|

|

市場調査レポート

商品コード

1107619

熱システムの世界市場:用途別・技術別・コンポーネント別・車両別・地域別の将来予測 (2027年)Thermal Systems Market by Application (Front & Rear A/C, Powertrain, Seat, Steering, Battery, Motor, Power Electronics, Waste Heat Recovery, Sensor), Technology, Components, Vehicle (ICE, Electric, Off-Vehicle & ATV) and Region - Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 熱システムの世界市場:用途別・技術別・コンポーネント別・車両別・地域別の将来予測 (2027年) |

|

出版日: 2022年07月25日

発行: MarketsandMarkets

ページ情報: 英文 386 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

熱システム市場は、2022年の376億米ドルから2027年には417億米ドルへと、2.1%のCAGRで成長すると予測されています。

この市場は、さまざまな国での厳しい排ガス規制によるパワートレイン熱管理の重要性の増大など、いくつかの要因によって有望な成長可能性を秘めています。また、快適性を向上させた高級車の需要が高まっていることから、熱管理が必要とされています。最後に、電気自動車の普及に伴い、バッテリー、モーター、その他のパワーエレクトロニクスモジュールの効果的な熱管理が必要となります。

高級車、特にハイエンドのフルサイズSUVの需要が高まる中、ステアリングヒーター、シートヒーター/ベンチレーション、オートエアコン、リアエアコンなど、いくつかの熱システムは、技術、快適性、安全性の面で進化してきました。例えば、3列目の乗客に十分な冷却を提供するために、OEMはフルサイズSUVに独立したリアエアコンユニットを設置しており、需要の増加に伴い、リアシートエアコン市場も成長すると考えられます。高級車に対する需要の高まりは、グリルシャッター、パッシブキャビンベンチレーション、アクティブキャビンベンチレーション、アクティブシートベンチレーション、ガラスやグレージングなど、現在普及率が非常に低い高度な熱システムおよび機能の必要性を高めると考えられています。

"バッテリー式電気自動車セグメントが電気・ハイブリッド車用サーマルシステム市場を牽引"

厳しい排ガス規制により、世界的に電気自動車に注目が集まり、近年、これらの車種は飛躍的な成長を遂げました。電気自動車の販売台数の増加により、電動コンプレッサー、バッテリー、電気モーター、パワーエレクトロニクス、熱交換器などの電動コンポーネントの需要に拍車がかかっています。また、航続距離の伸びや急速充電の需要により、バッテリーやモーターの熱管理は電気自動車にとって重要な要素となっています。さらに自動車業界では、車内のプリコンディショニング、空気冷却装置と冷媒冷却式バッテリー、ヒートポンプ、廃熱の回収・再利用など、さまざまな熱管理コンセプトを組み合わせて実験しています。したがって、電気自動車の販売台数の増加は、今後サーマルシステム市場を活性化させるでしょう。

"廃熱回収技術:予測期間中に最も速い速度で成長"

廃熱回収は、特に西欧と北米における排ガス規制の厳格化により、レビュー期間中に最も成長するセグメントとなる見通しです。欧州諸国、トルコ、イスラエルは、排出ガス削減と燃費向上を実現するための「世界調和型軽自動車試験方法 (WLTP) 」を義務化しています。今後、他の国もこのプログラムに参加することが予想され、今後、小型エンジンを中心にEGR技術の採用が促進される可能性があります。これにより、排ガス再循環 (EGR) と熱電発電機 (TEG) の利用が今後成長し、熱システムプロバイダーに新たなビジネスチャンスをもたらすものと思われます。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える傾向/混乱

- 熱システムの市場シナリオ

- 現実的なシナリオ

- 影響の少ないシナリオ

- 影響の大きいシナリオ

- ポーターのファイブフォース分析

- 熱システム市場のエコシステム

- サプライチェーン分析

- 北米:熱システムの主要サプライヤー

- 購入基準

- 価格分析

- 特許分析

- ケーススタディ分析

- 貿易分析

- 規制状況

- 規制機関/政府機関

- 主な会議とイベント (2022年~2023年)

- 技術分析

- 熱システム技術分析

- 乗客快適性技術

- 間接給気冷却

- 液体冷却チャージエアクーラー

第6章 熱システム市場:用途別 (ICE)

- イントロダクション

- エンジン冷却

- フロントエアコン

- リアエアコン

- トランスミッションシステム

- 暖房/換気シート

- ステアリングヒーター

- 廃熱回収

第7章 熱システム市場:コンポーネント別 (ICE)

- イントロダクション

- エアフィルター

- コンデンサー

- コンプレッサー

- 水ポンプ

- モーター

- 熱交換器

- ヒーター制御

- 熱電発電機

- EGRバルブ

- エアコンバルブ

- 酸素センサー

- 温度センサー

- チャージエアクーラー (給気冷却器)

第8章 自動車用熱システム市場、技術別 (ICE)

- イントロダクション

- アクティブトランスミッションウォームアップ

- EGR (排気ガス再循環)

- エンジン熱質量削減

- HVACシステム負荷軽減

- その他の技術

第9章 熱システム市場:車種別 (ICE)

- イントロダクション

- 乗用車

- 小型商用車 (LCV)

- トラック

- バス

第10章 電気自動車・ハイブリッド車用熱システム市場:用途別

- イントロダクション

- バッテリー熱管理

- トランスミッションシステム

- エンジン冷却

- フロントエアコン

- モーター熱管理

- パワーエレクトロニクス

- リアエアコン

- 暖房/換気シート

- ステアリングヒーター

- 廃熱回収

第11章 電気自動車・ハイブリッド車用熱システム市場:コンポーネント別

- イントロダクション

- エアフィルター

- コンデンサー

- 電動コンプレッサー

- 電動ウォーターポンプ

- 熱交換器

- ヒーター制御

- 電気モーター

- 熱電発電機

第12章 電気自動車・ハイブリッド車用熱システム市場:車種別

- イントロダクション

- バッテリー式電気自動車 (BEV)

- プラグインハイブリッド車 (PHEV)

- 燃料電池車 (FCEV)

- 48Vマイルドハイブリッド

- 電気商用車

第13章 オフハイウェイ車用熱システム市場:機器の種類別

- イントロダクション

- 建設・鉱山機械

- 農場用トラクター

第14章 全地形対応車 (ATV) 用熱システム市場:地域別

- イントロダクション

- 電動ATV

- ガソリンATV

第15章 熱システム市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- タイ

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- ロシア

- 他の欧州諸国

- 北米

- 米国

- カナダ

- メキシコ

- 他の国々 (RoW)

- イラン

- ブラジル

- アルゼンチン

- その他

第16章 MarketsandMarketsの提言

第17章 競合情勢

- 概要

- 熱システム市場のシェア分析 (2021年)

- 北米の熱システム市場:ランキング分析 (大手企業、2021年)

- フロント・リアエアコン:北米市場のランキングと主要企業

- エンジン冷却:北米市場のランキングと主要企業

- バッテリー冷却:北米市場のランキングと主要企業

- EGRシステム:北米市場のランキングと主要企業

- 暖房/換気シート:北米市場ランキング

- 大手企業/上場企業の収益分析

- 競合評価クアドラント:熱システムメーカー

- 競合評価クアドラント:電気自動車・ハイブリッド車の熱システムメーカー

- 競合シナリオ

- 新製品の発売

- 資本取引

- 拡張

- 主要企業の戦略/勝つ権利 (2018年~2022年)

第18章 企業プロファイル

- 熱システム市場:大手企業

- DENSO CORPORATION

- MAHLE GMBH

- VALEO SA

- HANON SYSTEMS

- BORGWARNER INC.

- GENTHERM INC.

- SCHAEFFLER AG

- JOHNSON ELECTRIC HOLDINGS LTD.

- DANA LIMITED

- ROBERT BOSCH GMBH

- 熱システム市場:その他の企業

- EBERSPACHER

- CONTINENTAL AG

- VOSS AUTOMOTIVE GMBH

- GRAYSON THERMAL SYSTEMS

- CAPTHERM SYSTEMS

- DUPONT

- BEHR-HELLA THERMOCONTROL GMBH (BHTC)

- BOYD CORPORATION

- SANDEN HOLDINGS CORPORATION

- SANHUA AUTOMOTIVE

- SHANDONG HOUFENG GROUP

- 熱システム市場:その他の企業 (北米)

- MAGNA INTERNATIONAL

- LEAR CORPORATION

- STANT CORPORATION

- AIR INTERNATIONAL THERMAL SYSTEMS

- MICHIGAN AUTOMOTIVE COMPRESSOR, INC.

- MODINE MANUFACTURING COMPANY

- WELLS VEHICLE ELECTRONICS

- T.RAD NORTH AMERICA, INC.

- THERMAL SOLUTION MANUFACTURING, INC.

- AKG THERMAL SYSTEMS INC

第19章 付録

The thermal systems market is projected to grow from USD 37.6 billion in 2022 to USD 41.7 billion in 2027, at a CAGR of 2.1%. The market has a promising growth potential due to several factors, such as stringent emission norms across various countries, which would create the importance of powertrain thermal management. The growing demand for premium cars with increased comfort features would require thermal management. Lastly, rising electric vehicle vehicles require effective thermal management for batteries, motors, and other power electronics modules.

With the rising demand for luxury cars, especially high-end full-size SUVs, several thermal systems such as heated steering, heated/ventilated seats, automatic climate control, and rear air conditioning have evolved in terms of technology, comfort, and safety. For instance, to provide sufficient cooling to third-row passengers, OEMs are installing separate rear A/C units in full-size SUVs, and with growing demand, the market for rear-seat air conditioning will also grow. Increasing demand for luxury vehicles would drive the need for advanced thermal systems and features, such as grille shutters, passive cabin ventilation, active cabin ventilation, active seat ventilation, and glass or glazing, which currently have very low penetration.

"Battery Electric vehicles segment would lead the electric & hybrid vehicle thermal systems market."

Stringent emissions regulations have shifted the global focus on electric vehicles, which has resulted in exponential growth of these vehicle types in recent years. An increase in electric vehicle sales has spurred the demand for electric components such as electric compressors, batteries, electric motors, power electronics, and heat exchangers. Also, demand for a higher driving range and fast charging has made battery and motor thermal management an important aspect of electric vehicles. Further, according to a survey of BEV architectures, the industry has been experimenting with combinations of different thermal management concepts such as pre-conditioning of the cabin, air coolant and refrigerant-cooled batteries, heat pumping, collection, and re-use of waste heat, etc. Thus, growing electric vehicles sales would fuel the thermal systems market in the coming future

"Waste heat recovery technology to grow at the fastest rate during the forecast period"

Waste heat recovery will be the fastest growing segment under the review period owing to increasing emission regulation stringency, especially in Western Europe and North America. European countries, Turkey, and Israel have made the 'Worldwide Harmonized Light Vehicle Test Procedure (WLTP)' mandatory, which helps to achieve reduced emissions and increased fuel efficiency. Some other countries are expected to join this program in the future, which may fuel the adoption of EGR technology, mainly for compact engines in the years to come. This would create a growth opportunity for using Exhaust gas recirculation (EGR) and Thermoelectric Generator (TEG) in the coming year and bring new business opportunities for thermal system providers

Europe is estimated to be the second largest market for thermal systems market

Europe accounted to be the second largest market for thermal systems. The region has a higher demand for passenger cars, particularly for premium cars (C segment and above). These premium cars are installed with efficient engine cooling, transmission cooling, waste heat recovery systems, advanced HVAC system, heated/ventilated seats, heated steering, etc. These emit less harmful gases, offer enhanced performance, and provide superior cabin comfort to the passengers. With increasing premium car sales, the region's demand for thermal systems is expected to grow. Further, electric & hybrid vehicles also seen a considerable adoption rate in Europe.

According to the Global Electric Vehicle Outlook 2022 publication by IEA, Europe recorded EV sales of 2.3 million units in 2021, with robust growth of about 65% against 2020. Increasing EV sales would positively impact battery thermal and motor thermal management systems. The growing demand for the thermal system will be sufficed by major regional suppliers such as Valeo (France), MAHLE GmbH (Germany), and AKG Group (Germany).

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs -25%, Tier 1 - 65% and Tier 2 - 10%

- By Designation: C Level Executives - 15%, Directors - 20%, and Others - 65%

- By Region: Asia Pacific - 50%,Europe - 15%, North America - 30%, RoW- 5%

Denso Corporation (Japan), MAHLE GmbH (Germany), Hanon Systems (South Korea), Valeo SA (France), and BorgWarner Inc. (US) are the leading providers of thermal systems in the global market.

Research Coverage:

The thermal system market is segmented based on application (ICE) (engine cooling, front air conditioning, rear air conditioning, transmission system, heated/ventilated seats, heated steering, waste heat recovery vehicle), vehicle type (passenger car, LCV, truck, and bus), application (Electric and Hybrid Vehicle) (battery thermal system, transmission system, engine cooling, front air conditioning, motor thermal management, power electronics, rear air conditioning, heated/ventilated seats, heated steering, and waste heat recovery) , electric & hybrid vehicle type (BEV, PHEV, FCEV, and 48V mild hybrid), technology (ICE) (active transmission warm up, exhaust gas recirculation, engine thermal mass reduction, reduced HVAC system loading, and other technologies), Component (ICE) (air filter, condenser, compressor, water pump, motor, heat exchanger, heater control unit, thermoelectric generator, electric compressor, electric water pump, EGR valve, A/C valve, oxygen sensor, temperature sensor, and charge air cooler), Component (Electric and Hybrid Vehicle) (air filter, condenser, electric compressor, electric water pump, electric motor, heat exchanger, heater control unit, and thermoelectric generator), Off-highway vehicle by equipment (construction &mining equipment, and farm tractors) , ATV by region (North America, Europe, Asia Pacific, and Rest of the world) and region (Asia Pacific, Europe, North America, and the Rest of the World).

The study also includes an in-depth competitive analysis of the major thermal systems product manufacturers in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants in this market with the information on the closest approximations of the revenue numbers for the overall automotive thermal systems market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 THERMAL SYSTEMS MARKET FOR AUTOMOTIVE: MARKET SEGMENTATION

- 1.3.2 THERMAL SYSTEMS MARKET, BY REGION

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 SUMMARY OF CHANGES

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 THERMAL SYSTEMS MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- 2.2 SECONDARY DATA

- 2.2.1 KEY SECONDARY SOURCES FOR VEHICLE PRODUCTION AND ELECTRIC VEHICLE SALES

- 2.2.2 KEY SECONDARY SOURCES FOR MARKET SIZING

- 2.2.3 KEY DATA FROM SECONDARY SOURCES

- 2.3 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

- 2.3.2 PRIMARY PARTICIPANTS

- 2.4 MARKET SIZE ESTIMATION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 6 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- 2.4.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 ASSUMPTIONS & ASSOCIATED RISKS

- 2.7.1 RESEARCH ASSUMPTIONS

- 2.7.2 MARKET ASSUMPTIONS

- TABLE 1 ASSUMPTIONS, ASSOCIATED RISKS, AND IMPACT

- 2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 INTRODUCTION

- 3.2 REPORT SUMMARY

- FIGURE 9 THERMAL SYSTEMS MARKET, BY APPLICATION (ICE), 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN THERMAL SYSTEMS MARKET

- FIGURE 10 STRINGENT EMISSION NORMS, GROWING PREMIUM VEHICLES, AND RISING DEMAND FOR ELECTRIC VEHICLES TO DRIVE THERMAL SYSTEMS MARKET

- 4.2 THERMAL SYSTEMS MARKET, BY REGION (ICE)

- FIGURE 11 ASIA PACIFIC EXPECTED TO DOMINATE THERMAL SYSTEMS MARKET

- 4.3 THERMAL SYSTEMS MARKET, BY APPLICATION (ICE)

- FIGURE 12 FRONT AIR CONDITIONING SEGMENT TO HOLD LARGEST MARKET

- 4.4 THERMAL SYSTEMS MARKET, BY TECHNOLOGY (ICE)

- FIGURE 13 EGR LED THE TECHNOLOGY MARKET DURING FORECAST PERIOD

- 4.5 THERMAL SYSTEMS MARKET, BY COMPONENT (ICE)

- FIGURE 14 HEAT EXCHANGER TO HOLD LARGEST SHARE OF COMPONENTS MARKET

- 4.6 THERMAL SYSTEMS MARKET, BY VEHICLE TYPE (ICE)

- FIGURE 15 PASSENGER CAR SEGMENT PROJECTED TO HOLD LARGEST MARKET

- 4.7 ELECTRIC & HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY APPLICATION

- FIGURE 16 WASTE HEAT RECOVERY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.8 ELECTRIC & HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY COMPONENT

- FIGURE 17 HEAT EXCHANGER TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.9 ELECTRIC & HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY VEHICLE TYPE

- FIGURE 18 BEV SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.10 OFF-HIGHWAY VEHICLE THERMAL SYSTEMS MARKET, BY EQUIPMENT

- FIGURE 19 FARM TRACTOR TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.11 ALL-TERRAIN VEHICLE THERMAL SYSTEMS MARKET, BY REGION

- FIGURE 20 NORTH AMERICA TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 THERMAL SYSTEMS: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent emission regulations

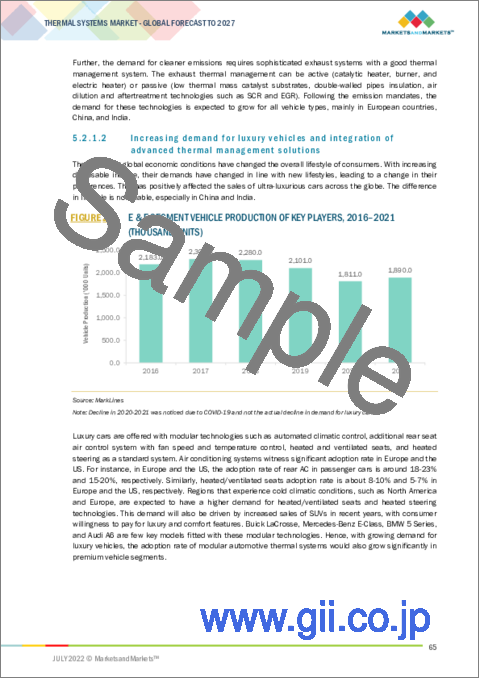

- 5.2.1.2 Increasing demand for luxury vehicles and integration of advanced thermal management solutions

- FIGURE 22 E & F SEGMENT VEHICLE PRODUCTION OF KEY PLAYERS, 2016-2021 (THOUSAND UNITS)

- TABLE 2 ADVANCED THERMAL SYSTEM TECHNOLOGIES OFFERED BY KEY OEMS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost

- TABLE 3 ECONOMIC COMPARISON OF THERMAL SYSTEM TECHNOLOGIES: VALUE VS. COST OF CO2 REDUCTION

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in mobility solutions require innovative thermal products

- 5.2.3.2 Growing EV demand

- FIGURE 23 ELECTRIC AND HYBRID PASSENGER VEHICLE SALES & FORECAST, 2018-2027 ('000 UNITS)

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardization

- 5.2.4.2 Low adoption of advanced thermal systems in developing countries

- TABLE 4 ADOPTION RATE OF THERMAL SYSTEMS IN PASSENGER CARS IN KEY COUNTRIES

- 5.3 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.4 THERMAL SYSTEMS MARKET SCENARIO

- FIGURE 25 THERMAL SYSTEMS MARKET SCENARIO, 2018-2027 (USD MILLION)

- 5.4.1 REALISTIC SCENARIO

- TABLE 5 THERMAL SYSTEMS MARKET (REALISTIC SCENARIO), BY REGION, 2018-2027 (USD BILLION)

- 5.4.2 LOW-IMPACT SCENARIO

- TABLE 6 THERMAL SYSTEMS MARKET (LOW-IMPACT SCENARIO), BY REGION, 2018-2027 (USD MILLION)

- 5.4.3 HIGH-IMPACT SCENARIO

- TABLE 7 THERMAL SYSTEMS MARKET (HIGH-IMPACT SCENARIO), BY REGION, 2018-2027 (USD MILLION)

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF SUBSTITUTES

- 5.5.2 THREAT OF NEW ENTRANTS

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 BARGAINING POWER OF SUPPLIERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 THERMAL SYSTEMS MARKET ECOSYSTEM

- FIGURE 27 THERMAL SYSTEMS MARKET: ECOSYSTEM ANALYSIS

- TABLE 9 THERMAL SYSTEMS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.7 SUPPLY CHAIN ANALYSIS

- FIGURE 28 SUPPLY CHAIN ANALYSIS: THERMAL SYSTEMS MARKET

- 5.8 NORTH AMERICA: KEY THERMAL SYSTEM SUPPLIERS

- TABLE 10 NORTH AMERICA: KEY THERMAL SYSTEM SUPPLIERS

- 5.9 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR TOP 4 COMPONENTS

- TABLE 11 KEY BUYING CRITERIA FOR TOP 4 COMPONENTS

- 5.10 PRICE ANALYSIS

- 5.10.1 PASSENGER CAR

- TABLE 12 AVERAGE REGIONAL PRICE TREND: PASSENGER CAR THERMAL SYSTEM COMPONENTS (USD/UNIT), 2021

- 5.10.2 LIGHT COMMERCIAL VEHICLE

- TABLE 13 AVERAGE REGIONAL PRICE TREND: LIGHT COMMERCIAL VEHICLE THERMAL SYSTEM COMPONENTS (USD/UNIT), 2021

- 5.10.3 TRUCK

- TABLE 14 AVERAGE REGIONAL PRICE TREND: TRUCK THERMAL SYSTEM COMPONENTS (USD/UNIT), 2021

- 5.11 PATENT ANALYSIS

- TABLE 15 APPLICATIONS AND PATENTS GRANTED, 2019-2021

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 COOLING SYSTEM MAINTENANCE AND SERVICE CASE STUDY

- 5.12.2 OPTARE CASE STUDY

- 5.12.3 DENSO CORPORATION CASE STUDY

- 5.12.4 GENTHERM AND GM CASE STUDY

- 5.13 TRADE ANALYSIS

- 5.13.1 RADIATORS AND PARTS - IMPORT AND EXPORT DATA, BY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 16 RADIATORS AND PARTS IMPORT TRADE DATA, BY COUNTRY, 2017-2021

- TABLE 17 RADIATORS AND PARTS EXPORT TRADE DATA, BY COUNTRY, 2017-2021

- 5.13.2 AIR CONDITIONING MACHINES USED IN VEHICLES FOR CABIN - IMPORT AND EXPORT DATA OF, BY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 18 VEHICLE AIR CONDITIONERS IMPORT TRADE DATA, BY COUNTRY, 2017-2021

- TABLE 19 VEHICLE AIR CONDITIONERS EXPORT TRADE DATA, BY COUNTRY, 2017-2021

- 5.14 REGULATORY LANDSCAPE

- TABLE 20 EMISSION NORM SPECIFICATIONS IN KEY COUNTRIES FOR PASSENGER CARS

- 5.14.1 EMISSION REGULATIONS

- 5.14.1.1 On-road vehicles

- TABLE 21 EURO-5 VS. EURO-6 VEHICLE EMISSION STANDARDS ON NEW EUROPEAN DRIVING CYCLE

- TABLE 22 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR PASSENGER CARS, 2016-2021

- FIGURE 30 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR HEAVY-DUTY VEHICLES, 2014-2025

- 5.14.2 FUEL ECONOMY NORMS

- 5.14.2.1 US

- TABLE 23 US: CAFE STANDARDS FOR EACH MODEL YEAR IN MILES PER GALLON, 2012-2025

- 5.14.2.2 Europe

- 5.14.2.3 China

- 5.14.2.4 India

- 5.15 REGULATORY BODIES/GOVERNMENT AGENCIES

- TABLE 24 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 KEY CONFERENCES & EVENTS IN 2022-2023

- 5.16.1 THERMAL SYSTEMS MARKET: DETAILED LIST OF UPCOMING CONFERENCES & EVENTS

- 5.17 TECHNOLOGY ANALYSIS

- 5.17.1 THERMAL SYSTEMS TECHNOLOGY ANALYSIS

- 5.17.2 PASSENGER COMFORT TECHNOLOGY

- 5.17.3 INDIRECT CHARGE AIR COOLING

- FIGURE 31 COOLANT CIRCUIT IN INDIRECT CHARGE AIR

- 5.17.4 LIQUID-COOLED CHARGE AIR COOLERS

6 THERMAL SYSTEMS MARKET, BY APPLICATION (ICE)

- 6.1 INTRODUCTION

- 6.1.1 RESEARCH METHODOLOGY

- 6.1.2 ASSUMPTIONS

- 6.1.3 INDUSTRY INSIGHTS

- FIGURE 32 THERMAL SYSTEMS MARKET, BY APPLICATION (ICE), 2022 VS. 2027 (USD MILLION)

- TABLE 27 THERMAL SYSTEMS MARKET, BY APPLICATION (ICE), 2018-2021 ('000 UNITS)

- TABLE 28 THERMAL SYSTEMS MARKET, BY APPLICATION (ICE), 2022-2027 ('000 UNITS)

- TABLE 29 THERMAL SYSTEMS MARKET, BY APPLICATION (ICE), 2018-2021 (USD MILLION)

- TABLE 30 THERMAL SYSTEMS MARKET, BY APPLICATION (ICE), 2022-2027 (USD MILLION)

- 6.2 ENGINE COOLING

- 6.2.1 ENGINE DOWNSIZING AND DEMAND FOR LOW-EMISSION ENGINES TO DRIVE SEGMENT

- TABLE 31 ENGINE COOLING: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 32 ENGINE COOLING: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 33 ENGINE COOLING: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (MILLION USD)

- TABLE 34 ENGINE COOLING: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 FRONT AIR CONDITIONING

- 6.3.1 INCREASING DEMAND FOR COMFORT AND ADVANCEMENTS IN TECHNOLOGY TO DRIVE SEGMENT

- TABLE 35 FRONT AIR CONDITIONING: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 36 FRONT AIR CONDITIONING: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 37 FRONT AIR CONDITIONING: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 FRONT AIR CONDITIONING: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 REAR AIR CONDITIONING

- 6.4.1 RISING DEMAND FOR FULL-SIZE SUVS TO DRIVE SEGMENT

- TABLE 39 REAR AIR CONDITIONING: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 40 REAR AIR CONDITIONING: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 41 REAR AIR CONDITIONING: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 REAR AIR CONDITIONING: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 TRANSMISSION SYSTEM

- 6.5.1 GROWING DEMAND FOR AUTOMATIC TRANSMISSION IN DEVELOPING COUNTRIES TO DRIVE SEGMENT

- TABLE 43 TRANSMISSION SYSTEM: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 44 TRANSMISSION SYSTEM: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 45 TRANSMISSION SYSTEM: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 46 TRANSMISSION SYSTEM: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.6 HEATED/ VENTILATED SEATS

- 6.6.1 INCREASING DEMAND FOR CABIN COMFORT TO DRIVE SEGMENT

- TABLE 47 HEATED/ VENTILATED SEATS: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 48 HEATED VENTILATED SEATS: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 49 HEATED/ VENTILATED SEATS: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 50 HEATED/ VENTILATED SEATS: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.7 HEATED STEERING

- 6.7.1 DEMAND FOR COMFORT FEATURES IN COLD REGIONS TO DRIVE SEGMENT

- TABLE 51 HEATED STEERING: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 52 HEATED STEERING: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 53 HEATED STEERING: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 54 HEATED STEERING: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.8 WASTE HEAT RECOVERY

- 6.8.1 EMISSION REGULATIONS AND INCREASING DEMAND FOR HYBRID VEHICLES TO DRIVE SEGMENT

- TABLE 55 WASTE HEAT RECOVERY: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 56 WASTE HEAT RECOVERY: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 57 WASTE HEAT RECOVERY: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 58 WASTE HEAT RECOVERY: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

7 THERMAL SYSTEMS MARKET, BY COMPONENT (ICE)

- 7.1 INTRODUCTION

- 7.1.1 RESEARCH METHODOLOGY

- 7.1.2 ASSUMPTIONS

- 7.1.3 INDUSTRY INSIGHTS

- FIGURE 33 THERMAL SYSTEMS MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

- TABLE 59 THERMAL SYSTEMS MARKET, BY COMPONENT, 2018-2021 ('000 UNITS)

- TABLE 60 THERMAL SYSTEMS MARKET, BY COMPONENT, 2022-2027 ('000 UNITS)

- TABLE 61 THERMAL SYSTEMS MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 62 THERMAL SYSTEMS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 7.2 AIR FILTER

- 7.2.1 DEMAND FOR COMPLEX FLOW GUIDANCE DESIGNS TO DRIVE SEGMENT

- TABLE 63 AIR FILTER: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 64 AIR FILTER: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 65 AIR FILTER: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 66 AIR FILTER: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 CONDENSER

- 7.3.1 FOCUS ON REDUCING POWER CONSUMPTION AND INCREASING FUEL EFFICIENCY TO DRIVE SEGMENT

- TABLE 67 CONDENSER: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 68 CONDENSER: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 69 CONDENSER: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 70 CONDENSER: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 COMPRESSOR

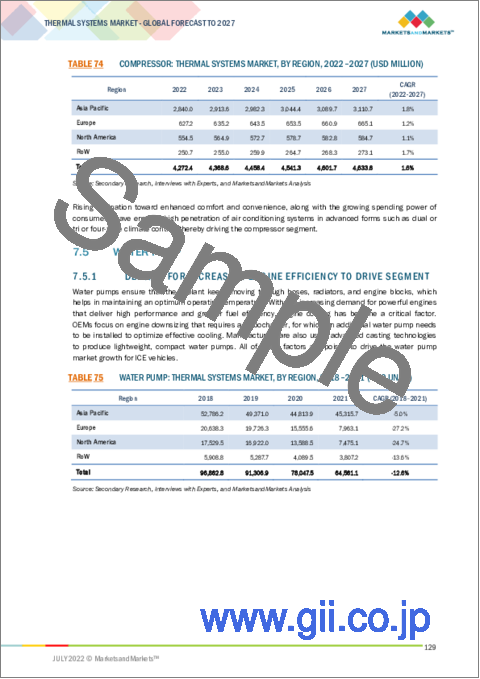

- 7.4.1 GROWING TREND OF ADVANCED COMFORT AND CONVENIENCE FEATURES TO DRIVE SEGMENT

- TABLE 71 COMPRESSOR: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 72 COMPRESSOR: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 73 COMPRESSOR: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 74 COMPRESSOR: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.5 WATER PUMP

- 7.5.1 DEMAND FOR INCREASING ENGINE EFFICIENCY TO DRIVE SEGMENT

- TABLE 75 WATER PUMP: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 76 WATER PUMP: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 77 WATER PUMP: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 78 WATER PUMP: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.6 MOTOR

- 7.6.1 BENEFITS LIKE BETTER EFFICIENCY AND PERFORMANCE TO DRIVE SEGMENT

- TABLE 79 MOTOR: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 80 MOTOR: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 81 MOTOR: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 82 MOTOR: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.7 HEAT EXCHANGER

- 7.7.1 INCREASING DEMAND FOR ELECTRIC AND HYBRID VEHICLES TO DRIVE SEGMENT

- TABLE 83 HEAT EXCHANGER: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 84 HEAT EXCHANGER: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 85 HEAT EXCHANGER: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 86 HEAT EXCHANGER: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.8 HEATER CONTROL

- 7.8.1 INCREASING DEMAND FOR LUXURY AND COMFORT TO DRIVE SEGMENT

- TABLE 87 HEATER CONTROL: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 88 HEATER CONTROL: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 89 HEATER CONTROL: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 90 HEATER CONTROL: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.9 THERMOELECTRIC GENERATOR

- 7.9.1 NEED FOR REDUCTION IN FUEL CONSUMPTION TO DRIVE SEGMENT

- TABLE 91 THERMOELECTRIC GENERATOR: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 92 THERMOELECTRIC GENERATOR: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 93 THERMOELECTRIC GENERATOR: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 94 THERMOELECTRIC GENERATOR: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.10 EGR VALVE

- 7.10.1 STRINGENT FUEL CONSUMPTION AND EMISSION NORMS TO DRIVE SEGMENT

- TABLE 95 EGR VALVE: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 96 EGR VALVE: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 97 EGR VALVE: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 98 EGR VALVE: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.11 A/C VALVE

- 7.11.1 DEMAND FOR EFFICIENT CABIN CLIMATE CONTROL TECHNOLOGIES TO DRIVE SEGMENT

- TABLE 99 A/C VALVE: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 100 A/C VALVE: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 101 A/C VALVE: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 102 A/C VALVE: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.12 OXYGEN SENSOR

- 7.12.1 GROWING ENVIRONMENTAL AWARENESS TO DRIVE SEGMENT

- TABLE 103 OXYGEN SENSOR: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 104 OXYGEN SENSOR: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 105 OXYGEN SENSOR: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 106 OXYGEN SENSOR: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.13 TEMPERATURE SENSOR

- 7.13.1 NEED FOR MEASURING HIGH TEMPERATURES TO DRIVE SEGMENT

- TABLE 107 TEMPERATURE SENSOR: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 108 TEMPERATURE SENSOR: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 109 TEMPERATURE SENSOR: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 110 TEMPERATURE SENSOR: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.14 CHARGE AIR COOLER

- 7.14.1 NEED FOR HIGH-POWER ENGINE OUTPUT TO DRIVE SEGMENT

- TABLE 111 CHARGE AIR COOLER: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 112 CHARGE AIR COOLER: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 113 CHARGE AIR COOLER: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 114 CHARGE AIR COOLER: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

8 AUTOMOTIVE THERMAL SYSTEMS MARKET, BY TECHNOLOGY (ICE)

- 8.1 INTRODUCTION

- 8.1.1 RESEARCH METHODOLOGY

- 8.1.2 ASSUMPTIONS

- 8.1.3 INDUSTRY INSIGHTS

- FIGURE 34 THERMAL SYSTEMS MARKET, BY TECHNOLOGY, 2022 VS. 2027 ('000 UNITS)

- TABLE 115 AUTOMOTIVE THERMAL SYSTEMS MARKET, BY TECHNOLOGY, 2018-2021 ('000 UNITS)

- TABLE 116 AUTOMOTIVE THERMAL SYSTEMS MARKET, BY TECHNOLOGY, 2022-2027 ('000 UNITS)

- 8.2 ACTIVE TRANSMISSION WARM UP

- 8.2.1 FUEL ECONOMY AND FASTER TRANSMISSION TECHNOLOGY TO DRIVE SEGMENT

- TABLE 117 ACTIVE TRANSMISSION WARM UP: AUTOMOTIVE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 118 ACTIVE TRANSMISSION WARM UP: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- 8.3 EGR

- 8.3.1 INCREASED ADOPTION OF SCR SYSTEMS TO RESTRAIN SEGMENT

- TABLE 119 EGR: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 120 EGR: AUTOMOTIVE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- 8.4 ENGINE THERMAL MASS REDUCTION

- 8.4.1 DEMAND FOR FUEL-EFFICIENT VEHICLES TO DRIVE SEGMENT

- TABLE 121 ENGINE THERMAL MASS REDUCTION: AUTOMOTIVE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 122 ENGINE THERMAL MASS REDUCTION: AUTOMOTIVE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- 8.5 REDUCED HVAC SYSTEM LOADING

- 8.5.1 DEMAND FOR ENHANCED CABIN COMFORT TO DRIVE SEGMENT

- TABLE 123 REDUCED HVAC SYSTEM LOADING: AUTOMOTIVE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 124 REDUCED HVAC SYSTEM LOADING: AUTOMOTIVE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- 8.6 OTHER TECHNOLOGIES

- TABLE 125 OTHER TECHNOLOGIES: AUTOMOTIVE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 126 OTHER TECHNOLOGIES: AUTOMOTIVE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

9 THERMAL SYSTEMS MARKET, BY VEHICLE TYPE (ICE)

- 9.1 INTRODUCTION

- 9.1.1 RESEARCH METHODOLOGY

- 9.1.2 ASSUMPTIONS

- 9.1.3 INDUSTRY INSIGHTS

- FIGURE 35 THERMAL SYSTEMS MARKET, BY VEHICLE TYPE (ICE), 2022 VS. 2027 (USD MILLION)

- TABLE 127 THERMAL SYSTEMS MARKET, BY VEHICLE TYPE (ICE), 2018-2021 ('000 UNITS)

- TABLE 128 THERMAL SYSTEMS MARKET, BY VEHICLE TYPE (ICE), 2022-2027 ('000 UNITS)

- TABLE 129 THERMAL SYSTEMS MARKET, BY VEHICLE TYPE (ICE), 2018-2021 (USD MILLION)

- TABLE 130 THERMAL SYSTEMS MARKET, BY VEHICLE TYPE (ICE), 2022-2027 (USD MILLION)

- 9.2 PASSENGER CAR

- 9.2.1 NEED FOR FUEL EFFICIENCY TO DRIVE SEGMENT

- TABLE 131 PASSENGER CAR: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 132 PASSENGER CAR: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 133 PASSENGER CAR: THERMAL SYSTEMS MARKET, 2018-2021 (USD MILLION)

- TABLE 134 PASSENGER CAR: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 LIGHT COMMERCIAL VEHICLE (LCV)

- 9.3.1 HIGH DEMAND IN NORTH AMERICA TO DRIVE SEGMENT

- TABLE 135 LIGHT COMMERCIAL VEHICLE: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 136 LIGHT COMMERCIAL VEHICLE: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 137 LIGHT COMMERCIAL VEHICLE: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 138 LIGHT COMMERCIAL VEHICLE: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 TRUCK

- 9.4.1 GROWTH OF LARGE-SCALE INDUSTRIES, LOGISTICS, AND CONSTRUCTION TO DRIVE SEGMENT

- TABLE 139 TRUCK: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 140 TRUCK: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 141 TRUCK: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 142 TRUCK: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 BUS

- 9.5.1 HIGH DEPENDENCY ON PUBLIC TRANSPORT TO DRIVE SEGMENT

- TABLE 143 BUS: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 144 BUS: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 145 BUS: THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 146 BUS: THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

10 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.1.1 RESEARCH METHODOLOGY

- 10.1.2 ASSUMPTIONS

- 10.1.3 INDUSTRY INSIGHTS

- FIGURE 36 ELECTRIC AND HYBRID THERMAL SYSTEMS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 147 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 148 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 149 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 150 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.2 BATTERY THERMAL MANAGEMENT

- 10.2.1 GOVERNMENT POLICIES FOR ELECTRIC VEHICLES TO DRIVE SEGMENT

- TABLE 151 BATTERY THERMAL MANAGEMENT: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 152 BATTERY THERMAL MANAGEMENT: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 153 BATTERY THERMAL MANAGEMENT: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 154 BATTERY THERMAL MANAGEMENT: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 TRANSMISSION SYSTEM

- 10.3.1 INCREASED DEMAND FOR AUTOMATIC TRANSMISSION AND CVT TO DRIVE SEGMENT

- TABLE 155 TRANSMISSION SYSTEM: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 156 TRANSMISSION SYSTEM: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 157 TRANSMISSION SYSTEM: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 158 TRANSMISSION SYSTEM: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 ENGINE COOLING

- 10.4.1 DEMAND FOR EFFICIENT ENGINES TO DRIVE SEGMENT

- TABLE 159 ENGINE COOLING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 160 ENGINE COOLING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 161 ENGINE COOLING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 162 ENGINE COOLING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 FRONT AIR CONDITIONING

- 10.5.1 DEMAND FOR COMFORT AND CONVENIENCE TO DRIVE SEGMENT

- TABLE 163 FRONT AIR CONDITIONING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 164 FRONT AIR CONDITIONING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 165 FRONT AIR CONDITIONING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 166 FRONT AIR CONDITIONING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.6 MOTOR THERMAL MANAGEMENT

- 10.6.1 DEMAND FOR ADVANCED ELECTRIC AND HYBRID POWERTRAINS TO DRIVE SEGMENT

- TABLE 167 MOTOR TYPE USED IN DIFFERENT ELECTRIC VEHICLES

- TABLE 168 MOTOR THERMAL MANAGEMENT: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 169 MOTOR THERMAL MANAGEMENT: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 170 MOTOR THERMAL MANAGEMENT: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 171 MOTOR THERMAL MANAGEMENT: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.7 POWER ELECTRONICS

- 10.7.1 DEMAND FOR SMART EMISSION-FREE VEHICLES TO DRIVE SEGMENT

- TABLE 172 POWER ELECTRONICS: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 173 POWER ELECTRONICS: ELECTRIC AND HYBRID THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 174 POWER ELECTRONICS: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 175 POWER ELECTRONICS: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.8 REAR AIR CONDITIONING

- 10.8.1 INCREASED DEMAND FOR LUXURY AND MID-SEGMENT VEHICLES TO DRIVE SEGMENT

- TABLE 176 REAR AIR CONDITIONING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 177 REAR AIR CONDITIONING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 178 REAR AIR CONDITIONING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 179 REAR AIR CONDITIONING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.9 HEATED/ VENTILATED SEATS

- 10.9.1 DEMAND FOR CABIN COMFORT FEATURES TO DRIVE SEGMENT

- TABLE 180 HEATED/VENTILATED SEATS: ELECTRIC AND HYBRID THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 181 HEATED/VENTILATED SEATS: ELECTRIC AND HYBRID THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 182 HEATED/VENTILATED SEATS: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 183 HEATED/VENTILATED SEATS: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.10 HEATED STEERING

- 10.10.1 DEMAND FOR LUXURY VEHICLES TO DRIVE SEGMENT

- TABLE 184 HEATED STEERING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 185 HEATED STEERING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 186 HEATED STEERING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 187 HEATED STEERING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.11 WASTE HEAT RECOVERY

- 10.11.1 ADVENT OF NEW TECHNOLOGIES TO DRIVE SEGMENT

- TABLE 188 WASTE HEAT RECOVERY: ELECTRIC AND HYBRID THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 189 WASTE HEAT RECOVERY: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 190 WASTE HEAT RECOVERY: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 191 WASTE HEAT RECOVERY: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

11 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY COMPONENT

- 11.1 INTRODUCTION

- 11.1.1 RESEARCH METHODOLOGY

- 11.1.2 ASSUMPTIONS

- 11.1.3 INDUSTRY INSIGHTS

- FIGURE 37 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

- TABLE 192 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY COMPONENT, 2018-2021 ('000 UNITS)

- TABLE 193 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY COMPONENT, 2022-2027 ('000 UNITS)

- TABLE 194 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 195 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 11.2 AIR FILTER

- 11.2.1 DEMAND FOR COMPLEX FLOW GUIDANCE DESIGNS TO DRIVE SEGMENT

- TABLE 196 AIR FILTER: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 197 AIR FILTER: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 198 AIR FILTER: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 199 AIR FILTER: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3 CONDENSER

- 11.3.1 FOCUS ON REDUCING POWER CONSUMPTION AND INCREASING FUEL EFFICIENCY TO DRIVE SEGMENT

- TABLE 200 CONDENSER: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 201 CONDENSER: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 202 CONDENSER: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 203 CONDENSER: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4 ELECTRIC COMPRESSOR

- 11.4.1 INCREASING ELECTRIC VEHICLE SALES AND TREND OF ADVANCED COMFORT AND CONVENIENCE FEATURES TO DRIVE SEGMENT

- TABLE 204 ELECTRIC COMPRESSOR: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 205 ELECTRIC COMPRESSOR: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 206 ELECTRIC COMPRESSOR: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 207 ELECTRIC COMPRESSOR: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.5 ELECTRIC WATER PUMP

- 11.5.1 DEMAND FOR FUEL-EFFICIENT VEHICLES TO DRIVE SEGMENT

- TABLE 208 ELECTRIC WATER PUMP: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 209 ELECTRIC WATER PUMP: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 210 ELECTRIC WATER PUMP: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 211 ELECTRIC WATER PUMP: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.6 HEAT EXCHANGER

- 11.6.1 GROWING NEED FOR LONG RANGE AND FAST CHARGING TO DRIVE SEGMENT

- TABLE 212 HEAT EXCHANGER: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 213 HEAT EXCHANGER: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 214 HEAT EXCHANGER: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 215 HEAT EXCHANGER: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.7 HEATER CONTROL

- 11.7.1 INCREASING DEMAND FOR LUXURY AND COMFORT TO DRIVE SEGMENT

- TABLE 216 HEATER CONTROL: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 217 HEATER CONTROL: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 218 HEATER CONTROL: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 219 HEATER CONTROL: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.8 ELECTRIC MOTOR

- 11.8.1 BENEFITS LIKE LOW MAINTENANCE AND ZERO-EMISSION TO DRIVE SEGMENT

- TABLE 220 ELECTRIC MOTOR: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 221 ELECTRIC MOTOR: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 222 ELECTRIC MOTOR: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 223 ELECTRIC MOTOR: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.9 THERMOELECTRIC GENERATOR

- 11.9.1 NEED FOR REDUCTION IN FUEL CONSUMPTION TO DRIVE SEGMENT

- TABLE 224 THERMOELECTRIC GENERATOR: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 225 THERMOELECTRIC GENERATOR: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 226 THERMOELECTRIC GENERATOR: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 227 THERMOELECTRIC GENERATOR: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

12 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY VEHICLE TYPE

- 12.1 INTRODUCTION

- 12.1.1 RESEARCH METHODOLOGY

- 12.1.2 ASSUMPTIONS

- 12.1.3 INDUSTRY INSIGHTS

- FIGURE 38 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 228 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY VEHICLE TYPE, 2018-2021 ('000 UNITS)

- TABLE 229 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY VEHICLE TYPE, 2022-2027 ('000 UNITS)

- TABLE 230 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 231 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 12.2 BATTERY ELECTRIC VEHICLE (BEV)

- 12.2.1 GOVERNMENT SUBSIDIES AND INVESTMENTS IN CHARGING INFRASTRUCTURE TO DRIVE SEGMENT

- TABLE 232 BEV: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 233 BEV: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 234 BEV: ELECTRIC AND HYBRID THERMAL SYSTEMS MARKET, 2018-2021 (USD MILLION)

- TABLE 235 BEV: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 12.3.1 BENEFIT OF HIGHER RANGE TO DRIVE SEGMENT

- TABLE 236 PHEV: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 237 PHEV: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 238 PHEV: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 239 PHEV: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

- 12.4.1 ADVANTAGE OF BETTER FUEL ECONOMY TO DRIVE SEGMENT

- TABLE 240 FCEV: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 241 FCEV: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 242 FCEV: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 243 FCEV: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.5 48V MILD-HYBRID

- 12.5.1 EMISSION REGULATIONS TO DRIVE SEGMENT

- TABLE 244 MILD-HYBRID (48V): ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 245 MILD-HYBRID (48V): ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 246 MILD-HYBRID (48V): ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 247 MILD-HYBRID (48V): ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.6 ELECTRIC COMMERCIAL VEHICLE

- 12.6.1 GOVERNMENT SUPPORT FOR ZERO-EMISSION TRANSPORTATION TO DRIVE SEGMENT

- TABLE 248 ELECTRIC COMMERCIAL VEHICLE: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 249 ELECTRIC COMMERCIAL VEHICLE: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 250 ELECTRIC COMMERCIAL VEHICLE: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 251 ELECTRIC COMMERCIAL VEHICLE: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

13 OFF-HIGHWAY THERMAL SYSTEMS MARKET, BY EQUIPMENT TYPE

- 13.1 INTRODUCTION

- 13.1.1 RESEARCH METHODOLOGY

- 13.1.2 ASSUMPTIONS

- 13.1.3 INDUSTRY INSIGHTS

- FIGURE 39 OFF-HIGHWAY THERMAL SYSTEMS MARKET, BY EQUIPMENT TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 252 OFF-HIGHWAY THERMAL SYSTEMS MARKET, BY EQUIPMENT TYPE, 2018-2021 ('000 UNITS)

- TABLE 253 OFF-HIGHWAY THERMAL SYSTEMS MARKET, BY EQUIPMENT TYPE, 2022-2027 ('000 UNITS)

- TABLE 254 OFF-HIGHWAY THERMAL SYSTEMS MARKET, BY EQUIPMENT TYPE, 2018-2021 (USD MILLION)

- TABLE 255 OFF-HIGHWAY THERMAL SYSTEMS MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- 13.2 CONSTRUCTION AND MINING EQUIPMENT

- 13.2.1 INCREASED CONSTRUCTION ACTIVITIES AND INDUSTRIAL DEVELOPMENT PROJECTS TO DRIVE SEGMENT

- TABLE 256 CONSTRUCTION AND MINING EQUIPMENT THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 257 CONSTRUCTION AND MINING EQUIPMENT THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 258 CONSTRUCTION AND MINING EQUIPMENT THERMAL SYSTEMS MARKET, 2018-2021 (USD MILLION)

- TABLE 259 CONSTRUCTION AND MINING EQUIPMENT THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.3 FARM TRACTOR

- 13.3.1 ADOPTION OF MECHANIZED FARMING TO DRIVE SEGMENT

- TABLE 260 FARM TRACTOR THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 261 FARM TRACTOR THERMAL SYSTEMS MARKET, 2022-2027 ('000 UNITS)

- TABLE 262 FARM TRACTOR THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 263 FARM TRACTOR THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

14 ALL-TERRAIN VEHICLE (ATV) THERMAL SYSTEMS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.1.1 RESEARCH METHODOLOGY

- 14.1.2 ASSUMPTIONS

- 14.1.3 INDUSTRY INSIGHTS

- FIGURE 40 ALL-TERRAIN VEHICLE THERMAL SYSTEMS MARKET, 2022 VS. 2027 (USD MILLION)

- TABLE 264 ALL-TERRAIN VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 265 ALL-TERRAIN VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 266 ALL-TERRAIN VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 267 ALL-TERRAIN VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.2 ELECTRIC ATV

- 14.2.1 DEVELOPMENTS IN BATTERIES AND NEW ELECTRIC MODEL LAUNCHES TO DRIVE MARKET

- 14.3 GASOLINE ATV

- 14.3.1 HIGHER EFFICIENCY AND WIDE APPLICATION AREAS TO DRIVE SEGMENT

15 THERMAL SYSTEMS MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.1.1 RESEARCH METHODOLOGY

- 15.1.2 ASSUMPTIONS

- 15.1.3 INDUSTRY INSIGHTS

- FIGURE 41 THERMAL SYSTEMS MARKET, 2022 VS. 2027 (USD MILLION)

- TABLE 268 THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 269 THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 270 THERMAL SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 271 THERMAL SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 15.2 ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: THERMAL SYSTEMS MARKET SNAPSHOT

- TABLE 272 ASIA PACIFIC: THERMAL SYSTEMS MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 273 ASIA PACIFIC: THERMAL SYSTEMS MARKET, BY COUNTRY, 2022-2027 ('000 UNITS)

- TABLE 274 ASIA PACIFIC: THERMAL SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 275 ASIA PACIFIC: THERMAL SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 15.2.1 CHINA

- 15.2.1.1 High passenger vehicle demand to drive market

- TABLE 276 CHINA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 277 CHINA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 278 CHINA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 279 CHINA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.2.2 INDIA

- 15.2.2.1 Growth in vehicle sales and demand for comfort features to drive market

- TABLE 280 INDIA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 281 INDIA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 282 INDIA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 283 INDIA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.2.3 JAPAN

- 15.2.3.1 Advanced features in cabin comfort to drive market

- TABLE 284 JAPAN: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 285 JAPAN: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 286 JAPAN: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 287 JAPAN: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.2.4 SOUTH KOREA

- 15.2.4.1 Demand for luxury cars to drive market

- TABLE 288 SOUTH KOREA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 289 SOUTH KOREA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 290 SOUTH KOREA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 291 SOUTH KOREA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.2.5 THAILAND

- 15.2.5.1 Growing demand for automotive components to drive market

- TABLE 292 THAILAND: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 293 THAILAND: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 294 THAILAND: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 295 THAILAND: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.2.6 REST OF ASIA PACIFIC

- TABLE 296 REST OF ASIA PACIFIC: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 297 REST OF ASIA PACIFIC: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 298 REST OF ASIA PACIFIC: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 299 REST OF ASIA PACIFIC: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.3 EUROPE

- FIGURE 43 EUROPE: THERMAL SYSTEMS MARKET, 2022-2027 (USD MILLION)

- TABLE 300 EUROPE: THERMAL SYSTEMS MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 301 EUROPE: THERMAL SYSTEMS MARKET, BY COUNTRY, 2022-2027 ('000 UNITS)

- TABLE 302 EUROPE: THERMAL SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 303 EUROPE: THERMAL SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 15.3.1 GERMANY

- 15.3.1.1 High demand for premium cars to drive market

- TABLE 304 GERMANY: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 305 GERMANY: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 306 GERMANY: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 307 GERMANY: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.3.2 FRANCE

- 15.3.2.1 Increasing demand for premium comfort features to drive market

- TABLE 308 FRANCE: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 309 FRANCE: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 310 FRANCE: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 311 FRANCE: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.3.3 UK

- 15.3.3.1 Strict emission norms to drive market

- TABLE 312 UK: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 313 UK: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 314 UK: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 315 UK: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.3.4 SPAIN

- 15.3.4.1 Increasing production of passenger cars to drive market

- TABLE 316 SPAIN: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 317 SPAIN: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 318 SPAIN: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 319 SPAIN: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.3.5 ITALY

- 15.3.5.1 Presence of premium vehicle manufacturers to drive market

- TABLE 320 ITALY: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 321 ITALY: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 322 ITALY: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 323 ITALY: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.3.6 RUSSIA

- 15.3.6.1 Increasing sales of passenger cars to drive market

- TABLE 324 RUSSIA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 325 RUSSIA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 326 RUSSIA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 327 RUSSIA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.3.7 REST OF EUROPE

- TABLE 328 REST OF EUROPE: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 329 REST OF EUROPE: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 330 REST OF EUROPE: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 331 REST OF EUROPE: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.4 NORTH AMERICA

- FIGURE 44 NORTH AMERICA: THERMAL SYSTEMS MARKET SNAPSHOT

- TABLE 332 NORTH AMERICA: THERMAL SYSTEMS MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 333 NORTH AMERICA: THERMAL SYSTEMS MARKET, BY COUNTRY, 2022-2027 ('000 UNITS)

- TABLE 334 NORTH AMERICA: THERMAL SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 335 NORTH AMERICA: THERMAL SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 15.4.1 US

- 15.4.1.1 High demand for green vehicles to drive market

- TABLE 336 US: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 337 US: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 338 US: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 339 US: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.4.2 CANADA

- 15.4.2.1 Government policies and regulatory standards to drive market

- TABLE 340 CANADA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 341 CANADA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 342 CANADA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 343 CANADA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.4.3 MEXICO

- 15.4.3.1 Advanced thermal system solutions to drive market

- TABLE 344 MEXICO: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 345 MEXICO: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 346 MEXICO: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 347 MEXICO: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.5 ROW

- FIGURE 45 ROW: THERMAL SYSTEMS MARKET, 2021-2026 (USD MILLION)

- TABLE 348 ROW: THERMAL SYSTEMS MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 349 ROW: THERMAL SYSTEMS MARKET, BY COUNTRY, 2022-2027 ('000 UNITS)

- TABLE 350 ROW: THERMAL SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 351 ROW: THERMAL SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 15.5.1 IRAN

- 15.5.1.1 Heavy investments in automotive sector to drive market

- TABLE 352 IRAN: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 353 IRAN: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 354 IRAN: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 355 IRAN: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.5.2 BRAZIL

- 15.5.2.1 Presence of major automotive companies to drive market

- TABLE 356 BRAZIL: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 357 BRAZIL: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 358 BRAZIL: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 359 BRAZIL: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.5.3 ARGENTINA

- 15.5.3.1 Production of commercial vehicles to drive market

- TABLE 360 ARGENTINA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 361 ARGENTINA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 362 ARGENTINA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 363 ARGENTINA: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.5.4 OTHERS

- TABLE 364 REST OF WORLD: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 365 REST OF WORLD: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 366 REST OF WORLD: THERMAL SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 367 REST OF WORLD: THERMAL SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

16 RECOMMENDATIONS BY MARKETSANDMARKETS

- 16.1 ASIA PACIFIC WILL BE MAJOR MARKET FOR THERMAL SYSTEMS

- 16.2 ELECTRIC & HYBRID VEHICLE THERMAL SYSTEM APPLICATIONS CAN BE KEY FOCUS AREA FOR MANUFACTURERS

- 16.3 CONCLUSION

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 THERMAL SYSTEMS MARKET SHARE ANALYSIS, 2021

- TABLE 368 MARKET SHARE ANALYSIS FOR THERMAL SYSTEMS MARKET, 2021

- FIGURE 46 THERMAL SYSTEMS MARKET SHARE ANALYSIS, 2021

- 17.3 NORTH AMERICA THERMAL SYSTEMS MARKET RANKING ANALYSIS, (TOP PLAYERS) 2021

- 17.3.1 FRONT & REAR AIR CONDITIONING: NORTH AMERICA MARKET RANKING AND KEY PLAYERS

- TABLE 369 FRONT & REAR AIR CONDITIONING: NORTH AMERICA MARKET RANKING AND KEY PLAYERS, 2021

- 17.3.2 ENGINE COOLING: NORTH AMERICA MARKET RANKING AND KEY PLAYERS

- TABLE 370 ENGINE COOLING: NORTH AMERICA MARKET RANKING AND KEY PLAYERS, 2021

- 17.3.3 BATTERY COOLING: NORTH AMERICA MARKET RANKING AND KEY PLAYERS

- TABLE 371 BATTERY COOLING: NORTH AMERICA MARKET RANKING AND KEY PLAYERS, 2021

- 17.3.4 EGR SYSTEM: NORTH AMERICA MARKET RANKING AND KEY PLAYERS

- TABLE 372 EGR SYSTEM: NORTH AMERICA MARKET RANKING AND KEY PLAYERS, 2021

- 17.3.5 HEATED/VENTILATED SEATS: NORTH AMERICA MARKET RANKING

- TABLE 373 HEATED/VENTILATED SEATS: NORTH AMERICA MARKET RANKING, 2021

- 17.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- 17.5 COMPETITIVE EVALUATION QUADRANT - THERMAL SYSTEM MANUFACTURERS

- 17.5.1 TERMINOLOGY

- 17.5.2 STARS

- 17.5.3 EMERGING LEADERS

- 17.5.4 PERVASIVE COMPANIES

- 17.5.5 PARTICIPANTS

- TABLE 374 THERMAL SYSTEMS MARKET: COMPANY PRODUCT FOOTPRINT, 2021

- TABLE 375 THERMAL SYSTEMS MARKET: COMPANY APPLICATION FOOTPRINT, 2021

- TABLE 376 THERMAL SYSTEMS MARKET: COMPANY REGION FOOTPRINT, 2021

- FIGURE 47 THERMAL SYSTEM MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2021

- 17.6 COMPETITIVE EVALUATION QUADRANT: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEM MANUFACTURERS

- 17.6.1 STARS

- 17.6.2 EMERGING LEADERS

- 17.6.3 PERVASIVE COMPANIES

- 17.6.4 PARTICIPANTS

- FIGURE 48 ELECTRIC VEHICLE THERMAL SYSTEM MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2021

- 17.7 COMPETITIVE SCENARIO

- 17.7.1 NEW PRODUCT LAUNCHES

- TABLE 377 PRODUCT LAUNCHES, 2020- 2022

- 17.7.2 DEALS

- TABLE 378 DEALS, 2020-2022

- 17.7.3 EXPANSIONS

- TABLE 379 EXPANSIONS, 2020-2022

- 17.8 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2018-2022

- TABLE 380 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSION AS KEY GROWTH STRATEGIES, 2018-2022

18 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 18.1 THERMAL SYSTEMS MARKET - KEY PLAYERS

- 18.1.1 DENSO CORPORATION

- TABLE 381 DENSO CORPORATION: BUSINESS OVERVIEW

- FIGURE 49 DENSO CORPORATION: COMPANY SNAPSHOT

- TABLE 382 DENSO CORPORATION - PRODUCT LAUNCHES

- TABLE 383 DENSO CORPORATION- DEALS

- TABLE 384 DENSO CORPORATION: EXPANSIONS

- 18.1.2 MAHLE GMBH

- TABLE 385 MAHLE GMBH: BUSINESS OVERVIEW

- FIGURE 50 MAHLE GMBH: COMPANY SNAPSHOT

- TABLE 386 MAHLE GMBH - PRODUCT LAUNCHES

- TABLE 387 MAHLE GMBH: DEALS

- TABLE 388 MAHLE GMBH: EXPANSIONS

- 18.1.3 VALEO SA

- TABLE 389 VALEO SA: BUSINESS OVERVIEW

- FIGURE 51 VALEO: COMPANY SNAPSHOT

- 18.1.4 HANON SYSTEMS

- TABLE 390 HANON SYSTEMS: BUSINESS OVERVIEW

- FIGURE 52 HANON SYSTEMS: COMPANY SNAPSHOT

- TABLE 391 HANON SYSTEMS: DEALS

- TABLE 392 HANNON SYSTEMS: EXPANSIONS

- 18.1.5 BORGWARNER INC.

- TABLE 393 BORGWARNER INC.: BUSINESS OVERVIEW

- FIGURE 53 BORGWARNER INC.: COMPANY SNAPSHOT

- TABLE 394 BORGWARNER - PRODUCT LAUNCHES

- TABLE 395 BORGWARNER INC.: DEALS

- TABLE 396 BORGWARNER INC.: EXPANSIONS

- 18.1.6 GENTHERM INC.

- TABLE 397 GENTHERM: BUSINESS OVERVIEW

- FIGURE 54 GENTHERM: COMPANY SNAPSHOT

- TABLE 398 GENTHERM - PRODUCT LAUNCHES

- TABLE 399 GENTHERM: DEALS

- 18.1.7 SCHAEFFLER AG

- TABLE 400 SCHAEFFLER AG: BUSINESS OVERVIEW

- FIGURE 55 SCHAEFFLER AG: COMPANY SNAPSHOT

- TABLE 401 SCHAEFFLER AG: PRODUCT LAUNCHES

- TABLE 402 SCHAEFFLER AG: EXPANSIONS

- 18.1.8 JOHNSON ELECTRIC HOLDINGS LTD.

- TABLE 403 JOHNSON ELECTRIC HOLDINGS: BUSINESS OVERVIEW

- FIGURE 56 JOHNSON ELECTRIC HOLDINGS: COMPANY SNAPSHOT

- TABLE 404 JOHNSON ELECTRIC HOLDINGS LTD.: PRODUCT LAUNCHES

- 18.1.9 DANA LIMITED

- TABLE 405 DANA LIMITED: BUSINESS OVERVIEW

- FIGURE 57 DANA LIMITED: COMPANY SNAPSHOT

- TABLE 406 DANA LIMITED: PRODUCT LAUNCHES

- TABLE 407 DANA LIMITED: DEALS

- TABLE 408 DANA LTD.: EXPANSIONS

- 18.1.10 ROBERT BOSCH GMBH

- TABLE 409 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

- FIGURE 58 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- TABLE 410 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- 18.2 THERMAL SYSTEMS MARKET - ADDITIONAL PLAYERS

- 18.2.1 EBERSPACHER

- TABLE 411 EBERSPACHER: COMPANY OVERVIEW

- 18.2.2 CONTINENTAL AG

- TABLE 412 CONTINENTAL AG: COMPANY OVERVIEW

- 18.2.3 VOSS AUTOMOTIVE GMBH

- TABLE 413 VOSS AUTOMOTIVE GMBH: COMPANY OVERVIEW

- 18.2.4 GRAYSON THERMAL SYSTEMS

- TABLE 414 GRAYSON THERMAL SYSTEMS: COMPANY OVERVIEW

- 18.2.5 CAPTHERM SYSTEMS

- TABLE 415 CAPTHERM SYSTEMS: COMPANY OVERVIEW

- 18.2.6 DUPONT

- TABLE 416 DUPONT: COMPANY OVERVIEW

- 18.2.7 BEHR-HELLA THERMOCONTROL GMBH (BHTC)

- TABLE 417 BEHR-HELLA THERMOCONTROL GMBH (BHTC): COMPANY OVERVIEW

- 18.2.8 BOYD CORPORATION

- TABLE 418 BOYD CORPORATION: COMPANY OVERVIEW

- 18.2.9 SANDEN HOLDINGS CORPORATION

- TABLE 419 SANDEN HOLDINGS CORPORATION: COMPANY OVERVIEW

- 18.2.10 SANHUA AUTOMOTIVE

- TABLE 420 SANHUA AUTOMOTIVE: COMPANY OVERVIEW

- 18.2.11 SHANDONG HOUFENG GROUP

- TABLE 421 SHANDONG HOUFENG GROUP: COMPANY OVERVIEW

- 18.3 THERMAL SYSTEMS MARKET - ADDITIONAL PLAYERS (NORTH AMERICA)

- 18.3.1 MAGNA INTERNATIONAL

- TABLE 422 MAGNA INTERNATIONAL: COMPANY OVERVIEW

- 18.3.2 LEAR CORPORATION

- TABLE 423 LEAR CORPORATION: COMPANY OVERVIEW

- 18.3.3 STANT CORPORATION

- TABLE 424 STANT CORPORATION: COMPANY OVERVIEW

- 18.3.4 AIR INTERNATIONAL THERMAL SYSTEMS

- TABLE 425 AIR INTERNATIONAL THERMAL SYSTEMS: COMPANY OVERVIEW

- 18.3.5 MICHIGAN AUTOMOTIVE COMPRESSOR, INC.

- TABLE 426 MICHIGAN AUTOMOTIVE COMPRESSOR, INC: COMPANY OVERVIEW

- 18.3.6 MODINE MANUFACTURING COMPANY

- TABLE 427 MODINE MANUFACTURING COMPANY: COMPANY OVERVIEW

- 18.3.7 WELLS VEHICLE ELECTRONICS

- TABLE 428 WELLS VEHICLE ELECTRONICS: COMPANY OVERVIEW

- 18.3.8 T.RAD NORTH AMERICA, INC.

- TABLE 429 T.RAD NORTH AMERICA, INC: COMPANY OVERVIEW

- 18.3.9 THERMAL SOLUTION MANUFACTURING, INC.

- TABLE 430 THERMAL SOLUTIONS MANUFACTURING, INC: COMPANY OVERVIEW

- 18.3.10 AKG THERMAL SYSTEMS INC

- TABLE 431 AKG THERMAL SYSTEMS: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

19 APPENDIX

- 19.1 KEY INSIGHTS OF INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 19.4 AVAILABLE CUSTOMIZATIONS

- 19.4.1 ELECTRIC & HYBRID THERMAL SYSTEMS MARKET, BY APPLICATION COUNTRY-WISE DATA

- 19.4.1.1 Battery Thermal System

- 19.4.1.2 Transmission system

- 19.4.1.3 Engine Cooling

- 19.4.1.4 Front Air Conditioning

- 19.4.1.5 Motor Thermal System

- 19.4.1.6 Power Electronics

- 19.4.1.7 Rear Air Conditioning

- 19.4.1.8 Heated/Ventilated Seats

- 19.4.1.9 Heated Steering

- 19.4.1.10 Waste Heat Recovery

- 19.4.2 ELECTRIC & HYBRID THERMAL SYSTEMS MARKET, BY VEHICLE TYPE COUNTRY-WISE DATA

- 19.4.2.1 BEV

- 19.4.2.2 PHEV

- 19.4.2.3 FCEV

- 19.4.1 ELECTRIC & HYBRID THERMAL SYSTEMS MARKET, BY APPLICATION COUNTRY-WISE DATA

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS