|

|

市場調査レポート

商品コード

1107620

軍用ウェアラブル機器の世界市場:エンドユーザー別 (陸軍、海軍、空軍)・技術別・ウェアラブル機器の種類別 (ヘッドウェア、アイウェア、リストウェア、ヒアラブル、ボディウェア)・地域別 (北米、欧州、アジア太平洋、中東、その他の地域) の将来予測 (2027年まで)Military Wearables Market by End User (Army, Navy, Air Force), Technology, Wearable Type (Headwear, Eyewear, Wristwear, Hearables and Bodywear) and Region (North America, Europe, Asia Pacific, Middle East, Rest of the World) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 軍用ウェアラブル機器の世界市場:エンドユーザー別 (陸軍、海軍、空軍)・技術別・ウェアラブル機器の種類別 (ヘッドウェア、アイウェア、リストウェア、ヒアラブル、ボディウェア)・地域別 (北米、欧州、アジア太平洋、中東、その他の地域) の将来予測 (2027年まで) |

|

出版日: 2022年07月25日

発行: MarketsandMarkets

ページ情報: 英文 260 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

軍用ウェアラブル機器の市場規模は、2022年の31億米ドルから2027年には34億米ドルに成長し、2022年から2027年までのCAGRは1.8%に達すると予測されています。

軍用ウェアラブル機器市場は、世界各国で実施された兵士近代化プログラムのために成長すると想定されています。これらの国は、高度なヘッドマウントディスプレイ、身体診断センサー、高度な個人用衣服、改良型ナビゲーション・通信デバイス、その他の種類の軍用ウェアラブル機器などの最先端技術を、戦闘効果を高めるために標準の兵士の装備リストに積極的に組み込んでいます。

"エンドユーザー別では、予測期間中、陸軍セグメントが市場シェアを独占する"

陸軍は、危険な作業環境にさらされることが多く、不安や抑うつ、外部からの危険による人命損失のリスクが高まるため、現在のウェアラブル技術の大半は陸軍の戦闘効率を高めるために設計されており、陸軍セグメントは予測期間中に市場シェアを独占すると予測されます。

"予測期間中は、ビジョン・監視分野が軍用ウェアラブル機器市場をリードする"

技術別では、ビジョン・監視分野が予測期間中に軍用ウェアラブル機器の市場をリードすると予測されています。また、この市場では、AR/VR技術ベースの製品に大きな需要が見られます。さらに、ナイトビジョンヘッドウェア技術の進歩も、軍隊が夜間や視界の悪い状況下で重要な任務を遂行するのに役立つため、市場を牽引しています。

"2022年は、ヘッドウェアセグメントが最大シェアを占める"

ウェアラブル機器の種類別では、ヘッドウェアセグメントは予測期間中に市場をリードすると予測されます。このセグメントはさらに、アイウェア、ボディウェア、ヒアラブル、リストウェアに区分されます。ヘッドウェアと先進技術(AR/VR)の統合による巨大な需要が、ウェアラブル機器セグメントの推進要因となっています。

"2022年に、アジア太平洋が最大シェアを占める"

2022年の市場シェアはアジア太平洋が最大で、中東は予測期間中に最も高いCAGRを記録すると予測されています。この地域での地政学的緊張の高まりは、兵士向けの最新のウェアラブル技術の採用に向けて投資を奨励しており、これはその地域における市場の成長可能性を支えています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える傾向/混乱

- 価格分析

- 市場エコシステム

- 大手企業

- 未上場・小規模企業

- エンドユーザー

- バリューチェーン分析

- 技術分析

- 無線周波数 (RF)

- 積層造形 (AM)

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 主な会議とイベント (2022年~2023年)

- 航空宇宙産業の規制状況

第6章 産業動向

- イントロダクション

- サプライチェーン分析

- 技術動向

- 個々の状況認識:すべてのコマンドレベルで決定を下す

- 訓練・シミュレーション用の拡張・仮想現実 (AR/VR)

- マルチバンド戦術通信アンプ

- MUOS (Mobile User Objective System):携帯電話に類似したソフトウェア無線の機能

- 近距離通信

- スマート衣料品

- マイクロエレクトロメカニカルシステムとナノテクノロジー

- 次世代センサーシステム

- IoTベースのウェアラブル機器

- スマートバッテリー

- メガトレンドの影響

- インダストリー4.0の実装

- 軍用ウェアラブル機器製造のサプライチェーンの進歩

- イノベーションと特許登録

第7章 軍用ウェアラブル機器市場:エンドユーザー別

- イントロダクション

- 陸軍

- 空軍

- 海軍

第8章 軍用ウェアラブル機器市場:技術別

- イントロダクション

- ビジョン・監視

- 拡張・仮想現実 (AR/VR)

- イメージング

- スケルトン (外骨格)

- パッシブスケルトン

- パワードスケルトン

- 通信・コンピューティングシステム

- マルチバンド戦術無線

- ウェアラブルコンピュータ

- 戦術用ヘッドセット

- 組み込みアンテナ

- ナビゲーション

- 歩兵用IFF (敵味方識別装置)

- 人員回収装置

- DAPS (歩兵用位置・ナビゲーション・タイミング)

- 電力・エネルギー管理

- バッテリー

- 環境発電装置

- ワイヤレス充電器

- スマートテキスタイル

- 迷彩服

- 環境発電

- 温度監視・制御

- 保護・移動性

- ネットワーク・接続管理

- ウェアラブルPAN (パーソナルエリアネットワーク) とハブ

- コンパクトコネクタ

- ワイヤー・ケーブル

- 健康モニタリングと診断

- モニタリング

- スマートバンドとアクティビティトラッカー

- ウェアラブルパッチ

- 身体診断センサー

第9章 軍用ウェアラブル機器市場:ウェアラブル機器の種類別

- イントロダクション

- ヘッドウェア

- アイウェア

- ボディウェア

- ヒアラブル

- リストウェア

第10章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- ロシア

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- 他のアジア太平洋諸国

- 中東

- サウジアラビア

- アラブ首長国連邦

- イスラエル

- トルコ

- 他の中東諸国

- その他の地域

- ラテンアメリカ

- アフリカ

第11章 競合情勢

- イントロダクション

- 主要企業の市場シェア分析 (2021年)

- 上位5社のランキング分析 (2021年)

- 上位5社の収益分析 (2021年)

- 企業の製品フットプリント分析

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合シナリオ

- 市場評価フレームワーク

- 新製品の発売と開発

- 資本取引

- ベンチャー/契約/拡張

第12章 企業プロファイル

- イントロダクション

- 主要企業

- BAE SYSTEMS PLC

- ELBIT SYSTEMS LTD

- RHEINMETALL AG

- SAAB AB

- THALES GROUP

- ASELSAN A.S.

- TELEDYNE FLIR LLC

- GENERAL DYNAMICS CORPORATION

- BIONIC POWER INC.

- L3HARRIS TECHNOLOGIES INC.

- LEONARDO S.P.A.

- LOCKHEED MARTIN CORPORATION

- NORTHROP GRUMMAN CORPORATION

- SAFRAN SA

- ULTRA-ELECTRONICS

- INTERACTIVE WEAR AG

- TT ELECTRONICS PLC

- TE CONNECTIVITY LTD.

- ST ENGINEERING

- VIASAT INC.

- その他の企業

- GLENAIR INC

- EPSILOR-ELECTRIC FUEL LTD

- MILPOWER SOURCE INC

- SAFARILAND L.L.C.

第13章 付録

The military wearables market size is projected to grow from USD 3.1 Billion in 2022 to USD 3.4 Billion by 2027, at a CAGR of 1.8% from 2022 to 2027. The military wearables market is envisioned to grow on account of the soldier modernization programs undertaken by several nations across the globe. These nations are actively integrating cutting-edge technologies like advanced head mounted displays, body diagnostics sensors, advanced personal clothing, improved navigation & communication devices, and other types of military wearables in their standard soldier equipment list to enhance their combat effectiveness.

The land forces segment is projected to dominate market share in the End User segment during the forecast period

Based on end user, the land forces segment is projected to domainate market share during the forecast period as most of the current generation wearable technologies are designed to enhance the combat effectiveness of land forces as these personnel are often exposed to hazardous working conditions leading to anxiety, depression, and an increased risk of loss of life due to external danger.

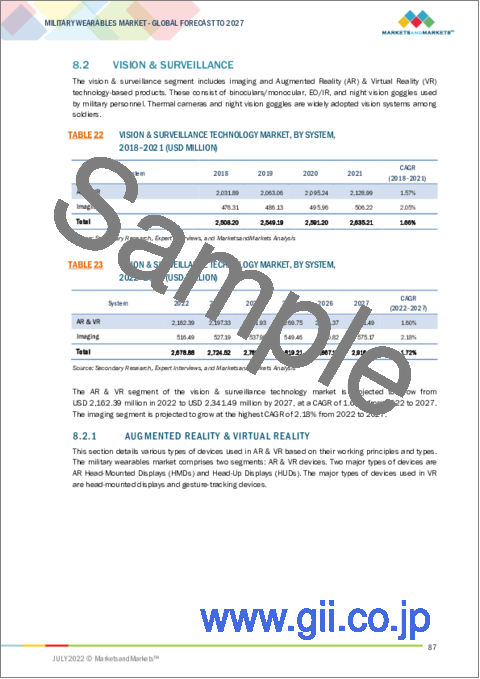

The vision & surveillance segment projected to lead military wearables market during forecast period

Based on technology, the video & surveillance segment is projected to lead the military wearables market during the forecast period. The market is also witnessing huge demand for Augmented Reality (AR) & Virtual Reality (VR) technology-based product. Additionally, advancement in the night vision headwear technologies is also driving the market as these technologies help armed forces carry out critical mission at night or during conditions with low visibility.

Headwear segment is expected to account for the largest share in 2022

Based on wearables type, the headwear segment is projected to lead the military wearables market during the forecast period. This segment has been further segmented into eyewear, body wear, hearables, wristwear. There is huge demand due to the integration of the headwear with advanced technology (Augmented Reality (AR) & Virtual Reality (VR)) is the driven factor for wearables segment.

Asia Pacific is expected to account for the largest share in 2022

The Military Wearables industry has been studied for North America, Europe, Asia Pacific, Middle East, and Rest of the World. Asia Pacific accounted for the largest market share in 2022, and Middle East is projected to witness the highest CAGR during the forecast period. The escalating geopolitical tension in the regions has encouraged investments towards the adoption of modern wearable technologies of the soldiers, which favors the growth potential of the market in focus in the regions.

The break-up of profile of primary participants in the Simulators market:

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: C Level - 50%, Director Level - 25%, Others-25%

- By Region: North America -60%, Europe - 20%, AsiaPacific - 10%,Middle East - 5%, and Rest of the World - 5%

Major players operating in the military wearables market are BAE Systems PLC (UK), Elbit Systems Ltd.(Israel), Rheinmetall AG(Germany), Thales Group(France), Saab AB(Sweden), Aselsan A.S(Turkey), General Dynamic Corporation (US) are some of the market players.

Research Coverage:

The report segments the military wearables market based on End User, Technology , Wearable Type and Region. Based on End User, the military wearables market is segmented into Army, Navy, & Air Force. Based on the technology, the market is segmented into commuinication & computing, network and connectivity management, navigation, vision & surveillance, exoskeleton, monitoring, power and energy source, smart textiles . Based on the wearables type, the market is segmented into headwear, eyewear, wristwear, hearbles, bodywear. The military wearbles market has been studied for North America, Europe, Asia Pacific, Middle East, and Rest of the World. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the military wearables market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; Contracts, partnerships, agreements new product & service launches, mergers and acquisitions; and recent developments associated with the military wearables market. Competitive analysis of upcoming startups in the military wearables market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall military wearables market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on military wearables offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product& service launches in the military wearables market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the military wearables market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the military wearables market

- Competitive Assessment: In-depth assessment of market shares, growth strategies andservice offerings of leading players in the military wearables market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY AND PRICING CONSIDERED

- TABLE 1 USD EXCHANGE RATES

- 1.5 INCLUSIONS AND EXCLUSIONS

- TABLE 2 MILITARY WEARABLES MARKET, BY SEGMENT

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- FIGURE 1 OLD VS NEW MARKET ESTIMATES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 MILITARY WEARABLES MARKET: RESEARCH DESIGN

- 2.2 SECONDARY DATA

- 2.2.1 SECONDARY SOURCES

- 2.3 PRIMARY DATA

- 2.3.1 PRIMARY SOURCES

- 2.4 DEMAND- AND SUPPLY-SIDE ANALYSIS

- 2.4.1 INTRODUCTION

- 2.4.2 DEMAND-SIDE INDICATORS

- 2.4.2.1 Widening geopolitical rift leading to tactical evolution

- 2.4.3 SUPPLY-SIDE INDICATORS

- 2.4.3.1 Oligopolistic market and supply of raw materials affect availability and pricing

- 2.5 RESEARCH APPROACH & METHODOLOGY

- TABLE 3 SEGMENTS AND SUBSEGMENTS

- 2.6 MARKET SIZE ESTIMATION

- 2.6.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND-SIDE)

- 2.6.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SUPPLY-SIDE)

- 2.6.3 BREAKDOWN OF PRIMARIES

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.7 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

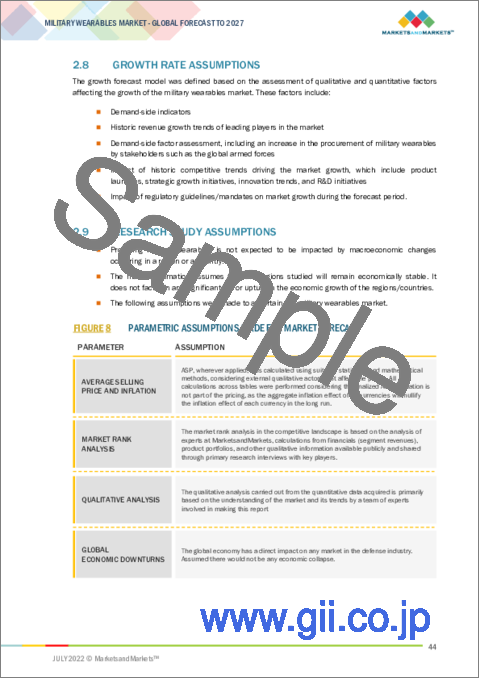

- 2.8 GROWTH RATE ASSUMPTIONS

- 2.9 RESEARCH STUDY ASSUMPTIONS

- FIGURE 8 PARAMETRIC ASSUMPTIONS MADE FOR MARKET FORECAST

- 2.10 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 9 LAND FORCES SEGMENT TO LEAD MILITARY WEARABLES MARKET FROM 2022 TO 2027

- FIGURE 10 MONITORING SEGMENT OF MILITARY WEARABLES MARKET TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 11 REGIONAL ANALYSIS: MILITARY WEARABLES MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN MILITARY WEARABLES MARKET

- FIGURE 12 INCREASING MILITARY MODERNIZATION PROGRAMS DRIVING MARKET GROWTH

- 4.2 MILITARY WEARABLES MARKET, BY END USER

- FIGURE 13 LAND FORCES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

- 4.3 MILITARY WEARABLES MARKET, BY WEARABLE TYPE

- FIGURE 14 HEADWEAR SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- 4.4 COMMUNICATION & COMPUTING SYSTEM MILITARY WEARABLES MARKET, BY PRODUCT

- FIGURE 15 TACTICAL MULTIBAND RADIOS TO LEAD COMMUNICATION & COMPUTING SYSTEM SEGMENT FROM 2022 TO 2027

- 4.5 VISION & SURVEILLANCE MILITARY WEARABLES MARKET, BY SYSTEM

- FIGURE 16 IMAGING SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 4.6 MILITARY WEARABLES MARKET, BY TECHNOLOGY

- FIGURE 17 VISION & SURVEILLANCE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

- 4.7 MILITARY WEARABLES MARKET, BY COUNTRY

- FIGURE 18 CANADA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 MILITARY WEARABLES MARKET: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Developing lightweight and rugged wearable systems

- TABLE 4 CAPABILITIES OF MILITARY WEARABLES

- TABLE 5 SOLDIER MODERNIZATION PROGRAMS, BY COUNTRY/GROUP

- 5.2.1.2 Asymmetric warfare encourages adoption of military wearable technologies

- FIGURE 20 NUMBER OF CASUALTIES DUE TO TERRORIST ATTACKS WORLDWIDE, 2006-2016

- 5.2.2 RESTRAINTS

- 5.2.2.1 Conventional warfare systems preferred over advanced systems in developing countries

- 5.2.2.2 Supply chain disruptions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Developing and integrating advanced technologies to enhance current generation military wearable capabilities

- TABLE 6 CAPABILITY DEFICIENCIES OF EXISTING MILITARY WEARABLES

- 5.2.3.2 Integrating nanotechnology into military wearable subsystems

- TABLE 7 USE OF NANOTECHNOLOGY IN MILITARY WEARABLES

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of strategic clarity and technology readiness

- 5.2.4.2 Reducing weight of military wearables without compromising on protection and combat performance

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MILITARY WEARABLES MANUFACTURERS

- FIGURE 21 REVENUE SHIFT IN MILITARY WEARABLES MARKET

- 5.4 PRICING ANALYSIS

- TABLE 8 AVERAGE SELLING PRICE RANGE: MILITARY WEARABLES MARKET (BY TECHNOLOGY)

- 5.5 MARKET ECOSYSTEM

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- FIGURE 22 MARKET ECOSYSTEM MAP: MILITARY WEARABLES

- TABLE 9 MILITARY WEARABLES MARKET ECOSYSTEM

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS: MILITARY WEARABLES MARKET

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 RADIOFREQUENCY

- 5.7.2 ADDITIVE MANUFACTURING

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 SMART CLOTHING

- 5.8.2 SITUATION AWARENESS

- 5.8.3 TRAINING & SIMULATION

- 5.8.4 EXOSKELETON

- 5.8.5 WEARABLE BATTERIES & ENERGY HARVESTERS

- 5.9 PORTER'S FIVE FORCES MODEL

- TABLE 10 MILITARY WEARABLES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 COMPETITION IN THE INDUSTRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MILITARY WEARABLE TECHNOLOGIES

- TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MILITARY WEARABLE TECHNOLOGIES (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR MILITARY WEARABLES TECHNOLOGIES

- TABLE 12 KEY BUYING CRITERIA FOR MILITARY WEARABLES TECHNOLOGIES

- 5.11 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 13 MILITARY WEARABLES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.12 TARIFF REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 26 SUPPLY CHAIN ANALYSIS OF MILITARY WEARABLES MARKET

- 6.3 TECHNOLOGY TRENDS

- 6.3.1 INDIVIDUAL SITUATIONAL AWARENESS: DELIVERING DECISIONS AT ALL COMMAND LEVELS

- 6.3.2 AR AND VR FOR TRAINING AND SIMULATION

- 6.3.3 MULTIBAND TACTICAL COMMUNICATION AMPLIFIERS

- 6.3.4 MOBILE USER OBJECTIVE SYSTEM: CELL PHONE-LIKE CAPABILITY FOR SOFTWARE-DEFINED RADIOS

- 6.3.5 NEAR FIELD COMMUNICATION

- 6.3.6 SMART CLOTHING

- 6.3.7 MICRO-ELECTROMECHANICAL SYSTEMS AND NANOTECHNOLOGY

- 6.3.8 NEXT-GENERATION SENSOR SYSTEMS

- 6.3.9 IOT-BASED WEARABLES

- 6.3.10 SMART BATTERIES

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 IMPLEMENTATION OF INDUSTRY 4.0

- 6.4.2 ADVANCEMENTS IN SUPPLY CHAIN FOR MILITARY WEARABLES MANUFACTURING

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 17 INNOVATIONS AND PATENT REGISTRATIONS, 2019-2022

7 MILITARY WEARABLES MARKET, BY END USER

- 7.1 INTRODUCTION

- FIGURE 27 LAND FORCES SEGMENT TO DOMINATE MILITARY WEARABLES MARKET FROM 2022 TO 2027

- TABLE 18 MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 19 MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- 7.2 LAND FORCES

- 7.2.1 ADOPTION OF WEARABLES TO ENHANCE NIGHT COMBAT AND LOAD-CARRYING CAPABILITIES OF LAND SOLDIERS

- 7.3 AIRBORNE FORCES

- 7.3.1 AR-BASED HELMETS USAGE BY FIGHTER PILOTS FOR BETTER SITUATIONAL AWARENESS

- 7.4 NAVAL FORCES

- 7.4.1 HEALTH MONITORING WEARABLE DEVICES USAGE FOR NAVAL FORCES

8 MILITARY WEARABLES MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- FIGURE 28 VISION & SURVEILLANCE SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- TABLE 20 MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 21 MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 8.2 VISION & SURVEILLANCE

- TABLE 22 VISION & SURVEILLANCE TECHNOLOGY MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 23 VISION & SURVEILLANCE TECHNOLOGY MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- 8.2.1 AUGMENTED REALITY & VIRTUAL REALITY

- TABLE 24 AUGMENTED REALITY & VIRTUAL REALITY MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 25 AUGMENTED REALITY & VIRTUAL REALITY MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 8.2.1.1 Head-mounted displays

- 8.2.1.1.1 Adoption of HMDs with AR in airborne forces

- 8.2.1.2 Smart glasses

- 8.2.1.2.1 Smart glasses integrated with 3D stereoscopic displays, wireless connectivity, and high-performance positional sensors to be explored by defense industry

- 8.2.1.3 Gesture tracking devices

- 8.2.1.3.1 Gesture-controlled robotics drives adoption

- 8.2.1.4 Smart helmets

- 8.2.1.4.1 Smart helmets integrated with low-resolution, high-resolution, and infrared cameras for integrated soldier suit

- 8.2.1.1 Head-mounted displays

- 8.2.2 IMAGING

- TABLE 26 IMAGING MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 27 IMAGING MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 8.2.2.1 Night vision goggles

- 8.2.2.1.1 Enhancing night combat capabilities of individual soldiers and integrating NVGs with smart helmets drive growth

- 8.2.2.2 Sights & scopes

- 8.2.2.2.1 Adopting sights & scopes for accurate targeting by combat soldiers

- 8.2.2.3 EO/IR & thermal cameras

- 8.2.2.3.1 EO/IR imaging systems in high demand for target acquisition and situational awareness

- 8.2.2.1 Night vision goggles

- 8.3 EXOSKELETON

- TABLE 28 EXOSKELETON TECHNOLOGY MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 29 EXOSKELETON TECHNOLOGY MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 8.3.1 PASSIVE EXOSKELETONS

- 8.3.1.1 Low cost and powerless operation led to high adoption of passive exoskeletons

- 8.3.2 POWERED EXOSKELETONS

- 8.3.2.1 R&D activities to develop advanced battery-powered exoskeletons for land soldiers

- 8.4 COMMUNICATION & COMPUTING SYSTEM

- TABLE 30 COMMUNICATION & COMPUTING SYSTEM TECHNOLOGY MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 31 COMMUNICATION & COMPUTING SYSTEM TECHNOLOGY MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 8.4.1 TACTICAL MULTIBAND RADIOS

- 8.4.1.1 Portable radio programs boost tactical multiband radio growth in North America and Europe

- 8.4.2 WEARABLE COMPUTERS

- 8.4.2.1 Electronic devices wired into clothing to track enemy targets increased soldier network with airborne, land, and naval forces

- 8.4.3 TACTICAL HEADSETS

- 8.4.3.1 Developing cutting-edge headsets for tactical communication and hearing protection

- 8.4.4 EMBEDDED ANTENNAS

- 8.4.4.1 IoT and jam-resistant communication led to adoption of embedded antennas

- 8.5 NAVIGATION

- TABLE 32 NAVIGATION TECHNOLOGY MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 33 NAVIGATION TECHNOLOGY MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 8.5.1 DISMOUNTED IFF

- 8.5.1.1 Adoption of dismounted IFF for special forces

- 8.5.2 PERSONNEL RECOVERY DEVICES

- 8.5.2.1 Used by land forces to signal, alert, and notify authorities about well-being of soldiers

- 8.5.3 DISMOUNTED POSITIONING, NAVIGATION, AND TIMING

- 8.5.3.1 Replaces GPS receivers and single source of positioning & navigation to support communications, command and control, logistics, and targeting

- 8.6 POWER & ENERGY MANAGEMENT

- TABLE 34 POWER & ENERGY MANAGEMENT TECHNOLOGY MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 35 POWER & ENERGY MANAGEMENT TECHNOLOGY MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 8.6.1 BATTERIES

- 8.6.1.1 Developing fuel cells powered batteries and solar-powered batteries for land soldiers

- 8.6.2 ENERGY HARVESTERS

- 8.6.2.1 Requirement of energy harvesters for battery support applications

- 8.6.3 WIRELESS CHARGERS

- TABLE 36 POWER & ENERGY MANAGEMENT TECHNOLOGY MARKET, BY WIRELESS CHARGER, 2018-2021 (USD MILLION)

- TABLE 37 POWER & ENERGY MANAGEMENT TECHNOLOGY MARKET, BY WIRELESS CHARGER, 2022-2027 (USD MILLION)

- 8.6.3.1 Magnetic resonance technology

- 8.6.3.1.1 Developing magnetic resonance technology for large power requirement wearables

- 8.6.3.2 Inductive technology

- 8.6.3.2.1 Adopting inductive wireless chargers for smart textiles and e-textiles to power wearables

- 8.6.3.3 Capacitive coupling/conductive

- 8.6.3.3.1 R&D in capacitive charging techniques to power devices and batteries

- 8.6.3.1 Magnetic resonance technology

- 8.7 SMART TEXTILES

- 8.7.1 CAMOUFLAGE

- 8.7.1.1 Bionic adaptive material & thermal and photosensitive fibers in camouflage materials

- 8.7.2 ENERGY HARVEST

- 8.7.2.1 Growing need for energy harvesters in various applications

- 8.7.3 TEMPERATURE MONITORING & CONTROL

- 8.7.3.1 Real-time monitoring of body heat map of defense personnel to enhance training

- 8.7.4 PROTECTION AND MOBILITY

- 8.7.4.1 Advancement in soldier protection equipment & wearables

- 8.7.1 CAMOUFLAGE

- 8.8 NETWORK & CONNECTIVITY MANAGEMENT

- TABLE 38 NETWORK & CONNECTIVITY MANAGEMENT TECHNOLOGY MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 39 NETWORK & CONNECTIVITY MANAGEMENT TECHNOLOGY MARKET, 2022-2027 (USD MILLION)

- 8.8.1 WEARABLE PERSONAL AREA NETWORKS & HUBS

- 8.8.1.1 Effective information sharing among war-fighting platforms by network-enabled capability in wearable PAN

- 8.8.2 COMPACT CONNECTORS

- 8.8.2.1 Next-generation integrated connectors offer maximum wearability, modularity, and performance by withstanding severe operating and environmental conditions

- 8.8.3 WIRES & CABLES

- 8.8.3.1 High-rate data transmission and rugged design explored in new range of wires & cables

- 8.8.4 HEALTH MONITORING AND DIAGNOSTICS

- 8.8.4.1 Adopting biometric sensor integrated wearables

- 8.9 MONITORING

- TABLE 40 MONITORING TECHNOLOGY MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 41 MONITORING TECHNOLOGY MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 8.9.1 SMART BANDS & ACTIVITY TRACKERS

- 8.9.1.1 Adoption of smart bands and smartwatches among land soldiers for activity tracking and health monitoring

- 8.9.2 WEARABLE PATCHES

- 8.9.2.1 Wearable patches usage for real-time non-invasive sensing and assessment of a soldier's physiological condition

- 8.9.3 BODY DIAGNOSTIC SENSORS

- 8.9.3.1 Developing wide range of body diagnostic sensors for health monitoring applications

9 MILITARY WEARABLES MARKET, BY WEARABLE TYPE

- 9.1 INTRODUCTION

- FIGURE 29 HEADWEAR SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- TABLE 42 MILITARY WEARABLES MARKET, BY WEARABLE TYPE, 2018-2021 (USD MILLION)

- TABLE 43 MILITARY WEARABLES MARKET, BY WEARABLE TYPE, 2022-2027 (USD MILLION)

- 9.2 HEADWEAR

- 9.2.1 INTEGRATING ADVANCED TECHNOLOGIES IN HEADWEAR

- 9.3 EYEWEAR

- 9.3.1 TECHNOLOGICALLY ADVANCED NIGHT VISION EQUIPMENT TO DRIVE GROWTH

- 9.4 BODYWEAR

- 9.4.1 ADVANCEMENTS IN EXOSKELETONS, SMART TEXTILES, AND MONITORING SENSORS

- 9.5 HEARABLES

- 9.5.1 STRENGTHENING ARMY BY USING ADVANCED HEADSETS FOR COMMUNICATION

- 9.6 WRISTWEAR

- 9.6.1 FITBIT, SMARTWATCHES, AND WEARABLES PATCHES USAGE FOR TRACKING SOLDIER HEALTH

10 REGIONAL ANALYSIS

- 10.1 INTRODUCTION

- FIGURE 30 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF MILITARY WEARABLES MARKET IN 2022

- TABLE 44 MILITARY WEARABLES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 45 MILITARY WEARABLES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 31 NORTH AMERICA: MILITARY WEARABLES MARKET SNAPSHOT

- TABLE 46 NORTH AMERICA: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 47 NORTH AMERICA: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 48 NORTH AMERICA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 49 NORTH AMERICA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 50 NORTH AMERICA: MILITARY WEARABLES MARKET, BY WEARABLE TYPE, 2018-2021 (USD MILLION)

- TABLE 51 NORTH AMERICA: MILITARY WEARABLES MARKET, BY WEARABLE TYPE, 2022-2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: MILITARY WEARABLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 53 NORTH AMERICA: MILITARY WEARABLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Increased spending on innovative technologies by US defense organizations and presence of private players fuel market growth

- TABLE 54 US: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 55 US: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 56 US: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 57 US: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Developing command & control devices lead to advancements in soldier protection systems

- TABLE 58 CANADA: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 59 CANADA: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 60 CANADA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 61 CANADA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 PESTLE ANALYSIS: EUROPE

- FIGURE 32 EUROPE: MILITARY WEARABLES MARKET SNAPSHOT

- TABLE 62 EUROPE: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 63 EUROPE: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 64 EUROPE: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 65 EUROPE: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 66 EUROPE: MILITARY WEARABLES MARKET, BY WEARABLE TYPE, 2018-2021 (USD MILLION)

- TABLE 67 EUROPE: MILITARY WEARABLES MARKET, BY WEARABLE TYPE, 2022-2027 (USD MILLION)

- TABLE 68 EUROPE: MILITARY WEARABLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 69 EUROPE: MILITARY WEARABLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Future soldier modernization to drive market growth

- TABLE 70 UK: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 71 UK: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 72 UK: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 73 UK: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Terrorist activities and inter-conflict situations in Europe lead to procuring advanced military wearables

- TABLE 74 FRANCE: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 75 FRANCE: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 76 FRANCE: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 77 FRANCE: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Procuring advanced military wearables for German military modernization drive market growth

- TABLE 78 GERMANY: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 79 GERMANY: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 80 GERMANY: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 81 GERMANY: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.3.5 RUSSIA

- 10.3.5.1 Procuring military wearables under RATNIK program

- TABLE 82 RUSSIA: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 83 RUSSIA: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 84 RUSSIA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 85 RUSSIA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.3.6 REST OF EUROPE

- 10.3.6.1 Developing military equipment and wearables industry in rest of Europe

- TABLE 86 REST OF EUROPE: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 87 REST OF EUROPE: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 88 REST OF EUROPE: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 89 REST OF EUROPE: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: MILITARY WEARABLES MARKET SNAPSHOT

- TABLE 90 ASIA PACIFIC: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MILITARY WEARABLES MARKET, BY WEARABLE TYPE, 2018-2021 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MILITARY WEARABLES MARKET, BY WEARABLE TYPE, 2022-2027 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MILITARY WEARABLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MILITARY WEARABLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Rising R&D activities for military wearables

- TABLE 98 CHINA: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 99 CHINA: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 100 CHINA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 101 CHINA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Improving domestic capabilities for technological development in defense industry to drive market

- TABLE 102 INDIA: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 103 INDIA: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 104 INDIA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 105 INDIA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Technologically advanced and significant defense budget to drive market

- TABLE 106 JAPAN: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 107 JAPAN: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 108 JAPAN: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 109 JAPAN: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Investments in advanced and smart wearable products

- TABLE 110 SOUTH KOREA: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 111 SOUTH KOREA: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 112 SOUTH KOREA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 113 SOUTH KOREA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.4.6 AUSTRALIA

- 10.4.6.1 Military demands for advanced wearable technologies

- TABLE 114 AUSTRALIA: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 115 AUSTRALIA: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 116 AUSTRALIA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 117 AUSTRALIA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- 10.4.7.1 Advancements in supply chain to meet raw material needs of military wearables manufacturers

- TABLE 118 REST OF ASIA PACIFIC: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.5 MIDDLE EAST

- 10.5.1 PESTLE ANALYSIS: MIDDLE EAST

- FIGURE 34 MIDDLE EAST: MILITARY WEARABLES MARKET SNAPSHOT

- TABLE 122 MIDDLE EAST: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 123 MIDDLE EAST: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 124 MIDDLE EAST: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 125 MIDDLE EAST: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 126 MIDDLE EAST: MILITARY WEARABLES MARKET, BY WEARABLE TYPE, 2018-2021 (USD MILLION)

- TABLE 127 MIDDLE EAST: MILITARY WEARABLES MARKET, BY WEARABLE TYPE, 2022-2027 (USD MILLION)

- TABLE 128 MIDDLE EAST: MILITARY WEARABLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 129 MIDDLE EAST: MILITARY WEARABLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.5.2 SAUDI ARABIA

- 10.5.2.1 Soldier modernization plan to be integral part of Saudi vision 2030

- TABLE 130 SAUDI ARABIA: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 131 SAUDI ARABIA: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 132 SAUDI ARABIA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 133 SAUDI ARABIA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.5.3 UAE

- 10.5.3.1 Procuring advanced military equipment for security forces

- TABLE 134 UAE: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 135 UAE: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 136 UAE: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 137 UAE: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.5.4 ISRAEL

- 10.5.4.1 Advanced integrated communication & navigation systems and advanced combat equipment adoption drives growth

- TABLE 138 ISRAEL: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 139 ISRAEL: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 140 ISRAEL: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 141 ISRAEL: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.5.5 TURKEY

- 10.5.5.1 Terrorist activities pushing up defense budgets to strengthen armed forces

- TABLE 142 TURKEY: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 143 TURKEY: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 144 TURKEY: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 145 TURKEY: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.5.6 REST OF MIDDLE EAST

- 10.5.6.1 Strengthening military forces with advanced equipment

- TABLE 146 REST OF MIDDLE EAST: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 147 REST OF MIDDLE EAST: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 148 REST OF MIDDLE EAST: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 149 REST OF MIDDLE EAST: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.6 REST OF THE WORLD

- 10.6.1 PESTLE ANALYSIS: REST OF THE WORLD

- FIGURE 35 REST OF THE WORLD: MILITARY WEARABLES MARKET SNAPSHOT

- TABLE 150 REST OF THE WORLD: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 151 REST OF THE WORLD: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 152 REST OF THE WORLD: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 153 REST OF THE WORLD: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 154 REST OF THE WORLD: MILITARY WEARABLES MARKET, BY WEARABLE TYPE, 2018-2021 (USD MILLION)

- TABLE 155 REST OF THE WORLD: MILITARY WEARABLES MARKET, BY WEARABLE TYPE, 2022-2027 (USD MILLION)

- TABLE 156 REST OF THE WORLD: MILITARY WEARABLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 157 REST OF THE WORLD: MILITARY WEARABLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.6.2 LATIN AMERICA

- 10.6.2.1 Increasing national security budgets and procuring advanced wearables for security forces

- TABLE 158 LATIN AMERICA: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 159 LATIN AMERICA: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 160 LATIN AMERICA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 161 LATIN AMERICA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 10.6.3 AFRICA

- 10.6.3.1 Military modernization programs in African countries boost market growth

- TABLE 162 AFRICA: MILITARY WEARABLES MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 163 AFRICA: MILITARY WEARABLES MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 164 AFRICA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 165 AFRICA: MILITARY WEARABLES MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- TABLE 166 MILITARY WEARABLES MARKET: DEGREE OF COMPETITION

- FIGURE 36 MARKET SHARE OF TOP PLAYERS IN MILITARY WEARABLES MARKET, 2021

- TABLE 167 KEY DEVELOPMENTS BY LEADING PLAYERS IN MARKET BETWEEN 2020 AND 2022

- 11.3 TOP FIVE PLAYERS RANKING ANALYSIS, 2021

- FIGURE 37 MARKET RANKING OF LEADING PLAYERS, 2021

- 11.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2021

- FIGURE 38 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST 5 YEARS

- 11.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 168 COMPANY PRODUCT FOOTPRINT

- TABLE 169 COMPANY SOLUTION TYPE FOOTPRINT

- TABLE 170 COMPANY REGION FOOTPRINT

- 11.6 COMPANY EVALUATION QUADRANT

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 39 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- 11.7 STARTUP/SME EVALUATION QUADRANT

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 STARTING BLOCKS

- 11.7.4 DYNAMIC COMPANIES

- TABLE 171 MILITARY WEARABLES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- FIGURE 40 MILITARY WEARABLES MARKET (STARTUP) COMPETITIVE LEADERSHIP MAPPING, 2021

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 MARKET EVALUATION FRAMEWORK

- 11.8.2 NEW PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 172 NEW PRODUCT LAUNCHES AND DEVELOPMENTS, 2020-2022

- 11.8.3 DEALS

- TABLE 173 CONTRACTS, 2020-2022

- 11.8.4 VENTURES/AGREEMENTS/EXPANSIONS

- TABLE 174 ACQUISITIONS/PARTNERSHIPS/JOINT VENTURES/AGREEMENTS/EXPANSIONS, 2020-2022

12 COMPANY PROFILES

- 12.1 INTRODUCTION

(Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 12.2 KEY PLAYERS

- 12.2.1 BAE SYSTEMS PLC

- TABLE 175 BAE SYSTEMS PLC: BUSINESS OVERVIEW

- FIGURE 41 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- TABLE 176 BAE SYSTEMS PLC: PRODUCT DEVELOPMENTS

- TABLE 177 BAE SYSTEMS PLC: DEALS

- 12.2.2 ELBIT SYSTEMS LTD

- TABLE 178 ELBIT SYSTEMS LTD: BUSINESS OVERVIEW

- FIGURE 42 ELBIT SYSTEMS LTD: COMPANY SNAPSHOT

- TABLE 179 ELBIT SYSTEMS LTD: DEALS

- 12.2.3 RHEINMETALL AG

- TABLE 180 RHEINMETALL AG: BUSINESS OVERVIEW

- FIGURE 43 RHEINMETALL AG: COMPANY SNAPSHOT

- TABLE 181 RHEINMETALL AG: PRODUCT LAUNCHES

- TABLE 182 RHEINMETALL AG: DEALS

- 12.2.4 SAAB AB

- TABLE 183 SAAB AB: BUSINESS OVERVIEW

- FIGURE 44 SAAB AB: COMPANY SNAPSHOT

- TABLE 184 SAAB AB: PRODUCT LAUNCHES

- TABLE 185 SAAB AB: DEALS

- 12.2.5 THALES GROUP

- TABLE 186 THALES GROUP: BUSINESS OVERVIEW

- FIGURE 45 THALES GROUP: COMPANY SNAPSHOT

- TABLE 187 THALES GROUP: DEALS

- 12.2.6 ASELSAN A.S.

- TABLE 188 ASELSAN A.S.: BUSINESS OVERVIEW

- FIGURE 46 ASELSAN A.S.: COMPANY SNAPSHOT

- TABLE 189 ASELSAN A.S.: PRODUCT LAUNCHES

- TABLE 190 ASELSAN A.S.: DEALS

- 12.2.7 TELEDYNE FLIR LLC

- TABLE 191 TELEDYNE FLIR LLC: BUSINESS OVERVIEW

- FIGURE 47 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- TABLE 192 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 193 TELEDYNE FLIR LLC: DEALS

- 12.2.8 GENERAL DYNAMICS CORPORATION

- TABLE 194 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- FIGURE 48 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- TABLE 195 GENERAL DYNAMICS CORPORATION: DEALS

- 12.2.9 BIONIC POWER INC.

- TABLE 196 BIONIC POWER INC.: BUSINESS OVERVIEW

- 12.2.10 L3HARRIS TECHNOLOGIES INC.

- TABLE 197 L3HARRIS TECHNOLOGIES INC.: BUSINESS OVERVIEW

- FIGURE 49 L3HARRIS TECHNOLOGIES INC: COMPANY SNAPSHOT

- TABLE 198 L3HARRIS TECHNOLOGIES INC: DEALS

- 12.2.11 LEONARDO S.P.A.

- TABLE 199 LEONARDO S.P.A.: BUSINESS OVERVIEW

- FIGURE 50 LEONARDO S.P.A.: COMPANY SNAPSHOT

- TABLE 200 LEONARDO S.P.A.: DEALS

- 12.2.12 LOCKHEED MARTIN CORPORATION

- TABLE 201 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- FIGURE 51 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 202 LOCKHEED MARTIN CORPORATION: DEALS

- 12.2.13 NORTHROP GRUMMAN CORPORATION

- TABLE 203 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- FIGURE 52 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 204 NORTHROP GRUMMAN CORPORATION: DEALS

- 12.2.14 SAFRAN SA

- TABLE 205 SAFRAN SA: BUSINESS OVERVIEW

- FIGURE 53 SAFRAN SA: COMPANY SNAPSHOT

- TABLE 206 SAFRAN SA: DEALS

- 12.2.15 ULTRA-ELECTRONICS

- TABLE 207 ULTRA-ELECTRONICS: BUSINESS OVERVIEW

- FIGURE 54 ULTRA-ELECTRONICS: COMPANY SNAPSHOT

- TABLE 208 ULTRA-ELECTRONICS: DEALS

- 12.2.16 INTERACTIVE WEAR AG

- TABLE 209 INTERACTIVE WEAR AG: BUSINESS OVERVIEW

- 12.2.17 TT ELECTRONICS PLC

- TABLE 210 TT ELECTRONICS PLC: BUSINESS OVERVIEW

- FIGURE 55 TT ELECTRONICS PLC: COMPANY SNAPSHOT

- 12.2.18 TE CONNECTIVITY LTD.

- TABLE 211 TE CONNECTIVITY LTD.: BUSINESS OVERVIEW

- FIGURE 56 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

- 12.2.19 ST ENGINEERING

- TABLE 212 ST ENGINEERING: BUSINESS OVERVIEW

- FIGURE 57 ST ENGINEERING: COMPANY SNAPSHOT

- 12.2.20 VIASAT INC.

- TABLE 213 VIASAT INC.: BUSINESS OVERVIEW

- FIGURE 58 VIASAT INC.: COMPANY SNAPSHOT

- TABLE 214 VIASAT INC.: DEALS

- 12.3 OTHER PLAYERS

- 12.3.1 GLENAIR INC

- TABLE 215 GLENAIR INC: COMPANY OVERVIEW

- 12.3.2 EPSILOR-ELECTRIC FUEL LTD

- TABLE 216 EPSILOR ELECTRIC FUEL LTD: COMPANY OVERVIEW

- 12.3.3 MILPOWER SOURCE INC

- TABLE 217 MILPOWER SOURCE INC: COMPANY OVERVIEW

- 12.3.4 SAFARILAND L.L.C.

- TABLE 218 SAFARILAND L.L.C.: COMPANY OVERVIEW

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATIONS OFFERED

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS