|

|

市場調査レポート

商品コード

1174000

データファブリックの世界市場:コンポーネント別 (ソリューション、サービス)・種類別 (ディスクベース、インメモリ)・用途別 (不正検出・セキュリティ管理、予防保全分析)・業種別 (BSFI、医療・ライフサイエンス)・地域別の将来予測 (2027年まで)Data Fabric Market by Component (Solutions & Services), Type (Disk-Based & In-Memory), Application (Fraud Detection & Security Management, Preventive Maintenance Analysis), Vertical (BFSI, Healthcare & Life Sciences) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| データファブリックの世界市場:コンポーネント別 (ソリューション、サービス)・種類別 (ディスクベース、インメモリ)・用途別 (不正検出・セキュリティ管理、予防保全分析)・業種別 (BSFI、医療・ライフサイエンス)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年12月14日

発行: MarketsandMarkets

ページ情報: 英文 295 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のデータファブリックの市場規模は、2022年の16億米ドルから2027年には62億米ドルへと、予測期間中に30.9%のCAGRで拡大すると予測されます。

ビジネスデータの量と種類が増え続けていることに加え、リアルタイムの洞察を得るために業務合理化・アクセスの容易性・ビジネスの俊敏性を求めるニーズが進化していることが、市場におけるデータファブリックソリューションへの道を開くことにつながっています。

各種コンポーネントの中でも専門サービス分野では、教育・トレーニングが最大のCAGRで成長する見通しです。

組織規模別に見ると、中小企業 (従業員0~999人の組織) が最も高いCAGRで成長する見通しです。データファブリックベンダーが提供する拡張可能な機能は、中小企業がインフラに投資することなく戦略を実行し、達成した利益を享受することを支援します。

地域別に見ると、世界のデジタルハブの1つであり、今後は最も高いCAGRで成長すると考えられています。アジア太平洋におけるデータファブリック市場の急速な発展は、同地域のあらゆる産業でデータが大量に増加していることに起因しています。

当レポートでは、世界のデータファブリックの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コンポーネント別・種類別・組織規模別・展開方式別・用途別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と動向

- イントロダクション

- データファブリック市場:アーキテクチャ

- データファブリックの主な柱

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- エコシステム

- ケーススタディ分析

- サプライチェーン分析

- 規制の影響

- 特許分析

- 主な会議とイベント (2022年~2023年)

- 技術分析

- 人工知能 (AI) とIoT

- 人工知能と機械学習 (ML)

- ビッグデータ

- 価格分析

- 主要なビジネス機能におけるデータファブリックの役割

- 人事

- 販売・マーケティング

- 財務

- サプライチェーン・物流

- ポーターのファイブフォース分析

- データファブリック市場:不況の影響

- 主な利害関係者と購入基準

- データファブリック市場の顧客/クライアントに影響を与えるトレンド/混乱

第6章 データファブリック市場:コンポーネント別

- イントロダクション

- ソリューション

- サービス

- 専門サービス

- マネージドサービス

第7章 データファブリック市場:種類別

- イントロダクション

- ディスクベース

- インメモリ

第8章 データファブリック市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第9章 データファブリック市場:展開方式別

- イントロダクション

- オンプレミス

- クラウド

第10章 データファブリック市場:用途別

- イントロダクション

- 不正検出・セキュリティ管理

- ガバナンス・リスク・コンプライアンス管理

- カスタマーインテリジェンス

- 販売・マーケティング管理

- 業務工程管理

- 予防保全分析

- その他の用途

第11章 データファブリック市場:業種別

- イントロダクション

- 銀行・金融サービス・保険 (BFSI)

- 政府・防衛・公的機関

- 通信

- 小売業・eコマース

- 製造業

- エネルギー・鉱業

- 医療・ライフサイエンス

- メディア・エンターテイメント

- その他の業種

第12章 データファブリック市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- 他の欧州諸国

- アジア太平洋

- インド

- 日本

- 中国

- オーストラリア

- 他のアジア太平洋諸国

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- 他の中東・アフリカ諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第13章 競合情勢

- 概要

- 主要企業が採用した戦略

- 収益分析

- 市場シェア分析

- 市場評価フレームワーク

- 企業評価クアドラント

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- スタートアップ/中小企業の競合ベンチマーキング

- 競合シナリオと動向

- 新製品の発売

- 資本取引

第14章 企業プロファイル

- イントロダクション

- 主要企業

- IBM

- SAP

- ORACLE

- INFORMATICA

- TALEND

- DENODO

- HPE

- DELL TECHNOLOGIES

- NETAPP

- TERADATA

- SOFTWARE AG

- TIBCO SOFTWARE

- SPLUNK

- GLOBAL IDS

- PRECISELY

- CINCHY

- K2VIEW

- IDERA

- INCORTA

- RADIANT LOGIC

- INTENDA

- スタートアップ/中小企業のプロファイル

- ATLAN

- NEXLA

- STARDOG

- GLUENT

- STARBURST DATA

- HEXSTREAM

- QOMPLX

- CLUEDIN

- IGUAZIO

- ALEX SOLUTIONS

第15章 隣接・関連市場

- イントロダクション

- ビッグデータ:世界市場の予測 (2027年まで)

- データカタログ:世界市場の予測 (2027年まで)

第16章 付録

The Data Fabric market size to grow from USD 1.6 billion in 2022 to USD 6.2 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 30.9% during the forecast period. The ever-increasing volume and variety of business data coupled with the evolving need for business agility with ease of access to streamline business operations to gain real-time insights to pave the way for data fabric solutions in the market.

Data fabric is a distributed data management platform that enables organizations to integrate various data management processes, including data access, data discovery, data orchestration, data processing, data ingestion, data analytics, and data visualization. It combines disparate data sets, both historical and real-time, and automatically efficiently processes them to deliver a comprehensive view of customer and business data across an organization.

Education & Training Services to register for the largest CAGR during the forecast period

Professional services are classified into three categories: consulting, education & training, and support & maintenance. Organizations focus on their core business and do not have to manage the data fabric, due to which they cannot provide complete attention to the niche areas of management. In this case, professional service providers come into existence. The companies can outsource their professional services to these organizations that take complete responsibility for the work and provide complete security and safety.

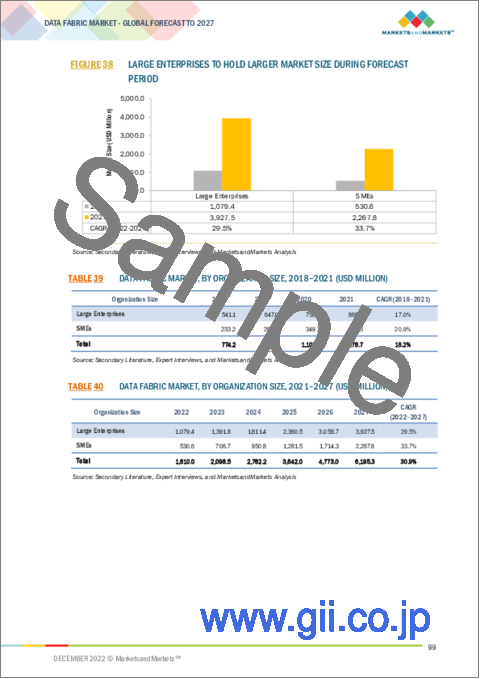

SMEs to hold highest CAGR during the forecast period

Based on organization size, the data fabric market has been segmented into SMEs and large enterprises. Organizations with several employees between 0 and 999 are said to be SMEs. SMEs are also implementing data fabric strategies to store and analyze various amounts and data. SMEs are using data fabric to store data of a larger target audience globally. Organizations providing data fabric solutions need robust infrastructure to help reduce costs and increase profits. The scalable functionality of data fabric provided by data fabric vendors helps SMEs implement strategies without investing in the infrastructure and reap the profits attained using their solutions. The agile and robust characteristics of data fabric enable organizations to store and analyze their data more efficiently

Asia Pacific to hold highest CAGR during the forecast period

Based on regions, the Edge AI market is segmented into North America, Asia Pacific, Europe, Middle East & Africa and Latin America. Asia Pacific is among the digital hubs of the world. Thus, businesses in the region have quickly identified the benefits of cloud technology as a facilitator of digital transformation. The region has great scope for growth in the data fabric market. It is focused on innovating and developing BI solutions that utilize data fabric technology in various verticals, such as telecom & IT, transportation, and BFSI. Japan, China, and India use data fabric tools and platforms across different business verticals to provide effective solutions. The rapid development of the data fabric market in the Asia Pacific region can be attributed to the massive data growth in all industries across the region.

Whether the BFSI, retail & eCommerce, and healthcare end users, the massive data flow has created the need for effective data fabric solutions. Moreover, the rapid expansion of domestic enterprises and the higher development of infrastructure are some of the important factors expected to drive the growth of the data fabric market in Asia Pacific. IBM, SAP, HPE, and Oracle are some companies offering data fabric solutions to provide insights across various end-users.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the frontline workers training market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, D-Level Executives: 25%, and Managers: 40%

- By Region: APAC: 30%, Europe: 20%, North America: 45%, Rest of the World: 5%

The report includes the study of key players offering Data Fabric solutions. The major players in the Data Fabric market include IBM (US), SAP (Germany), Oracle (US), Informatica (US), Talend (US), Denodo (US), HPE (US), Dell Technologies (US), NetApp (US), Teradata (US), Splunk (US), TIBCO Software (US), Software AG (Germany), Intenda (South Africa), Radiant Logic (US), Incorta (US), Idera (US), K2View (US), Cinchy (Canada), Precisely (US), Global IDs (US), Alex Solutions (Australia), Iguazio (Israel), CluedIn (Denmark), QOMPLX (US), HEXstream (US), Starburst Data (US), Gluent (US), Stardog (US), Nexla (US), and Atlan (Singapore).

Research Coverage

The new research study includes the market drivers for each segment and regions on the edge AI software market. The market dynamics and industry trends have been updated. A few sections such as vertical-wise use cases, government regulations, patent analysis, pricing analysis for 2022, supply chain, architecture, and ecosystem have been updated as per the latest trends. The new study also comprises operational drivers for adoption in each segment and region. The new research study features 31 players as compared to 30 in the previous version. Updated financial information/product portfolio of players: The new edition of the report provides updated financial information in the context of the data fabric market till 2021-2022 for each listed company in graphical representation. The new research study includes the updated market developments of profiled players, including those from 2020 to 2022. The new study includes quantitative data for historical years (2018-2021), base year (2021), and forecast years (2022-2027). The new study also includes quantitative data from adjacent markets.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Data Fabric market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019-2021

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 DATA FABRIC MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- TABLE 2 PRIMARY INTERVIEWS

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 DATA FABRIC MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF DATA FABRIC MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF DATA FABRIC MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/ SERVICES OF DATA FABRIC MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF DATA FABRIC THROUGH OVERALL DATA FABRIC SPENDING

- 2.4 MARKET FORECAST

- TABLE 3 FACTOR ANALYSIS

- 2.5 COMPANY EVALUATION MATRIX METHODOLOGY

- FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 2.6 EVALUATION MATRIX METHODOLOGY FOR STARTUPS/SMES

- FIGURE 9 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 4 GLOBAL DATA FABRIC MARKET SIZE AND GROWTH RATE, 2018-2021 (USD MILLION, Y-O-Y %)

- TABLE 5 GLOBAL DATA FABRIC MARKET SIZE AND GROWTH RATE, 2022-2027 (USD MILLION, Y-O-Y %)

- FIGURE 10 SOLUTIONS SEGMENT TO DOMINATE MARKET IN 2022

- FIGURE 11 PROFESSIONAL SERVICES TO ACCOUNT FOR LARGER SHARE IN 2022

- FIGURE 12 SUPPORT & MAINTENANCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 13 DISK-BASED SEGMENT TO DOMINATE MARKET IN 2022

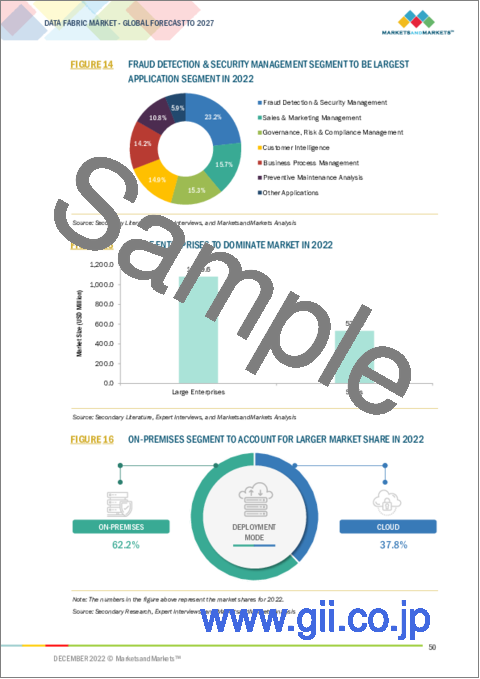

- FIGURE 14 FRAUD DETECTION & SECURITY MANAGEMENT SEGMENT TO BE LARGEST APPLICATION SEGMENT IN 2022

- FIGURE 15 LARGE ENTERPRISES TO DOMINATE MARKET IN 2022

- FIGURE 16 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

- FIGURE 17 BFSI VERTICAL TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DATA FABRIC MARKET

- FIGURE 19 EMERGING NEED FOR BUSINESS AGILITY WITH ACCESSIBILITY AND INCREASING VOLUME AND VARIETY OF BUSINESS DATA

- 4.2 DATA FABRIC MARKET, BY KEY APPLICATION

- FIGURE 20 PREVENTIVE MAINTENANCE ANALYSIS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: DATA FABRIC MARKET, BY COMPONENT AND KEY VERTICAL

- FIGURE 21 SOLUTIONS AND BFSI SEGMENTS TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2022

- 4.4 DATA FABRIC MARKET, BY REGION

- FIGURE 22 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 DATA FABRIC MARKET: ARCHITECTURE

- FIGURE 23 ARCHITECTURE: DATA FABRIC MARKET

- 5.3 KEY PILLARS OF DATA FABRIC

- 5.4 MARKET DYNAMICS

- FIGURE 24 DATA FABRIC MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.4.1 DRIVERS

- 5.4.1.1 Increasing volume and variety of business data

- 5.4.1.2 Emerging need for business agility and accessibility

- 5.4.1.3 Rising demand for real-time streaming analytics

- 5.4.2 RESTRAINTS

- 5.4.2.1 Lack of awareness regarding implementation of data fabric solutions

- 5.4.2.2 Issues related to integrating legacy systems

- 5.4.3 OPPORTUNITIES

- 5.4.3.1 Generating positive return on investment

- 5.4.3.2 Growing demand for cloud-based data fabric solutions for better scalability

- 5.4.3.3 Increasing advancements in in-memory computing

- 5.4.4 CHALLENGES

- 5.4.4.1 Reluctance in investment in new technologies

- 5.4.4.2 Lack of sufficiently skilled workforce

- 5.5 ECOSYSTEM

- FIGURE 25 DATA FABRIC MARKET: ECOSYSTEM

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 CASE STUDY 1: BMC TRANSFORMED COMPLEX TECHNOLOGY INTO EXTRAORDINARY BUSINESS PERFORMANCE WITH DATA FABRIC

- 5.6.2 CASE STUDY 2: DUCATI AND NETAPP BUILT DATA FABRIC SOLUTIONS TO BOOST INNOVATION

- 5.6.3 CASE STUDY 3: INGENICO USED HPE EZMERAL DATA FABRIC SOLUTION TO DEVELOP SINGLE UNIFIED DATA PLATFORM

- 5.6.4 CASE STUDY 4: LEADING HEALTHCARE PROVIDER USED HPE EZMERAL DATA FABRIC TO BRING TOGETHER DISPARATE DATA SOURCES INTO ONE DATA LAKE

- 5.6.5 CASE STUDY 5: HACKENSACK MERIDIAN HEALTH MASTERED AND CATALOG PATIENT DATA

- 5.6.6 CASE STUDY 6: CITY FURNITURE LEVERAGED DENODO PLATFORM TO ESTABLISH LOGICAL DATA FABRIC IN SUPPORT OF DIGITAL TRANSFORMATION

- 5.6.7 CASE STUDY 7: SYRACUSE UNIVERSITY IMPROVED UNIVERSITY OPERATIONS AND ACADEMIC CAPABILITY WITH UNIFIED DATA FABRIC

- 5.6.8 CASE STUDY 8: BREMBO ASURION ACHIEVED CLOUD MODERNIZATION WITH PROPER DATA SECURITY AND GOVERNANCE IN PLACE

- 5.6.9 CASE STUDY 9: KPMG IMPLEMENTED INFORMATICA MDM SOLUTIONS TO HELP OPTIMIZE DATA FOR DIGITAL TRANSFORMATION

- 5.7 SUPPLY CHAIN ANALYSIS

- FIGURE 26 SUPPLY CHAIN ANALYSIS

- TABLE 6 DATA FABRIC MARKET: SUPPLY CHAIN

- 5.8 REGULATORY IMPLICATIONS

- 5.8.1 GENERAL DATA PROTECTION REGULATION

- 5.8.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.8.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

- 5.8.4 SARBANES-OXLEY ACT OF 2002

- 5.8.5 GRAMM-LEACH-BLILEY ACT

- 5.8.6 ISO/IEC 27001

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.9.2 DOCUMENT TYPE

- TABLE 7 PATENTS FILED, 2019-2022

- 5.9.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 27 PATENTS GRANTED, 2019-2022

- 5.9.4 TOP APPLICANTS

- FIGURE 28 TOP 10 PATENT APPLICANTS, 2019-2022

- 5.10 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 8 DATA FABRIC MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 ARTIFICIAL INTELLIGENCE AND INTERNET OF THINGS

- 5.11.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 5.11.3 BIG DATA

- 5.12 PRICING ANALYSIS

- TABLE 9 AVERAGE SELLING PRICING ANALYSIS, 2022

- 5.13 ROLE OF DATA FABRIC ACROSS MAJOR BUSINESS FUNCTIONS

- 5.13.1 HUMAN RESOURCES

- 5.13.2 SALES AND MARKETING

- 5.13.3 FINANCE

- 5.13.4 SUPPLY CHAIN AND LOGISTICS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 IMPACT OF EACH FORCE ON DATA FABRIC MARKET

- FIGURE 29 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 DATA FABRIC MARKET: RECESSION IMPACT

- FIGURE 30 DATA FABRIC MARKET TO WITNESS DECLINE IN Y-O-Y GROWTH IN 2022

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.16.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.17 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF DATA FABRIC MARKET

- FIGURE 33 DATA FABRIC MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

6 DATA FABRIC MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENTS: DATA FABRIC MARKET DRIVERS

- FIGURE 34 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 13 DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 14 DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 NEED TO GAIN VISIBILITY INTO HIGHLY COMPLEX AND HETEROGENEOUS DATA LANDSCAPES TO DRIVE MARKET GROWTH

- TABLE 15 SOLUTIONS: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 16 SOLUTIONS: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 DATA FABRIC SERVICES HELP DEPLOY PLATFORMS TO RUN AND SUPPORT APPLICATIONS

- 6.3.2 PROFESSIONAL SERVICES

- TABLE 23 PROFESSIONAL SERVICES: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 24 PROFESSIONAL SERVICES: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.2.1 Consulting

- 6.3.2.2 Education and training

- TABLE 27 EDUCATION AND TRAINING: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 28 EDUCATION AND TRAINING: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.2.3 Support and maintenance

- TABLE 29 SUPPORT AND MAINTENANCE: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 SUPPORT AND MAINTENANCE: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.3 MANAGED SERVICES

7 DATA FABRIC MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.1.1 TYPES: DATA FABRIC MARKET DRIVERS

- FIGURE 37 IN-MEMORY TYPE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 33 DATA FABRIC MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 34 DATA FABRIC MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.2 DISK-BASED

- 7.2.1 DISK-BASED DATA FABRIC OFFERS FLEXIBILITY TO MIGRATE DATA REDUCING COST OF OWNERSHIP

- TABLE 35 DISK-BASED: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 DISK-BASED: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 IN-MEMORY

- 7.3.1 RESILIENT WEB ACCELERATION AND CACHE AS A SERVICE FEATURES TO BE OFFERED TO END USERS

- TABLE 37 IN-MEMORY: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 IN-MEMORY: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

8 DATA FABRIC MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZE: DATA FABRIC MARKET DRIVERS

- FIGURE 38 LARGE ENTERPRISES TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- 8.2 LARGE ENTERPRISES

- 8.2.1 DATA FABRIC HELPS LARGE ENTERPRISES GATHER DATA TO CREATE INFORMATION NETWORK POWERING BUSINESS APPLICATIONS

- 8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 8.3.1 DATA FABRIC SOLUTIONS HELP INCREASE PRODUCTIVITY, BOOST MARKETING STRATEGIES, AND STREAMLINE BUSINESS PROCESSES

- TABLE 43 SMALL AND MEDIUM-SIZED ENTERPRISES: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 SMALL AND MEDIUM-SIZED ENTERPRISES: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

9 DATA FABRIC MARKET, BY DEPLOYMENT MODE

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT MODES: DATA FABRIC MARKET DRIVERS

- FIGURE 39 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 45 DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 46 DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- 9.2 ON-PREMISES

- 9.2.1 DEVELOPMENT OF IN-HOUSE IT INFRASTRUCTURE FOR BETTER SECURITY

- TABLE 47 ON-PREMISES: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 48 ON-PREMISES: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 CLOUD

- 9.3.1 COST-SAVING BENEFIT LEADS TO INCREASE IN OPERATIONAL EFFICIENCY AND SCALABILITY

- TABLE 49 CLOUD: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 50 CLOUD: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

10 DATA FABRIC MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.1.1 APPLICATIONS: DATA FABRIC MARKET DRIVERS

- FIGURE 40 PREVENTIVE MAINTENANCE ANALYSIS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 51 DATA FABRIC MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 52 DATA FABRIC MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.2 FRAUD DETECTION & SECURITY MANAGEMENT

- 10.2.1 DETECTING FRAUD AND SECURITY THREATS IN REAL TIME BY ORGANIZATIONS TO DRIVE MARKET

- TABLE 53 FRAUD DETECTION & SECURITY MANAGEMENT: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 54 FRAUD DETECTION & SECURITY MANAGEMENT: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 GOVERNANCE, RISK & COMPLIANCE MANAGEMENT

- 10.3.1 DATA FABRIC ENABLES DEFINING GUIDELINES AND CONTROLS FOR ORGANIZATIONAL GOVERNANCE PROCESS

- TABLE 55 GOVERNANCE, RISK & COMPLIANCE MANAGEMENT: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 56 GOVERNANCE, RISK & COMPLIANCE MANAGEMENT: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 CUSTOMER INTELLIGENCE

- 10.4.1 ORGANIZATIONS CAN CREATE 360-DEGREE UNIFIED CUSTOMER PROFILES BY IMPLEMENTING DATA FABRIC SOLUTIONS

- TABLE 57 CUSTOMER INTELLIGENCE: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 58 CUSTOMER INTELLIGENCE: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 SALES & MARKETING MANAGEMENT

- 10.5.1 DATA FABRIC HELPS SALES & MARKETING TEAMS EXTRACT DATA FROM EMBEDDED DEVICES PROVIDING DEEPER INSIGHTS INTO CUSTOMER BEHAVIORS

- TABLE 59 SALES & MARKETING MANAGEMENT: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 60 SALES & MARKETING MANAGEMENT: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.6 BUSINESS PROCESS MANAGEMENT

- 10.6.1 DATA FABRIC SOLUTIONS HELP BUSINESSES TRANSFORM BOOSTING ADOPTION OF BUSINESS PROCESS MANAGEMENT

- TABLE 61 BUSINESS PROCESS MANAGEMENT: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 62 BUSINESS PROCESS MANAGEMENT: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.7 PREVENTATIVE MAINTENANCE ANALYSIS

- 10.7.1 DATA FABRIC ACCESSES INSIGHTS FROM VARIOUS DATA POINTS TO PREDICT PREVENTIVE MAINTENANCE CYCLE

- TABLE 63 PREVENTATIVE MAINTENANCE ANALYSIS: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 64 PREVENTATIVE MAINTENANCE ANALYSIS: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.8 OTHER APPLICATIONS

- TABLE 65 OTHER APPLICATIONS: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 66 OTHER APPLICATIONS: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

11 DATA FABRIC MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.1.1 VERTICALS: DATA FABRIC MARKET DRIVERS

- 11.1.2 DATA FABRIC: ENTERPRISE USE CASES

- FIGURE 41 HEALTHCARE & LIFE SCIENCES VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 67 DATA FABRIC MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 68 DATA FABRIC MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.2 BFSI

- 11.2.1 DATA FABRIC HELPS BUILD HYBRID CLOUD FOUNDATIONS TO ENSURE DIGITAL TRUST AND IMPROVE DIGITAL RESILIENCE

- TABLE 69 BFSI: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 70 BFSI: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3 GOVERNMENT, DEFENSE, & PUBLIC AGENCIES

- 11.3.1 ADOPTION OF DATA FABRIC SOLUTIONS HELPS STRENGTHEN DATA COMPUTING ABILITIES

- TABLE 71 GOVERNMENT, DEFENSE, & PUBLIC AGENCIES: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 72 GOVERNMENT, DEFENSE, & PUBLIC AGENCIES: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4 TELECOM

- 11.4.1 HIGH AMOUNT OF DATA GENERATED REQUIRES BETTER DATA MANAGEMENT LEADING TO ADOPTION OF DATA FABRIC SOLUTIONS

- TABLE 73 TELECOM: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 74 TELECOM: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.5 RETAIL & ECOMMERCE

- 11.5.1 INCREASING USE OF IOT DEVICES AND OPTIMIZATION OF CURRENT MARKET SCENARIO TO DRIVE MARKET

- TABLE 75 RETAIL & ECOMMERCE: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 76 RETAIL & ECOMMERCE: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.6 MANUFACTURING

- 11.6.1 DATA FABRIC HELPS INTEGRATE, STORE, AND ANALYZE DATA LEADING TO INCREASING PRODUCTIVITY

- TABLE 77 MANUFACTURING: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 78 MANUFACTURING: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.7 ENERGY & MINING

- 11.7.1 ADOPTION OF DATA FABRIC SOLUTIONS TO GAIN INSIGHTS AND SECURE MARKET COMPETITIVENESS

- TABLE 79 ENERGY & MINING: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 80 ENERGY & MINING: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.8 HEALTHCARE & LIFE SCIENCES

- 11.8.1 DATA FABRIC HELPS INTEGRATE AND ANALYZE DATA OBTAINED FROM APPLICATIONS, SOFTWARE, AND OPERATION SOURCES

- TABLE 81 HEALTHCARE & LIFE SCIENCES: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 82 HEALTHCARE & LIFE SCIENCES: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.9 MEDIA & ENTERTAINMENT

- 11.9.1 STORAGE OF MASSIVE VOLUMES OF DIGITAL DATA REQUIRES DATA FABRIC SOLUTIONS

- TABLE 83 MEDIA & ENTERTAINMENT: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 84 MEDIA & ENTERTAINMENT: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.10 OTHER VERTICALS

- TABLE 85 OTHER VERTICALS: DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 86 OTHER VERTICALS: DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

12 DATA FABRIC MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.1.1 REGIONS: DATA FABRIC MARKET DRIVERS

- FIGURE 42 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 87 DATA FABRIC MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 88 DATA FABRIC MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: RECESSION IMPACT

- 12.2.2 NORTH AMERICA: REGULATIONS

- 12.2.2.1 Health Insurance Portability and Accountability Act of 1996

- 12.2.2.2 California Consumer Privacy Act

- 12.2.2.3 Gramm-Leach-Bliley Act

- 12.2.2.4 The Personal Information Protection and Electronic Documents Act

- 12.2.2.5 Federal Information Security Management Act

- FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 89 NORTH AMERICA: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 90 NORTH AMERICA: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: DATA FABRIC MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 92 NORTH AMERICA: DATA FABRIC MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: DATA FABRIC MARKET, BY PROFESSIONAL SERVICE, 2018-2021 (USD MILLION)

- TABLE 94 NORTH AMERICA: DATA FABRIC MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD MILLION)

- TABLE 95 NORTH AMERICA: DATA FABRIC MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 96 NORTH AMERICA: DATA FABRIC MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 97 NORTH AMERICA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 98 NORTH AMERICA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 99 NORTH AMERICA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 100 NORTH AMERICA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 101 NORTH AMERICA: DATA FABRIC MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 102 NORTH AMERICA: DATA FABRIC MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 103 NORTH AMERICA: DATA FABRIC MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 104 NORTH AMERICA: DATA FABRIC MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 105 NORTH AMERICA: DATA FABRIC MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 106 NORTH AMERICA: DATA FABRIC MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.2.3 US

- 12.2.3.1 Adoption of innovative data fabric solutions for gaining insights from higher data volumes to drive market

- TABLE 107 US: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 108 US: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 109 US: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 110 US: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 111 US: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 112 US: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.2.4 CANADA

- 12.2.4.1 Favorable startup ecosystem and rising government investments to boost growth

- TABLE 113 CANADA: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 114 CANADA: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 115 CANADA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 116 CANADA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 117 CANADA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 118 CANADA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 EUROPE: RECESSION IMPACT

- 12.3.2 EUROPE: REGULATIONS

- 12.3.2.1 General Data Protection Regulation

- 12.3.2.2 European Committee for Standardization

- 12.3.2.3 EU Data Governance Act

- 12.3.2.4 European Technical Standards Institute

- TABLE 119 EUROPE: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 120 EUROPE: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 121 EUROPE: DATA FABRIC MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 122 EUROPE: DATA FABRIC MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 123 EUROPE: DATA FABRIC MARKET, BY PROFESSIONAL SERVICE, 2018-2021 (USD MILLION)

- TABLE 124 EUROPE: DATA FABRIC MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD MILLION)

- TABLE 125 EUROPE: DATA FABRIC MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 126 EUROPE: DATA FABRIC MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 127 EUROPE: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 128 EUROPE: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 129 EUROPE: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 130 EUROPE: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 131 EUROPE: DATA FABRIC MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 132 EUROPE: DATA FABRIC MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 133 EUROPE: DATA FABRIC MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 134 EUROPE: DATA FABRIC MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 135 EUROPE: DATA FABRIC MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 136 EUROPE: DATA FABRIC MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Need to enhance networking infrastructure and security capabilities across major verticals

- TABLE 137 UK: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 138 UK: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 139 UK: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 140 UK: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 141 UK: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 142 UK: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.3.4 GERMANY

- 12.3.4.1 Growth in digitalization and IT spending across industries to fuel market growth

- TABLE 143 GERMANY: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 144 GERMANY: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 145 GERMANY: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 146 GERMANY: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 147 GERMANY: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 148 GERMANY: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.3.5 FRANCE

- 12.3.5.1 Several digital transformation levels across data fabric vendors to propel market growth

- TABLE 149 FRANCE: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 150 FRANCE: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 151 FRANCE: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 152 FRANCE: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 153 FRANCE: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 154 FRANCE: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.3.6 REST OF EUROPE

- TABLE 155 REST OF EUROPE: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 156 REST OF EUROPE: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 157 REST OF EUROPE: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 158 REST OF EUROPE: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 159 REST OF EUROPE: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 160 REST OF EUROPE: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT

- 12.4.2 ASIA PACIFIC: REGULATIONS

- 12.4.2.1 Personal Data Protection Act

- 12.4.2.2 International Organization for Standardization 27001

- 12.4.2.3 Act on the Protection of Personal Information

- 12.4.2.4 Critical Information Infrastructure

- FIGURE 45 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 161 ASIA PACIFIC: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 162 ASIA PACIFIC: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 163 ASIA PACIFIC: DATA FABRIC MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 164 ASIA PACIFIC: DATA FABRIC MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 165 ASIA PACIFIC: DATA FABRIC MARKET, BY PROFESSIONAL SERVICE, 2018-2021 (USD MILLION)

- TABLE 166 ASIA PACIFIC: DATA FABRIC MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD MILLION)

- TABLE 167 ASIA PACIFIC: DATA FABRIC MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 168 ASIA PACIFIC: DATA FABRIC MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 169 ASIA PACIFIC: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 170 ASIA PACIFIC: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 171 ASIA PACIFIC: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 172 ASIA PACIFIC: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 173 ASIA PACIFIC: DATA FABRIC MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 174 ASIA PACIFIC: DATA FABRIC MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 175 ASIA PACIFIC: DATA FABRIC MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 176 ASIA PACIFIC: DATA FABRIC MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 177 ASIA PACIFIC: DATA FABRIC MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 178 ASIA PACIFIC: DATA FABRIC MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.4.3 INDIA

- 12.4.3.1 Increase in government initiatives for managing huge data volumes to fuel demand for data fabric solutions

- TABLE 179 INDIA: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 180 INDIA: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 181 INDIA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 182 INDIA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 183 INDIA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 184 INDIA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Adoption of data management technologies to gain insights from rising data in real-time across verticals to drive market

- TABLE 185 JAPAN: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 186 JAPAN: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 187 JAPAN: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 188 JAPAN: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 189 JAPAN: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 190 JAPAN: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.4.5 CHINA

- 12.4.5.1 Need to efficiently manage huge amounts of clinical data to boost demand for data fabric solutions

- TABLE 191 CHINA: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 192 CHINA: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 193 CHINA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 194 CHINA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 195 CHINA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 196 CHINA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.4.6 AUSTRALIA

- 12.4.6.1 Increase in number of IoT and analytics startups to fuel market growth

- TABLE 197 AUSTRALIA: DATA FABRIC MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 198 AUSTRALIA: DATA FABRIC MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 199 AUSTRALIA: DATA FABRIC MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 200 AUSTRALIA: DATA FABRIC MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 201 AUSTRALIA: DATA FABRIC MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 202 AUSTRALIA: DATA FABRIC MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 12.4.7 REST OF ASIA PACIFIC

- TABLE 203 REST OF ASIA PACIFIC: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 12.5.2 MIDDLE EAST & AFRICA: REGULATIONS

- 12.5.2.1 ISRAELI Privacy Protection Regulations (Data Security), 5777-2017

- 12.5.2.2 Cloud Computing Framework

- 12.5.2.3 GDPR Applicability in KSA

- 12.5.2.4 Protection of Personal Information Act

- 12.5.2.5 TRA's IoT Regulatory Policy in UAE

- TABLE 209 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY PROFESSIONAL SERVICE, 2018-2021 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.5.3 SAUDI ARABIA

- 12.5.3.1 Favorable startup ecosystem to propel market growth

- TABLE 227 SAUDI ARABIA: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 228 SAUDI ARABIA: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 229 SAUDI ARABIA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 230 SAUDI ARABIA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 231 SAUDI ARABIA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 232 SAUDI ARABIA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.5.4 UAE

- 12.5.4.1 Rapid IT resource deployment and remote monitoring capabilities to drive market

- TABLE 233 UAE: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 234 UAE: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 235 UAE: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 236 UAE: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 237 UAE: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 238 UAE: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.5.5 SOUTH AFRICA

- 12.5.5.1 Investment by data fabric software vendors in South Africa to expedite market growth

- TABLE 239 SOUTH AFRICA: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 240 SOUTH AFRICA: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 241 SOUTH AFRICA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 242 SOUTH AFRICA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 243 SOUTH AFRICA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 244 SOUTH AFRICA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.5.6 REST OF MIDDLE EAST & AFRICA

- TABLE 245 REST OF MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 247 REST OF MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 248 REST OF MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 249 REST OF MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 250 REST OF MIDDLE EAST & AFRICA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: RECESSION IMPACT

- 12.6.2 LATIN AMERICA: REGULATIONS

- 12.6.2.1 Brazil Data Protection Law

- 12.6.2.2 Argentina Personal Data Protection Law No. 25.326

- TABLE 251 LATIN AMERICA: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 252 LATIN AMERICA: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 253 LATIN AMERICA: DATA FABRIC MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 254 LATIN AMERICA: DATA FABRIC MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 255 LATIN AMERICA: DATA FABRIC MARKET, BY PROFESSIONAL SERVICE, 2018-2021 (USD MILLION)

- TABLE 256 LATIN AMERICA: DATA FABRIC MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD MILLION)

- TABLE 257 LATIN AMERICA: DATA FABRIC MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 258 LATIN AMERICA: DATA FABRIC MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 259 LATIN AMERICA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 260 LATIN AMERICA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 261 LATIN AMERICA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 262 LATIN AMERICA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 263 LATIN AMERICA: DATA FABRIC MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 264 LATIN AMERICA: DATA FABRIC MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 265 LATIN AMERICA: DATA FABRIC MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 266 LATIN AMERICA: DATA FABRIC MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 267 LATIN AMERICA: DATA FABRIC MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 268 LATIN AMERICA: DATA FABRIC MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.6.3 BRAZIL

- 12.6.3.1 Brazil to incorporate data fabric solutions and services to increase business fourfold across verticals

- TABLE 269 BRAZIL: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 270 BRAZIL: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 271 BRAZIL: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 272 BRAZIL: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 273 BRAZIL: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 274 BRAZIL: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.6.4 MEXICO

- 12.6.4.1 Rising need to enhance IT infrastructure and manage IoT data, quality, and speed of broadband to boost market growth

- TABLE 275 MEXICO: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 276 MEXICO: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 277 MEXICO: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 278 MEXICO: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 279 MEXICO: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 280 MEXICO: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.6.5 REST OF LATIN AMERICA

- TABLE 281 REST OF LATIN AMERICA: DATA FABRIC MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 282 REST OF LATIN AMERICA: DATA FABRIC MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 283 REST OF LATIN AMERICA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 284 REST OF LATIN AMERICA: DATA FABRIC MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 285 REST OF LATIN AMERICA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 286 REST OF LATIN AMERICA: DATA FABRIC MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 287 OVERVIEW OF STRATEGIES ADOPTED BY KEY DATA FABRIC VENDORS

- 13.3 REVENUE ANALYSIS

- 13.3.1 HISTORICAL REVENUE ANALYSIS

- FIGURE 46 HISTORICAL REVENUE ANALYSIS OF TOP FIVE LEADING PLAYERS, 2019-2021 (USD MILLION)

- 13.4 MARKET SHARE ANALYSIS

- FIGURE 47 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2021

- TABLE 288 DATA FABRIC MARKET: DEGREE OF COMPETITION

- 13.5 MARKET EVALUATION FRAMEWORK

- FIGURE 48 MARKET EVALUATION FRAMEWORK: EXPANSIONS AND CONSOLIDATIONS IN DATA FABRIC MARKET BETWEEN 2019 AND 2022

- 13.6 COMPANY EVALUATION QUADRANT

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- FIGURE 49 KEY DATA FABRIC MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- 13.7 COMPETITIVE BENCHMARKING

- 13.7.1 COMPANY PRODUCT FOOTPRINT

- FIGURE 50 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

- FIGURE 51 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS

- TABLE 289 DATA FABRIC MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, 2022

- 13.8 STARTUP/SME EVALUATION QUADRANT

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- FIGURE 52 STARTUP/SME DATA FABRIC PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- 13.9 STARTUP/SME COMPETITIVE BENCHMARKING

- 13.9.1 COMPANY PRODUCT FOOTPRINT

- FIGURE 53 PRODUCT PORTFOLIO ANALYSIS OF STARTUPS/SMES

- FIGURE 54 BUSINESS STRATEGY EXCELLENCE OF STARTUPS/SMES

- TABLE 290 DATA FABRIC MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SMES, 2021

- TABLE 291 DATA FABRIC MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 13.10 COMPETITIVE SCENARIO AND TRENDS

- 13.10.1 NEW PRODUCT LAUNCHES

- TABLE 292 NEW SERVICE/PRODUCT LAUNCHES, 2019-2022

- 13.10.2 DEALS

- TABLE 293 DEALS, 2019-2022

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 14.2 KEY PLAYERS

- 14.2.1 IBM

- TABLE 294 IBM: BUSINESS OVERVIEW

- FIGURE 55 IBM: COMPANY SNAPSHOT

- TABLE 295 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 297 IBM: DEALS

- 14.2.2 SAP

- TABLE 298 SAP: BUSINESS OVERVIEW

- FIGURE 56 SAP: COMPANY SNAPSHOT

- TABLE 299 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 301 SAP: DEALS

- 14.2.3 ORACLE

- TABLE 302 ORACLE: BUSINESS OVERVIEW

- FIGURE 57 ORACLE: COMPANY SNAPSHOT

- TABLE 303 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- 14.2.4 INFORMATICA

- TABLE 305 INFORMATICA: BUSINESS OVERVIEW

- FIGURE 58 INFORMATICA: COMPANY SNAPSHOT

- TABLE 306 INFORMATICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 INFORMATICA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 308 INFORMATICA: DEALS

- 14.2.5 TALEND

- TABLE 309 TALEND: BUSINESS OVERVIEW

- TABLE 310 TALEND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 TALEND: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 312 TALEND: DEALS

- 14.2.6 DENODO

- TABLE 313 DENODO: BUSINESS OVERVIEW

- TABLE 314 DENODO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 DENODO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 316 DENODO: DEALS

- 14.2.7 HPE

- TABLE 317 HPE: BUSINESS OVERVIEW

- FIGURE 59 HPE: COMPANY SNAPSHOT

- TABLE 318 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 320 HPE: DEALS

- 14.2.8 DELL TECHNOLOGIES

- TABLE 321 DELL TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 60 DELL TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 322 DELL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 DELL TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 324 DELL TECHNOLOGIES: DEALS

- 14.2.9 NETAPP

- TABLE 325 NETAPP: BUSINESS OVERVIEW

- FIGURE 61 NETAPP: COMPANY SNAPSHOT

- TABLE 326 NETAPP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 NETAPP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 328 NETAPP: DEALS

- 14.2.10 TERADATA

- TABLE 329 TERADATA: BUSINESS OVERVIEW

- FIGURE 62 TERADATA: COMPANY SNAPSHOT

- TABLE 330 TERADATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 TERADATA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 332 TERADATA: DEALS

- 14.2.11 SOFTWARE AG

- TABLE 333 SOFTWARE AG: BUSINESS OVERVIEW

- FIGURE 63 SOFTWARE AG: COMPANY SNAPSHOT

- TABLE 334 SOFTWARE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 SOFTWARE AG: DEALS

- 14.2.12 TIBCO SOFTWARE

- TABLE 336 TIBCO SOFTWARE: BUSINESS OVERVIEW

- TABLE 337 TIBCO SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 338 TIBCO SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 339 TIBCO SOFTWARE: DEALS

- 14.2.13 SPLUNK

- 14.2.14 GLOBAL IDS

- 14.2.15 PRECISELY

- 14.2.16 CINCHY

- 14.2.17 K2VIEW

- 14.2.18 IDERA

- 14.2.19 INCORTA

- 14.2.20 RADIANT LOGIC

- 14.2.21 INTENDA

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 14.3 STARTUP/SME PROFILES

- 14.3.1 ATLAN

- 14.3.2 NEXLA

- 14.3.3 STARDOG

- 14.3.4 GLUENT

- 14.3.5 STARBURST DATA

- 14.3.6 HEXSTREAM

- 14.3.7 QOMPLX

- 14.3.8 CLUEDIN

- 14.3.9 IGUAZIO

- 14.3.10 ALEX SOLUTIONS

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 BIG DATA MARKET - GLOBAL FORECAST TO 2027

- 15.2.1 MARKET DEFINITION

- 15.2.2 MARKET OVERVIEW

- 15.2.2.1 Big data market, by component

- TABLE 340 BIG DATA MARKET, BY COMPONENT, 2016-2020 (USD MILLION)

- TABLE 341 BIG DATA MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- 15.2.2.2 Big data market, by business function

- TABLE 342 BIG DATA MARKET, BY BUSINESS FUNCTION, 2016-2020 (USD MILLION)

- TABLE 343 BIG DATA MARKET, BY BUSINESS FUNCTION, 2021-2026 (USD MILLION)

- 15.2.2.3 Big data market, by deployment mode

- TABLE 344 BIG DATA MARKET, BY DEPLOYMENT MODE, 2016-2020 (USD MILLION)

- TABLE 345 BIG DATA MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 15.2.2.4 Big data market, by industry vertical

- TABLE 346 BIG DATA MARKET, BY INDUSTRY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 347 BIG DATA MARKET, BY INDUSTRY VERTICAL, 2021-2026 (USD MILLION)

- 15.2.2.5 Big data market, by region

- TABLE 348 BIG DATA MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 349 BIG DATA MARKET, BY REGION, 2021-2026 (USD MILLION)

- 15.3 DATA CATALOGUE MARKET - GLOBAL FORECAST TO 2027

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.3.2.1 Data catalogue market, by component

- TABLE 350 DATA CATALOG MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 351 DATA CATALOG MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 15.3.2.2 Data catalogue market, by deployment mode

- TABLE 352 DATA CATALOG MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 353 DATA CATALOG MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- 15.3.2.3 Data catalogue market, by data consumer

- TABLE 354 DATA CATALOG MARKET, BY DATA CONSUMER, 2017-2021 (USD MILLION)

- TABLE 355 DATA CATALOG MARKET, BY DATA CONSUMER, 2022-2027 (USD MILLION)

- 15.3.2.4 Data catalog market, by metadata type

- TABLE 356 DATA CATALOG MARKET, BY METADATA TYPE, 2017-2021 (USD MILLION)

- TABLE 357 DATA CATALOG MARKET, BY METADATA TYPE, 2022-2027 (USD MILLION)

- 15.3.2.5 Data catalogue market, by organization size

- TABLE 358 DATA CATALOG MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 359 DATA CATALOG MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 15.3.2.6 Data catalogue market, by vertical

- TABLE 360 DATA CATALOG MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 361 DATA CATALOG MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 15.3.2.7 Data catalogue market, by region

- TABLE 362 DATA CATALOG MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 363 DATA CATALOG MARKET, BY REGION, 2022-2027 (USD MILLION)

16 APPENDIX

- 16.1 INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS