|

|

市場調査レポート

商品コード

1188886

圧迫療法の世界市場:製品別 (包帯、ラップ、ストッキング、テープ、矯正ブレース、ポンプ)・用途別 (静脈瘤、深部静脈血栓症 (DVT)、リンパ浮腫潰瘍)・流通チャネル別 (病院・クリニック、薬局、eコマース) の将来予測 (2027年まで)Compression Therapy Market by Technique, Product (Bandages, Wraps, Stockings, Tapes, Ortho Braces, Pump), Application (Varicose Vein, DVT, Lymphedema Ulcer), Distribution Channel(Hospitals, Clinics, Pharmacies, E-Commerce) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 圧迫療法の世界市場:製品別 (包帯、ラップ、ストッキング、テープ、矯正ブレース、ポンプ)・用途別 (静脈瘤、深部静脈血栓症 (DVT)、リンパ浮腫潰瘍)・流通チャネル別 (病院・クリニック、薬局、eコマース) の将来予測 (2027年まで) |

|

出版日: 2023年01月13日

発行: MarketsandMarkets

ページ情報: 英文 226 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の圧迫療法の市場規模は、2022年の37億米ドルから2027年には49億米ドルへと、5.5%のCAGRで成長する予想されています。

糖尿病・静脈性下腿潰瘍・深部静脈血栓症などの有病率の上昇や、整形外科疾患を持つ高齢者の急増が、圧迫療法製品の普及を後押ししているようです。また、スポーツによる損傷の増加、一部疾患の管理での圧迫療法製品の使用による良好な臨床的証拠、世界の大手企業による圧迫療法の新たな開発は、さらに市場の成長をサポートすると予想されます。

製品別では、圧迫ポンプ部門が予測期間中に最も高い成長率を記録する見通しです。がんの発生件数の増加、慢性静脈疾患の有病率の上昇、股関節・膝関節手術の増加などの要因が、予測期間中の圧迫ポンプ市場の成長を促進すると予想されます。

用途別では、2021年に静脈瘤治療分野が最大の市場シェアを獲得しています。その要因として、静脈瘤の有病率の増加、静脈瘤の第一選択治療としての圧迫療法の人気の高さなどが挙げられます。

地域別に見ると、アジア太平洋市場が予測期間中に最も高いCAGRで成長すると期待されています。その背景には、糖尿病患者の増加、高齢者人口の増加、整形外科疾患の増加、医療インフラの改善といった要因があります。

当レポートでは、世界の圧迫療法の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、技術別・製品別・用途別・流通チャネル別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 価格動向の分析

- 技術分析

- ワイヤレスバイオセンサー

- 衣料品製造技術

- 規制分析

- 償還シナリオ

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 特許分析

- 貿易分析

- 主な会議とイベント (2022年~2023年)

- 主な利害関係者と購入基準

第6章 圧迫療法市場:技術別

- イントロダクション

- 静的圧縮療法

- 動的圧縮療法

第7章 圧迫療法市場:製品別

- イントロダクション

- 圧迫包帯

- 圧迫ラップ

- 圧迫ストッキング

- クラスI圧迫ストッキング

- クラスII圧迫ストッキング

- クラスIII圧迫ストッキング

- 圧迫テープ

- 圧迫ポンプ

- 間欠式ポンプ

- 連続式ポンプ

- 圧迫ブレース

- その他の圧迫ウェア

第8章 圧迫療法市場:用途別

- イントロダクション

- 静脈瘤の治療

- 深部静脈血栓症 (DTV) の治療

- リンパ浮腫の治療

- 下腿潰瘍の治療

- その他の用途

第9章 圧迫療法市場:流通チャネル別

- イントロダクション

- 薬局・小売業者

- eコマース・プラットフォーム

- 病院・クリニック

- 在宅医療

第10章 圧迫療法市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- 他のアジア太平洋諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 収益シェア分析

- 市場シェア分析

- 競合状況・動向

- 企業評価クアドラント

- 競合リーダーシップマッピング:企業評価クアドラント (2021年)

- 競合リーダーシップマッピング:スタートアップ/中小企業の評価クアドラント (2021年)

- 競合ベンチマーキング

- 競合シナリオ

- 製品の発売

- 資本取引

- その他の動向

第12章 企業プロファイル

- 主要企業

- 3M

- ARJOHUNTLEIGH

- BIO COMPRESSION SYSTEMS, INC.

- BSN MEDICAL (ESSITYの子会社)

- CARDINAL HEALTH, INC.

- CONVATEC INC.

- DJO, LLC (COLFAX CORPORATIONの子会社)

- JULIUS ZORN GMBH

- MEDI GMBH & CO. KG

- PAUL HARTMANN AG

- SANYLEG S.R.L.

- SIGVARIS GROUP

- SMITH & NEPHEW PLC

- TACTILE SYSTEMS TECHNOLOGY, INC. ("TACTILE MEDICAL")

- MEGO AFEK LTD.

- その他の企業

- MEDLINE INDUSTRIES, LP

- GOTTFRIED MEDICAL, INC.

- THERMOTEK, INC.

- BAUERFEIND AG

- OFA BAMBERG GMBH

- ACI MEDICAL, LLC

- AIROS MEDICAL INC.

- BARCELCOM TEXTEIS, S.A.

- CIZETA MEDICALI S.P.A.

- BOSL MEDIZINTECHNIK

第13章 付録

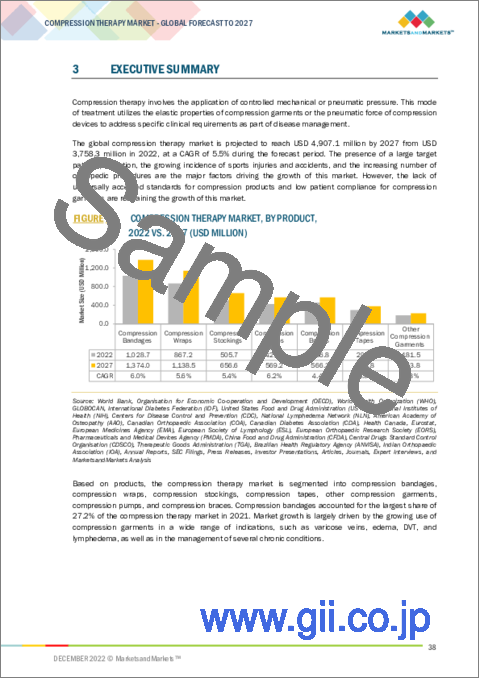

The compression therapy market size is expected to grow from an estimated USD 3.7 billion in 2022 to USD 4.9 billion by 2027, at a CAGR of 5.5%. Rising global prevalence of diabetes, venus leg ulcer, deep vein thrombosis and rapid growth in the older population with orthopedic disorders are likely to boost the adoption of compression therapy products. Growing cases of sports injuries, favorable clinical evidence for the use of compression therapy products in the management of several diseases and new developments in compression therapy by global giants are further anticipated to support the growth of the market.

"Compression pumps segment is expected to witness the highest growth rate during the forecast period"

On the basis of product, the compression therapy market is segmented into compression bandages, compression wraps, compression stockings, compression tapes, compression pumps, compression braces, and other compression garments. Compression pumps segment is anticipated to register the highest CAGR during the forecast period. Factors such as the increasing incidence of cancer, the rising prevalence of chronic venous diseases, and the growing number of hip and knee surgeries are expected to drive the growth of the compression pumps market during the forecast period.

"varicose vein treatment segment to capture the largest market share or compression therapy market in 2021, by application

On the basis of application, the compression therapy market is segmented into varicose vein treatment, deep vein thrombosis treatment, lymphedema treatment, leg ulcer treatment, and other applications. The varicose vein treatment segment accounted for the largest share the compression therapy market in 2021. The large share of this segment is mainly driven by the increasing prevalence of varicose veins, the high preference for compression therapy as the first line of treatment for varicose veins,

" The Asia Pacific market is expected to grow at the highest CAGR during the forecast period"

The global compression therapy market is segmented into North America, Europe, the Asia Pacific, and the Rest of the World (Latin America and the Middle East & Africa). During the forecast period of Asia Pacific market is estimated to grow at the highest CAGR owing to the increase in patient population with diabetes, large geriatric patient pool, growing prevalence of orthopedic disorders and improved healthcare infrastructure in the region.

A breakdown of the primary participants referred to for this report is provided below:

By Company Type: Tier 1-48%, Tier 2-36%, and Tier 3- 16%

By Designation: C-level-10%, Director-level-14%, and Others-76%

By Region: North America-40%, Europe-32%, Asia Pacific-20%, Latin America-5%, and the Middle East & Africa-3%

The major players operating in the compression therapy market are DJO, Inc. (US), BSN Medical (US), medi GmbH & Co. KG (Germany), Tactile Medical (US), SIGVARIS (Switzerland), Paul Hartmann AG (Germany), Sanyleg S.r.l. (Italy), 3M (US), ConvaTec Inc. (US), ArjoHuntleigh (Sweden), Julius Zorn GmbH (Germany), Bio Compression Systems, Inc. (US), Cardinal Health, Inc. (US), Smith & Nephew Plc (UK) and Mego Afek Ltd. (Israel).

Research Coverage

This report studies the compression therapy market based on product, technique, application, distribution channel, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the below-mentioned strategies for strengthening their market presence.

This report provides insights on the following pointers:

Market Penetration: Comprehensive information on the product portfolios offered by the top players in the compression therapy market

Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the compression therapy market

Market Development: Comprehensive information on lucrative emerging regions

Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the compression therapy market

Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- 1.5 LIMITATIONS

- 1.6 KEY MARKET STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Indicative list of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET ESTIMATION METHODOLOGY

- FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

- 2.2.2 SALES/DISTRIBUTION CHANNEL-BASED MARKET ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: GLOBAL COMPRESSION THERAPY MARKET

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.3 RECESSION IMPACT

- 2.3.1 IMPACT OF RECESSION ON COMPRESSION THERAPY MARKET

- 2.4 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 COMPRESSION THERAPY MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 COMPRESSION THERAPY MARKET SHARE, BY TECHNIQUE, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 COMPRESSION THERAPY MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 COMPRESSION THERAPY MARKET SHARE, BY DISTRIBUTION CHANNEL, 2022 VS. 2027

- FIGURE 11 GEOGRAPHICAL SNAPSHOT OF COMPRESSION THERAPY MARKET

4 PREMIUM INSIGHTS

- 4.1 COMPRESSION THERAPY MARKET OVERVIEW

- FIGURE 12 GROWING INCIDENCE OF SPORTS INJURIES AND FAVORABLE CLINICAL EVIDENCE TO DRIVE MARKET GROWTH

- 4.2 COMPRESSION THERAPY MARKET SHARE, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 COMPRESSION PUMPS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 STATIC COMPRESSION THERAPY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 HOSPITALS & CLINICS TO ACCOUNT FOR LARGEST SHARE OF COMPRESSION THERAPY MARKET IN 2027

- 4.5 COMPRESSION THERAPY MARKET, BY REGION, 2020-2027

- FIGURE 16 ASIA PACIFIC TO WITNESS FASTEST GROWTH IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 COMPRESSION THERAPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Large target patient population

- FIGURE 18 GERIATRIC POPULATION, BY REGION, 2015 VS. 2030 VS. 2050

- 5.2.1.2 Growing incidence of sports injuries and accidents

- FIGURE 19 EUROPE: ROAD DEATHS PER MILLION INHABITANTS, BY COUNTRY, 2021

- 5.2.1.3 Increasing number of orthopedic procedures

- 5.2.1.4 Greater product affordability and market availability

- 5.2.1.5 Clinical evidence favoring adoption of compression therapy for management of target conditions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of universally accepted standards for compression products

- 5.2.2.2 Low patient compliance with compression garments

- FIGURE 20 REASONS FOR NON-COMPLIANCE TO COMPRESSION THERAPY

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth potential offered by emerging markets

- 5.2.3.2 Growing patient awareness regarding benefits of compression therapy

- 5.2.3.3 Increased sales of off-the-shelf and online products

- 5.2.4 CHALLENGES

- 5.2.4.1 Significant adoption of alternative therapies for specific target indications

- 5.2.4.2 Increasing pricing pressure on market players

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 OVERVIEW

- TABLE 2 COMPRESSION THERAPY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 THREAT FROM NEW ENTRANTS

- 5.3.5 THREAT FROM SUBSTITUTES

- 5.3.6 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 PRICING TREND ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE, BY PRODUCT

- TABLE 3 AVERAGE PRICE OF KEY COMPRESSION THERAPY PRODUCTS, 2021 (USD)

- 5.4.2 AVERAGE SELLING PRICE, BY REGION

- TABLE 4 REGIONAL PRICING ANALYSIS OF KEY COMPRESSION THERAPY PRODUCTS, 2021 (USD)

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 WIRELESS BIOSENSORS

- 5.5.2 GARMENT MANUFACTURING TECHNOLOGIES

- 5.6 REGULATORY ANALYSIS

- 5.6.1 NORTH AMERICA

- 5.6.1.1 US

- TABLE 5 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 6 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.6.1.2 Canada

- TABLE 7 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- FIGURE 21 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

- 5.6.2 EUROPE

- FIGURE 22 EUROPE: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES (MDR)

- 5.6.3 ASIA PACIFIC

- 5.6.3.1 Japan

- TABLE 8 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- 5.6.3.2 China

- TABLE 9 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- 5.6.3.3 India

- 5.6.1 NORTH AMERICA

- 5.7 REIMBURSEMENT SCENARIO

- TABLE 10 REIMBURSEMENT CODES FOR VARIOUS PROCEDURES AS OF 2021

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS-MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

- 5.9 SUPPLY CHAIN ANALYSIS

- 5.9.1 PROMINENT COMPANIES

- 5.9.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.9.3 END USERS

- FIGURE 24 SUPPLY CHAIN ANALYSIS

- 5.10 ECOSYSTEM ANALYSIS

- 5.10.1 PARENT MARKET: ORTHOPEDIC IMPLANTS, SURGICAL DEVICES, AND SUPPORT PRODUCTS

- 5.11 PATENT ANALYSIS

- FIGURE 25 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- TABLE 11 IMPORT DATA FOR COMPRESSION STOCKINGS (HS CODE 611510), BY COUNTRY, 2017-2021 (USD)

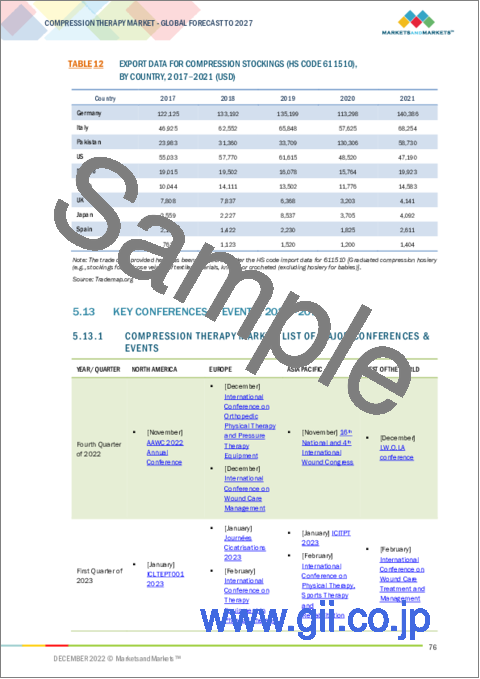

- TABLE 12 EXPORT DATA FOR COMPRESSION STOCKINGS (HS CODE 611510), BY COUNTRY, 2017-2021 (USD)

- 5.13 KEY CONFERENCES & EVENTS, 2022-2023

- 5.13.1 COMPRESSION THERAPY MARKET: LIST OF MAJOR CONFERENCES & EVENTS

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS, BY DISTRIBUTION CHANNEL

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY DISTRIBUTION CHANNEL

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY DISTRIBUTION CHANNEL (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA, BY DISTRIBUTION CHANNEL

- TABLE 14 KEY BUYING CRITERIA, BY DISTRIBUTION CHANNEL

6 COMPRESSION THERAPY MARKET, BY TECHNIQUE

- 6.1 INTRODUCTION

- TABLE 15 COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- 6.2 STATIC COMPRESSION THERAPY

- 6.2.1 PROCEDURAL ADVANTAGES OF STATIC COMPRESSION THERAPY TO DRIVE GROWTH

- TABLE 16 STATIC COMPRESSION THERAPY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 DYNAMIC COMPRESSION THERAPY

- 6.3.1 RISING INCIDENCE OF TARGET CONDITIONS TO SUPPORT MARKET

- TABLE 17 DYNAMIC COMPRESSION THERAPY MARKET, BY REGION, 2020-2027 (USD MILLION)

7 COMPRESSION THERAPY MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- TABLE 18 COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 7.2 COMPRESSION BANDAGES

- 7.2.1 LIMITED AVAILABILITY OF MEDICAL REIMBURSEMENTS FOR VARICOSE VEIN SURGERIES TO RESTRAIN MARKET GROWTH

- TABLE 19 COMPRESSION BANDAGES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 20 COMPRESSION BANDAGES MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- TABLE 21 COMPRESSION BANDAGES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 22 COMPRESSION BANDAGES MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

- 7.3 COMPRESSION WRAPS

- 7.3.1 RISING GERIATRIC POPULATION AND INCREASING INCIDENCE OF SPORTS INJURIES TO DRIVE MARKET

- TABLE 23 COMPRESSION WRAPS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 24 COMPRESSION WRAPS MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- TABLE 25 COMPRESSION WRAPS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 26 COMPRESSION WRAPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

- 7.4 COMPRESSION STOCKINGS

- TABLE 27 COMPRESSION STOCKINGS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 28 COMPRESSION STOCKINGS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 29 COMPRESSION STOCKINGS MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- TABLE 30 COMPRESSION STOCKINGS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 31 COMPRESSION STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

- 7.4.1 CLASS I COMPRESSION STOCKINGS

- 7.4.1.1 Advantages such as comfort and durability to drive demand for class I stockings

- TABLE 32 CLASS I COMPRESSION STOCKINGS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.4.2 CLASS II COMPRESSION STOCKINGS

- 7.4.2.1 Increasing number of lymphedema and DVT patients to fuel demand

- TABLE 33 CLASS II COMPRESSION STOCKINGS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.4.3 CLASS III COMPRESSION STOCKINGS

- 7.4.3.1 High level of compression provided to boost adoption of class III stockings

- TABLE 34 CLASS III COMPRESSION STOCKINGS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.5 COMPRESSION TAPES

- 7.5.1 ABILITY TO PREVENT FURTHER MUSCLE INJURY TO DRIVE DEMAND FOR COMPRESSION TAPES

- TABLE 35 COMPRESSION TAPES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 36 COMPRESSION TAPES MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- TABLE 37 COMPRESSION TAPES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 38 COMPRESSION TAPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

- 7.6 COMPRESSION PUMPS

- TABLE 39 COMPRESSION PUMPS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 40 COMPRESSION PUMPS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 41 COMPRESSION PUMPS MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- TABLE 42 COMPRESSION PUMPS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 43 COMPRESSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

- 7.6.1 INTERMITTENT PUMPS

- 7.6.1.1 Availability of wide range of intermittent pumps with varying designs and complexity to boost demand

- TABLE 44 INTERMITTENT COMPRESSION PUMPS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.6.2 SEQUENTIAL PUMPS

- 7.6.2.1 Wide usage to prevent development of DVT to boost growth

- TABLE 45 SEQUENTIAL COMPRESSION PUMPS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.7 COMPRESSION BRACES

- 7.7.1 RISING NUMBER OF JOINT REPLACEMENT SURGERIES TO SUPPORT MARKET

- TABLE 46 COMPRESSION BRACES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 47 COMPRESSION BRACES MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- TABLE 48 COMPRESSION BRACES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 49 COMPRESSION BRACES MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

- 7.8 OTHER COMPRESSION GARMENTS

- TABLE 50 OTHER COMPRESSION GARMENTS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 51 OTHER COMPRESSION GARMENTS MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- TABLE 52 OTHER COMPRESSION GARMENTS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 53 OTHER COMPRESSION GARMENTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

8 COMPRESSION THERAPY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 54 COMPRESSION THERAPY MARKET, BY APPLICATION, 2020-2027(USD MILLION)

- 8.2 VARICOSE VEIN TREATMENT

- 8.2.1 GROWING GLOBAL PREVALENCE OF VARICOSE VEINS TO DRIVE MARKET

- TABLE 55 COMPRESSION THERAPY MARKET FOR VARICOSE VEIN TREATMENT, BY REGION, 2020-2027 (USD MILLION)

- 8.3 DEEP VEIN THROMBOSIS TREATMENT

- 8.3.1 AVAILABILITY OF ALTERNATIVE TREATMENTS FOR DVT TO LIMIT GROWTH

- TABLE 56 COMPRESSION THERAPY MARKET FOR DEEP VEIN THROMBOSIS TREATMENT, BY REGION, 2020-2027 (USD MILLION)

- 8.4 LYMPHEDEMA TREATMENT

- 8.4.1 RISING INCIDENCE OF CANCER TO CONTRIBUTE TO GROWTH

- TABLE 57 COMPRESSION THERAPY MARKET FOR LYMPHEDEMA TREATMENT, BY REGION, 2020-2027 (USD MILLION)

- 8.5 LEG ULCER TREATMENT

- 8.5.1 GROWING DISEASE BURDEN ACROSS MAJOR COUNTRIES TO BOOST MARKET

- TABLE 58 COMPRESSION THERAPY MARKET FOR LEG ULCER TREATMENT, BY REGION, 2020-2027 (USD MILLION)

- 8.6 OTHER APPLICATIONS

- TABLE 59 COMPRESSION THERAPY MARKET FOR OTHER APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

9 COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL

- 9.1 INTRODUCTION

- TABLE 60 COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

- 9.2 PHARMACIES & RETAILERS

- 9.2.1 RISING ADOPTION OF OFF-THE-SHELF PRODUCTS TO SUPPORT MARKET GROWTH

- TABLE 61 COMPRESSION THERAPY MARKET FOR PHARMACIES & RETAILERS, BY REGION, 2020-2027 (USD MILLION)

- 9.3 E-COMMERCE PLATFORMS

- 9.3.1 E-COMMERCE PLATFORMS TO REGISTER HIGH CAGR DURING FORECAST PERIOD

- TABLE 62 COMPRESSION THERAPY MARKET FOR E-COMMERCE PLATFORMS, BY REGION, 2020-2027 (USD MILLION)

- 9.4 HOSPITALS & CLINICS

- 9.4.1 HEALTHCARE INFRASTRUCTURAL IMPROVEMENTS TO BOOST GROWTH

- TABLE 63 COMPRESSION THERAPY MARKET FOR HOSPITALS & CLINICS, BY REGION, 2020-2027 (USD MILLION)

- 9.5 HOME CARE SETTINGS

- 9.5.1 GROWING INCLINATION TOWARD HOME HEALTHCARE TO DRIVE MARKET

- TABLE 64 COMPRESSION THERAPY MARKET FOR HOME CARE SETTINGS, BY REGION, 2020-2027 (USD MILLION)

10 COMPRESSION THERAPY MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 65 COMPRESSION THERAPY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 28 NORTH AMERICA: COMPRESSION THERAPY MARKET SNAPSHOT

- TABLE 66 NORTH AMERICA: COMPRESSION THERAPY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- TABLE 68 NORTH AMERICA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: COMPRESSION THERAPY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 70 NORTH AMERICA: COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Rising number of sports injuries to drive market growth

- TABLE 71 US: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Increasing incidence of target diseases to support growth

- TABLE 72 CANADA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.3 EUROPE

- TABLE 73 EUROPE: COMPRESSION THERAPY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 74 EUROPE: COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- TABLE 75 EUROPE: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 76 EUROPE: COMPRESSION THERAPY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 77 EUROPE: COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Inconsistent reimbursement for compression therapy products to restrain market growth

- TABLE 78 GERMANY: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Rising prevalence of lymphedema and DVT to drive market

- TABLE 79 UK: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 High incidence of diabetes to drive demand for compression therapy

- TABLE 80 FRANCE: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 Rising awareness about preventive care for musculoskeletal injuries to fuel growth

- TABLE 81 ITALY: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.3.5 SPAIN

- 10.3.5.1 Growing presence of key manufacturers to increase access to compression therapy products

- TABLE 82 SPAIN: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 83 HIP AND KNEE SURGERY PROCEDURES (PER 100,000 PEOPLE) IN EUROPEAN COUNTRIES

- TABLE 84 REST OF EUROPE: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 29 ASIA PACIFIC: COMPRESSION THERAPY MARKET SNAPSHOT

- TABLE 85 ASIA PACIFIC: COMPRESSION THERAPY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 86 ASIA PACIFIC: COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- TABLE 87 ASIA PACIFIC: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 88 ASIA PACIFIC: COMPRESSION THERAPY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 89 ASIA PACIFIC: COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

- 10.4.1 JAPAN

- 10.4.1.1 Japan to dominate Asia Pacific compression therapy market

- TABLE 90 JAPAN: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Modernization of healthcare facilities to drive market growth

- TABLE 91 CHINA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Growing number of hip & knee surgeries to support market

- TABLE 92 INDIA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.4.4 AUSTRALIA

- 10.4.4.1 Government subsidies related to compression garments for lymphedema patients to promote growth

- TABLE 93 AUSTRALIA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Increasing number of plastic surgeries to drive demand for compression garments

- TABLE 94 SOUTH KOREA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 95 REST OF ASIA PACIFIC: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.5 LATIN AMERICA

- TABLE 96 LATIN AMERICA: COMPRESSION THERAPY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 97 LATIN AMERICA: COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- TABLE 98 LATIN AMERICA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 99 LATIN AMERICA: COMPRESSION THERAPY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 100 LATIN AMERICA: COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

- 10.5.1 BRAZIL

- 10.5.1.1 Rising number of cosmetic surgeries to support market

- TABLE 101 BRAZIL: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.5.2 MEXICO

- 10.5.2.1 Lack of reimbursement for bracing products to limit growth

- TABLE 102 MEXICO: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.5.3 REST OF LATIN AMERICA

- TABLE 103 REST OF LATIN AMERICA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 UNFAVORABLE REIMBURSEMENT SCENARIO TO HAMPER MARKET GROWTH

- TABLE 104 MIDDLE EAST & AFRICA: COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2020-2027 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: COMPRESSION THERAPY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN COMPRESSION THERAPY MARKET

- TABLE 108 STRATEGIES ADOPTED BY KEY COMPRESSION THERAPY PRODUCT MANUFACTURING COMPANIES

- 11.3 REVENUE SHARE ANALYSIS

- FIGURE 30 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN COMPRESSION THERAPY MARKET

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 31 COMPRESSION THERAPY MARKET SHARE, BY KEY PLAYER, 2021

- 11.5 COMPETITIVE SITUATIONS AND TRENDS

- TABLE 109 COMPRESSION THERAPY MARKET: DEGREE OF COMPETITION

- 11.6 COMPANY EVALUATION QUADRANT

- 11.7 COMPETITIVE LEADERSHIP MAPPING: COMPANY EVALUATION QUADRANT (2021)

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- FIGURE 32 COMPRESSION THERAPY MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

- 11.8 COMPETITIVE LEADERSHIP MAPPING: START-UP/SME EVALUATION QUADRANT (2021)

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 STARTING BLOCKS

- 11.8.3 RESPONSIVE COMPANIES

- 11.8.4 DYNAMIC COMPANIES

- FIGURE 33 COMPRESSION THERAPY MARKET: COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS) (2021)

- 11.9 COMPETITIVE BENCHMARKING

- FIGURE 34 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS OF TOP PLAYERS IN COMPRESSION THERAPY MARKET

- TABLE 110 COMPANY PRODUCT FOOTPRINT

- TABLE 111 COMPANY REGIONAL FOOTPRINT

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- 11.10.2 DEALS

- 11.10.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

- 12.1.1 3M

- TABLE 112 3M: BUSINESS OVERVIEW

- FIGURE 35 3M: COMPANY SNAPSHOT (2021)

- 12.1.2 ARJOHUNTLEIGH

- TABLE 113 ARJOHUNTLEIGH: BUSINESS OVERVIEW

- FIGURE 36 ARJOHUNTLEIGH: COMPANY SNAPSHOT (2021)

- 12.1.3 BIO COMPRESSION SYSTEMS, INC.

- TABLE 114 BIO COMPRESSION SYSTEMS, INC.: BUSINESS OVERVIEW

- 12.1.4 BSN MEDICAL (A SUBSIDIARY OF ESSITY)

- TABLE 115 ESSITY: BUSINESS OVERVIEW

- FIGURE 37 ESSITY: COMPANY SNAPSHOT (2021)

- 12.1.5 CARDINAL HEALTH, INC.

- TABLE 116 CARDINAL HEALTH, INC.: BUSINESS OVERVIEW

- FIGURE 38 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT (2022)

- 12.1.6 CONVATEC INC.

- TABLE 117 CONVATEC INC.: BUSINESS OVERVIEW

- FIGURE 39 CONVATEC INC.: COMPANY SNAPSHOT (2021)

- 12.1.7 DJO, LLC (A SUBSIDIARY OF COLFAX CORPORATION)

- TABLE 118 DJO, LLC: BUSINESS OVERVIEW

- FIGURE 40 COLFAX CORPORATION: COMPANY SNAPSHOT (2021)

- 12.1.8 JULIUS ZORN GMBH

- TABLE 119 JULIUS ZORN GMBH: BUSINESS OVERVIEW

- 12.1.9 MEDI GMBH & CO. KG

- TABLE 120 MEDI GMBH & CO. KG: BUSINESS OVERVIEW

- 12.1.10 PAUL HARTMANN AG

- TABLE 121 PAUL HARTMANN AG: BUSINESS OVERVIEW

- FIGURE 41 PAUL HARTMANN AG: COMPANY SNAPSHOT (2021)

- 12.1.11 SANYLEG S.R.L.

- TABLE 122 SANYLEG S.R.L.: BUSINESS OVERVIEW

- 12.1.12 SIGVARIS GROUP

- TABLE 123 SIGVARIS GROUP: BUSINESS OVERVIEW

- 12.1.13 SMITH & NEPHEW PLC

- TABLE 124 SMITH & NEPHEW PLC: BUSINESS OVERVIEW

- FIGURE 42 SMITH & NEPHEW PLC: COMPANY SNAPSHOT (2021)

- 12.1.14 TACTILE SYSTEMS TECHNOLOGY, INC. ("TACTILE MEDICAL")

- TABLE 125 TACTILE MEDICAL: BUSINESS OVERVIEW

- FIGURE 43 TACTILE MEDICAL: COMPANY SNAPSHOT (2021)

- 12.1.15 MEGO AFEK LTD.

- TABLE 126 MEGO AFEK LTD.: BUSINESS OVERVIEW

- 12.2 OTHER PLAYERS

- 12.2.1 MEDLINE INDUSTRIES, LP

- 12.2.2 GOTTFRIED MEDICAL, INC.

- 12.2.3 THERMOTEK, INC.

- 12.2.4 BAUERFEIND AG

- 12.2.5 OFA BAMBERG GMBH

- 12.2.6 ACI MEDICAL, LLC

- 12.2.7 AIROS MEDICAL INC.

- 12.2.8 BARCELCOM TEXTEIS, S.A.

- 12.2.9 CIZETA MEDICALI S.P.A.

- 12.2.10 BOSL MEDIZINTECHNIK

Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS