|

|

市場調査レポート

商品コード

1089149

自動車用熱交換器の世界市場:推進装置/コンポーネント別 (ICE、EV)・電気自動車の種類別 (BEV、PHEV、HEV)・設計別 (プレートバー、チューブフィン)・車種別 (乗用車、LCV、トラック、バス)・オフハイウェイ車の種類別・地域別の将来予測 (2027年まで)Automotive Heat Exchanger Market by Propulsion & Component (ICE, EV), Electric Vehicle Type (BEV, PHEV, HEV), Design (Plate Bar, Tube Fin), Vehicle Type, Off-Highway Vehicle Type (Passenger Car, LCV, Truck, Bus) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自動車用熱交換器の世界市場:推進装置/コンポーネント別 (ICE、EV)・電気自動車の種類別 (BEV、PHEV、HEV)・設計別 (プレートバー、チューブフィン)・車種別 (乗用車、LCV、トラック、バス)・オフハイウェイ車の種類別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年06月08日

発行: MarketsandMarkets

ページ情報: 英文 304 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車用熱交換器の市場規模は、2022年の289億米ドルから2027年までに343億米ドルへ、3.5%のCAGRで成長すると予測されます。

市場の主な促進要因として、ハイブリッド車 (HEV) やプラグインハイブリッド車 (PHEV) の需要増加や、自動車生産台数の着実な増加などが挙げられます。また、モビリティソリューションの進化とバッテリー熱管理システムの需要増が、この市場に新たな機会をもたらすと考えられます。

電気自動車 (EV) の種類別では、PHEVのセグメントが予測期間中に大きな成長を遂げると考えられています。オフハイウェイ車の種類別では、建設機械向け分野が最大の市場となる見通しです。

当レポートでは、世界の自動車用熱交換器の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、市場動向の見通し、推進装置/コンポーネント別・設計別・車種別・電気自動車の種類別・オフハイウェイ車の種類別・地域別の詳細動向、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 分析方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- 課題

- 市場に影響を与える動向とディスラプション

- 自動車用熱交換器市場のシナリオ (2022年~2027年)

- 最も可能性の高いシナリオ

- 楽観的なシナリオ

- 悲観的なシナリオ

- ポーターのファイブフォース分析

- 自動車用熱交換器市場のエコシステム

- バリューチェーン分析

- 価格分析

- マクロ経済指標

- 主要国のGDPの動向と予測

- 世界の自動車生産統計 (2020年・2021年)

- 特許分析

- 特許の法的地位 (2012年~2021年)

- 主な特許出願人 (2012年~2021年)

- ケーススタディ

- 技術分析

- バッテリー熱管理システム

- 間接式チャージエアクーラー

- 液冷式チャージエアクーラー

- 貿易分析

- 規制の概要

- 主要な会議とイベント (2022年~2023年)

- 主要な利害関係者と購入基準

第6章 自動車用熱交換器市場:推進装置/コンポーネント別

- イントロダクション

- 内燃機関 (ICE)

- ICE車用熱交換器市場:コンポーネント別

- エンジンラジエーター

- コンデンサー

- 蒸発器

- オイルクーラー

- ヒーター

- チャージエアクーラー

- 排気ガス熱交換器

- 電気自動車 (BEV、PHEV、HEV)

- 電気自動車用熱交換器市場:コンポーネント別

- バッテリー冷却システム

- エンジンラジエーター

- コンデンサー

- 蒸発器

- オイルクーラー

- ヒーター

- チャージエアクーラー

- 排気ガス熱交換器

- 主な洞察

第7章 自動車用熱交換器市場:設計別

- イントロダクション

- プレートバー

- チューブフィン

- その他

- 主な洞察

第8章 自動車用熱交換器市場:車種別

- イントロダクション

- 乗用車

- 小型商用車 (LCV)

- トラック

- バス

- 主な主な洞察

第9章 自動車用熱交換器市場:電気自動車の種類別

- イントロダクション

- BEV

- HEV

- PHEV

- 主な洞察

第10章 自動車用熱交換器市場:オフハイウェイ車の種類別

- イントロダクション

- 農業機械

- 建設機械

- 主な洞察

第11章 自動車用熱交換器市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- 他のアジア太平洋諸国

- 欧州

- フランス

- ドイツ

- イタリア

- スペイン

- 英国

- 他の欧州諸国

- 北米

- カナダ

- メキシコ

- 米国

- 他の国々 (RoW)

- ブラジル

- ロシア

- 南アフリカ

- 他のRoW諸国

第12章 競合情勢

- 概要

- 上位企業の収益分析

- 市場シェア分析

- 競合シナリオ

- 資本取引

- 新製品の発売

- その他 (2018年~2021年)

- 自動車用熱交換器市場の企業評価クアドラント

- 競合評価クアドラント:中小企業

- 有力企業

第13章 企業プロファイル

- 主要企業

- DENSO CORPORATION

- VALEO

- DANA INCORPORATED

- MAHLE GMBH

- HANON SYSTEMS

- MARELLI CORPORATION

- SANDEN CORPORATION

- T.RAD CO. LTD.

- AKG GROUP

- NIPPON LIGHT METAL HOLDINGS COMPANY, LTD.

- MODINE MANUFACTURING COMPANY

- その他の企業

- CLIZEN INC.

- SM AUTO ENGINEERING PVT LTD.

- GRIFFIN THERMAL PRODUCTS

- BANCO PRODUCTS (INDIA) LTD.

- NISSENS AUTOMOTIVE A/S

- G&M RADIATOR

- SENIOR PLC

- BORGWARNER INC.

- SWAMI VESSELS PRIVATE LIMITED

- CLIMETAL S.L.

- TYC BROTHER INDUSTRIAL CO., LTD.

第14章 MarketsandMarketsの提言

第15章 付録

The global automotive heat exchanger market is projected to grow from USD 28.9 billion in 2022 to USD 34.3 billion by 2027, at a CAGR of 3.5%. Parameters such as increase in demand for hybrid and plug-in hybrid vehicles, along with steady increase in vehicle production will increase the demand for the automotive heat exchangers. In addition, the advancements in mobility solutions, paired with increase in demand for battery thermal management systems will create new opportunities for this market.

"PHEV segment is expected to grow at a significant rate during the forecast period, by electric vehicle type."

The PHEV segment of the automotive heat exchanger market is projected to grow at the noticeable rate during the forecast period. PHEVs have rechargeable batteries that can be charged by connecting to external power sources. PHEVs share attributes of both electric vehicles and traditional ICE vehicles. PHEVs have a higher electric range than HEVs and lack range anxiety associated with BEVs. Also, PHEVs can cover greater distances than BEVs due to the presence of an ICE. There are two major types of PHEVs: series PHEV and parallel PHEV. In series PHEVs, only the electric motor is connected to the wheels, and the ICE is used to generate power for the electric energy. On the other hand, both the electric motor and ICE are connected to the powertrain in parallel PHEVs.

The increasing number of charging stations in China, the US, and the UK is expected to increase PHEV demand. The demand for PHEVs is also expected to rise due to tax benefits and incentives provided by various governments. For instance, the Japanese government provides subsidies up to USD 8,500 for PHEVs. Countries in Europe, North America, and Asia Pacific have supported PHEV growth through vehicle ownership tax reductions, state incentives, charging-based incentives, and a high fuel price difference.

"North America is expected to be the second-largest market during the forecast period."

The North American region is estimated to demonstrate significant growth during the forecast period. North America has presence of several major OEMs such as Ford, General Motors, and Fiat-Chrysler. In addition, presence of key automotive heat exchanger manufacturers such as Dana Incorporated (US), Modine Manufacturing Company (US), BorgWarner Inc. (US), and Griffin Thermal Products (US) will also offer the requisite impetus to the automotive heat exchanger market in North America during the forecast period. The US is estimated to account for the largest share of the North American automotive heat exchanger market. The US automotive industry is highly inclined toward innovation, technology, and the development of safe and comfortable automobiles. The US automotive sector is still highly dependent on ICE vehicles, making it the prominent segment. In 2021, the country produced over 6.3 million passenger cars (including SUVs). The country also has many electric vehicle manufacturing companies such as Tesla, GM, and Nissan.

"Construction Equipment segment is estimated to be the largest market in terms of value in the automotive heat exchanger market during the forecast period"

Construction Equipment is expected to be the largest segment by application during the forecast period. Construction is an important industry, especially in regions such as Asia Pacific, where the government is driving infrastructure-oriented construction by implementing stimulus packages. Post COVID-19, China is focusing on constructing new digital infrastructure across the country, including building 5G networks, intercity high-speed rail, AI, IoT, ultra-high voltage power transmission, and setting up R&D institutions. China will spend approximately USD 1.4 trillion on digital infrastructure by 2025. In addition, in March 2021, the Government of India passed a bill to set up the National Bank for Financing Infrastructure and Development (NaBFID) to fund infrastructure projects in the country. Such factors are expected to drive the construction sector in Asia Pacific. Further, technological advancements in construction equipment and increasing infrastructure developments in growing economies are key factors expected to support the growth of the heat exchanger market for construction equipment.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 24%, Tier I - 67%, and Others - 9%

- By Designation: CXOs - 33%, Managers - 52%, and Others - 15%

- By Region: North America - 41%, Europe - 23%, Asia Pacific - 32%, and RoW - 4%

The automotive heat exchanger market is dominated by major players including Denso Corporation (Japan), MAHLE GmbH (Germany), Valeo (France), Hanon Systems (South Korea), and T.RAD Co., Ltd. (Japan). These companies have strong product portfolio as well as strong distribution networks at the global level.

Research Coverage:

The report covers the automotive heat exchanger market, in terms of Propulsion & Component (ICE, and EV), Design (Plate Bar, Tube Fin, and Others), Electric Vehicle Type (BEV, PHEV, & HEV), Vehicle Type (Passenger Car, LCV, Truck, Bus), Off-Highway Vehicle Type (Agriculture Equipment, and Construction Equipment), and Region (Asia Pacific, Europe, North America, and Row). It covers the competitive landscape and company profiles of the major players in the automotive heat exchanger market ecosystem.

The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants in this market with information on the closest approximations of revenue numbers for the overall automotive heat exchanger market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the pulse of the market and provides them information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trend of different automotive heat exchangers based on their capacity.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- TABLE 1 AUTOMOTIVE HEAT EXCHANGER MARKET DEFINITION, BY ELECTRIC VEHICLE TYPE

- TABLE 2 AUTOMOTIVE HEAT EXCHANGER MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 3 AUTOMOTIVE HEAT EXCHANGER MARKET DEFINITION, BY COMPONENT

- TABLE 4 AUTOMOTIVE HEAT EXCHANGER MARKET DEFINITION, BY DESIGN

- 1.2.1 INCLUSIONS & EXCLUSIONS

- TABLE 5 INCLUSIONS & EXCLUSIONS IN AUTOMOTIVE HEAT EXCHANGER MARKET

- 1.3 MARKET SCOPE

- FIGURE 1 MARKETS COVERED

- 1.3.1 YEARS CONSIDERED FOR STUDY

- 1.4 CURRENCY & PRICING

- TABLE 6 CURRENCY EXCHANGE RATES

- 1.5 PACKAGE SIZE

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AUTOMOTIVE HEAT EXCHANGER MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for automotive heat exchanger market

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.1 List of primary participants

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 6 AUTOMOTIVE HEAT EXCHANGER MARKET SIZE: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 TOP-DOWN APPROACH: AUTOMOTIVE HEAT EXCHANGER MARKET

- FIGURE 7 AUTOMOTIVE HEAT EXCHANGER MARKET: MARKET ESTIMATION NOTES

- FIGURE 8 AUTOMOTIVE HEAT EXCHANGER MARKET: RESEARCH DESIGN & METHODOLOGY FOR ICE VEHICLES - DEMAND SIDE

- FIGURE 9 AUTOMOTIVE HEAT EXCHANGER MARKET: RESEARCH DESIGN & METHODOLOGY FOR ELECTRIC VEHICLES - DEMAND SIDE

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP (SUPPLY SIDE) - COLLECTIVE MARKET SHARE OF MAJOR PLAYERS

- 2.3 DATA TRIANGULATION

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- 2.4 FACTOR ANALYSIS

- FIGURE 12 FACTOR ANALYSIS: AUTOMOTIVE HEAT EXCHANGER MARKET

- 2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 13 AUTOMOTIVE HEAT EXCHANGER MARKET OVERVIEW

- FIGURE 14 AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2022-2027

- FIGURE 15 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN, 2022 VS. 2027

- FIGURE 16 KEY PLAYERS IN AUTOMOTIVE HEAT EXCHANGER MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE HEAT EXCHANGER MARKET

- FIGURE 17 STEADY SURGE IN MOTOR VEHICLE PRODUCTION TO DRIVE MARKET

- 4.2 AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION

- FIGURE 18 ASIA PACIFIC PROJECTED TO BE LARGEST MARKET

- 4.3 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION

- FIGURE 19 ICE ESTIMATED TO BE LARGER SEGMENT OF MARKET (USD MILLION)

- 4.4 AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE + EV)

- FIGURE 20 EXHAUST GAS HEAT EXCHANGER TO BE LARGEST SEGMENT OF MARKET (USD MILLION)

- 4.5 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN

- FIGURE 21 TUBE FIN TO BE LARGEST SEGMENT OF MARKET (USD MILLION)

- 4.6 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE

- FIGURE 22 HEV EXPECTED TO BE LARGEST SEGMENT OF MARKET IN 2022 (USD MILLION)

- 4.7 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE

- FIGURE 23 PASSENGER CAR EXPECTED TO BE LARGEST SEGMENT OF MARKET, 2022 VS. 2027 (USD MILLION)

- 4.8 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE

- FIGURE 24 CONSTRUCTION EQUIPMENT EXPECTED TO BE LARGER SEGMENT OF MARKET, 2022 VS. 2027 (USD MILLION)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 25 AUTOMOTIVE HEAT EXCHANGER MARKET: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Revival of automotive industry

- FIGURE 26 FOUR MAJOR CHALLENGES AMID COVID-19 CRISIS FOR AUTOMOBILE MANUFACTURERS

- FIGURE 27 GLOBAL ICE VEHICLE SALES & PRODUCTION, 2020 & 2021

- 5.2.1.2 Increase in demand for hybrid and plug-in hybrid vehicles

- FIGURE 28 GLOBAL PHEV CAR STOCK, 2017-2020, BY REGION

- FIGURE 29 GLOBAL PHEV CAR SALES, 2016-2021

- 5.2.1.3 Increasing adoption of HVAC systems in high-end commercial and off-highway vehicles

- TABLE 7 ROAD TRAFFIC DEATH RATES, PER 100,000 POPULATION

- FIGURE 30 DECADE OF ACTION FOR ROAD SAFETY, 2021-2030

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing demand for BEVs

- FIGURE 31 GLOBAL BEV CAR SALES, 2016-2021

- 5.2.2.2 Anticipated decline in sales of ICE vehicles

- FIGURE 32 EV SHIFT AND TARGET OF COUNTRIES AROUND THE WORLD

- TABLE 8 LIST OF OEMS AND TARGET FOR PHASING OUT ICE VEHICLES

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increase in demand for battery thermal management systems

- 5.2.3.2 Advancements in mobility solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Upcoming emission norms pose challenge for EGR and intercoolers

- FIGURE 33 ON-ROAD LIGHT AND HEAVY-DUTY VEHICLE EMISSION REGULATION OUTLOOK

- TABLE 9 AUTOMOTIVE HEAT EXCHANGER MARKET: IMPACT OF MARKET DYNAMICS

- 5.3 TRENDS & DISRUPTIONS IMPACTING MARKET

- FIGURE 34 REVENUE SHIFT DRIVING AUTOMOTIVE HEAT EXCHANGER MARKET

- 5.4 AUTOMOTIVE HEAT EXCHANGER MARKET SCENARIOS (2022-2027)

- FIGURE 35 AUTOMOTIVE HEAT EXCHANGER MARKET - FUTURE TRENDS & SCENARIOS, 2022-2027 (USD MILLION)

- 5.4.1 MOST LIKELY SCENARIO

- TABLE 10 MOST LIKELY SCENARIO, BY REGION, 2022-2027 (USD MILLION)

- 5.4.2 OPTIMISTIC SCENARIO

- TABLE 11 OPTIMISTIC SCENARIO, BY REGION, 2022-2027 (USD MILLION)

- 5.4.3 PESSIMISTIC SCENARIO

- TABLE 12 PESSIMISTIC SCENARIO, BY REGION, 2022-2027 (USD MILLION)

- 5.5 PORTER'S FIVE FORCES

- FIGURE 36 PORTER'S FIVE FORCES: AUTOMOTIVE HEAT EXCHANGER MARKET

- TABLE 13 AUTOMOTIVE HEAT EXCHANGER MARKET: IMPACT OF PORTERS 5 FORCES

- 5.5.1 THREAT OF SUBSTITUTES

- 5.5.2 THREAT OF NEW ENTRANTS

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 BARGAINING POWER OF SUPPLIERS

- 5.5.5 RIVALRY AMONG EXISTING COMPETITORS

- 5.6 AUTOMOTIVE HEAT EXCHANGER MARKET ECOSYSTEM

- FIGURE 37 AUTOMOTIVE HEAT EXCHANGER MARKET: ECOSYSTEM ANALYSIS

- TABLE 14 AUTOMOTIVE HEAT EXCHANGER MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 38 VALUE CHAIN ANALYSIS: AUTOMOTIVE HEAT EXCHANGER MARKET

- 5.8 PRICING ANALYSIS

- FIGURE 39 AVERAGE PRICING OF AUTOMOTIVE HEAT EXCHANGERS IN ASIA PACIFIC, 2022 & 2027

- FIGURE 40 AVERAGE PRICING OF AUTOMOTIVE HEAT EXCHANGERS IN EUROPE, 2022 & 2027

- FIGURE 41 AVERAGE PRICING OF AUTOMOTIVE HEAT EXCHANGERS IN NORTH AMERICA, 2022 & 2027

- FIGURE 42 AVERAGE PRICING OF AUTOMOTIVE HEAT EXCHANGERS IN REST OF THE WORLD, 2022 & 2027

- 5.9 MACROECONOMIC INDICATORS

- 5.9.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- TABLE 15 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2018-2026 (USD BILLION)

- 5.9.2 WORLD MOTOR VEHICLE PRODUCTION STATISTICS, 2020 & 2021

- TABLE 16 WORLD MOTOR VEHICLE PRODUCTION STATISTICS IN 2021 (UNITS)

- TABLE 17 WORLD MOTOR VEHICLE PRODUCTION STATISTICS IN 2020 (UNITS)

- 5.10 PATENT ANALYSIS

- FIGURE 43 PUBLICATION TRENDS (2012-2021)

- 5.11 LEGAL STATUS OF PATENTS (2012-2021)

- FIGURE 44 LEGAL STATUS OF PATENTS FILED FOR AUTOMOTIVE HEAT EXCHANGERS (2012-2021)

- 5.12 TOP PATENT APPLICANTS (2012-2021)

- FIGURE 45 AUTOMOTIVE HEAT EXCHANGERS, BY APPLICANT

- TABLE 18 IMPORTANT PATENT REGISTRATIONS RELATED TO AUTOMOTIVE HEAT EXCHANGER MARKET

- 5.13 CASE STUDY

- TABLE 19 HIETA TECHNOLOGIES LTD: WATER CHARGE AIR COOLER

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 BATTERY THERMAL MANAGEMENT SYSTEM

- 5.14.2 INDIRECT CHARGE AIR COOLING

- FIGURE 46 COOLANT CIRCUIT IN INDIRECT CHARGE AIR

- 5.14.3 LIQUID-COOLED CHARGE AIR COOLERS

- 5.15 TRADE ANALYSIS

- 5.15.1 IMPORT SCENARIO (HS CODE 870891)

- FIGURE 47 IMPORTS, BY KEY COUNTRIES, 2017-2021 (USD MILLION)

- 5.15.2 EXPORT SCENARIO (HS CODE 870891)

- FIGURE 48 EXPORTS, BY KEY COUNTRIES, 2017-2021 (USD MILLION)

- 5.15.3 IMPORT SCENARIO (HS CODE 841520)

- FIGURE 49 IMPORTS, BY KEY COUNTRIES, 2016-2020 (USD MILLION)

- 5.15.4 EXPORT SCENARIO (HS CODE 841520)

- FIGURE 50 EXPORTS, BY KEY COUNTRIES, 2016-2020 (USD MILLION)

- 5.16 REGULATORY OVERVIEW

- TABLE 20 REGULATIONS FOR AUTOMOTIVE HEAT EXCHANGERS

- 5.17 KEY CONFERENCE & EVENTS IN 2022 & 2023

- TABLE 21 AUTOMOTIVE HEAT EXCHANGER MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 22 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

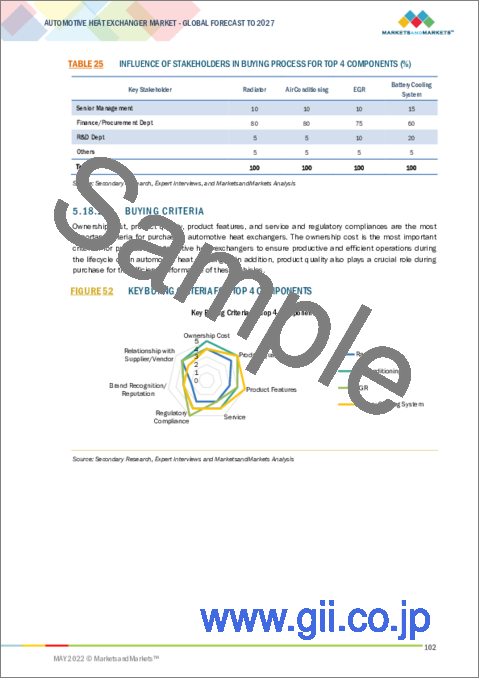

- 5.18 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.18.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 51 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 4 VEHICLE TYPES

- TABLE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 4 COMPONENTS (%)

- 5.18.2 BUYING CRITERIA

- FIGURE 52 KEY BUYING CRITERIA FOR TOP 4 COMPONENTS

- TABLE 26 KEY BUYING CRITERIA FOR TOP 4 COMPONENTS

6 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION & COMPONENT

- 6.1 INTRODUCTION

- FIGURE 53 ICE TO HOLD LARGER MARKET SHARE IN TERMS OF VALUE, 2022-2027

- TABLE 27 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION, 2018-2021 (THOUSAND UNITS)

- TABLE 28 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION, 2022-2027 (THOUSAND UNITS)

- TABLE 29 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION, 2018-2021 (USD MILLION)

- TABLE 30 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION, 2022-2027 (USD MILLION)

- 6.1.1 OPERATIONAL DATA

- TABLE 31 MOTOR VEHICLE SALES, BY VEHICLE TYPE (THOUSAND UNITS)

- 6.1.2 ASSUMPTIONS

- TABLE 32 ASSUMPTIONS: BY PROPULSION TYPE & COMPONENT

- 6.1.3 RESEARCH METHODOLOGY

- 6.2 ICE

- 6.2.1 REVIVAL OF ICE VEHICLE PRODUCTION TO DRIVE SEGMENT

- TABLE 33 ICE HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 34 ICE HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 35 ICE HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 ICE HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.2 ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT

- TABLE 37 ICE HEAT EXCHANGER MARKET, BY COMPONENT, 2018-2021 (THOUSAND UNITS)

- TABLE 38 ICE HEAT EXCHANGER MARKET, BY COMPONENT, 2022-2027 (THOUSAND UNITS)

- TABLE 39 ICE HEAT EXCHANGER MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 40 ICE HEAT EXCHANGER MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.2.3 ENGINE RADIATOR

- 6.2.4 CONDENSER

- 6.2.5 EVAPORATOR

- 6.2.6 OIL COOLER

- 6.2.7 HEATER

- 6.2.8 CHARGE AIR COOLER

- 6.2.9 EXHAUST GAS HEAT EXCHANGER

- 6.3 ELECTRIC VEHICLE (BEV, PHEV, & HEV)

- 6.3.1 GROWING ADOPTION OF ELECTRIC VEHICLES WORLDWIDE TO DRIVE SEGMENT

- TABLE 41 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 42 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 43 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.2 ELECTRIC VEHICLE AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT

- TABLE 45 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY COMPONENT, 2018-2021 (THOUSAND UNITS)

- TABLE 46 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY COMPONENT, 2022-2027 (THOUSAND UNITS)

- TABLE 47 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 48 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.3.3 BATTERY COOLING SYSTEM

- 6.3.4 ENGINE RADIATOR

- 6.3.5 CONDENSER

- 6.3.6 EVAPORATOR

- 6.3.7 OIL COOLER

- 6.3.8 HEATER

- 6.3.9 CHARGE AIR COOLER

- 6.3.10 EXHAUST GAS HEAT EXCHANGER

- 6.4 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN

- 7.1 INTRODUCTION

- FIGURE 54 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN, 2022 VS. 2027 (USD MILLION)

- TABLE 49 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN, 2018-2021 (THOUSAND UNITS)

- TABLE 50 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN, 2022-2027 (THOUSAND UNITS)

- TABLE 51 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN, 2018-2021 (USD MILLION)

- TABLE 52 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN, 2022-2027 (USD MILLION)

- 7.1.1 OPERATIONAL DATA

- TABLE 53 PRODUCT OFFERING BY LEADING HEAT EXCHANGER MANUFACTURERS, BY DESIGN

- 7.1.2 ASSUMPTIONS

- TABLE 54 ASSUMPTIONS: BY DESIGN

- 7.1.3 RESEARCH METHODOLOGY

- 7.2 PLATE BAR

- 7.2.1 INCREASING HCV PRODUCTION TO DRIVE DEMAND

- TABLE 55 PLATE BAR AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 56 PLATE BAR AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 57 PLATE BAR AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 58 PLATE BAR AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 TUBE FIN

- 7.3.1 LOW COST AND SIMPLE DESIGN TO DRIVE DEMAND

- TABLE 59 TUBE FIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 60 TUBE FIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 61 TUBE FIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 62 TUBE FIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 OTHERS

- TABLE 63 OTHER AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 64 OTHER AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 65 OTHER AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 66 OTHER AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.5 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- FIGURE 55 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 67 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 68 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 69 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 70 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 8.1.1 OPERATIONAL DATA

- TABLE 71 GLOBAL PASSENGER CARS AND COMMERCIAL VEHICLES PRODUCTION DATA, 2021 (THOUSAND UNITS)

- 8.1.2 ASSUMPTIONS

- TABLE 72 ASSUMPTIONS: BY VEHICLE TYPE

- 8.1.3 RESEARCH METHODOLOGY

- 8.2 PASSENGER CAR

- 8.2.1 GROWING DEMAND FOR PREMIUM VEHICLES TO DRIVE SEGMENT

- TABLE 73 PASSENGER CAR AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 74 PASSENGER CAR AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 75 PASSENGER CAR AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 76 PASSENGER CAR AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 LIGHT COMMERCIAL VEHICLE

- 8.3.1 STRINGENT ENVIRONMENTAL REGULATIONS TO DRIVE SEGMENT

- TABLE 77 LIGHT COMMERCIAL VEHICLES HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 78 LIGHT COMMERCIAL VEHICLES HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 79 LIGHT COMMERCIAL VEHICLES HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 80 LIGHT COMMERCIAL VEHICLES HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 TRUCK

- 8.4.1 STRONG ROAD TRANSPORTATION SECTOR ACROSS THE GLOBE TO DRIVE SEGMENT

- FIGURE 56 US SHIPMENT OF GOODS

- TABLE 81 TRUCK HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 82 TRUCK HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 83 TRUCK HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 84 TRUCK HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.5 BUS

- 8.5.1 HIGH DEPENDENCY OF PEOPLE ON PUBLIC TRANSPORT TO DRIVE SEGMENT

- TABLE 85 BUS HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 86 BUS HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 87 BUS HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 88 BUS HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.6 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE

- 9.1 INTRODUCTION

- FIGURE 57 BEV SEGMENT TO HOLD LARGEST MARKET SHARE, BY VALUE, BY 2027 (USD MILLION)

- TABLE 89 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 90 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 91 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 92 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE, 2022-2027 (USD MILLION)

- 9.1.1 OPERATIONAL DATA

- TABLE 93 ELECTRIC VEHICLE SALES, BY PROPULSION TYPE, 2018-2021 (THOUSAND UNITS)

- 9.1.2 ASSUMPTIONS

- TABLE 94 ASSUMPTIONS: BY ELECTRIC VEHICLE TYPE

- 9.1.3 RESEARCH METHODOLOGY

- 9.2 BEV

- 9.2.1 INCREASING NEED FOR EMISSION-FREE VEHICLES TO DRIVE SEGMENT

- TABLE 95 BEV HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 96 BEV HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 97 BEV HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 98 BEV HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 99 BEV HEAT EXCHANGER MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 100 BEV HEAT EXCHANGER MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 9.3 HEV

- 9.3.1 LIMITED DEPENDENCY ON CHARGING INFRASTRUCTURE TO DRIVE SEGMENT

- TABLE 101 HEV HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 102 HEV HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 103 HEV HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 104 HEV HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 105 HEV HEAT EXCHANGER MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 106 HEV HEAT EXCHANGER MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 9.4 PHEV

- 9.4.1 TAX BENEFITS AND INCENTIVES FROM GOVERNMENTS TO DRIVE SEGMENT

- TABLE 107 PHEV HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 108 PHEV HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 109 PHEV HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 110 PHEV HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 111 PHEV HEAT EXCHANGER MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 112 PHEV HEAT EXCHANGER MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 9.5 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE TYPE

- 10.1 INTRODUCTION

- FIGURE 58 CONSTRUCTION EQUIPMENT TO HOLD LARGER MARKET SHARE IN TERMS OF VALUE, 2022 VS. 2027

- TABLE 113 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 114 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS )

- TABLE 115 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 116 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 10.1.1 ASSUMPTIONS

- TABLE 117 ASSUMPTIONS: BY OFF-HIGHWAY VEHICLE TYPE

- 10.1.2 RESEARCH METHODOLOGY FOR OFF-HIGHWAY VEHICLE TYPE SEGMENT

- 10.2 AGRICULTURAL EQUIPMENT

- 10.2.1 STRONG TRACTOR SALES IN 2021 TO DRIVE SEGMENT

- TABLE 118 AGRICULTURAL EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 119 AGRICULTURAL EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 120 AGRICULTURAL EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 121 AGRICULTURAL EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- 10.3 CONSTRUCTION EQUIPMENT

- 10.3.1 GROWING INFRASTRUCTURAL ACTIVITIES IN ASIA PACIFIC TO DRIVE SEGMENT

- TABLE 122 CONSTRUCTION EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 123 CONSTRUCTION EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 124 CONSTRUCTION EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 125 CONSTRUCTION EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- 10.4 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 59 AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY REGION, 2022 VS. 2027

- TABLE 126 AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 127 AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 128 AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 129 AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY REGION, 2022-2027 (USD MILLION)

- 11.2 ASIA PACIFIC

- FIGURE 60 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET SNAPSHOT

- TABLE 130 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE + EV), 2018-2021 (USD MILLION)

- TABLE 131 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE + EV), 2022-2027 (USD MILLION)

- TABLE 132 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2018-2021 (THOUSAND UNITS)

- TABLE 133 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2022-2027 (THOUSAND UNITS)

- TABLE 134 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2018-2021 (USD MILLION)

- TABLE 135 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2022-2027 (USD MILLION)

- TABLE 136 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 137 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY COUNTRY, 2022-2027 (THOUSAND UNITS)

- TABLE 138 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 139 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY COUNTRY, 2022-2027 (USD MILLION)

- 11.2.1 CHINA

- 11.2.1.1 Growing passenger vehicle demand to drive market

- TABLE 140 CHINA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 141 CHINA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 142 CHINA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 143 CHINA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.2.2 INDIA

- 11.2.2.1 Growth in vehicle sales across categories to drive market

- TABLE 144 INDIA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 145 INDIA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 146 INDIA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 147 INDIA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.2.3 JAPAN

- 11.2.3.1 Presence of major automobile manufacturers to drive market

- TABLE 148 JAPAN: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 149 JAPAN: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 150 JAPAN: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 151 JAPAN: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Increasing demand for passenger cars to drive market

- TABLE 152 SOUTH KOREA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 153 SOUTH KOREA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 154 SOUTH KOREA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 155 SOUTH KOREA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.2.5 REST OF ASIA PACIFIC

- TABLE 156 REST OF ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 157 REST OF ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 158 REST OF ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.3 EUROPE

- FIGURE 61 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY

- TABLE 160 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE + EV), 2018-2021 (USD MILLION)

- TABLE 161 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE + EV), 2022-2027 (USD MILLION)

- TABLE 162 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2018-2021 (THOUSAND UNITS)

- TABLE 163 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2022-2027 (THOUSAND UNITS)

- TABLE 164 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2018-2021 (USD MILLION)

- TABLE 165 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2022-2027 (USD MILLION)

- TABLE 166 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 167 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2027 (THOUSAND UNITS)

- TABLE 168 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 169 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.3.1 FRANCE

- 11.3.1.1 High production of passenger cars and LCVs to drive market

- TABLE 170 FRANCE: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 171 FRANCE: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 172 FRANCE: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 173 FRANCE: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Emission norms and shift toward BEVs & PHEVs to drive market

- TABLE 174 GERMANY: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 175 GERMANY: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 176 GERMANY: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 177 GERMANY: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.3.3 ITALY

- 11.3.3.1 Growth in automotive production to drive market

- TABLE 178 ITALY: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 179 ITALY: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 180 ITALY: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 181 ITALY: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.3.4 SPAIN

- 11.3.4.1 Demand for heavy trucks to drive market

- TABLE 182 SPAIN: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 183 SPAIN: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 184 SPAIN: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 185 SPAIN: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.3.5 UK

- 11.3.5.1 Demand for premium passenger cars to drive market

- TABLE 186 UK: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 187 UK: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 188 UK: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 189 UK: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.3.6 REST OF EUROPE

- TABLE 190 REST OF EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 191 REST OF EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 192 REST OF EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 193 REST OF EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- FIGURE 62 TURKEY AUTOMOTIVE INDUSTRY SNAPSHOT

- 11.4 NORTH AMERICA

- FIGURE 63 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET SNAPSHOT

- TABLE 194 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE + EV), 2018-2021 (USD MILLION)

- TABLE 195 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE + EV), 2022-2027 (USD MILLION)

- TABLE 196 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2018-2021 (THOUSAND UNITS)

- TABLE 197 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2022-2027 (THOUSAND UNITS)

- TABLE 198 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2018-2021 (USD MILLION)

- TABLE 199 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2022-2027 (USD MILLION)

- TABLE 200 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 201 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2027 (THOUSAND UNITS)

- TABLE 202 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 203 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.4.1 CANADA

- 11.4.1.1 Emission regulations to drive market

- TABLE 204 CANADA: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY VEHICLE TYPE, 2018-2021(THOUSAND UNITS)

- TABLE 205 CANADA: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 206 CANADA: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 207 CANADA: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.4.2 MEXICO

- 11.4.2.1 Stringent emission norms to drive market

- TABLE 208 MEXICO: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 209 MEXICO: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 210 MEXICO: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 211 MEXICO: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.4.3 US

- 11.4.3.1 Growth in vehicle production to drive market

- TABLE 212 US: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 213 US: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 214 US: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 215 US: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.5 REST OF THE WORLD

- FIGURE 64 REST OF THE WORLD: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

- TABLE 216 REST OF THE WORLD AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2018-2021 (THOUSAND UNITS)

- TABLE 217 REST OF THE WORLD AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2022-2027 (THOUSAND UNITS)

- TABLE 218 REST OF THE WORLD AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2018-2021 (USD MILLION)

- TABLE 219 REST OF THE WORLD AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT (ICE), 2022-2027 (USD MILLION)

- TABLE 220 REST OF THE WORLD: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 221 REST OF THE WORLD: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY COUNTRY, 2022-2027 (THOUSAND UNITS)

- TABLE 222 REST OF THE WORLD: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 223 REST OF THE WORLD: AUTOMOTIVE HEAT EXCHANGER MARKET (ICE), BY COUNTRY, 2022-2027 (USD MILLION)

- 11.5.1 BRAZIL

- 11.5.1.1 Robust demand for passenger cars and LCVs to drive market

- TABLE 224 BRAZIL: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 225 BRAZIL: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 226 BRAZIL: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 227 BRAZIL: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.5.2 RUSSIA

- 11.5.2.1 Decline in vehicle production and heavy economic sanctions to hamper market

- TABLE 228 RUSSIA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 229 RUSSIA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 230 RUSSIA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 231 RUSSIA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Presence of key OEMs and demand for passenger cars to drive market

- TABLE 232 SOUTH AFRICA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 233 SOUTH AFRICA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 234 SOUTH AFRICA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 235 SOUTH AFRICA: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 11.5.4 OTHERS

- TABLE 236 OTHERS: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 237 OTHERS: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 238 OTHERS: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 239 OTHERS: AUTOMOTIVE HEAT EXCHANGER MARKET SIZE (ICE), BY VEHICLE TYPE, 2022-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 REVENUE ANALYSIS OF TOP COMPANIES

- FIGURE 65 5-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN AUTOMOTIVE HEAT EXCHANGER MARKET

- 12.3 MARKET SHARE ANALYSIS

- TABLE 240 AUTOMOTIVE HEAT EXCHANGER MARKET: DEGREE OF COMPETITION

- 12.4 COMPETITIVE SCENARIO

- 12.4.1 DEALS

- TABLE 241 DEALS, 2018-2021

- 12.4.2 NEW PRODUCT LAUNCHES

- TABLE 242 NEW PRODUCT LAUNCHES, 2018-2021

- 12.4.3 OTHERS, 2018-2021

- TABLE 243 EXPANSIONS, 2018-2021

- 12.5 COMPANY EVALUATION QUADRANT FOR AUTOMOTIVE HEAT EXCHANGER MARKET

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE

- 12.5.4 PARTICIPANTS

- FIGURE 66 AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY EVALUATION QUADRANT, 2021

- TABLE 244 AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY FOOTPRINT, 2021

- TABLE 245 AUTOMOTIVE HEAT EXCHANGER MARKET: PRODUCT TYPE FOOTPRINT, 2021

- TABLE 246 AUTOMOTIVE HEAT EXCHANGER MARKET: REGIONAL FOOTPRINT, 2021

- 12.6 COMPETITIVE EVALUATION QUADRANT, SME PLAYERS

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 67 AUTOMOTIVE HEAT EXCHANGER MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SME, 2021

- 12.7 RIGHT TO WIN, 2018-2021

- TABLE 247 RIGHT TO WIN, 2018-2021

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business overview, Products offered, Recent Developments, MNM view)**

- 13.1.1 DENSO CORPORATION

- TABLE 248 DENSO CORPORATION: BUSINESS OVERVIEW

- FIGURE 68 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 DENSO CORPORATION'S SHAREHOLDERS (2020)

- TABLE 249 DENSO CORPORATION: KEY CUSTOMERS

- TABLE 250 DENSO CORPORATION: SALES BREAKDOWN BY OEM

- TABLE 251 DENSO CORPORATION: MAJOR SUBSIDIARIES AND AFFILIATES

- TABLE 252 DENSO CORPORATION: PRODUCTS OFFERED

- TABLE 253 DENSO CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 254 DENSO CORPORATION: OTHERS

- 13.1.2 VALEO

- TABLE 255 VALEO: BUSINESS OVERVIEW

- FIGURE 70 VALEO: COMPANY SNAPSHOT

- FIGURE 71 VALEO: ORIGINAL EQUIPMENT SALES BY CUSTOMER PORTFOLIO (2021)

- TABLE 256 VALEO: PRODUCTS OFFERED

- TABLE 257 VALEO: KEY CUSTOMERS

- TABLE 258 VALEO: MAJOR SUPPLY AGREEMENTS

- TABLE 259 VALEO: BUSINESS GROUPS WITH MAJOR COMPETITORS

- TABLE 260 VALEO: NEW PRODUCT DEVELOPMENTS

- TABLE 261 VALEO: DEALS

- TABLE 262 VALEO: OTHERS

- 13.1.3 DANA INCORPORATED

- TABLE 263 DANA INCORPORATED: BUSINESS OVERVIEW

- FIGURE 72 DANA INCORPORATED: COMPANY SNAPSHOT

- FIGURE 73 DANA INCORPORATED: CUSTOMER SALES SNAPSHOT (2020)

- TABLE 264 DANA INCORPORATED: PRODUCTS OFFERED

- TABLE 265 DANA INCORPORATED: KEY CUSTOMERS

- TABLE 266 DANA INCORPORATED: MAJOR SUPPLY AGREEMENTS

- TABLE 267 DANA INCORPORATED: COMPETITORS

- TABLE 268 DANA INCORPORATED: NUMBER OF MANUFACTURING AND DISTRIBUTION FACILITIES, AS OF DECEMBER 31, 2020

- TABLE 269 DANA INCORPORATED: DEALS

- TABLE 270 DANA INCORPORATED: OTHERS

- 13.1.4 MAHLE GMBH

- TABLE 271 MAHLE GMBH: BUSINESS OVERVIEW

- FIGURE 74 DUAL STRATEGY FOLLOWED BY MAHLE GMBH

- FIGURE 75 MAHLE GMBH: COMPANY SNAPSHOT

- TABLE 272 MAHLE GMBH: PRODUCTS OFFERED

- TABLE 273 MAHLE GMBH: KEY CUSTOMERS

- TABLE 274 MAHLE GMBH: MAJOR SUPPLY AGREEMENTS

- TABLE 275 MAHLE GMBH: NEW PRODUCT DEVELOPMENTS

- TABLE 276 MAHLE GMBH: DEALS

- TABLE 277 MAHLE GMBH: OTHERS

- 13.1.5 HANON SYSTEMS

- TABLE 278 HANON SYSTEMS: BUSINESS OVERVIEW

- FIGURE 76 HANON SYSTEMS: COMPANY SNAPSHOT

- TABLE 279 HANON SYSTEMS: PRODUCTS OFFERED

- TABLE 280 HANON SYSTEMS: KEY CUSTOMERS

- TABLE 281 HANON SYSTEMS: MAJOR SUPPLY AGREEMENTS

- TABLE 282 HANON SYSTEMS: NEW PRODUCT DEVELOPMENTS:

- TABLE 283 HANON SYSTEMS: DEALS

- TABLE 284 HANON SYSTEMS: OTHERS

- 13.1.6 MARELLI CORPORATION

- TABLE 285 MARELLI CORPORATION: BUSINESS OVERVIEW

- TABLE 286 MARELLI CORPORATION: PRODUCTS OFFERED

- TABLE 287 MARELLI CORPORATION: KEY CUSTOMERS

- TABLE 288 MARELLI CORPORATION: MAJOR SUPPLY AGREEMENTS

- TABLE 289 MARELLI CORPORATION: MAJOR AREAS OF R&D

- TABLE 290 MARELLI CORPORATION: NEW PRODUCT DEVELOPMENTS:

- TABLE 291 MARELLI CORPORATION: DEALS

- TABLE 292 MARELLI CORPORATION: OTHERS

- 13.1.7 SANDEN CORPORATION

- TABLE 293 SANDEN CORPORATION: BUSINESS OVERVIEW

- FIGURE 77 SANDEN CORPORATION: COMPANY SNAPSHOT

- TABLE 294 SANDEN CORPORATION: PRODUCTS OFFERED

- TABLE 295 SANDEN CORPORATION: KEY CUSTOMERS

- TABLE 296 SANDEN CORPORATION: MAJOR SUPPLY AGREEMENTS

- TABLE 297 SANDEN CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 298 SANDEN CORPORATION: DEALS

- TABLE 299 SANDEN CORPORATION: OTHER DEVELOPMENTS

- 13.1.8 T.RAD CO. LTD.

- TABLE 300 T.RAD CO. LTD.: BUSINESS OVERVIEW

- FIGURE 78 T.RAD CO. LTD.: COMPANY SNAPSHOT

- TABLE 301 T.RAD CO. LTD.: PRODUCT RANGE OFFERED

- TABLE 302 T.RAD CO. LTD.: DEALS

- TABLE 303 T.RAD CO. LTD.: OTHER DEVELOPMENTS

- 13.1.9 AKG GROUP

- TABLE 304 AKG GROUP: BUSINESS OVERVIEW

- TABLE 305 AKG GROUP: PRODUCTS OFFERED

- TABLE 306 AKG GROUP: DEVELOPMENTS

- 13.1.10 NIPPON LIGHT METAL HOLDINGS COMPANY, LTD.

- TABLE 307 NIPPON LIGHT METAL HOLDINGS COMPANY, LTD.: BUSINESS OVERVIEW

- FIGURE 79 NIPPON LIGHT METAL HOLDINGS COMPANY, LTD.: COMPANY SUBSIDIARIES

- FIGURE 80 NIPPON LIGHT METAL HOLDINGS COMPANY, LTD.: COMPANY SNAPSHOT

- TABLE 308 NIPPON LIGHT METAL HOLDINGS COMPANY, LTD.: PRODUCTS OFFERED

- 13.1.11 MODINE MANUFACTURING COMPANY

- TABLE 309 MODINE MANUFACTURING COMPANY: BUSINESS OVERVIEW

- FIGURE 81 MODINE MANUFACTURING COMPANY: COMPANY SNAPSHOT

- TABLE 310 MODINE MANUFACTURING COMPANY: PRODUCTS OFFERED

- TABLE 311 MODINE MANUFACTURING COMPANY: DEALS

- TABLE 312 MODINE MANUFACTURING COMPANY: OTHERS

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 13.2 OTHER KEY PLAYERS

- 13.2.1 CLIZEN INC.

- TABLE 313 CLIZEN INC.: BUSINESS OVERVIEW

- 13.2.2 SM AUTO ENGINEERING PVT LTD.

- TABLE 314 SM AUTO ENGINEERING PVT LTD.: BUSINESS OVERVIEW

- 13.2.3 GRIFFIN THERMAL PRODUCTS

- TABLE 315 GRIFFIN THERMAL PRODUCTS: BUSINESS OVERVIEW

- 13.2.4 BANCO PRODUCTS (INDIA) LTD.

- TABLE 316 BANCO PRODUCTS (INDIA) LTD.: BUSINESS OVERVIEW

- 13.2.5 NISSENS AUTOMOTIVE A/S

- TABLE 317 NISSENS AUTOMOTIVE A/S: BUSINESS OVERVIEW

- 13.2.6 G&M RADIATOR

- TABLE 318 G&M RADIATOR: BUSINESS OVERVIEW

- 13.2.7 SENIOR PLC

- TABLE 319 SENIOR PLC: BUSINESS OVERVIEW

- 13.2.8 BORGWARNER INC.

- TABLE 320 BORGWARNER INC.: BUSINESS OVERVIEW

- 13.2.9 SWAMI VESSELS PRIVATE LIMITED

- TABLE 321 SWAMI VESSELS PRIVATE LIMITED: BUSINESS OVERVIEW

- 13.2.10 CLIMETAL S.L.

- TABLE 322 CLIMETAL S.L.: BUSINESS OVERVIEW

- 13.2.11 TYC BROTHER INDUSTRIAL CO., LTD.

- TABLE 323 TYC BROTHER INDUSTRIAL CO., LTD.: BUSINESS OVERVIEW

14 RECOMMENDATIONS BY MARKETSANDMARKETS

- 14.1 ASIA PACIFIC TO DOMINATE AUTOMOTIVE HEAT EXCHANGER MARKET

- 14.2 CHINA AND INDIA WILL BE PROMISING MARKETS FOR MANUFACTURERS IN COMING YEARS

- 14.3 BEV TO EMERGE AS FASTEST-GROWING SEGMENT

- 14.4 CONCLUSION

15 APPENDIX

- 15.1 KEY INSIGHTS OF INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 15.4 AVAILABLE CUSTOMIZATIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS