|

|

市場調査レポート

商品コード

1117288

LiDARドローンの世界市場:LiDARの種類別 (地形測量用、海底測量用)・コンポーネント別 (LiDARレーザー、UAVカメラ)・ドローンの種類別 (回転翼式、固定翼式)・航続距離別 (短距離、中距離、長距離)・用途別・地域別の将来予測 (2027年まで)LiDAR Drone Market by LiDAR Type (Topographic, Bathymetric), By Component (LiDAR Lasers, UAV Cameras), Drone Type (Rotary-wing, Fixed-wing), Range (Short-range, Medium-range, Long-range), Application, Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| LiDARドローンの世界市場:LiDARの種類別 (地形測量用、海底測量用)・コンポーネント別 (LiDARレーザー、UAVカメラ)・ドローンの種類別 (回転翼式、固定翼式)・航続距離別 (短距離、中距離、長距離)・用途別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年08月11日

発行: MarketsandMarkets

ページ情報: 英文 189 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

LiDARドローン市場は、2022年の1億4,700万米ドルから2027年には5億800万米ドルに成長すると予測されており、予測期間中に28.1%のCAGRで成長する見込みです。

鉱山オペレーターがLiDARドローン技術を活用してデータ品質の向上、安全性の向上、運用経費の削減を行っていることから、鉱山用途におけるLiDARドローンの採用が成長を促進しています。また、新しい高度な技術の採用が進んでおり、精密農業アプリケーションにおけるLiDARドローンの需要が高まってきています。

"中距離LiDARドローンの市場は、予測期間中に最も高いCAGRで成長する"

中距離LiDARドローンは、高い精度を提供し、200~500mの範囲で動作します。これらのLiDARドローンは中規模のコリドーマッピング、林業、海岸線管理、農業のアプリケーションに適しています。

"コリドーマッピング用途の市場は、予測期間中に最も高いCAGRで成長する。"

LiDARドローンは、短距離、中距離、または長距離レーザーを使用して、地形の3Dマップを作成するために使用されます。道路、鉄道、送電線、地雷の3D点群を測量・作成することでコリドーマッピングに使用されます。低高度で飛行するLiDARドローンは、データを正確に収集するため、コリドーマッピングアプリケーションに最適です。

"アジア太平洋は2022年から2027年の間に、LiDARドローン市場に大きな成長機会を提供する"

アジア太平洋地域では、LiDARドローンは主に環境、コリドーマッピング、精密農業のアプリケーションで使用されています。同地域の市場成長の背景には、インフラ開発プロジェクトの進行、森林管理に対する意識の高まり、鉱業活動の増加により、測量やマッピング作業へのLiDARドローンの採用が増加していることがあります。また、精密農業も同地域の市場を牽引するものと期待されています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- バリューチェーン分析

- LiDARドローン市場:エコシステム

- 価格分析

- 顧客に影響を与える傾向と混乱

- 技術分析

- 人工知能 (AI) を利用したLiDAR

- LiDARドローン技術

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ

- 貿易分析

- 特許分析 (2012年~2022年)

- 主な会議とイベント (2022年~2023年)

- 規制と基準

第6章 LiDARドローン市場:LiDARの種類別

- イントロダクション

- 地形測量用LiDAR

- 海底測量用LiDAR

第7章 LiDARドローン市場:コンポーネント別

- イントロダクション

- LiDARレーザー

- ナビゲーション・測位システム

- UAVカメラ

- その他

第8章 LiDARドローン市場:ドローンの種類別

- イントロダクション

- 回転翼式LiDARドローン

- 固定翼式LiDARドローン

第9章 LiDARドローン市場:航続距離別

- イントロダクション

- 短距離LiDARドローン

- 中距離LiDARドローン

- 長距離LiDARドローン

第10章 LiDARドローン市場:用途別

- イントロダクション

- コリドーマッピング (回廊地形マッピング)

- 考古学

- 建設

- 環境

- エンターテイメント

- 精密農業

- その他

第11章 LiDARドローン市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東・アフリカ

- 南米

第12章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 市場シェア分析 (2021年)

- 主要企業の評価クアドラント (2021年)

- LiDARドローン市場:企業のフットプリント

- 中小企業 (SME) の評価マトリックス (2021年)

- 競合シナリオと動向

- LiDARドローン市場:製品の発売 (2019年~2022年)

- LiDARドローン市場:資本取引 (2019~2022年)

第13章 企業プロファイル

- 主要企業

- PHOENIX LiDAR SYSTEMS

- RIEGL LASER MEASUREMENT SYSTEMS GMBH

- VELODYNE LiDAR, INC.

- TELEDYNE OPTECH

- UMS SKELDAR

- LiDARUSA

- YELLOWSCAN

- GEODETICS, INC.

- ONYXSCAN

- SICK AG

- DELAIR

- MICRODRONES

- その他の企業

- LIVOX

- ROUTESCENE

- NEXTCORE

- GREENVALLEY INTERNATIONAL (GVI)

- SURESTAR

- BENEWAKE (BEIJING) CO., LTD.

- SABRE ADVANCED 3D SURVEYING SYSTEMS

- CEPTON, INC.

- DRAGANFLY INC.

- GEOCUE GROUP INC.

- VOLATUS AEROSPACE CORP.

- MODUS

- PRECISIONHAWK

第14章 隣接・関連市場

- イントロダクション

- 隣接市場:制限事項

- TOFセンサー市場:用途別

- 拡張・仮想現実 (AR・VR)

- LiDAR

第15章 付録

The LiDAR Drone market is projected to grow from USD 147 million in 2022 to USD 508 million in 2027; it is expected to grow at a CAGR of 28.1% during the forecasted period.LiDAR drone's adoption in mining application is driving the growth as mine operators are leveraging LiDAR drone technology to improve data quality, increase safety, and reduce operational expenses; while growing adoption of new and advanced technologies has led to an increased demand for LiDAR drones for precision farming applications.

"Market for medium-range LiDAR drone is expected to grow at highest CAGR during the forecasted period."

Medium-range LiDAR drones offer high accuracy and operate in a 200-500m range. These LiDAR drones are heavy and are suitable for medium-scale corridor mapping, forestry, coastline management, and agriculture applications. In many countries, commercial drones can fly at an altitude of 200-500m without requiring additional permission from regulatory bodies.

"Market for corridor mapping application is to grow at highest CAGR during forecast period. "

LiDAR drones are used to create 3D maps of terrains using short-range, medium-range, or long-range lasers. They are used for corridor mapping by surveying and creating a 3D point cloud of roads, railways, power lines, and mines.LiDAR drones flying at low altitudes are preferable for corridor mapping applications, as they collect data accurately. They are used to carry out corridor mapping for the transportation sector to support the planning and management of roads or railway tracks, which require high spatial resolution and accurate mapping. Thus, such various applications of LiDAR drone in corridor mapping is expected to create significant demand in coming years.

"APAC to offer significant growth opportunities for LiDAR drone market between 2022 and 2027."

In Asia Pacific, LiDAR drones are majorly used in environmental, corridor mapping, and precision agriculture applications. The market growth in the regioncan be attributed to the increased adoption of LiDAR drones for surveying and mapping operations owing to ongoing infrastructural development projects, growing awareness in Asia Pacific countries about forest management, and increasing mining activities in the region. Precision agriculture is also expected to drive the market in the region.

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the LiDAR Drone marketspace. The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1 - 55%, Tier 2 - 30%, and Tier 3 - 15%

- By Designation: C-level Executives - 45%, Directors - 35%, and Others - 20%

- By Region: North America -34%, APAC- 31%, Europe - 24%, and RoW - 12%

The report profiles key players in the LiDAR drone market with their respective market ranking analysis. Prominent players profiled in this report areVelodyne Lidar, Inc.(US),RIEGL Laser Measurement Systems GmbH(Austria), Teledyne Optech Inc.(Canada),Phoenix LiDAR Systems(US), Microdrones (Germany), YellowScan(France), UMS Skeldar(Switzerland), LIDARUSA(US), SICK AG (Germany), and GeoCue Group (US).

Research Coverage:

This research report categorizes the LiDAR drone market on the basis LiDAR type, component, drone type, range, application, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the LiDAR Drone market and forecasts the same till 2027. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the LiDAR Drone ecosystem.

Key Benefits of Buying the Report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall LiDAR Drone market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 LIDAR DRONE MARKET: GEOGRAPHIC SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 LIDAR DRONE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 List of key primary interview participants

- 2.1.3.3 Breakdown of primaries

- 2.1.3.4 Key data from primary sources

- 2.1.3.5 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

- FIGURE 3 LIDAR DRONE MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

- FIGURE 4 LIDAR DRONE MARKET: TOP-DOWN APPROACH

- FIGURE 5 LIDAR DRONE MARKET: SUPPLY-SIDE ANALYSIS

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 LIDAR DRONE MARKET, 2018-2027 (USD MILLION)

- FIGURE 8 TOPOGRAPHIC LIDAR TO HOLD LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 9 LIDAR LASERS TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 10 ROTARY-WING LIDAR DRONES TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 11 CORRIDOR MAPPING TO HOLD LARGEST SHARE OF LIDAR DRONE MARKET IN 2027

- FIGURE 12 NORTH AMERICA EXPECTED TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 ADOPTION OF LIDAR DRONES IN MINING APPLICATIONS TO BOOST MARKET GROWTH

- 4.2 LIDAR DRONE MARKET, BY LIDAR TYPE

- FIGURE 14 TOPOGRAPHIC LIDAR TO HOLD LARGER MARKET SIZE IN 2027

- 4.3 LIDAR DRONE MARKET, BY COMPONENT

- FIGURE 15 LIDAR LASERS TO DOMINATE LIDAR DRONE MARKET IN 2027

- 4.4 LIDAR DRONE MARKET, BY DRONE TYPE

- FIGURE 16 ROTARY-WING LIDAR DRONES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 4.5 LIDAR DRONE MARKET IN NORTH AMERICA, BY COUNTRY AND APPLICATION

- FIGURE 17 US AND CORRIDOR MAPPING TO ACCOUNT FOR LARGEST MARKET SHARES IN NORTH AMERICA IN 2027

- 4.6 LIDAR DRONE MARKET, BY COUNTRY

- FIGURE 18 US TO HOLD LARGEST SHARE OF LIDAR DRONE MARKET IN 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 LIDAR DRONE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Adoption of LiDAR drones in mining applications

- 5.2.1.2 Easing of regulations related to use of commercial drones

- 5.2.1.3 Growing demand for LiDAR drones for corridor mapping and precision agriculture applications

- FIGURE 20 LIDAR DRONE MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Easy availability of low-cost and lightweight photogrammetry systems

- 5.2.2.2 Stringent regulations and restrictions related to use of drones in various countries

- FIGURE 21 LIDAR DRONE MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Government initiatives encourage use of LiDAR drones for large-scale surveys

- 5.2.3.2 Emergence of 4D LiDAR sensors

- FIGURE 22 LIDAR DRONE MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 High purchasing and operational costs of LiDAR drones

- 5.2.4.2 Issues related to drone safety and security

- FIGURE 23 LIDAR DRONE MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 24 LIDAR DRONE MARKET: MAJOR VALUE ADDITION BY MANUFACTURERS OF LIDAR DRONE COMPONENTS AND THEIR INTEGRATORS AND DISTRIBUTORS

- 5.4 LIDAR DRONE MARKET: ECOSYSTEM

- FIGURE 25 LIDAR DRONE MARKET: ECOSYSTEM

- TABLE 1 LIDAR DRONE MARKET: ECOSYSTEM

- 5.5 PRICING ANALYSIS

- TABLE 2 AVERAGE SELLING PRICES OF LIDAR DRONE COMPONENTS OFFERED BY TOP COMPANIES, 2021

- TABLE 3 INDICATIVE PRICES OF LIDAR DRONES

- 5.5.1 AVERAGE SELLING PRICES OF KEY PLAYERS

- FIGURE 26 AVERAGE SELLING PRICES OF KEY PLAYERS, BY COMPONENT

- TABLE 4 AVERAGE SELLING PRICES OF KEY PLAYERS, BY COMPONENT (USD)

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 ARTIFICIAL INTELLIGENCE (AI)-POWERED LIDAR

- 5.7.2 LIDAR DRONE TECHNOLOGIES

- 5.7.2.1 2D LiDAR Drones

- 5.7.2.2 3D LiDAR Drones

- 5.7.2.3 4D LiDAR Drones

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES ON LIDAR DRONE MARKET, 2021

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.10 CASE STUDIES

- 5.10.1 VENTUS-TECH USED YELLOWSCAN'S SURVEYOR SYSTEM TO GENERATE PRECISE MAPPING DATA

- 5.10.2 GEODETICS USES VELODYNE COST-EFFICIENT LIDAR SENSORS

- 5.10.3 GEOTERRA AND FLYTHRU PARTNERED WITH NEATH PORT TALBOT COUNCIL AND EARTH SCIENCE TO SOLVE YSTALYFERA MOUNTAINSIDE ISSUE

- 5.10.4 SENSEFLY FIXED-WING DRONES HELPED PUBLIC POWER CORPORATION S.A. (PPC) CALCULATE LIGNITE VOLUMES

- 5.10.5 WITH HONEYWELL, IMU LIDAR USA ACHIEVED GREATER LOCATION ACCURACY ON GROUND AND IN AIR

- 5.11 TRADE ANALYSIS

- FIGURE 29 IMPORT DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- FIGURE 30 EXPORT DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- 5.12 PATENT ANALYSIS, 2012-2022

- FIGURE 31 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

- FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 8 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 9 LIST OF FEW PATENTS IN LIDAR DRONE MARKET, 2020-2021

- 5.13 KEY CONFERENCES AND EVENTS, 2022-2023

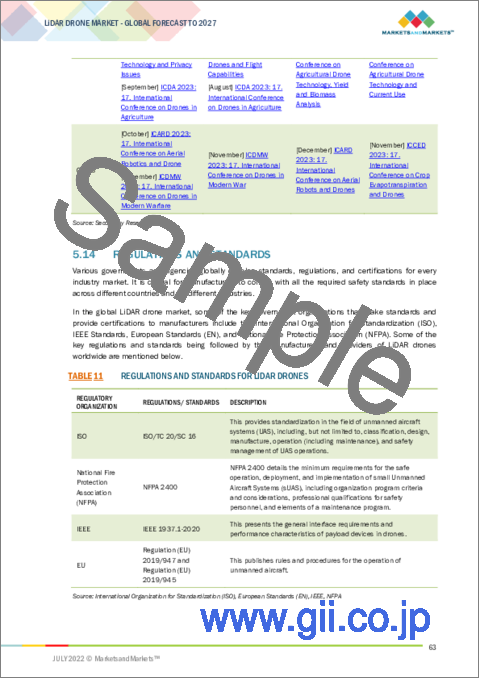

- TABLE 10 LIDAR DRONE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.14 REGULATIONS AND STANDARDS

- TABLE 11 REGULATIONS AND STANDARDS FOR LIDAR DRONES

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 LIDAR DRONE MARKET, BY LIDAR TYPE

- 6.1 INTRODUCTION

- FIGURE 33 TOPOGRAPHIC LIDAR TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

- TABLE 15 LIDAR DRONE MARKET, BY LIDAR TYPE, 2018-2021 (USD MILLION)

- TABLE 16 LIDAR DRONE MARKET, BY LIDAR TYPE, 2022-2027 (USD MILLION)

- 6.2 TOPOGRAPHIC LIDAR

- 6.2.1 HIGHLY ADOPTED IN MAPPING AND SURVEYING APPLICATIONS

- 6.3 BATHYMETRIC LIDAR

- 6.3.1 PRODUCE HIGH-QUALITY UNDERWATER DATA

7 LIDAR DRONE MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 34 LIDAR LASERS SEGMENT PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 17 LIDAR DRONE MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 18 LIDAR DRONE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 7.2 LIDAR LASERS

- 7.2.1 KEY COMPONENTS IN MEASURING LARGE DISTANCES

- TABLE 19 LIDAR LASERS: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 20 LIDAR LASERS: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- 7.3 NAVIGATION AND POSITIONING SYSTEMS

- 7.3.1 OBTAIN ACCURATE GEOGRAPHICAL INFORMATION IN LIDAR DRONES

- TABLE 21 NAVIGATION AND POSITIONING SYSTEMS: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 22 NAVIGATION AND POSITIONING SYSTEMS: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- 7.4 UAV CAMERAS

- 7.4.1 COMBINE LIDAR DATA AND CAMERA IMAGES FOR ACCURATE, COLORED IMAGES

- TABLE 23 UAV CAMERAS: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 24 UAV CAMERAS: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- 7.5 OTHERS

- TABLE 25 OTHERS: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 26 OTHERS: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

8 LIDAR DRONE MARKET, BY DRONE TYPE

- 8.1 INTRODUCTION

- FIGURE 35 ROTARY-WING LIDAR DRONES TO GROW AT HIGHER CAGR FROM 2022 TO 2027

- TABLE 27 LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 28 LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- 8.2 ROTARY-WING LIDAR DRONES

- 8.2.1 ROTARY-WING LIDAR DRONES ARE LOW-COST AND HIGHLY FLEXIBLE

- TABLE 29 ROTARY-WING LIDAR DRONES: LIDAR DRONE MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 30 ROTARY-WING LIDAR DRONES: LIDAR DRONE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 31 ROTARY-WING LIDAR DRONES: LIDAR DRONE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 32 ROTARY-WING LIDAR DRONES: LIDAR DRONE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 33 ROTARY-WING LIDAR DRONES: LIDAR DRONE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 34 ROTARY-WING LIDAR DRONES: LIDAR DRONE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 FIXED-WING LIDAR DRONES

- 8.3.1 FIXED-WING LIDAR DRONES HAVE SIGNIFICANT RANGE AND HIGH STABILITY

- TABLE 35 FIXED-WING LIDAR DRONES: LIDAR DRONE MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 36 FIXED-WING LIDAR DRONES: LIDAR DRONE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 37 FIXED-WING LIDAR DRONES: LIDAR DRONE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 38 FIXED-WING LIDAR DRONES: LIDAR DRONE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 39 FIXED-WING LIDAR DRONES: LIDAR DRONE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 40 FIXED-WING LIDAR DRONES: LIDAR DRONE MARKET, BY REGION, 2022-2027 (USD MILLION)

9 LIDAR DRONE MARKET, BY RANGE

- 9.1 INTRODUCTION

- FIGURE 36 MEDIUM-RANGE LIDAR DRONES PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 41 LIDAR DRONE MARKET, BY RANGE, 2018-2021 (USD MILLION)

- TABLE 42 LIDAR DRONE MARKET, BY RANGE, 2022-2027 (USD MILLION)

- 9.2 SHORT-RANGE LIDAR DRONES

- 9.2.1 USED TO CONDUCT SMALL-SCALE SURVEYS

- 9.3 MEDIUM-RANGE LIDAR DRONES

- 9.3.1 SUITABLE FOR MEDIUM-SCALE MAPPING APPLICATIONS

- 9.4 LONG-RANGE LIDAR DRONES

- 9.4.1 RISING DEPLOYMENT TO SCAN LARGE AREAS

10 LIDAR DRONE MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 37 CORRIDOR MAPPING TO ACCOUNT FOR LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- TABLE 43 LIDAR DRONE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 44 LIDAR DRONE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 45 RECENT PROJECTS INVOLVING USE OF LIDAR DRONES

- 10.2 CORRIDOR MAPPING

- 10.2.1 INCREASED ADOPTION OF LIDAR DRONES TO SURVEY DIFFICULT TERRAINS

- TABLE 46 CORRIDOR MAPPING: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 47 CORRIDOR MAPPING: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- TABLE 48 CORRIDOR MAPPING: LIDAR DRONE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 49 CORRIDOR MAPPING: LIDAR DRONE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 ARCHAEOLOGY

- 10.3.1 LIDAR DRONES HELP IN SITE DOCUMENTATION AND 3D MODELING OF ARCHAEOLOGICAL SITES

- TABLE 50 ARCHAEOLOGY: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 51 ARCHAEOLOGY: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- TABLE 52 ARCHAEOLOGY: LIDAR DRONE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 53 ARCHAEOLOGY: LIDAR DRONE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 CONSTRUCTION

- 10.4.1 LIDAR DRONES EMPLOYED TO SURVEY ROAD AND RAILWAY LINES

- TABLE 54 CONSTRUCTION: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 55 CONSTRUCTION: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- TABLE 56 CONSTRUCTION: LIDAR DRONE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 57 CONSTRUCTION: LIDAR DRONE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 ENVIRONMENT

- 10.5.1 RISING USE OF LIDAR DRONES FOR ENVIRONMENTAL ASSESSMENT

- TABLE 58 ENVIRONMENT: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 59 ENVIRONMENT: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- TABLE 60 ENVIRONMENT: LIDAR DRONE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 61 ENVIRONMENT: LIDAR DRONE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.6 ENTERTAINMENT

- 10.6.1 VIDEO GAMES INDUSTRY EXPECTED TO DRIVE GROWTH OF UAV LIDAR TECHNOLOGY

- TABLE 62 ENTERTAINMENT: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 63 ENTERTAINMENT: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- TABLE 64 ENTERTAINMENT: LIDAR DRONE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 65 ENTERTAINMENT: LIDAR DRONE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.7 PRECISION AGRICULTURE

- 10.7.1 USE OF LIDAR DRONES FOR CROP MONITORING AND CATEGORIZATION

- TABLE 66 PRECISION AGRICULTURE: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 67 PRECISION AGRICULTURE: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- TABLE 68 PRECISION AGRICULTURE: LIDAR DRONE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 69 PRECISION AGRICULTURE: LIDAR DRONE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.8 OTHERS

- 10.8.1 ADOPTION OF LIDAR FOR OPERATIONAL INSPECTION AND MONITORING INDUSTRIES

- TABLE 70 OTHERS: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 71 OTHERS: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- TABLE 72 OTHERS: LIDAR DRONE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 73 OTHERS: LIDAR DRONE MARKET, BY REGION, 2022-2027 (USD MILLION)

11 LIDAR DRONE MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 38 LIDAR DRONE MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 74 LIDAR DRONE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 75 LIDAR DRONE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 39 NORTH AMERICA: LIDAR DRONE MARKET SNAPSHOT

- TABLE 76 NORTH AMERICA: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 77 NORTH AMERICA: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: LIDAR DRONE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 79 NORTH AMERICA: LIDAR DRONE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 80 NORTH AMERICA: LIDAR DRONE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 81 NORTH AMERICA: LIDAR DRONE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 US to continue dominating LiDAR drone market during forecast period

- FIGURE 40 CONSTRUCTION SPENDING IN US (2017-2021), USD BILLION

- 11.2.2 CANADA

- 11.2.2.1 Adoption of LiDAR drones in government projects to drive market growth

- 11.2.3 MEXICO

- 11.2.3.1 Archaeology and forestry offer market opportunities

- 11.3 EUROPE

- FIGURE 41 EUROPE: LIDAR DRONE MARKET SNAPSHOT

- TABLE 82 EUROPE: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 83 EUROPE: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- TABLE 84 EUROPE: LIDAR DRONE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 85 EUROPE: LIDAR DRONE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 86 EUROPE: LIDAR DRONE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 87 EUROPE: LIDAR DRONE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.3.1 UK

- 11.3.1.1 Deployment of LiDAR drones for mapping and surveying applications

- 11.3.2 GERMANY

- 11.3.2.1 LiDAR drones to enhance military aerial vehicle capabilities

- 11.3.3 FRANCE

- 11.3.3.1 Prominent LiDAR drone providers offer improved survey solutions

- 11.3.4 ITALY

- 11.3.4.1 Infrastructure planning and inspection to offer opportunities

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: LIDAR DRONE MARKET SNAPSHOT

- TABLE 88 ASIA PACIFIC: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 89 ASIA PACIFIC: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- TABLE 90 ASIA PACIFIC: LIDAR DRONE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 91 ASIA PACIFIC: LIDAR DRONE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 92 ASIA PACIFIC: LIDAR DRONE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 93 ASIA PACIFIC: LIDAR DRONE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 Manufacturing capabilities in the country to drive market growth

- 11.4.2 JAPAN

- 11.4.2.1 Expansion of Japan-based LiDAR drone players to drive market growth

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Smart city initiatives expected to create growth opportunities

- 11.4.4 INDIA

- 11.4.4.1 Growing adoption of advanced technologies in agriculture

- 11.4.5 AUSTRALIA

- 11.4.5.1 Increased adoption of LiDAR drones for mining operations

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 ROW

- TABLE 94 ROW: LIDAR DRONE MARKET, BY DRONE TYPE, 2018-2021 (USD MILLION)

- TABLE 95 ROW: LIDAR DRONE MARKET, BY DRONE TYPE, 2022-2027 (USD MILLION)

- TABLE 96 ROW: LIDAR DRONE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 97 ROW: LIDAR DRONE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 98 ROW: LIDAR DRONE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 99 ROW: LIDAR DRONE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.5.1 MIDDLE EAST & AFRICA

- 11.5.1.1 Oil & gas industry to drive adoption of LiDAR drones

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Surge in adoption of LiDAR drones for archaeological surveys

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 100 OVERVIEW OF STRATEGIES ADOPTED BY VENDORS OF LIDAR DRONE MARKET

- 12.3 MARKET SHARE ANALYSIS, 2021

- FIGURE 43 LIDAR DRONE MARKET: MARKET SHARE ANALYSIS, 2021

- 12.4 KEY COMPANY EVALUATION QUADRANT, 2021

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- FIGURE 44 LIDAR DRONE MARKET: KEY COMPANY EVALUATION QUADRANT, 2021

- 12.5 LIDAR DRONE MARKET: COMPANY FOOTPRINT

- TABLE 101 COMPANY FOOTPRINT

- TABLE 102 COMPONENT FOOTPRINT OF COMPANIES

- TABLE 103 APPLICATION FOOTPRINT OF COMPANIES

- TABLE 104 REGIONAL FOOTPRINT OF COMPANIES

- 12.6 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION MATRIX, 2021

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 45 LIDAR DRONE MARKET: SME EVALUATION QUADRANT, 2021

- 12.6.5 START-UP EVALUATION MATRIX

- TABLE 105 LIDAR DRONE MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 106 LIDAR DRONE MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.7 COMPETITIVE SCENARIOS AND TRENDS

- 12.7.1 LIDAR DRONE MARKET: PRODUCT LAUNCHES, 2019-2022

- 12.7.2 LIDAR DRONE MARKET: DEALS, 2019-2022

13 COMPANY PROFILES

- (Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1 KEY PLAYERS

- 13.1.1 PHOENIX LIDAR SYSTEMS

- TABLE 107 PHOENIX LIDAR SYSTEMS: BUSINESS OVERVIEW

- TABLE 108 PHOENIX LIDAR SYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.2 RIEGL LASER MEASUREMENT SYSTEMS GMBH

- TABLE 109 RIEGL LASER MEASUREMENT SYSTEMS GMBH: BUSINESS OVERVIEW

- TABLE 110 RIEGL LASER MEASUREMENT SYSTEMS GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.3 VELODYNE LIDAR, INC.

- TABLE 111 VELODYNE LIDAR, INC.: BUSINESS OVERVIEW

- FIGURE 46 VELODYNE LIDAR, INC.: COMPANY SNAPSHOT

- TABLE 112 VELODYNE LIDAR, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.4 TELEDYNE OPTECH

- TABLE 113 TELEDYNE OPTECH: BUSINESS OVERVIEW

- TABLE 114 TELEDYNE OPTECH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.5 UMS SKELDAR

- TABLE 115 UMS SKELDAR: BUSINESS OVERVIEW

- TABLE 116 UMS SKELDAR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.6 LIDARUSA

- TABLE 117 LIDARUSA: BUSINESS OVERVIEW

- TABLE 118 LIDARUSA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.7 YELLOWSCAN

- TABLE 119 YELLOWSCAN: BUSINESS OVERVIEW

- TABLE 120 YELLOWSCAN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.8 GEODETICS, INC.

- TABLE 121 GEODETICS: BUSINESS OVERVIEW

- TABLE 122 GEODETICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.9 ONYXSCAN

- TABLE 123 ONYXSCAN: BUSINESS OVERVIEW

- TABLE 124 ONYXSCAN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.10 SICK AG

- TABLE 125 SICK AG: BUSINESS OVERVIEW

- FIGURE 47 SICK AG: COMPANY SNAPSHOT

- TABLE 126 SICK AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.11 DELAIR

- TABLE 127 DELAIR: BUSINESS OVERVIEW

- TABLE 128 DELAIR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.12 MICRODRONES

- TABLE 129 MICRODRONES: BUSINESS OVERVIEW

- TABLE 130 MICRODRONES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 LIVOX

- TABLE 131 LIVOX: BUSINESS OVERVIEW

- 13.2.2 ROUTESCENE

- TABLE 132 ROUTESCENE: BUSINESS OVERVIEW

- 13.2.3 NEXTCORE

- TABLE 133 NEXTCORE: BUSINESS OVERVIEW

- 13.2.4 GREENVALLEY INTERNATIONAL (GVI)

- TABLE 134 GREENVALLEY INTERNATIONAL (GVI): BUSINESS OVERVIEW

- 13.2.5 SURESTAR

- TABLE 135 SURESTAR: BUSINESS OVERVIEW

- 13.2.6 BENEWAKE (BEIJING) CO., LTD.

- TABLE 136 BENEWAKE (BEIJING) CO., LTD.: BUSINESS OVERVIEW

- 13.2.7 SABRE ADVANCED 3D SURVEYING SYSTEMS

- TABLE 137 SABRE ADVANCED 3D SURVEYING SYSTEMS: BUSINESS OVERVIEW

- 13.2.8 CEPTON, INC.

- TABLE 138 CEPTON, INC.: BUSINESS OVERVIEW

- 13.2.9 DRAGANFLY INC.

- TABLE 139 DRAGANFLY INC.: BUSINESS OVERVIEW

- 13.2.10 GEOCUE GROUP INC.

- TABLE 140 GEOCUE GROUP INC.: BUSINESS OVERVIEW

- 13.2.11 VOLATUS AEROSPACE CORP.

- TABLE 141 VOLATUS AEROSPACE CORP.: BUSINESS OVERVIEW

- 13.2.12 MODUS

- TABLE 142 MODUS: BUSINESS OVERVIEW

- 13.2.13 PRECISIONHAWK

- TABLE 143 PRECISIONHAWK: BUSINESS OVERVIEW

- *Details on Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKET

- 14.1 INTRODUCTION

- 14.2 ADJACENT MARKET: LIMITATIONS

- 14.3 TOF SENSOR MARKET, BY APPLICATION

- TABLE 144 TIME-OF-FLIGHT SENSOR MARKET, BY APPLICATION, 2017-2025 (USD MILLION)

- 14.4 AR AND VR

- 14.4.1 INCREASING USE OF AR AND VR TECHNOLOGY-BASED SYSTEMS IN EDUCATION, HEALTHCARE, AND ENTERTAINMENT APPLICATIONS DRIVES DEMAND FOR TOF SENSORS

- 14.5 LIDAR

- 14.5.1 INCREASING ADOPTION OF LIDAR TECHNOLOGY IN AUTOMOBILES, RETAIL STORES, AND MANUFACTURING PLANTS TO SURGE DEMAND FOR TOF SENSORS

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS