|

|

市場調査レポート

商品コード

1305956

ATPアッセイの世界市場:製品別 (消耗品、装置)・用途別・エンドユーザー別の将来予測 (2028年まで)ATP Assays Market by Product (Consumables, Instruments ), Application, End User - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ATPアッセイの世界市場:製品別 (消耗品、装置)・用途別・エンドユーザー別の将来予測 (2028年まで) |

|

出版日: 2023年06月28日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のATPアッセイの市場規模は、2023年の3億米ドルから、2028年には5億米ドルに達し、予測期間中に7.8%のCAGRで成長すると予測されています。

ATPアッセイ市場の成長の主な要因は、製薬・バイオテクノロジー研究開発への投資の増加、培養ベースの検査から迅速検査への変化、がんやその他の感染症の有病率の上昇などです。しかし、小規模企業や新規参入企業の存続は、市場成長をある程度妨げると予想されます。

"消耗品・付属品セグメントが最大のシェアを占める"

製品別に見ると、消耗品・付属品セグメントは、2022年にATPアッセイ市場で最大のシェアを占めました。その要因として、細胞生存率を評価するために研究機関でATPアッセイが広く使用されていること、慢性疾患の増加により腫瘍検査や細胞増殖 (特にがん) のニーズが高まっていること、製薬企業やバイオテクノロジー企業が消耗品を頻繁に購入していることなどが挙げられます。

"用途別では、2023年には汚染検査セグメントが最大シェアを占める"

用途別に見ると、2023年には、汚染検査セグメントがATPアッセイ市場で最大のシェアを占めると予測されます。これは、製薬企業や食品・飲料企業による非汚染生産の規制強化や、病院における環境表面の洗浄・消毒の必要性によるものです。

"エンドユーザー別では、製薬・バイオテクノロジー企業が2022年に最大シェアを占める"

製薬・バイオテクノロジー企業セグメントの優位性は、いくつかの重要な要因によるものと考えられます。その中には、この市場に多額の投資を行っている多数の製薬企業の存在、汚染検査にATPアッセイの使用を必要とする細胞培養ベースのワクチンに対する規制当局の承認の増加、様々な製薬企業による商業活動の拡大、慢性疾患と闘うための細胞・遺伝子治療に対する需要の増加などが含まれます。

"地域別では、北米がATPアッセイ市場で最大シェアを占める"

地域別では、北米が2023年のATPアッセイ市場で最大のシェアを占めました。その要因としては、慢性疾患に対する細胞・遺伝子治療需要の増加、製薬・バイオ製薬企業における研究開発の活発化、COVID-19医薬品の生産増加、医薬品開発におけるセルベースアッセイの採用増加、汚染検査におけるATPアッセイの使いやすさなどが挙げられます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界の動向

- 技術分析

- 規制分析

- 特許分析

- バリューチェーン分析

- エコシステム・市場マップ

- ポーターのファイブフォース分析

- 価格分析

- 主な会議とイベント (2023年~2024年)

- 主要な利害関係者と購入基準

第6章 ATPアッセイ市場:用途別

- イントロダクション

- 汚染検査

- 疾患検査

- 創薬・開発

第7章 ATPアッセイ市場:製品別

- イントロダクション

- 消耗品・付属品

- 試薬・キット

- マイクロプレート

- その他の消耗品・付属品

- 装置

- 照度計

- 分光光度計

第8章 ATPアッセイ市場:エンドユーザー別

- イントロダクション

- 製薬・バイオテクノロジー企業

- 食品・飲料産業

- 病院・診断検査室

- 学術研究機関

第9章 ATPアッセイ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要企業が採用した戦略

- 主要企業の収益シェア分析

- ATPアッセイ市場:主要企業の市場ランキング

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業のフットプリント

- 競争シナリオと動向

第11章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC INC.

- MERCK KGAA

- PROMEGA CORPORATION

- NEOGEN CORPORATION

- PERKINELMER INC.

- AGILENT TECHNOLOGIES, INC.

- PROMOCELL GMBH

- DANAHER CORPORATION

- LONZA

- ABCAM PLC

- 3M

- ABNOVA CORPORATION

- GENO TECHNOLOGY INC.

- AAT BIOQUEST, INC.

- BIOTHEMA AB

- BIOTIUM

- CREATIVE BIOARRAY

- CANVAX

- ELABSCIENCE BIOTECHNOLOGY INC.

- MBL INTERNATIONAL CORPORATION

- その他の企業

- RUHOF CORPORATION

- CHARM SCIENCES

- BIO SHIELD TECH, LLC

- CAYMAN CHEMICAL

- CELL SIGNALING TECHNOLOGY, INC.

第12章 付録

The global ATP Assays market is projected to reach USD 0.5 illion by 2028 from USD 0.3 billion in 2023, at a CAGR of 7.8% during the forecast period. Growth in the ATP assays market can primarily be attributed to factors such as the growing investments in pharmaceutical & biotechnology Research & Development, the change from culture-based tests to rapid tests, and rising prevalence of cancer and other infectious diseases. However, the survival of small players and new entrants, are expected to challenge market growth to a certain extent.

The consumables & accessories segment is projected to account for the largest share of the ATP assays market

By product, ATP assays market is segmented into consumables & accessories and instruments. The consumables & accessories segment accounted for the largest share of the ATP assays market in 2022.This prevalence can be attributed to the extensive usage of ATP assays in research institutes to evaluate cell viability, the increasing need for tumor testing and cell proliferation (particularly in cancer) due to the rise in chronic diseases, and the frequent acquisition of consumables by pharmaceutical and biotechnology companies.

Contamination Testing segment is projected to account for the largest share of the ATP assays market in 2023

By application, the ATP assays market is segmented into contamination testing, disease testing, and drug discovery & development. In 2023, the contamination testing segment is projected to account for the largest share of the ATP assays market due to the growing regulatory severity of pharmaceutical and food & beverage companies for non-contaminated production, and the necessity for cleaning and disinfection of environmental surfaces in hospitals.

By end user, Pharmaceutical & Biotechnology companies accounted for the largest share of the market in 2022

By end users, The ATP assays market is segmented into pharmaceutical & biotechnology companies, the food & beverage industry, hospitals & diagnostic laboratories, and academic & research institutes. The dominance of Pharmaceutical & Biotechnology companies segment can be attributed to several significant factors. These include the presence of a substantial number of pharmaceutical players who are making significant investments in this market, the increasing regulatory approvals for cell culture-based vaccines that require the use of ATP assays in contamination testing, the expansion of commercial activities by various pharmaceutical companies, the growing demand for cell and gene therapies to combat chronic diseases.

By region, North America is projected to account for the largest share of the ATP assays market

By region,North America accounted for the largest share of the ATP assays market in 2023. Factors such as the increasing demand for cell and gene therapies for chronic diseases, significant R&D in pharmaceutical & biopharmaceutical companies, increasing production of COVID-19 drugs, increasing adoption of cell-based assays for drug development, and the ease of use of ATP assays in contamination testing.

Break of primary participants was as mentioned below:

- By Company Type - Tier 1-35%, Tier 2-45%, and Tier 3-20%

- By Designation - C-level-35%, Director-level-25%, Others-40%

- By Region - North America-45%, Asia Pacific-20%, Europe-30%, Latin America- 3%, Middle East and Africa-2%

Key players in the ATP Assays Market

The key players operating in the ATP Assays Market include Thermo Fisher Scientific, Inc. (US), Promega Corporation (US), Merck KGaA (Germany), PerkinElmer, Inc. (US), Agilent Technologies, Inc. (US), Abcam plc (UK), Lonza Group (Switzerland), Neogen Corporation (US), 3M (US), Danaher Corporation (US), PromoCell GmbH (Germany), Geno Technology, Inc. (US), Abnova Corporation (Taiwan), AAT Bioquest,Inc. (US), BioThema AB (Sweden), Elabscience Biotechnology Inc. (US), MBL International Corporation (US), Biotium (US), Creative Bioarray (US), Canvax Biotech S.L. (Spain), Ruhof Corporation (US), Charm Sciences, Inc. (US), Bio Shield Tech, LLC (US), Cayman Chemical (US), and Cell Signaling Technology,Inc. (US).

Research Coverage:

The report analyzes the ATP Assays Market and aims at estimating the market size and future growth potential of this market based on various segments such as product, application and end user. The report also includes a product portfolio matrix of various ATP Assays products available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, service offerings, and key market strategies.

Reasons to Buy the Report

The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn would help them, garner a more significant share of the market. Firms purchasing the report could use one or any combination of the below-mentioned strategies to strengthen their position in the market.

This report provides insights into the following pointers:

Analysis of key drivers (increasing food safety concerns, growing demand for ATP assays in pharmaceutical & biotechnology companies, rising investments in pharmaceutical & biotechnology R&D, increasing prevalence of cancer and other chronic and infectious diseases, and the shift from culture-based tests to rapid tests), restraints (the high cost of instruments and inability to differentiate between extracellular and intracellular ATP),opportunities (technological enhancements in ATP Assay probes and growth prospects in emerging markets) and challenges (survival of small players and new entrants) influencing the growth of ATP Assays market.

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the global ATP Assays Market. The report analyzes this market by, applications and end user.

- Service Enhancement/Innovation: Detailed insights on upcoming trends in the global ATP Assays Market

- Market Development: Comprehensive information on the lucrative emerging markets by applications, products and end user.

- Market Diversification: Exhaustive information about new services or service enhancements, growing geographies, recent developments, and investments in the global ATP Assays Market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product and service offerings, company evaluation quadrant, and capabilities of leading players in the global ATP Assays Market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKET SEGMENTATION

- FIGURE 1 ATP ASSAYS MARKET SEGMENTATION

- FIGURE 2 ATP ASSAYS MARKET: REGIONAL SEGMENTATION

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY CONSIDERED

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE PARTICIPANTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: DEMAND-SIDE PARTICIPANTS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 8 MARKET SIZE APPROACH: REVENUE SHARE ANALYSIS

- FIGURE 9 REVENUE SHARE ANALYSIS ILLUSTRATION: THERMO FISHER SCIENTIFIC INC.

- FIGURE 10 GLOBAL ATP ASSAYS MARKET: BY PRODUCT

- FIGURE 11 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 12 CAGR PROJECTIONS: ATP ASSAYS MARKET

- FIGURE 13 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET RANKING ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: ATP ASSAYS MARKET

- 2.8 RECESSION IMPACT ON ATP ASSAYS MARKET

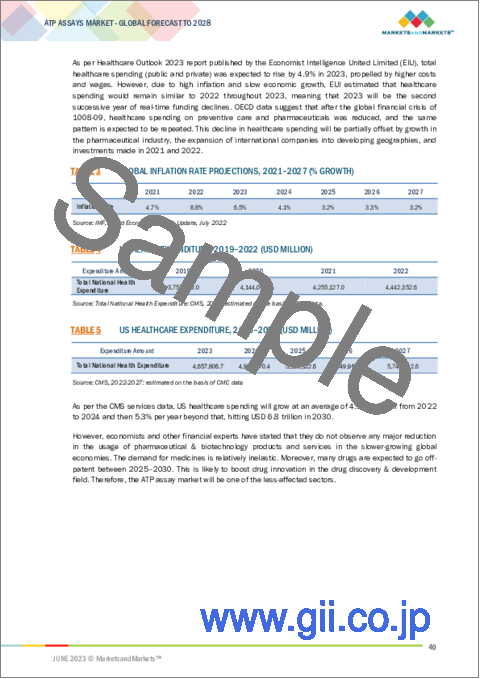

- TABLE 3 GLOBAL INFLATION RATE PROJECTIONS, 2021-2027 (% GROWTH)

- TABLE 4 US HEALTH EXPENDITURE, 2019-2022 (USD MILLION)

- TABLE 5 US HEALTHCARE EXPENDITURE, 2023-2027 (USD MILLION)

3 EXECUTIVE SUMMARY

- FIGURE 15 ATP ASSAYS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 ATP ASSAYS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 ATP ASSAYS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT OF ATP ASSAYS MARKET

4 PREMIUM INSIGHTS

- 4.1 ATP ASSAYS MARKET OVERVIEW

- FIGURE 19 INCREASING FOOD SAFETY CONCERNS TO DRIVE MARKET

- 4.2 ASIA PACIFIC: ATP ASSAYS MARKET, BY END USER AND COUNTRY (2022)

- FIGURE 20 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC ATP ASSAYS MARKET IN 2022

- 4.3 ATP ASSAYS MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- FIGURE 21 CHINA TO REGISTER HIGHEST GROWTH RATE IN ATP ASSAYS MARKET DURING FORECAST PERIOD

- 4.4 ATP ASSAYS MARKET, BY REGION (2023-2028)

- FIGURE 22 NORTH AMERICA TO DOMINATE GLOBAL ATP ASSAYS MARKET IN 2028

- 4.5 ATP ASSAYS MARKET: DEVELOPED VS. EMERGING ECONOMIES

- FIGURE 23 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING STUDY PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 ATP ASSAYS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 6 ATP ASSAYS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing food safety concerns globally

- 5.2.1.2 Growing demand for ATP assays in pharmaceutical & biotechnology companies

- 5.2.1.3 Rising investments in pharmaceutical & biotechnology R&D

- FIGURE 25 GLOBAL PHARMACEUTICAL R&D SPENDING, 2014-2028 (USD BILLION)

- 5.2.1.4 Increasing prevalence of cancer globally

- TABLE 7 ESTIMATED NEW CANCER CASES IN US, 2023

- FIGURE 26 GLOBAL CANCER INCIDENCE AND MORTALITY, 2020

- 5.2.1.5 Shift from culture-based tests to rapid tests

- 5.2.1.6 Rising incidence and prevalence of chronic and infectious diseases

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of instruments and reagents

- 5.2.2.2 Inability to differentiate between extracellular and intracellular ATP

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological enhancements in ATP assay probes

- 5.2.3.2 Growth prospects in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Low survival rate for small players and new entrants

- 5.3 INDUSTRY TRENDS

- 5.3.1 INCREASING REGULATIONS FOR FOOD BUSINESSES

- 5.3.2 ADOPTION OF ATP TESTING FOR MONITORING ENVIRONMENTAL CONTAMINATION CAUSED BY SARS-COV-2

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 HOMOGENEOUS TIME-RESOLVED FLUORESCENCE TECHNOLOGY FOR RAPID SCREENING OF ATP CONCENTRATIONS

- 5.4.2 EASE OF USE OF LIQUID CHROMATOGRAPHY-TANDEM MASS SPECTROMETRY ANALYZERS IN CLINICAL LABORATORIES

- 5.4.3 ADVANCED ASSAY STABILITY (AAS) SYSTEMS TO MATCH ROOM TEMPERATURE WHILE PERFORMING ASSAYS

- 5.4.4 OTHER TECHNOLOGICAL INNOVATIONS

- 5.5 REGULATORY ANALYSIS

- 5.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5.1.1 North America

- 5.5.1.1.1 US

- 5.5.1.1.2 Canada

- 5.5.1.2 Europe

- 5.5.1.3 Asia Pacific

- 5.5.1.4 Rest of the World

- 5.5.1.1 North America

- 5.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6 PATENT ANALYSIS

- 5.6.1 PATENT PUBLICATION TRENDS FOR ATP ASSAYS

- FIGURE 27 PATENT PUBLICATION TRENDS (JANUARY 2011-JUNE 2023)

- 5.6.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 28 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR ATP ASSAY PATENTS (JANUARY 2011-JUNE 2023)

- 5.6.3 LIST OF PATENTS/PATENT APPLICATIONS IN ATP ASSAYS MARKET

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 29 ATP ASSAYS MARKET: VALUE CHAIN ANALYSIS

- 5.8 ECOSYSTEM MARKET MAP

- FIGURE 30 ATP ASSAYS MARKET: ECOSYSTEM MARKET MAP

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 ATP ASSAYS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- TABLE 9 AVERAGE SELLING PRICE, BY KEY PLAYER

- TABLE 10 REGIONAL PRICING ANALYSIS OF ATP ASSAYS, 2021 (USD)

- 5.10.2 AVERAGE SELLING PRICE TREND

- 5.11 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 11 ATP ASSAYS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS IN 2023-2024

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ATP ASSAY PRODUCTS

- 5.12.2 BUYING CRITERIA FOR ATP ASSAYS

- FIGURE 32 KEY BUYING CRITERIA FOR END USERS

6 ATP ASSAYS MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- TABLE 12 ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 6.2 CONTAMINATION TESTING

- 6.2.1 INCREASING REQUIREMENTS TO MEET REGULATORY MANDATES FOR QUALITY TESTING TO DRIVE MARKET

- TABLE 13 ATP ASSAYS MARKET FOR CONTAMINATION TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 DISEASE TESTING

- 6.3.1 GROWING DISEASE INCIDENCE AND RISING PATIENT AWARENESS TO DRIVE MARKET

- TABLE 14 ATP ASSAYS MARKET FOR DISEASE TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4 DRUG DISCOVERY & DEVELOPMENT

- 6.4.1 INCREASING R&D PIPELINE FOR PHARMACEUTICAL DRUGS TO DRIVE MARKET

- TABLE 15 ATP ASSAYS MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2021-2028 (USD MILLION)

7 ATP ASSAYS MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- TABLE 16 ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 7.2 CONSUMABLES & ACCESSORIES

- TABLE 17 KEY ATP CONSUMABLES & ACCESSORIES AVAILABLE

- TABLE 18 ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 19 ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1 REAGENTS & KITS

- 7.2.1.1 Growing prevalence of infectious diseases and increasing use of contamination testing to drive segment

- TABLE 20 REAGENTS & KITS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.2 MICROPLATES

- 7.2.2.1 Increasing demand in drug discovery and preclinical safety studies to drive segment

- TABLE 21 MICROPLATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.3 OTHER CONSUMABLES & ACCESSORIES

- TABLE 22 OTHER CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 INSTRUMENTS

- TABLE 23 ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 24 ATP ASSAYS MARKET FOR INSTRUMENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 25 KEY ATP INSTRUMENTS AVAILABLE

- 7.3.1 LUMINOMETERS

- 7.3.1.1 Low cost, quick output, and ease of usage to drive segment

- TABLE 26 LUMINOMETERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.2 SPECTROPHOTOMETERS

- 7.3.2.1 Higher cost of spectrophotometers to limit market

- TABLE 27 SPECTROPHOTOMETERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

8 ATP ASSAYS MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 28 ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 8.2.1 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES TO DOMINATE ATP ASSAYS END USER MARKET DURING STUDY PERIOD

- TABLE 29 ATP ASSAYS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 FOOD & BEVERAGE INDUSTRY

- 8.3.1 RISING INCIDENCE OF FOOD CONTAMINATION AND GROWING NEED FOR FOOD SAFETY TO DRIVE MARKET

- TABLE 30 ATP ASSAYS MARKET FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 HOSPITALS & DIAGNOSTIC LABORATORIES

- 8.4.1 GROWING DEMAND FOR EARLY DISEASE DIAGNOSIS TO DRIVE MARKET

- TABLE 31 ATP ASSAYS MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.5 ACADEMIC & RESEARCH INSTITUTES

- 8.5.1 INCREASING USE IN CELL CULTURE EXPERIMENTS AND CANCER RESEARCH TO DRIVE MARKET

- TABLE 32 ATP ASSAYS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

9 ATP ASSAYS MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 33 ATP ASSAYS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 34 NORTH AMERICA: ATP ASSAYS MARKET SNAPSHOT

- TABLE 34 NORTH AMERICA: ATP ASSAYS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 US to dominate North American ATP assays market during forecast period

- TABLE 40 US: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 41 US: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 42 US: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 43 US: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 44 US: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Government funding programs for life science research to drive market

- TABLE 45 CANADA: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 46 CANADA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 47 CANADA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 48 CANADA: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 49 CANADA: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 EUROPE: RECESSION IMPACT

- TABLE 50 EUROPE: ATP ASSAYS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 51 EUROPE: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 52 EUROPE: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 53 EUROPE: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 54 EUROPE: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 55 EUROPE: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.2 GERMANY

- 9.3.2.1 Large-scale outsourcing of clinical diagnostic testing by hospitals to commercial service providers to drive market

- TABLE 56 GERMANY: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 57 GERMANY: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 58 GERMANY: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 59 GERMANY: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 60 GERMANY: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Increasing R&D expenditure in pharmaceutical companies and growing life science industry to drive market

- FIGURE 35 UK: PHARMACEUTICAL R&D EXPENDITURE, 2011-2020 (USD MILLION)

- TABLE 61 UK: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 62 UK: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 63 UK: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 64 UK: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 65 UK: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.4 FRANCE

- 9.3.4.1 Highly profitable agro-food sector and increased focus on biotechnology R&D to drive market

- TABLE 66 FRANCE: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 67 FRANCE: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 68 FRANCE: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 69 FRANCE: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 70 FRANCE: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5 ITALY

- 9.3.5.1 Presence of well-developed healthcare system and high cancer burden to drive market

- TABLE 71 ITALY: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 72 ITALY: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 73 ITALY: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 74 ITALY: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 75 ITALY: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.6 SPAIN

- 9.3.6.1 Growth in personalized medicines and clinical diagnostics to drive market

- TABLE 76 SPAIN: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 77 SPAIN: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 78 SPAIN: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 79 SPAIN: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 80 SPAIN: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.7 REST OF EUROPE

- TABLE 81 REST OF EUROPE: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 82 REST OF EUROPE: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 83 REST OF EUROPE: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 84 REST OF EUROPE: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 85 REST OF EUROPE: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 36 ASIA PACIFIC: ATP ASSAYS MARKET SNAPSHOT

- TABLE 86 ASIA PACIFIC: ATP ASSAYS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Increasing pharmaceutical R&D investments to drive market

- TABLE 92 CHINA: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 93 CHINA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 94 CHINA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 CHINA: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 96 CHINA: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Higher incidence of cancer and greater geriatric population to drive market

- TABLE 97 JAPAN: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 98 JAPAN: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 99 JAPAN: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 100 JAPAN: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 101 JAPAN: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Growing adoption of ATP assay techniques in research and clinical applications to drive market

- TABLE 102 INDIA: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 103 INDIA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 104 INDIA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 105 INDIA: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 106 INDIA: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.5 REST OF ASIA PACIFIC

- TABLE 107 REST OF ASIA PACIFIC: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5 LATIN AMERICA

- 9.5.1 LATIN AMERICA: RECESSION IMPACT

- TABLE 112 LATIN AMERICA: ATP ASSAYS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 113 LATIN AMERICA: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 114 LATIN AMERICA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 LATIN AMERICA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 116 LATIN AMERICA: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 117 LATIN AMERICA: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.2 BRAZIL

- 9.5.2.1 Increasing research activities and growing pharmaceutical industry to drive market

- TABLE 118 BRAZIL: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 119 BRAZIL: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 120 BRAZIL: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 121 BRAZIL: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 122 BRAZIL: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.3 MEXICO

- 9.5.3.1 Increase in research centers and manufacturing units to drive market

- TABLE 123 MEXICO: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 124 MEXICO: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 MEXICO: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 126 MEXICO: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 127 MEXICO: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.4 REST OF LATIN AMERICA

- TABLE 128 REST OF LATIN AMERICA: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 129 REST OF LATIN AMERICA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 130 REST OF LATIN AMERICA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 131 REST OF LATIN AMERICA: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 132 REST OF LATIN AMERICA: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWING FUNDING INITIATIVES AND INCREASING STRATEGIC PARTNERSHIPS TO DRIVE MARKET

- 9.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 133 MIDDLE EAST & AFRICA: ATP ASSAYS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: ATP ASSAYS MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: ATP ASSAYS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: ATP ASSAYS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: ATP ASSAYS MARKET, BY END USER, 2021-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 138 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ATP ASSAYS MARKET

- 10.3 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS

- FIGURE 37 REVENUE ANALYSIS OF KEY PLAYERS IN ATP ASSAYS MARKET

- 10.4 MARKET RANKING OF KEY PLAYERS IN ATP ASSAYS MARKET

- FIGURE 38 ATP ASSAYS MARKET RANKING, BY KEY PLAYER, 2022

- 10.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 39 ATP ASSAYS MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- 10.6 COMPANY EVALUATION MATRIX FOR START-UPS/SMES

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 DYNAMIC COMPANIES

- 10.6.3 STARTING BLOCKS

- 10.6.4 RESPONSIVE COMPANIES

- FIGURE 40 ATP ASSAYS MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)

- 10.7 COMPANY FOOTPRINT

- TABLE 139 COMPANY FOOTPRINT: ATP ASSAYS MARKET (2022)

- 10.7.1 PRODUCT FOOTPRINT

- TABLE 140 PRODUCT FOOTPRINT: ATP ASSAYS MARKET (2022)

- 10.7.2 APPLICATION FOOTPRINT

- TABLE 141 APPLICATION FOOTPRINT: ATP ASSAYS MARKET (2022)

- 10.7.3 END USER FOOTPRINT

- TABLE 142 END USER FOOTPRINT: ATP ASSAYS MARKET (2022)

- 10.7.4 GEOGRAPHICAL FOOTPRINT

- TABLE 143 REGIONAL FOOTPRINT: ATP ASSAYS MARKET (2022)

- 10.8 COMPETITIVE SCENARIOS AND TRENDS

- 10.8.1 KEY PRODUCT LAUNCHES

- TABLE 144 KEY PRODUCT LAUNCHES, JANUARY 2019-JUNE 2023

- 10.8.2 KEY DEALS

- TABLE 145 KEY DEALS, JANUARY 2019-JUNE 2023

- 10.8.3 OTHER KEY DEVELOPMENTS

- TABLE 146 OTHER KEY DEVELOPMENTS, JANUARY 2019-JUNE 2023

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business overview, Products offered, Recent Developments, MNM view)**

- 11.1.1 THERMO FISHER SCIENTIFIC INC.

- TABLE 147 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- FIGURE 41 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- 11.1.2 MERCK KGAA

- TABLE 148 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 42 MERCK KGAA: COMPANY SNAPSHOT (2022)

- 11.1.3 PROMEGA CORPORATION

- TABLE 149 PROMEGA CORPORATION: COMPANY OVERVIEW

- 11.1.4 NEOGEN CORPORATION

- TABLE 150 NEOGEN CORPORATION: COMPANY OVERVIEW

- FIGURE 43 NEOGEN CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.5 PERKINELMER INC.

- TABLE 151 PERKINELMER INC.: COMPANY OVERVIEW

- FIGURE 44 PERKINELMER INC.: COMPANY SNAPSHOT (2022)

- 11.1.6 AGILENT TECHNOLOGIES, INC.

- TABLE 152 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 45 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- 11.1.7 PROMOCELL GMBH

- TABLE 153 PROMOCELL GMBH: COMPANY OVERVIEW

- 11.1.8 DANAHER CORPORATION

- TABLE 154 DANAHER CORPORATION: COMPANY OVERVIEW

- FIGURE 46 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.9 LONZA

- TABLE 155 LONZA: COMPANY OVERVIEW

- FIGURE 47 LONZA: COMPANY SNAPSHOT (2022)

- 11.1.10 ABCAM PLC

- TABLE 156 ABCAM PLC: COMPANY OVERVIEW

- FIGURE 48 ABCAM PLC: COMPANY SNAPSHOT (2022)

- 11.1.11 3M

- TABLE 157 3M: COMPANY OVERVIEW

- FIGURE 49 3M: COMPANY SNAPSHOT (2022)

- 11.1.12 ABNOVA CORPORATION

- TABLE 158 ABNOVA CORPORATION: COMPANY OVERVIEW

- 11.1.13 GENO TECHNOLOGY INC.

- TABLE 159 GENO TECHNOLOGY INC.: COMPANY OVERVIEW

- 11.1.14 AAT BIOQUEST, INC.

- TABLE 160 AAT BIOQUEST, INC.: COMPANY OVERVIEW

- 11.1.15 BIOTHEMA AB

- TABLE 161 BIOTHEMA AB: COMPANY OVERVIEW

- 11.1.16 BIOTIUM

- TABLE 162 BIOTIUM: COMPANY OVERVIEW

- 11.1.17 CREATIVE BIOARRAY

- TABLE 163 CREATIVE BIOARRAY: COMPANY OVERVIEW

- 11.1.18 CANVAX

- TABLE 164 CANVAX: COMPANY OVERVIEW

- 11.1.19 ELABSCIENCE BIOTECHNOLOGY INC.

- TABLE 165 ELABSCIENCE BIOTECHNOLOGY INC.: COMPANY OVERVIEW

- 11.1.20 MBL INTERNATIONAL CORPORATION

- TABLE 166 MBL INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 RUHOF CORPORATION

- 11.2.2 CHARM SCIENCES

- 11.2.3 BIO SHIELD TECH, LLC

- 11.2.4 CAYMAN CHEMICAL

- 11.2.5 CELL SIGNALING TECHNOLOGY, INC.

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS