|

|

市場調査レポート

商品コード

1076186

電力配分装置の世界市場:タイプ(ベーシック、メーター式、切り替え式、モニター式、ATS、ホットスワップ、デュアルサーキット)、位相(単相、三相)、定格電力(120V未満、120~240V、240~400V、400V超)、エンドユーザー、地域別 - 2027年までの予測Power Distribution Unit Market by Type (Basic, Metered, Switched, Monitored, ATS, Hot Swap, Dual Circuit), Phase (Single & Three), Power Rating (Up to 120 V, 120-240 V, 240-400 V, above 400 V), End User and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 電力配分装置の世界市場:タイプ(ベーシック、メーター式、切り替え式、モニター式、ATS、ホットスワップ、デュアルサーキット)、位相(単相、三相)、定格電力(120V未満、120~240V、240~400V、400V超)、エンドユーザー、地域別 - 2027年までの予測 |

|

出版日: 2022年05月12日

発行: MarketsandMarkets

ページ情報: 英文 198 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の電力配分装置の市場規模は、2022年の39億米ドルから、2027年までに57億米ドルに達すると予測されています。

同市場の主な促進要因には、通信・IT分野での需要増への対応、データセンター数の増加、オートメーション・デジタル化投資の拡大、様々な業界における電力配分装置の用途増加などが挙げられます。

当レポートでは、世界の電力配分装置市場について調査し、市場力学、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- COVID-19健康評価

- COVID-19経済的評価

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

- COVID-19の影響

- 市場マップ

- バリューチェーン分析

第6章 タイプ別:電力配分装置市場

- ベーシック

- メーター式

- 切り替え式

- モニター式

- 自動転送スイッチ

- ホットスワップ

- デュアルサーキット

第7章 位相別:電力配分装置市場

- 単相

- 三相

第8章 定格電力別:電力配分装置市場

- 120V未満

- 120~240V

- 240~400V

- 400V超

第9章 エンドユーザー別:電力配分装置市場

- 通信・IT

- BFSI

- ヘルスケア

- 製造業・加工業

- 自動車

- 政府・防衛

- エネルギー

第10章 地域分析

- アジア太平洋

- 北米

- 欧州

- 南米

- 中東・アフリカ

第11章 競合情勢

- 主要企業の戦略

- 主要企業5社の市場シェア分析

- 主要市場参入企業5社の収益分析

- 企業評価クアドラント

- 企業のフットプリント

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- SCHNEIDER ELECTRIC

- LEGRAND

- EATON

- CISCO SYSTEMS

- ABB

- VERTIV

- NVENT

- PANDUIT

- ATEN

- DELTA ELECTRONICS

- HEWLETT PACKARD ENTERPRISE

- SOCOMEC

第13章 付録

The power distribution unit market is projected to reach USD 5.7 billion by 2027 from an estimated of USD 3.9 billion in 2022, in order to meet the increasing demand from telecom & IT sector. Some of the major driving factors for the market include the increase in number of data centers. Secondly, growing investments in automation and digitalization supports the implementation of power distribution unit market. Increasing application of power distribution unit in various industries is likely to propel the growth of power distribution unit market.

Power distribution units can either be basic or intelligent, depending on the features they have. These products can monitor, track, and manage every aspect of data center activity and provide efficient solutions for critical power devices, along with data center security and server management.

The recent COVID-19 pandemic has impacted the global power distribution unit market. Though the pandemic caused large-scale disruptions and challenges, it also created opportunities for the sector. The data centers were keeping things running smoothly for organizations to focus on maintaining operations. Data centers were used to support increased internet traffic, collaborative software offerings and maintain data security as well. The growing dependency on data centers has created a global demand for power distribution units.

"Metered PDUs: The largest- growing segment of the power distribution unit market"

Based on by type of power distribution unit , the metered type segment is estimated to be the largest-growing market from 2022 to 2027. Metered PDUs deliver local visual monitoring capability through an in-built LED screen that displays real-time power consumption data. The metered PDUs are categorized as inlet and outlet. The inlet metered PDUs determine the available capacity of the racks, whereas the outlet metered PDUs permit end users to understand the actual power consumption at the device or server level. Metered power distribution units provide information about the real-time remote monitoring of connected loads and power consumption of PDUs as a whole or by individual outlets.

"120-240 V power rating: The largest segment by power rating in power distribution unit market"

The 120-240 V segment, by power rating, is projected to hold the highest market share during the forecast period. These PDUs prevent accidental shutdowns and costly downtime. Thus, they are suitable to deploy high power to IT equipment racks. They provide reliable single-phase power distribution. Such PDUs are ideally suited for the IT, networking, telecom, and security industries. Also, they offer versatile installation options. These are the features that boost the demand for 120-240 V segment in power distribution unit market.

"North America: The fastest-growing region in power distribution unit market"

North America is estimated to hold the largest market share in the power distribution unit market. The region is witnessing substantial growth for colocation data centers and provides lucrative opportunities for the players operating in the power distribution unit market. These companies are taking initiatives to build new PDU platforms for colocation data centers to cater to the demand from large enterprise facilities.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level- 30%, Director Level- 25%, and Others- 45%

By Region: Asia Pacific- 70%, North America- 12%, Europe- 12%, Middle East & Africa- 11%, and South America - 7%.

Note: Others includes sales managers, engineers, and regional managers.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The leading players in the power distribution unit market include ABB (Switzerland), Schneider Electric (France), Legrand (France), Eaton (Ireland), and Cisco Systems (US),

Research Coverage:

The report explains, describes, and forecasts the global power distribution unit market, by type, by phase, by power rating, by end user, and region.

It also offers a detailed qualitative and quantitative analysis of the power distribution unit market. The report provides a thorough review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the power distribution unit market.

Key Benefits of Buying the Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the power distribution unit market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 POWER DISTRIBUTION UNIT MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

- 1.3.2 POWER DISTRIBUTION UNIT MARKET, BY PHASE: INCLUSIONS AND EXCLUSIONS

- 1.3.3 POWER DISTRIBUTION UNIT MARKET, BY POWER RATING: INCLUSIONS AND EXCLUSIONS

- 1.3.4 POWER DISTRIBUTION UNIT MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

- 1.3.5 POWER DISTRIBUTION UNIT MARKET, BY REGION: INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- 1.4.2 REGIONAL SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 POWER DISTRIBUTION UNIT MARKET: RESEARCH DESIGN

- 2.2 DATA TRIANGULATION

- 2.2.1 POWER DISTRIBUTION UNIT MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- 2.2.2 SECONDARY DATA

- 2.2.2.1 Key data from secondary sources

- 2.2.3 PRIMARY DATA

- 2.2.3.1 Key data from primary sources

- 2.2.3.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE METRICS

- FIGURE 6 METRICS CONSIDERED IN ANALYSIS AND DEMAND ASSESSMENT

- 2.3.4 CALCULATION FOR DEMAND-SIDE METRICS

- 2.3.5 RESEARCH ASSUMPTIONS FOR DEMAND-SIDE METRICS

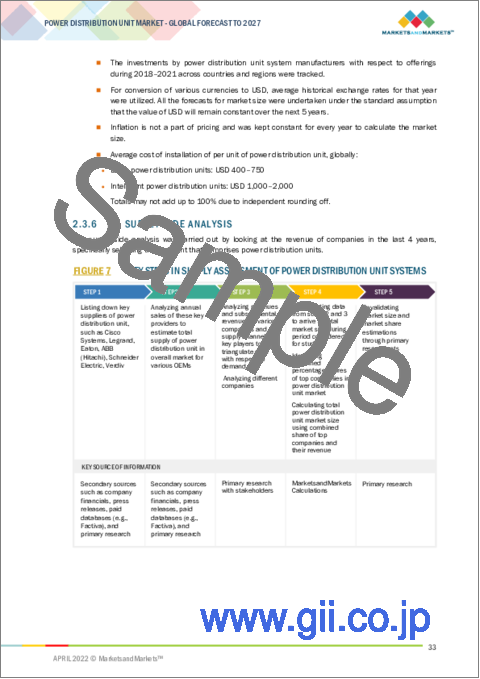

- 2.3.6 SUPPLY-SIDE ANALYSIS

- FIGURE 7 KEY STEPS IN SUPPLY ASSESSMENT OF POWER DISTRIBUTION UNIT SYSTEMS

- FIGURE 8 POWER DISTRIBUTION UNIT MARKET: SUPPLY-SIDE ANALYSIS

- 2.3.6.1 Supply side calculation

- 2.3.6.2 Assumptions for supply side

- 2.3.7 FORECAST

- 2.4 LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 1 POWER DISTRIBUTION UNIT MARKET SHARE, BY SEGMENT

- FIGURE 9 GLOBAL POWER DISTRIBUTION UNIT MARKET, BY TYPE, 2022-2027

- FIGURE 10 GLOBAL POWER DISTRIBUTION UNIT MARKET, BY PHASE, 2022-2027

- FIGURE 11 GLOBAL POWER DISTRIBUTION UNIT MARKET, BY POWER RATING, 2022-2027

- FIGURE 12 GLOBAL POWER DISTRIBUTION UNIT MARKET, BY END USER, 2022-2027

- FIGURE 13 GLOBAL POWER DISTRIBUTION UNIT MARKET, BY REGION, 2022-2027

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN POWER DISTRIBUTION UNIT MARKET

- FIGURE 14 INVESTMENTS MADE BY DATA CENTER OPERATORS TO INSTALL POWER-EFFICIENT DISTRIBUTION INFRASTRUCTURE ARE EXPECTED TO DRIVE POWER DISTRIBUTION UNIT MARKET FROM 2022 TO 2027

- 4.2 POWER DISTRIBUTION UNIT MARKET IN NORTH AMERICA, BY TYPE AND COUNTRY

- FIGURE 15 METERED TYPE AND US HELD LARGEST SHARES OF POWER DISTRIBUTION UNIT MARKET IN NORTH AMERICA IN 2021

- 4.3 POWER DISTRIBUTION UNIT MARKET, BY TYPE

- FIGURE 16 METERED TYPE CAPTURED MAJOR MARKET SHARE IN 2021

- 4.4 POWER DISTRIBUTION UNIT MARKET, BY PHASE

- FIGURE 17 SINGLE PHASE HELD LARGEST SHARE OF GLOBAL POWER DISTRIBUTION UNIT MARKET IN 2021

- 4.5 POWER DISTRIBUTION UNIT MARKET, BY POWER RATING

- FIGURE 18 120-240 V SEGMENT HELD LARGEST SHARE OF GLOBAL POWER DISTRIBUTION UNIT MARKET IN 2021

- 4.6 POWER DISTRIBUTION UNIT MARKET, BY END USER

- FIGURE 19 TELECOM & IT ACCOUNTED FOR LARGEST SHARE OF POWER DISTRIBUTION UNIT MARKET IN 2021

- 4.7 POWER DISTRIBUTION UNIT MARKET, BY REGION

- FIGURE 20 ASIA PACIFIC TO RECORD HIGHEST CAGR IN POWER DISTRIBUTION UNIT MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 COVID-19 HEALTH ASSESSMENT

- FIGURE 21 GLOBAL PROPAGATION OF COVID-19

- FIGURE 22 PROPAGATION OF COVID-19 CASES IN SELECTED COUNTRIES

- 5.3 COVID-19 ECONOMIC ASSESSMENT

- FIGURE 23 COMPARISON OF GDP FOR SELECTED G20 COUNTRIES IN 2020

- 5.4 MARKET DYNAMICS

- FIGURE 24 POWER DISTRIBUTION UNIT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.4.1 DRIVERS

- 5.4.1.1 Rising concerns over power stability for uninterrupted business operations

- 5.4.1.2 Increasing number of data centers

- FIGURE 25 INCREASE IN NUMBER OF GLOBAL INTERNET USERS, 2005-2021

- 5.4.1.3 Rising power distribution unit installations for reducing energy losses

- 5.4.2 RESTRAINTS

- 5.4.2.1 Space constraints in old data centers leading to heating up of spaces

- TABLE 2 THERMAL GUIDELINES FOR DATA CENTERS

- 5.4.2.2 Complex wiring systems with increasing number of power distribution units

- 5.4.3 OPPORTUNITIES

- 5.4.3.1 Containerized power solutions for edge data centers

- TABLE 3 CONVENTIONAL DATA CENTERS VS. EDGE DATA CENTERS

- 5.4.3.2 Strong growth from enterprises' shift toward cloud applications

- FIGURE 26 ENTERPRISE SPENDING ON CLOUD AND DATA CENTERS FROM 2009 TO 2020

- 5.4.4 CHALLENGES

- 5.4.4.1 Integration of old power distribution units with data management software platform

- 5.5 COVID-19 IMPACT

- 5.6 MARKET MAP

- FIGURE 27 MARKET MAP: POWER DISTRIBUTION UNIT MARKET

- TABLE 4 POWER DISTRIBUTION UNIT MARKET: ROLE IN ECOSYSTEM

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 28 VALUE CHAIN ANALYSIS: POWER DISTRIBUTION UNIT MARKET

- 5.7.1 COMPONENT MANUFACTURERS

- 5.7.2 POWER DISTRIBUTION UNIT MANUFACTURERS/ASSEMBLERS

- 5.7.3 DISTRIBUTORS (BUYERS)

- 5.7.4 END USERS

6 POWER DISTRIBUTION UNIT MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 29 POWER DISTRIBUTION UNIT MARKET, BY TYPE, 2021 (%)

- TABLE 5 POWER DISTRIBUTION UNIT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 6.2 BASIC

- 6.2.1 COST-EFFECTIVE POWER DISTRIBUTION SOLUTIONS FROM SMALL BUSINESS SECTORS INFLUENCE GROWTH OF BASIC PDUS

- TABLE 6 BASIC PDU: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 METERED

- 6.3.1 REAL-TIME POWER CONSUMPTION DATA AT COMPARATIVELY LOW COST DRIVE METERED POWER DISTRIBUTION UNIT MARKET

- TABLE 7 METERED PDU: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.4 SWITCHED

- 6.4.1 INCREASED CLOUD-BASED OPERATIONS CREATE DEMAND FOR SWITCHED POWER DISTRIBUTION UNITS

- TABLE 8 SWITCHED PDU: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.5 MONITORED

- 6.5.1 INTELLIGENT POWER MANAGEMENT CAPABILITIES OF MONITORED PDUS ARE BOOSTING DEMAND FOR THESE PDUS

- TABLE 9 MONITORED PDU: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.6 AUTOMATIC TRANSFER SWITCH

- 6.6.1 GROWING DEMAND FOR UPS FOR SMOOTH BUSINESS OPERATIONS DRIVES AUTOMATIC TRANSFER SWITCH MARKET

- TABLE 10 AUTOMATIC TRANSFER SWITCH PDU: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

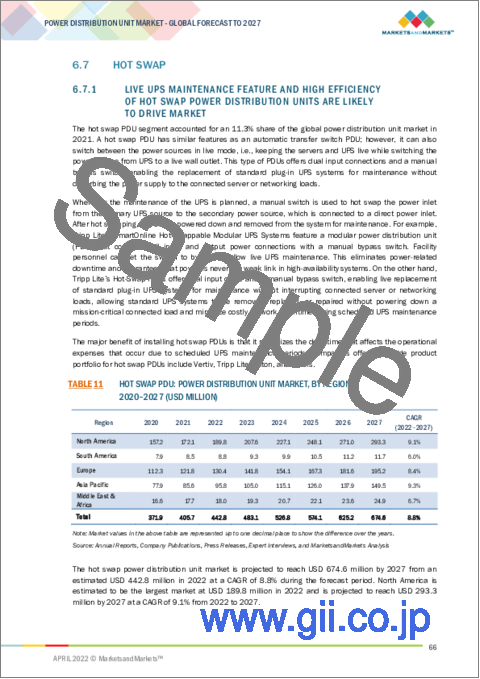

- 6.7 HOT SWAP

- 6.7.1 LIVE UPS MAINTENANCE FEATURE AND HIGH EFFICIENCY OF HOT SWAP POWER DISTRIBUTION UNITS ARE LIKELY TO DRIVE MARKET

- TABLE 11 HOT SWAP PDU: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.8 DUAL CIRCUIT

- 6.8.1 EFFICIENT AND MANAGEABLE POWER DISTRIBUTION SOLUTIONS FOR MULTIPLE SERVERS THROUGH DUAL CIRCUIT PDUS

- TABLE 12 DUAL CIRCUIT PDU: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

7 POWER DISTRIBUTION UNIT MARKET, BY PHASE

- 7.1 INTRODUCTION

- FIGURE 30 POWER DISTRIBUTION UNIT MARKET, BY PHASE, 2021

- TABLE 13 POWER DISTRIBUTION UNIT MARKET SIZE, BY PHASE, 2020-2027 (USD MILLION)

- 7.2 SINGLE PHASE

- 7.2.1 RESIDENTIAL SECTOR TO DRIVE MARKET FOR SINGLE-PHASE POWER DISTRIBUTION UNITS

- TABLE 14 SINGLE PHASE: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3 THREE PHASE

- 7.3.1 RAPID INCREASE IN ELECTRICAL LOADS IS DRIVING GROWTH OF THREE-PHASE POWER DISTRIBUTION UNITS

- TABLE 15 THREE PHASE: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

8 POWER DISTRIBUTION UNIT MARKET, BY POWER RATING

- 8.1 INTRODUCTION

- FIGURE 31 POWER DISTRIBUTION UNIT MARKET, BY POWER RATING, 2021 (%)

- TABLE 16 POWER DISTRIBUTION UNIT MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 8.2 UP TO 120 V

- 8.2.1 HIGH DEMAND FOR SINGLE-PHASE 120 V POWER DISTRIBUTION UNITS WOULD FOSTER MARKET GROWTH

- TABLE 17 UP TO 120 V: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.3 120-240 V

- 8.3.1 RISING FOCUS ON PREVENTING ACCIDENTAL OVERLOADS IS DRIVING DEMAND FOR 120-240 V POWER DISTRIBUTION UNITS

- TABLE 18 120-240 V: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.4 240-400 V

- 8.4.1 WIDE USE IN HIGH-DENSITY NETWORK CLOSETS TO PROPEL GROWTH OF 240-400 V POWER DISTRIBUTION UNITS

- TABLE 19 240-400 V: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.5 ABOVE 400 V

- 8.5.1 DEVELOPMENT OF HYPERSCALE DATA CENTERS CREATES OPPORTUNITIES FOR 400 V POWER DISTRIBUTION UNITS

- TABLE 20 ABOVE 400 V: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

9 POWER DISTRIBUTION UNIT MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 32 POWER DISTRIBUTION UNIT MARKET, BY END USER, 2021 (%)

- TABLE 21 POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2 TELECOM & IT

- 9.2.1 INCREASING NUMBER OF DATA CENTERS ARE DRIVING TELECOM & IT SECTOR

- TABLE 22 TELECOM & IT: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.3 BFSI

- 9.3.1 TECHNOLOGICAL DEVELOPMENTS AND ADOPTION OF DIGITAL TECHNOLOGY ARE DRIVING MARKET IN BFSI SECTOR

- TABLE 23 BFSI: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.4 HEALTHCARE

- 9.4.1 REQUIREMENT FOR CONTINUOUS POWER SUPPLY IN HEALTHCARE INDUSTRY IS DRIVING MARKET

- TABLE 24 HEALTHCARE: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.5 MANUFACTURING & PROCESSING INDUSTRIES

- 9.5.1 DATA CENTER CONSOLIDATION WITH INDUSTRIAL OPERATIONS IS LIKELY TO DRIVE MARKET IN MANUFACTURING & PROCESSING INDUSTRIES

- TABLE 25 MANUFACTURING & PROCESSING INDUSTRIES: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.6 AUTOMOTIVE

- 9.6.1 ADOPTION OF CLOUD PLATFORMS IN AUTOMOTIVE SECTOR DRIVES POWER DISTRIBUTION UNIT MARKET

- TABLE 26 AUTOMOTIVE: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.7 GOVERNMENT & DEFENSE

- 9.7.1 NEED FOR POWER DISTRIBUTION UNITS IN HARSH AND CRITICAL OPERATIONAL ENVIRONMENTS IS DRIVING MARKET

- TABLE 27 GOVERNMENT & DEFENSE: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.8 ENERGY

- 9.8.1 DEMAND FOR CLOUD-BASED APPLICATIONS FROM ENERGY INDUSTRY IS BOOSTING POWER DISTRIBUTION UNIT MARKET

- TABLE 28 ENERGY: POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

10 GEOGRAPHIC ANALYSIS

- 10.1 INTRODUCTION

- FIGURE 33 POWER DISTRIBUTION UNIT MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 34 POWER DISTRIBUTION UNIT MARKET SHARE FOR EACH REGION, 2021 (%)

- TABLE 29 POWER DISTRIBUTION UNIT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.2 ASIA PACIFIC

- 10.2.1 COVID-19 IMPACT

- FIGURE 35 SNAPSHOT: POWER DISTRIBUTION UNIT MARKET IN ASIA PACIFIC, 2021

- 10.2.2 BY TYPE

- TABLE 30 ASIA PACIFIC: POWER DISTRIBUTION UNIT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.2.3 BY PHASE

- TABLE 31 ASIA PACIFIC: POWER DISTRIBUTION UNIT MARKET, BY PHASE, 2020-2027 (USD MILLION)

- 10.2.4 BY POWER RATING

- TABLE 32 ASIA PACIFIC: POWER DISTRIBUTION UNIT MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 10.2.5 BY END USER

- TABLE 33 ASIA PACIFIC: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.6 BY COUNTRY

- TABLE 34 ASIA PACIFIC: POWER DISTRIBUTION UNIT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.2.7 CHINA

- 10.2.7.1 Investments in Big Data centers to drive the China-based power distribution unit market

- TABLE 35 CHINA: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.8 INDIA

- 10.2.8.1 Increasing investments in data centers by IT companies fueling growth of market

- TABLE 36 INDIA: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.9 AUSTRALIA

- 10.2.9.1 Automation in automotive industries driving demand for power distribution units in Australia

- TABLE 37 AUSTRALIA: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.10 JAPAN

- 10.2.10.1 Significant impact of iot across end-user industries likely to bring opportunities

- TABLE 38 JAPAN: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.11 REST OF ASIA PACIFIC

- TABLE 39 REST OF ASIA PACIFIC: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3 NORTH AMERICA

- 10.3.1 COVID 19 IMPACT

- FIGURE 36 SNAPSHOT: POWER DISTRIBUTION UNIT MARKET IN NORTH AMERICA, 2021

- 10.3.2 BY TYPE

- TABLE 40 NORTH AMERICA: POWER DISTRIBUTION UNIT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.3.3 BY PHASE

- TABLE 41 NORTH AMERICA: POWER DISTRIBUTION UNIT MARKET, BY PHASE, 2020-2027 (USD MILLION)

- 10.3.4 BY POWER RATING

- TABLE 42 NORTH AMERICA: POWER DISTRIBUTION UNIT MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 10.3.5 BY END USER

- TABLE 43 NORTH AMERICA: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.6 BY COUNTRY

- TABLE 44 NORTH AMERICA: POWER DISTRIBUTION UNIT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.3.6.1 US

- 10.3.6.1.1 Increasing applications of power distribution units in various industries for power solutions

- 10.3.6.1 US

- TABLE 45 US: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.6.2 Canada

- 10.3.6.2.1 Optimum utilization of power components in industries likely to boost canadian market

- 10.3.6.2 Canada

- TABLE 46 CANADA: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.6.3 Mexico

- 10.3.6.3.1 Emerging automotive sector to attract opportunities in Mexico

- 10.3.6.3 Mexico

- TABLE 47 MEXICO: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4 EUROPE

- 10.4.1 COVID 19 IMPACT

- 10.4.2 BY TYPE

- TABLE 48 EUROPE: POWER DISTRIBUTION UNIT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.4.3 BY PHASE

- TABLE 49 EUROPE: POWER DISTRIBUTION UNIT MARKET, BY PHASE, 2020-2027 (USD MILLION)

- 10.4.4 BY POWER RATING

- TABLE 50 EUROPE: POWER DISTRIBUTION UNIT MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 10.4.5 BY END USER

- TABLE 51 EUROPE: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.6 BY COUNTRY

- TABLE 52 EUROPE: POWER DISTRIBUTION UNIT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.4.6.1 UK

- 10.4.6.1.1 Expansion of data center networks by major players to bring opportunities

- 10.4.6.1 UK

- TABLE 53 UK: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.6.2 France

- 10.4.6.2.1 Expansion of cloud based services likely to boost french market

- 10.4.6.2 France

- TABLE 54 FRANCE: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.6.3 Germany

- 10.4.6.3.1 Rising concerns about reducing energy consumption from German data centers are driving market

- 10.4.6.3 Germany

- TABLE 55 GERMANY: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.6.4 Rest of Europe

- TABLE 56 REST OF EUROPE: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5 SOUTH AMERICA

- 10.5.1 COVID 19 IMPACT

- 10.5.2 BY TYPE

- TABLE 57 SOUTH AMERICA: POWER DISTRIBUTION UNIT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.5.3 BY PHASE

- TABLE 58 SOUTH AMERICA: POWER DISTRIBUTION UNIT MARKET, BY PHASE, 2020-2027 (USD MILLION)

- 10.5.4 BY POWER RATING

- TABLE 59 SOUTH AMERICA: POWER DISTRIBUTION UNIT MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 10.5.5 BY END USER

- TABLE 60 SOUTH AMERICA: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5.6 BY COUNTRY

- TABLE 61 SOUTH AMERICA: POWER DISTRIBUTION UNIT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.5.6.1 Brazil

- 10.5.6.1.1 Large investment in power grid infrastructure to boost market growth

- 10.5.6.1 Brazil

- TABLE 62 BRAZIL: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5.6.2 Rest of South America

- TABLE 63 REST OF SOUTH AMERICA: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 COVID 19 IMPACT

- 10.6.2 BY TYPE

- TABLE 64 MIDDLE EAST & AFRICA: POWER DISTRIBUTION UNIT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 10.6.3 BY PHASE

- TABLE 65 MIDDLE EAST & AFRICA: POWER DISTRIBUTION UNIT MARKET, BY PHASE, 2020-2027 (USD MILLION)

- 10.6.4 BY POWER RATING

- TABLE 66 MIDDLE EAST & AFRICA: POWER DISTRIBUTION UNIT MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 10.6.5 BY END USER

- TABLE 67 MIDDLE EAST & AFRICA: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.6.6 BY COUNTRY

- TABLE 68 MIDDLE EAST & AFRICA: POWER DISTRIBUTION UNIT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.6.6.1 Saudi Arabia

- 10.6.6.1.1 Rising demand for adopting cloud-based technologies is driving demand for power distribution units

- 10.6.6.1 Saudi Arabia

- TABLE 69 SAUDI ARABIA: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.6.6.2 Turkey

- 10.6.6.2.1 Increasing number of colocation data centers is driving Turkish market

- 10.6.6.2 Turkey

- TABLE 70 TURKEY: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.6.6.3 South Africa

- 10.6.6.3.1 Need for storage facility for electronic data generated from various end users to drive demand

- 10.6.6.3 South Africa

- TABLE 71 SOUTH AFRICA: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.6.6.4 Rest of Middle East & Africa

- TABLE 72 REST OF MIDDLE EAST & AFRICA: POWER DISTRIBUTION UNIT MARKET, BY END USER, 2020-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 KEY PLAYERS STRATEGIES

- TABLE 73 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, AUGUST 2017- SEPTEMBER 2022

- 11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- TABLE 74 POWER DISTRIBUTION UNIT MARKET: DEGREE OF COMPETITION

- FIGURE 37 POWER DISTRIBUTION UNIT MARKET SHARE ANALYSIS, 2021

- 11.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- FIGURE 38 TOP PLAYERS IN POWER DISTRIBUTION MARKET FROM 2017 TO 2021

- 11.4 COMPANY EVALUATION QUADRANT

- 11.4.1 STAR

- 11.4.2 PERVASIVE

- 11.4.3 EMERGING LEADER

- 11.4.4 PARTICIPANT

- FIGURE 39 COMPETITIVE LEADERSHIP MAPPING: POWER DISTRIBUTION UNIT MARKET, 2021

- 11.5 POWER DISTRIBUTION UNIT MARKET: COMPANY FOOTPRINT

- TABLE 75 COMPANY FOOTPRINT: BY TYPE

- TABLE 76 COMPANY FOOTPRINT: BY PHASE

- TABLE 77 COMPANY FOOTPRINT: BY END USER

- TABLE 78 COMPANY FOOTPRINT: BY POWER RATING

- TABLE 79 BY REGION: COMPANY FOOTPRINT

- TABLE 80 OVERALL COMPANY FOOTPRINT

- 11.6 COMPETITIVE SCENARIO

- TABLE 81 POWER DISTRIBUTION MARKET: PRODUCT LAUNCHES, AUGUST 2017- MARCH 2022

- TABLE 82 POWER DISTRIBUTION MARKET: DEALS, JANUARY 2020- APRIL 2022

- TABLE 83 POWER DISTRIBUTION MARKET: OTHERS, SEPTEMBER 2021- APRIL 2022

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products, Recent Developments, MnM View)**

- 12.1.1 SCHNEIDER ELECTRIC

- TABLE 84 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- FIGURE 40 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT (2021)

- TABLE 85 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

- TABLE 86 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 87 SCHNEIDER ELECTRIC: EXPANSIONS

- 12.1.2 LEGRAND

- TABLE 88 LEGRAND: BUSINESS OVERVIEW

- FIGURE 41 LEGRAND: COMPANY SNAPSHOT (2021)

- TABLE 89 LEGRAND: PRODUCTS OFFERED

- 12.1.3 EATON

- TABLE 90 EATON: BUSINESS OVERVIEW

- FIGURE 42 EATON: COMPANY SNAPSHOT (2021)

- TABLE 91 EATON: PRODUCTS OFFERED

- TABLE 92 EATON: PRODUCT LAUNCHES

- TABLE 93 EATON: DEALS

- 12.1.4 CISCO SYSTEMS

- TABLE 94 CISCO SYSTEMS: BUSINESS OVERVIEW

- FIGURE 43 CISCO SYSTEMS: COMPANY SNAPSHOT (2021)

- TABLE 95 CISCO SYSTEMS: PRODUCTS OFFERED

- TABLE 96 CISCO SYSTEMS: PRODUCT LAUNCHES

- TABLE 97 CISCO SYSTEMS: DEALS

- 12.1.5 ABB

- TABLE 98 ABB: BUSINESS OVERVIEW

- FIGURE 44 ABB: COMPANY SNAPSHOT (2021)

- TABLE 99 ABB: PRODUCTS OFFERED

- 12.1.6 VERTIV

- TABLE 100 VERTIV: BUSINESS OVERVIEW

- TABLE 101 VERTIV: PRODUCTS OFFERED

- 12.1.7 NVENT

- TABLE 102 NVENT: BUSINESS OVERVIEW

- FIGURE 45 NVENT: COMPANY SNAPSHOT (2021)

- TABLE 103 NVENT: PRODUCTS OFFERED

- TABLE 104 NVENT: PRODUCT LAUNCHES

- TABLE 105 NVENT: DEALS

- TABLE 106 NVENT: EXPANSIONS

- 12.1.8 PANDUIT

- TABLE 107 PANDUIT: BUSINESS OVERVIEW

- TABLE 108 PANDUIT: PRODUCTS OFFERED

- TABLE 109 PANDUIT: PRODUCT LAUNCHES

- TABLE 110 PANDUIT: DEALS

- 12.1.9 ATEN

- TABLE 111 ATEN: BUSINESS OVERVIEW

- FIGURE 46 ATEN: COMPANY SNAPSHOT (2020)

- TABLE 112 ATEN: PRODUCTS OFFERED

- TABLE 113 ATEN: PRODUCT LAUNCHES

- TABLE 114 ATEN: DEALS

- 12.1.10 DELTA ELECTRONICS

- TABLE 115 DELTA ELECTRONICS: COMPANY OVERVIEW

- FIGURE 47 DELTA ELECTRONICS: COMPANY SNAPSHOT (2020)

- TABLE 116 DELTA ELECTRONICS: PRODUCTS OFFERED

- TABLE 117 DELTA ELECTRONICS: DEALS

- 12.1.11 HEWLETT PACKARD ENTERPRISE

- TABLE 118 HEWLETT PACKARD ENTERPRISE: COMPANY OVERVIEW

- FIGURE 48 HEWLETT PACKARD ENTERPRISE: COMPANY SNAPSHOT (2021)

- TABLE 119 HEWLETT PACKARD ENTERPRISE: PRODUCTS OFFERED

- TABLE 120 HEWLETT PACKARD ENTERPRISE: PRODUCT LAUNCHES

- TABLE 121 HEWLETT PACKARD ENTERPRISE: DEALS

- TABLE 122 HEWLETT PACKARD ENTERPRISE: EXPANSIONS

- 12.1.12 SOCOMEC

- TABLE 123 SOCOMEC: COMPANY OVERVIEW

- TABLE 124 SOCOMEC: PRODUCTS OFFERED

- *Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 AVAILABLE CUSTOMIZATIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS