|

|

市場調査レポート

商品コード

1174448

ドライブバイワイヤーの世界市場:用途別・センサー別・車種別・コンポーネント別・地域別の将来予測 (2027年まで)Drive by Wire Market by Application (Brake, Park, Shift, Steer, Throttle), Sensor (Brake Pedal, Throttle Position, Park, Gearshift, Handwheel, Pinion), Vehicle (On & Off-Highway, BEV, PHEV, FCEV, Autonomous), Component & Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ドライブバイワイヤーの世界市場:用途別・センサー別・車種別・コンポーネント別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月28日

発行: MarketsandMarkets

ページ情報: 英文 302 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車用ドライブバイワイヤーの市場規模は、2022年の206億米ドルに達した後、予測期間中に6.2%のCAGRで成長し、2027年には279億米ドルに達すると予測されます。

市場の主な促進要因として、EVの販売増加や自動運転車の開発、高級車の販売拡大などが挙げられます。また、厳しい安全基準の導入も、ドライブバイワイヤーシステムの普及を後押ししています。

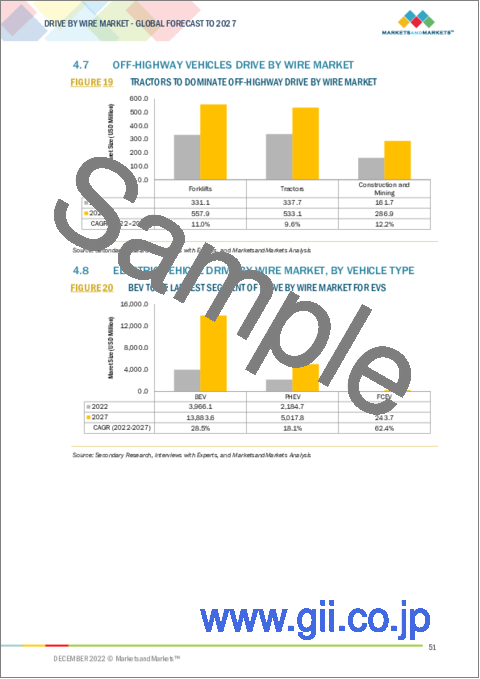

オフハイウェイ車向けドライブバイワイヤー市場の中でも、建設・鉱業は予測期間中に最も急成長する分野だと予想されます。インフラプロジェクトの開発、鉱業活動、物流・貨物産業の流通センターの成長により、オフハイウェイ車の需要が高まると予想されます。

コンポーネント別では、アクチュエーターが予測期間中に最大の市場シェアを占める見通しです。1台の車両には複数のアクチュエーターが採用されるため、プレミアムカーの普及や内燃機関車の電子回路化により、アクチュエーターの数量は増加すると予想されます。

地域別では、アジア太平洋が最大の市場シェアを占めています。域内各国 (中国、インド、韓国、日本など) で高度なシステムを搭載したプレミアムカーの需要が増加したことが、市場成長の主な要因となっています。また、各国で排ガス規制が厳しくなっており、ドライブバイワイヤー市場の拡大が期待されています。

当レポートでは、世界のドライブバイワイヤーの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、用途別・センサーの種類別・コンポーネント別・車種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ドライブバイワイヤー市場のシナリオ (2018年~2027年)

- 最も可能性の高いシナリオ

- 影響の小さいシナリオ

- 影響の大きいシナリオ

- 市場エコシステム

- 技術分析

- ケーススタディ分析

- 特許分析

- 価格分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- 規制状況

- 購入プロセスと購入基準における主要な利害関係者

- 主な会議

第6章 ドライブバイワイヤー市場:用途別

- イントロダクション

- ブレーキバイワイヤー

- パークバイワイヤー

- シフトバイワイヤー

- ステアバイワイヤー

- スロットルバイワイヤー

第7章 ドライブバイワイヤー市場:センサーの種類別

- イントロダクション

- ブレーキペダルセンサー

- ハンドル角度センサー

- ギアシフトポジションセンサー

- ピニオン角度センサー

- パークセンサー

- スロットルペダルセンサー

- スロットルポジションセンサー

第8章 ドライブバイワイヤー市場:コンポーネント別

- イントロダクション

- アクチュエーター

- 電子制御ユニット (ECU)

- エンジン制御モジュール (ECM)

- 電子スロットル制御モジュール (ETCM)

- 電子トランスミッション制御ユニット (ETCU)

- フィードバックモーター

- パーキングポール

第9章 ドライブバイワイヤー市場:オンハイウェイ車別

- イントロダクション

- 乗用車

- 小型商用車 (LCV)

- トラック

- バス

第10章 ドライブバイワイヤー市場:電気自動車の種類別

- イントロダクション

- バッテリー式電気自動車 (BEV)

- プラグインハイブリッド車 (PHEV)

- 燃料電池車 (FCEV)

第11章 EV向けドライブバイワイヤー市場:センサーの種類別

- イントロダクション

- ブレーキペダルセンサー

- ハンドル角度センサー

- ギアシフトポジションセンサー

- ピニオン角度センサー

- パークセンサー

- スロットルペダルセンサー

- スロットルポジションセンサー

第12章 ドライブバイワイヤー市場:オフハイウェイ車別

- イントロダクション

- 農業用トラクター

- 建設・鉱山機械

- フォークリフト

第13章 自動運転車向けドライブバイワイヤー市場:用途別

- イントロダクション

- ブレーキバイワイヤー

- パークバイワイヤ

- シフトバイワイヤ

- ステアバイワイヤ

- スロットルバイワイヤ

第14章 ドライブバイワイヤー市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- タイ

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- フランス

- ロシア

- スペイン

- 英国

- トルコ

- イタリア

- 他の欧州諸国

- 北米

- カナダ

- メキシコ

- 米国

- 他の国々 (RoW)

- ブラジル

- イラン

- アルゼンチン

- 南アフリカ

- その他

第15章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 上位5社の収益分析 (2019~2021年)

- 市場シェア分析

- 競合リーダーシップマッピング

- 競合シナリオ

- 新製品開発

- 契約、パートナーシップ、コラボレーション、合弁事業

第16章 企業プロファイル

- 主要企業

- ROBERT BOSCH GMBH

- CONTINENTAL AG

- ZF FRIEDRICHSHAFEN AG

- INFINEON TECHNOLOGIES AG

- NEXTEER AUTOMOTIVE

- CTS CORPORATION

- FICOSA INTERNACIONAL SA

- KONGSBERG AUTOMOTIVE

- HITACHI, LTD.

- CURTISS-WRIGHT CORPORATION

- その他の企業

- ASIA PACIFIC

- EUROPE

- NORTH AMERICA

- ドライブバイワイヤー用コンポーネントのサプライヤー

- REE AUTOMOTIVE

- NXP SEMICONDUCTORS NV

- HELLA GMBH & CO. KGAA

- SNT MOTIV CO., LTD.

- LEM EUROPE GMBH

- ALLIED MOTION TECHNOLOGIES INC.

- SCHAEFFLER TECHNOLOGIES AG & CO.

- NTN CORPORATION

- IMMERSION CORPORATION

- SORL AUTO PARTS, INC.

第17章 MarketsandMarketsの提言

第18章 付録

The automotive drive-by-wire market is projected to grow from USD 20.6 billion in 2022 to reach USD 27.9 billion by 2027 at a CAGR of 6.2% during the forecast period. Increasing EV sales, developments in autonomous vehicles, and growing sales of luxury vehicles are boosting demand for drive-by-wire systems. Implementing stringent safety norms is also driving the adoption of automotive drive-by-wire systems.

"Construction and Mining drive-by-wire segment is expected to be the fastest-growing segment."

The construction and Mining segment is expected to be the fastest-growing drive-by-wire during the forecast period. Development of infrastructure projects, mining activities, and growth of logistics and freights industry distribution centers are expected to boost off-highway vehicle demand. Moreover, OEMs are shifting focus to introduce drive-by-wire technologies in off-highway equipment for better operational accuracy and fuel economy. In many developing countries like China, India, and other African nations, governments have announced major billion-dollar infrastructure projects to boost overall construction and mining vehicle segments. This will allow vehicle manufacturers to build more drive-by-wire-enabled systems.

"Drive-by-wire Actuators would showcase the largest market during the forecast period."

Actuators will have the largest market share during the forecast period. The actuator is an important component of the drive-by-wire system and is used in all drive-by-wire applications considered in the study. Every drive-by-wire application uses one or more actuators. Since multiple actuators are employed in a vehicle, the volume of actuators is expected to grow with the increasing popularity of premium vehicles and the adoption of electronic circuits in ICE vehicles. As there is more innovation towards reducing weight and increasing space, there will be an eventual move towards adopting more and more electromechanical systems, and hence more actuators like hydraulic, electric, pneumatic, and mechanical actuators will find their place inside the vehicles as they are small, efficient, and moderately priced compared to larger mechanical systems.

Asia Pacific is the largest market for the automotive drive-by-wire market

Asia Pacific countries such as China, India, South Korea, and Japan account for a major share of the drive-by-wire market due to the demand for premium vehicles equipped with advanced systems. Many premium vehicles are equipped with drive-by-wire systems. Vehicles like Volvo XC-40, TATA Altroz DCA, and BMWs drive are some examples of vehicles with drive by wire system. Also, with stringent emission norms in the Asia Pacific, the drive-by-wire market is expected to boost. This is because the use of X-by-wire systems reduces the overall weight and hence makes the vehicle lighter, thereby making the engine function more efficiently. The Chinese market is shifting toward the adoption of advanced technologies, such as automated manual transmission in mid-size and economy-class vehicles. As a result, manufacturers are investing in deploying advanced technologies like drive by wire systems into their vehicles like throttle by wire, shift by wire etc. Various developments in drive-by-wire technology, particularly in components such as sensors and actuators, are also popularizing drive-by-wire among various automakers. Thus, considering the aforementioned factors, drive-by-wire adoption is expected to grow significantly in the coming years.

Breakdown of primaries

The study contains various industry experts' insights, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Supply-side - 70%, Demand-side - 30%

- By Designation: C level - 20%, Director Level- 20%, Others- 60%

- By Region: Asia Pacific - 80%, Europe - 10%, North America - 10%

Note: Others include Design Engineer, Exterior Drive-by-wire Designer, etc.

The key players in the automotive drive-by-wire market are Bosch (Germany), Continental (Germany), ZF (Germany), Infineon Technologies (Germany), Nexteer Automotive (US). The key strategies adopted by major companies to sustain their position in the market are expansions, contracts and agreements, and partnerships.

Research Coverage

The automotive drive-by-wire market By application (throttle-by-wire, steer-by-wire,shift-by-wire, brake-by-wire, and park-by-wire), By sensor type (throttle pedal sensor, throttle position sensor, pinion angle sensor, hand wheel angle sensor, gear shift position sensor, park sensor, and brake pedal sensor), By component (ECU-Electronic Control Unit, ECM-Engine Control Module, actuator, feedback motor, parking pawl, ETCM-Electronic Throttle Control Module, and ETCU, Electronic Transmission Control Unit), By on-highway vehicle type (passenger car, light commercial vehicle, bus, and truck), By off-highway vehicle type (construction & mining equipment, agriculture tractors, and forklift), By electric vehicle type (BEV, HEV/PHEV, and FCEV), Autonomous vehicles by application (throttle-by-wire, steer-by-wire, shift-by-wire, brake-bywire, and park-by-wire), Electric vehicle drive-by-wire market by sensor type (throttle pedal, sensor, throttle position sensor, pinion angle sensor, hand wheel angle sensor, gear position sensor, park sensor, and brake pedal sensor) , By region (Asia Pacific, Europe, North America and RoW.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall automotive glass market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 MARKET DEFINITIONS

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 DRIVE BY WIRE MARKET SEGMENTATION

- FIGURE 2 DRIVE BY WIRE MARKET: BY REGION

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 RESEARCH METHODOLOGY MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources for building base numbers

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.1 List of primary participants

- 2.2 MARKET ESTIMATION METHODOLOGY

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 SAMPLING TECHNIQUES AND DATA COLLECTION METHODS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 7 DRIVE BY WIRE MARKET SIZE: BOTTOM-UP APPROACH (ICE VEHICLE, APPLICATION, AND REGION)

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 8 DRIVE BY WIRE MARKET SIZE: TOP-DOWN APPROACH (ELECTRIC VEHICLE, AUTONOMOUS VEHICLE, AND OFF-HIGHWAY VEHICLE)

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- FIGURE 10 DRIVE BY WIRE MARKET: FACTORS IMPACTING MARKET

- 2.6 ASSUMPTIONS

- 2.6.1 ASSUMPTIONS

- 2.6.2 MARKET ASSUMPTIONS

- 2.7 LIMITATIONS/RISK FACTORS

3 EXECUTIVE SUMMARY

- FIGURE 11 DRIVE BY WIRE MARKET OUTLOOK

- FIGURE 12 DRIVE BY WIRE MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN DRIVE BY WIRE MARKET

- FIGURE 13 INCREASING FOCUS ON ELECTRIFICATION AND AUTONOMOUS DRIVING TO BOOST MARKET

- 4.2 DRIVE BY WIRE MARKET, BY REGION

- FIGURE 14 ASIA PACIFIC TO GROW AT FASTEST RATE DURING FORECAST PERIOD

- 4.3 DRIVE BY WIRE MARKET, BY APPLICATION

- FIGURE 15 STEER-BY-WIRE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.4 DRIVE BY WIRE MARKET, BY SENSOR TYPE

- FIGURE 16 GEAR SHIFT POSITION SENSORS SEGMENT TO LEAD DRIVE BY WIRE MARKET

- 4.5 PASSENGER CAR DRIVE BY WIRE MARKET, BY COMPONENT

- FIGURE 17 ACTUATORS TO LEAD COMPONENT-WISE DRIVE BY WIRE MARKET

- 4.6 ON-HIGHWAY VEHICLES DRIVE BY WIRE MARKET

- FIGURE 18 PASSENGER VEHICLES TO LEAD DRIVE BY WIRE MARKET FOR ON-HIGHWAY VEHICLES

- 4.7 OFF-HIGHWAY VEHICLES DRIVE BY WIRE MARKET

- FIGURE 19 TRACTORS TO DOMINATE OFF-HIGHWAY DRIVE BY WIRE MARKET

- 4.8 ELECTRIC VEHICLE DRIVE BY WIRE MARKET, BY VEHICLE TYPE

- FIGURE 20 BEV TO BE LARGEST SEGMENT OF DRIVE BY WIRE MARKET FOR EVS

- 4.9 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION

- FIGURE 21 STEER-BY-WIRE TO BE FASTEST-GROWING MARKET FOR AUTONOMOUS VEHICLE DRIVE BY WIRE APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 DRIVE BY WIRE MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Higher investments and adoption of systems

- TABLE 2 FOLLOWING POPULAR VEHICLE MODELS USE BRAKE-BY-WIRE TECHNOLOGY

- 5.2.1.2 Decreased tail-pipe emissions

- 5.2.1.2.1 On-road vehicles

- 5.2.1.2 Decreased tail-pipe emissions

- TABLE 3 EURO 5 VS. EURO 6 VEHICLE EMISSION STANDARDS ON NEW EUROPEAN DRIVING CYCLE

- TABLE 4 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR PASSENGER CARS, 2016-2021

- FIGURE 23 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR HEAVY-DUTY VEHICLES, 2014-2025

- 5.2.1.2.2 Off-road vehicles

- FIGURE 24 OFF-ROAD VEHICLE EMISSION REGULATION OUTLOOK, 2019-2025

- 5.2.1.3 Easy integration and independence of design

- FIGURE 25 NISSAN MURANO CONCEPT CAR: DRIVE BY WIRE

- 5.2.1.4 High operational accuracy and reduced mechanical loss

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and limited public acceptance

- 5.2.2.2 Threat of cyberattacks

- FIGURE 26 TOP SMART MOBILITY ATTACK VENDORS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in autonomous vehicles

- FIGURE 27 AUTONOMOUS VEHICLE MARKET, BY PRODUCTION, 2019-2030 (MILLION UNITS)

- 5.2.3.2 Developments in autonomous off-highway equipment

- FIGURE 28 AUTONOMOUS TRACTOR MARKET, 2019-2025 (THOUSAND UNITS)

- 5.2.3.3 Increased demand for autonomous vehicles

- 5.2.3.4 Latent demand for semi-autonomous and autonomous trucks

- 5.2.4 CHALLENGES

- 5.2.4.1 Electronic failures

- 5.2.4.2 Rapid developments in automotive electronics

- 5.3 DRIVE BY WIRE MARKET, SCENARIOS (2018-2027)

- FIGURE 29 DRIVE BY WIRE MARKET SCENARIOS, 2018-2027 (USD MILLION)

- 5.3.1 MOST LIKELY SCENARIO

- TABLE 5 DRIVE BY WIRE MARKET (REALISTIC SCENARIO), BY REGION, 2021-2027 (USD MILLION)

- 5.3.2 LOW IMPACT SCENARIO

- TABLE 6 DRIVE BY WIRE MARKET (LOW IMPACT SCENARIO), BY REGION, 2021-2027 (USD MILLION)

- 5.3.3 HIGH IMPACT SCENARIO

- TABLE 7 DRIVE BY WIRE MARKET (HIGH IMPACT SCENARIO), BY REGION, 2021-2027 (USD MILLION)

- 5.4 MARKET ECOSYSTEM

- FIGURE 30 MARKET ECOSYSTEM: DRIVE BY WIRE MARKET

- TABLE 8 DRIVE BY WIRE MARKET: ECOSYSTEM

- 5.5 TECHNOLOGY ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.7 PATENT ANALYSIS

- 5.8 PRICING ANALYSIS

- 5.8.1 BY APPLICATION AND REGION

- TABLE 9 DRIVE BY WIRE-AVERAGE SELLING PRICE, BY APPLICATION, 2022 (USD)

- 5.9 SUPPLY CHAIN ANALYSIS

- FIGURE 31 SUPPLY CHAIN ANALYSIS: DRIVE BY WIRE MARKET

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS: DRIVE BY WIRE MARKET

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 DRIVE BY WIRE STANDARDS, BY COUNTRY

- TABLE 10 DRIVE BY WIRE STANDARDS, MAJOR COUNTRIES, AND REGIONS

- 5.12 KEY STAKEHOLDERS IN BUYING PROCESS AND BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA FOR VEHICLES WITH DRIVE BY WIRE SYSTEMS

- TABLE 11 KEY BUYING CRITERIA, BY PROPULSION TYPE

- 5.13 KEY CONFERENCES

- 5.13.1 DRIVE BY WIRE MARKET: UPCOMING CONFERENCES AND EVENTS, 2022-2023

6 DRIVE BY WIRE MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.1.1 RESEARCH METHODOLOGY

- 6.1.2 ASSUMPTIONS

- 6.1.3 INDUSTRY INSIGHTS

- FIGURE 34 DRIVE BY WIRE MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 12 DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 13 DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 14 DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 15 DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 6.2 BRAKE-BY-WIRE

- 6.2.1 CONTINUOUS DEVELOPMENTS AND BETTER OPERATIONAL ACCURACY

- TABLE 16 BRAKE-BY-WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 17 BRAKE-BY-WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 18 BRAKE-BY-WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 19 BRAKE-BY-WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 PARK-BY-WIRE

- 6.3.1 REDUCES WEAR AND TEAR OF VEHICLES

- TABLE 20 PARK-BY-WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 21 PARK-BY-WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 22 PARK-BY-WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 23 PARK-BY-WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 SHIFT-BY-WIRE

- 6.4.1 SMOOTH GEAR SHIFTING AND REDUCED VEHICLE WEIGHT

- TABLE 24 SHIFT-BY-WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 25 SHIFT-BY-WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 26 SHIFT-BY-WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 27 SHIFT-BY-WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 STEER-BY-WIRE

- 6.5.1 INCREASING R&D BY AUTOMAKERS AND BETTER VEHICLE HANDLING TO BOOST DEMAND

- TABLE 28 STEER-BY-WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 29 STEER-BY-WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 30 STEER-BY-WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 STEER-BY-WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.6 THROTTLE-BY-WIRE

- 6.6.1 STRENGTHENING OF EMISSION NORMS TO DRIVE MARKET GROWTH

- TABLE 32 THROTTLE-BY-WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 33 THROTTLE-BY-WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 34 THROTTLE-BY-WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 THROTTLE-BY-WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

7 DRIVE BY WIRE MARKET, BY SENSOR TYPE

- 7.1 INTRODUCTION

- 7.1.1 RESEARCH METHODOLOGY

- 7.1.2 ASSUMPTIONS

- 7.1.3 INDUSTRY INSIGHTS

- TABLE 36 NUMBER OF SENSORS USED PER DRIVE BY WIRE APPLICATION

- FIGURE 35 DRIVE BY WIRE MARKET, BY SENSOR TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 37 DRIVE BY WIRE MARKET, BY SENSOR TYPE, 2018-2021 ('000 UNITS)

- TABLE 38 DRIVE BY WIRE MARKET, BY SENSOR TYPE, 2022-2027 ('000 UNITS)

- TABLE 39 DRIVE BY WIRE MARKET, BY SENSOR TYPE, 2018-2021 (USD MILLION)

- TABLE 40 DRIVE BY WIRE MARKET, BY SENSOR TYPE, 2022-2027 (USD MILLION)

- 7.2 BRAKE PEDAL SENSORS

- 7.2.1 INCREASED DEMAND FOR SAFETY TO DRIVE SEGMENT

- TABLE 41 BRAKE PEDAL SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 42 BRAKE PEDAL SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 43 BRAKE PEDAL SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 BRAKE PEDAL SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 HANDWHEEL ANGLE SENSORS

- 7.3.1 ENHANCED SAFETY AND OPERATIONAL ACCURACY

- TABLE 45 HANDWHEEL ANGLE SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 46 HANDWHEEL ANGLE SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 47 HANDWHEEL ANGLE SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 48 HANDWHEEL ANGLE SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 GEAR SHIFT POSITION SENSORS

- 7.4.1 REDUCES WEAR AND TEAR AND INCREASES VEHICLE LIFESPAN

- TABLE 49 GEAR SHIFT POSITION SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 50 GEAR SHIFT POSITION SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 51 GEAR SHIFT POSITION SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 52 GEAR SHIFT POSITION SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

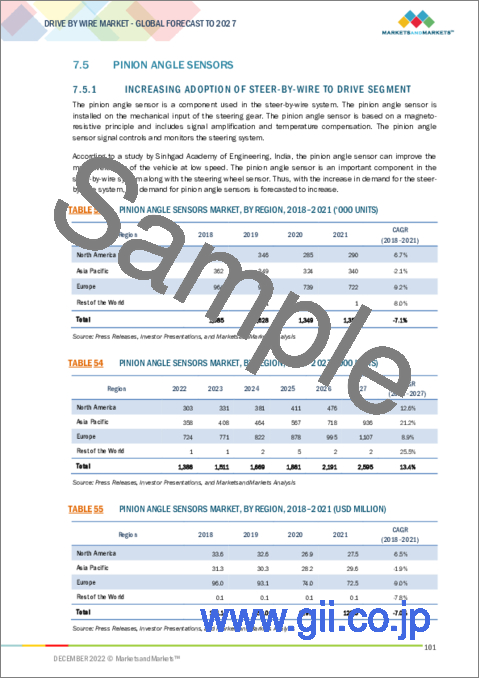

- 7.5 PINION ANGLE SENSORS

- 7.5.1 INCREASING ADOPTION OF STEER-BY-WIRE TO DRIVE SEGMENT

- TABLE 53 PINION ANGLE SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 54 PINION ANGLE SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 55 PINION ANGLE SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 56 PINION ANGLE SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.6 PARK SENSORS

- 7.6.1 EASY AND EFFORTLESS PARKING BENEFIT

- TABLE 57 PARK SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 58 PARK SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 59 PARK SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 60 PARK SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.7 THROTTLE PEDAL SENSORS

- 7.7.1 PROVIDES OPERATIONAL ACCURACY

- TABLE 61 THROTTLE PEDAL SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 62 THROTTLE PEDAL SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 63 THROTTLE PEDAL SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 64 THROTTLE PEDAL SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.8 THROTTLE POSITION SENSORS

- 7.8.1 INCREASING POPULARITY TO BOOST ADOPTION

- TABLE 65 THROTTLE POSITION SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 66 THROTTLE POSITION SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 67 THROTTLE POSITION SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 68 THROTTLE POSITION SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

8 DRIVE BY WIRE MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.1.1 RESEARCH METHODOLOGY

- 8.1.2 ASSUMPTIONS

- 8.1.3 INDUSTRY INSIGHTS

- TABLE 69 DRIVE BY WIRE APPLICATION VS. AVERAGE NUMBER OF COMPONENTS USED PER APPLICATION

- FIGURE 36 DRIVE BY WIRE MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

- TABLE 70 DRIVE BY WIRE MARKET, BY COMPONENT, 2018-2021 ('000 UNITS)

- TABLE 71 DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 ('000 UNITS)

- TABLE 72 DRIVE BY WIRE MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 73 DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 8.2 ACTUATORS

- 8.2.1 INCREASING POPULARITY OF PREMIUM VEHICLES TO DRIVE SEGMENT

- TABLE 74 ACTUATORS: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 75 ACTUATORS: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 ('000 UNITS)

- TABLE 76 ACTUATORS: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 77 ACTUATORS: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 8.3 ELECTRONIC CONTROL UNITS (ECU)

- 8.3.1 IMPROVED FUEL ECONOMY AND ACCURACY

- TABLE 78 ECU: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 79 ECU: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 ('000 UNITS)

- TABLE 80 ECU: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 81 ECU: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 8.4 ENGINE CONTROL MODULES (ECM)

- 8.4.1 OFFERS BETTER VALVE CONTROL

- TABLE 82 ECM: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 83 ECM: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 ('000 UNITS)

- TABLE 84 ECM: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 85 ECM: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 (USD MILLION )

- 8.5 ELECTRONIC THROTTLE CONTROL MODULES (ETCM)

- 8.5.1 HIGHER ACCURACY AND PRECISION

- TABLE 86 ETCM: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 87 ETCM: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 ('000 UNITS)

- TABLE 88 ETCM: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION )

- TABLE 89 ETCM: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 8.6 ELECTRONIC TRANSMISSION CONTROL UNITS (ETCU)

- 8.6.1 GROWING ADOPTION OF AUTOMATIC TRANSMISSION TO BOOST SEGMENT

- TABLE 90 ETCU: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 91 ETCU: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 ('000 UNITS)

- TABLE 92 ETCU: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 93 ETCU: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 8.7 FEEDBACK MOTORS

- 8.7.1 LOW MAINTENANCE AND HIGH EFFICIENCY

- TABLE 94 FEEDBACK MOTORS: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 95 FEEDBACK MOTORS: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 ('000 UNITS)

- TABLE 96 FEEDBACK MOTORS: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 97 FEEDBACK MOTORS: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 8.8 PARKING PAWL

- 8.8.1 BETTER TRACTION CONTROL

- TABLE 98 PARKING PAWL: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 99 PARKING PAWL: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 ('000 UNITS)

- TABLE 100 PARKING PAWL: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 101 PARKING PAWL: DRIVE BY WIRE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

9 DRIVE BY WIRE MARKET, BY ON-HIGHWAY VEHICLE

- 9.1 INTRODUCTION

- 9.1.1 RESEARCH METHODOLOGY

- 9.1.2 ASSUMPTIONS

- 9.1.3 INDUSTRY INSIGHTS

- FIGURE 37 DRIVE BY WIRE MARKET, BY ON-HIGHWAY VEHICLE, 2022 VS. 2027 (USD MILLION)

- TABLE 102 DRIVE BY WIRE MARKET, BY ON-HIGHWAY VEHICLE, 2018-2021 ('000 UNITS)

- TABLE 103 DRIVE BY WIRE MARKET, BY ON-HIGHWAY VEHICLE, 2022-2027 ('000 UNITS)

- TABLE 104 DRIVE BY WIRE MARKET, BY ON-HIGHWAY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 105 DRIVE BY WIRE MARKET, BY ON-HIGHWAY VEHICLE, 2022-2027 (USD MILLION)

- 9.2 PASSENGER CARS

- 9.2.1 GROWING DEMAND AND SALES OF PREMIUM CARS TO DRIVE MARKET

- TABLE 106 PASSENGER CARS: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 107 PASSENGER CARS: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 108 PASSENGER CARS: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 109 PASSENGER CARS: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 LIGHT COMMERCIAL VEHICLES (LCV)

- 9.3.1 PROVIDES AUTOMATIC TRANSMISSION

- TABLE 110 LIGHT COMMERCIAL VEHICLES: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 111 LIGHT COMMERCIAL VEHICLES: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 112 LIGHT COMMERCIAL VEHICLES: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 113 LIGHT COMMERCIAL VEHICLES: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 TRUCKS

- 9.4.1 BETTER MANEUVERABILITY AND REDUCED EMISSIONS

- TABLE 114 TRUCKS: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 115 TRUCKS: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 116 TRUCKS: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 117 TRUCKS: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 BUSES

- 9.5.1 INCREASED ADOPTION OF SHIFT-BY-WIRE EXPECTED TO DRIVE MARKET

- TABLE 118 BUSES: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 119 BUSES: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 120 BUSES: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 121 BUSES: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

10 DRIVE BY WIRE MARKET, BY ELECTRIC VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.1.1 RESEARCH METHODOLOGY

- 10.1.2 ASSUMPTIONS

- 10.1.3 INDUSTRY INSIGHTS

- FIGURE 38 DRIVE BY WIRE MARKET, BY ELECTRIC VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 122 ELECTRIC VEHICLE DRIVE BY WIRE MARKET, BY TYPE, 2018-2021 ('000 UNITS)

- TABLE 123 ELECTRIC VEHICLE TYPE DRIVE BY WIRE MARKET, BY TYPE, 2022-2027 ('000 UNITS)

- TABLE 124 ELECTRIC VEHICLE TYPE DRIVE BY WIRE MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 125 ELECTRIC VEHICLE TYPE DRIVE BY WIRE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.2 BATTERY ELECTRIC VEHICLES (BEV)

- 10.2.1 INCREASED INVESTMENTS BY AUTOMAKERS TO ELECTRIFY PRODUCTS TO DRIVE MARKET

- TABLE 126 BEV: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 127 BEV: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 128 BEV: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 129 BEV: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEV)

- 10.3.1 BENEFITS LIKE VEHICLE WEIGHT REDUCTION

- TABLE 130 PHEV: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 131 PHEV: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 132 PHEV: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 133 PHEV: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 FUEL CELL ELECTRIC VEHICLES (FCEV)

- 10.4.1 DEVELOPMENTS IN FCEV DRIVE BY WIRE COMPONENTS

- TABLE 134 FCEV: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 135 FCEV: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 136 FCEV: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 137 FCEV: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

11 EV DRIVE BY WIRE MARKET, BY SENSOR TYPE

- 11.1 INTRODUCTION

- 11.1.1 RESEARCH METHODOLOGY

- 11.1.2 ASSUMPTIONS

- 11.1.3 INDUSTRY INSIGHTS

- TABLE 138 NUMBER OF SENSORS USED PER EV DRIVE BY WIRE APPLICATION

- FIGURE 39 EV DRIVE BY WIRE MARKET, BY SENSOR TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 139 EV DRIVE BY WIRE MARKET, BY SENSOR TYPE, 2018-2021 ('000 UNITS)

- TABLE 140 EV DRIVE BY WIRE MARKET, BY SENSOR TYPE, 2022-2027 ('000 UNITS)

- TABLE 141 EV DRIVE BY WIRE MARKET, BY SENSOR TYPE, 2018-2021 (USD MILLION)

- TABLE 142 EV DRIVE BY WIRE MARKET, BY SENSOR TYPE, 2022-2027 (USD MILLION)

- 11.2 BRAKE PEDAL SENSORS

- 11.2.1 OPTIMIZATION OF REGENERATIVE BRAKING MECHANISM TO DRIVE MARKET

- TABLE 143 EV BRAKE PEDAL SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 144 EV BRAKE PEDAL SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 145 EV BRAKE PEDAL SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 146 EV BRAKE PEDAL SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3 HANDWHEEL ANGLE SENSORS

- 11.3.1 MANDATE FOR ELECTRONIC STABILITY CONTROL TO INCREASE DEMAND

- TABLE 147 EV HANDWHEEL ANGLE SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 148 EV HANDWHEEL ANGLE SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 149 EV HANDWHEEL ANGLE SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 150 EV HANDWHEEL ANGLE SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4 GEAR SHIFT POSITION SENSORS

- 11.4.1 EASY INTEGRATION WITH ICE AND EV VEHICLES

- TABLE 151 EV GEAR SHIFT POSITION SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 152 EV GEAR SHIFT POSITION SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 153 EV GEAR SHIFT POSITION SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 154 EV GEAR SHIFT POSITION SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.5 PINION ANGLE SENSORS

- 11.5.1 INCREASING ADOPTION OF STEER-BY-WIRE TO BOOST SEGMENT

- TABLE 155 EV PINION ANGLE SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 156 EV PINION ANGLE SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 157 EV PINION ANGLE SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 158 EV PINION ANGLE SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.6 PARK SENSORS

- 11.6.1 ADVANCED DRIVING FEATURES

- TABLE 159 EV PARK SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 160 EV PARK SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 161 EV PARK SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 162 EV PARK SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.7 THROTTLE PEDAL SENSORS

- 11.7.1 ENHANCED DRIVING COMFORT AND INCREASED BATTERY EFFICIENCY

- TABLE 163 EV THROTTLE PEDAL SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 164 EV THROTTLE PEDAL SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 165 EV THROTTLE PEDAL SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 166 EV THROTTLE PEDAL SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.8 THROTTLE POSITION SENSORS

- 11.8.1 DECREASING POPULARITY OF PHEV TO REDUCE MARKET SHARE

- TABLE 167 EV THROTTLE POSITION SENSORS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 168 EV THROTTLE POSITION SENSORS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 169 EV THROTTLE POSITION SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 170 EV THROTTLE POSITION SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

12 DRIVE BY WIRE MARKET, BY OFF-HIGHWAY VEHICLE

- 12.1 INTRODUCTION

- 12.1.1 RESEARCH METHODOLOGY

- 12.1.2 ASSUMPTIONS

- 12.1.3 INDUSTRY INSIGHTS

- FIGURE 40 OFF-HIGHWAY VEHICLE DRIVE BY WIRE MARKET, 2022 VS. 2027 (USD MILLION)

- TABLE 171 OFF-HIGHWAY VEHICLE DRIVE BY WIRE MARKET, BY VEHICLE TYPE, 2018-2021 ('000 UNITS)

- TABLE 172 OFF-HIGHWAY VEHICLE DRIVE BY WIRE MARKET, BY VEHICLE TYPE, 2022-2027 ('000 UNITS)

- TABLE 173 OFF-HIGHWAY VEHICLE DRIVE BY WIRE MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 174 OFF-HIGHWAY VEHICLE DRIVE BY WIRE MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 12.2 AGRICULTURE TRACTORS

- 12.2.1 DEVELOPMENT OF INTELLIGENT TECHNOLOGIES EXPECTED TO DRIVE SEGMENT

- TABLE 175 AGRICULTURE TRACTORS: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 176 AGRICULTURE TRACTORS: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 177 AGRICULTURE TRACTORS: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 178 AGRICULTURE TRACTORS: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.3 CONSTRUCTION AND MINING EQUIPMENT

- 12.3.1 INCREASED FUEL ECONOMY OF AUTONOMOUS EQUIPMENT EXPECTED TO DRIVE DEMAND

- TABLE 179 CONSTRUCTION AND MINING EQUIPMENT: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 180 CONSTRUCTION AND MINING EQUIPMENT: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 181 CONSTRUCTION AND MINING EQUIPMENT: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 182 CONSTRUCTION AND MINING EQUIPMENT: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.4 FORKLIFTS

- 12.4.1 INCREASING INDUSTRIAL OPERATIONS AND GROWTH OF E-COMMERCE TO DRIVE MARKET

- TABLE 183 FORKLIFTS: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 184 FORKLIFTS: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 185 FORKLIFTS: DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 186 FORKLIFTS: DRIVE BY WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

13 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- 13.1.1 RESEARCH METHODOLOGY

- 13.1.2 ASSUMPTIONS

- 13.1.3 INDUSTRY INSIGHTS

- FIGURE 41 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY REGION, 2025 VS. 2030 (USD MILLION)

- TABLE 187 AUTONOMOUS VEHICLE: DRIVE BY WIRE MARKET, BY REGION, 2025-2030 ('000 UNITS)

- TABLE 188 AUTONOMOUS VEHICLE: DRIVE BY WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 189 AUTONOMOUS VEHICLE: DRIVE BY WIRE MARKET, BY APPLICATION, 2025-2030 ('000 UNITS)

- TABLE 190 AUTONOMOUS VEHICLE: DRIVE BY WIRE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- 13.2 BRAKE-BY-WIRE

- TABLE 191 AUTONOMOUS VEHICLE: BRAKE-BY-WIRE MARKET, BY REGION, 2025-2030 ('000 UNITS)

- TABLE 192 AUTONOMOUS VEHICLE: BRAKE-BY-WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- 13.3 PARK-BY-WIRE

- TABLE 193 AUTONOMOUS VEHICLE: PARK-BY-WIRE MARKET, BY REGION, 2025-2030 ('000 UNITS)

- TABLE 194 AUTONOMOUS VEHICLE: PARK-BY-WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- 13.4 SHIFT-BY-WIRE

- TABLE 195 AUTONOMOUS VEHICLE: SHIFT-BY-WIRE MARKET, BY REGION, 2025-2030 ('000 UNITS)

- TABLE 196 AUTONOMOUS VEHICLE: SHIFT-BY-WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- 13.5 STEER-BY-WIRE

- TABLE 197 AUTONOMOUS VEHICLE: STEER-BY-WIRE MARKET, BY REGION, 2025-2030 ('000 UNITS)

- TABLE 198 AUTONOMOUS VEHICLE: STEE-BY-WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- 13.6 THROTTLE-BY-WIRE

- TABLE 199 AUTONOMOUS VEHICLE: THROTTLE-BY-WIRE MARKET, BY REGION, 2025-2030 ('000 UNITS)

- TABLE 200 AUTONOMOUS VEHICLE: THROTTLE-BY-WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

14 DRIVE BY WIRE MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.1.1 RESEARCH METHODOLOGY

- 14.1.2 ASSUMPTIONS

- 14.1.3 INDUSTRY INSIGHTS

- FIGURE 42 DRIVE BY WIRE MARKET, BY REGION, 2022 VS. 2030 (USD MILLION)

- TABLE 201 DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 202 DRIVE BY WIRE MARKET, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 203 DRIVE BY WIRE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 204 DRIVE BY WIRE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.2 ASIA PACIFIC

- FIGURE 43 ASIA PACIFIC: DRIVE BY WIRE MARKET SNAPSHOT

- TABLE 205 ASIA PACIFIC: DRIVE BY WIRE MARKET, BY COUNTRY, 2018-2021 (MILLION UNITS)

- TABLE 206 ASIA PACIFIC: DRIVE BY WIRE MARKET, BY COUNTRY, 2022-2027 (MILLION UNITS)

- TABLE 207 ASIA PACIFIC: DRIVE BY WIRE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 208 ASIA PACIFIC: AUTOMOTIVE DRIVE BY WIRE MARKET, BY COUNTRY, 2022-2027 (MILLION UNITS)

- 14.2.1 CHINA

- 14.2.1.1 Increasing popularity of premium vehicles

- TABLE 209 CHINA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 210 CHINA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 211 CHINA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 212 CHINA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.2.2 INDIA

- 14.2.2.1 Increasing popularity of automatic transmissions

- TABLE 213 INDIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 214 INDIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 215 INDIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 216 INDIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.2.3 JAPAN

- 14.2.3.1 Developments by domestic manufacturers

- TABLE 217 JAPAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 218 JAPAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 219 JAPAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 220 JAPAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Adoption of advanced technologies

- TABLE 221 SOUTH KOREA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 222 SOUTH KOREA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 223 SOUTH KOREA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 224 SOUTH KOREA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.2.5 THAILAND

- 14.2.5.1 Increased vehicle production and launch of new vehicle models

- TABLE 225 THAILAND: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 226 THAILAND: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 227 THAILAND: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 228 THAILAND: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.2.6 REST OF ASIA PACIFIC

- 14.2.6.1 Rising production of passenger cars

- TABLE 229 REST OF ASIA PACIFIC: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 230 REST OF ASIA PACIFIC: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 231 REST OF ASIA PACIFIC: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 232 REST OF ASIA PACIFIC: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.3 EUROPE

- FIGURE 44 EUROPE: DRIVE BY WIRE MARKET, BY COUNTRY, 2020 VS. 2025 (USD MILLION)

- TABLE 233 EUROPE: DRIVE BY WIRE MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 234 EUROPE: DRIVE BY WIRE MARKET, BY COUNTRY, 2022-2027 ('000 UNITS)

- TABLE 235 EUROPE: DRIVE BY WIRE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 236 EUROPE: DRIVE BY WIRE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 14.3.1 GERMANY

- 14.3.1.1 Increased demand for premium vehicles

- TABLE 237 GERMANY: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 238 GERMANY: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 239 GERMANY: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 240 GERMANY: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.3.2 FRANCE

- 14.3.2.1 Shift-by-wire to be fastest market due to popularity of automatic transmission

- TABLE 241 FRANCE: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 242 FRANCE: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 243 FRANCE: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 244 FRANCE: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.3.3 RUSSIA

- 14.3.3.1 Growth of premium vehicle sales

- TABLE 245 RUSSIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 246 RUSSIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 247 RUSSIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 248 RUSSIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.3.4 SPAIN

- 14.3.4.1 Popularity of luxury brands

- TABLE 249 SPAIN: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 250 SPAIN: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 251 SPAIN: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 252 SPAIN: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.3.5 UK

- 14.3.5.1 Developments in steer-by-wire and brake-by-wire

- TABLE 253 UK: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 254 UK: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 255 UK: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 256 UK: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.3.6 TURKEY

- 14.3.6.1 Growing presence of foreign luxury automakers

- TABLE 257 TURKEY: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 258 TURKEY: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 259 TURKEY: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 260 TURKEY: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.3.7 ITALY

- 14.3.7.1 Growing penetration of drive by wire in passenger cars

- TABLE 261 ITALY: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 262 ITALY: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 263 ITALY: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 264 ITALY: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.3.8 REST OF EUROPE

- 14.3.8.1 Throttle-by-wire to be largest market due to stringent emission norms

- TABLE 265 REST OF EUROPE: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 266 REST OF EUROPE: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 267 REST OF EUROPE: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 268 REST OF EUROPE: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.4 NORTH AMERICA

- FIGURE 45 NORTH AMERICA: DRIVE BY WIRE MARKET SNAPSHOT

- TABLE 269 NORTH AMERICA: DRIVE BY WIRE MARKET, BY COUNTRY, 2018-2021 (MILLION UNITS)

- TABLE 270 NORTH AMERICA: DRIVE BY WIRE MARKET, BY COUNTRY, 2022-2027 (MILLION UNITS)

- TABLE 271 NORTH AMERICA: DRIVE BY WIRE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 272 NORTH AMERICA: DRIVE BY WIRE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 14.4.1 CANADA

- 14.4.1.1 Demand for premium and advanced vehicles

- TABLE 273 CANADA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 274 CANADA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 275 CANADA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 276 CANADA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.4.2 MEXICO

- 14.4.2.1 Trade agreements with US

- TABLE 277 MEXICO: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 278 MEXICO: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 279 MEXICO: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 280 MEXICO: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.4.3 US

- 14.4.3.1 Increased number of supply contracts between manufacturers and automotive OEMs

- TABLE 281 US: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 282 US: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 283 US: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 284 US: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.5 REST OF THE WORLD (ROW)

- FIGURE 46 REST OF THE WORLD: DRIVE BY WIRE MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

- TABLE 285 REST OF THE WORLD: DRIVE BY WIRE MARKET, BY COUNTRY, 2018-2021 (MILLION UNITS)

- TABLE 286 REST OF THE WORLD: DRIVE BY WIRE MARKET, BY COUNTRY, 2022-2027 (MILLION UNITS)

- TABLE 287 REST OF THE WORLD: DRIVE BY WIRE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 288 REST OF THE WORLD: DRIVE BY WIRE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 14.5.1 BRAZIL

- 14.5.1.1 Trade agreements with key countries

- TABLE 289 BRAZIL: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 290 BRAZIL: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 291 BRAZIL: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 292 BRAZIL: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.5.2 IRAN

- 14.5.2.1 Cost-sensitive nature leads to sluggish market growth

- TABLE 293 IRAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 294 IRAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 295 IRAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 296 IRAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.5.3 ARGENTINA

- 14.5.3.1 Reduced import duties

- TABLE 297 ARGENTINA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 298 ARGENTINA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 299 ARGENTINA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 300 ARGENTINA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.5.4 SOUTH AFRICA

- 14.5.4.1 Launch of premium vehicle models

- TABLE 301 SOUTH AFRICA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 302 SOUTH AFRICA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 303 SOUTH AFRICA: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 304 SOUTH AFRICA: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.5.5 OTHERS

- 14.5.5.1 Domestic initiatives to fuel market

- TABLE 305 OTHERS: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 ('000 UNITS)

- TABLE 306 OTHERS: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 ('000 UNITS)

- TABLE 307 OTHERS: DRIVE BY WIRE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 308 OTHERS: DRIVE BY WIRE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 309 COMPANIES ADOPTED PRODUCT DEVELOPMENT AS KEY GROWTH STRATEGY, 2019-2021

- 15.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019-2021

- FIGURE 47 REVENUE ANALYSIS OF TOP 5 PLAYERS IN DRIVE BY WIRE MARKET

- 15.4 MARKET SHARE ANALYSIS

- TABLE 310 MARKET STRUCTURE, 2021

- FIGURE 48 MARKET SHARE ANALYSIS, 2021

- 15.5 COMPETITIVE LEADERSHIP MAPPING

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- FIGURE 49 COMPETITIVE LEADERSHIP MAPPING: DRIVE BY WIRE MANUFACTURERS

- TABLE 311 DRIVE BY WIRE MARKET: COMPANY FOOTPRINT

- TABLE 312 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 313 COMPANY REGION FOOTPRINT (19 COMPANIES)

- 15.6 COMPETITIVE SCENARIO

- 15.7 NEW PRODUCT DEVELOPMENTS

- TABLE 314 NEW PRODUCT DEVELOPMENTS, 2019-2022

- 15.8 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

- TABLE 315 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES, 2019-2022

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 16.1.1 ROBERT BOSCH GMBH

- TABLE 316 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

- FIGURE 50 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- TABLE 317 ROBERT BOSCH GMBH: DEALS

- 16.1.2 CONTINENTAL AG

- TABLE 318 CONTINENTAL AG: BUSINESS OVERVIEW

- FIGURE 51 CONTINENTAL AG: COMPANY SNAPSHOT

- TABLE 319 CONTINENTAL AG: PRODUCT DEVELOPMENTS

- TABLE 320 CONTINENTAL AG: DEALS

- 16.1.3 ZF FRIEDRICHSHAFEN AG

- TABLE 321 ZF FRIEDRICHSHAFEN AG: BUSINESS OVERVIEW

- FIGURE 52 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

- TABLE 322 ZF FRIEDRICHSHAFEN AG: PRODUCT LAUNCHES

- TABLE 323 ZF FRIEDRICHSHAFEN AG: DEALS

- 16.1.4 INFINEON TECHNOLOGIES AG

- TABLE 324 INFINEON TECHNOLOGIES AG: BUSINESS OVERVIEW

- FIGURE 53 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- TABLE 325 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- 16.1.5 NEXTEER AUTOMOTIVE

- TABLE 326 NEXTEER AUTOMOTIVE: BUSINESS OVERVIEW

- FIGURE 54 NEXTEER AUTOMOTIVE: COMPANY SNAPSHOT

- TABLE 327 NEXTEER AUTOMOTIVE: PRODUCT LAUNCHES

- TABLE 328 NEXTEER AUTOMOTIVE: DEALS

- 16.1.6 CTS CORPORATION

- TABLE 329 CTS CORPORATION: BUSINESS OVERVIEW

- FIGURE 55 CTS CORPORATION: COMPANY SNAPSHOT

- 16.1.7 FICOSA INTERNACIONAL SA

- TABLE 330 FICOSA INTERNACIONAL SA: BUSINESS OVERVIEW

- 16.1.8 KONGSBERG AUTOMOTIVE

- TABLE 331 KONGSBERG AUTOMOTIVE: BUSINESS OVERVIEW

- FIGURE 56 KONGSBERG AUTOMOTIVE: COMPANY SNAPSHOT

- TABLE 332 KONGSBERG AUTOMOTIVE: DEALS

- 16.1.9 HITACHI, LTD.

- TABLE 333 HITACHI, LTD.: BUSINESS OVERVIEW

- FIGURE 57 HITACHI, LTD.: COMPANY SNAPSHOT

- TABLE 334 HITACHI, LTD.: PRODUCT LAUNCHES

- TABLE 335 HITACHI, LTD.: DEALS

- 16.1.10 CURTISS-WRIGHT CORPORATION

- TABLE 336 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

- FIGURE 58 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 16.2 OTHER KEY PLAYERS

- 16.2.1 ASIA PACIFIC

- 16.2.1.1 Denso Corporation

- TABLE 337 DENSO CORPORATION: BUSINESS OVERVIEW

- 16.2.1.2 Nissan Corporation

- TABLE 338 NISSAN CORPORATION: BUSINESS OVERVIEW

- 16.2.1.3 JTEKT Corporation

- TABLE 339 JTEKT CORPORATION: BUSINESS OVERVIEW

- 16.2.2 EUROPE

- 16.2.2.1 AB SKF

- TABLE 340 AB SKF: BUSINESS OVERVIEW

- 16.2.2.2 Aptiv plc

- TABLE 341 APTIV PLC: BUSINESS OVERVIEW

- 16.2.2.3 ThyssenKrupp AG

- TABLE 342 THYSSENKRUPP AG

- 16.2.3 NORTH AMERICA

- 16.2.3.1 Orscheln Group

- TABLE 343 ORSCHELN GROUP: BUSINESS OVERVIEW

- 16.2.3.2 KSR International Inc.

- TABLE 344 KSR INTERNATIONAL INC.: BUSINESS OVERVIEW

- 16.2.3.3 LORD Corporation

- TABLE 345 LORD CORPORATION: BUSINESS OVERVIEW

- 16.2.3.4 Dura Automotive Systems

- TABLE 346 DURA AUTOMOTIVE SYSTEMS: BUSINESS OVERVIEW

- 16.2.1 ASIA PACIFIC

- 16.3 DRIVE BY WIRE COMPONENT SUPPLIERS

- 16.3.1 REE AUTOMOTIVE

- TABLE 347 REE AUTOMOTIVE: BUSINESS OVERVIEW

- 16.3.2 NXP SEMICONDUCTORS NV

- TABLE 348 NXP SEMICONDUCTORS NV: BUSINESS OVERVIEW

- 16.3.3 HELLA GMBH & CO. KGAA

- TABLE 349 HELLA GMBH & CO. KGAA: BUSINESS OVERVIEW

- 16.3.4 SNT MOTIV CO., LTD.

- TABLE 350 SNT MOTIV CO., LTD.: BUSINESS OVERVIEW

- 16.3.5 LEM EUROPE GMBH

- TABLE 351 LEM EUROPE GMBH: BUSINESS OVERVIEW

- 16.3.6 ALLIED MOTION TECHNOLOGIES INC.

- TABLE 352 ALLIED MOTION TECHNOLOGIES INC.: BUSINESS OVERVIEW

- 16.3.7 SCHAEFFLER TECHNOLOGIES AG & CO.

- TABLE 353 SCHAEFFLER TECHNOLOGIES AG & CO.: BUSINESS OVERVIEW

- 16.3.8 NTN CORPORATION

- TABLE 354 NTN CORPORATION: BUSINESS OVERVIEW

- 16.3.9 IMMERSION CORPORATION

- TABLE 355 IMMERSION CORPORATION: BUSINESS OVERVIEW

- 16.3.10 SORL AUTO PARTS, INC.

- TABLE 356 SORL AUTO PARTS, INC.: BUSINESS OVERVIEW

17 RECOMMENDATIONS BY MARKETSANDMARKETS

- 17.1 ASIA PACIFIC TO BE POTENTIAL HIGH-GROWTH MARKET FOR DRIVE BY WIRE MANUFACTURERS

- 17.2 COMPANIES TO EMPHASIZE ON STEER-BY-WIRE FOR DRIVE BY WIRE APPLICATIONS

- 17.3 ELECTRIC VEHICLES

- 17.4 ELECTRIFICATION AND AUTONOMOUS VEHICLES

- 17.5 CONCLUSION

18 APPENDIX

- 18.1 CURRENCY AND PRICING

- TABLE 357 CURRENCY EXCHANGE RATES (PER USD)

- 18.2 INSIGHTS FROM INDUSTRY EXPERTS

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.4.1 DRIVE BY WIRE MARKET, BY SENSOR TYPE (COUNTRY LEVEL)

- 18.4.1.1 Throttle Pedal Sensors

- 18.4.1.2 Throttle Position Sensors

- 18.4.1.3 Pinion Angle Sensors

- 18.4.1.4 Hand Wheel Angle Sensors

- 18.4.1.5 Gear Shift Position Sensors

- 18.4.1.6 Brake Pedal Sensors

- 18.4.1.7 Park Sensors

- 18.4.2 DRIVE BY WIRE MARKET, BY COMPONENT (COUNTRY LEVEL)

- 18.4.2.1 ECU (Electronic Control Units)

- 18.4.2.2 ECM (Engine Control Modules)

- 18.4.2.3 Actuators

- 18.4.2.4 Feedback Motors

- 18.4.2.5 ETCM (Electronic Throttle Control Modules)

- 18.4.2.6 Electronic Transmission Control Units

- 18.4.2.7 Parking Pawl

- 18.4.3 ELECTRIC VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION (COUNTRY LEVEL)

- 18.4.3.1 Brake-by-wire

- 18.4.3.2 Park-by-wire

- 18.4.3.3 Shift-by-wire

- 18.4.3.4 Steer-by-wire

- 18.4.3.5 Throttle-by-wire

- 18.4.1 DRIVE BY WIRE MARKET, BY SENSOR TYPE (COUNTRY LEVEL)

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS