|

|

市場調査レポート

商品コード

1107624

同期コンデンサの世界市場:冷却の種類別 (水素冷却、空冷、水冷)・種類別 (新設、改修)・始動方式別 (静止型周波数変換器、ポニーモーター)・エンドユーザー別・無効定格電力別・地域別の将来予測 (2030年まで)Synchronous Condenser Market by Cooling Type (Hydrogen-Cooles, Air-Cooled, Water-Cooled), Type (New & Refurbished), Starting Method (Static Frequency Converter, Pony Motor), End-User, Reactive Power Rating and Region - Global Forecast to 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 同期コンデンサの世界市場:冷却の種類別 (水素冷却、空冷、水冷)・種類別 (新設、改修)・始動方式別 (静止型周波数変換器、ポニーモーター)・エンドユーザー別・無効定格電力別・地域別の将来予測 (2030年まで) |

|

出版日: 2022年07月26日

発行: MarketsandMarkets

ページ情報: 英文 226 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

同期コンデンサの世界市場は、分析期間中に2.6%のCAGRで成長し、2022年の6億6,100万米ドルから、2030年には8億1,100万米ドルまで成長すると予測されます。

送電網と配電網の整備による電力網の維持と、再生可能エネルギーの設備容量の拡大への投資の増加が、同期コンデンサ市場の成長を促す主な要因となっています。

"同期コンデンサ市場:種類別では新設が最大"

新設同期コンデンサは、2極または4極 (2極ペア) で構成され、水素、空気、水による冷却が可能なコンデンサです。HVDCネットワークの世界の拡大に伴い、カナダ、ブラジル、イタリアなどの国では、送電系統の安定化と強度向上のために新型同期コンデンサを配備しています。さらに、電圧変動の抑制や無効電力の供給にも利用されています。

"予測期間中の市場規模は、北米が最大となる"

北米は電力インフラの老朽化が進んでおり、停電のリスクを高める可能性があります。そのため、各国政府は、送電網の信頼性と回復力を向上させるために、スマート電力ネットワークを開発し、老朽化したインフラの更新と交換に積極的に注力しています。北米の電力セクターは現在、エネルギー効率目標の達成、連邦政府の炭素政策の遵守、さまざまな分散型発電源のグリッドへの統合といった課題に直面しています。

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- マーケットマップ

- バリューチェーン分析

- 原材料の供給業者/サプライヤー

- コンポーネントメーカー

- 同期コンデンサのメーカー/組立業者/サービスプロバイダー

- 流通業者/エンドユーザー

- アフターサービス業者

- 同期コンデンサ市場に関連する法令と規制

- 規制機関、政府機関、その他の組織

- イノベーションと特許登録

- ポーターのファイブフォース分析

- ケーススタディ分析

- 価格分析

- 技術分析

- 主な利害関係者と購入基準

- 主な会議とイベント (2022年~2024年)

第6章 同期コンデンサ市場:種類別

- イントロダクション

- 新設同期コンデンサ

- 改修同期コンデンサ

第7章 同期コンデンサ市場:冷却技術別

- イントロダクション

- 水素冷却式同期コンデンサ

- 空冷式同期コンデンサ

- 水冷式同期コンデンサ

第8章 同期コンデンサ市場:始動方式別

- イントロダクション

- 静止型周波数変換器

- ポニーモーター

- その他

第9章 同期コンデンサ市場:無効定格電力別

- イントロダクション

- 100MVAR以下

- 101~200 MVAR

- 200MVAR以上

第10章 同期コンデンサ市場:エンドユーザー別

- イントロダクション

- 電気事業

- 産業部門

第11章 同期コンデンサ市場:地域別

- イントロダクション

- 北米

- 欧州

- 南米

- アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 主要企業の戦略

- 市場シェア分析

- 上位5社の収益シェア分析

- 企業評価クアドラント

- 同期コンデンサ市場:企業のフットプリント

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ABB

- SIEMENS ENERGY

- GE

- WEG

- EATON

- ANDRITZ GROUP

- ANSALDO ENERGIA

- MITSUBISHI HEAVY INDUSTRIES

- VOITH GROUP

- FUJI ELECTRIC

- BHARAT HEAVY ELECTRICALS LIMITED (BHEL)

- IDEAL ELECTRIC POWER (HYUNDAI IDEAL ELECTRIC CO.)

- POWER SYSTEMS & CONTROLS

- BRUSH GROUP

- ELECTROMECHANICAL ENGINEERING ASSOCIATES

- ANHUI ZHONGDIAN(ZDDQ)ELECTRIC CO., LTD.

- SHANGHAI ELECTRIC

- INGETEAM

- DOOSAN SKODA POWER

- HANGZHOU JINGCHENG ELECTRICAL EQUIPMENT CO., LTD.

第14章 付録

The global synchronous condenser market is projected to grow from USD 661 million in 2022 to USD 811 million by 2030, registering a CAGR of 2.6% during the review period. The developments in the power transmission and distribution networks to maintain grid operations and the increasing investments in expanding the renewable energy capacities are the key factors driving the growth of the synchronous condenser market.

"New Synchronous Condenser: is expected to be the largest segment synchronous condenser market, by type"

The type segment is categorized as New Synchronous Condenser and refurbished synchronous condenser. A new synchronous condenser is constructed with 2 or 4 poles (2-pole pair), which can be cooled with hydrogen, air, and water. With the globally expanding HVDC network, countries such as Canada, Brazil, and Italy have deployed new synchronous condensers for stabilizing and improving transmission systems' stability and strength. Besides, they are also being deployed to control voltage fluctuations and provide reactive power support.

"The hydrogen cooled synchronous condenser segment is expected to emerge as the fastest segment, by Cooling technology"

The Synchronous Condenser market has been segmented into hydrogen cooled synchronous condenser, Air cooled synchronous condenser and Water cooled synchronous condenser. The hydrogen-cooled synchronous condenser uses gaseous hydrogen as a coolant because of its superior cooling properties. It exhibits low density, high specific heat, and high thermal conductivity features. The hydrogen-cooled synchronous condenser has 1.5 times higher heat transfer capability and 1/14th the density than its air-cooled counterpart, resulting in fewer friction losses and faster cooling. Hydrogen-cooled synchronous condensers can be operated at a higher load with the same temperature rise, and the windage loss is lower than air-cooled synchronous condensers.

"North America is expected to account for the largest market size during the forecast period."

North America is expected to be the largest market during the forecast period. North America has aging power infrastructures, which may increase the risk of blackouts. Therefore, governments of different countries in this region are actively focusing on upgrading and replacing aging infrastructures to improve grid reliability and resilience and develop smart electricity networks. The North American power sector is currently facing challenges such as meeting energy-efficiency targets, compliance with federal carbon policies, and integrating various distributed generation sources in the grid.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level- 30%, Director Level- 25%, and Others- 45%

By Region: North America- 33%,Europe - 27%, South America-20 %,Asia Pacific- 12% Central America- 8%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined based on their total revenues as of 2017. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The Synchronous Condenser market is dominated by a few major players that have a wide regional presence. The leading players in the synchronous condenser market are ABB (Switzerland), Siemens (Germany), GE (US), Eaton (Ireland), Voith Group (Germany), Fuji Electric (Japan), and WEG (Brazil).

Research Coverage:

The report defines, describes, and forecasts the synchronous condenser market, Cooling Technology, Reactive Power Rating, Type, Starting Method, End User, and Region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the synchronous condenser market.

Key Benefits of Buying the Report

1. The report identifies and addresses the key markets for synchronous condenser market, which would help cable manufacturers review the growth in demand.

2. The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

3. The report will help key players understand the strategies of their competitors better and help them in making better strategic decisions.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY: INCLUSIONS AND EXCLUSIONS

- 1.3.2 SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING: INCLUSIONS AND EXCLUSIONS

- 1.3.3 SYNCHRONOUS CONDENSER MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 SYNCHRONOUS CONDENSER MARKET: SEGMENTATION

- 1.4.2 SYNCHRONOUS CONDENSER MARKET: REGIONAL SCOPE

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 SYNCHRONOUS CONDENSER MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- 2.2.1 SECONDARY DATA

- 2.3 SCOPE OF STUDY

- 2.4 DEMAND-SIDE ANALYSIS

- FIGURE 2 PARAMETERS CONSIDERED WHILE ASSESSING DEMAND FOR SYNCHRONOUS CONDENSERS

- 2.4.1 DEMAND-SIDE ANALYSIS: BOTTOM-UP APPROACH

- FIGURE 3 SYNCHRONOUS CONDENSER MARKET: INDUSTRY AND REGION-/COUNTRY-WISE ANALYSIS

- 2.4.1.1 Demand-side analysis of synchronous condenser market

- 2.4.1.2 Assumptions while calculating demand-side market size

- 2.4.2 SUPPLY-SIDE ANALYSIS

- FIGURE 4 CALCULATION OF REVENUES OF MAJOR PLAYERS FROM SALES OF SYNCHRONOUS CONDENSERS TO IDENTIFY GLOBAL MARKET SIZE

- 2.4.2.1 Supply-side analysis of synchronous condenser market

- FIGURE 5 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF SYNCHRONOUS CONDENSERS

- 2.4.2.2 Assumptions while calculating supply-side market size

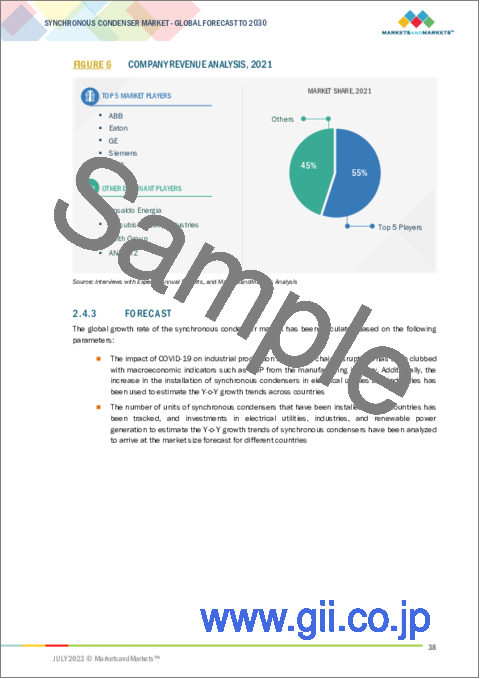

- FIGURE 6 COMPANY REVENUE ANALYSIS, 2021

- 2.4.3 FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 SYNCHRONOUS CONDENSER MARKET: SNAPSHOT

- FIGURE 7 NORTH AMERICA DOMINATED SYNCHRONOUS CONDENSER MARKET IN 2021

- FIGURE 8 HYDROGEN-COOLED SYNCHRONOUS CONDENSER SEGMENT TO DOMINATE MARKET, BY COOLING TECHNOLOGY, DURING FORECAST PERIOD

- FIGURE 9 STATIC FREQUENCY CONVERTER TO BE FASTEST-GROWING SEGMENT OF SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, DURING FORECAST PERIOD

- FIGURE 10 ABOVE 200 MVAR SEGMENT TO DOMINATE SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, DURING FORECAST PERIOD

- FIGURE 11 ELECTRICAL UTILITIES SEGMENT TO DOMINATE SYNCHRONOUS CONDENSER MARKET, BY END USER, DURING FORECAST PERIOD

- FIGURE 12 NEW SYNCHRONOUS CONDENSER SEGMENT TO LEAD MARKET, BY TYPE, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SYNCHRONOUS CONDENSER MARKET

- FIGURE 13 RISING INVESTMENTS IN DEVELOPING POWER INFRASTRUCTURES AND INTEGRATION OF RENEWABLE SOURCES INTO GRIDS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS DURING FORECAST PERIOD

- 4.2 SYNCHRONOUS CONDENSER MARKET, BY REGION

- FIGURE 14 NORTH AMERICAN SYNCHRONOUS CONDENSER MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE AND COUNTRY, 2021

- FIGURE 15 REFURBISHED SYNCHRONOUS CONDENSER SEGMENT AND US HELD LARGER SHARES OF NORTH AMERICAN SYNCHRONOUS CONDENSER MARKET IN 2021

- 4.4 SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING

- FIGURE 16 ABOVE 200 MVAR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2030

- 4.5 SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD

- FIGURE 17 STATIC FREQUENCY CONVERTER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2030

- 4.6 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY

- FIGURE 18 HYDROGEN-COOLED SYNCHRONOUS CONDENSER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2030

- 4.7 SYNCHRONOUS CONDENSER MARKET, BY TYPE

- FIGURE 19 NEW SYNCHRONOUS CONDENSER SEGMENT TO DOMINATE MARKET BY 2030

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 SYNCHRONOUS CONDENSER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing use of renewable and sustainable energy sources and increasing investments in capacity additions

- FIGURE 21 RENEWABLE ELECTRICITY CAPACITY ADDITION, 2014-2021

- FIGURE 22 INSTALLED RENEWABLE ELECTRICITY GENERATING CAPACITY, 2020-2050

- 5.2.1.2 Growing requirement for power factor correction (PFC) and increasing investments in developing transmission and distribution (T&D) infrastructures

- FIGURE 23 INVESTMENTS IN ELECTRICITY NETWORKS, BY REGION (2015-2021)

- TABLE 2 TRANSMISSION AND DISTRIBUTION (T&D) INFRASTRUCTURE EXPANSION PLANS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High manufacturing and maintenance costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Conversion of synchronous generators into synchronous condensers

- 5.2.3.2 Rising adoption of high-voltage direct current (HVDC) systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability of low-cost substitutes

- TABLE 3 COMPARISON BETWEEN SYNCHRONOUS CONDENSER AND ITS SUBSTITUTES

- 5.2.4.2 Shortage of components/parts used in manufacturing of synchronous condensers due to COVID-19

- TABLE 4 CHANGE IN PRICES OF COMMODITIES, 2019-2020

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SYNCHRONOUS CONDENSER MANUFACTURERS

- FIGURE 24 REVENUE SHIFT FOR SYNCHRONOUS CONDENSER MANUFACTURERS

- 5.4 MARKET MAP

- FIGURE 25 SYNCHRONOUS CONDENSER MARKET: MARKET MAP

- TABLE 5 SYNCHRONOUS CONDENSER MARKET: ROLE IN ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 26 SYNCHRONOUS CONDENSER MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL PROVIDERS/SUPPLIERS

- 5.5.2 COMPONENT MANUFACTURERS

- 5.5.3 SYNCHRONOUS CONDENSER MANUFACTURERS/ASSEMBLERS/ SERVICE PROVIDERS

- 5.5.4 DISTRIBUTORS/END USERS

- 5.5.5 POST-SALES SERVICE PROVIDERS

- 5.6 CODES AND REGULATIONS RELATED TO SYNCHRONOUS CONDENSER MARKET

- TABLE 6 SYNCHRONOUS CONDENSER MARKET: CODES AND REGULATIONS

- 5.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 12 SYNCHRONOUS CONDENSER MARKET: INNOVATIONS AND PATENT REGISTRATIONS, FEBRUARY 2016-NOVEMBER 2021

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 SYNCHRONOUS CONDENSER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF SUBSTITUTES

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF NEW ENTRANTS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 USE OF GE'S SYNCHRONOUS CONDENSERS IN NORTHWEST VERMONT RELIABILITY PROJECT

- 5.10.1.1 Problem statement

- 5.10.1.2 Solution

- 5.10.2 REFURBISHMENT OF SYNCHRONOUS GENERATORS TO SYNCHRONOUS CONDENSERS

- 5.10.2.1 Problem statement

- 5.10.2.2 Solution

- 5.10.3 USE OF TERNA'S SYNCHRONOUS CONDENSERS TO STABILIZE GRID IN SARDINIA REGION

- 5.10.3.1 Problem statement

- 5.10.3.2 Solution

- 5.10.1 USE OF GE'S SYNCHRONOUS CONDENSERS IN NORTHWEST VERMONT RELIABILITY PROJECT

- 5.11 PRICING ANALYSIS

- TABLE 14 AVERAGE SELLING PRICE OF SYNCHRONOUS CONDENSERS

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 HIGH-TEMPERATURE SUPERCONDUCTOR (HTS) DYNAMIC SYNCHRONOUS CONDENSER

- 5.12.2 MODE OF OPERATION (APPLICATION)

- 5.12.2.1 Standalone synchronous condenser

- 5.12.2.2 Power plants with synchronous condensing capacity

- 5.12.2.3 Retrofitting of existing and decommissioned power plants

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY END USER

- TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY END USER (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR END USERS

- TABLE 16 KEY BUYING CRITERIA, BY END USER

- 5.14 KEY CONFERENCES AND EVENTS, 2022-2024

- TABLE 17 SYNCHRONOUS CONDENSER MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 SYNCHRONOUS CONDENSER MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 30 NEW SYNCHRONOUS CONDENSER SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2021

- TABLE 18 SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 19 SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2022-2030 (USD MILLION)

- 6.2 NEW SYNCHRONOUS CONDENSER

- 6.2.1 EXPANSION OF HVDC NETWORKS TO INCREASE INSTALLATION OF NEW SYNCHRONOUS CONDENSERS

- TABLE 20 NEW SYNCHRONOUS CONDENSER: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 21 NEW SYNCHRONOUS CONDENSER: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

- 6.3 REFURBISHED SYNCHRONOUS CONDENSER

- 6.3.1 LOW COST OF REFURBISHED SYNCHRONOUS CONDENSERS TO FUEL DEMAND

- TABLE 22 REFURBISHED SYNCHRONOUS CONDENSER: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 23 REFURBISHED SYNCHRONOUS CONDENSER: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

7 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 31 HYDROGEN-COOLED SYNCHRONOUS CONDENSER SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- TABLE 24 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 25 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2022-2030 (USD MILLION)

- 7.2 HYDROGEN-COOLED SYNCHRONOUS CONDENSER

- 7.2.1 LOW WINDAGE LOSS AND HIGH THERMAL CONDUCTIVITY FEATURES OF HYDROGEN-COOLED SYNCHRONOUS CONDENSERS TO FUEL DEMAND

- TABLE 26 HYDROGEN-COOLED SYNCHRONOUS CONDENSER: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 27 HYDROGEN-COOLED SYNCHRONOUS CONDENSER: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

- 7.3 AIR-COOLED SYNCHRONOUS CONDENSER

- 7.3.1 EXCELLENT COOLING FEATURE OF AIR-COOLED SYNCHRONOUS CONDENSERS TO PROPEL DEMAND

- TABLE 28 AIR-COOLED SYNCHRONOUS CONDENSER: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 29 AIR-COOLED SYNCHRONOUS CONDENSER: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

- 7.4 WATER-COOLED SYNCHRONOUS CONDENSER

- 7.4.1 HIGHER EFFICIENCY OF WATER-COOLED SYNCHRONOUS CONDENSERS COMPARED TO HYDROGEN-COOLED CONDENSERS TO FUEL DEMAND

- TABLE 30 WATER-COOLED SYNCHRONOUS CONDENSER: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 WATER-COOLED SYNCHRONOUS CONDENSER: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

8 SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD

- 8.1 INTRODUCTION

- FIGURE 32 STATIC FREQUENCY CONVERTER SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- TABLE 32 SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2018-2021 (USD MILLION)

- TABLE 33 SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2022-2030 (USD MILLION)

- 8.2 STATIC FREQUENCY CONVERTER

- 8.2.1 LOW INSTALLATION COST OF STATIC FREQUENCY CONVERTER TO FUEL DEMAND

- TABLE 34 STATIC FREQUENCY CONVERTER: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 STATIC FREQUENCY CONVERTER: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

- 8.3 PONY MOTOR

- 8.3.1 LOW COST AND ABILITY TO START LOW-CAPACITY SYNCHRONOUS CONDENSERS (BELOW 50 MVAR) TO FUEL DEMAND FOR PONY MOTORS

- TABLE 36 PONY MOTOR: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 37 PONY MOTOR: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

- 8.4 OTHERS

- TABLE 38 OTHERS: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 OTHERS: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

9 SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING

- 9.1 INTRODUCTION

- FIGURE 33 ABOVE 200 MVAR SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- TABLE 40 SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2018-2021 (USD MILLION)

- TABLE 41 SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2022-2030 (USD MILLION)

- 9.2 UP TO 100 MVAR

- 9.2.1 RISING USE OF AIR- AND WATER-COOLED SYNCHRONOUS CONDENSERS TO FUEL MARKET GROWTH

- TABLE 42 UP TO 100 MVAR: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 UP TO 100 MVAR: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

- 9.3 101-200 MVAR

- 9.3.1 GROWING NEED TO ENSURE STABILITY OF TRANSMISSION GRIDS TO FUEL DEMAND FOR 101-200 MVAR SYNCHRONOUS CONDENSERS

- TABLE 44 101-200 MVAR: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 45 101-200 MVAR: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

- 9.4 ABOVE 200 MVAR

- 9.4.1 RISING ADOPTION OF LARGE-SIZED HYDROGEN-COOLED SYNCHRONOUS CONDENSERS TO DRIVE MARKET GROWTH

- TABLE 46 ABOVE 200 MVAR: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 ABOVE 200 MVAR: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

10 SYNCHRONOUS CONDENSER MARKET, BY END USER

- 10.1 INTRODUCTION

- FIGURE 34 ELECTRICAL UTILITIES SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2021

- TABLE 48 SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 49 SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 10.2 ELECTRICAL UTILITIES

- 10.2.1 RISING NEED TO IMPROVE GRID STABILITY TO BOOST MARKET GROWTH

- TABLE 50 ELECTRICAL UTILITIES: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 ELECTRICAL UTILITIES: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

- 10.3 INDUSTRIAL SECTOR

- 10.3.1 INCREASING NEED TO PERFORM POWER FACTOR CORRECTION OF INDUSTRIAL LOADS TO FUEL DEMAND FOR SYNCHRONOUS CONDENSERS

- TABLE 52 INDUSTRIAL SECTOR: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 53 INDUSTRIAL SECTOR: SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

11 SYNCHRONOUS CONDENSER MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 35 SYNCHRONOUS CONDENSER MARKET: REGIONAL SNAPSHOT

- FIGURE 36 REGIONAL ANALYSIS OF SYNCHRONOUS CONDENSER MARKET, 2021

- TABLE 54 SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 55 SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 56 SYNCHRONOUS CONDENSER MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 57 SYNCHRONOUS CONDENSER MARKET, BY REGION, 2022-2030 (UNITS)

- 11.2 NORTH AMERICA

- FIGURE 37 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET SNAPSHOT

- 11.2.1 BY TYPE

- TABLE 58 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 59 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2022-2030 (USD MILLION)

- 11.2.2 BY COOLING TECHNOLOGY

- TABLE 60 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 61 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2022-2030 (USD MILLION)

- 11.2.3 BY STARTING METHOD

- TABLE 62 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2018-2021 (USD MILLION)

- TABLE 63 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2022-2030 (USD MILLION)

- 11.2.4 BY REACTIVE POWER RATING

- TABLE 64 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2018-2021 (USD MILLION)

- TABLE 65 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2022-2030 (USD MILLION)

- 11.2.5 BY END USER

- TABLE 66 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 67 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.2.6 BY COUNTRY

- TABLE 68 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 69 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 11.2.6.1 US

- 11.2.6.1.1 Government-led initiatives to upgrade legacy power infrastructures and phase out coal-based power plants to fuel demand for synchronous condensers

- 11.2.6.1 US

- FIGURE 38 PLANNED RETIREMENTS OF UTILITY-SCALE ELECTRICITY-GENERATING CAPACITIES IN US, 2022-2030

- TABLE 70 US: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 71 US: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.2.6.2 Canada

- 11.2.6.2.1 Rising investments in renewable energy generation to propel market growth

- 11.2.6.2 Canada

- TABLE 72 CANADA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 73 CANADA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.3 EUROPE

- FIGURE 39 EUROPE: SYNCHRONOUS CONDENSER MARKET SNAPSHOT

- 11.3.1 BY TYPE

- TABLE 74 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 75 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2022-2030 (USD MILLION)

- 11.3.2 BY COOLING TECHNOLOGY

- TABLE 76 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 77 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2022-2030 (USD MILLION)

- 11.3.3 BY STARTING METHOD

- TABLE 78 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2018-2021 (USD MILLION)

- TABLE 79 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2022-2030 (USD MILLION)

- 11.3.4 BY REACTIVE POWER RATING

- TABLE 80 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2018-2021 (USD MILLION)

- TABLE 81 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2022-2030 (USD MILLION)

- 11.3.5 BY END USER

- TABLE 82 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 83 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.3.6 BY COUNTRY

- TABLE 84 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 85 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 11.3.6.1 Denmark

- 11.3.6.1.1 Growing need to stabilize gird transmission to fuel demand for synchronous condensers

- 11.3.6.1 Denmark

- TABLE 86 DENMARK: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 87 DENMARK: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.3.6.2 Italy

- 11.3.6.2.1 Rising integration of renewable sources into grids to propel demand for synchronous condensers

- 11.3.6.2 Italy

- TABLE 88 ITALY: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 89 ITALY: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.3.6.3 Germany

- 11.3.6.3.1 Government-led initiatives to replace fossil fuels with renewable sources in power generation mix to drive market growth

- 11.3.6.3 Germany

- TABLE 90 GERMANY: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 91 GERMANY: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.3.6.4 Norway

- 11.3.6.4.1 Rising investments in expansion of HVDC networks to fuel demand for synchronous condensers

- 11.3.6.4 Norway

- TABLE 92 NORWAY: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 93 NORWAY: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.3.6.5 Rest of Europe

- TABLE 94 REST OF EUROPE: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 95 REST OF EUROPE: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.4 SOUTH AMERICA

- 11.4.1 BY TYPE

- TABLE 96 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 97 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2022-2030 (USD MILLION)

- 11.4.2 BY COOLING TECHNOLOGY

- TABLE 98 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 99 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2022-2030 (USD MILLION)

- 11.4.3 BY STARTING METHOD

- TABLE 100 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 101 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2022-2030 (USD MILLION)

- 11.4.4 BY REACTIVE POWER RATING

- TABLE 102 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2018-2021 (USD MILLION)

- TABLE 103 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2022-2030 (USD MILLION)

- 11.4.5 BY END USER

- TABLE 104 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 105 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.4.6 BY COUNTRY

- TABLE 106 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 107 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 11.4.6.1 Brazil

- 11.4.6.1.1 Government-led initiatives to develop power infrastructures to fuel demand for synchronous condensers

- 11.4.6.1 Brazil

- TABLE 108 BRAZIL: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 109 BRAZIL: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.4.6.2 Rest of South America

- TABLE 110 REST OF SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 111 REST OF SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.5 ASIA PACIFIC

- FIGURE 40 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET SNAPSHOT

- 11.5.1 BY TYPE

- TABLE 112 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 113 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2022-2030 (USD MILLION)

- 11.5.2 BY COOLING TECHNOLOGY

- TABLE 114 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 115 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2022-2030 (USD MILLION)

- 11.5.3 BY STARTING METHOD

- TABLE 116 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2018-2021 (USD MILLION)

- TABLE 117 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2022-2030 (USD MILLION)

- 11.5.4 BY REACTIVE POWER RATING

- TABLE 118 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2018-2021 (USD MILLION)

- TABLE 119 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2022-2030 (USD MILLION)

- 11.5.5 BY END USER

- TABLE 120 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 121 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.5.6 BY COUNTRY

- TABLE 122 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 123 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 11.5.6.1 China

- 11.5.6.1.1 Growing need to improve power reliability to fuel demand for synchronous condensers

- 11.5.6.1 China

- TABLE 124 CHINA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 125 CHINA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.5.6.2 Australia

- 11.5.6.2.1 Rising deployment of synchronous condensers in power infrastructures to drive market growth

- 11.5.6.2 Australia

- TABLE 126 AUSTRALIA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 127 AUSTRALIA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.5.6.3 Rest of Asia Pacific

- TABLE 128 REST OF ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 BY TYPE

- TABLE 130 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2022-2030 (USD MILLION)

- 11.6.2 BY COOLING TECHNOLOGY

- TABLE 132 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2022-2030 (USD MILLION)

- 11.6.3 BY STARTING METHOD

- TABLE 134 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2018-2021 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2022-2030 (USD MILLION)

- 11.6.4 BY REACTIVE POWER RATING

- TABLE 136 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2018-2021 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2022-2030 (USD MILLION)

- 11.6.5 BY END USER

- TABLE 138 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.6.6 BY COUNTRY

- TABLE 140 REST OF THE MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 141 REST OF THE MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 11.6.6.1 Kenya

- 11.6.6.1.1 Increasing number of power generation projects to drive market growth

- 11.6.6.1 Kenya

- TABLE 142 KENYA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 143 KENYA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

- 11.6.6.2 Rest of Middle East & Africa

- TABLE 144 REST OF MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 145 REST OF MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2022-2030 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 KEY PLAYER STRATEGIES

- TABLE 146 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP MARKET PLAYERS, JANUARY 2017-JUNE 2022

- 12.2 MARKET SHARE ANALYSIS

- TABLE 147 SYNCHRONOUS CONDENSER MARKET: DEGREE OF COMPETITION

- FIGURE 41 SYNCHRONOUS CONDENSER MARKET SHARE ANALYSIS, 2021

- 12.3 REVENUE SHARE ANALYSIS OF TOP 5 MARKET PLAYERS

- FIGURE 42 TOP 5 PLAYERS DOMINATED SYNCHRONOUS CONDENSER MARKET FROM 2017 TO 2021

- 12.4 COMPANY EVALUATION QUADRANT

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- FIGURE 43 COMPETITIVE LEADERSHIP MAPPING: SYNCHRONOUS CONDENSER MARKET, 2021

- 12.5 SYNCHRONOUS CONDENSER MARKET: COMPANY FOOTPRINT

- TABLE 148 TYPE: COMPANY FOOTPRINT

- TABLE 149 REACTIVE POWER RATING: COMPANY FOOTPRINT

- TABLE 150 REGION: COMPANY FOOTPRINT

- TABLE 151 OVERALL COMPANY FOOTPRINT

- 12.6 COMPETITIVE SCENARIO

- TABLE 152 SYNCHRONOUS CONDENSER MARKET: PRODUCT LAUNCHES, JANUARY 2017-SEPTEMBER 2021

- TABLE 153 SYNCHRONOUS CONDENSER MARKET: DEALS, JANUARY 2017- SEPTEMBER 2021

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 13.1.1 ABB

- TABLE 154 ABB: BUSINESS OVERVIEW

- FIGURE 44 ABB: COMPANY SNAPSHOT, 2021

- TABLE 155 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 ABB: PRODUCT LAUNCHES

- TABLE 157 ABB: DEALS

- TABLE 158 ABB: OTHERS

- 13.1.2 SIEMENS ENERGY

- TABLE 159 SIEMENS ENERGY: BUSINESS OVERVIEW

- FIGURE 45 SIEMENS ENERGY: COMPANY SNAPSHOT, 2021

- TABLE 160 SIEMENS ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 SIEMENS ENERGY: OTHERS

- 13.1.3 GE

- TABLE 162 GE: BUSINESS OVERVIEW

- FIGURE 46 GE: COMPANY SNAPSHOT, 2021

- TABLE 163 GE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 GE: OTHERS

- 13.1.4 WEG

- TABLE 165 WEG: BUSINESS OVERVIEW

- FIGURE 47 WEG: COMPANY SNAPSHOT, 2021

- TABLE 166 WEG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 WEG: DEALS

- TABLE 168 WEG: OTHERS

- 13.1.5 EATON

- TABLE 169 EATON: BUSINESS OVERVIEW

- FIGURE 48 EATON: COMPANY SNAPSHOT, 2021

- TABLE 170 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.6 ANDRITZ GROUP

- TABLE 171 ANDRITZ GROUP: BUSINESS OVERVIEW

- FIGURE 49 ANDRITZ GROUP: COMPANY SNAPSHOT, 2021

- TABLE 172 ANDRITZ GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 ANDRITZ GROUP: OTHERS

- 13.1.7 ANSALDO ENERGIA

- TABLE 174 ANSALDO ENERGIA: BUSINESS OVERVIEW

- FIGURE 50 ANSALDO ENERGIA: COMPANY SNAPSHOT, 2021

- TABLE 175 ANSALDO ENERGIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 ANSALDO ENERGIA: OTHERS

- 13.1.8 MITSUBISHI HEAVY INDUSTRIES

- TABLE 177 MITSUBISHI HEAVY INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 51 MITSUBISHI HEAVY INDUSTRIES: COMPANY SNAPSHOT, 2020

- TABLE 178 MITSUBISHI HEAVY INDUSTRIES: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 179 MITSUBISHI HEAVY INDUSTRIES: OTHERS

- 13.1.9 VOITH GROUP

- TABLE 180 VOITH GROUP: BUSINESS OVERVIEW

- FIGURE 52 VOITH GROUP: COMPANY SNAPSHOT, 2021

- TABLE 181 VOITH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 VOITH GROUP: OTHERS

- 13.1.10 FUJI ELECTRIC

- TABLE 183 FUJI ELECTRIC: BUSINESS OVERVIEW

- FIGURE 53 FUJI ELECTRIC: COMPANY SNAPSHOT, 2020

- TABLE 184 FUJI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.11 BHARAT HEAVY ELECTRICALS LIMITED (BHEL)

- TABLE 185 BHARAT HEAVY ELECTRICALS LIMITED (BHEL): BUSINESS OVERVIEW

- FIGURE 54 BHARAT HEAVY ELECTRICALS LIMITED (BHEL): COMPANY SNAPSHOT, 2021

- TABLE 186 BHARAT HEAVY ELECTRICALS LIMITED (BHEL): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- 13.1.12 IDEAL ELECTRIC POWER (HYUNDAI IDEAL ELECTRIC CO.)

- TABLE 187 IDEAL ELECTRIC POWER: BUSINESS OVERVIEW

- TABLE 188 IDEAL ELECTRIC POWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.13 POWER SYSTEMS & CONTROLS

- TABLE 189 POWER SYSTEMS & CONTROLS (PS&C): BUSINESS OVERVIEW

- TABLE 190 POWER SYSTEMS & CONTROLS (PS&C): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- 13.1.14 BRUSH GROUP

- TABLE 191 BRUSH GROUP: BUSINESS OVERVIEW

- TABLE 192 BRUSH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.15 ELECTROMECHANICAL ENGINEERING ASSOCIATES

- TABLE 193 ELECTROMECHANICAL ENGINEERING ASSOCIATES (EME): BUSINESS OVERVIEW

- TABLE 194 ELECTROMECHANICAL ENGINEERING ASSOCIATES (EME): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ELECTROMECHANICAL ENGINEERING ASSOCIATES (EME): OTHERS

- 13.1.16 ANHUI ZHONGDIAN (ZDDQ) ELECTRIC CO., LTD.

- TABLE 196 ANHUI ZHONGDIAN ELECTRIC CO., LTD.: BUSINESS OVERVIEW

- TABLE 197 ANHUI ZHONGDIAN ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- 13.1.17 SHANGHAI ELECTRIC

- TABLE 198 SHANGHAI ELECTRIC: BUSINESS OVERVIEW

- TABLE 199 SHANGHAI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.18 INGETEAM

- TABLE 200 INGETEAM: BUSINESS OVERVIEW

- TABLE 201 INGETEAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.19 DOOSAN SKODA POWER

- TABLE 202 DOOSAN SKODA POWER: BUSINESS OVERVIEW

- TABLE 203 DOOSAN SKODA POWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.20 HANGZHOU JINGCHENG ELECTRICAL EQUIPMENT CO., LTD.

- TABLE 204 HANGZHOU JINGCHENG ELECTRICAL EQUIPMENT CO., LTD.: BUSINESS OVERVIEW

- TABLE 205 HANGZHOU JINGCHENG ELECTRICAL EQUIPMENT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS