|

|

市場調査レポート

商品コード

1164609

自動車用ディファレンシャルの世界市場:種類別・駆動方式別・OEコンポーネント・オン/オフハイウェイ車・電気自動車・アフターマーケット・地域別の将来予測 (2027年まで)Automotive Differential Market by Type (Open, Locking, Limited Slip, Electronic Limited Slip, Torque-Vectoring), Drive Type (FWD, RWD, 4WD/AWD), OE Component, On- & Off-Highway Vehicle, Electric Vehicle, Aftermarket & Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自動車用ディファレンシャルの世界市場:種類別・駆動方式別・OEコンポーネント・オン/オフハイウェイ車・電気自動車・アフターマーケット・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月15日

発行: MarketsandMarkets

ページ情報: 英文 311 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車用ディファレンシャルの市場規模は、2022年の200億米ドルから、2027年には237億米ドルへと、3.5%のCAGRで成長すると予測されます。

市場の主な成長要因として、洗練された快適機能と優れたドライビング・ダイナミクスを有し、FRや4WD/AWDのオプションを備えたプレミアム車、成長中の大型トラック、さまざまな旅行体験を伴う都市間移動向け多軸バスの需要増加などが挙げられます。経済状況の改善や、究極の性能・快適性の要求の高まりにより、主にプレミアムセグメントの自動車やSUVにAWD/4WDシステムが搭載されるようになりました。これらの要因は、結果として多輪駆動システムの市場に影響を与え、自動車用ディファレンシャルの需要を促進することになるでしょう。さらに、中国、日本、欧州、北米の国々におけるプラグインハイブリッドセダンやSUVの強い需要と今後の新モデルの発売が、電気自動車やハイブリッド車セグメントにおけるディファレンシャル市場の成長を加速させると予測されます。

"乗用車:自動車用ディファレンシャルの最大市場"

インド・中国・タイなどの新興国における乗用車の生産台数の増加により、乗用車は自動車用ディファレンシャルの世界市場において最大のシェアを記録しました。また、ここ数年でSUVのシェアが2倍になるなど、大型車への急激な嗜好の変化が見られます。米国で販売される自動車のほぼ半分、欧州で販売される自動車の3分の1がSUVです。さらに、消費者の志向が基本的かつ高度な快適性と贅沢な機能を備えた大型車にシフトしていることから、世界のOEMはFRまたは4WD/AWDシステムを備えたSUVやミディアムカー、プレミアムカーを拡充しています。これに伴い、オープンデフやアドバンスドデフの市場も乗用車セグメントで成長すると思われます。

"オープンデフが最大のシェアを占める"

オープンデフは、2輪の各輪に等しいトルクを伝達する最もシンプルな形式のディファレンシャルです。乗用車のほとんどは前輪駆動で、他のタイプに比べて価格が安いこと、エネルギー損失が少ないこと、ディファレンシャルに使用するギアの構成が少ないことから、オープンディファレンシャルが搭載されています。乗用車のほぼ60~65%がオープンデフタイプを搭載しており、商用トラックや小型商用車にも幅広く適用されています。

"アフターマーケットではデフシールが最大のシェアを占める"

デフシールは、自動車用ディファレンシャルの出力軸に設置されています。通常、アクスルシャフトをデフに対してシールし、デフが作動する際に流体が漏れるのを防止しています。デフシールは他のコンポーネントと比較して頻繁に摩耗する可能性があり、一定の時間間隔で交換する必要があります。デフには多くのシールが使用され、一定期間ごとに交換されるため、アフターマーケットでのデファレンシャルシールの需要が生まれます。

"北米:自動車用ディファレンシャルの第2位の市場"

北米は、世界の自動車用ディファレンシャルの第2位の市場であると推定されます。この地域は、乗用車、特にプレミアムカー (Cセグメント以上) の需要が高いです。また、米国ではセカンドカー所有の需要も増加していますが、その中でも小型トラックが多く、FRやリミテッドスリップデフ、ELSD、トルクベクトルデフを搭載した4WD/AWDが主流であることが確認されています。さらに、ハイブリッド車も北米でかなりの普及率を見せています。これらすべての要因が、北米のディファレンシャル市場を牽引すると予想されます。

当レポートでは、世界の自動車用ディファレンシャル (差動装置) の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、セグメント別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バイヤーに影響を与えるトレンド/混乱

- 自動車ディファレンシャルの市場シナリオ

- ポーターのファイブフォース分析

- 自動車用ディファレンシャルのエコシステム

- サプライチェーン分析

- 価格分析

- ケーススタディ分析

- 輸出・輸入データ

- 主な会議とイベント (2022年~2023年)

- 特許分析

- 購入基準

- 規制分析

- 技術分析

- EV用電子ディファレンシャルの開発

- プレートを圧縮しディファレンシャルをロックするための電子作動式クラッチの開発

第6章 自動車用ディファレンシャル (ICE用) 市場:ディファレンシャルの種類別

- イントロダクション

- 電子式リミテッドスリップデフ (eLSD)

- デフロック

- リミテッドスリップデフ (LSD)

- オープンデフ

- トルクベクタリングデフ

第7章 自動車用ディファレンシャル (ICE用) 市場:駆動方式別

- イントロダクション

- 前輪駆動

- 後輪駆動

- 全輪駆動/四輪駆動 (AWD/4WD)

第8章 自動車用ディファレンシャル (ICE用) 市場:車種別

- イントロダクション

- 乗用車

- 小型商用車 (LCV)

- トラック

- バス

第9章 電気自動車・ハイブリッド車用ディファレンシャル市場:車種別

- イントロダクション

- プラグインハイブリッド車 (PHEV)

- 燃料電池自動車 (FCEV)

第10章 電気自動車・ハイブリッド車用ディファレンシャル市場:ディファレンシャルの種類別

- イントロダクション

- 電子式リミテッドスリップデフ (eLSD)

- デフロック

- リミテッドスリップデフ (LSD)

- オープンデフ

- トルクベクタリングデフ

第11章 自動車用ディファレンシャル (ICE用) 市場:コンポーネント別

- イントロダクション

- ピニオンギア

- デフハウジング

- サイドギア

- リングギア

- デフベアリング

第12章 自動車用ディファレンシャル (ICE) のアフターマーケット:コンポーネント別

- イントロダクション

- デフベアリング

- デフギア

- デフガスケット

- デフシール

第13章 オフハイウェイ車用ディファレンシャル市場:機器の種類別

- イントロダクション

- 農業用トラクター

- 二輪駆動

- 四輪駆動

- フォークリフト

第14章 自動車用ディファレンシャル市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- タイ

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- フランス

- 英国

- スペイン

- トルコ

- ロシア

- 他の欧州諸国

- 北米

- 米国

- カナダ

- メキシコ

- 他の国々 (RoW)

- イラン

- ブラジル

- その他のRoW諸国

第15章 MarketsandMarketsの提言

第16章 競合情勢

- 概要

- 市場シェア分析 (2021年)

- 主な上場企業の収益分析

- 競合評価クアドラント

- 競合シナリオ

- 製品の発売

- 資本取引

- 拡張

- 主要企業が採用した戦略/有力企業 (2018年~2022年)

- 競合ベンチマーキング

第17章 企業プロファイル

- 自動車用ディファレンシャル市場:主要企業

- GKN AUTOMOTIVE

- EATON CORPORATION PLC

- AMERICAN AXLE & MANUFACTURING, INC.

- DANA INC.

- BORGWARNER INC.

- LINAMAR CORPORATION

- SCHAEFFLER AG

- JTEKT CORPORATION

- HYUNDAI WIA CORPORATION

- ZF

- 自動車用ディファレンシャル市場:その他の企業

- AUBURN GEAR

- NEAPCO HOLDINGS LLC

- MAGNA

- DREXLER AUTOMOTIVE GMBH

- QUAIFE ENGINEERING LTD

- XTRAC

- NSK LTD

- BHARAT GEARS LTD

- CUSCO

- POWERTRAX

- JIANGSU PACIFIC PRECISION FORGING CO., LTD.

- COMMERCIAL GEAR & SPROCKET COMPANY, INC.

- AMTECH INTERNATIONAL

- MERITOR INC.

- SHOWA CORPORATION

第18章 付録

The automotive differential market is projected to grow from USD 20.0 billion in 2022 to USD 23.7 billion in 2027 at a CAGR of 3.5%. The factors attributed to the growth of automotive differential are increasing demand for premium vehicles with sophisticated comfort features and excellent driving dynamics offered with RWD and 4WD/AWD options, growing heavy trucks, and multi-axle buses & coaches for intercity travel with different travel experiences. Improving economic conditions and growing requirements of ultimate performance and comfort features primarily drive AWD/4WD systems installation in the premium segment cars and SUVs. These factors would consequently influence the market for multi-wheel drive systems, which would drive the demand for the automotive differential. Additionally, strong demand and upcoming new model launches for plug-in hybrid sedans and SUVs in China, Japan, and European and North American countries are expected to accelerate the differential market growth for the electric and hybrid vehicle segment.

"Passenger cars is the largest market for automotive differentials."

Passenger cars registered the largest market share in the global automotive differential market owing to the rising production of passenger cars in developing countries such as India, China, and Thailand. Further, a drastic preference shift is noted for bigger cars, with doubled SUVs share over the past few years. According to IEA, the number of SUVs on the world's roads increased by more than 35 million in 2021. According to MarketsandMarkets Analysis, of total premium cars produced globally, the share of premium SUVs stood at ~53% in 2016, which grew to ~62% in 2021. US, Canada, China, Japan, and South Korea lead the market for premium SUVs and sedan cars, constituting more than 90% of total production globally.

Further, almost half of all cars sold in the US and one-third of those sold in Europe are SUVs. Furthermore, with consumers shifting their inclination towards bigger cars with basic and advanced comfort and luxury functionalities, global OEMs are expanding their SUVs and medium and premium cars with either RWD or 4WD/AWD systems. In line with this, the demand for open differential and advanced differentials market would also grow for the passenger cars segment.

"Open Differential hold the largest share in the automotive differential market."

Open differential is the simplest form of differential which transmits the equal torque to each wheel of the two wheels. Most of the passenger cars are front wheel drives installed with open differential due to lower price amongst other types, less energy loss, and less gear configuration used in differential. Asia Pacific holds the largest market share for open differential due to the higher production of passenger cars in this region. Almost 60-65% passenger cars are equipped with open differential type. and it also have wide application in commercial truck and light commercial vehicle. Thus, rise in demand for passenger cars and commercial trucks will create demand for open differentials.

"Differential seals hold the largest share in the automotive differential component aftermarket.

The differential seals are located at the output shafts of a vehicle's differential. They usually seal the axle shafts against the differential and prevent fluid from leaking out of the differential as it operates. Differential seals have maximum and frequent chances of wearing out as compared to other components of a differential system; hence it requires replacement over fixed time intervals. Using damaged seals in the differential may lead to considerable damage to gears, axles, and other differential components owing to oil leakage. It may further damage whole differential assembly. Thus, the high number of seals in differentials and replacement over fixed time intervals creates the demand for differential seals in the aftermarket.

North America is estimated to be the second-largest market for automotive differential

North America accounted to be the second-largest market for automotive differentials. The region has a higher demand for passenger vehicles, particularly premium cars (C segment and above). These premium cars are installed with advanced safety, driving features, and AWD/4WD drive systems. With increasing premium car sales, the region's demand for automotive differentials is expected to grow. The demand for light trucks and vans has witnessed rapid growth in the North American region. Also, there is an increase in demand for second vehicle ownership in the US. It has been observed that most of the second preferred vehicles in the US are light trucks, which are mostly RWD, or 4WD/AWD installed with limited slip differential, ELSD, and Torque vectoring differentials. Lexus, Porche, Toyota, and Audi are offering models installed with advanced differentials. Also, few commercial vehicle manufacturers such as Volvo VNX 300, VNX 400, and VNX 740 are offering heavy trucks and tippers with 4x4, 4x6, etc. configurations. Further, increasing industrialization, growing logistic business and e-commerce industry has created the huge demand for trucks production and sales in the US will subsequently create the demand for automotive differential. In addition to this, hybrid vehicle has also seen a considerable adoption rate in North America. All these factors are expected to drive the market of differentials in the North American region.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs -10%, and Tier 1 - 90%

- By Designation: C Level Executives - 15%, Directors - 35%, and Others - 50%

- By Region: Asia Pacific - 50%, Europe - 10%, North America - 30%, and RoW- 10%

GKN Driveline (UK), Eaton Plc (Ireland), American Axle & Manufacturing Company (US), Dana Inc. (US), BorgWarner Inc. (US), Linamar Corporation (Canada), Schaeffler AG (Germany), JTEKT Corporation (Japan), ZF (Germany), Hyundai Wia Corporation (South Korea) are the leading supplier of automotive differential in the global market.

Research Coverage:

The automotive differential market is segmented on differential Type (ICE) (open, locking, limited slip, electronic limited slip, and torque-vectoring differential), drive type (front-wheel drive, rear-wheel drive, and all-wheel drive/4-wheel drive), OE component market (pinion gear, differential housing, side gear, ring gear, and differential bearings), aftermarket by component (differential bearings, differential gears, differential gaskets, and differential seals), electric & hybrid differential by EV type (PHEV, and FCEV), electric & hybrid differential market by differential type (open, locking, limited slip, electronic limited slip, and torque-vectoring differential), off-highway differential by equipment type (agricultural tractors, and forklifts) and region (Asia Pacific, Europe, North America, and ROW).

The study also includes an in-depth competitive analysis of the major automotive differential manufacturers in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help the market leaders in this market with information on the closest approximations of the revenue numbers for the overall automotive differential market and the sub-segments. This report will help differential component manufacturers to understand the OE and aftermarket demand of components. This report would also help stakeholders to understand the fastest growing and largest market for automotive differential at regional and global level. The report helps stakeholders to understand the opportunities in differential OE and aftermarket of components based on the replacement life. This report will help stakeholders to understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- TABLE 1 AUTOMOTIVE DIFFERENTIAL MARKET: INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 AUTOMOTIVE DIFFERENTIAL MARKET SEGMENTATION

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 SUMMARY OF CHANGES

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN - AUTOMOTIVE DIFFERENTIAL MARKET

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for vehicle production and electric vehicle sales

- 2.1.1.2 Key secondary sources for market sizing

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.1 Sampling techniques & data collection methods

- 2.1.2.2 Primary participants

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 6 AUTOMOTIVE DIFFERENTIAL MARKET: BOTTOM-UP APPROACH

- 2.2.2 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS AND ASSOCIATED RISKS

- 2.5.1 RESEARCH ASSUMPTIONS

- 2.5.2 MARKET ASSUMPTIONS

- TABLE 2 ASSUMPTIONS, ASSOCIATED RISKS, AND IMPACT

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 AUTOMOTIVE DIFFERENTIAL MARKET: MARKET OUTLOOK

- FIGURE 8 AUTOMOTIVE DIFFERENTIAL MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE DIFFERENTIAL MARKET

- FIGURE 9 INCREASE IN DEMAND FOR SUV AND LUXURY VEHICLES TO DRIVE AUTOMOTIVE DIFFERENTIAL MARKET

- 4.2 AUTOMOTIVE DIFFERENTIAL MARKET, BY REGION (ICE)

- FIGURE 10 ASIA PACIFIC TO DOMINATE AUTOMOTIVE DIFFERENTIAL MARKET

- 4.3 AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE (ICE)

- FIGURE 11 OPEN DIFFERENTIALS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- 4.4 AUTOMOTIVE DIFFERENTIAL MARKET, BY DRIVE TYPE (ICE)

- FIGURE 12 AWD/4WD DRIVE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 AUTOMOTIVE DIFFERENTIAL MARKET, BY VEHICLE TYPE (ICE)

- FIGURE 13 PASSENGER CARS SEGMENT TO DOMINATE DURING FORECAST PERIOD

- 4.6 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY VEHICLE TYPE

- FIGURE 14 PHEV SEGMENT TO BE LARGEST MARKET

- 4.7 ELECTRIC & HYBRID DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE

- FIGURE 15 ELSD SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- 4.8 AUTOMOTIVE DIFFERENTIAL OE MARKET, BY COMPONENT (ICE)

- FIGURE 16 PINION GEARS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.9 AUTOMOTIVE DIFFERENTIAL AFTERMARKET, BY COMPONENT (ICE)

- FIGURE 17 DIFFERENTIAL BEARINGS TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.10 AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY DRIVE TYPE (ICE)

- FIGURE 18 2WD DRIVE TRACTORS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.11 OFF-HIGHWAY DIFFERENTIAL MARKET, BY EQUIPMENT TYPE (ICE)

- FIGURE 19 AGRICULTURAL TRACTORS TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.12 AUTOMOTIVE DIFFERENTIAL MARKET, BY REGION (ICE)

- FIGURE 20 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 AUTOMOTIVE DIFFERENTIAL MARKET: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for commercial and heavy-duty vehicles

- FIGURE 22 HEAVY TRUCKS PRODUCTION, 2018-2021 (UNITS)

- 5.2.1.2 Increased investment in infrastructure to boost demand for construction & mining equipment

- FIGURE 23 CONSTRUCTION EQUIPMENT SALES, 2018-2025 (UNITS)

- FIGURE 24 MINING EQUIPMENT SALES, 2018-2025 (UNITS)

- 5.2.1.3 Growing penetration of all-wheel drive (AWD) and four-wheel drive (4WD) vehicles

- FIGURE 25 LCV: DRIVETRAIN INSTALLATION RATE (BY DRIVE TYPE), 2014-2021

- FIGURE 26 HCV: DRIVETRAIN INSTALLATION RATE (BY DRIVE TYPE), 2014-2021

- 5.2.1.4 Rising preference for luxury vehicles and SUVs

- TABLE 3 KEY OEMS OFFERING SUVS WITH AWD & 4WD SYSTEMS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Growing demand for electric passenger and commercial vehicles

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in differential technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Presence of local and regional suppliers

- 5.3 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.4 AUTOMOTIVE DIFFERENTIAL MARKET SCENARIO

- FIGURE 28 AUTOMOTIVE DIFFERENTIAL MARKET SCENARIO, 2018-2027 (USD MILLION)

- 5.4.1 REALISTIC SCENARIO

- TABLE 4 AUTOMOTIVE DIFFERENTIAL MARKET (REALISTIC SCENARIO), BY REGION, 2018-2027 (USD MILLION)

- 5.4.2 LOW IMPACT SCENARIO

- TABLE 5 AUTOMOTIVE DIFFERENTIAL MARKET (LOW IMPACT SCENARIO), BY REGION, 2018-2027 (USD MILLION)

- 5.4.3 HIGH IMPACT SCENARIO

- TABLE 6 AUTOMOTIVE DIFFERENTIAL MARKET (HIGH IMPACT SCENARIO), BY REGION, 2018-2027 (USD MILLION)

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 PORTER'S FIVE FORCES ANALYSIS: ESTABLISHED GLOBAL PLAYERS INCREASE COMPETITION

- 5.5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 THREAT OF NEW ENTRANTS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 BARGAINING POWER OF SUPPLIERS

- 5.5.6 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 AUTOMOTIVE DIFFERENTIAL ECOSYSTEM

- FIGURE 30 AUTOMOTIVE DIFFERENTIAL MARKET ECOSYSTEM

- TABLE 7 AUTOMOTIVE DIFFERENTIAL MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.7 SUPPLY CHAIN ANALYSIS

- FIGURE 31 SUPPLY CHAIN ANALYSIS: AUTOMOTIVE DIFFERENTIAL MARKET

- 5.8 PRICING ANALYSIS

- 5.8.1 BY TYPE AND REGION (USD/UNIT), 2021

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 GKN AUTOMOTIVE AND PORSCHE ENGINEERING DEVELOP NEW METAL AM FOR E-DRIVE APPLICATION

- 5.9.2 GKN AUTOMOTIVE AND ROMAX CONSULTING DESIGN HIGH-EFFICIENCY E-DRIVE SYSTEM

- 5.10 IMPORT & EXPORT DATA

- 5.10.1 IMPORT DATA

- 5.10.1.1 US

- TABLE 8 US: DIFFERENTIAL IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.1.2 Mexico

- TABLE 9 MEXICO: DIFFERENTIAL IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.1.3 China

- TABLE 10 CHINA: DIFFERENTIAL IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.1.4 Japan

- TABLE 11 JAPAN: DIFFERENTIAL IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.1.5 India

- TABLE 12 INDIA: DIFFERENTIAL IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.1.6 Germany

- TABLE 13 GERMANY: DIFFERENTIAL IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.1.7 France

- TABLE 14 FRANCE: DIFFERENTIAL IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.1.8 Spain

- TABLE 15 SPAIN: DIFFERENTIAL IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.2 EXPORT DATA

- 5.10.2.1 US

- TABLE 16 US: DIFFERENTIAL EXPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.2.2 Mexico

- TABLE 17 MEXICO: DIFFERENTIAL EXPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.2.3 China

- TABLE 18 CHINA: DIFFERENTIAL EXPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.2.4 Japan

- TABLE 19 JAPAN: DIFFERENTIAL EXPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.2.5 India

- TABLE 20 INDIA: DIFFERENTIAL EXPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.2.6 Germany

- TABLE 21 GERMANY: DIFFERENTIAL EXPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.2.7 France

- TABLE 22 FRANCE: DIFFERENTIAL EXPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.2.8 Spain

- TABLE 23 SPAIN: DIFFERENTIAL EXPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.1 IMPORT DATA

- 5.11 KEY CONFERENCES AND EVENTS, 2022-2023

- 5.11.1 AUTOMOTIVE DIFFERENTIAL MARKET: UPCOMING CONFERENCES AND EVENTS

- 5.12 PATENT ANALYSIS

- 5.12.1 APPLICATIONS AND PATENTS GRANTED, 2019-2022

- 5.13 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR ICE AND ELECTRIC & HYBRID VEHICLES

- TABLE 24 KEY BUYING CRITERIA FOR ICE AND ELECTRIC & HYBRID VEHICLES

- 5.14 REGULATORY ANALYSIS

- TABLE 25 DIFFERENTIAL/4WD/AWD REGULATIONS, BY REGION

- 5.14.1 EMISSION REGULATIONS

- 5.14.1.1 On-road vehicles

- TABLE 26 EURO-5 VS. EURO-6 VEHICLE EMISSION STANDARDS FOR NEW EUROPEAN DRIVING CYCLE

- TABLE 27 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR PASSENGER CARS, 2016-2021

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 DEVELOPMENT OF ELECTRONIC DIFFERENTIALS FOR ELECTRIC VEHICLES

- 5.15.2 DEVELOPMENT OF ELECTRONICALLY ACTIVATED CLUTCHES TO COMPRESS PLATES AND LOCK DIFFERENTIAL

6 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY DIFFERENTIAL TYPE

- 6.1 INTRODUCTION

- 6.1.1 RESEARCH METHODOLOGY

- 6.1.2 ASSUMPTIONS

- 6.1.3 INDUSTRY INSIGHTS: ICE VEHICLES, BY DIFFERENTIAL TYPE

- FIGURE 33 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY DIFFERENTIAL TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 28 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 29 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 30 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 31 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 6.2 ELECTRONIC LIMITED SLIP DIFFERENTIALS

- TABLE 32 ELSD MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 33 ELSD MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 34 ELSD MARKET, BY REGION, 2018-2021 (MILLION USD)

- TABLE 35 ELSD MARKET, BY REGION, 2022-2027 (MILLION USD)

- 6.3 LOCKING DIFFERENTIALS

- TABLE 36 LOCKING DIFFERENTIALS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 37 LOCKING DIFFERENTIALS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 38 LOCKING DIFFERENTIALS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 LOCKING DIFFERENTIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 LIMITED SLIP DIFFERENTIALS

- TABLE 40 LIMITED SLIP DIFFERENTIALS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 41 LIMITED SLIP DIFFERENTIALS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 42 LIMITED SLIP DIFFERENTIALS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 LIMITED SLIP DIFFERENTIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 OPEN DIFFERENTIALS

- TABLE 44 OPEN DIFFERENTIALS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 45 OPEN DIFFERENTIALS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 46 OPEN DIFFERENTIALS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 OPEN DIFFERENTIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

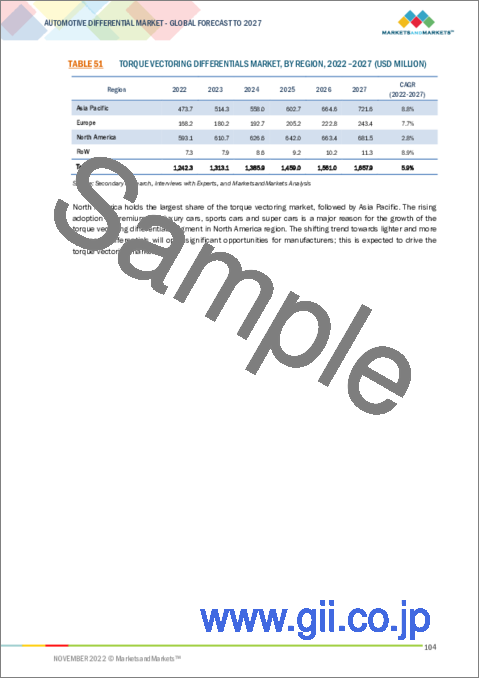

- 6.6 TORQUE VECTORING DIFFERENTIALS

- TABLE 48 TORQUE VECTORING DIFFERENTIALS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 49 TORQUE VECTORING DIFFERENTIALS MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 50 TORQUE VECTORING DIFFERENTIALS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 TORQUE VECTORING DIFFERENTIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

7 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY DRIVE TYPE

- 7.1 INTRODUCTION

- 7.1.1 RESEARCH METHODOLOGY

- 7.1.2 ASSUMPTIONS

- 7.1.3 INDUSTRY INSIGHTS: ICE VEHICLES, BY DRIVE TYPE

- FIGURE 34 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY DRIVE TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 52 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY DRIVE TYPE, 2018-2021 ('000 UNITS)

- TABLE 53 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY DRIVE TYPE, 2022-2027 ('000 UNITS)

- TABLE 54 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY DRIVE TYPE, 2018-2021 (USD MILLION)

- TABLE 55 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY DRIVE TYPE, 2022-2027 (USD MILLION)

- 7.2 FRONT-WHEEL DRIVE

- TABLE 56 FWD: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 57 FWD: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 58 FWD: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 59 FWD: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 7.3 REAR-WHEEL DRIVE

- TABLE 60 RWD: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 61 RWD: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 62 RWD: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 63 RWD: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 7.4 ALL-WHEEL DRIVE/FOUR-WHEEL DRIVE (AWD/4WD)

- TABLE 64 AWD/4WD: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 65 AWD/4WD: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 66 AWD/4WD: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 67 AWD/4WD: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

8 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY VEHICLE TYPE

- 8.1 INTRODUCTION

- 8.1.1 RESEARCH METHODOLOGY

- 8.1.2 ASSUMPTIONS

- 8.1.3 INDUSTRY INSIGHTS: BY VEHICLE TYPE (ICE)

- FIGURE 35 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 68 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY VEHICLE TYPE, 2018-2021 ('000 UNITS)

- TABLE 69 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY VEHICLE TYPE, 2022-2027 ('000 UNITS)

- TABLE 70 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 71 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 8.2 PASSENGER CARS

- TABLE 72 PASSENGER CARS MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 73 PASSENGER CARS MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 74 PASSENGER CARS MARKET (ICE), 2018-2021 (USD MILLION)

- TABLE 75 PASSENGER CARS MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 8.3 LIGHT COMMERCIAL VEHICLES (LCV)

- TABLE 76 LIGHT COMMERCIAL VEHICLES MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 77 LIGHT COMMERCIAL VEHICLES MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 78 LIGHT COMMERCIAL VEHICLES MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 79 LIGHT COMMERCIAL VEHICLES MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 8.4 TRUCKS

- TABLE 80 TRUCKS DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 81 TRUCKS DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 82 TRUCKS DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 83 TRUCKS MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 8.5 BUSES

- TABLE 84 BUSES DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 85 BUSES DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 86 BUSES DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 87 BUSES DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

9 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY VEHICLE TYPE

- 9.1 INTRODUCTION

- 9.1.1 RESEARCH METHODOLOGY

- 9.1.2 ASSUMPTIONS

- 9.1.3 INDUSTRY INSIGHTS: ELECTRIC & HYBRID VEHICLES, BY VEHICLE TYPE

- FIGURE 36 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 88 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY VEHICLE TYPE, 2018-2021 ('000 UNITS)

- TABLE 89 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY VEHICLE TYPE, 2022-2027 ('000 UNITS)

- TABLE 90 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 91 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 9.2 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEV)

- 9.2.1 GOVERNMENT SUBSIDIES AND INVESTMENTS IN CHARGING INFRASTRUCTURE TO DRIVE SEGMENT

- TABLE 92 PHEV DIFFERENTIAL MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 93 PHEV DIFFERENTIAL MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 94 PHEV DIFFERENTIAL MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 95 PHEV DIFFERENTIAL MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 FUEL CELL ELECTRIC VEHICLES (FCEV)

- 9.3.1 ENVIRONMENT-FRIENDLY PROPERTIES TO DRIVE DEMAND

- TABLE 96 FCEV DIFFERENTIAL MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 97 FCEV DIFFERENTIAL MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 98 FCEV DIFFERENTIAL MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 99 FCEV DIFFERENTIAL MARKET, BY REGION, 2022-2027 (USD MILLION)

10 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE

- 10.1 INTRODUCTION

- 10.1.1 RESEARCH METHODOLOGY

- 10.1.2 ASSUMPTIONS

- 10.1.3 INDUSTRY INSIGHTS: ELECTRIC & HYBRID VEHICLES, BY DIFFERENTIAL TYPE

- FIGURE 37 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 100 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 101 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 102 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 103 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 10.2 ELECTRONIC LIMITED SLIP DIFFERENTIAL

- TABLE 104 ELSD: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 105 ELSD: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 106 ELSD: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 107 ELSD: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 LOCKING DIFFERENTIALS

- TABLE 108 LOCKING DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 109 LOCKING DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 110 LOCKING DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 111 LOCKING DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 LIMITED SLIP DIFFERENTIALS

- TABLE 112 LIMITED SLIP DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 113 LIMITED SLIP DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 114 LIMITED SLIP DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 115 LIMITED SLIP DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 OPEN DIFFERENTIALS

- TABLE 116 OPEN DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 117 OPEN DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 118 OPEN DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 119 OPEN DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.6 TORQUE VECTORING DIFFERENTIALS

- TABLE 120 TORQUE VECTORING DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 121 TORQUE VECTORING DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 122 TORQUE VECTORING DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 123 TORQUE VECTORING DIFFERENTIALS: ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY REGION, 2022-2027 (USD MILLION)

11 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY COMPONENT

- 11.1 INTRODUCTION

- 11.1.1 RESEARCH METHODOLOGY

- 11.1.2 ASSUMPTIONS

- 11.1.3 INDUSTRY INSIGHTS: OE BY COMPONENT TYPE

- FIGURE 38 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY COMPONENT TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 124 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY COMPONENT TYPE, 2018-2021 ('000 UNITS)

- TABLE 125 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY COMPONENT TYPE, 2022-2027 ('000 UNITS)

- TABLE 126 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY COMPONENT TYPE, 2018-2021 (USD MILLION)

- TABLE 127 AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY COMPONENT TYPE, 2022-2027 (USD MILLION)

- 11.2 PINION GEARS

- TABLE 128 PINION GEARS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 129 PINION GEARS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 130 PINION GEARS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 131 PINION GEARS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 11.3 DIFFERENTIAL HOUSINGS

- TABLE 132 DIFFERENTIAL HOUSINGS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 133 DIFFERENTIAL HOUSINGS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 134 DIFFERENTIAL HOUSINGS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 135 DIFFERENTIAL HOUSINGS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 11.4 SIDE GEARS

- TABLE 136 SIDE GEARS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 137 SIDE GEARS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 138 SIDE GEARS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 139 SIDE GEARS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 11.5 RING GEARS

- TABLE 140 RING GEARS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 141 RING GEARS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 142 RING GEARS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 143 RING GEARS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 11.6 DIFFERENTIAL BEARINGS

- TABLE 144 DIFFERENTIAL BEARINGS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 145 DIFFERENTIAL BEARINGS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 146 DIFFERENTIAL BEARINGS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 147 DIFFERENTIAL BEARINGS: AUTOMOTIVE DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

12 AUTOMOTIVE DIFFERENTIAL AFTERMARKET (ICE), BY COMPONENT

- 12.1 INTRODUCTION

- 12.1.1 RESEARCH METHODOLOGY

- 12.1.2 ASSUMPTIONS

- 12.1.3 INDUSTRY INSIGHTS: AFTERMARKET BY COMPONENT TYPE

- FIGURE 39 AUTOMOTIVE DIFFERENTIAL AFTERMARKET (ICE), BY COMPONENT TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 148 AUTOMOTIVE DIFFERENTIAL AFTERMARKET (ICE), BY COMPONENT TYPE, 2018-2021 ('000 UNITS)

- TABLE 149 AUTOMOTIVE DIFFERENTIAL AFTERMARKET (ICE), BY COMPONENT TYPE, 2022-2027 ('000 UNITS)

- TABLE 150 AUTOMOTIVE DIFFERENTIAL AFTERMARKET (ICE), BY COMPONENT TYPE, 2018-2021 (USD MILLION)

- TABLE 151 AUTOMOTIVE DIFFERENTIAL AFTERMARKET (ICE), BY COMPONENT TYPE, 2022-2027 (USD MILLION)

- 12.2 DIFFERENTIAL BEARINGS

- TABLE 152 DIFFERENTIAL BEARINGS AFTERMARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 153 DIFFERENTIAL BEARINGS AFTERMARKET (ICE)), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 154 DIFFERENTIAL BEARINGS AFTERMARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 155 DIFFERENTIAL BEARINGS AFTERMARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 12.3 DIFFERENTIAL GEARS

- TABLE 156 DIFFERENTIAL GEARS AFTERMARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 157 DIFFERENTIAL GEARS AFTERMARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 158 DIFFERENTIAL GEARS AFTERMARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 159 DIFFERENTIAL GEARS AFTERMARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 12.4 DIFFERENTIAL GASKETS

- TABLE 160 DIFFERENTIAL GASKETS AFTERMARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 161 DIFFERENTIAL GASKETS AFTERMARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 162 DIFFERENTIAL GASKETS AFTERMARKET (ICE)), BY REGION, 2018-2021 (USD MILLION)

- TABLE 163 DIFFERENTIAL GASKETS AFTERMARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 12.5 DIFFERENTIAL SEALS

- TABLE 164 DIFFERENTIAL SEALS AFTERMARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 165 DIFFERENTIAL SEALS AFTERMARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 166 DIFFERENTIAL SEALS AFTERMARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 167 DIFFERENTIAL SEALS AFTERMARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

13 OFF-HIGHWAY VEHICLE DIFFERENTIAL MARKET, BY EQUIPMENT TYPE

- 13.1 INTRODUCTION

- 13.1.1 RESEARCH METHODOLOGY

- 13.1.2 ASSUMPTIONS

- 13.1.3 INDUSTRY INSIGHTS: OFF-HIGHWAY VEHICLE DIFFERENTIAL MARKET (ICE), BY EQUIPMENT TYPE

- FIGURE 40 OFF-HIGHWAY VEHICLE DIFFERENTIAL MARKET (ICE), BY EQUIPMENT TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 168 OFF-HIGHWAY VEHICLE DIFFERENTIAL MARKET (ICE), BY EQUIPMENT TYPE, 2018-2021 ('000 UNITS)

- TABLE 169 OFF-HIGHWAY VEHICLE DIFFERENTIAL MARKET (ICE), BY EQUIPMENT TYPE, 2022-2027 ('000 UNITS)

- TABLE 170 OFF-HIGHWAY VEHICLE DIFFERENTIAL MARKET (ICE), BY EQUIPMENT TYPE, 2018-2021 (USD MILLION)

- TABLE 171 OFF-HIGHWAY VEHICLE DIFFERENTIAL MARKET (ICE), BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- 13.2 AGRICULTURAL TRACTORS

- TABLE 172 AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY DRIVE TYPE, 2018-2021 ('000 UNITS)

- TABLE 173 AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY DRIVE TYPE, 2022-2027 ('000 UNITS)

- TABLE 174 AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY DRIVE TYPE, 2018-2021 (USD MILLION)

- TABLE 175 AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY DRIVE TYPE, 2022-2027 (USD MILLION)

- 13.2.1 TWO-WHEEL DRIVE

- TABLE 176 2WD: AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 177 2WD: AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 178 2WD: AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 179 2WD: AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.2.2 FOUR-WHEEL DRIVE

- TABLE 180 4WD: AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 181 4WD: AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 182 4WD: AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 183 4WD: AGRICULTURAL TRACTORS DIFFERENTIAL MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.3 FORKLIFTS

- TABLE 184 FORKLIFTS DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 ('000 UNITS)

- TABLE 185 FORKLIFTS DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 ('000 UNITS)

- TABLE 186 FORKLIFTS DIFFERENTIAL MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 187 FORKLIFTS DIFFERENTIAL MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

14 AUTOMOTIVE DIFFERENTIAL MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.1.1 RESEARCH METHODOLOGY

- 14.1.2 ASSUMPTIONS

- 14.1.3 INDUSTRY INSIGHTS: DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE

- FIGURE 41 AUTOMOTIVE DIFFERENTIAL MARKET, 2022 VS. 2027 (USD MILLION)

- TABLE 188 AUTOMOTIVE DIFFERENTIAL MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 189 AUTOMOTIVE DIFFERENTIAL MARKET, BY REGION, 2022-2027 ('000 UNITS)

- TABLE 190 AUTOMOTIVE DIFFERENTIAL MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 191 AUTOMOTIVE DIFFERENTIAL MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.2 ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: AUTOMOTIVE DIFFERENTIAL MARKET SNAPSHOT

- TABLE 192 ASIA PACIFIC: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 193 ASIA PACIFIC: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2022-2027 ('000 UNITS)

- TABLE 194 ASIA PACIFIC: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 195 ASIA PACIFIC: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 14.2.1 CHINA

- 14.2.1.1 Booming passenger vehicle demand to fuel market

- TABLE 196 CHINA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 197 CHINA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 198 CHINA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 199 CHINA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.2.2 INDIA

- 14.2.2.1 Growth in vehicle sales to create opportunity for market

- TABLE 200 INDIA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 201 INDIA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 202 INDIA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 203 INDIA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.2.3 JAPAN

- 14.2.3.1 Growing use of technologically-advanced differentials to impact market

- TABLE 204 JAPAN: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 205 JAPAN: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 206 JAPAN: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 207 JAPAN: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Demand for luxury cars to propel market

- TABLE 208 SOUTH KOREA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 209 SOUTH KOREA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 210 SOUTH KOREA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 211 SOUTH KOREA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.2.5 THAILAND

- 14.2.5.1 Rising demand for automotive components to boost market

- TABLE 212 THAILAND: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 213 THAILAND: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 214 THAILAND: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 215 THAILAND: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.2.6 REST OF ASIA PACIFIC

- TABLE 216 REST OF ASIA PACIFIC: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 217 REST OF ASIA PACIFIC: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 218 REST OF ASIA PACIFIC: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 219 REST OF ASIA PACIFIC: AUTOMOTIVE DIFFERENTIAL MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.3 EUROPE

- FIGURE 43 EUROPE: AUTOMOTIVE DIFFERENTIAL MARKET, 2022-2027 (USD MILLION)

- TABLE 220 EUROPE: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 221 EUROPE: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2022-2027 ('000 UNITS)

- TABLE 222 EUROPE: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 223 EUROPE: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 14.3.1 GERMANY

- 14.3.1.1 High demand for premium cars to drive market

- TABLE 224 GERMANY: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 225 GERMANY: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 226 GERMANY: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 227 GERMANY: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.3.2 FRANCE

- 14.3.2.1 Increase in production of hybrid vehicles to propel market

- TABLE 228 FRANCE: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 229 FRANCE: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 230 FRANCE: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 231 FRANCE: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.3.3 UK

- 14.3.3.1 Rising sales of AWD/4WD vehicles to drive market

- TABLE 232 UK: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 233 UK: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 234 UK: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 235 UK: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.3.4 SPAIN

- 14.3.4.1 Increased production of passenger cars to create higher requirement for differentials

- TABLE 236 SPAIN: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 237 SPAIN: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 238 SPAIN: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 239 SPAIN: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.3.5 TURKEY

- 14.3.5.1 Rising focus on exports to drive market

- TABLE 240 TURKEY: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 241 TURKEY: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 242 TURKEY: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 243 TURKEY: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.3.6 RUSSIA

- 14.3.6.1 Increasing sales of passenger cars to bolster market

- TABLE 244 RUSSIA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 245 RUSSIA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 246 RUSSIA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 247 RUSSIA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.3.7 REST OF EUROPE

- TABLE 248 REST OF EUROPE: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 249 REST OF EUROPE: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 250 REST OF EUROPE: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 251 REST OF EUROPE: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.4 NORTH AMERICA

- FIGURE 44 NORTH AMERICAN AUTOMOTIVE DIFFERENTIAL MARKET SNAPSHOT

- TABLE 252 NORTH AMERICA: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 253 NORTH AMERICA: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2022-2027 ('000 UNITS)

- TABLE 254 NORTH AMERICA: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 255 NORTH AMERICA: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 14.4.1 US

- 14.4.1.1 Increasing production of SUVs and luxury vehicles to drive market

- TABLE 256 US: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 257 US: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 258 US: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 259 US: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.4.2 CANADA

- 14.4.2.1 Rising automotive vehicle production to drive market

- TABLE 260 CANADA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 261 CANADA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 262 CANADA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 263 CANADA: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.4.3 MEXICO

- 14.4.3.1 Growing demand for advanced differential types to drive market

- TABLE 264 MEXICO: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 265 MEXICO: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 266 MEXICO: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 267 MEXICO: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.5 ROW

- FIGURE 45 ROW: AUTOMOTIVE DIFFERENTIAL MARKET, 2021-2026 (USD MILLION)

- TABLE 268 ROW: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 269 ROW: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2022-2027 ('000 UNITS)

- TABLE 270 ROW: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 271 ROW: AUTOMOTIVE DIFFERENTIAL MARKET, BY COUNTRY, BY COUNTRY, 2022-2027 (USD MILLION)

- 14.5.1 IRAN

- 14.5.1.1 Heavy investments in automotive sector to impact market

- TABLE 272 IRAN: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 273 IRAN: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 274 IRAN: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 275 IRAN: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.5.2 BRAZIL

- 14.5.2.1 Presence of major automotive companies to drive market

- TABLE 276 BRAZIL: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 277 BRAZIL: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 278 BRAZIL: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 279 BRAZIL: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

- 14.5.3 REST OF ROW

- TABLE 280 REST OF WORLD: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 ('000 UNITS)

- TABLE 281 REST OF WORLD: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 ('000 UNITS)

- TABLE 282 REST OF WORLD: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2018-2021 (USD MILLION)

- TABLE 283 REST OF WORLD: AUTOMOTIVE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE, 2022-2027 (USD MILLION)

15 RECOMMENDATIONS BY MARKETSANDMARKETS

- 15.1 ASIA PACIFIC TO BE KEY MARKET FOR AUTOMOTIVE DIFFERENTIALS

- 15.2 ELECTRONIC LIMITED SLIP DIFFERENTIALS TO GAIN TRACTION

- 15.3 CONCLUSION

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 MARKET SHARE ANALYSIS, 2021

- TABLE 284 MARKET SHARE ANALYSIS FOR AUTOMOTIVE DIFFERENTIAL MARKET, 2021

- FIGURE 46 AUTOMOTIVE DIFFERENTIAL MARKET SHARE ANALYSIS, 2021

- 16.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- 16.4 COMPETITIVE EVALUATION QUADRANT

- 16.4.1 TERMINOLOGY

- 16.4.2 STARS

- 16.4.3 EMERGING LEADERS

- 16.4.4 PERVASIVE PLAYERS

- 16.4.5 PARTICIPANTS

- TABLE 285 AUTOMOTIVE DIFFERENTIAL MARKET: COMPANY PRODUCT FOOTPRINT, 2021

- TABLE 286 AUTOMOTIVE DIFFERENTIAL MARKET: COMPANY APPLICATION FOOTPRINT, 2021

- TABLE 287 AUTOMOTIVE DIFFERENTIAL MARKET: COMPANY REGION FOOTPRINT, 2021

- FIGURE 47 AUTOMOTIVE DIFFERENTIAL MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2021

- 16.5 COMPETITIVE SCENARIO

- 16.5.1 PRODUCT LAUNCHES

- TABLE 288 PRODUCT LAUNCHES, 2018-2022

- 16.5.2 DEALS

- TABLE 289 DEALS, 2018-2022

- 16.5.3 EXPANSIONS

- TABLE 290 EXPANSIONS, 2018-2022

- 16.6 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN, 2018-2022

- TABLE 291 KEY GROWTH STRATEGIES, 2018-2022

- 16.7 COMPETITIVE BENCHMARKING

- TABLE 292 AUTOMOTIVE DIFFERENTIAL MARKET: KEY PLAYERS

17 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 17.1 AUTOMOTIVE DIFFERENTIAL MARKET - KEY PLAYERS

- 17.1.1 GKN AUTOMOTIVE

- TABLE 293 GKN AUTOMOTIVE: BUSINESS OVERVIEW

- FIGURE 48 GKN AUTOMOTIVE: COMPANY SNAPSHOT

- TABLE 294 GKN AUTOMOTIVE: PRODUCT LAUNCHES

- TABLE 295 GKN AUTOMOTIVE: DEALS

- TABLE 296 GKN AUTOMOTIVE: EXPANSIONS

- 17.1.2 EATON CORPORATION PLC

- TABLE 297 EATON CORPORATION PLC: BUSINESS OVERVIEW

- FIGURE 49 EATON CORPORATION PLC: COMPANY SNAPSHOT

- TABLE 298 EATON CORPORATION PLC: PRODUCT LAUNCHES

- TABLE 299 EATON CORPORATION PLC: DEALS

- TABLE 300 EATON CORPORATION PLC: EXPANSIONS

- 17.1.3 AMERICAN AXLE & MANUFACTURING, INC.

- TABLE 301 AMERICAN AXLE & MANUFACTURING, INC.: BUSINESS OVERVIEW

- FIGURE 50 AMERICAN AXLE & MANUFACTURING, INC.: COMPANY SNAPSHOT

- TABLE 302 AMERICAN AXLE & MANUFACTURING, INC.: PRODUCT LAUNCHES

- TABLE 303 AMERICAN AXLE & MANUFACTURING, INC.: DEALS

- TABLE 304 AMERICAN AXLE & MANUFACTURING, INC.: EXPANSIONS

- 17.1.4 DANA INC.

- TABLE 305 DANA INC.: BUSINESS OVERVIEW

- FIGURE 51 DANA INC.: COMPANY SNAPSHOT

- TABLE 306 DANA INC.: PRODUCT LAUNCHES

- TABLE 307 DANA INC.: DEALS

- TABLE 308 DANA INC.: EXPANSIONS

- 17.1.5 BORGWARNER INC.

- TABLE 309 BORGWARNER INC.: BUSINESS OVERVIEW

- FIGURE 52 BORGWARNER INC.: COMPANY SNAPSHOT

- TABLE 310 BORGWARNER INC.: DEALS

- TABLE 311 BORGWARNER INC.: EXPANSIONS

- 17.1.6 LINAMAR CORPORATION

- TABLE 312 LINAMAR CORPORATION: BUSINESS OVERVIEW

- FIGURE 53 LINAMAR CORPORATION: COMPANY SNAPSHOT

- TABLE 313 LINAMAR CORPORATION: PRODUCT LAUNCHES

- TABLE 314 LINAMAR CORPORATION: DEALS

- TABLE 315 LINAMAR CORPORATION: EXPANSIONS

- 17.1.7 SCHAEFFLER AG

- TABLE 316 SCHAEFFLER AG: BUSINESS OVERVIEW

- FIGURE 54 SCHAEFFLER AG: COMPANY SNAPSHOT

- TABLE 317 SCHAEFFLER AG: PRODUCT LAUNCHES

- TABLE 318 SCHAEFFLER AG: EXPANSIONS

- 17.1.8 JTEKT CORPORATION

- TABLE 319 JTEKT CORPORATION: BUSINESS OVERVIEW

- FIGURE 55 JTEKT CORPORATION: COMPANY SNAPSHOT

- TABLE 320 JTEKT CORPORATION: PRODUCT LAUNCHES

- TABLE 321 JTEKT CORPORATION: DEALS

- 17.1.9 HYUNDAI WIA CORPORATION

- TABLE 322 HYUNDAI WIA CORPORATION: BUSINESS OVERVIEW

- FIGURE 56 HYUNDAI WIA CORPORATION: COMPANY SNAPSHOT

- TABLE 323 HYUNDAI WIA CORPORATION: PRODUCT LAUNCHES

- 17.1.10 ZF

- TABLE 324 ZF: BUSINESS OVERVIEW

- FIGURE 57 ZF: COMPANY SNAPSHOT

- TABLE 325 ZF: PRODUCT LAUNCHES

- 17.2 AUTOMOTIVE DIFFERENTIAL MARKET - ADDITIONAL PLAYERS

- 17.2.1 AUBURN GEAR

- TABLE 326 AUBURN GEAR: COMPANY OVERVIEW

- 17.2.2 NEAPCO HOLDINGS LLC

- TABLE 327 NEAPCO HOLDINGS LLC: COMPANY OVERVIEW

- 17.2.3 MAGNA

- TABLE 328 MAGNA: COMPANY OVERVIEW

- 17.2.4 DREXLER AUTOMOTIVE GMBH

- TABLE 329 DREXLER AUTOMOTIVE GMBH: COMPANY OVERVIEW

- 17.2.5 QUAIFE ENGINEERING LTD

- TABLE 330 QUAIFE ENGINEERING LTD: COMPANY OVERVIEW

- 17.2.6 XTRAC

- TABLE 331 XTRAC: COMPANY OVERVIEW

- 17.2.7 NSK LTD

- TABLE 332 NSK LTD: COMPANY OVERVIEW

- 17.2.8 BHARAT GEARS LTD

- TABLE 333 BHARAT GEARS LTD: COMPANY OVERVIEW

- 17.2.9 CUSCO

- TABLE 334 CUSCO: COMPANY OVERVIEW

- 17.2.10 POWERTRAX

- TABLE 335 POWERTRAX: COMPANY OVERVIEW

- 17.2.11 JIANGSU PACIFIC PRECISION FORGING CO., LTD.

- TABLE 336 JIANGSU PACIFIC PRECISION FORGING CO., LTD.: COMPANY OVERVIEW

- 17.2.12 COMMERCIAL GEAR & SPROCKET COMPANY, INC.

- TABLE 337 COMMERCIAL GEAR & SPROCKET COMPANY, INC.: COMPANY OVERVIEW

- 17.2.13 AMTECH INTERNATIONAL

- TABLE 338 AMTECH INTERNATIONAL: COMPANY OVERVIEW

- 17.2.14 MERITOR INC.

- TABLE 339 MERITOR INC.: COMPANY OVERVIEW

- 17.2.15 SHOWA CORPORATION

- TABLE 340 SHOWA CORPORATION: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

18 APPENDIX

- 18.1 KEY INDUSTRY INSIGHTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.4.1 AUTOMOTIVE DIFFERENTIAL MARKET, BY DRIVE TYPE (COUNTRY LEVEL)

- 18.4.1.1 FWD

- 18.4.1.2 RWD

- 18.4.1.3 AWD/4WD

- 18.4.2 ELECTRIC & HYBRID VEHICLE DIFFERENTIAL MARKET, BY DIFFERENTIAL TYPE (COUNTRY LEVEL)

- 18.4.2.1 Electronic limited slip differential (ELSD)

- 18.4.2.2 Locking differential

- 18.4.2.3 Limited slip differential (LSD)

- 18.4.2.4 Open differential

- 18.4.2.5 Torque vectoring differential

- 18.4.1 AUTOMOTIVE DIFFERENTIAL MARKET, BY DRIVE TYPE (COUNTRY LEVEL)

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS