|

|

市場調査レポート

商品コード

1128180

鉄道システムの世界市場:システムタイプ別(補助動力、HVAC、推進、車載制御、列車情報、列車安全)、輸送形態別、用途別(旅客輸送、貨物輸送)、地域別 - 2027年までの予測Railway System Market by System Type (Auxiliary Power, HVAC, Propulsion, On-board Vehicle Control, Train Information & Train Safety), Transit Type, Application (Passenger & Freight Transportation), & Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 鉄道システムの世界市場:システムタイプ別(補助動力、HVAC、推進、車載制御、列車情報、列車安全)、輸送形態別、用途別(旅客輸送、貨物輸送)、地域別 - 2027年までの予測 |

|

出版日: 2022年09月19日

発行: MarketsandMarkets

ページ情報: 英文 196 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の鉄道システムの市場規模は、2022年の251億米ドルから2027年には309億米ドルへと、CAGR4.2%で成長すると予測されています。

高速列車は、高度な電子列車制御システム、ビデオ監視、乗客情報ディスプレイ、ネットワークビデオレコーダーなど、高度な機能と接続ソリューションを備えたプレミアム列車です。高速鉄道にこれらのシステムが採用されることで、鉄道システムの市場は拡大します。このように、先進国だけでなく新興国でも高速鉄道のネットワークが拡大していることは、鉄道システム市場の成長の機会となっています。

世界の鉄道市場は、過去10年間で大きく成長しました。世界的に見ると、鉄道業界はここ最近、漸増的な成長を遂げています。欧州、アジア太平洋、中東のいくつかの国では、高速大量輸送を促進するために高速鉄道プロジェクトを導入しています。フランス、ドイツ、中国、インド、サウジアラビアなどの政府当局は、現在の輸送手段に対するストレスの増加を緩和するために、鉄道インフラの整備を推進しています。このような鉄道市場と鉄道インフラの開拓は、鉄道システム市場の成長を直接的に後押しすることになるでしょう

"欧州は予測期間中、旅客列車輸送における最大の鉄道システム市場になると予想される"

欧州の鉄道の多くは、無線接続、無線データ通信、環境に優しい車両、快適機能などのハイエンド技術を搭載しています。しかし、英国、ドイツ、フランス、スペインなどの西欧諸国に比べ、東欧ではハイエンド技術の採用が遅れています。このため、鉄道システムベンダーにとっては、東欧での存在感を高めるチャンスとなります。EU鉄道は、2030年までに31,000kmの高速鉄道路線を建設することを目標としています。さらに、欧州鉄道研究諮問委員会(ERRAC)、FP7プロジェクト、Horizon 2020、SHIFT2RAILなどのプロジェクトが、欧州鉄道システム市場の成長を後押しすることになります。

"列車情報システムは予測年に大きな成長が期待される"

列車情報システム(TIS)は、乗客への情報提供に使用される通信システムで、乗客と運行会社間の双方向通信を可能にします。経路に関する視覚的、音響的な情報を提供する電子的な装置で、自動運転や手動でプログラムすることができます。TISは、リアルタイムの追跡、外出先でのルート情報、旅行計画、リアルタイム到着予測システム、オンライン接続ソリューションを提供することができます。エンターテインメント、乗客情報、乗客数カウントなど、さまざまなアプリケーションをホストするために必要な車載リソースは、エッジコンピューティング(分散型データ管理)により提供されます。接続された高速列車に対する需要の高まりは、列車情報システムの需要を促進しています。さらに、自律走行型列車の登場は、今後の列車情報システム市場の成長の触媒として作用するでしょう。

"日本は予測期間中、鉄道システム市場において大きなシェアを占めると推定される"

日本は鉄道システム市場の技術リーダーです。同国は、鉄道システム市場における革新的な技術の開拓に継続的に投資しています。日本の鉄道システム市場は、主に新幹線列車(高速列車)によって牽引されています。これらの列車には、運行のための高度なシステムが搭載されています。日本のメーカーは、最も優れた列車の安全性と列車情報システムを提供しています。例えば、東芝は、非常に信頼性の高いCPUと高速伝送技術を組み込んだ列車情報制御システムを提供しています。これらのシステムは、高効率な車両機器制御、安全な運行、適切な乗客への通知サービスを機能的に兼ね備えています。また、車両と地上を通信し、運行・保守に関する情報を提供する統合システムも提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 市場力学の影響

- ポーターのファイブフォース

- 顧客のビジネスに影響を与える動向

- 特許分析

- ケーススタディ分析

- 貿易分析

- 主な会議とイベント(2022-2023)

- 規制状況と規制の状況

- マクロ指標分析

- エコシステム分析

- 技術分析

- 鉄道システム市場、シナリオ(2022-2027)

第6章 輸送別:鉄道システム市場

- イントロダクション

- 運用データ

- 従来型

- ディーゼル機関車

- 電気機関車

- 電気ディーゼル機関車

- コーチ

- 高速鉄道

- ディーゼルマルチプルユニット(DMU)

- 電気複合ユニット(EMU)

- ライトレール/トラム

- 地下鉄

第7章 システム別:鉄道システム市場

- イントロダクション

- 運用データ

- 推進システム

- 補助電源システム

- 列車情報システム

- 列車安全システム

- 空調システム

- 車載車両制御

第8章 用途別:鉄道システム市場

- イントロダクション

- 貨物輸送

- 旅客輸送

第9章 地域別:鉄道システム市場

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- 欧州

- フランス

- ドイツ

- イタリア

- ロシア

- スペイン

- 英国

- 北米

- 米国

- メキシコ

- カナダ

- その他地域

- ブラジル

- アラブ首長国連邦(UAE)

第10章 競合情勢

- 概要

- 市場ランキング分析

- トップ企業の収益分析

- 競合シナリオ

- 競合リーダーシップマッピング

- 企業評価クアドラント

- 中小企業評価クアドラント

- 中小企業評価クアドラント

第11章 企業プロファイル

- 主要企業

- CRRC

- ALSTOM

- ABB

- KNORR-BREMSE

- THERMO KING

- SIEMENS

- MITSUBISHI HEAVY INDUSTRIES

- TOSHIBA

- HITACHI

- その他の企業

- CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES(CAF)

- STRUKTON

- WOOJIN INDUSTRIAL SYSTEMS

- AMERICAN EQUIPMENT COMPANY

- INGETEAM

- CALAMP

- SINARA TRANSPORT MACHINES

- FUJI ELECTRIC

- SKODA TRANSPORTATION

- MEDCOM

第12章 MARKETS AND MARKETSによる提言

- アジア太平洋地域が鉄道システムの主要市場になる

- 次世代クリーン推進システムの開発

- 高速鉄道が鉄道システム市場で最も収益性の高いセグメントになる

- 結論

第13章 付録

The global railway system market is estimated to grow at a CAGR of 4.2%, from USD 25.1 billion in 2022 to USD 30.9 billion by 2027. High-speed trains are premium trains equipped with advanced features and connectivity solutions such as advanced electronic train control systems, video surveillance, passenger information display, and network video recorders. The adoption of these systems in high-speed trains will drive the market for railway systems. Thus, the increasing network of high-speed rail in emerging countries, as well as developed countries, provides an opportunity for the growth of the railway system market.

The world railway market has grown significantly in the last decade. Globally, the railway industry has witnessed incremental growth in the recent past. Several countries in Europe, Asia Pacific, and the Middle East have introduced high-speed rail projects to encourage rapid mass transit. The government authorities of countries such as France, Germany, China, India, and Saudi Arabia are pushing the growth of rail infrastructure to ease the increasing stress on current transportation. This development of the rail market and railway infrastructure will directly foster the growth of the railway system market

"Europe is expected to be the largest Railway system market for Passenger Train transportation during the forecast period."

Most European rails are equipped with high-end technologies that include wireless radio connection, wireless data transmission, eco-friendly cars, and comfort features. However, the adoption of high-end technologies is lower in Eastern Europe compared to Western Europe countries such as the UK, Germany, France, and Spain. This offers railway system vendors an opportunity to increase their presence in Eastern Europe. The EU Railway's target is to build 31,000 km of high-speed rail track by 2030. Furthermore, projects such as the European Rail Research Advisory Council (ERRAC), FP7 projects, Horizon 2020, and SHIFT2RAIL will boost the growth of the European railway system market.

"The train information system is expected to grow at a significant rate for the forecasted year."

Train Information System (TIS) is a communication system used for providing information to passengers and enables two-way communication between passengers and operators. It is an electronically operated device that provides visual and acoustic information about the route, which is operated automatically and programmed manually. TIS can provide real-time tracking, route information on the go, travel planning, real-time arrival prediction systems, online connectivity solution. The onboard resources needed to host a variety of applications, including entertainment, passenger information, and passenger counting, are provided through edge computing (decentralized data management). The growing demand for connected and high-speed trains is propelling the demand for train information systems. Moreover, the advent of autonomous trains will act as a catalyst in the growth of the train information system market in the future.

"Japan is estimated to have significant market share in railway system market during the forecast period."

Japan is a technology leader in the railway system market. The country is continuously investing in the development of innovative technologies in the railway system market. The Japanese railway system market is primarily driven by Shinkansen trains (high-speed trains). These trains are equipped with advanced systems for their operations. Japanese manufacturers offer one of the best train safety and train information systems. For instance, Toshiba provides train information control systems that incorporate extremely dependable CPUs and fast transmission technologies. These systems functionally combine high efficiency rolling stock equipment control, secure operation, and adequate passenger notification services. Furthermore, Toshiba offers integrated systems that communicate between rolling stock and the ground to provide information about operation and maintenance.

The study contains insights from various industry experts, ranging from component suppliers to tier I companies and OEMs.

The break-up of the primaries is as follows:

- By Company Type: Tier I: 27%, Tier II: 27%, OEM: 46%

- By Designation: C level: 32%, D level: 38%, Others: 30%

- By Region: Asia Pacific: 50%, Europe: 27%, North America: 15%, Rest of the World: 8%

Major players profiled in the report are:

- CRRC (China)

- Alstom (France)

- ABB (Switzerland)

- Siemens (Germany)

- Thermo King (US)

- Knorr Bremse (Germany)

- Hyundai Rotem (South Korea)

- Mitsubishi Heavy Industries (Japan)

- Toshiba (Japan)

- Hitachi (South Korea)

Research Coverage:

The report segments the railway system market, by value, on the basis of region (Asia Pacific, Europe, North America, and the Rest of the World), application (passenger transportation and freight transportation), system type (auxiliary power system, HVAC, propulsion system, onboard vehicle control, train information system, train safety system), and transit type (conventional and rapid). The report contains various levels of analysis, including industry analysis, industry trends, and company profiles, which together comprise and discuss the basic views on the emerging and high-growth segments of the railway system market, high-growth regions and countries, government initiatives, and market dynamics such as drivers, restraints, opportunities, and challenges.

Reasons to Buy the Report:

- The report will help market leaders/new entrants in this market with information on the closest approximations of revenue numbers for the overall railway system market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the pulse of the market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 RAILWAY SYSTEM MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 CURRENCY EXCHANGE RATES (WRT USD)

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RAILWAY SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- 2.2 SECONDARY DATA

- 2.2.1 KEY SECONDARY SOURCES

- 2.2.2 KEY DATA FROM SECONDARY SOURCES

- 2.3 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.3.1 PRIMARY PARTICIPANTS

- 2.4 MARKET ESTIMATION METHODOLOGY

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.6 MARKET SIZE ESTIMATION

- 2.6.1 TOP-DOWN APPROACH

- FIGURE 7 RAILWAY SYSTEM MARKET: TOP-DOWN APPROACH

- 2.7 FACTOR ANALYSIS

- FIGURE 8 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.8 ASSUMPTIONS

- 2.9 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 RAILWAY SYSTEM MARKET OVERVIEW

- FIGURE 10 RAILWAY SYSTEM MARKET, BY REGION, 2022-2027

- FIGURE 11 RAILWAY SYSTEM MARKET, BY TRANSIT, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 KEY PLAYERS OPERATING IN RAILWAY SYSTEM MARKET, BY REGION

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RAILWAY SYSTEM MARKET

- FIGURE 13 INCREASING PREFERENCE FOR RAIL-BASED PUBLIC TRANSPORT TO DRIVE MARKET

- 4.2 RAILWAY SYSTEM MARKET SHARE, BY REGION

- FIGURE 14 EUROPE IS ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF RAILWAY SYSTEM MARKET IN 2022

- 4.3 RAILWAY SYSTEM MARKET, BY TRANSIT

- FIGURE 15 RAPID TRANSIT SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 4.4 RAILWAY SYSTEM MARKET, BY APPLICATION

- FIGURE 16 PASSENGER TRANSPORTATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 RAILWAY SYSTEM MARKET, BY SYSTEM

- FIGURE 17 TRAIN INFORMATION SYSTEMS TO DOMINATE FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 RAILWAY SYSTEM MARKET: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing preference for public rail transport to reduce traffic congestion

- FIGURE 19 DRIVING TIME SPENT IN TRAFFIC CONGESTION, 2020

- FIGURE 20 DRIVING TIME SPENT IN TRAFFIC CONGESTION IN US, BY CITY, 2021

- 5.2.1.2 Growing demand for energy-efficient transport

- FIGURE 21 GLOBAL CO2 EMISSIONS FROM DIFFERENT TRANSPORT SEGMENTS, 2000-2030

- 5.2.1.3 Increasing penetration of EMUs

- FIGURE 22 ENERGY DEMAND IN GLOBAL RAILWAY INDUSTRY, 2017-2050

- FIGURE 23 ENERGY DEMAND IN GLOBAL RAILWAY INDUSTRY, 2017-2050

- 5.2.1.4 Refurbishment of existing rolling stock

- 5.2.2 RESTRAINTS

- 5.2.2.1 Capital-intensive and high development complexities

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing railway projects across the globe

- TABLE 2 SOME LATEST RAILWAY PROJECTS AND THEIR COST

- 5.2.3.2 Government support for alternative fuel-powered railway operations

- 5.2.3.3 Inclination of emerging countries toward high-speed rail for rapid transit

- FIGURE 24 WORLD'S LONGEST HIGH-SPEED RAIL NETWORKS

- 5.2.3.4 Increase in use of railways for industrial and mining activities

- TABLE 3 DIFFERENT MODES OF FREIGHT TRANSPORTATION

- 5.2.4 CHALLENGES

- 5.2.4.1 High overhaul and maintenance costs

- 5.2.5 IMPACT OF MARKET DYNAMICS

- TABLE 4 RAILWAY SYSTEM MARKET: IMPACT OF MARKET DYNAMICS

- 5.3 PORTER'S FIVE FORCES

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES ON RAILWAY SYSTEM MARKET

- FIGURE 25 PORTER'S FIVE FORCES: RAILWAY SYSTEM MARKET

- 5.3.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 THREAT OF NEW ENTRANTS

- 5.4 TRENDS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 TRENDS IMPACTING CUSTOMER BUSINESS IN RAILWAY SYSTEM MARKET

- 5.5 PATENT ANALYSIS

- 5.5.1 INTRODUCTION

- FIGURE 27 PATENT TREND, 2011-2021

- 5.5.2 LEGAL STATUS OF PATENTS

- FIGURE 28 LEGAL STATUS OF PATENTS FILED FOR RAILWAY SYSTEMS

- 5.5.3 TOP PATENT APPLICANTS

- FIGURE 29 RAILWAY SYSTEM PATENTS

- TABLE 6 PATENT ANALYSIS: RAILWAY SYSTEM MARKET (ACTIVE PATENTS)

- 5.6 CASE STUDY ANALYSIS

- TABLE 7 EXCAVATION OF BIG ANALOG DATA VALUE: COMPACTRIO & NI INSIGHTCM

- 5.6.1 GOLINC-M MODULES

- 5.7 TRADE ANALYSIS

- FIGURE 30 IMPORT OF RAILWAY SYSTEMS, KEY COUNTRIES (2017-2021), USD MILLION

- FIGURE 31 EXPORT OF RAILWAY SYSTEMS, KEY COUNTRIES, (2017-2021), USD MILLION

- 5.8 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 8 RAILWAY SYSTEM MARKET: LIST OF CONFERENCES & EVENTS

- 5.9 TARIFF AND REGULATORY LANDSCAPE

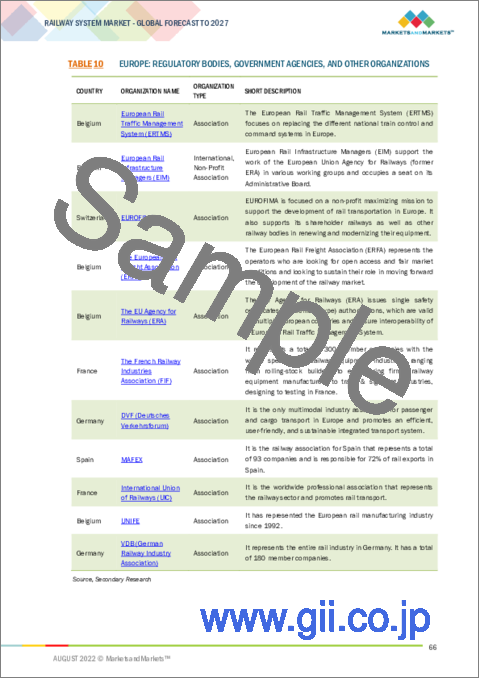

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 MACROINDICATOR ANALYSIS

- 5.10.1 GROWTH OF RAILWAY SYSTEM MARKET

- 5.10.2 GDP (USD BILLION)

- 5.10.3 GNI PER CAPITA, ATLAS METHOD (USD)

- 5.10.4 GDP PER CAPITA PPP (USD)

- 5.10.5 MACROINDICATORS INFLUENCING RAILWAY SYSTEM MARKET, TOP THREE COUNTRIES

- 5.10.5.1 Germany

- 5.10.5.2 US

- 5.10.5.3 China

- 5.11 ECOSYSTEM ANALYSIS

- FIGURE 32 RAILWAY SYSTEM MARKET: ECOSYSTEM ANALYSIS

- TABLE 13 ROLE OF COMPANIES IN RAILWAY SYSTEM ECOSYSTEM

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 REGENERATIVE BRAKING IN TRAINS

- 5.12.3 AUTONOMOUS TRAINS

- 5.13 RAILWAY SYSTEM MARKET, SCENARIOS (2022-2027)

- FIGURE 33 FUTURE TRENDS & SCENARIOS: RAILWAY SYSTEM MARKET, 2022-2027 (USD MILLION)

- 5.13.1 MOST LIKELY SCENARIO

- TABLE 14 MOST LIKELY SCENARIO: RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 5.13.2 OPTIMISTIC SCENARIO

- TABLE 15 OPTIMISTIC SCENARIO: RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 5.13.3 PESSIMISTIC SCENARIO

- TABLE 16 PESSIMISTIC SCENARIO: EV TEST EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

6 RAILWAY SYSTEM MARKET, BY TRANSIT

- 6.1 INTRODUCTION

- FIGURE 34 RAILWAY SYSTEM MARKET, BY TRANSIT, 2022 VS. 2027 (USD MILLION)

- TABLE 17 RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 18 RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 6.2 OPERATIONAL DATA

- TABLE 19 RAILWAY SYSTEM OFFERINGS, BY COMPANY

- 6.2.1 ASSUMPTIONS

- TABLE 20 ASSUMPTIONS: BY TRANSIT

- 6.2.2 RESEARCH METHODOLOGY

- 6.3 CONVENTIONAL

- 6.3.1 GROWING TREND OF ELECTRIFICATION

- 6.3.2 DIESEL LOCOMOTIVES

- 6.3.3 ELECTRIC LOCOMOTIVES

- 6.3.4 ELECTRO-DIESEL LOCOMOTIVES

- 6.3.5 COACHES

- TABLE 21 CONVENTIONAL TRANSIT: RAILWAY SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 22 CONVENTIONAL TRANSIT: RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 RAPID

- 6.4.1 INCREASING INVESTMENTS BY EMERGING COUNTRIES IN METRO PROJECTS

- 6.4.2 DIESEL MULTIPLE UNIT (DMU)

- 6.4.3 ELECTRIC MULTIPLE UNIT (EMU)

- 6.4.4 LIGHT RAIL/TRAM

- 6.4.5 METRO/SUBWAYS

- TABLE 23 RAPID TRANSIT: RAILWAY SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 24 RAPID TRANSIT: RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

7 RAILWAY SYSTEM MARKET, BY SYSTEM

- 7.1 INTRODUCTION

- FIGURE 35 RAILWAY SYSTEM MARKET, BY SYSTEM, 2022 VS. 2027 (USD MILLION)

- TABLE 25 RAILWAY SYSTEM MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 26 RAILWAY SYSTEM MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- 7.2 OPERATIONAL DATA

- TABLE 27 RAILWAY SYSTEM MARKET, BY SYSTEM

- 7.2.1 ASSUMPTIONS

- TABLE 28 ASSUMPTIONS: BY SYSTEM

- 7.2.2 RESEARCH METHODOLOGY

- 7.3 PROPULSION SYSTEM

- 7.3.1 GROWING DEMAND FOR HYBRID AND BATTERY-OPERATED TRAINS

- TABLE 29 PROPULSION SYSTEM: RAILWAY SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 PROPULSION SYSTEM: RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 AUXILIARY POWER SYSTEM

- 7.4.1 NEED FOR MODERN, LIGHTWEIGHT AUXILIARY POWER SYSTEMS

- TABLE 31 AUXILIARY POWER SYSTEM: RAILWAY SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 32 AUXILIARY POWER SYSTEM: RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.5 TRAIN INFORMATION SYSTEM

- 7.5.1 INTEGRATION OF IT AND EDGE COMPUTING

- TABLE 33 TRAIN INFORMATION SYSTEM: RAILWAY SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 34 TRAIN INFORMATION SYSTEM: RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.6 TRAIN SAFETY SYSTEM

- 7.6.1 FOR SAFE AND COMFORTABLE PASSENGER TRANSPORT

- TABLE 35 TRAIN SAFETY SYSTEM: RAILWAY SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 TRAIN SAFETY SYSTEM: RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.7 HVAC SYSTEM

- 7.7.1 REQUIRED TO REDUCE DEGREE OF INFECTIONS POST-COVID-19

- TABLE 37 HVAC SYSTEM: RAILWAY SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 HVAC SYSTEM: RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.8 ON-BOARD VEHICLE CONTROL

- 7.8.1 TECHNOLOGY COLLABORATIONS LEAD TO ADVANCEMENTS

- TABLE 39 ON-BOARD VEHICLE CONTROL SYSTEM: RAILWAY SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 40 ON-BOARD VEHICLE CONTROL SYSTEM: RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

8 RAILWAY SYSTEM MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 36 RAILWAY SYSTEM MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 41 RAILWAY SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 42 RAILWAY SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.1.1 OPERATIONAL DATA

- FIGURE 37 FREIGHT TRANSPORTATION SERVICES INDEX, DECEMBER 2018 - DECEMBER 2021

- 8.1.2 ASSUMPTIONS

- TABLE 43 ASSUMPTIONS: BY APPLICATION

- 8.1.3 RESEARCH METHODOLOGY

- 8.2 FREIGHT TRANSPORTATION

- 8.2.1 GROWING MINING AND INDUSTRIAL ACTIVITIES

- TABLE 44 FREIGHT TRANSPORTATION: RAILWAY SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 45 FREIGHT TRANSPORTATION: RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 PASSENGER TRANSPORTATION

- 8.3.1 RAPID URBANIZATION EXPECTED TO FUEL SEGMENT

- TABLE 46 PASSENGER TRANSPORTATION: RAILWAY SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 PASSENGER TRANSPORTATION: RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

9 RAILWAY SYSTEM MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 38 RAILWAY SYSTEM MARKET, BY REGION, 2022-2027

- TABLE 48 RAILWAY SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 49 RAILWAY SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2 ASIA PACIFIC

- FIGURE 39 ASIA PACIFIC: RAILWAY SYSTEM MARKET SNAPSHOT

- TABLE 50 ASIA PACIFIC: RAILWAY SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 51 ASIA PACIFIC: RAILWAY SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.2.1 CHINA

- 9.2.1.1 High investments in railway infrastructure

- TABLE 52 CHINA: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 53 CHINA: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.2.2 INDIA

- 9.2.2.1 Upcoming railway projects

- TABLE 54 INDIA: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 55 INDIA: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.2.3 JAPAN

- 9.2.3.1 Technological advancements in high-speed trains

- TABLE 56 JAPAN: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 57 JAPAN: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Expansion of urban rail networks

- TABLE 58 SOUTH KOREA: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 59 SOUTH KOREA: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.3 EUROPE

- FIGURE 40 EUROPE: RAILWAY SYSTEM MARKET, BY COUNTRY, 2022 VS. 2027

- TABLE 60 EUROPE: RAILWAY SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 61 EUROPE: RAILWAY SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.3.1 FRANCE

- 9.3.1.1 Increasing adoption of light rails/trams

- TABLE 62 FRANCE: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 63 FRANCE: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.3.2 GERMANY

- 9.3.2.1 High investments in digital technologies

- TABLE 64 GERMANY: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 65 GERMANY: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.3.3 ITALY

- 9.3.3.1 Ambitious investment programs for rapid transit

- TABLE 66 ITALY: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 67 ITALY: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.3.4 RUSSIA

- 9.3.4.1 Government initiatives to promote public transport

- TABLE 68 RUSSIA: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 69 RUSSIA: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Investments in high-speed trains

- TABLE 70 SPAIN: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 71 SPAIN: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.3.6 UK

- 9.3.6.1 Upcoming projects and government funding

- TABLE 72 UK: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 73 UK: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.4 NORTH AMERICA

- 9.4.1 UPCOMING RAPID TRANSIT PROJECTS IN NORTH AMERICA

- TABLE 74 MAJOR RAPID TRANSIT PROJECTS IN NORTH AMERICA

- FIGURE 41 NORTH AMERICA: RAILWAY SYSTEM MARKET SNAPSHOT

- TABLE 75 NORTH AMERICA: RAILWAY SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 76 NORTH AMERICA: RAILWAY SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.4.2 US

- 9.4.2.1 Increasing urban mobility and OEM investments

- TABLE 77 US: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 78 US: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.4.3 MEXICO

- 9.4.3.1 Emergence of private players in conventional transit

- TABLE 79 MEXICO: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 80 MEXICO: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.4.4 CANADA

- 9.4.4.1 Growing concerns over traffic congestion

- TABLE 81 CANADA: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 82 CANADA: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.5 REST OF THE WORLD (ROW)

- FIGURE 42 REST OF THE WORLD: RAILWAY SYSTEM MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

- TABLE 83 REST OF THE WORLD: RAILWAY SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 84 REST OF THE WORLD: RAILWAY SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.5.1 BRAZIL

- 9.5.1.1 High spending on urban mobility projects

- TABLE 85 BRAZIL: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 86 BRAZIL: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

- 9.5.2 UNITED ARAB EMIRATES (UAE)

- 9.5.2.1 Increasing use of technologically advanced metro trains

- TABLE 87 UAE: RAILWAY SYSTEM MARKET, BY TRANSIT, 2018-2021 (USD MILLION)

- TABLE 88 UAE: RAILWAY SYSTEM MARKET, BY TRANSIT, 2022-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- TABLE 89 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ROLLING STOCK MARKET

- 10.2 MARKET RANKING ANALYSIS

- FIGURE 43 MARKET RANKING, 2021

- 10.3 REVENUE ANALYSIS OF TOP PLAYERS

- FIGURE 44 TOP PLAYERS IN RAILWAY SYSTEM MARKET DURING LAST THREE YEARS

- 10.4 COMPETITIVE SCENARIO

- 10.4.1 NEW PRODUCT DEVELOPMENTS

- TABLE 90 NEW PRODUCT DEVELOPMENTS, 2019-2022

- 10.4.2 PARTNERSHIPS/SUPPLY CONTRACTS/COLLABORATIONS/ JOINT VENTURES/LICENSE AGREEMENTS

- TABLE 91 PARTNERSHIPS/SUPPLY CONTRACTS/COLLABORATIONS/JOINT VENTURES/ AGREEMENTS, 2019-2022

- 10.4.3 EXPANSIONS

- TABLE 92 EXPANSIONS, 2019-2022

- 10.5 COMPETITIVE LEADERSHIP MAPPING

- 10.5.1 STARS

- 10.5.2 PERVASIVE COMPANIES

- 10.5.3 EMERGING LEADERS

- 10.5.4 PARTICIPANTS

- FIGURE 45 RAILWAY SYSTEM MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.6 COMPANY EVALUATION QUADRANT

- TABLE 93 COMPANY REGION FOOTPRINT

- TABLE 94 COMPANY APPLICATION TYPE FOOTPRINT

- TABLE 95 COMPANY APPLICATION & REGION FOOTPRINT

- 10.7 SME EVALUATION QUADRANT

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- FIGURE 46 RAILWAY SYSTEM MARKET: COMPANY EVALUATION MATRIX FOR SMES, 2021

- 10.8 SME EVALUATION QUADRANT

- TABLE 96 SME REGION FOOTPRINT

- TABLE 97 SME APPLICATION FOOTPRINT

- TABLE 98 SME APPLICATION & REGION FOOTPRINT

11 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 11.1 KEY PLAYERS

- 11.1.1 CRRC

- TABLE 99 CRRC: BUSINESS OVERVIEW

- FIGURE 47 CRRC: COMPANY SNAPSHOT

- TABLE 100 CRRC: PRODUCTS OFFERED

- TABLE 101 CRRC: NEW PRODUCT LAUNCHES

- TABLE 102 CRRC: DEALS

- 11.1.2 ALSTOM

- TABLE 103 ALSTOM: BUSINESS OVERVIEW

- FIGURE 48 ALSTOM: COMPANY SNAPSHOT

- TABLE 104 ALSTOM: PRODUCTS OFFERED

- TABLE 105 ALSTOM: NEW PRODUCT LAUNCHES

- TABLE 106 ALSTOM: DEALS

- TABLE 107 ALSTOM: OTHERS

- 11.1.3 ABB

- TABLE 108 ABB: BUSINESS OVERVIEW

- FIGURE 49 ABB: COMPANY SNAPSHOT

- TABLE 109 ABB: PRODUCTS OFFERED

- TABLE 110 ABB: DEALS

- 1.1.4 KNORR-BREMSE

- TABLE 111 KNORR-BREMSE: BUSINESS OVERVIEW

- TABLE 112 KNORR-BREMSE: PRODUCTS OFFERED

- TABLE 113 KNORR-BREMSE: OTHERS

- 11.1.5 THERMO KING

- TABLE 114 THERMO KING: BUSINESS OVERVIEW

- FIGURE 50 THERMO KING: COMPANY SNAPSHOT

- TABLE 115 THERMO KING: PRODUCTS OFFERED

- TABLE 116 THERMO KING: NEW PRODUCT DEVELOPMENTS

- 11.1.6 SIEMENS

- TABLE 117 SIEMENS: BUSINESS OVERVIEW

- FIGURE 51 SIEMENS: COMPANY SNAPSHOT

- TABLE 118 SIEMENS: PRODUCTS OFFERED

- TABLE 119 SIEMENS: NEW PRODUCT LAUNCHES

- TABLE 120 SIEMENS: DEALS

- TABLE 121 HYUNDAI ROTEM: BUSINESS OVERVIEW

- FIGURE 52 HYUNDAI ROTEM COMPANY: COMPANY SNAPSHOT

- TABLE 122 HYUNDAI ROTEM: PRODUCTS OFFERED

- TABLE 123 HYUNDAI ROTEM: DEALS

- 11.1.8 MITSUBISHI HEAVY INDUSTRIES

- TABLE 124 MITSUBISHI HEAVY INDUSTRIES: BUSINESS OVERVIEW

- TABLE 125 MITSUBISHI HEAVY INDUSTRIES: PRODUCTS OFFERED

- TABLE 126 MITSUBISHI HEAVY INDUSTRIES: DEALS

- 11.1.9 TOSHIBA

- TABLE 127 TOSHIBA: BUSINESS OVERVIEW

- FIGURE 53 TOSHIBA: COMPANY SNAPSHOT

- TABLE 128 TOSHIBA: PRODUCTS OFFERED

- TABLE 129 TOSHIBA: OTHERS

- 11.1.10 HITACHI

- TABLE 130 HITACHI: BUSINESS OVERVIEW

- FIGURE 54 HITACHI: COMPANY SNAPSHOT

- 11.1.10.2 Products offered

- TABLE 131 HITACHI: PRODUCTS OFFERED

- 11.1.10.3 Recent Developments

- TABLE 132 HITACHI: PRODUCT LAUNCHES

- TABLE 133 HITACHI: DEALS

- TABLE 134 HITACHI: OTHERS

- 11.2 OTHER KEY PLAYERS

- 11.2.1 CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES (CAF)

- TABLE 135 CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES (CAF): BUSINESS OVERVIEW

- 11.2.2 STRUKTON

- TABLE 136 STRUKTON: BUSINESS OVERVIEW

- 11.2.3 WOOJIN INDUSTRIAL SYSTEMS

- TABLE 137 WOOJIN INDUSTRIAL SYSTEMS: BUSINESS OVERVIEW

- 11.2.4 AMERICAN EQUIPMENT COMPANY

- TABLE 138 AMERICAN EQUIPMENT COMPANY: BUSINESS OVERVIEW

- 11.2.5 INGETEAM

- TABLE 139 INGETEAM: BUSINESS OVERVIEW

- 11.2.6 CALAMP

- TABLE 140 CALAMP: BUSINESS OVERVIEW

- 11.2.7 SINARA TRANSPORT MACHINES

- TABLE 141 SINARA TRANSPORT MACHINES: BUSINESS OVERVIEW

- 11.2.8 FUJI ELECTRIC

- TABLE 142 FUJI ELECTRIC: BUSINESS OVERVIEW

- 11.2.9 SKODA TRANSPORTATION

- TABLE 143 SKODA TRANSPORTATION: BUSINESS OVERVIEW

- 11.2.10 MEDCOM

- TABLE 144 MEDCOM: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 RECOMMENDATIONS BY MARKETSANDMARKETS

- 12.1 ASIA PACIFIC TO BE MAJOR MARKET FOR RAILWAY SYSTEMS

- 12.2 DEVELOPMENT OF NEXT-GEN CLEAN PROPULSION SYSTEMS

- 12.3 RAPID TRANSIT TO BE MOST PROFITABLE SEGMENT OF RAILWAY SYSTEM MARKET

- 12.4 CONCLUSION

13 APPENDIX

- 13.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS