|

|

市場調査レポート

商品コード

1359919

臨床検査技能試験の世界市場 (~2028年):産業 (臨床診断・微生物・医薬品・食品&飼料・水・オピオイド)・技術 (PCR・細胞培養)・地域別の分析・予測・アンメットニーズ・ステークホルダー・購入基準Laboratory Proficiency Testing Market by Industry (Clinical Diagnostics, Microbiology, Pharmaceutical, Food & Animal Feed, Water, Opioid), Technology (PCR, Cell Culture), and Region; Unmet Needs, Stakeholder & Buying Criteria - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 臨床検査技能試験の世界市場 (~2028年):産業 (臨床診断・微生物・医薬品・食品&飼料・水・オピオイド)・技術 (PCR・細胞培養)・地域別の分析・予測・アンメットニーズ・ステークホルダー・購入基準 |

|

出版日: 2023年10月04日

発行: MarketsandMarkets

ページ情報: 英文 388 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の臨床検査技能試験の市場規模は、2023年の12億米ドルから、予測期間中は7.4%のCAGRで推移し、2028年には16億米ドルの規模に成長すると予測されています。

CLIA、APLAC、CLSIなどの対象となる各種産業の検査室にとって、技能試験は必須要件であり、同市場は予測期間中に大きな成長が見込まれています。また、規制機関や顧客から独立した適任証明に対する要求が高まる中で、技能試験 (PT) は、製品の品質と安全性を試験するすべての検査施設で重要視されるようになっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額(米ドル) |

| 部門 | 産業・技術・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ |

産業別では、臨床診断の部門が2022年に最大のシェアを示しています。この部門の大きなシェアは、対象疾患の発生率の増加、臨床診断技術の進歩、早期かつ正確な疾患診断に対する需要の高まり、革新的な臨床検査を開発するための研究助成金や資金提供、官民投資の増加、臨床診断検査の品質と価格を改善するための政府のイニシアチブの拡大などに起因しています。

技術別では、細胞培養の部門が2022年に最大のシェアを示しています。バイオ医薬品業界が急拡大を続ける中、製品の安全性と有効性を確保するための細胞培養技術における技能試験の需要が急増しています。さらに、米国のFDAや欧州のEMAなどの規制機関は、これらのプロセスを綿密に監視し、高水準を維持し、患者の安全を確保するために厳格な技能試験を義務付けています。

当レポートでは、世界の臨床検査技能試験の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許動向、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場の課題

- 業界の動向

- 技術分析

- エコシステム分析

- バリューチェーン分析

- ポーターのファイブフォース分析

- 特許分析

- 関税と規制状況

- 価格分析

- 顧客の事業に影響を与える動向・ディスラプション

- 主な会議とイベント

- 主なステークホルダーと購入基準

- アンメットニーズ

第6章 臨床検査技能試験市場:産業別

- 臨床診断

- 微生物

- 食品・飼料

- 商用飲料

- 環境

- 医薬品

- 水

- 栄養補助食品

- 生物製剤

- 大麻/オピオイド

- 栄養補助食品

- 化粧品

第7章 臨床検査技能試験市場:技術別

- 細胞培養

- ポリメラーゼ連鎖反応(PCR)

- 免疫学的検査

- クロマトグラフィ

- 分光光度計

- その他

第8章 臨床検査技能試験市場:地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第9章 競合情勢

- 概要

- 主要企業の採用戦略

- 有力企業

- 収益シェア分析

- 市場ランキング分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競合状況と動向

第10章 企業プロファイル

- 主要企業

- LGC LIMITED

- COLLEGE OF AMERICAN PATHOLOGISTS

- BIO-RAD LABORATORIES, INC.

- MERCK KGAA

- AMERICAN PROFICIENCY INSTITUTE

- RANDOX LABORATORIES LTD.

- FAPAS(A DIVISION OF FERA SCIENCE LTD.)

- WATERS CORPORATION

- QACS

- WEQAS

- AOAC INTERNATIONAL

- BIPEA

- SPEX CERTIPREP

- ABSOLUTE STANDARDS INC.

- TRILOGY ANALYTICAL LABORATORY

- ADVANCED ANALYTICAL SOLUTIONS

- AMERICAN INDUSTRIAL HYGIENE ASSOCIATION

- MATRIX SCIENCES

- AASHVI PROFICIENCY TESTING & ANALYTICAL SERVICES

- GLOBAL PROFICIENCY LTD.

- THE EMERALD TEST

- その他の企業

- FLUXANA GMBH & CO. KG

- PHENOVA INC.

- FARE LABS

- GO PLUS SERVICES SDN BHD.

- MUVA KEMPTEN GMBH

第11章 付録

The global laboratory proficiency testing market is projected to reach USD 1.6 billion by 2028 from USD 1.2 billion in 2023, at a CAGR of 7.4%. Due to the mandatory nature of proficiency testing procedures for laboratories operating in various industries subject to regulation by organizations like CLIA, APLAC, and CLSI. The market for proficiency testing is expected to witness significant growth during the forecast period. With the increasing demand for independent proof of competence from regulatory bodies and customers, proficiency testing (PT) has become relevant for all laboratories testing product quality and safety. PT has become an integral component of the laboratory accreditation process, and the adoption of PT programs has increased significantly over the years. Also, the market's growth is strengthened by stringent safety and quality regulations governing food and pharmaceutical products, as well as a growing emphasis on water testing. However, the need for substantial capital investment to ensure precise and sensitive testing is anticipated to act as a hindrance to market expansion throughout the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Values (USD Million/Billion) |

| Segments | Industry, Technology, and Region |

| Regions covered | North America, Europe, APAC, Latin America, the Middle East and Africa |

"Clinical Diagnostics held the largest share in 2022."

Based on industry, the laboratory proficiency testing market is segmented into clinical diagnostics, food & animal feed, water, biologics, pharmaceuticals, microbiology, environmental, commercial beverages, cannabis/opioids, cosmetics, dietary supplements, and nutraceuticals. In 2022, the clinical diagnostics segment accounted for the largest share of the laboratory proficiency testing market. The large share of this segment is attributed to the increasing incidence of target diseases, advancements in clinical diagnostic techniques, rising demand for early and accurate disease diagnosis, growing public-private investments as well as research grants and funding to develop innovative laboratory testing procedures, and rising government initiatives to improve the quality and affordability of clinical diagnostic testing procedures.

"The cell culture segment held the largest share in 2022."

Based on technology, the global laboratory proficiency testing market has been segmented into PCR, spectrophotometry, immunoassays, chromatography, cell culture, and other technologies. As the biopharmaceutical industry continues to expand rapidly, the demand for proficiency testing in cell culture techniques to ensure product safety and efficacy has surged. Additionally, regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), closely monitor these processes, mandating rigorous proficiency testing to maintain high standards and ensure patient safety. Owing to these factors, the cell culture segment accounted for the largest share of the laboratory proficiency testing market in 2022.

"North America to dominate the Laboratory proficiency testing market in 2023."

In the US, it is mandatory for clinical laboratories to enroll in PT programs for maintaining CLIA certification and performing testing in certain industries. A combination of factors, including stringent regulations governing the launch of new products, growing focus on water and environmental testing, and the increasing value of US exports, have driven the need to ensure efficient laboratory and manufacturer performance, thereby supporting market growth. In addition, the US is one of the most promising markets for cannabis testing owing to the legalization of medical cannabis. This is expected to boost the need and demand for proficiency testing to ensure consumer safety.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the laboratory proficiency testing market.

- By Company Type: Tier 1: 40%, Tier 2: 30%, and Tier 3: 30%

- By Designation: C-level Executives: 27%, Directors: 18%, and Others: 55%

- By Region: North America: 30%, Europe: 35%, APAC: 15%, Latin America: 10% and Middle East & Africa: 5%

The prominent players in the laboratory proficiency testing market are LGC Limited (UK), College of American Pathologists (US), Bio-Rad Laboratories (US), Merck KGaA (Germany), American Proficiency Institute (US), Randox Laboratories (UK), Fapas (Fera Science Ltd.) (UK), Waters Corporation (US), QACS (Greece), Weqas (UK), AOAC INTERNATIONAL (US), Bipea (France), SPEX CertiPrep (US), Absolute Standards Inc. (US), Trilogy Analytical Laboratory (US), Advanced Analytical Solutions (US), American Industrial Hygiene Association (US), Matrix Sciences (US), Aashvi Proficiency Testing & Analytical Services (India), Global Proficiency (New Zealand), The Emerald Test (US), FLUXANA GmbH & Co. KG (Germany), Phenova Inc. (US), FARE Labs (India), Go Plus Services SDN BHD (Malaysia), and Muva Kempten GmbH (Germany).

Research Coverage:

This report describes and studies the global laboratory proficiency testing market based on industry, technology, and regional levels. It provides detailed information regarding the major factors influencing the growth of this market. The report includes an in-depth competitive analysis and the product matrix of the prominent players in this market, along with their company profiles, product portfolios, recent developments, and MNM overview.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants in this market and provide information regarding the closest approximations of the revenue numbers for the overall laboratory proficiency testing market and its subsegments. This report will help stakeholders understand the competitive landscape to gain more insights to better position their businesses and to plan suitable go-to-market strategies. The report will also help the stakeholders understand the pulse of the market and provide information on key market drivers, restraints, opportunities, and challenges.

This report provides insights on:

- Analysis of key drivers (growing need for proficiency testing for operational excellence, stringent safety and quality regulations for food and pharmaceutical products, increasing focus on water testing), restraints (requirement of high capital investments for accurate and sensitive testing, complexity in testing technique), opportunities (technological advancements in testing industry, increasing adoption of proficiency tests to prevent food adulteration, growth opportunities in emerging countries), and challenges (need for proficiency testing scheme harmonization, logistical and data interpretation challenges, dearth of skilled professionals) influencing the growth of laboratory proficiency testing market.

- Market Penetration: Comprehensive information on the product portfolios of the top players in the laboratory proficiency testing market. The report analyzes this market by industry, technology, and region.

- Market Development: Comprehensive information on the lucrative emerging markets by industry, technology, and region

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the laboratory proficiency testing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the laboratory proficiency testing market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 LABORATORY PROFICIENCY TESTING MARKET

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 SECONDARY RESEARCH

- 2.1.3 PRIMARY RESEARCH

- FIGURE 3 PRIMARY SOURCES

- 2.1.3.1 Key data from primary sources

- FIGURE 4 INSIGHTS FROM INDUSTRY EXPERTS

- 2.1.3.2 Breakdown of primary sources

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEW (SUPPLY SIDE): BY COMPANY TYPE, DESIGNAITON AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 7 LABORATORY PROFICIENCY TESTING MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 8 LABORATORY PROFICIENCY TESTING MARKET: TOP-DOWN APPROACH

- FIGURE 9 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 10 SUPPLY-SIDE MARKET SIZE ESTIMATION: LABORATORY PROFICIENCY TESTING MARKET (2022)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF LABORATORY PROFICIENCY TESTING MARKET (2023-2028)

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT: LABORATORY PROFICIENCY TESTING MARKET

- 2.7 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- FIGURE 14 LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 20 GEOGRAPHICAL SNAPSHOT OF LABORATORY PROFICIENCY TESTING MARKET

4 PREMIUM INSIGHTS

- 4.1 LABORATORY PROFICIENCY TESTING MARKET OVERVIEW

- FIGURE 21 STRINGENT SAFETY AND QUALITY REGULATIONS FOR FOOD AND PHARMACEUTICAL PRODUCTS TO DRIVE MARKET GROWTH

- 4.2 LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE (2023-2028)

- FIGURE 22 CLINICAL CHEMISTRY SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY AND COUNTRY (2022)

- FIGURE 23 CELL CULTURE ACCOUNTED FOR LARGEST SHARE OF APAC LABORATORY PROFICIENCY TESTING MARKET IN 2022

- 4.4 LABORATORY PROFICIENCY TESTING MARKET: GEOGRAPHIC MIX

- FIGURE 24 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

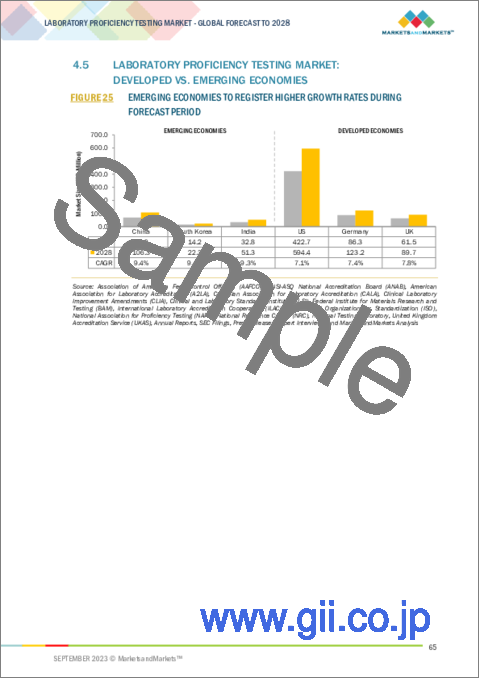

- 4.5 LABORATORY PROFICIENCY TESTING MARKET: DEVELOPED VS. EMERGING ECONOMIES

- FIGURE 25 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 26 LABORATORY PROFICIENCY TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 MARKET DRIVERS

- 5.2.1.1 Growing need for proficiency testing for operational excellence

- FIGURE 27 CLIA-REGISTERED LABORATORIES GLOBALLY (2011-2022)

- 5.2.1.2 Stringent safety and quality regulations for food and pharmaceutical products

- TABLE 2 FOOD SAFETY LEGISLATION IN DEVELOPING COUNTRIES

- TABLE 3 REGULATORY AGENCIES FOR PHARMACEUTICAL INDUSTRY

- 5.2.1.3 Increasing focus on water testing

- 5.2.2 MARKET RESTRAINTS

- 5.2.2.1 Requirement of high-capital investments for accurate and sensitive testing

- TABLE 4 COST OF ADVANCED TECHNOLOGIES USED FOR PROFICIENCY TESTING

- 5.2.2.2 Complexity in testing techniques

- 5.2.3 MARKET OPPORTUNITIES

- 5.2.3.1 Technological advancements in testing industry

- 5.2.3.2 Growth opportunities in emerging countries

- FIGURE 28 PROJECTED PHARMACEUTICAL SALES IN ASIAN COUNTRIES (2022)

- 5.2.3.3 Increasing adoption of proficiency tests to prevent food adulteration

- 5.2.4 MARKET CHALLENGES

- 5.2.4.1 Need for proficiency testing scheme harmonization

- 5.2.4.2 Logistical and data interpretation challenges

- 5.2.4.3 Dearth of skilled professionals

- 5.3 INDUSTRY TRENDS

- 5.3.1 GROWING FOCUS ON ORGANIC GROWTH STRATEGIES

- TABLE 5 NUMBER OF PRODUCT LAUNCHES, BY KEY PLAYER (JANUARY 2020 TO JULY 2023)

- 5.4 TECHNOLOGY ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- TABLE 6 LABORATORY PROFICIENCY TESTING MARKET: ECOSYSTEM

- FIGURE 29 LABORATORY PROFICIENCY TESTING MARKET: ECOSYSTEM MAP

- FIGURE 30 LABORATORY PROFICIENCY TESTING MARKET: INDUSTRY AND TECHNOLOGY MAPPING

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 31 VALUE CHAIN ANALYSIS

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 LABORATORY PROFICIENCY TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 BARGAINING POWER OF SUPPLIERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PATENT ANALYSIS

- 5.8.1 PATENT PUBLICATION TRENDS FOR LABORATORY PROFICIENCY TESTING

- FIGURE 32 PATENT PUBLICATION TRENDS (2011-2023)

- 5.8.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 33 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR PROFICIENCY TESTING PATENTS (JANUARY 2011-JULY 2023)

- FIGURE 34 TOP APPLICANT COUNTRIES/REGIONS FOR PROFICIENCY TESTING PATENTS (JANUARY 2011-JULY 2023)

- 5.9 TARIFF & REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ICH QUALITY GUIDELINES FOR PHARMACEUTICAL GMP

- TABLE 9 EUROPE: ACCREDITATION BODIES FOR MEDICAL LABORATORIES

- TABLE 10 OVERVIEW OF GUIDELINES OF LABORATORY SERVICES

- TABLE 11 RULES FOR PROFICIENCY TESTING LAID DOWN BY CNAS: REQUIREMENTS FOR SELECTION OF PROFICIENCY TESTING ACTIVITIES

- 5.9.2 NORTH AMERICA

- 5.9.2.1 US

- 5.9.2.2 Canada

- 5.9.3 EUROPE

- TABLE 12 DEVELOPMENT OF GLP ACROSS COUNTRIES

- TABLE 13 REGULATORY AUTHORITIES AND LAUNCH OF GLP MONITORING PROGRAMS IN EUROPEAN COUNTRIES

- 5.9.4 ASIA PACIFIC

- 5.9.4.1 India

- 5.9.4.2 Japan

- 5.9.4.3 China

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY LABORATORY PROFICIENCY TESTING PROGRAM

- TABLE 14 AVERAGE SELLING PRICE FOR LABORATORY PROFICIENCY TESTING PROGRAMS, BY KEY PLAYER (2022)

- 5.10.2 INDICATIVE PRICING ANALYSIS, BY TECHNOLOGY

- TABLE 15 AVERAGE PRICING ANALYSIS OF LABORATORY PROFICIENCY TESTING PROGRAMS (2022)

- 5.10.3 INDICATIVE PRICING ANALYSIS, BY INDUSTRY

- 5.11 TRENDS & DISRUPTIONS AFFECTING CUSTOMERS' BUSINESSES

- 5.11.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR LABORATORY PROFICIENCY TESTING MARKET

- FIGURE 35 LABORATORY PROFICIENCY TESTING MARKET: TRENDS & DISRUPTIONS AFFECTING CUSTOMERS' BUSINESSES

- 5.12 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 16 LABORATORY PROFICIENCY TESTING MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF LABORATORY PROFICIENCY TESTING SERVICES

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF LABORATORY PROFICIENCY TESTING SERVICES (%)

- 5.13.2 BUYING CRITERIA FOR LABORATORY PROFICIENCY TESTING SERVICES

- FIGURE 37 KEY BUYING CRITERIA FOR INDUSTRIES

- TABLE 18 KEY BUYING CRITERIA FOR INDUSTRIES

- 5.14 UNMET NEEDS

- TABLE 19 UNMET NEEDS IN LABORATORY PROFICIENCY TESTING MARKET

- 5.14.1 END-USER EXPECTATIONS

- TABLE 20 END-USER EXPECTATIONS IN LABORATORY PROFICIENCY TESTING MARKET

6 LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY

- 6.1 INTRODUCTION

- TABLE 21 LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- 6.2 CLINICAL DIAGNOSTICS

- TABLE 22 LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 23 LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.1 DRIVERS

- 6.2.1.1 Increasing adoption of fully automated instruments and automation in laboratories

- 6.2.1.2 Growth opportunities in developing economies

- 6.2.2 RESTRAINTS

- 6.2.2.1 Procedural shift from lab-based to home-based/point-of-care testing procedures

- 6.2.3 LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE

- 6.2.3.1 Clinical chemistry

- 6.2.3.1.1 Ongoing development and launch of new clinical chemistry tests to support growth

- 6.2.3.1 Clinical chemistry

- TABLE 24 LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL CHEMISTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.3.2 Immunology/immunochemistry

- 6.2.3.2.1 High adoption of novel immunology tests in developed countries to favor market growth

- 6.2.3.2 Immunology/immunochemistry

- TABLE 25 LABORATORY PROFICIENCY TESTING MARKET FOR IMMUNOLOGY/IMMUNOCHEMISTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.3.3 Hematology

- 6.2.3.3.1 Future breakthroughs in stem cell research, genetic therapies, and proteomics to boost market

- 6.2.3.3 Hematology

- TABLE 26 LABORATORY PROFICIENCY TESTING MARKET FOR HEMATOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.3.4 Molecular diagnostics

- 6.2.3.4.1 Increasing incidence of influenza, tuberculosis, sexually transmitted diseases, and hepatitis to boost demand

- 6.2.3.4 Molecular diagnostics

- TABLE 27 LABORATORY PROFICIENCY TESTING MARKET FOR MOLECULAR DIAGNOSTICS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.3.5 Cytology

- 6.2.3.5.1 Development of advanced techniques for anatomic pathology to propel growth

- 6.2.3.5 Cytology

- TABLE 28 LABORATORY PROFICIENCY TESTING MARKET FOR CYTOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.3.6 Other clinical diagnostic tests

- TABLE 29 LABORATORY PROFICIENCY TESTING MARKET FOR OTHER CLINICAL DIAGNOSTIC TESTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 MICROBIOLOGY

- TABLE 30 LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 31 LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.1 DRIVERS

- 6.3.1.1 Stringent safety regulations

- 6.3.2 LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE

- 6.3.2.1 Pathogen testing

- 6.3.2.1.1 Growing need to detect pathogens and spoilage in food & beverage industry to boost market

- 6.3.2.1 Pathogen testing

- TABLE 32 LABORATORY PROFICIENCY TESTING MARKET FOR PATHOGEN TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2.2 Sterility testing

- 6.3.2.2.1 Need to provide accurate investigations of quality of raw materials in pharmaceutical industry to support adoption

- 6.3.2.2 Sterility testing

- TABLE 33 LABORATORY PROFICIENCY TESTING MARKET FOR STERILITY TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2.3 Endotoxin & pyrogen testing

- 6.3.2.3.1 Need to detect bacterial toxins and pyrogens in products intended for human use to favor growth

- 6.3.2.3 Endotoxin & pyrogen testing

- TABLE 34 LABORATORY PROFICIENCY TESTING MARKET FOR ENDOTOXIN & PYROGEN TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2.4 Growth promotion testing

- 6.3.2.4.1 Need to determine suitability of culture media used for microbial enumeration and sterility tests to fuel growth

- 6.3.2.4 Growth promotion testing

- TABLE 35 LABORATORY PROFICIENCY TESTING MARKET FOR GROWTH PROMOTION TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2.5 Other microbiology tests

- TABLE 36 LABORATORY PROFICIENCY TESTING MARKET FOR OTHER MICROBIOLOGY TESTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4 FOOD & ANIMAL FEED

- TABLE 37 LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 38 LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.1 DRIVERS

- 6.4.1.1 Stringent food safety regulations

- 6.4.1.2 Increasing outbreaks of foodborne illnesses

- 6.4.1.3 Increasing demand for packaged food products

- 6.4.1.4 Increasing cases of chemical contamination in food processing and manufacturing

- 6.4.2 RESTRAINTS

- 6.4.2.1 Lack of harmonization of food safety regulations

- 6.4.2.2 Lack of food control infrastructure in developing countries

- 6.4.3 LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE

- 6.4.3.1 Meat & meat product testing

- 6.4.3.1.1 Growing availability of programs for testing of nitrates and nitrites in meat products to drive growth

- 6.4.3.1 Meat & meat product testing

- TABLE 39 LABORATORY PROFICIENCY TESTING MARKET FOR MEAT & MEAT PRODUCT TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.3.2 Fruit & vegetable testing

- 6.4.3.2.1 Growing outbreaks of foodborne illnesses to propel market

- 6.4.3.2 Fruit & vegetable testing

- TABLE 40 LABORATORY PROFICIENCY TESTING MARKET FOR FRUIT & VEGETABLE TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.3.3 Dairy product testing

- 6.4.3.3.1 Stringent regulations and increasing consumer demand for high-quality and safe dairy products to propel growth

- 6.4.3.3 Dairy product testing

- TABLE 41 LABORATORY PROFICIENCY TESTING MARKET FOR DAIRY PRODUCT TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.3.4 Fish testing

- 6.4.3.4.1 Need to check for authenticity, adulteration, and presence of allergens in fish and fish products to fuel growth

- 6.4.3.4 Fish testing

- TABLE 42 LABORATORY PROFICIENCY TESTING MARKET FOR FISH TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.3.5 Egg testing

- 6.4.3.5.1 Need to detect Fipronil in eggs and egg-based products to favor market growth

- 6.4.3.5 Egg testing

- TABLE 43 LABORATORY PROFICIENCY TESTING MARKET FOR EGG TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.3.6 Fat/oil testing

- 6.4.3.6.1 Growing demand for fat/oil proficiency testing programs to boost market

- 6.4.3.6 Fat/oil testing

- TABLE 44 LABORATORY PROFICIENCY TESTING MARKET FOR FAT/OIL TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.3.7 Other food & animal feed tests

- TABLE 45 LABORATORY PROFICIENCY TESTING MARKET FOR OTHER FOOD & ANIMAL FEED TESTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.5 COMMERCIAL BEVERAGES

- TABLE 46 LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 47 LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.5.1 DRIVERS

- 6.5.1.1 Rising consumption of commercial beverages

- 6.5.2 RESTRAINTS

- 6.5.2.1 High capital investments

- 6.5.3 LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE

- 6.5.3.1 Non-alcoholic beverages

- 6.5.3.1.1 Increasing awareness about presence of antioxidants in non-alcohol beverages to drive consumption

- 6.5.3.1 Non-alcoholic beverages

- TABLE 48 LABORATORY PROFICIENCY TESTING MARKET FOR NON-ALCOHOLIC BEVERAGES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.5.3.2 Alcoholic beverages

- 6.5.3.2.1 Rapid economic growth and changes in lifestyles to support demand for alcoholic beverages

- 6.5.3.2 Alcoholic beverages

- TABLE 49 LABORATORY PROFICIENCY TESTING MARKET FOR ALCOHOLIC BEVERAGES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.6 ENVIRONMENTAL

- 6.6.1 NEED TO REDUCE EMISSIONS AND PREVENT EXPOSURE TO TOXIC CHEMICALS TO BOOST MARKET

- TABLE 50 LABORATORY PROFICIENCY TESTING MARKET FOR ENVIRONMENTAL INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.6.2 DRIVERS

- 6.6.2.1 Privatization of environmental testing services

- 6.6.2.2 Environment protection regulations

- TABLE 51 PROMINENT ENVIRONMENT PROTECTION REGULATIONS, BY COUNTRY

- 6.6.2.3 Availability of cost- and time-efficient customized testing services

- 6.6.3 RESTRAINTS

- 6.6.3.1 Lack of basic supporting infrastructure

- 6.7 PHARMACEUTICAL

- TABLE 52 LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 53 LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.7.1 DRIVERS

- 6.7.1.1 Stringent quality control in production of pharmaceutical products

- 6.7.1.2 Growth in pharmaceutical industry

- FIGURE 38 GLOBAL PHARMACEUTICAL DRUG SALES, 2012-2022 (USD BILLION)

- 6.7.1.3 Surge in generics market

- 6.7.1.4 Emerging biosimilars market

- 6.7.2 RESTRAINTS

- 6.7.2.1 Cost- and time-intensive drug manufacturing process

- 6.7.3 LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE

- 6.7.3.1 Branded/innovator drug testing

- 6.7.3.1.1 Rising demand for prescription drugs for treatment of various diseases to support growth

- 6.7.3.1 Branded/innovator drug testing

- TABLE 54 LABORATORY PROFICIENCY TESTING MARKET FOR BRANDED/INNOVATOR DRUG TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.7.3.2 Generic drug testing

- 6.7.3.2.1 Government initiatives to promote usage of generics to control healthcare expenses

- 6.7.3.2 Generic drug testing

- TABLE 55 LABORATORY PROFICIENCY TESTING MARKET FOR GENERIC DRUG TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.7.3.3 Over-the-counter drug testing

- 6.7.3.3.1 Increased penetration of OTC drugs in emerging markets to fuel growth

- 6.7.3.3 Over-the-counter drug testing

- TABLE 56 LABORATORY PROFICIENCY TESTING MARKET FOR OVER-THE-COUNTER DRUG TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.7.3.4 Biosimilar testing

- 6.7.3.4.1 Growing demand for biosimilar drugs due to cost-effectiveness to boost adoption

- 6.7.3.4 Biosimilar testing

- TABLE 57 LABORATORY PROFICIENCY TESTING MARKET FOR BIOSIMILAR TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.8 WATER

- TABLE 58 LABORATORY PROFICIENCY TESTING MARKET FOR WATER INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.8.1 DRIVERS

- 6.8.1.1 Growing industrial applications

- 6.8.1.2 Increasing need for microbial water quality analysis

- 6.8.2 RESTRAINTS

- 6.8.2.1 Limited market penetration in non-industrial applications

- 6.9 NUTRACEUTICAL

- 6.9.1 GROWING NUTRACEUTICAL MARKET TO INCREASE NEED FOR PROFICIENCY TESTING

- TABLE 59 LABORATORY PROFICIENCY TESTING MARKET FOR NUTRACEUTICAL INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.10 BIOLOGICS

- TABLE 60 LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 61 LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.10.1 DRIVERS

- 6.10.1.1 Growing R&D investments in life science industry

- 6.10.1.2 High incidence and large economic burden of chronic diseases

- 6.10.2 RESTRAINTS

- 6.10.2.1 Dearth of skilled professionals

- 6.10.3 LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE

- 6.10.3.1 Monoclonal antibody testing

- 6.10.3.1.1 Growing number of mAb product candidates currently in development to boost market

- 6.10.3.1 Monoclonal antibody testing

- TABLE 62 LABORATORY PROFICIENCY TESTING MARKET FOR MONOCLONAL ANTIBODY TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.10.3.2 Vaccine testing

- 6.10.3.2.1 Increased global vaccine production to drive market growth

- 6.10.3.2 Vaccine testing

- TABLE 63 LABORATORY PROFICIENCY TESTING MARKET FOR VACCINE TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.10.3.3 Blood testing

- 6.10.3.3.1 Growing need to test for quality and safety of blood and blood products to fuel growth

- 6.10.3.3 Blood testing

- TABLE 64 LABORATORY PROFICIENCY TESTING MARKET FOR BLOOD TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.10.3.4 Tissue testing

- 6.10.3.4.1 Growing use of tissue-based therapies for treatment of various diseases to favor market growth

- 6.10.3.4 Tissue testing

- TABLE 65 LABORATORY PROFICIENCY TESTING MARKET FOR TISSUE TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.11 CANNABIS/OPIOIDS

- TABLE 66 LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 67 LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.11.1 DRIVERS

- 6.11.1.1 Legalization of medical cannabis and growing number of cannabis testing laboratories

- 6.11.1.2 Emerging markets

- 6.11.1.3 Growing adoption of LIMS in cannabis testing laboratories

- 6.11.1.4 Increasing awareness

- 6.11.2 RESTRAINTS

- 6.11.2.1 Dearth of trained laboratory professionals

- 6.11.2.2 Lack of industry standards for cannabis testing

- 6.11.2.3 High start-up costs for cannabis testing laboratories

- 6.11.3 LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE

- 6.11.3.1 Potency testing

- 6.11.3.1.1 Increasing legalization of medical cannabis to boost market

- 6.11.3.1 Potency testing

- TABLE 68 LABORATORY PROFICIENCY TESTING MARKET FOR POTENCY TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.11.3.2 Terpene profiling

- 6.11.3.2.1 Growing demand for terpene profiling for confirming identity and authenticity of select products to support growth

- 6.11.3.2 Terpene profiling

- TABLE 69 LABORATORY PROFICIENCY TESTING MARKET FOR TERPENE PROFILING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.11.3.3 Residual solvent testing

- 6.11.3.3.1 Need to remove residual solvents due to their harmful effects to boost demand

- 6.11.3.3 Residual solvent testing

- TABLE 70 LABORATORY PROFICIENCY TESTING MARKET FOR RESIDUAL SOLVENT TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.11.3.4 Pesticide screening

- 6.11.3.4.1 Importance of pesticide removal prior to cannabis consumption to propel market

- 6.11.3.4 Pesticide screening

- TABLE 71 LABORATORY PROFICIENCY TESTING MARKET FOR PESTICIDE SCREENING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.11.3.5 Heavy metal testing

- 6.11.3.5.1 Need to ensure cannabis products are free from toxic metals to drive growth

- 6.11.3.5 Heavy metal testing

- TABLE 72 LABORATORY PROFICIENCY TESTING MARKET FOR HEAVY METAL TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.11.3.6 Other cannabis/opioids tests

- TABLE 73 LABORATORY PROFICIENCY TESTING MARKET FOR OTHER CANNABIS/OPIOIDS TESTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.12 DIETARY SUPPLEMENTS

- 6.12.1 NEED TO ENSURE SAFETY AND QUALITY OF DIETARY SUPPLEMENTS TO DRIVE MARKET

- TABLE 74 LABORATORY PROFICIENCY TESTING MARKET FOR DIETARY SUPPLEMENTS INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.13 COSMETIC

- TABLE 75 LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 76 LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.13.1 DRIVERS

- 6.13.1.1 Opposition to animal testing

- 6.13.1.2 Customer interest in environmentally friendly and sustainable product ingredients in cosmetics and personal care products

- 6.13.2 LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE

- 6.13.2.1 Trace elements testing

- 6.13.2.1.1 Need to detect contaminants such as arsenic and lead in cosmetics to drive growth

- 6.13.2.1 Trace elements testing

- TABLE 77 LABORATORY PROFICIENCY TESTING MARKET FOR TRACE ELEMENTS TESTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.13.2.2 Other cosmetic tests

- TABLE 78 LABORATORY PROFICIENCY TESTING MARKET FOR OTHER COSMETIC TESTS, BY COUNTRY, 2021-2028 (USD MILLION)

7 LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- TABLE 79 LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 7.2 CELL CULTURE

- 7.2.1 GROWING USE OF CELL CULTURES IN PRODUCTION AND TESTING OF VARIOUS BIOPHARMACEUTICALS TO SUPPORT MARKET GROWTH

- TABLE 80 LABORATORY PROFICIENCY TESTING MARKET FOR CELL CULTURE, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 POLYMERASE CHAIN REACTION (PCR)

- 7.3.1 HIGH SPECIFICITY AND ACCURACY OF PCR TO BOOST DEMAND

- TABLE 81 LABORATORY PROFICIENCY TESTING MARKET FOR PCR, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 IMMUNOASSAYS

- 7.4.1 EMERGENCE OF COST-EFFECTIVE TECHNOLOGIES AND LABORATORY AUTOMATION FOR IMMUNOASSAYS TO DRIVE MARKET

- TABLE 82 LABORATORY PROFICIENCY TESTING MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.5 CHROMATOGRAPHY

- 7.5.1 HIGH ADOPTION OF CHROMATOGRAPHY IN BIOLOGICS AND PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

- TABLE 83 LABORATORY PROFICIENCY TESTING MARKET FOR CHROMATOGRAPHY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.6 SPECTROPHOTOMETRY

- 7.6.1 TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET GROWTH

- TABLE 84 LABORATORY PROFICIENCY TESTING MARKET FOR SPECTROPHOTOMETRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.7 OTHER TECHNOLOGIES

- TABLE 85 LABORATORY PROFICIENCY TESTING MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021-2028 (USD MILLION)

8 LABORATORY PROFICIENCY TESTING MARKET, BY REGION

- 8.1 INTRODUCTION

- TABLE 86 LABORATORY PROFICIENCY TESTING MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.2 NORTH AMERICA

- 8.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 39 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET SNAPSHOT

- TABLE 87 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.2.2 US

- 8.2.2.1 US to dominate North American laboratory proficiency testing market during forecast period

- TABLE 98 US: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 99 US: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 100 US: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 US: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 US: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 103 US: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 104 US: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 105 US: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 US: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 107 US: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.2.3 CANADA

- 8.2.3.1 Growing demand for analytical testing services to support growth

- TABLE 108 CANADA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 109 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 110 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 114 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 116 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 117 CANADA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.3 EUROPE

- 8.3.1 EUROPE: RECESSION IMPACT

- TABLE 118 EUROPE: LABORATORY PROFICIENCY TESTING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 119 EUROPE: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 120 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 121 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 123 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 126 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 127 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 128 EUROPE: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.3.2 GERMANY

- 8.3.2.1 Germany to dominate laboratory proficiency testing market in Europe during forecast period

- TABLE 129 GERMANY: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 130 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 131 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 133 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 134 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 135 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 137 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 138 GERMANY: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.3.3 FRANCE

- 8.3.3.1 France to become most attractive destination for FDI projects in Europe

- TABLE 139 FRANCE: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 140 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 142 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 143 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 145 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 147 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 148 FRANCE: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.3.4 UK

- 8.3.4.1 Increased government funding for biopharmaceutical research to support growth

- TABLE 149 UK: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 150 UK: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 151 UK: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 152 UK: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 153 UK: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 154 UK: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 155 UK: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 156 UK: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 UK: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 158 UK: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.3.5 ITALY

- 8.3.5.1 Increasing number of clinical trials to drive market growth

- TABLE 159 ITALY: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 160 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 161 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 162 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 163 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 164 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 165 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 166 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 167 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 168 ITALY: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.3.6 SPAIN

- 8.3.6.1 Growth in biologics industry and rising consumption of biosimilars to boost market

- TABLE 169 SPAIN: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 170 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 171 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 172 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 173 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 174 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 175 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 176 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 177 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 178 SPAIN: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.3.7 RUSSIA

- 8.3.7.1 Growth in pharmaceutical and water testing industries to favor market growth

- TABLE 179 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 180 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 181 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 182 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 183 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 184 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 185 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 186 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 187 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 188 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.3.8 REST OF EUROPE

- TABLE 189 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 190 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 191 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 192 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 193 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 194 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 195 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 196 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 197 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 198 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.4 ASIA PACIFIC

- 8.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 40 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET SNAPSHOT

- TABLE 199 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 200 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 201 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 202 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 203 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 204 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 205 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 206 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 207 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 208 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 209 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.4.2 JAPAN

- 8.4.2.1 Japan to dominate APAC laboratory proficiency testing market during forecast period

- TABLE 210 JAPAN: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 211 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 212 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 213 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 214 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 215 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 216 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 217 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 218 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 219 JAPAN: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.4.3 CHINA

- 8.4.3.1 Growth of pharmaceutical and biologics testing to drive market

- TABLE 220 CHINA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 221 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 222 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 223 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 224 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 225 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 226 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 227 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 228 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 229 CHINA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.4.4 INDIA

- 8.4.4.1 Increasing government support for biotechnology R&D to support market growth

- TABLE 230 INDIA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 231 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 232 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 233 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 234 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 235 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 236 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 237 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 238 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 239 INDIA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.4.5 SOUTH KOREA

- 8.4.5.1 Investments in biopharmaceutical research to propel market

- TABLE 240 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 241 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 242 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 243 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 244 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 245 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 246 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 247 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 248 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 249 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.4.6 REST OF ASIA PACIFIC

- TABLE 250 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 251 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 252 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 253 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 254 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 255 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 256 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 257 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 258 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 259 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.5 LATIN AMERICA

- 8.5.1 FINANCIAL AND ECONOMIC LIMITATIONS IN LATIN AMERICAN COUNTRIES TO LIMIT MARKET GROWTH

- 8.5.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 260 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 261 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 262 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 263 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 264 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 265 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 266 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 267 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 268 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 269 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.6 MIDDLE EAST & AFRICA

- 8.6.1 GROWING AWARENESS OF HEALTHCARE AND ANALYTICAL TESTING TO SUPPORT MARKET GROWTH

- TABLE 270 FOOD SAFETY LEGISLATION IN AFRICAN COUNTRIES

- 8.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 271 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 272 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 276 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 41 KEY DEVELOPMENTS BY LEADING PLAYERS IN LABORATORY PROFICIENCY TESTING MARKET, 2020-2023

- 9.3 RIGHT TO WIN

- 9.4 REVENUE SHARE ANALYSIS

- 9.5 MARKET RANKING ANALYSIS

- FIGURE 43 RANK OF COMPANIES IN GLOBAL LABORATORY PROFICIENCY TESTING MARKET (2022)

- 9.6 COMPANY EVALUATION MATRIX

- 9.6.1 STARS

- 9.6.2 EMERGING LEADERS

- 9.6.3 PERVASIVE PLAYERS

- 9.6.4 PARTICIPANTS

- FIGURE 44 LABORATORY PROFICIENCY TESTING MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS (2022)

- 9.6.5 COMPANY FOOTPRINT

- TABLE 281 COMPANY FOOTPRINT: LABORATORY PROFICIENCY TESTING MARKET (2022)

- 9.6.5.1 Company industry footprint

- TABLE 282 INDUSTRY FOOTPRINT: LABORATORY PROFICIENCY TESTING MARKET (2022)

- 9.6.5.2 Company regional footprint

- TABLE 283 REGIONAL FOOTPRINT: LABORATORY PROFICIENCY TESTING MARKET (2022)

- 9.7 START-UPS/SMES EVALUATION MATRIX

- 9.7.1 PROGRESSIVE COMPANIES

- 9.7.2 STARTING BLOCKS

- 9.7.3 RESPONSIVE COMPANIES

- 9.7.4 DYNAMIC COMPANIES

- FIGURE 45 LABORATORY PROFICIENCY TESTING MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2022)

- 9.7.5 COMPETITIVE BENCHMARKING

- TABLE 284 START-UP/SME FOOTPRINT: LABORATORY PROFICIENCY TESTING MARKET (2022)

- 9.7.5.1 Company industry footprint

- TABLE 285 START-UP/SME INDUSTRY FOOTPRINT: LABORATORY PROFICIENCY TESTING MARKET (2022)

- 9.7.5.2 Company regional footprint

- TABLE 286 START-UP/SME REGIONAL FOOTPRINT: LABORATORY PROFICIENCY TESTING MARKET (2022)

- 9.8 COMPETITIVE SITUATION AND TRENDS

- 9.8.1 LABORATORY PROFICIENCY TESTING MARKET: PRODUCT LAUNCHES

- TABLE 287 KEY PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2023

- 9.8.2 LABORATORY PROFICIENCY TESTING MARKET: DEALS

- TABLE 288 KEY DEALS, JANUARY 2020-AUGUST 2023

- 9.8.3 LABORATORY PROFICIENCY TESTING MARKET: OTHER DEVELOPMENTS

- TABLE 289 OTHER KEY DEVELOPMENTS, JANUARY 2020-AUGUST 2023

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 10.1.1 LGC LIMITED

- TABLE 290 LGC LIMITED: BUSINESS OVERVIEW

- FIGURE 46 LGC LIMITED: COMPANY SNAPSHOT (2022)

- 10.1.2 COLLEGE OF AMERICAN PATHOLOGISTS

- TABLE 291 COLLEGE OF AMERICAN PATHOLOGISTS: BUSINESS OVERVIEW

- FIGURE 47 COLLEGE OF AMERICAN PATHOLOGISTS: COMPANY SNAPSHOT (2022)

- 10.1.3 BIO-RAD LABORATORIES, INC.

- TABLE 292 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- FIGURE 48 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- 10.1.4 MERCK KGAA

- TABLE 293 MERCK KGAA: BUSINESS OVERVIEW

- FIGURE 49 MERCK KGAA: COMPANY SNAPSHOT (2022)

- 10.1.5 AMERICAN PROFICIENCY INSTITUTE

- TABLE 294 AMERICAN PROFICIENCY INSTITUTE: BUSINESS OVERVIEW

- 10.1.6 RANDOX LABORATORIES LTD.

- TABLE 295 RANDOX LABORATORIES LTD.: BUSINESS OVERVIEW

- 10.1.7 FAPAS (A DIVISION OF FERA SCIENCE LTD.)

- TABLE 296 FAPAS: BUSINESS OVERVIEW

- 10.1.8 WATERS CORPORATION

- TABLE 297 WATERS CORPORATION: BUSINESS OVERVIEW

- FIGURE 50 WATERS CORPORATION: COMPANY SNAPSHOT (2022)

- 10.1.9 QACS

- TABLE 298 QACS: BUSINESS OVERVIEW

- 10.1.10 WEQAS

- TABLE 299 WEQAS: BUSINESS OVERVIEW

- 10.1.11 AOAC INTERNATIONAL

- TABLE 300 AOAC INTERNATIONAL: BUSINESS OVERVIEW

- 10.1.12 BIPEA

- TABLE 301 BIPEA: BUSINESS OVERVIEW

- 10.1.13 SPEX CERTIPREP

- TABLE 302 SPEX CERTIPREP: BUSINESS OVERVIEW

- 10.1.14 ABSOLUTE STANDARDS INC.

- TABLE 303 ABSOLUTE STANDARDS INC.: BUSINESS OVERVIEW

- 10.1.15 TRILOGY ANALYTICAL LABORATORY

- TABLE 304 TRILOGY ANALYTICAL LABORATORY: BUSINESS OVERVIEW

- 10.1.16 ADVANCED ANALYTICAL SOLUTIONS

- TABLE 305 ADVANCED ANALYTICAL SOLUTIONS: BUSINESS OVERVIEW

- 10.1.17 AMERICAN INDUSTRIAL HYGIENE ASSOCIATION

- TABLE 306 AMERICAN INDUSTRIAL HYGIENE ASSOCIATION: BUSINESS OVERVIEW

- 10.1.18 MATRIX SCIENCES

- TABLE 307 MATRIX SCIENCES: BUSINESS OVERVIEW

- 10.1.19 AASHVI PROFICIENCY TESTING & ANALYTICAL SERVICES

- TABLE 308 AASHVI PROFICIENCY TESTING & ANALYTICAL SERVICES: BUSINESS OVERVIEW

- 10.1.20 GLOBAL PROFICIENCY LTD.

- TABLE 309 GLOBAL PROFICIENCY LTD.: BUSINESS OVERVIEW

- 10.1.21 THE EMERALD TEST

- TABLE 310 THE EMERALD TEST: BUSINESS OVERVIEW

- 10.2 OTHER PLAYERS

- 10.2.1 FLUXANA GMBH & CO. KG

- 10.2.2 PHENOVA INC.

- 10.2.3 FARE LABS

- 10.2.4 GO PLUS SERVICES SDN BHD.

- 10.2.5 MUVA KEMPTEN GMBH

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORT

- 11.5 AUTHOR DETAILS