|

|

市場調査レポート

商品コード

1069888

ANPRシステムの世界市場:種類別 (固定型、移動型、ポータブル)・コンポーネント別 (ANPRカメラ、AMPRソフトウェア、フレームグラバー、トリガー)・用途別・エンドユーザー別 (政府、商業施設、公共施設)・地域別 (北米、アジア太平洋、欧州など) の将来予測 (2027年まで)ANPR System Market by Type (Fixed, Mobile, Portable), Component (ANPR Cameras, ANPR Software, Frame Grabbers, Triggers), Application, End-User (Government, Commercial, Institutions) & Region (North America, APAC, Europe, RoW) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ANPRシステムの世界市場:種類別 (固定型、移動型、ポータブル)・コンポーネント別 (ANPRカメラ、AMPRソフトウェア、フレームグラバー、トリガー)・用途別・エンドユーザー別 (政府、商業施設、公共施設)・地域別 (北米、アジア太平洋、欧州など) の将来予測 (2027年まで) |

|

出版日: 2022年04月11日

発行: MarketsandMarkets

ページ情報: 英文 248 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のANPR (ナンバープレート自動認識) システムの世界市場は、2022年の31億米ドルから、2027年までに48億米ドルに達する見通しです。

また、2022年から2027年までのCAGRは9.2%と予想されています。

市場の主な促進要因として、セキュリティ・監視や交通管理目的でのANPRシステムの導入拡大や、新興国でのインフラ整備、車両のインテリジェント監視向けの動画解析技術の利用増加、スマート駐車場ソリューションの需要急増などが挙げられます。また、IoT・深層学習・AIなどの先進技術をAMPRシステムに統合することで、アクセス制御や料金徴収などの用途での利用も拡大しています。

当レポートでは、世界のANPRシステムの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、市場動向の見通し、エンジン別・コンポーネント別・車両タイプ別・サポート技術別・地域別の詳細動向、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 分析方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- 課題

- バリューチェーン分析

- 原材料のサプライヤー

- メーカー

- 流通業者

- エンドユーザー

- アフターサービスのプロバイダー

- エコシステム

- 顧客に影響を与える傾向/ディスラプション

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ

- 技術動向

- 画像処理ソリューションの成長

- ANPRシステムにおける深層学習・人工知能 (AI) 技術の実装

- ビデオベースの料金徴収を容易にするためのスマートフォンの使用

- 駐車場管理におけるタッチやキューの実装

- 価格分析

- 特許分析

- 貿易分析

- 規格

- 主要な会議とイベント (2022年~2023年)

- 関税・規制状況

第6章 ANPRシステム市場:種類別

- イントロダクション

- 固定型ANPRシステム

- 移動型ANPRシステム

- ポータブルANPRシステム

第7章 ANPRシステム市場:コンポーネント別

- イントロダクション

- ANPRカメラ

- ANPRソフトウェア

- フレームグラバー

- トリガー

- その他

第8章 ANPRシステム市場:用途別

- イントロダクション

- 交通管理

- 法執行機関

- 電子料金徴収 (ETC)

- 駐車場管理

- アクセス制御

第9章 ANPRシステム市場:エンドユーザー別

- イントロダクション

- 政府

- 商業施設

- 公共施設

第10章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 他のアジア太平洋諸国

- その他の地域

- 南米

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 上位企業の収益分析

- 市場シェア分析

- 企業評価クアドラント (2021年)

- 中小企業の評価クアドラント (2021年)

- 競合状況・動向

- 製品の発売

- 資本取引

第12章 企業プロファイル

- イントロダクション

- 主要企業

- KAPSCH TRAFFICCOM

- SIEMENS

- CONDUENT, INC.

- GENETEC, INC.

- Q-FREE ASA

- ADAPTIVE RECOGNITION

- VIGILANT SOLUTIONS

- NEOLOGY

- TAGMASTER

- BOSCH SECURITY SYSTEMS

- JENOPTIK GROUP

- HIKVISION

- VIVOTEK, INC.

- AXIS COMMUNICATIONS

- NEDAP

- その他の企業

- TATTILE

- EFKON GMBH

- DIGITAL RECOGNITION SYSTEMS

- NDI RECOGNITION SYSTEM

- ALERTSYSTEMS

- QRO SOLUTIONS

- FF GROUP

- SENSYS GATSO GROUP

- CLEARVIEW COMMUNICATIONS

- BELTECH

第13章 隣接・関連市場

- イントロダクション

- 制限

- 道路向けITS (高度道路交通システム) 市場:システム別

- イントロダクション

- 高度交通管理システム (ATMS)

- 高度旅行者情報システム (ATIS)

- ITS対応の交通料金システム (ITPS)

- 高度公共交通システム (APTS)

- 商用車操作 (CVO) システム

第14章 付録

The global ANPR system market is projected to reach USD 4.8 billion by 2027 from USD 3.1 billion in 2022; it is expected to register a CAGR of 9.2% from 2022 to 2027. The major factors driving the growth of the ANPR system market include the increasing deployment of ANPR systems in security and surveillance and traffic management applications, infrastructure growth in emerging economies, increasing allocation of funds by various governments on ITS, and the growing use of video analytics technology for intelligent monitoring of vehicles. Additionally, the rapid surge in demand for smart parking solutions is a major driver for the growth of the ANPR system market. The integration of advanced technologies such as IoT, Deep Learning, and AI with the ANPR system is promoting the growth of ANPR systems across applications such as access control and road usage charging. Growing number of infrastructure development projects across the world such as the Smart Cities mission and roadways modernization projects are promoting the growth of the ANPR system market. Moreover, surging use of video analytics technology for intelligent monitoring of vehicles is enhancing the growth of the ANPR system market.

"FIXED ANPR SYSTEMS TO ACCOUNT FOR THE LARGEST SHARE OF THE ANPR SYSTEM MARKET DURING FORECAST PERIOD"

Fixed ANPR systems held the largest share of the ANPR system market in 2021. The increasing usage of fixed ANPR systems for traffic management solutions is a major driver for the sub-segment. With the increasing number of government initiatives across the world to modernize roadways infrastructure, there is a rising demand for improving the monitoring of vehicles and for automated solutions for tolling, which are promoting the growth of the fixed ANPR system market. Fixed ANPR systems are effectively deployed in areas where heavy congestion and traffic are owing to their capability of capturing images in high-speed and high-density traffic environments. Increasing demand for automated parking management solutions is also driving the demand for fixed ANPR systems in airports, car parks, shopping centers, etc. The use of fixed ANPR systems helps reduce the wastage of fuel and time and enhances productivity by reducing excess manpower at toll booths and parking facilities.

"ANPR SOFTWARE TO REGISTER HIGHEST CAGR IN THE ANPR SYSTEM MARKET DURING FORECAST PERIOD"

ANPR software is an integral part of the system. The integrated image processing software automatically scans the stream of incoming images for any vehicle and its number plate. ANPR software enables the conversion of captured images into a digital format for electronic storage and future reference. Technological advancements have enabled increased rates of detection and have enhanced accuracy by many folds. Increasing demand for automated solutions such as red-light enforcement, speed detection & enforcement, barrier control, vehicle color, model & build recognition, and several such solutions are promoting the growth of advanced ANPR software.

"ELECTRONIC TOLL COLLECTION APPLICATION TO REGISTER HIGHEST CAGR IN ANPR SYSTEM MARKET DURING FORECAST PERIOD"

The market for the electronic toll collection application is expected to register the highest growth during the forecast period. With an increase in road connectivity, there is an increase in the number of toll booths across the world. To avoid overcrowding and to improve monitoring & detection of vehicles at toll booths, there is an increasing demand for automated solutions, which, in turn, is promoting the usage of ANPR systems for tolling. ANPR systems enable the prevention of scams & frauds and improve the accuracy of road charging systems. Also, the use of ANPR systems helps in reducing the wastage of fuel and the time and excess manpower involved in road charging activities.

"ANPR SYSTEM MARKET IN APAC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD"

The market in APAC is expected to register the highest growth during the forecast period. The growing population and urbanization in the region have resulted in an increasing number of vehicles. The governments in the region are actively adopting and implementing infrastructure development projects, several of which are aimed at roadways modernization. In addition, there is a rapid growth in the number of shopping centers, recreational & sports facilities, malls & multiplexes, and car parks, etc. in the region. Furthermore, there is an increasing demand for solutions for effective border control and vehicle theft prevention. Owing to these factors, APAC has become one of the fastest-growing markets for ANPR systems.

Breakdown of the profiles of primary participants:

- By Company Type: Tier 1 - 25%, Tier 2 - 35%, and Tier 3 - 40%

- By Designation: C-level Executives - 35%, Directors - 25%, and others - 40%

- By Region: North America - 14%, Europe - 43%, APAC - 29%, and RoW - 14%

Major players profiled in this report are as follows: Kapsch TrafficCom (Austria), Siemens (Germany), Conduent, Inc. (US), HikVision (China), Q-Free ASA (Norway), Genetec, Inc. (Canada), Adaptive Recognition (Hungary), Jenoptik Group (Germany), Axis Communications (Sweden), and Nedap (Netherlands) are a few major players in global ANPR System Market.

Research Coverage

This report analyzes the global ANPR System Market with COVID-19 Impact, By Type, Component, Application, End User, and Region. A detailed analysis of the regional markets has been undertaken to provide insights into potential business opportunities in different regions. In addition, the value chain analysis and market dynamics have been provided in the report. The study forecasts the size of the market in four main regions-North America, Europe, APAC, & RoW.

Key Benefits of Buying the Report:

The report would help market leaders/new entrants in this market in the following ways:

This report segments of the global ANPR System Market comprehensively and provides the closest approximation of the overall market size and subsegments that include Type, Component, Application, End User, and Region.

The report would help stakeholders understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities pertaining to the market.

This report would help stakeholders understand their competitors better and gain more insights to enhance their position in the business.

The competitive landscape section includes the competitor ecosystem, as well as growth strategies such as product launches, acquisitions, and expansions carried out by major market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 DEFINITION & SCOPE

- 1.3 INCLUSIONS & EXCLUSIONS

- TABLE 1 ANPR SYSTEM MARKET: INCLUSIONS & EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 ANPR SYSTEM MARKET SEGMENTATION

- FIGURE 2 ANPR SYSTEM MARKET, BY REGION

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 ANPR SYSTEM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF COMPANIES FROM ANPR SYSTEMS

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Arriving at market size by bottom-up approach (demand side)

- FIGURE 5 BOTTOM-UP APPROACH TO ARRIVE AT MARKET SIZE

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Arriving at market size by top-down approach (supply side)

- FIGURE 6 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5 RISK ASSESSMENT

- TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- FIGURE 9 ANALYSIS OF IMPACT OF COVID-19 ON ANPR SYSTEM MARKET

- 3.1 REALISTIC SCENARIO

- 3.2 PESSIMISTIC SCENARIO

- 3.3 OPTIMISTIC SCENARIO

- FIGURE 10 MOBILE ANPR SYSTEMS TO REGISTER HIGHEST CAGR IN ANPR SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 11 ANPR CAMERAS TO HOLD LARGEST SHARE OF ANPR SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 12 ELECTRONIC TOLL COLLECTION APPLICATION TO REGISTER HIGHEST CAGR IN ANPR SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 13 ANPR SYSTEM MARKET IN APAC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ANPR SYSTEM MARKET, 2022-2027 (USD MILLION)

- FIGURE 14 INCREASING NECESSITY FOR TRAFFIC MANAGEMENT AND ROAD SAFETY MANAGEMENT SOLUTIONS TO BOOST ANPR SYSTEM MARKET

- 4.2 ANPR SYSTEM MARKET, BY TYPE

- FIGURE 15 MOBILE ANPR SYSTEMS TO REGISTER HIGHEST CAGR IN ANPR SYSTEM MARKET DURING FORECAST PERIOD

- 4.3 ANPR SYSTEM MARKET, BY COMPONENT

- FIGURE 16 ANPR CAMERAS TO ACCOUNT FOR LARGEST SIZE OF ANPR SYSTEM MARKET DURING FORECAST PERIOD

- 4.4 ANPR SYSTEM MARKET, BY APPLICATION

- FIGURE 17 TRAFFIC MANAGEMENT APPLICATION TO ACCOUNT FOR LARGEST SIZE OF ANPR SYSTEM MARKET DURING FORECAST PERIOD

- 4.5 ANPR SYSTEM MARKET, BY GEOGRAPHY

- FIGURE 18 US TO ACCOUNT FOR LARGEST SHARE OF ANPR SYSTEM MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 ANPR SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- 5.2.1.1 Rising deployment of ANPR systems in security and surveillance, and traffic enforcement applications

- 5.2.1.2 Growing number of infrastructures in emerging economies

- 5.2.1.3 Increasing allocation of funds by various governments on ITS

- 5.2.1.4 Surging use of video analytics technology for intelligent monitoring of vehicles

- 5.2.1.5 Worldwide development of smart cities

- TABLE 3 GLOBAL INNOVATIVE SMART CITY PROJECTS

- 5.2.2 RESTRAINTS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- 5.2.2.1 Inconsistency in number plate designs

- 5.2.2.2 Incorrect cameras, lenses, or positioning of cameras

- 5.2.3 OPPORTUNITIES

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- 5.2.3.1 Integration of smart parking technology and tolling application

- 5.2.3.2 Increase in use of cloud-based storage services

- TABLE 4 TOP 10 CLOUD STORAGE SERVICES

- 5.2.3.3 Integration of new technologies such as AI and IoT with ANPR systems

- 5.2.4 CHALLENGES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- 5.2.4.1 Misinterpretation of ambiguous characters on number plates

- 5.2.4.2 Privacy concerns regarding stored images and records

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING MANUFACTURING STAGE

- 5.3.1 RAW MATERIAL SUPPLIERS

- 5.3.2 MANUFACTURERS

- 5.3.3 DISTRIBUTORS

- 5.3.4 END USERS

- 5.3.5 AFTER-SALES SERVICE PROVIDERS

- 5.4 ECOSYSTEM

- FIGURE 25 GLOBAL ANPR SYSTEM MARKET: ECOSYSTEM

- TABLE 5 ANPR SYSTEM MARKET: ECOSYSTEM

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

- 5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ANPR SYSTEM MANUFACTURERS

- FIGURE 26 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ANPR SYSTEM MARKET

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 IMPACT OF EACH FORCE ON ANPR SYSTEM MARKET

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 DEGREE OF COMPETITION

- 5.7 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

- TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS (%)

- 5.7.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 END USERS

- 5.8 CASE STUDIES

- 5.8.1 DISTRICT DEPARTMENT OF TRANSPORTATION (DDOT) OF WASHINGTON D.C. PARTNERED WITH CONDUENT, INC. TO OBTAIN BETTER PARKING MANAGEMENT THROUGH IMPLEMENTATION OF ANPR

- 5.8.2 BURJ KHALIFA ADOPTED ANPR SOLUTION BY ADAPTIVE RECOGNITION TO ENSURE BETTER SAFETY AND SECURITY

- 5.9 TECHNOLOGY TRENDS

- 5.9.1 GROWTH OF IMAGE PROCESSING SOLUTIONS

- 5.9.2 IMPLEMENTATION OF DEEP LEARNING AND ARTIFICIAL INTELLIGENCE (AI) TECHNIQUES IN ANPR SYSTEMS

- 5.9.3 USE OF SMARTPHONES TO FACILITATE VIDEO-BASED TOLL COLLECTION

- 5.9.4 IMPLEMENTATION OF NO TOUCH AND NO QUEUE IN PARKING MANAGEMENT

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICES OF PRODUCTS OFFERED BY KEY MARKET PLAYERS, BY COMPONENT

- FIGURE 29 AVERAGE SELLING PRICES OF PRODUCTS OFFERED BY KEY PLAYERS, BY COMPONENT

- TABLE 9 AVERAGE SELLING PRICES OF PRODUCTS OFFERED BY KEY PLAYERS, BY COMPONENT (USD)

- 5.11 PATENTS ANALYSIS

- FIGURE 30 ANALYSIS OF PATENTS GRANTED FOR ANPR SYSTEM MARKET

- 5.11.1 A FEW PATENTS PERTAINING TO ANPR SYSTEMS IN 2021

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORTS SCENARIO OF ANPR SYSTEMS

- FIGURE 31 ANPR SYSTEM EXPORTS, BY KEY COUNTRY, 2016-2020 (USD MILLION)

- 5.12.2 IMPORTS SCENARIO OF ANPR SYSTEMS

- FIGURE 32 ANPR SYSTEM IMPORTS, BY KEY COUNTRY, 2016-2020 (USD MILLION)

- 5.13 STANDARDS

- 5.13.1 EUROPEAN COMMITTEE FOR STANDARDISATION (CEN)

- 5.13.2 AMERICAN NATIONAL STANDARDS INSTITUTE (ANSI)

- 5.13.3 AMERICAN ASSOCIATION OF MOTOR VEHICLE ADMINISTRATORS (AAMVA)

- 5.13.4 INTERNATIONAL ORGANIZATION OF STANDARDIZATION (ISO)

- 5.13.5 STANDARDS AUSTRALIA

- 5.14 KEY CONFERENCES & EVENTS TO BE HELD DURING 2022-2023

- TABLE 10 ANPR SYSTEM MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

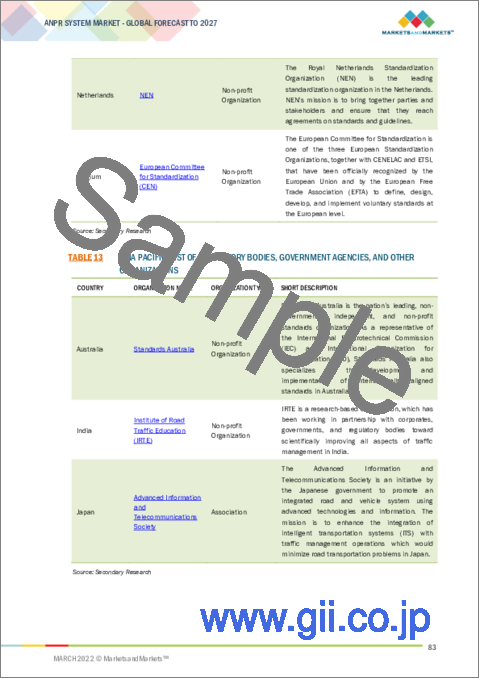

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 ANPR SYSTEM MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 33 ANPR SYSTEM MARKET, BY TYPE

- FIGURE 34 FIXED ANPR SYSTEMS TO HOLD LARGEST SHARE OF ANPR SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 15 ANPR SYSTEM MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 16 ANPR SYSTEM MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 17 ANPR SYSTEM MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 18 ANPR SYSTEM MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- 6.2 FIXED ANPR SYSTEMS

- 6.2.1 INCREASING DEMAND FOR FIXED ANPR SYSTEMS FOR TRAFFIC MANAGEMENT AND ELECTRONIC TOLL COLLECTION APPLICATIONS DRIVING GROWTH OF ANPR SYSTEM MARKET

- TABLE 19 ANPR SYSTEM MARKET FOR FIXED TYPE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 20 ANPR SYSTEM MARKET FOR FIXED TYPE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 21 ANPR SYSTEM MARKET FOR FIXED TYPE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 22 ANPR SYSTEM MARKET FOR FIXED TYPE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 23 FIXED ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 24 FIXED ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 25 FIXED ANPR SYSTEM MARKET FOR LAW ENFORCEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 26 FIXED ANPR SYSTEM MARKET FOR LAW ENFORCEMENT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 27 FIXED ANPR SYSTEM MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 28 FIXED ANPR SYSTEM MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2022-2027 (USD MILLION)

- TABLE 29 FIXED ANPR SYSTEM MARKET FOR PARKING MANAGEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 FIXED ANPR SYSTEM MARKET FOR PARKING MANAGEMENT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 31 FIXED ANPR SYSTEM MARKET FOR ACCESS CONTROL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 32 FIXED ANPR SYSTEM MARKET FOR ACCESS CONTROL, BY REGION, 2022-2027 (USD MILLION)

- 6.3 MOBILE ANPR SYSTEMS

- 6.3.1 MOBILE ANPR SYSTEMS EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 33 ANPR SYSTEM MARKET FOR MOBILE TYPE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 34 ANPR SYSTEM MARKET FOR MOBILE TYPE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 35 ANPR SYSTEM MARKET FOR MOBILE TYPE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 ANPR SYSTEM MARKET FOR MOBILE TYPE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 37 MOBILE ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 MOBILE ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 39 MOBILE ANPR SYSTEM MARKET FOR LAW ENFORCEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 40 MOBILE ANPR SYSTEM MARKET FOR LAW ENFORCEMENT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 41 MOBILE ANPR SYSTEM MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 MOBILE ANPR SYSTEM MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2022-2027 (USD MILLION)

- TABLE 43 MOBILE ANPR SYSTEM MARKET FOR PARKING MANAGEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 MOBILE ANPR SYSTEM MARKET FOR PARKING MANAGEMENT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 45 MOBILE ANPR SYSTEM MARKET FOR ACCESS CONTROL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 46 MOBILE ANPR SYSTEM MARKET FOR ACCESS CONTROL, BY REGION, 2022-2027 (USD MILLION)

- 6.4 PORTABLE ANPR SYSTEMS

- 6.4.1 EFFORTLESS DEPLOYMENT AT VEHICLE CHECKPOINTS DUE TO FLEXIBLE HARDWARE IS DRIVING DEMAND FOR PORTABLE ANPR SYSTEMS

- TABLE 47 ANPR SYSTEM MARKET FOR PORTABLE TYPE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 48 ANPR SYSTEM MARKET FOR PORTABLE TYPE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 49 ANPR SYSTEM MARKET FOR PORTABLE TYPE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 50 ANPR SYSTEM MARKET FOR PORTABLE TYPE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 51 PORTABLE ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 52 PORTABLE ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 53 PORTABLE ANPR SYSTEM MARKET FOR LAW ENFORCEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 54 PORTABLE ANPR SYSTEM MARKET FOR LAW ENFORCEMENT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 55 PORTABLE ANPR SYSTEM MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 56 PORTABLE ANPR SYSTEM MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2022-2027 (USD MILLION)

- TABLE 57 PORTABLE ANPR SYSTEM MARKET FOR PARKING MANAGEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 58 PORTABLE ANPR SYSTEM MARKET FOR PARKING MANAGEMENT, BY REGION, 2022-2027 (USD MILLION)

7 ANPR SYSTEM MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 35 ANPR SYSTEM MARKET, BY COMPONENT

- FIGURE 36 ANPR CAMERAS TO HOLD LARGEST SHARE OF ANPR SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 59 ANPR SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 60 ANPR SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 7.2 ANPR CAMERAS

- 7.2.1 RAPID SURGE IN DEMAND FOR DEPLOYMENT OF ANPR SYSTEMS FOR TRAFFIC MONITORING AND TOLL COLLECTION APPLICATIONS DRIVING DEMAND FOR ANPR CAMERAS

- 7.3 ANPR SOFTWARE

- 7.3.1 ANPR SOFTWARE IS EXPECTED TO REGISTER HIGHEST CAGR IN ANPR SYSTEM MARKET DURING FORECAST PERIOD

- 7.4 FRAME GRABBERS

- 7.4.1 INCREASING DEMAND FOR COMPUTER VISION SYSTEMS TO HANDLE VIDEO PROCESSING AND STORING ENABLING GROWTH OF FRAME GRABBER MARKET

- 7.5 TRIGGERS

- 7.5.1 INCREASING NECESSITY OF AUTOMATIC SYSTEM TRIGGERING IN CASE OF EMERGENCY IS PROMOTING USE OF TRIGGERS

- 7.6 OTHERS

8 ANPR SYSTEM MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 37 ANPR SYSTEM MARKET, BY APPLICATION

- FIGURE 38 TRAFFIC MANAGEMENT APPLICATION TO HOLD LARGEST SHARE OF OVERALL ANPR SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 61 ANPR SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 62 ANPR SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.2 TRAFFIC MANAGEMENT

- 8.2.1 INCREASING NECESSITY FOR INTELLIGENT TRANSPORTATION SYSTEMS TO MANAGE TRAFFIC CONGESTION DRIVING DEMAND FOR ANPR SYSTEMS

- TABLE 63 ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 64 ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 65 ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 66 ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2022-2027 (USD MILLION)

- 8.3 LAW ENFORCEMENT

- 8.3.1 GROWING NECESSITY FOR CAPTURING AND PROCESSING EVIDENCE ON REAL-TIME BASIS DRIVING DEMAND FOR ANPR SYSTEMS

- TABLE 67 ANPR SYSTEM MARKET FOR LAW ENFORCEMENT, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 68 ANPR SYSTEM MARKET FOR LAW ENFORCEMENT, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 69 ANPR SYSTEM MARKET FOR LAW ENFORCEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 70 ANPR SYSTEM MARKET FOR LAW ENFORCEMENT, BY REGION, 2022-2027 (USD MILLION)

- 8.4 ELECTRONIC TOLL COLLECTION

- 8.4.1 ELECTRONIC TOLL COLLECTION APPLICATION TO REGISTER HIGHEST CAGR IN ANPR SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 71 ANPR SYSTEM MARKET FOR ELECTRONIC TOLL COLLECTION, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 72 ANPR SYSTEM MARKET FOR ELECTRONIC TOLL COLLECTION, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 73 ANPR SYSTEM MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 74 ANPR SYSTEM MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2022-2027 (USD MILLION)

- 8.5 PARKING MANAGEMENT

- 8.5.1 GROWING DEMAND FOR SMART PARKING SOLUTIONS ACCELERATING DEMAND FOR ANPR SYSTEMS

- TABLE 75 ANPR SYSTEM MARKET FOR PARKING MANAGEMENT, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 76 ANPR SYSTEM MARKET FOR PARKING MANAGEMENT, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 77 ANPR SYSTEM MARKET FOR PARKING MANAGEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 78 ANPR SYSTEM MARKET FOR PARKING MANAGEMENT, BY REGION, 2022-2027 (USD MILLION)

- 8.6 ACCESS CONTROL

- 8.6.1 EXTENSIVE USAGE OF ANPR SYSTEMS FOR AUTOMATING ENTRANCE AND BARRIER CONTROL FOR ENTERING AND EXITING OPERATIONS PROPELLING GROWTH OF ANPR SYSTEM MARKET

- TABLE 79 ANPR SYSTEM MARKET FOR ACCESS CONTROL, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 80 ANPR SYSTEM MARKET FOR ACCESS CONTROL, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 81 ANPR SYSTEM MARKET FOR ACCESS CONTROL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 82 ANPR SYSTEM MARKET FOR ACCESS CONTROL, BY REGION, 2022-2027 (USD MILLION)

9 ANPR SYSTEM MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 39 ANPR SYSTEM MARKET, BY END USER

- 9.2 GOVERNMENT

- 9.2.1 INITIATIVES FOR SAFER ROADS AND EFFICIENT TOLL CHARGING DRIVING DEMAND FOR ANPR SYSTEMS

- TABLE 83 GLOBAL ANPR PROJECTS ADOPTED BY GOVERNMENT AUTHORITIES

- 9.2.2 SUCCESS STORIES

- 9.2.2.1 ANPR systems helped track over 200 vehicles on account of involvement in international crime deterrence operation in Gloucestershire

- 9.3 COMMERCIAL

- 9.3.1 RAPID GROWTH IN DEMAND FOR ANPR SYSTEMS FOR PARKING MANAGEMENT SOLUTIONS

- FIGURE 40 PARKING MANAGEMENT SOLUTION BY SMART PARKING LIMITED

- 9.3.2 SUCCESS STORIES

- 9.3.2.1 Tivoli hotel in Copenhagen used ANPR technology to implement smart parking systems

- 9.4 INSTITUTIONS

- 9.4.1 SURGING DEMAND FOR AUTOMATED ENTRY AND EXIT BARRIERS AT BUSINESS PARKS AND EDUCATIONAL CAMPUSES DRIVING DEMAND FOR ANPR SYSTEMS

- FIGURE 41 ACCESS CONTROL SOLUTION BY ADAPTIVE RECOGNITION

- 9.4.2 SUCCESS STORIES

- 9.4.2.1 University Of Hertfordshire deployed ANPR systems to automate rising bollards

10 GEOGRAPHIC ANALYSIS

- 10.1 INTRODUCTION

- FIGURE 42 INDIA TO EXHIBIT HIGHEST CAGR IN OVERALL ANPR SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 84 ANPR SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 85 ANPR SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 43 SNAPSHOT OF ANPR SYSTEM MARKET IN NORTH AMERICA

- TABLE 86 ANPR SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 87 ANPR SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 88 ANPR SYSTEM MARKET IN NORTH AMERICA, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 89 ANPR SYSTEM MARKET IN NORTH AMERICA, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 90 ANPR SYSTEM MARKET IN NORTH AMERICA, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 91 ANPR SYSTEM MARKET IN NORTH AMERICA, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Rapid surge in demand for traffic management solutions is driving growth of ANPR system market in US

- 10.2.2 CANADA

- 10.2.2.1 Increasing necessity for use of ANPR systems for law enforcement applications is propelling ANPR system market growth in Canada

- 10.2.3 MEXICO

- 10.2.3.1 Mexico is expected to register highest CAGR in ANPR system market in North America during forecast period

- 10.3 EUROPE

- FIGURE 44 SNAPSHOT OF ANPR SYSTEM MARKET IN EUROPE

- TABLE 92 ANPR SYSTEM MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 93 ANPR SYSTEM MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 94 ANPR SYSTEM MARKET IN EUROPE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 95 ANPR SYSTEM MARKET IN EUROPE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 96 ANPR SYSTEM MARKET IN EUROPE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 97 ANPR SYSTEM MARKET IN EUROPE, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.3.1 UK

- 10.3.1.1 Surging demand for automated parking management solutions driving adoption of ANPR systems

- 10.3.2 GERMANY

- 10.3.2.1 Increasing demand for intelligent transportation systems promoting growth of ANPR system market in Germany

- 10.3.3 FRANCE

- 10.3.3.1 Rising government measures to improve security and surveillance accelerating growth of ANPR system market

- 10.3.4 REST OF EUROPE

- 10.4 APAC

- FIGURE 45 SNAPSHOT OF ANPR SYSTEM MARKET IN APAC

- TABLE 98 ANPR SYSTEM MARKET IN APAC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 99 ANPR SYSTEM MARKET IN APAC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 100 ANPR SYSTEM MARKET IN APAC, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 101 ANPR SYSTEM MARKET IN APAC, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 102 ANPR SYSTEM MARKET IN APAC, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 103 ANPR SYSTEM MARKET IN APAC, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 China held largest share of ANPR system market in APAC during forecast period

- 10.4.2 JAPAN

- 10.4.2.1 Growing demand for effective traffic management solutions driving growth of ANPR system market in Japan

- 10.4.3 INDIA

- 10.4.3.1 Increasing necessity for effective enforcement of road safety regulations to drive ANPR system market in India

- 10.4.4 REST OF APAC

- 10.5 ROW

- TABLE 104 ANPR SYSTEM MARKET IN ROW, BY REGION, 2018-2021 (USD MILLION)

- TABLE 105 ANPR SYSTEM MARKET IN ROW, BY REGION, 2022-2027 (USD MILLION)

- TABLE 106 ANPR SYSTEM MARKET IN ROW, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 107 ANPR SYSTEM MARKET IN ROW, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 108 ANPR SYSTEM MARKET IN ROW, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 109 ANPR SYSTEM MARKET IN ROW, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 South America is expected to register highest growth in ANPR system market during forecast period

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Government initiatives to modernize roadways infrastructure to drive demand for ANPR systems

- 10.5.3 AFRICA

- 10.5.3.1 Initiatives to improve road safety and manage traffic congestion to boost demand for ANPR systems

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.1.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN ANPR SYSTEM MARKET

- 11.2 REVENUE ANALYSIS OF TOP PLAYERS

- FIGURE 46 TOP PLAYERS IN ANPR SYSTEM MARKET, 2016-2020

- 11.3 MARKET SHARE ANALYSIS

- TABLE 110 ANPR SYSTEMS: MARKET SHARES OF KEY COMPANIES

- 11.4 COMPANY EVALUATION QUADRANT, 2021

- 11.4.1 STAR

- 11.4.2 EMERGING LEADER

- 11.4.3 PERVASIVE

- 11.4.4 PARTICIPANT

- FIGURE 47 ANPR SYSTEM MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

- 11.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2021

- 11.5.1 PROGRESSIVE COMPANY

- 11.5.2 RESPONSIVE COMPANY

- 11.5.3 DYNAMIC COMPANY

- 11.5.4 STARTING BLOCK

- FIGURE 48 ANPR SYSTEM MARKET (GLOBAL): SME EVALUATION QUADRANT, 2021

- 11.5.5 ANPR SYSTEM MARKET: COMPANY FOOTPRINT

- TABLE 111 TYPE FOOTPRINT

- TABLE 112 COMPONENT FOOTPRINT

- TABLE 113 APPLICATION FOOTPRINT

- TABLE 114 END USER FOOTPRINT

- TABLE 115 REGION FOOTPRINT

- TABLE 116 COMPANY FOOTPRINT

- 11.5.6 ANPR SYSTEM MARKET: STARTUP/SME MATRIX

- TABLE 117 ANPR SYSTEM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 118 ANPR SYSTEM: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.6 COMPETITIVE SITUATIONS AND TRENDS

- 11.6.1 PRODUCT LAUNCHES

- TABLE 119 ANPR SYSTEM MARKET: PRODUCT LAUNCHES, MARCH 2020-DECEMBER 2021

- 11.6.2 DEALS

- TABLE 120 ANPR SYSTEM MARKET: DEALS, MARCH 2020-JANUARY 2022

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.2.1 KAPSCH TRAFFICCOM

- TABLE 121 KAPSCH TRAFFICCOM: BUSINESS OVERVIEW

- FIGURE 49 KAPSCH TRAFFICCOM: COMPANY SNAPSHOT

- TABLE 122 KAPSCH TRAFFICCOM: PRODUCT OFFERINGS

- TABLE 123 KAPSCH TRAFFICCOM: DEALS

- 12.2.2 SIEMENS

- TABLE 124 SIEMENS: BUSINESS OVERVIEW

- FIGURE 50 SIEMENS: COMPANY SNAPSHOT

- TABLE 125 SIEMENS: PRODUCT OFFERINGS

- TABLE 126 SIEMENS: DEALS

- 12.2.3 CONDUENT, INC.

- TABLE 127 CONDUENT, INC.: BUSINESS OVERVIEW

- FIGURE 51 CONDUENT, INC.: COMPANY SNAPSHOT

- TABLE 128 CONDUENT, INC.: PRODUCT OFFERINGS

- TABLE 129 CONDUENT, INC.: DEALS

- 12.2.4 GENETEC, INC.

- TABLE 130 GENETEC, INC.: BUSINESS OVERVIEW

- TABLE 131 GENETEC, INC.: PRODUCT OFFERINGS

- TABLE 132 GENETEC, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 133 GENETEC, INC.: DEALS

- 12.2.5 Q-FREE ASA

- TABLE 134 Q-FREE ASA: BUSINESS OVERVIEW

- FIGURE 52 Q-FREE ASA: COMPANY SNAPSHOT

- TABLE 135 Q-FREE ASA: PRODUCT OFFERINGS

- TABLE 136 Q-FREE ASA: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 137 Q-FREE ASA: DEALS

- 12.2.6 ADAPTIVE RECOGNITION

- TABLE 138 ADAPTIVE RECOGNITION: BUSINESS OVERVIEW

- TABLE 139 ADAPTIVE RECOGNITION: PRODUCT OFFERINGS

- TABLE 140 ADAPTIVE RECOGNITION: PRODUCT LAUNCHES AND DEVELOPMENTS

- 12.2.7 VIGILANT SOLUTIONS

- TABLE 141 VIGILANT SOLUTIONS: BUSINESS OVERVIEW

- TABLE 142 VIGILANT SOLUTIONS: PRODUCT OFFERINGS

- TABLE 143 VIGILANT SOLUTIONS: PRODUCT LAUNCHES AND DEVELOPMENTS

- 12.2.8 NEOLOGY

- TABLE 144 NEOLOGY: BUSINESS OVERVIEW

- TABLE 145 NEOLOGY: PRODUCT OFFERINGS

- TABLE 146 NEOLOGY: DEALS

- 12.2.9 TAGMASTER

- TABLE 147 TAGMASTER: BUSINESS OVERVIEW

- TABLE 148 TAGMASTER: PRODUCT OFFERINGS

- TABLE 149 TAGMASTER: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 150 TAGMASTER: DEALS

- 12.2.10 BOSCH SECURITY SYSTEMS

- TABLE 151 BOSCH SECURITY SYSTEMS: BUSINESS OVERVIEW

- TABLE 152 BOSCH SECURITY SYSTEMS: PRODUCT OFFERINGS

- TABLE 153 BOSCH SECURITY SYSTEMS: PRODUCT LAUNCHES AND DEVELOPMENTS

- 12.2.11 JENOPTIK GROUP

- TABLE 154 JENOPTIK GROUP: BUSINESS OVERVIEW

- FIGURE 53 JENOPTIK GROUP: COMPANY SNAPSHOT

- TABLE 155 JENOPTIK GROUP: PRODUCT OFFERINGS

- TABLE 156 JENOPTIK GROUP: DEALS

- 12.2.12 HIKVISION

- TABLE 157 HIKVISION: BUSINESS OVERVIEW

- FIGURE 54 HIKVISION: COMPANY SNAPSHOT

- TABLE 158 HIKVISION: PRODUCT OFFERINGS

- TABLE 159 HIKVISION: PRODUCT LAUNCHES AND DEVELOPMENTS

- 12.2.13 VIVOTEK, INC.

- TABLE 160 VIVOTEK, INC.: BUSINESS OVERVIEW

- FIGURE 55 VIVOTEK, INC.: COMPANY SNAPSHOT

- TABLE 161 VIVOTEK, INC.: PRODUCT OFFERINGS

- TABLE 162 VIVOTEK, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 163 VIVOTEK, INC.: DEALS

- 12.2.14 AXIS COMMUNICATIONS

- TABLE 164 AXIS COMMUNICATIONS: BUSINESS OVERVIEW

- TABLE 165 AXIS COMMUNICATIONS: PRODUCT OFFERINGS

- 12.2.15 NEDAP

- TABLE 166 NEDAP: BUSINESS OVERVIEW

- FIGURE 56 NEDAP: COMPANY SNAPSHOT

- TABLE 167 NEDAP: PRODUCT OFFERINGS

- TABLE 168 NEDAP: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 169 NEDAP: DEALS

- 12.3 OTHER KEY PLAYERS

- 12.3.1 TATTILE

- TABLE 170 TATTILE: COMPANY OVERVIEW

- 12.3.2 EFKON GMBH

- TABLE 171 EFKON GMBH: COMPANY OVERVIEW

- 12.3.3 DIGITAL RECOGNITION SYSTEMS

- TABLE 172 DIGITAL RECOGNITION SYSTEMS: COMPANY OVERVIEW

- 12.3.4 NDI RECOGNITION SYSTEM

- TABLE 173 NDI RECOGNITION SYSTEM: COMPANY OVERVIEW

- 12.3.5 ALERTSYSTEMS

- TABLE 174 ALERTSYSTEMS: COMPANY OVERVIEW

- 12.3.6 QRO SOLUTIONS

- TABLE 175 QRO SOLUTIONS: COMPANY OVERVIEW

- 12.3.7 FF GROUP

- TABLE 176 FF GROUP: COMPANY OVERVIEW

- 12.3.8 SENSYS GATSO GROUP

- TABLE 177 SENSYS GATSO GROUP: COMPANY OVERVIEW

- 12.3.9 CLEARVIEW COMMUNICATIONS

- TABLE 178 CLEARVIEW COMMUNICATIONS: COMPANY OVERVIEW

- 12.3.10 BELTECH

- TABLE 179 BELTECH: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 ITS MARKET FOR ROADWAYS, BY SYSTEM

- 13.3.1 INTRODUCTION

- TABLE 180 ITS MARKET FOR ROADWAYS, BY SYSTEM, 2017-2020 (USD BILLION)

- TABLE 181 ITS MARKET FOR ROADWAYS, BY SYSTEM, 2021-2026 (USD BILLION)

- 13.3.2 ADVANCED TRAFFIC MANAGEMENT SYSTEM (ATMS)

- 13.3.2.1 ATMS segment Currently holds largest share of ITS market

- TABLE 182 ROADWAYS: ITS MARKET FOR ADVANCED TRAFFIC MANAGEMENT SYSTEMS, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 183 ROADWAYS: ITS MARKET FOR ADVANCED TRAFFIC MANAGEMENT SYSTEMS, BY APPLICATION, 2021-2026 (USD MILLION)

- TABLE 184 ROADWAYS: ITS MARKET FOR ADVANCED TRAFFIC MANAGEMENT SYSTEMS, BY REGION, 2017-2020 (USD MILLION)

- TABLE 185 ROADWAYS: ITS MARKET FOR ADVANCED TRAFFIC MANAGEMENT SYSTEMS, BY REGION, 2021-2026 (USD MILLION)

- 13.3.3 ADVANCED TRAVELER INFORMATION SYSTEMS (ATIS)

- 13.3.3.1 Vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), vehicle-to-everything (V2X) communication

- 13.3.3.1.1 V2V, V2I, and V2X technologies are vital for connected vehicles

- 13.3.3.1 Vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), vehicle-to-everything (V2X) communication

- TABLE 186 ROADWAYS: ITS MARKET FOR ADVANCED TRAVELER INFORMATION SYSTEMS, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 187 ROADWAYS: ITS MARKET FOR ADVANCED TRAVELER INFORMATION SYSTEMS, BY APPLICATION, 2021-2026 (USD MILLION)

- TABLE 188 ROADWAYS: ITS MARKET FOR ADVANCED TRAVELER INFORMATION SYSTEMS, BY REGION, 2017-2020 (USD MILLION)

- TABLE 189 ROADWAYS: ITS MARKET FOR ADVANCED TRAVELER INFORMATION SYSTEMS, BY REGION, 2021-2026 (USD MILLION)

- 13.3.4 ITS-ENABLED TRANSPORTATION PRICING SYSTEMS (ITPS)

- 13.3.4.1 Market for ITPS is expected to witness significant growth during forecast period

- TABLE 190 ROADWAYS: ITS MARKET FOR ITS-ENABLED TRANSPORTATION PRICING SYSTEMS, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 191 ROADWAYS: ITS MARKET FOR ITS-ENABLED TRANSPORTATION PRICING SYSTEMS, BY APPLICATION, 2021-2026 (USD MILLION)

- TABLE 192 ROADWAYS: ITS MARKET FOR ITS-ENABLED TRANSPORTATION PRICING SYSTEMS, BY REGION, 2017-2020 (USD MILLION)

- TABLE 193 ROADWAYS: ITS MARKET FOR ITS-ENABLED TRANSPORTATION PRICING SYSTEMS, BY REGION, 2021-2026 (USD MILLION)

- 13.3.5 ADVANCED PUBLIC TRANSPORTATION SYSTEMS (APTS)

- 13.3.5.1 Impact of COVID-19 on APTS may be greater as compared to other systems

- TABLE 194 ROADWAYS: ITS MARKET FOR ADVANCED PUBLIC TRANSPORTATION SYSTEMS, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 195 ROADWAYS: ITS MARKET FOR ADVANCED PUBLIC TRANSPORTATION SYSTEMS, BY APPLICATION, 2021-2026 (USD MILLION)

- TABLE 196 ROADWAYS: ITS MARKET FOR ADVANCED PUBLIC TRANSPORTATION SYSTEMS, BY REGION, 2017-2020 (USD MILLION)

- TABLE 197 ROADWAYS: ITS MARKET FOR ADVANCED PUBLIC TRANSPORTATION SYSTEMS, BY REGION, 2021-2026 (USD MILLION)

- 13.3.6 COMMERCIAL VEHICLE OPERATIONS (CVO) SYSTEMS

- 13.3.6.1 Commercial vehicle operation systems expected to record highest CAGR of market during forecast period

- TABLE 198 ROADWAYS: ITS MARKET FOR COMMERCIAL VEHICLE OPERATIONS SYSTEMS, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 199 ROADWAYS: ITS MARKET FOR COMMERCIAL VEHICLE OPERATIONS SYSTEMS, BY APPLICATION, 2021-2026 (USD MILLION)

- TABLE 200 ROADWAYS: ITS MARKET FOR COMMERCIAL VEHICLE OPERATIONS SYSTEMS, BY REGION, 2017-2020 (USD MILLION)

- TABLE 201 ROADWAYS: ITS MARKET FOR COMMERCIAL VEHICLE OPERATIONS SYSTEMS, BY REGION, 2021-2026 (USD MILLION)

14 APPENDIX

- 14.1 INSIGHTS OF INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 AVAILABLE CUSTOMIZATIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS