|

|

市場調査レポート

商品コード

1104960

NaaS(Network as a Service)の世界市場:タイプ別(LAN・WLAN、WAN、コミュニケーション・コラボレーション、ネットワークセキュリティ)、組織規模別(大企業、中小企業)、アプリケーション別、エンドユーザー別、地域別 - 2027年までの予測Network as a Service Market by Type (LAN and WLAN, WAN, Communication and Collaboration, and Network Security), Organization Size (Large Enterprises and SMEs), Application, End User (BFSI, Manufacturing, Healthcare) and Region - Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| NaaS(Network as a Service)の世界市場:タイプ別(LAN・WLAN、WAN、コミュニケーション・コラボレーション、ネットワークセキュリティ)、組織規模別(大企業、中小企業)、アプリケーション別、エンドユーザー別、地域別 - 2027年までの予測 |

|

出版日: 2022年07月18日

発行: MarketsandMarkets

ページ情報: 英文 286 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のNaaS(Network as a Service)の市場規模は、2022年の132億米ドルから2027年までに466億米ドルに達し、予測期間中にCAGRで19.0%の成長が予測されています。

NaaSは、SDN、NFV、SD-WANなどのさまざまな先進技術によって接続サービスを補完するものです。これらの技術は、ネットワーク接続のさまざまなコンポーネントをデジタル化し、ハードウェアの代わりにソフトウェアアプリケーションを使用することで、シームレスな接続を実現します。SDNは画期的な技術であり、既存のネットワーキングとデータセンターのインフラを完全に変革させる勢いです。

アプリケーション別では、VPNセグメントが予測期間中に最も高いCAGRで成長する

アプリケーション別では、VPNが予測期間中に最も高いCAGRで成長すると予測されています。VPNセグメントを促進している3つの主な要因は、データベースの安全性の問題の増加、高度で包括的なサイバーセキュリティ脅威の増加、企業内でのモバイルおよび無線ガジェットの使用の発展です。また、VPNを使用することの利点は、ネットワーク接続を可能にし、ジオブロックを回避し、容量制限を排除し、ウェブストアの差別を排除するなど、セグメントの成長につながります。

地域別では、アジア太平洋(APAC)が予測期間中に最も高いCAGRを記録

地域別では、アジア太平洋地域がNaaS(Network as a Service)市場で最も高いCAGR 30.2%を維持すると推定されます。IT部門の大幅な拡大、大企業と中小企業の両方によるクラウドサービスの急速な普及、新しいデータセンターインフラの拡大、スマートデバイス(5G/IoT/VR/AR)などの数々の技術革新が、アジア太平洋地域の高い成長率の要因であると考えられます。

エンドユーザー別では、BFSIが予測期間中に最も高い市場規模を有する

エンドユーザー別では、BFSIがNaaS(Network as a Service)市場において予測期間中に最も高い市場規模を有すると推定されます。NaaS(Network as a Service)のエンドユーザーセグメントには、BFSI、小売・Eコマース、ソフトウェア・IT、政府、医療、製造、教育、メディア・エンターテインメント、その他(輸送・物流、ホスピタリティ、エネルギー・ユーティリティ)などが含まれます。消費者のハイテク志向が高まり、BFSIは技術力を高め、顧客にモバイルバンキングソリューションを提供する必要に迫られています。銀行業界では、データ保護が優先事項となっています。CIOは、データ保護を強化し、消費者のニーズを満たし、消費者に新しい選択肢を提供するために、結果として安全な無線機能を使用しています。大多数のサプライヤーが極めて安定したSD-WANとWi-Fiサービスを消費者に提供しているため、BFSIのエンドユーザーセグメントではNaaSモデルの浸透が始まっています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- バリューチェーン分析

- サプライチェーンのエコシステム

- 業界規制

- 技術分析

第6章 NaaS(Network as a Service)市場:タイプ別

- イントロダクション

- LAN・WLAN

- WAN

- コミュニケーション・コラボレーション

- ネットワークセキュリティ

第7章 NaaS(Network as a Service)市場:アプリケーション別

- イントロダクション

- UCAAS/ビデオ会議

- VPN

- クラウド・SaaS接続

- 帯域幅オンデマンド

- マルチブランチ接続

- WAN最適化

- セキュアWebゲートウェイ

- ネットワークアクセス制御

- その他

第8章 NaaS(Network as a Service)市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第9章 NaaS(Network as a Service)市場:エンドユーザー別

- イントロダクション

- 銀行・金融サービス・保険

- 製造

- 小売・Eコマース

- ソフトウェア・IT

- メディア・エンターテインメント

- 医療

- 教育

- 政府

- その他

第10章 NaaS(Network as a Service)市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- その他

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- その他

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- メキシコ

- ブラジル

- その他

第11章 競合情勢

- イントロダクション

- 企業評価象限

第12章 企業プロファイル

- 主要企業

- AT&T

- VERIZON

- TELEFONICA

- NTT COMMUNICATIONS

- ORANGE BUSINESS SERVICES

- VODAFONE

- BT GROUP

- TATA COMMUNICATIONS

- LUMEN

- COMCAST BUSINESS

- AXIANS

- その他の企業

- SERVSYS

- TELUS

- KDDI

- CLOUDFLARE

- PCCW GLOBAL

- CHINA TELECOM

- SINGTEL

- CHINA MOBILE

- GTT COMMUNICATIONS

- ARYAKA NETWORKS

- TELIA

- TELSTRA

- DEUTSCHE TELEKOM

- COLT TECHNOLOGY SERVICES

- WIPRO

- HGC

- TENFOUR

- PACKETFABRIC

- ONX CANADA

- MEGAPORT

- EPSILON

- IPC TECH

- MICROLAND

第13章 隣接市場

第14章 付録

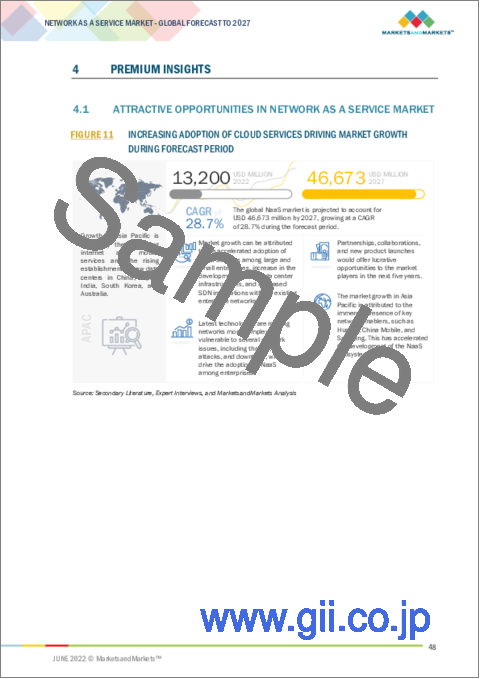

The global network as a service market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 19.0% during the forecast period, to reach USD 46.6 billion by 2027 from USD 13.2 billion in 2022. NaaS complements connectivity services through various advanced technologies, including SDN, NFV, and SD-WAN. These technologies provide seamless connectivity by digitalizing various components of network connectivity and using software applications instead of hardware. SDN is a ground-breaking technology, which is poised to entirely revolutionize the existing networking and data center infrastructure.

As per application, virtual private network segment to grow at a the highest CAGR during the forecast period

As per application, virtual private network is expected to grow at the highest CAGR during the forecast period. The three main drivers fueling the virtual private network segment are an increase in database safety issues, a rise in sophisticated and comprehensive cybersecurity threats, and a development in the use of mobile and wireless gadgets within enterprises. Also the benefits of using a virtual private network, can be connected to the growth of the segment such as enabling network connectivity, evading geo-blocks, eliminating capacity limiting, and eliminating webstores discrimination.

As per regions, Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

As per regions, the Asia Pacific is estimated to hold the highest Compound Annual Growth Rate (CAGR) of 30.2% in the network as a service market. The considerable expansion of the IT sector, the rapid uptake of cloud services by both large and small businesses, the expansion of new data centre infrastructure, and numerous technological innovations like smart devices (5G/IoT/VR/AR) can all be attributed to the Asia Pacific region's high growth rate.

As per end user, BFSI to have the highest market size during the forecast period

As per end user, BFSI is estimated BFSI to have the highest market size during the forecast period in the network as a service market. The end user segment of the network as a service includes BFSI, retail and eCommerce, software and IT, government, healthcare, manufacturing, education, media and entertainment, and others (transportation and logistics, hospitality, and energy and utilities). The Consumers are becoming more tech-savvy, forcing BFSI organizations to develop their technical capabilities and offer customers mobile banking solutions. Data protection is a priority in the banking industry. CIOs use secured wireless capabilities as a result to increase data protection, meet consumer needs, and provide consumers with new options. Since the majority of suppliers are providing consumers with extremely stable SD-WAN and Wi-Fi services, the penetration of the NaaS model has begun to increase in the BFSI end-user segment.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the network as a service market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, D-Level Executives: 25%, and Managers: 40%

- By Region: APAC: 25%, Europe: 30%, North America: 30%, MEA: 10%, Latin America: 5%

The report includes the study of key players offering network as a service solutions and services. It profiles major vendors in the network as a service market. Some of the major network as a service market vendors are AT&T (US), Verizon (US), Telefonica (Spain), NTT Communications (Japan), Orange Business Services (France), Vodafone (UK), BT Group (UK), Tata Communications (India), Lumen (US), Comcast Business (US), and Axians (France).

Research Coverage

The market study covers the network as a service market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as types, organization size, end users, applications, and regions. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall network as a service market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 NETWORK AS A SERVICE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primaries

- FIGURE 2 NETWORK AS A SERVICE MARKET: BREAKDOWN OF PRIMARIES

- 2.1.2.2 Insights from industry experts

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 4 RESEARCH METHODOLOGY

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 1): SUPPLY-SIDE ANALYSIS OF REVENUE FROM LAN AND WLAN, WAN, COMMUNICATION AND COLLABORATION, AND NETWORK SECURITY

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 2): BOTTOM-UP (SUPPLY-SIDE), COLLECTIVE REVENUE OF NETWORK AS A SERVICE VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATION OF COMPANY REVENUE ESTIMATION IN NETWORK AS A SERVICE MODEL

- 2.4 MARKET FORECAST

- TABLE 1 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.5.1 ASSUMPTIONS FOR THE STUDY

- 2.5.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

- TABLE 2 NETWORK AS A SERVICE MARKET AND GROWTH RATE, 2016-2021 (USD MILLION, Y-O-Y %)

- TABLE 3 NETWORK AS A SERVICE MARKET AND GROWTH RATE, 2022-2027 (USD MILLION, Y-O-Y %)

- FIGURE 8 NETWORK AS A SERVICE MARKET: HOLISTIC VIEW

- FIGURE 9 NETWORK AS A SERVICE MARKET: GROWTH TREND

- FIGURE 10 ASIA PACIFIC EXPECTED TO GROW AT HIGHEST GROWTH RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN NETWORK AS A SERVICE MARKET

- FIGURE 11 INCREASING ADOPTION OF CLOUD SERVICES DRIVING MARKET GROWTH DURING FORECAST PERIOD

- 4.2 NORTH AMERICA: NETWORK AS A SERVICE MARKET, BY TYPE AND ORGANIZATION SIZE

- FIGURE 12 WAN AND LARGE ENTERPRISES SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN NORTH AMERICAN MARKET IN 2022

- 4.3 EUROPE: NETWORK AS A SERVICE MARKET, BY TYPE AND ORGANIZATION SIZE

- FIGURE 13 WAN AND LARGE ENTERPRISES SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN EUROPEAN MARKET IN 2022

- 4.4 ASIA PACIFIC: NETWORK AS A SERVICE MARKET, BY TYPE AND ORGANIZATION SIZE

- FIGURE 14 WAN AND LARGE ENTERPRISES SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN ASIA PACIFIC MARKET IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: NETWORK AS A SERVICE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Accelerated adoption of cloud services among large and small enterprises

- 5.2.1.2 High reliability and security for mission-critical business applications

- 5.2.1.3 Increase in development of new data center infrastructures

- 5.2.1.4 Rise in SDN integration with existing network infrastructures

- 5.2.1.5 Reduction in time and money spent on automation

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of standardization in NaaS market

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Demand for SDN- and NFV-based cloud-native solutions to replace traditional networking model

- 5.2.3.2 Growing mobile workforce

- 5.2.3.3 Adoption of a hybrid working model

- FIGURE 16 ADOPTION OF HYBRID WORKING MODEL

- 5.2.4 CHALLENGES

- 5.2.4.1 Data security and privacy concerns

- 5.2.4.2 Loss of WAN connection impeding business network activities

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 ARYAKA NETWORKS

- 5.3.2 TELEFONICA

- 5.3.3 CBTS

- 5.3.4 NETFOUNDRY

- 5.3.5 GTT COMMUNICATIONS

- 5.3.6 PACKETFABRIC

- 5.3.7 HITACHI LTD

- 5.3.8 GLOBAL RETAILER

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 17 NETWORK AS A SERVICE MARKET: VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ECOSYSTEM

- 5.6 INDUSTRY REGULATIONS

- 5.6.1 GENERAL DATA PROTECTION REGULATION

- 5.6.2 CALIFORNIA CONSUMER PRIVACY ACT

- 5.6.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

- 5.6.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.6.5 DIGITAL IMAGING AND COMMUNICATIONS IN MEDICINE

- 5.6.6 HEALTH LEVEL SEVEN

- 5.6.7 GRAMM-LEACH-BLILEY ACT

- 5.6.8 SARBANES-OXLEY ACT

- 5.6.9 SERVICE ORGANIZATION CONTROL 2

- 5.6.10 COMMUNICATIONS DECENCY ACT

- 5.6.11 DIGITAL MILLENNIUM COPYRIGHT ACT

- 5.6.12 ANTI-CYBERSQUATTING CONSUMER PROTECTION ACT

- 5.6.13 LANHAM ACT

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 VIRTUAL ETHERNET PORT AGGREGATOR

- 5.7.2 VIRTUAL EXTENSIBLE LOCAL AREA NETWORK

- 5.7.3 TRANSPARENT INTERCONNECTION OF LOTS OF LINKS

- 5.7.4 SHORTEST PATH BRIDGING

- 5.7.5 FIBER CHANNEL OVER ETHERNET

- 5.7.6 NETWORK VIRTUALIZATION USING GENERIC ROUTING ENCAPSULATION

- 5.7.7 DATA CENTER BRIDGING

- 5.7.8 PRIORITY FLOW CONTROL

- 5.7.9 BANDWIDTH MANAGEMENT

- 5.7.10 DATA CENTER BRIDGING EXCHANGE

6 NETWORK AS A SERVICE MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 18 NETWORK SECURITY SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 4 NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 5 NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 6.1.1 TYPE: NETWORK AS A SERVICE MARKET DRIVERS

- 6.1.2 TYPE: COVID-19 IMPACT

- 6.2 LOCAL AREA NETWORK AND WIRELESS LOCAL AREA NETWORK

- 6.2.1 DIGITALIZATION OF BUSINESSES REVOLUTIONIZING LOCAL AREA NETWORK AND WIRELESS LOCAL AREA NETWORK SERVICES

- TABLE 6 LOCAL AREA NETWORK AND WIRELESS LOCAL AREA NETWORK: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 7 LOCAL AREA NETWORK AND WIRELESS LOCAL AREA NETWORK: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 WIDE AREA NETWORK

- 6.3.1 EMERGENCE OF SD-WAN INCREASING ADOPTION OF NETWORK AS A SERVICE MODEL IN WIDE AREA NETWORK

- TABLE 8 WIDE AREA NETWORK: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 9 WIDE AREA NETWORK: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 COMMUNICATION AND COLLABORATION

- 6.4.1 REMOTE WORKING TRENDS DRIVING DEMAND FOR VIDEO COLLABORATION SERVICES

- TABLE 10 COMMUNICATION AND COLLABORATION: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 11 COMMUNICATION AND COLLABORATION: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 NETWORK SECURITY

- 6.5.1 BORDERLESS NETWORK INFRASTRUCTURE BOOSTING DEMAND FOR NETWORK SECURITY SERVICES

- TABLE 12 NETWORK SECURITY: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 13 NETWORK SECURITY: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

7 NETWORK AS A SERVICE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: NETWORK AS A SERVICE MARKET DRIVERS

- 7.1.2 APPLICATION: COVID-19 IMPACT

- FIGURE 19 VIRTUAL PRIVATE NETWORK SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 14 NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 15 NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.2 UCAAS/VIDEO CONFERENCING

- 7.2.1 RISING NEED FOR REDUCING COMMUNICATION GAPS AND ENHANCING COMMUNICATION

- TABLE 16 UCAAS/VIDEO CONFERENCING: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 17 UCAAS/VIDEO CONFERENCING: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 VIRTUAL PRIVATE NETWORK

- 7.3.1 WORK FROM HOME AND HYBRID WORKFORCE MODEL DRIVING DEMAND

- TABLE 18 VIRTUAL PRIVATE NETWORK: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 19 VIRTUAL PRIVATE NETWORK: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 CLOUD AND SAAS CONNECTIVITY

- 7.4.1 DEMAND FOR HIGHER DEGREE OF RESILIENCE, FASTER PERFORMANCE, AND ENHANCED SECURITY

- TABLE 20 CLOUD AND SAAS CONNECTIVITY: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 21 CLOUD AND SAAS CONNECTIVITY: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.5 BANDWIDTH ON DEMAND

- 7.5.1 FLEXIBLE BANDWIDTH, CONNECTIVITY, AND LOCATION BENEFITS

- TABLE 22 BANDWIDTH ON DEMAND: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 23 BANDWIDTH ON DEMAND: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.6 MULTI-BRANCH CONNECTIVITY

- 7.6.1 INCREASING NEED TO CONNECT MULTIPLE BRANCHES WITH SEVERAL MOBILE DEVICES AND ENDPOINTS

- TABLE 24 MULTI-BRANCH CONNECTIVITY: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 25 MULTI-BRANCH CONNECTIVITY: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.7 WAN OPTIMIZATION

- 7.7.1 NEED FOR APPLICATION ACCELERATION AND ENHANCED USER EXPERIENCE

- TABLE 26 WAN OPTIMIZATION: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 27 WAN OPTIMIZATION: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.8 SECURE WEB GATEWAY

- 7.8.1 RISING NEED TO PREVENT UNSECURED WEB TRAFFIC FROM ENTERING OR LEAVING NETWORKS

- TABLE 28 SECURE WEB GATEWAY: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 29 SECURE WEB GATEWAY: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.9 NETWORK ACCESS CONTROL

- 7.9.1 INCREASED NETWORK VISIBILITY AND REDUCED RISKS

- TABLE 30 NETWORK ACCESS CONTROL: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 31 NETWORK ACCESS CONTROL: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.10 OTHER APPLICATIONS

- TABLE 32 OTHER APPLICATIONS: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 33 OTHER APPLICATIONS: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

8 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- FIGURE 20 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 34 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 35 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 8.1.1 ORGANIZATION SIZE: NETWORK AS A SERVICE MARKET DRIVERS

- 8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

- 8.2 LARGE ENTERPRISES

- 8.2.1 INCREASING DIGITALIZATION BOOSTING GROWTH OF NETWORK AS A SERVICE SOLUTIONS

- TABLE 36 LARGE ENTERPRISES: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 37 LARGE ENTERPRISES: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

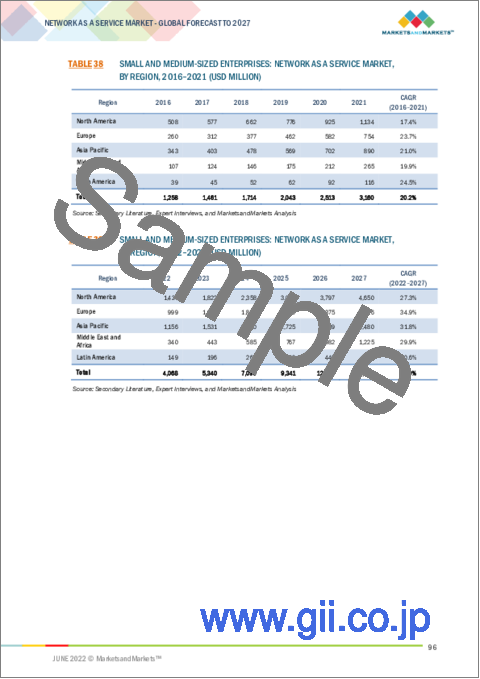

- 8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 8.3.1 NEED FOR COST-EFFECTIVENESS MAXIMIZING LARGE-SCALE ADOPTION OF NETWORK AS A SERVICE MODEL

- TABLE 38 SMALL AND MEDIUM-SIZED ENTERPRISES: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 39 SMALL AND MEDIUM-SIZED ENTERPRISES: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

9 NETWORK AS A SERVICE MARKET, BY END-USER

- 9.1 INTRODUCTION

- FIGURE 21 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 40 NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 41 NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- 9.1.1 END-USER: NETWORK AS A SERVICE MARKET DRIVERS

- 9.1.2 END-USER: COVID-19 IMPACT

- 9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 9.2.1 NEED FOR REAL-TIME CUSTOMER SERVICE AND GROWTH OF FINTECH

- TABLE 42 BANKING, FINANCIAL SERVICES, AND INSURANCE: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 43 BANKING, FINANCIAL SERVICES, AND INSURANCE: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 MANUFACTURING

- 9.3.1 NEED FOR ACCELERATING DIGITALIZATION AND AUTOMATION

- TABLE 44 MANUFACTURING: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 45 MANUFACTURING: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 RETAIL AND ECOMMERCE

- 9.4.1 INCREASING ADOPTION OF LATEST TECHNOLOGIES

- TABLE 46 RETAIL AND ECOMMERCE: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 47 RETAIL AND ECOMMERCE: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 SOFTWARE AND TECHNOLOGY

- 9.5.1 FOCUS NEEDED ON GAINING INSIGHTS FROM VOLUMINOUS CONTENT

- TABLE 48 SOFTWARE AND TECHNOLOGY: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 49 SOFTWARE AND TECHNOLOGY: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.6 MEDIA AND ENTERTAINMENT

- 9.6.1 DEMAND FOR MANAGING DATA

- TABLE 50 MEDIA AND ENTERTAINMENT: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 51 MEDIA AND ENTERTAINMENT: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.7 HEALTHCARE

- 9.7.1 DIGITAL REVOLUTION IN HEALTHCARE

- TABLE 52 HEALTHCARE: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 53 HEALTHCARE: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.8 EDUCATION

- 9.8.1 INCREASED FOCUS ON COST SAVING

- TABLE 54 EDUCATION: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 55 EDUCATION: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.9 GOVERNMENT

- 9.9.1 RE-ENGINEERED TRADITIONAL MODELS ENCOURAGING GROWTH

- TABLE 56 GOVERNMENT: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 57 GOVERNMENT: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.10 OTHER END-USERS

- TABLE 58 OTHER END-USERS: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 59 OTHER END-USERS: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

10 NETWORK AS A SERVICE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.1.1 COVID-19 IMPACT

- FIGURE 22 ASIA PACIFIC EXPECTED TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 23 NORTH AMERICA EXPECTED TO LEAD DURING FORECAST PERIOD

- TABLE 60 NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 61 NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: NETWORK AS A SERVICE MARKET DRIVERS

- FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 62 NORTH AMERICA: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 63 NORTH AMERICA: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 64 NORTH AMERICA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 65 NORTH AMERICA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 66 NORTH AMERICA: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 67 NORTH AMERICA: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 68 NORTH AMERICA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 69 NORTH AMERICA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 70 NORTH AMERICA: NETWORK AS A SERVICE MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 71 NORTH AMERICA: NETWORK AS A SERVICE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.2.2 UNITED STATES

- 10.2.2.1 Demand for high-performance networks and high adoption of reliable connectivity solutions

- TABLE 72 UNITED STATES: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 73 UNITED STATES: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 74 UNITED STATES: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 75 UNITED STATES: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 76 UNITED STATES: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 77 UNITED STATES: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 78 UNITED STATES: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 79 UNITED STATES: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Rising adoption of innovative delivery methods

- TABLE 80 CANADA: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 81 CANADA: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 82 CANADA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 83 CANADA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 84 CANADA: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 85 CANADA: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 86 CANADA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 87 CANADA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: NETWORK AS A SERVICE MARKET DRIVERS

- TABLE 88 EUROPE: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 89 EUROPE: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 90 EUROPE: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 91 EUROPE: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 92 EUROPE: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 93 EUROPE: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 94 EUROPE: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 95 EUROPE: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 96 EUROPE: NETWORK AS A SERVICE MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 97 EUROPE: NETWORK AS A SERVICE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.3.2 UNITED KINGDOM

- 10.3.2.1 Need for better overall network management solutions

- TABLE 98 UNITED KINGDOM: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 99 UNITED KINGDOM: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 100 UNITED KINGDOM: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 101 UNITED KINGDOM: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 102 UNITED KINGDOM: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 103 UNITED KINGDOM: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 104 UNITED KINGDOM: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 105 UNITED KINGDOM: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.3.3 GERMANY

- 10.3.3.1 New government regulations and digitalization

- TABLE 106 GERMANY: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 107 GERMANY: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 108 GERMANY: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 109 GERMANY: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 110 GERMANY: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 111 GERMANY: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 112 GERMANY: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 113 GERMANY: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.3.4 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: NETWORK AS A SERVICE MARKET DRIVERS

- FIGURE 25 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 114 ASIA PACIFIC: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 115 ASIA PACIFIC: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 116 ASIA PACIFIC: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 117 ASIA PACIFIC: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 118 ASIA PACIFIC: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 119 ASIA PACIFIC: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 120 ASIA PACIFIC: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 121 ASIA PACIFIC: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 122 ASIA PACIFIC: NETWORK AS A SERVICE MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 123 ASIA PACIFIC: NETWORK AS A SERVICE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Broad internet user base and widespread adoption of Wi-Fi technology

- TABLE 124 CHINA: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 125 CHINA: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 126 CHINA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 127 CHINA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 128 CHINA: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 129 CHINA: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 130 CHINA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 131 CHINA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Expansion in 5G and focus on cloud supporting adoption of NaaS model

- TABLE 132 JAPAN: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 133 JAPAN: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 134 JAPAN: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 135 JAPAN: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 136 JAPAN: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 137 JAPAN: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 138 JAPAN: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 139 JAPAN: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Strategic collaborations and developed infrastructure driving market growth

- TABLE 140 SOUTH KOREA: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 141 SOUTH KOREA: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 142 SOUTH KOREA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 143 SOUTH KOREA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 144 SOUTH KOREA: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 145 SOUTH KOREA: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 146 SOUTH KOREA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 147 SOUTH KOREA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.4.5 INDIA

- 10.4.5.1 Rising adoption of NaaS among retail and eCommerce and telecom industries

- TABLE 148 INDIA: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 149 INDIA: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 150 INDIA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 151 INDIA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 152 INDIA: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 153 INDIA: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 154 INDIA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 155 INDIA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST AND AFRICA

- 10.5.1 MIDDLE EAST AND AFRICA: NETWORK AS A SERVICE MARKET DRIVERS

- TABLE 156 MIDDLE EAST AND AFRICA: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 157 MIDDLE EAST AND AFRICA: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 158 MIDDLE EAST AND AFRICA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 159 MIDDLE EAST AND AFRICA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 160 MIDDLE EAST AND AFRICA: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 161 MIDDLE EAST AND AFRICA: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 162 MIDDLE EAST AND AFRICA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 163 MIDDLE EAST AND AFRICA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 164 MIDDLE EAST AND AFRICA: NETWORK AS A SERVICE MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 165 MIDDLE EAST AND AFRICA: NETWORK AS A SERVICE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Supportive government initiatives boosting higher adoption of NaaS

- TABLE 166 MIDDLE EAST: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 167 MIDDLE EAST: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 168 MIDDLE EAST: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 169 MIDDLE EAST: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 170 MIDDLE EAST: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 171 MIDDLE EAST: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 172 MIDDLE EAST: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 173 MIDDLE EAST: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.5.3 AFRICA

- 10.5.3.1 Business transformations and supportive policies gaining market traction

- TABLE 174 AFRICA: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 175 AFRICA: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 176 AFRICA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 177 AFRICA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 178 AFRICA: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 179 AFRICA: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 180 AFRICA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 181 AFRICA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: NETWORK AS A SERVICE MARKET DRIVERS

- TABLE 182 LATIN AMERICA: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 183 LATIN AMERICA: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 184 LATIN AMERICA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 185 LATIN AMERICA: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 186 LATIN AMERICA: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 187 LATIN AMERICA: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 188 LATIN AMERICA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 189 LATIN AMERICA: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 190 LATIN AMERICA: NETWORK AS A SERVICE MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 191 LATIN AMERICA: NETWORK AS A SERVICE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.6.2 MEXICO

- 10.6.2.1 Wireless internet connectivity initiatives fueling market growth

- TABLE 192 MEXICO: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 193 MEXICO: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 194 MEXICO: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 195 MEXICO: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 196 MEXICO: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 197 MEXICO: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 198 MEXICO: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 199 MEXICO: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Increasing adoption of wireless internet connectivity among enterprises

- TABLE 200 BRAZIL: NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 201 BRAZIL: NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 202 BRAZIL: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 203 BRAZIL: NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 204 BRAZIL: NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 205 BRAZIL: NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 206 BRAZIL: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 207 BRAZIL: NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.6.4 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 COMPANY EVALUATION QUADRANT

- 11.2.1 STARS

- 11.2.2 EMERGING LEADERS

- 11.2.3 PERVASIVE PLAYERS

- 11.2.4 PARTICIPANTS

- FIGURE 26 NETWORK AS A SERVICE MARKET, COMPANY EVALUATION QUADRANT, 2021

- 11.2.5 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

- TABLE 208 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN NETWORK AS A SERVICE MARKET

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

Business overview, Solutions offered, Recent Developments, MNM view)**

- 12.2.1 AT&T

- TABLE 209 AT&T: BUSINESS OVERVIEW

- FIGURE 27 AT&T: COMPANY SNAPSHOT

- TABLE 210 AT&T: SOLUTIONS OFFERED

- TABLE 211 AT&T: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 212 AT&T: DEALS

- 12.2.2 VERIZON

- TABLE 213 VERIZON: BUSINESS OVERVIEW

- FIGURE 28 VERIZON: COMPANY SNAPSHOT

- TABLE 214 VERIZON: SOLUTIONS OFFERED

- TABLE 215 VERIZON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 216 VERIZON: DEALS

- TABLE 217 VERIZON: OTHERS

- 12.2.3 TELEFONICA

- TABLE 218 TELEFONICA: BUSINESS OVERVIEW

- FIGURE 29 TELEFONICA: COMPANY SNAPSHOT

- TABLE 219 TELEFONICA: SOLUTIONS OFFERED

- TABLE 220 TELEFONICA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 221 TELEFONICA: DEALS

- TABLE 222 TELEFONICA: OTHERS

- 12.2.4 NTT COMMUNICATIONS

- TABLE 223 NTT COMMUNICATIONS: BUSINESS OVERVIEW

- FIGURE 30 NTT COMMUNICATIONS: COMPANY SNAPSHOT

- TABLE 224 NTT COMMUNICATIONS: SOLUTIONS OFFERED

- TABLE 225 NTT COMMUNICATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 226 NTT COMMUNICATIONS: DEALS

- 12.2.5 ORANGE BUSINESS SERVICES

- TABLE 227 ORANGE BUSINESS SERVICES: BUSINESS OVERVIEW

- FIGURE 31 ORANGE BUSINESS SERVICES: COMPANY SNAPSHOT

- TABLE 228 ORANGE BUSINESS SERVICES: SOLUTIONS OFFERED

- TABLE 229 ORANGE BUSINESS SERVICES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 230 ORANGE BUSINESS SERVICES: DEALS

- 12.2.6 VODAFONE

- TABLE 231 VODAFONE: BUSINESS OVERVIEW

- FIGURE 32 VODAFONE: COMPANY SNAPSHOT

- TABLE 232 VODAFONE: SOLUTIONS OFFERED

- TABLE 233 VODAFONE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 234 VODAFONE: DEALS

- TABLE 235 VODAFONE: OTHERS

- 12.2.7 BT GROUP

- TABLE 236 BT GROUP: BUSINESS OVERVIEW

- FIGURE 33 BT GROUP: COMPANY SNAPSHOT

- TABLE 237 BT GROUP: SOLUTIONS OFFERED

- TABLE 238 BT GROUP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 239 BT GROUP: DEALS

- 12.2.8 TATA COMMUNICATIONS

- TABLE 240 TATA COMMUNICATIONS: BUSINESS OVERVIEW

- FIGURE 34 TATA COMMUNICATIONS: COMPANY SNAPSHOT

- TABLE 241 TATA COMMUNICATIONS: SOLUTIONS OFFERED

- TABLE 242 TATA COMMUNICATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 243 TATA COMMUNICATIONS: DEALS

- 12.2.9 LUMEN

- TABLE 244 LUMEN: BUSINESS OVERVIEW

- FIGURE 35 LUMEN: COMPANY SNAPSHOT

- TABLE 245 LUMEN: SOLUTIONS OFFERED

- TABLE 246 LUMEN: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 247 LUMEN: DEALS

- TABLE 248 LUMEN: OTHERS

- 12.2.10 COMCAST BUSINESS

- TABLE 249 COMCAST BUSINESS: BUSINESS OVERVIEW

- TABLE 250 COMCAST BUSINESS: SOLUTIONS OFFERED

- TABLE 251 COMCAST BUSINESS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 252 COMCAST BUSINESS: DEALS

- 12.2.11 AXIANS

- TABLE 253 AXIANS: BUSINESS OVERVIEW

- TABLE 254 AXIANS: SOLUTIONS OFFERED

- TABLE 255 AXIANS: DEALS

- 12.3 OTHER PLAYERS

- 12.3.1 SERVSYS

- 12.3.2 TELUS

- 12.3.3 KDDI

- 12.3.4 CLOUDFLARE

- 12.3.5 PCCW GLOBAL

- 12.3.6 CHINA TELECOM

- 12.3.7 SINGTEL

- 12.3.8 CHINA MOBILE

- 12.3.9 GTT COMMUNICATIONS

- 12.3.10 ARYAKA NETWORKS

- 12.3.11 TELIA

- 12.3.12 TELSTRA

- 12.3.13 DEUTSCHE TELEKOM

- 12.3.14 COLT TECHNOLOGY SERVICES

- 12.3.15 WIPRO

- 12.3.16 HGC

- 12.3.17 TENFOUR

- 12.3.18 PACKETFABRIC

- 12.3.19 ONX CANADA

- 12.3.20 MEGAPORT

- 12.3.21 EPSILON

- 12.3.22 IPC TECH

- 12.3.23 MICROLAND

- *Details on Business overview, Solutions offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

13 ADJACENT MARKETS

- 13.1 INTRODUCTION

- 13.1.1 LIMITATIONS

- 13.1.2 NETWORK MANAGEMENT SYSTEM

- 13.1.2.1 Market definition

- 13.1.2.2 Network management system market, by component

- TABLE 256 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2017-2024 (USD MILLION)

- 13.1.2.3 Network management system market, by deployment mode

- TABLE 257 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017-2024 (USD MILLION)

- 13.1.2.4 Network management system market, by organization size

- TABLE 258 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2017-2024 (USD MILLION)

- 13.1.2.5 Network management system market, by vertical

- TABLE 259 NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2017-2024 (USD MILLION)

- 13.1.3 WAN OPTIMIZATION MARKET

- 13.1.3.1 Market definition

- 13.1.3.2 WAN optimization market, by component

- TABLE 260 WAN OPTIMIZATION MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

- 13.1.3.3 WAN optimization market, by end-user

- 13.1.3.3.1 Small and medium-sized enterprises

- 13.1.3.3 WAN optimization market, by end-user

- TABLE 261 SMALL AND MEDIUM-SIZED ENTERPRISES: WAN OPTIMIZATION MARKET, BY REGION, 2018-2025 (USD MILLION)

- 13.1.3.3.2 Large enterprises

- TABLE 262 LARGE ENTERPRISES: WAN OPTIMIZATION MARKET, BY REGION, 2018-2025 (USD MILLION)

- 13.1.3.4 WAN optimization market, by vertical

- 13.1.3.4.1 Banking, financial services, and insurance

- 13.1.3.4 WAN optimization market, by vertical

- TABLE 263 BANKING, FINANCIAL SERVICES, AND INSURANCE: WAN OPTIMIZATION MARKET, BY REGION, 2018-2025 (USD MILLION)

- 13.1.3.4.2 Healthcare

- TABLE 264 HEALTHCARE: WAN OPTIMIZATION MARKET, BY REGION, 2018-2025 (USD MILLION)

- 13.1.3.4.3 Information technology and telecom

- TABLE 265 INFORMATION TECHNOLOGY AND TELECOM: WAN OPTIMIZATION MARKET, BY REGION, 2018-2025 (USD MILLION)

- 13.1.3.4.4 Manufacturing

- TABLE 266 MANUFACTURING: WAN OPTIMIZATION MARKET, BY REGION, 2018-2025 (USD MILLION)

- 13.1.3.4.5 Retail

- TABLE 267 RETAIL: WAN OPTIMIZATION MARKET, BY REGION, 2018-2025 (USD MILLION)

- 13.1.3.4.6 Media and entertainment

- TABLE 268 MEDIA AND ENTERTAINMENT: WAN OPTIMIZATION MARKET, BY REGION, 2018-2025 (USD MILLION)

- 13.1.3.4.7 Energy

- TABLE 269 ENERGY: WAN OPTIMIZATION MARKET, BY REGION, 2018-2025 (USD MILLION)

- 13.1.3.4.8 Education

- TABLE 270 EDUCATION: WAN OPTIMIZATION MARKET, BY REGION, 2018-2025 (USD MILLION)

- 13.1.3.5 WAN optimization market, by region

- 13.1.3.5.1 Europe

- 13.1.3.5 WAN optimization market, by region

- TABLE 271 EUROPE: WAN OPTIMIZATION MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

- TABLE 272 EUROPE: WAN OPTIMIZATION MARKET, BY SOLUTION, 2018-2025 (USD MILLION)

- TABLE 273 EUROPE: WAN OPTIMIZATION MARKET, BY SERVICE, 2018-2025 (USD MILLION)

- TABLE 274 EUROPE: WAN OPTIMIZATION MARKET, BY END-USER, 2018-2025 (USD MILLION)

- TABLE 275 EUROPE: WAN OPTIMIZATION MARKET, BY DEPLOYMENT MODE, 2018-2025 (USD MILLION)

- TABLE 276 EUROPE: WAN OPTIMIZATION MARKET, BY VERTICAL, 2018-2025 (USD MILLION)

- TABLE 277 EUROPE: WAN OPTIMIZATION MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATION

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS