|

|

市場調査レポート

商品コード

1247345

創薬サービスの世界市場:プロセス別・種類別・薬物の種類別・治療領域別・エンドユーザー別・地域別の将来予測 (2028年まで)Drug Discovery Services Market by Process, Type, Drug Type, Therapeutic Area, End User & Region - Global Forecasts to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 創薬サービスの世界市場:プロセス別・種類別・薬物の種類別・治療領域別・エンドユーザー別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月20日

発行: MarketsandMarkets

ページ情報: 英文 334 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の創薬サービスの市場規模は、2023年の206億米ドルから、2028年には413億米ドルに達し、予測期間中 (2023年~2028年) に14.9%のCAGRで成長する見通しです。

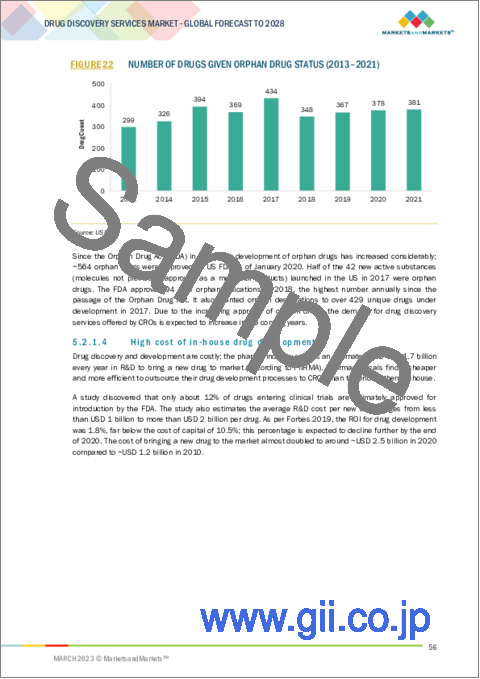

製薬・バイオテクノロジー分野における研究開発費の増加、医薬品の研究開発パイプラインの拡大とアウトソーシングへの依存度の上昇、希少疾患やオーファンドラッグに関する研究への取り組み、自社での医薬品開発コストの高さなどが、市場の成長をもたらすと予測されます。

"治療領域別では、腫瘍が最大のシェアを占める"

治療領域別では、腫瘍・がん領域が最大のシェアを占めています。治験の件数増加や、製薬企業によるがん治療薬への研究開発費の拡大により、がん治療薬として開発中の薬剤の数は年々増加しています。がんの罹患率は、世界中で急速に増加しています。がんの新規患者数は、2020年の1,930万人から2040年には2,890万人に達すると予測されており、2020年から2040年までのCAGRは最大2%と見込まれています。このような背景から、企業はがんに対する新薬の開発にますます力を注いでおり、この治療領域の成長を促進すると予想されます。

"プロセス別では、H2L (Hit to Lead) 同定の分野が最大のシェアを占める"

2022年の創薬サービス市場では、H2L同定の分野が最大のシェアを占めています。創薬プロセスにおける重要な役割のため、H2L同定は最大の収益を生むプロセスであり、現在、多くの創薬企業がこのサービスを製薬企業に提供しています。

"欧州:創薬サービス市場で2番目に大きな地域"

創薬サービス市場を地域別に見ると、欧州は北米に次いで、世界第2位の医薬品市場となっています。研究開発型の医薬品産業は、進歩する世界経済において将来の競争力を確保するために重要な役割を果たすことができます。研究開発活動の活発化とともに、新しい化学・生物学的分子の開拓が、欧州における創薬サービス市場の成長を後押しすることになるでしょう。

当レポートでは、世界の創薬サービスの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、プロセス別・種類別・薬物の種類別・治療領域別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 市場動向

- 範囲/シナリオ

- 顧客ビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 価格分析

- 規制分析

- ポーターのファイブフォース分析

- 主な会議とイベント (2022年~2023年)

- 主な利害関係者と購入基準

第6章 創薬サービス市場:プロセス別

- イントロダクション

- 標的選択

- 標的検証

- H2L (Hit to Lead) 同定

- リード最適化

- 候補薬検証

第7章 創薬サービス市場:種類別

- イントロダクション

- 化学サービス

- 生物学サービス

第8章 創薬サービス市場:薬物の種類別

- イントロダクション

- 低分子医薬品

- 生物製剤

第9章 創薬サービス市場:治療領域別

- イントロダクション

- 腫瘍

- 感染症

- 心血管疾患

- 神経疾患

- 免疫疾患

- 内分泌・代謝障害

- 呼吸器疾患

- 消化器系疾患

- 泌尿器・生殖器疾患、ウィメンズヘルス

- その他の治療領域

第10章 創薬サービス市場:エンドユーザー別

- イントロダクション

- 製薬企業・バイオテクノロジー会社

- ティア1企業

- ティア2企業

- ティア3企業

- 教育機関

- その他のエンドユーザー

第11章 創薬サービス市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- 他のアジア太平洋諸国

- ラテンアメリカ

- ブラジル

- 他のラテンアメリカ諸国

- 中東・アフリカ

第12章 競合情勢

- 概要

- 主要企業が採用した主要な戦略

- 市場シェア分析

- 主要企業の収益シェア分析

- 企業評価クアドラント

- 企業評価クアドラント:新興企業/中小企業

- 企業のフットプリント分析

- 企業のサービスフットプリント

- 企業の地域フットプリント

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- LABORATORY CORPORATION OF AMERICA HOLDINGS

- CHARLES RIVER LABORATORIES INTERNATIONAL, INC.

- WUXI APPTEC

- THERMO FISHER SCIENTIFIC

- PHARMARON BEIJING CO., LTD.

- EVOTEC SE

- EUROFINS SCIENTIFIC SE

- PIRAMAL ENTERPRISES LIMITED

- SYNGENE INTERNATIONAL LIMITED

- CURIA GLOBAL INC.

- GENSCRIPT BIOTECH CORPORATION

- JUBILANT PHARMOVA LIMITED

- FRONTAGE HOLDINGS CORPORATION

- SHANGHAI MEDICILON INC.

- AURIGENE DISCOVERY TECHNOLOGIES (DR. REDDY'S LABORATORIES)

- SYGNATURE DISCOVERY LTD.

- ONCODESIGN SERVICES

- その他の企業

- SELVITA S.A.

- VIVA BIOTECH HOLDINGS

- TCG LIFESCIENCES PVT LTD.

- SHANGHAI CHEMPARTNER CO., LTD.

- DOMAINEX LTD.

- NUVISAN PHARMA HOLDING GMBH

- DALTON PHARMA SERVICES

- ARAGEN LIFE SCIENCES PVT. LTD.

- PROMEGA CORPORATION

第14章 付録

The global Drug discovery services market is projected to reach USD 41.3 billion by 2028 from USD 20.6 billion in 2023, at a CAGR of 14.9% during the forecast period of 2023 to 2028. Growing R&D expenditure in pharma-biotech sector, increasing drug R&D pipeline and rising reliance on outsourcing, initiatives for research on rare diseases and orphan drugs, and high cost of in-house drug development are expected to provide growth to the market.

Oncology is expected to account for the largest share for therapeutic area segment

Based on therapeutic are the oncology segment has the largest market share. The list of drugs in development for oncology has increased over the years due to the rising number of clinical trials and the growing R&D expenditure by pharmaceutical companies on oncology-based drugs. The incidence of cancer has increased rapidly across the globe. According to GLOBOCAN, the number of new cases is projected to reach 28.9 million by 2040 from 19.3 million in 2020, at a CAGR of ~2% from 2020 to 2040. Owing to this, companies are increasingly focusing on developing novel medicines for cancer; this is expected to drive the growth of this therapeutic segment.

The Hit-to-lead identification segment accounted for the largest share of the process segment in the drug discovery services market

Based on process, the drug discovery services market is broadly classified into target selection, target validation, hit-to-lead identification, lead optimization, and candidate validation. Hit-to-lead identification segment accounted for the largest share of the drug discovery services market in 2022. Due to its crucial role in the drug discovery process, the hit-to-lead identification is the maximum revenue generating process, and currently many drug discovery companies are specifically offering these services to pharmaceutical companies.

Europe is the second largest region in the drug discovery services market

The drug discovery services market is segmented into North America, Europe, Asia Pacific, Latin America (LATAM) and Middle East and Africa (MEA). After North America, Europe is the second-largest regional pharmaceutical market globally. The research-based pharmaceutical industry can play a critical role in ensuring future competitiveness in an advancing global economy (Source: EFPIA). The development of new chemical and biological molecules, alongside increased R&D activities, will help drive the growth of the drug discovery services market in Europe.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 70% and Demand Side 30%

- By Designation: Managers- 45%, CXOs and Director level - 30%, and Executives - 25%

- By Region: North America -20%, Europe -10%, Asia-Pacific -55%, Latin America -10%, and Middle East and Africa - 5%

Prominent Players of the drug discovery services market are Laboratory Corporation of America Holdings (US), Thermo Fisher Scientific Inc. (US), Charles River Laboratories International, Inc. (US), WuXi AppTec (China), Eurofins Scientific SE (Germany), Evotec SE (Germany), Syngene International Limited (India), Curia Global Inc. (US), Dr. Reddy Laboratories Ltd. (Aurigene Discovery Technologies) (India), Pharmaron Beijing Co., Ltd. (China), Piramal Enterprises Limited (India)

Research Coverage:

This report provides a detailed picture of the drug discovery market. It aims at estimating the size and future growth potential of the market across different segments such as the product, application, end user and region. The report also includes an in-depth competitive analysis of the key market players along with their company profiles recent developments and key market strategies.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall drug discovery market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, challenges, trends, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing R&D expenditure in pharma-biotech sector, Increasing drug R&D pipeline and rising reliance on outsourcing, Initiatives for research on rare diseases and orphan drugs, and High cost of in-house drug development), restraints (Stringent regulations governing drug discovery and animal usage), opportunities (Technological advancements and new drug discovery techniques, Rising demand for specialized testing services among end users, Patent expiries of key biologics, and High growth prospects in emerging markets), and challenges (Shortage of skilled personnel) influencing the growth of drug discovery services market.

- Service Development/Innovation: Detailed insights on newly launched services, and technological assessment of the drug discovery market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the drug discovery services market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the drug discovery services market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Laboratory Corporation of America Holdings (US), Thermo Fisher Scientific Inc. (US), Charles River Laboratories International, Inc. (US), WuXi AppTec (China) among others in the drug discovery services market. The report also helps stakeholders understand the pulse of drug discovery services market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- FIGURE 2 DRUG DISCOVERY SERVICES MARKET: BREAKDOWN OF PRIMARIES

- 2.2 MARKET ESTIMATION METHODOLOGY

- FIGURE 3 DRUG DISCOVERY SERVICES MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2022

- FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ANALYSIS-BASED ESTIMATION), 2022

- FIGURE 5 ILLUSTRATIVE EXAMPLE OF COMPANY REVENUE ANALYSIS, 2022

- 2.2.1 INSIGHTS FROM PRIMARY EXPERTS

- FIGURE 6 MARKET SIZE VALIDATION FROM PRIMARY SOURCES

- 2.3 MARKET GROWTH RATE PROJECTIONS

- FIGURE 7 DRUG DISCOVERY SERVICES MARKET (SUPPLY-SIDE): CAGR PROJECTIONS

- FIGURE 8 DRUG DISCOVERY SERVICES MARKET (DEMAND-SIDE): GROWTH ANALYSIS OF DEMAND-SIDE DRIVERS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RECESSION IMPACT ANALYSIS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021-2027 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019-2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023-2027 (USD MILLION)

3 EXECUTIVE SUMMARY

- FIGURE 10 DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 DRUG DISCOVERY SERVICES MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF DRUG DISCOVERY SERVICES MARKET, 2022

4 PREMIUM INSIGHTS

- 4.1 DRUG DISCOVERY SERVICES MARKET OVERVIEW

- FIGURE 15 INCREASING R&D EXPENDITURE IN PHARMACEUTICAL AND BIOPHARMACEUTICAL INDUSTRY TO DRIVE MARKET GROWTH

- 4.2 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE AND COUNTRY (2022)

- FIGURE 16 SMALL-MOLECULE DRUGS HELD LARGEST SHARE OF NORTH AMERICAN DRUG DISCOVERY MARKET IN 2022

- 4.3 DRUG DISCOVERY SERVICES MARKET SHARE, BY TYPE (2022)

- FIGURE 17 CHEMISTRY SERVICES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.4 DRUG DISCOVERY SERVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 18 ASIA PACIFIC COUNTRIES TO REGISTER HIGHEST GROWTH FROM 2023-2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRUG DISCOVERY SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 4 DRUG DISCOVERY SERVICES MARKET: IMPACT ANALYSIS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing R&D expenditure in pharma-biotech sector

- FIGURE 20 RISING GLOBAL PHARMACEUTICAL R&D SPENDING, 2014-2028

- 5.2.1.2 Increasing drug R&D pipeline and rising reliance on outsourcing

- FIGURE 21 ACTIVE PHARMACEUTICAL PIPELINE, 2012-2022

- 5.2.1.3 Initiatives for research on rare diseases and orphan drugs

- FIGURE 22 NUMBER OF DRUGS GIVEN ORPHAN DRUG STATUS (2013-2021)

- 5.2.1.4 High cost of in-house drug development

- FIGURE 23 AVERAGE COST TO DEVELOP A PHARMACEUTICAL COMPOUND FROM DISCOVERY TO LAUNCH, 2010-2020 (USD BILLION)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations governing drug discovery and animal usage

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements and new drug discovery techniques

- 5.2.3.2 Rising demand for specialized testing services among end users

- 5.2.3.3 Patent expiries of key biologics

- TABLE 5 US: BIOLOGICS GOING OFF-PATENT DURING 2023-2027

- 5.2.3.4 High growth prospects in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled personnel

- 5.2.5 MARKET TRENDS

- 5.2.5.1 Adoption of AI in drug discovery

- 5.2.5.2 Increased outsourcing to emerging Asian economies

- 5.2.5.3 CRO industry consolidation

- TABLE 6 DRUG DISCOVERY SERVICES MARKET: PROMINENT ACQUISITIONS, 2023-2021

- 5.2.5.4 Integrated end-to-end R&D service offerings

- 5.3 RANGES/SCENARIOS

- FIGURE 24 SPECTRUM OF SCENARIOS BASED ON IMPACT OF UNCERTAINTIES ON DRUG DISCOVERY SERVICES MARKET GROWTH

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- FIGURE 25 REVENUE SHIFT AND NEW POCKETS FOR DRUG DISCOVERY SERVICE PROVIDERS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 26 VALUE CHAIN ANALYSIS OF DRUG DISCOVERY SERVICES MARKET: HIT-TO-LEAD IDENTIFICATION AND LEAD OPTIMIZATION PHASES ADD MAXIMUM VALUE

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 27 ECOSYSTEM ANALYSIS: DRUG DISCOVERY SERVICES MARKET

- TABLE 7 SUPPLY CHAIN ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND ANALYSIS

- TABLE 8 DRUG DISCOVERY AND DEVELOPMENT PROCESS & COST OVERVIEW (2018 VS 2022)

- 5.9 REGULATORY ANALYSIS

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 DRUG DISCOVERY SERVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 14 DRUG DISCOVERY SERVICES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF DRUG DISCOVERY SERVICES

- 5.12.2 BUYING CRITERIA FOR DRUG DISCOVERY SERVICES

- FIGURE 29 KEY BUYING CRITERIA FOR END USERS

6 DRUG DISCOVERY SERVICES MARKET, BY PROCESS

- 6.1 INTRODUCTION

- TABLE 15 DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- 6.2 TARGET SELECTION

- 6.2.1 DEVELOPMENT OF NEW TECHNOLOGIES TO SUPPORT MARKET GROWTH

- TABLE 16 DRUG DISCOVERY SERVICES MARKET FOR TARGET SELECTION, BY REGION, 2021-2028 (USD MILLION)

- TABLE 17 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR TARGET SELECTION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 18 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR TARGET SELECTION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 19 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR TARGET SELECTION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 20 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR TARGET SELECTION, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 TARGET VALIDATION

- 6.3.1 EMPHASIS ON TARGET VALIDATION TO AVOID LATE-STAGE FAILURE TO PROMOTE MARKET GROWTH

- TABLE 21 DRUG DISCOVERY SERVICES MARKET FOR TARGET VALIDATION, BY REGION, 2021-2028 (USD MILLION)

- TABLE 22 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR TARGET VALIDATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 23 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR TARGET VALIDATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 24 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR TARGET VALIDATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 25 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR TARGET VALIDATION, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4 HIT-TO-LEAD IDENTIFICATION

- 6.4.1 HIT-TO-LEAD IDENTIFICATION TO HOLD LARGEST MARKET SHARE

- TABLE 26 DRUG DISCOVERY SERVICES MARKET FOR HIT-TO-LEAD IDENTIFICATION, BY REGION, 2021-2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR HIT-TO-LEAD IDENTIFICATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 28 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR HIT-TO-LEAD IDENTIFICATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR HIT-TO-LEAD IDENTIFICATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 30 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR HIT-TO-LEAD IDENTIFICATION, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.5 LEAD OPTIMIZATION

- 6.5.1 NEED FOR TRANSPARENT PRESENTATION AND ANALYSIS TO BOOST FOCUS ON LEAD OPTIMIZATION

- TABLE 31 DRUG DISCOVERY SERVICES MARKET FOR LEAD OPTIMIZATION, BY REGION, 2021-2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR LEAD OPTIMIZATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 33 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR LEAD OPTIMIZATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR LEAD OPTIMIZATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 35 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR LEAD OPTIMIZATION, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.6 CANDIDATE VALIDATION

- 6.6.1 POSSIBILITY OF DRUG FAILURE DURING DEVELOPMENT TO DRIVE ADOPTION OF CANDIDATE VALIDATION SERVICES

- TABLE 36 DRUG DISCOVERY SERVICES MARKET FOR CANDIDATE VALIDATION, BY REGION, 2021-2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR CANDIDATE VALIDATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 38 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR CANDIDATE VALIDATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR CANDIDATE VALIDATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 40 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR CANDIDATE VALIDATION, BY COUNTRY, 2021-2028 (USD MILLION)

7 DRUG DISCOVERY SERVICES MARKET, BY TYPE

- 7.1 INTRODUCTION

- TABLE 41 DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 7.2 CHEMISTRY SERVICES

- 7.2.1 CHEMISTRY SERVICES TO DOMINATE SERVICE TYPE MARKET

- TABLE 42 CHEMISTRY SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: CHEMISTRY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 44 EUROPE: CHEMISTRY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: CHEMISTRY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 46 LATIN AMERICA: CHEMISTRY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 BIOLOGY SERVICES

- 7.3.1 RESTRICTIONS ON ANIMAL USAGE TO SLOW MARKET GROWTH

- TABLE 47 BIOLOGY SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: BIOLOGY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 49 EUROPE: BIOLOGY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: BIOLOGY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 51 LATIN AMERICA: BIOLOGY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

8 DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE

- 8.1 INTRODUCTION

- TABLE 52 DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- 8.2 SMALL-MOLECULE DRUGS

- 8.2.1 SMALL-MOLECULE DRUGS TO HOLD LARGEST MARKET SHARE

- TABLE 53 DRUG DISCOVERY SERVICES MARKET FOR SMALL-MOLECULE DRUGS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR SMALL-MOLECULE DRUGS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 55 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR SMALL-MOLECULE DRUGS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 56 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR SMALL-MOLECULE DRUGS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 57 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR SMALL-MOLECULE DRUGS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 BIOLOGICS

- 8.3.1 MARKET GROWTH OF BIOLOGICS & CHALLENGES ASSOCIATED WITH DISCOVERY TO DRIVE ADOPTION OF OUTSOURCING SERVICES

- TABLE 58 DRUG DISCOVERY SERVICES MARKET FOR BIOLOGICS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR BIOLOGICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 60 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR BIOLOGICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR BIOLOGICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 62 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR BIOLOGICS, BY COUNTRY, 2021-2028 (USD MILLION)

9 DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA

- 9.1 INTRODUCTION

- TABLE 63 DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- 9.2 ONCOLOGY

- 9.2.1 HIGH AND GROWING NUMBER OF RESEARCH STUDIES ON CANCER THERAPEUTICS TO SUPPORT MARKET GROWTH

- FIGURE 30 NUMBER OF ONCOLOGY CLINICAL TRIALS, 2012-2022 (THOUSAND)

- TABLE 64 LIST OF FDA DRUGS APPROVED FOR ONCOLOGY (2022)

- TABLE 65 DRUG DISCOVERY SERVICES MARKET FOR ONCOLOGY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 67 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 69 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 INFECTIOUS DISEASES

- 9.3.1 RISING EPIDEMIC OUTBREAKS TO BOOST DRUG DISCOVERY ACTIVITY

- TABLE 70 DRUG DISCOVERY SERVICES MARKET FOR INFECTIOUS DISEASES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA DRUG DISCOVERY SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 72 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 74 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.4 CARDIOVASCULAR DISEASES

- 9.4.1 HIGH MORTALITY RATES PROMPTING PHARMACEUTICAL COMPANIES TO DEVELOP NEW TREATMENT OPTIONS

- TABLE 75 LIST OF PIPELINE DRUGS FOR CARDIOVASCULAR DISEASES (AS OF DECEMBER 2022)

- TABLE 76 DRUG DISCOVERY SERVICES MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 78 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 80 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.5 NEUROLOGICAL DISEASES

- 9.5.1 INCREASING INVESTMENTS IN R&D FOR NEUROLOGICAL DISORDERS TO DRIVE MARKET

- TABLE 81 LIST OF PIPELINE DRUGS FOR NEUROLOGICAL DISORDERS (2022)

- TABLE 82 DRUG DISCOVERY SERVICES MARKET FOR NEUROLOGICAL DISEASES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR NEUROLOGICAL DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 84 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR NEUROLOGICAL DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR NEUROLOGICAL DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 86 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR NEUROLOGICAL DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.6 IMMUNOLOGICAL DISORDERS

- 9.6.1 GROWING DRUG PIPELINE FOR IMMUNOLOGICAL DISORDERS TO FAVOR MARKET GROWTH

- TABLE 87 LIST OF PIPELINE DRUGS FOR IMMUNOLOGICAL DISORDERS (2022)

- TABLE 88 DRUG DISCOVERY SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 90 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 92 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.7 ENDOCRINE & METABOLIC DISORDERS

- 9.7.1 INCREASING DIABETIC POPULATION TO BOOST MARKET

- FIGURE 31 ESTIMATED NUMBER OF INDIVIDUALS WITH DIABETES, 2000-2045 (MILLION)

- TABLE 93 DRUG DISCOVERY SERVICES MARKET FOR ENDOCRINE & METABOLIC DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR ENDOCRINE & METABOLIC DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 95 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR ENDOCRINE & METABOLIC DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR ENDOCRINE & METABOLIC DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 97 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR ENDOCRINE & METABOLIC DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.8 RESPIRATORY DISORDERS

- 9.8.1 RISING BURDEN OF RESPIRATORY DISORDERS TO SUPPORT GROWTH

- TABLE 98 LIST OF PIPELINE DRUGS FOR RESPIRATORY DISORDERS (2022)

- TABLE 99 DRUG DISCOVERY SERVICES MARKET FOR RESPIRATORY DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 101 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 103 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.9 DIGESTIVE SYSTEM DISEASES

- 9.9.1 RISING DISEASE INCIDENCE DUE TO LIFESTYLE AND DIETARY CHANGES TO PROPEL MARKET

- TABLE 104 DRUG DISCOVERY SERVICES MARKET FOR DIGESTIVE SYSTEM DISEASES, BY REGION, 2021-2028 (USD MILLION )

- TABLE 105 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR DIGESTIVE SYSTEM DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 106 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR DIGESTIVE SYSTEM DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR DIGESTIVE SYSTEM DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 108 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR DIGESTIVE SYSTEM DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.10 GENITOURINARY DISEASES & WOMEN'S HEALTH

- 9.10.1 RISING PREVALENCE OF CHRONIC DISORDERS IN WOMEN TO BOOST MARKET

- TABLE 109 DRUG DISCOVERY SERVICES MARKET FOR GENITOURINARY DISEASES & WOMEN'S HEALTH, BY REGION, 2021-2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR GENITOURINARY DISEASES & WOMEN'S HEALTH, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 111 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR GENITOURINARY DISEASES & WOMEN'S HEALTH, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR GENITOURINARY DISEASES & WOMEN'S HEALTH, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 113 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR GENITOURINARY DISEASES & WOMEN'S HEALTH, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.11 OTHER THERAPEUTIC AREAS

- TABLE 114 DRUG DISCOVERY SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 116 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 118 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2021-2028 (USD MILLION)

10 DRUG DISCOVERY SERVICES MARKET, BY END USER

- 10.1 INTRODUCTION

- TABLE 119 DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- FIGURE 32 R&D SPENDING OF PHRMA MEMBER COMPANIES, 2011-2021

- TABLE 120 DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 121 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 122 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 124 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.2.1 DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE

- TABLE 125 DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.2.2 TIER 1 COMPANIES

- 10.2.2.1 High investing capacity to drive growth

- TABLE 126 TOP PHARMA COMPANIES, BY REVENUE (2022)

- TABLE 127 DRUG DISCOVERY SERVICES MARKET FOR TIER 1 COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 128 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR TIER 1 COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 129 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR TIER 1 COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR TIER 1 COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 131 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR TIER 1 COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.2.3 TIER 2 COMPANIES

- 10.2.3.1 Limited investment capacity to slow market growth

- TABLE 132 DRUG DISCOVERY SERVICES MARKET FOR TIER 2 COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 133 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR TIER 2 COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 134 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR TIER 2 COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR TIER 2 COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 136 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR TIER 2 COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.2.4 TIER 3 COMPANIES

- 10.2.4.1 Insufficient technical advantages to restrain growth

- TABLE 137 DRUG DISCOVERY SERVICES MARKET FOR TIER 3 COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR TIER 3 COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 139 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR TIER 3 COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR TIER 3 COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 141 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR TIER 3 COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.3 ACADEMIC INSTITUTES

- 10.3.1 COLLABORATION WITH MARKET PLAYERS TO PROVIDE MORE FLEXIBLE AND EFFICIENT PATHWAYS FOR CLINICAL DEVELOPMENT

- TABLE 142 DRUG DISCOVERY SERVICES MARKET FOR ACADEMIC INSTITUTES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 143 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 144 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 146 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.4 OTHER END USERS

- TABLE 147 DRUG DISCOVERY SERVICES MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 149 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 151 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

11 DRUG DISCOVERY SERVICES MARKET, BY REGION

- 11.1 INTRODUCTION

- TABLE 152 DRUG DISCOVERY SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 33 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET SNAPSHOT (2022)

- TABLE 153 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 155 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 156 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 157 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 158 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 159 NORTH AMERICA: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 US to dominate North American market

- FIGURE 34 DISTRIBUTION OF R&D COMPANIES, BY COUNTRY/REGION (2021 VS. 2022)

- TABLE 160 US: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 161 US: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 162 US: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 163 US: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 164 US: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 165 US: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Growing preference to conduct clinical trials in Canada to support market growth

- TABLE 166 CANADA: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 167 CANADA: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 168 CANADA: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 169 CANADA: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 170 CANADA: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 171 CANADA: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.2.3 NORTH AMERICA: RECESSION IMPACT

- 11.3 EUROPE

- TABLE 172 EUROPE: DRUG DISCOVERY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 173 EUROPE: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 174 EUROPE: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 175 EUROPE: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 176 EUROPE: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 177 EUROPE: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 178 EUROPE: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Germany to hold largest share of European market

- TABLE 179 GERMANY: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 180 GERMANY: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 181 GERMANY: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 182 GERMANY: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 183 GERMANY: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 184 GERMANY: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Government-private sector collaborations to boost market

- TABLE 185 UK: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 186 UK: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 187 UK: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 188 UK: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 189 UK: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 190 UK: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Growing number of oncology research projects to propel market

- TABLE 191 FRANCE: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 192 FRANCE: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 193 FRANCE: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 194 FRANCE: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 195 FRANCE: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 196 FRANCE: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.4 ITALY

- 11.3.4.1 High number of clinical trials and low drug approval time to augment market

- TABLE 197 NUMBER OF CLINICAL TRIALS IN ITALY, BY COMPANY (JANUARY 2022)

- TABLE 198 ITALY: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 199 ITALY: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 200 ITALY: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 201 ITALY: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 202 ITALY: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 203 ITALY: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.5 SPAIN

- 11.3.5.1 Short study start-up times and rising R&D expenditure to augment market

- TABLE 204 SPAIN: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 205 SPAIN: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 206 SPAIN: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 207 SPAIN: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 208 SPAIN: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 209 SPAIN: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.6 REST OF EUROPE

- TABLE 210 REST OF EUROPE: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 211 REST OF EUROPE: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 212 REST OF EUROPE: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 213 REST OF EUROPE: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 214 REST OF EUROPE: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 215 REST OF EUROPE: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.7 EUROPE: RECESSION IMPACT

- 11.4 ASIA PACIFIC

- FIGURE 35 APAC: DRUG DISCOVERY SERVICES MARKET SNAPSHOT (2022)

- TABLE 216 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 217 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 218 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 219 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 220 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 221 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 222 ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 Robust pharma industry and presence of key CROs to account for China's large market share

- TABLE 223 CHINA: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 224 CHINA: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 225 CHINA: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 226 CHINA: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 227 CHINA: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 228 CHINA: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.4.2 JAPAN

- 11.4.2.1 Government initiatives for drug innovation to support market growth

- TABLE 229 TOTAL NUMBER OF CLINICAL TRIALS IN JAPAN, BY THERAPEUTIC AREA, 2020 VS. 2022

- TABLE 230 JAPAN: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 231 JAPAN: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 232 JAPAN: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 233 JAPAN: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 234 JAPAN: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 235 JAPAN: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Low-cost services, availability of skilled workforce, and strong government support to propel market

- TABLE 236 INDIA: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 237 INDIA: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 238 INDIA: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 239 INDIA: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 240 INDIA: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 241 INDIA: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.4.4 AUSTRALIA

- 11.4.4.1 Large number of clinical trials to make Australia a favorable location for drug discovery

- TABLE 242 AUSTRALIA: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 243 AUSTRALIA: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 244 AUSTRALIA: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 245 AUSTRALIA: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 246 AUSTRALIA: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 247 AUSTRALIA: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Government initiatives and growing R&D activities for drug development to drive growth

- TABLE 248 SOUTH KOREA: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 249 SOUTH KOREA: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 250 SOUTH KOREA: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 251 SOUTH KOREA: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 252 SOUTH KOREA: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 253 SOUTH KOREA: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 254 REST OF ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 255 REST OF ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 256 REST OF ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 257 REST OF ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 258 REST OF ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 259 REST OF ASIA PACIFIC: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.4.7 ASIA PACIFIC: RECESSION IMPACT

- 11.5 LATIN AMERICA

- TABLE 260 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 261 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 262 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 263 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 264 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 265 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 266 LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.5.1 BRAZIL

- 11.5.1.1 Brazil to dominate Latin American market

- TABLE 267 BRAZIL: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 268 BRAZIL: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 269 BRAZIL: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 270 BRAZIL: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 271 BRAZIL: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 272 BRAZIL: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.5.2 REST OF LATIN AMERICA

- TABLE 273 REST OF LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 274 REST OF LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 275 REST OF LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 276 REST OF LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 277 REST OF LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 278 REST OF LATIN AMERICA: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.5.3 LATIN AMERICA: RECESSION IMPACT

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GROWING PHARMACEUTICAL INDUSTRY TO BOOST MARKET

- TABLE 279 MIDDLE EAST & AFRICA: DRUG DISCOVERY SERVICES MARKET, BY PROCESS, 2021-2028 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: DRUG DISCOVERY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE, 2021-2028 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: DRUG DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA, 2021-2028 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: DRUG DISCOVERY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 284 MIDDLE EAST & AFRICA: DRUG DISCOVERY SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY TYPE, 2021-2028 (USD MILLION)

- 11.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- FIGURE 36 KEY STRATEGIES ADOPTED BY PLAYERS IN DRUG DISCOVERY SERVICES MARKET, 2020-2023

- 12.3 MARKET SHARE ANALYSIS

- FIGURE 37 DRUG DISCOVERY SERVICES MARKET: MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- TABLE 285 DRUG DISCOVERY SERVICES MARKET: DEGREE OF COMPETITION

- 12.4 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

- FIGURE 38 REVENUE SHARE ANALYSIS OF TOP PLAYERS, 2020-2022

- 12.5 COMPANY EVALUATION QUADRANT

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 39 DRUG DISCOVERY SERVICES MARKET: COMPANY EVALUATION QUADRANT, 2022

- 12.6 COMPANY EVALUATION QUADRANT: START-UPS/SMES

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 40 DRUG DISCOVERY SERVICES MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2022

- 12.7 COMPANY FOOTPRINT ANALYSIS

- 12.7.1 COMPANY SERVICE FOOTPRINT

- TABLE 286 SERVICE PORTFOLIO ANALYSIS: DRUG DISCOVERY SERVICES MARKET (2022)

- 12.7.2 COMPANY GEOGRAPHIC FOOTPRINT

- TABLE 287 GEOGRAPHIC REVENUE MIX: DRUG DISCOVERY SERVICES MARKET (2022)

- 12.8 COMPETITIVE SCENARIO

- TABLE 288 DRUG DISCOVERY SERVICES MARKET: SERVICE LAUNCHES, JANUARY 2020-MARCH 2023

- TABLE 289 DRUG DISCOVERY SERVICES MARKET: DEALS, JANUARY 2020-MARCH 2023

- TABLE 290 DRUG DISCOVERY SERVICES MARKET: EXPANSION: JANUARY 2020-MARCH 2023

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

- 13.1.1 LABORATORY CORPORATION OF AMERICA HOLDINGS

- TABLE 291 LABORATORY CORPORATION OF AMERICA HOLDINGS: BUSINESS OVERVIEW

- FIGURE 41 LABORATORY CORPORATION OF AMERICA HOLDINGS: COMPANY SNAPSHOT (2022)

- 13.1.2 CHARLES RIVER LABORATORIES INTERNATIONAL, INC.

- TABLE 292 CHARLES RIVER LABORATORIES INTERNATIONAL: BUSINESS OVERVIEW

- FIGURE 42 CHARLES RIVER LABORATORIES INTERNATIONAL: COMPANY SNAPSHOT (2022)

- 13.1.3 WUXI APPTEC

- TABLE 293 WUXI APPTEC: BUSINESS OVERVIEW

- FIGURE 43 WUXI APPTEC: COMPANY SNAPSHOT (2021)

- 13.1.4 THERMO FISHER SCIENTIFIC

- TABLE 294 THERMO FISHER SCIENTIFIC: BUSINESS OVERVIEW

- FIGURE 44 THERMO FISHER SCIENTIFIC INC: COMPANY SNAPSHOT (2022)

- 13.1.5 PHARMARON BEIJING CO., LTD.

- TABLE 295 PHARMARON BEIJING CO., LTD.: BUSINESS OVERVIEW

- FIGURE 45 PHARMARON BEIJING CO., LTD.: COMPANY SNAPSHOT (2021)

- 13.1.6 EVOTEC SE

- TABLE 296 EVOTEC SE: BUSINESS OVERVIEW

- FIGURE 46 EVOTEC SE: COMPANY SNAPSHOT (2021)

- 13.1.7 EUROFINS SCIENTIFIC SE

- TABLE 297 EUROFINS SCIENTIFIC SE: BUSINESS OVERVIEW

- FIGURE 47 EUROFINS SCIENTIFIC SE: COMPANY SNAPSHOT (2022)

- 13.1.8 PIRAMAL ENTERPRISES LIMITED

- TABLE 298 PIRAMAL ENTERPRISES LIMITED: BUSINESS OVERVIEW

- FIGURE 48 PIRAMAL ENTERPRISES LIMITED: COMPANY SNAPSHOT (2021)

- 13.1.9 SYNGENE INTERNATIONAL LIMITED

- TABLE 299 SYNGENE INTERNATIONAL LIMITED: BUSINESS OVERVIEW

- FIGURE 49 SYNGENE INTERNATIONAL LIMITED: COMPANY SNAPSHOT (2021)

- 13.1.10 CURIA GLOBAL INC.

- TABLE 300 CURIA GLOBAL INC.: BUSINESS OVERVIEW

- 13.1.11 GENSCRIPT BIOTECH CORPORATION

- TABLE 301 GENSCRIPT BIOTECH CORPORATION: BUSINESS OVERVIEW

- FIGURE 50 GENSCRIPT BIOTECH CORPORATION: COMPANY SNAPSHOT (2021)

- 13.1.12 JUBILANT PHARMOVA LIMITED

- TABLE 302 JUBILANT PHARMOVA LIMITED: BUSINESS OVERVIEW

- FIGURE 51 JUBILANT PHARMOVA LIMITED: COMPANY SNAPSHOT (2021)

- 13.1.13 FRONTAGE HOLDINGS CORPORATION

- TABLE 303 FRONTAGE HOLDINGS CORPORATION: BUSINESS OVERVIEW

- FIGURE 52 FRONTAGE HOLDINGS CORPORATION: COMPANY SNAPSHOT (2021)

- 13.1.14 SHANGHAI MEDICILON INC.

- TABLE 304 SHANGHAI MEDICILON INC.: BUSINESS OVERVIEW

- 13.1.15 AURIGENE DISCOVERY TECHNOLOGIES (DR. REDDY'S LABORATORIES)

- TABLE 305 DR. REDDY'S LABORATORIES LTD.: BUSINESS OVERVIEW

- FIGURE 53 DR. REDDY'S LABORATORIES LTD.: COMPANY SNAPSHOT (2021)

- 13.1.16 SYGNATURE DISCOVERY LTD.

- TABLE 306 SYGNATURE DISCOVERY LTD: BUSINESS OVERVIEW

- 13.1.17 ONCODESIGN SERVICES

- TABLE 307 ONCODESIGN SERVICES: BUSINESS OVERVIEW

- FIGURE 54 ONCODESIGN SERVICES: COMPANY SNAPSHOT (2021)

Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 13.2 OTHER COMPANIES

- 13.2.1 SELVITA S.A.

- 13.2.2 VIVA BIOTECH HOLDINGS

- 13.2.3 TCG LIFESCIENCES PVT LTD.

- 13.2.4 SHANGHAI CHEMPARTNER CO., LTD.

- 13.2.5 DOMAINEX LTD.

- 13.2.6 NUVISAN PHARMA HOLDING GMBH

- 13.2.7 DALTON PHARMA SERVICES

- 13.2.8 ARAGEN LIFE SCIENCES PVT. LTD.

- 13.2.9 PROMEGA CORPORATION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS