|

|

市場調査レポート

商品コード

1111951

鉄道デジタル化の世界市場:ソリューション別(遠隔モニタリング、ネットワーク管理、セキュリティ、分析)、サービス別、用途別(鉄道運行管理、旅客情報システム、資産管理)、地域別 - 2027年までの市場予測Digital Railway Market by Solutions (Remote Monitoring, Network Management, Security, Analytics and Services), Application (Rail Operations Management, Passenger Information System, and Asset Management) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 鉄道デジタル化の世界市場:ソリューション別(遠隔モニタリング、ネットワーク管理、セキュリティ、分析)、サービス別、用途別(鉄道運行管理、旅客情報システム、資産管理)、地域別 - 2027年までの市場予測 |

|

出版日: 2022年08月05日

発行: MarketsandMarkets

ページ情報: 英文 224 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

MarketsandMarketsは、世界の鉄道デジタル化の市場規模は、2022年の630億米ドルから、2027年には1,001億米ドルに成長する見通しで、予測期間中のCAGRは9.7%と予測しています。

"ソリューション別では、ネットワークマネジメント分野が予測期間中に2番目に高い市場シェアで成長する"

これからのニーズに対応した国内および国境を越えた鉄道輸送は、運行上の安全性、効率性、費用対効果に優れている必要があります。そのため、運用の効率化と信頼性の向上を実現するためのネットワーク管理の需要が高まっています。ネットワーク管理ソリューションは、災害対策や損失を最小限に抑えるために重要です。このソリューションでは、ネットワーク全体の信号からリアルタイムにデータを収集します。このデータを分析することで、パフォーマンス測定、旅行時間やスケジュール、交差点の遅延や停止の可能性を同時に提供することができます。

"用途別では、資産管理分野が予測期間中、2番目に高い市場シェアを占める"

資産管理システムは、鉄道インフラ全体を管理するための安全性、信頼性、実質性、効率性を備えたアプローチです。これには、インフラへの介入のための活動、リソース、タイムスケールを含む路線計画、特定の路線に関わる資産を管理する路線資産戦略、更新、保守、強化の提供を最適化するための詳細計画を形成する提供スケジュール/プログラムが含まれます。鉄道資産管理システムは、貨物管理者、乗客、鉄道事業者、インフラ管理者が、サービスの有用性の向上などの問題に対処するのを支援します。また、モバイル、固定、リニアの各資産のパフォーマンスと利用率を管理し、信頼性と定時性を高め、サービスの障害を減らし、資産コストを最小化します。

"サービス別では、システムインテグレーション&デプロイメントサービスプロバイダー分野が予測期間中に最も高い市場シェアで成長すると予想される"

システム統合・展開サービスは、既存のインフラで鉄道デジタル化ソフトウェアをサポートするために、鉄道ITインフラの適応またはアップグレードの必要性を特定し、当該ソフトウェアの制約を回避することを支援します。これらのサービスは、導入の迅速化、時間とコストの削減、効率的な作業の実現、導入に伴う障害の最小化に貢献します。システムインテグレーションとデプロイメントサービスは、お客様の要望を収集することから始まり、ソリューションの展開、統合、テスト、ロールアウトを行います。システム統合・導入サービスプロバイダーは、エンドユーザーがスマートインフラストラクチャーのソリューションを既存のインフラと統合するのを支援します。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 価格モデル分析

- バイヤーに影響を与える動向とディスラプション

- 鉄道デジタル化市場:COVID-19の影響

- ケーススタディ分析

- バリューチェーン分析

- エコシステム

- 特許分析

- 技術分析

- 規制の影響

- ポーターのファイブフォース分析

第6章 鉄道デジタル化市場:ソリューション別

- イントロダクション

- 遠隔モニタリング

- ルート最適化とスケジューリング

- 分析

- ネットワーク管理

- 予知保全

- セキュリティ

- その他

第7章 鉄道デジタル化市場:サービス別

- イントロダクション

- プロフェッショナルサービス

- マネージドサービス

第8章 鉄道デジタル化市場:用途別

- イントロダクション

- 鉄道運行管理

- 鉄道自動化管理

- レールコントロール

- スマートチケット

- 要員管理

- 旅客情報システム

- 資産管理

- その他

第9章 鉄道デジタル化市場:地域別

- イントロダクション

- 北米

- 北米:市場促進要因

- 北米:規制の影響

- 米国

- カナダ

- 欧州

- 欧州:市場促進要因

- 欧州:規制の影響

- 英国

- ドイツ

- フランス

- その他

- アジア太平洋

- アジア太平洋:市場促進要因

- アジア太平洋:規制の影響

- 中国

- インド

- 日本

- その他

- 中東・アフリカ

- 中東・アフリカ:市場促進要因

- 中東・アフリカ:規制の影響

- ナイジェリア

- アラブ首長国連邦

- 南アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:市場促進要因

- ラテンアメリカ:規制の影響

- ブラジル

- メキシコ

- その他

第10章 競合情勢

- 概要

- 主要企業の戦略

- 市場シェア分析

- 収益分析

- 企業評価クアドラント

- 競合ベンチマーキング

- スタートアップ/中小企業評価クアドラント

- 競合シナリオ

第11章 企業プロファイル

- INTRODUCTION

- SIEMENS

- CISCO

- HITACHI

- WABTEC

- ALSTOM

- IBM

- ABB

- HUAWEI

- THALES

- FUJITSU

- DXC

- INDRA

- NOKIA

- ATKINS

- TOSHIBA

- BOMBARDIER

- ZEDAS

- R2P

- SIMPLEWAY

- TEGO

- ASSETIC

- OXPLUS

- PASSIO TECHNOLOGIES

- DELPHISONIC

- UPTAKE

- KONUX

- MACHINES WITH VISION

第12章 隣接/関連市場

- イントロダクション

- スマート鉄道市場 - 2026年までの世界予測

- 鉄道管理システム市場 - 2025年までの世界予測

第13章 付録

MarketsandMarkets forecasts the global digital railway market size is expected to grow USD 63.0 billion in 2022 to USD 100.1 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 9.7% during the forecast period.

"By Solutions, the Network Management segment to grow at the second highest market share during the forecast period"

Domestic and cross-border rail traffic for upcoming needs should be operationally safe, efficient, and cost-effective. Hence, there is a demand for network management to achieve efficiency and increased reliability in operations. Network management solutions are important for disaster management and for minimizing loss. The solution collects real-time data from signals throughout the network. This data can be analyzed to provide simultaneous performance measures, travel times and schedules, and potential intersection delays and stoppages.

"By Application, the asset management segment to hold the second highest market share during the forecast period"

An asset management system is a safe, reliable, substantial, and efficient approach to managing the entire rail infrastructure. It includes route plans that involve activities, resources, and timescales for interventions on the infrastructure; route asset strategies to manage the asset involved in a specific route; and delivery schedules/programs that form detailed plans to optimize the delivery of renewals, maintenance, and enhancement. The rail asset management system assists freight managers, passengers, rail operators, and infrastructure managers in addressing issues, such as the improvement in service availability. It also manages performance and utilization for mobile, fixed, and linear assets; increases reliability and punctuality, reduces service failures; and minimizes asset costs.

"By Services, the system integration & deployment service providers segment is expected to grow at the highest market share during the forecast period"

System integration and deployment services help identify the need for adaptation or upgradation of railway IT infrastructure to support the digital railway software in the existing infrastructure and avoid the restriction of such software. These services help speed deployment, save time and costs, enable efficient working, and minimize deployment-related disruptions. System integration and deployment services begin with collecting customers' requirements and then deploying, integrating, testing, and rolling out solutions. System integration and deployment service providers help end users integrate smart infrastructure solutions with their existing infrastructure.

The breakup of the profiles of the primary participants is given below:

- By Company: Tier 1 - 34%, Tier 2 - 43%, and Tier 3 - 23%

- By Designation: C-Level Executives - 50%, Directors- 30%, Others*-20%

- By Region: North America - 30%, Europe - 30%, Asia Pacific - 25%, Middle East and Africa - 10%, Latin America - 5%

This research study outlines the market potential, market dynamics, and major vendors operating in the digital railway market. Key and innovative vendors in the digital railway market include Siemens(Germany), Cisco (US), Hitachi (Japan), Wabtec (US), Alstom (France), IBM (US), ABB (Switzerland), Huawei (China), Thales (France), Fujitsu (Japan), DXC (US), Indra (Spain), Nokia (Finland), Atkins (UK), Toshiba (Japan), and Bombardier (Canada), ZEDAS(Germany), r2p(Germany), Simpleway(Czech Republic), Tego(US), Assetic(Australia), OXplus(Netherlands), Passio Technologies (US), Delphisonic(US), Uptake(US), KONUX(Germany), Machines With Vision(UK).

Research Coverage

Digital railway market is segmented on solutions, services, application, and region. A detailed analysis of the key industry players has been undertaken to provide insights into their business overviews; services; key strategies; new service and product launches; partnerships, agreements, and collaborations; business expansions; and competitive landscape associated with the virtual customer premises equipment market.

Key benefits of buying the report

The report is expected to help the market leaders/new entrants in this market by providing them information on the closest approximations of the revenue numbers for the overall digital railway market and its segments. This report is also expected to help stakeholders understand the competitive landscape and gain insights to improve the position of their businesses and to plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATE, 2019-2021

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 DIGITAL RAILWAY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 DIGITAL RAILWAY MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM DIGITAL RAILWAY SOLUTIONS/SERVICES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL DIGITAL RAILWAY SOLUTIONS/SERVICES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (DEMAND-SIDE): SHARE OF DIGITAL RAILWAY THROUGH OVERALL DIGITAL RAILWAY SPENDING

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 COMPANY EVALUATION MATRIX METHODOLOGY

- FIGURE 7 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

- FIGURE 8 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 2.7 ASSUMPTIONS

- 2.8 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 DIGITAL RAILWAY MARKET TO WITNESS SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

- FIGURE 10 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE IN 2022

- FIGURE 11 REMOTE MONITORING SEGMENT TO HOLD LARGEST MARKET SIZE IN 2022

- FIGURE 12 PROFESSIONAL SERVICES SEGMENT TO HOLD HIGHEST MARKET SHARE IN 2022

- FIGURE 13 SYSTEM INTEGRATION & DEPLOYMENT SEGMENT TO HOLD HIGHEST MARKET SHARE IN 2022

- FIGURE 14 RAIL OPERATIONS MANAGEMENT SEGMENT TO HOLD LARGEST MARKET SIZE IN 2022

- FIGURE 15 NORTH AMERICA TO HOLD HIGHEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE DIGITAL RAILWAY MARKET

- FIGURE 16 RISING ADOPTION OF AUTOMATION TECHNOLOGIES TO DRIVE DIGITAL RAILWAY MARKET GROWTH

- 4.2 DIGITAL RAILWAY MARKET: TOP THREE SOLUTIONS

- FIGURE 17 REMOTE MONITORING SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD (2022-2027)

- 4.3 DIGITAL RAILWAY MARKET, BY REGION

- FIGURE 18 EUROPE TO HOLD HIGHEST MARKET SHARE IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DIGITAL RAILWAY MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in passenger numbers over the past few years

- 5.2.1.2 Rising adoption of IoT in railways

- 5.2.1.3 Advancements in communication technology

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of robust railway infrastructure in underdeveloped countries

- 5.2.2.2 High initial cost of deployment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising need for advanced transportation infrastructure

- 5.2.3.2 Autonomous train to be significant opportunity for digital railway solution providers

- 5.2.3.3 Emerging trend of smart cities

- 5.2.4 CHALLENGES

- 5.2.4.1 Increased threat of cyberattacks as railway system becomes digital

- 5.2.4.2 Lack of IT infrastructure and skilled personnel

- 5.3 PRICING MODEL ANALYSIS

- TABLE 3 PRICING ANALYSIS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING BUYERS

- FIGURE 20 REVENUE SHIFT FOR DIGITAL RAILWAY MARKET

- 5.5 DIGITAL RAILWAY MARKET: COVID-19 IMPACT

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 USE CASES

- 5.6.1.1 Case study 1: Siemens provides maintenance services to Govia Thameslink Railway

- 5.6.1.2 Case study 2: Thales provided Bane (NOR) with next-generation traffic management system

- 5.6.1.3 Case study 3: Assetic helped Sydney Trains visualize rail assets for optimized asset management

- 5.6.1.4 Case study 4: Thales provided train-to-ground broadband data communication solution to Brescia Metro

- 5.6.1.5 Case study 5: Taiwan High Speed Rail Corporation selected IBM Maximo to build an advanced maintenance management solution

- 5.6.1 USE CASES

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS

- 5.8 ECOSYSTEM

- FIGURE 22 DIGITAL RAILWAY MARKET: ECOSYSTEM

- TABLE 4 DIGITAL RAILWAY MARKET: ECOSYSTEM

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.9.2 DOCUMENT TYPE

- TABLE 5 PATENTS FILED, 2019-2022

- 5.9.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 23 ANNUAL NUMBER OF PATENTS GRANTED, 2019-2022

- 5.9.3.1 Top applicants

- FIGURE 24 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019-2022

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 INTERNET OF THINGS IN RAILWAYS

- 5.10.2 BIG DATA ANALYTICS AND CLOUD COMPUTING IN RAILWAYS

- 5.10.3 HYPERLOOP - THE FUTURE OF TRANSPORTATION

- 5.10.4 DRONES FOR IDENTIFYING RAILWAY INFRASTRUCTURE ISSUES

- 5.10.5 AUTOMATIC WARNING SYSTEM

- 5.11 REGULATORY IMPLICATIONS

- 5.11.1 ISO

- 5.11.1.1 ISO/IEC JTC 1

- 5.11.1.2 ISO/IEC 27001

- 5.11.1.3 ISO/IEC 19770-1

- 5.11.1.4 ISO/IEC JTC 1/SWG 5

- 5.11.1.5 ISO/IEC JTC 1/SC 31

- 5.11.1.6 ISO/IEC JTC 1/SC 27

- 5.11.1.7 ISO/IEC JTC 1/WG 7 sensors

- 5.11.2 GDPR

- 5.11.3 FMCSA

- 5.11.4 FHWA

- 5.11.5 MARAD

- 5.11.6 FAA

- 5.11.7 FRA

- 5.11.8 IEEE-SA

- 5.11.9 CEN/ISO

- 5.11.10 CEN/CENELEC

- 5.11.11 ETSI

- 5.11.12 ITU-T

- 5.11.1 ISO

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 DIGITAL RAILWAY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

6 DIGITAL RAILWAY MARKET, BY SOLUTION

- 6.1 INTRODUCTION

- 6.1.1 SOLUTION: MARKET DRIVERS

- FIGURE 25 PREDICTIVE MAINTENANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 7 DIGITAL RAILWAY MARKET, BY SOLUTION, 2017-2021 (USD BILLION)

- TABLE 8 DIGITAL RAILWAY MARKET, BY SOLUTION, 2022-2027 (USD BILLION)

- 6.2 REMOTE MONITORING

- 6.2.1 REMOTE MONITORING SOLUTIONS TO IMPROVE RELIABILITY OF RAILWAY INFRASTRUCTURE

- TABLE 9 DIGITAL RAILWAY REMOTE MONITORING MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 10 DIGITAL RAILWAY REMOTE MONITORING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 6.3 ROUTE OPTIMIZATION & SCHEDULING

- 6.3.1 ROUTE OPTIMIZATION & SCHEDULING SOLUTIONS TO ENABLE EFFICIENT MANAGEMENT OF ROUTINE OPERATIONS FOR TRAINS

- TABLE 11 DIGITAL RAILWAY ROUTE OPTIMIZATION & SCHEDULING MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 12 DIGITAL RAILWAY ROUTE OPTIMIZATION & SCHEDULING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 6.4 ANALYTICS

- 6.4.1 RAIL ANALYTICS SYSTEMS TO HELP IN DEMAND PLANNING, REVENUE AND WORKFORCE MANAGEMENT, TRANSIT ANALYSIS, AND PRICING ANALYSIS

- TABLE 13 DIGITAL RAILWAY ANALYTICS MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 14 DIGITAL RAILWAY ANALYTICS MARKET, BY REGION, 2022-2027 (USD BILLION)

- 6.5 NETWORK MANAGEMENT

- 6.5.1 NETWORK MANAGEMENT SOLUTIONS PLAY AN IMPORTANT ROLE IN DISASTER MANAGEMENT AND MINIMIZING LOSS

- TABLE 15 DIGITAL RAILWAY NETWORK MANAGEMENT MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 16 DIGITAL RAILWAY NETWORK MANAGEMENT MARKET, BY REGION, 2022-2027 (USD BILLION)

- 6.6 PREDICTIVE MAINTENANCE

- 6.6.1 PREDICTIVE MAINTENANCE SOLUTIONS TO INCREASE ASSET LIFE AND IMPROVE RAIL OPERATIONS AND SAFETY

- TABLE 17 DIGITAL RAILWAY PREDICTIVE MAINTENANCE MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 18 DIGITAL RAILWAY PREDICTIVE MAINTENANCE MARKET, BY REGION, 2022-2027 (USD BILLION)

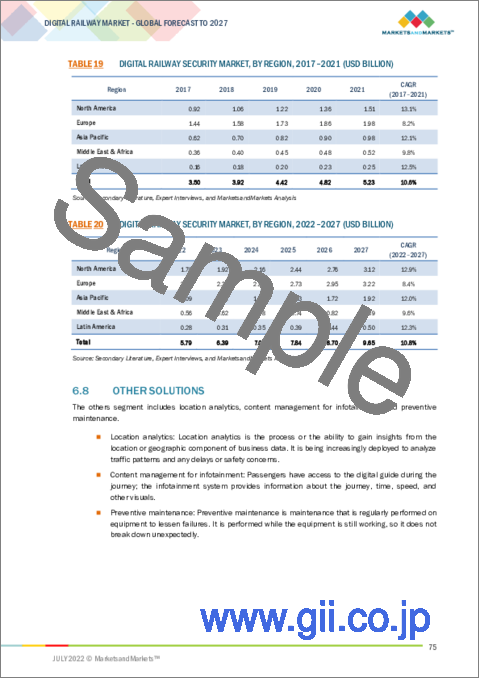

- 6.7 SECURITY

- 6.7.1 RAIL SECURITY SOLUTIONS TO BE ADOPTED INCREASINGLY WITH HIGHER DEPLOYMENT OF DIGITAL SOLUTIONS

- TABLE 19 DIGITAL RAILWAY SECURITY MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 20 DIGITAL RAILWAY SECURITY MARKET, BY REGION, 2022-2027 (USD BILLION)

- 6.8 OTHER SOLUTIONS

- TABLE 21 OTHER DIGITAL RAILWAY SOLUTIONS MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 22 OTHER DIGITAL RAILWAY SOLUTIONS MARKET, BY REGION, 2022-2027 (USD BILLION)

7 DIGITAL RAILWAY MARKET, BY SERVICE

- 7.1 INTRODUCTION

- 7.1.1 SERVICE: MARKET DRIVERS

- FIGURE 26 MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 23 DIGITAL RAILWAY MARKET, BY SERVICE, 2017-2021 (USD BILLION)

- TABLE 24 DIGITAL RAILWAY MARKET, BY SERVICE, 2022-2027 (USD BILLION)

- 7.2 PROFESSIONAL SERVICES

- TABLE 25 DIGITAL RAILWAY PROFESSIONAL SERVICES MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 26 DIGITAL RAILWAY PROFESSIONAL SERVICES MARKET, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 27 DIGITAL RAILWAY PROFESSIONAL SERVICES MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 28 DIGITAL RAILWAY PROFESSIONAL SERVICES MARKET, BY REGION, 2022-2027 (USD BILLION)

- 7.2.1 CONSULTING

- 7.2.1.1 Consulting service vendors to offer recommendations on implementing new technologies

- TABLE 29 DIGITAL RAILWAY CONSULTING SERVICES MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 30 DIGITAL RAILWAY CONSULTING SERVICES, BY REGION, 2022-2027 (USD BILLION)

- 7.2.2 SYSTEM INTEGRATION & DEPLOYMENT

- 7.2.2.1 System integration & deployment service providers to help integrate smart solutions with their existing infrastructure

- TABLE 31 DIGITAL RAILWAY SYSTEM INTEGRATION & DEPLOYMENT MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 32 DIGITAL RAILWAY SYSTEM INTEGRATION & DEPLOYMENT MARKET, BY REGION, 2022-2027 (USD BILLION)

- 7.2.3 SUPPORT & MAINTENANCE

- 7.2.3.1 Support & maintenance services to assist in installing freight management system solutions

- TABLE 33 DIGITAL RAILWAY SUPPORT & MAINTENANCE MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 34 DIGITAL RAILWAY SUPPORT & MAINTENANCE MARKET, BY REGION, 2022-2027 (USD BILLION)

- 7.3 MANAGED SERVICES

- TABLE 35 DIGITAL RAILWAY MANAGED SERVICES MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 36 DIGITAL RAILWAY MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD BILLION)

8 DIGITAL RAILWAY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 APPLICATION: MARKET DRIVERS

- FIGURE 27 PASSENGER INFORMATION SYSTEMS TO BE FASTEST-GROWING SEGMENT

- TABLE 37 DIGITAL RAILWAY MARKET, BY APPLICATION, 2017-2021 (USD BILLION)

- TABLE 38 DIGITAL RAILWAY MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- 8.2 RAIL OPERATIONS MANAGEMENT

- TABLE 39 DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 40 DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY REGION, 2022-2027 (USD BILLION)

- TABLE 41 DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 42 DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2022-2027 (USD BILLION)

- 8.2.1 RAIL AUTOMATION MANAGEMENT

- 8.2.1.1 Rail automation system comprises traffic monitoring and protection systems to ensure safety and better experience

- TABLE 43 RAIL AUTOMATION MANAGEMENT APPLICATION MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 44 RAIL AUTOMATION MANAGEMENT APPLICATION MARKET, BY REGION, 2022-2027 (USD BILLION)

- 8.2.2 RAIL CONTROL

- TABLE 45 DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 46 DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2022-2027 (USD BILLION)

- 8.2.2.1 Signaling Solutions

- 8.2.2.1.1 Signaling solutions to ensure communication between trains, stations, and workforce

- 8.2.2.1 Signaling Solutions

- TABLE 47 DIGITAL RAILWAY SIGNALING SOLUTION MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 48 DIGITAL RAILWAY SIGNALING SOLUTION MARKET, BY REGION, 2022-2027 (USD BILLION)

- 8.2.2.2 Rail Traffic Management

- 8.2.2.2.1 Rail traffic management to offer flexible solutions to increase railway network capacity and efficiency

- 8.2.2.2 Rail Traffic Management

- TABLE 49 DIGITAL RAIL TRAFFIC MANAGEMENT MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 50 DIGITAL RAIL TRAFFIC MANAGEMENT MARKET, BY REGION, 2022-2027 (USD BILLION)

- 8.2.2.3 Freight Management

- 8.2.2.3.1 Freight management systems to help freight operators in infrastructure and planning decisions

- 8.2.2.3 Freight Management

- TABLE 51 DIGITAL RAILWAY FREIGHT MANAGEMENT MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 52 DIGITAL RAILWAY FREIGHT MANAGEMENT MARKET, BY REGION, 2022-2027 (USD BILLION)

- 8.2.3 SMART TICKETING

- 8.2.3.1 Smart ticketing to help contribute to overall improvement of railway transport network

- TABLE 53 DIGITAL RAILWAY SMART TICKETING MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 54 DIGITAL RAILWAY SMART TICKETING MARKET, BY REGION, 2022-2027 (USD BILLION)

- 8.2.4 WORKFORCE MANAGEMENT

- 8.2.4.1 Workforce management to ensure significant cost reduction and effective employee engagement

- TABLE 55 DIGITAL RAILWAY WORKFORCE MANAGEMENT MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 56 DIGITAL RAILWAY WORKFORCE MANAGEMENT MARKET, BY REGION, 2022-2027 (USD BILLION)

- 8.3 PASSENGER INFORMATION SYSTEMS

- 8.3.1 PASSENGER INFORMATION SYSTEMS TO BE KEY COMMUNICATION LINK BETWEEN TRANSPORTATION OPERATORS AND PASSENGER CONNECTIVITY

- TABLE 57 DIGITAL RAILWAY PASSENGER INFORMATION SYSTEM MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 58 DIGITAL RAILWAY PASSENGER INFORMATION SYSTEM MARKET, BY REGION, 2022-2027 (USD BILLION)

- 8.4 ASSET MANAGEMENT

- 8.4.1 RAIL ASSET MANAGEMENT TO OPTIMIZE PERFORMANCE AND RAIL INFRASTRUCTURE

- TABLE 59 DIGITAL RAILWAY ASSET MANAGEMENT MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 60 DIGITAL RAILWAY ASSET MANAGEMENT MARKET, BY REGION, 2022-2027 (USD BILLION)

- 8.5 OTHER APPLICATIONS

- TABLE 61 OTHER DIGITAL RAILWAY APPLICATIONS MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 62 OTHER DIGITAL RAILWAY APPLICATIONS MARKET, BY REGION, 2022-2027 (USD BILLION)

9 DIGITAL RAILWAY MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 28 ASIA PACIFIC TO BE FASTEST-GROWING REGION IN DIGITAL RAILWAY MARKET

- FIGURE 29 EUROPE TO BE LARGEST REGIONAL DIGITAL RAILWAY MARKET IN 2022

- TABLE 63 DIGITAL RAILWAY MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 64 DIGITAL RAILWAY MARKET, BY REGION, 2022-2027 (USD BILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: DIGITAL RAILWAY MARKET DRIVERS

- 9.2.2 NORTH AMERICA: REGULATORY IMPLICATIONS

- FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 65 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY OFFERING, 2017-2021 (USD BILLION)

- TABLE 66 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- TABLE 67 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY SOLUTION, 2017-2021 (USD BILLION)

- TABLE 68 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY SOLUTION, 2022-2027 (USD BILLION)

- TABLE 69 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY SERVICE, 2017-2021 (USD BILLION)

- TABLE 70 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY SERVICE, 2022-2027 (USD BILLION)

- TABLE 71 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2017-2021 (USD BILLION)

- TABLE 72 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD BILLION)

- TABLE 73 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY APPLICATION, 2017-2021 (USD BILLION)

- TABLE 74 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 75 NORTH AMERICA: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 76 NORTH AMERICA: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 77 NORTH AMERICA: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 78 NORTH AMERICA: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 79 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY COUNTRY, 2017-2021 (USD BILLION)

- TABLE 80 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY COUNTRY, 2022-2027 (USD BILLION)

- 9.2.3 US

- 9.2.3.1 Government initiatives to drive market in US

- 9.2.4 CANADA

- 9.2.4.1 Increase in number of passengers and higher freight traffic to drive market in Canada

- 9.3 EUROPE

- 9.3.1 EUROPE: MARKET DRIVERS

- 9.3.2 EUROPE: REGULATORY IMPLICATIONS

- TABLE 81 EUROPE: DIGITAL RAILWAY MARKET, BY OFFERING, 2017-2021 (USD BILLION)

- TABLE 82 EUROPE: DIGITAL RAILWAY MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- TABLE 83 EUROPE: DIGITAL RAILWAY MARKET, BY SOLUTION, 2017-2021 (USD BILLION)

- TABLE 84 EUROPE: DIGITAL RAILWAY MARKET, BY SOLUTION, 2022-2027 (USD BILLION)

- TABLE 85 EUROPE: DIGITAL RAILWAY MARKET, BY SERVICE, 2017-2021 (USD BILLION)

- TABLE 86 EUROPE: DIGITAL RAILWAY MARKET, BY SERVICE, 2022-2027 (USD BILLION)

- TABLE 87 EUROPE: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2017-2021 (USD BILLION)

- TABLE 88 EUROPE: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD BILLION)

- TABLE 89 EUROPE: DIGITAL RAILWAY MARKET, BY APPLICATION, 2017-2021 (USD BILLION)

- TABLE 90 EUROPE: DIGITAL RAILWAY MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 91 EUROPE: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 92 EUROPE: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 93 EUROPE: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 94 EUROPE: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 95 EUROPE: DIGITAL RAILWAY MARKET, BY COUNTRY, 2017-2021 (USD BILLION)

- TABLE 96 EUROPE: DIGITAL RAILWAY MARKET, BY COUNTRY, 2022-2027 (USD BILLION)

- 9.3.3 UK

- 9.3.3.1 Need to improve efficiency of existing railway infrastructure to boost market in UK

- 9.3.4 GERMANY

- 9.3.4.1 Greater adoption of IoT and analytics to boost market in Germany

- 9.3.5 FRANCE

- 9.3.5.1 High investment by railway operators to drive market in France

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: DIGITAL RAILWAY MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: REGULATORY IMPLICATIONS

- FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 97 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY OFFERING, 2017-2021 (USD BILLION)

- TABLE 98 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- TABLE 99 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY SOLUTION, 2017-2021 (USD BILLION)

- TABLE 100 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY SOLUTION, 2022-2027 (USD BILLION)

- TABLE 101 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY SERVICE, 2017-2021 (USD BILLION)

- TABLE 102 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY SERVICE, 2022-2027 (USD BILLION)

- TABLE 103 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2017-2021 (USD BILLION)

- TABLE 104 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD BILLION)

- TABLE 105 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY APPLICATION, 2017-2021 (USD BILLION)

- TABLE 106 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 107 ASIA PACIFIC: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 108 ASIA PACIFIC: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 109 ASIA PACIFIC: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 110 ASIA PACIFIC: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 111 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY COUNTRY, 2017-2021 (USD BILLION)

- TABLE 112 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY COUNTRY, 2022-2027 (USD BILLION)

- 9.4.3 CHINA

- 9.4.3.1 High government investments in railway infrastructure and rapid growth in railways to drive market in China

- 9.4.4 INDIA

- 9.4.4.1 Higher railway profits and government initiatives for smart cities to drive market in India

- 9.4.5 JAPAN

- 9.4.5.1 Increase in adoption of railway technologies to boost market in Japan

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: REGULATORY IMPLICATIONS

- TABLE 113 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY OFFERING, 2017-2021 (USD BILLION)

- TABLE 114 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- TABLE 115 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY SOLUTION, 2017-2021 (USD BILLION)

- TABLE 116 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY SOLUTION, 2022-2027 (USD BILLION)

- TABLE 117 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY SERVICE, 2017-2021 (USD BILLION)

- TABLE 118 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY SERVICE, 2022-2027 (USD BILLION)

- TABLE 119 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2017-2021 (USD BILLION)

- TABLE 120 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD BILLION)

- TABLE 121 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY APPLICATION, 2017-2021 (USD BILLION)

- TABLE 122 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 123 MIDDLE EAST & AFRICA: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 124 MIDDLE EAST & AFRICA: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 125 MIDDLE EAST & AFRICA: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 126 MIDDLE EAST & AFRICA: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 127 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY COUNTRY, 2017-2021 (USD BILLION)

- TABLE 128 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY COUNTRY, 2022-2027 (USD BILLION)

- 9.5.3 NIGERIA

- 9.5.3.1 Government initiatives combined with cooperation with other countries to boost market in Nigeria

- 9.5.4 UAE

- 9.5.4.1 Government initiatives to drive market in UAE

- 9.5.5 SOUTH AFRICA

- 9.5.5.1 Increased demand for transportation services to match regional trade requirements to drive market in South Africa

- 9.5.6 REST OF THE MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: DIGITAL RAILWAY MARKET DRIVERS

- 9.6.2 LATIN AMERICA: REGULATORY IMPLICATIONS

- TABLE 129 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY OFFERING, 2017-2021 (USD BILLION)

- TABLE 130 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- TABLE 131 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY SOLUTION, 2017-2021 (USD BILLION)

- TABLE 132 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY SOLUTION, 2022-2027 (USD BILLION)

- TABLE 133 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY SERVICE, 2017-2021 (USD BILLION)

- TABLE 134 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY SERVICE, 2022-2027 (USD BILLION)

- TABLE 135 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2017-2021 (USD BILLION)

- TABLE 136 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD BILLION)

- TABLE 137 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY APPLICATION, 2017-2021 (USD BILLION)

- TABLE 138 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 139 LATIN AMERICA: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 140 LATIN AMERICA: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 141 LATIN AMERICA: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2017-2021 (USD BILLION)

- TABLE 142 LATIN AMERICA: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 143 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY COUNTRY, 2017-2021 (USD BILLION)

- TABLE 144 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY COUNTRY, 2022-2027 (USD BILLION)

- 9.6.3 BRAZIL

- 9.6.3.1 Large scope for further development of railway infrastructure to boost opportunity in Brazil

- 9.6.4 MEXICO

- 9.6.4.1 Strategic location in North America to play key role in development of railway infrastructure in Mexico

- 9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES

- 10.3 MARKET SHARE ANALYSIS

- FIGURE 32 DIGITAL RAILWAY MARKET SHARE ANALYSIS OF KEY PLAYERS

- TABLE 145 DIGITAL RAILWAY MARKET: DEGREE OF COMPETITION

- 10.4 REVENUE ANALYSIS

- FIGURE 33 REVENUE ANALYSIS FOR LEADING PLAYERS, 2019-2021

- 10.5 COMPANY EVALUATION QUADRANT

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 34 KEY DIGITAL RAILWAY MARKET PLAYER EVALUATION MATRIX, 2022

- 10.6 COMPETITIVE BENCHMARKING

- TABLE 146 COMPANY PRODUCT FOOTPRINT

- TABLE 147 COMPANY REGION FOOTPRINT

- 10.7 STARTUP/SME EVALUATION QUADRANT

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- FIGURE 35 STARTUP/SME DIGITAL RAILWAY MARKET EVALUATION MATRIX, 2022

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT LAUNCHES

- TABLE 148 PRODUCT LAUNCHES, JUNE 2019-DECEMBER 2021

- 10.8.2 DEALS

- TABLE 149 DEALS, MARCH 2018-MAY 2022

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- (Business Overview, Products, Key Insights, Recent Developments, Response to COVID-19, MnM View)**

- 11.1.1 SIEMENS

- TABLE 150 SIEMENS: BUSINESS OVERVIEW

- FIGURE 36 SIEMENS: COMPANY SNAPSHOT

- TABLE 151 SIEMENS: PRODUCTS OFFERED

- TABLE 152 SIEMENS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 153 SIEMENS: DEALS

- 11.1.2 CISCO

- TABLE 154 CISCO: BUSINESS OVERVIEW

- FIGURE 37 CISCO: COMPANY SNAPSHOT

- TABLE 155 CISCO: PRODUCTS OFFERED

- TABLE 156 CISCO: DEALS

- 11.1.3 HITACHI

- TABLE 157 HITACHI: BUSINESS OVERVIEW

- FIGURE 38 HITACHI: COMPANY SNAPSHOT

- TABLE 158 HITACHI: PRODUCTS OFFERED

- TABLE 159 HITACHI: DEALS

- 11.1.4 WABTEC

- TABLE 160 WABTEC: BUSINESS OVERVIEW

- FIGURE 39 WABTEC: COMPANY SNAPSHOT

- TABLE 161 WABTEC: PRODUCTS OFFERED

- TABLE 162 WABTEC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 163 WABTEC: DEALS

- 11.1.5 ALSTOM

- TABLE 164 ALSTOM: BUSINESS OVERVIEW

- FIGURE 40 ALSTOM: COMPANY SNAPSHOT

- TABLE 165 ALSTOM: PRODUCTS OFFERED

- TABLE 166 ALSTOM: DEALS

- 11.1.6 IBM

- TABLE 167 IBM: BUSINESS OVERVIEW

- FIGURE 41 IBM: COMPANY SNAPSHOT

- TABLE 168 IBM: PRODUCTS OFFERED

- 11.1.7 ABB

- TABLE 169 ABB: BUSINESS OVERVIEW

- FIGURE 42 ABB: COMPANY SNAPSHOT

- TABLE 170 ABB: PRODUCTS OFFERED

- TABLE 171 ABB: PRODUCT LAUNCHES

- TABLE 172 ABB: DEALS

- 11.1.8 HUAWEI

- TABLE 173 HUAWEI: BUSINESS OVERVIEW

- FIGURE 43 HUAWEI: COMPANY SNAPSHOT

- TABLE 174 HUAWEI: PRODUCTS OFFERED

- TABLE 175 HUAWEI: PRODUCT LAUNCHES

- TABLE 176 HUAWEI: DEALS

- 11.1.9 THALES

- TABLE 177 THALES: BUSINESS OVERVIEW

- FIGURE 44 THALES: COMPANY SNAPSHOT

- TABLE 178 THALES: PRODUCTS OFFERED

- TABLE 179 THALES: PRODUCT LAUNCHES

- TABLE 180 THALES: DEALS

- 11.1.10 FUJITSU

- TABLE 181 FUJITSU: BUSINESS OVERVIEW

- FIGURE 45 FUJITSU: COMPANY SNAPSHOT

- TABLE 182 FUJITSU: PRODUCTS OFFERED

- TABLE 183 FUJITSU: DEALS

- 11.1.11 DXC

- TABLE 184 DXC: BUSINESS OVERVIEW

- FIGURE 46 DXC: COMPANY SNAPSHOT

- TABLE 185 DXC: PRODUCTS OFFERED

- TABLE 186 DXC: DEALS

- 11.1.12 INDRA

- 11.1.13 NOKIA

- 11.1.14 ATKINS

- 11.1.15 TOSHIBA

- 11.1.16 BOMBARDIER

- 11.1.17 ZEDAS

- 11.1.18 R2P

- 11.1.19 SIMPLEWAY

- 11.1.20 TEGO

- 11.1.21 ASSETIC

- 11.1.22 OXPLUS

- 11.1.23 PASSIO TECHNOLOGIES

- 11.1.24 DELPHISONIC

- 11.1.25 UPTAKE

- 11.1.26 KONUX

- 11.1.27 MACHINES WITH VISION

- *Details on Business Overview, Products Recent Developments, Response to COVID-19, MnM View might not be captured in case of unlisted companies.

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.1.1 LIMITATIONS

- 12.2 SMART RAILWAYS MARKET - GLOBAL FORECAST TO 2026

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 SMART RAILWAYS MARKET, BY OFFERING

- TABLE 187 SMART RAILWAYS MARKET, BY OFFERING, 2017-2020 (USD MILLION)

- TABLE 188 SMART RAILWAYS MARKET, BY OFFERING, 2021-2026 (USD MILLION)

- 12.2.4 SMART RAILWAYS MARKET, BY SOLUTION

- TABLE 189 SOLUTIONS: SMART RAILWAYS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 190 SOLUTIONS: SMART RAILWAYS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 12.2.5 SMART RAILWAYS MARKET, BY SERVICE

- TABLE 191 SERVICES: SMART RAILWAYS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 192 SERVICES: SMART RAILWAYS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 12.2.6 SMART RAILWAYS MARKET, BY PROFESSIONAL SERVICE

- TABLE 193 PROFESSIONAL SERVICES: SMART RAILWAYS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 194 PROFESSIONAL SERVICES: SMART RAILWAYS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 12.2.7 SMART RAILWAYS MARKET, BY REGION

- TABLE 195 SMART RAILWAYS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 196 SMART RAILWAYS MARKET, BY REGION, 2021-2026 (USD MILLION)

- 12.3 RAILWAY MANAGEMENT SYSTEM MARKET - GLOBAL FORECAST TO 2025

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING

- TABLE 197 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016-2019 (USD MILLION)

- TABLE 198 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2025 (USD MILLION)

- 12.3.4 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION

- TABLE 199 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2016-2019 (USD MILLION)

- TABLE 200 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2025 (USD MILLION)

- 12.3.5 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION

- TABLE 201 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 202 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2025 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATIONS OFFERED

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS