|

|

市場調査レポート

商品コード

1128614

植物抽出エキスの世界市場:タイプ別(オレオレジン、エッセンシャルオイル、フラボノイド、アルカロイド、カロテノイド)、用途別(食品・飲料、化粧品、医薬品、栄養補助食品)、形態別、由来別、地域別 - 2027年までの予測Plant Extracts Market by Product Type (Oleoresins, Essential Oils, Flavonoids, Alkaloids, Carotenoids), Application (Food & Beverages, Cosmetics, Pharmaceuticals, Dietary Supplements), Form, Source and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 植物抽出エキスの世界市場:タイプ別(オレオレジン、エッセンシャルオイル、フラボノイド、アルカロイド、カロテノイド)、用途別(食品・飲料、化粧品、医薬品、栄養補助食品)、形態別、由来別、地域別 - 2027年までの予測 |

|

出版日: 2022年09月20日

発行: MarketsandMarkets

ページ情報: 英文 342 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の植物抽出物の市場規模は、2022年に344億米ドルと推定され、2027年までに615億米ドルに達し、金額ベースのCAGRで12.3%の成長が予測されています。

植物抽出物は、果物・野菜、ハーブ・スパイス、花など、さまざまなものから生産されています。

植物抽出物は、食品・飲料、化粧品、製薬産業など、数多くの用途で使用されています。植物抽出物は、消費者のライフスタイルの変化や天然・有機製品への嗜好の変化により、需要が増加しています。消費者は、植物抽出物に関連する健康上の利点についてますます認識するようになっており、メーカーがこれらの植物抽出物をさまざまな用途に組み込むための機会が増えています。

"用途別では、植物由来の医薬品の利用が増加し、植物抽出物市場の成長を牽引"

植物抽出物は、様々な創薬プログラムにおいて生物活性化合物の重要な供給源として機能しており、いくつかの重要な薬物が植物から単離され、同定されています。薬用植物は、伝統的な医療で直接使用される以外にも、全抽出物やチンキ剤、精製抽出物、化学製品を生産するために工業規模で使用されています。

"由来別では、化粧品産業やフレグランスにおける花抽出物の使用増加が植物抽出物市場の成長を牽引"

花からの抽出物は、食品・飲料から医薬品・栄養補助食品に至るまで、いくつかの用途で使用されています。食品・飲料用途では、花や果実は一般的に風味や香りを提供するために使用されます。

"予測期間中、北米地域が最も高いCAGRで成長すると予測"

北米地域は、植物抽出物の消費量が最も多いため、世界市場で重要な役割を果たすと予想されています。この地域は、エッセンシャルオイル、オレオレジン、フラボノイドの継続的な受け入れのために、様々な種類の植物抽出物の主要な輸入国の1つです。オレオレジンやエッセンシャルオイルは、風味、色、または天然の抗酸化剤などの天然スパイス属性を加えるために、米国のほぼすべての食品用途で使用されているためです。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- バリューチェーン

- サプライチェーン分析

- 植物抽出物の市場マップとエコシステム

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- 価格分析

- 植物抽出物市場:特許分析

- 貿易分析:植物抽出物市場

- ケーススタディ:植物抽出物市場

- 主な会議とイベント

- 関税と規制情勢

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

第7章 植物抽出物市場:タイプ別

- イントロダクション

- オレオレジン

- エッセンシャルオイル

- フラボノイド

- アルカロイド

- カロテノイド

- その他

第8章 植物抽出物市場:用途別

- イントロダクション

- 医薬品

- 栄養補助食品

- 食品・飲料

- 化粧品

- その他

第9章 植物抽出物市場:由来別

- イントロダクション

- 果物・野菜

- 花

- ハーブ・スパイス

第10章 植物抽出物市場:形態別

- イントロダクション

- 乾燥

- 液体

第11章 植物抽出物市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- ポーランド

- その他

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- シンガポール

- その他

- その他の地域

- 南米

- アフリカ

- 中東

第12章 競合情勢

- 概要

- 市場シェア分析

- 主要企業のセグメント収益分析

- 主要企業の戦略

- 企業の評価象限(主要企業)

- 植物抽出物市場:スタートアップ/中小企業の評価象限

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- SYMRISE

- SENSIENT TECHNOLOGIES CORPORATION

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- GIVAUDAN

- ADM

- CARGILL, INCORPORATED

- DSM

- KERRY GROUP PLC

- DOHLER

- CARBERY GROUP

- SYNTHITE INDUSTRIES LTD

- INDESSO

- VIDYA HERBS

- KALSEC INC.

- MARTINBAUER

- KANGCARE BIOINDUSTRY CO. LTD.

- その他の企業(中小企業/スタートアップ)

- NATIVE EXTRACTS PTY LTD

- ARJUNA NATURAL

- BLUE SKY BOTANICS

- TOKIWA PHYTOCHEMICAL CO., LTD.

- SHAANXI JIAHE PHYTOCHEM CO., LTD(JIAHERB, INC.)

- ALCHEMY CHEMICALS

- PRINOVA GROUP LLC

- VITAL HERBS

- SYDLER INDIA PVT. LTD.

- PLANTNAT

第14章 隣接/関連市場

第15章 付録

According to MarketsandMarkets, the global plant extracts market size is estimated to be valued at USD 34.4 billion in 2022 and is projected to reach USD 61.5 billion by 2027, recording a CAGR of 12.3% in terms of value. Plant extracts are produced from various sources, such as fruits and vegetables, herbs and spices, and flowers.

They are used in numerous applications for the food, beverage, cosmetics, and pharmaceutical industries. Plant extracts has been experiencing increased demand due to changes in the lifestyle of consumers and their preferences for natural and organic products. Consumers are increasingly aware of the health benefits associated with the plant extracts, which provides an increasing opportunity for manufacturers for incorporating these plant extracts in various applications. These markets seem to develop and formulate new products and technologies using plant ingredients, resulting innovation, and implementing groundbreaking products with an array of applications. These ingredients are also used in cosmetics and skincare preparation, and this market is booming due to increased awareness related to maintaining healthy skin. The other factors, such as healthy aging and the threat of antimicrobial resistance, also contribute to this significantly. Likewise, within the food & beverages industry, there is a growing trend of consuming natural ingredients with additional functional properties, which has been boosting the demand for plant extracts

"By application, there is increased use of plant-based medicines, driving the growth of plant extracts market"

Plant extracts have served as an important source of bioactive compounds for various drug discovery programs, and several important drugs have been isolated and identified from plants. Beyond their direct use in traditional medicine, medicinal plants are used on an industrial scale to produce total extracts and tinctures, purified extracts, and chemical products. Regulatory approval of some of the more widely known medicinal herb extracts has potentially been made easier than that of new chemical entities. Some Phyto pharm chemical companies are focusing their efforts on single molecules or plant extracts with the aim of simplifying the regulatory process by avoiding complex mixtures and combinations.

"By source, increase in use of flower extracts in cosmetics industry and fragrance drives the growth of plant extract market"

Extracts from flowers are used in several applications, ranging from food & beverages to pharmaceuticals & dietary supplements. In the food & beverages application, flowers and fruits are generally used to provide flavors and aroma. Essential Oils from flowers, when incorporated into finished products impart various benefits, such as a pleasant aroma in perfumery, shine or conditioning effects in hair care products, and improving the elasticity of the skin. Significantly high application potential of flower extracts is also used in fragrances. Extracts from some other flowers such as Hibiscus, Chamomile, Magnolia, and Echinacea are highly used in Pharmaceuticals and dietary supplement applications due to the various therapeutic effects they offer.

"The North America region is projected to grow at the highest CAGR during the forecast period"

The North America region has highest consumption of plant extracts and hence is expected to play an important role in the global market. The region is one of the major importers of various types of plant extracts due to the continued acceptance of essential oils, oleoresins, flavonoids, since oleoresins and essential oils are used in almost every food application in US to add natural spice attributes such as flavor, color, or as a natural antioxidant. Antibiotic- and hormone-free ingredients, local and organic consumer goods are expected to gain market share as consumers seek these green and ethical attributes in their dietary supplements, cosmetics, and food & beverage products to fit the new lifestyle trend. These trends are further projected to attract investments from plant extract-based product manufacturers across the globe, driving the plant extracts market.

Break-up of Primaries:

- By Value Chain Side: Demand Side-41%, Supply Side-59%

- By Designation: CXOs-31%, Managers - 24%, D-Level- 30%, and Executives- 45%

- By Region: Europe - 25%, Asia Pacific - 15%, North America - 45%, RoW - 5%, South America-10%

Leading players profiled in this report:

- International Flavors & Fragrances Inc. (US)

- Givaudan (Switzerland)

- Symrise (Germany)

- Kerry Group Plc (Ireland)

- ADM (US)

- Synthite Industries Ltd (India)

- Kalsec Inc. (US)

- Kangcare bioindustry co. ltd. (China)

- Carbery Group (Ireland)

- DSM (Netherlands)

- Dohler (Germany)

- Synthite Industries Ltd (India)

- Indesso (Indonesia)

- Vidya Herbs (India)

Research Coverage:

The report segments the plant extracts market on the basis on product type, application, form, source, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global plant extracts, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the plant extracts market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the plant extracts market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017-2021

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PLANT EXTRACTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 PLANT EXTRACTS MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

- FIGURE 5 PLANT EXTRACTS MARKET SIZE ESTIMATION (DEMAND-SIDE)

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 PLANT EXTRACTS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 PLANT EXTRACTS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 2 PLANT EXTRACTS MARKET SHARE SNAPSHOT, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 PLANT EXTRACTS MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 PLANT EXTRACTS MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 PLANT EXTRACTS MARKET SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 PLANT EXTRACTS MARKET SHARE AND GROWTH RATE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PLANT EXTRACTS MARKET

- FIGURE 13 GROWING DEMAND FOR NATURAL AND PLANT-BASED INGREDIENTS

- 4.2 PLANT EXTRACTS MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 14 ASIA PACIFIC WAS LARGEST MARKET GLOBALLY IN 2021

- 4.3 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY SOURCE & COUNTRY

- FIGURE 15 CHINA TO DOMINATE ASIA PACIFIC MARKET IN 2021

- 4.4 PLANT EXTRACTS MARKET, BY FORM

- FIGURE 16 DRY SEGMENT TO DOMINATE PLANT EXTRACTS MARKET

- 4.5 PLANT EXTRACTS MARKET, BY APPLICATION

- 4.6 PLANT EXTRACTS MARKET, BY SOURCE

- 4.7 PLANT EXTRACTS MARKET, BY TYPE & REGION

- FIGURE 19 ASIA PACIFIC TO DOMINATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 EXPORT OF SPICES

- FIGURE 20 INDIA: EXPORT DATA OF SPICE OILS & OLEORESINS, 2018-2021

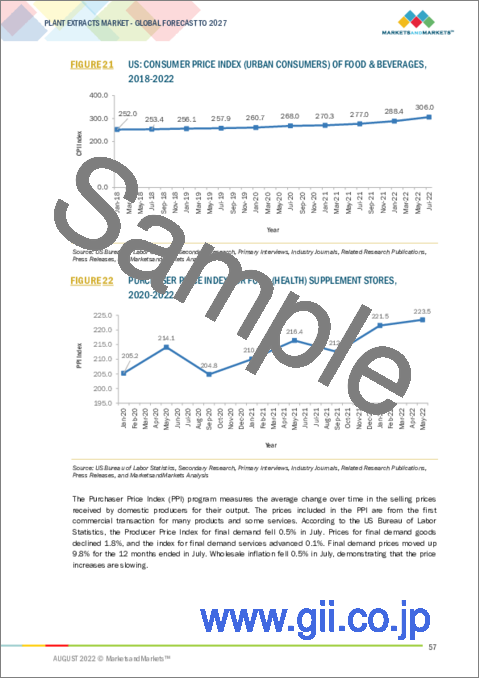

- 5.2.2 CONSUMER PRICE INDEX

- FIGURE 21 US: CONSUMER PRICE INDEX (URBAN CONSUMERS) OF FOOD & BEVERAGES, 2018-2022

- FIGURE 22 PURCHASER PRICE INDEX FOR FOOD (HEALTH) SUPPLEMENT STORES, 2020-2022

- 5.2.3 ORGANIC FOOD DEMAND

- 5.3 MARKET DYNAMICS

- FIGURE 23 PLANT EXTRACTS MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Demand for essential oils from cosmetics industry

- 5.3.1.2 Increasing demand for natural ingredients and clean label products

- 5.3.1.3 Growing market for nutraceuticals and herbal supplements

- FIGURE 24 GROWING DEMAND FOR BOTANICAL DIETARY SUPPLEMENTS

- 5.3.1.4 Adverse side-effects of synthetic flavors

- FIGURE 25 INCREASING DEMAND FOR NATURAL FLAVORS & FRAGRANCES

- 5.3.2 RESTRAINTS

- 5.3.2.1 Lack of standardization and varying regulations and quality standards

- 5.3.2.2 Price fluctuations and inadequate supply of raw materials

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Technological intervention in production processes

- 5.3.3.2 Growing trend of veganism among consumers

- 5.3.3.3 Government initiatives to promote natural ingredients

- 5.3.4 CHALLENGES

- 5.3.4.1 Lack of downstream processing facilities and resultant microbial contamination

- 5.3.4.2 Adulteration and cost margins for natural additives compared to synthetic counterparts

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN

- 6.2.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.2.2 RAW MATERIAL SOURCING

- 6.2.3 MANUFACTURING

- 6.2.4 PACKAGING, STORAGE, AND DISTRIBUTION

- 6.2.5 END USERS

- FIGURE 26 PLANT EXTRACTS MARKET: VALUE CHAIN

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 27 PLANT EXTRACTS MARKET: SUPPLY CHAIN

- 6.4 MARKET MAP AND ECOSYSTEM OF PLANT EXTRACTS

- 6.4.1 DEMAND SIDE

- 6.4.2 SUPPLY SIDE

- FIGURE 28 PLANT EXTRACTS MARKET: ECOSYSTEM MAP

- 6.4.3 ECOSYSTEM MAP

- TABLE 3 PLANT EXTRACTS MARKET: ECOSYSTEM

- 6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN PLANT EXTRACTS MARKET

- FIGURE 29 REVENUE SHIFT IMPACTING PLANT EXTRACTS MARKET

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 GREEN TECHNOLOGIES

- 6.6.2 DRYING TECHNOLOGY

- 6.6.3 CELLULAR EXTRACTION

- 6.7 PRICING ANALYSIS

- 6.7.1 SELLING PRICE CHARGED BY KEY PLAYERS IN TERMS OF PRODUCT SOURCE

- FIGURE 30 SELLING PRICE OF KEY PLAYERS FOR PLANT EXTRACTS' PRODUCT SOURCE

- TABLE 4 SELLING PRICE OF KEY PLAYERS FOR PRODUCT FORM (USD/KG)

- FIGURE 31 AVERAGE SELLING PRICE IN KEY REGIONS, BY PRODUCT TYPE, 2017-2021 (USD/KG)

- TABLE 5 OLEORESINS: AVERAGE SELLING PRICE, BY REGION, 2017-2021 (USD/KG)

- TABLE 6 ESSENTIAL OILS: AVERAGE SELLING PRICE, BY REGION, 2017-2021 (USD/KG)

- TABLE 7 FLAVONOIDS: AVERAGE SELLING PRICE, BY REGION, 2017-2021 (USD/KG)

- TABLE 8 ALKALOIDS: AVERAGE SELLING PRICE, BY REGION, 2017-2021 (USD/KG)

- TABLE 9 CAROTENOIDS: AVERAGE SELLING PRICE, BY REGION, 2017-2021 (USD/KG)

- TABLE 10 OTHER PRODUCT TYPES: AVERAGE SELLING PRICE, BY REGION, 2017-2021 (USD/KG)

- 6.8 PLANT EXTRACTS MARKET: PATENT ANALYSIS

- FIGURE 32 NUMBER OF PATENTS GRANTED FOR PLANT EXTRACTS, 2011-2021

- FIGURE 33 TOP PATENT APPLICANTS FOR PLANT EXTRACTS, 2019-2022

- FIGURE 34 REGIONAL ANALYSIS OF PATENTS GRANTED FOR PLANT EXTRACTS, 2019-2022

- 6.8.1 LIST OF MAJOR PATENTS

- TABLE 11 LIST OF FEW PATENTS IN PLANT EXTRACTS MARKET, 2019-2022

- 6.9 TRADE ANALYSIS: PLANT EXTRACTS MARKET

- 6.9.1 EXPORT SCENARIO OF VEGETABLE SAPS AND EXTRACTS

- FIGURE 35 VEGETABLE SAPS AND EXTRACTS EXPORTS, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 12 EXPORT DATA OF VEGETABLE SAPS AND EXTRACTS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

- 6.9.2 IMPORT SCENARIO OF VEGETABLE SAPS AND EXTRACTS

- FIGURE 36 VEGETABLE SAPS AND EXTRACTS IMPORTS, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 13 IMPORT DATA OF VEGETABLE SAPS AND EXTRACTS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

- 6.9.3 EXPORT SCENARIO OF EXTRACTS, ESSENCES, AND CONCENTRATES OF COFFEE, TEA, OR MATE

- FIGURE 37 EXPORTS: EXTRACTS, ESSENCES, AND CONCENTRATES OF COFFEE, TEA, OR MATE, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 14 EXPORT DATA OF EXTRACTS, ESSENCES, AND CONCENTRATES OF COFFEE, TEA, OR MATE FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

- 6.9.4 IMPORT SCENARIO OF EXTRACTS, ESSENCES, AND CONCENTRATES OF COFFEE, TEA, OR MATE

- FIGURE 38 IMPORTS: EXTRACTS, ESSENCES, AND CONCENTRATES OF COFFEE, TEA, OR MATE, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 15 IMPORT DATA OF EXTRACTS, ESSENCES, AND CONCENTRATES OF COFFEE, TEA, OR MATE FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

- 6.9.5 EXPORT SCENARIO: ESSENTIAL OILS FROM CITRUS FRUITS

- FIGURE 39 EXPORTS: ESSENTIAL OILS OF CITRUS FRUITS, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 16 EXPORT DATA OF ESSENTIAL OILS OF CITRUS FRUIT FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

- 6.9.6 IMPORT SCENARIO: ESSENTIAL OILS FROM CITRUS FRUITS

- FIGURE 40 IMPORTS: ESSENTIAL OILS OF CITRUS FRUITS, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 17 IMPORT DATA FOR ESSENTIAL OILS OF CITRUS FRUITS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

- 6.9.7 EXPORT SCENARIO: EXTRACTED OLEORESINS

- FIGURE 41 EXPORTS: EXTRACTED OLEORESINS, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 18 EXPORT DATA OF EXTRACTED OLEORESINS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

- 6.9.8 IMPORT SCENARIO: EXTRACTED OLEORESINS

- FIGURE 42 IMPORTS: EXTRACTED OLEORESINS, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 19 IMPORT DATA FOR EXTRACTED OLEORESINS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

- 6.10 CASE STUDIES: PLANT EXTRACTS MARKET

- 6.10.1 ARJUNA NATURAL: NATURAL SOLUTION FOR FRUIT JUICE PRESERVATION

- 6.10.2 SYMRISE: HALAL VANILLA

- 6.11 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 20 KEY CONFERENCES AND EVENTS IN PLANT EXTRACTS MARKET

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.2 REGULATORY FRAMEWORK

- 6.12.2.1 North America

- 6.12.2.1.1 United States

- 6.12.2.1.2 Canada

- 6.12.2.2 Europe

- 6.12.2.3 Asia Pacific

- 6.12.2.3.1 China

- 6.12.2.3.2 India

- 6.12.2.3.3 Australia

- 6.12.2.4 South America

- 6.12.2.4.1 Brazil

- 6.12.2.4.2 Argentina

- 6.12.2.1 North America

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 25 PLANT EXTRACTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 DEGREE OF COMPETITION

- 6.13.2 BARGAINING POWER OF SUPPLIERS

- 6.13.3 BARGAINING POWER OF BUYERS

- 6.13.4 THREAT OF SUBSTITUTES

- 6.13.5 THREAT OF NEW ENTRANTS

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 43 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP APPLICATIONS

- TABLE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP APPLICATIONS (%)

- 6.14.2 BUYING CRITERIA

- FIGURE 44 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 27 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

7 PLANT EXTRACTS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 45 PLANT EXTRACTS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 28 PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 29 PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 30 PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 31 PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 7.2 OLEORESINS

- 7.2.1 OLEORESINS PRESERVE ROBUST FLAVOR AND AROMA OF SPICES

- TABLE 32 OLEORESINS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 33 OLEORESINS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 34 OLEORESINS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 35 OLEORESINS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- 7.3 ESSENTIAL OILS

- 7.3.1 RISING TREND OF AROMATHERAPY IN DEVELOPING COUNTRIES

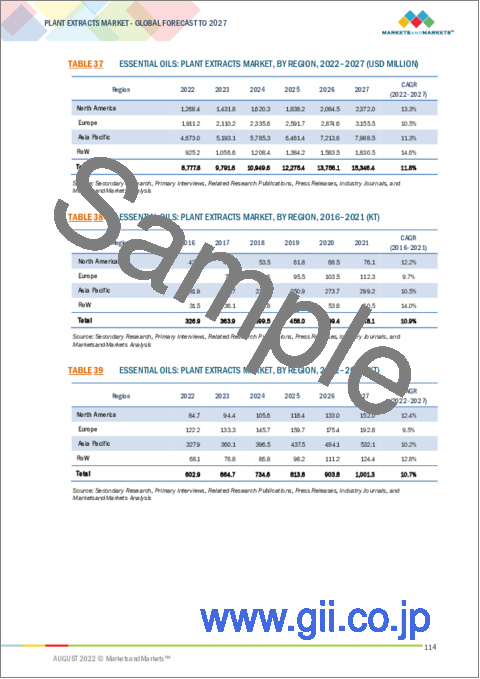

- TABLE 36 ESSENTIAL OILS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 37 ESSENTIAL OILS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 38 ESSENTIAL OILS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 39 ESSENTIAL OILS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- 7.4 FLAVONOIDS

- 7.4.1 ANTI-OXIDATIVE AND ANTI-INFLAMMATORY PROPERTIES

- TABLE 40 FLAVONOIDS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 41 FLAVONOIDS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 42 FLAVONOIDS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 43 FLAVONOIDS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- 7.5 ALKALOIDS

- 7.5.1 ANTI-CANCEROUS PROPERTIES

- TABLE 44 ALKALOIDS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 45 ALKALOIDS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 46 ALKALOIDS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 47 ALKALOIDS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- 7.6 CAROTENOIDS

- 7.6.1 INCREASING INCLINATION OF CONSUMERS TOWARD NATURAL PRODUCTS

- TABLE 48 CAROTENOIDS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 49 CAROTENOIDS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 50 CAROTENOIDS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 51 CAROTENOIDS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- 7.7 OTHER TYPES

- TABLE 52 OTHER TYPES: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 53 OTHER TYPES: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 54 OTHER TYPES: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 55 OTHER TYPES: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

8 PLANT EXTRACTS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 46 PLANT EXTRACTS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 56 PLANT EXTRACTS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 57 PLANT EXTRACTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 58 PLANT EXTRACTS MARKET, BY APPLICATION, 2016-2021 (KT)

- TABLE 59 PLANT EXTRACTS MARKET, BY APPLICATION, 2022-2027 (KT)

- 8.2 PHARMACEUTICALS

- 8.2.1 INCREASED DEMAND FOR PLANT-BASED MEDICINES

- TABLE 60 PHARMACEUTICALS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 61 PHARMACEUTICALS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 62 PHARMACEUTICALS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 63 PHARMACEUTICALS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- 8.3 DIETARY SUPPLEMENTS

- 8.3.1 BENEFITS SUCH AS BOOSTING IMMUNITY RELATED TO HERBAL SUPPLEMENTS

- TABLE 64 DIETARY SUPPLEMENTS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 65 DIETARY SUPPLEMENTS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 66 DIETARY SUPPLEMENTS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 67 DIETARY SUPPLEMENTS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- 8.4 FOOD & BEVERAGES

- 8.4.1 RISING VEGAN POPULATION DEMANDING PLANT-BASED FOODS

- TABLE 68 FOOD & BEVERAGES: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 69 FOOD & BEVERAGES: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 70 FOOD & BEVERAGES: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 71 FOOD & BEVERAGES: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- 8.5 COSMETICS

- 8.5.1 ANTIMICROBIAL AND ANTIOXIDANT PROPERTIES OF PLANT EXTRACTS LEADING TO ADOPTION OF HERBAL COSMETICS

- TABLE 72 COSMETICS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 73 COSMETICS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 74 COSMETICS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 75 COSMETICS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- 8.6 OTHER APPLICATIONS

- TABLE 76 OTHER APPLICATIONS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 77 OTHER APPLICATIONS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 78 OTHER APPLICATIONS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 79 OTHER APPLICATIONS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

9 PLANT EXTRACTS MARKET, BY SOURCE

- 9.1 INTRODUCTION

- FIGURE 47 PLANT EXTRACTS MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

- TABLE 80 PLANT EXTRACTS MARKET, BY SOURCE, 2016-2021 (USD MILLION)

- TABLE 81 PLANT EXTRACTS MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 82 PLANT EXTRACTS MARKET, BY SOURCE, 2016-2021 (KT)

- TABLE 83 PLANT EXTRACTS MARKET, BY SOURCE, 2022-2027 (KT)

- 9.2 FRUITS & VEGETABLES

- 9.2.1 INTRODUCTION OF NEWER TECHNOLOGIES

- TABLE 84 FRUITS & VEGETABLES: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 85 FRUITS & VEGETABLES: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 86 FRUITS & VEGETABLES: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 87 FRUITS & VEGETABLES: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- 9.3 FLOWERS

- 9.3.1 RISING USAGE OF FLOWER EXTRACTS FOR FRAGRANCES IN THE COSMETICS INDUSTRY

- TABLE 88 FLOWERS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 89 FLOWERS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 90 FLOWERS: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 91 FLOWERS: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- 9.4 HERBS & SPICES

- 9.4.1 BIOACTIVE FUNCTION OF HERBS & SPICES

- TABLE 92 SOURCES OF HERBS & SPICES

- TABLE 93 BIOACTIVE FUNCTIONS OF SPICES & HERBS

- TABLE 94 HERBS & SPICES: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 95 HERBS & SPICES: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 96 HERBS & SPICES: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 97 HERBS & SPICES: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

10 PLANT EXTRACTS MARKET, BY FORM

- 10.1 INTRODUCTION

- FIGURE 48 PLANT EXTRACTS MARKET (VALUE), BY FORM, 2022 VS. 2027

- TABLE 98 PLANT EXTRACTS MARKET, BY FORM, 2016-2021 (USD MILLION)

- TABLE 99 PLANT EXTRACTS MARKET, BY FORM, 2022-2027 (USD MILLION)

- 10.2 DRY

- 10.2.1 INCREASING USE IN PHARMACEUTICALS AND DIETARY SUPPLEMENTS

- TABLE 100 DRY: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 101 DRY: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 LIQUID

- 10.3.1 SHIFTING CONSUMER PREFERENCES

- TABLE 102 LIQUID: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 103 LIQUID: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

11 PLANT EXTRACTS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 49 GEOGRAPHIC SNAPSHOT (2022-2027): RAPIDLY GROWING MARKETS EMERGING AS NEW HOTSPOTS

- FIGURE 50 PLANT EXTRACTS MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

- TABLE 104 PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 105 PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 106 PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 107 PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- 11.2 NORTH AMERICA

- FIGURE 51 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 108 NORTH AMERICA: PLANT EXTRACTS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 109 NORTH AMERICA: PLANT EXTRACTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 110 NORTH AMERICA: PLANT EXTRACTS MARKET, BY COUNTRY, 2016-2021 (KT)

- TABLE 111 NORTH AMERICA: PLANT EXTRACTS MARKET, BY COUNTRY, 2022-2027 (KT)

- TABLE 112 NORTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 113 NORTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 114 NORTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 115 NORTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 116 NORTH AMERICA: PLANT EXTRACTS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 117 NORTH AMERICA: PLANT EXTRACTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 118 NORTH AMERICA: PLANT EXTRACTS MARKET, BY APPLICATION, 2016-2021 (KT)

- TABLE 119 NORTH AMERICA: PLANT EXTRACTS MARKET, BY APPLICATION, 2022-2027 (KT)

- TABLE 120 NORTH AMERICA: PLANT EXTRACTS MARKET, BY SOURCE, 2016-2021 (USD MILLION)

- TABLE 121 NORTH AMERICA: PLANT EXTRACTS MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 122 NORTH AMERICA: PLANT EXTRACTS MARKET, BY SOURCE, 2016-2021 (KT)

- TABLE 123 NORTH AMERICA: PLANT EXTRACTS MARKET, BY SOURCE, 2022-2027 (KT)

- TABLE 124 NORTH AMERICA: PLANT EXTRACTS MARKET, BY FORM, 2016-2021 (USD MILLION)

- TABLE 125 NORTH AMERICA: PLANT EXTRACTS MARKET, BY FORM, 2022-2027 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 Concept of healthy aging and rising trend of health-conscious diets

- TABLE 126 US: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 127 US: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 128 US: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 129 US: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.2.2 CANADA

- 11.2.2.1 Rising consumption of plant-based products

- TABLE 130 CANADA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 131 CANADA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 132 CANADA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 133 CANADA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.2.3 MEXICO

- 11.2.3.1 Growing health and wellness trend to drive market for phytomedicines and herbal extracts

- TABLE 134 MEXICO: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 135 MEXICO: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 136 MEXICO: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 137 MEXICO: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.3 EUROPE

- TABLE 138 EUROPE: PLANT EXTRACTS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 139 EUROPE: PLANT EXTRACTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 140 EUROPE: PLANT EXTRACTS MARKET, BY COUNTRY, 2016-2021 (KT)

- TABLE 141 EUROPE: PLANT EXTRACTS MARKET, BY COUNTRY, 2022-2027 (KT)

- TABLE 142 EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 143 EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 144 EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 145 EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 146 EUROPE: PLANT EXTRACTS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 147 EUROPE: PLANT EXTRACTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 148 EUROPE: PLANT EXTRACTS MARKET, BY APPLICATION, 2016-2021 (KT)

- TABLE 149 EUROPE: PLANT EXTRACTS MARKET, BY APPLICATION, 2022-2027 (KT)

- TABLE 150 EUROPE: PLANT EXTRACTS MARKET, BY SOURCE, 2016-2021 (USD MILLION)

- TABLE 151 EUROPE: PLANT EXTRACTS MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 152 EUROPE: PLANT EXTRACTS MARKET, BY SOURCE, 2016-2021 (KT)

- TABLE 153 EUROPE: PLANT EXTRACTS MARKET, BY SOURCE, 2022-2027 (KT)

- TABLE 154 EUROPE: PLANT EXTRACTS MARKET, BY FORM, 2016-2021 (USD MILLION)

- TABLE 155 EUROPE: PLANT EXTRACTS MARKET, BY FORM, 2022-2027 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Thriving food & beverage industry and growing demand for natural ingredients

- TABLE 156 GERMANY: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 157 GERMANY: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 158 GERMANY: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 159 GERMANY: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.3.2 UNITED KINGDOM

- 11.3.2.1 Herbal tea gaining popularity

- TABLE 160 UK: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 161 UK: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 162 UK: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 163 UK: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.3.3 FRANCE

- 11.3.3.1 Consumption of plant extracts for production of dietary supplements and functional foods

- TABLE 164 FRANCE: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 165 FRANCE: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 166 FRANCE: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 167 FRANCE: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.3.4 ITALY

- 11.3.4.1 Growth of food supplements

- TABLE 168 ITALY: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 169 ITALY: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 170 ITALY: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 171 ITALY: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.3.5 SPAIN

- 11.3.5.1 Increasing focus of food manufacturers on producing functional food & beverages

- TABLE 172 SPAIN: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 173 SPAIN: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 174 SPAIN: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 175 SPAIN: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.3.6 RUSSIA

- 11.3.6.1 Consumption of herbal dietary supplements to create dynamic opportunities

- TABLE 176 RUSSIA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 177 RUSSIA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 178 RUSSIA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 179 RUSSIA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.3.7 POLAND

- 11.3.7.1 Reduced consumption of meat leading to plant-based alternatives

- TABLE 180 POLAND: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 181 POLAND: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 182 POLAND: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 183 POLAND: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.3.8 REST OF EUROPE

- TABLE 184 REST OF EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 185 REST OF EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 186 REST OF EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 187 REST OF EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.4 ASIA PACIFIC

- FIGURE 52 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 188 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 189 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 190 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY COUNTRY, 2016-2021 (KT)

- TABLE 191 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY COUNTRY, 2022-2027 (KT)

- TABLE 192 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 193 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 194 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 195 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 196 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 197 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 198 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY APPLICATION, 2016-2021 (KT)

- TABLE 199 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY APPLICATION, 2022-2027 (KT)

- TABLE 200 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY SOURCE, 2016-2021 (USD MILLION)

- TABLE 201 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 202 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY SOURCE, 2016-2021 (KT)

- TABLE 203 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY SOURCE, 2022-2027 (KT)

- TABLE 204 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY FORM, 2016-2021 (USD MILLION)

- TABLE 205 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY FORM, 2022-2027 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 Increasing rejection of chemical products

- TABLE 206 CHINA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 207 CHINA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 208 CHINA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 209 CHINA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.4.2 INDIA

- 11.4.2.1 Shifting trend from synthetic to herbal medicines

- TABLE 210 INDIA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 211 INDIA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 212 INDIA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 213 INDIA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.4.3 JAPAN

- 11.4.3.1 Increasing need for natural ingredients in health care, cosmetics, and toiletries

- TABLE 214 JAPAN: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 215 JAPAN: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 216 JAPAN: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 217 JAPAN: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Rising investments by governments

- TABLE 218 AUSTRALIA & NEW ZEALAND: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 219 AUSTRALIA & NEW ZEALAND: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 220 AUSTRALIA & NEW ZEALAND: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 221 AUSTRALIA & NEW ZEALAND: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.4.5 SINGAPORE

- 11.4.5.1 Rising concerns over health risks

- TABLE 222 SINGAPORE: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 223 SINGAPORE: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 224 SINGAPORE: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 225 SINGAPORE: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 226 REST OF ASIA PACIFIC: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 227 REST OF ASIA PACIFIC: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 229 REST OF ASIA PACIFIC: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.5 REST OF THE WORLD

- TABLE 230 ROW: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 231 ROW: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 232 ROW: PLANT EXTRACTS MARKET, BY REGION, 2016-2021 (KT)

- TABLE 233 ROW: PLANT EXTRACTS MARKET, BY REGION, 2022-2027 (KT)

- TABLE 234 ROW: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 235 ROW: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 236 ROW: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 237 ROW: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 238 ROW: PLANT EXTRACTS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 239 ROW: PLANT EXTRACTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 240 ROW: PLANT EXTRACTS MARKET, BY APPLICATION, 2016-2021 (KT)

- TABLE 241 ROW: PLANT EXTRACTS MARKET, BY APPLICATION, 2022-2027 (KT)

- TABLE 242 ROW: PLANT EXTRACTS MARKET, BY SOURCE, 2016-2021 (USD MILLION)

- TABLE 243 ROW: PLANT EXTRACTS MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 244 ROW: PLANT EXTRACTS MARKET, BY SOURCE, 2016-2021 (KT)

- TABLE 245 ROW: PLANT EXTRACTS MARKET, BY SOURCE, 2022-2027 (KT)

- TABLE 246 ROW: PLANT EXTRACTS MARKET, BY FORM, 2016-2021 (USD MILLION)

- TABLE 247 ROW: PLANT EXTRACTS MARKET, BY FORM, 2022-2027 (USD MILLION)

- 11.5.1 SOUTH AMERICA

- TABLE 248 SOUTH AMERICA: PLANT EXTRACTS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 249 SOUTH AMERICA: PLANT EXTRACTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 250 SOUTH AMERICA: PLANT EXTRACTS MARKET, BY COUNTRY, 2016-2021 (KT)

- TABLE 251 SOUTH AMERICA: PLANT EXTRACTS MARKET, BY COUNTRY, 2022-2027 (KT)

- 11.5.1.1 Brazil

- 11.5.1.1.1 Biodiversity to enable development of variety of plant extract products

- 11.5.1.1 Brazil

- TABLE 252 BRAZIL: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 253 BRAZIL: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 254 BRAZIL: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 255 BRAZIL: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.5.1.2 Rest of South America

- 11.5.1.2.1 Rising demand for organic products in food, cosmetics, and pharma industries

- 11.5.1.2 Rest of South America

- TABLE 256 REST OF SOUTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 257 REST OF SOUTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 258 REST OF SOUTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 259 REST OF SOUTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.5.2 AFRICA

- TABLE 260 AFRICA: PLANT EXTRACTS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 261 AFRICA: PLANT EXTRACTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 262 AFRICA: PLANT EXTRACTS MARKET, BY COUNTRY, 2016-2021 (KT)

- TABLE 263 AFRICA: PLANT EXTRACTS MARKET, BY COUNTRY, 2022-2027 (KT)

- 11.5.2.1 South Africa

- 11.5.2.1.1 Unique qualities of plant extracts leading to their increased use in cosmetics

- 11.5.2.1 South Africa

- TABLE 264 SOUTH AFRICA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 265 SOUTH AFRICA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 266 SOUTH AFRICA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 267 SOUTH AFRICA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.5.2.2 Rest of Africa

- 11.5.2.2.1 Inability of western medicine to provide cures for some diseases and infections

- 11.5.2.2 Rest of Africa

- TABLE 268 REST OF AFRICA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 269 REST OF AFRICA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 270 REST OF AFRICA: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 271 REST OF AFRICA: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

- 11.5.3 MIDDLE EAST

- 11.5.3.1 Growing import demand for plant extracts from North America

- TABLE 272 MIDDLE EAST: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 273 MIDDLE EAST: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 274 MIDDLE EAST: PLANT EXTRACTS MARKET, BY TYPE, 2016-2021 (KT)

- TABLE 275 MIDDLE EAST: PLANT EXTRACTS MARKET, BY TYPE, 2022-2027 (KT)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2021

- TABLE 276 PLANT EXTRACTS MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- 12.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 53 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021 (USD MILLION)

- 12.4 KEY PLAYER STRATEGIES

- TABLE 277 STRATEGIES ADOPTED BY KEY PLANT EXTRACT MANUFACTURERS

- 12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 54 PLANT EXTRACTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 12.5.5 PRODUCT FOOTPRINT

- TABLE 278 COMPANY FOOTPRINT, BY SOURCE

- TABLE 279 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 280 COMPANY FOOTPRINT, BY REGION

- TABLE 281 OVERALL COMPANY FOOTPRINT

- 12.6 PLANT EXTRACTS MARKET: EVALUATION QUADRANT FOR START-UPS/SMES, 2021

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 55 PLANT EXTRACTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UPS/SMES)

- 12.6.5 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 282 PLANT EXTRACTS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 283 PLANT EXTRACTS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 NEW PRODUCT LAUNCHES

- TABLE 284 PLANT EXTRACTS: NEW PRODUCT LAUNCHES, 2021-2022

- 12.7.2 DEALS

- TABLE 285 PLANT EXTRACTS: DEALS, 2019-2022

- 12.7.3 OTHERS

- TABLE 286 PLANT EXTRACTS: OTHERS, 2021-2022

13 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 SYMRISE

- TABLE 287 SYMRISE: BUSINESS OVERVIEW

- FIGURE 56 SYMRISE: COMPANY SNAPSHOT

- TABLE 288 SYMRISE: PRODUCTS OFFERED

- TABLE 289 SYMRISE: NEW PRODUCT LAUNCHES

- TABLE 290 SYMRISE: DEALS

- TABLE 291 SYMRISE: OTHERS

- 13.2.2 SENSIENT TECHNOLOGIES CORPORATION

- TABLE 292 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- FIGURE 57 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 293 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

- TABLE 294 SENSIENT TECHNOLOGIES CORPORATION: NEW PRODUCT LAUNCHES

- TABLE 295 SENSIENT TECHNOLOGIES CORPORATION: DEALS

- 13.2.3 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- TABLE 296 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- FIGURE 58 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- TABLE 297 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS OFFERED

- TABLE 298 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- 13.2.4 GIVAUDAN

- TABLE 299 GIVAUDAN: BUSINESS OVERVIEW

- FIGURE 59 GIVAUDAN: COMPANY SNAPSHOT

- TABLE 300 GIVAUDAN: PRODUCTS OFFERED

- TABLE 301 GIVAUDAN: NEW PRODUCT LAUNCHES

- TABLE 302 GIVAUDAN: DEALS

- TABLE 303 GIVAUDAN: OTHERS

- 13.2.5 ADM

- TABLE 304 ADM: BUSINESS OVERVIEW

- FIGURE 60 ADM: COMPANY SNAPSHOT

- TABLE 305 ADM: PRODUCTS OFFERED

- TABLE 306 ADM: DEALS

- 13.2.6 CARGILL, INCORPORATED

- TABLE 307 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- FIGURE 61 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 308 CARGILL, INCORPORATED: PRODUCTS OFFERED

- TABLE 309 CARGILL, INCORPORATED: NEW PRODUCT LAUNCHES

- 13.2.7 DSM

- TABLE 310 DSM: BUSINESS OVERVIEW

- FIGURE 62 DSM: COMPANY SNAPSHOT

- TABLE 311 DSM: PRODUCTS OFFERED

- TABLE 312 DSM: DEALS

- 13.2.8 KERRY GROUP PLC

- TABLE 313 KERRY GROUP PLC: BUSINESS OVERVIEW

- FIGURE 63 KERRY GROUP PLC: COMPANY SNAPSHOT

- TABLE 314 KERRY GROUP PLC: PRODUCTS OFFERED

- TABLE 315 KERRY GROUP PLC: DEALS

- TABLE 316 KERRY GROUP PLC: OTHERS

- 13.2.9 DOHLER

- TABLE 317 DOHLER: BUSINESS OVERVIEW

- TABLE 318 DOHLER: PRODUCTS OFFERED

- TABLE 319 DOHLER: DEALS

- 13.2.10 CARBERY GROUP

- TABLE 320 CARBERY GROUP: BUSINESS OVERVIEW

- TABLE 321 CARBERY GROUP: PRODUCTS OFFERED

- TABLE 322 CARBERY GROUP: DEALS

- TABLE 323 CARBERY GROUP: OTHERS

- 13.2.11 SYNTHITE INDUSTRIES LTD

- TABLE 324 SYNTHITE INDUSTRIES LTD: BUSINESS OVERVIEW

- TABLE 325 SYNTHITE INDUSTRIES LTD: PRODUCTS OFFERED

- 13.2.12 INDESSO

- TABLE 326 INDESSO: BUSINESS OVERVIEW

- TABLE 327 INDESSO: PRODUCTS OFFERED

- TABLE 328 INDESSO: DEALS

- TABLE 329 INDESSO: OTHERS

- 13.2.13 VIDYA HERBS

- TABLE 330 VIDYA HERBS: BUSINESS OVERVIEW

- TABLE 331 VIDYA HERBS: PRODUCTS OFFERED

- TABLE 332 VIDYA HERBS: NEW PRODUCT LAUNCHES

- 13.2.14 KALSEC INC.

- TABLE 333 KALSEC INC.: BUSINESS OVERVIEW

- TABLE 334 KALSEC INC.: PRODUCTS OFFERED

- TABLE 335 KALSEC INC.: NEW PRODUCT LAUNCHES

- TABLE 336 KALSEC INC.: DEALS

- TABLE 337 KALSEC INC.: OTHERS

- 13.2.15 MARTINBAUER

- TABLE 338 MARTINBAUER: BUSINESS OVERVIEW

- TABLE 339 MARTINBAUER: PRODUCTS OFFERED

- TABLE 340 MARTINBAUER: DEALS

- TABLE 341 MARTINBAUER: OTHERS

- 13.2.16 KANGCARE BIOINDUSTRY CO. LTD.

- TABLE 342 KANGCARE BIOINDUSTRY CO. LTD.: BUSINESS OVERVIEW

- TABLE 343 KANGCARE BIOINDUSTRY CO. LTD.: PRODUCTS OFFERED

- 13.3 OTHER PLAYERS (SMES/START-UPS)

- 13.3.1 NATIVE EXTRACTS PTY LTD

- TABLE 344 NATIVE EXTRACTS PTY LTD: BUSINESS OVERVIEW

- TABLE 345 NATIVE EXTRACTS PTY LTD: PRODUCTS OFFERED

- TABLE 346 NATIVE EXTRACTS PTY LTD: NEW PRODUCT LAUNCHES

- TABLE 347 NATIVE EXTRACTS PTY LTD: DEALS

- 13.3.2 ARJUNA NATURAL

- TABLE 348 ARJUNA NATURAL: BUSINESS OVERVIEW

- TABLE 349 ARJUNA NATURAL: PRODUCTS OFFERED

- TABLE 350 ARJUNA NATURAL: NEW PRODUCT LAUNCHES

- 13.3.3 BLUE SKY BOTANICS

- TABLE 351 BLUE SKY BOTANICS: BUSINESS OVERVIEW

- TABLE 352 BLUE SKY BOTANICS: PRODUCTS OFFERED

- 13.3.4 TOKIWA PHYTOCHEMICAL CO., LTD.

- TABLE 353 TOKIWA PHYTOCHEMICAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 354 TOKIWA PHYTOCHEMICAL CO., LTD.: PRODUCTS OFFERED

- 13.3.5 SHAANXI JIAHE PHYTOCHEM CO., LTD (JIAHERB, INC.)

- TABLE 355 SHAANXI JIAHE PHYTOCHEM CO., LTD (JIAHERB, INC.): BUSINESS OVERVIEW

- TABLE 356 SHAANXI JIAHE PHYTOCHEM CO., LTD. (JIAHERB, INC.): PRODUCTS OFFERED

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

- 13.3.6 ALCHEMY CHEMICALS

- 13.3.7 PRINOVA GROUP LLC

- 13.3.8 VITAL HERBS

- 13.3.9 SYDLER INDIA PVT. LTD.

- 13.3.10 PLANTNAT

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 ESSENTIAL OIL MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 ESSENTIAL OIL MARKET, BY TYPE

- TABLE 357 ESSENTIAL OILS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 358 ESSENTIAL OILS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 359 ESSENTIAL OILS MARKET, BY TYPE, 2017-2020 (KT)

- TABLE 360 ESSENTIAL OILS MARKET, BY TYPE, 2021-2026 (KT)

- 14.3.4 ESSENTIAL OIL MARKET, BY REGION

- TABLE 361 ESSENTIAL OILS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 362 ESSENTIAL OILS MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 363 ESSENTIAL OILS MARKET, BY REGION, 2017-2020 (KT)

- TABLE 364 ESSENTIAL OILS MARKET, BY REGION, 2021-2026 (KT)

- 14.4 BOTANICAL EXTRACTS MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.4.3 BOTANICAL EXTRACTS MARKET, BY SOURCE

- TABLE 365 BOTANICAL EXTRACTS MARKET, BY SOURCE, 2015-2022 (USD MILLION)

- TABLE 366 BOTANICAL EXTRACTS MARKET, BY SOURCE, 2015-2022 (TONS)

- 14.4.4 BOTANICAL EXTRACTS MARKET, BY REGION

- TABLE 367 BOTANICAL EXTRACTS MARKET, BY REGION, 2015-2022 (USD MILLION)

- TABLE 368 BOTANICAL EXTRACTS MARKET, BY REGION, 2015-2022 (TONS)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS