|

|

市場調査レポート

商品コード

1138435

GNSSシミュレーターの世界市場:コンポーネント別 (ソフトウェア、ハードウェア、サービス)・GNSS受信機別 (GPS、Galileo、GLONASS、BeiDou)・用途別 (車両支援システム、位置情報サービス、マッピング)・業種別・地域別の将来予測 (2027年まで)GNSS Simulators Market by Component (Software, Hardware, & Services), GNSS Receiver (GPS, Galileo, GLONASS, & BeiDou), Application (Vehicle Assistance Systems, Location-based Services, & Mapping), Vertical, Type & Region - Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| GNSSシミュレーターの世界市場:コンポーネント別 (ソフトウェア、ハードウェア、サービス)・GNSS受信機別 (GPS、Galileo、GLONASS、BeiDou)・用途別 (車両支援システム、位置情報サービス、マッピング)・業種別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年10月11日

発行: MarketsandMarkets

ページ情報: 英文 254 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

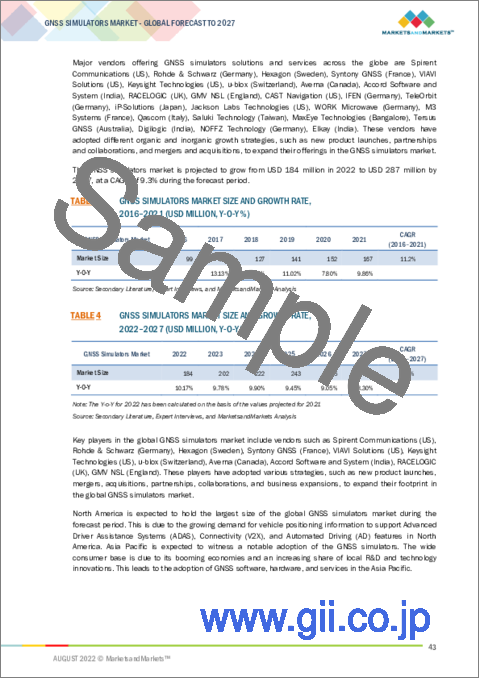

世界のGNSSシミュレーターの市場規模は、2022年の1億8,400万米ドルから、2027年には2億8,700万米ドルへと、2022年から2027年までの間に9.3%のCAGRで成長すると予測されます。

市場成長の要因としては、コネクティビティにおける5Gの利用拡大やUAVの需要増などが挙げられます。

用途別では、位置情報サービス分野が予測期間中に高い市場シェアを占める見込みです。受信機別では、BeiDouが予測期間中に最も高いCAGRで成長します。

当レポートでは、世界のGNSSシミュレーターの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コンポーネント別・種類別・受信機別・用途別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- バリューチェーン分析

- エコシステム

- 技術分析

- 複雑なナビゲーションの問題を解決する量子技術

- GNSSとIoT

- 5GとGNSS

- GNSSと機械学習/人工知能

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 価格モデル分析

- 特許分析

- 顧客のビジネスに影響を与える傾向と混乱

- 規制状況

- 主な会議とイベント (2022年~2023年)

第6章 GNSSシミュレーター市場:コンポーネント別

- イントロダクション

- GNSSシミュレーターの市場出荷台数

- ハードウェア

- ソフトウェア

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 GNSSシミュレーター市場:種類別

- イントロダクション

- シングルチャンネル

- マルチチャンネル

第8章 GNSSシミュレーター市場:受信機別

- イントロダクション

- GPS

- GALILEO

- GLONASS

- BeiDou

- その他

第9章 GNSSシミュレーター市場:用途別

- イントロダクション

- ナビゲーション

- マッピング

- 測量

- 位置情報サービス (LBS)

- 車両支援システム

- その他の用途

第10章 GNSSシミュレーター市場:業種別

- イントロダクション

- 軍事・防衛

- 自動車

- 家電

- 海洋

- 航空宇宙

- その他の業種

第11章 GNSSシミュレーター市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- 他のアジア太平洋諸国

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第12章 競合情勢

- 概要

- 市場評価フレームワーク

- 主要企業の収益分析

- 主要企業の市場シェア分析

- 過去の収益分析

- 主要企業のランキング

- 主要企業の評価マトリックス

- 競合ベンチマーキング

- 中小企業の評価マトリックス

- 競合シナリオ

第13章 企業プロファイル

- イントロダクション

- 主要企業

- SPIRENT COMMUNICATIONS

- ROHDE & SCHWARZ

- HEXAGON

- SYNTONY GNSS

- VIAVI SOLUTIONS

- KEYSIGHT TECHNOLOGIES

- U-BLOX

- AVERNA

- ACCORD SOFTWARE & SYSTEMS

- RACELOGIC

- GMV NSL

- その他の企業

- CAST NAVIGATION

- IFEN

- TELEORBIT

- IP-SOLUTION

- JACKSON LABS TECHNOLOGIES

- WORK MICROWAVE

- M3 SYSTEMS

- QASCOM

- SALUKI TECHNOLOGIES

- MAXEYE TECHNOLOGY

- TERSUS GNSS

- DIGILOGIC

- NOFFZ TECHNOLOGY

- ELKAY

第14章 隣接市場

- イントロダクション:市場概略

- 制限事項

- GNSSシミュレーター市場:隣接市場

- シミュレーター市場

- 位置情報サービス (LBS)・リアルタイム位置情報システム (RTLS) 市場

第15章 付録

The global GNSS simulators market size is expected to grow from an estimated value of USD 184 million in 2022 to USD 287 million by 2027, at a Compound Annual Growth Rate (CAGR) of 9.3% from 2022 to 2027. Some of the factors that are driving the market growth includes increased use of 5G in connectivity and growing demand for UAVs.

By application, location-based services segment to account for a higher market share during the forecast period

Location tracking systems enable enterprises to identify, track, and manage their key assets, such as equipment, tools, containers, personnel/staff, and animals, by placing a tag on them. Location-based solutions and technologies support applications that integrate geographic-location information with business processes, thereby helping analyze location information. Location-based information is required in distinct business datasets for relating, comparing, and analyzing the relationship between the data. Software-based solutions include geocoding and reverse geocoding, Geospatial Transformation and Load (GTL), reporting and visualization, location analytics, context accelerator, geofencing, risk analytics, and threat prevention. Hardware-based solutions include sensors and readers, tags, and transponders. Vehicle tracking systems use GPS to keep track of multiple fleets of vehicles in real-time. Fleet management solutions comprise data logging, satellite positioning, and data communication for managing transportation. These solutions also enable services, such as vehicle finance, vehicle maintenance, vehicle telematics (tracking and diagnosis), and fuel management. Smartphones, tablets, tracking devices, digital cameras, portable computers, and fitness gear use GNSS positioning for navigation, mapping, and determining consumer preferences.

By receiver, BeiDou to grow at the highest CAGR during the forecast period

The BeiDou Navigation Satellite System (BDS), also known as BeiDou-2, is China's second-generation satellite navigation system. It is capable of providing PNT services to users on a continuous worldwide basis. The Chinese government approved the development and deployment of the BeiDou system in 2006, and the global BeiDou navigation satellite system is expected to become operational by 2020. By December 2011, the BeiDou system was officially announced to provide an initial operational service comprising initial passive PNT services for the APAC region with a constellation of 10 satellites (5 Geostationary Earth Orbit [GEO] satellites and five Inclined Geosynchronous Orbit [IGSO] satellites). In 2012, five additional satellites were launched, comprising 1 GEO satellite and four Medium Earth Orbit (MEO) satellites. There are currently 38 BeiDou satellites: 18 BeiDou-2 satellites and 20 BeiDou-3 satellites in orbit, providing various services to global users.

Breakdown of primary participants:

- By Company Type: Tier 1 = 25%, Tier 2 = 40%, and Tier 3 = 35%

- By Designation: C-Level Executives = 30%, Directors = 35% and Others = 35%

- By Region: North America = 15%, Europe = 25%, APAC = 30%, MEA = 10%, Latin America= 20%

Major vendors in the global GNSS simulators market include Spirent Communications (UK), Rohde & Schwarz (Germany), Hexagon (Sweden), Syntony GNSS (France), VIAVI Solutions (US), Keysight Technologies (US), u-blox (Switzerland), Averna (Canada), Accord Software & Systems (India), RACELOGIC (UK), GMV NSL (UK), CAST Navigation (US), IFEN (Germany), TeleOrbit (Germany), iP-Solutions (Japan), Jackson Labs Technologies (US), WORK Microwave (Germany), M3 Systems (France), Qascom (Italy), Saluki Technologies (Taiwan), MaxEye Technologies (India), Tersus GNSS (Australia), Digilogic (India), NOFFZ Technologies (Germany), Elkay (India).

The study includes an in-depth competitive analysis of the key players in the GNSS simulators market, with their company profiles, recent developments, and key market strategies.

Research coverage

The report segment the GNSS simulators market and forecast its size, by GNSS simulators market by Component (Hardware, software and services), by type (single channel and multi channel), by receiver, by application, by vertical and by region (North America, Europe, Asia Pacific, Middle East and Africa), and Latin America).

The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key benefits of buying the report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall GNSS simulators market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2021

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 GNSS SIMULATORS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- FIGURE 2 BREAKUP OF PRIMARY SOURCES BY COMPANY, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- FIGURE 3 KEY INDUSTRY INSIGHTS

- 2.2 DATA TRIANGULATION

- FIGURE 4 DATA TRIANGULATION PROCESS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 REVENUE ESTIMATES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 3 GNSS SIMULATORS MARKET SIZE AND GROWTH RATE, 2016-2021 (USD MILLION, Y-O-Y %)

- TABLE 4 GNSS SIMULATORS MARKET SIZE AND GROWTH RATE, 2022-2027 (USD MILLION, Y-O-Y %)

- FIGURE 7 NORTH AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GNSS SIMULATORS MARKET

- FIGURE 8 INCREASING USE OF WEARABLE DEVICES UTILIZING LOCATION INFORMATION TO FUEL GROWTH OF MARKET

- 4.2 GNSS SIMULATORS MARKET, BY COMPONENT

- FIGURE 9 HARDWARE SEGMENT TO ACCOUNT FOR HIGHEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 GNSS SIMULATORS MARKET, BY SERVICE

- FIGURE 10 PROFESSIONAL SERVICES TO GAIN HIGHEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 GNSS SIMULATORS MARKET, BY TYPE

- FIGURE 11 MULTI-CHANNEL TO ACCOUNT FOR HIGHER MARKET SHARE DURING FORECAST PERIOD

- 4.5 GNSS SIMULATIONS MARKET, BY GNSS RECEIVER

- FIGURE 12 GPS TO ACCOUNT FOR HIGHEST MARKET SHARE DURING FORECAST PERIOD

- 4.6 GNSS SIMULATORS MARKET SHARE OF TOP THREE VERTICALS AND REGIONS

- FIGURE 13 MILITARY AND DEFENSE AND NORTH AMERICA TO ACCOUNT FOR HIGHEST RESPECTIVE MARKET SHARES IN 2022

- 4.7 MARKET INVESTMENT SCENARIO

- FIGURE 14 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 GNSS SIMULATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid penetration of consumer IoT

- 5.2.1.2 Contribution of 5G in connectivity

- 5.2.1.3 Increasing use of wearable devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of digital infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for UAVs

- 5.2.3.2 Recent advancements in power consumption

- 5.2.3.3 Advent of SDR GNSS simulators

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of geodetic infrastructure

- 5.2.4.2 Ensuring synchronization accuracy in networks

- 5.2.4.3 Increase in jamming and spoofing attacks

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: OROLIA'S GSG-8 ADVANCED SIMULATOR DRIVES R&D TESTING FOR STELLANTIS

- 5.3.2 CASE STUDY 2: LABSAT PROVIDES GNSS TESTING CAPABILITIES TO CAMBIUM NETWORKS FOR ITS PRODUCTION LINE TESTING SOLUTION

- 5.3.3 CASE STUDY:3 SKYGUIDE COMPLIES WITH NEW FLIGHT PROCEDURES DUE TO IFEN'S NAVX-NCS PROFESSIONAL GNSS SIMULATOR

- 5.3.4 CASE STUDY 4: OROLIA PROVIDES GSG-8 WITH FULLY OPERATIONAL SBAS FUNCTION TO BECKER AVIONICS

- 5.3.5 CASE STUDY 5:NI AND M3 SYSTEMS COLLABORATE ON STELLA-NGC ADVENTURE TO CREATE ATTRACTIVE GNSS SIMULATION PRODUCTS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 16 VALUE CHAIN: GNSS SIMULATORS MARKET

- 5.5 ECOSYSTEM

- FIGURE 17 GNSS SIMULATORS MARKET: ECOSYSTEM

- TABLE 5 GNSS SIMULATORS MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 QUANTUM TECHNOLOGIES SOLVING COMPLEX NAVIGATION PROBLEMS

- 5.6.1.1 Quantum navigation algorithms

- 5.6.1.2 Quantum sensing

- 5.6.1.3 Quantum encryption

- 5.6.2 GNSS AND INTERNET OF THINGS

- 5.6.3 5G AND GNSS

- 5.6.4 GNSS AND MACHINE LEARNING/ARTIFICIAL INTELLIGENCE

- 5.6.1 QUANTUM TECHNOLOGIES SOLVING COMPLEX NAVIGATION PROBLEMS

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 GNSS SIMULATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 GNSS SIMULATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- FIGURE 19 KEY STAKEHOLDERS IN BUYING PROCESS: GNSS SIMULATORS MARKET

- 5.9 PRICING MODEL ANALYSIS

- TABLE 7 SELLING PRICE ANALYSIS OF OROLIA GNSS SIMULATORS

- TABLE 8 SELLING PRICE ANALYSIS OF M3 SYSTEMS GNSS SIMULATION SOFTWARE

- 5.10 PATENT ANALYSIS

- FIGURE 20 PATENT ANALYSIS: GNSS SIMULATORS MARKET

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 TRENDS AND DISRUPTIONS IN GNSS SIMULATORS MARKET IMPACTING CUSTOMER BUSINESS

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 EUROPEAN UNION'S REGULATION NO. 1285/2013 - IMPLEMENTATION AND EXPLOITATION OF EUROPEAN SATELLITE NAVIGATION SYSTEMS

- 5.12.2 EUROPEAN UNION'S REGULATION NO. 2015/758 - ECALL IN-VEHICLE SYSTEM

- 5.12.3 US SPACE-BASED POSITIONING, NAVIGATION, AND TIMING POLICY

- 5.12.4 GDPR

- 5.12.5 ICAO POLICY ON GNSS

- 5.12.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 10 GNSS SIMULATOR MARKET: LIST OF CONFERENCES AND EVENTS

6 GNSS SIMULATORS MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 22 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 11 GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 12 GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.2 GNSS SIMULATOR MARKET SHIPMENT (UNITS)

- 6.2.1 SHIPMENTS: GNSS SIMULATORS MARKET DRIVERS

- TABLE 13 SHIPMENT: GNSS SIMULATORS MARKET, BY REGION, 2021 (UNITS)

- 6.3 HARDWARE

- 6.3.1 HARDWARE-BASED GNSS RECEIVERS ENABLE PROCESSING OF SATELLITE SIGNALS

- 6.3.2 HARDWARE: GNSS SIMULATORS MARKET DRIVERS

- TABLE 14 HARDWARE: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 15 HARDWARE: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 SOFTWARE

- 6.4.1 GNSS SIMULATION SOFTWARE ENABLES RECEIVERS TO SIMULATE SIGNALS FROM SATELLITES.

- 6.4.2 SOFTWARE: GNSS SIMULATORS MARKET DRIVERS

- TABLE 16 SOFTWARE: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 17 SOFTWARE: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 SERVICES

- FIGURE 23 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 18 GNSS SIMULATORS MARKET, BY SERVICES, 2016-2021 USD MILLION)

- TABLE 19 GNSS SIMULATORS MARKET, BY SERVICES, 2022-2027 (USD MILLION)

- TABLE 20 SERVICES: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 21 SERVICES: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5.1 PROFESSIONAL SERVICES

- 6.5.1.1 Demand for complex GNSS simulation solutions to drive growth

- 6.5.1.2 Professional services: GNSS simulators market drivers

- TABLE 22 PROFESSIONAL SERVICES: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 23 PROFESSIONAL SERVICES: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5.2 MANAGED SERVICES

- 6.5.2.1 Managed services to govern hardware and software functions

- 6.5.2.2 Managed services: GNSS simulators market drivers

- TABLE 24 MANAGED SERVICES: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 25 MANAGED SERVICES: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

7 GNSS SIMULATORS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 24 SINGLE CHANNEL SIMULATORS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 26 GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 27 GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.2 SINGLE CHANNEL

- 7.2.1 SINGLE CHANNE SIMULATORS TO TRACK SENSITIVITY MEASUREMENTS FOR R&D TESTING.

- 7.2.2 SINGLE CHANNEL: GNSS SIMULATORS MARKET DRIVERS

- TABLE 28 SINGLE CHANNEL: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 29 SINGLE CHANNEL: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 MULTI-CHANNEL

- 7.3.1 GNSS RF SIGNALS HELP TO DESIGN, MANUFACTURE, AND PRE-LAUNCH TESTS.

- 7.3.2 MULTI CHANNEL: GNSS SIMULATORS MARKET DRIVERS

- TABLE 30 MULTI CHANNEL: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 31 MULTI CHANNEL: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

8 GNSS SIMULATORS MARKET, BY RECEIVER

- 8.1 INTRODUCTION

- FIGURE 25 GPS TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 32 GNSS SIMULATORS MARKET, BY RECEIVER, 2016-2021 (USD MILLION)

- TABLE 33 GNSS SIMULATORS MARKET, BY RECEIVER, 2022-2027 (USD MILLION)

- 8.2 GPS

- 8.2.1 GPS USED FOR TELEMATICS, IN-VEHICLE SYSTEMS, AND CONSIGNMENT TRACKING

- 8.2.2 GPS: GNSS SIMULATORS MARKET DRIVERS

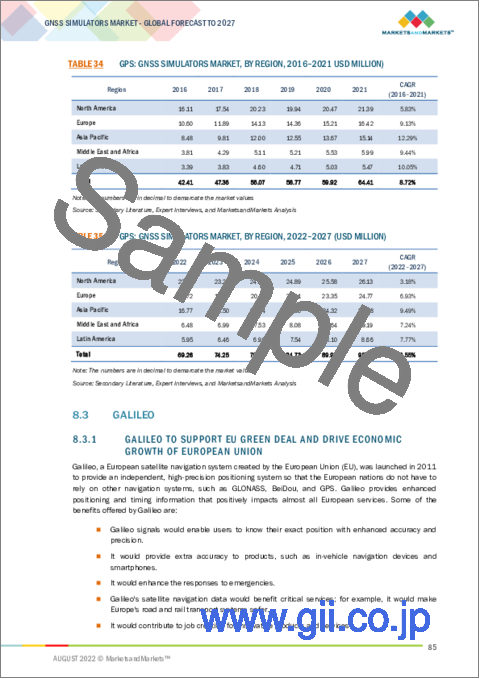

- TABLE 34 GPS: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 35 GPS: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 GALILEO

- 8.3.1 GALILEO TO SUPPORT EU GREEN DEAL AND DRIVE ECONOMIC GROWTH OF EUROPEAN UNION

- 8.3.2 GALILEO: GNSS SIMULATORS MARKET DRIVERS

- TABLE 36 GALILEO: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 37 GALILEO: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 GLONASS

- 8.4.1 GLONASS-K SATELLITE LAUNCHED INTO CALCULATED ORBIT USING FREGAT BOOSTER

- 8.4.2 GLONASS: GNSS SIMULATORS MARKET DRIVERS

- TABLE 38 GLONASS: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 39 GLONASS: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.5 BEIDOU

- 8.5.1 END OF CHINA'S DEPENDENCY ON GPS NETWORK

- 8.5.2 BEIDOU: GNSS SIMULATORS MARKET DRIVERS

- TABLE 40 BEIDOU: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 41 BEIDOU: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.6 OTHER

- TABLE 42 OTHER: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 43 OTHER: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

9 GNSS SIMULATORS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 26 VEHICLE ASSISTANCE SYSTEMS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 44 GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 45 GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2 NAVIGATION

- 9.2.1 INCREASING USE OF GNSS SIMULATORS FOR TRACKING TO DRIVE DEMAND

- 9.2.2 NAVIGATION: GNSS SIMULATORS MARKET DRIVERS

- TABLE 46 NAVIGATION: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 47 NAVIGATION: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 MAPPING

- 9.3.1 PRECISE POSITIONING BY GALILEO TO BENEFIT MAPPING SECTOR

- 9.3.2 MAPPING: GNSS SIMULATORS MARKET DRIVERS

- TABLE 48 MAPPING: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 49 MAPPING: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 SURVEYING

- 9.4.1 GNSS SIMULATION OFFERS NAVIGATION SYSTEM TO OPERATE IN ADVERSE ENVIRONMENTS

- 9.4.2 SURVEYING: GNSS SIMULATORS MARKET DRIVERS

- TABLE 50 SURVEYING: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 51 SURVEYING: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 LOCATION-BASED SERVICES

- 9.5.1 LOCATION-BASED SERVICES (LBS) RELY ON GNSS DATA.

- 9.5.2 LOCATION-BASED SERVICES: GNSS SIMULATORS MARKET DRIVERS

- TABLE 52 LOCATION-BASED SERVICES: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 53 LOCATION-BASED SERVICES: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.6 VEHICLE ASSISTANCE SYSTEMS

- 9.6.1 ADVANCED GNSS COMPLEMENTS VEHICLE PERCEPTION TO BE USED WITH IMU (INERTIAL MEASUREMENT UNIT)

- 9.6.2 VEHICLE ASSISTANCE SYSTEMS: GNSS SIMULATORS MARKET DRIVERS

- TABLE 54 VEHICLE ASSISTANCE SYSTEMS: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 55 VEHICLE ASSISTANCE SYSTEMS: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.7 OTHER APPLICATIONS

- TABLE 56 OTHER APPLICATIONS: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 57 OTHER APPLICATIONS: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

10 GNSS SIMULATORS MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 27 AUTOMOTIVE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 58 GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 59 GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.2 MILITARY AND DEFENSE

- 10.2.1 GNSS WITH SITUATIONAL AWARENESS (SA) TO DRIVE DEMAND FOR GNSS SIMULATIONS

- 10.2.2 MILITARY AND DEFENSE: GNSS SIMULATORS MARKET DRIVERS

- TABLE 60 MILITARY AND DEFENSE: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 61 MILITARY AND DEFENSE: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 AUTOMOTIVE

- 10.3.1 GNSS SIMULATIONS TO BE USED IN AUTOMOTIVE TO TRACE LOCATION

- 10.3.2 AUTOMOTIVE: GNSS SIMULATORS MARKET DRIVERS

- TABLE 62 AUTOMOTIVE: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 63 AUTOMOTIVE: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 CONSUMER ELECTRONICS

- 10.4.1 INCREASED IOT USAGE AND WEARABLE DEVICES TO IMPACT MARKET

- 10.4.2 CONSUMER ELECTRONICS: GNSS SIMULATORS MARKET DRIVERS

- TABLE 64 CONSUMER ELECTRONICS: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 65 CONSUMER ELECTRONICS: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 MARINE

- 10.5.1 COMMERCIAL FISHING CONVOYS USE GNSS TO NAVIGATE

- 10.5.2 MARINE: GNSS SIMULATORS MARKET DRIVERS

- TABLE 66 MARINE: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 67 MARINE: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.6 AEROSPACE

- 10.6.1 USE OF GNSS IN DRONES TO NAVIGATE

- 10.6.2 AEROSPACE: GNSS SIMULATORS MARKET DRIVERS

- TABLE 68 AEROSPACE: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 69 AEROSPACE: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.7 OTHER VERTICALS

- TABLE 70 OTHER VERTICALS: GNSS SIMULATORS MARKET, BY REGION, 2016-2021 USD MILLION)

- TABLE 71 OTHER VERTICALS: GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

11 GNSS SIMULATOR MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 28 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 72 GNSS SIMULATORS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 73 GNSS SIMULATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: GNSS SIMULATOR MARKET DRIVERS

- 11.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 74 NORTH AMERICA: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION

- TABLE 75 NORTH AMERICA: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 76 NORTH AMERICA: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION

- TABLE 77 NORTH AMERICA: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 79 NORTH AMERICA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 80 NORTH AMERICA: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION

- TABLE 81 NORTH AMERICA: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 82 NORTH AMERICA: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION

- TABLE 83 NORTH AMERICA: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 84 NORTH AMERICA: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 85 NORTH AMERICA: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: GNSS SIMULATORS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 87 NORTH AMERICA: GNSS SIMULATORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.2.3 US

- 11.2.3.1 Government support results an ideal environment for research and innovation

- TABLE 88 US: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION

- TABLE 89 US: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 90 US: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 91 US: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 92 US: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 93 US: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 94 US: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 95 US: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 96 US: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 97 US: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 98 US: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 99 US: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.2.4 CANADA

- 11.2.4.1 Use of PNT-Policy for security, emergency preparedness, and science interests

- TABLE 100 CANADA: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 101 CANADA: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 102 CANADA: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 103 CANADA: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 104 CANADA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 105 CANADA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 106 CANADA: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 107 CANADA: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 108 CANADA: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 109 CANADA: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 110 CANADA: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 111 CANADA: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: GNSS SIMULATORS MARKET DRIVERS

- 11.3.2 EUROPE: REGULATORY LANDSCAPE

- TABLE 112 EUROPE: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 113 EUROPE: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 114 EUROPE: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 115 EUROPE: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 116 EUROPE: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 117 EUROPE: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 118 EUROPE: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 119 EUROPE: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 120 EUROPE: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 121 EUROPE: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 122 EUROPE: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 123 EUROPE: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 124 EUROPE: GNSS SIMULATORS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 125 EUROPE: GNSS SIMULATORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Developed outline plans for a conventional satellite system as an alternative to American GPS

- TABLE 126 UK: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 127 UK: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 128 UK: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 129 UK: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 130 UK: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 131 UK: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 132 UK: GNSS SIMULATORS MARKET SIZE, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 133 UK: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 134 UK: GNSS SIMULATORS MARKET SIZE, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 135 UK: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 136 UK: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 137 UK: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.3.4 GERMANY

- 11.3.4.1 GNSS simulation technology to be leveraged heavily by German automobile technology

- TABLE 138 GERMANY: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 139 GERMANY: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 140 GERMANY: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 141 GERMANY: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 142 GERMANY: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 143 GERMANY: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 144 GERMANY: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 145 GERMANY: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 146 GERMANY: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 147 GERMANY: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 148 GERMANY: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 149 GERMANY: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.3.5 FRANCE

- 11.3.5.1 Government to focus on implementation plan for Performance-Based Navigation (PBN)

- TABLE 150 FRANCE: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 151 FRANCE: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 152 FRANCE: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 153 FRANCE: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 154 FRANCE: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 155 FRANCE: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 156 FRANCE: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 157 FRANCE: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 158 FRANCE: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 159 FRANCE: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 160 FRANCE: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 161 FRANCE: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.3.6 REST OF EUROPE

- TABLE 162 REST OF EUROPE: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 163 REST OF EUROPE: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 164 REST OF EUROPE: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 165 REST OF EUROPE: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 166 REST OF EUROPE: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 167 REST OF EUROPE: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 168 REST OF EUROPE: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 169 REST OF EUROPE: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 170 REST OF EUROPE: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 171 REST OF EUROPE: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 172 REST OF EUROPE: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 173 REST OF EUROPE: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: GNSS SIMULATORS MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 174 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 175 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 176 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 177 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 178 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 179 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 180 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 181 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 182 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 183 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 184 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 185 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 186 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 187 ASIA PACIFIC: GNSS SIMULATORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 BeiDou created impact on China's Belt and Road Initiative (BRI)

- TABLE 188 CHINA: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 189 CHINA: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 190 CHINA: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 191 CHINA: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 192 CHINA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 193 CHINA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 194 CHINA: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 195 CHINA: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 196 CHINA: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 197 CHINA: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 198 CHINA: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 199 CHINA: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Government to increase spending on GNSS projects

- TABLE 200 JAPAN: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 201 JAPAN: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 202 JAPAN: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 203 JAPAN: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 204 JAPAN: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 205 JAPAN: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 206 JAPAN: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 207 JAPAN: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 208 JAPAN: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 209 JAPAN: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 210 JAPAN: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 211 JAPAN: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.4.5 INDIA

- 11.4.5.1 GNSS projects of government to drive GNSS simulation demand

- TABLE 212 INDIA: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 213 INDIA: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 214 INDIA: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 215 INDIA: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 216 INDIA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 217 INDIA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 218 INDIA: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 219 INDIA: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 220 INDIA: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 221 INDIA: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 222 INDIA: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 223 INDIA: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Government to build GPS under space development plan

- TABLE 224 SOUTH KOREA: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 225 SOUTH KOREA: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 226 SOUTH KOREA: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 227 SOUTH KOREA: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 228 SOUTH KOREA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 229 SOUTH KOREA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 230 SOUTH KOREA: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 231 SOUTH KOREA: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 232 SOUTH KOREA: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 233 SOUTH KOREA: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 234 SOUTH KOREA: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 235 SOUTH KOREA: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.4.7 REST OF ASIA PACIFIC

- TABLE 236 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 237 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 238 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 240 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 241 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 242 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 243 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 244 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 245 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 246 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 247 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.5 MIDDLE EAST AND AFRICA

- 11.5.1 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET DRIVERS

- 11.5.2 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

- TABLE 248 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 249 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 250 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 251 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 252 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 253 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 254 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 255 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 256 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 257 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 258 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 259 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 260 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 261 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.5.3 MIDDLE EAST

- 11.5.3.1 Government to launch two navigation satellites

- 11.5.4 AFRICA

- 11.5.4.1 Africa launches SBAS system

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: GNSS SIMULATORS MARKET DRIVERS

- 11.6.2 LATIN AMERICA: REGULATORY LANDSCAPE

- TABLE 262 LATIN AMERICA: GNSS SIMULATORS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 263 LATIN AMERICA: GNSS SIMULATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 264 LATIN AMERICA: GNSS SIMULATORS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 265 LATIN AMERICA: GNSS SIMULATORS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 266 LATIN AMERICA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2016-2021 (USD MILLION)

- TABLE 267 LATIN AMERICA: GNSS SIMULATORS MARKET, BY GNSS RECEIVER, 2022-2027 (USD MILLION)

- TABLE 268 LATIN AMERICA: GNSS SIMULATORS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 269 LATIN AMERICA: GNSS SIMULATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 270 LATIN AMERICA: GNSS SIMULATORS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 271 LATIN AMERICA: GNSS SIMULATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 272 LATIN AMERICA: GNSS SIMULATORS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 273 LATIN AMERICA: GNSS SIMULATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 274 LATIN AMERICA: GNSS SIMULATORS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 275 LATIN AMERICA: GNSS SIMULATORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.6.3 BRAZIL

- 11.6.3.1 Increased usage of GNSS simulation in automobile and IoT

- 11.6.4 MEXICO

- 11.6.4.1 Mexico launched Galileo Information Center (GIC)

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET EVALUATION FRAMEWORK

- FIGURE 31 MARKET EVALUATION FRAMEWORK: 2019-2022 WITNESSED MARKET EXPANSION AND CONSOLIDATION

- 12.3 REVENUE ANALYSIS OF LEADING PLAYERS

- FIGURE 32 GNSS SIMULATORS MARKET: REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

- TABLE 276 GNSS SIMULATORS MARKET: DEGREE OF COMPETITION

- 12.5 HISTORICAL REVENUE ANALYSIS

- FIGURE 33 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS 2017-2021 (USD MILLION)

- 12.6 RANKING OF KEY PLAYERS

- FIGURE 34 GNSS SIMULATORS MARKET KEY PLAYER RANKING, 2021

- 12.7 KEY COMPANY EVALUATION MATRIX

- 12.7.1 KEY COMPANY EVALUATION MATRIX (DEFINITIONS AND METHODOLOGY)

- 12.7.2 STARS

- 12.7.3 EMERGING LEADERS

- 12.7.4 PERVASIVE PLAYERS

- 12.7.5 PARTICIPANTS

- FIGURE 35 GNSS SIMULATORS MARKET, KEY PLAYER EVALUATION QUADRANT, 2022

- 12.8 COMPETITIVE BENCHMARKING

- 12.8.1 EVALUATION CRITERIA OF KEY COMPANIES

- TABLE 277 EVALUATION CRITERIA

- TABLE 278 COMPANY INDUSTRY FOOTPRINT

- TABLE 279 COMPANY REGION FOOTPRINT

- 12.9 SME EVALUATION MATRIX

- FIGURE 36 SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 37 GNSS SIMULATORS MARKET, SME EVALUATION MATRIX, 2022

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT/SOLUTION LAUNCHES

- TABLE 280 GNSS SIMULATORS MARKET: PRODUCT/SOLUTION LAUNCHES AND ENHANCEMENTS 2019-2022

- 12.10.2 DEALS

- TABLE 281 GNSS SIMULATORS MARKET: DEALS 2019-2022

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats)**

- 13.2 KEY PLAYERS

- 13.2.1 SPIRENT COMMUNICATIONS

- TABLE 282 SPIRENT COMMUNICATIONS: BUSINESS OVERVIEW

- FIGURE 38 SPIRENT COMMUNICATIONS: COMPANY SNAPSHOT

- TABLE 283 SPIRENT COMMUNICATIONS: SOLUTIONS OFFERED

- TABLE 284 SPIRENT COMMUNICATIONS: SERVICES OFFERED

- TABLE 285 SPIRENT COMMUNICATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 286 SPIRENT COMMUNICATIONS: DEALS

- 13.2.2 ROHDE & SCHWARZ

- TABLE 287 ROHDE & SCHWARZ: BUSINESS OVERVIEW

- TABLE 288 ROHDE & SCHWARZ: SOLUTIONS OFFERED

- TABLE 289 ROHDE & SCHWARZ: SERVICES OFFERED

- TABLE 290 ROHDE & SCHWARZ: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 291 ROHDE & SCHWARZ: DEALS

- 13.2.3 HEXAGON

- TABLE 292 HEXAGON: BUSINESS OVERVIEW

- FIGURE 39 HEXAGON: COMPANY SNAPSHOT

- TABLE 293 HEXAGON: SOLUTIONS OFFERED

- TABLE 294 HEXAGON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 295 HEXAGON: DEALS

- 13.2.4 SYNTONY GNSS

- TABLE 296 SYNTONY GNSS: BUSINESS OVERVIEW

- TABLE 297 SYNTONY GNSS: SOLUTIONS OFFERED

- TABLE 298 SYNTONY GNSS: DEALS

- 13.2.5 VIAVI SOLUTIONS

- TABLE 299 VIAVI SOLUTIONS: BUSINESS OVERVIEW

- FIGURE 40 VIAVI SOLUTIONS: COMPANY SNAPSHOT

- TABLE 300 VIAVI SOLUTIONS: SOLUTIONS OFFERED

- TABLE 301 VIAVI SOLUTIONS: PRODUCT LAUNCHES

- TABLE 302 VIAVI SOLUTIONS: DEALS

- 13.2.6 KEYSIGHT TECHNOLOGIES

- TABLE 303 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 41 KEYSIGHT TECHNOLOGY: COMPANY SNAPSHOT

- TABLE 304 KEYSIGHT TECHNOLOGIES: SOLUTIONS OFFERED

- TABLE 305 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 306 KEYSIGHT TECHNOLOGIES: DEALS

- 13.2.7 U-BLOX

- TABLE 307 U-BLOX: BUSINESS OVERVIEW

- FIGURE 42 U-BLOX: COMPANY SNAPSHOT

- TABLE 308 U-BLOX: SOLUTIONS OFFERED

- TABLE 309 U-BLOX: SERVICES OFFERED

- TABLE 310 U-BLOX: PRODUCT LAUNCHES

- TABLE 311 U-BLOX: DEALS

- 13.2.8 AVERNA

- TABLE 312 AVERNA: BUSINESS OVERVIEW

- TABLE 313 AVERNA: SOLUTIONS OFFERED

- TABLE 314 AVERNA: PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.2.9 ACCORD SOFTWARE & SYSTEMS

- TABLE 315 ACCORD SOFTWARE & SYSTEMS: BUSINESS OVERVIEW

- TABLE 316 ACCORD SOFTWARE & SYSTEMS: SOLUTIONS OFFERED

- TABLE 317 ACCORD SOFTWARE & SYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.2.10 RACELOGIC

- TABLE 318 RACELOGIC: BUSINESS OVERVIEW

- TABLE 319 RACELOGIC: SOLUTIONS OFFERED

- TABLE 320 RACELOGIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 321 RACELOGIC: DEALS

- 13.2.11 GMV NSL

- TABLE 322 GMV NSL: BUSINESS OVERVIEW

- TABLE 323 GMV NSL: SOLUTIONS OFFERED

- TABLE 324 GMV NSL: SERVICES OFFERED

- TABLE 325 GMV NSL: DEALS

- 13.3 OTHER PLAYERS

- 13.3.1 CAST NAVIGATION

- 13.3.2 IFEN

- 13.3.3 TELEORBIT

- 13.3.4 IP-SOLUTION

- 13.3.5 JACKSON LABS TECHNOLOGIES

- 13.3.6 WORK MICROWAVE

- 13.3.7 M3 SYSTEMS

- 13.3.8 QASCOM

- 13.3.9 SALUKI TECHNOLOGIES

- 13.3.10 MAXEYE TECHNOLOGY

- 13.3.11 TERSUS GNSS

- 13.3.12 DIGILOGIC

- 13.3.13 NOFFZ TECHNOLOGY

- 13.3.14 ELKAY

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT MARKETS

- 14.1 INTRODUCTION TO ADJACENT MARKETS

- TABLE 326 ADJACENT MARKETS AND FORECASTS

- 14.2 LIMITATIONS

- 14.3 GNSS SIMULATORS MARKET: ADJACENT MARKETS

- 14.3.1 SIMULATORS MARKET

- TABLE 327 SIMULATOR MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 328 SIMULATOR MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 329 SIMULATOR MARKET, BY SERVICE, 2019-2021 (USD MILLION)

- TABLE 330 SIMULATOR MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- 14.3.2 LOCATION-BASED SERVICES (LBS) AND REAL-TIME LOCATION SYSTEMS (RTLS) MARKET

- TABLE 331 LBS AND RTLS MARKET, BY APPLICATION, 2016-2020 (USD MILLION)

- TABLE 332 LBS AND RTLS MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- TABLE 333 TRACKING AND NAVIGATION: LBS AND RTLS MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 334 TRACKING AND NAVIGATION: LBS AND RTLS MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 335 MARKETING AND ADVERTISING: LBS AND RTLS MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 336 MARKETING AND ADVERTING: LBS AND RTLS MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 337 LOCATION-BASED SOCIAL NETWORKS: LBS AND RTLS MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 338 LOCATION-BASED SOCIAL NETWORKS: LBS AND RTLS MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 339 LOCATION-BASED HEALTH MONITORING: LBS AND RTLS MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 340 LOCATION-BASED HEALTH MONITORING: LBS AND RTLS MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 341 OTHERS: LBS AND RTLS MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 342 OTHERS: LBS AND RTLS MARKET, BY REGION, 2021-2026 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS