|

|

市場調査レポート

商品コード

1109068

農業用噴霧器の世界市場:種類別 (自走式、トラクター搭載式、牽引式、ハンドヘルド式、空中)・容量別・農場の規模別・作物の種類別・ノズルの種類別・用途別・動力源別 (燃料式、電動式・バッテリー駆動式、手動式、ソーラー式)・地域別の将来予測 (2027年)Agricultural Sprayers Market by Type (Self-propelled, Tractor-mounted, Trailed, Handheld, Aerial), Capacity, Farm Size, Crop Type, Nozzle Type, Usage, Power Source (Fuel-based, Electric & Battery-driven, Manual, Solar), & Region -Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 農業用噴霧器の世界市場:種類別 (自走式、トラクター搭載式、牽引式、ハンドヘルド式、空中)・容量別・農場の規模別・作物の種類別・ノズルの種類別・用途別・動力源別 (燃料式、電動式・バッテリー駆動式、手動式、ソーラー式)・地域別の将来予測 (2027年) |

|

出版日: 2022年07月29日

発行: MarketsandMarkets

ページ情報: 英文 297 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

農業用噴霧器の世界市場は、2022年に25億米ドルと推定されています。

2027年には35億米ドルに達すると予測され、予測期間中に6.8%のCAGRを記録しています。近年、農業用噴霧器は農家や生産者が必要に応じて収穫期に肥料・除草剤・殺虫剤を散布するために重要となっています。技術開発は、農家が効果的な方法で化学物質を適用することを可能にします。したがって、農業用噴霧器の市場は、農業技術や技術的な採用の変化のために勢いを得ています。さらに、農業の効率性と生産性、アジア諸国の穀物生産の増加、近代的な農業の方法論に向かって政府の支援の重要性の高まりは、農業用噴霧器の市場成長を促進する重要な要因のいくつかです。

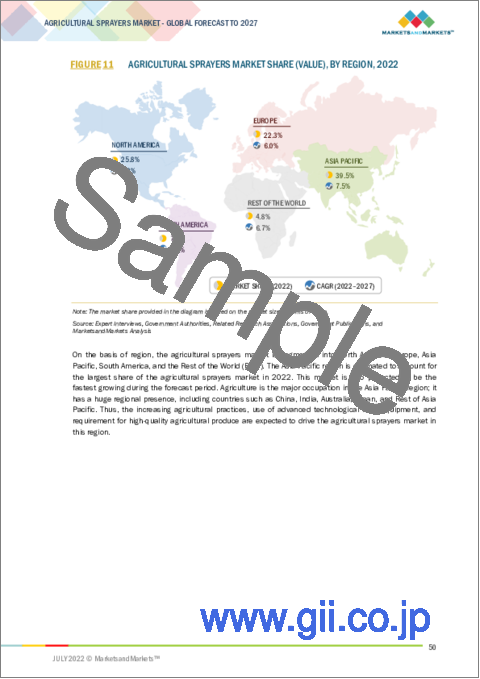

"アジア太平洋は、予測期間中に7.5%の成長を遂げる"

新興国では農産物市場が急速に変化しており、国際基準に向けてますます開放的で均質化されています。インド、オーストラリア、日本など、アジア太平洋地域の国々は伝統的な農業国です。これらの国々は近代的な農業技術を採用し、新しい流通チャネルと一緒にトラクターに取り付けられた噴霧器などの機器は、アジア太平洋地域の農業用噴霧器市場を煽っています。

"自走式農業用噴霧器が金額ベースで全体の38.6%のシェアを占め、市場を独占している"

最も使用されている噴霧器の1つである自走式噴霧器は、使いやすく、ノズルの種類や高さ調節の面で大きな柔軟性を提供します。自走式噴霧器は、農作物の大量生産に対応するために利用されています。自走式噴霧器は、タンクサイズを選択することができ、農場の規模に応じてタンクサイズを増減させることができます。農場を広くカバーする装置の需要の高まりは、近い将来、自走式農業用噴霧器を牽引すると予想されます。

"大規模農家における空中散布機の用途拡大が市場成長の原動力となる"

大型機械に投資する余裕のある大規模農場では、耕起や植え付け作業を迅速に行うことで、土壌水分の機会にうまく対応することができます。ハンドヘルド噴霧器は大規模農家で使用するには速度が遅く、効率も悪いです。そこで、大規模農家や農業協同組合では、空中散布機が好まれています。この噴霧器なら、広い農地の表面にも簡単に、しかも最小限の労力で噴霧することができます。また、大規模農家の収穫量を効率的に管理するために、各メーカーはさまざまな空中散布機を導入しています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- マクロ経済指標

- 耕地需要の増加

- 市場力学

第6章 産業動向

- イントロダクション

- バリューチェーン分析

- 原材料

- 研究開発

- 製造

- 流通、マーケティング・販売、エンドユーザー

- 技術分析

- 可変作業技術 (VRT)

- 磁気スプレー

- 人工知能・IoT

- 価格分析

- 平均販売価格の動向分析

- 平均販売価格の動向分析:容量別

- 特許分析

- マーケットマップ

- 関税・規制状況

- ケーススタディ分析

- 主な利害関係者と購入基準

第7章 農業用噴霧器市場:ノズルの種類別

- イントロダクション

- 油圧ノズル

- ガスノズル

- 遠心ノズル

- サーマルノズル

第8章 農業用噴霧器市場:種類別

- イントロダクション

- 自走式

- トラクター搭載式

- 牽引式

- ハンドヘルド式

- 空中噴霧器

第9章 農業用噴霧器市場:動力源別

- イントロダクション

- 燃料式

- 電動式・バッテリー駆動式

- 手動式

- ソーラー式

第10章 農業用噴霧器市場:容量別

- イントロダクション

- 小音量

- 大音量

- 超小容量

第11章 農業用噴霧器市場:農場の規模別

- イントロダクション

- 中規模

- 大規模

- 小規模

第12章 農業用噴霧器市場:作物の種類別

- イントロダクション

- 穀物

- トウモロコシ

- 小麦

- その他の穀物

- 油糧種子

- 大豆

- 菜種・キャノーラ

- ヒマワリ・綿実

- その他の油糧種子

- 果物・野菜

- 他の種類の作物

第13章 農業用噴霧器市場:用途別

- イントロダクション

- 畑地向け噴霧器

- 果樹園向け噴霧器

第14章 農業用噴霧器市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- タイ

- 他のアジア太平洋諸国

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- フランス

- ドイツ

- ロシア

- スペイン

- 英国

- イタリア

- 他の欧州諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 他の国々 (RoW)

- 中東

- アフリカ

第15章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の戦略

- 主要企業の収益分析:セグメント別

- 企業評価クアドラント (主要企業)

- 農業用噴霧器市場:スタートアップ/中小企業の評価クアドラント

- 製品発売・資本取引・その他の動向

第16章 企業プロファイル

- 主要企業

- JOHN DEERE

- CNH INDUSTRIAL N.V.

- KUBOTA CORPORATION

- MAHINDRA & MAHINDRA LTD.

- STIHL

- AGCO CORPORATION

- YAMAHA MOTOR CORPORATION

- BUCHER INDUSTRIES AG

- DJI

- EXEL INDUSTRIES

- AMAZONEN-WERKE

- BGROUP S.P.A

- CASE IH

- H.D. HUDSON MANUFACTURING CO.

- BUHLER INDUSTRIES INC.

- AMERICAN SPRING & PRESSING WORKS PVT. LTD.

- AGRO CHEM INC.

- H & H FARM MACHINE CO.

- AG SPRAY EQUIPMENT, INC.

- EQUIPMENT TECHNOLOGIES

- その他の企業

- 3THI ROBOTICS PRIVATE LIMITED

- FUSITE CO. LTD.

- NEPTUNE SPRAYERS

- HYLIO

- GANPATHY AGRO INDUSTRIES

第17章 隣接市場

- イントロダクション

- 制限事項

- 農業用ポンプ市場

- 農業用VRT (可変作業技術) 市場

第18章 付録

The global Agricultural sprayers is estimated at USD 2.5 Billion in 2022. It is projected to reach USD 3.5 Billion by 2027, recording a CAGR of 6.8% during the forecast period. Farming equipment are essential to enhance crop yield and cut down the labor cost. Over the past few years, Agricultural sprayers have become important for farmers or growers for spraying fertilizers, herbicides, and pesticides during the harvest time as per the need. Technological developments permit farmers to apply chemicals in an effective manner. Therefore, the market for agricultural sprayers has gained a momentum because change in farming techniques and technological adoption. Furthermore, growing importance on farm efficiency and productivity, increasing production of cereals & grains in Asian countries, and government support toward modern agricultural methodologies are some of the important factors driving the agricultural sprayers market growth.

"Asia Pacific is projected to witness the growth of 7.5% during the forecast period."

In developing economies, the markets for agri-food products are rapidly changing, becoming increasingly open and homogenized toward international standards. Countries in Asia Pacific such as India, Australia, Japan, and others are traditional agricultural countries. These countries are adopting modern farming techniques and equipment such as tractor mounted sprayers along with new distribution channels are fueling the agricultural sprayers market in the Asia-Pacific region.

"Self-propelled agricultural sprayers dominate the market with 38.6% of total market share in value."

One of the most used types of sprayers, self-propelled sprayers are easy to use and offers great flexibility in terms of nozzle types and height adjustment. Self-propelled sprayers are utilized to attain the large-scale productivity demand of crops. Self-propelled sprayers are attached with a selectable tank size, which can be increased or decreased depending on the farm size. The growing demand for wide coverage equipment on farms is anticipated to drive the self-propelled agricultural sprayers in near future.

"Growing application of aerial sprayers in large-sized farms to drive the market growth"

larger farms that can afford to invest in large machinery can respond to soil moisture opportunities better by undertaking tillage and planting operations promptly. Handheld sprayers work with low pressures. This low pressure makes them slow and inefficient enough to use on large farms. Therefore, large-scale farmers and farming cooperation's prefer aerial sprayers. These sprayers easily manage to spray on large farm surfaces with minimal effort. Additionally, manufacturers are introducing various aerial sprayers to effectively manage the crop yield of farmers with large-size farms. In December 2021, China-based one of the key players in drone and camera technology Da-Jiang Innovation (DJI) unveiled agriculture drone DJI AGRAS T20 that offers enhanced spraying system for greater crop efficacy

Break-up of Primaries:

- By Company Type: Tier 1 - 34.0%, Tier 2- 46.0%, Tier 3 - 20.0%

- By Designation: Director - 40.0%, CXOs - 30.0%, and Others- 30.0%

- By Region: North America - 45%, Europe - 30%, Asia Pacific - 20%, and RoW - 5%

Leading players profiled in this report:

- John Deere (US)

- CNH Industrial N.V. (UK)

- Kubota Corporation (Japan)

- Mahindra & Mahindra Ltd. (India)

- STIHL (Germany)

- AGCO Corporation (US)

- Yamaha Motor Corp. (Japan)

- Bucher Industries AG (Switzerland)

- EXEL Industries (France)

Research Coverage:

The report segments the agricultural sprayers market on the basis of type, farm size, nozzle type, power source, capacity, crop type, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global agricultural sprayers, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the agricultural sprayers market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the agricultural sprayers market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- TABLE 1 AGRICULTURAL SPRAYERS MARKET: INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2018-2021

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AGRICULTURAL SPRAYERS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 AGRICULTURAL SPRAYERS MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

- FIGURE 4 AGRICULTURAL SPRAYERS MARKET SIZE ESTIMATION (DEMAND-SIDE)

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 7 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.4.1 ASSUMPTIONS

- 2.4.2 LIMITATIONS AND RISK ASSESSMENTS

3 EXECUTIVE SUMMARY

- TABLE 3 AGRICULTURAL SPRAYERS MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 8 AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 AGRICULTURAL SPRAYERS MARKET SHARE (VALUE), BY FARM SIZE, 2022 VS. 2027

- FIGURE 10 AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 AGRICULTURAL SPRAYERS MARKET SHARE (VALUE), BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES IN AGRICULTURAL SPRAYERS MARKET

- FIGURE 12 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN AGRICULTURAL SPRAYERS MARKET

- 4.2 AGRICULTURAL SPRAYERS MARKET: KEY COUNTRIES, 2021

- FIGURE 13 INDIA EXPECTED TO GROW AT HIGHEST RATE

- 4.3 AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE & REGION, 2021

- FIGURE 14 CEREAL CROPS SEGMENT DOMINATED MARKET IN 2021

- 4.4 AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022 VS. 2027

- FIGURE 15 SELF-PROPELLED SEGMENT EXPECTED TO DOMINATE MARKET IN 2022

- 4.5 AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022 VS. 2027

- FIGURE 16 FUEL-BASED SEGMENT EXPECTED TO DOMINATE MARKET IN 2022

- 4.6 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY & COUNTRY, 2021

- FIGURE 17 CHINA EXPECTED ACCOUNTED FOR LARGEST SHARE IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INCREASE IN DEMAND FOR ARABLE LAND

- TABLE 4 LAND WITH RAINFED CROP PRODUCTION POTENTIAL, BY REGION/GROUP, 2018

- 5.3 MARKET DYNAMICS

- FIGURE 18 MARKET DYNAMICS: AGRICULTURAL SPRAYERS

- 5.3.1 DRIVERS

- 5.3.1.1 Increasing focus on farm efficiency and productivity

- 5.3.1.2 Increase in farm size

- 5.3.1.3 Government support for modern agricultural techniques

- 5.3.1.4 Increase in mechanization of agricultural activities

- FIGURE 19 LEVEL OF MECHANIZATION OF AGRICULTURE, BY COUNTRY, 2018

- 5.3.2 RESTRAINTS

- 5.3.2.1 High capital investments in modern agricultural equipment

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Growth in precision and other modern farming practices

- 5.3.3.2 Growth of agriculture in developing economies

- FIGURE 20 ASIA: GROSS AGRICULTURE PRODUCTION INDEX, 2015-2018

- 5.3.4 CHALLENGES

- 5.3.4.1 Risks associated with spray drift

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 21 AGRICULTURAL SPRAYERS MARKET: VALUE CHAIN ANALYSIS

- 6.2.1 RAW MATERIALS

- 6.2.2 RESEARCH & DEVELOPMENT

- 6.2.3 MANUFACTURING

- 6.2.4 DISTRIBUTION, MARKETING & SALES, AND END USERS

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 VARIABLE RATE TECHNOLOGY

- 6.3.2 MAGNETIC SPRAYING

- 6.3.3 ARTIFICIAL INTELLIGENCE AND IOT

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE FOR AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD PER UNIT)

- 6.4.2 AVERAGE SELLING PRICE TREND ANALYSIS, BY CAPACITY

- FIGURE 23 AVERAGE SELLING PRICE FOR AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (USD PER UNIT)

- 6.5 PATENT ANALYSIS

- FIGURE 24 PATENTS GRANTED FOR AGRICULTURAL SPRAYERS MARKET, 2011-2021

- FIGURE 25 REGIONAL ANALYSIS OF PATENTS GRANTED FOR AGRICULTURAL SPRAYERS MARKET, 2011-2021

- TABLE 5 KEY PATENTS PERTAINING TO AGRICULTURAL SPRAYERS MARKET, 2019-2022

- 6.6 MARKET MAP

- 6.6.1 MARKET MAP

- FIGURE 26 AGRICULTURAL SPRAYERS MARKET: MARKET MAP

- TABLE 6 AGRICULTURAL SPRAYERS MARKET ECOSYSTEM

- 6.7 TARIFF AND REGULATORY LANDSCAPE

- 6.7.1 REGULATORY FRAMEWORKS

- 6.7.1.1 Asia Pacific

- 6.7.1.2 North America

- 6.7.1.3 Europe

- 6.7.1.4 South America

- 6.7.1.5 Rest of the World

- 6.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.7.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- FIGURE 27 REVENUE SHIFT FOR AGRICULTURAL SPRAYERS MARKET

- 6.7.1 REGULATORY FRAMEWORKS

- 6.8 CASE STUDY ANALYSIS

- 6.8.1 ARABLE CROP SPRAYER TECHNOLOGY DELIVERING NOVEL TECHNOLOGY AND SYSTEMS

- 6.8.2 VARIABLE-RATE AGRICULTURE BY AGCO USING INTERNET OF THINGS TECHNOLOGY

- 6.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING AGRICULTURAL SPRAYERS FOR DIFFERENT FARM SIZES

- TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING AGRICULTURAL SPRAYERS FOR DIFFERENT FARM SIZES (BY PERCENTAGE)

- 6.9.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR AGRICULTURAL SPRAYER TYPES

- TABLE 12 KEY BUYING CRITERIA FOR AGRICULTURAL SPRAYER TYPES

7 AGRICULTURAL SPRAYERS MARKET, BY NOZZLE TYPE

- 7.1 INTRODUCTION

- 7.2 HYDRAULIC NOZZLE

- 7.2.1 PRESSURE PUMPS USED IN HYDRAULIC NOZZLES PROVIDE MORE COVERAGE WITH LESSER LIQUID CONTENT

- 7.3 GASEOUS NOZZLE

- 7.3.1 GASEOUS NOZZLES HELP FARMERS MONITOR AMOUNT OF LIQUID ADMINISTERED INTO FIELD

- 7.4 CENTRIFUGAL NOZZLE

- 7.4.1 CENTRIFUGAL NOZZLES IN DRONES MAKE FOR INNOVATIVE NOZZLE SPRAY TECHNOLOGY

- 7.5 THERMAL NOZZLE

- 7.5.1 THERMAL NOZZLES WIDELY USED TO OBTAIN MIST APPLICATION FOR CROPS

8 AGRICULTURAL SPRAYERS MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 30 SELF-PROPELLED SEGMENT EXPECTED TO DOMINATE AGRICULTURAL SPRAYERS MARKET BY 2027

- TABLE 13 AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 14 AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 15 AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 16 AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 8.2 SELF-PROPELLED

- 8.2.1 USE OF SELF-PROPELLED SPRAYERS FOR LARGE-SCALE CROP PRODUCTION

- TABLE 17 SELF-PROPELLED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 18 SELF-PROPELLED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 19 SELF-PROPELLED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 20 SELF-PROPELLED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 21 SELF-PROPELLED AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 22 SELF-PROPELLED AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.3 TRACTOR-MOUNTED

- 8.3.1 BETTER MANEUVERABILITY OF TRACTOR-MOUNTED SPRAYERS

- TABLE 23 TRACTOR-MOUNTED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 24 TRACTOR-MOUNTED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 25 TRACTOR-MOUNTED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 26 TRACTOR-MOUNTED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- 8.4 TRAILED

- 8.4.1 GREATER TANK CAPACITY OF TRAILED SPRAYERS

- TABLE 27 TRAILED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 28 TRAILED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 29 TRAILED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 30 TRAILED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- 8.5 HANDHELD

- 8.5.1 COST-EFFECTIVE HANDHELD SPRAYERS PREFERRED BY SMALL FARMERS

- TABLE 31 HANDHELD AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 32 HANDHELD AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 33 HANDHELD AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 34 HANDHELD AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- 8.6 AERIAL

- 8.6.1 COST AND TIME-EFFECTIVENESS OF AERIAL SPRAYERS

- TABLE 35 AERIAL AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 AERIAL AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 37 AERIAL AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 38 AERIAL AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

9 AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE

- 9.1 INTRODUCTION

- FIGURE 31 FUEL-BASED SEGMENT EXPECTED TO DOMINATE AGRICULTURAL SPRAYERS MARKET BY 2027

- TABLE 39 AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018-2021 (USD MILLION)

- TABLE 40 AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022-2027 (USD MILLION)

- TABLE 41 AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018-2021 (THOUSAND UNITS)

- TABLE 42 AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022-2027 (THOUSAND UNITS)

- 9.2 FUEL-BASED

- 9.2.1 FUEL-BASED SPRAYERS USED FOR HIGH VOLUME SPRAYING TECHNOLOGIES

- TABLE 43 FUEL-BASED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 FUEL-BASED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 45 FUEL-BASED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 46 FUEL-BASED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

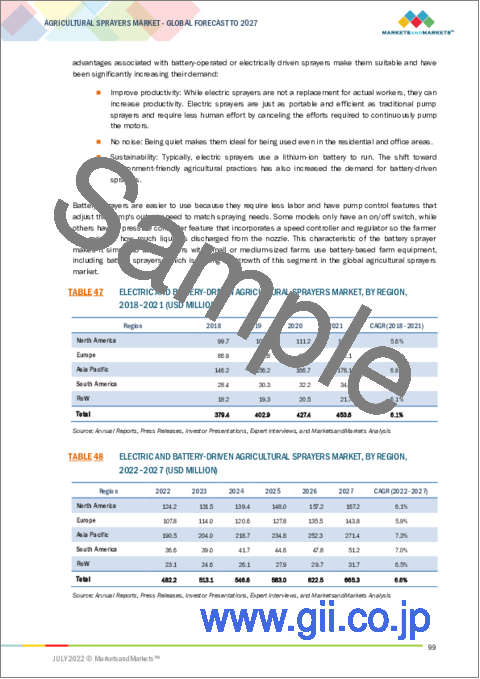

- 9.3 ELECTRIC AND BATTERY-DRIVEN

- 9.3.1 COST-EFFICIENCY OF ELECTRIC AND BATTERY-DRIVEN SPRAYERS

- TABLE 47 ELECTRIC AND BATTERY-DRIVEN AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 48 ELECTRIC AND BATTERY-DRIVEN AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 49 ELECTRIC AND BATTERY-DRIVEN AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 50 ELECTRIC AND BATTERY-DRIVEN AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- 9.4 MANUAL

- 9.4.1 USE OF MANUAL SPRAYERS FOR SMALL-SIZED APPLICATIONS

- TABLE 51 MANUAL AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 52 MANUAL AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 53 MANUAL AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 54 MANUAL AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- 9.5 SOLAR

- 9.5.1 SUSTAINABILITY AND ENVIRONMENTAL-FRIENDLY CHARACTERISTICS OF SOLAR SPRAYERS

- TABLE 55 SOLAR AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 56 SOLAR AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 57 SOLAR AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 58 SOLAR AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

10 AGRICULTURAL SPRAYERS MARKET, BY CAPACITY

- 10.1 INTRODUCTION

- FIGURE 32 LOW VOLUME SPRAYERS SEGMENT EXPECTED TO DOMINATE AGRICULTURAL SPRAYERS MARKET BY 2027

- TABLE 59 AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 60 AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2022-2027 (USD MILLION)

- TABLE 61 AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (THOUSAND UNITS)

- TABLE 62 AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2022-2027 (THOUSAND UNITS)

- 10.2 LOW VOLUME

- 10.2.1 WIDER COVERAGE AND GOOD PENETRATION OF LOW VOLUME SPRAYERS

- TABLE 63 LOW VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 64 LOW VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 65 LOW VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 66 LOW VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- 10.3 HIGH VOLUME

- 10.3.1 USE OF SELF-PROPELLED, TRACTOR-MOUNTED, AND TRAILED SPRAYERS FOR DISPENSING HIGH VOLUME SPRAYS

- TABLE 67 HIGH VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 68 HIGH VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 69 HIGH VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 70 HIGH VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- 10.4 ULTRA-LOW VOLUME

- 10.4.1 ADOPTION OF ULTRA-LOW VOLUME SPRAYERS BY SMALL-SCALE FARMERS AND PRIVATE HOUSEHOLDS

- TABLE 71 ULTRA-LOW VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 72 ULTRA-LOW VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 73 ULTRA-LOW VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 74 ULTRA-LOW VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

11 AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE

- 11.1 INTRODUCTION

- FIGURE 33 MEDIUM-SIZED SEGMENT TO DOMINATE AGRICULTURAL SPRAYERS MARKET THROUGH 2027

- TABLE 75 AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018-2021 (USD MILLION)

- TABLE 76 AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2022-2027 (USD MILLION)

- TABLE 77 AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018-2021 (THOUSAND UNITS)

- TABLE 78 AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2022-2027 (THOUSAND UNITS)

- 11.2 MEDIUM-SIZED

- 11.2.1 HIGH ADOPTION OF SELF-PROPELLED, TRACTOR-MOUNTED, AND TRAILED SPRAYERS IN MEDIUM FARMS

- TABLE 79 AGRICULTURAL SPRAYERS MARKET FOR MEDIUM-SIZED FARMS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 80 AGRICULTURAL SPRAYERS MARKET FOR MEDIUM-SIZED FARMS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 81 AGRICULTURAL SPRAYERS MARKET FOR MEDIUM-SIZED FARMS, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 82 AGRICULTURAL SPRAYERS MARKET FOR MEDIUM-SIZED FARMS, BY REGION, 2022-2027 (THOUSAND UNITS)

- 11.3 LARGE

- 11.3.1 INCREASE IN APPLICATION OF AERIAL SPRAYERS IN LARGE-SIZED FARMS

- TABLE 83 AGRICULTURAL SPRAYERS MARKET FOR LARGE FARMS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 84 AGRICULTURAL SPRAYERS MARKET FOR LARGE FARMS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 85 AGRICULTURAL SPRAYERS MARKET FOR LARGE FARMS, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 86 AGRICULTURAL SPRAYERS MARKET FOR LARGE FARMS, BY REGION, 2022-2027 (THOUSAND UNITS)

- 11.4 SMALL

- 11.4.1 HANDHELD (MANUAL) SPRAYERS MOSTLY USED IN SMALL-SIZED FARMS DUE TO THEIR AFFORDABILITY AND EASY AVAILABILITY

- TABLE 87 AGRICULTURAL SPRAYERS MARKET FOR SMALL FARMS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 88 AGRICULTURAL SPRAYERS MARKET FOR SMALL FARMS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 89 AGRICULTURAL SPRAYERS MARKET FOR SMALL FARMS, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 90 AGRICULTURAL SPRAYERS MARKET FOR SMALL FARMS, BY REGION, 2022-2027 (THOUSAND UNITS)

12 AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE

- 12.1 INTRODUCTION

- FIGURE 34 CEREALS SEGMENT EXPECTED TO DOMINATE AGRICULTURAL SPRAYERS MARKET THROUGH 2027

- TABLE 91 AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2018-2021 (USD MILLION)

- TABLE 92 AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 12.2 CEREALS

- 12.2.1 INCREASING DEMAND FOR CEREALS AND GRAINS

- TABLE 93 AGRICULTURAL SPRAYERS MARKET FOR CEREALS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 94 AGRICULTURAL SPRAYERS MARKET FOR CEREALS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 95 AGRICULTURAL SPRAYERS MARKET, BY CEREAL, 2018-2021 (USD MILLION)

- TABLE 96 AGRICULTURAL SPRAYERS MARKET, BY CEREAL, 2022-2027 (USD MILLION)

- 12.2.2 MAIZE

- 12.2.3 WHEAT

- 12.2.4 OTHER CEREALS AND GRAINS

- 12.3 OILSEEDS

- 12.3.1 INCREASE IN DEMAND FOR HIGH-YIELDING AND DISEASE-RESISTANT OILSEEDS

- TABLE 97 AGRICULTURAL SPRAYERS MARKET FOR OILSEEDS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 98 AGRICULTURAL SPRAYERS MARKET FOR OILSEEDS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 99 AGRICULTURAL SPRAYERS MARKET, BY OILSEED, 2018-2021 (USD MILLION)

- TABLE 100 AGRICULTURAL SPRAYERS MARKET, BY OILSEED, 2022-2027 (USD MILLION)

- 12.3.2 SOYBEAN

- 12.3.3 RAPESEED/CANOLA

- 12.3.4 SUNFLOWER AND COTTONSEED

- 12.3.5 OTHER OILSEEDS

- 12.4 FRUITS AND VEGETABLES

- 12.4.1 HIGHER CULTIVATION OF FRUITS AND VEGETABLES UNDER CONTROLLED CONDITIONS DRIVING USAGE OF AGRICULTURAL SPRAYERS

- TABLE 101 AGRICULTURAL SPRAYERS MARKET FOR FRUITS AND VEGETABLES, BY REGION, 2018-2021 (USD MILLION)

- TABLE 102 AGRICULTURAL SPRAYERS MARKET FOR FRUITS AND VEGETABLES, BY REGION, 2022-2027 (USD MILLION)

- 12.5 OTHER CROP TYPES

- TABLE 103 AGRICULTURAL SPRAYERS MARKET FOR OTHER CROPS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 104 AGRICULTURAL SPRAYERS MARKET FOR OTHER CROPS, BY REGION, 2022-2027 (USD MILLION)

13 AGRICULTURAL SPRAYERS MARKET, BY USAGE

- 13.1 INTRODUCTION

- 13.2 FIELD SPRAYERS

- 13.2.1 FIELD SPRAYERS - AN IMPORTANT TOOL FOR CROP PROTECTION

- 13.3 ORCHARD SPRAYERS

- 13.3.1 ORCHARD SPRAYERS COVERING A LARGER AREA WITH LESS LABOR

14 AGRICULTURAL SPRAYERS MARKET, BY REGION

- 14.1 INTRODUCTION

- FIGURE 35 INDIA EXPECTED TO GROW AT FASTEST RATE DURING FORECAST PERIOD

- TABLE 105 AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 106 AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 107 AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 108 AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- 14.2 ASIA PACIFIC

- FIGURE 36 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET SNAPSHOT

- TABLE 109 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 112 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2022-2027 (THOUSAND UNITS)

- TABLE 113 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 116 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 117 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 118 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2022-2027 (USD MILLION)

- TABLE 119 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (THOUSAND UNITS)

- TABLE 120 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2022-2027 (THOUSAND UNITS)

- TABLE 121 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018-2021 (USD MILLION)

- TABLE 122 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2022-2027 (USD MILLION)

- TABLE 123 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018-2021 (THOUSAND UNITS)

- TABLE 124 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2022-2027 (THOUSAND UNITS)

- TABLE 125 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2018-2021 (USD MILLION)

- TABLE 126 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- TABLE 127 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018-2021 (USD MILLION)

- TABLE 128 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022-2027 (USD MILLION)

- TABLE 129 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018-2021 (THOUSAND UNITS)

- TABLE 130 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022-2027 (THOUSAND UNITS)

- 14.2.1 CHINA

- 14.2.1.1 Country's heavy reliance on agriculture persuading government to adopt advanced technologies and machinery

- TABLE 131 CHINA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 132 CHINA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 133 CHINA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 134 CHINA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.2.2 INDIA

- 14.2.2.1 Demand for agricultural sprayers expected to rise with rising demand for food

- TABLE 135 INDIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 136 INDIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 137 INDIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 138 INDIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.2.3 JAPAN

- 14.2.3.1 Country's highly industrialized and developed agricultural sprayers industry

- TABLE 139 JAPAN: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 140 JAPAN: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 141 JAPAN: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 142 JAPAN: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.2.4 AUSTRALIA

- 14.2.4.1 Agriculture contributing to country's GDP and promoting mechanization

- TABLE 143 AUSTRALIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 144 AUSTRALIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 145 AUSTRALIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 146 AUSTRALIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.2.5 THAILAND

- 14.2.5.1 Government's focus on developing agricultural sector by emphasizing automation

- TABLE 147 THAILAND: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 148 THAILAND: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 149 THAILAND: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 150 THAILAND: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.2.6 REST OF ASIA PACIFIC

- TABLE 151 REST OF ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 154 REST OF ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.3 NORTH AMERICA

- TABLE 155 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 156 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 157 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 158 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2022-2027 (THOUSAND UNITS)

- TABLE 159 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 160 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 161 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 162 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 163 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 164 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2022-2027 (USD MILLION)

- TABLE 165 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (THOUSAND UNITS)

- TABLE 166 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2022-2027 (THOUSAND UNITS)

- TABLE 167 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018-2021 (USD MILLION)

- TABLE 168 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2022-2027 (USD MILLION)

- TABLE 169 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018-2021 (THOUSAND UNITS)

- TABLE 170 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2022-2027 (THOUSAND UNITS)

- TABLE 171 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2018-2021 (USD MILLION)

- TABLE 172 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- TABLE 173 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018-2021 (USD MILLION)

- TABLE 174 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022-2027 (USD MILLION)

- TABLE 175 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018-2021 (THOUSAND UNITS)

- TABLE 176 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022-2027 (THOUSAND UNITS)

- 14.3.1 US

- 14.3.1.1 Increasing shift toward precision agriculture

- TABLE 177 US: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 178 US: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 179 US: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 180 US: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.3.2 CANADA

- 14.3.2.1 Improved efficiency through use of agricultural sprayers

- TABLE 181 CANADA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 182 CANADA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 183 CANADA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 184 CANADA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.3.3 MEXICO

- 14.3.3.1 Increasing agricultural activities offering opportunities to agricultural sprayers

- TABLE 185 MEXICO: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 186 MEXICO: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 187 MEXICO: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 188 MEXICO: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.4 EUROPE

- TABLE 189 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 190 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 191 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 192 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2022-2027 (THOUSAND UNITS)

- TABLE 193 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 194 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 195 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 196 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 197 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 198 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2022-2027 (USD MILLION)

- TABLE 199 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (THOUSAND UNITS)

- TABLE 200 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2022-2027 (THOUSAND UNITS)

- TABLE 201 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018-2021 (USD MILLION)

- TABLE 202 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2022-2027 (USD MILLION)

- TABLE 203 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018-2021 (THOUSAND UNITS)

- TABLE 204 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2022-2027 (THOUSAND UNITS)

- TABLE 205 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2018-2021 (USD MILLION)

- TABLE 206 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- TABLE 207 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018-2021 (USD MILLION)

- TABLE 208 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022-2027 (USD MILLION)

- TABLE 209 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018-2021 (THOUSAND UNITS)

- TABLE 210 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022-2027 (THOUSAND UNITS)

- 14.4.1 FRANCE

- 14.4.1.1 Increased government support and focus on improving agricultural productivity

- TABLE 211 FRANCE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 212 FRANCE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 213 FRANCE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 214 FRANCE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.4.2 GERMANY

- 14.4.2.1 High adoption of self-propelled and trailed sprayers equipped with advanced technologies

- TABLE 215 GERMANY: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 216 GERMANY: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 217 GERMANY: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 218 GERMANY: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.4.3 RUSSIA

- 14.4.3.1 Usage of agricultural equipment with multi-functional sprayers and aerial technology

- TABLE 219 RUSSIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 220 RUSSIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 221 RUSSIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 222 RUSSIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.4.4 SPAIN

- 14.4.4.1 Dry climate and shortage of rainfall fueling demand for sprayers for applying water and agrochemicals

- TABLE 223 SPAIN: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 224 SPAIN: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 225 SPAIN: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 226 SPAIN: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.4.5 UK

- 14.4.5.1 Strong government support spurring business development in farming

- TABLE 227 UK: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 228 UK: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 229 UK: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 230 UK: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.4.6 ITALY

- 14.4.6.1 Increasing need for farm mechanization and rise in technological advancements

- TABLE 231 ITALY: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 232 ITALY: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 233 ITALY: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 234 ITALY: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.4.7 REST OF EUROPE

- TABLE 235 REST OF EUROPE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 236 REST OF EUROPE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 237 REST OF EUROPE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 238 REST OF EUROPE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.5 SOUTH AMERICA

- TABLE 239 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 240 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 241 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 242 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2022-2027 (THOUSAND UNITS)

- TABLE 243 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 244 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 245 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 246 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 247 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 248 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2022-2027 (USD MILLION)

- TABLE 249 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (THOUSAND UNITS)

- TABLE 250 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2022-2027 (THOUSAND UNITS)

- TABLE 251 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018-2021 (USD MILLION)

- TABLE 252 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2022-2027 (USD MILLION)

- TABLE 253 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018-2021 (THOUSAND UNITS)

- TABLE 254 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2022-2027 (THOUSAND UNITS)

- TABLE 255 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2018-2021 (USD MILLION)

- TABLE 256 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- TABLE 257 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018-2021 (USD MILLION)

- TABLE 258 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022-2027 (USD MILLION)

- TABLE 259 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018-2021 (THOUSAND UNITS)

- TABLE 260 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022-2027 (THOUSAND UNITS)

- 14.5.1 BRAZIL

- 14.5.1.1 Technological advancements, favorable soil & weather conditions, and strong government support boosting growth

- TABLE 261 BRAZIL: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 262 BRAZIL: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 263 BRAZIL: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 264 BRAZIL: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.5.2 ARGENTINA

- 14.5.2.1 Country employing highly skilled workers to strengthen its farm mechanization industry

- TABLE 265 ARGENTINA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 266 ARGENTINA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 267 ARGENTINA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 268 ARGENTINA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.5.3 REST OF SOUTH AMERICA

- TABLE 269 REST OF SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 270 REST OF SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 271 REST OF SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 272 REST OF SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.6 REST OF THE WORLD (ROW)

- TABLE 273 ROW: AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 274 ROW: AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 275 ROW: AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 276 ROW: AGRICULTURAL SPRAYERS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 277 ROW: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 278 ROW: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 279 ROW: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 280 ROW: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 281 ROW: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (USD MILLION)

- TABLE 282 ROW: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2022-2027 (USD MILLION)

- TABLE 283 ROW: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (THOUSAND UNITS)

- TABLE 284 ROW: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2022-2027 (THOUSAND UNITS)

- TABLE 285 ROW: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018-2021 (USD MILLION)

- TABLE 286 ROW: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2022-2027 (USD MILLION)

- TABLE 287 ROW: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018-2021 (THOUSAND UNITS)

- TABLE 288 ROW: AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2022-2027 (THOUSAND UNITS)

- TABLE 289 ROW: AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2018-2021 (USD MILLION)

- TABLE 290 ROW: AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- TABLE 291 ROW: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018-2021 (USD MILLION)

- TABLE 292 ROW: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022-2027 (USD MILLION)

- TABLE 293 ROW: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018-2021 (THOUSAND UNITS)

- TABLE 294 ROW: AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022-2027 (THOUSAND UNITS)

- 14.6.1 MIDDLE EAST

- 14.6.1.1 Continued growth in agriculture fueling demand for agricultural sprayers

- TABLE 295 MIDDLE EAST: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 296 MIDDLE EAST: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 297 MIDDLE EAST: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 298 MIDDLE EAST: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 14.6.2 AFRICA

- 14.6.2.1 Government support and shift toward digital agriculture techniques increasing demand for sprayers

- TABLE 299 AFRICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 300 AFRICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 301 AFRICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 302 AFRICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 MARKET SHARE ANALYSIS

- TABLE 303 AGRICULTURAL SPRAYERS MARKET SHARE (CONSOLIDATED)

- 15.3 KEY PLAYER STRATEGIES

- TABLE 304 KEY PLAYER STRATEGIES, 2019-2021

- 15.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 37 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2019-2021 (USD BILLION)

- 15.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 15.5.1 STARS

- 15.5.2 PERVASIVE PLAYERS

- 15.5.3 EMERGING LEADERS

- 15.5.4 PARTICIPANTS

- FIGURE 38 AGRICULTURAL SPRAYERS MARKET, COMPANY EVALUATION QUADRANT, 2021 (OVERALL MARKET)

- 15.5.5 PRODUCT FOOTPRINT

- TABLE 305 COMPANY PRODUCT TYPE FOOTPRINT

- TABLE 306 COMPANY APPLICATION FOOTPRINT

- TABLE 307 COMPANY REGIONAL FOOTPRINT

- TABLE 308 OVERALL COMPANY FOOTPRINT

- 15.6 AGRICULTURAL SPRAYERS MARKET, STARTUP/SME EVALUATION QUADRANT

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 STARTING BLOCKS

- 15.6.3 RESPONSIVE COMPANIES

- 15.6.4 DYNAMIC COMPANIES

- FIGURE 39 AGRICULTURAL SPRAYERS MARKET, COMPANY EVALUATION QUADRANT, 2021 (STARTUP/SME)

- 15.6.5 COMPETITIVE BENCHMARKING

- TABLE 309 AGRICULTURAL SPRAYERS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 310 AGRICULTURAL SPRAYERS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 15.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

- 15.7.1 PRODUCT LAUNCHES

- TABLE 311 AGRICULTURAL SPRAYERS MARKET: PRODUCT LAUNCHES, 2020-2021

- 15.7.2 DEALS

- TABLE 312 AGRICULTURAL SPRAYERS MARKET: DEALS, 2019-2022

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- (Business overview. Products offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats)**

- 16.1.1 JOHN DEERE

- TABLE 313 JOHN DEERE: BUSINESS OVERVIEW

- FIGURE 40 JOHN DEERE: COMPANY SNAPSHOT

- TABLE 314 JOHN DEERE: PRODUCT LAUNCHES

- TABLE 315 JOHN DEERE: DEALS

- 16.1.2 CNH INDUSTRIAL N.V.

- TABLE 316 CNH INDUSTRIAL N.V.: BUSINESS OVERVIEW

- FIGURE 41 CNH INDUSTRIAL N.V.: COMPANY SNAPSHOT

- 16.1.3 KUBOTA CORPORATION

- TABLE 317 KUBOTA CORPORATION: BUSINESS OVERVIEW

- FIGURE 42 KUBOTA CORPORATION: COMPANY SNAPSHOT

- TABLE 318 KUBOTA CORPORATION: DEALS

- 16.1.4 MAHINDRA & MAHINDRA LTD.

- TABLE 319 MAHINDRA AND MAHINDRA LTD.: BUSINESS OVERVIEW

- FIGURE 43 MAHINDRA & MAHINDRA LTD.: COMPANY SNAPSHOT

- TABLE 320 MAHINDRA AND MAHINDRA LTD.: DEALS

- 16.1.5 STIHL

- TABLE 321 STIHL: BUSINESS OVERVIEW

- FIGURE 44 STIHL: COMPANY SNAPSHOT

- TABLE 322 STIHL: PRODUCT LAUNCHES

- 16.1.6 AGCO CORPORATION

- TABLE 323 AGCO CORPORATION: BUSINESS OVERVIEW

- FIGURE 45 AGCO CORPORATION: COMPANY SNAPSHOT

- TABLE 324 AGCO CORPORATION: DEALS

- TABLE 325 AGCO CORPORATION: OTHERS

- 16.1.7 YAMAHA MOTOR CORPORATION

- TABLE 326 YAMAHA MOTOR CORPORATION: BUSINESS OVERVIEW

- FIGURE 46 YAMAHA MOTOR CORPORATION: COMPANY SNAPSHOT

- TABLE 327 YAMAHA MOTOR CORPORATION: OTHERS

- 16.1.8 BUCHER INDUSTRIES AG

- TABLE 328 BUCHER INDUSTRIES AG: BUSINESS OVERVIEW

- FIGURE 47 BUCHER INDUSTRIES AG: COMPANY SNAPSHOT

- 16.1.9 DJI

- TABLE 329 DJI: BUSINESS OVERVIEW

- TABLE 330 DJI: DEALS

- TABLE 331 DJI: PRODUCT LAUNCHES

- 16.1.10 EXEL INDUSTRIES

- TABLE 332 EXEL INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 48 EXEL INDUSTRIES: COMPANY SNAPSHOT

- 16.1.11 AMAZONEN-WERKE

- TABLE 333 AMAZONEN-WERKE: BUSINESS OVERVIEW

- TABLE 334 AMAZONEN-WERKE: DEALS

- 16.1.12 BGROUP S.P.A

- TABLE 335 BGROUP S.P.A.: BUSINESS OVERVIEW

- 16.1.13 CASE IH

- TABLE 336 CASE IH: BUSINESS OVERVIEW

- 16.1.14 H.D. HUDSON MANUFACTURING CO.

- TABLE 337 H.D. HUDSON MANUFACTURING CO.: BUSINESS OVERVIEW

- 16.1.15 BUHLER INDUSTRIES INC.

- TABLE 338 BUHLER INDUSTRIES INC.: BUSINESS OVERVIEW

- FIGURE 49 BUHLER INDUSTRIES INC.: COMPANY SNAPSHOT

- 16.1.16 AMERICAN SPRING & PRESSING WORKS PVT. LTD.

- TABLE 339 AMERICAN SPRING & PRESSING WORKS PVT. LTD.: BUSINESS OVERVIEW

- 16.1.17 AGRO CHEM INC.

- TABLE 340 AGRO CHEM INC.: BUSINESS OVERVIEW

- 16.1.18 H & H FARM MACHINE CO.

- TABLE 341 H & H FARM MACHINE CO.: BUSINESS OVERVIEW

- 16.1.19 AG SPRAY EQUIPMENT, INC.

- TABLE 342 AG SPRAY EQUIPMENT, INC.: BUSINESS OVERVIEW

- 16.1.20 EQUIPMENT TECHNOLOGIES

- TABLE 343 EQUIPMENT TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 344 EQUIPMENT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 345 EQUIPMENT TECHNOLOGIES: OTHERS

- 16.2 OTHER PLAYERS

- 16.2.1 3THI ROBOTICS PRIVATE LIMITED

- TABLE 346 3THI ROBOTICS PRIVATE LIMITED: COMPANY OVERVIEW

- 16.2.2 FUSITE CO. LTD.

- TABLE 347 FUSITE CO. LTD.: COMPANY OVERVIEW

- 16.2.3 NEPTUNE SPRAYERS

- TABLE 348 NEPTUNE SPRAYERS: COMPANY OVERVIEW

- 16.2.4 HYLIO

- TABLE 349 HYLIO: COMPANY OVERVIEW

- 16.2.5 GANPATHY AGRO INDUSTRIES

- TABLE 350 GANPATHY AGRO INDUSTRIES: COMPANY OVERVIEW

- *Details on Business overview. Products offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

17 ADJACENT MARKETS

- 17.1 INTRODUCTION

- 17.2 LIMITATIONS

- 17.3 AGRICULTURAL PUMPS MARKET

- 17.3.1 MARKET DEFINITION

- 17.3.2 MARKET OVERVIEW

- 17.3.3 AGRICULTURAL PUMPS MARKET, BY TYPE

- 17.3.3.1 Introduction

- TABLE 351 AGRICULTURAL PUMPS MARKET, BY TYPE, 2018-2025 (USD MILLION)

- 17.3.4 AGRICULTURAL PUMPS MARKET, BY REGION

- 17.3.4.1 Introduction

- 17.3.4.2 Asia Pacific

- TABLE 352 ASIA PACIFIC: AGRICULTURAL PUMPS MARKET, BY TYPE, 2018-2025 (USD MILLION)

- TABLE 353 ASIA PACIFIC: POSITIVE DISPLACEMENT PUMPS MARKET, BY SUBTYPE, 2018-2025 (USD MILLION)

- TABLE 354 ASIA PACIFIC: ROTODYNAMIC PUMPS MARKET, BY SUBTYPE, 2018-2025 (USD MILLION)

- 17.3.4.3 Europe

- TABLE 355 EUROPE: AGRICULTURAL PUMPS MARKET, BY TYPE, 2018-2025 (USD MILLION)

- TABLE 356 EUROPE: ROTODYNAMIC PUMPS MARKET, BY SUBTYPE, 2018-2025 (USD MILLION)

- TABLE 357 EUROPE: POSITIVE DISPLACEMENT PUMPS MARKET, BY SUBTYPE, 2018-2025 (USD MILLION)

- 17.3.4.4 North America

- TABLE 358 NORTH AMERICA: AGRICULTURAL PUMPS MARKET, BY TYPE, 2018-2025 (USD MILLION)

- TABLE 359 NORTH AMERICA: ROTODYNAMIC PUMPS MARKET, BY SUBTYPE, 2018-2025 (USD MILLION)

- TABLE 360 NORTH AMERICA: POSITIVE DISPLACEMENT PUMPS MARKET, BY SUBTYPE, 2018-2025 (USD MILLION)

- 17.3.4.5 South America

- TABLE 361 SOUTH AMERICA: AGRICULTURAL PUMPS MARKET, BY TYPE, 2018-2025 (USD MILLION)

- TABLE 362 SOUTH AMERICA: ROTODYNAMIC PUMPS MARKET, BY SUBTYPE, 2018-2025 (USD MILLION)

- TABLE 363 SOUTH AMERICA: POSITIVE DISPLACEMENT PUMPS MARKET, BY SUBTYPE, 2018-2025 (USD MILLION)

- 17.3.4.6 Rest of the World (RoW)

- TABLE 364 ROW: AGRICULTURAL PUMPS MARKET, BY TYPE, 2018-2025 (USD MILLION)

- TABLE 365 ROW: ROTODYNAMIC PUMPS MARKET, BY SUBTYPE, 2018-2025 (USD MILLION)

- TABLE 366 ROW: POSITIVE DISPLACEMENT PUMPS MARKET, BY SUBTYPE, 2018-2025 (USD MILLION)

- 17.4 AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET

- 17.4.1 LIMITATIONS

- 17.4.2 MARKET DEFINITION

- 17.4.3 MARKET OVERVIEW

- 17.4.4 AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY TYPE

- 17.4.4.1 Introduction

- TABLE 367 AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY TYPE, 2015-2022 (USD MILLION)

- 17.4.5 AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY REGION

- 17.4.5.1 Introduction

- TABLE 368 AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY REGION, 2015-2022 (USD MILLION)

- 17.4.5.2 North America

- TABLE 369 NORTH AMERICA: AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY APPLICATION METHOD, 2015-2022 (USD MILLION)

- 17.4.5.3 Europe

- TABLE 370 EUROPE: AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY APPLICATION METHOD, 2015-2022 (USD MILLION)

- 17.4.5.4 Asia Pacific

- TABLE 371 ASIA PACIFIC: AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY APPLICATION METHOD, 2015-2022 (USD MILLION)

- 17.4.5.5 South America

- TABLE 372 SOUTH AMERICA: AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY APPLICATION METHOD, 2015-2022 (USD MILLION)

- 17.4.5.6 Rest of the World (RoW)

- TABLE 373 ROW: AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY APPLICATION METHOD, 2015-2022 (USD MILLION)

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS