USE OF LARGE REFLECTORS FOR HIGH-SPEED TRANSMISSION

- 6.2.5 ONBOARD RADIOFREQUENCY AND BASEBAND EQUIPMENT

- 6.2.6 DIGITIZED SATELLITE COMMUNICATIONS PAYLOAD

- 6.3 TECHNOLOGY TRENDS

- 6.3.1 USE OF KA- AND KU- BANDS FOR SATCOM

- 6.3.2 MULTIBAND TACTICAL COMMUNICATION AMPLIFIERS

- 6.3.3 SOFTWARE-DEFINED RADIO

- 6.3.4 USE OF WIDE V-BAND FOR SATELLITE-AIRCRAFT COMMUNICATION

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.4.1 MAJOR COMPANIES

- 6.4.2 SMALL AND MEDIUM ENTERPRISES

- 6.4.3 MRO SUPPLIERS

- 6.4.4 END USERS/CUSTOMERS IN SATCOM ON-THE-MOVE MARKET

- FIGURE 27 SUPPLY CHAIN ANALYSIS

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 13 INNOVATIONS & PATENT REGISTRATIONS, 2019-2021

- 6.6 IMPACT OF MEGATRENDS

- 6.6.1 HYBRID BEAMFORMING METHODS

- 6.6.2 DEVELOPMENT OF SMART ANTENNAE

- 6.6.3 MULTI-BAND, MULTI-MISSION (MBMM) ANTENNA

7 AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE

- 7.1 INTRODUCTION

- FIGURE 28 NEW INSTALLATION SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 14 AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 15 AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- 7.2 NEW INSTALLATION

- 7.2.1 DEPLOYMENT OF ADVANCED AIRBORNE SATCOM SYSTEMS ACROSS COMMERCIAL AND MILITARY APPLICATIONS TO DRIVE SEGMENT

- 7.3 UPGRADE

- 7.3.1 FREQUENT UPGRADE OF OLD AIRCRAFT FLEET TO DRIVE SEGMENT

8 AIRBORNE SATCOM MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- FIGURE 29 TRANSCEIVER SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 16 AIRBORNE SATCOM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 17 AIRBORNE SATCOM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 8.2 SATCOM TERMINALS

- TABLE 18 SATCOM TERMINALS: AIRBORNE SATCOM MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 19 SATCOM TERMINALS: AIRBORNE SATCOM MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.2.1 ANTENNAE

- 8.2.1.1 Fuselage-mount antennae

- 8.2.1.1.1 Increased use in commercial and special mission aircraft to drive segment

- 8.2.1.2 Tail-mount Antennae

- 8.2.1.2.1 Increased use in business jets to drive segment

- 8.2.1.1 Fuselage-mount antennae

- TABLE 20 SATCOM TERMINALS: AIRBORNE SATCOM MARKET, BY ANTENNA TYPE, 2018-2021 (USD MILLION)

- TABLE 21 SATCOM TERMINALS: AIRBORNE SATCOM MARKET, BY ANTENNA TYPE, 2022-2027 (USD MILLION)

- 8.2.2 RADIOFREQUENCY (RF) UNITS

- 8.2.2.1 Demand for higher bandwidth to support faster data rates to drive segment

- 8.2.3 NETWORKING DATA UNITS (NDU)

- 8.2.3.1 Increased need to gauge current position of aircraft to drive segment

- 8.2.4 ANTENNAE SUBSYSTEMS

- 8.2.4.1 Antennae control units

- 8.2.4.1.1 Need for precision satellite tracking devices and flyaway antennae to drive segment

- 8.2.4.2 Stabilized antennae pedestals

- 8.2.4.2.1 Increasing need for real-time information in any environment to drive segment

- 8.2.4.1 Antennae control units

- 8.3 TRANSCEIVERS

- TABLE 22 TRANSCEIVERS: AIRBORNE SATCOM MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 23 TRANSCEIVERS: AIRBORNE SATCOM MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.3.1 RECEIVERS

- 8.3.1.1 Block downconverters

- 8.3.1.1.1 Increased need for uninterrupted satellite communication to drive segment

- 8.3.1.2 Low-noise amplifiers

- 8.3.1.2.1 Need for radio communication systems to drive segment

- 8.3.1.1 Block downconverters

- 8.3.2 TRANSMITTERS

- 8.3.2.1 Block upconverters

- 8.3.2.1.1 Increased need for aircraft movement and connectivity information to drive segment

- 8.3.2.2 High-power amplifiers

- 8.3.2.2.1 Need for high amplitude signals to drive segment

- 8.3.2.1 Block upconverters

- 8.4 AIRBORNE RADIO

- 8.4.1 NEED FOR INCREASING RANGE AND PHYSICAL SECURITY OF COMMUNICATION SYSTEMS TO DRIVE SEGMENT

- 8.5 MODEMS & ROUTERS

- 8.5.1 NEED FOR HIGH-SPEED DATA COMMUNICATION IN AIRCRAFT TO DRIVE SEGMENT

- 8.6 SATCOM RADOMES

- 8.6.1 NEED FOR SAFETY AND SECURITY OF AIRBORNE SATCOM SYSTEMS IN HARSH ENVIRONMENTS TO DRIVE SEGMENT

- 8.7 OTHER COMPONENTS

9 AIRBORNE SATCOM MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 30 COMMERCIAL SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 24 AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 25 AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2 GOVERNMENT & DEFENSE

- TABLE 26 GOVERNMENT & DEFENSE AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 27 GOVERNMENT & DEFENSE AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2.1 ISR MISSIONS

- 9.2.1.1 Increased need to provide advanced SA is driving this segment

- 9.2.2 EMERGENCY RESPONSE & PUBLIC SAFETY

- 9.2.2.1 Growing aircraft rescue missions to drive segment

- 9.2.3 BORDER PROTECTION & SURVEILLANCE

- 9.2.3.1 Increasing use of UAVs for real-time battlefield information to drive segment

- 9.2.4 COMMAND, CONTROL & COMMUNICATIONS ON-THE-MOVE

- 9.2.4.1 Increased spending on system deployment to drive segment

- 9.3 COMMERCIAL

- TABLE 28 COMMERCIAL AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 29 COMMERCIAL AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.3.1 IN-FLIGHT CONNECTIVITY

- 9.3.1.1 Increased demand for enhanced passenger experience to drive segment

- 9.3.2 REAL-TIME DATA GATHERING

- 9.3.2.1 Increased use of aerial platforms to broadcast and communicate to drive segment

- 9.3.3 TELEMEDICINE

- 9.3.3.1 Need for improved medical services to drive segment

10 AIRBORNE SATCOM MARKET, BY FREQUENCY

- 10.1 INTRODUCTION

- FIGURE 31 EHF/SHF BAND SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 30 AIRBORNE SATCOM MARKET, BY FREQUENCY, 2018-2021 (USD MILLION)

- TABLE 31 AIRBORNE SATCOM MARKET, BY FREQUENCY, 2022-2027 (USD MILLION)

- 10.2 VHF/UHF-BAND

- 10.2.1 MAJOR USE IN CUBESATS FOR COMMUNICATION APPLICATIONS TO DRIVE SEGMENT

- 10.3 L-BAND

- 10.3.1 EXTENSIVE USE IN DATA COMMUNICATIONS AND TRAFFIC INFORMATION TO DRIVE SEGMENT

- 10.4 S-BAND

- 10.4.1 LOW DRAG, LIGHTWEIGHT, AND COMPATIBILITY WITH AIRCRAFT PLATFORMS TO DRIVE SEGMENT

- 10.5 C-BAND

- 10.5.1 USE IN UNMANNED AIRCRAFT TO DRIVE SEGMENT

- 10.6 X-BAND

- 10.6.1 USE IN LONG-ENDURANCE SURVEILLANCE AND RECONNAISSANCE TO DRIVE SEGMENT

- 10.7 KU-BAND

- 10.7.1 USE IN SMALL PLATFORMS TO PROVIDE IMAGING APPLICATIONS IN REMOTE LOCATIONS TO DRIVE SEGMENT

- 10.8 KA-BAND

- 10.8.1 USE IN MILITARY AND COMMERCIAL AIRCRAFT FOR HIGH BANDWIDTH COMMUNICATION TO DRIVE SEGMENT

- 10.9 EHF/SHF BAND

- 10.9.1 USE IN MOST RADAR TRANSMITTERS TO DRIVE SEGMENT

- 10.10 MULTI-BAND

- 10.10.1 NEED FOR SEAMLESS, ASSURED CONNECTIVITY BETWEEN NETWORK AND GRID TO DRIVE SEGMENT

- 10.11 Q-BAND

- 10.11.1 NEED TO REDUCE SIGNAL FADING AT HIGH-FREQUENCY TO DRIVE SEGMENT

11 AIRBORNE SATCOM MARKET, BY PLATFORM

- 11.1 INTRODUCTION

- FIGURE 32 UAV SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 32 AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 33 AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 11.2 FIXED WING

- TABLE 34 FIXED WING AIRBORNE SATCOM MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 35 FIXED WING AIRBORNE SATCOM MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.1 COMMERCIAL AVIATION

- TABLE 36 COMMERCIAL AVIATION AIRBORNE SATCOM MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 37 COMMERCIAL AVIATION AIRBORNE SATCOM MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 11.2.1.1 Narrow-body aircraft

- 11.2.1.1.1 Increasing domestic air travel to drive segment

- 11.2.1.2 Wide-body aircraft

- 11.2.1.2.1 Growing military and commercial usage to drive segment

- 11.2.1.3 Regional transport aircraft (RTA)

- 11.2.1.3.1 Increasing demand for short-distance transport to drive segment

- 11.2.1.1 Narrow-body aircraft

- 11.2.2 BUSINESS AVIATION & GENERAL AVIATION

- TABLE 38 BUSINESS AVIATION & GENERAL AVIATION AIRBORNE SATCOM MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 39 BUSINESS AVIATION & GENERAL AVIATION AIRBORNE SATCOM MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.2.1 Business jets

- 11.2.2.1.1 Increasing customization requirements to drive segment

- 11.2.2.2 Light aircraft

- 11.2.2.2.1 Growing business travel across the world to drive segment

- 11.2.2.1 Business jets

- 11.2.3 MILITARY AVIATION

- TABLE 40 MILITARY AVIATION AIRBORNE SATCOM MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 41 MILITARY AVIATION AIRBORNE SATCOM MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.3.1 Fighter aircraft

- 11.2.3.1.1 Increasing modernization programs by militaries to drive segment

- 11.2.3.2 Special mission aircraft

- 11.2.3.2.1 Increasing defense spending in North America and Asia Pacific to drive segment

- 11.2.3.3 Transport aircraft

- 11.2.3.3.1 Consistent global military operations to drive segment

- 11.2.3.1 Fighter aircraft

- 11.3 ROTARY WING

- TABLE 42 ROTARY WING AIRBORNE SATCOM MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 43 ROTARY WING AIRBORNE SATCOM MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 11.3.1 COMMERCIAL HELICOPTER

- 11.3.1.1 Increasing operational capabilities and decreasing cost of production to drive segment

- 11.3.2 MILITARY HELICOPTER

- 11.3.2.1 Increasing need to cater to military applications to drive segment

- 11.4 UNMANNED AERIAL VEHICLES

- TABLE 44 UNMANNED AERIAL VEHICLES AIRBORNE SATCOM MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 45 UNMANNED AERIAL VEHICLES AIRBORNE SATCOM MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.1 FIXED WING UAV

- 11.4.1.1 Wide range of military applications to drive segment

- 11.4.2 FIXED-WING HYBRID VTOL UAV

- 11.4.2.1 Long flight and large payload capacities to drive segment

- 11.4.3 ROTARY WING UAV

- 11.4.3.1 Technical advancements and innovations to drive segment

12 AIRBORNE SATCOM MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 33 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF AIRBORNE SATCOM MARKET IN 2022

- TABLE 46 AIRBORNE SATCOM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 AIRBORNE SATCOM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 PESTLE ANALYSIS

- FIGURE 34 NORTH AMERICA: AIRBORNE SATCOM MARKET SNAPSHOT

- TABLE 48 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 49 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 50 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 51 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 53 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 55 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Presence of leading aircraft manufacturers to drive market

- TABLE 56 US: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 57 US: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 58 US: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 59 US: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 60 US: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 61 US: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Growing aircraft deliveries and old fleet upgrade to drive market

- TABLE 62 CANADA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 63 CANADA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 64 CANADA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 65 CANADA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 66 CANADA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 67 CANADA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 PESTLE ANALYSIS

- FIGURE 35 EUROPE: AIRBORNE SATCOM MARKET SNAPSHOT

- TABLE 68 EUROPE: AIRBORNE SATCOM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 69 EUROPE: AIRBORNE SATCOM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 70 EUROPE: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 71 EUROPE: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 72 EUROPE: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 73 EUROPE: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 74 EUROPE: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 75 EUROPE: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.3.2 UK

- 12.3.2.1 Advancements in unmanned technologies to drive market

- TABLE 76 UK: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 77 UK: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 78 UK: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 79 UK: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 80 UK: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 81 UK: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Availability of affordable and advanced technologies to drive market

- TABLE 82 FRANCE: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 83 FRANCE: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 84 FRANCE: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 85 FRANCE: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 86 FRANCE: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 87 FRANCE: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.3.4 GERMANY

- 12.3.4.1 Demand for defense and commercial aircraft to drive market

- TABLE 88 GERMANY: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 89 GERMANY: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 90 GERMANY: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 91 GERMANY: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 92 GERMANY: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 93 GERMANY: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.3.5 RUSSIA

- 12.3.5.1 Increased spending on aviation to enhance aircraft capabilities to drive market

- TABLE 94 RUSSIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 95 RUSSIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 96 RUSSIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 97 RUSSIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 98 RUSSIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 99 RUSSIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.3.6 ITALY

- 12.3.6.1 Replacement of old fleets by domestic airlines to drive market

- TABLE 100 ITALY: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 101 ITALY: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 102 ITALY: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 103 ITALY: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 104 ITALY: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 105 ITALY: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- 12.4.1 PESTLE ANALYSIS

- FIGURE 36 ASIA PACIFIC: AIRBORNE SATCOM MARKET SNAPSHOT

- TABLE 106 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 107 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 108 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 109 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 110 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 111 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Growing demand for new aircraft to drive market

- TABLE 114 CHINA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 115 CHINA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 116 CHINA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 117 CHINA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 118 CHINA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 119 CHINA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.4.3 INDIA

- 12.4.3.1 Defense spending on different types of military aircraft to drive market

- TABLE 120 INDIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 121 INDIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 122 INDIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 123 INDIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 124 INDIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 125 INDIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Increased focus on commercial IFC services to drive market

- TABLE 126 JAPAN: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 127 JAPAN: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 128 JAPAN: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 129 JAPAN: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 130 JAPAN: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 131 JAPAN: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.4.5 AUSTRALIA

- 12.4.5.1 Advancements in IFC to drive market

- TABLE 132 AUSTRALIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 133 AUSTRALIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 134 AUSTRALIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 135 AUSTRALIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 136 AUSTRALIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 137 AUSTRALIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Significant growth opportunities for domestic production to drive market

- TABLE 138 SOUTH KOREA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 139 SOUTH KOREA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 140 SOUTH KOREA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 141 SOUTH KOREA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 142 SOUTH KOREA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 143 SOUTH KOREA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.5 LATIN AMERICA

- 12.5.1 PESTLE ANALYSIS

- FIGURE 37 LATIN AMERICA: AIRBORNE SATCOM MARKET SNAPSHOT

- TABLE 144 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 145 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 146 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 147 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 148 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 149 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 150 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 151 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.5.2 BRAZIL

- 12.5.2.1 Increase in domestic production of aircraft to drive market

- TABLE 152 BRAZIL: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 153 BRAZIL: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 154 BRAZIL: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 155 BRAZIL: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 156 BRAZIL: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 157 BRAZIL: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.5.3 MEXICO

- 12.5.3.1 Increased investments by global aircraft manufacturing companies to drive market

- TABLE 158 MEXICO: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 159 MEXICO: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 160 MEXICO: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 161 MEXICO: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 162 MEXICO: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 163 MEXICO: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.6 MIDDLE EAST AND AFRICA

- 12.6.1 PESTLE ANALYSIS

- FIGURE 38 MIDDLE EAST: AIRBORNE SATCOM MARKET SNAPSHOT

- TABLE 164 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, 2018-2021 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, 2022-2027 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.6.2 TURKEY

- 12.6.2.1 Focus on in-house production of UAVs to drive market

- TABLE 172 TURKEY: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 173 TURKEY: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 174 TURKEY: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 175 TURKEY: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 176 TURKEY: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 177 TURKEY: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.6.3 SAUDI ARABIA

- 12.6.3.1 Increasing investments in UAVs to drive market

- TABLE 178 SAUDI ARABIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 179 SAUDI ARABIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 180 SAUDI ARABIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 181 SAUDI ARABIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 182 SAUDI ARABIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 183 SAUDI ARABIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.6.4 ISRAEL

- 12.6.4.1 Presence of leading OEMs to drive market

- TABLE 184 ISRAEL: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 185 ISRAEL: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 186 ISRAEL: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 187 ISRAEL: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 188 ISRAEL: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 189 ISRAEL: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 12.6.5 SOUTH AFRICA

- 12.6.5.1 Demand for advanced connectivity in new and old fleets of major airlines to drive market

- TABLE 190 SOUTH AFRICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 191 SOUTH AFRICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 192 SOUTH AFRICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 193 SOUTH AFRICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 194 SOUTH AFRICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 195 SOUTH AFRICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 MARKET SHARE ANALYSIS, 2021

- TABLE 196 DEGREE OF COMPETITION

- FIGURE 39 MARKET SHARE OF TOP PLAYERS IN AIRBORNE SATCOM MARKET, 2021 (%)

- 13.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2021

- 13.4 COMPANY EVALUATION QUADRANT

- 13.4.1 STARS

- 13.4.2 EMERGING LEADERS

- 13.4.3 PERVASIVE COMPANIES

- 13.4.4 PARTICIPANTS

- FIGURE 40 COMPETITIVE LEADERSHIP MAPPING, 2021

- 13.5 START-UP EVALUATION QUADRANT

- 13.5.1 PROGRESSIVE COMPANIES

- 13.5.2 RESPONSIVE COMPANIES

- 13.5.3 STARTING BLOCKS

- 13.5.4 DYNAMIC COMPANIES

- FIGURE 41 COMPETITIVE LEADERSHIP MAPPING OF STARTUPS, 2021

- TABLE 197 AIRBORNE SATCOM MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 198 AIRBORNE SATCOM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- TABLE 199 COMPANY PRODUCT FOOTPRINT

- TABLE 200 COMPANY FOOTPRINT BY APPLICATION

- TABLE 201 COMPANY FOOTPRINT BY PLATFORM

- TABLE 202 COMPANY FOOTPRINT BY REGION

- 13.6 COMPETITIVE SCENARIO

- 13.6.1 DEALS

- TABLE 203 DEALS, 2019-2022

- 13.6.2 NEW PRODUCT DEVELOPMENTS

- TABLE 204 NEW PRODUCT DEVELOPMENTS, 2019-2022

- 13.6.3 OTHERS

- TABLE 205 OTHERS, 2019-2022

14 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 L3HARRIS TECHNOLOGIES

- TABLE 206 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 42 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 207 L3HARRIS TECHNOLOGIES: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 208 L3HARRIS TECHNOLOGIES: DEALS

- TABLE 209 L3HARRIS CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 210 L3HARRIS CORPORATION: OTHERS

- 14.2.2 THALES GROUP

- TABLE 211 THALES GROUP: BUSINESS OVERVIEW

- FIGURE 43 THALES GROUP: COMPANY SNAPSHOT

- TABLE 212 THALES GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 213 THALES GROUP: DEALS

- 14.2.3 COLLINS AEROSPACE

- TABLE 214 COLLINS AEROSPACE: BUSINESS OVERVIEW

- FIGURE 44 COLLINS AEROSPACE SYSTEM: COMPANY SNAPSHOT

- TABLE 215 COLLINS AEROSPACE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 216 COLLINS AEROSPACE: DEALS

- TABLE 217 COLLINS AEROSPACE: OTHERS

- 14.2.4 ISRAEL AEROSPACE INDUSTRIES

- TABLE 218 ISRAEL AEROSPACE INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 45 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

- TABLE 219 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS/SOLUTIONS OFFERED

- TABLE 220 ISRAEL AEROSPACE INDUSTRIES: DEALS

- TABLE 221 ISRAEL AEROSPACE INDUSTRIES: OTHERS

- 14.2.5 HONEYWELL INTERNATIONAL INC.

- TABLE 222 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- FIGURE 46 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 223 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 224 HONEYWELL INTERNATIONAL: DEALS

- TABLE 225 HONEYWELL INTERNATIONAL: NEW PRODUCT DEVELOPMENTS

- TABLE 226 HONEYWELL INTERNATIONAL: OTHERS

- 14.2.6 RAYTHEON INTELLIGENCE AND SPACE

- TABLE 227 RAYTHEON INTELLIGENCE AND SPACE: BUSINESS OVERVIEW

- FIGURE 47 RAYTHEON INTELLIGENCE AND SPACE: COMPANY SNAPSHOT

- TABLE 228 RAYTHEON INTELLIGENCE AND SPACE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 229 RAYTHEON INTELLIGENCE AND SPACE: DEALS

- TABLE 230 RAYTHEON INTELLIGENCE AND SPACE: OTHERS

- 14.2.7 ASELSAN A.S.

- TABLE 231 ASELSAN A.S: BUSINESS OVERVIEW

- FIGURE 48 ASELSAN A.S.: COMPANY SNAPSHOT

- TABLE 232 ASELSAN A.S.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 233 ASELSAN A.S: DEALS

- 14.2.8 BAE SYSTEMS

- TABLE 234 BAE SYSTEMS: BUSINESS OVERVIEW

- FIGURE 49 BAE SYSTEMS: COMPANY SNAPSHOT

- TABLE 235 BAE SYSTEMS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 236 BAE SYSTEMS: DEALS

- 14.2.9 GENERAL DYNAMICS MISSION SYSTEMS, INC.

- TABLE 237 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- FIGURE 50 GENERAL DYNAMICS MISSION SYSTEMS, INC.: COMPANY SNAPSHOT

- TABLE 238 GENERAL DYNAMICS MISSION SYSTEMS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 239 GENERAL DYNAMICS MISSION SYSTEMS, INC.: DEALS

- TABLE 240 GENERAL DYNAMICS MISSION SYSTEMS, INC.: NEW PRODUCT DEVELOPMENTS

- 14.2.10 GILAT SATELLITE NETWORKS

- TABLE 241 GILAT SATELLITE NETWORKS: BUSINESS OVERVIEW

- FIGURE 51 GILAT SATELLITE NETWORKS: COMPANY SNAPSHOT

- TABLE 242 GILAT SATELLITE NETWORKS: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 243 GILAT SATELLITE NETWORKS: DEALS

- TABLE 244 GILAT SATELLITE NETWORKS: NEW PRODUCT DEVELOPMENTS

- TABLE 245 GILAT SATELLITE NETWORKS: OTHERS

- 14.2.11 HUGHES NETWORK SYSTEMS

- TABLE 246 HUGHES NETWORK SYSTEMS: BUSINESS OVERVIEW

- FIGURE 52 HUGHES NETWORK SYSTEMS: COMPANY SNAPSHOT

- TABLE 247 HUGHES NETWORK SYSTEMS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 248 HUGHES NETWORK SYSTEMS: DEALS

- TABLE 249 HUGHES NETWORK SYSTEMS: NEW PRODUCT DEVELOPMENTS

- 14.2.12 VIASAT, INC

- TABLE 250 VIASAT, INC: BUSINESS OVERVIEW

- FIGURE 53 VIASAT, INC: COMPANY SNAPSHOT

- TABLE 251 VIASAT, INC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 252 VIASAT INC.: DEALS

- TABLE 253 VIASAT INC.: NEW PRODUCT DEVELOPMENTS

- TABLE 254 VIASAT INC.: OTHERS

- 14.2.13 ORBIT COMMUNICATION SYSTEMS LTD

- TABLE 255 ORBIT COMMUNICATION SYSTEM LTD: BUSINESS OVERVIEW

- FIGURE 54 ORBIT COMMUNICATION SYSTEMS: COMPANY SNAPSHOT

- TABLE 256 ORBIT COMMUNICATION SYSTEMS LTD: PRODUCTS/SOLUTIONS OFFERED

- TABLE 257 ORBIT COMMUNICATION SYSTEMS: DEALS

- TABLE 258 ORBIT COMMUNICATION SYSTEMS: NEW PRODUCT DEVELOPMENTS

- TABLE 259 ORBIT COMMUNICATION SYSTEMS: OTHERS

- 14.2.14 SMITHS GROUP PLC

- TABLE 260 SMITHS GROUP PLC: BUSINESS OVERVIEW

- FIGURE 55 SMITHS GROUP PLC: COMPANY SNAPSHOT

- TABLE 261 SMITHS GROUP PLC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 262 SMITHS GROUP PLC: DEALS

- TABLE 263 SMITHS GROUP PLC: OTHERS

- 14.2.15 ST ENGINEERING

- TABLE 264 ST ENGINEERING: BUSINESS OVERVIEW

- FIGURE 56 ST ENGINEERING: COMPANY SNAPSHOT

- TABLE 265 ST ENGINEERING: PRODUCTS/SOLUTIONS OFFERED

- TABLE 266 ST ENGINEERING: DEALS

- 14.2.16 IRIDIUM COMMUNICATIONS INC.

- TABLE 267 IRIDIUM COMMUNICATIONS INC.: BUSINESS OVERVIEW

- FIGURE 57 IRIDIUM COMMUNICATIONS INC: COMPANY SNAPSHOT

- TABLE 268 IRIDIUM COMMUNICATIONS INC: PRODUCTS/ SOLUTIONS OFFERED

- TABLE 269 IRIDIUM COMMUNICATIONS INC: NEW PRODUCT DEVELOPMENTS

- 14.2.17 TELEDYNE DEFENSE ELECTRONICS

- TABLE 270 TELEDYNE DEFENSE ELECTRONICS: BUSINESS OVERVIEW

- FIGURE 58 TELEDYNE DEFENSE ELECTRONICS: COMPANY SNAPSHOT

- TABLE 271 TELEDYNE DEFENSE ELECTRONICS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 272 TELEDYNE DEFENSE ELECTRONICS: DEALS

- TABLE 273 TELEDYNE DEFENSE ELECTRONICS: NEW PRODUCT DEVELOPMENTS

- 14.3 OTHER PLAYERS

- 14.3.1 COBHAM AEROSPACE COMMUNICATIONS

- TABLE 274 COBHAM AEROSPACE COMMUNICATIONS: COMPANY OVERVIEW

- 14.3.2 BALL CORPORATION

- TABLE 275 BALL CORPORATION: COMPANY OVERVIEW

- 14.3.3 ASTRONICS CORPORATION

- TABLE 276 ASTRONICS CORPORATION: COMPANY OVERVIEW

- 14.3.4 ECLIPSE GLOBAL CONNECTIVITY

- TABLE 277 ECLIPSE GLOBAL CONNECTIVITY: COMPANY OVERVIEW

- 14.3.5 THINKOM SOLUTIONS

- TABLE 278 THINKOM SOLUTIONS: COMPANY OVERVIEW

- 14.3.6 GET SAT

- TABLE 279 GET SAT: COMPANY OVERVIEW

- 14.3.7 NORSAT INTERNATIONAL INC

- TABLE 280 NORSAT INTERNATIONAL INC: COMPANY OVERVIEW

- 14.3.8 SATCOM DIRECT

- TABLE 281 SATCOM DIRECT: COMPANY OVERVIEW

- 14.3.9 COMTECH TELECOMMUNICATIONS CORP.

- TABLE 282 COMTECH TELECOMMUNICATIONS CORP.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATION

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS