|

|

市場調査レポート

商品コード

1128618

航空機用センサーの世界市場:航空機タイプ別(固定翼機、回転翼機、UAV、AAM)、用途別(エンジン、航空構造、燃料・油圧、キャビン)、センサータイプ別、最終用途別(OEM、アフターマーケット)、コネクティビティ別、地域別 - 2027年までの予測Aircraft Sensors Market by aircraft type (Fixed-wing, Rotary-wing, UAVs, AAM), Application (Engine, Aerostructures, Fuel & Hydraulic, Cabin), Sensor Type, End Use (OEM, Aftermarket), Connectivity (Wired, Wireless) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 航空機用センサーの世界市場:航空機タイプ別(固定翼機、回転翼機、UAV、AAM)、用途別(エンジン、航空構造、燃料・油圧、キャビン)、センサータイプ別、最終用途別(OEM、アフターマーケット)、コネクティビティ別、地域別 - 2027年までの予測 |

|

出版日: 2022年09月21日

発行: MarketsandMarkets

ページ情報: 英文 239 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の航空機用センサーの市場規模は、2022年の47億米ドルから2027年までに70億米ドルに達し、予測期間中にCAGRで8.3%の成長が予測されています。

航空業界は、航空機モデルの技術的進歩という点で、大きな変革期を迎えています。このため、航空機に使用されるセンサーネットワークの改良が進んでいます。より多くの電気およびハイブリッド電気航空機が、航空業界の将来の一部であり、その採用率は将来的に大幅に増加すると予想されます。

過去10年間で、航空機用センサーに使用される技術に大きな進歩がありました。これらの技術は、パイロットの飛行制御能力と状況認識レベルを向上させ、乗客の快適性レベルを向上させました。これらの技術は、民間航空機と軍用航空機の全体的な運用効率の向上につながり、重要かつ複雑な航空任務の遂行や、軍用および民間航空会社の効率的な日常業務の維持に、それぞれ適したものとなっています。

固定翼機セグメントが、予測期間中に最大の市場シェアを占める

航空機タイプ別では、固定翼機セグメントが予測期間中に最も高い成長を遂げると予想されます。航空輸送量の増加が、全地域で民間航空機の需要を促進しています。航空交通量の増加は、これらの航空機の安全性と健康状態を確保する必要性も高めています。したがって、航空機の健康と安全を確保するために、高度で効率的なセンサーソリューションが必要とされています。これが、航空機用センサーのニーズを高める主な要因の1つとなっています。

温度センサーが、予測期間中に最も高い成長を示す

センサータイプ別では、温度センサーが予測期間中に最も高い成長を示しています。温度センサーは、燃料温度、外気温度、機内温度、貨物温度、タービン入口温度などの用途に広く使用されています。航空交通量の増加、運航コストの上昇、性能に対する要求の高まりにより、安全性と最大限の性能を発揮するためには、精密な航空データ測定が必要になっています。そのため、航空機の効率的な運用には、正確で信頼性の高い全温度計測が欠かせません。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 航空機用センサー市場:バリューチェーン分析

- 航空機用センサー市場のエコシステム

- 貿易データ統計

- 技術分析

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向/混乱

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 主な会議とイベント

- 航空宇宙産業の関税と規制状況

第6章 業界動向

- イントロダクション

- サプライチェーン分析

- 航空機用センサー市場の技術動向

- メガトレンドの影響

- 航空機用センサー市場:特許分析

第7章 航空機用センサー市場:センサータイプ別

- イントロダクション

- 圧力センサー

- 温度センサー

- フォースセンサー

- トルクセンサー

- スピードセンサー

- 位置・変位センサー

- レベルセンサー

- 近接センサー

- フローセンサー

- 光センサー

- モーションセンサー

- レーダーセンサー

- 煙感知センサー

- GPSセンサー

- その他

第8章 航空機用センサー市場:用途別

- イントロダクション

- 燃料・油圧・空気圧システム

- エンジン/推進力

- キャビン・貨物環境制御

- 航空構造・飛行制御

- フライトデッキ

- 着陸装置システム

- 武器システム

- その他

第9章 航空機用センサー市場:航空機タイプ別

- イントロダクション

- 固定翼機

- 回転翼機

- 無人航空機(UAV)

- 先進航空モビリティ(AAM)

第10章 航空機用センサー市場:最終用途別

- イントロダクション

- OEM

- アフターマーケット

第11章 航空機用センサー市場:コネクティビティ別

- イントロダクション

- 有線センサー

- 無線センサー

第12章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- イタリア

- ロシア

- その他

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他

- 中東

- PESTLE分析

- イスラエル

- アラブ首長国連邦

- サウジアラビア

- トルコ

- その他中東

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- アフリカ

- 南アフリカ

- ナイジェリア

- その他

第13章 競合情勢

- イントロダクション

- 市場シェア分析

- 主要企業5社の収益分析

- 企業の評価象限

- スタートアップ/中小企業の評価象限

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- HONEYWELL INTERNATIONAL INC.

- SAFRAN GROUP

- TE CONNECTIVITY LTD.

- MEGGITT PLC

- AMETEK INC.

- LOCKHEED MARTIN CORPORATION

- WOODWARD INC.

- GENERAL ELECTRIC COMPANY

- THALES GROUP

- L3HARRIS TECHNOLOGIES, INC.

- THE BOSCH GROUP

- TRIMBLE INC.

- CURTISS-WRIGHT CORPORATION

- EATON CORPORATION

- CRANE AEROSPACE & ELECTRONICS

- LORD SENSING STELLAR TECHNOLOGY

- AMPHENOL CORPORATION

- KONGSBERG GRUPPEN ASA

- TDK CORPORATION

- ULTRA ELECTRONICS

- VECTORNAV TECHNOLOGIES LLC

- SYSTRON DONNER INERTIAL

- その他の企業

- AEROSONIC

- SENSOR SYSTEMS LLC

- CIRCOR AEROSPACE

第15章 付録

The Aircraft Sensors Market is projected to grow from USD 4.7 billion in 2022 to USD 7.0 billion by 2027, at a CAGR of 8.3% during the forecast period.

The aviation industry is witnessing major transformations in terms of technological advancements in aircraft models. This has given rise to improvements in the sensor networks used in aircraft. More electric and hybrid electric aircraft are part of the future of the aviation industry, with their adoption rate expected to significantly increase in the future.

In the last 10 years, there have been significant advancements in technologies used in aircraft sensors. These technologies have enhanced the flight control capabilities and situational awareness levels of pilots while increasing the comfort level of passengers. They have resulted in the improvement of overall operational efficiency of both, commercial and military aircraft, making them better suited to carry out critical and complex air missions as well as maintain effective day-to-day operations of military and commercial airlines, respectively.

Fixed Wing segment to witness largest market share in the forecast period

By Aircraft Type, the fixed wing segment is expected to growth the highest in the forecast period. The increase in air traffic is driving the demand for commercial aircraft across all regions. The increasing air traffic is also driving the need to ensure safety and health of these aircrafts. Hence advanced and efficient sensors solutions are required to ensure health and safety of these aircraft. This is one of the major factors driving the need for aircraft sensors.

Temperature Sensors to witness highest growth in the forecast period.

Based on Sensor type, the Temperature sensors are witnessing highest growth in the forecast period. Temperature sensors are widely used for application in fuel temperatures, outside air temperature, cabin temperature, cargo temperature, and turbine inlet temperature. Increasing air traffic, higher operating costs, and greater performance demands have made precision air data measurements necessary for safety and maximum performance. Thus, accurate and reliable total temperature measurement is essential for the efficient operation of aircraft.

Break-up of profile of primary participants in the aircraft sensors market:

- By Company Type: Tier 1 - 20%, Tier 2 - 55%, and Tier 3 - 25%

- By Designation: C Level - 50%, Director Level - 25%, and Others - 25%

- By Region: North America - 60%, Europe - 20%, Asia Pacific - 10%, South America- 5%, and RoW - 5%

Major players operating in the aircraft sensors market include: Honeywell (US), TE Connectivity (US), Meggitt PLC (UK), AMETEK Inc. (US), and Safran (France)among others. These key players offer aircraft sensors and services to different key stakeholders.

Research Coverage:

This research report categorizes the aircraft generator market on the basis of aircraft type (Fixed-wing, Rotary-wing, UAVs, AAM), Application (Engine, Aerostructures, Fuel & Hydraulic, Cabin), Sensor Type, End Use (OEM, Aftermarket), Connectivity (Wired, Wireless), and Region. These segments have been mapped across major regions, namely, North America, Europe, Asia Pacific, Middle East, Latin America, and Africa. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the aircraft sensors market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; new product launches; mergers; and partnerships, agreements, and collaborations; and recent developments associated with the sustainable aviation fuel market. In addition, the startups in aircraft sensors market ecosystem are covered in this report to provide usable insights and developments happening in the emerging market of aircraft sensors.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aircraft sensors market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on aircraft sensors market offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches, contracts, agreements, and expansion plans in the aircraft sensors market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the aircraft sensors market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the aircraft sensors market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the aircraft sensors market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 AIRCRAFT SENSORS MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- FIGURE 2 AIRCRAFT SENSORS MARKET: REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- FIGURE 3 AIRCRAFT SENSORS MARKET: YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY & PRICING

- TABLE 2 USD YEARLY AVERAGE EXCHANGE RATES

- 1.6 LIMITATIONS

- 1.7 MARKET STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- FIGURE 1 AIRCRAFT SENSORS MARKET: SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 AIRCRAFT SENSORS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.2 DEMAND- & SUPPLY-SIDE ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 Growing trend of more electric technology

- 2.2.2.2 Increasing demand for new commercial aircraft

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.3.1 Advancements in technologies to make aircraft more fault-tolerant and efficient

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 AIRCRAFT SENSORS MARKET: SEGMENTS AND SUBSEGMENTS

- 2.4 RESEARCH APPROACH & METHODOLOGY

- 2.4.1 AIRCRAFT SENSORS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 AIRCRAFT SENSORS MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

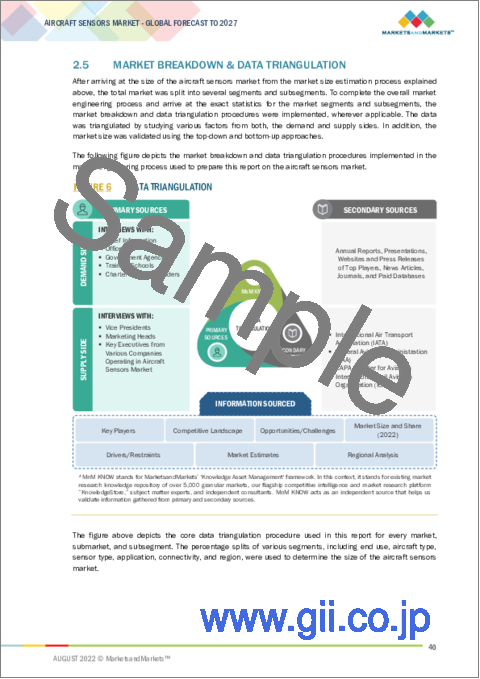

- 2.5 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.6 GROWTH RATE ASSUMPTIONS

- 2.7 ASSUMPTIONS FOR RESEARCH STUDY

- 2.8 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 7 FUEL, HYDRAULIC, AND PNEUMATIC SYSTEMS TO BE LARGEST APPLICATION IN 2022

- FIGURE 8 WIRED CONNECTIVITY SEGMENT TO ACCOUNT FOR MAJOR MARKET SHARE IN 2022

- FIGURE 9 NORTH AMERICA TO DOMINATE AIRCRAFT SENSORS MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN AIRCRAFT SENSORS MARKET

- FIGURE 10 INCREASING NEED FOR ADVANCED SENSING SOLUTIONS EXPECTED TO DRIVE MARKET FROM 2022 TO 2027

- 4.2 AIRCRAFT SENSORS MARKET, BY END USE

- FIGURE 11 OEM SEGMENT PROJECT TO LEAD MARKET FROM 2022 TO 2027

- 4.3 AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE

- FIGURE 12 FIXED-WING SEGMENT PROJECTED TO DOMINATE MARKET FROM 2022 TO 2027

- 4.4 AIRCRAFT SENSORS MARKET, BY COUNTRY

- FIGURE 13 AIRCRAFT SENSORS MARKET IN AUSTRALIA PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 AIRCRAFT SENSORS: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased usage of sensors for data sensing & measurement

- 5.2.1.2 Advancements in micro-electrical-mechanical systems (MEMS) technology

- 5.2.1.3 High demand for sensors in military UAVs

- 5.2.2 RESTRAINTS

- 5.2.2.1 Frequent calibration of sensors to ensure efficient working of systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased adoption of internet of things in aviation industry

- 5.2.3.2 Increasing need for sensors for structural monitoring

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity risks

- 5.3 AIRCRAFT SENSORS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 15 VALUE CHAIN ANALYSIS: AIRCRAFT SENSORS MARKET

- 5.4 AIRCRAFT SENSORS MARKET ECOSYSTEM

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 END USERS

- FIGURE 16 AIRCRAFT SENSORS MARKET ECOSYSTEM MAP

- TABLE 3 AIRCRAFT SENSORS MARKET ECOSYSTEM

- 5.5 TRADE DATA STATISTICS

- TABLE 4 TRADE DATA FOR AIRCRAFT SENSORS IN INDIA

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 INCREASED SITUATIONAL AWARENESS

- 5.6.2 MICRO-ELECTRO-MECHANICAL SYSTEMS (MEMS) AND NANO TECHNOLOGY

- 5.6.3 NEXT-GENERATION SENSOR SYSTEMS

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 USE CASE: WIRELESS AIRCRAFT TIRE BRAKE & TEMPERATURE MONITORING SYSTEM

- 5.7.2 USE CASE: CAN-BUS DATA CONNECTIVITY SENSORS

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRCRAFT SENSOR MANUFACTURERS

- FIGURE 17 REVENUE SHIFT IN AIRCRAFT SENSORS MARKET

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 AIRCRAFT SENSORS MARKET: PORTER'S FIVE FORCE ANALYSIS

- FIGURE 18 AIRCRAFT SENSORS MARKET: PORTER'S FIVE FORCE ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT SENSORS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT SENSORS (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 20 KEY BUYING CRITERIA FOR AIRCRAFT SENSORS

- TABLE 7 KEY BUYING CRITERIA FOR AIRCRAFT SENSORS

- 5.11 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 8 AIRCRAFT SENSORS MARKET: CONFERENCES AND EVENTS (2022-2023)

- 5.12 TARIFF AND REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 21 SUPPLY CHAIN ANALYSIS

- 6.3 TECHNOLOGY TRENDS IN AIRCRAFT SENSORS MARKET

- 6.3.1 WIRELESS SENSING SYSTEMS

- 6.3.2 MULTI-SENSOR POD SYSTEMS

- 6.4 IMPACT OF MEGATRENDS

- 6.5 AIRCRAFT SENSORS MARKET: PATENT ANALYSIS

- TABLE 13 KEY PATENTS

7 AIRCRAFT SENSORS MARKET, BY SENSOR TYPE

- 7.1 INTRODUCTION

- FIGURE 22 PROXIMITY SENSORS PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 14 AIRCRAFT SENSORS MARKET, BY SENSOR TYPE, 2018-2021 (USD MILLION)

- TABLE 15 AIRCRAFT SENSORS MARKET, BY SENSOR TYPE, 2022-2027 (USD MILLION)

- 7.2 PRESSURE SENSORS

- 7.2.1 INCREASED USAGE IN CABIN PRESSURE SENSING AND LIQUID PRESSURE SENSING

- 7.3 TEMPERATURE SENSORS

- 7.3.1 USED IN COMMERCIAL AND MILITARY AIRCRAFT FOR OPTIMAL SYSTEM TEMPERATURE

- 7.4 FORCE SENSORS

- 7.4.1 INCREASING ADOPTION IN ELECTRONIC CONTROL SYSTEMS TO IMPROVE RESPONSE TIME

- 7.5 TORQUE SENSORS

- 7.5.1 INCREASE IN DEMAND FOR HIGH-QUALITY SENSORS WITH REGULATION STAMPS

- 7.6 SPEED SENSORS

- 7.6.1 USED TO MONITOR RPM OF AIRCRAFT ENGINES

- 7.7 POSITION & DISPLACEMENT SENSORS

- 7.7.1 REQUIRED IN CRITICAL FLIGHT CONTROL SYSTEMS WITH ENGINES AND HYDRAULIC SYSTEMS

- 7.8 LEVEL SENSORS

- 7.8.1 INTEGRAL TO MONITORING OF FUEL AND OTHER FLUID LEVELS

- 7.9 PROXIMITY SENSORS

- 7.9.1 VITAL TO SAFETY OF AEROSTRUCTURE AND OTHER SUBSYSTEMS

- 7.10 FLOW SENSORS

- 7.10.1 INDICATE FLOW LEVEL OF FLUIDS ACROSS ALL SYSTEMS

- 7.11 OPTICAL SENSORS

- 7.11.1 INCREASING USAGE IN MILITARY AND AUTONOMOUS APPLICATIONS

- 7.12 MOTION SENSORS

- 7.12.1 USED FOR NAVIGATION AND TO MEASURE VIBRATIONS

- 7.13 RADAR SENSORS

- 7.13.1 WIDE-SCALE USAGE IN WEATHER AND COMMUNICATION SYSTEMS

- 7.14 SMOKE DETECTION SENSORS

- 7.14.1 INCREASING DEMAND TO DETECT AND PREVENT FIRES

- 7.15 GPS SENSORS

- 7.15.1 USED AS PARALLEL SYSTEM TO MEASURE SPEED AND POSITION

- 7.16 OTHERS

- 7.16.1 TECHNOLOGICAL DEVELOPMENTS IN CABINS AND FLIGHT DECKS ON THE RISE

8 AIRCRAFT SENSORS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 23 FUEL, HYDRAULIC, AND PNEUMATIC SYSTEMS TO DOMINATE DURING FORECAST PERIOD

- TABLE 16 AIRCRAFT SENSORS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 17 AIRCRAFT SENSORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.2 FUEL, HYDRAULIC, AND PNEUMATIC SYSTEMS

- 8.2.1 USED FOR OPTIMUM OPERATION OF SYSTEMS

- 8.3 ENGINE/PROPULSION

- 8.3.1 USED IN ELECTRICAL SYSTEMS OF COMMERCIAL AND MILITARY AIRCRAFT

- 8.4 CABIN & CARGO ENVIRONMENTAL CONTROLS

- 8.4.1 ADVANCEMENTS IN CABINS ENHANCE PASSENGER EXPERIENCE

- 8.5 AEROSTRUCTURE & FLIGHT CONTROLS

- 8.5.1 INCREASING ADOPTION TO MAINTAIN OPTIMUM CONDITIONS

- 8.6 FLIGHT DECKS

- 8.6.1 SENSORS USED TO PROVIDE MORE INFORMATION ON FLIGHT AND SYSTEM OPERATIONS

- 8.7 LANDING GEAR SYSTEMS

- 8.7.1 INTEGRAL FOR SAFETY OF AIRCRAFT

- 8.8 WEAPON SYSTEMS

- 8.8.1 INCREASING TECHNOLOGICAL ADVANCEMENTS DRIVE DEMAND FOR SENSORS

- 8.9 OTHERS

- 8.9.1 ENSURE OPTIMUM HEALTH OF AIRCRAFT

9 AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE

- 9.1 INTRODUCTION

- FIGURE 24 FIXED-WING SEGMENT PROJECTED TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 18 AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 19 AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 9.2 FIXED-WING AIRCRAFT

- 9.2.1 COMMERCIAL AVIATION

- TABLE 20 COMMERCIAL AVIATION: FIXED-WING AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 21 COMMERCIAL AVIATION: FIXED-WING AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 9.2.1.1 Narrow-body aircraft

- 9.2.1.1.1 Ideal to accommodate high air passenger traffic

- 9.2.1.2 Wide-body aircraft

- 9.2.1.2.1 Increase in long-haul travel boosts production

- 9.2.1.3 Regional transport aircraft

- 9.2.1.3.1 Increasing use in US and Japan

- 9.2.1.1 Narrow-body aircraft

- 9.2.2 BUSINESS & GENERAL AVIATION

- TABLE 22 BUSINESS & GENERAL AVIATION: FIXED-WING AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 23 BUSINESS & GENERAL AVIATION: FIXED-WING AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 9.2.2.1 Business jets

- 9.2.2.1.1 Increase in private aviation companies across the globe

- 9.2.2.2 Light aircraft

- 9.2.2.2.1 Technology advancements and modernization of general aviation

- 9.2.2.1 Business jets

- 9.2.3 MILITARY AVIATION

- TABLE 24 MILITARY AVIATION: FIXED-WING AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 25 MILITARY AVIATION: FIXED-WING AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 9.2.3.1 Fighter aircraft

- 9.2.3.1.1 Growing use in regions with border tensions

- 9.2.3.2 Transport aircraft

- 9.2.3.2.1 Increasing demand in military operations

- 9.2.3.3 Special Mission Aircraft

- 9.2.3.3.1 Demand driven by high defense spending and territorial disputes

- 9.2.3.1 Fighter aircraft

- 9.3 ROTARY-WING AIRCRAFT

- TABLE 26 ROTARY-WING AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 27 ROTARY-WING AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 9.3.1 COMMERCIAL HELICOPTERS

- 9.3.1.1 Increasing usage for corporate and emergency purposes

- 9.3.2 MILITARY HELICOPTERS

- 9.3.2.1 Technologically advanced with next-generation electro-optic systems

- 9.4 UNMANNED AERIAL VEHICLES

- 9.4.1 FIXED-WING UAVS

- 9.4.1.1 Surveillance and communication drones widely used

- 9.4.2 FIXED-WING HYBRID VTOL UAVS

- 9.4.2.1 Increasing usage for cargo delivery and transportation

- 9.4.3 ROTARY-WING UAVS

- 9.4.3.1 Used in law enforcement and agriculture

- TABLE 28 UNMANNED AERIAL VEHICLES: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 29 UNMANNED AERIAL VEHICLES: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 9.4.1 FIXED-WING UAVS

- 9.5 ADVANCED AIR MOBILITY

- TABLE 30 ADVANCED AIR MOBILITY: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 9.5.1 AIR TAXIS

- 9.5.1.1 Manned taxis

- 9.5.1.2 Drone taxis

- 9.5.2 AIR SHUTTLES & AIR METROS

- 9.5.3 PERSONAL AERIAL VEHICLES

- 9.5.4 CARGO AIR VEHICLES

- 9.5.5 LAST-MILE DELIVERY VEHICLES

- 9.5.6 AIR AMBULANCES & MEDICAL EMERGENCY VEHICLES

10 AIRCRAFT SENSORS MARKET, BY END USE

- 10.1 INTRODUCTION

- FIGURE 25 OEM SEGMENT PROJECTED TO COMMAND MARKET DURING FORECAST PERIOD

- TABLE 31 AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 32 AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 10.2 ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

- 10.2.1 INCREASING NEED FOR NEW AIRCRAFT DRIVES MANUFACTURING

- 10.3 AFTERMARKET

- 10.3.1 FOCUS ON REDUCED REPAIR TIME AND IMPROVED READINESS

11 AIRCRAFT SENSORS MARKET, BY CONNECTIVITY

- 11.1 INTRODUCTION

- FIGURE 26 WIRED SENSORS PROJECTED TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 33 AIRCRAFT SENSORS MARKET, BY CONNECTIVITY, 2018-2021 (USD MILLION)

- TABLE 34 AIRCRAFT SENSORS MARKET, BY CONNECTIVITY, 2022-2027 (USD MILLION)

- 11.2 WIRED SENSORS

- 11.2.1 CONVENTIONAL AND RELIABLE METHOD OF DATA MEASUREMENT AND CONTROL

- 11.3 WIRELESS SENSORS

- 11.3.1 FOCUS ON ENHANCED ACCURACY AND PRECISION

12 REGIONAL ANALYSIS

- 12.1 INTRODUCTION

- FIGURE 27 AIRCRAFT SENSORS MARKET: REGIONAL SNAPSHOT

- TABLE 35 AIRCRAFT SENSORS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 AIRCRAFT SENSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 28 NORTH AMERICA: AIRCRAFT SENSORS MARKET SNAPSHOT

- 12.2.1 PESTLE ANALYSIS: NORTH AMERICA

- TABLE 37 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 38 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 40 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: AIRCRAFT GENERATOR MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 42 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Presence of leading OEMs to drive market

- TABLE 43 US: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 44 US: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 45 US: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 46 US: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Aircraft modernization programs to fuel demand for aircraft sensors

- TABLE 47 CANADA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 48 CANADA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 49 CANADA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 50 CANADA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- FIGURE 29 EUROPE: AIRCRAFT SENSORS MARKET SNAPSHOT

- 12.3.1 PESTLE ANALYSIS

- TABLE 51 EUROPE: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 52 EUROPE: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 53 EUROPE: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 54 EUROPE: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 55 EUROPE: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 56 EUROPE: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.3.2 UK

- 12.3.2.1 Technological advancements in air travel to drive market

- TABLE 57 UK: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 58 UK: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 59 UK: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 60 UK: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Heavy investments in aerospace to increase demand for aircraft sensors

- TABLE 61 FRANCE: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 62 FRANCE: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 63 FRANCE: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 64 FRANCE: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.3.4 GERMANY

- 12.3.4.1 Growing investments in air travel and connectivity to drive market

- TABLE 65 GERMANY: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 66 GERMANY: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 67 GERMANY: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 68 GERMANY: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.3.5 ITALY

- 12.3.5.1 Demand for electric components from domestic aircraft manufacturers supports market growth

- TABLE 69 ITALY: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 70 ITALY: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 71 ITALY: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 72 ITALY: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.3.6 RUSSIA

- 12.3.6.1 Ongoing Russo-Ukrainian war impeding market growth

- TABLE 73 RUSSIA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 74 RUSSIA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 75 RUSSIA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 76 RUSSIA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.3.7 REST OF EUROPE

- 12.3.7.1 Aviation development initiatives by countries in Rest of Europe to drive market growth

- TABLE 77 REST OF EUROPE: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 78 REST OF EUROPE: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 79 REST OF EUROPE: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 80 REST OF EUROPE: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 30 ASIA PACIFIC: AIRCRAFT SENSORS MARKET SNAPSHOT

- 12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- TABLE 81 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 82 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 83 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 84 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 85 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 86 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Growing demand for aerospace products to drive market

- TABLE 87 CHINA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 88 CHINA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 89 CHINA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 90 CHINA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.4.3 INDIA

- 12.4.3.1 Improving domestic capabilities of aerospace industry to drive market

- TABLE 91 INDIA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 92 INDIA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 93 INDIA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 94 INDIA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Increasing in-house development of aircraft to drive demand for sensors

- TABLE 95 JAPAN: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 96 JAPAN: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 97 JAPAN: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 98 JAPAN: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.4.5 AUSTRALIA

- 12.4.5.1 Increase in air traffic and new aircraft deliveries to fuel market growth

- TABLE 99 AUSTRALIA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 100 AUSTRALIA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 101 AUSTRALIA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 102 AUSTRALIA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Modernization programs in aviation industry to drive demand for aircraft sensors

- TABLE 103 SOUTH KOREA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 104 SOUTH KOREA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 105 SOUTH KOREA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 106 SOUTH KOREA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.4.7 REST OF ASIA PACIFIC

- 12.4.7.1 Replacement of aging aircraft to drive market growth

- TABLE 107 REST OF ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.5 MIDDLE EAST

- 12.5.1 PESTLE ANALYSIS

- TABLE 111 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 112 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 113 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 114 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 115 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 116 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.5.2 ISRAEL

- 12.5.2.1 Increasing air transport traffic to contribute to market growth

- TABLE 117 ISRAEL: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 118 ISRAEL: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 119 ISRAEL: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 120 ISRAEL: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.5.3 UAE

- 12.5.3.1 Increasing upgrades of commercial airlines

- TABLE 121 UAE: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 122 UAE: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 123 UAE: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 124 UAE: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.5.4 SAUDI ARABIA

- 12.5.4.1 High military expenditure to drive demand for aircraft sensors

- TABLE 125 SAUDI ARABIA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 126 SAUDI ARABIA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 127 SAUDI ARABIA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 128 SAUDI ARABIA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.5.5 TURKEY

- 12.5.5.1 Substantial rise in military spending and development of UAVs

- TABLE 129 TURKEY: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 130 TURKEY: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 131 TURKEY: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 132 TURKEY: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.5.6 REST OF MIDDLE EAST

- 12.5.6.1 Growing demand for aircraft electric components

- TABLE 133 REST OF MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 134 REST OF MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 135 REST OF MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 136 REST OF MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.6 LATIN AMERICA

- 12.6.1 PESTLE ANALYSIS

- TABLE 137 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 138 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 139 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 140 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 141 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 142 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.6.2 BRAZIL

- 12.6.2.1 Presence of OEMs and growing passenger traffic to drive market

- TABLE 143 BRAZIL: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 144 BRAZIL: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 145 BRAZIL: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 146 BRAZIL: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.6.3 MEXICO

- 12.6.3.1 Rising use of UAVs to fight organized crimes and carry out surveillance activities to drive market

- TABLE 147 MEXICO: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 148 MEXICO: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 149 MEXICO: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 150 MEXICO: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.6.4 REST OF LATIN AMERICA

- 12.6.4.1 Increasing aircraft fleet size to drive market growth

- TABLE 151 REST OF LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 152 REST OF LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 153 REST OF LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 154 REST OF LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.7 AFRICA

- 12.7.1 PESTLE ANALYSIS: AFRICA

- TABLE 155 AFRICA: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 156 AFRICA: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 157 AFRICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 158 AFRICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 159 AFRICA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 160 AFRICA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.7.2 SOUTH AFRICA

- 12.7.2.1 Increase in passenger movement to drive market

- TABLE 161 SOUTH AFRICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 162 SOUTH AFRICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 163 SOUTH AFRICA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 164 SOUTH AFRICA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.7.3 NIGERIA

- 12.7.3.1 Expansion in aviation sector to drive market

- TABLE 165 NIGERIA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 166 NIGERIA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 167 NIGERIA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 168 NIGERIA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 12.7.4 REST OF AFRICA

- 12.7.4.1 Presence of MRO service providers in aviation sector to drive market

- TABLE 169 REST OF AFRICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 170 REST OF AFRICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 171 REST OF AFRICA: AIRCRAFT SENSORS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 172 REST OF AFRICA: AIRCRAFT SENSORS MARKET, BY END USE, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 MARKET SHARE ANALYSIS, 2021

- TABLE 173 DEGREE OF COMPETITION

- FIGURE 31 SHARE OF TOP PLAYERS IN AIRCRAFT SENSORS MARKET, 2021 (%)

- 13.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2021

- FIGURE 32 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN AIRCRAFT SENSORS MARKET

- 13.4 COMPANY EVALUATION QUADRANT

- 13.4.1 STARS

- 13.4.2 EMERGING LEADERS

- 13.4.3 PERVASIVE PLAYERS

- 13.4.4 PARTICIPANTS

- FIGURE 33 AIRCRAFT SENSORS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- TABLE 174 COMPANY PRODUCT FOOTPRINT

- TABLE 175 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 176 COMPANY FOOTPRINT, BY END USE

- TABLE 177 COMPANY REGIONAL FOOTPRINT

- 13.5 START-UPS/SME EVALUATION QUADRANT

- 13.5.1 PROGRESSIVE COMPANIES

- 13.5.2 RESPONSIVE COMPANIES

- 13.5.3 DYNAMIC COMPANIES

- 13.5.4 STARTING BLOCKS

- FIGURE 34 AIRCRAFT SENSORS MARKET START-UPS/SME COMPETITIVE LEADERSHIP MAPPING, 2021

- 13.5.5 COMPETITIVE BENCHMARKING

- TABLE 178 AIRCRAFT SENSORS MARKET: KEY START-UPS/SMES

- TABLE 179 AIRCRAFT SENSORS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 13.6 COMPETITIVE SCENARIO

- 13.6.1 DEALS

- TABLE 180 DEALS, 2018-2022

14 COMPANY PROFILES

(Business Overview, Products/Solutions/Service Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 HONEYWELL INTERNATIONAL INC.

- TABLE 181 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- FIGURE 35 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 182 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 HONEYWELL INTERNATIONAL INC.: DEALS

- 14.2.2 SAFRAN GROUP

- TABLE 184 SAFRAN GROUP: BUSINESS OVERVIEW

- FIGURE 36 SAFRAN GROUP: COMPANY SNAPSHOT

- TABLE 185 SAFRAN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 SAFRAN GROUP: DEALS

- 14.2.3 TE CONNECTIVITY LTD.

- TABLE 187 TE CONNECTIVITY LTD.: BUSINESS OVERVIEW

- FIGURE 37 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

- TABLE 188 TE CONNECTIVITY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 TE CONNECTIVITY LTD.: DEALS

- 14.2.4 MEGGITT PLC

- TABLE 190 MEGGITT PLC: BUSINESS OVERVIEW

- FIGURE 38 MEGGITT PLC: COMPANY SNAPSHOT

- TABLE 191 MEGGITT PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 MEGGITT PLC: DEALS

- 14.2.5 AMETEK INC.

- TABLE 193 AMETEK INC.: BUSINESS OVERVIEW

- FIGURE 39 AMETEK INC.: COMPANY SNAPSHOT

- TABLE 194 AMETEK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 AMETEK INC.: DEALS

- 14.2.6 LOCKHEED MARTIN CORPORATION

- TABLE 196 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- FIGURE 40 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 197 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 LOCKHEED MARTIN CORPORATION: DEALS

- 14.2.7 WOODWARD INC.

- TABLE 199 WOODWARD INC.: BUSINESS OVERVIEW

- FIGURE 41 WOODWARD INC.: COMPANY SNAPSHOT

- TABLE 200 WOODWARD INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.8 GENERAL ELECTRIC COMPANY

- TABLE 201 GENERAL ELECTRIC COMPANY: BUSINESS OVERVIEW

- FIGURE 42 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

- TABLE 202 GENERAL ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.9 THALES GROUP

- TABLE 203 THALES GROUP: BUSINESS OVERVIEW

- FIGURE 43 THALES GROUP: COMPANY SNAPSHOT

- TABLE 204 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 THALES GROUP: DEALS

- 14.2.10 L3HARRIS TECHNOLOGIES, INC.

- TABLE 206 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 44 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 207 L3 HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 L3HARRIS TECHNOLOGIES, INC.: DEALS

- 14.2.11 THE BOSCH GROUP

- TABLE 209 THE BOSCH GROUP: BUSINESS OVERVIEW

- FIGURE 45 THE BOSCH GROUP: COMPANY SNAPSHOT

- TABLE 210 THE BOSCH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.12 TRIMBLE INC.

- TABLE 211 TRIMBLE INC.: BUSINESS OVERVIEW

- FIGURE 46 TRIMBLE INC.: COMPANY SNAPSHOT

- TABLE 212 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.13 CURTISS-WRIGHT CORPORATION

- TABLE 213 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

- FIGURE 47 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- TABLE 214 CURTISS-WRIGHT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.14 EATON CORPORATION

- TABLE 215 EATON CORPORATION: BUSINESS OVERVIEW

- FIGURE 48 EATON CORPORATION: COMPANY SNAPSHOT

- TABLE 216 EATON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 EATON CORPORATION: DEALS

- 14.2.15 CRANE AEROSPACE & ELECTRONICS

- TABLE 218 CRANE AEROSPACE & ELECTRONICS: BUSINESS OVERVIEW

- FIGURE 49 CRANE AEROSPACE & ELECTRONICS: COMPANY SNAPSHOT

- TABLE 219 CRANE AEROSPACE & ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.16 LORD SENSING STELLAR TECHNOLOGY

- TABLE 220 LORD SENSING STELLAR TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 221 LORD SENSING STELLAR TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.17 AMPHENOL CORPORATION

- TABLE 222 AMPHENOL CORPORATION: BUSINESS OVERVIEW

- FIGURE 50 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- TABLE 223 AMPHENOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 AMPHENOL CORPORATION: DEALS

- 14.2.18 KONGSBERG GRUPPEN ASA

- TABLE 225 KONGSBERG GRUPPEN ASA: BUSINESS OVERVIEW

- FIGURE 51 KONGSBERG GRUPPEN ASA: COMPANY SNAPSHOT

- TABLE 226 KONGSBERG GRUPPEN ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.19 TDK CORPORATION

- TABLE 227 TDK CORPORATION: BUSINESS OVERVIEW

- FIGURE 52 TDK CORPORATION: COMPANY SNAPSHOT

- TABLE 228 TDK CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.20 ULTRA ELECTRONICS

- TABLE 229 ULTRA ELECTRONICS: BUSINESS OVERVIEW

- FIGURE 53 ULTRA ELECTRONICS: COMPANY SNAPSHOT

- TABLE 230 ULTRA ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.21 VECTORNAV TECHNOLOGIES LLC

- TABLE 231 VECTORNAV TECHNOLOGIES LLC: BUSINESS OVERVIEW

- TABLE 232 VECTORNAV TECHNOLOGIES LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.22 SYSTRON DONNER INERTIAL

- TABLE 233 SYSTRON DONNER INERTIAL: BUSINESS OVERVIEW

- TABLE 234 SYSTRON DONNER INERTIAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.3 OTHER PLAYERS

- 14.3.1 AEROSONIC

- TABLE 235 AEROSONIC: COMPANY OVERVIEW

- 14.3.2 SENSOR SYSTEMS LLC

- TABLE 236 SENSOR SYSTEMS LLC: COMPANY OVERVIEW

- 14.3.3 CIRCOR AEROSPACE

- TABLE 237 CIRCOR AEROSPACE: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Service Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATION

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS