|

|

市場調査レポート

商品コード

1358286

心臓安全性サービスの世界市場:タイプ別、サービス別、エンドユーザー別、地域別 - 予測(~2028年)Cardiac Safety Services Market by Type (Standalone, Integrated), Services (ECG/Holter Measurement, Blood Pressure Measurement, Cardiac Imaging, Thorough QT Studies), End User (Pharmaceutical & Biopharma, CROs), Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 心臓安全性サービスの世界市場:タイプ別、サービス別、エンドユーザー別、地域別 - 予測(~2028年) |

|

出版日: 2023年10月03日

発行: MarketsandMarkets

ページ情報: 英文 199 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の心臓安全性サービスの市場規模は、2023年に7億3,900万米ドル、2028年までに12億8,200万米ドルに達し、2023年~2028年の予測期間中にCAGRで11.6%の成長が予測されています。

市場の成長は、心血管疾患の罹患率の上昇、研究開発活動の増加、心臓安全性サービスのアウトソーシングの増加に起因する可能性があります。例えば、主に研究活動の増加により、活動中の医薬品パイプラインは毎年増加しています。製薬企業は競争力を維持し、コア機能に集中するため、研究活動を学術機関や開発業務受託機関(CRO)にアウトソーシングするケースが増えています。製薬企業のパイプラインの拡大が、サービスのアウトソーシングが増加した主な理由です。

"エンドユーザー別では予測期間中に製薬・バイオ製薬企業セグメントが最大のシェアを占めます。"

2022年、エンドユーザー別では製薬・バイオ製薬企業セグメントが市場で最大のシェアを占めました。心臓の安全性に関する懸念は、有望な医薬品の開発中止の原因となることが多いため、製薬・バイオ医薬品企業では心臓安全性サービスに対する大きな需要が生じています。

"欧州:心臓安全性サービス市場で2番目に大きい地域"

欧州は市場において北米に次いで2番目に大きな市場を占めています。欧州市場は、慢性疾患の罹患率の増加などの人口動態の変化に牽引され、近年大幅な成長を示しています。これは、同地域における老年人口の増加に起因しています。欧州委員会の発表によると、2025年までに欧州人の20%以上が65歳以上になると予測されており、80歳以上の高齢者も急増することから、医療サービスに対する需要の大きな伸びが示唆されています。このことは、創薬に向けた製薬・バイオ製薬の臨床試験活動を促進し、心臓安全性サービスなどの関連市場の成長に直接寄与する見込みです。

当レポートでは、世界の心臓安全性サービス市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 心臓安全性サービス市場の概要

- 北米の心臓安全性サービス市場:タイプ別、国別(2022年)

- 心臓安全性サービス市場:サービスタイプ別(2023年・2028年)

- 心臓安全性サービス市場:地理的な成長機会

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 動向

- 技術分析

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 規制分析

- 価格分析

- 主な会議とイベント

- 主なステークホルダーと購入基準

- 購入プロセスにおける主なステークホルダー

- 購入基準

第6章 心臓安全性サービス市場:タイプ別

- イントロダクション

- 統合サービス

- スタンドアロンサービス

第7章 心臓安全性サービス市場:サービスタイプ別

- イントロダクション

- ECG/ホルター測定サービス

- 血圧測定サービス

- 心血管画像サービス

- Thorough QT試験

- その他の心臓安全性サービス

第8章 心臓安全性サービス市場:エンドユーザー別

- イントロダクション

- 製薬・バイオ製薬企業

- 開発業務受託機関(CRO)

第9章 心臓安全性サービス市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 北米の不況の影響

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- 欧州の不況の影響

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他のアジア太平洋

- アジア太平洋の不況の影響

- ラテンアメリカ

- ブラジル

- その他のラテンアメリカ

- ラテンアメリカの不況の影響

- 中東

- アフリカ

第10章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 市場シェア分析

- 収益シェア分析

- 主要企業の評価マトリクス

- 主要企業25社の競合ベンチマーキング(2022年)

- 企業のサービスフットプリント(25社)

- 企業の地域フットプリント(25社)

- スタートアップ/中小企業の評価マトリクス

- スタートアップ/中小企業の競合ベンチマーキング(2022年)

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- LABORATORY CORPORATION OF AMERICA HOLDINGS

- MEDPACE

- KONINKLIJKE PHILIPS N.V.

- CLARIO

- NCARDIA

- IQVIA

- CERTARA

- PPD, INC. (PART OF THERMO FISHER SCIENTIFIC, INC.)

- SGS S.A.

- ICON PLC

- WUXI APPTEC

- CHARLES RIVER LABORATORIES

- EUROFINS SCIENTIFIC

- FRONTAGE LABS

- BANOOK GROUP

- その他の企業

- BIOTRIAL

- CELERION

- RICHMOND PHARMACOLOGY

- PHYSIOSTIM

- SHANGHAI MEDICILON INC.

- ACM GLOBAL LABORATORIES

- WORLDWIDE CLINICAL TRIALS

- NOVA RESEARCH LABORATORIES LLC

- BIOBEAT

- CRS. EXPERTS. EARLY PHASE.

第12章 付録

The global cardiac safety services market is projected to reach USD 1,282 million by 2028 from USD 739 million in 2023, at a CAGR of 11.6% during the forecast period of 2023 to 2028. The growth of this market can be attributed to the rising incidence of cardiovascular diseases, increasing research and development activities, and increasing outsourcing of cardiac safety services. For instance, The active pharmaceutical drug pipeline is increasing annually, primarily led by an increase in research activities. Pharmaceutical companies are increasingly outsourcing research activities to academic organizations and Contract Research Organizations (CROs) to stay competitive and retain focus on core functions. The R&D tasks primarily outsourced range from basic research to late-stage development, genetic engineering, target validation, assay development, hit exploration & lead optimization (hit candidates-as-a-service), safety studies/tests in animal models, and clinical trials involving humans. The growing pipeline of pharmaceutical companies is a key reason attributing to the high outsourcing of services.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD |

| Segments | Type, Service Type, End User, Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

"The pharmaceutical and biopharmaceutical companies segment accounted for the largest share by end user during the forecast period"

In 2022, pharmaceutical & biopharmaceutical companies segment accounted for the largest share by end user in the global cardiac safety services market. Cardiac safety services are utilized by pharmaceutical and biopharmaceutical companies to oversee clinical trials for newly developed drugs, with these companies dedicated to the development of innovative treatments for diverse medical conditions and diseases. These companies are required to provide precise data pertaining to drug development and subsequently complete applications for submission to regulatory authorities. Cardiac safety concerns frequently lead to the discontinuation of potentially promising drugs during their development, creating a substantial demand for cardiac safety services within the pharmaceutical and biopharmaceutical companies.

"Europe: The second largest region in the cardiac safety services market"

Europe accounted for the second-largest market for cardiac safety services market after North America. The European cardiac safety services market has witnessed significant growth in recent years, driven by demographic changes, such as the growing incidence of chronic diseases. This is attributed to the rising geriatric population in the region. As per the European Commission, by 2025, more than 20% of Europeans are expected to be 65 years and above, with a rapid increase in the number of people aged 80 years and above, indicating strong demand growth for healthcare services. This will drive pharmaceutical and biopharmaceutical clinical trial activity for novel drug discoveries and directly contribute to the growth of associated markets, such as cardiac safety services.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 70% and Demand Side 30%

- By Designation: C-level - 50%, D-level - 20%, and Others - 30%

- By Region: North America -35%, Europe -24%, Asia-Pacific -25%, Latin America - 10%, Middle East - 4% & Africa- 2%

List of Companies Profiled in the Report:

- Laboratory Corporation of America Holdings (US)

- Medpace (US)

- Koninklijke Philips N.V. (Netherland)

- Clario (US)

- Ncardia (Netherlands)

- IQVIA (US)

- Certara (US)

- PPD Inc. (Part of Thermo Fisher Scientific, Inc.) (US)

- SGS S.A. (Switzerland)

- ICON Plc (Ireland)

- WuXi AppTec (China)

- Charles River Laboratories (US)

- Eurofins Scientific (Luxembourg)

- Frontage Labs (US)

- Banook Group (France)

- Biotrial (France)

- Celerion (US)

- Richmond Pharmacology (UK)

- PhysioStim (France)

- Shanghai Medicilon Inc. (China)

- ACM Global Laboratories (India)

- Worldwide Clinical Trials (US)

- Nova Research Laboratories LLC (US)

- Biobeat (Israel)

- CRS. Experts. Early Phase. (Germany)

Research Coverage:

This report provides a detailed picture of the cardiac safety services market. It aims at estimating the size and future growth potential of the market across different segments such as the type, service type, end user and region. The report also includes an in-depth competitive analysis of the key market players along with their company profiles recent developments and key market strategies.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges

The report provides insights on the following pointers:

- Analysis of key drivers (Rising incidence of cardiovascular diseases, Increasing outsourcing of cardiac safety services related activities, and Large number of clinical trials pertaining to the cardiac -related issues), restraints (Stringent regulations and compliance guidelines, The Iinadequacy of cardiotoxicity testing), opportunities (Emergence of new methods to curb cardiotoxicity, Growth in biosimilars and biologics), and challenges (High cost of cardiac safety evaluation services) influencing the growth of the market.

- Service Development/Innovation: Detailed insights on newly launched service platform and technological assessment of the cardiac safety services market

- Market Development: Comprehensive information about lucrative markets - the report analyses the market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the cardiac safety services market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Laboratory Corporation of America Holdings (US), Medpace (US), Koninklijke Philips N.V. (Netherland), Clario (US), Ncardia (Netherlands), IQVIA (US), Certara (US), PPD Inc. (Part of Thermo Fisher Scientific, Inc.) (US), SGS S.A. (Switzerland), ICON Plc (Ireland), WuXi AppTec (China), Charles River Laboratories (US), Eurofins Scientific (Luxembourg), Frontage Labs (US), Banook Group (France), Biotrial (France), Celerion (US), Richmond Pharmacology (UK), PhysioStim (France), Shanghai Medicilon Inc. (China), ACM Global Laboratories (India), Worldwide Clinical Trials (US), Nova Research Laboratories LLC (US), Biobeat (Israel), and CRS. Experts. Early Phase. (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 CARDIAC SAFETY SERVICES MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.6.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- FIGURE 3 CARDIAC SAFETY SERVICES MARKET: BREAKDOWN OF PRIMARIES

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION FOR CARDIAC SAFETY SERVICES: REVENUE SHARE ANALYSIS

- 2.2.1 INSIGHTS FROM PRIMARIES

- FIGURE 6 MARKET VALIDATION FROM PRIMARY EXPERTS

- 2.2.2 SEGMENTATION ASSESSMENT (BY TYPE, SERVICE TYPE, AND END USER)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 GROWTH FORECAST

- FIGURE 8 CARDIAC SAFETY SERVICES MARKET: CAGR PROJECTIONS

- FIGURE 9 CARDIAC SAFETY SERVICES MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RECESSION IMPACT ANALYSIS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021-2027 (% GROWTH)

3 EXECUTIVE SUMMARY

- FIGURE 11 CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 CARDIAC SAFETY SERVICES MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF CARDIAC SAFETY SERVICES MARKET

4 PREMIUM INSIGHTS

- 4.1 CARDIAC SAFETY SERVICES MARKET OVERVIEW

- FIGURE 15 RISING INCIDENCE OF CARDIOVASCULAR DISEASES TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- 4.2 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY TYPE AND COUNTRY (2022)

- FIGURE 16 INTEGRATED SERVICES SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2022

- 4.3 CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2023 VS. 2028

- FIGURE 17 ECG/HOLTER MEASUREMENT SERVICES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 CARDIAC SAFETY SERVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 18 EUROPEAN COUNTRIES TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 CARDIAC SAFETY SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES, AND TRENDS

- TABLE 2 CARDIAC SAFETY SERVICES MARKET: IMPACT ANALYSIS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising incidence of cardiovascular diseases

- 5.2.1.2 Increasing outsourcing of services to CROs

- 5.2.1.3 High number of clinical trials for cardiac treatments

- FIGURE 20 TOTAL CLINICAL TRIAL REGISTRATIONS WORLDWIDE (2000-2022)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations and compliance guidelines

- 5.2.2.2 Inadequacy of cardiotoxicity testing

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of innovative testing methods

- 5.2.3.2 Growth in biosimilars and biologics development

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of cardiac safety evaluation services

- 5.2.5 TRENDS

- 5.2.5.1 Rising technological advancements

- 5.2.5.2 Transition to patient-centric approach

- 5.3 TECHNOLOGY ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 21 CARDIAC SAFETY SERVICES MARKET: VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 22 CARDIAC SAFETY SERVICES MARKET: ECOSYSTEM ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 CARDIAC SAFETY SERVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.6.2 BARGAINING POWER OF SUPPLIERS

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 THREAT OF NEW ENTRANTS

- 5.7 REGULATORY ANALYSIS

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 PRICING ANALYSIS

- 5.9 KEY CONFERENCES AND EVENTS

- TABLE 9 CARDIAC SAFETY SERVICES MARKET: LIST OF KEY CONFERENCES AND EVENTS (2023-2024)

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 CARDIAC SAFETY SERVICES MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR END USERS

6 CARDIAC SAFETY SERVICES MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 10 CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2 INTEGRATED SERVICES

- 6.2.1 COMPREHENSIVE DATA INTEGRATION AND IMPROVED QUALITY TO PROPEL MARKET

- TABLE 11 INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 12 NORTH AMERICA: INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 13 EUROPE: INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 14 ASIA PACIFIC: INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 15 LATIN AMERICA: INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 STANDALONE SERVICES

- 6.3.1 COST-EFFECTIVE BENEFITS TO SUPPORT MARKET GROWTH

- TABLE 16 STANDALONE CARDIAC SAFETY SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 17 NORTH AMERICA: STANDALONE CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

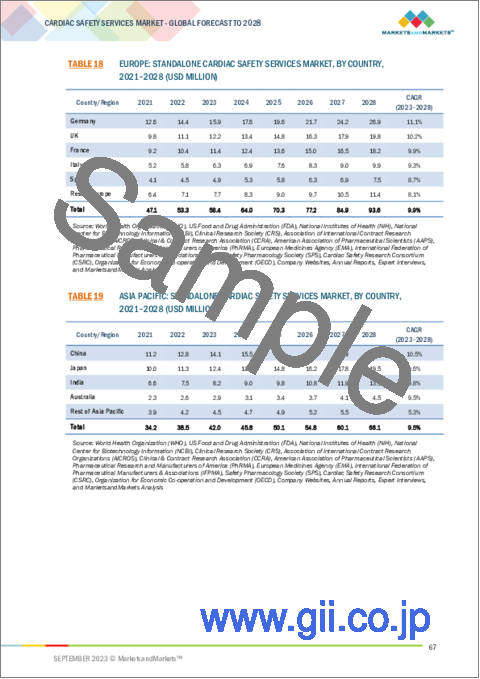

- TABLE 18 EUROPE: STANDALONE CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 19 ASIA PACIFIC: STANDALONE CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 20 LATIN AMERICA: STANDALONE CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

7 CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE

- 7.1 INTRODUCTION

- TABLE 21 CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- 7.2 ECG/HOLTER MEASUREMENT SERVICES

- 7.2.1 FEATURES SUCH AS TREND ASSESSMENT AND ENHANCED QUALITY METRICS TO BOOST DEMAND

- TABLE 22 ECG/HOLTER MEASUREMENT SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: ECG/HOLTER MEASUREMENT SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 24 EUROPE: ECG/HOLTER MEASUREMENT SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: ECG/HOLTER MEASUREMENT SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 26 LATIN AMERICA: ECG/HOLTER MEASUREMENT SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 BLOOD PRESSURE MEASUREMENT SERVICES

- 7.3.1 GROWING IMPORTANCE IN CARDIOVASCULAR HEALTH ASSESSMENT TO SUPPORT GROWTH

- TABLE 27 BLOOD PRESSURE MEASUREMENT SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: BLOOD PRESSURE MANAGEMENT SERVICES MARKET BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 29 EUROPE: BLOOD PRESSURE MANAGEMENT SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 30 ASIA PACIFIC: BLOOD PRESSURE MANAGEMENT SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 31 LATIN AMERICA: BLOOD PRESSURE MANAGEMENT SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 CARDIOVASCULAR IMAGING SERVICES

- 7.4.1 NEED TO ASSESS DRUG EFFICACY AND SAFETY TO PROPEL DEMAND

- TABLE 32 CARDIOVASCULAR IMAGING SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: CARDIOVASCULAR IMAGING SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 34 EUROPE: CARDIOVASCULAR IMAGING SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: CARDIOVASCULAR IMAGING SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 36 LATIN AMERICA: CARDIOVASCULAR IMAGING SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.5 THOROUGH QT STUDIES

- 7.5.1 NEED TO CONDUCT CLINICAL INVESTIGATIONS AND MEASURE MEDICAL INTERVENTION TO DRIVE GROWTH

- TABLE 37 THOROUGH QT STUDIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: THOROUGH QT STUDIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 39 EUROPE: THOROUGH QT STUDIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: THOROUGH QT STUDIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 41 LATIN AMERICA: THOROUGH QT STUDIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.6 OTHER CARDIAC SAFETY SERVICES

- TABLE 42 OTHER CARDIAC SAFETY SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: OTHER CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 44 EUROPE: OTHER CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: OTHER CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 46 LATIN AMERICA: OTHER CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

8 CARDIAC SAFETY SERVICES MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 47 CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

- 8.2.1 GROWING COLLABORATIONS FOR CLINICAL TRIALS TO PROPEL MARKET

- TABLE 48 CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 50 EUROPE: CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 52 LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 CONTRACT RESEARCH ORGANIZATIONS (CROS)

- 8.3.1 RISING OUTSOURCING OF DRUG DISCOVERY SERVICES TO DRIVE MARKET

- TABLE 53 CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS (CROS), BY REGION, 2021-2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS (CROS), BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 55 EUROPE: CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS (CROS), BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 56 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS (CROS), BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 57 LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS (CROS), BY COUNTRY, 2021-2028 (USD MILLION)

9 CARDIAC SAFETY SERVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 58 CARDIAC SAFETY SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 25 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET SNAPSHOT

- TABLE 59 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Increasing clinical trials for drug discovery & development to drive market

- TABLE 63 TOTAL NUMBER OF CLINICAL TRIALS REGISTERED

- TABLE 64 US: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 65 US: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 66 US: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Availability of high-end facilities for drug discovery to propel market

- TABLE 67 CANADA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 68 CANADA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 69 CANADA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.3 NORTH AMERICA: RECESSION IMPACT

- 9.3 EUROPE

- FIGURE 26 EUROPE: CARDIAC SAFETY SERVICES MARKET SNAPSHOT

- TABLE 70 EUROPE: CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 71 EUROPE: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 72 EUROPE: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 73 EUROPE: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 High pharmaceutical production to propel market

- TABLE 74 GERMANY: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 75 GERMANY: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 76 GERMANY: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Growth in life science research to drive market

- TABLE 77 UK: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 78 UK: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 79 UK: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Growing focus on biosimilars to fuel market

- TABLE 80 FRANCE: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 81 FRANCE: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 82 FRANCE: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Availability of funding for novel services to support market growth

- TABLE 83 ITALY: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 84 ITALY: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 85 ITALY: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Presence of multinational pharma companies to drive market

- TABLE 86 SPAIN: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 87 SPAIN: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 88 SPAIN: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 89 REST OF EUROPE: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 90 REST OF EUROPE: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 91 REST OF EUROPE: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.7 EUROPE: RECESSION IMPACT

- 9.4 ASIA PACIFIC

- TABLE 92 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 China to dominate APAC market for cardiac safety services

- TABLE 96 CHINA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 CHINA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 98 CHINA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Supportive regulatory policies for safety measures to drive market

- TABLE 99 JAPAN: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 100 JAPAN: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 101 JAPAN: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Rising growth in pharmaceutical & biotechnology industries to propel market

- TABLE 102 INDIA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 103 INDIA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 104 INDIA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.4 AUSTRALIA

- 9.4.4.1 Rising investments by medical device companies to support market growth

- TABLE 105 AUSTRALIA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 AUSTRALIA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 107 AUSTRALIA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.5 REST OF ASIA PACIFIC

- TABLE 108 REST OF ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.6 ASIA PACIFIC: RECESSION IMPACT

- 9.5 LATIN AMERICA

- TABLE 111 LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 112 LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 114 LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.1 BRAZIL

- 9.5.1.1 Low costs and presence of skilled clinical investigators to drive market

- TABLE 115 BRAZIL: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 116 BRAZIL: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 117 BRAZIL: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.2 REST OF LATIN AMERICA

- TABLE 118 REST OF LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 119 REST OF LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 120 REST OF LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.3 LATIN AMERICA: RECESSION IMPACT

- 9.6 MIDDLE EAST

- 9.6.1 GROWING CRO HUB TO DRIVE MARKET

- TABLE 121 MIDDLE EAST: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 MIDDLE EAST: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 123 MIDDLE EAST: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6.2 MIDDLE EAST: RECESSION IMPACT

- 9.7 AFRICA

- 9.7.1 RISING PREVALENCE OF CARDIOVASCULAR DISEASES TO SUPPORT MARKET GROWTH

- TABLE 124 AFRICA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 AFRICA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021-2028 (USD MILLION)

- TABLE 126 AFRICA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.7.2 AFRICA: RECESSION IMPACT

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 27 CARDIAC SAFETY SERVICES MARKET: STRATEGIES ADOPTED BY KEY PLAYERS (2020-2023)

- 10.3 MARKET SHARE ANALYSIS

- FIGURE 28 CARDIAC SAFETY SERVICES MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- TABLE 127 CARDIAC SAFETY SERVICES MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 10.4 REVENUE SHARE ANALYSIS

- FIGURE 29 REVENUE SHARE ANALYSIS FOR KEY COMPANIES (2020-2022)

- 10.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 10.5.1 STARS

- 10.5.2 PERVASIVE PLAYERS

- 10.5.3 EMERGING LEADERS

- 10.5.4 PARTICIPANTS

- FIGURE 30 CARDIAC SAFETY SERVICES MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- 10.6 COMPETITIVE BENCHMARKING OF LEADING 25 PLAYERS (2022)

- 10.6.1 SERVICE FOOTPRINT OF COMPANIES (25 COMPANIES)

- TABLE 128 CARDIAC SAFETY SERVICES MARKET: SERVICE FOOTPRINT ANALYSIS OF KEY PLAYERS

- 10.6.2 REGIONAL FOOTPRINT OF COMPANIES (25 COMPANIES)

- TABLE 129 CARDIAC SAFETY SERVICES MARKET: REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- 10.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- FIGURE 31 CARDIAC SAFETY SERVICES MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- 10.8 COMPETITIVE BENCHMARKING OF STARTUPS/SME PLAYERS (2022)

- TABLE 130 CARDIAC SAFETY SERVICES MARKET: DETAILED LIST OF STARTUPS/SME PLAYERS

- TABLE 131 CARDIAC SAFETY SERVICES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SME PLAYERS

- 10.9 COMPETITIVE SCENARIO AND TRENDS

- 10.9.1 SERVICE LAUNCHES

- TABLE 132 CARDIAC SAFETY SERVICES MARKET: SERVICE LAUNCHES (JANUARY 2020-SEPTEMBER 2023)

- 10.9.2 DEALS

- TABLE 133 CARDIAC SAFETY SERVICES MARKET: DEALS (JANUARY 2020-SEPTEMBER 2023)

- 10.9.3 OTHER DEVELOPMENTS

- TABLE 134 CARDIAC SAFETY SERVICES MARKET: OTHER DEVELOPMENTS (JANUARY 2020-SEPTEMBER 2023)

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 11.1.1 LABORATORY CORPORATION OF AMERICA HOLDINGS

- TABLE 135 LABORATORY CORPORATION OF AMERICA HOLDINGS: BUSINESS OVERVIEW

- FIGURE 32 LABORATORY CORPORATION OF AMERICA HOLDINGS: COMPANY SNAPSHOT (2022)

- 11.1.2 MEDPACE

- TABLE 136 MEDPACE: BUSINESS OVERVIEW

- FIGURE 33 MEDPACE: COMPANY SNAPSHOT (2022)

- 11.1.3 KONINKLIJKE PHILIPS N.V.

- TABLE 137 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- FIGURE 34 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- 11.1.4 CLARIO

- TABLE 138 CLARIO: BUSINESS OVERVIEW

- 11.1.5 NCARDIA

- TABLE 139 NCARDIA: BUSINESS OVERVIEW

- 11.1.6 IQVIA

- TABLE 140 IQVIA: BUSINESS OVERVIEW

- FIGURE 35 IQVIA: COMPANY SNAPSHOT (2022)

- 11.1.7 CERTARA

- TABLE 141 CERTARA: BUSINESS OVERVIEW

- FIGURE 36 CERTARA: COMPANY SNAPSHOT (2022)

- 11.1.8 PPD, INC. (PART OF THERMO FISHER SCIENTIFIC, INC.)

- TABLE 142 PPD, INC.: BUSINESS OVERVIEW

- FIGURE 37 PPD, INC.: COMPANY SNAPSHOT (2022)

- 11.1.9 SGS S.A.

- TABLE 143 SGS S.A.: BUSINESS OVERVIEW

- FIGURE 38 SGS S.A.: COMPANY SNAPSHOT (2022)

- 11.1.10 ICON PLC

- TABLE 144 ICON PLC: BUSINESS OVERVIEW

- FIGURE 39 ICON PLC: COMPANY SNAPSHOT (2022)

- 11.1.11 WUXI APPTEC

- TABLE 145 WUXI APPTEC: BUSINESS OVERVIEW

- FIGURE 40 WUXI APPTEC: COMPANY SNAPSHOT (2022)

- 11.1.12 CHARLES RIVER LABORATORIES

- TABLE 146 CHARLES RIVER LABORATORIES: BUSINESS OVERVIEW

- FIGURE 41 CHARLES RIVER LABORATORIES: COMPANY SNAPSHOT

- 11.1.13 EUROFINS SCIENTIFIC

- TABLE 147 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

- FIGURE 42 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- 11.1.14 FRONTAGE LABS

- TABLE 148 FRONTAGE LABS: BUSINESS OVERVIEW

- FIGURE 43 FRONTAGE LABS: COMPANY SNAPSHOT (2022)

- 11.1.15 BANOOK GROUP

- TABLE 149 BANOOK GROUP: BUSINESS OVERVIEW

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 BIOTRIAL

- 11.2.2 CELERION

- 11.2.3 RICHMOND PHARMACOLOGY

- 11.2.4 PHYSIOSTIM

- 11.2.5 SHANGHAI MEDICILON INC.

- 11.2.6 ACM GLOBAL LABORATORIES

- 11.2.7 WORLDWIDE CLINICAL TRIALS

- 11.2.8 NOVA RESEARCH LABORATORIES LLC

- 11.2.9 BIOBEAT

- 11.2.10 CRS. EXPERTS. EARLY PHASE.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS