|

|

市場調査レポート

商品コード

1231102

PVDF膜の世界市場:技術別・種類別 (疎水性、親水性)・用途別 (一般ろ過、サンプル調製、ビーズベースアッセイ)・エンドユース産業別 (バイオ医薬品、工業、食品・飲料)・地域別の将来予測 (2027年まで)PVDF Membrane Market by Technology, Type (Hydrophobic, Hydrophilic), Application (General Filtration, Sample Preparation, Bead ? Based Assays), End-Use Industry (Biopharmaceutical, Industrial, Food & Beverage), and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| PVDF膜の世界市場:技術別・種類別 (疎水性、親水性)・用途別 (一般ろ過、サンプル調製、ビーズベースアッセイ)・エンドユース産業別 (バイオ医薬品、工業、食品・飲料)・地域別の将来予測 (2027年まで) |

|

出版日: 2023年02月23日

発行: MarketsandMarkets

ページ情報: 英文 213 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のPVDF膜の市場規模は、2022年の7億7,900万米ドルから、2027年には11億2,600万米ドルに達し、2022年から2027年の間に7.7%のCAGRで成長する、と予測されます。

バイオ医薬品業界からの需要拡大や工業化の進展が、PVDF膜メーカーに大きな成長機会をもたらすと期待されています。

エンドユース産業別では、工業用の分野が金額ベースで2位のシェアを占めています。PVDFは独自の優れた特性 (高い抵抗率、多孔性、通気性など) により、サンプル微粒子の重量測定、化学分析、顕微鏡分析に最適となっています。

技術別では、精密ろ過 (MF) が最も急速に成長しているセグメントとなっています。特に乳製品産業で、細菌の削減や、牛乳・ホエーの脂肪除去、タンパク質やカゼインの標準化などに用いられています。

地域別に見ると、北米が2021年に金額ベースで28.0%のシェアを占め、世界で2番目に大きな市場となっています。浄水・ろ過用途でのPVDF膜の利用を促進する政府の支援も市場成長の原動力となっています。

当レポートでは、世界のPVDF (ポリフッ化ビニリデン) 膜の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・技術別・用途別・エンドユース産業別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- エコシステムマッピング

- バリューチェーン分析

- 景気後退:リスク評価

- ケーススタディ分析

- マクロ経済データ

- 規制枠組み:地域別

- 平均販売価格の分析

第6章 PVDF膜市場:種類別

- イントロダクション

- 疎水性

- 親水性

第7章 PVDF膜市場:技術別

- イントロダクション

- 限外ろ過

- 精密ろ過

- ナノろ過

第8章 PVDF膜市場:用途別

- イントロダクション

- 一般ろ過

- 溶媒ろ過

- 化学中間ろ過

- バイオ製品ろ過

- サンプル調製

- HPLCサンプル調製

- ビーズベースアッセイ

- その他

第9章 PVDF膜市場:エンドユース産業別

- イントロダクション

- バイオ医薬品

- 透析・ろ過

- サンプル調製

- 工業用

- 水道・下水処理

- 工業用ガス処理

- 膜蒸留

- 食品・飲料

- 乳製品への適用

- ジュースとワインの生産

- その他

第10章 PVDF膜市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- マレーシア

- インドネシア

- タイ

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- オランダ

- スペイン

- 他の欧州諸国

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- トルコ

- 他の中東・アフリカ諸国

第11章 競合情勢

- 概要

- 主要企業のランキング分析 (2022年)

- 市場シェア分析

- 大手企業の収益分析 (2019年~2021年)

- 市場評価マトリックス

- 企業評価マトリックス (ティア1、2022年)

- スタートアップ・中小企業 (SME) の評価マトリックス

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合シナリオ

- 製品の発売

- 資本取引

- その他の動向

第12章 企業プロファイル

- 主要企業

- ARKEMA S.A.

- MERCK MILLIPORE

- KOCH SEPARATION SOLUTIONS

- PALL CORPORATION

- CYTIVA LIFE SCIENCES

- BIO-RAD LABORATORIES

- CITIC ENVIROTECH PTE LTD

- GVS FILTER TECHNOLOGY

- MEMBRANE SOLUTIONS, LLC.

- THERMO FISHER SCIENTIFIC INC.

- TORAY INDUSTRIES, INC.

- その他の企業

- ADVANCED MICRODEVICES PVT. LTD.

- ASAHI KASEI CORPORATION

- COBETTER FILTRATION GROUP

- ELABSCIENCE

- HIMEDIA LABORATORIES PVT. LTD.

- HYUNDAI MICRO CO., LTD.

- KAMPS GMBH

- LG CHEM

- MITSUBISHI CHEMICAL CORPORATION

- PENTAIR PLC

- STARLAB GROUP

- STERLITECH CORPORATION

- SYNDER FILTRATION

- THEWAY MEMBRANES

第13章 付録

The global PVDF Membrane market size is projected to grow from USD 779 million in 2022 to USD 1,126 million by 2027, at a CAGR of 7.7% between 2022 and 2027. Rising demand from biopharmaceutical industry and growing industrialization are expected to offer significant growth opportunities to manufacturers of PVDF Membrane.

"The industrial segment accounted for the second largest share in the PVDF Membrane market in terms of value."

The industrial segment includes water & wastewater treatment, industrial gas processing, and membrane distillation. In the industrial filtration process, a PVDF membrane acts as a filter. It has accurately controlled pore size distribution, high strength, and flexibility, ensuring reproducibility and consistency. The unique properties of PVDF membranes, such as high resistivity, porosity, and airflow, make them ideal for gravimetric, chemical, and microscopic analysis of sample particulate.

"Microfiltration is the fastest growing PVDF Membrane technology."

MF membranes are generally incorporated into a larger system, occurring downstream from media filtration units that capture large particles and upstream from processes that provide further separation, purification, or industrial water treatment. Microfiltration uses a porous membrane to separate suspended particles with diameters ranging between 0.1 µm and 5 µm. MF removes the undesired microorganisms, dead cells, and physical contaminants from the brine and other beverages without altering the product's chemical composition. MF is a low-pressure-driven membrane filtration process widely used in the dairy industry. Some common applications are bacteria reduction, fat removal in milk and whey, and standardization of protein and casein.

"North America is estimated to be the second-largest market for PVDF Membrane"

North America is the second-largest PVDF membrane market, which accounted for a share of 28.0%, in terms of value, in 2021. Government support to promote the use of PVDF membranes in water purification and filtration applications also drives market growth. The stringent environmental regulations in this region, which directly affect the water treatment industry, are the Clean Water Act (CWA), the United States Environmental Protection Agency (EPA), and the Safe Drinking Water Act (SDWA).

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the PVDF Membrane market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives- 20%, Directors - 10%, and Others - 70%

- By Region: APAC - 50%, Europe - 20%, North America - 10%, the Middle East & Africa -10%, and South America- 10%

The key players in this market are Arkema S.A. (France), Merck Millipore (US), KOCH Separation Solutions (US), Pall Corporation (US), Cytiva Life Science (US), CITIC Envirotech Pte Ltd (Singapore), Bio-Rad laboratories (US), Thermo Fisher Scientific Inc. (US), Membrane Solutions, LLC. (US), GVS Filter Technology (Italy), and Toray Industries, Inc. (Japan).

Research Coverage:

The report offers insights into the PVDF Membrane market in key regions. It aims at estimating the size of the PVDF Membrane market during the forecast period and projects future growth of the market across various segments based on type, technology, application, end-use industry, and region. The report also includes an in-depth competitive analysis of the key players in the PVDF Membrane market, along with company profiles, MNM view, recent developments, and key market strategies.

Key Benefits of Buying the Report

From an insight perspective, this research report focuses on various levels of analysis - industry analysis (industry trends), market share ranking of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the PVDF Membrane; high growth regions; and market drivers, restraints, opportunities, and challenges.

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 PVDF MEMBRANE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary interviews - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 2 PVDF MEMBRANE MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 3 PVDF MEMBRANE MARKET: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 4 PVDF MEMBRANE MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ANALYSIS

3 EXECUTIVE SUMMARY

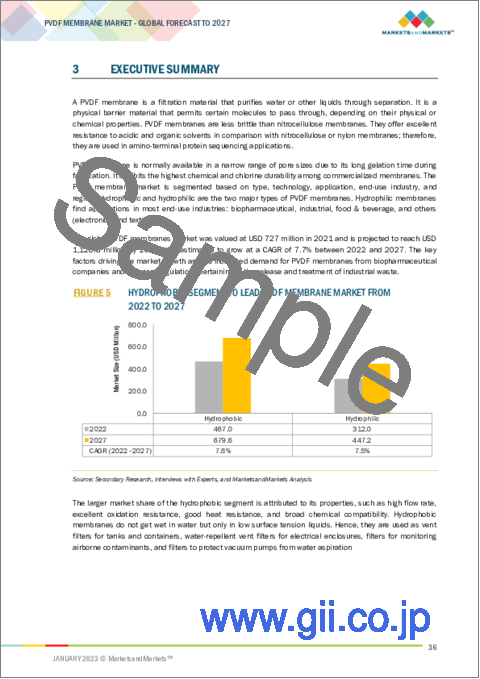

- FIGURE 5 HYDROPHOBIC SEGMENT TO LEAD PVDF MEMBRANE MARKET

FROM 2022 TO 2027

- FIGURE 6 ULTRAFILTRATION TO BE LARGEST SEGMENT IN PVDF MEMBRANE MARKET, BY TECHNOLOGY, THROUGHOUT FORECAST PERIOD

- FIGURE 7 GENERAL FILTRATION SEGMENT ACCOUNTED FOR LARGEST SHARE OF PVDF MEMBRANE MARKET, BY APPLICATION, IN 2021

- FIGURE 8 BIOPHARMACEUTICAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF PVDF MARKET, BY END-USE INDUSTRY, BETWEEN 2022 AND 2027

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF GLOBAL PVDF MEMBRANE MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN PVDF MEMBRANE MARKET

- FIGURE 10 ASIA PACIFIC TO BE MOST POTENTIAL MARKET FOR PROVIDERS OF PVDF MEMBRANES IN COMING YEARS

- 4.2 PVDF MEMBRANE MARKET IN ASIA PACIFIC, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 11 INDUSTRIAL SEGMENT AND CHINA LED MARKET IN ASIA PACIFIC IN 2021

- 4.3 PVDF MEMBRANE MARKET, BY TYPE

- FIGURE 12 HYDROPHOBIC SEGMENT TO DOMINATE MARKET, IN TERMS OF VOLUME, THROUGHOUT FORECAST PERIOD

- 4.4 PVDF MEMBRANE MARKET, BY TECHNOLOGY

- FIGURE 13 ULTRAFILTRATION TECHNOLOGY TO HOLD LARGEST MARKET SHARE, IN TERMS OF VOLUME, IN 2027

- 4.5 PVDF MEMBRANE MARKET, BY APPLICATION

- FIGURE 14 GENERAL FILTRATION SEGMENT TO LEAD MARKET, IN TERMS OF VOLUME, THROUGHOUT FORECAST PERIOD

- 4.6 PVDF MEMBRANE MARKET, BY END-USE INDUSTRY

- FIGURE 15 BIOPHARMACEUTICAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE, IN TERMS OF VOLUME, IN 2027

- 4.7 PVDF MEMBRANE MARKET, BY COUNTRY

- FIGURE 16 INDIA TO BE FASTEST-GROWING MARKET GLOBALLY DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 PVDF MEMBRANE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Thriving biopharmaceutical industry

- FIGURE 18 PROJECTED R&D EXPENDITURE BY TOP PHARMACEUTICAL COMPANIES, 2026

- 5.2.1.2 Stringent regulations pertaining to release and treatment of municipal and industrial wastewater

- 5.2.1.3 Advancements in membrane filtration technologies

- 5.2.1.4 Shift from chemical to physical water treatments

- 5.2.2 RESTRAINTS

- 5.2.2.1 High production cost of PVDF membranes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising need for water treatment services by emerging economies

- 5.2.3.2 Increase in scarcity of fresh water

- 5.2.3.3 Rising adoption of PVDF membranes in microfiltration, venting, and medical applications

- TABLE 1 APPLICATIONS OF PVDF MEMBRANES IN MEDICAL INDUSTRY

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues related to lifespan and efficiency of PVDF membranes

- 5.2.4.2 Shortage of key raw materials

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 PVDF MEMBRANE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 2 PVDF MEMBRANE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- FIGURE 20 ECOSYSTEM MAP

- TABLE 3 KEY COMPANIES AND THEIR ROLE IN PVDF MEMBRANE ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 21 PVDF MEMBRANE MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 MANUFACTURERS

- 5.5.3 DISTRIBUTORS

- 5.5.4 END USERS

- 5.6 ECONOMIC RECESSION: RISK ASSESSMENT

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 KOCH SEPARATION SOLUTIONS ADOPTED MBR TECHNOLOGY WITH TMBR SYSTEM TO IMPROVE SAO PAULO'S NEED FOR WATER FOR INDUSTRIAL USE

- 5.7.2 KOCH SEPARATION SOLUTIONS SUPPLIED PURON MBR SYSTEM TO MCGM TO ENABLE REUSE OF WASTEWATER

- 5.7.3 HASGAK WATER PVT. LTD. HELPED MEET INCREASING DEMAND FOR CLEAN WATER IN SEZ BY OFFERING ZLD SYSTEM

- 5.8 MACROECONOMIC DATA

- 5.8.1 TRENDS IN HEALTHCARE SECTOR

- TABLE 4 HEALTHCARE EXPENDITURE BY KEY COUNTRIES (% OF GDP, 2019)

- 5.8.2 CHEMICAL SALES

- TABLE 5 CHEMICAL SALES IN KEY COUNTRIES, 2020 (USD BILLION)

- 5.9 REGULATORY FRAMEWORK, BY REGION

- 5.9.1 ASIA PACIFIC

- 5.9.2 EUROPE

- 5.9.3 NORTH AMERICA

- 5.9.3.1 US

- 5.9.3.2 Canada

- 5.9.4 MEDICAL DEVICES

- TABLE 6 COUNTRY-WISE REGULATIONS

- 5.10 AVERAGE SELLING PRICE ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE BASED ON REGION

- FIGURE 22 AVERAGE SELLING PRICE BASED ON REGION (USD/KG)

- 5.10.2 AVERAGE SELLING PRICE BASED ON APPLICATION

- TABLE 7 AVERAGE SELLING PRICE BASED ON APPLICATION (USD/KG), 2020-2027

6 PVDF MEMBRANE MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 23 HYDROPHOBIC PVDF MEMBRANES TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- TABLE 8 PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 9 PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 10 PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 11 PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022-2027 (TON)

- 6.2 HYDROPHOBIC

- 6.2.1 HYDROPHOBIC PVDF MEMBRANES KNOWN FOR HIGH FLOW RATE, EXCELLENT OXIDATION RESISTANCE, AND HIGH HEAT RESISTANCE

- 6.3 HYDROPHILIC

- 6.3.1 HYDROPHILIC PVDF MEMBRANES FEATURE HIGH POROSITY, FLOW RATE, THROUGHPUT, AND STRENGTH

7 PVDF MEMBRANE MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 24 ULTRAFILTRATION TECHNOLOGY TO CAPTURE LARGEST SHARE OF PVDF MEMBRANE MARKET DURING FORECAST PERIOD

- TABLE 12 PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 13 PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 14 PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018-2021 (TON)

- TABLE 15 PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022-2027 (TON)

- 7.2 ULTRAFILTRATION

- 7.2.1 ADOPTION OF ULTRAFILTRATION TECHNOLOGY TO PRODUCE POTABLE WATER

- 7.3 MICROFILTRATION

- 7.3.1 IMPLEMENTATION OF MICROFILTRATION TECHNOLOGY TO STERILIZE COLD BEVERAGES; CLEAR FRUIT JUICES, WINES, AND BEERS; AND PRODUCE WHEY PROTEIN ISOLATES

- 7.4 NANOFILTRATION

- 7.4.1 UTILIZATION OF NANOFILTRATION TECHNOLOGY IN DAIRY APPLICATIONS SUCH AS ICE CREAMS AND YOGURTS

8 PVDF MEMBRANE MARKET, BY APPLICATION

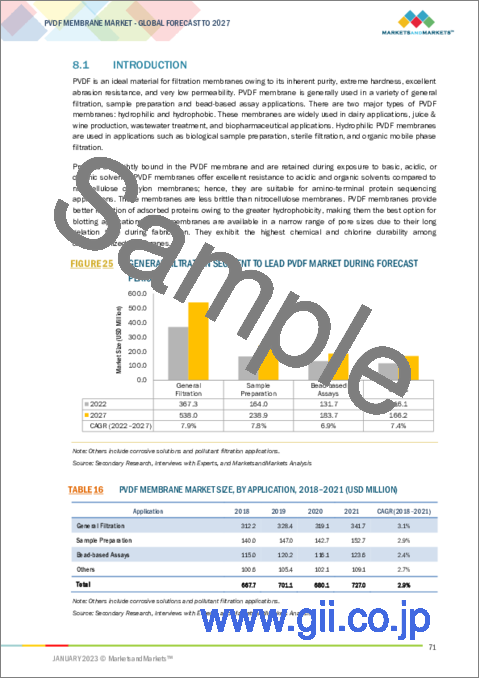

- 8.1 INTRODUCTION

- FIGURE 25 GENERAL FILTRATION SEGMENT TO LEAD PVDF MARKET DURING FORECAST PERIOD

- TABLE 16 PVDF MEMBRANE MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 17 PVDF MEMBRANE MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 18 PVDF MEMBRANE MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 19 PVDF MEMBRANE MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- 8.2 GENERAL FILTRATION

- 8.2.1 SOLVENT FILTRATION

- 8.2.1.1 Good heat resistance and chemical stability to facilitate use of PVDF membranes in filtration applications

- 8.2.2 CHEMICAL INTERMEDIATE FILTRATION

- 8.2.2.1 Requirement to decolorize, clarify, and demineralize acid to boost demand for PVDF membranes

- 8.2.3 BIOPRODUCTS FILTRATION

- 8.2.3.1 Use of PVDF membranes to filter protein solutions, tissue culture media, additives, antibiotics, and alcohol to stimulate market growth

- 8.2.1 SOLVENT FILTRATION

- 8.3 SAMPLE PREPARATION

- 8.3.1 ULTRA-LOW BINDING AND RESISTANCE TO BROAD CHEMICALS AND TEMPERATURES TO DRIVE DEMAND IN SAMPLE PREPARATION

- 8.3.2 HPLC SAMPLE PREPARATION

- 8.3.2.1 Durability and excellent housing strength to boost usage in HPLC sample preparation

- 8.4 BEAD-BASED ASSAYS

- 8.4.1 LOW BINDING, INERT SUPPORT OFFERED BY PVDF MEMBRANES TO BOOST THEIR DEMAND IN BEAD-BASED SEPARATION APPLICATIONS

- 8.5 OTHERS

9 PVDF MEMBRANE MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 26 BIOPHARMACEUTICAL SEGMENT TO DOMINATE PVDF MEMBRANE MARKET THROUGHOUT FORECAST PERIOD

- TABLE 20 PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 21 PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 22 PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 23 PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.2 BIOPHARMACEUTICAL

- 9.2.1 RISING DEMAND FROM MEDICAL SECTOR TO SUPPORT MARKET GROWTH

- 9.2.2 DIALYSIS AND FILTRATION

- 9.2.2.1 Use of PVDF membranes in dialysis and filtration to separate small molecules from macromolecules

- 9.2.3 SAMPLE PREPARATION

- 9.2.3.1 Implementation of PVDF membranes to reduce sample processing time

- 9.3 INDUSTRIAL

- 9.3.1 STRINGENT GOVERNMENT POLICIES REGARDING TREATMENT OF INDUSTRIAL WASTE TO DRIVE MARKET

- 9.3.2 WATER & WASTEWATER TREATMENT

- 9.3.2.1 Need to discharge contaminated water generated during industrial processes to propel growth

- 9.3.3 INDUSTRIAL GAS PROCESSING

- 9.3.3.1 Low maintenance cost, simple design, and environmental friendliness of PVDF membranes to lead to increased use for processing natural gas

- 9.3.4 MEMBRANE DISTILLATION

- 9.3.4.1 Adoption of hydrophobic polymer-fabricated PVDF membranes to drive market

- 9.4 FOOD & BEVERAGE

- 9.4.1 USE OF PVDF MEMBRANES IN FOOD & BEVERAGE INDUSTRY TO CONCENTRATE OR REMOVE SPECIFIC SUBSTANCES FROM LIQUID STREAMS TO DRIVE MARKET

- 9.4.2 DAIRY APPLICATION

- 9.4.2.1 Need to retain lactose and organic molecules in milk and whey products to increase demand for PVDF membranes

- 9.4.3 JUICE & WINE PRODUCTION

- 9.4.3.1 Adoption of PVDF membranes to enhance color and flavor of juices and drinks to stimulate market growth

- 9.5 OTHERS

10 PVDF MEMBRANE MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 27 INDIA TO BE FASTEST-GROWING MARKET FOR PVDF MEMBRANES GLOBALLY DURING FORECAST PERIOD

- TABLE 24 PVDF MEMBRANE MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 25 PVDF MEMBRANE MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 26 PVDF MEMBRANE MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 27 PVDF MEMBRANE MARKET SIZE, BY REGION, 2022-2027 (TON)

- 10.2 ASIA PACIFIC

- FIGURE 28 ASIA PACIFIC: PVDF MEMBRANE MARKET SNAPSHOT

- TABLE 28 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 29 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 30 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 31 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 32 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 33 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 34 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 35 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 36 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 37 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 38 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018-2021 (TON)

- TABLE 39 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022-2027 (TON)

- TABLE 40 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 41 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 42 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 43 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.2.1 CHINA

- 10.2.1.1 Increased healthcare expenditure to drive market

- TABLE 44 CHINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 45 CHINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 46 CHINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 47 CHINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.2.2 JAPAN

- 10.2.2.1 Thriving food and filtration industries to boost demand for PVDF membranes

- TABLE 48 JAPAN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 49 JAPAN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 50 JAPAN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 51 JAPAN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.2.3 INDIA

- 10.2.3.1 Government initiatives toward infrastructure development and industrial growth to drive market

- TABLE 52 INDIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 53 INDIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 54 INDIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 55 INDIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Rising demand for PVDF membranes by food & beverage industry to drive market

- TABLE 56 SOUTH KOREA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 57 SOUTH KOREA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 58 SOUTH KOREA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 59 SOUTH KOREA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.2.5 AUSTRALIA

- 10.2.5.1 Presence of key water treatment organizations to propel market

- TABLE 60 AUSTRALIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 61 AUSTRALIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 62 AUSTRALIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 63 AUSTRALIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.2.6 MALAYSIA

- 10.2.6.1 Need to recycle and reuse wastewater for industrial use to boost demand for PVDF membranes

- TABLE 64 MALAYSIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 65 MALAYSIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 66 MALAYSIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 67 MALAYSIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.2.7 INDONESIA

- 10.2.7.1 Water & wastewater treatment projects to drive market

- TABLE 68 INDONESIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 69 INDONESIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 70 INDONESIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 71 INDONESIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.2.8 THAILAND

- 10.2.8.1 Investments in desalination plants to support market growth

- TABLE 72 THAILAND: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 73 THAILAND: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 74 THAILAND: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 75 THAILAND: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.2.9 REST OF ASIA PACIFIC

- TABLE 76 REST OF ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 78 REST OF ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 79 REST OF ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.3 EUROPE

- FIGURE 29 EUROPE: PVDF MEMBRANE MARKET SNAPSHOT

- TABLE 80 EUROPE: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 81 EUROPE: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 82 EUROPE: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 83 EUROPE: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 84 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 85 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 86 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 87 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 88 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 89 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 90 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018-2021 (TON)

- TABLE 91 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022-2027 (TON)

- TABLE 92 EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 93 EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 94 EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 95 EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.3.1 GERMANY

- 10.3.1.1 Technological advancements in biopharmaceutical industry to support market growth

- TABLE 96 GERMANY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 97 GERMANY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 98 GERMANY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 99 GERMANY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.3.2 UK

- 10.3.2.1 Growing food industry to stimulate market growth

- TABLE 100 UK: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 101 UK: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 102 UK: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 103 UK: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.3.3 FRANCE

- 10.3.3.1 Investments in wastewater treatment to drive market

- TABLE 104 FRANCE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 105 FRANCE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 106 FRANCE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 107 FRANCE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.3.4 ITALY

- 10.3.4.1 Booming food processing industry to drive market

- TABLE 108 ITALY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 109 ITALY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 110 ITALY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 111 ITALY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.3.5 NETHERLANDS

- 10.3.5.1 Water scarcity to result in high demand for PVDF membranes

- TABLE 112 NETHERLANDS: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 113 NETHERLANDS: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 114 NETHERLANDS: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 115 NETHERLANDS: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.3.6 SPAIN

- 10.3.6.1 Construction of desalination plants to propel demand for PVDF membranes

- TABLE 116 SPAIN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 117 SPAIN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 118 SPAIN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 119 SPAIN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.3.7 REST OF EUROPE

- TABLE 120 REST OF EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 121 REST OF EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 122 REST OF EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 123 REST OF EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.4 NORTH AMERICA

- FIGURE 30 NORTH AMERICA: PVDF MEMBRANE MARKET SNAPSHOT

- TABLE 124 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 125 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 126 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 127 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 128 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 129 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 130 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 131 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 132 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 133 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 134 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY,

- 2018-2021 (TON)

- TABLE 135 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY,

- 2022-2027 (TON)

- TABLE 136 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 137 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 138 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 139 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.4.1 US

- 10.4.1.1 Large chemical and oil & gas companies to boost demand for PVDF membranes in filtration applications

- TABLE 140 US: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (USD MILLION)

- TABLE 141 US: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (USD MILLION)

- TABLE 142 US: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (TON)

- TABLE 143 US: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (TON)

- 10.4.2 CANADA

- 10.4.2.1 Flourishing chemical industry due to abundance of natural resources to stimulate demand

- TABLE 144 CANADA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (USD MILLION)

- TABLE 145 CANADA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (USD MILLION)

- TABLE 146 CANADA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (TON)

- TABLE 147 CANADA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (TON)

- 10.4.3 MEXICO

- 10.4.3.1 Rising demand for healthy food products to fuel market growth

- TABLE 148 MEXICO: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (USD MILLION)

- TABLE 149 MEXICO: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (USD MILLION)

- TABLE 150 MEXICO: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (TON)

- TABLE 151 MEXICO: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (TON)

- 10.5 SOUTH AMERICA

- TABLE 152 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY,

- 2018-2021 (USD MILLION)

- TABLE 153 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY,

- 2022-2027 (USD MILLION)

- TABLE 154 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY,

- 2018-2021 (TON)

- TABLE 155 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY,

- 2022-2027 (TON)

- TABLE 156 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE,

- 2018-2021 (USD MILLION)

- TABLE 157 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE,

- 2022-2027 (USD MILLION)

- TABLE 158 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE,

- 2018-2021 (TON)

- TABLE 159 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE,

- 2022-2027 (TON)

- TABLE 160 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY,

- 2018-2021 (USD MILLION)

- TABLE 161 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY,

- 2022-2027 (USD MILLION)

- TABLE 162 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY,

- 2018-2021 (TON)

- TABLE 163 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY,

- 2022-2027 (TON)

- TABLE 164 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 165 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 166 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 167 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.5.1 BRAZIL

- 10.5.1.1 Production and export of agricultural products to support market growth

- TABLE 168 BRAZIL: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (USD MILLION)

- TABLE 169 BRAZIL: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (USD MILLION)

- TABLE 170 BRAZIL: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (TON)

- TABLE 171 BRAZIL: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (TON)

- 10.5.2 ARGENTINA

- 10.5.2.1 Increasing export of food products and beverages to boost demand

- TABLE 172 ARGENTINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 173 ARGENTINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 174 ARGENTINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 175 ARGENTINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.5.3 REST OF SOUTH AMERICA

- TABLE 176 REST OF SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 177 REST OF SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 178 REST OF SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 179 REST OF SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.6 MIDDLE EAST & AFRICA

- TABLE 180 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 183 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 184 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TYPE,

- 2018-2021 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TYPE,

- 2022-2027 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TYPE,

- 2018-2021 (TON)

- TABLE 187 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TYPE,

- 2022-2027 (TON)

- TABLE 188 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018-2021 (TON)

- TABLE 191 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022-2027 (TON)

- TABLE 192 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 195 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.6.1 SAUDI ARABIA

- 10.6.1.1 Significant demand from chemical and petrochemical industries to support market growth

- TABLE 196 SAUDI ARABIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 197 SAUDI ARABIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 198 SAUDI ARABIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 199 SAUDI ARABIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.6.2 UAE

- 10.6.2.1 Changing energy-mix to drive market

- TABLE 200 UAE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (USD MILLION)

- TABLE 201 UAE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (USD MILLION)

- TABLE 202 UAE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (TON)

- TABLE 203 UAE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (TON)

- 10.6.3 QATAR

- 10.6.3.1 Increased health-conscious customers to boost demand for PVDF membranes

- TABLE 204 QATAR: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (USD MILLION)

- TABLE 205 QATAR: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (USD MILLION)

- TABLE 206 QATAR: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (TON)

- TABLE 207 QATAR: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (TON)

- 10.6.4 SOUTH AFRICA

- 10.6.4.1 Food industry to contribute to market growth

- TABLE 208 SOUTH AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 209 SOUTH AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 210 SOUTH AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 211 SOUTH AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 10.6.5 TURKEY

- 10.6.5.1 Increasing investments in pharmaceutical industry to drive market

- TABLE 212 TURKEY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (USD MILLION)

- TABLE 213 TURKEY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (USD MILLION)

- TABLE 214 TURKEY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2018-2021 (TON)

- TABLE 215 TURKEY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY,

- 2022-2027 (TON)

- 10.6.6 REST OF MIDDLE EAST & AFRICA

- TABLE 216 REST OF MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE,

- BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 217 REST OF MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 218 REST OF MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 219 REST OF MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- TABLE 220 COMPANIES ADOPTED ACQUISITIONS AND EXPANSIONS AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2022

- 11.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- FIGURE 31 RANKING OF TOP FIVE PLAYERS IN PVDF MEMBRANE MARKET, 2022

- 11.3 MARKET SHARE ANALYSIS

- FIGURE 32 PVDF MEMBRANE MARKET SHARE, BY COMPANY (2022)

- 11.4 REVENUE ANALYSIS OF TOP PLAYERS, 2019-2021

- TABLE 221 PVDF MEMBRANE MARKET: REVENUE ANALYSIS, 2019-2021 (USD)

- 11.5 MARKET EVALUATION MATRIX

- TABLE 222 MARKET EVALUATION MATRIX

- 11.6 COMPANY EVALUATION MATRIX (TIER 1), 2022

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 33 PVDF MEMBRANE MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.7 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 11.7.1 RESPONSIVE COMPANIES

- 11.7.2 STARTING BLOCKS

- 11.7.3 PROGRESSIVE COMPANIES

- 11.7.4 DYNAMIC COMPANIES

- FIGURE 34 PVDF MEMBRANE MARKET: START-UPS AND SMES MATRIX, 2022

- 11.8 STRENGTH OF PRODUCT PORTFOLIO

- 11.9 BUSINESS STRATEGY EXCELLENCE

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- TABLE 223 PRODUCT LAUNCHES, 2021

- 11.10.2 DEALS

- TABLE 224 DEALS, 2018-2022

- 11.10.3 OTHER DEVELOPMENTS

- TABLE 225 OTHER DEVELOPMENTS, 2018-2022

12 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

- 12.1 KEY PLAYERS

- 12.1.1 ARKEMA S.A.

- TABLE 226 ARKEMA S.A.: COMPANY OVERVIEW

- FIGURE 35 ARKEMA S.A.: COMPANY SNAPSHOT

- TABLE 227 ARKEMA S.A.: PRODUCT OFFERINGS

- TABLE 228 ARKEMA S.A.: DEALS

- TABLE 229 ARKEMA S.A.: OTHERS

- 12.1.2 MERCK MILLIPORE

- TABLE 230 MERCK MILLIPORE: COMPANY OVERVIEW

- FIGURE 36 MERCK: COMPANY SNAPSHOT

- TABLE 231 MERCK MILLIPORE: PRODUCT OFFERINGS

- TABLE 232 MERCK MILLIPORE: OTHERS

- 12.1.3 KOCH SEPARATION SOLUTIONS

- TABLE 233 KOCH SEPARATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 234 KOCH SEPARATION SOLUTIONS: PRODUCT OFFERINGS

- TABLE 235 KOCH SEPARATION SOLUTIONS: PRODUCT LAUNCHES

- TABLE 236 KOCH SEPARATION SOLUTIONS: DEALS

- TABLE 237 KOCH SEPARATION SOLUTIONS: OTHERS

- 12.1.4 PALL CORPORATION

- TABLE 238 PALL CORPORATION: COMPANY OVERVIEW

- TABLE 239 PALL CORPORATION: PRODUCT OFFERINGS

- TABLE 240 PALL CORPORATION: OTHERS

- 12.1.5 CYTIVA LIFE SCIENCES

- TABLE 241 CYTIVA LIFE SCIENCES: COMPANY OVERVIEW

- TABLE 242 CYTIVA LIFE SCIENCES: PRODUCT OFFERINGS

- TABLE 243 CYTIVA LIFE SCIENCES: DEALS

- TABLE 244 CYTIVA LIFE SCIENCES: OTHERS

- 12.1.6 BIO-RAD LABORATORIES

- TABLE 245 BIO-RAD LABORATORIES: COMPANY OVERVIEW

- FIGURE 37 BIO-RAD LABORATORIES: COMPANY SNAPSHOT

- TABLE 246 BIO-RAD LABORATORIES: PRODUCT OFFERINGS

- 12.1.7 CITIC ENVIROTECH PTE LTD

- TABLE 247 CITIC ENVIROTECH PTE LTD: COMPANY OVERVIEW

- TABLE 248 CITIC ENVIROTECH PTE LTD: PRODUCT OFFERINGS

- TABLE 249 CITIC ENVIROTECH PTE LTD: DEALS

- 12.1.8 GVS FILTER TECHNOLOGY

- TABLE 250 GVS FILTER TECHNOLOGY: COMPANY OVERVIEW

- FIGURE 38 GVS FILTER TECHNOLOGY: COMPANY SNAPSHOT

- TABLE 251 GVS FILTER TECHNOLOGY: PRODUCT OFFERINGS

- TABLE 252 GVS FILTER TECHNOLOGY: DEALS

- 12.1.9 MEMBRANE SOLUTIONS, LLC.

- TABLE 253 MEMBRANE SOLUTIONS, LLC.: COMPANY OVERVIEW

- TABLE 254 MEMBRANE SOLUTIONS, LLC.: PRODUCT OFFERINGS

- 12.1.10 THERMO FISHER SCIENTIFIC INC.

- TABLE 255 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- FIGURE 39 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- TABLE 256 THERMO FISHER SCIENTIFIC INC.: PRODUCT OFFERINGS

- 12.1.11 TORAY INDUSTRIES, INC.

- TABLE 257 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 40 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 258 TORAY INDUSTRIES, INC.: PRODUCT OFFERINGS

- TABLE 259 TORAY INDUSTRIES, INC.: DEALS

- TABLE 260 TORAY INDUSTRIES, INC.: OTHERS

- 12.2 OTHER PLAYERS

- 12.2.1 ADVANCED MICRODEVICES PVT. LTD.

- 12.2.2 ASAHI KASEI CORPORATION

- 12.2.3 COBETTER FILTRATION GROUP

- 12.2.4 ELABSCIENCE

- 12.2.5 HIMEDIA LABORATORIES PVT. LTD.

- 12.2.6 HYUNDAI MICRO CO., LTD.

- 12.2.7 KAMPS GMBH

- 12.2.8 LG CHEM

- 12.2.9 MITSUBISHI CHEMICAL CORPORATION

- 12.2.10 PENTAIR PLC

- 12.2.11 STARLAB GROUP

- 12.2.12 STERLITECH CORPORATION

- 12.2.13 SYNDER FILTRATION

- 12.2.14 THEWAY MEMBRANES

Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS